Analysis of Kraft's Acquisition of Cadburys

Info: 15432 words (62 pages) Dissertation

Published: 4th Oct 2021

Tagged: FinanceBusiness Analysis

Abstract

This paper aims to critically evaluate the success of Kraft's acquisition of UK based company Cadburys. The essence of this paper focuses primarily on how mergers and acquisition “M&A” success is evaluated and whether Kraft’s acquisition of Cadburys was a success or not. Firstly, the paper uses literature, existing research, whether theoretical or empirical to explain the aims of acquisitions, the types of M&A, motives for acquisitions, the different ways of financing an acquisition, the different measures that can be used to determine whether an acquisition has been a success or failure and the main success factors of an acquisition. This was undertaken to provide the evaluative resource with which I used to help test in the second half of the paper whether Kraft’s acquisition of Cadburys was a success or not. Secondly, the paper will use data to describe the events, actions and outcome of Kraft’s acquisition of Cadbury. This will be followed by an Analysis section, in which I analysed all actual findings regarding the literature. Lastly, the conclusion summarises all findings and concludes the reason why ultimately Kraft’s acquisition of Cadburys was indeed a success.

Table of Contents

2.1 The Types of Mergers and Acquisitions

5. The main reasons why acquisitions fail

6.1 Announcement-effect event study measurement method

6.2 Long- term stock performance measurement method

6.3 Accounting-based measurement method

6.5 Managerial self-assessment method

6.6 Expert-Opinion Measurement Method

7.1 Organisation and Strategies Skills

8.1 Accounting based measurement method:

8.4 Managerial measurement method

8.5 Expert opinion measurement method

9.0 Measuring Kraft’s acquisition of Cadburys success

9.1 Organisation and strategy skills

1.0 Introduction

Reis et al. (2015) argues, M&A have long interested manager’s attention and have been explored by several viewpoints and using different theories. Barmeyer & Mayrhofer (2008) defined M&A as a strategic agreement amongst two or more autonomous corporation that choose to share their resources i.e. sales with the endeavour to reach common goals.

Hitt et al. (2012) maintained the judgment that M&A are a configuration of organizational augmentation which permits companies fast advancement, organic growth and that an acquisition is the taking over of one company by another either in a friendly way – i.e., when shareholders vote for the acquisition – or in an inimical manner – i.e., when the acquiring firm buys another firm’s equity in the stock market. Mayrhofer (2004) proclaimed that in a merger, firms combine their assets with the intention of creating a renovated company, whereas in an acquisition, one firm takes control of most of the capital of another corporation and unite the two companies.

Therefore, one could argue M&A are an effective way for companies to increase their operational domain in search for external growth (Wei, 2006). Nevertheless, most research indicates that most M&A are financial failures and produce undesirable consequences for the people and the establishment involved. This is because noteworthy evidence displays the idea that many M&A fail. Barmeyer and Mayrhofer, (2008, pp. 28–38), for instance, found that many M&A “remain unsuccessful”. Similarly, it is estimated” failure rates are typically between 60 and 80%” (Marks and Mirvis, 2001, p80).

Nevertheless, many academics argue that acquisitions are one of the most valued means to business growth (Grundy, 2003). Therefore, in this paper I will be evaluating the success of Kraft’s acquisition of the UK based company Cadbury. Firstly, there are many aspects of the M&A process that can contribute towards the success of a merger or acquisition. I will be focusing on the most common success factors set out in the literature in this paper, when evaluating the success of the Kraft-Cadbury acquisition.

Secondly, On Tuesday, January 19th 2010 Kraft agreed to procure Cadbury for 11.9 billion pounds ($19.6 billion) (Ruddick, 2010). The company borrowed £7bn ($11.5bn) to finance the deal (BBC, 2010). Additionally, Cadbury was not only not for sale, but it vigorously withstood the Kraft takeover (Moeller, 2012). Regardless of this in 2009 Kraft Foods launched a hostile bid for Cadbury (Wood, 2016).

Thirdly, Kraft’s motive to attain Cadbury was based on the intention that Cadbury would offer Kraft better accessibility to better progress in emerging markets along with some of the world’s prominent chocolate, sweets and chewing gum brands (Ruddick, 2010). Irene B. Rosenfeld maintained this claim by arguing “It transforms the portfolio, accelerates long-term augmentation and give forth highly alluring returns (Nicholson and Michael J. De La Merced, 2014).” Therefore, Kraft was interested in acquiring Cadbury since they believed the organisation would flourish as part of Kraft’s corporation (Butler, 2009). Finally, in this paper I will first consider relevant M&A literature, focusing distinctly on the analytic and evaluative utility of the theory therein. Thereafter I will thoroughly evaluate the success of Kraft’s acquisition of Cadbury.

2. Literature Review

2.1 The Types of Mergers and Acquisitions

M&A are characterised as either horizontal, vertical or conglomerate (Biller, 2016). Conn (1985) stated the dissimilar kinds of acquisitions are considered a substantial factor to contemplate when measuring a business’s success as it aids in determining whether a company’s M&A was a success or not.

2.2 Vertical M&A

Cartwright, (2014) states vertical M&A comprise of the combination of two parties from sequent processes in the matching businesses, therefore a vertical acquisition consists of a establishment obtaining another party which is also ‘above’ or ‘below’ it in the supply chain. For example, a company that accumulates oak furniture might buy a plantation establishment which increase oak trees, in that way safeguarding an orderly supply of raw materials in future (This is known as an ‘upward’ acquisition). On the other hand, the furniture company might buy a distribution company, to safeguard that its products are transported successfully to customers (please note: this is known as a downward acquisition).

Cartwright, (2006) states vertical M&A are advantageous to organisation using this system of measurement to decide whether their acquisition was successful or not since it arguably helps make strategic decisions. For example, the return on investment of the combined companies may not be higher after the acquisition, despite this the operational risk of the company may be lower (Lubatkin and O’Neill, 1987).

2.3 Conglomerate M&A

Conglomerate M&A, on the other hand, refer to the state of affairs where the attained company is in a fully inaccessible field of business activity (Gaughan, 2011). i.e. an investment establishment that purchases numerous companies in diverse industries.

Furthermore, the motive for this impression might be to support i.e. in the case Kraft decides to produce a high-performing, well-diversified collection of companies in their organisation. Also, a conglomerate M&A might buy a company because if the high returns it is earning, or to balance its portfolio. So, the return on investment after the acquisition might be expected to grow in the first case, but not necessarily in the second case (although the overall portfolio risk may decrease if the portfolio is more balanced).

2.4 Horizontal M&A

Horizontal M&A on the other hand “involve combination of two similar organizations in the same industry” (Gaughan, 2011). An acquiring company might make a ‘horizontal’ acquisition. This indicates purchasing a company which is of the same type, e.g. one bank buying another. Merritt (2016) supported this view by stating horizontal M&A include businesses that suggest the same products or services to the same kinds of customers. Horizontal M&A offer “economies of scale,” which means that that the regular costs lessen as the business does more business interactions. Such M&A also increase market share, although in the case of the horizontal acquisition mentioned above, the combined bank may be able to close branches in certain towns and cities where both banks operated, in this way, it would reduce its entire investment and cut its costs, without reducing revenues, the overall return on investment is therefore likely to improve (Bodamer, 2013). Therefore, there are three types of acquisitions which consist of different elements and which are measured in different ways, however success in each type of acquisition can be therefore be very different.

3. Motives

3.1 Synergy

Dutordoir, Roosenboom & Vasconcelos, (2014) puts forward the conception synergy gain is primarily the reason why firms undertake M&A. This is because two firms together are valuable more than the worth of the firms a part, which therefore makes the M&A a gain for the acquiring firm whether that be i.e. market power or economies of scale. For instance, the motive of market power is considered beneficial as it fetters the capacity for a company to raise prices directly above the level that would prevail lower than competitive circumstances (Long, & Link, 1983). Also market power is associated with cost advantages which will therefore benefit the acquiring company (Berger & Hannan, 1998). Nevertheless, this motive is criticised for not adhering to horizontal M&A (Gugler & Siebert, 2007).

3.2 Economies of Scale

Roller, Stennek & Verboven (2006) states Economies of scale is considered another reason for why some companies persist in trying to attain an M&A. This is because of the idea such as in the short run, as promptly as it is for physical assets to retain safe economies of scale, it may also cause the manufacturing of lesser costly amount, therefore short run economics of scale may well take advantage of newly acquired M&A as it helps to allow disposing of dual fixed cost. i.e., custodies that may consist of managerial employment, customer service, billing, etc.

De Paula & Fernando (2002), however criticised economies of scale by arguing shareholder gains have received support to extend the market value of the firm because of M&A, therefore since the advance in the value of the business immediately aids in helping its owners (shareholders) this is the reason why it is considered as a shareholder gain.

3.3 Bargain Buying

Arnold (2013), held the position that another reason some company’s pursued M&A surround the idea of bargain buying, this is because the target company can be bought at an amount below the current rate of the targets future cash flow when in the hands on new management. This argument also assist to eradicate inept and mislead management and improve underrated shares such as robust companies of partial sturdy form of stock market inadequacy.

On the other hand, managerial motive is considered a more efficient reason for pursuing an M&A since it helps to build a company’s empire, status, power, remuneration, hubris while trying to accomplish longevity by taking an immediate development of strategy that aids in reducing the likelihood of being takeover target (Arnold, 2013).

3.4 Interest Rates

Jensen and Ruback (1983), nevertheless proposed interest rates was another motive for acquiring an M&A. This is because often smalls businesses are not able to receive competitive interest rates because of liquidity restrictions or to unequal information in the external capital market, subsequently since a big company has better-quality accessibility to the external capital market that a small one has, which thus motivates acquiring firms to carry out M&A as it fetters the contingency for the new organization to borrow more cheaply than separate units.

4. The different ways of financing an acquisition, and the advantages and disadvantages of each method

See appendix A.

5. The main reasons why acquisitions fail

See appendix B.

6.0 Measuring M&A

6.1 Announcement-effect event study measurement method

Farma et al. (1969) argues the announcement is the most often used measurement method to measure acquisition performance. Cording (2010) implies this is because the announcement effect event study measurement method is arguably useful at times when studying the proceed of variables that are publicly known at the time period of the acquisition declaration such as strategic likeness, acquirer acquisition reputation, or pre-acquisition profitability.

Furthermore, this method is considered beneficial since when returns are evaluated over a moderately short period, aspects other than the acquisition that could potentially have an impact on the stock value can be eliminated (Cording, 2010). However, this measurement method is criticised on the grounds the assumption of rationality is questioned, this is because the events under study using this measurement method is majority of the time unexpected, which is therefore considered disadvantageous as the assumptions made may not be reliable which could potentially cause implications (Cording, 2010).

Brown & Warner (1985), states that for abnormal returns to accurately measure the markets valuation of an acquisition, its indication must first imitate new data for existing investors. Lubatkin and Shrieves (1986) however criticised this view on the grounds the assumption made can be questioned since investors may anticipate a company’s acquisition approach before the announcement takes place. Therefore because of the various assumptions required in the use of this method, and the weaknesses which result from these assumptions (as set out above), this method will not be applied in this study.

6.2 Long- term stock performance measurement method

Long term stock performance measurement method is another measurement method that is considered beneficial since it extends the time frame to one or more years to help capture more efficient information that is of use to investors and which also consists of allowing accurate estimates of future cash flows whilst reducing precariousness (Lubatkin, 1987). However, this method is criticised on the grounds long term stock performance method respecting to short-term measures of stock performance is impressible to influence factors that are unrelated to the acquisition of interest such as competitor’s product introductions that occur between the date of the acquisition and the termination of the time for which long-term performance is measured (Chatterjee 1986). Furthermore, this method is also criticised since it has methodogical problems. For example, test conducted using this method are essentially joint tests of stock market effectiveness and a model of market equilibrium as the stableness of the expected stock price is the basis of the measure. Additionally, concerns regarding this measurement method revolve around the idea that the fundamental expectations relating to costs are desecrated as per the event window being lengthened (Andrade et la, 2001). This therefore means that the results of long term expected returns and measures of long term abnormal returns are imprecise. Subsequently, because of the weakness of this approach it will not be used in this study.

6.3 Accounting-based measurement method

Cording (2010) states accounting based measurement method is based on accounting data which also captures a long-term perspective of acquisition performance. Return on equity “ROE” or return on assets “ROA” are considered a well-organized process for three years’ time frame after the acquisition, whilst maintaining returns that are assessed relative to the acquirer’s pre-acquisition accounting performance. This method is considered beneficial as it depicts the showing of actual returns a company may accumulate. Haspeslagh & Jemison, (1991), Zollo and Singh, (2004) similarly criticised this view because it tends to be destroyed during the integration process. Nevertheless, the method is arguably useful and generally better than i.e. the announcement effect event studies measurement since while it assumes that the efficiency of integration has the capacity to be projected from information taken in stock prices at the date of the acquisition, accounting methods are more advantageous as they are able to find a means of lessening the noise from this assumption by ultimately apprehending the performance implication of the integration since information is revealed during the integration process (Cording, 2010). Conversely, accounting based measures is criticised because mangers may manipulate accounting returns and company’s may take up different accounting procedures (Chakravarthy, 1986). In the same way, the method is also criticised for reflecting only past financial performance and providing no sign of future possibility (Montgomery & Wilson, 1986). On the other hand, accounting-based method is arguably useful since it has the capacity to understand the consequence of less visible factors that can be expected to have a direct impact on the acquirer’s financial results, such as modernising employee morale, target and acquirer’s cultural dissimilarity, or knowledge transfer (Cording, 2010). Hence, because the strengths of this method outweigh the strengths of the first two quantitative methods discussed, it will be used in this study using certain accounting ratios. These will be set out and discussed below.

6.4 Accounting Ratios

Profitability Ratio

Firstly, profitability ratio is a useful measure that helps to measure the financial performance of an acquisition. This is because profitability ratio helps to measure the economic activities of a company and evaluate a business efficiency levels Rani, Yadav, & Jain, (2015). Moreover, profitability ratios are advantageous as they are commonly used in comparative study and because it signifies a combined effect of financial asset and debt management on operational outcomes of a businesses’ doings which is considered beneficial (Brigham 1997).

Profitability ratios the paper will focus on:

| Ratios | What does it tell YOU? |

| Return on assets | This ratio aids in measuring the size and assess the cost-effectiveness of conducting assets by the means of an economic entity that could be done by means of the return on assets “ROA” indicator (Yadav & Jain, 2015). |

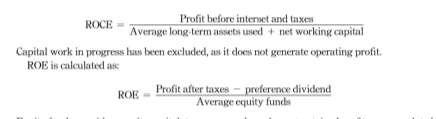

| Return on equity | ROE ratio is used to show and illustrate efficiency of equity, it is also used to assist in identifying issues such as those related to the estimation of equity level (Waśniewski, Skoczylas 2002). |

| Return on sales | ROS is implemented to aid in analysing economic behaviour and assess the effects that were made by the economic entity (Bednarski, 2001). |

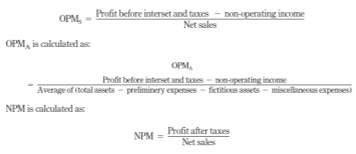

| Net profit margin | NPR is used to help calculate the results of the net profit as a proportion of the earnings in internal evaluation. (Accounting Tools, 2017) |

| Operating Profit Margin | A business’s operating profit margin ratio illustrates how well a company is doing in terms of their operations contribute to its profitability. For example, a company that has by means of substantial profit margin ratio can create more money on every single amount of sales than a company that consists of a small profit margin.

(The Balance, 2017) |

| Return on capital employed | ROCE is used to help figure out how efficiently financial capitals are organised by obtaining corporations. ROCE also helps to specifies how efficiently the long-term amounts of the holders and lenders remain being used and emphases straight on operating efficiency (ACCA, 2016). |

Efficiency Ratio’s

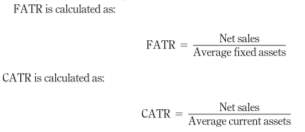

Rani, Yadav & Jain, (2015) argues efficiency ratio is used to help to measure the operational performance of the acquiring company before and after acquisitions take place i.e. fixed asset turnover and current asset turnover. In this study, I will be using current asset turnover “CATR” and “FATR” (fixed asset turnover) since they are the most effective efficiency ratio to use when measuring a company financial performance (Rani, Yadav, & Jain, 2015).

Leverage Ratio’s

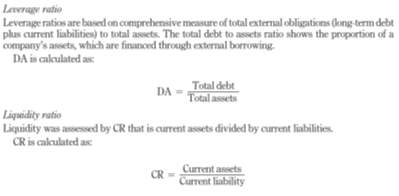

Secondly, financial leverage ratios help to measure effectively the value of equity that a business may have by evaluating the businesses debt. These sets of ratios also help to compare debt or equity to assets as well as shares unanswered to aid in measuring the correct value a company may have (Tahir & Anuar, 2015). Hence, in this study I will be using debt to asset ratio “DA” since they are the most useful leverage ratio to use when measuring a company financial performance (Rani, Yadav, & Jain, 2015).

Liquidity ratio

Thirdly, liquidity ratios are used to examine the capability of a business to pay off its existing current liabilities and its long-term accountabilities. In summary, these ratios display the cash levels of a company and the aptitude to navigate other assets into cash to help rectify and pay off the long-term liabilities and other current owing (Rehman, 2011).

| Ratio: | What they tell you |

| Current ratio | “The current ratio is a liquidity and efficiency ratio that measures a company’s capability to pay off its short-term liabilities with its current assets. The current ratio is an important measure of liquidity because short-term liabilities are due within the next year.” Therefore, I will be using this particular liquidity ratio as it is the most useful one when measuring a company’s performance (Rani, Yadav, & Jain, 2015). |

6.5 Managerial self-assessment method

Cording (2010), argues managerial self-assessment is well-defined as the managerial views regarding the level of value creation. This method is considered beneficial as it helps to capture both public and private evidence and tries to evade problems such as aggregation inclination, nevertheless other prevalent predispositions are current. Additionally, the method is considered advantageous as a means of measuring M&A as this process can measure value better than other, more i.e. traditional methods that implement procedures such as using financial material since it has the capacity of apprehending detailed value-creating mechanisms (Capron, 1999). Furthermore, this method is considered useful as it aids in helping researcher in choosing an appropriate study that bring into the forefront the proposed judgement with the option of measures that results in more financial information accuracy. For example, this method can seize the effects of detailed, privately recognised variables that could take a substantial amount of time to produce results, such as new capacity development (Cording, 2010). Therefore, for these reasons this method will be used in this study.

6.6 Expert-Opinion Measurement Method

Cording (2010), argues the expert opinion is considered advantageous as arguably it is the most vital measurement method when historical data are insufficient, modelling is problematic and/or a fully renewed product is anticipated. Hence, in most cases, it is applied when experts in the area under study can be well-defined and they can contribute. Nevertheless, this method is criticised since selecting the expert is the most problematic aspect of i.e. scheming an expert opinion technique (Cording, 2010). On the other hand, the method is beneficial as experts are seen as providing valuable source for the elaborate history of a certain technology and its evolutionary steps that have occurred in the past. Nevertheless, the process is also criticised for having a difficulty to identify experts and since bias arise from the knowledge of expert. It is felt, however, that the strengths of this approach outweigh the weaknesses, and for this reason this method will also be used in this study (Cording, 2010).

7.0 M&A Success

Hitt, Harrison, & Ireland (2001) the acquisition of one company by another is considered one of the most challenging strategic activities a company can venture into. Nevertheless, M&A are arguably the most rewarding endeavours an acquiring company can benefit from. Hence, this has led some scholars to argue the main reasons why M&A are successful.

7.1 Organisation and Strategies Skills

Meckl (2004), for instance, maintained the view that the main reasons M&A are successful is because of the corporation’s project organisation in which they ensemble. Trautwein (1990) supported this conception by arguing strategies and organisation aid to decide whether a merger or acquisition will be successful or not. This is because strategic decision making and execution process have three major characteristics: the company’s option between acquisition and organic development, the company’s choice between related and irrelative acquisitions, and the corporation’s choice between integration and autonomy of the acquired unit.

Collan and Kinnunen (2009) similarly, argued a company must have an efficient strategic plan for the merger or acquisition to be a success. Jennings (1985) however criticised this notion by arguing most M&A fail and happens to be due to the idea, the acquiring company have a deficient defined strategy, organisation and analysis of alternatives.

7.2 Culture

Bijlsma-Frankema, (2001) argues cultural fit is considered another reason why M&A are debatably successful. This is because cultural fit can aid in confidence building relationship among employees (Anderson & Weitz, 1989), shorten organizational difficulty (Vaara, 2003), and organizational resistance (Bijlsma-Frankema, 2001). Exploration also depict, that qualified acquirers can produce routines and habit for acquisition implementation which is considered advantageous to the acquiring company (Al-Laham et al., 2010).

Stahl and Voigt (2008) however criticised this judgment by arguing culture was the main reason M&A prevail or not. Weber & Camerer (2003), however criticised this opinion and put forward the sentiment that culture, distinctly cultural dissimilarity between two company’s combine together was the main cause of M&A failure since it entangles different levels of culture, performance measures and organizations studied. This view therefore suggest researchers should focus more on how culture affects the M&A outcomes and what can be done to govern the cultural differences more completely in the M&A process. Furthermore, Mirc, (2014) support the view that the main reasons M&A fail was due to cultural differences.

7.3 Speed of integration

Savovic, (2012) stated Speed of integration is one of the main factors that contribute to the success factors for M&A. This is because examination hint that realizing the possibility in a M&A depends on successful integration. (Brock, 2005). DiGeorgio (2002) however, criticised this view by arguing speed integration is recognised as the reason why some acquisition fail. Despite this, its argued business organisations stress the advantage of speed integration to companies pursuing merger and acquisition success (Schlaepfer et al., 2008). Therefore, one could dispute the arguably negative impact of speed integration since it is complex with limited study examining speed of integration (Bauer & Matzler, 2014).

7.4 Communication

Bertoncelj (2009) maintained the view efficient communication is the primary reason why M&A prosper by investigating five difficult success factors and five soft success factors. Barsade and Gibson (2007) second this opinion by arguing emotional intelligence in negotiation procedure is an essential quality which contributes to M&A success factors. This means negotiators who communicate in positive mood tend to be more cooperative and in the case the acquiring company have certain personality characteristics such as cultural sensitivity, empathy and flexibility in the trading process, which naturally lead to a win-win agreement between the two joining organisations.

Turner (1993) however criticised this inclination by arguing internal and external context are the main reasons some M&A are successful. Epstein (2005) however criticised this idea by emphasizing that external factors have a negative effect on M&A success and should therefore contemplate more carefully. For instance, Foreign companies frequently face big difficulties or fail in their M&A activities due to their unfamiliarity with target country’s unique business, cultural, legal framework and regulatory environment Epstein (2005).

8.0 Data Analysis

Kraft type of acquisition

By the time of the offer for Cadbury, it was the world’s second-largest food conglomerate, with seven brands that each generated annual revenues of more than $1bn.

https://www.ft.com/content/1cb06d30-332f-11e1-a51e-00144feabdc0

Kraft’s motive for the Cadbury acquisition

The British confectioner offers Kraft greater access to sharp growth in emerging markets as well as some of the world’s leading chocolate, sweets and chewing gum brands. Kraft has lauded Cadbury’s leading brands “such as Trident and Halls”. Based in the state of Illinois, Kraft also believes it can squeeze savings of at least $675m annually by the end of the third year.

The way Kraft’s acquisition was financed and the advantages and disadvantages of this method

The company borrowed £7bn ($11.5bn) to finance the deal (BBC, 2010).

Ownership

When you take out a bank loan, you have complete control over what you do with the money. Unlike other forms of loans and financing, the bank does not assume any sort of ownership or influence in the way you run your business. Nevertheless, paying back the loan also is your responsibility, and failure to do so can result in the bank foreclosing on your business. This is different from equity financing, for example, through which investors take part ownership of your business. In that situation, you are not personally liable if they want to cash out, and it’s up to them to find a buyer.

Flexibility

Bank loans offer you access to a wide array of terms, fees, application requirements and interest rates. These variables often differ from bank to bank, and usually can be negotiated and adjusted; you can shop around for the loan terms that best suit you and work with the bank to make the deal as sweet as possible. An issue to keep in mind is that interest rates can rise, making a loan unpalatable or very difficult to pay back. In some cases, interest rates and other terms can change during the repayment period, making the success of your business subject to alterations in the bank’s demands.

Application

Banks normally require a lengthy and thorough application process before they will approve you or your business for a loan. Especially in the case of small businesses, which often fail, banks want many details about your business plan before they are confident about loaning you money. This can be a hassle and an obstacle to funding. However, a strong application with a solid business plan and good referrals can make you look very appealing to the bank and win you favorable terms for the repayment of the loan. The application process might even prompt you to address important facets of your business that you hadn’t considered previously.

Credit

Credit history is a crucial determining factor for getting a bank loan. Poor credit can pose an obstacle against favorable loan terms or even for securing a loan at all. This is not an issue for other types of funding, such as stock offerings. However, good credit can result in a much higher chance of approval for a loan and favorable terms of repayment. Credit ratings can be repaired and bolstered before approaching a bank for a loan. Even for people with substandard credit, bank loans can be beneficial. Although the terms might be harsh at first, successful repayment of bank loans can be used to build up your credit, making you a more appealing candidate for loans in the future.

http://smallbusiness.chron.com/advantages-disadvantages-borrowing-money-bank-61049.html

M&A Measures

Performance measures for a long period of time has been a difficult problem that researchers have previously faced within their particular field of study (Dess and Robinson, 1984) This has therefore led naturally to the picking of suitable performance measures that are relevant to the fields in this case of M&A of which varied origins have led to the adoption of a extensive series of performance measures in present research (Cartwright and Schoenberg, 2006; Larsson and Finkelstein, 1999). Consequently, below will concentrate on the three measurements such as accounting measures, managerial measurement method and expert opinion measurement method to help assess whether Kraft’s acquisition of Cadbury was a success or not.

8.1 Accounting based measurement method

Accounting Ratios

The analyses above were conducted using accounting measures of performance such as ratios to evaluate the overall performance of Kraft’s acquisition of Cadbury to help conclude whether the acquisition was a success or not. Schoenberg, R. (2006) states to evaluate whether an acquisition was a success or not, it must first be measured on average for a period of three years immediately after the acquisition. Cabanda, (2007) however criticised this view by stating three years after an acquisition is not long enough to measure whether an acquisition was a success. Therefore, this idea prompted I myself to measure Cadbury financial performance three years before the acquisition and 3 years after the acquisition took place, as it will help to give I myself more insight and therefore a more accurate illustration on whether Kraft’s acquisition of Cadbury was a success or not.

Profitability ratio’s

Firstly, I measured Cadbury accounting measure of profitability performance three years before the acquisition, and Kraft’s performance three years after the acquisition since some surveys of merger and acquisition decisions have indicated that managers primarily seek to improve profitability through mergers and acquisition (Ingham, Kran, & Lovestam, 1992; Rose, 1989). Cadbury (ROA) in 2007 was 3.6%, 4.11% in 2008 and 6.27%. However, although Cadbury (ROA) percentage increased from 2007-2009, after Kraft’s takeover Cadbury financial result increased even more. This is because in 2011 krafts (ROA) was 8.24%, 7.04% in 2012 and 11.73 in 2013. These findings therefore indicate Kraft’s company’s profitability was therefore enhanced after the acquisition, which thus suggest Kraft’s acquisition of Cadbury was therefore a success.

Furthermore, Cadbury (ROS) was 5.11% in 2007, 6.80% in 2008 and 8.54%, these findings suggest that the company’s (ROS) increased from 2007-2009. However immediately one year after Kraft’s hostile takeover, in 2011 the company’s (ROS) for that specific year was 9.55%. this result therefore suggests the company’s (ROS) decreased after the acquisition which thus motivates one to question whether the acquisition was a success or not. Nevertheless, a year after this, in 2012 the company’s (ROS) increased to 8.99% and 14.90% in 2013. One could therefore argue although Kraft’s (ROS) decreased in 2011, two years after this overall their results increased significantly to 14.90. these findings therefore suggest Kraft’s takeover of Cadbury was a success as Kraft’s profitability level was higher than Cadbury financial performance before the acquisition.

Also in 2007 Cadbury’s (ROE) was 9.75%, 10.36% in 2008 and 14.48% in 2009. However, three years after Kraft’s successful bid for Cadbury, the company’s (ROE) was 10.70% in 2011, 45.97% and 52.34%, since Kraft’s (ROE) improved after the acquisition, this suggest the company has become more efficient and thus more profitable after the Cadbury takeover which therefore suggest the acquisition was a success. Furthermore, in 2007 the company’s ROCE was 11.71%, 7.05% in 2008 and 8.80% in 2009. This increased in 2011 to 14.91%, 13.54 in 2012 and 23.23% in 2013. Kraft’s ROCE results therefore indicates that after their acquisition of Cadbury the company’s operating efficiency increased significant post-acquisition, therefore one could argue, these findings suggest Kraft’s acquisition of Cadbury was a success since the company’s profitability increased. However, (NPR) is also used to measure a company’s profitability. In 2007 Cadbury (NPR) was 5.10%, 6.80% in 2008 and 8.53% in 2009. Despite this, after the acquisition, in 2011 the company (NPR) was 5.93%, 4.44% in 2012 and 7.55 in 2013. One could therefore argue this implies that the company’s acquisition was not a success as the company’s net profit decreased post-acquisition, which indicates a lower level of margin of safety.

Efficiency Ratio

Secondly, I measured Cadbury financial performance three years before the acquisition and Kraft’s financial performance three years after the acquisition using the efficiency ratio. I found the company’s. (CATR) was 3.07 in 2007, 2.04 in 2008 and 2.81 in 2009, whereas after Kraft acquired Cadbury (CATR) increased in 2011 to 3.78, 3.80 in 2012 and 5.57 in 2013. These findings therefore indicate that the company’s operational efficiency level improved after Kraft’s acquisition of Cadbury. One could argue these findings therefore suggest that the acquisition of Cadbury’s was a success.

Similarly, leverage ratios were used in this study to help evaluate whether the acquisition was a success or not. This is because leverage ratios is used the evaluate a company’s debt levels. This means if the company’s debt levels were lower before the acquisition it would bring into question whether Kraft’s acquisition of Cadbury was arguably a success. In 2007 Cadbury debt to asset ratio was 63.19%, this decreased the next following year to 60.27% in 2008 and to 56.67% in 2009. Additionally, a year after kraft acquired Cadbury, in 2011 the company’s debt to asset ratio was 21.40%. However, although the company debt levels appeared to be decreasing, the following year in 2012 it significantly increased to 84.60%. therefore, one could argue the fact that Kraft’s debt levels increased after they acquired Cadbury suggest the acquisition was not a success as the amount of debts the company has significantly increased. Despite this, one could argue although the company’s debt level increased, the acquiring company debt level is expected to be high two years after acquisition, therefore you should not conclude whether an acquisition was successful or not purely on if the fact the acquiring company debt level is immediately high straight after the acquisition. (,,,,,) supported this view by arguing one should look at the acquiring company debt levels at least five years after the acquisition.

Liquidity ratio

Liquidity ratio was also used to help measure the financial performance of Kraft’s acquisition of Cadburys. The current ratio in 2007 was 56.35%, 77.77% in 2008 followed by 87.30% in 2009. However, after Kraft acquired Cadbury in 2011 it was 1.27%, this increased to 1.34% in 2012 and further to 1.44% in 2013.

Efficiency Ratio

Efficiency ratio was also used in this study to help evaluate whether Kraft’s acquisition of Cadburys was a success or not. For instance, in 2007 Cadburys FATR was 3.07, followed by 89.88% in 2008 and

99. 65% 2009. However, after Kraft acquired Cadburys this decreased to 47.5 in 2011, 56. 22 in 2012. The fact that the company’s efficiency levels started to lessen therefore suggest Kraft’s acquisition of Cadburys was not a success since the company’s operational performance stated to decline. Furthermore, the efficiency ratio of CATR was also used in this study to help confirm these findings. However, the results found imply Kraft’s efficiency level improved after Cadburys acquisition which suggest that the acquisition was a success. For instance, in 2007 CATR was 3.07, 2.04 in 2008 and 2.81 in 2009, whereas after Kraft’s acquisition of Cadburys this increased in 3.78 in 2011, 3.80 in 2012 and 5.57 in 2013.

8.2 Workings out

The figures in the 2007 column derive from Cadburys annual report (Cadburys Schweppes, 2007). Similarly, the figures in the 2008 and 2009 column originate from Cadburys annual report (Cadbury Report & Accounts 2009, 2010). However, the figures shown in the 2011, 2012 and 2013 come from Kraft’s annual report.

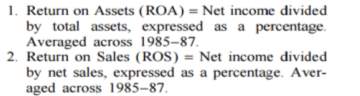

all ratios besides the “ROA” and the “ROS” were calculated by using the “Financial performance analysis of mergers and acquisitions: evidence from India” journal formulas (Rani, Yadav, & Jain, 2015). The “ROA” and the “ROS” were calculated using the Independent and Joint Effects of the Skill and Physical Bases of Relatedness in Diversification journal formula. (Farjoun, 1998).

Ratio formula

See appendix C.

8.3 calculation table

See appendix D.

8.4 Managerial measurement method

Capron (1999) argues managerial self-assessment is beneficial since the process can measure value better than other, more traditional methods using financial data as it is capable of capturing ‘fine-grained value-creating mechanisms’. Therefore, Managerial measurement method is considered beneficial as it helps to capture and measure in detail what Kraft’s mangers have noted on the topic of the Cadbury takeover, to help conclude whether for instance, the acquisition was a success or not. For instance, On January 19, 2010, Kraft publicised the terms of their final offer for each outstanding ordinary share of Cadbury, one could argue since the Cadbury Board of Directors suggested that Cadbury shareholders agree to the terms of the final offer, it implies Kraft’s acquisition would be a success since they recommended their own shareholders to accept the deal (Kraft foods, 2011).

Furthermore, one could argue Kraft’s acquisition of Cadburys was a success since the company’s net revenues increased as a primarily request of the Cadbury acquisition which also added $9,143 million in net revenues for the company the following year after the acquisition (Kraft foods, 2011). In addition, after the Cadbury acquisition, Kraft’s operating income increased by $260 million, which thus indicates that Kraft’s acquisition of Cadbury was a success (Kraft foods, 2011). Moreover, Kraft’s acquisition of Cadbury is considered a success since total selling, administrative expenses decreased by $25 million following the Cadbury takeover (Kraft foods, 2011).

Also, the company’s net revenues increased by $1,037 million due to the Cadbury acquisition, despite this, it’s been argued Kraft’s acquisition of Cadbury was not a success since net pricing increased and operating income decreased by $8 million (Kraft foods, 2011).

Regardless of these incidents, its argued Kraft’s acquisition of Cadbury on the whole was a success as $337 million in restructuring charges were reversed, after the Cadbury takeover, lower manufacturing cost, selling, general and administrative expenses were implement all suggest the company’s acquisition led to inevitably a success as they were evidently thriving after the acquisition (Kraft foods, 2011).

This idea is evident especially because there was a 27% increase in dividends which led to an increase in shares for shareholder due primarily because of the Cadbury acquisition. From my observation, it’s evident that the Kraft’s acquisition of Cadbury was a success since it appears that the company will benefit in the longer run from the takeover (Kraft foods, 2011).

This idea therefore brings me to question whether Cadbury shareholders selling the company to Kraft was really a smart move as it appears Cadbury was selling itself too short in the long run. Moeller, (2012) supported this view by arguing shareholders should reject Kraft’s offer since Cadbury is arguably invaluable because it is a British treasure. Nevertheless, above ultimately suggest Kraft acquisition of Cadbury was a success.

8.5 Expert opinion measurement method

Expert opinion measurement method is considered beneficial as debatably it is required the most, when historical data are inadequate, modelling is difficult and/or a fully renovated product is forecasted (Schoenberg, 2006). Also, it advantageous as it provides valuable expertise to help measure i.e. whether Kraft’s acquisition of Cadbury was a success or failure.

For instance one could argue Kraft acquisition of Cadbury was a success since Irene Rosenfeld, the woman who organised Kraft’s takeover of Cadbury was handed a pay rise of more than 40% which resulted in her receiving more than £17 million, therefore the fact her salary increased and since The Kraft manager was paid a salary of $1.5m, together with $7.8m of stock awards, nearly $2m in option awards, about $4m of annual incentive payments and $10.6m from another incentive plan suggest the acquisition was a success as these individuals are ripping the benefit of the acquisition they successfully achieved (Finch, 2017).

Finch, (2017), suggest Kraft acquisition of Cadbury was a success since the Financial Times argued that for the first time in a while it is possible for a manger of a company as opposed to the owner of the business to become rich, therefore one could argue Kraft’s acquisition was Cadbury was a success as mangers are benefiting significantly from the acquisition. Furthermore, The SEC report said Kraft’s remuneration committee had considered that the group had “significantly exceeded” targets on profitability and cash-flow, which therefore suggest the acquisition was a success (Finch, 2017).

Finch, (2017) however criticised this view by stating Kraft’s revenue targets were missed, which therefore bring one to question whether the acquisition was indeed a success. Wearden, (2017) similarly stated the takeover of Cadbury by Kraft would probably be a disaster and lead to widespread job losses. This is because cultural differences between the two companies were probably too great, and that it on balance it was more likely that a merger or an acquisition would be unsuccessful. Wearden, (2017) supported this view by stating M&A are difficult to exercise since two companies that are joining may have completely different cultures, and there way of operating may be so unlike that it will lead to a potential disaster more than it could possibly be a success.

Luff, (2010) summarily reinforced this view by arguing 80% of hostile takeovers failed to deliver the value promised when they took place, often because there was not enough common culture between the two sides. In addition, its argued since Kraft failed to keep their promise to keep a York factory open after they purchased another British chocolate maker called “Terry’s” in 1993, suggest they will most likely fail to keep their promise they made to workers when acquiring Cadburys, which proposes the idea that their acquisition of Cadbury was unsuccessful (Wearden, 2017). This is evident since the company take was taking over Cadbury, Kraft foods, promised to keep open the chocolate firm’s Somerdale factory near Bristol. Despite their promise soon after the deal was done, Kraft announced that they will be shutting the factory, which led to the redundancy of 400 employees who worked in that factory.

Additionally, this incident has also led to the firm announcing further 200 job cuts (BBC News, 2017). Its argued that the fact Kraft went back on its own words and had to resort to even cutting more job suggest the company’s is really struggling after their acquisition of Cadbury. These actions conducted by the company therefore suggest the acquisition is arguably unsuccessful as they are most likely resorting to one of their last measures to keep themselves afloat after their acquisition of Cadbury. Regardless of this, its argued the acquisition was a success as Kraft managed to honour the two-year agreement of no redundancies proposed by Cadbury’s shareholders before they sold of their shares, this therefore implies Kraft acquisition of Kraft was a success (Finch, 2017).

9. Measuring Kraft’s acquisition of Cadburys success

9.1 Organisation and strategy skills

One could argue that one of the main means of measuring whether an acquisition was success is too look at the company’s organisation skills. Meckl (2004) maintained this view by arguing the main reasons that M&A are successful is because of the corporation’s organisation skills. Trautwein (1990) supported this conception by arguing strategies and a company’s organization aid to decide whether a merger or acquisition will be successful or not. Kraft foods, (2011) states after Kraft acquisition of Cadbury’s the company’s organisation was good. Therefore, one could argue that Kraft’s acquisition of Cadbury is highly likely to be a success since the company has good organisation capacities which arguably leads to having a successful company such as a newly acquired endeavour.

Collan & Kinnunen (2009) similarly, argued a company has to have an effective strategic plan in order for the merger or acquisition to be a success. Kraft foods, (2011) states after Kraft’s acquisition of Cadbury the company implemented three strategies such as “To delight global Snacks consumers; to unleash the Power of our Iconic Heritage Brands; and To Create a Performance-Driven, Values-Led Organization”. Therefore, one could argue that Kraft acquisition of Cadburys was a success since they implemented a strategic plan after the successful acquisition. Furthermore, it is assumed that Kraft had a strategic plan to acquire Cadbury, the fact they achieved this goal therefore also advocates the notion that Kraft’s acquisition of Cadbury was a success.

9.2 Culture

Bijlsma-Frankema, (2001) argues cultural fit is considered another reason why M&A are debatably successful. Kraft foods, (2011) states after Kraft acquired Cadburys they adhered to a compliant and ethical corporate culture, which includes following the laws and industry regulations in the United States and abroad. This as it is integral to their success. Therefore, one could argue since Kraft’s cultural integration was a success, this implies that the acquisition was therefore also a success.

Savovic, (2012) stated Speed of integration is one of the main factors that contribute to the success factors for mergers and acquisitions. This is because examination hint that realizing the possibility in a merger or acquisition depends on successful integration. However, Kraft failed to implement this after their acquisition of Cadbury. One could argue as speed of integration is considered significant and arguably the primary reason acquisition succeed Kraft acquisition of Cadbury was not a success as they failed to implement this process.

9.3 Speed of integration

DiGeorgio (2002) and Goldberg & Goodwin, (2001) however, criticised this view by arguing speed integration is recognised as the reason why some acquisition fail. Therefore, one could argue this process is not the best way to measure whether an acquisition has been successful or not as it is arguably also the reason why some M&A lead to failures.

9.4 Communication

Bertoncelj (2009) maintained the view efficient communication is the primary reason why M&A prosper by investigating five difficult success factors and five soft success factors. One could argue after Kraft acquisition of Cadbury the company maintained a successful brand image, this is because the company was dependant on communication within the organisation. Therefore, this suggest Kraft acquisition of Cadbury was a success as they implemented effective communication.

11. References

(Butler, S. (2009). ‘Cadbury staff’s bittersweet feelings over Kraft bid’ The Telegraph, 11 September 2009, [Online] http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/6175979/Cadbury-staffs-bittersweet-feelings-over-Kraft-bid.html [accessed 1st April 2017]

ACCA, (2016) ‘Ratio Analysis’ (Online) http://www.accaglobal.com/uk/en/student/exam-support-resources/fundamentals-exams-study-resources/f2/technical-articles/ratio-analysis.html Accessed [2nd April 2017].

Accounting Tools, (2017) ‘ Net profit ratio’ (online) http://www.accountingtools.com/net-profit-ratio, Accessed [2nd April 2017].

Accounting Tools, (2017) “what is the selling, general and administrative expenses’ (Online) http://www.accountingtools.com/questions-and-answers/what-is-the-selling-general-and-administrative-expense.html Accessed [2nd April 2017].

Agrawal, A., Jaffe, J., & Mandelker, G. (1992). The post-merger performance of acquiring firms: A re-examination of an anomaly. Journal of Finance, vol 47, no. 14, pp 1605-1622.

Agrawal, A., Jaffe, J.F. & Mandelker, G.N. 1992, “The Post-Merger Performance of Acquiring Firms: A Re-examination of an Anomaly”, The Journal of Finance, vol. 47, no. 4, pp. 1605.

Al-Laham, A., Schweizer, L., & Amburgey, T. (2010). Dating before marriage? Analyzing the influence of pre-acquisition experience and target familiarity on acquisition success in the M&A as R&D type of acquisition. Scandinavian Journal of Management, vol 26, pp. 25–37.

Anderson, E., & Weitz, B. (1989). Determinants of continuity in conventional industrial channel dyads. Marketing Science, vol 8, pp 310–323.

Andrade, G., Mitchell, M. and Stafford, E. (2001) ‘New Evidence and Perspectives on Mergers’, Journal of Economic Perspectives vol 15, pp 103–20.

Andrade, G., Mitchell, M. and Stafford, E. (2001) ‘New Evidence and Perspectives on Mergers’, Journal of Economic Perspectives vol 15, pp 103–20.

Arnold, G. (2013). Corporate financial management. Harlow: Pearson.

Arrow, K. J. (1982) ‘Risk Perception Psychology and Economics’, Economic Inquiry pp 20: 1–9.

Ashkenas, R. and Francis, S.C. (2000) ‘Integration managers: Special leaders for special times. Harvard Business Review’, vol 78, no 6, pp. 108–116.

Barmeyer, C. and Mayrhofer, U. (2008) ‘The contribution of intercultural management to the success of international mergers and acquisitions: An analysis of the EADS group’, International Business Review, Vol17, No 1, pp 28–38.

Barsade, S.G. and Gibson, D.E. (2007), “Why does affect matter in organizations?”, Academy of Management Perspectives, Vol. 21, No. 1, pp. 36-59.

Bauer, F., & Matzler, K. (2014). Antecedents of M&A success: The role of strategic complementarity, cultural fit, and degree and speed of integration. Strategic Management Journal, vol 35, pp 269–291.

BBC News, (2010) ‘Cadbury agrees Kraft takeover bid’. [online] http://news.bbc.co.uk/1/hi/8467007.stm[accessed 1st April 2017].

BBC News. (2017). Kraft and Cadbury: How is it working out? – BBC News. [online] Available at: http://www.bbc.co.uk/news/uk-england-birmingham-16067571 [Accessed 3 Apr. 2017].

Bednarski, P. J. (2001, June 11). Branding a perception. Broadcasting & Cable, p. 19.

Berger, A.N. & Hannan, T.H. 1998, “The Efficiency Cost of Market Power in the Banking Industry: A Test of the “Quiet Life” and Related Hypotheses”, The Review of Economics and Statistics, vol. 80, no. 3, pp. 454-465.

Bertoncelj, A. (2009), “Critical success factors in mergers and acquisitions: evidence from Slovenia”, International Journal of Sustainable Economy, Vol. 1, No. 2, pp. 198-212.

Bijlsma-Frankema, K. (2001). On managing cutural integration and cultural change processes in mergers and acquisitions. Journal of European Industrial Training, vol 25, pp 192–207.

Bijlsma-Frankema, K. (2001). On managing cutural integration and cultural change processes in mergers and acquisitions. Journal of European Industrial Training, vol 25, pp 192–207.

Biller, K. (2016), “Mergers and Acquisitions”, Focus on Powder Coatings, vol. 2016, no. 5, pp. 1-2.

Bodamer, D. (2013), “Economies of Scale”, National Real Estate Investor, vol. 55, no. 4, pp. 37.

Brigham, E.F. and Gapenski, L.C. (1997). Financial management, theory and practice. (8th ed.). Orlando: The Dryden Press.

Brigham, E.F. and Gapenski, L.C. (1997). Financial management, theory and practice. (8th ed.). Orlando: The Dryden Press.

Brock, D. M. (2005). Multinational acquisition integration: the role of national culture in creating synergies. International Business Review, vol 14, pp 269–288.

Bromiley, P. (2005) The Behavioral Foundations of Strategic Management, Malden, MA: Blackwell.

Bromiley, P. and Marcus, A. (1989) ‘The Deterrent to Dubious Corporate Behavior: Profitability, Probability and Safety Recalls’, Strategic Management Journal, Vol 10, No 3, pp 233–49.

Bromiley, P., Govekar, M. and Marcus, A. (1988) ‘On Using Event-Study Methodology in Strategic Management Research’, Technovation, Vol 8, pp 25–42.

Brown, S. J. and Warner, J. B. (1985) ‘Using Daily Stock Returns: The Case of Event Studies’, Journal of Financial Economics, Vol 14, pp 3–31.

Buono, A.F. and Bowditch, J.L. (1989) The human side of mergers and acquisitions: Managing collisions between people, cultures, and organizations. San Francisco: Jossey-Bass Publishers.

Cabanda, E. (2007) Merger In The Philippines: Evidence In The Corporate Performance Of William, Gothong, And Aboitiz (WG&A) Shipping Companies, Journal of Business Case Studies, Vol 3, No. 4, pp 96.

Cadbury Report & Accounts 2009, (2010) CADBURY PLC AUDITED CONSOLIDATED FINANCIAL STATEMENTS FOR YEAR ENDED 12/31/2009. London, Deloitte LLP.

Cadburys Schweppes, (2007), Annual Report & Accounts 2007. London, Cadbury Schweppes plc.

Capron, L. (1999) ‘The Long-Term Performance of Horizontal Acquisitions’, Strategic Management Journal, vol 20, pp 987–1018.

Carol Yeh-Yun LinYu-Chen Wei. (2006). The role of business ethics in merger and acquisition success: An empirical study. Journal of Business Ethics, Vol69, No 1, pp 95-109.

Cartwright, S., & Schoenberg, R. (2006). Thirty years of mergers and acquisitions research: Recent advances and future opportunities. British Journal of Management, vol 17, pp1–5.

Cartwright, S., Cooper, C.L. (1996). ‘Managing mergers, acquisitions and strategic alliances’: integrating people and cultures, 2nd edn, Butterworth-Heinemann, Oxford.

Cartwright, S., Cooper, C.L. (2006). ‘thirty years of mergers and acquisition research: recent advances and future opportunites’, British Journal of management, Vol 17, pp. 1-5.

Chakravarthy, B. S. (1986) ‘Measuring Strategic Performance’, Strategic Management Journal, vol 7, pp 437–58.

Chatterjee, S. (1986) ‘Types of Synergy and Economic Value: The Impact of Acquisitions on Merging and Rival Firms’, Strategic Management Journal vol 7, pp 119–40.

Collan, M. and Kinnunen, J. (2009), “Acquisition strategy and real options”, The IUP Journal of Business Strategy, Vol 5, No, 3/4, pp. 45-65.

Conn, R. (1985). “A Re-Examination of Merger Studies That Use the Capital Asset Pricing Model Methodology.” Cambridge Journal of Economics, vol. 9, no. 1, pp. 43–56.

Cording, M (2010). Measuring theoretically complex constructs: the case of acquisition performance. Strategic Organization, Vol 8, pp 11–41.

Cording, M., Christmann, P., & King, D. (2008). Reducing causal ambiguity in acquisition integration: Intermediate goals as mediators of integration decisions and acquisition performance. Academy of Management Journal, vol 51, pp 744–767.

Dess, G. and R. Robinson (1984). ‘Measuring Organizational Performance in the Absence of Objective Measures: The Case of the Privately-held Firm and Conglomerate Business Unit’, Strategic Management Journal, vol 5, pp. 265-273.

DiGeorgio, R.M. (2002), “Making mergers and acquisitions work: what we know and don’t know”, Journal of Change Management, Vol. 3 No. 2, pp. 134-148.

Dutordoir, M., Roosenboom, P. & Vasconcelos, M. 2014, “Synergy disclosures in mergers and acquisitions”, International review of financial analysis, vol. 31, pp. 88-100.

El Zuhairy, H., Taher, A. and Shafei, I. (2015) ‘Post-mergers and acquisitions: The motives, success factors and key success indicators’, Eurasian Journal of Business and Management, vol 3, no 2, pp. 1–11.

Epstein, M.J. (2005), “The determinants and evaluation of merger success”, Business Horizons, Vol. 48, pp. 37-46.

Fama, E. F. (1970) ‘Efficient Capital Markets: A Review of Theory and Empirical Work’, Journal of Finance, Vol 25, pp 383–417.

Fama, E. F. (1970) ‘Efficient Capital Markets: A Review of Theory and Empirical Work’, Journal of Finance, vol 25, pp 383–417.

Fama, E. F., Fisher, L., Jensen, M. C. and Roll, R. (1969) ‘The Adjustment of Stock Prices to New Information’, International Economic Review, Vol 10, pp 1–21.

Farjoun, M. 1998, “The Independent and Joint Effects of the Skill and Physical Bases of Relatedness in Diversification”, Strategic Management Journal, vol. 19, no. 7, pp. 611-630.

Finch, J. (2017). Cadbury takeover earns Kraft’s Irene Rosenfeld a 40% rise. [online] the Guardian. Available at: https://www.theguardian.com/business/2010/mar/30/kraft-irene-rosenfeld-payrise-cadbury [Accessed 3 Apr. 2017].

Finch, J. (2017). Cadbury takeover earns Kraft’s Irene Rosenfeld a 40% rise. [online] the Guardian. Available at: https://www.theguardian.com/business/2010/mar/30/kraft-irene-rosenfeld-payrise-cadbury [Accessed 3 Apr. 2017]

Gaughan, P.A. (2011), Mergers, acquisitions, and corporate restructurings, 5th edn, Wiley, Hoboken, N.J.

Gill, R. (1999). Mergers and acquisitions: The route to failure? Training Journal, 20. Retrieved from

Grundy, T. (2003) Smart things to know about mergers and acquisitions. Oxford: Capstone Publishing.

Grundy, T. (2003) Smart things to know about mergers and acquisitions. Oxford: Capstone Publishing.

Gugler, K. & Siebert, R. 2007, “Market Power versus Efficiency Effects of Mergers and Research Joint Ventures: Evidence from the Semiconductor Industry”, The Review of Economics and Statistics, vol. 89, no. 4, pp. 645-659.

Haspeslagh, P. C. and Jemison, D. B. (1991) Managing Acquisitions: Creating Value through Corporate Renewal. New York: The Free Press

Haspeslagh, P. C. and Jemison, D. B. (1991) Managing Acquisitions: Creating Value through Corporate Renewal. New York: The Free Press.

Hitt, M.A., A, T., King, D., Marquette, Krishnan, H., Makri, M., Shimizu, K. and Zhu, H. (2012) ‘Creating value through mergers and acquisitions: Challenges and Opportunity’ by Michael A. Hitt, David king et al. Available at: http://epublications.marquette.edu/mgmt_fac/124/ (Accessed: 25 November 2016).

Hitt, Michael A, Duane R Ireland, and Jeffrey S Harrison. Mergers And Acquisitions. Oxford: Oxford University Press, 2001.

Jennings, O.R. (1985), “Preventing acquisition failures”, Management Review, Vol. 74, No. 9, pp. 37-39

Jensen, M. G., and Ruback, T. (1983): “The Market for Corporate Control: The Scientific Evidence,” Journal of Financial Economics, Vol 11, No.4, pp 5-50.

Kasparova, I. 2007, “Financing Mergers and Acquisitions: Specific Russian Characteristics”, Problems of Economic Transition, vol. 50, no. 5, pp. 61-72.

Kraft Foods (2014), Kraft Foods Group In. United States, Kraft Foods Group.

Kraft foods, (2011) Kraft Foods Inc. United states, Kraft Foods Group.

Long, J.E. & Link, A.N. 1983, “The Impact of Market Structure on Wages, Fringe Benefits, and Turnover”, Industrial and Labor Relations Review, vol. 36, no. 2, pp. 239-250.

Lubatkin, M. & O’Neill, H.M. (1987), “Merger Strategies and Capital Market Risk”, The Academy of Management Journal, vol. 30, no. 4, pp. 665-684.

Lubatkin, M. (1987) ‘Merger Strategies and Stockholder Value’, Strategic Management Journal, Vol8, pp 39–53.

Lubatkin, M. (1987) ‘Merger Strategies and Stockholder Value’, Strategic Management Journal, vol 8, pp 39–53.

Lubatkin, M., and Shrieves, R. E. (1986) ‘Towards Reconciliation of Market Performance Measures to Strategic Management Research’, Academy of Management Review, Vol 11, pp 497–512.

Luff. P (2010) ‘mergers, acquisitions and takeovers: the takeover of Cadbury by Kraft ninth report of session 2009-10 report, together with formal minutes, oral and written evidence’, Mergers, acquisitions and takeovers. (2010). London: Stationery Office.

Marks, M. L., & Mirvis, P. H. (2011). Merge ahead: A research agenda to increase merger and acquisition success. Journal of Business and Psychology, vol 26, no 2, pp 161-168.

Marks, M.L., Mirvis, P.H. and Brajkovich, L.F. (2001) ‘Making mergers and acquisitions work: Strategic and psychological preparation [and executive Commentary]’, The Academy of Management Executive (1993-2005), Vol 15, No 1, pp. 80–94.

Mayrhofer, U. (2004) ‘The influence of national origin and uncertainty on the choice between cooperation and merger-acquisition: An analysis of french and German firms’, Vol 13, No 1, pp 83–99.

McWilliams, A. and Siegel, D. (1997) ‘Event Studies in Management Research: Theoretical and Empirical Issues’, Academy of Management Journal, Vol 40, pp 626–57.

Meckl, R. (2004), “Organising and leading M&A projects”, International Journal of Project Management, Vol. 22, pp. 455-462.

Merced, M (2014). ‘Kraft to Acquire Cadbury in Deal Worth $19 Billion’ The New York times, 19 January 2010, [Online] http://www.nytimes.com/2010/01/20/business/global/20kraft.html[accessed 1st April 2017].

Merritt, C. (2016) ‘What are the Three different types of corporate mergers & what is the rationale for each type?’. Small Business Chron.[Online]. http://smallbusiness.chron.com/three-different-types-corporate-mergers-rationale-type-74109.html.[accessed 1st April 2017].

Moeller, S. (2012) ‘case study: krafts takeover of Cadbury’. The financial Times, 9th January 2012 [Online] https://www.ft.com/content/1cb06d30-332f-11e1-a51e-00144feabdc0

Montgomery, C. A. and Wilson, V. A. (1986) ‘Mergers that Last: A Predicable Pattern?’, Strategic Management Journal, vol 7, pp 91–7.

N., Yadav, S.S. & Jain, P.K. (2015). Innovatative mode of financing and abnormal returns to shareholders of indian acquiring firms. In Sushil and G. Chroust (Ed), systermatic flexability and business agility (pp 367-383).

Nicola Mirc, (2014), Human Impacts on the Performance of Mergers and Acquisitions, in Cary L. Cooper , Sydney Finkelstein (ed.) Advances in Mergers and Acquisitions (Advances in Mergers and Acquisitions, Volume 12) Emerald Group Publishing Limited, pp.1 – 31.

Odenthal, M. (2016) Best methods of financing mergers and acquisitions – deal making wire. Available at: https://www.idealsvdr.com/blog/methods-of-financing-mergers-and-acquisitions/ (Accessed: 24 November 2016).

Oler, D. K., Harrison, J. S. and Allen, M. R. (2008) ‘The Danger of Misinterpreting Short-Window Event Study Findings in Strategic Management Research: An Empirical Illustration Using Horizontal Acquisitions’, Strategic Organization, Vol 6, No.2, pp 151–84.

Proft, C. (2014). The speed of human and task integration in mergers and acquisitions: human integration as basis for task integration. Wiesbaden, Germany: Springer Gabler

Rani, N., Yadav, S.S. & Jain, P.K. 2015, “Financial performance analysis of mergers and acquisitions: evidence from India“, International Journal of Commerce and Management, vol. 25, no. 4, pp 402.

Rani, N., Yadav, S.S. & Jain, P.K. 2015, “Financial performance analysis of mergers and acquisitions: evidence from India”, International Journal of Commerce and Management, vol. 25, no. 4, pp 402.

Rani, N., Yadav, S.S. & Jain, P.K. 2015, “Financial performance analysis of mergers and acquisitions: evidence from India”, International Journal of Commerce and Management, vol. 25, no. 4, pp. 402.

Rehman. R (2011) ‘Impacts of liquidity ratios on profitability’ Interdisciplinary Journal of Research in Business, Vol 1, No. 7, pp.95-98.

Reis, Rosa, N., de Oliveira Carvalho, P., Manuel, F. and Vasconcelos, J. (2015) An overview of Three decades of mergers and acquisitions research by Nuno Rosa Reis, Fernando Manuel Pereira de Oliveira Carvalho, José Vasconcelos Ferreira: SSRN, Iberoamerican Journal of Strategic Management, Vol 14, No 2, pp51-71.

Rodrigues de Paula, Luiz Fernando 2002, “Expansion strategies of banks: does size matter?”, Nova economia, vol. 12, no. 2, pp. 133-145.

Roller L-H, Stennek, J., and Verboven F. (2006): “Efficiency Gains from Mergers,” in European Merger Control: Do We Need and Efficiency Defence, ed. by Ilzkovitz and Meiklejohn. Edward Elgar. (market power)

Romanek, B. and Krus, C.M. (2002) Mergers and acquisitions finance 05.09. United Kingdom: Capstone Publishing.

Ruddick, G. (2010) ‘Kraft buys Cadbury for £11.9bn: a Q&A’. The telegraph, 19 January 2010 [Online] http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/7027042/Kraft-buys-Cadbury-for-11.9bn-a-QandA.html [Accessed 1st April 2017].

Savovic. S, (2012), The importance of post-acquisition intergration for value creation and success of mergers and acquisitions, Economic Horizons, Vol 14, No. 3, pp 195 – 207.

Schlaepfer, R., di Paola, S., Kupiers, R., Brauchli-Rohrer, B., Marti, A., & Brun, P. (2008). How can leadership make a difference—An integration survey. PWC1–16.

Schoenberg, R. (2006), “Measuring the Performance of Corporate Acquisitions: An Empirical Comparison of Alternative Metrics”, British Journal of Management, vol. 17, no. 4, pp. 361-370.

Schoenberg, R. 2006, “Measuring the Performance of Corporate Acquisitions: An Empirical Comparison of Alternative Metrics”, British Journal of Management, vol. 17, no. 4, pp. 361-370.

Sherman, A.J. (2010) Mergers and acquisitions from A to Z. 3rd edn. New York: American Management Association.

Stahl, G.,(2013). Sociocultural integration in mergers and acquisitions: Unresolved paradoxes and directions for future research. Thunderbird International Business Review, vol55, pp 333–356.

Stahl, G.K. and Voigt, A. (2008), “Do cultural differences matter in mergers and acquisitions? A tentative model and examination”, Organization Science, Vol. 19, No. 1, pp. 160-176.

Stahl,G., & Voight, A. (2008).Do cultural differences matter in mergers and acquisitions?: A tentative model and examination. Organization Science, vol 19, pp 160–176.

Tahir, M. & Anuar, M.B.A. 2015; “The determinants of working capital management and firms performance of textile sector in pakistan”, Quality & Quantity, vol. 50, no. 2, pp. 605-618.

The Balance, (2016) ‘Cost of Goods Sold’ (Online) https://www.thebalance.com/cost-of-goods-sold-398161 Accessed [2nd April 2017].

The Balance, (2017) ‘What is operating profit margin ratio? (Online) https://www.thebalance.com/what-is-the-operating-profit-margin-ratio-393205, Accessed [2nd April 2017].

Trautwein, F. (1990), “Merger motives and merger prescriptions”, Strategic Management Journal, Vol. 11, No. 4, pp. 283-295.

Turner, J.R. (1993), The Handbook of Project Based Management, McGraw-Hill, London.

Vaara, E. (2003). Post-acquisition integration as sense making: Glimpses of ambiguity, confusion, hypocrisy, and politicization. Journal of Management Studies, vol 40, pp 859–894.

Waśniewski T., Skoczylas W. (2002), Teoria i praktyka analizy finansowej w przedsiębiorstwie, Fundacja Rozwoju Rachunkowości w Polsce, Warszawa.

Wearden, G. (2017). Cadbury takeover likely to be a ‘disaster’, MPs warned. [online] the Guardian. Available at: https://www.theguardian.com/business/2010/jan/12/cadbury-takeover-warning-mps-committee [Accessed 3 Apr. 2017].

Weber, R.A. & Camerer, C.F. 2003, “Cultural Conflict and Merger Failure: An Experimental Approach”, Management Science, vol. 49, no. 4, pp. 400-415.

Weber, Y. and Pliskin, N. (1996) ‘The effects of information systems integration and organizational culture on a firm’s effectiveness’, Information & Management, vol 3, no.2, pp. 81–90.

Wood, Z (2016). ‘Kraft Foods challenges Cadbury over its hostile bid defence’ The Guardian, Tuesday 15th December 2009, [Online] https://www.theguardian.com/business/2009/dec/15/cadbury-kraft-foods-takeover-defence [accessed 1st April 2017].

Zollo, M. & Singh, H. (2004). Deliberate learning in corporate acquisitions: Post-acquisition strategies and integration capabilities in US bank mergers. Strategic Management Journal, vol 25, pp 1233–1256.

Zollo, M. and Singh, H. (2004) ‘Deliberate Learning in Corporate Acquisitions: Post-Acquisition Strategies and Integration Capability in US Bank Mergers’, Strategic Management Journal, vol 25, pp 1233–1256.

Appendix A

The different ways of financing an acquisition

Firstly, the way in which a company finances its acquisition is imperative for its success. This is because it could help to maximize the company’s revenue. Kasparova, (2007), for instance, argues M&A can be financed in different way, however cash, ordinary shares, IPO, bonds, and derivates play a crucial role in helping to achieve a company’s M&A success. Odenthal (2016), maintained this view by arguing that there are several different methods for financing mergers and acquisitions, however the best way to finance a company depends on the state of the company.

Appendix B

The main reasons why acquisitions fail

Gill, (1999) argued that M&A frequently fail due to the difficultly of embracing two joining companies’ cultures, which is known as merger syndrome. Sherman (2010) put forward the notion that M&A often fail as they are fraught with potential issues and downfalls. Additionally, evidence demonstrates that M&A fail to produce any significant gains in shareholder value (Grundy, 2003). Furthermore, M&A fail primarily because of the poor execution. Moreover, M&A arguably fail because of “mismanaged untested commitment, over-enthusiasm and the thrill of the chase”, (El Zuhairy, Taher, and Shafei, 2015). Also, many M&A fail since many managers fail to realise that merging with another business involves more than taking control of properties, and merging premises, capital, and equipment. Moreover, the top ten reasons for failures include “failing to agree on explicit visions and objectives, an unreal value on synergies, trends and the business plan, complex management and organizational structure, a lack of accountability and cultural incompatibility leading to poor communication” (El Zuhairy, Taher, and Shafei, 2015).find quote

Buono & Bowditch (1989), however, argued that many M&A fail because of unsuccessful management of the acquisition process. Marks & Mirvis (2011), despite this argued that most M&A are financial failures and produce undesirable outcomes for the people and companies involved, i.e. evidence shows that “83% of all deals fail to deliver shareholder value and 53% actually destroyed value”.

Marks and Mirvis (2011), argued that the main reason why M&A fail is due to the underestimation of the difficulties of merging two cultures’’ and another study found that, while 80% of senior executives felt underprepared to deal with culture, those that did give early attention to it were more likely to realize synergies. This is supported by Weber and Pliskin (1996), who argued that cultural differences negatively impact functional integration and organizational effectiveness. “Furthermore, another reason why acquisition may fail may be because M&A would pose serious threats to the corporate culture of time and because M&A are Difficult in modifying cultures which becomes “quite salient during mergers and acquisitions” (Chatterje et al.,1992).

Agrawal et al., (1992) nevertheless put forward the view that M&A fail because of reasons such as low shareholder value, low or negative return on equity/assets and declining stock price, among others. Zollo & Meier, (2008) however criticised this view by arguing given that acquisition performance is a complex and multifaceted concept, our conceptualization is rather broader as we define M&As failure as a situation in which an acquisition did not realize its potential to create and appropriate economic rent through the integrated value chain activities. Research indicates that generally, M&A activity does not have a positive effect on the long-term financial performance of the acquiring firms (e.g. Agrawal et al., 1992).

Appendix C

Ratio used in this study formulas

Profitability ratios

(Farjoun, 1998).

(Rani, Yadav, & Jain,2015).

(Rani, Yadav, & Jain, 2015).

(Rani, Yadav, & Jain, 2015).

(Rani, Yadav, & Jain, 2015).

Efficiency ratio

(Rani, Yadav, & Jain, 2015).

Leverage and liquidity ratios

(Rani, Yadav, & Jain, 2015).

Appendix D

Cadbury financial performance three years’ pre-acquisition

| Profitability Ratios: | 2007 | 2008 | 2009 |

| Return on assets | 407/11,338*100

= 3.6% |

366/8,895*100

= 4.11% |

510/8129*100

= 6.27% |

| Return on sales | 407/7,971*100

= 5.11% |

366/5,384*100

= 6.80% |

510/5975*100

=8.54% |

| Return on equity | 407/4173*100

=9.75% |

366/3534*100

=10.36% |

510/3522*100

=14.48% |

| ROCE | 788/11338-4614= 11.71% | 388/8,895-3388

=7.05% |

507/8129-2434

= 8.80% |

| Net profit margin | 407/797*100

= 5.10% |

366/5384*100

= 6.80% |

510/5975*100

=8.53% |

| Efficiency Ratio: | |||

| FATR | 7971/8667*100

=91.97% |

5, 384/5990*100

= 89.88% |

5975/ 5996*100

=99. 65% |

| CATR | 7971/2600

= 3.07 |

5384/2635

=2. 04 |

5975/2125

=2.81 |

| Leverage Ratio: | |||

| DA | 7165/11338*100

= 63.19 % |

5361/ 8,895*100

=60.27% |

4607/8129*100

=56.67% |

| Liquidity Ratio: | |||

| CR | 2600/ 4614

=56.35% |

2635/ 3388

= 77.77% |

2125/ 2434

=87.30% |

Kraft’s financial performance 3 years’ post-acquisition

| Profitability Ratios: | 2011 | 2012 | 2013 |

| Return on assets | 1,775/21539

*100= 8.24% |

1642/23329

*100= 7.04% |

2,715/23,148

*100= 11.73% |

| Return on sales | 1775/18, 576

*100= 9.55% |

1642/18271

*100=8.99% |

2715/18218

*100=14.90 |

| Return on equity | 1775/ 16588

*100= 10.70% |

1642/3572

*100= 45.97% |

2715/5187*100

=52. 34% |

| ROCE | 2828/ 21539

-2572*100= 14.91% |

2670/ 23, 329-3606*100= 13.54 | 4591/23148-3, 410*100= 23.23% |

| Net profit margin | 1101/18576*100

=5.93 |

811/18271*100

=4.44 |

1375/18218*100

=7.55 |

| Efficiency Ratio: | |||

| FATR | 18576/391= 47.5 | 18271/ 325= 56. 22 | 18218/ 43= 423. 67 |

| CATR | 18576/ 4908= 3.78 | 18271/ 4823 = 3.80 | 18218/ 3, 272= 5.57 |

| Leverage Ratio: | |||

| DA | 4951/ 23148

= 21.40 |

19, 607/ 23, 179

=84. 60 |

17961/ 21539

= 83. 40 |

| Liquidity Ratio: | |||