Costco Business Analysis: PESTLE and Industry Evaluation

Info: 5983 words (24 pages) Dissertation

Published: 26th Aug 2021

Tagged: PESTLEBusiness Analysis

Introduction

Costco Wholesale Corp. is a wholesaling-retailer of a wide range of merchandise categories. Membership with Costco is necessary for a customer to be able to buy products from its warehouses that sell limited options of national and select private-label products at low prices (Forbes, 2018). The company has been identified in a lot of ways since its founding in 1983. According to Forbes (2018), it currently ranks 27th among top regarded U.S. companies, places 103rd as best U.S. company employer for new graduates this year and occupies the 189th spot of Forbes’ prestigious Global 2000 list for 2018.

This report will involve in-depth discussions of Costco as a company examined in various aspects. Firstly, the company will analyze the regarding opportunities and threats it presently faces by performing an environmental scan of PESTEL forces that may significantly impact Costco’s operations.

Also, a risk analysis should be conducted by assessing the market attractiveness of its industry, where the focus is an evaluation of the intensity of industry rivalry, due primarily to major domestic and foreign competition.

Secondly, the company’s overall financial health will be thoroughly examined by utilizing ratios in looking into its financial strength (liquidity and solvency), profitability, efficiency, and effectiveness of management.

Thirdly, a focused financial statement analysis will follow the knowledge on free cash flows, market value added, and economic value added will be evaluated.

Fourthly, calculation of the company’s current weighted average cost of capital has deemed a necessity to be able to formulate development strategies. The report will then conclude with recommendations to management for strategy development.

Opportunities and threats

The first part of the analysis of Costco Wholesale Corp. will commence, where opportunities and threats stemming from its political, economic, socio-cultural, technological, ecological (natural environment), and legal environments will be assessed. Also, the market attractiveness of the U.S. discount stores industry under the cyclical consumer goods and services sector will be included in this section.

PESTEL Analysis

For a Political environment, the current political climate of the U.S. under a Trump administration may be described in a lot of ways when a comprehensive view is taken. For example, the evident and widening divide between the country’s two major parties, Democratic and Republican, may be deemed as a negative indication of the country’s current political climate; to state the apparent, political stability of the country is conducive for growth in a lot of areas such as its economy, business and trade, etc. However, the focus of analysis for this part would be the impacts of domestic and foreign trade policies of the Trump administration on businesses such as Costco, the current status of NAFTA, and the obvious implications of the results of local and national elections. Beginning with current trade wars with other countries, especially China, are yet to manifest their negative impacts on the U.S. economy. As of September 2018, additional tariffs will be imposed for $200 billion on Chinese imported products (Jackson, 2018). Although the retaliatory tariffs by China will significantly impact American farmers, ranchers, and industrial workers, and not Costco in particular. An indirect effect can be perceived in terms of agricultural (fruits, vegetables, dairy, and other food items) and household industrial (electronics, appliances, gadgets, etc.) products that the company may sell to its customers; the impact will be in terms of high prices due to tariffs that will be passed on by Chinese exporters to American consumers.

Another major political event is the anticipated finalization of NAFTA’s renegotiation. With other implications, NAFTA could mean tariff resolves that will benefit every country member in this trilateral free trade deal between the Canada, Mexico, and the U.S. (Gray, 2018). Concerning how developments in NAFTA’s renegotiation may significantly impact Costco, the industries that may win or lose big time depending on how the tides turn include agriculture and apparel, which produce goods that the company makes available to its customers. In an economic environment, Trumponomics or the common economic policies of the Trump administration may be making America great again or otherwise, depending on who is explaining available economic information. Yahoo! Finance (2018) gives Trumponomics a grade of B based on six critical economic indicators: total employment, manufacturing employment, average hourly earnings, exports, S&P 500, and real GDP per capita. If one compared the current administration’s economic achievements with the six immediately preceding administrations, based on the indicators as mentioned above, one would conclude that the incumbent leaders have outperformed their predecessors.

Looking into the future (between five and ten years from now), it is also wise for Costco’s management to investigate the possibilities of the U.S. economic system changing from capitalism to socialism. This idea is included in this PESTEL assessment because the Democratic Party at this point has been vocal with their advocacy for and support of probable electoral candidates for the presidency and other high public offices, such as Bernie Sanders and Alexandria Ocasio-Cortez. These political characters have been consistent about their vision for America and its residents a future of democratic socialism (www.berniesanders.com), (Frizell, 2015), and (Remnick, 2018). Will Costco be able to thrive, after at least three decades since its founding in 1983, under a democratic socialist form of economy, assuming the Democratic Party will be able to have their way? While Costco’s management may appropriately respond to cross the bridge when it gets there, the critical point is to assess developments in the country that will have impacts on it as a corporate entity; Costco is currently doing well under the existing economic system.

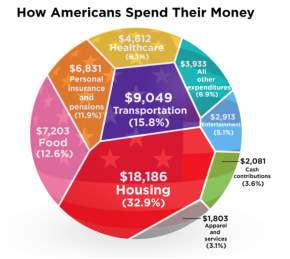

Based on a Socio-cultural environment, according to its latest annual report, Costco had paid membership of almost 50 million in 2017. This included American and international members (Costco, 2018). The need for the company to regularly assess the consumption and spending habits of its customer base cannot be stressed enough. Depending on the source of information or consultancy advice, different marketing experts would offer different opinions regarding the most effective and profitable manner of reaching out to customers and translating the relationship with them into sales, and ultimately profits. For example, Banco Santander (2018) gives a broad reminder that American consumers have a growing price consciousness because of their experiences under the global crisis; this forced some consumers to abandon expensive for more affordable brands. And about Costco’s policy of making available a limited set of options (few yet value-for-money brands in warehouse stores), Banco Santander found out that only less than 10% of American consumers are replacing their preferred with less expensive or private label (home) brands. Elkins’ (2017) illustrative breakdown (please see Figure 1 below) of how Americans spend their money provides meaningful insights to Costco, regarding the inventories to stock more of during the year; of course, the company may also rely on their records of inventory turnover.

Figure 1: Breakdown of average annual expenditures of $57,311 of a typical U.S. consumer

Figure 1 above shows the different components of an American’s average annual expenditures of $57,311 from an average income before taxes of $74,664 (Elkins, 2017). Notice how food takes a 12.6% share of the ‘pie.’ This is one of the product categories that Costco sells to its members. Lastly, the shopping statistics accessible through (www.finder.com) may also prove to be significant sources of information on how to manage profitable relationships with customers. The website compiles a lot of information from expenditures on drinking, Valentine’s Day products, Super Bowl purchases trends, etc. based on relatively recent surveys (from 2016 to date).

For scanning the technological environment for any opportunities and threats, it has been determined that Costco provides its members the option of taking their shopping experience online, even though the company is famous for the adventure it allows its customers through treasure hunting inside its warehouse stores. The strategy of Costco to realize online shopping for those who prefer so is evaluated as sound because it has been determined that more and more customers prefer online over traditional shopping (Saleh, 2017). Aside from online shopping, no other recent technological developments are identified that either create opportunities for or pose risks to the company.

Ecological (Natural) Environment.

For this section of the environmental scanning, the primary focus points are operational sustainability (carbon footprint, ecological impacts, etc.) and the effect of natural calamities to Costco’s ability to sustainably source supplies, mainly agricultural and food. For operational sustainability, Yahoo! Finance (2018) reports that Costco garners a rating between 50% and 60% on the ESG scale. ESG or environment, social, and governance performance helps analysts to evaluate the corporate behavior of companies and determine their future financial performance (Financial Times, 2018). Specifically, Costco’s environment performance alone has significantly improved through the years, beating the industry average by a few points during 2017-2018. Hurricane Florence has currently devastated North Carolina, especially its agriculture industry. Poultry products, estimated at 3.4 million chickens and turkeys, have been lost due to the calamity. As for pork and pork-based products, industry estimates of losses come up to 5,500 hogs lost or dead. The cotton crop of the area was not spared as well (Daniels, 2018). This is another valid point to make on how Costco needs to regularly scan its natural environment for impacts of natural calamities on its operations. The last worry to the company is the sustainability of agricultural supply as food products to stock and sell inside its warehouse stores.

Industry Analysis

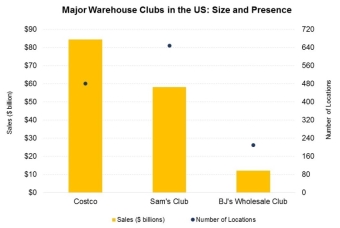

At this point, an analysis of industry risks will be limited to assessing how stiff the competition is between Costco and its rivals. According to D&B Hoovers (2018), Costco’s top competitors include Wal-Mart Stores through its Sam’s West, Inc. division, BJ’s Wholesale Club Holding, Inc., and the Kroger Co. Soni (2016) identifies the same set of significant competitors, except for Kroger Co, while Cardenal (2014) would instead compare Costco with other discount store giants, such as Wal-Mart and Target. The second figure below offers a straightforward comparative analysis among Costco, Sam’s Club, and BJ’s Wholesale Club regarding revenues and the number of locations. Notice how Costco soars above its competitors concerning sales dollars even though it ranks second only concerning warehouse store (location) counts. Cardenal (2014) offers some significant reasons why the company is outperforming its competitors. Firstly, Costco’s business model (warehouse club membership) allows it to produce profits from membership fees, instead of the markup on top of product costs. Secondly, superior customer service is a proven distinguishing factor for Costco. Its customers collectively gave the company a rating of 84 in the American Customer Satisfaction Index in 2014, which defeated its competitors’ criteria. Finally, Cardenal (2014) points out that as a warehouse club membership business, the company enjoys a consistent renewal rate of at least 85%.

Figure 2: Comparative analysis of Costco and competitors in terms of sales and number of locations

Switching the focus of analysis, Costco’s management should not discount threats from foreign entrants into the U.S. retail industry. As of 2014, the entire U.S. retail market remained as the world’s largest retail market, estimated to have generated about $2,897 billion during the year (Business Sweden, 2015). This is more than enough reason for successful foreign retail companies to expand their operations into the country. While not yet established and may compete with Costco only indirectly, Thomas (2018) identified seven international retailers with a common business strategy of either venturing into the U.S. or increasing their existing but subtle American market presence. These retailers are Primark, L:A Bruket, KidZania, Parfois, Compaigne de Provence, Superdry, and Bershka; to reiterate, the bottom line is for Costco’s management to never sit on their laurels and neglect the fact that competition can be heightened any time not only by local industry rivals but also those coming from abroad.

Costco’s Performance Evaluation: Ratio Analysis

At this point, the report will zoom in on Costco’s financial performance. A performance evaluation will be conveyed through ratio analysis; Costco’s profitability, liquidity and solvency, efficiency, and effectiveness will be viewed. Financial information that is relevant to conduct the ratio analysis will be essentially taken from the company’s annual reports. However, Yahoo! Finance and related websites that compile financial information and significant statistics may also be consulted, especially when specific information cannot be found from the annual reports.

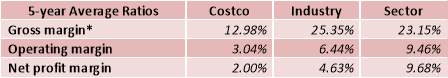

Ratio Analysis: Profitability

Concerning profitability, Costco’s gross profit, operating, and net profit margins are estimated for the previous five years. Then, the results are averaged, which will be compared with industry and sector-wide five-year averages for purposes of an apples-to-apples comparison. Please refer to Figure 3 below on the following page.

Figure 3: Comparative analysis of Costco, its industry, and its sector based on profitability ratios.

Based on the above information, Costco did not outperform its industry and sector. It is essential to take note that the low profitability ratios of the company are consistent with both its overall business strategy of cost leadership and unique business model of making profits through membership fees. The company does not earn its net earnings from the prices it charges its customers. Instead, its benefits mainly come from membership fees (Kline, 2017).

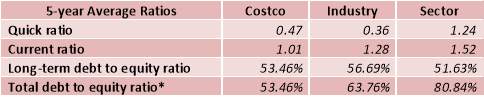

Ratio Analysis: Liquidity and Solvency

From its profitability, let’s move to assess the company through its ability to service short- and long-term liabilities; Costco’s liquidity (short-term) and solvency (long-term) will be precisely evaluated. And among the possible combination of liquidity and solvency ratios, quick, current, long-term debt-to-equity, and total debt-to-equity ratios were mainly chosen. Reemphasizing the ratios are derived based on financial information taken from the annual reports of Costco (from 2013 to 2017). As for industry and sector 5-year average information, these were lifted from Reuter’s company profile data (www.reuters.com).

Figure 4: Comparative analysis of Costco, its industry, and its sector based on liquidity and solvency ratios.

Above in figure 4 presents comparative information regarding select liquidity and solvency ratios of Costco, its industry, and its sector. As can be seen, the company’s better quick ratio than the industry (but not the sector) may be assessed as not ideal because it is low. This indicates a weak to moderate ability to pay currently maturing obligations. As for the current ratio, while this is slightly above 1.00, and the least among the three compared, this current ratio does not beat the rule of thumb of at least 2.00.

Let’s now evaluate the company’s ability in paying long-term debt. Based on Figure 4 above, the company is slightly better than the industry for long-term debt-to-equity ratio and outperforms both the industry and sector based on the total debt-to-equity ratio. For both rates, it is assumed that the reasonably lower they are, the better since they both indicate an ability to avoid bankruptcy.

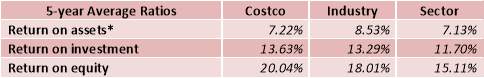

Ratio Analysis: Effectiveness

The finale of the ratio analysis of Costco will examine the company regarding how its resources have been employed to yield returns. Precisely, the ratios chosen for the following analysis are returned on assets or ROA, return on investment or ROI, and return on equity or ROE.

Figure 5: Comparative analysis of Costco, its industry, and its sector based on effectiveness ratios.

Figure 5 above facilitates the comparative analysis of Costco against its industry and sector concerning effectiveness ratios. And based on the above information, it can be concluded that Costco has effectively competed with other businesses in all aspects. Through its return on investment and return on equity, Costco climbed to the top. As for return on assets, Costco was able to beat its competitors sector-wide. It is essential to emphasize that these three ratios inform us about the dollars earned per dollar of assets, investments, or equity contribution. Thus, interpreting Costco’s 5-year average ROA for example, we would state that the company has earned $0.07 per dollar of assets that it owns.

Financial Statement Analysis

A financial statement analysis will accomplish this, where the company is examined in three dimensions: free cash flows, market value added, and economic value added. Free cash flows are a metric of financial performance. This measures how much money is available as provided by operating activities after deducting investments in fixed or long-term assets (CFI Education Inc, 2018). The purpose of this report, a straightforward formula is used to derive the free cash flows of Costco through a five-year-period, from 2013 to 2017.

Figure 6: Financial statement analysis of Costco – free cash flows from 2013 to 2017.

In figure 6 above shows the free cash flows of Costco from 2013 to 2017 and the apparent trend through this five-year period. Per Nasdaq.com, in 2013, the company had free cash flows of at least $1.35 billion, which rose to $4.22 billion or 212.0% after five years. Notice though that the level of free cash flows fluctuated, which dipped from 2015 to 2016 at less than $650 million. Therefore, Costco may be assessed as a great-performing company because its free cash flows were always positive for the immediately preceding five years. This is indicative of sound stewardship by its management.

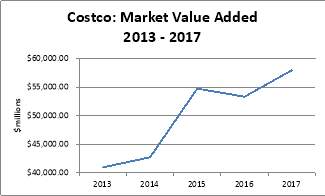

Market Value Added

Another indicator of shareholder value is the market value added or MVA. This is a measure of shareholder value by calculating the excess of the market value of a company over its book value (MBA Knowledge Base, n.d.). It is important to remember that the market value added of a firm may be reliably calculated only for listed or public companies. This is so since listed companies have stocks that are priced in an active market.

Figure 7: Financial statement analysis of Costco – market value added from 2013 to 2017.

As can be seen in Figure 7, Costco’s market value added through the years has increased, from above $40 billion in 2013 to almost $57 billion in 2017. Because there is market value added, management of Costco may be assessed as very useful in discharging their responsibilities to company stakeholders, especially the shareholders.

Economic Value Added

Similar to the MVA, economic value added, or EVA is another measure of shareholders’ value. Derivation of EVA may be deemed relatively more straightforward than MVA, where the net operating profit after tax is reduced by return on invested capital. The EVA has a short-term orientation in measuring the effectiveness of resource utilization by management (Petravicius & Tamosiuniene, 2008).

Cost of Capital

The final financial information to assess, to conclude the analysis of Costco as a company and proceed to recommendations for strategy development, is its cost of capital. Cost of capital is the return that capital providers (both debt and equity) reasonably expect for their investments into a company (Gallo, 2015). In the case of Costco, since it has both long-term debt and share capital, its cost of capital will consist of the cost of debt, cost and value of equity. However, analysts devoted to the regular evaluation of Costco’s financial performance have identified another component to the company’s cost of capital; this is lease payments. Since we already pre-determined the 5-year average ROI of Costco, please refer to Figure 6, we are confident to conclude that management has been effective stewards of the resources entrusted to them by capital providers. The most recent 5-year average ROI is 13.63%, which is almost 4.5% above the cost of capital.

Conclusion

In conclusion, the PESTEL analysis revealed that the ongoing trade wars, especially with China (another economic giant), NAFTA’s renegotiation deal, and the upcoming elections (within two years) may have adverse impacts against Costco’s business operations either directly (through trade tariffs) or indirectly (elected officials and their economic policies); these events were scanned from the political environment. Also, Trumponomics may be viewed overall as a decisive factor toward U.S. businesses. To reiterate, economists and experts are combined with their opinions, but companies like Costco have already benefitted from the Trump administration’s economic policies. The bottom line, macroeconomic forces will render Costco and other U.S. businesses vulnerable. In the socio-cultural environment, Costco’s management needs to continually scan any trends that indicate changes in tastes, preferences, and habits of its customers to be able to re-strategize accordingly. Studying the technological environment, Costco, as a business threatened by Amazon.com, needs to explore more the feasibility and opportunities of providing its customers or members both options of an in-store and online shopping experience. As for opportunities and threats from the ecological or natural environment, sustainability of operations and sustainability of supply of inventories are areas that management must always monitor. Lastly, the legal environment scan was limited to assessing the tax cuts and its impacts on U.S. businesses like Costco. And, salary raise, increase in sales, and ultimately increase in net profits have been the blessings so far of tax cuts to the company. Nonetheless, this should not prevent Costco’s management to stay vigilant in regularly scanning the legal environment for events that may result in either opportunities or threats.

The industry analysis was undertaken, which was focused on assessing the attractiveness of Costco’s U.S. market regarding the intensity due to national rivalry and threats from potential foreign entrants, resulted in knowing that Costco has been successful in winning against its direct (warehouse clubs) and indirect (retailers in general) competitors. However, Costco’s ability to continue as a going concern is being consistently challenged, especially by e-commerce big fishes like Amazon.com. Based on Costco’s financial performance for five years, 2013-2017, the ratios, was impressive. The financial statement analysis conducted centered on free cash flows, market value added, and economic value added as both performance and shareholders’ value indicators. Based on the results of the analysis, Costco has demonstrated consistent outstanding performance. It is noteworthy that the overall outcome of this analysis also speaks volume about the quality of stewardship implemented by Costco’s management.

Finally, when the company’s cost of capital was surveyed, it was found out that it stayed relatively constant, at an average of 9.21% for the last five years. Because Costco’s 5-year average ROI was 13.63%, the obvious conclusion based on this company assessment was a positive one. By stating the obvious, Costco’s management has been pursuing projects that earned a moderate to high level of returns.

References

Banco Santander. (2018). United States: Reaching the consumer. Retrieved on October 13, 2018 from https://en.portal.santandertrade.com/analyse-markets/united-states/reaching-the-consumers

Business Sweden. (2015, September). The U.S. retail industry. Retrieved on October 13, 2018 from https://www.business-sweden.se/contentassets/35c752683ac6415090a3fc3489a2cba1/the-us-retail-industry—a-business-sweden-fact-pack-new.pdf

Cardenal, A. (2014, June 25). The main reason Costco is outperforming Wal-Mart and Target. Retrieved on October 13, 2018 from https://www.businessinsider.com/costco-is-outperforming-competitors-2014-6?IR=T

CFI Education Inc. (2018). What is a free cash flow? Retrieved on October 13, 2018, from https://corporatefinanceinstitute.com/resources/knowledge/valuation/what-is-free-cash-flow-fcf/

Costco. (2018). Annual report 2017. Retrieved on October 13, 2018 from http://www.annualreports.com/HostedData/AnnualReports/PDF/NASDAQ_COST_2017.pdf

D&B Hoovers. (2018). Costco Wholesale Corporation. Retrieved October 13, 2018, from http://www.hoovers.com/company-information/cs/company-profile.costco_wholesale_corporation.9acf2327527015f2.html#competitors

Daniels, J. (2018, September 18). Florence hammers North Carolina agriculture and killing 3.4 million chickens, turkeys. Retrieved on October 13, 2018 from https://www.cnbc.com/2018/09/18/florence-hits-north-carolina-agriculture-drowns-1point7-million-chickens.html

Elkins, K. (2017, October 6). Here’s how your spending habits compare to those of the typical American. Retrieved on October 13, 2018 from https://www.cnbc.com/2017/10/06/how-your-spending-habits-compare-to-the-typical-american.html

Elliott, M. (2018, June 12). Amazon Is Completely Destroying These Iconic Stores. Retrieved on October 13, 2018 from https://www.cheatsheet.com/money-career/stores-destroyed-by-amazon.html/

Financial Times. (2018). Definition of ESG. Retrieved October 13, 2018, from http://lexicon.ft.com/Term?term=ESG

Forbes. (2018). #27 Costco Wholesale. Retrieved October 13, 2018, from https://www.forbes.com/companies/costco-wholesale/#e5751de2b29e

Frizell, S. (2015, November 19). Here’s how Bernie Sanders explained democratic socialism. Retrieved on October 13, 2018 from http://time.com/4121126/bernie-sanders-democratic-socialism/

Gallo, A. (2015, April 30). A refresher on cost of capital. Retrieved on October 13, 2018 from https://hbr.org/2015/04/a-refresher-on-cost-of-capital

Gray, S. (2018, April 25). Here’s what the Trump administration’s NAFTA negotiations mean for you. Retrieved on October 13, 2018 from http://fortune.com/2018/04/25/trump-nafta-canada-mexico/

Investor’s Business Daily. (2018, June 4). Costco execs owe their workers a giant-sized apology in addition to those raises. Retrieved on October 13, 2018 from https://www.investors.com/politics/editorials/trump-tax-cuts-costco-employee-raises/

Jackson, D. (2018, September 18). Trump accuses China of trying to sway U.S. midterms with retaliatory tariffs. Retrieved on October 13, 2018 from https://www.usatoday.com/story/news/politics/2018/09/18/donald-trump-says-china-seeking-hurt-gop-midterms-tariffs/1343973002/

Kline, D. (2017, May 5). How Costco Wholesale Corporation makes most of its money. Retrieved on October 13, 2018 from https://www.fool.com/investing/2017/05/05/how-costco-wholesale-corporation-makes-most-of-its.aspx

MBA Knowledge Base. (n.d.). Market value added (MVA). Retrieved October 19, 2018, from https://www.mbaknol.com/financial-management/market-value-added-mva/

Pethokoukis, J. (2018, February 23). The unbelievable magic of Trumponomics. Retrieved on October 13, 2018 from theweek.com/articles/756855/unbelievable-magic-trumponomics

Petravicius, T., & Tamosiuniene, R. (2008). Corporate performance and the measures of value added. Transport, 194-201.

Ponnuru, R., & Strain, M. R. (2018, July 26). Trumponomics. Retrieved on October 13, 2018 from https://www.nationalreview.com/magazine/2018/08/13/trumponomics/

Rampell, C. (2018, July 26). The economy’s great. That doesn’t mean Trumponomics is. Retrieved on October 13, 2018 from https://www.washingtonpost.com/opinions/the-economys-great-that-doesnt-mean-trumponomics-is/2018/07/26/2327dd6e-910c-11e8-bcd5-9d911c784c38_story.html?noredirect=on&utm_term=.716375aa1c74

Raul. (2017, September 5). How Americans spend their money. Retrieved on October 13, 2018 from https://www.businessinsider.com/how-americans-spend-their-money-2017-9?IR=T

Remnick, D. (2018, July 23). Alexandria Ocasio-Cortez’s historic win and the future of the Democratic Party. Retrieved on October 13, 2018 from https://www.newyorker.com/magazine/2018/07/23/alexandria-ocasio-cortezs-historic-win-and-the-future-of-the-democratic-party

Romano, B. (2018, March 7). Costco says extra profit from tax cuts will be shared with employees. Retrieved on October 13, 2018 from https://www.seattletimes.com/business/retail/costco-sales-surge-in-second-quarter-profits-boosted-by-tax-cuts/

Saleh, K. (2017). Online consumer shopping habits and behavior. Retrieved October 13, 2018, from https://www.invespcro.com/blog/online-consumer-shopping-habits-behavior/

Soni, P. (2016, January 20). Sizing up the competition for Costco and other warehouse clubs. Retrieved on October 13, 2018 from https://marketrealist.com/2016/01/sizing-competition-costco-warehouse-clubs

Stock Analysis on Net. (2018). Costco Wholesale Corp. (COST). Retrieved October 13, 2018, from https://www.stock-analysis-on.net/NASDAQ/Company/Costco-Wholesale-Corp/Performance-Measure/Economic-Value-Added

Taylor, K., Hanbury, M., & Green, D. (2018, June 28). Amazon’s growth could threaten these 10 industries. Retrieved on October 13, 2018 from https://www.businessinsider.com/amazon-is-killing-these-7-companies-2017-7/?r=AU&IR=T/#electronics-retailers-1

Thomas, L. (2018, April 5). These 7 international retailers want to make a splash in the US. Retrieved on October 13, 2018 from https://www.cnbc.com/2018/04/05/these-7-international-retailers-want-to-make-a-splash-in-the-us.html

WACC (2018). The Web’s Best WACC Calculator. Retrieved on October 13, 2018 from http://thatswacc.com/index.php

Yahoo! Finance. (2018, October 13). Environment, social and governance (ESG) ratings. Retrieved on October 13, 2018 from https://finance.yahoo.com/quote/COST/sustainability?p=COST

Yahoo! Finance. (2018, October 10). Yahoo Finance Trumponomics report card. Retrieved on October 13, 2018 from https://finance.yahoo.com/trumponomics/

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Analysis"

Business Analysis is a research discipline that looks to identify business needs and recommend solutions to problems within a business. Providing solutions to identified problems enables change management and may include changes to things such as systems, process, organisational structure etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: