Determinants of Local Tax Revenue and its Implication to Local Financial Independence

Info: 9853 words (39 pages) Dissertation

Published: 17th Jan 2022

ABSTRACT

This research aimed to analyze the effect of government spending, inflation and population number in local tax revenues and the implications to local financial independence in 10 Districts of Nusa Tenggara Barat. This study was conducted in 10 Districts of Nusa Tenggara Barat province with four years pooled data (2012-2015). The method used is path analysis approach through Ordinary Least Square (OLS) regression.

The results showed that at the mediation effect detection stage, government spending has positive and significant effect on local tax revenue, while population number does not significantly influence the local tax revenue, this insignificant results of population number led this variable to set aside in the second equation. The second equation obtained results that government spending and local tax are significant and positive impact on the local financial independence directly. Sobel test results proved that local taxes were able to mediate government spending and local financial independence significantly.

Keywords: local tax, local financial independence, government spending, inflation, population number

Introduction

The implementation of regional autonomy is marked by publication law No.22 of 1999 about local government and law No.25 of 1999 about the financial balance between center and regions. Regional autonomy is expected to spur the development process in the region. Implementation of regional autonomy and fiscal decentralization will certainly have consequences for local governments to be more independent both from a financing system as well as in determining the direction of regional development according to the priorities and interests of local societies.

Efforts to minimize dependency of local governments to the central government, local government can do to two things (P. Mahardika, 2003) the first is to increase local revenue (PAD) using innovative breakthroughs that doesn’t conflict with the interests of society and the government. The second effort is related to the cost savings to improve the quality and quantity of development and service to the local community.

Table 1 Ratio of local tax against local revenue in 10 district at Nusa Tenggara Barat Province 2012-2015 (%)

| No | Districts | 2012 | 2013 | 2014 | 2015 |

| 1 | Lombok Barat | 53.33 | 52.83 | 44.90 | 41.14 |

| 2 | Lombok Tengah | 24.15 | 18.94 | 26.54 | 16.22 |

| 3 | Lombok Timur | 14.28 | 14.04 | 14.46 | 15.08 |

| 4 | Sumbawa | 20.07 | 20.97 | 15.75 | 16.35 |

| 5 | Dompu | 10.31 | 13.56 | 7.89 | 9.51 |

| 6 | Kab. Bima | 12.05 | 9.35 | 9.86 | 10.99 |

| 7 | Sumbawa Barat | 39.25 | 52.81 | 36.28 | 43.98 |

| 8 | Lombok Utara | 62.34 | 64.29 | 60.21 | 72.00 |

| 9 | Kota Mataram | 49.74 | 59.05 | 45.29 | 46.18 |

| 10 | Kota Bima | 40.62 | 37.28 | 36.88 | 45.56 |

| Rata-rata | 32.62 | 34.31 | 29.80 | 31.70 | |

Source: BPKAD Nusa Tenggara Barat Province

Compared to the region that has a good level of local financial independence, 31.70 percent is still very low, for example, local tax revenue in Denpasar has reached 75 percent of PAD (Sriparno & Sari, 2015).

Table 1 Local Financial Independence Ratio of 10 districts in Nusa Tenggara Barat (%)

| No | Districts | 2012 | 2013 | 2014 | 2015 |

| 1 | Lombok Barat | 8.63 | 12.20 | 17.53 | 16.06 |

| 2 | Lombok Tengah | 7.98 | 10.59 | 11.02 | 18.07 |

| 3 | Lombok Timur | 7.54 | 7.01 | 11.96 | 12.30 |

| 4 | Sumbawa | 7.64 | 7.63 | 12.29 | 10.89 |

| 5 | Dompu | 5.03 | 5.70 | 10.53 | 8.81 |

| 6 | Kab. Bima | 4.97 | 5.33 | 9.51 | 8.14 |

| 7 | Sumbawa Barat | 7.92 | 5.44 | 7.24 | 7.52 |

| 8 | Lombok Utara | 10.04 | 11.16 | 16.52 | 15.05 |

| 9 | Kota Mataram | 14.00 | 18.52 | 23.30 | 21.96 |

| 10 | Kota Bima | 3.06 | 3.01 | 4.10 | 3.62 |

| 7.68 | 8.66 | 12.40 | 12.24 |

Source: BPKAD Nusa Tenggara Barat Province

Almost all districts in the province of Nusa Tenggara Barat has the local financial independence ratio were still considered “less” based on the criteria of Tim Litbang Depdagri-Fisipol UGM (I. G. N. S. Mahardika & Artini, 2014). This is showing that fiscal capacity to finance programs and provide services to the societies is still very dependent on the central government and provincial governments. Even to cover indirect expenditure alone, local revenue is still not sufficient.

Stewardship Theory considers that the Local Government act as stewards which is one of the state institutions can be trusted to act, accordance to the public interest as principals in carrying out its duties and functions effectively and efficiently (Raharjo, 2007). The local government is also required to responsible for the given trust so that public services can be achieved optimally.

The local government in its role as the stewards will attempt to utilize its expenditure as effective as possible in order to improve the economic welfare of the whole society (principals), either directly or indirectly, and eventually create the potential for local tax revenue. Government expenditure of the government policy in efforts to improve the welfare of society. Government activity will shift from the provision of infrastructure and expenditures on social activities that can ultimately increase economic activity. In this case, the local governments impose taxes and levies so that tax revenues and fees also increased. An increase in local revenues will certainly lead to better local financial independence ratio.

Inflation in this study is considered affecting tax revenue in the region. Inflation has a broad impact on the economy of a country. Inflation will cause a reduction in people’s purchasing power and the increase in production costs. The increase in production costs would reduce corporate profits. Because of corporate profits reduced, tax revenue that government charges against the company be decreased. Local governments as stewards will attempt to suppress the inflation rate as small as possible, this is a manifestation of the government initiative in an effort to maintain the society welfare. The cost of production in the real sector is not significantly increased, and the purchasing power of people (principals) is maintained so that the potential of local tax revenue did not decline. Here it can be deduced that the inflation rate is very influential on local tax revenue, which when the inflation rate increases, the local tax revenue will decline as well as the area of financial independence ratio will decline as well.

Helti (2010) who studied the factors that affect the local tax revenue and the level of efficiency and effectiveness in collecting at Karanganyar, Saputra, Sudjana, & Djudi, (2014) with a study entitled analysis of affecting factors to the effectiveness of local tax collecting, and Haniz & Sasana (2013), which examines the factors that affecting the local tax revenue in Tegal found that the inflation factor has no significant effect to the local tax revenue.

In contrast to Tamara (2009) in a study entitled Analysis of factors affecting local tax revenue in Bandung (1999-2008), Shiska & Nizaruddin (2013) in a study entitled effect of effect of population growth, the GDP, Economy, and inflation the local tax revenue to Pangkalpinang (2005-2009), Rafsanjani, Kertahadi, & Handayani (2015) who studied effect of inflation, unemployment, and regional per capita income tax and revenue against levies, and Nastiti, (2015) in research on factors affecting local taxes, found that inflation had a significant impact on local tax revenue.

The next factor that can affect the local tax revenue is population number. The population according to Hansen’s theory of a stagnation (secular stagnation) which states that increasing population will actually create or increase aggregate demand, especially investment (Irawan & Suparmoko, 1996), the growth of business world will certainly increase the potential of local tax revenue. Rapid population growth is not always an obstacle to the course of economic development as the population has two roles in economic development. First in demand side and second in supply side. In terms of demand, people act as consumers and in terms of supply, a resident acting as producer. Therefore, the population growth is not always an obstacle to economic development, if the population has a high capacity to generate and absorb the production that produced. This means a high rate of population growth will be accompanied by a high level of income as well. Based on the above description and population growth will affect the number of taxpayers to pay local taxes.

Tamara (2009) with a study entitled analysis of factors affecting local tax revenue in Bandung (1999-2008), Helti (2010) in his research on the factors that affect the local tax revenue and the level of efficiency and effectiveness in collecting at Karanganyar, Digdaya & Darso (2015) which examined the influence of total population, income per capita, inflation, and gross domestic product against tax Revenue region in Central Java province and Nastiti (2015) in his research on the factors that affect the local tax , revealed that the population number significantly influence local tax revenue. While according to Fatah, et al. (2015) which examined the effect of population and number of industry and advertising tax revenue effect in local tax revenue find that the population number does not significantly influence local tax revenue.

Ariasih, Utama, & Wirathi (2013) in research on the effect of population and GDP per capita to acceptance of PKB and BBNKB and regional financial independence Bali Province from 1991 to 2010 found that population number are not directly influenced to local financial independence. while Taryoko, (2016) found the opposite that population number directly positive effect to local financial independence in a study entitled analysis of factors affecting regional financial independence in Yogyakarta (2006-2013).

Local financial independence should be achieved by local governments as stewards, this is the mandate of people (principals) as stipulated in law on regional autonomy. Local tax is one of the main instrument in achieving local finance independence, to the local governments as stewards must be able to utilize the potential of local taxes optimally, previous research Meiliana, (2014), shows that the local tax has positive and significant effect on the local financial independence.

Lack of local financial independence ratio in districts and cities in Nusa Tenggara Barat, as well as local tax revenues are still ranged below 50 percent of local revenue despite decentralization has been going on for nearly two decades. these two things are what motivates researchers to treat these issues.

Research objectives of this study are 1) Analyze the effect of government spending, inflation, and population number on local tax revenues in the District in of Nusa Tenggara Barat; and 2) Analyzing the effect of government spending, inflation, population number and local tax on local financial independence in the District in Nusa Tenggara Barat.

Theoretical Framework and Hypothesis Development

Theoretical Framework

Stewardship Theory

Stewardship theory describes a situation where the manager is not motivated by the goals of individuals but rather aimed at their main objectives for the benefit of the organization. This theory has the basic psychology and sociology that has been arranged, where the executive as steward motivated to act according to the principals wishes, besides the steward’s behavior will not leave the organization because the steward tried to reach the target organization.

Stewardship theory is designed for researchers to describe a situation where the executive role as stewardess can be motivated to act in the best way for his principals (Donaldson and Davis, 1989, 1991, in (Raharjo, 2007)). In stewardship theory, the manager will behave according to common interests. When the steward and owner’s interests are not the same, the stewards will try to work together rather than against it, because the stewards felt common interests and behave in accordance with the owner’s behavior is a rational judgment as steward rather look at efforts to achieve organizational goals.

Local Financial Independence

Local financial independence demonstrated the ability of local governments to finance its own activities of governance, development, and service to the public who have to pay taxes and levies as a source of revenue required by the region (Halim, 2002). In principle, independence of the autonom region will depend on two things, the financial ability of regions in mobilizing financial resources that exist and the region dependence on aid from the central government. The ratio of independence can be formulated as follows (I. G. N. S. Mahardika & Artini, 2014):

LFI= LR(DP central and Province) + loan x 100%

Where:

LFI: Local Finance Independence

LR: Locally generated revenue

DP: Balance Fund

Hypothesis Development

Stewardship Theory assumes that managers will always strive to manage resources optimally and take the best decision for the organization and work based on the premise that the profit (fulfillment) managers or stewards and principals come from a strong organization organizationally and economically. Local governments as stewards will attempt to utilize its expenditure as effective as possible in order to improve the economic welfare of the whole society (principals) and ultimately will create the potential for local tax revenue.

Implementation of regional development is a program that requires the involvement of all elements of society (Sukirno, 2004). The government’s role in development is a catalyst and facilitator would need a variety of facilities and support facilities, including the implementation of the budget in the context of sustainable development. The expenditure is mostly used for construction administration and others for development activities in various types of critical infrastructure. Expenditures will increase aggregate spending and enhance economic activities. Government activity should be more to the provision of facilities and infrastructure as well as expenses for social activities or concerning lives of many people, which in turn can boost economic activities and improve the level of welfare.

With the increasing economic activities and social welfare, the flow of government revenues through the locally generated revenue including local taxes also increased. Improving the welfare of society can also be defined poverty figures, this affects to fiscal capacity, making the fiscal capacity index increased so that the local financial independence ratio increase.

H1: Government spending has positive influence on local tax revenue

H2: Government spending has positive effect on local financial independence

Budiono defines inflation as the tendency of rising prices in general and continuous (Boediono, 1997), then Sadono Sukirno provides a definition of inflation as prices increasing process that prevailing in the economy (Sukirno, 2004). Increasing price of one or two types of goods alone can not be referred to as inflation unless the increase result from large increasing in the price of other goods. For example, the rise in prices before the feast or occurring once and had no impact on most of the increase in prices of other goods are not referred to as inflation.

Inflation has a broad impact on the economy of a country. Inflation will cause a reduction in people’s purchasing power and the increase in production costs. The increase in production costs would lead to reduced corporate profits. Because of corporate profits reduce, the tax revenue the government charges against the company will be decreased. Thus concluded that the rate of inflation negatively affects on local tax revenues, which when the inflation rate increases, the local tax revenue will decline.

Inflation may result in a decrease in purchasing power of people in the region. The local government as the steward will seek to suppress the inflation rate as small as possible, this is a manifestation of the government initiative in an effort to maintain the societies welfare, so that the purchasing power of people (principals) is maintained, and the potential of local tax revenues do not decline. In addition to the fall in purchasing power will lead to increasing poverty, declining fiscal capacity index, and encouraging the central governments to provide greater balance funds that led to the decrease in the ratio of local financial independence

Research conducted Helti (2010), Saputra et al. (2014), and Haniz & Sasana (2013) found no significant effect on inflation factor to the local tax revenue. In contrast Tamara (2009), Shiska & Nizaruddin (2013), Rafsanjani et al., (2015) and Nastiti (2015) which found that inflation had a significant impact on local tax revenue.

H3: Inflation has negative effect on local tax revenue

H4: Inflation has negative effect on local financial independence

Population number according to Hansen’s theory of a stagnation (secular stagnation) which states that increasing population will actually create or increase aggregate demand, especially investment. Rapid population growth is not always an obstacle to the economic development process as the population has two roles in economic development. The first is demand side and second is supply side. In terms of demand, people act as consumers and in terms of deals, a resident acting as producer. Therefore, the population growth is not always an obstacle to economic development, if the population has a high capacity to generate and absorb the production produced. This means a high rate of population growth will be accompanied by a high level of income as well. Based on the above description and population growth will affect the number of taxpayers to pay local taxes.

The role of local governments as stewards would direct the potential of population number to accelerate the process of regional development. Local authorities should be able to strive how society continue to increase their productivity, because if not then the potential of population number will only hinder the ongoing development process. This empowerment process will lead to an increase in societies welfare (principals), and of course, this potential will increase local taxes revenue. The increase in local revenue through local taxes and poverty reduction will lead to improvement in the ratio of local financial independence.

Tamara (2009), Helti (2010), Digdaya & Darso (2015) and Nastiti (2015) revealed that population number has significant effect on local tax revenue. Meanwhile, according to Fatah et al., (2015) found that population number does not significantly influence local tax revenue.

Ariasih et al., (2013) found that the population does not directly influence on local financial independence. While Taryoko (2016) found the opposite, that population number directly has positive effect to local financial independence.

H5: Population number has positive effect on local tax revenue

H6: Population number has positive effect on local financial independence

The level of independence of a region is indicated by local revenue contributions to finance regional expenditures. Improvement of local taxes that are part of the local revenue would improve local financial independence as well. Therefore, this study expects that the local tax has significant effect on the level of local financial independence. Because if a region has a relatively high local tax revenue, it will increase local revenues and decrease regional dependency on the central government. With the reduced level of regional dependency on the central government then the region can be said to be independent.

Local financial independence is a requirement of society (principals) to be achieved by local governments. Local tax is one of the principal instruments in achieving the independence to the region, the local governments as stewards are expected to utilize the potential of local taxes optimally.

H7: Local tax has positive effect on local financial independence

Research Method

Types of Research

The research type used in this research is explanatory research. Explanatory research is a research method that is intended to explain the position of the variables that were analyzed and the causal relationship between the variables with each other through a hypothesis (Sugiyono, 2014).

Location and Research Time

The research was conducted in all District Government in the province of Nusa Tenggara Barat (10 district), in the span of four years from 2012 until 2015.

Population and Sample

The population used in this study were all counties and cities in Nusa Tenggara Barat. The samples were determined by total sampling technique, the entire population sampled. The number of districts and cities in Nusa Tenggara Barat are 8 districts and two municipalities, means that the sample used in this study were all counties and cities in Nusa Tenggara Barat.

Types and Sources of Data

This study uses secondary data with panel data (pooled data), merging the cross section data and time series data from 2012 to 2015. Sources of data obtained from the Badan Pengelolaan Keuangan dan Aset Daerah of Nusa Tenggara Barat Province, taken from budget data and budget Realization Report. Other data obtained from Badan Pusat Statistik of Nusa Tenggara Barat province.

Variables Classification

- Independent variables, variables that are not influenced by other variables in the research model. In this study, the independent variable is government spending, population number, and local tax.

- Dependent variables, variables that are influenced by other variables in the research model. In this study, the dependent variable is the local financial independence

- Mediator variables, variables that influence the relation between independent variables and dependent variable. In this study, the mediating variables is local tax

Variables Operational Definition

This study uses independent variables consisting of government spending (GS), population number (PN), Inflation (INF) and local tax (LT) with the local financial independence dependent variable (LFI), and one mediating variable local tax (LT).

- Government spending is the amount of expenditure in the budget each district in West Nusa employees beyond salary expenditures in each fiscal year during the years 2012-2015, in rupiah units.

- Population number is all the people who live in each district in Nusa Tenggara Barat. The population used is population number end of the year 2012-2015, in life units.

- Local Tax is the number of Regional Tax revenue realization during the period of 2012-2015 in each District in Nusa Tenggara Barat, in rupiah units.

- Local financial independence shows the ability of local governments to self-finance government activities, development, and service to the public who have to pay taxes and levies as a source of revenue required by the region (Halim, 2002). The level of local financial independence is measured in percent units by the following formula:

LFI= LRDP central and province+ loan x 100%

Where:

LFI: Local Finance Independence

LR: Locally generated revenue

DP: Balance Fund

Data Collection Technique

Data collection techniques used in this research is literature study is a way of collecting data from a review of the literature in the form of budget realization reports county and city governments, journals, reports, and other references that had to do with the problems examined.

Classic Assumption Test

Examination of hypothesis in the study using multiple linear regression analysis, therefore, it’s necessary to test classical assumption before, normality test, multicollinearity test, heteroskedasticity test, and autocorrelation test (Ghozali, 2016)

Path Analysis

Path analysis is the use of regression analysis to estimate the causal relationships between variables (model casual) are predetermined based on the theory. Path analysis alone can not determine the causal relationship and also can not be used as a substitute for the researcher to see causal relationships between variables (Ghozali, 2016).

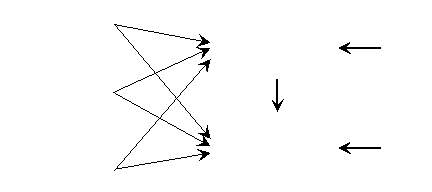

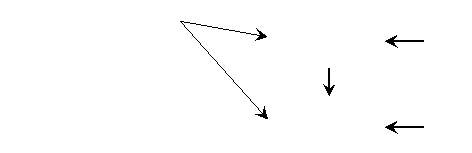

Path diagram aims to describe the causality to be tested. The causal relationship can also be described in a path diagram. Based on the theoretical relationship between variables can be modeled in the form of the path diagram as follows:

Picture 1 Path Diagram

Where:

Total effect of government spending = p5 + (p1p4)

Total effect of inflation = p6 + (p2p4)

Total effect of population number = p7 + (p3p4)

Total effect of local tax = p8

Mediation Effect Detection

The influence of mediating variables can be detected directly by viewing the model in Picture 1, based on the image regression equation can be written as follows (Ghozali, 2016):

LT = α0 + α1 GS + α2 INF + α3 PN (1)

LFI = β0 + β1 GS + β2 INF + β3 PN (2)

LFI = λ0 + λ1 GS + λ2 INF + λ3PN + λ4LT (3)

Path Coefficient

Based on the first image to determine the pattern of the relationship of each variable in this study used regression calculation by the method of ordinary least squares (OLS). Parameter estimation using a recursive model for the calculation of standardized data regression coefficients. Based on the above path diagram, can be assembled structure of this system of equations (Ghozali, 2016):

LT = α1 GS + α2 INF + α3 PN + e1

LFI = β1 GS + β2 INF + β3 PN + β4 LT + e2

e1=1-R12

e2=1-R22

Where:

LFI = Local Financial Independence

LT = Local Tax

GS = Government Spending

INF = Inflation

PN = Population Number

α1, α2, α3, β1, β2, β3, β4 = Coefficient

e1, e2 = Error

Coefficient of Determination Analysis (R2)

The coefficient of determination (R2) essentially measures how far the model’s ability to explain variations in the dependent variable. The coefficient of determination is between zero and one. A small value (R2) means that the ability of independent variables in explaining the dependent variables variation is very limited. A value close to one means that the independent variables provide almost all the information needed to predict the variation of the dependent variable (Ghozali, 2016).

Hypothesis testing

The hypothesis was tested by F statistical test and t statistical test. F statistical test shows the effect of all independent variables together on the dependent variable. While the t statistical test shows the effect of all independent variables individually against the dependent variable (Ghozali, 2016).

Sobel test

Sobel test was used to test the level of significance in the indirect influence of an independent variable on the dependent variable which is mediated by a mediator variable. Tests of significance with Sobel Test requires a large number of samples, in the case of the small sample there is a tendency not normally distributed so that the results can be misleading significance test (Ghozali, 2016).

Results Analysis Interpretation

Path analysis in addition to explaining the direct effect also explains the effect of indirect and total influence. Beta coefficient is called the path coefficient which is a direct effect, whereas the indirect effect is done by multiplying the beta coefficients with the variables passed. Total effect was calculated by summing the effect of direct and indirect effect

Results

Mediation Effect Detection

Government Spending, Inflation and Population Number Effect on Local Taxes

Classic Assumption Test

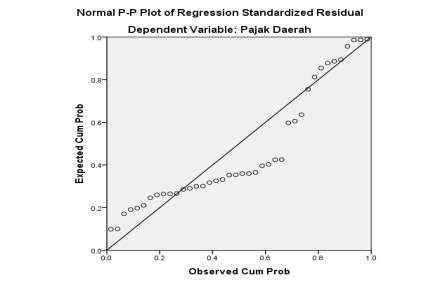

Picture 2 Normal Probability plot

Normal probability plots show a pattern rather skewed, normal plots dots spread around the diagonal line. Conclusion, residual or confounding variables have not a normal distribution. The Central limit theorem states that if a sample was taken from a population large enough, then the sampling distribution of the sample average would approach normal distribution with any initial distribution shape (Nurudin, Mara, and Kusnandar, 2014). This research used sample saturated with 40 samples, so it can be classified using a large sample, and the central limit theorem can be applied here. Although the distribution is not normal, but it can be said to be close to normal for relatively large sample so that it can be done t-test and ANOVA

| Table 3 Coefficient Correlationsa first equation | |||||

| Model | Inflasi | Population number | Government spending | ||

| 1 | Correlations | Inflation | 1.000 | -.059 | .232 |

| Population number | -.059 | 1.000 | -.500 | ||

| Government spending | .232 | -.500 | 1.000 | ||

| Covariances | Inflation | 2.275 | -.001 | .012 | |

| Population number | -.001 | .000 | .000 | ||

| Government spending | .012 | .000 | .001 | ||

| a. Dependent Variable: Local tax | |||||

The Magnitude of the correlation between the independent variables was most likely in Government Spending variable with a variable population number with the level of correlation of -0.500 or about 50 percent. All figures in the independent variable correlation level remain below the 95 percent. So that concluded there is no serious multicollinierity occur

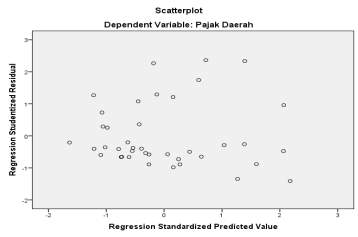

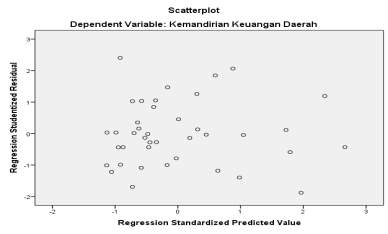

Picture 3 Scatterplot

The scatterplot graph above shows that the dots randomly spread both above and below from zero points on the Y axis. Conclusion, no symptoms of heteroskedasticity on this regression model.

| Table 4 Model Summary first equation | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

| 1 | .423a | .179 | .111 | 24.21347 | 1.514 |

| A. Predictors: (Constant), Inflation, Population Number, Governments Spending | |||||

| b. Dependent Variable: Local Tax | |||||

The above table shows DW values amounted to 1.514, dL value amounted to 1.338, and dU value amounted to 1,659, so DW value is between dL and dU value (≤ d ≤ dU dL). In conclusion, there are doubts whether autocorrelation happens or not in this regression model.

First Regression Model

| Table 5 Coefficients first equation | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | -3.200 | 16.742 | -.191 | .849 | |||

| Governments Spending | .087 | .034 | .455 | 2.535 | .016 | .709 | 1.411 | |

| Population Number | -.005 | .014 | -.065 | -.371 | .712 | .746 | 1.340 | |

| Inflation | .103 | 1.508 | .011 | .068 | .946 | .942 | 1.062 | |

| a. Dependent Variable: Local Tax | ||||||||

LT = 0,455GS + 0,011INF – 0,065PN + e1

Where: R2 = 0,179, e1 = 0,906

t Test

- Government spending has 0.455 coefficient with 2.535 t value, significant at .016, so it concluded that government spending has positive and significant effect on local tax.

- Inflation has 0.011 coefficient, with 0.068 t value, significant at 0.946, so it was concluded that inflation does not affect significantly on local tax.

- Population number has -0.065 coefficient with -0.372 t value, significant at the 0.712, so it was concluded that population number does not affect significantly on local tax

F Test

| Tabel 6 ANOVAa first equation | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 4608.859 | 3 | 1536.286 | 2.620 | .066b |

| Residual | 21106.523 | 36 | 586.292 | |||

| Total | 25715.382 | 39 | ||||

| a. Dependent Variable: Local Tax | ||||||

| b. Predictors: (Constant), Population Number, Inflation, Government Spending | ||||||

F value in this equation is 2.620, significant at 0.66, meaning that at 5 percent significant level, all independent variables in this equation simultaneously are not significant to the local tax. Whereas if using 10 percent significact level simultaneously all independent variables significantly affec local tax.

Government Spending and Local Tax Effect on Local Financial Independence

This section should describe how the effect of government spending, inflation, population and local taxes to local financial independence. But as in the previous section found no significant effect on inflation and population variables, then the two variables are set aside in this section.

Classic Assumption Test

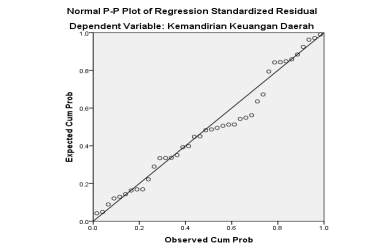

Picture 4 Normal Probability plot

The normal plot shows the normal pattern, normal plots dots spread around the diagonal line, with the deployment approach diagonal line. Conclusion, residual or confounding variables have a normal distribution.

| Table 7 Coefficient Correlationsa second equation | ||||

| Model | Local Tax | Government Spending | ||

| 1 | Correlations | Local Tax | 1.000 | -.420 |

| Government Spending | -.420 | 1.000 | ||

| Covariances | Local Tax | .000 | -1.438E-5 | |

| Government Spending | -1.438E-5 | 6.531E-6 | ||

| a. Dependent Variable: Local Finance Independence | ||||

The magnitude of the correlation between the independent variables was most likely in Government Spending variable with a variable population number with the level of correlation of -0.420 or about 42 percent. The level of correlation on the independent variable still below the 95 percent. So that concluded there is no serious multicollinearity occur.

Picture 5 Scatterplot

The scatterplot graph above shows that the dots randomly spread both above and below the number 0 on the Y axis. Conclusion, no symptoms of heteroskedasticity on this regression model.

| Table 8 Model Summaryb second equation | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

| 1 | .926a | .858 | .851 | 1.95163 | 1.620 |

| a. Predictors: (Constant), Local Tax, Government Spending | |||||

| b. Dependent Variable: Local Finance Independence | |||||

Table 8 shows DW value amounted 1,620, dL value amounted 1.285 and dU value amounted 1.721, so the value of DW is between the value of dL and dU (≤ d ≤ dU dL). In conclusion there are doubts whether autocorrelation happens or not in this regression model.

Second Regression Model

| Table 10 Coefficientsa Second Equation | ||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||||

| B | Std. Error | Beta | Tolerance | VIF | ||||||

| 1 | (Constant) | 2.781 | .941 | 2.956 | .005 | |||||

| Government Spending | .008 | .003 | .202 | 2.969 | .005 | .824 | 1.214 | |||

| Local Tax | .162 | .013 | .823 | 12.074 | .000 | .824 | 1.214 | |||

| a. Dependent Variable: Local Finance Independence | ||||||||||

LFI = 0,202GS + 0,823LT + e2

Where: R2 = 0,858, e2 = 0,514

t Test

- Government Spending has 0.202 coefficient with 2.969 t value, significant at 0.005, so it concluded that government spending has positive and significant effect on local financial independence.

- Local Taxes has 0.823 coefficient with 12.074 t value, significant at 0.000, so it was concluded that local taxes had positive and significant effect on local financial independence.

F Test

| Table 11 ANOVA second equation | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 853.988 | 4 | 213.497 | 53.164 | .000b |

| Residual | 140.554 | 35 | 4.016 | |||

| Total | 994.542 | 39 | ||||

| a. Dependent Variable: Local Finance Independence | ||||||

| b. Predictors: (Constant), Local Tax, Government Spending | ||||||

F value in this equation is 53.164, significant at 0.000, meaning that at 5 percent significant level, all independent variables in this equation simultaneously are influenced significantly on local financial independence.

Path Diagram

Path Diagram

Where:

Indirect effect of government spending = 0,455 x 0,823 = 0,374

Total effect of government spending = 0,202 + (0,455 x 0,823)

= 0,565

Total effect of local tax = 0,823

Sobel Test

Indirect effect amount of government spending to local financial independence through the local tax is 0.0129, significant at 0.0057. Conclusion, relations between government spending and local financial independence mediated by local tax.

Discussion

Table 12 Hypothesis summary

| Code | Hypothesis | Test result |

| H1 | Government spending has positive influence on local tax revenue | Accepted (significant) |

| H2 | Government spending has positive effect on local financial independence | Accepted (significant) |

| H3 | Inflation has negative effect on local tax revenue | Rejected (not significant) |

| H4 | Inflation has negative effect on local financial independence | Independent variable is set aside / Not tested |

| H5 | Population number has positive effect on local tax revenue | Rejected (not significant) |

| H6 | Population number has positive effect on local financial independence | Independent variable is set aside / Not tested |

| H7 | Local tax has positive effect on local financial independence | Accepted (significant) |

First hypothesis (H1) stated that government spending has positive effect on local tax revenue. Hypothesis testing results showed a significance value of 0,016, less than 0.05, which means that government spending variables affect on local tax revenue significantly.

Second hypothesis (H2) stated that government spending has positive effect on local financial independence. Hypothesis testing results showed the significant value of 0.005, less than 0.05, which means that government spending affects significantly on local financial independence.

Nusa Tenggara Barat economic improvement can be seen from the growth of Gross Domestic Product that continues to increase year by year, especially if you see the growth from 2012 to 2015 that reached an average of 7.37 percent (GDP at constant prices 2010), its shows that the government has managed to spur the empowerment of the local economy through their spending. This improved economic activity is then added more local revenues from local tax, which in turn will increase local financial independence ratio. Besides, the many local government activities held in the hotel or restaurant also had a direct impact of government spending on the income from these businesses, and this, of course, will increase local tax revenue.

These results also strengthen the stewardship theory, local governments who act as stewards have been able to carry out their duties and act in accordance with the public interest. This is reflected in the expenditure policy that is able to increase revenue. The increase in revenue is also certainly related to local wealth management policies effectivity and efficiency so that the potential of local revenues can be implemented optimally.

Third hypothesis (H3) suggested that inflation negatively affect on local tax. Hypothesis testing results show that the significance value of 0.946, greater than 0.05, which means that the inflation variable does not significantly affects on local tax revenue.

This hypothesis is not proven. Inflation insignificant caused by the definition of inflation that is a price rise in general, almost occurred in all sectors, so that in ratio, its can not provide a significant impact on local taxes. The increase or decrease occurred only in nominal terms, the increase in revenue that occurs certainly also be followed by the increase in expenses to obtain the revenue, even the possibility of nominal spending to acquire local revenue has increased higher than the income itself. So it is concluded that the changes caused by the inflation factor, did not cause significant changes in the local tax revenue.

These results support the results of research conducted by Helti (2010), Saputra et al., (2014), and Haniz & Sasana (2013) found no significant effect on inflation factor to the local tax revenue.

The fifth hypothesis (H5) states that population number has positive effect on local tax revenue. Hypothesis testing results showed 0.712 significance value, greater than 0.05, which means that population number does not affect on local tax revenue significantly.

This hypothesis is not proven. Not evenly distributed development results especially the limited range of empowerment programs are the main cause. The main indicators regarding the uneven results of this development is the Gini ratio that demonstrates population income equity that occurs in a region. Just some residents can enjoy the regional economy increase, while others still have not get results as expected. Gini ratio in Nusa Tenggara Barat in the last three years still stood at approximately 0.3 to 0.5, in the category of medium income inequality, so it is still very necessary to repair. In addition, the level of compliance in paying taxes is still low also become one of the main causes.

The results support the research by Fatah, et al. (2015) that found the number of the population does not significantly affect on local tax revenue.

Seventh hypothesis (H7) claimed that the local tax has positive effect on the local financial independence. Hypothesis testing results show that the significant value is 0.000, less than 0.05, which means that the local tax variables significantly influence local financial independence.

These results show the effect of local taxes in the forming of local financial independence. The local tax which is a major component in local revenues will no doubt contribute significantly to strengthen local financial independence. This should be a concern of stakeholders so that efforts to increase local tax revenues, including enlarging its potential through programs that are friendly to investors become a priority in local budget policy.

These results are consistent with research by Meiliana (2014) on the influence of local taxes, levies, and DBH against local financial independence at Bandar Lampung, which found that the local tax has positive effect on local financial independence.

Based on Sobel test results, it was concluded that the local tax variables may mediate the relations between government spending and local financial independence. The Indirect effect of government spending to local financial independence through the local tax are significant at 0.0129, with a significant level of 5 percent. Other variables did not do Sobel test because test results were not significant partially.

Conclusion, Implication, and Limitation

Conclusion

Based on the research results, can be drawn some conclusions that government spending significantly positive effect on local tax revenue and local financial independence. Local tax positive and significant effect on local financial independence, local taxes also proved to mediate the relation between government spending and local financial independence significantly. Meanwhile, inflation and population do not significantly influence local tax revenue. It is the evident that local government as stewards managed to control its spending to achieve organizational goals as a form of mandate from the people (principals).

Implication

The results showed empirical evidence that government spending has positive effect on local tax revenues and local financial independence. Local taxes also proved significant in mediating the relations between government expenditures and local financial independence. This practically gave the advice to the district and city in Nusa Tenggara Barat province expected to accelerate an increase in public expenditure, and of course, reduce personnel expenditures as efficient as possible, include reducing the share of expenditure relating to the employee on public spending. Public spending should be more for the programs that are community economic empowerment as well as the infrastructure to support them.

Limitation

Limitations in this study are that the study is limited to four independent variables alone, is still much more dependent variables that can explain the independent variable. Then the study period relatively short, only four (4) years, as well as the scope of the research is also relatively small, only in the province of West Nusa Tenggara.

Suggestions

Further researchers expected to expand the area of research, such as Nusa Tenggara regional, or even in Indonesia, in order to obtain research results more comprehensive and general nature. Furthermore, other independent variables in order to be more explored, and more research time range, for example by adding more variables specific government spending on government wealth management that can generate local revenue directly.

References

Ariasih, N. N. P., Utama, I. M. S., & Wirathi, I. G. A. P. (2013). Pengaruh Jumlah Penduduk dan PDRB per kapita Terhadap Penerimaan PKB dan BBNKB serta Kemandirian Keuangan Daerah Provinsi Bali Tahun 1991-2010. E-Jurnal Ekonomi dan Bisnis Universitas Udayana, 2(08), 20.

Boediono. (1997). Seri Sinopsis Pengantar Ilmu Ekonomi No. 2 Ekonomi Makro. Yogyakarta: BPFE.

Digdaya, A. P., & Darso, M. (2015). Pengaruh Jumlah Penduduk, Pendapatan Perkapita, Inflasi, Dan Produk Domestik Regional Bruto Terhadap Penerimaan Pajak Daerah (Studi Kasus Kabupaten/Kota Propinsi Jawa Tengah Tahun 2011-2013). Students´ Journal of Accounting and Banking, 4(1).

Fatah, A. A., Suhadak, & Hidayat, K. (2015). Pengaruh Jumlah Penduduk Dan Jumlah Industri Terhadap Penerimaan Pajak Reklame Dan Efeknya Pada Penerimaan Pajak Daerah (Studi Pada Dinas Pendapatan Daerah Kota Malang Periode Tahun 2000-2013). Jurnal Administrasi Bisnis – Perpajakan (JAB), 5(1).

Ghozali, I. (2016). Aplikasi Analisis Multivariate dengan Program SPSS IBM SPSS 23. Semarang: ISBN.

Halim, A. (2002). Akuntansi Sektor Publik Akuntansi Keuangan Daerah. Jakarta: Salemba Empat.

Haniz, N. F., & Sasana, H. (2013). Analisis Faktor-Faktor Yang Mempengaruhi Penerimaan Pajak Daerah Kota Tegal. Diponegoro Journal Of Economics, 3(1), 1-13.

Helti, K. A. (2010). Analisis Faktor-Faktor yang Mempengaruhi Pajak Daerah Serta Tingkat Efisiensi dan Efektivitas Dalam Pemungutan. Universitas Sebelas Maret.

Irawan, & Suparmoko. (1996). Ekonomika Pembangunan. Yogyakarta: BPFE.

Mahardika, I. G. N. S., & Artini, L. G. S. (2014). Analisis Kemandirian Keuangan Daerah Di Era Otonomi Pada Pemerintah Kabupaten Tabanan. E-journal Manajemen Universitas Udayana, 3(3), 18.

Mahardika, P. (2003). Analisis Efisiensi dan Efektivitas Pemungutan Retribusi Pasar Pemerintahan Kab. Sleman. Lintasan Ekonomi, XX(2).

Meiliana. (2014). Pengaruh Pajak Daerah, Retribusi Daerah, Dan Dana Bagi Hasil Terhadap Kemandirian Keuangan Daerah Kota Bandar Lampung. Universitas Lampung.

Nastiti, C. R. (2015). Analisis Faktor-Faktor Yang Mempengaruhi Pajak Daerah. Jurnal Ilmiah Mahasiswa FEB Universitas Brawijaya, 4(1).

Nurudin, M., Mara, M. N., & Kusnandar, D. (2014). Ukuran Sampel Dan Distribusi Sampling Dari Beberapa Variabel Random Kontinu. Buletin Ilmiah Mat. Stat. dan Terapannya (Bimaster), 3(1), 1-6.

Rafsanjani, F. A., Kertahadi, & Handayani, S. R. (2015). Pengaruh Tingkat Inflasi, Pengangguran, Dan Pendapatan Per Kapita Regional Terhadap Penerimaan Pajak Dan Retribusi Daerah (Studi Pada Badan Pusat Statistik Dan Dinas Pendapatan Daerah Kota Batu Periode Tahun 2004-2013). Jurnal Administrasi Bisnis – Perpajakan (JAB), 6(2), 1-6.

Raharjo, E. (2007). Teori Agensi dan Teori Stewardship Dalam Perspektif Akuntansi. Fokus Ekonomi, 2(1), 37-46.

Saputra, A. D., Sudjana, N., & Djudi, M. (2014). Analisis Faktor – Faktor Yang Mempengaruhi Efektivitas Pemungutan Pajak Daerah (Studi Pada Dinas Pendapatan Daerah Kabupaten Tulungagung). Jurnal Perpajakan, 3(1).

Shiska, E., & Nizaruddin, A. (2013). Pengaruh Pengaruh Pertumbuhan Penduduk, PDRB, Ekonomi, Dan Tingkat Inflasi Terhadap Penerimaan Pajak Daerah Pada Kota Pangkalpinang Tahun 2005-2009. Journal of Accountancy Fakultas Ekonomi UBB, 1(1), 55-65.

Sriparno, A. R., & Sari, M. M. R. (2015). Analisis Pajak Dan Retribusi Daerah Pada Tingkat Efektivitas Dan Kemandirian Keuangan Daerah. E-Jurnal Akuntansi Universitas Udayana, 13(2), 368-386.

Sugiyono. (2014). Metode Penelitian Bisnis. Bandung: Alfabeta.

Sukirno, S. (2004). Makro Ekonomi. Jakarta: PT. Raja Grafindo Persada.

Tamara, D. A. D. (2009). Analisis Faktor-Faktor Yang Mempengaruhi Penerimaan Pajak Daerah Di Kota Bandung (1999-2008). Jurnal Ekonomi, Keuangan, Perbankan dan Akuntansi, 1(2), 151-172.

Taryoko. (2016). Analisis Faktor-Faktor Yang Mempengaruhi Kemandirian Keuangan Daerah Di Daerah Istimewa Yogyakarta Periode 2006-2013. Universitas Negeri Yogyakarta.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Finance"

Finance is a field of study involving matters of the management, and creation, of money and investments including the dynamics of assets and liabilities, under conditions of uncertainty and risk.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: