Impact and Innovations in FinTech

Info: 6447 words (26 pages) Dissertation

Published: 9th Dec 2019

Tagged: BusinessFinanceTechnology

1.1. Retail Industry

1.1.1. What is the Retail Industry?

Retail industry is comprised of the considerable number of organizations that offer products and enterprises through stores, on the web et cetera to the general population purported purchasers in the economy (the retail part Meaning in the Cambridge English Dictionary, no date). Retail Sector can be taken into numerous headings like general retailers, departmental stores, claim to fame stores, on-line stores et cetera (The Industry Handbook: The Retailing Industry, 2004). Ireland’s retail area comprises of around 40,000 retail organizations in which 90% are Irish-claimed (administrator and Department of Business Enterprise and Innovation, no date).

1.1.2. History of the Retail Industry?

Retail has turned into a basic piece of present day humanity’s revaluation. Merchant dependably have been a critical fragment of each period, from trading camels to call clients utilizing I-cushions et cetera. Life saver of present day retail industry is cash, however in antiquated occasions there was exchanging before the creation of money. In 9000-6000 BC, it was trade framework in which creature, for example, camels, sheep, and so forth are traded in exchanging and were the most seasoned type of cash. In 1883, first money enlist was imagined by James Ritty (Bellis, no date). 1796 was the beginning of advanced retail chains, the period denoted the progress from mother and-pop shops and general stores to retail establishments (A past filled with the retail establishment, no date). 1920 was the foundations of plastic: were called as “Mastercards” or “charge cards”, were given as a comfort to clients who might typically need to movement to the bank to pull back money (Buy Now, Pay Later: A History of the Credit Card, no date). The primary Wal-Mart, the huge box retail taken after by Kmart and Target were open in the 1960’s (The Past And Future Of America’s Biggest Retailers, no date). Web based shopping is conceived in 1994, Pizza Hut was the first to acknowledge online-orders (Grothaus and Grothaus, 2015). In 1995, Amazon the eCom pioneer was built up and sold its first book (‘The History of E-Commerce, Online Shopping Evolution, and Buyers Behavior’, no date).

1.1.3. Ireland’s Retail Industry and Its Future

Retail is the basic area in the Irish economy. Change has been found in the most recent decades in the Irish retail viewpoint. Change because of increment in rivalry, changes in buyer practices, developing client desires, advancement in innovation. Different elements like Brexit will put representative new difficulties in not so distant future. Decrease in the benefit of sterling have officially affected the part’s execution, in like manner on propensity of retailers of Ireland. Albeit Irish retailers are hopeful about the future, parcels goal-oriented for advancement, intending to put and exhausting their business in coming years. (Molding the Future of Irish Retail 2020 | Retail Ireland, no date)

1.2. Fintech

1.2.1. What is Fintech?

Money related innovation, otherwise called Fintech, is a monetary industry made out of organizations that utilization innovation to make budgetary administrations more proficient (McAuley, 2014).

As per the National Digital Research Center in Dublin, Ireland, characterizes money related innovation as “advancement in budgetary administrations”, including that “the term has begun to be utilized for more extensive uses of innovation in the space – to front-end purchaser items, to new contestants contending with existing players, and even to new standards, for example, Bitcoin”. Alt, and Puschmann ( 2012) showed that Fintech alludes to new arrangements which exhibit an incremental or radical/troublesome advancement improvement of utilizations, procedures, items or plans of action in the budgetary administrations industry. These arrangements can be isolated in five zones.

- The banking or insurance sector are distinguished as potential business sectors. Solutions for the insurance industry are often more specifically named “InsurTech”.

The solutions differ with regard to their supported business processes such as financial information, payments (such as mobile payment), investments, financing, advisory and cross-process support. - The targeted customer segment distinguishes between retail, private and corporate banking as well as life and non-life insurance.

- The interaction form can either be business-to-business (B2B), business-to-consumer (B2C) or consumer-to-consumer (C2C).

- The solutions vary with regard to their market position.

The term fintech created from the matching of two necessary fields budgetary administrations and arrangements in view of trend setting innovation (Nicoletti, 2017). Oxford word reference characterize fintech as: “PC programs and other innovation used to help or empower saving money and budgetary services”(fintech | Definition of fintech in English by Oxford Dictionaries, no date). While money related administration industry has been overwhelmed by the customary monetary organizations already, a move towards more digitisation and interlinkage is apparently inside skyline (Arner, Barberis and Buckley, 2015). This impression of collected bond amongst fund and innovation is best known as “Fintech” or “Money related Technology”. Money related items and administrations made with advanced and creative arrangements in fund for the end-clients i.e. customers are fintech (Chuen, Swee and Jinrui, 2015).

The new age budgetary administrations embedded with the Information Technology engineering to offer its customers a radical new client involvement as far as conveying monetary exchanges by methods for various channel like versatile saving money, e-managing an account, web keeping money, block chain advancements, computerized signature arrangements and middle or ongoing instalment frameworks. These inventive monetary administrations incorporate ATM, EFTPOS, SWIFT, EDI, Bit-Coins and Direct-Debit that internetwork exchanges and instalment administrations (Jarunee Wonglimpiyarat, 2017). The customary monetary market and money related exchanges has been tested by the ascent of ‘Bitcoin’, as it opened the conceivable outcomes to complete budgetary settlements with no an exchange expense or directions (EY – Fintech: Are banks reacting fittingly? – EY – China, 2015).

Year 1967 was the Beginning in the beginning of monetary innovation with the dispatch of the mechanized teller machine. A major development towards advanced industry from simple in budgetary administrations device put from 1967 through 1987. Foundation of the Society of Worldwide Interbank Financial Telecommunications (SWIFT) in 1973 was the main most noteworthy marvel towards the internationalization of the installment services (Swift History, no date). In 2009, Paul Volcker (former executive, US Federal Reserve) said “The most vital monetary development that I have seen the previous 20 years is the programmed teller machine, that truly helps individuals and avoids visits to the bank and it is a genuine convenience”(Paul Volcker, 2009). In Fintech history, MasterCard Inc. what’s more, Visa Inc. were the two of the biggest IPOs. Both MasterCard and Visa, process installments on charge and Visas on restrictive installment systems (Wilson, 2017).

Being after the Global Financial Crisis, monetary industry has been reshaping bit by bit with budgetary innovation and will reshape eventual fate of the money related administrations. In the field of installments, contributing and loaning, money related innovation is empowering new firms, for example, new businesses and TechBanks to supply appealing options for general society. The result of the Global Financial emergencies offered rise to exponential advancement of FinTech new businesses and other non-bank contenders (Jakšič and Marinč, 2015).

Fintech contributed in new improvement of the worldwide monetary area and gave numerous progressions to determine the impediments and issues that customers by and large faces in their budgetary exchanges. Retail money related administrations are by and large more digitized through installment applications, e-wallets, internet loaning stages and these fintech administrations are rapidly picking up clients. Unbanked populaces can make buys and keep their cash through installment applications and secure portable wallets without stressing to convey and store huge measure of money (Desai, 2015).

“FinTech noun: an economic industry composed of companies that use technology to make financial systems more efficient. “(McAuley, D Wharton FinTech, Online 2014)

Roy S.Freedman examines in his book Introduction to Financial Technology what he sees monetary innovation to mean. The creator portrays budgetary innovation with being worried about building frameworks that model, esteem and process monetary items, for example, securities, stocks, contracts and cash. (Freedman, Roy S, 2006 pg 1). The creator delineates how monetary items incorporate value, time and credit. Freedman examinations how monetary frameworks which can be seen as like business frameworks include purchasing and offering of items in various markets at various occasions through exchanging frameworks and exchanging innovation. Monetary Technology includes secure correspondence to others in a market through normal dialect with a speedy conveyance of data and news which can be open or privates and this is done through a correspondence arrange. Money related Technology incorporates exchanging innovation like that of business frameworks. Exchanging incorporates a few activities such unloading, arranging, purchasing, offering, getting, renting, handling, managing and so forth.

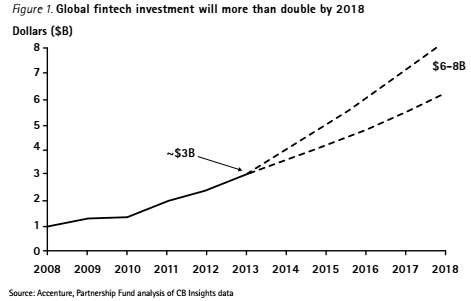

As specified as of now the worldwide interest in monetary innovation in the course of recent years is amazing. Worldwide Management Consulting innovation powerhouse Accenture as of late delivered a paper on “The Rise of FinTech”. The paper examines that because of the new period of open programming and distributed computing this has opened up the market along these lines decreasing hindrances which permits new contestants into the money related innovation industry. Because of this the money related foundations including banks and so forth are being pressurized to bring down expenses and drive development openings which have come to fruition from the computerized transformation.

In New York the FinTech Innovation Lab which helps brilliant FinTech business people to build up their most recent developments has seen the Lab’s past graduated class raise $76 million and one organization was obtained for $175 million. (Gach, R and Gotsch, M, Accenture, 2014) The FinTech advertise in New York has seen development of double the rate contrasted with Silicon Valley. In the course of recent years FinTech has seen Global Investment which supersedes wander contributing by four times in general. The US has holds solid as the principle center point for this speculation with a tremendous 83% of worldwide interest in 2013 and almost 1$ Billion in the primary quarter of 2014. Budgetary Times reports “The aggregate sum put resources into the worldwide FinTech division ascended from simply finished $4bn in 2013 to more than $12bn a year ago”. (Arnold, Martin 2015, Financial Times Online)

The Financial Times (Arnold, Martin 2015, Irish Times Online) additionally reports that $3.5 Billion was put into KKR otherwise called Kickstarter. Kickstarter are a gift based group financing organization whom enable business people to finance a task or wander by fund-raising for vast gatherings of individuals essentially finished the web.

The FT likewise outlines that there was $865 million raised by the loaning club on the New York stock trade. Forbes online reports how The Lending Club which includes distributed loaning has issued over $1 Billion in credits and they are the reasonable pioneer in the market. Distributed loaning like group subsidizing is a creative budgetary innovation offering credit at much lower rate than the conventional banks. (Caldbeck, Ryan Forbes, Online 2012)

FinTech, characterized as innovation arrangements and new companies that have disturbed or potentially enhanced the way fund, saving money and protection ventures work together, has turned out to be one of the biggest development businesses in the realms of back and innovation. The part is turning into the following incredible innovation unrest, similar to no other found over the most recent ten years. The guarantee of the present FinTech incorporates more noteworthy security, speedier exchanges, and progressive choices for business, money related administrations, and protection.

The business is probably going to overturn customary managing an account, fund, and protection with arrangements that serve customer and business needs in a consistently evolving, innovation driven culture. Another age of innovation business people and back area veterans have thought up and assembled imaginative money related arrangements like Blockchain, crowdfunding, versatile installments, and shared loaning, taking a centuries old industry and standing it on its head.

1.2.2. History of Fintech

Innovation, technique, and fund have been firmly joined for a considerable length of time. One such association and a critical factor in customer saving money systems for some budgetary establishments, the ATM (robotized teller machine), first showed up in 1967. All the more as of late, reacting to the development of the Internet and the move toward versatile stages, almost all money related establishments and insurance agencies have moved their techniques and their responsibilities.

After the crash of the monetary part in 2008, an incredible intersection of occasions shot FinTech to new noticeable quality as another industry. Amid the recuperation that took after, the budgetary division was accused of actualizing the Dodd-Frank Act, an enormous arrangement of new controls intended to keep any future crash, and 8.7 million individuals, numerous from the universes of back and saving money, were recently jobless. Alongside disturbance and direction, be that as it may, this period saw the universality and the utility of cell phones among purchasers.

FinTech new companies started to manifest to address repressed interest for versatile and online trade applications, more noteworthy security, and little and small scale business financing and administrations. This period saw the rise of organizations like Square for smaller scale versatile installments (established 2009); Kickstarter, for crowdfunding (established 2009); and SoFi, for online individual advances (established 2011). Both Bitcoin and Blockchain likewise were conceived (established 2008). As a result of inheritance innovation and huge administrative weights, occupant establishments couldn’t move sufficiently quick to stay aware of these youthful upstarts, and an entire age of recently designed budgetary, managing an account, and protection arrangements were made everywhere throughout the world. The vast foundations did not kick back and observe the greater part of this happen, notwithstanding. Rather, they purchased new businesses, supported new advancements, and built up their own particular advances. The fight between existing players and newcomers is progressing.

For occupant organizations, private ventures, and shoppers alike, the abilities of a considerable lot of the most recent FinTech developments have advocated the fervor and huge speculation. New innovation, as Blockchain or dispersed record, guarantees for all intents and purposes un-hackable exchanges to make secure trade and record-keeping more than ever observed.

FinTech makes the ‘gig economy’ (an adaptable, circulated, regularly independently employed model of working, think Uber) more conceivable than any time in recent memory, giving less demanding, more accessible administrations to this division of the workforce, for example, portable installments and charging, small scale subsidizing, and customized protection. Shoppers have praised the accommodation and straightforwardness by which installments can be made and gotten with advancements like Apple Pay and Google Wallet.

Maybe one of the best effects of FinTech will be on the 1.2 billion unbanked individuals around the world. Progressive advancements will empower them to wind up some portion of the worldwide economy, purchasing, offering, sending and getting cash, all with no physical bank inclusion by basically utilizing a cell phone and cell organize.

FinTech for the most part contains two classifications, helpful or troublesome. Helpful FinTech works with the current fund foundation and either streamlines it or makes it more easy to understand (e.g. internet saving money). Troublesome advancements have reconsidered back out and out and designed better approaches for working together (e.g. crowdfunding). The business is additionally regularly fragmented by the business procedure it gives (e.g. store accounts, installments, loaning, riches administration or contributing, protection, showcases, and back office tasks) and the client fragment it serves (e.g. retail managing an account, protection, and corporate keeping money).

Driving this transformation are the informed, experienced, and creative youthful business people and fund industry greats, many dislodged after the Great Financial Crisis of 2008. (bitcoinist.net) In this field lies a mind boggling open door for business and innovation understudies, staff, and colleges to prepare the up and coming age of FinTech designers and trend-setters. Throughout the most recent two years, colleges have perceived this reality and started creating projects, courses, and gatherings to help FinTech development and training. This area, if grew legitimately by colleges, can possibly offer energizing profession and progression open doors for a whole age of business and innovation understudies. The two colleges with business colleges and understudies who neglect to perceive the huge open door might be deserted.

Figure: Global FinTech Investment will more than double by 2018, Gach R et al pg 2

1.3. Fintech and its Components

FinTech can be broke down into several different areas within the financial sector:

1.3.1. Asset Management

Resource Management is just the administration of a customer’s speculations by a monetary administrations organization like a venture bank. The bank or organization will then contribute for the benefit of the customer. FinTech is having a genuine effect in this segment with the UK being viewed as the world’s biggest store administration focus on the planet representing more than 6.2trn of benefits under administration. (Shaul, David, UK FinTech Online, 2015) An incredible illustration an organization flourishing inside the FinTech universe of Asset Management is Motif Investing. An organization set up by two companions to make to enable financial specialists to put resources into incredible thoughts requiring little to no effort arrangement. This is done through online readymade portfolios called themes. Theme Investing as of late won a honor for being the most troublesome FinTech Company in the market perceived by Benzinga. (Market Watch Online, 2015)

1.3.2. Bank Technology

Another key pattern which has banks and monetary foundations heating and rushing with new FinTech advancement is Omni Channel arrangements. Back Base is a phenomenal case omni-channel arrangement where the client encounter stage enabling clients to make online interfaces and portable applications. There programming permits organizations which is to a great degree useful to money related foundations to oversee client benefit encounters. Adobe reports how today clients have more control about how and when they interface with their cash. They can get to their records and monetary administrations through cell phones, PCs, tablets, on the web, ATMs and even through online networking. A report by the Federal Reserve board found that banking services accessed by U.S internet users during a twelve-month period found that:

- 85% visited a bank branch

- 74% used an ATM

- 74% used online banking

- 34% used telephone banking

- 29% used mobile banking

- 15% made a mobile payment

The report suggests that although financial institutions are becoming more effective with engaging with customers through apps, mobile technology, online it acknowledges that social media is causing problems. Although social media has its benefits for reaching customers banks are struggling to comprehend how to use it effectively and efficiently. (Adobe, 2014)

1.3.3. Crowd funding

Crowd Funding is a standout amongst the most encouraging regions inside the FinTech world. This is another imaginative monetary innovation stage which includes raising capital, fund or cash from a substantial gathering of individuals fundamentally finished the web for endeavors or activities. Etsy which is a commercial center where individuals can purchase and offer remarkable items online have as of late investigated swarm financing. The Wall Street Journal reports how Etsy are to dispatch a group subsidizing program which will enable venders to fund-raise on the site which will help finance the assembling of new items. Etsy item supervisor Joe Lallouz talks about how enthusiastic the organization are about their merchants and they perceive that assets or back are an issue for dealers. “A considerable measure of merchants distinguished financing as a major obstacle to development,” (Leslie, J Wall Street Journal, 2015) and multi month pilot for its task propelling because of a blast in swarm subsidizing.

1.3.4. Cryptocurrency

The origin of cryptographic money began in 2008 which were designed by Satashi Nakamoto through an association called Bitcoin. Bitcoin is installment organize utilizing shared innovation which works with no national banks. Bitcoin and cryptographic money is an advanced cash and this is issued by the system. When we take a gander at how the central bank framework where governments can control cash through printing cash in any case; they can’t control digital currency as this is decentralized. The drawback to Bitcoin or cryptographic money is that in spite of the fact that it isn’t issued by banks nor is it ensured by banks. Uncover another start-up which in digital currency like Bitcoin. (Wallace, Benjamin 2011, Wired Online)

1.3.5. Information Portal

Enterprise Information Portal or (EIG) is another region which can influence the money related innovation world. EIG is structure uniting data, individuals and procedures all through hierarchical limits like that of a web-based interface. Its entrance to an organization’s data, learning base of workers and for clients, business accomplices and so forth. Quroa online report in their article how ” Big Data has made profound interest for investigation and representation programming in the fund business and in addition expanded access to money related data for customers. Online stages consider joint effort and swarm sourced examinations continuously. “(Werneck, Bruno Quroa Online, 2015) VC Experts gives important and intense data on the financing of privately owned businesses and the gathering pledges. “VC Experts has turned into a basic asset for business visionaries, financial specialists, attorneys, and different administrations gives in the investment and private value enterprises.” (ACE, NYSE Online, 2015)

1.3.6. Investment Management

Investment Management is another key pattern in FinTech, which includes the purchasing and offering speculations inside a portfolio. Keeping money, planning and charges can go under Investment Banking notwithstanding; it normally comprises of portfolio administration. Forbes online talk about how Investment administration is the place individuals who are putting into a lot of records at work, that speculation administration appears as shared assets. Shared assets are controlled by cash administrators who put these assets keeping in mind the end goal to get capital additions for these financial specialists. These shared assets are coordinated by lead venture chiefs towards stocks and securities that make up the assets. (Forbes Online, 2013) There has been a decrease in organization charges and also item expenses and clients are receiving the rewards alongside more open proficient counsel. The advancement of new items inside venture administration, for example, swarm sourced ETF’s.

1.3.7. Machine Intelligence

Artificial Intelligence is having a critical effect in the monetary administrations industry. Jon Kay talks about on the Harrington Star how start up associations in the FinTech division are utilizing computerized reasoning to make and create programming answers for structure information and make a machine learning framework. This imaginative programming will empower a framework to act without being coordinated or requested to do it. The creator examines how the expansive venture banks are taking AI innovation to create frameworks on a versatile stage to make a more intuitive client encounter and to forestall botches by staff or buyers themselves (Kay, Jon, Harrington Starr Online, 2014). Sentifi.com have as of late propelled an AI based FinTech benefit which indentifies essential occasions and issues to recorded stocks around the world. (Sentifi, Start-Up Ticker, 2015)

1.3.8. Marketplace Lending

FinTech is gravely affecting the loaning side of the money related world. Commercial center loaning which incorporates both distributed loaning and social loaning just furnishes borrowers with bring down rates on credits and financial specialists with a higher wellspring of settled wage. Following the money related emergency in 2008 borrowers have been searching for ways and intends to get bring down rates on advances and thus loan specialists to get a higher rate of profit for their speculations. Banks have been managing the high control that exists with the budgetary administrations segment and this has opened entryways for shared loaning. The procedure includes an online stage that offers borrowers simple and productive access to moneylenders. Shared loaning in the U.S created $6.6 Billion a year ago up 128%. Europe and the UK specifically have seen tremendous development achieving €3 Billion up 144%. (Bakker, Evan 2015, UK Business Insider)

1.3.9. Money Management

Money Management is something that is indispensable to every one of us both on an individual level and business level. Dealing with our cost reports in our own lives and in a business way is fundamental to remaining above water. Cash Management firms offer more quick witted inventive routes on spending and some knowledge proposals. Organizations like Abacus or Concur are interesting on the web FinTech techniques for paying costs in a hurry. These online cost stages are even accessible in applications for your savvy gadgets. The stages are setup for representatives to transfer costs while enabling directors basic access to support them. Once these have been affirmed they can naturally be moved into your ledger.

1.3.10. Payments

The installment organizations have likewise attempted emotional changes from the advancement of monetary innovation. The associations included are continually searching for new imaginative approaches to make the procedure easier from the exchange of a thing of significant worth starting with one gathering then onto the next. One such new FinTech start up exceeding expectations in this part is Irish organization Stripe. Stripe is a one of a kind online installment stage permitting which enables dealers or individuals to acknowledge installments online through applications. They have been named the new PayPal which as of now offers this administration. The new imaginative firm was set up by four limerick siblings and is presently esteemed at a stunning $3.5 Billion. The organization has been touted for a firm opponent to PayPal (Newenham, Pamela, Irish Times Online, 2014)

1.3.11. Private Markets

Towers Watson in their paper “Investing in Private Markets” portrays private markets as an umbrella term containing an assortment illiquid speculation. At the end of the day ventures that can’t be sold at short notice and because of this require an all the more long haul approach with understanding capital. (Towers Watson, 2012) Private markets are frequently alluded to as private value optional markets. This region of budgetary innovation has additionally observed headways because of the huge measure of data accessible from warning administrations and privately owned businesses. DueDil has as of late turned into Britain’s biggest wellspring of data about privately owned businesses as per Euro Money on the web. (Lee, Peter Euro Money Online, 2015) Equityzen is another organization in the monetary innovation universe of private markets which associates investors of privately owned businesses with financial specialists looking for elective venture.

1.3.12. Real Estate

Online Real Estate which is to a great degree like crowdfunding in that it hopes to interface speculators with land improvement ventures. Planwise is an organization that enhanced into the land online FinTech industry detecting a hole in the market by offering its posting stage for nothing? This enabled it to challenge the huge players as of now in the market, for example, Zillow and Trulia. (Pozin, Illya Forbes Online, 2014) Crowdstreet an organization start up in 2012 intended to associate financial specialists with land supports like a crowdfunding association is developing in the market. Anand Sanwal CEO and Co Founder of CB Insights talks about how FinTech new businesses in the loaning side will veer towards the land advertise “I think some about these blade tech new companies who are centered around loaning may in the end get into contracts as they attempt to wind up a greater amount of full-specialist organizations,” Sanwal told Inman. “In any case, since many are as of now handling huge loaning markets as of now, they may center around their underlying verticals previously beginning to differentiate and attempt new markets.” (Swinderman, A. Inman Online, 2015)

1.3.13. Trading

This last area of FinTech is inside the exchanging business again observing critical headways. More open access to Wall Street’s securities exchanges, speculation thoughts and land. For instance organizations, for example, StockTwits which are an online association offering monetary association between financial specialists and brokers, like a web based life webpage. The association offers a few of stages giving data on stocks and markets over the web and internet based life. FinTech Exchange is another occasion in relationship with FinTex Chicago was composed to impart most recent in monetary innovation for budgetary markets and exchanging firms. The occasion will show the diverse accessible exchanging programming, investigation, advertise information and distributed computing.

1.4. Impact of Fintech on Retail Banking

Disruption in ‘consumer payment solutions’; ‘consumer credits’; saving and current bnk accounts; ‘merchant payment solutions’; etc. has created scope for alternate payment solutions like ‘Apply Pay’, ‘Amazon Wallet’, ‘Revolut’, etc.

Disruption in ‘P2P’ and crowdfunding segments which gave SME’s ease of access to financial services which were difficult to obtain through traditional channels.

The payment system, which were dominated by the banks earlier are witnessing number of new entrants, especially from non-banking business offering customers a highly convenient payment services that are quick, versatile, easier-to-deploy option with the promise of established reputation. Non-banking player includes retailers (Amazon, Uber), telecommunication providers (Vodafone), technology companies (Apple, Oyster, Google, Samsung) and start-ups (Revolut) (PricewaterhouseCoopers, 2016).

The emergence of big tech players like Apple, Google, Facebook, Amazon and Samsung in the financial services is big breakthrough for Financial Technology revolution (SUMMERS, 2017).

1.5. How Fintech Impacts Purchasing Behavior of Customers

Increased adoption of Fintech solutions created significant transformation in purchasing behavior of customers. Significant increase in the use of fintech payment methods is due to its convenient and customer-focus nature. Technology and customer experience-centricity fintech solutions such as PayPal, Paytm, Square and so on are compose of first generation and are making benchmark of the much convenient payments experience in every prospect.

The most affected sector by these solutions is Retail or commerce & boosted and empowered the advancement of SMEs. Purchasing experience preference have been changed by these simple payments, mobile-focused solutions. It not just challenged current approaches but has also introduced different ways for all stakeholders (retailers, customers, etc) to win (Mesropyan, 2017).

Customers can also benefits from the functionality to visualize, understanding and adjustment of spending habits in ways which were not available previously (Branch, 2016).

1.6. How Fintech is changing the payment method

Fintech organizations had genuinely made another lift in the installment exchange when it propelled an online money related administrations and applications arrangement with different types of installment as per the destinations and the shopper’s needs (Grant, 2016). These days, with the Fintech advancement, clients don’t have to go to bank for all their installment exchanges, rather can play out the entirety of their installments utilizing on the web money related administrations easily wherever and at whatever point they need in simple and quicker way.

In the present occupied society, the customers dependably need to improve their day by day budgetary exchange to the base level to spare time and endeavors yet at the same time can guarantee the required wellbeing and security. The money related exchanges as of late have experienced numerous positive changes as installment for the client the same number of nations have begun changing to perform non-money exchanges (Desai, 2015).

1.6.1. Mobile wallet

The mobile wallet is a computerized wallet which utilizes innovation to store the digitized assets, for example, the Mastercards or charge cards which empowers the clients to make instalments at stores safely and rapidly (Grant, 2016). The key target behind the innovation of this instalment strategy are to supplant the physical wallets which individuals dependably convey in their pockets, upgrade the accommodation, speed and secure for the clients and in addition endeavour to assemble the cashless society later on (Mobile Payment Solutions: Consumer Retail, Peer-to-Peer Payments, Wallet Market and Forecasts 2014 – 2020, 2014).

1.6.2. Cryptocurrency

A cryptographic money is an advanced or virtual cash intended to fill in as a medium of trade. It utilizes cryptography to anchor and check exchanges and additionally to control the production of new units of a digital money (What is Cryptocurrency. Guide for Beginners, no date). The development of ‘Bitcoin’ has tested the customary monetary market and money related exchanges, as it opened the potential outcomes to do budgetary settlements with no controls or an exchange charge (EY – Fintech: Are banks reacting suitably? – EY – China, 2015)

Utilizing Bitcoin by clients can likewise help the straightforwardness, wellbeing and briskness and productivity in playing out the money related exchange. For instance, From the vender’s viewpoint, Bitcoin is a decent choice on the grounds that if the instalment is made by means of PayPal, the purchaser can assert his cash back whenever, while Bitcoin does not enable the purchaser to take the cash back if the dealer has officially gotten it. From the purchaser’ point of view, Bitcoin makes the exchanges more straightforward and snappier as it utilizes P2P instalment demonstrate instead of different go-betweens (Carrick, 2016).

The birthplaces of digital currency began in 2008 which were imagined by Satashi Nakamoto through an association called Bitcoin. Bitcoin is instalment organize utilizing distributed innovation which works with no national banks. Bitcoin and cryptographic money is a computerized cash and this is issued by the system. When we take a gander at how the central bank framework where governments can control cash through printing cash be that as it may; they can’t control digital currency as this is decentralized. The drawback to Bitcoin or digital money is that in spite of the fact that it isn’t issued by banks nor is it ensured by banks. Uncover another start-up which in digital currency like Bitcoin. (Wallace, Benjamin 2011, Wired Online).

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Technology"

Technology can be described as the use of scientific and advanced knowledge to meet the requirements of humans. Technology is continuously developing, and is used in almost all aspects of life.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: