The British System of Film Financing

Info: 10632 words (43 pages) Dissertation

Published: 10th Dec 2019

Tagged: Film StudiesFinance

Entertainment Law Coursework

“A comparison between the two different cinema financing systems based on fiscal incentives in the United Kingdom and Italy”

Introduction

The film industry is a huge machine encompassing an infinite number of elements, ranging from the provision of jobs to the creation of movies. From its creation in the early years of the 19thcentury by the Lumière brothers, to the present times, the seventh art[1] has represented one of the main hobbies for members of our community, increasing in its magnitude and catchment area year after year. This also being a result of the development of new technology and methods for improving film quality, therefore augmenting incredibly the relevance of this sector to our modern-day society. As a result, new methods of financing have been established to facilitate the creation of new movies and incentivize producers to generate new material and render it available to the market. These methods include ways of direct financing provided by the state on a tax relief basis detracted from the costs of production. The two most recongized and effective methods of movie financing through detaxation are the tax shelter and tax credit, the first one covering the reallocation of company profits reinvested in the film industry whilst the second one offers relief on taxes for domestic and foreign ventures of the industry investing in the production of a film.[2] For greater clarity, domestic(internal) investors are considered those who are part of the cinematic chain (the producer, distributor, operators such as cinema owners and post producers) therefore people who participate in the production and distribution of the film, on the other hand foreign (external) investors are all those companies unrelated to the film industry which decide to invest in a film production (eg.Nike contributing to the production budget). This essay will address both tax relief systems; mainly concentrating on the most important and used between the two, which is the tax credit, regarding the United Kingdom and Italy. Assessing the benefits they bring, the economic impact of the two separate film industries and the modalities and extent of their application on national level in order to construct a detailed and accurate comparison. This will be done with the aid of data regarding the quantity of films produced in the recent years, funds made available and cash flow generated. Relevant data and crucial pieces of information will be provided by the British Film Institute, the Italian Minister of Culture and Tourism along with professors and professionals of the Industry (most of them encountered personally). To cover the argument thoroughly and detect the basics of these legal mechanisms, a general context considering the provisions established by the European Union and how these have been incorporated by the above two nations will be provided; also, briefly referring to the issues encountered in the legislative process.

Preliminary Reflections on the evolution of the audio-visual market and the involvement of the European Union

The insertion of cinema in societies daily life has driven legislators to pay greater attention to such an uprising phenomenon. This being the result of the massive diffusion and approval the seventh art has earned in social contexts and in gaining political consent. Therefore, not only the scope of protection provided by intellectual property law necessarily needed to be expanded; having to protect the rights of the artists, assigning copyright protection and royalties also to directors and screenwriters. Also, the creation of a system of financing and support on behalf of the national states before, and the European Union later, has been paramount to efficiently sustain the industry. On top of this, one must consider the capacity of the audio-visual sector (including mainly television) to create work, therefore incentivizing European politicians to delve into the field of investments to make the sector a solid source of employment. Nevertheless, this process has presented several obstacles on the path of the legislator in creating a single European market, given the cultural nature of the audio-visuals themselves, being linked to the traditions of each member state and the mosaic of languages that make up the European physiognomy. The Union is in fact a set of different cultures, values and patrimony, to be preserved in its own specificity, to create that particular fusion that does not flatten the peculiarities but exalts them by identifying common ends. A harmony between different realities able to compete with the power of the American productive apparatus, a giant whose dimensions are so, that it is capable of absorbing much of the world film market[4]. This is why the European Union established mechanisms like the tax credit, tax shelter or Media Program so to provide financial support to a broad spectrum of activities relating to the production, distribution, promotion and development of audiovisual works, both for film and television.

The role of the European Union

Both the tax credit and tax shelter systems, represent ways by which the state offers help to producers, investors and workers of the film industry, these being either external or internal. As all other kinds of state aid, also the above cited are subject to regulations established by the European union (in the European Communities Act), which aim to limit the scope of benefit afforded and add specific requirements to be fulfilled, in order to consider a state eligible to request such a kind of help. Considering that in the Community context, state aid poses a potential threat to the principles of freedom of trade and free competition[5]. Therefore, the goal of the position adopted by the EU[6] on regulating state aids, is to harmonize and equilibrate the relevant sectors of the market throughout all the member states, preventing that too much aid is given to an activity, creating a disproportionate advantage in respect of the other member states and competing regions of the market. This said, it is now time to explicate the ways in which the European Union implemented and coordinates said provisions, considering the “cultural exception” granted to state aids and analysing the laws established and their gradual evolution in relation to tax credit and tax shelter. The rapid and exponential growth of cinema and the audio-visual sector has obliged the European Union and its legislators to intervene, proposing and implementing laws that could regulate and aid the exploitation of such an uprising market. Since the Union came into existence, the issue regarding a European audio-visual industry has been long debated, yet such a project has proven to be very difficult to realize. Such competence has developed implicitly over the years, in the area of freedom of establishment and freedom to provide services, thanks to an extensive interpretation of the Court of Justice of the European Union to expand the concept of free provision of services in the audio-visual sector (broadcasting, television, cinema). The first signs of developing a European audio-visual system are contained in important reference documents of the European Commission, such as the 1957 White Paper or the 1958 Green Paper, to direct action on the harmonization of national policies and to ensure the effective convergence of audio-visual systems adopted by individual Member States by contributing to the opening of national markets to free competition[7]. The attribution to the Community of regulatory competences in the cultural sector comes through the introduction of article 151 of the TEU (Treaty on the European Union) in 1992 after Maastricht (discussed later); however, the absence of this competence in previous years did not prevent the EU from touching cultural areas in the exercise of its regulatory activity, coordinating economic cultural activities themselves and above all, intervening, through limited actions, in order to achieve a progressive “Adaptation du droit communautaire au secteur culturel” (Adaptation of Community law to the cultural sector). The Directives[8] created throughout the years, before the establishment of the Treaty of Maastricht, stand as a clear example to this last statement; representing the first forms of intervention on behalf of the Union in the field of cinema. Concerning the application of the concepts of freedom of establishment and provision of services to the cinematographic sector.

The first decisive and most important step taken by the European Union in creating boundaries to regulate state aids for sectors of the market having a cultural value has been the establishment of the Treaty of Maastricht (also known as the Treaty on the European Union, TEU) in 1992; articles 87,88 and 89 (replaced by arts. 107,108 and 109 of the Treaty on the Functioning of the European Union, which will be discussed later) being the most relevant to the cinema industry. Furthermore, with the insertion of a specific paragraph on Culture (Article 151 of the Treaty of Nice, now art.167 Treaty of Lisbon – TFEU – Treaty on the Functioning of the European Union), the legal foundations to put in place the actions promoted by the Community to encourage, promote, integrate and develop initiatives undertaken by Member States in respect of each of their cultural diversities have been defined[9]. After the 1992 Treaty, there have been three main legislative steps that determined the result achieved in 2007 with the Treaty of Lisbon, of adding the “cultural exception” to the derogations for state aid request. “The Resolution of the EU Council” on the 12th of February 2001 being the first one and the most concerned towards cinema, considering the great importance conferred to the national subsidies available for cinematographic and audio-visual sector in emphasizing their role “to ensure cultural diversity and to contribute to the Creation of a European audio-visual market”. The following two occurred shortly after, to be exact, the 2nd of November 2001[10] has seen the birth to the “Universal Declaration of UNESCO on Cultural Diversity” followed by the UNESCO Convention of 2005. The 2005 UNESCO Convention is an evolution of the 2001 Declaration in which cultural diversity plays an even more important role. These are the so-called “EU external measures” to protect the promotion of European culture to deal with competition from the US (and China) and to mitigate market liberalization processes in the audio-visual sector as well. These Declarations therefore reinforce the provisions of the Maastricht and Lisbon Treaties on State aid in the film sector[11]. In brief, the 2005 UNESCO Declaration and Convention on Cultural Diversity affirm the specificity of cultural products and the right of Member States to protect their cultural diversity and, in fact, determine the wording of the “Principle of Cultural Diversity”[12]. The final outcome is reflected in the provisions implemented in the Treaty of Lisbon in 2007 amending what had been established in Maastricht (TEU 1992) and in the Treaty on the Functioning of the European Union; relevant to this paper, the articles 107 and 108 present in section 2 of the aforementioned treaty and article 167. Taking a final official position on the “cultural exception” and setting the requirements for a state aid request (which will be analysed in relation to the cinema industry and film production). The abovementioned rules aim to prevent public support from affecting competition between businesses, thereby creating a distorted system of competition, in order to avoid a substantial protectionism contrary to the freedom of trade. The audio-visual sector is the area where the cultural derogation has been found to be more effective, indeed it can be considered the most striking and debated case of “derogation” that EU history contemplates[13]. Art. 107 para.1 of the TFEU indicates, as a general rule, that State aid is incompatible with the internal market, with the exception of derogations. Paragraphs 2 and 3 state that “aid intended to promote culture and heritage conservation is compatible when it does not affect the conditions of trade and competition in the Union in contravention of the common interest” (the audio-visual sector falls within the field of culture). According to this article, the requirements a measure must have to qualify as State aid in the Community sense of the term are four and must be simultaneously present: State aid origin (State aid granted through State resources); the presence of a selective advantage; impact on competition and impact on trade between Member States. The aid must be subject to control by the Commission, which authorizes them only when they fall within one of the derogations laid down in the Treaty; it has the discretion to apply them and must reason its decisions. Article 108 TFEU also provides that the Council may determine that aid is compatible with the common market and that authorization, upon request by a Member State, must be decided on a unanimous basis and only where exceptional circumstances justify such a decision. This is rarely the case. Generally, the aid deemed compatible by the Commission must have objectives of common interest (eg. promotion of culture), nevertheless providing for a market shortage[14]. If the Commission considers that aid granted by a State is incompatible, it is expected that the State responsible for its supply either suppress or modify it in compliance with the Commission’s ruling. If the requested State fails to comply with the decision within the time-limit, “the Commission or any other State concerned may refer directly to the European Court of Justice, by way of derogation from Articles 258 and 259”. It should also be stressed that in 1992 the Commission introduced the “de minimis rule”, namely the minimum value: below a certain quantitative threshold, aid may be granted by individual States, without having to communicate it to the Commission and avoiding, as a result, the lengthy procedures envisaged. This scheme provides that State aid, to be compatible with the European system, should not exceed € 500,000 or be considered compatible with the Commission in accordance with the “principle of cultural exception”[15]. Finally, article 167 TFEU has made it easier for the EU and the Member States to intervene in the field of culture and the audio-visual sector, offering the possibility of providing incentives for and in support of national initiatives (thus leaving the competence to the Member States in these matters) setting at community level the protection and enhancement of the “common legacy” and promotion of culture[16].

Defining the role of the “Cultural Exception”

Now that the whole spectrum regarding European law has been considered, it is important for the sake of this paper and the explanation of how tax credit and tax shelter systems are applied in Italy and the United Kingdom, to thoroughly explain what the “cultural exception” is and the requirements conditions it purports in order to deem a state aid fit for execution. Community legislation considers the principle of “cultural exception” since 1989 with the Directive 89/552 / EEC, “Television without Frontiers” in the text of which, to articles 4 and 5, it intervenes on the programming quotas in defence of the European market. These provisions represent the application of the principle of “cultural exception” as the defence of the audio-visual sector at European level. The so-called “cultural derogation” establishes that aid “intended to promote culture and heritage conservation” can be considered compatible with the internal market when they do not affect the “conditions of trade and competition in the Union to an extent contrary to the common interest”; it was first officially introduced in 1992 with the Treaty of Maastricht which definitely attributes competence to the EU in this field. Currently, all the active systems for tax incentives in cinema and the audio-visual present in the EU are based on the principle of derogation defined by the “cultural exception”. The positive complement to the cultural exception is the defence of the idea of ”cultural diversity”: according to a principle of subsidiarity[17], each Member State can be delegated the task of defending its cultural diversity, in compliance with Community principles, including supportive policies structured with mechanisms typical of state aids, and always in the light of a strengthening of the European market. For the audio-visual, therefore, the cultural exception is articulated with the necessity to ensure the cultural expression and creative potential on a regional and national level, especially through the tools represented by cinema and television. The Commission’s assessment of audio-visual support schemes proposed by the various Member States is based on verifying compliance with the following criteria[18]: criterion of general legality[19] and the specific compatibility criteria for film production and television[20], which entails four sub-criteria: the criterion of the cultural product, criterion of territorialisation of expenditure, aid intensity criterion and the criterion for specificity of support[21]. Since the introduction of these criteria, most of the European countries have introduced forms of tax incentives for cinema, gaining attractive economic benefits in terms of volume and production quality, as well as in terms of added value for the protection and enhancement of national cultural identity. However, one must not neglect the fact that, all the schemes in force, although in their specific nature, (since every country is free to implement EU provisions as they prefer) are characterized by the respect of the Community criteria.

Together with the abovementioned legal procedures, the fact that around Europe tax benefits in favour of cinema are already widely used stands in support of the notion that the Commission recognizes the importance of European cinematography and the need to promote European production; nevertheless, fulfilling its role of ascertaining that national support systems are compatible with Community legislation in the light of cultural objectives. In conclusion, European cinema is the foundation of European cultural expression and its cultural value consists in being a witness to the richness of cultural identities in Europe and the variety of its peoples. Audio-visual works, and cinema in particular, play an essential role in shaping European identities. All audio-visual works have peculiar characteristics due to their dual nature: they are economic goods that offer great opportunities to create wealth and employment but at the same time are also cultural assets that reflect and shape society[22].

The British system of film financing

Public support for the British film industry moves on two main tracks: direct (through national and regional agencies) and indirect (through fiscal incentives to stimulate investment) funding. Previously to the introduction of the British Film Institute, approximately 60% of direct funding was managed by the UK Film Council, the agency established by the Labour Government in the year 2000 which had grouped the various pre-existing departments into one body, being solely responsible for the development and promotion of the film industry in the UK. However, on the 26th of July 2010 the council has been officially abolished being replaced by the BFI[23]. Together with funds allocated from the national lottery (more detail will be provided later), another important portion of funding available to the film industry derives from the investments made by public and private television broadcasters. Despite the fact, they have no investment obligation, public and private TVs voluntarily participate in the enhancement of national and European film production. Public televisions, in particular, allocate 0.7% of their budget to cinema through pre-purchase or co-productions of European films. The BBC itself launched a partnership with the Film Council in February 2006[24] (now regulated by the BFI), raising from £ 10 to £ 15 million the annual amount allocated by the broadcaster to the production of British films. Indirect funding occurs through the application of fiscal incentives on the investments and production budget for cinematographic productions that satisfied the required criteria. Initially, there were two types of incentives: the tax credit and the tax shelter, both governed by the 1997 Finance Act (section 48), subsequently amended in 2006, while the criteria for establishing the ‘British’ nature of a production (and therefore the eligibility for incentives) were set in the 1985 “Films Act”. The 2006 Finance Act amendment determined a great change in the spectrum of movie financing through tax incentives, abolishing the tax shelter model, because of the significant leakages and distortions it suffered[25], while reinforcing the provisions related to tax credit “with the aim of providing an incentive within the British tax system for the production of culturally British films[26].” Such a change was regarded as essential to sustain “the UK film industry’s reputation for excellence in a globally competitive market”, and supporting the “sustainable production of British films, by recognising the cultural and economic benefits that they bring.”[27]The British support schemes acquired unique characteristics (as no other state has such provisions) thanks to the extensions implemented in 2011,2013 and 2014[28] extending the scope of the tax relief incentives provided to high-end television (only for productions costing more than £1 million per television hour and children programming), animation programs and video games[29].

Today’s British film tax relief (Ftr) includes both a tax credit payable directly to producers and a deduction of the profits invested in production. Very recent changes have been carried out to the values of the tax relief by the British government to encourage the production of culturally British films in the UK and attract investments. In 2014, the UK minimum spend requirement has been lowered from an initial 25% to the actual 10%[30], while in 2015[31], a 25% tax relief rate has been made available for all eligible film productions regardless of their budget, abrogating the old provision that awarded a 25% cash rebate only on the first £20 million spent, and 20% thereafter[32]. Not subject to recent modifications; tax credit for British qualifying productions is granted up to a maximum of 80% of the total costs incurred or on the actual UK core expenditure, depending on the lower between the two[33], with no limits or caps on the payment of the amount that may be claimed. However, relief is not provided on total production expenditure, as it is limited to expenses incurred on pre-production, principal photography and post-production, excluding any cost relevant to the development, distribution or other non-production activities. In order to be considered eligible for a tax relief request, a film must fulfil a number of requirements relative to its characteristics and productive elements. Together with the previously illustrated minimum spend requirement (NB expenditure incurred on production activities which take place within the UK, irrespective of the nationality of the persons carrying out the activity) a film must: be intended for theatrical release, either pass the Cultural Test or qualify as an official co-production (under either one of the UK’s official bilateral co-production agreements or the European Convention on Cinematographic Co-production) and the Film Production Company must be within the UK corporation tax net[34]. To be clear, the Cultural Test is an assessment of the cultural relevance of the film, scrutinised in order to ascertain the presence of an adequate number of cultural elements in the script and/or production and cast. It is established on a point awarding basis, following 4 (Cultural content, contribution, hubs and practitioners) different criteria for a total of 35 points (illustrated in detail below)[35].

| Cultural Test | Points | |

| A | Cultural Content | |

| A1 | Film set in the UK or EEA | 4 points |

| A2 | Lead characters British or EEA citizens or residents | 4 points |

| A3 | Film based on British or EEA subject matter or underlying material | 4 points |

| A4 | Original dialogue recorded mainly in English or UK indigenous language or EEA language | 6 points |

| Total Section A | 18 points | |

| B | Cultural Contribution | |

| The film demonstrates British creativity, British heritage and/or diversity | 4 points | |

| Total Section B | 4 points | |

| C | Cultural Hubs | |

| C1 | (a) At least 50% of the principal photography or SFX takes place in the UK | 2 points |

| (b) At least 50% of the VFX takes place in the UK | 2 points | |

| (c) An extra 2 points can be awarded if at least 80% of principal photography or VFX or SFX takes place in the UK | 2 points | |

| C2 | Music Recording/Audio Post Production/Picture Post Production | 1 point |

| Total Section C (Maximum 4 points in total in C1) | 5 points | |

| D | Cultural Practitioners (UK or EEA citizens or residents) | |

| D1 | Director | 1 point |

| D2 | Scriptwriter | 1 point |

| D3 | Producer | 1 point |

| D4 | Composer | 1 point |

| D5 | Lead Actors | 1 point |

| D6 | Majority of Cast | 1 point |

| D7 | Key Staff (lead cinematographer, lead production designer, lead costume designer, lead editor, lead sound designer, lead visual effects supervisor, lead hair and makeup supervisor) | 1 point |

| D8 | Majority of Crew | 1 point |

| Total Section D | 8 points | |

| Total all sections (pass mark 18) | 35 points | |

The British Film Institute is the main body responsible for the certification and assessment of the film tax relief incentive, it works side by side with the Inland Revenue (UK’s tax agency), in charge for the tax detraction calculations and final payments (considering the cash rebates given for any outstanding amount resulting after the reduction of taxes owed by the production company), and last but not least, the Department of Culture, Media and Sport which has the duty to evaluate the correct presentation of the documents and give his approval[36]. Application for the incentive can be done online (on the BFI website)[37], however the law requires that a paper copy also be submitted, including the original signature of the applicant. Simultaneously with the abovementioned, the application process requires the producer to submit multiple other documents, “including the completed cultural test (if relevant), a shooting script and synopsis in English, a shooting schedule, a production budget or cost report (depending on the timing of the application), and a chain of title for the film”[38]. Upon completion, the Certification Unit at the BFI has 28 days to return the application, with this timeline only beginning when the paper application is received. Following certification, the paper certificates are then forwarded to the Department of Culture, Media and Sport for signature. The legislation currently requires that the minister in charge or their nominated representative must personally sign them[39].

As mentioned in the beginning of this chapter, the BFI replaced the UK Film Council becoming the principal(public) institution responsible for managing and redirecting funds for cinema (direct and indirect). It operates with three sources of income: public money allocated by the Department for Culture, Media and Sport; commercial activity such as receipts from ticket sales (eg. IMAX theatre); grants and sponsorships obtained from various sources, including the National Lottery fund[40], private sponsors and through donations[41]. By virtue of these sources of income, the BFI has created and manages four funds: the film fund, the innovation film fund, the print and advertisement fund and the film export fund; with the first two encompassing the tax relief incentive schemes and Cultural Test requirement[42]. Finally, it is important to note that public support is not the sole way of seeking funds for a film production in the UK and that the BFI does not represent the sole public film funding body, as there are several others around the UK[43]; although it certainly stands as a reference point because of the great decisional power it has on tax relief applications and the enormous amounts of funding it receives (especially from the government) and (potentially) allocates to productions and funds. Private film funding companies represent a great alternative to public support bodies because of their greater efficiency in allocating funds and support provided in setting up the elements of production. There is a great variety of companies; some dedicated to large budget productions (Ingenious) while others (Montfilm) interested in aiding films that require lesser investments[44]. The recent growth[45] in the private company industry may be considered in the light of the SEIS incentive model[46], under which private stakeholders (in this case) interested in investing in the film industry may receive up to a 50% tax relief (subject to the terms of the act), therefore having a minimal risk in respect to the potential gain. Despite the recent changes to most of the relevant national law concerning tax relief incentives and the incredibly advantageous schemes adopted, it is impossible to predict the steps the British Government will take in relation to the aforementioned incentives; even though it appears unrealistic to believe there will be drastic changes to the law, as it would be highly counterproductive for the UK’s entire system of fiscal incentives to cinema.

The Italian System of Film Financing

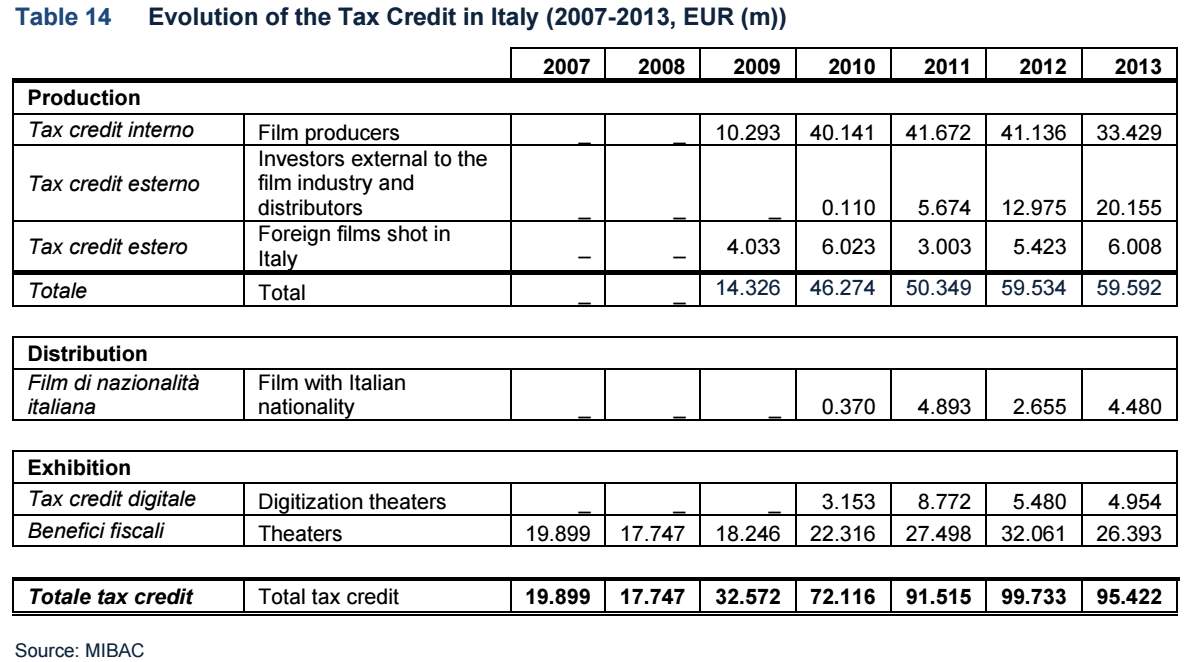

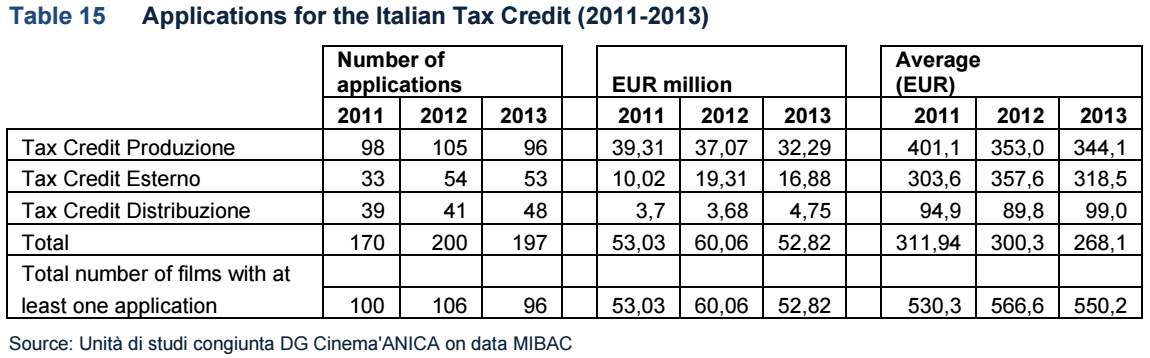

Since the beginning of film production in the early 1920s, there has been a direct State intervention in movie production in Italy, which has changed in various ways throughout the years. However, only in recent times have fiscal incentives dedicated to film production been introduced. The Italian 2008 Finance Act (244/2007) presented a tax incentive system to support the film industry. This tax credit procedure extended its right to film producers, distributors and theater owners, as well as for investors who don’t belong to the film industry, yet pay taxes in Italy. The benefit of the tax credit is calculated on the total cost of the first copy of the film (excluding distribution’s costs). The above amount represents the eligible costs and covers the expenses that meet the requirements of the law. These are: financial, insurance and guarantee costs (up to 7.5% of the cost); expenditures not directly caused by the production of the film (up to 7.5% of the production costs); Staff costs. The expenses must be done on the Italian territory and involve both the subject and the script, the artistic director and the cast, as well as technical personnel, costumes, technical means as well as stage design, music and organizing expenses. If more than 50% of total production days are executed in Italy, these costs are calculated at 100% of their value. Regarding distribution, eligible expenses are: printing of copies; promotion; launch of the movie; subtitling and dubbing. Before describing the tax credit discipline, I will explain what this tax benefit entails. A tax credit allows you to offset tax debts (all local and national taxes, VAT, social insurance and insurance contributions) and it comprises two different categories: internal and external. Internal tax credit is the tax benefit granted to companies operating in the film industry. Italian movie producers enjoy a tax benefit of 15% of the eligible costs subject to the following requirements: film type: only for films of Italian nationality; cultural eligibility ( films must pass a cultural test); the maximum annual credit is 3.5 million euro per single company (for a total investment of 23.3 million euro); use of the national territory: there is an obligation to locate spending in Italy up to 12% of the investment; aid intensity: access to other State aid is expected to be up to 50% of production costs (80% for difficult and/or low budget films).Producers of foreign films that hire Italian companies dealing with the production of foreign films enjoy a benefit of 25% of the production costs incurred and spent on Italian territory according to the following requirements: film types: films do not require Italian nationality;cultural eligibility: films must pass a specific culture test for foreign films; upper limit: the maximum annual credit is € 5 million per film (for total costs incurred on national soil up to € 20 million);use on national territory: eligible expenditures cannot exceed 60% of the total budget of the film (up to 30% of the total can be spent in another European country);intensity of the aid: it is foreseen that the credit is combined with others State aid up to a maximum of 50% of the cost of production. The third category of internal tax credit concerns Italian film distributors who enjoy a tax benefit of 10% for films of Italian nationality or 15% for films of cultural interest of the distribution cost of the movie. The requirements are: film type: Italian language (in this case, the benefit is 10%) and films of cultural interest (in this case, the benefit is 15%); cultural eligibility: film must pass the cultural test; upper limit: the maximum annual credit is € 1.5 million for films of cultural interest and € 2 million for films that are in Italian. aid intensity: cumulativeness of the credit with other State aid is planned up to a maximum of 50% of the distribution cost. Theater owners enjoy a credit of up to 30% of the total costs incurred for the acquisition of equipment for digital projection (the maximum annual limit for each screen is 50,000 euros). Beneficiaries can be: mono screen theaters and multiscreen theaters up to four screens, wherever they are located, multiscreen theatres up to 10 screens located in municipalities with less than 50,000 inhabitants. For all other types of theater owners, tax credit is granted according to precise programming obligations of Italian movies. On the other hand, this tax benefit covers investors outside of the cinematographic chain and allows a 40% tax credit of the investment, which takes place through partnership contracts for the economic exploitation of the work. The maximum limit is one million euro per year. These are the requirements: the cash contribution must be made inside of a partnership agreement; the conclusion of the contract and the economic outlay must be made by the date of submission of the public projection request; the producer and external investor who sign the agreement must inform the Ministry within 30 days; the contract must last at least 18 months; the economic input of the investor cannot exceed 49% of the budget; participation in external profits may not exceed 70%; the producer must spend at least 80% of the amount received by the investor in Italy. This type of tax credit is an important resource for filmmakers as it allows non-filmmakers to become partners in the production of a national film (footnote 2) that has passed the Italian cultural test. Such investments cannot make up the majority of the production costs. The filmmaker is the owner of the movie and the “external” contribution is a form of capital risk. For the investor, this is an opportunity since: The investor benefits from a major tax credit that considerably reduces the risks of losing money in the operation; tax credit, once matured, is easy to achieve through the tax return; any profits are subject to reduced taxation (5%); the investor does not assume any obligation towards third parties. Although it does not manage production, it has the right to control its execution and has the right to a final report; the flexibility of the partnership agreement protects the investor in an appropriate manner; the agreement enables co-marketing or co-branding activities for the launch and promotion of the film; It allows the inclusion of its own products or brand within the film (if the investment exceeds 10% of the budget of the film)[47].

Since tax credit law came into force until 2016, more than 900 films were financed through tax credit; the share of private funding has risen from approximately 16% in 2009 to about 77% in 2016; If the State had to finance the same number of films with direct contributions it would have spent more than twice the approximately 135 million paid from investors in the form of tax credits. Again since 2009, thanks to the tax credit, 27 foreign productions have shot all or part of their film in Italy, receiving € 77 million of tax credits by the State, but spending about 300 million euros in Italy. In November 2016, the tax credit was updated, with the enforcement of the so-called Franceschini Law[48]. In addition to confirming the extension of tax benefits to all audiovisual works (including TV and WEB, video games), a series of novelties designed to improve the financial dynamics of the industry were added. First, the modification of the tax credits that allows producers to come to discuss with external investors with greater negotiating power, restricting the possibility of harassing behavior by “aggressive” investors; this is due to the rise in the rate of the domestic tax credit from 15% to 30%, and the reduction of the external tax credit to 30%.

Pre-conclusive statistical confrontation

Preamble

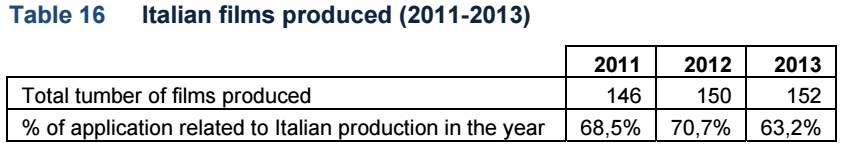

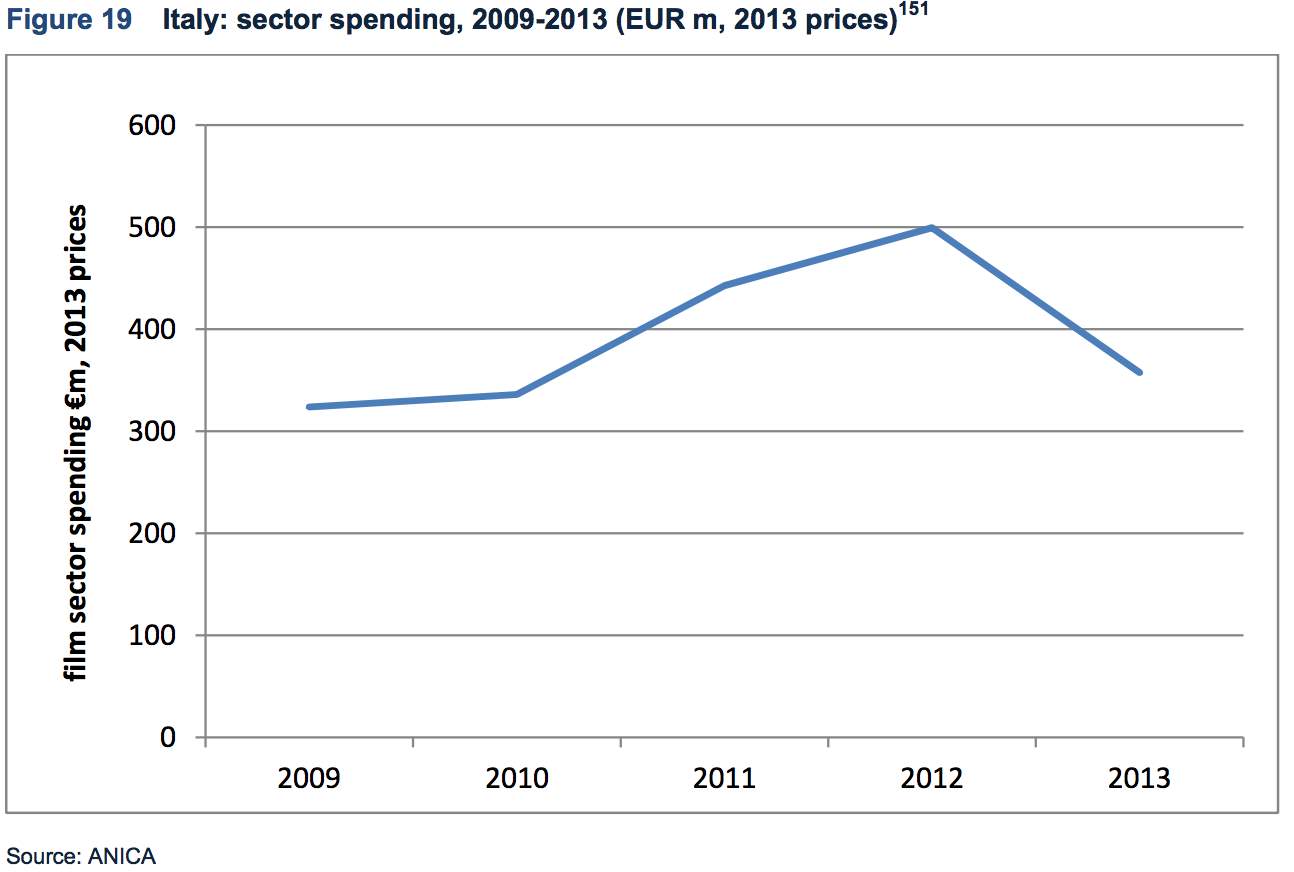

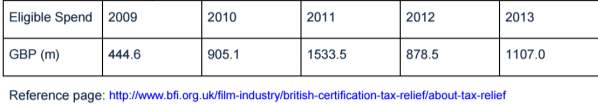

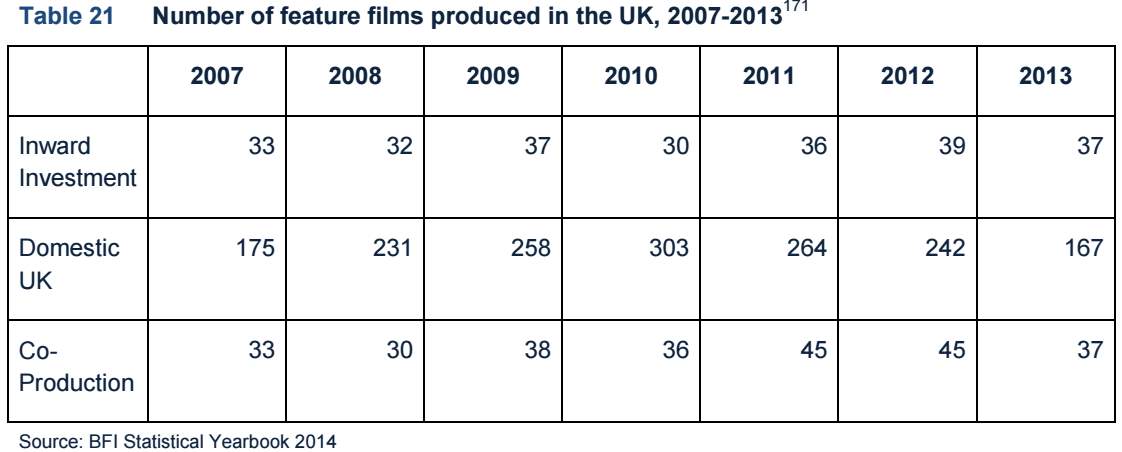

By virtue of the recent changes to the regulations on tax incentives related to the cinema, the statistics shown below are updated through 2014 as the 2015/16 biennium has not yet been covered at 360 degrees, official analysis, on matters relating to this paper. The graphs below perform the main function of highlighting the growth patterns of the cinematic sector resulting from the introduction of said tax relief systems in the United Kingdom and Italy. This chapter plays a key role in illustrating the considerations in chapters (UK) and (IT) and supports a comprehensive conclusion for the purposes set out in the first chapter concerning the main purpose of the thesis. Short comments will be made on the differences in data for both countries.

The table below[49] highlights the massive gap in the investment and subsidy between Italy and the United Kingdom. In 2013 and 2014 the investment for the production of national initiative films in the UK was approximately 3.5 times larger than that in Italy. Furthermore, the public subsidies for the sector were more than twice as much as those in Italy. A major difference we can draw between the two schemes is that the Italian system finances most of the national initiative movies (60%), while the English one only funds around one third of the movies.

| 2013 | 2014 | |||

| Italy | UK | Italy | UK | |

| Investment in the production of national initiative movies and co-productions | 493.1 | 1178.6 | 356.6 | 1267.6 |

| Investment in the production of national initiative movies | 336.8 | 1089.7 | 280.4 | 1,203.5 |

|

Total public subsidy

|

199.4 |

434.1 |

187.3 |

430.9 |

| Total public subsidy, as a % of the investment in the production of national initiative movies and co-productions | 40.4 | 36.8 | 52.4 | 34.0 |

| Total public subsidy, as a % of the investment in the production of national initiative movies | 59.2 | 39.8 | 66.8 | 35.8 |

Table 1: Investment and public subsidy in the production of movies in Italy and the UK (In millions of euros-UK figures converted to euros using the current exchange rate to ease the comparison)

Italy[50]

United Kingdom[51]

The tables above show that the majority of film productions in Italy applying for public support are for national productions, rather than international ones. By comparing the statistics across -2011 to 2013- the horizon for UK and Italy we can deduce that the average eligible tax credit per movie is significantly higher for British productions than Italian ones. This can be justified by the restrictions on public tax credit set by the Italian government as a result of the major economic recession. This has been calculated by dividing the amount of eligible tax credit in each country by the number of film productions that received it. This point is furtherly supported by the larger UK market for film production, where every pound of tax relief translates into £12.50 in revenue[52].

Conclusive considerations

Film tax incentives have influenced the international competitiveness of various European countries in the cinematographic field over the past decade. Such benefits have been created to foster the development of national culture of each Member State and of Europe itself, as a matter of fact acting as true instruments of industrial arbitrage in respect to competition and free movement[53]. The collective use of these type of measures and their widespread homologation[54], has led the film market to a level playing field over time. Italy’s entry into the “fiscally facilitated” circle of countries allows it to adjust on the same level as the other Member States regarding industrial competitiveness in the film industry. Italian legislation has been able to enhance foreign involvements by offering a highly-articulated infrastructure of laws like those adopted abroad, attracting foreign capital to the industry and rewarding the creation of an integrated network within the industry itself. As a matter of fact, the incentives granted to the chain have demonstrated value through joint programming made by producers, distributors and traders. On the other hand, the British government has been one of the first to adopt and encourage the implementation of said incentives. Therefore, the fact that in 2016 UK film’s industry has generated a GVA of 4.3 billion and £875m of tax revenues is not surprising[55]. Finally, the competitiveness of the FTR scheme can be exemplified by the fact that 276 films received final certification with a UK spend of £960 (around 60%) million out of total budget of £1,608 million[56].

Bibliography

- British Film Institute, ‘British Film Certification Co-Production Guidance Notes’ (UK Government 2016)

- Celata G, L’Impresa Audiovisiva: Economia, Scenari, Tecnologie Mercato (1st edn, Roma Tre- University 2016)

- Chianese L, ‘Analisi E Verifica Dell’Impatto Nel Settore Cinematografico Dei Meccanismi Introdotti Dalla Vigente Legislazione Del Tax Credit E Del Tax Shelter’ (2008)

- ‘Communication From The Commission On State Aid For Films And Other Audiovisual Works’ [2013] Official Journal of the European Union <http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:52013XC1115(01)> accessed 15 April 2017

- Di Pasquale A, INVESTIRE NEL CINEMA (1st edn, Il Sole 24 ORE 2012)

- Dipartimento Spettacolo, ‘Presentazione Della Proposta Di Legge N. C 2303, “Agevolazioni Fiscali E Contributi Per Il Sostegno Al Settore Cinematografico E Dell’Audiovisivo”’ (Sala Stampa, Camera dei Deputati 2007)

- EPRS-European Parliamentary Research Service, ‘An Overview Of Europe’s Film Industry’ (European Union 2014)

- European Commission -Directorate-General for Communication, ‘The EU Explained: Culture And Audiovisual’ (Publications Office of the European Union 2014)

- European Commission, ‘Treaty On The Functioning Of The European Union’ (2017)

- Ministro dei beni e delle attività’ culturali e del turismo, ‘Disciplina Del Cinema E Dell’audiovisivo, numero 220’ (2016)

- Ministro dell’economia e delle finanze, ‘Direzione Generale Per Il Cinema’ (Ministero per i Beni e le Attività Culturali 2017)

- Olsberg J and Barnes A, Impact Analysis Of Fiscal Incentive Schemes Supporting Film And Audiovisual Production In Europe (1st edn, European Audiovisual Observatory 2014)

- Olsberg J, ‘A Comparison Of The Production Costs Of Feature Films Shot In Ten Locations Around The World’ (Office of the British Film Commissioner 2008)

- Perotti R, GLI AIUTI AL CINEMA IN ITALIA,FRANCIA E GRAN BRETAGNA (1st edn, 2015)

- Serra F, ‘Film Production Incentives In Europe: Who Is The Most “Ciak” Appealing?’ (Postgraduate, Copenhagen Business School 2014 2017)

- Tavolaro D, ‘Dall’Ideazione Alla Fruizione: L’Evoluzione Della Filiera Cinematografica Nell’Era Del Digitale’ (postgraduate, Università Ca ‘Foscari Venezia 2014)

- Antonio Di Lascio, Silvia Ortolani, “Istituzioni di diritto e legislazione dello spettacolo,dal 1860 al 2010, i 150 anni dell’unità d’Italia nello spettacolo”, Franco Angeli Editore, 2010;

- Buccheri Vincenzo, Il film. Dalla sceneggiatura alla distribuzione, Carocci,Editore, Roma, 2003;

- G. Profita, “L’Europa dei Film. Sostegni comunitari all’industria cinematografica” , Edizioni Kappa, 2004;

- Le leggi del cinema. Il contesto italiano nelle politiche Europee” di C. Rocca, Milano, 2003;

- Il mercato e l’industria del cinema in Italia, rapporti 2007/2013

- La Torre Mario (a cura di), La finanza del cinema, Bancaria Editrice,Roma, 2006;

- TOMASI G., Il cinema e la misurazione delle performance, Egea, Milano, 2004;

- Terry Ilott, Budget and Markets, a study of the budgeting of European Film, 1996, Handcover

- Fondazione ente dello spettacolo, RAPPORTO 2008: il mercato e l’industria del cinema in Italia, Edizioni Fondazione Ente dello Spettacolo, 2009;

- Fondazione ente dello spettacolo, RAPPORTO 2009: il mercato e l’industria del cinema in Italia, Edizioni Fondazione Ente dello Spettacolo, 2010;

- Fondazione ente dello spettacolo, RAPPORTO 2010: il mercato e l’industria del cinema in Italia, Edizioni Fondazione Ente dello Spettacolo, 2011;

- Fondazione ente dello spettacolo, RAPPORTO 2011: il mercato e l’industria del cinema in Italia, Edizioni Fondazione Ente dello Spettacolo, 2012;

- Fondazione ente dello spettacolo, RAPPORTO 2012: il mercato e l’industria del cinema in Italia, Edizioni Fondazione Ente dello Spettacolo, 2013;

- World Film Market Trends, Martin Kanzler and Julio Talavera, 2014;

- Paolo Bertetto, Storia del cinema. Uno sguardo d’insieme, Marsilio Editori, 201

- ANICA & LUISS BUSINESS SCHOOL, ‘LE RICADUTE DEL TAX CREDIT’ (Federica D’Urso 2012)

- Matteo Catelli, Interview with Sandro Gozi, ‘Under-Secretary Of The Council Of Ministers’ (Rome, Italy, 4 April 2017)

- Profita G, Il Sostegno Al Cinema Italiano Introdotto Dalla Legge Finanziaria 2008 E Panoramica Internazionale Degli Schemi Pubblici Di Agevolazioni Fiscali (1st edn, Aracne 2008)

- The Economic Impact Of The UK Film Industry (1st edn, Oxford Economics 2012) <http://www.bfi.org.uk/sites/bfi.org.uk/files/downloads/bfi-economic-impact-of-the-uk-film-industry-2012-09-17.pdf> accessed 2 May 2017

- UK Film Economy – BFI Statistical Yearbook (1st edn, 2016) <http://www.bfi.org.uk/sites/bfi.org.uk/files/downloads/bfi-uk-film-economy-2016-06-30.pdf> accessed 2 May 2017

- “Economic Contribution of the UK’s Film, High-End TV, Video Game, and Animation Programming Sectors” (Olsberg SPI with Nordicity for BFI, Pinewood Shepperton plc, Ukie, the British Film Commission) rep <http://www.o-spi.co.uk/wp-content/uploads/2015/02/SPI-Economic-Contribution-Study-2015-02-24.pdf> accessed May 2, 2017

- Interview with, Mario La Torre, Professorship in Economics of Financial Intermediaries, Faculty of Economics, La Sapienza University (Rome, Italy, March 8 2017)

- Interview with, Jie Ming Chung, founder of “Want Film ltd” (London, Great Britain, March 22 2017)

- Interview with, Firminio Pasquali, Manager Cattleya SpA, (Rome, Italy, March 4 2017)

- Interview with, Maurizio Cisterna, executive producer Cattleya Film Production Company (Rome, Italy, March 4 2017)

[1] Term coined by Ricciotto Canudo in 1911, who defined dance and cinema as the 6th and 7th art. His publication added these two arts to the list previously styled by Hagel in his “Lecture on Aesthetics” where he classified: Architecture, Sculpting, Painting, Music and Poetry as the first five.

[2] A. Di Lascio, S. Ortolani, “Istituzioni di diritto e legislazione dello spettacolo” (FrancoAngeli, Milan 2010),pg.212

[3] These graphs illustrate the resources used when financing a film, highlighting the difference between internal and external investors. Such illustration has been taken by the book “Investire Nel Cinema”, Alberto Di Pasquale (Gruppo24Ore), page 86 figure 4.1

[4] Knowledge acquired thanks to the interview with the professor Ugo Di Tullio, holder of the professorship on organization of show and cinema of the university of Pisa.

[5] Ludovico Peirce Chianese,“Analisi e verifica dell’impatto nel settore cinematografico dei meccanismi introdotti dalla vigente legislazione del tax credit e del tax shelter” (December 2008), page 2

[6] Abbreviation for European Union

[7] knowledge acquired through interview- source XXXIXII in bibliography

[8] Council Directive 63/607 / EEC 15 October 1963, Council Directive 65/264 / EEC 13 May 1965, Council Directive 68/369 / EEC 15 October 1968, Council Directive 70/451 / EEC 29 September 1968 1970, The Green Paper of 1984 (COM 84/300), 1985 White Paper (COM 85/310), Council Directive 86/529 / EEC 3 November 1986, Directive 89/552 / EEC Television Without Frontiers “(TSF) of 1989.

[9] knowledge acquired through interview- source XL in bibliography

[10] knowledge acquired through interview- source XXXIII in bibliography

Art. 9 states “Cultural policies must ensure the free movement of ideas and works and at the same time create the conditions conducive to the production and dissemination of diversified cultural goods and services, through cultural institutions that have the means to affirm themselves On a local and worldwide scale. It is up to each state, in compliance with international obligations, to define its cultural policy and to implement it with the most appropriate instruments, whether it be operational support or appropriate regulatory frameworks ”

[11] knowledge acquired thanks to the interview conducted personally with the professor Bruno Zambardino,

[12] “The European Union explained: culture and audiovisual”, Luxembourg: Publications Office of the European Union, 2014, pgs.4,5

[13] id. interview with professor Di Tullio

[14] A. Di Lascio, S. Ortolani, “Istituzioni di diritto e legislazione dello spettacolo” (FrancoAngeli, Milan 2010),pg.33

[15] Decision 2008/484/EC

[16] id. Di Lascio, Ortolani, pgs. 33,34,35

[17] Oxford English Dictionarydefines subsidiarity as, “the principle that a central authority should have a subsidiary function, performing only those tasks which cannot be performed at a more local level.”

[18] The criteria for the assessment of State aids for the production of cinematographic works and other audiovisual works were originally published in the 2001 Communication on Film.

[19] Commission must ensure principles established in articles 18, 34, 36, 45, 49, 54, 56 of the TFUE are respected before accepting a request for state aid.

[20] Article 107, para. 3 (d) TFEU

[21] “Communication from the Commission on State aid for films and other audio-visual works” (Bruxelles 2012, European Commission) pgs. 10,11

[22] knowledge acquired through interview- source XXXIII in bibliography

[23] BFI abbreviation for British Film Institute

[24] http://www.bbc.co.uk/pressoffice/pressreleases/stories/2006/02_february/22/film.shtml

[25] Jonathan Olsberg, Andrew Barnes,“Impact analysis of fiscal incentive schemes supporting film and audio-visual production in Europe” (European Audiovisual Observatory, December 2014) pg,117

[26]id.(Olsberg,Barnes), 110

[27] Pre-Budget Report, HM Treasury (5th December 2005) sub-chapter 5.95

[28] all amendments contained in the Finance Act 2015, sections 29,30,31

[29] interview conducted personally with ….. il giallo

[30] Corporation Tax Act 2009, Section 1198(1)

[31] Part 15 Corporation Tax Act 2009, Section 1202 (3) sets out the rate of the payable credit that a company is entitled to. Until recently, this was based on whether the film was a limited budget film (which got 25% credit) or any other film (which was entitled to a 20% credit). However Finance Act 2014 removed some of this ‘cliff edge’ by allowing all films up to the ‘limited budget’ band to claim 25% credit and 20% credit for the remainder. This distinction will be removed so that all films, regardless of budget, are entitled to a 25% credit.

[32]https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/413951/TIIN_4072_ct_film_tax_relief.pdf

[33]Examples of how the scheme is applied can be found here: https://www.gov.uk/hmrc-internal-manuals/film-production-company-manual/fpc55020

[34] Pinewood: UK Film Tax Relief Summary

[35] http://www.bfi.org.uk/film-industry/british-certification-tax-relief/cultural-test-video-games/summary-points-cultural-test-film

[36] knowledge acquired through interview- source XLI in bibliography

[37] http://www.bfi.org.uk/supporting-uk-film/british-certification-tax-relief/cultural-test-film#application-forms

[38] id.(Olsberg,Barnes), 110,111

[39] ibid.111

[40] directed by Secreatry of State for Culture, Media and Sport

[41] knowledge acquired through interview- source XXXIX in bibliography

[42] Francesca Serra, “Film production incentives in Europe: who is the most “ciak” appealing?” (Copenhagen Business School 2014), pg.42

[43] listed on the BFI website- http://www.bfi.org.uk/sources-funding-uk/sources-funding-uk-filmmaker

[44] intervista tradotta ceo Monfilm non ricordo il nome

[45] Geoffey Macnab, “UK Private Financiers: Adventure Capital” (9 May,2016) http://www.screendaily.com/features/uk-private-financiers-adventure-capital/5103539.article

[46] Part 5A of the Income Tax Act 2007 and section 150E-F and Schedule 5BB of the Taxation of Chargeable Gains Act 1992- amended by section 54 of the Finance Act 2014

[47] Interview with,

[48] n.220 X on bibliography

[49] on page 19- source XIV of bibliography

[50] Graphs taken from – Jonathan Olsberg, Andrew Barnes,“Impact analysis of fiscal incentive schemes supporting film and audio-visual production in Europe” (European Audiovisual Observatory, December 2014)- permission to use them accorded by Alberto Di Pasquale: alberto.pasquale@uniroma1.it

[51] id. Contact references above

[52] https://www.gov.uk/government/news/record-year-for-uk-film-industry-tax-relief

[53] Profita G, Il Sostegno Al Cinema Italiano Introdotto Dalla Legge Finanziaria 2008 E Panoramica Internazionale Degli Schemi Pubblici Di Agevolazioni Fiscali (1st edn, Aracne 2008)

[54] ensured by the European Union

[55] “Economic Contribution of the UK’s Film, High-End TV, Video Game, and Animation Programming Sectors” (Olsberg SPI with Nordicity for BFI, Pinewood Shepperton plc, Ukie, the British Film Commission) rep <http://www.o-spi.co.uk/wp-content/uploads/2015/02/SPI-Economic-Contribution-Study-2015-02-24.pdf> accessed May 2, 2017,5

[56] British Film Institute statistical Yearbook 2016

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Finance"

Finance is a field of study involving matters of the management, and creation, of money and investments including the dynamics of assets and liabilities, under conditions of uncertainty and risk.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: