An Analysis and Evaluation of the Business and Financial Performance of African Sun Limited

Info: 8589 words (34 pages) Dissertation

Published: 10th Dec 2019

Tagged: FinanceBusiness Analysis

What is business and financial performance?

The term business performance is commonly referred to in and around work areas, especially by management as they discuss the activities their companies have been involved in and the success or failure of those activities. Financial performance on the other hand, is “a subjective measure of how well a firm can use assets from its primary mode of business to generate revenue.” (http://www.investopedia.com/terms/f/financialperformance.asp, 2017).My reasons for choosing this topic

I chose the topic so that I could get more insight on how well or how badly companies that operate in Zimbabwe’s hospitality industry have been operating, considering the economic turmoil that the company has been through for the past years. I have learnt a lot about analyzing financial statements and assessing the performance of businesses during the course of my studies. There are countless areas of a company’s operations that can affect its growth and profitability and I would therefore like to know more about how these different aspects link given a real world scenario. Financial performance can be measured and assessed in different ways and from different angles. I would like to get a better understanding of as many methods as I can of assessing the financial performance of a company, especially given one operating in an environment considered to be hostile to business growth and sustainability.About African Sun Limited

African Sun Limited was established in 1968 by a man named Shingi Munyeza as a hospitality management company. It is based in Zimbabwe and its operations stretch throughout the entire country. (https://en.wikipedia.org/wiki/African_Sun#cite_note-1, 2017). It operates hotels in every major tourist resort in four of five major cities the country and also has timeshare units and two casinos. As of 2015, the top two major shareholders were Brainworks Capital Management (Pvt) Ltd and Old Mutual Life Assurance Company Zimbabwe Limited, who both had a holding of 57% and 24% respectively (http://www.africansunhotels.com/about-us/shareholder-s-profile). The board consists of 7 males and 2 females, 7 of whom are non-executive directors. In the past, the company leased and managed hotel properties, but has restructured its business so as to become a hotel investment company, ceding most of its hotel management duties to another company, Legacy Hospitality Management Services.Reasons for choosing African Sun Limited

Growing up, African Sun hotels were always my mother’s favorite destination whenever we travelled, and I chose to select this company because of that. I have stayed in a number of their hotels, and in my opinion, enough the times to be able to relate my experiences with the information I will discover during the research process. I found it quite interesting that African Sun had all the beautiful pictures of its hotels and locations on their website. I want to understand whether the appealing picture presented to the public is seen in the same light by shareholders and other stakeholders. Given that the company is operating in an unstable and somewhat retrogressing economy, digging deep into the numbers and facts of the issues will give a better picture of the success and failures, if any, that the business has faced and is still facing.Research objectives

- To find out how the company has been operating financially in the period under review

- To find out how strong the market share of the company is, and whether it is strong enough to help them withstand changing preferences in the market and probable competition

- To find out if the company is raking enough profits in order to survive the economic hardships which are currently experienced by businesses operating in Zimbabwe

Research questions

- From a financial perspective, how well has the business been run over the three years from 2014 to 2016?

- Using an estimate, what is the market share of African Sun?

- Has the company managed to maintain its client base in the face of a changing business environment and probable competition?

- To what extend have the profits been adequate for the company to be considered as going concern, even into the future?

Overall research approach

I will examine and assess the financial performance of African Sun Limited over the last 3 years, by making use of the two models detailed below. Application of these models will provide me with the information I can then use to assess the performance of the company in question. I will also assess the financial performance of Rainbow Tourism Group, the competitor I have chosen for the purpose of this research. In addition to that, an examination of the business performance of the company in question over the same 3 year period will be done as well. Assessment of the business performance of the competitor will be detailed but not as much as that of African Sun. My next approach will be to obtain industry averages and market indicators which will be helpful when comparing all the results I will have gotten. My sources will be newspaper and scholarly articles, books published which are available in libraries and over the internet as well as any other material that can prove to be useful in the research. Part 2Sources of information

Boswell writes the following words spoken by Samuel Johnson, ‘Knowledge is of two kinds. We know a subject ourselves, or we know where we can find information upon it.’ (The life of Samuel Johnson, Volume 1, 1791).Primary data

This is generally the most reliable source of information as it details the first-hand account of what took place. Sources of this data would be speeches, letters, live recordings, historical documents e.g. birth certificates, diaries and so on. Care should be given to primary data as it may be subject to views or beliefs that are not subscribed to by the majority. It would therefore be wise to try and get this primary data from varied sources so as to reach a conclusion that is more widely accepted (https://www.skillsyouneed.com/learn/sources-info.html, 2011-2017).Secondary data

This is information provided in retrospect. An example of this would be a newspaper article where the editor seeks to communicate what happened, and this usually done within the context of the message that he/she may be trying to put across. Secondary data is therefore often subject to bias and misinterpretation of the actual facts of the primary data (https://www.skillsyouneed.com/learn/sources-info.html, 2011-2017).Methods used to gather information

Research and study of existing organizational material published by African Sun Limited. Research and study of articles, journals, books and other resources written by third parties about issues related to and affecting African Sun Limited and its competitors Questionnaire through the use of an online form to obtain information from the hotel’s previous customers regarding their stay and level of satisfaction of the services providedLimitations of gathering information

Inconsistent information over the three year period for RTG in that they published an annual report in 2014 and in 2015 and 2016 they only published abridged financial statements Inconsistent information provided by African Sun as well because of the restructuring that took place in 2015, where they moved the end of their financial year from September to December Outdated information regarding trends and statistics of the tourism industry in Zimbabwe such that the latest information available is up to 2015. Failure of Zimbabwe tourism industry to provide updated information was a limitation when I tried to determine the direction that certain issues had taken beyond 2015. My inability to have direct contact with an individual from the company in order to get primary/first-hand information about issues/challenges that the business was facing, especially because I was doing my research from abroad. Information available from newspaper articles is limited because reporters write the same thing about a common topic. The articles I read were structured the same way, and they contained the same information, lacking application of various ideologiesEthical issues encountered and how they were resolved

As I worked on this project, I faced one ethical issue. However, the code of ethics was not hard for me to apply during the course of the research because it directly links and agrees with my personal values, which I strive to uphold first and foremost. The code of ethics details that members, and students alike, should uphold the principles of integrity, objectivity, professional competence and due care, confidentiality and professional behavior. The principle of integrity requires me to be honest in all personal and business relationships. During my research, I created relationships with people I would need help from to complete the research. I received a few enquiries on what the information I had requested in my questionnaire was for and how it would be used. I was honest about my intentions of how I would use the information, in order to create a sense of trust that there was nothing unethical taking place, for which I am thankful that my counterparts did understand that my intentions were pure and solely academically related.Models to be used in the project and their limitations

Ratio analysis

This is one of the ways used to break down the volume of data contained in financial statements into understandable information. Ratios are used to reveal relations between absolute values of financial items through converting them under common bases, such that they obtain a meaningful comparison between financial data of different entities or that of the same entity but over a period of time (Financial Statement Analysis - second edition, Gokul Sinha, 2012).Types of ratios

Different ratios are used to analyze the varying elements of a company’s financial state and its performance. The elements are commonly known as profitability ratios, liquidity ratios, leverage ratios and activity ratios.Profitability

These compare income with sales and measure how well a company generates profit. Common profitability ratios are gross profit margin, operating profit margin and net profit margin. When calculating these, the denominator is always the same and the numerator changes, depending on which level of income you wish to calculate. Other profitability ratios are breakeven point, margin of safety, return on equity, return on net assets and return on operating assets (Analysis of Financial Statements – second edition, By Pamela P. Peterson, Frank J. Fabozzi,).Liquidity

“The liquidity of an organization is the ability to make payments as they fall due” (Managing liquidity, Lance Moir, 1997). A company’s liquidity needs is based on the duration between the time the cash is invested in goods and/or services to the time that those services produce more cash. The longer the time, the greater the company’s need for liquidity. Ratios used to illustrate this are the liquidity index, current ratio, quick ratio and cash coverage ratio (Analysis of Financial Statements – second edition, By Pamela P. Peterson, Frank J. Fabozzi,).Leverage

These are also known as debt ratios, they reveal the extent to which the company is using debt to finance its daily operations, and the likelihood of the company’s repayment. Leverage ratios also evaluate a company’s capital structure. In general, having high leverage is risky as it could lead to bankruptcy when business is low. Examples of these ratios are the debt-to-equity ratio, debt-to-asset ratio, capitalization ratio, debt ratio and equity ratio (https://www.readyratios.com/reference/debt/financial_leverage.html, 2011-2017).Limitations of ratio analysis

Ratios cannot be used in and of themselves. They only show the relationship between two items or two groups of items. Users of ratios are required to have a deep and clear understanding of how the ratios are calculated and of the financial grouping or line item extracted from the financial statements which represents each calculation. Ratio analysis can only explain relationships between current and past information, and does not give privy to future results and relationships between information which becomes useful when it comes to budgeting and decision-making. (http://accountingexplained.com/financial/ratios/advantages-limitations)Trend analysis

This method is otherwise known as historical analysis or horizontal analysis. The process involves the use of historical data to come up with meaningful information regarding each line item in the financials. The need and usefulness of trend analysis is in that financial statements can never provide information that shows the relationship between items over a period of time.Limitations of trend analysis

Trend analysis alone cannot identify the causes of differences. It will take further research and insight to know why and how the differences appear. There is no guarantee that past trends will continue in future. Trend analysis therefore becomes limiting when used in budgeting and forecasting as the future results cannot be predicted. (Financial Statement Analysis - second edition, Gokul Sinha, 2012)Business Analysis Models

To analyze the business performance of African Sun Limited, I will make use of Porters Five Forces Model and the SWOT analysis.Porters Five Forces

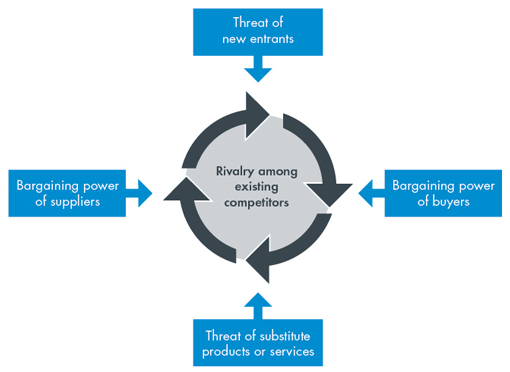

The model is used in the field of strategy, to assess the competitive forces that are faced by a company in a particular industry. Michael Porter identifies 5 forces that make up the structure of the competitive environment as shown below.

Threat of new entrants

New entrants to an industry increase competition and capacity, and the strength of this force is usually dependent on the barriers to entry that are in place and the response of the existing players towards the introduction of a competitor. There are different types of barriers to entry, and each industry is likely to have some that work best for it and others that don’t.Bargaining power of customers

Customers are always looking for better products at lower prices. A consumer’s success at getting good quality at a low price may shrink the company’s profit margin. Companies will therefore need to be wary of their competitors pricing and quality of products as this will directly impact their own profitability.Threat of substitute products and services

Substitutes can be identified as existing or potential products which are able to perform the same function as the one under review (Analyse the hotel industry in Porter Five Competitive Forces, Dr. David Y Cheng). They are always there, but may be hard to identify and easy to ignore because they may be different from the service or product offered. (https://www.cleverism.com/threat-of-substitutes-porters-five-forces-model/, 2017)Bargaining power of suppliers

Suppliers can influence the pressure for higher prices through a variety of ways. One of them being their knowledge of how important their product is towards the development of the final deliverable by the customer. Another is where they are the sole supplier, they can inflate the prices for that reason alone.Rivalry amongst existing competitors

High competition can come with market growth, greater capacity, price reduction, investment in new products and innovation and higher spending on advertising. Rivalry for a share of the market becomes intense when differentiation of the product/service is low, and when the costs likely to be faced by the customer for switching from one hotelier to another are also low (Analyse the hotel industry in Porter Five Competitive Forces, Dr. David Y Cheng).Limitations of Porters 5 forces model

One of the main limitations of this model is that it confines the company’s capabilities to basing them on industry influences alone without considering its various competencies, which may very well be good enough to restrain the effect of the negative forces from the market and enable profitability. This models also fails to look into the chances and opportunities of creating a new market, which may be a well worthwhile option, especially for companies under competitive threat. (https://strategiccfo.com/porters-five-forces-of-competition/, 2016)SWOT Analysis

The term SWOT is an acronym for Strengths, Weaknesses, Opportunities and Threats. This tool is to identify internal and external factors that will impact the formulation of a business’s strategy. Performing a SWOT analysis is helpful when it comes to making decisions, especially those that will facilitate the continuity of the company. (The SWOT Analysis, By Anja Böhm) Strengths - these are internal factors that place a company in a competitive position and increase its chances of success and survival when compared to its competitors Weaknesses – these are the opposite of strengths. They can be understood as threats to the survival of a company Opportunities – they are external forces that may boost a company’s competitive advantage. A point to note here is that these opportunities may be availed to the company as well as competitors at the same time Threats – these present a danger or warning sign for companies to keep watch of as such issues have the potential to compromise a company’s survival or competence in an industry (The SWOT Analysis: A key tool for developing your business strategy, By 50MINUTES.COM,). (https://www.kvrwebtech.com/blog/understanding-swot-analysis-need-business/, 2015

(https://www.kvrwebtech.com/blog/understanding-swot-analysis-need-business/, 2015

Limitations of SWOT

The upside of a SWOT analysis is that its results can lead to a fast analysis of the situation and this enables quick solutions to be developed. The downside of that at the same time is in developing fast solutions various other underlying yet crucial matters may be ignored or overlooked. Another thing is that the different aspects of the SWOT are not stand alone factors that are exclusive of each other. The model should therefore be used with an open mind (The SWOT Analysis: A key tool for developing your business strategy, By 50MINUTES.COM,). PART 3Financial analysis

Revenue

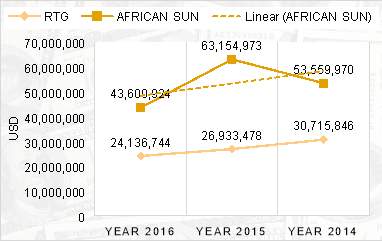

Source: Appendix E

The revenue of African Sun decreased by 18.59% from 2014 to 2016, with the highest reported figure of $63.15 million for the 15-month period to December 2015. In as much as the reports show an increase in revenue in 2015, when comparing the figures on a like for like basis, and assuming the inflows were spread out equally throughout the period, the revenue on a 12-month basis actually decreased by 5.67% from 2014. According to the Chairman’s financial review, this drop was caused by a drop in the average daily rate, and a major contributor to this being the introduction of VAT on foreign revenue. In as much as there was a slight increase in the room occupancy rate of African Sun in 2015 by 1%, which was contrary to the decline in national average during the same period by 1% as well, the effect of the drop in the average daily rate of each room led to a net decrease in income for the company. (2015 Annual Tourism Trends Statistics Report)

The revenue of RTG also took a slump, reporting a decrease of 21.42% from 2014 to 2016, which comes as no surprise since all companies in the industry were affected by the introduction of VAT (http://www.financialgazette.co.zw/vat-eroding-zims-tourism-competitiveness/, 2015).

The weakening of the ZAR to the USD is another contributor to the slump in revenue since South Africa is a major contributor to tourist arrival in Zimbabwe. Adding to that, the inflow of visitors from international markets was distinctly lower than before as the weakening of regional currencies made Zimbabwe a more expensive destination.

Many factors would influence the decisions of travelers in visiting Zimbabwe, which is currently ranked at number 114 of 136 countries as assessed by the World Tourism Organization. In as much as the country was considered to be the 53rd country with competitive prices, this alone was not enough to keep the country scoring high and attractive enough for foreigners (World Economic Forum; The Travel & Tourism Competitiveness Report 2017).

Source: Appendix E

The revenue of African Sun decreased by 18.59% from 2014 to 2016, with the highest reported figure of $63.15 million for the 15-month period to December 2015. In as much as the reports show an increase in revenue in 2015, when comparing the figures on a like for like basis, and assuming the inflows were spread out equally throughout the period, the revenue on a 12-month basis actually decreased by 5.67% from 2014. According to the Chairman’s financial review, this drop was caused by a drop in the average daily rate, and a major contributor to this being the introduction of VAT on foreign revenue. In as much as there was a slight increase in the room occupancy rate of African Sun in 2015 by 1%, which was contrary to the decline in national average during the same period by 1% as well, the effect of the drop in the average daily rate of each room led to a net decrease in income for the company. (2015 Annual Tourism Trends Statistics Report)

The revenue of RTG also took a slump, reporting a decrease of 21.42% from 2014 to 2016, which comes as no surprise since all companies in the industry were affected by the introduction of VAT (http://www.financialgazette.co.zw/vat-eroding-zims-tourism-competitiveness/, 2015).

The weakening of the ZAR to the USD is another contributor to the slump in revenue since South Africa is a major contributor to tourist arrival in Zimbabwe. Adding to that, the inflow of visitors from international markets was distinctly lower than before as the weakening of regional currencies made Zimbabwe a more expensive destination.

Many factors would influence the decisions of travelers in visiting Zimbabwe, which is currently ranked at number 114 of 136 countries as assessed by the World Tourism Organization. In as much as the country was considered to be the 53rd country with competitive prices, this alone was not enough to keep the country scoring high and attractive enough for foreigners (World Economic Forum; The Travel & Tourism Competitiveness Report 2017).

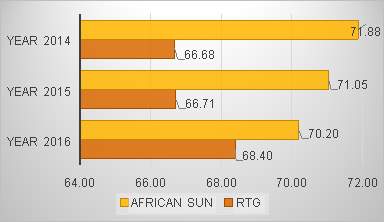

Gross profit margin

Source: Appendix E

Comparing the figures given, the gross profit increased by 16.6% in 2015, but these are not results compared on a like-for-like basis. Considering that the period reported in 2015 was a 15-month period, and assuming the profits were accrued evenly throughout those months, the gross profit earned within a 12-month period was $35,898,024.80 which resulted in a 6.8% decrease from the year 2014. Meanwhile, during the same period the revenue generated was $50,523,978.40, which was a decrease of 5.7%. Using the revalued amounts for a period of 12 months to compare the 2016 figures, gross profit decreased by 14.7% and revenue by 13.7%. Without considering other technicalities which would alter the results such as the change in reporting date which took place in 2015, the net effect throughout the 3 year period then becomes an approximate decrease in gross profit by 20.5% and a decrease in revenue by 18.6%. It therefore makes sense that we have a slight decrease in gross profit margin of 2.3% throughout the 3 year period, which almost equals the 2% difference between the decrease in gross profit and that of revenue. According to the introductory statement by the African Sun’s Chairman in their annual report of 2016, the operating environment in Zimbabwe continued to deteriorate, and that was evidenced by a negative inflation rate of 0.93% (African Sun Annual Report, 2016). My findings suggest that one of the major revenue generating streams for African Sun was from meetings and conferences, which was cut down significantly due to the countries liquidity crunch. Companies had to change how they held their meetings and trainings, from doing it in hotels to finding cheaper solutions like having them at their operational premises, all in an effort to cut costs. RTG on the other hand experienced a 12.3% decrease in gross profit in 2015, and a further decrease, but at a slightly lower rate of 8.1% in 2016. Revenue decreased by the same percentage as gross profit in 2015 and in 2016, by 10.4%. In 2016 RTG managed to increase their gross profit margin by 2.5%. This however did not change the company’s financial state because they were still operating in losses, and in fact, almost 9 times the losses of the previous year.Quick ratio

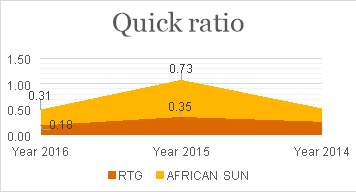

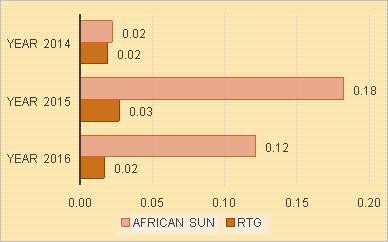

Source: Appendix E

The quick ratio shows a company’s ability to pay off its short term debts with its assets that are easily converted into cash (Investopedia, 2017). The ideal result will be to have a ratio of 1:1 or higher, which would indicate that the company is able to meet its short-term obligations. African Sun seemed to have been struggling to reach the desired result between the years 2014 to 2016. Their quick ratio was at its worst in 2014 and made an improvement of about 180% in 2015. However, the peak was temporary, as in 2016 the ratio came back down to 0.31, a decrease of 57.5%. In 2015, African Sun reduced their current borrowings by almost 50%, from $10.6 million to $5.4 million. On the other hand, and mainly because of the costs related to the cessation of foreign operations, their provisions for such liabilities increased by almost 300%. At the same time the company’s cash and cash equivalents increased by 280.5% which may have been due to the disposal of investments in Dawn Properties Limited (African Sun Annual Report, 2016). RTG’s quick ratio was very low as well, and it only became worse in 2016, where it was only slightly more than half of the average of 0.26. Comparing the quick ratio with the current ratio, quick ratio enables us to see the portion of inventory within current assets. For the three years, this proportion was the same, therefore the change in ratio was caused by the near 80% increase in current liabilities. The increase was because of an urgent need to clear a loan of $10 million excluding interest where negotiations to settle that amount in the long-term failed and the courts ruled that RTG should pay off its debt. This left the company in a worse state than before. Through an analysis of the figures, RTG would struggle to settle this amount, the interest that had accrued and all fees related to the case.Cash coverage ratio

Source: Appendix E

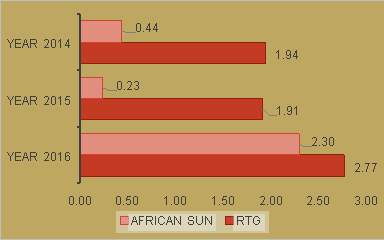

African Sun’s cash ratio indicates an improvement from 2014 to 2016. There is an overall increase from 0.02 to 0.12 through the three years. The ideal result would have been anything greater than 1, as this would show that the company is just able to meet its obligations (for a ratio of 1) or that it can repay and still have some funds left over which can be used for investment purposes or any other use which will grow the business. In light of that, these results are worrying, and provided the trend continues, it can be assumed that African Sun will not be able to survive the hard times and may have to close doors. Looking at the competitor of African Sun, the results are worse as there is no improvement during those three years. RTG’s ratio remains at 0.02 at the beginning and end of the period in question. This comes as no surprise, considering the economic hardships that the country faced during these years. The government of Zimbabwe through the Reserve Bank imposed cash withdrawal limits throughout the country. Within a space of about two months, the cash withdrawal limits changed from US$500 to US$40, and presently the crisis still continues as the US dollar is no longer available in the market (Zimbabwe cash crisis: An analysis of the real reasons behind, By Eddie Cross, November 2016). Such changes resulted in lower spending, and therefore a low cash coverage ratio for both African Sun and RTG from 2014 to 2016.Debt-to-Equity ratio

Source: Appendix E

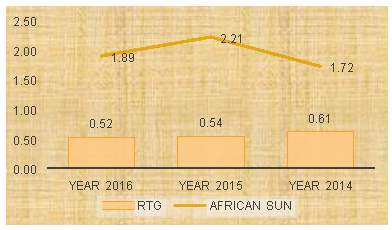

The growth of African Sun’s debt-to-equity ratio was 10 times more in 2016 as compared to the result in 2015. They moved from a position of having more of equity finance to one of very high debt. Their liabilities decreased by about 42% in 2015, which resulted in a decrease of the ratio by about 48%. As for RTG, their debt-to-equity was totally different from that of African Sun. Their assets were mostly funded by debt, and this became even worse when the ratio shot up from 1.9 to 2.8. Chances that they would manage to secure additional finance if required would be low, given that their level of debt was way above their equity value. It would be somewhat misleading to conclude that African Sun has a better contribution scheme to RTG in terms of their debt and equity funding as different companies use different financing strategies based on the nature of their businesses and their end goals. Also, the basis of conclusion would depend from whose perspective we are considering the results as both the shareholders and the creditors have differing interests. Comparing these results with the industry average, (LOOK FOR INDUSTRY STATS TO COMPARE THESE RESULTS WITH!) In African Sun books, there was a sudden appearance of amounts due to related parties, which is what largely contributes to the change in the ratio. From nothing to $10 million. The change can about due to (FIND WHAT CAUSED THE SUDDEN INCREASE IN LIABILITIES)Total Asset Turnover

Source: Appendix E

African Sun has managed to create a good amount of wealth given the assets that they have. The results indicate that they made almost double the revenue from the assets that they used. The peak in 2015 may have been due to the company’s sale of part of the their operations. According to the chairman, in his message to the readers of the 2015 annual report, “the board made a decision to exit all operations that were not self-sustaining in order to avoid subsidization by other business operations.” As a result this artificially changed the company’s asset turnover ratio to reflect the major once-off transaction as the company’s revenue was now applied to a lower value of assets, hence the increase. RTG’s performance was the opposite of their rival company. They only managed to generate half of the value of assets they used to operate. This trend was generally constant with a very slight decrease from year to year. This is usually the case when there is excess production capacity or ineffective revenue collection methods (government not paying??). RTG experienced these low levels of asset turnover partly because of their low occupancy rates. In 2015 the occupancy rate was 56% and in 2016 that reduced to 55% and this goes to show that 44% and 45% of the rooms were unoccupied through the two years respectively.Business Analysis

SWOT Analysis

Strengths

Hotels offer services which directly impact the decisions of tourists when deciding on a destination. In most cases, the ideal is to have a safe and peaceful place to sleep while relaxing on holiday, or even during a business trip. As such, the success of the hotel industry is partially linked to that of the tourism industry.1. Ownership of internationally recognized brands:

African Sun changed their business setup in 2015, from that of being an operating company to an investment one. Five of the company’s largest hotels were taken up for management by Legacy Hospitality Management Services, a successful hotelier with four and five star operations in key tourism and business locations in South Africa, Ghana, Nigeria, Gabon and Namibia (https://www.theindependent.co.zw/2015/08/21/african-sun-courts-sas-legacy-hotels-group/, 2015). The change took place in 2015 and positive results were expected in 2016, due to the hotels improved ratings as well as the closure of other loss making operations within the region. The restructuring left African Sun with hotels which were rebranded according to international standards, thus boosting their international presence. They have also maintained their franchises with IHG, another internationally recognized brand, and plan to continue rebranding their other properties in line with the new strategy.2. Locations in tourist destination:

The company has hotels in all major tourist destinations in Zimbabwe as well as some major cities like Harare, Bulawayo and Mutare (African Sun Annual Report, 2016). This has helped them to ensure that they have a presence in each area where the hospitality business is likely to boom especially due to the increasing success of the tourism industry, and can take advantage of opportunities as they arise.Weaknesses

1. Exposure to insufficient human capital

The company’s board authorized their management to further implement the structural changes by dismissing 9 management personnel so as to cut down on costs. This left African Sun with significantly reduced human capital and increased exposure to chances of being unable to adequately manage the functions which had been head by those nine individuals previously, of which if the risk was high, it would negatively affect the company’s business operations. The roles were taken up by other members of existing management, and some were not completely in line with their current responsibilities. For example, the chief executive became responsible for all operations oversight functions, casino functions, as well as the sales and marketing functions, in addition to his pre-existing duties (https://www.newsday.co.zw/2015/08/african-sun-chops-9-managers/, 2015).2. Loss of reputation and societal confidence

In 2016, African Sun retrenched 219 employees in an effort to cut costs (https://www.dailynews.co.zw/articles/2016/06/21/african-sun-retrenches-over-200, 2016). This move was in line with the company’s new strategy, but is likely to have impacted their local clientele in a negative manner, leaving the public confused about whether their new strategy incorporated their corporate social responsibilities in any way.Opportunities

1. Completion of the Victoria Falls Airport:

African Sun owns hotels in a city that hubs one of the 7 wonders of the world. An article written by Gavin Haines details that there are prospects of new direct flights arriving at the airport which has a runway that can accommodate some of the world’s largest jets. The airport was unveiled in November and is capable of handling about 1.5 million people a year (Telegraph Media Group Limited 2017). African Sun can therefore expect increased revenues and cash flow through the increased number of foreign arrivals and inflow of foreign currency, as opposed to the situation that has prevailed in the past. As mentioned above, African Sun holds the highest concentration of rooms in Victoria Falls and can maximize on this advantage.2. Relaxation of VISA requirements and processes:

In March 2016 the Zimbabwean government relaxed their tourist visa requirements in an effort to boost the tourism sector. The Department of Immigration principal mentioned that all SADC countries would have VISA free access to Zimbabwe and other countries which were in category C of the 3-tier VISA model would move to category B. Some passport holders are now also privileged to the convenience of applying for their VISA’s using an online portal (http://www.herald.co.zw/zim-relaxes-visa-requirements/, 2013). These changes make it easier for outsiders to gain access to Zimbabwe and resultantly give better opportunity to the hotels to be more profitable through increased occupancy and revenue generation.Threats

1. Introduction of VAT:

VAT was introduced in mid-January 2015 to be at 15% of foreign accommodation sales. According to Mr Ngwenya, the president for the Zimbabwe Council for Tourism, this would threaten the growth of tourism, the viability of hospitality operators (http://www.herald.co.zw/vat-a-threat-to-tourism-growth/, 2015). The change in this law was passed before the VISA requirements for foreigners were relaxed, and the benefit of having more people with greater accessibility to the country is less than it could have been. From a financial perspective, the introduction of VAT will not only stifle the growth of foreign markets but also make Zimbabwe a less attractive destination, which may leave African Sun as well as its competitors struggling with low foreign revenue.2. Deteriorating economic growth

Zimbabwe has been facing numerous economic hardships for the past few years which have inevitably affected the hotel and tourism industry. The growth rate took a slump from 3.9% in 2014 to 0.6% in 2016 (https://tradingeconomics.com/zimbabwe/gdp-growth-annual, 1961-2017). This condition reduced the number of local visitors into the country, and also made it difficult for companies to raise capital and grow their businesses. African Sun was no exception to this, and it still isn’t.Porter’s five forces

Threat of new entrants

The threat of new entrants in the hospitality industry is usually minimal due to the high setup costs that operating a hotel usually come with. Recent reports state that hotels, who’s focus is on the Zimbabwean market will have to welcome a competitor, Radisson Blu Hotel Harare, as the Carlson Rezidor Hotel Group opens doors in 2019. The Group has a global footprint covering 115 countries and has 1400 hotels in operation. A report by the Herald states the hotel is expected to be located along Chapman Golf Club, with 245 rooms and right in the CBD of the capital, making it convenient for locals and business travelers to reach the premises (http://allafrica.com/stories/201606240438.html, June 2016). There remains excess capacity for new entrants to penetrate the hospitality market and succeed. The increase in the number of arrivals into the country did not result in increased occupancy. Most people were visiting friends and family and therefore had no need to make use of the hotel rooms available to them (2015 Annual Tourism Trends Statistics Report ). From that perspective, it would be debatable whether the increase in competition will yield more returns in this case. In a recent article, the BCC economic development officer, Brian Hlongwane, mentioned that there is a lot of opportunity for Zimbabwe’s second largest city, Bulawayo, to expand its hospitality industry by building more hotels, conferencing facilities and especially a five-star hotel, seeing that the highest rated hotel within the region is a three-star. He also mentioned that there are sites which have been set aside for the purpose of this development (https://www.newsday.co.zw/2017/08/bcc-calls-investment-citys-hospitality-industry/, August 2017). This too would pose a threat to African Sun as there is capacity for new and better players to establish themselves within the region, as they respond to the call from Brian Hlongwane. There are a number of factors that threaten the emergence of competitors in the hospitality business as well as any other for that matter. Issues like the indigenization law and hyperinflation are two of the main factors that are considered by outside investors. Local entrants are restrained by the weak economic growth rate, shortages of cash and lack of sound financial systems to aid in the development of new business (The Irish Times, May 2015). This industry requires a great amount of capital injection towards infrastructure, furnishings, buildings and even staff. All these act as barriers to new entrants, as well as deterrents of growth for existing operators like African Sun.Bargaining power of customers

Consumers within the hotel industry can be grouped into 4. Backpackers prefer to spend as little as they can on a hotel room because they are more inclined to exploring the outdoors. Couples usually choose to spend more on a luxurious hotel room. Families have very specific needs. Hotels try to accommodate this group by creating an environment that is kid-friendly by offering children’s menus and discounts to amusement parks. Lastly are the business travelers whose attention on cost is oftentimes outweighed by their access to business related services like access to a telephone, printing and faxing, fast internet, etc. In as much as business travelers may travel in small numbers at times, they travel often and may account for almost half of a hotels guests (Consumer Segments in the Hotel Industry, Catherine Capozzi, 2017). Consumers of African Sun’s conferencing services such as NGO’s and government bodies can be said to have a relative amount of bargaining power, given that they are able to bargain for discounts and set the price they will pay for the provision of services they desire. However, in as much as they may bargain, the company does not rely on any one customer to reach their profit targets or to generate revenue. The regular hotel customers were also quite powerful as they managed to push African Sun to decrease its prices in order to remain competitive. There was a decrease of 5% in occupancy rate and revenue per available room (RevPAR) fell by $4 between 2015 and 2016 (African Sun Annual Report, 2016). These decreases were caused by the lack of demand and limited access to disposable income.Bargaining power of suppliers

A supplier is powerful when their total income cannot be compared to what they receive from one customer. They are powerful when they have been providing differentiated/specialized products, and the customer faces high switching costs and potentially lower quality if they are to change their source of supply. The situation worsens where there is no substitute for the product/service provided, and the business has no option but to succumb to provision of those services at an inflated price (On Competition, Michael E. Porter, 2008). A supplier which is likely to exercise power over any company in the hospitality industry is one who provides well-experienced labor and training, primarily because to a large extent, the success of the hotel industry is based on the quality of service offered by those who attend to the guests (Analyse the hotel industry in Porter Five Competitive Forces, Dr. David Y Cheng). The costs of developing such a team will be very significant especially considering the number of employees. It is likely that the company will continuously use one specific service provider to achieve this goal, as appropriate attention must be given to that area of service delivery. Given that the supplies used by African Sun are not differentiated, the company is unlikely to face any threat. However, a threat could be prevalent in the sense of the supplier closing business, where they are unable to meet the demand due to the economic conditions which have caused most operations in Zimbabwe to either operate on a smaller scale or shut down.Threat of substitute products

Substitute products become more of a threat when they are better priced, when they are of better quality and when there are low switching costs to consumers. Consumers would face monetary costs of switching from one product to the next and/or lifestyle switching costs. The easier and cheaper it is to switch from one product to the other, the higher the threat of the substitute (http://valuationacademy.com/threat-of-substitute-products-or-services/, 2010-2017). African Sun is threatened by local consumers’ options of staying at a friends or relatives house while on travel. Other customers coming from outside the country at times opt to rent a house for the duration of their stay. This is done in place of spending money on a hotel room so as to save a little more of the limited cash resource which is available in the country (2015 Annual Tourism Trends Statistics Report). In terms of conferencing services, a substitute which has become popular in the recent past is that of video conferencing. The ICT developments all over the world are moving fast, making it easier for people to collaborate and have meetings virtually as opposed to meeting in person and resultantly spending on hotel stays.Rivalry among existing companies

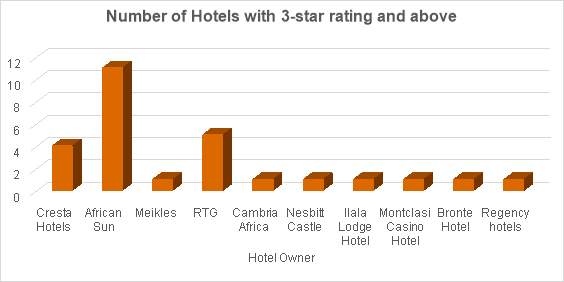

African Sun has been identified as one of the leading hospitality companies in Zimbabwe. It is surrounded by competitors like Rainbow Tourism Group, Cresta Hospitality, Meikles Hotel and other small players in the market as shown below. Source: Appendix F

Given the information above, it is obvious that African Sun has the greater share of the market and its closest rival is RTG.

The Hotel industry in Zimbabwe is very slightly differentiated as most brands offer the same products and services. Looking at African Sun and RTG for example, their hotels are present in the same areas and customers can expect the same services from them, i.e leisure, business, conferencing and banqueting. The majority of the hotel rooms are targeted to the mid-range travelers who prefer to have an economical mix of luxury and comfort.

The intensity of rivalry becomes high because most of the players within the industry offer the same services and products and it is therefore easy for a customers to change suppliers given that they get the same basic product regardless of the options available.

It would be important to note that because of the economic turmoil which the country has been facing for some years, operators within the leisure and hospitality industry have been working on capitalizing on their banqueting and conferencing segments. The domestic market continues to be depressed and now the bulk of local business comes from conferencing by NGO’s and local government bodies, who too are price sensitive given that they have also been impacted by the hardships of the economy (African Sun Annual Report, 2016). This creates a great deal of rivalry as the scramble for customers is intense by the numerous providers, because they realize that customers are making use of alternatives, e.g using their office spaces, or cheaper options available in the market, to conduct their regular meetings and conferences. The current rivalry in this segment of the industry is therefore intense. A slight advantage which African Sun may have is that it is the leading hotelier within Zimbabwe, operating internationally recognized brands which keep the company attractive enough when compared with existing competition, especially to multinational companies and external customers.

CONCLUSION AND RECOMMENDATIONS

Source: Appendix F

Given the information above, it is obvious that African Sun has the greater share of the market and its closest rival is RTG.

The Hotel industry in Zimbabwe is very slightly differentiated as most brands offer the same products and services. Looking at African Sun and RTG for example, their hotels are present in the same areas and customers can expect the same services from them, i.e leisure, business, conferencing and banqueting. The majority of the hotel rooms are targeted to the mid-range travelers who prefer to have an economical mix of luxury and comfort.

The intensity of rivalry becomes high because most of the players within the industry offer the same services and products and it is therefore easy for a customers to change suppliers given that they get the same basic product regardless of the options available.

It would be important to note that because of the economic turmoil which the country has been facing for some years, operators within the leisure and hospitality industry have been working on capitalizing on their banqueting and conferencing segments. The domestic market continues to be depressed and now the bulk of local business comes from conferencing by NGO’s and local government bodies, who too are price sensitive given that they have also been impacted by the hardships of the economy (African Sun Annual Report, 2016). This creates a great deal of rivalry as the scramble for customers is intense by the numerous providers, because they realize that customers are making use of alternatives, e.g using their office spaces, or cheaper options available in the market, to conduct their regular meetings and conferences. The current rivalry in this segment of the industry is therefore intense. A slight advantage which African Sun may have is that it is the leading hotelier within Zimbabwe, operating internationally recognized brands which keep the company attractive enough when compared with existing competition, especially to multinational companies and external customers.

CONCLUSION AND RECOMMENDATIONS

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Analysis"

Business Analysis is a research discipline that looks to identify business needs and recommend solutions to problems within a business. Providing solutions to identified problems enables change management and may include changes to things such as systems, process, organisational structure etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: