Corporate Governance and Risk Management - AO World PLC

Info: 7595 words (30 pages) Dissertation

Published: 10th Dec 2019

Table of Contents

3. Section A – Corporate Governance

4. Section B – Risk Management

4.1. Background Information regarding France

4.2. Risk Assessment of AO’s expansion into France

4.3.1. Risk Identification and Justification

4.3.2. Risk Control and Mitigation factors

4.4. Risk 2: Economic Instability

4.4.1. Risk Identification and Justification

4.4.2. Risk Control and Mitigation

5. Conclusions and Recommendations

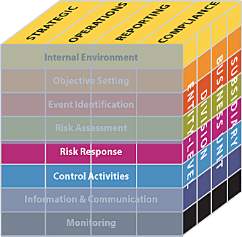

7.1. Appendix 1 – COSO Integrated framework for Enterprise Risk Management

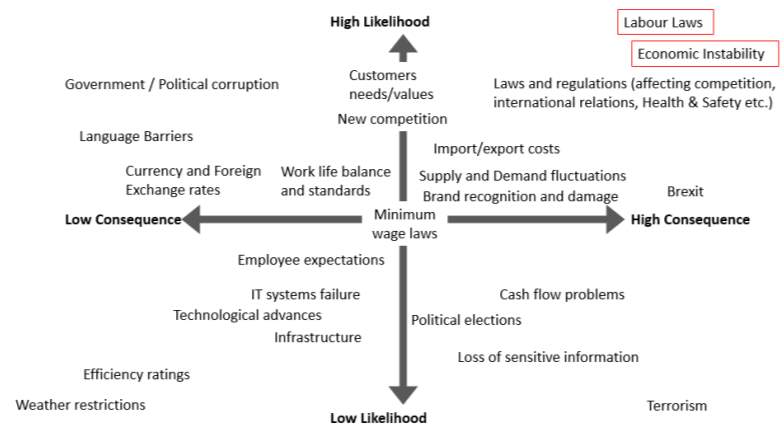

7.2. Appendix 2 – Risk Identification for AO’s proposed operations launching in France

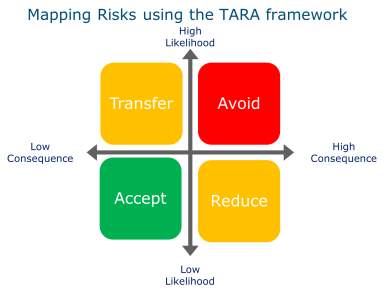

7.3. Appendix 3 – TARA Framework (for risk identification)

7.4. Appendix 4 – Risk Assessment and mapping

1. Executive Summary

1.1. Purpose of Report:

The purpose of this report is to review the current corporate governance and risk management approach on behalf of the AO shareholders.

To help AO shareholders and potential investors come to a decision, this report examines two key areas of interest:

- AO’s engagement and best practices demonstrated with UK Corporate Governance.

- AO’s expansion strategy into France and the associated risks with this proposed mitigation.

1.2. Conclusions:

From the findings within this report, we can conclude:

- Whilst AO’s utilisation of the flexibility of the ‘comply or explain’ principle suggest engagement with the best practices of the code the resulting vulnerability of minority shareholders indicated from the AGM voting results and recent appointment of Rudi Lamprecht indicates a lack of engagement and commitment.

- There are various cultural differences between UK and French corporate governance practice that AO need to take into consideration.

- The two key risks facing AO World Plc’s intended operations in France are Labour Laws and Economic Instability.

1.3. Key Recommendations:

- Further research needs to be undertaken to ensure additional elements of AO’s corporate governance practice are assessed; thus, allowing for a better understanding and engagement with the code.

- AO establish initial small scale operations in France to assess shareholder attitudes and the country’s economic climate before a decision is made about AO’s future in the long-term.

2. Introduction

The purpose of this report is to research and examine corporate governance and risk management issues within AO World plc (AO).

Therefore, this report will focus on two key areas of interest:

- Section A will focus on evaluate to what extent AO are demonstrating best practice with the UK corporate governance code.

- Section B of the report will be regarding AO’s proposed intentions to launch new operations within France and the related risks involved. This will include the determination of the cultural differences between the UK and France, and will assess the two main risks associated with the proposed plan.

3. Section A – Corporate Governance

3.1. Background Information

According to the ICAEW, the purpose of Corporate Governance is to facilitate effective, risk-taking and practical management that can deliver the long-term success for the business (ICAEW, 2017). The system by which companies are directed and controlled is defined as Corporate Governance (Cadbury, 1992).

The ‘comply and explain’ principle has been successfully implemented within the UK as one of the main aspects of the code and has helped businesses to promote high standards of corporate governance, thus leading to vast improvements in performance and best practice (FRC, 2012); (Sanderson, et al., 2010).

Recently there has been a steady increase in the implementation of the shareholder – centric approach (Goranova & Ryan, 2014). One of the most important factors influenced by the code is remuneration due to increased pressures from wider stakeholder groups, such as the government, businesses within the financial sector and the public. The code helps to avoids scandals such as Marks and Spencer’s shareholder hostility towards high remuneration rewarded when operating at a loss (Financial Times, 2009). Moreover, businesses need to act within the best practices for long-term success (Grant Thornton, 2016).

As a growing business, the remuneration committee requires strong leadership to guide AO towards the strategic goals, such as expansion into Europe; Furthermore, AO has highlighted their need for top-end executives filling the roles with the right experience, expertise and skill level needed to be successful (AO World PLC, 2016). In addition, the recruitment and selection process will require suitable remuneration packages to attract the appropriate executives to the role, thus improving AO’s operational performance.

Aligning AO’s performance with executive’s pay is important to determine ownership and control; therefore, if AO get this right then the board will become empowered, which is ideal for performance and satisfaction.

3.2. Performance Related Pay

Performance Related pay is topical for AO because you will need to consider the amount of executive pay and to how to retain these executives in relation to the financial performance of the business. Many economists suggest that businesses trading publicly suffer from incentive and motivational problems; subsequently the people operating within management are not the same people who own the business or who have a stake in the businesses success, such as the shareholders or stakeholders respectively (Financial Times, 2017).

In the year under review, AO did not meet their financial targets connected to the annual bonus; thus, AO are only rewarding performance as previously stated within the annual report. This demonstrates how AO are invested in the long-term success of the business as this sensible behaviour correlates with best practices. “The Company’s financial performance missed the thresholds set and therefore no bonus was payable for financial performance.”(AO World PLC, 2016, p. 57).

On the other hand, the 10% maximum bonus awarded for meeting the strategic objective of successfully launching into another country could be construed as not ambitious enough because even though it was not a huge sum of money awarded, this could be understood as AO not following the best practices from the shareholders’ perspective.

There are various environmental factors creating tough conditions for expansion into Europe and an increasingly competitive home market affecting AO’s profitability. Furthermore, profitability has been hindered recently, raising questions regarding awarding bonuses even when AO’s profitability is not the best; Moreover, this behaviour correlates with the publics negative perceptions of how executives are paid (BBC News, 2016). Revenue has increased steadily, but investment into distribution and expansion into the European markets has held back AO’s profits.

Academic work on incentives for high-calibre executives usually draws on agency theory, suggesting agents respond optimally to incentive structures, thus increasing operational performance. Bounded rationality also suggests rewarding employees will increase satisfaction and motivation towards to strategic objectives (Harris & Bromiley, 2007).

Consequently, a new report by MP’s has put forward measures for controlling ‘out of control executive pay’, in which it says no longer correlates performance with the executive’s skillset. The Business, Energy and Industrial Strategy (BEIS) Committee chairman – Iain Wright commented “Executive pay has been ratcheted up so high that it is impossible to see a credible link between remuneration and performance”. (Independent, 2017). This argument has highlighted the issue of differences in remuneration within many businesses, particularly the CEO being paid extravagantly compared to the average employee. Subsequently, Forbes (2016) found that the more CEO’s get paid, the worse the company performed across the board.

Hodgson suggested being mindful of the income gap as this reflects a certain mindset in an organisation because it reflects the way the decision-making process from Board and remuneration committee, and how these decisions impact every single employee within the business. (Fortune, 2015). Moreover, this reflects on the employees growing disparity between their pay and that of the CEO, thus leading to lack of motivation and weakened performance. Subsequently, AO have acted within best practice as you only reward when strategic goals are achieved.

Furthermore, AO has stated interest involving the wider workforce in the SAYE scheme; Moreover, equal distribution of remuneration policies throughout the organisation would help lessen the negative perceptions against executive remuneration.

The remuneration committee recognises that nurturing a valuable relationship with the shareholders can complement the development of the remuneration policy and welcomes any feedback; therefore, this activist shareholder approach allows the shareholders to input their own ‘say on pay’ alongside being empowered due to AO’s culture towards the people involved in the decision-making process. (PriceWaterhouseCoopers, 2015). Consequently, AO is aligned with the best practices due to the shareholder’s interests being taken into consideration meanwhile promoting long-term success for the business.

3.3. Benchmarking

Benchmarking against other remuneration policies should be conducted with caution due to the increased risk of raising an executive’s remuneration without profitability or performance increasing. Therefore, AO have taken the market conditions into consideration when benchmarking but more focus needs to be on profitability to elongate the long-term success for AO, thus engaging with best practice of the code.

Benchmarking against other remuneration policies should be conducted with caution due to the increased risk of raising an executive’s remuneration without profitability or performance increasing. Therefore, AO have taken the market conditions into consideration when benchmarking but more focus needs to be on profitability to elongate the long-term success for AO, thus engaging with best practice of the code.

The base salaries for the CEO and CFO within the AA plc are relatively higher than that of AO, the differences being £300,000 for CEO base pay and £180,000 CFO base pay. In addition, AA are operating at a profit whereas AO are currently operating at a loss aligned with the strategic objective of European expansion; therefore, AO are demonstrating best practice and good corporate governance by setting their remuneration appropriately lower in comparison to AA. Additionally, Poundland’s CEO receives £600,000 base pay, whereas AO’s CEO is £150,000 less. (Poundland PLC, 2016).

Moreover, balancing the level of reward and remuneration from the roles responsibility whilst not paying excessively is always a challenge. CEO’s of FTSE 100 businesses now have a median remuneration package of £4.3m, which is 140 times that of the average employee (BBC News, 2016). This difficulty when determining suitable remuneration for executives has led to the excessive level of pay. There has been a huge level of dissatisfaction relating the executive pay from 87% of the public and most people think a CEO should earn no more than 20 times average earnings compared with typical pay ratios in the FTSE 100. (PricewaterhouseCoopers, 2016).

3.4. Overboarding

The retirement of Bill Holroyd resulted in Rudi Lamprecht being elected for the role of non-executive director of the remuneration committee; Because all the members are non-executives, they will be able to provide a fair and unbiased opinion regarding remuneration for AO (Code Provision D.2.1.) (FRC, 2016).

In compliance with the code the members of the remuneration committee are expected to meet 3 times a year to discuss remuneration issues; however, Rudi did not attend one meeting which could be interpreted as lack of commitment from the newly appointed non-executive. Subsequently, Rudi might have been unsuitably chosen as a rushed decision from the board so AO would remain compliant during the year under review.

Rudi has many years’ experience of board membership and is currently a non-executive for Duagon AC and Fujitsu Technology Solutions (AO World PLC, 2016); (Bloomberg, 2017). Moreover, Rudi has taken on a lot of responsibility by sitting on 3 boards and might not be fully invested into the position within AO; therefore, Rudi is currently overboarding as he is holding various positions thus minimising effectiveness within AO. Rudi’s independence and overboarding still follows the recommend guidelines and adheres to the code; however, board members should limit their membership to increase their effectiveness and commitment to AO. Addressing the issue of overboarding, ISS governance has a policy in many markets which includes a recommend maximum number of directorships for any individual to hold (ISS Governance, 2017).

3.5. AGM Voting Results

Shareholders should be invited to approve all new long-term initiatives and significant changes. The results from the AGM show that nearly 16% of shareholders did not approve of the remuneration report, and that the authorisation of Directors allocating shares was also met with disapproval as 11.43% voted against this. Evidently, minority shareholders do not approve of the remuneration policies currently being agreed.

38.11% of the voting rights are held by the CEO and CFO thus they have a significantly influential. Consequently, there is a clear bias favourable to the executive directors and this does not demonstrate best practices because the shareholders’ interests and concerns are not being taken into consideration. Therefore, transparency needs to be increased to allow for the shareholders’ opinions to be valued and heard.

4. Section B – Risk Management

4.1. Background Information regarding France

Analysing the differences between the UK and France is important when evaluating AO’s intended launch of French operations, thus the way businesses operate in France may differ from UK operations (HSBC, 2017). Domestic industry and foreign investment in France is drastically increasing, Franco-Anglo relations have never been better and business prospects in France are promising (Start up Overseas, 2017). France is a preferred destination within Europe because it is a large economy within the eurozone, open to foreign investment and has supportive government initiatives creating a well-qualified workforce (Deloitte, 2014).

4.2. Risk Assessment of AO’s expansion into France

AO must identify, evaluate, manage and report many types of risk for improved external decision making (CIMA, 2008). Agenda for risk management set to clearly convey why AO undertakes risk management activities and the main features (Hopkin, 2013).

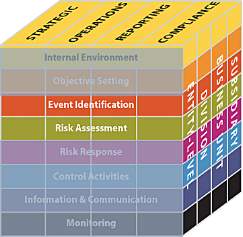

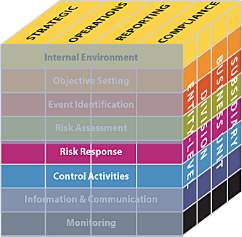

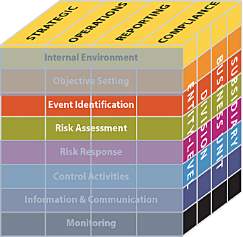

Although not much is known about AO’s proposed operations in France. it is important to examine the potential risks involved. The COSO framework (Appendix 1) has been utilised to identify (Appendix 2) and assess (Appendix 4) the potential risks involved, thus identifying AO’s risk appetite. AO’s risk appetite is directly related to strategy, and can be expressed as the balance between growth, risk and return (CIMA, 2008). All risk appetite statements should be linked back to AO’s strategic goals, in the words of Covey “Begin with the end in mind” (Covey, 2013). The purpose of risk identification and analysis is to prepare for risk mitigation (National Research Council, 2005).

Moreover, the risk identification process (by utilising the TARA framework – Appendix 2) has established Labour Laws and Economic Instabilityas the two key risks facing AO’s proposed expansion into France will be examined in terms of potential impacts and mitigation.

4.3. Risk 1: Labour Laws

4.3.1. Risk Identification and Justification

4.3.1. Risk Identification and Justification

When conducting research and identifying risks into the project of AO’s proposed launch of French operations, a key risk that has been previously recognised within the annual reports regarding EU expansion has been labour laws, and the influencing results on the people and culture within AO.

The French president has declared that France is in ‘a state of economic emergency’ under the record unemployment levels; therefore, suggesting that France’s strict and rigid labour laws will continue causing problems until radical improvements are implemented (HSBC, 2017). Unemployment is finally stabilising but remains high at 9.9% in May 2016, and at 10% in December 2016 (OECD, 2016); (Trading Economics, 2016). With 3.6 million unemployed, France has consistently topped the EU average over the last 15 years (Global Risk Insights, 2016). Moreover, rising youth unemployment and the way the workforce is handled within France will only heighten perceptions of social injustice and divisions, resulting in protests against the government’s decisions (Global Risk Insights, 2016); (Reuters, 2016). Subsequently, unemployment benefits are too generous and do not incentivise jobseeking (Telegraph, 2016). Despite strong opposition from labour unions, student organisations and from within parliament, the controversial reform of French labour laws were adopted (Library of Congress, 2016).

In addition, the rules and regulations within France are complex due to the strict procedural measures in place and unions play a key role in many aspects of French employment law (Lexology, 2017). HSBC argues that labour costs are extremely high, the market is inflexible and the skill levels of the workforce are problematic; thus, weighing on job creation and growth stimulation within France (Business Insider, 2016); (C.E.O, 2016).

4.3.2. Risk Control and Mitigation factors

4.3.2. Risk Control and Mitigation factors

Appendix 4 demonstrates how the risk: Labour laws has been ranked as highly likely with high consequences for AO; ideally, risk avoidance would be the preferred option but labour laws are externally influenced so AO can only mitigate this risk to remain competitive (MHA Consulting, 2013).

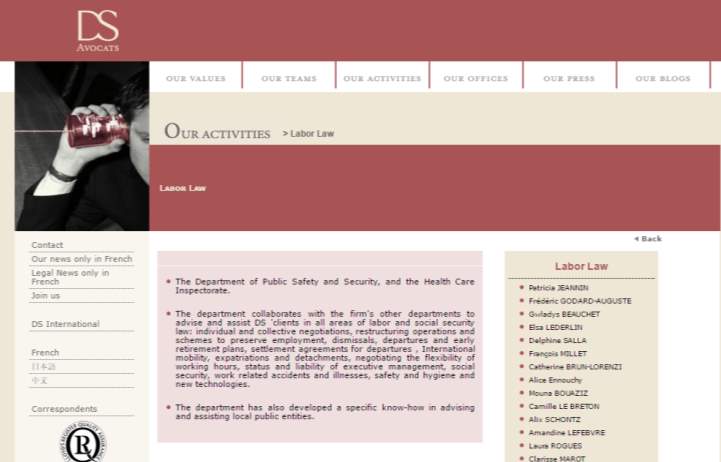

Torres (2010) suggests implementing social protection policies to protect the younger workforce; thus, effective policies are required to reconnect these young people to the labour market and improve their employability prospects (OECD, 2016). AO could hire a specialist French law firm such as DS Avocats (Appendix 5) to draw up a business contract in relation to labour laws protecting their employees from any changes in French labour laws that may arise from the recent French presidential election and the protests against the recent changes to the labour laws implemented by the government (Global Risk Insights, 2016). Therefore, DS Avocats can conduct independent reviews for AO to continuously mitigate the labour law risk in relation to AO’s proposed operations launching in France from July 2018.

In addition, the ‘Garantie Jeunes’ program focuses on individual employment counselling, assisted job placement, job search assistance and job readiness training; therefore, if AO adopted and implemented these measures within their French operations, this would emit positive results if adopted in the long-term relating to the risk of French labour laws and regulations (Garantie jeunes, 2017). Moreover, AO should pay close attention to the role of employee representatives because they must comply with the labour code and the organisational culture before making any detrimental business decisions (OECD, 2016). Therefore, in alignment with AO’s cultural values and strategic objectives each employee will have to monitor these labour laws and report back to the Board if these laws are not being adhered to if the French operations are established.

4.4. Risk 2: Economic Instability

4.4.1. Risk Identification and Justification

4.4.1. Risk Identification and Justification

The risk assessment process needs to be simple, practical and easy to understand to be effective and sustainable for AO (COSO, 2012). Another key risk facing AO is the economic instability within France, which is affected by many factors such as the inflation rate, terrorism threats, Brexit, a manufacturing slump worsened by strikes, a consumer hangover from the Bastille Day attack on Nice, and a plummet in productivity caused by France’s hosting the 2016 Euro’s (Telegraph, 2016); (The Local, 2016).

Inflation in France turned negative in January 2015, thus adding to worries over deflation in the eurozone; moreover, difficulties within the French retail sector worryingly could be an indicator that the economy is in trouble. The last time annual inflation was negative in France was during the recession; therefore, demonstrating how the inflation rate is a factor influencing the identified risk of economic instability (BBC News, 2015). While the whole eurozone struggles for growth and inflation, France is suffering the most, which could impact negatively on AO’s proposed operational launch in France (Telegraph, 2016).

Additionally, the French government shows willingness to unpeel the red tape, but France has a proud history of socialist economic policy and the benefits (Early retirement, Free education, 35-hour working week and their enviable productivity) will not be affected presently, even though the public are increasingly accepting the need to change the economy (Telegraph, 2016). Therefore, France’s fundamental economic problem is due to a lack of growth, causing instability within the labour market, financial markets and tarnishing investor confidence in France (BBC News, 2016).

4.4.2. Risk Control and Mitigation

Appendix 4 demonstrates how the risk: Economic Instability has been ranked as highly likely with high consequences for AO. Risk avoidance is underutilised as a strategy for risk mitigation and can be employed by knowledgeable employees within AO to their advantage (National Research Council, 2005).

Another potential mitigation response would be for AO to adapt their approach to the proposed operations to be launched in France. Instead of establishing large scale operations as proposed, AO could initially launch a smaller scale operation by advertising solely online throughout France as opposed to investing in expensive TV adverts, such as the television advertisements aired within the UK; therefore, the required level of investment from AO would be lower.

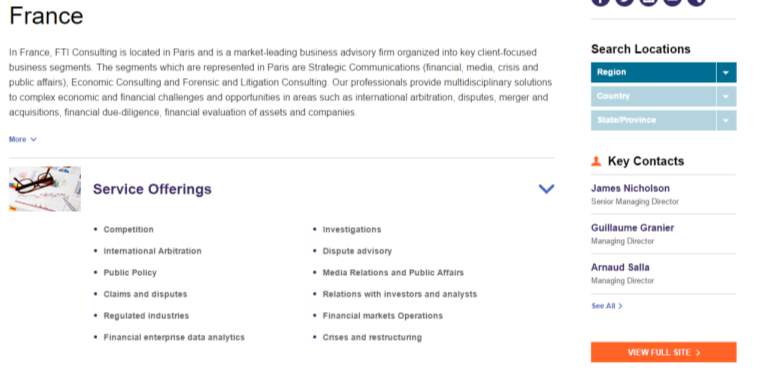

In addition, AO need to adopt a medium-term strategy focusing on economic fundamentals and balanced growth due to the vicious cycle of fiscal austerity measures which lead to weakened economic growth (Torres, 2010). In order to mitigate this risk of economic instability, AO could hire an advisory firm based in France such as FTI Consulting (Appendix 6). FTI Consulting will utilise their expert knowledge and allow AO to develop a greater understanding of France’s economic climate and instability due to the influencing factors such as interest rate, terrorism threats and Brexit.

Subsequently, the ridiculously outdated and inflexible employment market, in terms of job creation, that dominates France is contributing to the country’s inability to sustain both inflation and economic growth. The labour market is weighing on competitiveness and consumption, and helps to explain why the French economy is underperforming. (Business Insider, 2016). However, when a risk such as economic instability is assessed as having a potential high likelihood (Appendix 4), this indicates that AO may wish to avoid this risk altogether which can only be done if the proposed establishment of operations in France is terminated.

5. Conclusions and Recommendations

To conclude, the information detailed within this report indicates that although AO plc are compliant with section D of the code, there may be some unconvincing explanations of non-compliance with the norms of the code. In addition, AO plc ‘s profits don’t reflect success; therefore, the level of remuneration paid to the members of the board does not correlate with AO’s financial performance. AO have set their remuneration in favour of rewarding long term performance, hence demonstrating best practice. Achieving best practice in governance delivers benefits for AO (ICSA, 2015). However, solely relying on benchmarking can be risky, thus AO’s profitability should be taken into consideration. Additionally, the process of non-executive appointment should not be rushed as unsuitable candidates affect the effectiveness of the committee, and the remuneration committee requires all members to be wholeheartedly committed to responsibly support AO’s strategic aims.

This report also identifies the risks that will impact AO during the proposed expansion into France if this project was to commence. The risks of Labour Laws and Economic Instability can be mitigated to reduce this level of risk as they are both highly likely to occur with the chance of creating negative consequences for AO’s operations. The COSO framework (Appendix 1) emphasises the need to assess and oversee risks from a holistic perspective and when the leadership within AO utilise the information to make decisions regarding value, this is conducting risk assessment correctly (COSO, 2012). Moreover, there are a number of risks that have been identified by utilising the COSO framework and these can be elaborated on if AO sees that these risks are of higher importance than Labour Laws and Economic Instability.

The 2 identified risks Labour Laws and Economic Instability, and AO have the option of mitigating these risks that are facing the proposed launch of operations within France. However, it would be recommended that due to the current economic climate within France and the uproar due to the changes in Labour laws, now is not the correct time for AO to launch operations in France as it is believed that this would not best benefit AO, and would be too detrimental to AO’s strategic objectives and cultural values as an organisation. Moreover, further research needs to be conducted before AO establish operations within France and hinder their profitability and brand image if implemented poorly.

6. References

AO World PLC, 2016. Annual Report and Accounts 2016. [Online]

Available at: http://ao.com/corporate/wp-content/uploads/2016/06/AO-World-plc-2016-Annual-Report-and-Accounts.pdf

[Accessed 5 January 2017].

BBC News, 2015. French inflation turns negative. [Online]

Available at: http://www.bbc.co.uk/news/business-31532269

[Accessed 3 May 2017].

BBC News, 2016. Executive pay: Companies told to justify rates. [Online]

Available at: http://www.bbc.co.uk/news/business-38138815

[Accessed 8 April 2017].

BBC News, 2016. Online retailer AO World sees losses deepen. [Online]

Available at: http://www.bbc.co.uk/news/business-36477292

[Accessed 8 April 2017].

BBC News, 2016. What is the French economic problem?. [Online]

Available at: http://www.bbc.co.uk/news/business-36152571

[Accessed 5 May 2017].

Bloomberg, 2017. AO World Plc – Rudolf Lamprecht. [Online]

Available at: https://www.bloomberg.com/research/stocks/people/person.asp?personId=46398916&privcapId=51972899

[Accessed 8 April 2017].

Business Insider, 2016. France’s ridiculously old-fashioned labour market. [Online]

Available at: http://uk.businessinsider.com/hsbc-note-on-the-french-labour-market-and-economy-2016-3

[Accessed 4 May 2017].

C.E.O, 2016. Corporate Europe Observatory – How the EU pushed France to reforms of labour law. [Online]

Available at: https://corporateeurope.org/eu-crisis/2016/06/how-eu-pushed-france-reforms-labour-law

[Accessed 2 May 2017].

Cadbury, A., 1992. Report of the Committee on the Financial Aspects of Corporate Governance (The Cadbury Report), London: Gee and Co (A division of Professional Publishing Ltd).

CIMA, 2006. Management Accounting – Risk and Control Strategy. [Online]

Available at: http://www.cimaglobal.com/Documents/ImportedDocuments/fm_nov06_p42-43.pdf

[Accessed 1 May 2017].

CIMA, 2008. Introduction to managing risk. [Online]

Available at: http://www.cimaglobal.com/Documents/ImportedDocuments/cid_tg_intro_to_managing_rist.apr07.pdf

[Accessed 28 April 2017].

COSO, 2012. Risk assessment in practice. [Online]

Available at: https://www.coso.org/Documents/COSO-ERM-Risk-Assessment-in-Practice-Thought-Paper-October-2012.pdf

[Accessed 3 May 2017].

Covey, S. R., 2013. The 7 habits of highly effective people: Powerful lessons in personal change. 1st ed. New York: Simon & Schuster.

Deloitte, 2014. Doing Business in France, Paris: Invest in France Agency.

Financial Times, 2009. Sir Stuart Rose and the thorny issue of corporate governance. [Online]

Available at: www.ft.com/content/5df34ef6-eeec-11dc-97ec-0000779fd2ac?client=safari

[Accessed 5 January 2017].

Financial Times, 2017. ft.com/lexicon – Definition of Corporate Governance. [Online]

Available at: http://lexicon.ft.com/Term?term=corporate-governance

[Accessed 6 April 2017].

Forbes, 2016. The highest paid CEO’s are the worst performers – new study. [Online]

Available at: http://www.forbes.com/sites/susanadams/2014/06/16/the-highest-paid-ceos-are-the-worst-performers-new-study-says/#32cfe181293a

[Accessed 5 January 2017].

Fortune, 2015. Top CEOs make more than 300 times the average worker. [Online]

Available at: http://fortune.com/2015/06/22/ceo-vs-worker-pay/

[Accessed 6 April 2017].

FRC, 2012. Financial Reporting Council – What constitutes an explanation under ‘comply or explain’? – Report of discussions between companies and investors. [Online]

Available at: https://www.frc.org.uk/Our-Work/Publications/Corporate-Governance/What-constitutes-an-explanation-under-comply-or-ex.pdf

[Accessed 10 April 2017].

FRC, 2016. Financial Reporting Council – The UK Corporate Governance Code. [Online]

Available at: www.frc.org.u/Our-Work/Publications/Corporate-Governance/Final-Draft-UK-Corporate-Code-2016.pdf

[Accessed 5 January 2017].

Garantie jeunes, M. d. d. p. e., 2017. Garantie jeunes. [Online]

Available at: http://travail-emploi.gouv.fr/emploi/insertion-dans-l-emploi/mesures-jeunes/garantiejeunes/

[Accessed 3 May 2017].

Global Risk Insights, 2016. Labor reform and the potential political crisis in France. [Online]

Available at: http://globalriskinsights.com/2016/04/labor-reform-potential-political-crisis-france/

[Accessed 1 May 2017].

Goranova, M. & Ryan, L. V., 2014. Shareholder Activism: A multidisplinary Review. Journal of Management, 40(5), pp. 1230-1268.

Grant Thornton, 2016. The future of governance: One small step…, Chicago: Grant Thornton.

Harris, J. & Bromiley, P., 2007. Incentives to cheat: The influence of executive compensation and firm performance on financial misrepresentation. Organization Science, 18(3), pp. 350-367.

Hopkin, P., 2013. Risk Management. London: Kogan Page Ltd.

HSBC, 2017. HSBC – Country Guide – France. [Online]

Available at: http://www.business.hsbc.nl/en-gb/countryguide/france

[Accessed 24 April 2017].

ICAEW, 2017. What is Corporate Governance?. [Online]

Available at: https://www.icaew.com/en/technical/corporate-governance/overview/does-corporate-governance-matter

[Accessed 6 April 2017].

ICSA, 2015. Good practice for annual reports – guidance note. [Online]

Available at: https://www.icsa.org.uk/assets/files/free-guidance-notes/good-practice-for-annual-reports.pdf

[Accessed 3 May 2017].

Independent, 2017. Executive pay is ‘out of control’, warn MPs. [Online]

Available at: http://www.independent.co.uk/news/uk/politics/executive-pay-out-of-control-mps-business-committee-a7666951.html

[Accessed 6 April 2017].

IRM, 2002. A Risk Management Standard, London: The Institute of Risk Management.

ISS Governance, 2017. Director Overboarding (UK & Ireland). [Online]

Available at: https://www.issgovernance.com/file/policy/uk-ire-overboarding.pdf

[Accessed 8 April 2017].

Lexology, 2017. Employment and labour law in France. [Online]

Available at: http://www.lexology.com/library/detail.aspx?g=04707eaf-8286-4528-860c-b20c632b0ed0

[Accessed 3 May 2017].

Library of Congress, 2016. France: Controversial labor law reform adopted. [Online]

Available at: http://www.loc.gov/law/foreign-news/article/france-controversial-labor-law-reform-adopted/

[Accessed 3 May 2017].

MHA Consulting, 2013. Four types of risk mitigation and BCM governance, risk and compliance. [Online]

Available at: https://www.mha-it.com/2013/05/four-types-of-risk-mitigation/

[Accessed 3 May 2017].

National Research Council, 2005. The owner’s role in project risk management. 1st ed. Washington DC: The National Academies Press.

OECD, 2016. Employment Outlook 2016. [Online]

Available at: https://www.oecd.org/france/Employment-Outlook-France-EN.pdf

[Accessed 1 May 2017].

Poundland PLC, 2016. Annual Report and Accounts 2016. [Online]

Available at: http://www.poundlandcorporate.com/~/media/Files/P/Poundland/reports-and-presentations/poundland-ar-2016.pdf

[Accessed 5 January 2017].

PriceWaterhouseCoopers, 2015. Shareholder Activism – who, what, when and how?, London: PwC.

PricewaterhouseCoopers, 2016. PwC Executive Pay – time to listen. [Online]

Available at: https://www.pwc.co.uk/services/human-resource-services/insights/time-to-listen.html

[Accessed 8 April 2017].

Reuters, 2016. French government forces labor law through parliment, shrugs off protests. [Online]

Available at: http://www.reuters.com/article/us-france-politics-protests-idUSKCN0ZL0TM

[Accessed 3 May 2017].

Sanderson, P., Seidl, D., Krieger, B. & Roberts, J., 2010. Flexible or not? The comply-or-explain principle in UK and German Corporate Governance. Working Paper 407, pp. 1-42.

Start up Overseas, 2017. Why start a business in France?. [Online]

Available at: http://www.startupoverseas.co.uk/starting-a-business-in-france

[Accessed 24 April 2017].

Telegraph, 2016. How can France kickstart its sluggish economy?. [Online]

Available at: http://www.telegraph.co.uk/business/2016/09/26/how-can-france-kickstart-its-sluggish-economy/

[Accessed 3 May 2017].

The Local, 2016. France blames Brexit as economy looks set to suffer. [Online]

Available at: https://www.thelocal.fr/20161209/french-central-blames-brexit-as-economy

[Accessed 4 May 2017].

Torres, R., 2010. Incomplete crisis responses: Socio-economic costs and policy implications. International Labour Review, 149(2), pp. 227-237.

Trading Economics, 2016. France Unemployment Rate. [Online]

Available at: http://www.tradingeconomics.com/france/unemployment-rate

[Accessed 1 May 2017].

7. Appendices

7.1. Appendix 1 – COSO Integrated framework for Enterprise Risk Management

7.2. Appendix 2 – Risk Identification for AO’s proposed operations launching in France

| AO PLC | Strategic Risks

Customer Demand, Competition, Customer changes and industry changes

|

Hazard Risks

Contracts, Natural events, Suppliers, and Environment |

Operational Risks

Regulations, Culture, and Board composition |

Financial Risks

Interest rates, foreign exchange, credit |

| Internal |

|

|

|

|

| External |

|

|

|

|

| Both |

|

|

|

|

Step 3 of the COSO framework -Adapted from A Risk Management Standard: (IRM, 2002).

7.3. Appendix 3 – TARA Framework (for risk identification)

7.3. Appendix 3 – TARA Framework (for risk identification)

TARA Approach:

- Transfer

- High Likelihood / Low Consequence

- These risks must be monitored

- Move the risk via first / third party insurance

- Must consider the 6 C’s of Insurance: Cost, Coverage, Capacity, Capabilities, Claims and Compliance.

- Avoid

- High Likelihood / High Consequence

- Action is required to mitigate the risk

- Last case scenario

- Most extreme form of avoidance is termination of plans / cessation of operations.

- Reduce

- Low Likelihood / High Consequence

- These risks must be monitored

- Precautionary measures

- level of risk has changed over time due to new info or expectations from shareholders changing etc.

- Accept

- Low Likelihood / Low Consequence

- No action needs to be taken as this is a minor risk

- Residual risk always remains, benefit from accepting risk must exceed losses expected from that risk.

- Risk should stay at a level which is acceptable by matching the risk appetite.

(CIMA, 2006)

7.4. Appendix 4 – Risk Assessment and mapping

7.4. Appendix 4 – Risk Assessment and mapping

| Key risks for AO plc | Risk Categorisation | TARA framework | Hierarchy of Measures – Selection of controls |

| 1) Culture Failure | Operational Risk | Reduce | Preventative / Directive |

| 2) People | Operational Risk | Reduce | Preventative / Directive |

| 3) Failure of EU expansion | Market Risk | Reduce / Accept | Preventative / Directive |

| 4) Brand recognition and damage | Reputational Risk | Reduce | Preventative / Detective |

| 5) IT systems resilience (Internal) | Technological Risk | Reduce | Preventative / Directive / Corrective |

| 6) Website downtime (External) | Technological Risk | Reduce | Preventative / Detective |

| 7) Loss of sensitive information | Fraud Risk | Transfer | Preventative / Detective |

| 8) Laws and regulations | Legal & Political Risk | Transfer / Reduce | Preventative / Detective |

| 9) Business Interruption | Operational Risk | Transfer / Reduce | Preventative / Detective / Directive |

7.5. Appendix 5 – DS Avocats – French law firm

Link to DS Avocats (law firm) website: http://www.ds-avocats.com/Droit-social.html?lang=en

7.6. Appendix 6 – FTI Consulting – French Advisory Firm

Link to FTI Consulting’s website: http://www.fticonsulting.com/about/locations/regions/france

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Corporate Governance"

Corporate Governance is a term used to describe the way in which a corporation is governed and how operations are controlled. Corporate Governance covers the processes and procedures that employees must follow during business operations.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: