Study on Business Environment Problems of Ethiopia: The Case of Addis Ababa

Info: 33011 words (132 pages) Dissertation

Published: 12th Oct 2021

Tagged: International Business

ABSTRACT

The general objective of this study was to identify the major challenges of business environment of Ethiopia in the case of Addis Ababa city administration and to find out ways to improve current problems of BEE in the city and country. The research has been conducted based on a methodology developed in the light of positivism research philosophy; this research also followed the paradigm of constructive and applies an exploratory sequential mixed approach through mixed research method including survey questionnaire and secondary data strategy.

There are many research works about business environment published by World Bank groups, the prominent one among this publications is World Bank /IFC yearly report that determines favourability or severity of business enabling environment of each country out of 189 nations. However, most of these empirical studies on business environments are subjected to three constraints. Such as, Limited scope i.e. focused only on impact of business environment on private sector development. Applicability of data provided by few informants, just one or two firms focusing or interested by only tax indicators.1 and the number and diversity of informants for all indicators are not representative. This research attempted to fill this gap by diversifying government officials, employees, businesses and consumers as an informant and by incorporating major indicators and significant number of sub indicators.

Accordingly data in this research has been collected from a group of 103 sample population out of 120 purposively selected sampling schemes, including, 50% of private sectors’ or businesses, 25% of consumers and 25% government employees and officials which, generally reflected the major economic actors whose interests are affected by business environment factors in three sub city of Addis Ababa and three administration units within those sub cities.

The research aim has been achieved successfully through its three specific objectives including, identifying challenges of business enabling environment with respect to the role of Government, Business and consumer, pinpointing the major sources of challenges and problems that hinder business enabling environment, and providing solutions that help decision makers to take corrective measures, The major findings of the research relating to challenges of BEE in Addis Ababa as well as Ethiopia are: unregulated computation, tax administration, electricity supply, renewing business license, corruption, access to land and construction permit, access to finance, cost and availability of shops stores and offices, telecommunication service, frequent change in business laws and regulations.

The main sources of mentioned problems are legal, bureaucratic and technological incapability of government institutions. Unnecessary documentary requirements, lack of clarity of procedures, poor institutional coordination, uneven enforcement of rules, uneven registration for VAT, interruption and cuts in electric supply, unclear rules that leads to discretionary practices of officials, oligopolistic market structure, limited accessibility to the dispute resolution mechanism, severity of penalties and lack of guidance on compliance and severity of inefficacy in service provision and client handling.

While, most of problems detailed above have been caused by government’s legal, administrative and institutional inefficiency, government should have to take Lions share through legal, technological and institutional reform to improve all aspects of BEE. However, private sectors or businesses have had significant contribution through unethical business practice and consumers through ignorance of defending their rights. Accordingly, my paper also has shown that prospective roles be played by both consumers and privet sectors through PPP mechanisms and consumer associations respectively.

The major limitations of the research are lack of incorporating all EODB indicators in the survey questionnaires or in the primary research questions, like border trading, employing workers, registering property right and protecting investors while included to answer the first question through secondary data. The reason for this limitation is basically related to nature of business enabling environment components; that affect a wide pool of end-recipients, institutions and stockholders.

Key Words and phrases: BEE, government, business, consumer, Ethiopia and Addis Ababa

Table of contents

1.2 Originality and contribution

1.3 Statement of the Problem and research question

2.1 Definition and Type of Business Enabling Environment

2.2 Importance of Business Environment reform

2.3 Theoretical foundations of Business Environment

3 Business operating environment in Ethiopia

3.1 Political stability and sustainable economic growth

3.2 The role of Addis Ababa city administration in Ethiopian business environment

3.3 Business environment in Addis Ababa city administration

4 Methodology, Data source and measurement

4.2 Sampling strategy, frame and size

5 Data analysis and presentation

5.2 General structure and characteristics of respondents

5.3 Identified key challenges of business in Addis Ababa

6 Discussion, evaluation, conclusions and recommendations

Appendix A Survey Questionnaire for business persons

Appendix B : Survey questionnaire for government officials and Employee

Appendix C Survey questionnaire for consumers

List of tables

Table 2‑1, literature related to the importance and impact of business environment reform.

Table 2‑2, Theories pertaining to characteristics of business environment and the main challenges affecting its process

Table 5‑1, Structure and characteristics of respondents……………………..

Table 5‑2, Level of Severity or problems relating to each BEE indicators…………

Table 5‑3, problems related to consumer right protection

Table 5‑4, problems related to respecting business law and regulation

Table 5‑5 summery on Countries experience

Table 5‑6, summaries about role of stockholders………………………….

Table 6‑1, EODB rank of Ethiopia BY each indicator from 2008~2017 out of 189 countries……

List of figures

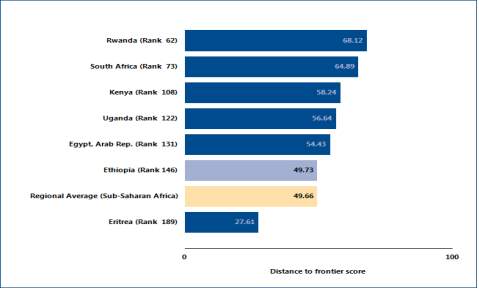

Figure 3‑1, How Ethiopia and competitors economies rank on the ease of doing business

Figure 5‑1,group of participants

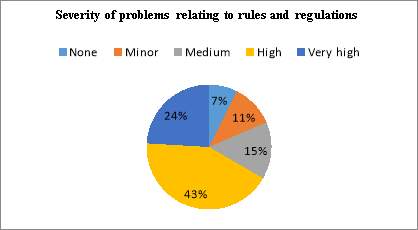

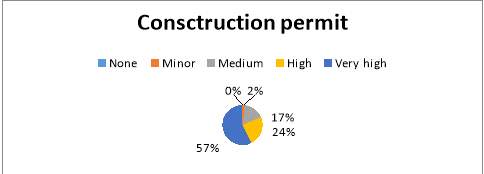

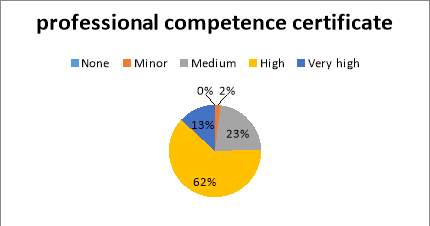

Figure 5‑2, perception of business about severity of problems relating to rules and regulations

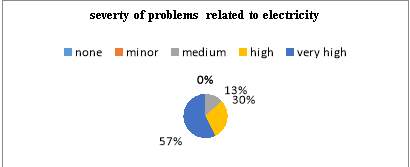

Figure 5‑3, perception of business about severity of problems relating to electricity supply

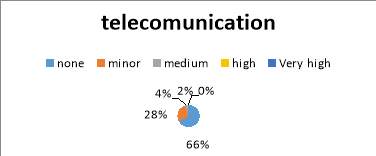

Figure 5‑4, perception of business about severity of problems relating to telecommunication

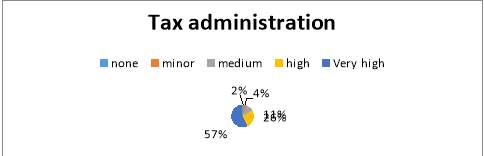

Figure 5‑5, perception of business about severity of problems relating to tax administration

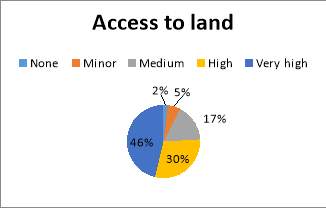

Figure 5‑7, perception of business about severity of problems relating to access to land

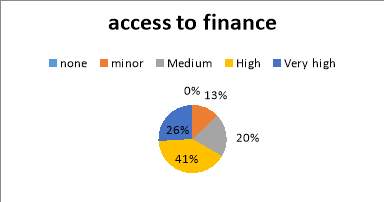

Figure 5‑9, perception of business about severity of problems relating to access to financing

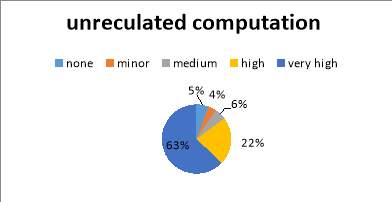

Figure 5‑10, perception of business about severity of problems relating to unregulated computation

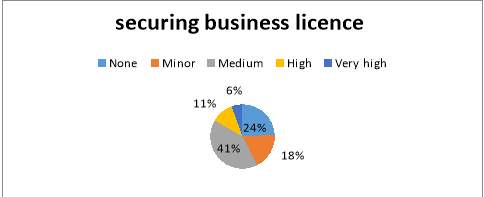

Figure 5‑12, perception of business about severity of problems relating to securing business license

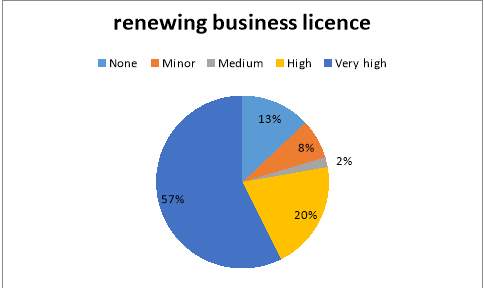

Figure 5‑13, perception of business about severity of problems relating to renewing business license

Figure 5‑14, perception of business about severity of problems business exit

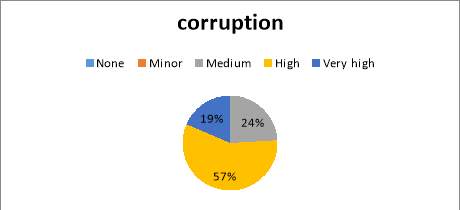

Figure 5‑15, perception of business about severity of problems relating to corruption

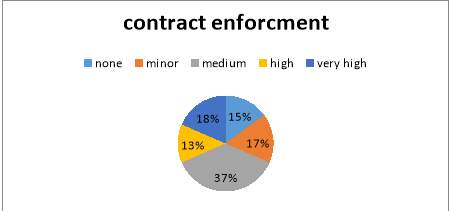

Figure 5‑16, perception of business about severity of problems relating to contract enforcement

ADLI Agricultural development led industrialization

BEE Business Enabling Environment

BEER Business Enabling Environment Reform

BITs Bilateral treaties

DB Doing Business

DCFED Donor Committee For Enterprise Development

DFID Department for International Development (United Kingdom)

DTTs Double taxation treaties

EODB Ease of doing business

FDRE Federal Democratic Republic of Ethiopia

GDP Gross domestic product

GTP Growth and transformation plan

HOF House of federations

HPR House of people’s representatives

IEG Independent Evaluation Group

IFC International Finance Corporation

MDGs Millennium development goals

MIGA Multilateral Investment Guarantee Agency

OECD Organization for Economic Co-operation and Development

VAT Value added tax

WB World Bank

WIPO World intellectual property organization

Introduction

1.1 Background of the study

Ethiopia is one of sub-Saharan African countries locating in east Africa with more than 96 million populations, and the second most populous country in Africa, after Nigeria. The government of Ethiopia follows an integrated 5-year development plan for the second round, the Growth and Transformation Plan (GTP2), which aims to achieve 11.2 – 14.9% GDP growth annually as well as achieve the sustainable Development Goals (SDGs) and attain middle-class income status by 2025. To realize these goals, the government is investing heavily in large-scale social, infrastructural and energy projects1. In line with its consistent GDP growth between 8% – 12 % over the past 12years, its population and stable investment climate, Ethiopia looks attractive and is becoming as priority for manufacturing sector through encouraging foreign and domestic investments.

To maximize these opportunities, government of Ethiopia had taken different regulatory, administrative and institutional reform measures for last 25years; however the key studies undertaken by international organizations aimed at benchmarking the business enabling environment and condition for doing business list similar barriers for business in Ethiopia. For instance, The World Bank’s/IFC doing business report of 2017 ranked Ethiopia 159 out of 189 economies in “Ease of doing Business (down from 112 in 2008). That indicates Ethiopia’s score is substantially worse than that of sub Saharan peers.

Hence, The general objective of this study is to identify the major challenges of business environment of Ethiopia in the case of Addis Ababa city administration and to find out ways to improve current problems of BEE in the city and as well as the country. Accordingly Addis Ababa is a proper place to conduct this research, to identify the main sources of challenges for doing business in Ethiopia and to determine the share of Addis Ababa city administration and to recommend measures taken by each actor (government businesses and consumers) by raising questions What are the major challenges of enabling business environment in Ethiopia? How have countries manage these kinds of reforms in the past and how they developed better enabling business environment? How business perceives severity of problems related to BEE in Addis Ababa: And what obstacles lie in its path? What are prospective roles of government, businesses and consumers to attain Better BEE in Addis Ababa? To answer these questions and to find more specific, relevant and reliable information, the research has been conducted based on a methodology developed in the light of positivism research philosophy; this research also follows the paradigm of constructivism and applies an exploratory sequential mixed approach through mixed research method including survey questionnaire and secondary data strategy.

The study was significant since it is expected to investigate the major problems that affect doing business in Ethiopia and Addis Ababa city administration. The researcher hopes that the study identified gaps that causes for dissatisfaction of all actors. In addition to that the survey will contribute on the efforts of government Endeavour for provision of effective and efficient service to businesses and consumers, it is also significant to determine the factors that affect fair trade computation and consumer right protection, further more it enables to demonstrate the role of each stakeholder for further improvement and development.

1.2 Originality and contribution

There are many research works about business environment published by World Bank groups, the prominent one among this publications is World Bank /IFC yearly report that determines favourability or severity of business enabling environment of each country out of 189 nations. However, most of these empirical studies on business environment subjected to three constraints. Such as, Limited scope i.e. focused only on impact of business environment on privet sector development. Applicability of data provided by few informants, just one or two firms focusing or interested by only tax indicators.1 and the number and diversity of informants for all indicators are not representative. In addition to that, these Previous studies focused only on the role of state (government)’s legal, institutional and regulatory frame works and measured mostly only deregulation and the good functioning of markets,

Though, Factors determining business enabling environment first formulated by World Bank/IFC doing business environment report and where, unit of analysis are countries, regions or industries, to my knowledge, no empirical study has identified BEE problems of Addis Ababa and pointing out the role of businesses and consumers to create better business enabling environment in Ethiopia, as well as, Addis Ababa’s. Based on that, this paper fills the gap of literature that lack attentions by identifying major problems of BEE based on Addis Ababa and by proposing prospective roles of government, business and consumers to attain the intended goals of creating favourable business environment in the Addis Ababa city administration.

1.3 Statement of the Problem and research question

Since its adoption of a market-oriented economic policy in the 1990’s, Ethiopia has practiced several policies and strategies that aim to foster the role of the private sector in the overall economic development. In recent years, far-reaching revisions have also been made to Ethiopians key business and investment legislation, including the rules governing business registration and licensing, investment screening and issuance of investment permits, and trading across borders. Because, Creating favorable business environment was part of economic reform and that was aimed at attaining the international competitiveness of the sector, in view of the competitive global environment, for all national and international businesses.

In contrast to that, favorability and business enabling environment rank of the country has decreased from 112 to 159th within last ten years. The intended objective of regulatory and institutional reform failed to satisfy the main stakeholders interest (the business, consumer and government). Business complains about poor doing business environment, Consumers complain about unfair price and quality. The government also complains on business community about disobedience for tax, trade competition and consumer right protection laws.

By understanding this fact we tried to assess the major challenges of business environment and the sources behind each indicator and attempted to recommend solutions based on the case of Addis Ababa city administration.

Because the Addis Ababa has been Ethiopia’s major economic hub accounting for the largest concentration of trade, service and manufacturing establishments. It is estimated that Addis Ababa accounts for at least 53% of the business related activities in the country owing to its role as the major manufacturing, trade and service center.

A .Research question

The following issues on the administrative legal and the institutional framework had been raised and resolved as much as possible.

- What are the major challenges of business enabling environment in Ethiopia?

- How have countries manage these kinds of reforms in the past and how they developed better enabling business environment?

- How business perceives severity of problems related to BEE in Addis Ababa: And what obstacles lie in its path?

- What are prospective roles of government, businesses and consumers to attain Better BEE in Addis Ababa?

1.4 Objectives of the Study

A General Objective

The general objective of this study was to identify the major business environment problems of Ethiopia in the case of Addis Ababa city administration and to recommend possible solutions.

B .Specific Objectives

The specific objectives which are developed based on the general objective are the following:

- To identify challenges of business enabling environment with respect to the role of Government, Business and consumer.

- To pinpoint the major sources of challenges and problems that hinder enabling business environment.

- To propose solutions that help decision makers to take corrective measures.

1.5 Structure of the paper

The first chapter of this study contains the research background, originality and contribution, statement of the problem, research question and objectives of the research, in chapter two literature review and the theoretical and conceptual grounds of the research, In chapter three, we try to overview current business environment of Ethiopia and Addis Ababa, chapter four consequently presents the methodology of the research and chapter five comprises data presentation and analysis. Finally, discussion of the result, conclusion and recommendation are included in chapter six.

Review of the Literature

This section provides an overview of literature pertaining to the definition, characteristics, major indicators, importance and impact of business environment. The literature search collected a vast amount of relevant theories and empirical studies exploring business environment reform. This review however, focuses more on identifying the main challenges on the process of business environment reform and the way how countries achieved better business environment reform implementation.

A substantial body of research has long established that the business environment reform processes are intimately connected with political economy of change and in or through the midst of stakeholders, government needs to take a leading role in reforming itself, its system of regulation and its administrative practice. (Doug Hindson and Jorg Meyer Stemer: 2007). Business environment reform is basically Regulatory reform and it is a dynamic force shaping the activities of business and non business stakeholders, enabling and motivating action as well as constraining it (Anyadike-Danes and others 2008; Kitching, Hart, and Wilson 2013; Kitching, Kašperová, and Collis 2013). Consequently, the appropriate analytical framework comprises a theory of change connecting regulatory reform, the actions of businesses, and the wide variety of stakeholders with whom they interact (consumers, suppliers, employees, investors, and others).

According to Miguel Laric: U.K Aid, 2012,The Business Enabling Environment (BEE) is a complex set of interconnected and overlapping systems that define the policies, rules and regulations administered by government that affect business. Furthermore, creating enabling business environment in all aspect is the important issue in today’s competitive world. According to (Norine Kennedy, USCIB), One critical and over-arching pre-condition for sustainable development is good governance and an enabling business environment.

2.1 Definition and Type of Business Enabling Environment

a. Business environment

From the study of Simon White (2004:3), the term business environment refer to all those factors external to business that either inhabit or favor their developments.1 Business environment also defined as the total surroundings, which have a direct or indirect bearing on the functioning of business. Such as economic factors, social factors, political and legal factors, demographic factors, technical factors etc. Which are uncontrollable in nature and affects the business decision of the firm.2 ‘Business environment’ generally refers to the external environment and includes factors outside the firm which can lead to opportunities for or threats to them.3

The Donor Committee for Enterprise Development defines the business environment as a complex of policy, legal, institutional, and regulatory conditions that govern business activities. It is a sub-set of the investment climate and includes the administration and enforcement mechanisms established to implement government policy, as well as the institutional arrangements that influence the way key actors operate (e.g., government agencies, regulatory authorities, and business membership organizations including businesswomen associations, civil society organizations, trade unions, etc.)4

There is no unanimity in the business environment literature on what should be included in the term different development agencies use a number of related terms to cover the same or similar ground. This includes “business climate”, “investment climate”, and enabling business environment. In a recent review aimed at creating some order out of this terminological disarray. White identifies a number of key factors. These are governance, policy frameworks, macroeconomic policies, and strategies, legal and regulatory frame work, organizational framework and capacity, access and cost of infrastructure, access and cost to finance, attitudinal influences and support services.

b. Types of Business Environment

According to, Surbhi (2015), Business environment is of two types- (i) Micro environment or the internal environment (ii) Macro environment or the external environment.

- Micro environment /Internal Environment/of Business

Micro environment comprises of the factors in the immediate environment of the company that affect the performance of the company. It includes the suppliers, competitors, Marketing intermediaries, customers, pressure groups and the general public. Supplier includes the financial labour input. Stock holders, banks and other similar organizations that supply money to the organization are also termed as suppliers. Managers always strive to ensure a study flow of inputs at the lowest price. Customers are also an important factor in the internal environment of business. The customers or the clients absorb the output of an organization and a business exists to meet the demands of the customers. Customers could be individuals, industries, government and other institutions. Labour force is also an important part of the internal environment of business. Other than these the business associates, competitors, regulatory agencies and the marketing intermediaries are also a part of the micro business environment.

- Macro environment/External environment/of Business

The forces and institutions outside of the organization that can potentially affect the performance of the organization come under the external environment of Business. The macro environments of business consist of the economic, demographic, natural, cultural and political forces. The external environment of business is often categorized into the economic environment, political and government environment, socio cultural environment and the international environment.

On the basis of Surbhi’s explanation and the above discussion the features of business environment can be summarised as follows.

- Business environment is the sum total of all factors external to the business firm and that greatly influences their functioning.

- It covers factors and forces like customers, competitors, suppliers, government, and the social, cultural, political, technological and legal conditions.

- The business environment is dynamic in nature that means it keeps on changing.

- The changes in business environment are unpredictable. It is very difficult to predict the exact nature of future happenings and the changes in economic and social environment.

- Business Environment differs from place to place, region to region and country to country.

Accordingly this research work focuses on identifying major challenges that emerged from outside their control or external business enabling environment problems involved in setting up and operating a business, quality and efficiency of government services,

Importance of Business Environment reform

A .The need for further business environment reform

Creating enabling business environment in all aspect is the important issue in today’s competitive world. According to (Norine Kennedy, USCIB), One critical and over-arching pre-condition for sustainable development is good governance and an enabling business environment. At all levels – domestic markets, foreign investment and international trade – private enterprise requires an operating environment conducive to growth and development, including: peace and stability, the rule of law, good governance with accountability and transparency, the absence of corruption, adequate infrastructure, an educated workforce, clear property rights and enforceable contracts.

Private sector development (PSD) drives economic growth driven by the quest for profits;11 and private firms invest in new ideas and strengthen the foundation of economic growth and prosperity”, According to World Bank (2004b) summery report, Sustained and broad-based growth in private investment will only occur when the business environment is favourable. If private firms do not believe that their investment is secure, that regulation is too burdensome or unpredictable, or that infrastructure is poor, they will not invest in new machinery and equipment (World Bank 2004b)

Business has a critical role to play in accelerating progress towards sustainable development as an engine of economic growth and employment, as a key contributor of government revenues, and as a driver of innovation, capacity building and technology development. Creating the right conditions for private enterprise may require strategic reforms to long-standing regulatory practices to unlock the full potential of private enterprise and open markets in a way that can promote economic growth, environmental protection and social development.

A sound business environment is a prerequisite for robust private sector growth and job creation. Regulatory simplification can also help create incentives for firms to move from the informal to the formal sector.12

Examples from Africa illustrate the critical role that business environment can play in creating jobs. Four evaluations conducted for IFC-supported investment climate reforms in Burkina Faso, Liberia, Rwanda, and Sierra Leone estimate that approximately 50,000 jobs had been created in those four countries in 2008–2010. This is roughly equivalent to about 0.3 percent of the total labour force in the four countries.

As stated on World bank/IFC report, While these programs were multipronged, not simple undertakings, the pay-offs of these types of efforts can be far-reaching. In each of these countries, the reforms helped generate in two years: I) about US dol1ar million to 5 million dollar in cost savings for the private sector; II) US dollar 5 million to 51 million dollar in savings for the private sector companies; and III) an additional 23,000 enterprises registered, of which about 10,000 were informal but chose to register and formalize as a result of the improvement in business regulations.

B The impact of an enabling business environment on economic development

According to (Haidar, Jamal Ibrahim, J: 2012, 287) each business regulatory reform is associated with a 0.15% increase in growth rate of GDP. Although macro policies are unquestionably important, there is a growing consensus that the quality of business regulation and the institutions that enforce it are a major determinant of prosperity. Hong Kong (China)’s economic success, Botswana’s stellar growth performance, and Hungary’s smooth transition experience have all been stimulated by a good business regulatory environment.

At the same time, some studies point out that a critical mass of reforms might be needed to be able to see an impact on business formation. The increase in entry is associated with a significant drop in time to register, suggesting that more modest improvements (for example, in countries with procedures that are already relatively streamlined) might have a more modest effect. Consistent with this, using cross-country data from the Doing Business report and World Bank Entrepreneurship Snapshots, Klapper and Love (2014) found that reductions of less than 40 percent in the cost and time required to start a business did not have a significant impact on new firm creation. Kaplan, Piedra, and Seira (2011) reached a similar conclusion: that bigger program of reform could have a greater impact.

Empirical tests of the expectation that reducing the time and cost of registration might affect formalization have found mixed results. The Doing Business report provides anecdotal evidence that relaxing entry restrictions might encourage registration. For example, the World Bank (2008c, p. 13) notes that “[after] Madagascar reduced it minimum capital requirement by more than 80 percent in 2006, the rate of new registrations jumped from 13 percent to 26 percent.” The report also notes that after it introduced a one-stop shop to help firms register, “Croatia saw company formation in Zagreb and Split increase by more than 300 percent over 3 years.”

Klapper, Amit, and Guillen (2010) note that the ratio of corporations to population increased by more than 30 percent, after electronic registries were introduced in Azerbaijan, Guatemala, Jordan, Oman, Slovenia, and Sri Lanka.

Finally, Kaplan, Piedra, when examining the first part of the question, BER is seen as stimulating investment at two levels: within individual firms and across the economy. The literature suggests that these results are produced through two causal links. The first focuses on the way BER affects the behaviour of firms, particularly informal firms. BER endeavours to influence the behaviour of firms in three major ways. First, by increasing investment in the firm in a manner that leads to increased employment and the upgrading of plant and equipment, including new technology. Second, reforms make it easier for firms to increase their share of the market and move into new markets. Third, as firms invest more and expand their market share, they become more likely to innovate and become more productive. The DCED has described how reforms are typically designed to bring about one or several of the following three direct results13

- More firms are encouraged to start-up or register as formal businesses, for example as a result of simplified business registration procedures or tax incentives.

- Firms invest more following the improvement of legislative or regulatory frameworks, or otherwise change their behaviour in ways that are conducive to their business.

Firms directly increase their sales/turnover or net income, for example through the removal of trade barriers or savings from more efficient licensing and inspections processes.

Table 2‑1, summarizes related literature

| Area of study | Importance | Impact | Author & year |

| BEE & privet sector development | BEE is precondition for Good governance and development | Sustained and broad based growth in private sector development will only occur when business environment is favourable. | Norine Kennedy, USCIB

World Bank 2004b |

| Business environment reform | Creating Better BEE is cause for Prosperity | The qualities of business regulation, the institutions that enforce it are a major determinants of prosperity | Hider Jamal Ibrahim 2012 |

| Investment climate reform | BEE needs complex set of Reform | BER stimulates investment

Bigger programme of reform have a greater impact on economic development |

Klapper and Love 2014

Kaplan, Piedra and Seira 2011 |

| Ease of doing business report | Relaxing business entry restrictions & good BER | Encourage formalization (informal business to formal)

Encourage Firms to increase their investment, sale, turn over and net income |

The world bank 2008c

DCED |

| Anuall review and report WB/IFC | Improving BEE through, Streamlining, online and one stop shopping | More new businesses being encouraged to register.

Increased saving, increase in total employment, |

RISE Annual Review May 2012. ICF Annual Review 2013,

Doing Business 2010, World Bank Group 2010, RISE Annual Review May 2012. |

| Tax reform | Reducing cost and time through tax reform may cause to achieve | GDP. Growth, increase productivity up to 60%. | Building a Reliable Investment Climate in Kenya DFID Business Case. |

Source: organised from different empirical works as stated in the table.

Theoretical foundations of Business Environment

A Public interest theory

Theoretical foundation had been simulated by public interest theory basically relay on role of government in the process of reforming business environment. Consistent with the study of Doug Hindson and Jorg Meyer Stemer (2007, pp17) government needs to take a leading role in reforming itself, its system of regulation and administrative practice. Business environment reform processes are intimately connected with the political economy of change.6 this includes the system of accountability and governance exercised within and on the state, the extent to which the state is open or captured, and the extent to which its policy-making processes are open to influence. Because business environment reform is fundamentally a process of political contestation, there are no formulas that may be imported from elsewhere. Each society needs to determine the political settlement that best accommodates its competing interests and then find the appropriate technical solution that suits and cause to political settlement.

Doug Hindson and Jorg Meyer Stemer (2007) also asserted that, Improving Endeavour of Business enabling environment needs complex, legal, institutional, and regulatory measures that should be taken stapes by stapes. However, even key stakeholders can resist proposals for change because they do not understand the benefits of the proposed objectives, considering things as they are and fear change, or because they benefit from the status quo. Thus, the challenge of the change also needs building effective coalitions to get the best possible result past that opposition. Government institutions can respond to resistance to reform by understanding where the resistance comes from and why; raising awareness and promoting the benefits of intended new environment; recognizing that those who are doing well in a poor business environment (e.g., where competition is reduced) may have something to lose; promoting coalitions of those who support reform – that is building constituencies for change; using regional organizations to support change; and promoting broader and deeper levels of public-private dialogue.

Sever business enabling environment may cause for less labour productivity and informality. A leading recent publication states that, “In much of Africa, excessive regulation stifles productive activity.” The study indicates that the more regulation worldwide, the less labour productivity (measured in USD per worker). “Productive businesses thrive where government focuses on the definition and protection of property rights7. But where the government regulates every aspect of business activity heavily, businesses operate in the informal economy. Regulatory intervention is particularly damaging in countries where its enforcement is subject to abuse and corruption.8 Heavier regulation is generally associated with more inefficiency in public institutions—longer delays and higher cost—and more unemployed people, corruption, less productivity and investment.9

It is never, however, associated with a better quality of private or public goods.” The study also notes that poor countries tend to have the most regulation but the least ability to enforce it, so that a lack of checks and balances in government gives space for corruption. It notes that the rich and powerful can get around cumbersome regulations, or they are not over-affected by it, whereas the poor are invariably the hardest-hit by it. Another key paper concludes: “Countries with heavier regulation of entry have higher corruption and larger unofficial economies, but not a better quality of public or private goods.10

Countries with more Democratic and limited governments have a lighter regulation. The evidence is inconsistent with public-interest theories of regulation, but supports the public-choice view that regulation benefits politicians and bureaucrats.” A government that pursues social efficiency counters these failures and protects the public through regulation. As applied to entry, this view holds that the government screens new entrants to make sure that consumers buy high-quality products from “desirable” sellers. Such regulation reduces market failures such as low-quality products from fly-by-night operators and externalities such as pollution. It is done to ensure that new companies meet minimum standards to provide goods or services. By being registered, new companies acquire an official approval. That, of course, makes them reputable enough to engage in transactions with the general public and other businesses.

B Theory of Change

In accordance with the study of Anyadike-Danes and other (2008), Kiteching Hort and Wilson (2013), Kiteching, Kasperova and Collis (2013), Miguel Laric:2012, have constructed their argument on the theory of change. This theory assumed a business environment reform as a complex set of interconnected and overlapping systems with whom interacting, the wide variety of stockholders.

The theory of change is mostly concerned with rules and regulations on which BEE reform reveals many critical challenges that an effective BEE programme must overcome and that make systemic reform slow and difficult: different systems and actors demand and supply different elements of the BEE and benefit differently; reform is slow because it is beset with complex interactions and weak incentives; and is intensely political; the social benefits are often unclear to actors or are overshadowed by the status quo’s private benefits; both supply and demand of changes are critical to success and sustainability; and both depend on the capacity and incentives of actors in the systems who must therefore own and take charge of reforms at the pace that internal capacity constraints allow. Purely technocratic solutions are unlikely to deliver lasting change.

C The Public choice theory

On the other hand, James M. Buchanan (2002), have revealed alternative theories, clustered under the heading, “The public-choice theory.” This does not see government as being so benign, and says that regulation is bound to be socially inefficient. The two main groups of theory, at any rate, are the following:

- The theory of regulatory capture, which states that regulation, is designed and operated primarily for the benefit of industry incumbents who acquire regulations that create rents for themselves, since they typically face lower information and organization costs than do the dispersed consumers. Regulating entry keeps out competitors and raises incumbents’ profits.

Because a stricter regulation raises barriers to entry, it leads to greater market power and profits, but does not bring any benefits to the consumers.

- The “tollbooth” view, on the other hand, holds that regulation is pursued for the benefit of politicians and bureaucrats. Politicians use regulation to create rents and to extract them through campaign contributions, votes and bribes. An important reason why many of these permits and regulations exist is probably to give officials the power to deny them and to collect bribes in return for providing the permits. This stresses benefits to politicians, even if it means a considerable loss to the industry.

Both theories refer to “rent” creation and extraction through political processes. James M. Buchanan conclusion is that the evidence overall suggests that the tollbooth theory is generally embraced by those governments that have more checks and balances and are more responsive to their voters (“better governments”). Such governments favour this theory because they tend to regulate entry less. Politicians with more leeway to benefit themselves, nevertheless, tend to create heavy regulatory systems. And there is evidence that this leads both to more corruption and a large unofficial economy. They regulate “because doing so benefits the regulators.”

One of the streams, to discuss and design reforms should be seen in the wider context of the political economy. Both theories i.e. theory of change and public interest theory considered BEE reform is a regulatory reform. Both theories suggest reforming process is slow and difficult by nature and that needs complex set of actions. Accordingly, The theory of public choice view focuses on the role of government in the reforming process by releasing reform energies and reinforce a growing demand for reform. These kinds of changes help developing and transition country governments to overcome governance bottlenecks.

The other stream, theory of regulatory capture believes that regulations designed and operated primarily for the benefit of industry incumbents who acquire regulations that create rents for themselves. Moreover, the toll both view also considered reforming the regulation is pursued for the benefit of politicians and bureaucrats. However, the proponents of public choice view (James M.Buchanan:2002) argues pursued social efficiency counters failure and government protects the public through regulations, such regulation reduces market failure. The latter theory suggests that the behaviors of public sector bureaucrats are supposed to work in the public interest putting in to practice the policies of the government as efficiently and effectively as possible. Finally, elements of major research stream relayed to characteristics and nature of business environment reform are presented for comparison in a table 2.2.

Table 2‑2, Theories pertaining to characteristics of business environment and the main challenges affecting its process

| Theoretical approach | Characteristics | Author (year) |

| Public interest theory | BEE reform process are intimately connected with the political economy of change | Doug Hindson andJorg Mayer Stemer 2007 |

| Theory of regulatory capture | Regulation is designed and operated primarily for the benefits of industry incumbents who acquire regulations that create rent for themselves | Doug Hindson and Jorg Mayer Stemer 2007 |

| Public choice view | The behaviour of public sector bureaucrats are supposed to work in the public interest putting in to practice the policies of government, as efficiently and effectively as possible | James M. Buchanan

1999-2002 |

| Theory of change | BEE is complex set of interconnected and overlapping systems, that defines policies, rules, and regulations regulated by government that affects business

BEE reform reveals many critical challenges that make systemic reform slow and difficult BEE is intensely political |

Anyadike-Danes and others 2008

Kiteching Hort and Wilson 2013 Kiteching Kasperova and collis 2013 |

As indicated above, theoretical studies only partly explore the role of government on the business environment reforming process and the main challenges of it. Moreover, there are many research works about business environment reform published by World Bank groups, and other international organizations, most of these empirical studies on business environment focused on impact of business environment on privet sector development. We used business environment reform indicators first formulated by World Bank/IFC independent evaluation groups and where, unit of analysis are countries, regions or industries. However, to my knowledge, no empirical study has evaluated the role of businesses and consumers on reforming process of Ethiopian business environment and as well as Addis Ababa’s too. Based on that, this paper fills the gap of literature that lack attentions relating to role of consumers and private sectors by exploring their perception in line with prospective roles of government, to attain the goals of intended business environment reform of the city administration

Business operating environment in Ethiopia

3.1 Political stability and sustainable economic growth

Ethiopia is considered as one of the most stable countries in Africa. The Constitution of the country, adopted in 1995, provides for a multiparty political system, Elections are held by universal adult suffrage every five years, The FDRE has a parliamentarian form of government with a bicameral parliament which comprises of the House of the Peoples’ Representatives (HPR) and the House of the, Federation (HOF). The House of the Peoples’ Representatives is the highest authority of the Federal Government, Power of government is assumed by the political party or a coalition of political parties that constitutes a majority in the House of the Peoples’ Representatives (HPR); Executive power is vested in the Prime Minister, elected from among the members of the HPR for a five year term;

Ethiopia may well be considered as a country with the lowest levels of crime and corruption among least developed countries. The Ethiopian government has formulated the five year Growth and Transformation Plan (GTP) to carry forward the important strategic directions in maintaining a fast growing economy in all sectors. Accordingly, Ethiopia’s economy is projected to grow at an average rate of11.2 percent annually. Enormous efforts have been made in major key sectors to achieve the Millennium Development Goals (MDGs).

Ethiopia’s economy is based on agriculture, which accounts, in 2012/13, for about 42.9 percent of the gross domestic product (GDP), 90% of foreign currency earnings, and 85% of employment. Generally, the overall economic growth of the country has been highly associated with the performance of the agriculture sector. Coffee is a critical commodity to the Ethiopian economy. It earned US dollars 745.1 million in exports in 2012/13. Other important export products (2012/13) include gold (US58 dollars 4.4 million), oil seeds (US dollars 437.1 million),chat (US dollars 270.6millions),flowers (US1 dollars 97.0 million),pulses (US dollars 232.5 million), live animals (US1 dollars 60 million), leather and leather products (US dollars 120.6 million), meat and meat products(US74.1 dollars million), fruits and vegetables (US dollars 43.7 million).The industrial sector, which mainly comprises small and medium enterprise, accounts for about 12.4 percent of GDP in 2012/13. Similarly, the service sector comprised of social services, trade, hotels and restaurants, finance, real estate, etc. accounts for about 45.2 percent of GDP in the same year.

A Policy and institutional environment

The Industry Development Strategy of the country has put in place the principles that primarily focus on the promotion of agricultural-led industrialization, exported development, and expansion of labour intensive industries. These principles are inter-dependent and inter-linked one with another. The strategy has also set the other principles that clearly stated the pivotal contribution of the private sector, the leader ship role of the government, and the integrated and coordinated participation of the public at large in nurturing the strategy. This strategy refers to those industries which are primarily involved in the production of manufactured goods. It is also tried to include other industrial classified sectors in the document other than the manufacturing industries. The fundamental principles of the Ethiopian industry development strategy are; Considering the Private Sector as an Engine of the Industrial Development Strategy, Implementing Agricultural Development Led Industrialization Principle, Implement Export-led industrialization principle since, Focusing on the expansion of labour intensive industry direction, Implementing effective domestic-foreign investment partnership method, Implementing the direction where, the government will play a leading managerial role In implementing the principle that encourages the active participation of the public.

B Legal and administrative frameworks /regulatory environment

The constitution is the supreme law, overriding all other legislation in the country. The legal system depends on codified laws, including civil, penal, civil procedure, and penal procedure; commercial and maritime codes. All proclaimed laws are published in official gazettes (Negarit Gazeta).1 In administering justice, courts are directed by internationally accepted principles of justice as well as by the laws of the FDRE. The practice of law is reserved for Ethiopians .However; foreign nationals have the right to appear in courts as witnesses. In such cases, the foreigner is allowed to communicate through a court-appointed translator.

The Commercial Code of 1960 provides the legal framework for undertaking business activities in Ethiopia. The constitution, in accordance with Article 40, ensures the right of every citizen to the ownership of private property, including the right to acquire, use and dispose of such property. The Investment Proclamation (769/2012) gives also a foreign investor the right to own a dwelling house and other immovable property necessary for his investment.

The Investment Proclamation (769/2012) guarantees investors against measures of expropriation or nationalization, and specifies advance payment of compensation “corresponding to the prevailing market value” of a private property earmarked for expropriation or nationalization for public interest. Ethiopia is a member of the World Intellectual Property Organization (WIPO) and the Multilateral Investment Guarantee Agency (MIGA). Furthermore, Ethiopia has concluded bilateral investment treaties (BITs) and double taxation treaties (DTTs) with a number of countries.

Business can be set up in the form of sole proprietorship, business organizations incorporated in Ethiopia (a private limited company, a share company or partnerships), branch of a foreign company, public enterprises and cooperative societies. Partner ships are associations of persons whose liability is unlimited (except limited partners in limited partnerships).

The laws that regulate formation of business entities in Ethiopia are the Ethiopian Commercial Code of 1960, Ethiopian Civil Code of 1960, Investment Proclamation of 2012 (as amended in 2014), Investment Regulation of 2013, Public Enterprises Proclamation of 1992, Cooperative Societies Proclamation of 2003, Commercial Registration and Business Licensing Proclamation of 2016.

C Recent tax and regulatory updates

The most recent government measures to create better business enabling environment is the second Growth and Transformation Plan for 2015/16-2019/20, which calls for privet sector-led economic growth through: support for development of large scale commercial agriculture; creation of favorable condition and extension of incentives for export oriented and import-substituting industries, particularly the sugar, textile, leather and cement industries; by giving special attention for small and medium enterprise development; and enhancing expansion and quality of infrastructural development including, among others, road networks, railway lines, electricity supply and telecommunication.

In recent years, another revision have also been made to Ethiopia’s key business and investment legislation, including the rules governing business registration and licensing, investment screening and issuance of investment permits, and trading across borders. For example, the administration of investment permit, and post permit investment supervision has been overhauled. Another area undergoing remarkable legal and institutional reform one is customs clearance and management. With the implementation of a business process re-engineering (BPR) project on human resource management and information communication as well as modernization of service delivery through partnership programs, also, several recently-introduced trade facilitation schemes promise to boost international trade and privet sector development in Ethiopia. These include the launch of multi-modal transport services,1 initiatives for the establishment of industrial development zones and the authorized economic operator (AEO) program,2 and voucher and bonded warehouse programs.

D Constraints on ease of business enabling environment

Figure 3‑1, How Ethiopia and competitors economies rank on the ease of doing business

Source:

Although several economic strategies have been formulated and implemented by the government, aiming to direct economic activities and privet sector development as per the overarching priorities of the country, businesses enabling environment in Ethiopia are confronted with different legal, regulatory and administrative barriers to their operations 1,as illustrated above most of Ethiopia’s ease of doing business rank indicators in World Bank doing business report 2016/17 are below regional average2.

In general terms, although some identified issues are specific to certain cities or regions, many are either national level problems or regional problems with national consequences.3 key problems identified by World Bank EODB report as constraining to doing business in Ethiopia are the prevalence of bureaucracy and inefficiency in many government offices providing business services, including Ministry of trade and regional trade bureau, ERCA and regional finance offices, the Ethiopian investment commission and regional investment bureaus, city councils notary offices as well as sect oral offices.4

3.2 The role of Addis Ababa city administration in Ethiopian business environment

The City of Addis Ababa has been Ethiopia’s major economic hub accounting for the largest concentration of trade, service and manufacturing establishments. It is estimated that Addis Ababa accounts for at least 40% of the business related activities in the country owing to its role as the major manufacturing, trade and service center. Addis Ababa is the most influential city in the country with big impacts on the country’s trade and marketing system, as it is the country’s administrative capital and the main distribution center for both locally manufactured and imported commodities. Addis Ababa is also home for an estimated 53% of the country’s business community that include the major investors, importers, distributors and wholesalers (TIDB, 2015). It is the pacesetter of the country’s trade system particularly prices of commodities and services.

3.3 Business environment in Addis Ababa city administration

Addis Ababa, as capital city of federal democratic republic of Ethiopia, most of business policies, rules and regulations are emanated from central government. Accordingly, operating business environment in Addis Ababa is reflection of the countries business environment record.

The Addis Ababa City Administration through Trade and Industry Development Bureau has prepared documents on the trade practice reform program as well as relevant sub programs, packages and projects, which were later reviewed and endorsed by the City’s Cabinet7. However, these, trade sector reform program covers wide ranging aspects of the trade system ; institutional capacity building, public privet partnership and privet sector development, consumer awareness creation and participation program.

Though, the city administration would adopt an inclusive approach in the process of crafting the reform document, implementation of the reform program has failed to satisfy the main stakeholders interest (the business, consumer and government). Business complains about poor doing business environment, Consumers complain about unfair price and quality. The government also complains on business community about disobedience for tax, trade competition and consumer right protection laws.

The researcher hopes that this study identifies the key challenges of business environment in Addis Ababa city administration and gaps that causes for dissatisfaction of all actors. In addition to that the survey will contribute on the efforts of government Endeavour for provision of effective and efficient service to businesses and consumers, it is also significant to determine the factors that affect fair trade computation and consumer right protection, further more it enables to demonstrate the role of each stakeholder for further improvement and development.

Methodology, Data source and measurement

The research philosophy employed in the writing of this dissertation was mainly positivism. According to Saunders: 2009/ Mertens and MCLaughlin, 2004. The Positivism is the research philosophy, which guides to collect different previously studied research related reliable and valid research data and create hypothetical growth to conduct a research1. This research also followed the paradigm of constructive and applies an exploratory sequential mixed approach: we integrated the paradigmatic perspectives of qualitative and quantitative traditions at all stage of a research project repeatedly and dynamically using each to question and improve the result of the other. We used primary data collected by questionnaires to identify the major sources of problems hindering business enabling environment in Addis Ababa and qualitative research is conducted through open-ended questions to explore participants’ views about severity of problems, the main sources of those problems and prospective roles of government, business and consumers to create better business enabling environment in Addis Ababa first, then validity of data collected through questioners and identified major problems of BEE in Ethiopia had been supported by secondary Quantitative time serious data (from 2003 ~ 2016) and other empirical documents to understand and to share experiences of countries who improved their EODB rank.

4.1 Data collection method

For conducting a valid research, it is necessary to generate valid research data according to the research nature and purpose2. Both quantitative and qualitative approaches were used in the study. primary Quantitative data were collected mostly from primary sources through questionnaires and secondary quantitative data from the annual reports of the World Bank doing business country reports, other related international organizations, Ethiopian ministry of trade and Addis Ababa trade bureau, Ethiopian investment commission. The qualitative information is gathered through semi-structured and open questionnaires. We used multiple versions of questionnaires and it will be translated in to Amharic3 for participants those who can’t speak English for the purpose of conducting the survey. The questionnaire in this research was adopted from World Bank IFC that was prepared for the purpose of identifying business enabling environment problems of the country.

4.2 Sampling strategy, frame and size

We used non proportional purposive quota sampling method to collect primary data through questionnaires and interview. In which we can represent different subgroups until we achieve a specific number of sampled units for each sub-group of a population. The major group of population includes government officials, employees, business persons (importers exporters, whole sellers, retailers) and consumers. The sampling frame and size for this research was 30 government officials and employees from trade bureau of Addis Ababa city administration, and selected three sub city trade offices, 30 consumers and 60 business persons from different sectors.

4.3 Data analysis tools

We applied three different data analysis methods such as Multi-linier regression model for the first question, content analysis for the second question and descriptive statistics for the third and fourth questions based on the nature of specific objectives and questions in this research.

4.4 Model specification

For the first question which is “To identify the major sources of challenges and problems that hinder enabling business environment” we used a multi-linier regression model. As per the literature reviewed above, world banks’/IFC indicator for ease of doing business environment and the availability of data, we identify the following variables. Business enabling environment (BEE) is our dependent variables and can be expressed by the number of business clothed within last ten years. The independent variables are: Starting business, Dealing with construction permit, Getting electricity, Registering property, Getting credit, Protecting investors, Paying tax, Trading across border, Enforcing contracts and Resolving insolvency are the independent variables. The independent variables have their own index value which is determined by World Bank/ IFC.

This model analyzes the effect of the mentioned variables on business environment and is presented as follows.

BEE = f (X), Where X includes Starting, business, dealing with construction permit, Getting electricity, Registering property, getting credit, protecting investors, paying tax, trading across border, Enforcing contracts and Resolving insolvency.

BEE= f (SB, DWCP, GE, RP, GC, PIR, PT, TAB, EF and RI)………. (1)

Where, BEE is, Business enabling environment and measured by the number of business clothed within last ten years.

- SB = Starting business

- DWCP = Dealing with construction permit

- GE = Getting electricity

- RP = Registering property

- GC = Getting credit

- PIR= Protecting investors

- PT= Paying tax

- TAB= Trading across border

- EF= Enforcing contracts

- RI= Resolving insolvency

Following the works of the researchers that are mentioned in the empirical literature and others, to answer the first question of this research “indentifying major challenges of BEE in Ethiopia” is conducted based on the secondary data which are collected and calculated by World Bank /IFC covers the period 2003-2016 and the variables discussed in the previous section used to determine doing business rank of each country out of 189 economies. Accordingly, multi-linier regression analysis is selected as an appropriate method.

The model employed can be given by:

BEEt= α + β1 SBt+β2 DWCPt+β3 GEt + β4 RPt + β5 GCt +β6 PIRt+ β7 PTt + β8 TABt+ β9 EFt+ β6RIt+ εt … (2)

For the purpose of testing the stationarity of data used in this study, Dickey-Fuller (DF) and Augmented Dickey-Fuller (ADF) tests have been conducted. In addition to that, Variables are said to be co-integrated if a long-run equilibrium relationship exists among them. Engle and Granger (1987) argue that for such relationship to exist, the error terms of the model should be stationary. For this purpose, co-integrated test also conducted at the next step.

For analyzing primary quantitative data we applied descriptive statistics and excel has been applied as a tool. The research result has also been supported by statistical analysis as mean, median, mode and standard deviation of responses against the research question asking “how respondents perceived” about level of severity relating to each variables. (William M.K. Trochim, 2005: 214) asserted that “the standard deviation is a more accurate and detailed estimate of dispersion.” The more that individual data points differ from the mean the larger the standard deviation will be. Conversely, if there is a great deal of similarity between data points, the standard deviation will be quite small. For the presentation of research data, different tables and charts have been applied. For example, pie chart, bar chart, histograms and radar charts, whereas, for the analysis of qualitative data, content analysis has been applied.

4.5 Limitations of study

The main challenge in evaluating business enabling environment is that BEE components, by their nature affect a wide pool of end-recipients, another limitation is the data especially for the first question is not long enough for econometric analysis and all EODB indicators not covered in primary data collection and analysis section like border trading, employing workers, registering property right and protecting investors while we used in secondary data.

Data analysis and presentation

This chapter presents the results of various data analyses obtained from implementing the previously described methods. In the analysis and presentation of the research, data collected against each research question have been arranged in the following sequential way. We used data collected from World Bank/IFC EODB rank of Ethiopia for the period of 2003~2016 out of 189 countries in line with appropriate statistical analysis, to investigate which variables among business enabling environment indicators were good predictors of BEE in Ethiopia, To answer the second research question and to understand how countries have been improved their BEE environment in the past, we conducted content analysis, finally, The responses to the questionnaire and a statistical analysis implemented to test validity of each variables or EODB indicators are presented respectively.

5.1 Testing for stationarity and co- integration

5.1.1 Test for stationary

The time series data (from 2003-2016) which is used for economic analysis is not rich is its nature – it only shows that the level of severity of each independent variables for BEE or dependent variable. It was not possible to see the interrelationship between our dependent and independent variables by using that time series data. Therefore, even though the data is not long enough for econometric analysis, we used another short data in terms of time which is extracted from world bank/IFC for the independent variables and data collected from Addis Ababa trade bureau for dependent variable to test the first question in this research.

As mentioned in the previous chapter, we examined whether the data series is stationary or not. The results we get by using non-stationary time series may be spurious. That is, they may indicate a relationship between variables. This does not exist in reality. Dou to this, to obtained a constant and reliable result we transformed the non-stationary data by differencing.

5.1.2 Co-integration

After testing our time-serious for stationary, the next step of our time-series analysis is testing for co-integration. Variables are said to be co-integrated if a long-run equilibrium relationship exists among them. Engle and Granger (1987) argue that for such relationship to exist, the error terms of the model should be stationary.

According to Engle and Granger: (1987), variables are said to be co-integrated if a long run equilibrium relationship exists among them and to exist this relationship, the error terms of the model should be stationary.

The stationar-ity and co-integration test conducted in this research suggest that model (2) should be estimated using different variables. The final short run model estimated therefore has the following form.

∆BEE = α + β1∆SB + β2∆DWCP + β3∆GE+ β4∆GE + β5∆GC + β6∆PT + β7∆PI+ β8∆EC+ β9∆TAB + β10∆PIS + Ʃx …(3)

Based on this short run model the regressions have been carried out to examine the determinants of BEE. There for, the next section should be analyzing the results of regressions.

Table: 5. Co-integration test

| Null Hypothesis: BEE has a unit root

Exogenous: constant Lag Length: D (Automatic- based on SIC, max lag- 10) |

|||

| t-statistic | prob | ||

| Augmented Dickey-Fuler test statistic | -1.418532

-4.297073 |

0.000 | |

| Test critical values | 1% level | ||

| 5% level | -3.212696 | ||

| 10% level | -2.747676 | ||

| Mackinon (1996), one-sided p-value | |||

From the above table, the value of t-statistic tells us there is long run relationship between variables can move together in the long run.

5.1.2.1 Long run model

The long run OLS estimation result shows that in the long run model business enabling environment is determined by 97% of R-squared by the independent variables. So, in the long run model the dependent variable BEE is highly determined by the independent variables. The 71.5% Adjusted R-squared (coefficient of determination) also measures the proportion or percentage of total variation in the dependent variable explained by the regression model. The value of Durban- Watson 3.00 states that there is no serial correlation between the variables in the long run.

The regression result in the above table also shows that coefficients of dealing with construction permit, paying tax, registering property and trading across border are negative while enforcing contract, getting credit protecting investor’s right, resolving insolvency and starting business have a positive relationship with the dependent variable BEE.

BEEt = -ἀ -ⱤDWCP1+ ⱤEF2+ ⱤGC3 + ⱤPIRⱤt4 -ⱤPTt5 +ⱤRIt6-ⱤRPt7 +ⱤSTB8 +ⱤTABt9 +ⱤGELt10t ….. (1)

BEEt =-5780984-34700.06DWCPt+41979.99ERt+8729.934GCt+49550.73PIRt–18659.32PTt +28517.12RIt –RPt +650.0000SBt-7936.489TABt +Ɽt… (2)

5.1.2.2 Short run dynamics

In addition to the long-run relationship, short-run relationship between variables should be checked. Error correction model (ECM) has been used to find out the short run dynamics. When the error term is stationary, the variables are integrated in the linear combination of those variables: and when the variables are co-integrated, they share a long-run relationship over time.

5.1.3 Model fitness

R-Squared (correlation coefficient), the measure of correlation between dependent and independent variables, with values well explained the model. Therefore the regressors and the regressed are highly correlated that shows the strength of the model. Adjusted R-Square (coefficient of determination) which is the most commonly used measures of the goodness of fit of a regression also measure the proportion or percentage of the total variation of the independent variable explained by the regression model. The value of Durbin Watson statistics which is a better test for detecting the existence of serial correlation is 2.668 and 3.00 in the long run and short run respectively. In both long run and short run model the study show that there is no a problem of serial correlation.

To the question: How have countries managed these kinds of challenges in the past, and how they developed better enabling business environment?

Depending on the nature of the question, we tried to assess different secondary research data especially reports of World Bank and other affiliated organizations. Most of the Countries selected in this study are from Sub Saharan Africa region. Which are Rwanda, Kenya, Zimbabwe, Nigeria and Côte d’Ivoire. All this countries have been challenged by the same problem like Ethiopia. The purpose of this research question is exploring their experiences as how this country managed such problem and how they can score better rank in their EODB report. The following table shows summery of experiences in line with each of the ten indicators.

Table 5‑5summery on Countries experience

| Reform area | country | Best practice |

| Starting a business | Rwanda | Rwanda made starting a business easier by improving the online registration

One-stop shop and streamlining post-registration procedures. |

| Kenya | Kenya made starting a business easier by removing the stamp duty fees required for the nominal

Capital, memorandum and articles of association. Kenya also eliminated requirements to sign the declaration of compliance before a commissioner of oaths. However, Kenya also made starting a business more expensive by introducing a flat fee for company incorporation. |

|

| Nigeria | Nigeria made starting a business easier by improving online government portals. This reform applies to both Kano and Lagos | |

| Dealing with construction permits | Rwanda | Rwanda made dealing with construction permits more cumbersome and expensive by introducing new requirements to obtain a building permit. At the same time, Rwanda also strengthened quality control by establishing required qualifications for architects and engineers. |

| Zimbabwe | Zimbabwe made dealing with construction permits faster by streamlining the building plan approval process. | |

| Côte d’Ivoire | Dealing with construction permits Côte d’Ivoire made dealing with construction permits more transparent by making building regulations accessible online. | |

| Registering property | Rwanda | Rwanda made it easier to register property by introducing effective time limits and increasing the transparency of the land administration system. |

| Kenya | Kenya made registering property easier by increasing the transparency at its land registry and cadastre. | |

| Zimbabwe | Zimbabwe made registering property easier by launching an official website containing information on the list of documents and fees for completing a property transaction, as well as, specific time frame for delivering a legally binding document that proves property ownership. | |

| Paying taxes | Rwanda | Rwanda made paying taxes more complicated by introducing a requirement that companies file and pay social security contributions monthly instead of quarterly |

| Getting electricity | Kenya | Kenya streamlined the process of getting electricity by introducing the use of a geographic information system which eliminates the need to conduct a site visit, thereby reducing the time and interactions needed to obtain an electricity connection. |

| protecting minority investors | Kenya | Kenya strengthened minority investor protections by introducing greater requirements for disclosure of related party transactions to the board of directors, by making it easier to sue directors in cases of prejudicial related party transactions and by allowing the rescission of related-party transactions that are shown to harm the company |

| Getting credit | Nigeria | Nigeria strengthened access to credit by creating a centralized collateral registry. This reform applies to both Kano and Lagos |

| Côte d’Ivoire | Côte d’Ivoire improved access to credit information by establishing a new credit bureau. | |

| Zimbabwe | Zimbabwe improved access to credit information by allowing the establishment of a credit registry. | |

| enforcing contracts | Côte d’Ivoire | Côte d’Ivoire made enforcing contracts easier by introducing a simplified fast track procedure for small claims that allows for parties’ self-representation. |

| Resolving insolvency | Côte d’Ivoire | Côte d’Ivoire made resolving insolvency easier by introducing a new conciliation procedure for companies in financial difficulties and a simplified preventive settlement procedure for small companies. |

| Trading across borders | Zimbabwe | Zimbabwe made trading across borders more difficult by introducing a mandatory pre-shipment inspection for imported products. |

| Labour market regulation | Zimbabwe | Zimbabwe reduced severance payments and introduced stricter rules governing fixed-term contracts. |

Source: empirical documents published by WB doing business.

How have they improved their rank?

Doing Business is widely used by policy makers in above mentioned countries to advance their reform agendas. Some of these economies have established units dedicated to specific reform action plans targeting the Doing Business indicators.

Rwanda, which ranks second in Africa in Doing Business 2017, is an example of an economy that used Doing Business as a guide to improve its business environment. From Doing Business 2005 to Doing Business 2017 Rwanda implemented a total of 47 reforms across all indicators. Rwanda is one of only 10 economies that have implemented reforms in all of the Doing Business indicators and every year since Doing Business 2006.16 These reforms are in line with Rwanda’s Vision 2020 development strategy, which aims to transform Rwanda from a low-income economy to a lower-middle-income economy by raising income per capita from $290 to $1,240 by 2020.17

In Kenya, for example, the Ease of Doing Business Delivery Unit operates under the leadership of the Ministry of Industrialization and the Deputy President, meeting on average every two weeks to discuss progress on an established action plan. The meeting is chaired by either the Deputy President or the Minister of Industrialization, while several stakeholder agencies are responsible for implementing measures stated in the action plan.

In Burundi, the investment climate reform agenda is overseen by the Office of the Second Vice President. The dedicated Doing Business Intelligence Committee comprises several ministers and is supported by an executive secretariat, which assumes the day-to-day work and reform coordination as well as public-private dialogue and communication on current reforms.

Nigeria’s government, which came to power in 2015, has placed a strong emphasis on increasing the country’s competitiveness. In early 2016 Nigeria established the Presidential Enabling Business Environment Council, which is chaired by the Vice President; the Federal Minister of Industry, Trade and Investment is the vice-chairman. The Council’s main mandate is the supervision of the competitiveness and investment climate agenda at the federal and state levels, while the Enabling Business Environment Secretariat is charged with day-to-day reform implementation.

Similarly, the Prime Minister of Côte d’Ivoire is the champion of the investment climate reform agenda and chairs the National Interdepartmental Doing Business Committee. The prerogative of this committee, which includes public and private sector stakeholders, is to formulate the reform agenda and to ensure the high-level monitoring of its implementation. Its permanent secretariat assumes coordination and implementation of the established reform agenda.

In Zimbabwe, the Office of the President and Cabinet oversees the Doing Business reform initiative using a Rapid Results Initiative approach. The Chief Secretary to the President and Cabinet is the strategic sponsor of the Initiative. Permanent Secretaries from more than 10 ministries are responsible for implementing measures outlined in the action plan for each of the Doing Business indicators.