Comparative Study on CSR Behaviour Across Industries in Mauritius

Info: 12190 words (49 pages) Dissertation

Published: 19th Aug 2021

Tagged: International BusinessCSR

Contents

2.1 Conceptual Framework and Theories of CSR

2.1.1 Carroll’s Pyramid (1991)

2.1.2 Triple Bottom Line Theory

2.2 Industry Effect on CSR Behaviour

2.3 CSR Behaviour Across Industries

2.3.1 CSR Behaviour in Finance Industry

2.3.2 CSR Behaviour in Manufacturing Industry

2.3.3 CSR behaviours in Retail Industry

2.3.4 CSR behaviours in Tourism Industry

2.4 Empirical evidence on CSR studies in Mauritius

3.Overview on Mauritius CSR law and Industries

3.2 Overview on Mauritian Industries

4.4 .1 Measurement of Firm’s financial performance- Profit before tax

5.1 Relationship between Profitability and CSR behaviour of companies

5.2 Relationship between Profitability and CSR behaviour in the Finance Industry

5.3 Relationship between Profitability and CSR behaviour in the Manufacturing Industry

5.4 Relationship between Profitability and CSR behaviour in the Tourism Industry

5.5 Relationship between Profitability and CSR behaviour in the Retail Industry

List of Figures

Figure 1: The Pyramid of Corporate Social Responsibility

List of Tables

Table 1: Relationship between Profitability and CSR behaviour of companies

Table 2: Relationship between Profitability and CSR behaviour in the Finance Industry

Table 3: Relationship between Profitability and CSR behaviour in the Manufacturing Industry

Table 4: Relationship between Profitability and CSR behaviour in the Tourism Industry

Table 5: Relationship between Profitability and CSR behaviour in the Retail Industry

Abbreviations

CSR – Corporate Social Responsibility

IASB- International Accounting Standards Board

NGO- Non-Governmental Organization

OECD- Organization for Economic and Cooperation Development

SRI-Socially Responsible Investment

UN- United Nations

1. Introduction

Corporate Social Responsibility (CSR) has a long underpinning history (Carroll 1999, Deegan 2002, Waddock 2002) and since then several theories have been developed to promote CSR behaviour among companies; Carroll’s Pyramid (1979), Elkington Triple Bottom Line (1998), stakeholder theory (1970) and much more. Backed by these theories, several scholarships have also engaged in more research on CSR in developing countries ranging from voluntary social reporting (Soobaroyen (2016), Soelen( 2015), Ojo(2015), Giuliani (2014) , Gokulsing (2011) to CSR impact on factors like human rights or economy as a whole.

In Mauritius, the CSR law was established in 2009 whereby profitable companies have to contribute 2% of their profit to social and environmental activities (Income Tax Act Section 50). This emerging practice has also given firms the opportunity to be more responsible and hence more accountable to different stakeholders. In this respect, Mahadeo, Oogarah-Hanuman and Soobaroyen (2011) has used content analysis to measure CSR reporting levels of listed companies and their motivations for such disclosures, Ntim and Soobaroyen, (2013); Khan, (2010) assessed the determinants of CSR disclosures and Soobaroyen and Mahadeo (2016) studied the changes in community disclosures.

1.1 Research objectives

Extant literature has explored different areas of CSR in Mauritius, but there has been a lack of study on comparative analysis of CSR behaviour across industries in Mauritius as several scholars ((Brammer and Pavelin, 2006; Godfrey et al., 2010; McWilliams et al., 2006) believe that CSR varies systematically across industries. In addition, with each financial budget, the Government of Mauritius tend to amend the CSR law.

This study aims to do a comparative analysis of CSR behaviour across industries; the finance, manufacturing, tourism and retailing sectors in Mauritius through content analysis of annual reports over a period of last five years (2011 to 2015). The study will gauge whether there is an industry effect on the CSR behaviour of firms and their economic performance based on literatures from Brammer and Pavelin, 2006; Godfrey et al., 2010; McWilliams et al., 2006)

1.2 Research Questions

Based on the objectives of the research, the research question for this study are as ‘Assessing the industry effect on CSR behaviour and their economic performance of firms in Mauritius’. Multiple regression has been used with panel data for analysis purposes. This study will be an additional contribution to the existing literatures as it will include industry effect which most studies carried out in Mauritius or in developing countries did not cater for.

1.3 Structure of the Research

Chapter Two: This chapter introduces the theories and academic literature based upon the responsibility levels of companies and how the industry effect impact on CSR behaviors across different sectors. It also provides empirical evidence on CSR behaviours of different industries and their economic performance.

Chapter Three: In this chapter, an overview will be provided on the CSR law in Mauritius, all amendments brought forward during the last five years and overview about the profile of each sector studied in this research.

Chapter Four: it comprises of the development of the hypotheses, the research methodology that has been adopted and expand on the research strategy carried out for data collection and analysis.

Chapter five: presents the research results of the content analysis and multiple regression statistics presented using Eviews software. It discusses the research findings and links these findings to the existing literature.

Chapter six: in this chapter, the conclusion of the research is given and the main research question is answered. It also provides recommendations for further research and highlights the main research limitations.

2. Literature Review

This chapter will provide an understanding of the concept of CSR behaviour, discusses about CSR theories namely; Carroll’s pyramid, triple bottom line, stakeholder theory and slack resources theory. It also presents the theories and empirical evidence on industry effect based on the four sectors analysed in the study and will end will existing research on CSR in Mauritius.

2.1 Conceptual Framework and Theories of CSR

The trend towards corporate being more socially responsible is clearly visible on a global level and over the years, however there has been a constant debate amongst academia over decades on how CSR should be defined and incorporated in company strategy. Several theories have been developed to give a new dimension to CSR and how it can be better related to corporate strategy. On international level, several agencies such as the OECD Guidelines for Multinational Enterprises, the 10 principles of the United Nations Global Compact or the ISO 26000 Guidance Standard on Social Responsibility have developed frameworks for CSR. This part will provide overview of framework and theories and how they have evolved over time. It is crucial to analyse the definitions of CSR so as to grasp what to include in the content analysis.

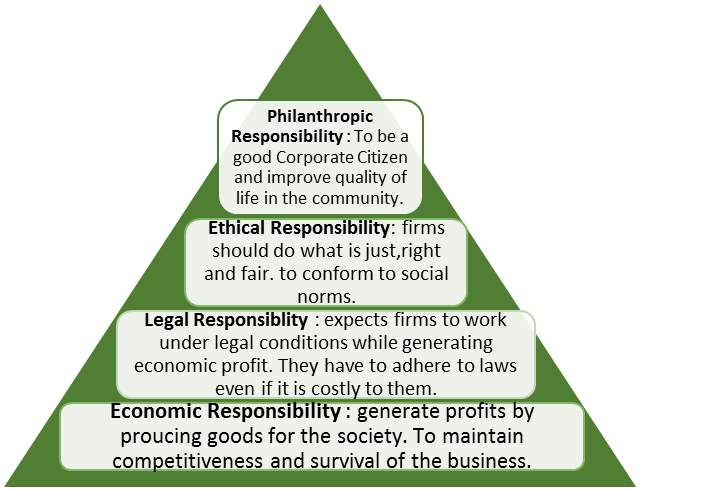

2.1.1 Carroll’s Pyramid (1991)

The most adapted and one of the oldest framework originates from Carroll’s Pyramid in 1979 which comprise of four levels of responsibilities which are defined by the figure below :

Figure 1: (Adapted from: Archie B. Carroll, “The Pyramid of Corporate Social Responsibility: Toward the Moral Management of Organisational Stakeholders)

2.1.2 Triple Bottom Line Theory

The Triple Bottom Line theory was introduced bt Elkington (1997) and gave importance to three areas of corporate responsibilities namely; economic, environmental and social responsibility.

The economic responsibility will encompass the notion of profitability, competitiveness and efficiency, relating mostly to maximizing shareholders’ wealth. However, Konrad, Stuerer, Langer and Martinuzzi (2006) stipulate that the economic sustainability should be highly related to the survival of the business as well. Thus, economic responsibility in that sense became more of a long-term competitiveness and of financial performance.

Environmental responsibility is highly related to the ecological environment and Konrad (2006) divided it into eco resources, greenhouse gas emissions and the loss and damages to the planet.

Social responsibility was given a wider definition of being able to contribute towards reducing the gap between wealth distribution and also improve the social conditions both internally and externally of the organization (Siltaoja 2006).

2.1.3 Stakeholder Theory

The stakeholder theory of Freeman (1984) is one of the most accepted concept to define the scope of the corporate responsibility towards the society. This theory believes on the ground that a stakeholder would be any individual who can affect or is affected by the firm’s activity (Kolk and Pinske 2006). However, Maio (2003) is of the view that this scope can extend to any individual or basically everyone. For this reason, it is wise to take reference from the definition that Clarkson (1995) had come up with. The latter divided the stakeholders into primary and secondary group; primary are those that are directly influence by the company’s going concern and secondary being who are not necessarily involved in the company’s activities but are still influenced by their decisions (Reynolds, Schultz, and Hekman 2006).

2.1.4 Slack Resources Theory

Several scholars have also used the slack resources theory to analyse the CSR behaviours (Bansal, Jiang & Jung 2015, Perez-Batres et al 2012, Waddock & Graves 1997). The slack resources theory stipulates that companies will engage in CSR activities depending on their availability of resources and these resources can be in various forms such as employees, financial or even under-utilized capacity. With regard to this theory it is implicit that companies that are more financially stable will able to contribute more towards CSR (Perez-Batres et al., 2012). Another study by Waddock & Graves (1997) found a bilateral relationship between a company financial performance and its engagement in CSR activities.

Based on the above theories, the term CSR would be most likely to involve social and environmental activities. These two areas also form part of the priority sector in Mauritius. The content analysis will be more focused on these two which will be later broken down in the methodology section.

2.2 Industry Effect on CSR Behaviour

Since decades, scholars have come up with various theories and framework that could help corporates to adopt CSR , however another stream of researchers also advocate that there is an industry effect on the CSR behaviour of firms that is firms from different industry will engage in different CSR activities according to their nature (Brammer and Pavelin, 2006; Godfrey et al., 2010; McWilliams et al., 2006). Melewar and Jenkins (2002) found that the firm’s industry has an invisible hand in promoting the corporate identity. Jones (1999) brought forward some industry related factors which can be in forms of public visibility and governmental scrutiny. The latter found that primary industries were more likely to care for the environment while secondary industries were more diverged towards employees, suppliers, customers and the communities while the service firms were more likely to invest more in employees and customers. Martinuzzi et al. (2010) conclude that CSR issues are highly industry, even subindustry, specific. They in turn propose that CSR activities/measures could be evaluated more easily if they were in line with the industry agenda and contributed to solving industry specific social and environmental problems. Taken together, these results indicate that the development and disclosure of CSR activities are likely a function of industry type.

Cottrill (1990) argues that any investigation of CSR that fails to incorporate industry level realities will be fatally deficient. While Cowen, Ferreri, and Parket (1987) and Balabanis, Philips, and Lyall (1998) report that disclosure does not differ by industry type; Waddock and Graves (1997) found great difference in CSR disclosure across industries. Simpson and Kohers (2002) concentrated on the banking industry and argue that differences between industries with regard to CSR is so great that research needs to stick to just one industry.

There has been some ‘single industry’ research in the CSR area. Moore (2001) focused on the supermarket industry and looked at CSR through the stakeholders: employees, customers, shareholders, suppliers, community and environment but did not analyse which stakeholder groups were granted more attention, etc. by firms. Hamid (2004) conducted a content analysis of the Annual Reports of 48 firms in the financial services industry and reported that firms in this industry focus on customers and employees as primary stakeholders. Mitnick (2000) observes that firms that have a negative impact on one area of CSR (for example, the environment) will not report this to a great extent, but instead will report other areas where they have a positive impact (such as charitable donations). Cooper et al. (2001) suggests that companies dealing directly with individual consumers are motivated to focus attention on this particular stakeholder.

2.3 CSR Behaviour Across Industries

2.3.1 CSR Behaviour in Finance Industry

The last few years have seen a metamorphosis in the social behaviour of the financial sector due to the 2008 financial crisis whereby a substantial amount of public fund was diverted towards managing the crisis. The financial crisis had several backdrops such as the poor economy, high debt level and the ever-increasing rate of unemployment. The financial sector has some distinct feature of information asymmetry with a large pool of direct stakeholders; borrowers, depositors, employees, and regulators and as a result can have a domino effect on the whole economy. This distinct feature also gives rise to different CSR practices (Yamak et al. 2005). It is believed that the banking sector can play an indirect role in promoting sustainability through lending to companies that are more environmental friendly. Other ways that a financial firm can be more responsible is by investing more in its bank lending, investment and asset management operations to be more sustainable (Viganò‒ Nicolai, 2009). In relation to the above, the financial industry thus takes the role of an intermediary that attempts to reduce the damages in the society (Thompson ‒ Cowton, 2004).

The financial industry faces special challenges in measuring CSR behaviour. The two main difficulties are a lack of transparent, detailed information, and the absence of a methodology to measure the full impact of CSR behaviour (Abbott & Monsen, 1979). These difficulties with measuring CSR behaviour stem from the financial industry’s intermediate role and its multiple influences on other industries.

2.3.2 CSR Behaviour in Manufacturing Industry

A CSR study performed in the manufacturing industry in India by Mishra & Suar (2010). They divided the sample into listed firms and non-listed firms, and the result reflects listed firms can obtain better financial returns than non-listed firms (Mishra & Suar, 2010). Thus, it indicates CSR disclosure and its transparency influence the relationship with outside stakeholders, accordingly, it positive impacts the listed firms’ financial status thereafter. One similar study performed by Andersen & Olsen (2011), the findings is that there exists a strong correlation but this association various in different industries from collected 1,273 year-observations over economic sectors. One characteristic of this study is utilizing canonical correlation analysis that examines the simultaneous relationship between two variables.

2.3.3 CSR behaviours in Retail Industry

In the intensely competitive retail market, sustaining repeat buying behaviour among store customers is one of the most important competition challenges. Lee et al. (2009) studied CSR attitudes of 100 retailers in the USA. Authors suggest that not enough retail firms are involved in communicating their beliefs in social responsibility to society. Retail corporations seem to feel that the primary audience consists of investors and stakeholders of the financial community.

Jones et al. (2005, 2007) came to the conclusion that environmental issues are the earliest and most commonly reported CSR agendas among top retailers. They include: energy and water consumption and emission, raw material usage, waste and packaging volume, recycling, GMOs, application of chemicals, access for disabled customers, and promoting local production of goods. Retailers also seem to recognise ethics in business and urban regeneration as predominant incentives in conducting their businesses. Operational business imperatives, economic viability, and CSR assure long-term growth and financial safety for stakeholders. Study of Hughes et al. (2007) confirmed these conclusions.

Wagner et al. (2008) tried to identify which business practices lead to perceptions of corporate social irresponsibility from the customers’ perspective. Based on quantitative data from a paper-based and on line survey, they named 14 factors that stand for corporate social irresponsibility in the retail sector. Among others, they were: natural environment, local businesses, societal rules, employee benefits and wages, and sales practices. Jones et al. (2010) studied the sustainability reports of the worlds’ leading retailers. They found some evident contradictions were being communicated to the public and are resulting from everyday operations.

Guercini and Runfola (2009) presented the concept of traceability, which refers to the generation and sharing of information about the product and production processes along the supply chain, from the B2B relations up to the customers in the final market. Authors found two approaches to the traceability: (a) some companies treat it as a tool for strengthening organisational control and are not willing to share information with customers, and (b) other companies treat traceability as a market tool, which enables customers to acquire knowledge about the origin of the products and the conditions under which they have been manufactured.

2.3.4 CSR behaviours in Tourism Industry

The worldwide tourism industry currently accounts for 760 million people and accounts for roughly a tenth of global employment and capital formation. In most countries, especially low income countries, tourism is seen as a viable option for economic growth, but current unsustainable tourism practices can impact the health and well-being of the environment and community as well as tourism itself. Within the tourism industry it is generally agreed that there are increasing overall societal and environmental concerns, and that this will increase the demand for more sustainable destinations and travel preferences. These will increase the pressure for destination management policies and tour operator responsibility. The destination which were the result of overbuilding, are expected to face severe decline as consumers look for more attractive destinations that feature a clean environment and well preserved natural and cultural attractions. Another trend affecting sustainable tourism is health and wellness. Active or adventure holidays, wellness and spa products and sun destinations are likely to increase in popularity. Authenticity or ‘experiential tourism’ is another trend. Artificial type destinations (e.g., theme parks), which do not meet higher consumer quality standards, will decrease as the consumer searches for the greater authenticity.

Álvarez, Burgos and Céspedes (2001) concluded that the age of establishment, size, chain membership, stakeholder pressures and the use of operational techniques of management exercised a lasting influence on the degree of implementation of environmental management practices and showed a positive relationship between environmental management and financial performance. Carmona et alt. (2004) suggested that group affiliation was associated with a higher level of environmental performance, but not necessarily with financial performance. Claver et alt. (2007) concluded that environmental proactivity has no direct impact, but indirectly through improved management systems. Lee and Park (2009) found a positive relationship for hotels and Kang and others (2010) examined the positive effects (proactive) and negative (reactive) of CSR activities in the performance for tourism-related industries 5 (airlines, casinos, hotels and restaurants) and found that in hotels and restaurants there was an improvement in the value of the company. Inoue and Lee (2010) examined how different CSR dimensions could affect the financial results of companies in four tourism-related industries (airlines, casinos, hotels and restaurants). Finally, there are great disparities in CSR accountability (Font, et al., 2012; Holcomb, et al., 2007), despite a positive relationship between CSR and share prices for tourism evidence (Nicolau, 2008; Rodriguez & del Mar Armas Cruz, 2007).

2.4 Empirical evidence on CSR studies in Mauritius

Existing literature investigating the CSR disclosures of businesses in Mauritius has focused on different streamlines such as the motivations for CSR reporting, how the disclosures have changed over time or what are the views of stakeholders on CSR disclosure and activities. Gokulsing (2011) examined the rationale behind CSR activities in Mauritius and also how the programmes were contributing to the business objectives. The latter conducted interviews of different stakeholders to capture their views on CSR activities. Mahadeo, Soobaroyen and Oogarah (2011) studied the social and environmental disclosures of listed companies for the period 2004-2007 prior to the enactment of the law. They found a significant increase in volume and quality of disclosures in annual reports. Ramdhony and Oogarah (2012) investigated the motivations for CSR reporting by Mauritian companies and also proposed solutions to improve their reporting. They found out that the principle driver of CSR reporting is reputation management followed by compliance with the code of Corporate Governance. A more recent study by Soobaroyen and Mahadeo (2016) investigated changes in community disclosures of listed companies for a time period 2004-2010 and found that the disclosures were not due to international pressures but rather due to local tensions and expectations. Ramdhony ,Padachi and Giroffle (2010) examined the perspectives on Sustainability reporting and found that on company’s behalf there are major obstacles such as time, reporting costs and measuring instruments of environmental activities. Ramdhony (2011) examined corporate reporting of local banks in Mauritius and found that bank with more visibility provide more CSR information which is in conformity with legitimacy theory.While the aforementioned research have primarily focused on the corporate social disclosures but from different perspectives and time span. First, we have extended the period of analysis post the implementation of the CSR levy in Mauritius to gauge the CSR behaviour and how they changed across industries.

3.Overview on Mauritius CSR law and Industries

3.1 CSR Law in Mauritius

Corporate social responsibility (CSR)” is a business approach that contributes to sustainable development by delivering economic, social and environmental benefits for all stakeholders.” It is a way to create more awareness to the companies upon their business impact on the society as well as on their stakeholders.

CSR has many definitions and practices. Each company and each country implement it differently. As it is a very broad concept, it addresses many and various topics such as human rights, corporate governance, health and safety, environmental effects, working conditions and contribution to economic development. It may have many definitions but the purpose of CSR is to drive change towards sustainability.

CSR was introduced in 2009 in Mauritius. All companies had to give 2% of their net profit for CSR activities. In 2010, the fund allocation was changed. Companies had to spend 50% of their 2% net profit on social activities such as eradication of absolute poverty, providing facilities for the well- being of vulnerable children and providing shelter. The companies had the right to spend the other 50% on any other CSR activities. In 2015, there was a change again. Companies were free to spend their fund on their own CSR framework. Their CSR activities were not controlled by the government. However, in 2016 the government took on the control of the CSR programmes by setting up the National CSR Foundation which will be managed by the private and the public sector. The companies have to contribute their 50% of their 2% net profit on this Foundation. As from 1st January 2018, the companies will have to allocate 75% in this Foundation. The companies will be able to use the remaining amount in their CSR programmes according to their existing framework. Hence, the NGOs will still benefit from the contributions of the private sector.

The money endowed to the foundation will be assigned to support civil society actions in six priority areas:

- Poverty alleviation targeting families listed in the Social Register of Mauritius

- Educational support targeting families listed in the Social Register of Mauritius

- Social housing targeting families listed in the Social Register of Mauritius

- Supporting persons with severe disabilities

- Dealing with health problems resulting from substance abuse and poor sanitation

- Family protection- protection to victims of domestic violence

3.2 Overview on Mauritian Industries

Mauritius is one of the strongest economies in the African country in featuring a business friendly market place, since it is ranked 19 globally on the 2013 World Bank Doing business report. Based on good governance and a well-developed legal, financial and commercial infrastructure, it has gained surprising economic and social success.

Financial services industry, tourism and exports of sugar and textiles are the main economy of Mauritius. Between 2007 and 2011, the economy growth was about 4.5 percent a year. The growth rate of Real GDP was 3.4 percent in 2012 and 3.7 percent in 2013 due to competition in the euro area.

Financial Industry

Mauritius has a modern and efficient financial sector infrastructure, such as payment, securities trading and settlement systems. The financial services sector has shown rapid growth in the last two decades and contributed 10.3% to the island economy’s Gross Domestic Product in 2014, with an annual growth rate of over 5%. As an important contributor to the economy, the financial services sector has succeeded in generating high value-added employment as well as contributing to government revenues and foreign exchange earnings. On the employment generation front, it may be noted that the Financial Services sector has given rise to 15,000 high skills jobs.

The financial services sector accounts for 11% of GDP. Leading banks have showcased record profits while the Stock Exchange of Mauritius grew by 18% in 2013. The sector grew healthily at 5.7% in 2012 and 5.4% in 2013.

Manufacturing Industry

The manufacturing sector in Mauritius was until the recent past on a declining path. Declining European markets for Mauritius manufacturing meant that the sector undergone contraction for three straight years up to 2011. The traditional textile companies have downsized their local operations significantly and are now expanding in Madagascar and Bangladesh. The textile industry has grown by 2% in 2013 compared to a contraction of 1.2% in 2012.

The recent rise of food processing has been the main factor behind the resurgence of manufacturing in Mauritius which grew by 2.2% in 2012 and 3% in 2013. It is widely expected that activities revolving around the seafood hub and an emerging ocean economy will continue to drive growth in the manufacturing sector.

Tourism Industry

The sector stagnated in 2012 and grew by 3.5% in 2013. The 2013 growth is partially explained by an increase in tourist arrivals as Mauritius is on the verge of reaching the milestone of one million arrivals per year.

The challenges are very similar to those which the manufacturing sector is currently facing. Tourism has traditionally focused on European markets. There have been many initiatives at diversification but the reality is far from simple. The entire sector was built on meeting cultural needs of comers from the west. Attracting customers from elsewhere implies a complete rebuilding of the Mauritius brand and packaging of its offering in line with the underlying cultures of these new prospective markets. Market players are hoping that their current initiatives will yield benefits in the longer term.

Concluding remarks

Mauritius has recorded an overall growth rate of 3.2% in 2013 and the forecasted figure for 2014 is 3.7%. All sectors of the economy, except for the construction industry, have been on the rise. This is a respectable achievement considering the economic conditions prevailing in the traditional markets for export.

Concerns are however raised by industry analysts that Mauritius needs deeper structural reforms to be able to achieve growth rates higher than 4%. Investment has fallen by 4.3% in 2013 and expressed as a percentage of GDP, this represent a fall from 23% to 21%. Analysts point out investment needs to reach 27% of GDP before Mauritius can achieve 4% growth rates. Getting there will inevitably require local businesses to rework capital structures and proceed with lower emphasis on debt financing.

4. Methodology

This chapter will be focused on the description of the methodology adopted which is content analysis and multiple regression. It will also be discussing on the variables that have been used and will built on the hypotheses for this study.

4.1 Content Analysis

Content analysis is a prevalent way to account for the social responsibilities of firms as it helps to quantify qualitative disclosures made by firms Milne & Adler (1999) especially where no other measure is available. Several past studies have adopted this method and found that it is both more reliable and systematic (Hackston & Milne, 1996; Islam & Deegan, 2008; Krippendorff,1980).

4.1.1 Index Studies

Content analysis can be further broken down into two approaches by Vourvachis (2007) ; Index studies and volumetric studies. Index studies involve verify the presence or absence of certain information Stone et al, 1966 and Holsti, 1969a describe as contingency analysis) and volumetric studies comprise of word counting of disclosures. In this report, the Index studies will be carried out giving a score of 1 if the information is present and a score of 0 if the element is not present. The reason for choosing Index studies over volumetric ones(Gray et al,1995) is because it is more reliable as every coder has less choices for coding and therefore less disagreement. Moreover, it eludes the possibility of repetition of disclosures that can be misleading. However, one drawback emanates in terms of scaling (Abbot and Monsen 1979), it does not measure the intensity of each responsibility that the firm is involved in.

4.1.2 Context Studies

As Krippendorff (2004) elaborates, it involves looking at the meaning of the word in the sentence. In case of decisions provided in a context, the whole paragraph or speech maybe considered. According to Milne and Adler (1999), studies about social or environmental tend to make use of content sentences in order to code their decisions.

4.2 Data Collection

The research makes use of a sample size of the three companies from each sector analysed in Mauritius. The time period was from 2011 to 2015.

Although, companies provide various source of information like press, newsletters, stand alone CSR reporting, website information, the annual reports remained the most reliable source of data (see Campbell,Moore, & Shrives, 2006; Islam & Deegan, 2008). In Mauritius, the annual reports are publicly available with the registrar of companies and these reports can contain information both of voluntary and regulated type. Annual reports comprises of financial statements, corporate governance report and CSR disclosures. However the governance code does not impede on companies to follow guidelines in reporting their social or environmental engagements. The only legal requirement regarding CSR is that companies must disclose the total amount of charitable donations.

The content analysis in this research has been executed in different stages.

- First of all, five priority areas were identified based on extant literature which is education, entrepreneur, environment, recycling and renewables. Data on these five areas has been collected.

- The chairperson section, the corporate governance section, the auditor’s responsibility statement, the financial statements and the CSR section were examined in the Annual reports. The next stage was to calculate the responsibility index.

- In this study, the unweighted index approach is adopted (Hanoffa and cook 2002, Saleh et al,2010;Rouf 2011) to measure the disclosures as a dichotomous variable i.e if the companies disclose items as per the checklist, a score of 1 will be given or otherwise a score of 0 will be provided (Gujrati, 2009).

4.3 Hypothesis Development

In order to find scientific proof of support to the literature review and the theoretical context above the following null hypotheses were developed:

H1: There is no relationship between profitability levels and CSR behaviour in finance industry.

H2: There is no relationship between profitability levels and CSR behaviour in manufacturing industry.

H3: There is no relationship between profitability levels and CSR behaviour in tourism industry.

H4: There is no relationship between profitability levels and CSR behaviour in retail industry.

The hypotheses are test at 5% significance level and the decision rule is the p-value obtained from the content analysis.

4.4 Regression Model

To test the relationship between responsibility levels and financial performance, regression analysis will be used. A cross sectional data analysis will be performed with financial performance as dependent variable, each five areas identified as independent variable and company size and leverage as control variables. The regression model used is as follows:

Y (net profit before tax)= + 1 Edu + 2 Entre + 3 Env + 4 Recy + 5 Ren+ 6size+ 7 size+8 leverage+

= intercept

Edu = Educaation

Entre= Entrpreneurship

Env=Environment

Rec= Recycling

Ren= Renewables

4.5 Variables used

4.4.1 Measurement of Firm’s financial performance - Profit before tax

Several studies have investigate the relationship between the CSR behaviour and financial performance(McWIlliams and Siegel 2000;Peters and Mullen, 2009;Soana,2011; Ehsan and Kaleem,2012). A positive relationship was derived from studies by McGuire et al (1988), Pava and Krausz (1996),Waddock and Graves (1997),Van de Velde et al (2005) and Moneva and Ortos (2010). However, McWilliams and Siegel (2000) , Abdul Rahman et al (2009) and Dragomir (2010) found no relationship between these two variables.

4.4.2 Control Variables

This study introduces control variables that may influence the relationship between the responsibility of firms and their financial performance. This study will therefore use (1) company size and (2) leverage of the firm as control variables.

(1) Company size: Company size is relevant as previous studies has showed that smaller companies may not have the same responsibility levels as the bigger ones. Waddock and Graves 1997 asserted that this may be due to growth of companies may attract more investoers thus implying more response to stakeholder needs. Other researchers (Trotman Graham and Ken 1981; Pava and Krausz 1996; Stanwick and Stanwick 1998) found that there is a significant positive relationship between company size and CSR. According to several researchers, company size is expected to play a role in a company’s CSR (Dierkes and Coppock 1978; Trotman Graham and Ken 1981; Perrini et al. 2007).

One of the company size measure is sales volume. A high volume of sales directly affects company profitability. The other factor of company size is total assets of the company. The total assets show the company’s liquidity. The present study utilizes only total assets for the company size as control variable.

(2) Leverage: Leverage reflects the degree of financial risk a company is exposed to, and from a pragmatic legitimacy perspective, the company needs to manage perceptions of its closest stakeholders (lenders) to ensure its survival. Companies having a higher degree of risk are compelled to be more responsible to avert or delay a negative reaction by lenders (Haniffa and Cooke 2005; Reverte 2009). However, the evidence in support of leverage is so far very mixed. For instance, Branco and Rodrigues (2008) report on a negative relationship, whilst Haniffa and Cooke (2005) and Reverte (2009) find no significant effect for leverage.

5. Analysis of Findings

This chapter will analyse the findings for the relationship between the profitability of the companies and their behaviour towards CSR. A multiple regression has been carried out for each industry to assess the aforementioned relationship and the analysis will be performed in a similar way. The analysis will be broken down to assess the industry effect of CSR behaviour of companies in Mauritius. Based on the literature in chapter 2, studies by Brammer and Pavelin, 2006; Godfrey et al., 2010; McWilliams et al., 2006 and Melewar and Jenkins 2002 found that the industry identity of firms tend to highly influence the CSR behaviour of companies.

5.1 Relationship between Profitability and CSR behaviour of companies

A multiple regression was carried out for all industries analysed and the results are as follows:

| Variable | Coefficient | t-Statistic | Prob |

| C | -33717215 | -0.201 | 0.8417 |

| EDUCATION | 20092053 | 0.165 | 0.8691 |

| ENTREPRENEUR | -81771709 | -1.206 | 0.2349 |

| RECYCLING | 1.48 | 2.790 | 0.0081 |

| RENEWABLES | -1.42 | -1.092 | 0.2815 |

| ENVIRONMENT | 28087269 | 0.234 | 0.8155 |

Table 6: Relationship between Profitability and CSR behaviour of companies

Table 1 illustrates the relationship between the profitability and CSR behaviour of companies in Mauritius. The model generated an R2 of 0.56 and the adjusted R2 was at 0.458, implying that the data fits the model by 56% only and can thus not help to explain the theory to a great extent. Using the p-value as the decision rule from the above table, the variables were tested at 5% level. A significant relationship could be deduced in for contributing towards education, entrepreneur, renewables and the environment. Thus, the null hypothesis cannot be rejected and it can be concluded that there is a relationship between the above variables and profitability. However, for recycling, there is an insignificant relationship with profitability. In this case the null hypothesis is rejected and it can be concluded that there is no relationship between profitability and recycling. This results is in conformity with the studies carried out by Brammer, Pavelin, & Porter, (2006), Thornton, Autry, Gligor, &Brik, (2013) and Lee (2008) who found out that the economic performance of firms can help to explain their engagement in social and environmental responsibilities.

A positive relationship can be noted for education and environment with a beta of 2.00 and 2.80 respectively. This implies that when the profitability of companies increase by 1, they will be more likely to invest in education and environmental sectors. In fact, based on their betas, they nearly double their investment in these sectors. One of the main motivation to do so, is that the four priority areas of the CSR levy in Mauritius, gives much importance to the education sector and thus motivating firms to engage more in that area. A negative relationship was noted for engagement in the entrepreneur sector. This could be due to the increasing profitability, firms tend to recategorize their social engagement and thus less attention is given to the entrepreneur area. The entrepreneur area remains one challenge that CSR funds need to tackle since there are not much incentive for companies to boost entrepreneurship in the region.

5.2 Relationship between Profitability and CSR behaviour in the Finance Industry

The financial industry has been one of the major pillar in the Mauritian economy since the last decade. The CSR behaviour of three major companies from the financial industry was analysed namely the Mauritius Commercial Bank (MCB), the commercial bank in Mauritius, an insurance company Mauritius Union and a non banking company, CIM Finance.

| Variable | Coefficient | t-Statistic | Prob |

| C | 2947256 | 0.470 | 0.6525 |

| EDUCATION | 18649086 | 2.730 | 0.0172 |

| ENTREPRENEUR | -3661655 | -0.694 | 0.5098 |

| RECYCLING | -2974513 | -0.185 | 0.8583 |

| RENEWABLES | 3553199 | 0.413 | 0.6916 |

| ENVIRONMENT | 8009547 | 0.1214 | 0.9068 |

Table 7: Relationship between Profitability and CSR behaviour in the Finance Industry

Table 2 illustrates the relationship between profitability and the CSR behaviour in the financial industry in Mauritius. From the following model, an R2 of 0.96 and an adjusted R2 of 0.94 was derived. This implies that the data helps to explain the model for the financial industry by over 90% and this is a very good fit for the model. Therefore, it can be stated that in the financial industry, profitability can influence the CSR behaviour of firms.

The table above shows that at a test of 5% level, there is a significant relationship between the variables tested for the social and environment areas for CSR. However, for the education area, an insignificant relationship was deduced at 5%. There is a positive relationship between profitability, environment and renewables areas. The beta for environment stands around 8.00 and that of Renewables is around 3.55. The high value of betas in this case gives a clear signal that the financial companies are more likely to invest in the environmental and sustainability areas as their financial performance improve. This in line with the study of Yamak et al,. (2005) who found out that the financial companies can highly impact on CSR by offering more environmental friendly products such as online banking, green loan and much more. In the case for Mauritius, a similar pattern could be deduced as the MCB has invested in the eco-buildings, eco-loan and power generation through renewables.

A negative relationship was registered between profitability, contribution towards entrepreneurship and recycling. The beta for entrepreneurship is -3.66 and that of recycling is -2.97. As mentioned previously, the entrepreneurship sector still remains one area that remains under funded by companies. While for the recycling, given the nature of activities of these financial companies being more of administrative, they might be more involved in reducing or cutting down waste rather than recycling.

Based on the above model for the financial industry, it can be concluded that environment and sustainability remains a priority area for CSR funding. This is in line with a study carried out by Ramdhony (2011) who analysed the CSR disclosures of Mauritian commercial banks and found out that they are in conformity with the legitimacy theory.

5.3 Relationship between Profitability and CSR behaviour in the Manufacturing Industry

The manufacturing industry has been on a down path since the last decade and a restructuring of the industry was experienced more specifically for the textile companies. Data from three manufacturing industries in Mauritius has been collected for analysis purposes namely from Innodis Ltd, Omnicane Group and Phoenix beverages. They are mainly from the food processing companies but Omnicane does a diverse range of activities including power generation.

| Variable | Coefficient | t-Statistic | Prob |

| C | 5086317 | 6.694 | 0.0000 |

| EDUCATION | 5562632 | 9.096 | 0.0000 |

| RECYCLING | 1333683 | 1.049 | 0.3148 |

| ENVIRONMENT | 5562632 | 9.096 | 0.0000 |

Table 8: Relationship between Profitability and CSR behaviour in the Manufacturing Industry

Table 3 shows the relationship between profitability and CSR behaviour of firms in the manufacturing industry. From the following model the R2 is at 0.43 and the adjusted R2 is around 0.39. These two values show that the data for manufacturing industry cannot help to explain the model. Consequently, it can also be deduced that the CSR behaviour of firms would not be related to the profitability of firms.

Based on the above explanation and the table, an insignificant relationship has been registered for all variables; education, entrepreneur, environment and renewables. Only for recycling, the relationship can be significant at 5% level. These results tend to contradict existing literatures by Andersen & Olsen (2011) and Mishra & Suar (2010) who found a significant and positive relationship between financial performance of firms and their CSR behaviours. This could be explained by the fact that the sample size consists mostly of firms from the food processing industry and does not include a diverse range of manufacturing firms. Had other types of firms be included, this result might differ.

In addition, the positive relationship between registered for recycling and profitability of companies can be highly due to the cost savings that these high waste intensive firms can obtain. The manufacturing industry is one of the industry that generate most waste, thus adopting recycling practices can positively impact on the performance of the firms.

5.4 Relationship between Profitability and CSR behaviour in the Tourism Industry

The tourism industry has been a prominent pillar of the Mauritian economy until very lately the growth in tourist arrival has been pretty stagnant. This is due to Mauritius was highly dependent on the European tourist market. For the purpose of this study, three main hotels were selected namely, Lux resorts, New Mauritius Hotels and Sun resorts.

| Variable | Coefficient | t-Statistic | Prob |

| C | 1.83 | 0.323 | 0.7561 |

| EDUCATION | 72145952 | 0.122 | 0.9060 |

| RECYCLING | 6.55 | 1.115 | 0.3015 |

| ENTREPRENEUR | -5.97 | -2.353 | 0.0404 |

| ENVIRONMENT | 2.55 | 1.715 | 0.1142 |

Table 9: Relationship between Profitability and CSR behaviour in the Tourism Industry

Table 4 illustrates the results for the multiple regression carried out over 5 years for the tourism industry in Mauritius. The R2 is around 0.56 and the adjusted R2 0.30. This shows that the data for the hotel industry fits the model only around 56% and thus can have some difficulties to explain the relationship between the variables.

The table above shows a significant relationship between education, environment and recycling at a test of 5% significance level. However, for entrepreneur and renewables, the p-value demonstrates an insignificant relationship with probability. Studies by Álvarez, Burgos and Céspedes (2001) stipulates that often stakeholder pressures would drive funding of social and environmental activities. This might be the case for Mauritius aiming to become a green and sustainable tourism sector. The insignificant relationship between entrepreneur and profitability can be explained by previous argument used that not much focus is given in this area. The New Mauritius Hotel does fund entrepreneurship projects like ‘project for handicrafts’ which is on its fifth year, but this practice is still not prevalent in other hotels which render an insignificant relationship. Hotels are also not very likely to invest in renewables. This could be explained by the results derived by Carmona et alt. (2004) who suggested that it is not necessary for economic performance to influence the level of environmental performance of the hotel. Sometimes, only better management can lead to the implementation of better environmental practices.

Based on the above, significant relationship between profitability, education, recycling and environment, a positive relationship was also noted among these variables. The beta for education stands at 1.83 which implies that a 1 unit increase in profitability will increase the funding towards contribution by 1.83. A beta of 2.55 was noted for the environmental practices and a much higher one of 6.55 for the recycling activities. A study by Inoue and Lee (2010) also found out that diverging towards more sustainable practices can be highly cost effective for hotels and thus increase economic performance. This might help to explain the high positive relationship between profitability and funding environmental activities.

5.5 Relationship between Profitability and CSR behaviour in the Retail Industry

The retail sector is considered to play a vital role in engaging in social activities due to its direct relationship and impact with customers and stakeholders. In this study, three retail companies in Mauritius have been chosen namely, Lottotech Ltd, a lottery company, Vivo Energy Ltd, an energy supply company and MCFI, agricultural trading company. This is a representation of different types of retail companies.

| Variable | Coefficient | t-Statistic | Prob |

| C | 2775551 | 3.889 | 0.0025 |

| EDUCATION | 2775551 | 3.889 | 0.0025 |

| ENVIRONMENT | 2775551 | 3.889 | 0.0025 |

Table 10: Relationship between Profitability and CSR behaviour in the Retail Industry

Table 5 illustrates the results for the multiple regression carried out over 5 years for the retail industry in Mauritius. The R2 is around 0.45 and the adjusted R2 0.40 This shows that the data for the hotel industry fits the model only around 45% and thus can have some difficulties to explain the relationship between the variables.

An insignificant relationship was found among all variables tested and the level of profitability. This result is in line with study by Lee et al. (2009) who analysed 100 retailers in USA and found out that though retailers are accountable to a diverse range of stakeholders, they do not engage in the practice of passing on their information about their social engagements to stakeholders. However, Jones et al. (2010) found that if good reporting practices are adopted, the operations of the retailers can improve as customers are becoming more environmental conscious these days. In case of Mauritius, there might not be very good reporting practice on the retailers behalf which render the analysis more difficult.

6. Conclusion

This study was focused on assessing if there is an industry effect on the relationship between the financial performance of firms and their CSR behaviour. This has been carried out through a comparative study across four different sectors in Mauritius; finance, manufacturing, tourism and retail sector. It can be observed that different industry had different funding patterns for CSR. For example, the financial sector more towards environment, the manufacturing industry is more engaged in recycling given the robust nature of high waste. In case of the tourism industry, a significant result was observed along most variable, indicating that the sector tends to invest in different areas and might not have a preference as such. For the retail industry, insignificant relationship was noted.

This study also has some limitations in terms of the small sample size tested. If a wider sample size of different types of companies from each industry would have been tested, the results might have differed. However, this study is a contribution to existing literature by analysing CSR behaviour across industries. This provides an understanding that CSR behaviour across industries is not the same.

References

Aguilera,R.V, Rupp, D.E., Williams, C.A. &Ganapathi, J.2007. “Putting the S back in Corporate social responsibility: a multilevel theory of social change in organizations”. The Academy of Management Review, 32(3), 836-863.

Aguinis, H. &Glavas, A. 2012, “What We Know and Don’t Know About Corporate Social Responsibility: A Review and Research Agenda”, Journal of Management, vol. 38, no. 4, pp. 932-968.

Aras, G., Aybars, A., Kutlu, O., 2010. Managing Corporate Performance: Investigating the Relationship between Corporate Social Responsibility and Financial Performance in Emerging Markets. International Journal of Productivity and Performance Management, 59(3), p. 229-254.

Aupperle, K. E., Carroll, A. B., & Hatfield J. D. 1985. “An empirical examination of the relationship between corporate social responsibility and profitability”. Academy of Management Journal, 28: 446-463.

Bhattacharyya, Asit. 2016. “Corporate Social and Environmental Responsibility in an Emerging Economy: Through the Lens of Legitimacy Theory”. Australasian Accounting, Business and Finance Journal, 9(2), 2015, 79-92

Bragdon, J., & Marlin, J. A. 1972. “Is pollution profitable?” Risk Management, 19: 9-18.

Branco, M.C. & Rodrigues, L.L., 2006, “Corporate social responsibility and resource based Perspectives”, Journal of Business Ethics 69(2), 111–132.

Carroll, A.B., 1991, “The pyramid of corporate social responsibility: toward the moral management of organizational stakeholders”, Business Horizons 34(4), 39–48.

Davis, K. 1960. “Can business afford to ignore social responsibilities?” California Management Review, 2,pp. 70–76.

Donaldson, T. & T.W. Dunfee, 1999: “Ties That Bind: A Social Contracts Approach to Business Ethics”. Boston, MA: Harvard Business School.

Dragomir, VD. 2010, “Environmentally sensitive disclosures and Financial performance in European setting” Journal of Accounting and Organisational Change. Vol 6. No.3 pp359-388

Ehsan.S ,Kaleem.DA. 2012 “An empirical investigation of relationship between corporate social responsibility and financial performance: evidence from manufacturing sector of Pakistan” Journal of Basic and Applied Scientific Research Vol.2 no.3 pp 2909-2922.

Elkington, J., 1997, “Cannibals with forks: The triple bottom line of 21st century business”, Capstone, Oxford.

Fernando, S. J. (2013). Corporate social responsibilitypractices in a developing country: Empirical evidence from Sri Lanka(Thesis, Doctor of Philosophy (PhD)) .

Gao, S. and Zhang, J. (2006). Stakeholder engagement, social auditing and corporate sustainability, Business Process Management Journal, Vol. 12, No. 6, pp. 722-740.

Garriga, E. & D. Melé, 2004: “Corporate social responsibility theories: Mapping the territory”, Journal of Business Ethics, 53 (1-2), 51-71.

Gokulsing, R. D. 2011. “CSR in the context of globalization in Mauritius.”Governance in the Business Environment (Developments in Corporate Governance and Responsibility, Volume 2: 153-175. Bingley, UK: Emerald.

Griffin, J. J. & Mahon, J. F. 1997. “The corporate social performance and corporate financial performance debate”. Business & Society

Hackston, D & Milne, M J. 1996, “Some Determinants of Social and Environmental Disclosures in New Zealand Companies”, Accounting, Auditing and Accountability Journal, Vol. 9, No 1, pp. 77-108.

Haniffa,RM&Cooke,TE. 2002, “Culture, Corporate Governance and disclosure in Malaysian Corporations.” Abacus vol.38. no.3.

Holsti, O R. 1969a, “Content Analysis for the Social Sciences and Humanities,” Addison- Wesley Publishing Company, Reading, MA.zenship17, 30–32.

Islam,MA&Deegan,C 2008 “Motivations for an organization within a developing country to report social responsibility information” Accounting and Auditing Journal vol 21. No.6 pp 850-874

Ismail &Haddow. 2014. “The impact of the theory of legitimacy on the disclosure of organizations in Jordan using a linear regression model” European Journal of Business and Management .Vol.6, No.16, 2014.

Khasharmeh, H. and Suwaidan M.S. (2010). Social responsibility disclosure in corporate annual reports: evidence from the Gulf Cooperation Council countries, International Journal of Accounting, Auditing and PerformanceEvaluation, Vol. 6, No. 4, pp. 327-345.

Krippendorff. K. 2004, “Content analysis, an introduction to its methodology.” Sage Publications Inc., Thousand Oaks, CA.

Jamali et al . 2015. “ Near and dear? The role of location in CSR engagement”.strategic management journal.

Lamport. M.,Seetanah.B.,Conhyedass.P.,& Sannassee.R.V.2010. “The association between ISO 9000 certification and financial performance”. International Research Symposium in Service Management.

Lin, C., Yang, H. &Liou, D. 2009, “The impact of corporate social responsibility on financial performance: Evidence from business in Taiwan”, Technology in Society, vol. 31, no. 1, pp. 56-63.

J.K. Lynes, M. Andrachuk . 2008. “Motivations for corporate social and environmental responsibility: A case study of Scandinavian Airlines” Journal of International Management, 14 (4) (2008), p. 377.

McGuire, J. B., Sundgren, A., &Schneeeweis, T. 1988. “Corporate social responsibility and firm financial performance.” Academy of Management Journal, 31: 854-872.

McIntosh, M., D. Leipziger, K. Jones & J. Coleman, 1998: “Corporate Citizenship: Successful Strategies for Responsible Companies”. London: Pitman

McWilliams, A., & Siegel, D. 2000. “Corporate social responsibility and financial performance: Correlation of misspecification?” Strategic Management Journal, 21: 603-609.

Md. Habib‐Uz‐Zaman Khan .2010. “The effect of corporate governance elements on corporate social responsibility (CSR) reporting: Empirical evidence from private commercial banks of Bangladesh”, International Journal of Law and Management, Vol. 52 Iss: 2, pp.82 – 109.

Mentor, Marly, 2016. “The Effects of Corporate Social Responsibility on Financial Performance” Honors in the Major Theses. Paper

Milne, MJ & Adler, RW 1999, “Exploring the reliability of social and environmental disclosures content analysis” Accounting & Auditing Journal vol.12, no.2 pp 237-256

Morsing, M. & Schultz, M. 2006, “Corporate social responsibility communication: stakeholder information, response and involvement strategies”, Business Ethics: A European Review, vol. 15, no. 4, pp. 323-338.

Moussa, G &Haasan, T. 2015 “Legitimacy Theory and Environmental Practices:Short Notes” International Journal of Business and Statistical Analysis.

Ojo, Marianne. 2015. “Poverty Reduction in Developed and Developing Countries: Analyzing the Relationship between Corporate Social Responsibility and Foreign Direct Investment”. IGI Global, Forthcoming.

Orlitzky, M., Schmidt, F., &Rynes, S. 2003. “Corporate social and financial performance: A meta-analysis.” Organization Studies, 24: 403-441.

Palmer, Harmony J.2012 , “Corporate Social Responsibility and Financial Performance: Does it Pay to Be Good?” CMC SeniorTheses. Paper 529.

Peloza, J. 2009, “The Challenge of Measuring Financial Impacts From Investments in Corporate Social Performance”, Journal of Management, vol. 35, no. 6, pp. 1518-1541.

Peloza John 2011, “The Challenge of Measuring Financial Impacts From Investments in Corporate Social Performance”, Journal of Management, School of Business Administration, Simon Fraser University, Burnaby, British Columbia, Canada

Porter & Kramer. 2006, “Strategy and Society: the link betweenncompetitive advantage and corporate social responsibility,” Harvard Business Review, vol. 84, no. 12, pp. 78-92

Ramdhony. D &Oogarah 2012, “Improving CSR Reporting in Mauritius – Accountants’ perspectives” World Journal of Social SciencesVol. 2. No. 4. July 2012. Pp. 195 – 207.

Ramdhony,D , Padachi,K&Giroffle L 2010 , “Environmental Reporting in Mauritian Listed Companies”, International Research Symposium in Service Management.

Rashid A ,Lodh S &Rudhkin, K 2010 “ Board composition and firm performance: evidence from Bangladesh” Australasian Accounting Business & Finance Journal vol.4 no.1 pp 76-95

Ratanajoinkol, S., Davey, H. and Low, M. 2006. Corporate social reporting in Thailand, the news is all good and increasing, Qualitative Research in Accounting & Management, Vol. 3, No. 1, pp. 67.

Reverte, C. 2009. “Determinants of corporate social responsibility disclosure ratings by Spanish listed firms”. Journal of Business Ethics, 88(2), 351–366.

Roshni Deepa Gokulsing, (2011) “CSR matters in the development of Mauritius”, Social Responsibility Journal, Vol. 7 Iss: 2, pp.218 – 233

Rouf, MA 2011 “the corporate social responsibility disclosure: a study of listed companies in Bangladesh” Business and Economics Research Journal vol.2 no.3 pp 19-32

Saleh, M, Norhayah, Z &Rusnah,M 2011 “looking for evidence of the relationship between corporate social responsibility and corporate financial performance in an emerging market” Asia Pacific Journal of business Administration, vol 3, no.2

Sethi, S. P.: 1975, “Dimensions of Corporate Social Performance: An analytic framework”, California Management Review 17. 58-64.

Soobaroyen, T., &Mahadeo, J. D. 2008. “Selective compliance with the corporate governance code in Mauritius: Is legitimacy theory at work?”Research in Accounting in Emerging Economies, 8, 239–272.

Soobaroyen et al. 2011 “Changes in social and environmental reporting practices in an emerging economy (2004–2007): Exploring the relevance of stakeholder and legitimacy theories”, Elsevier ltd

Sun, L. 2012, “Further evidence on the association between corporate social responsibility and financial performance”, International Journal of Law and Management, vol. 54, no. 6,.

Surroca, J., Tribó, J.A. &Waddock, S. 2009, “Corporate responsibility and financial performance: the role of intangible resources”, Strategic Management Journal, vol. 31, no. 5, pp. 463-490.

SvenssonGöran, &Wood Greg. 2009. “Business Ethics: through time and across contexts”.StudentlitteraturAB:Vol 1.

TeeroovenSoobaroyenJyoti Devi Mahadeo , (2016),”Community disclosures in a developing country:insights from a neo-pluralist perspective”, Accounting, Auditing & Accountability Journal, Vol. 29 Iss 3 pp. 452 – 482

Uddin, B., Hassan M.,&Kazi M. 2008, “Three dimensional aspects of Corporate Social Responsibility”, Daffodil International University, Journal of Business and Economics.

Unerman, J. and Bennett, M. (2004). Increased stakeholder dialogue and internet: towards greater corporate accountability or reinforcing capital hegemony? Accounting, Organizations & Society, Vol. 29, No. 1, pp. 685-707.

Visser, W.,2005. “Revisiting Carroll’s CSR pyramid: An African perspective,” In M. Huniche& E. R. Pedersen (Eds.), Corporate citizenship in developing countries: New partnership perspectives, Copenhagen: Copenhagen Business School Press, pp. 29–56

Visser, W. 2008. “Corporate Social Responsibility in Developing Countries”, In A. Crane, A. McWilliams, D. Matten, J. Moon & D. Siegel (eds.), The Oxford Handbook of Corporate Social Responsibility, Oxford: Oxford University Press, 473-479.

Vourvachis. 2007. “On the Use of Content Analysis (CA) in Corporate Social Reporting (CSR): Revisiting the debate on the units of analysis and the ways to define them”, Department of Accounting & Finance Kingston University ,Kingston Hill, Surrey.

Waddock, S. A., & Graves, S. B. 2000. “Performance characteristics of social and traditional investments.”Journal of Investing, 9: 27-38.

Willi, A., 2014. Corporate Social Responsibility in Developing Countries: An Institutional Analysis.Thesis (Doctor of Philosophy (PhD)). University of Bath.

Yaftian, A., Wise, V., Cooper, K. and Mirshekary, S. (2012). Social reporting in the annual reports of Iranian listed companies, Corporate Ownership & Control, Vol. 10, No. 1, pp. 26-33.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "CSR"

Corporate Social Responsibility (CSR) is a concept of self-regulation where businesses make positive contributions to society or communities. CSR can include donations, voluntary work, environmentally friendly commitments, and more.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: