Economic Impacts of Brexit

Info: 7544 words (30 pages) Dissertation

Published: 11th Dec 2019

International Business Project:

Brexit: The Beginning of the End or the End of the Beginning?

INDEX

Abbreviation……………………………………………..3

Abstract………………………………………………..3

Introduction……………………………………………..4

1. BREXIT: HOW TRADE CHANGES FOR UK……………………………..…..6

1.1 Economic Outlook……………………….…………………………………………… 6

1.2 Tariffs for non-EU members………………………………. 7

1.3 Single Market: new setting……………………………….. 8

1.4 UK and Developed Countries: the trade ………………………………………… ..9

1.5 UK and Capital Development……………………………..11

2. LONDON AS FINANCIAL POWER………………………..12

2.1 The Centre of the Progress…………………………………12

2.2 The Allure of the City……………………………………13

2.3 The Strength of UK influence………………………………14

2.4 Brexit Effect for London………………………………….15

3. FUTURE CONNECTION BETWEEN UK AND EU……………..17

3.1 Structure for Exit and Future Evolution………………………..17

3.2 EU: How the Economy will Change………………………….17

3.3 The Results…………………………………………..19

CONCLUSION…………………………………………..20

BIBLIOGRAPHY………………………………………..23

ABBREVIATIONS

CAP: Common Agricultural Policy GATS: General Agreement Trade in Services

CEE: Central and Eastern European GATT: General Agreement Tariffs and Trade

CJEU: European Court of Justice IMF: International Monetary Fund

EC: European Community MFN: Most Favoured Nation

ECB: European Central Bank NT: National Treatment

EEC: European Economic Community OCTA: Overseas Countries and Territories

EFTA: European Free Trade Association Association

EEA: Agreement on the European Economic Area QMV: Qualified Majority Voting

EMU: Economic and Monetary Union SEA: Single European Act

EP: European Parliament TEU: Treaty of the European Union

ERM: Exchange Rate Mechanism UK: United Kingdom

EU: European Union US: United States of America

FTA: Free Trade Agreement VAT: Value-added Tax

FTT: Financial Transaction Tax WTO: World Trade Organisation

Abstract

In this dissertation, my interest is to discover the effects of the withdraws of the Uk from the European Union, especially the consequences on economy in Uk and the main European countries. My intention is to provide a description of the effect of the Brexit, starting on the history of the Uk and Eu in general and the effect of the Brexit on uk Trade. I have also spoken about the single market and, of course, the situation for London, as centre of financial sector, that move almost 90% of the European capital market. After these descriptions, i have spoken about the future relations among EU and Uk, on economic, political and general agreement issues. As a result i found that the trade for Uk will change significantly and than the economy will be touched by its effects.

INTRODUCTION

In the 73″, UK economy was suffering for structural changes. Due to low barriers on trade, while, in the same time, the EC budget grew.

The Thatcher government had a strong ideological commitment to liberalisation of the markets, hence, the UK government became a strong force pushing for trade liberalisation in the EC. SEA, introduced the freeing of the movement of capital, goods, services and labour inside the Community and came into effect in 1987.

The Treaty of the European Union was signed in Maastricht and was applied on 1993. This agreement, was made up for monetary and political union. From that, the UK was able to have further and better access to the market.

In 2002, while 12 member states adopted the euro as their sole currency, UK did not enter this final stage of the EMU and the government decided not to hold a referendum. The changing UK governments were in many cases reluctant towards EU integration, though the UK has also been a strong force for integration, not least when it came to creating the single market.

On 23 June 2016, during Cameron’s government, an historic referendum was made up to decide whether the UK should leave or remain in the European Union. As a result, British people have voted to leave the EU with 51.9%. On 29 March 2017, in a letter to the President of the European Council Donald Tusk, from the Prime Minister of the United Kingdom, Theresa May, the UK invoked Article 50 of the Treaty on European Union thereby triggering the secession of the UK from the EU. The negotiations on the terms started on 19 June 2017 with the UK remaining a full member of the European Union until it will leaves the EU at the expected and agreed date.

There is no precedence for establishing relationships with former member states, so the UK would be the first member state to exit the EU. Though, for example, Greenland voted to leave the EEC in 1985, but it is still subject to EU treaties, as it is a part of the Danish Realm.

At this point, my question is: what is the real cause and effects of the Brexit? Is it only for economical purpose or also an excuse to get far from European affairs and decisions?

Hence, i wanted to provide different answers. My focus will be on the integration points such as Trade, Financial and Future Prospect for EU and UK relationship.

In the Chapter 1, I will describe the changing after the Brexit, for the Uk import and export in their new dimension in and outside EU agreement.

In the Chapter 2, I will be interested on treating the City of London. The Financial Services Industry is becoming increasingly important for the UK economy, and, together the insurance services contribute £126.9bn in gross value added. Being London the capital of the financial European market, is extremely important add this topic, analysing the power of London market and how it will change.

In the Chapter 3, I will concentrate on the economic next steps for EU and UK.

CHAPTER 1

BREXIT: HOW TRADE CHANGES FOR UK

1.1 Economic Outlook

Being a part of customs union, the countries are able to share and exchange their goods and services on a specific base. There are different prices and agreement, that allow countries to have lower price, higher output and additional benefit. Hence, this lead to a better economic result; not only this but also there can be an increase of exports because countries partners can remove their tariffs. So, leaving from EU, UK will face, for example, a decrease of these opportunities, an increase of costs of production and a lower consumption among UK citizen.

Leaving the custom union as member, the UK can earn maybe other opportunities due to the trade creation with other countries. It could happen, mainly, if the exit from EU group leads to new trade ways or diverted it, and also the new costs of the trade as new member with the EU.

It is possible to notice that the volume of the total export for UK will decrease, due to the withdraw of the EU treatment, and as a result, UK firms will face problem to reach economies of scale, competition due to the protectionism as an effect of the reduction of the domestic industry.

1.2 Tariffs for non-EU members

Analysing the costs of the trade from EU and UK after leaving the European Union, if the UK will not negotiate a trade agreement, as a member of the WTO, their tariffs will follow the obligation of the WTO.

WTO has two principles that drive the trade among relation members. These are: National Treatment (NT) and the Most Favoured Nation (MFN) principle. They apply across all sectors including goods, services, and technology. NT is a rule of internal non-discrimination and MFN, on the other hand, covers external non-discrimination (Schoenbaum & Chow, 2008). If the WTO rules that two products are not ‘like’, discrimination is justified. Hence, the UK could encounter problems in this regard.

In the Single Market there are good possibilities for firms and costumers because there are similar prices for companies and buyers, this can be changed for UK, now that will be out of this market. There are some products that cannot be substituted, because they accomplish to specific aims and needs, but they will now have a different and maybe higher price. Furthermore, there is also the possibility that British costumers will not substitute EU products with British one, but with others that come from different countries. Another possibility is that for example the price to product goods, and its final price, for UK companies will be less competitive.

Regarding the Financial Services, as the major sector for UK especially as exporter, there will be an increase of the UK’s trade deficit with the EU, due to EU committed market access and NT.

Within the WTO agreements there are no arrangements for investments, U will have to rely on treaties for enabling EU investments with it. That said, for the investment sector there is the GATS, which protect only if they concern services with investment made up on site.

1.3 Single Market: new setting

By being a member state of the EU, the UK is part of the world largest internal market, consisting of 508 million people and with a total GDP of $18.46 trillion. This economic zone gives UK businesses ample opportunity to export their goods and services, unrestricted as they are by customs duties or tariffs.

Exports of goods and services from the United Kingdom fell by a marginal 0.1 percent to £49.8 billion in April 2017, almost unchanged from March’s record high, due to a decrease of 0.5 percent in exports of trade in goods while exports of services rose by 0.6 percent.

Is notable see that sales of goods to the EU fell by 3.8 percent, mainly to Germany and Netherlands. By contrast, exports of goods to non-EU countries grew by 2.6 percent, boosted by higher sales to Switzerland, China and Hong Kong. The EU is the UK’s main trading partner, though the share of UK trade accounted for by the EU member states has fallen consistently since 1999.

There is an important effect from the Brexit; the international competition is increasing and UK is very demanding and open economy, so its firms will be intensive exposed with other international companies for different fields of business. UK companies, mast to remain challenging because those of EU are protected from structured rules that help to maintain lower prices of goods, so more attractive for costumers.

One of EU attractive points for countries is the product regulation. The UK products are already ready for the EU market, also after the Brexit, if the British companies will not change standard productions. It can be a domino effects if the UK firms will choose to not follow EU standards, in order to reduce the cost and be more efficient.

UK, as a result, has to follow the EU standards and the rules regarding the production to be able to remain in the Single Market. This is an important point because, otherwise, there could be a negative approach for UK goods, services, all based on a technical rule. Especially for small and medium companies which will be subject to higher costs to be available for EU single market.

1.4 UK and Developed Countries: the new trade

There is, recently, the idea that UK can earn trade ways and much more volume with economies under rapid development, and for that gain some steps and cover some Brexit negative effects.

In the short-term, there will be the rise for import costs, caused by a reduction of the agreement validity; there will also be a decrease for trade volume and as the uncertainly situation, there will be a reduction for outgoing and incoming investments.

On the other hand, UK should have better chances reaching comprehensive agreements with small, like-minded economies, but regarding the big emerging ones, such as China and India, it should not have as much margin. The UK will be dependent on trade with the EU and other large developed economies for the future deals, but the economic growth of developed countries is expanding at a much faster rate than the developed countries, there is, for UK, great potential in lowering barriers to trade with large emerging economies and so potential new positive effects.

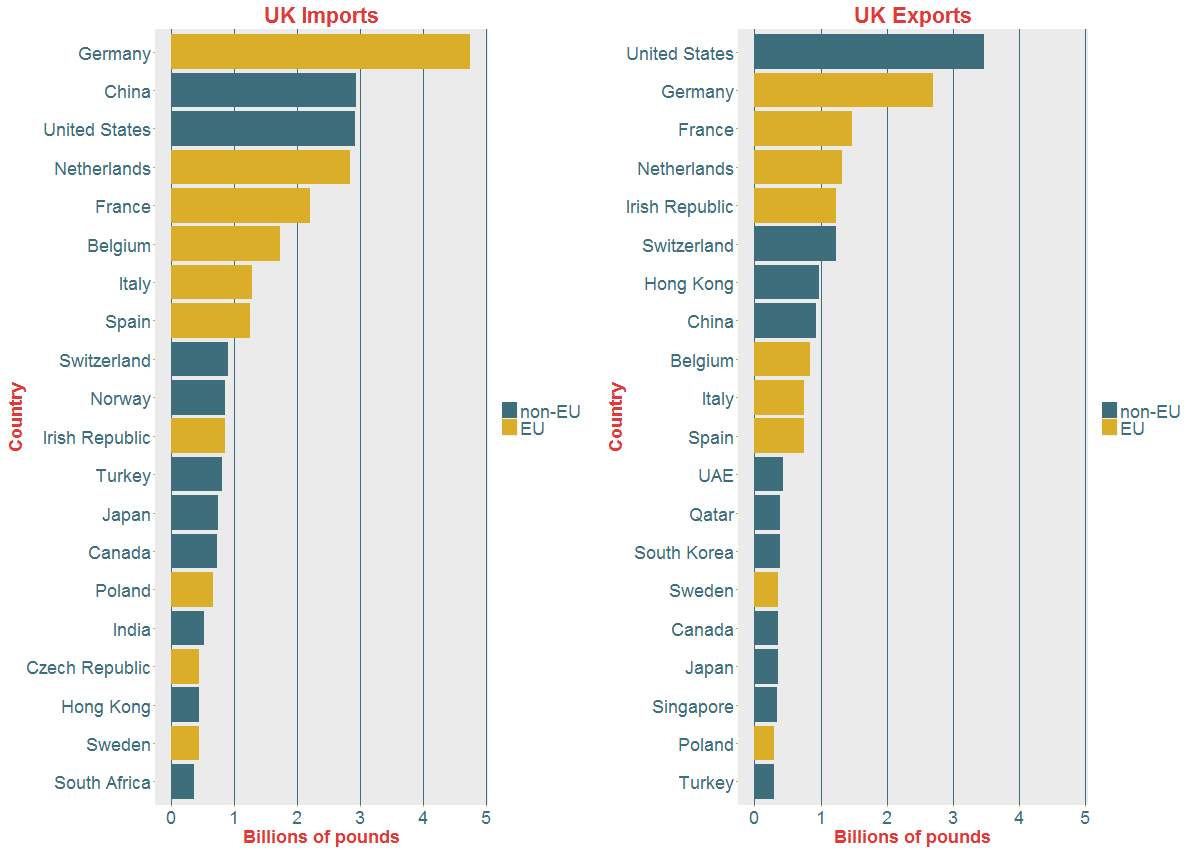

In below Table, the Top non-EU destinations for UK exports are listed, as well as the Top origins for UK imports. Germany is the largest importer into the UK in February 2016 (£4.75 billion) followed by China (£2.94 billion) and the US (£2.93 billion). In terms of exports, the UK exported the most goods to the US (£3.47 billion), followed by Germany (£2.70 billion) and France (£1.48 billion). In both plots, it is clear that there is a roughly equal split between EU and non-EU countries.

It can be seen that the destinations with the highest growth in UK exports are dominated by developing economies. This implies that there may be significant profits to be made from negotiating FTAs with developing economies, especially if they also have large populations. One of the largest markets for UK services is the US.

Talking about US agreements, there is the US-EU TTIP. From this cooperation there is a common accept of products from EU and US and vice versa. Some barriers for trade will offset and it will be more easy to trade. For UK companies will be an amazing opportunity to reduce the technical barriers and for this after Brexit, UK could miss this opportunity. It is early to say due to the long times involved.

That said, is important to argue that all the new potential economies partners have different technologies, and there are different preferences among new potential customers. So, to quantify the trade volume is uncertain, but there has been already some changes among the situations i have explained before.

To conclude, it is impossible to understand the times and the potential gain for this kind of trade. UK can, of course, start new deals with new economies but also try to maintain its position within the Single Market.

1.5 UK and Capital Development

UK has received much more investment from EU rather than other EU members. These investments are highly important for UK It receives those benefits thanks to be EU member.

From this kind of movement of capital, EU remove restriction for EU members and the commission negotiates investment in FTAs and as stand-alone agreements, making it a possibility that the UK upon negotiation can get many of the same advantages of the Single Market regarding the movement of capital. Is important to say that non EU countries invest capital, so there is a correlation and could be an effect from the Brexit. The position of UK within the Single Market is very important for foreign investment, its expands the power of UK in the Financial sector and for that, a lot of foreign companies have added their presence in the UK.

UK at 35% has the highest number of headquarter-based investments in Europe. Foreign investors, have an interest in placing their regional headquarters within the EU, this is because the subsidiaries on EU territory can demand to be subjected to the same regulations as the headquarter. It is not easy to estimate how much investment would be affected; while foreign capital is more mobile than domestic, is more likely to be relocated when market conditions change. Regarding the services, they are much difficult to move than manufacturing capital, and they account for 60% of FDI in the UK. In the end, it is impossible to assess how much incoming FDI will change with Brexit, but there is the impression that incoming FDI will fall.

CHAPTER 2

LONDON AS FINANCIAL POWER

2.1 The centre of the progress

Accounting for 22.8% of financial services in the world, London is the largest financial centre in Europe. Thank to EU activities for liberalisation the financial markets, to be a member of EU is an advantage for the UK financial industry. As be a part of the Single Market, UK allow London the capacity to accept European banks to create their wholesale activities in the city and it helps London to lead connections with also non financial institutions, which want to enter in the single market. London specialized its financial industry in the financial services and became the first city among other European ones.

After the collapse of the Bretton Woods System in 1971, the UK removed controls on foreign capital in unison with the US, Germany, and Canada, resulting in increased financial activity, but also smaller financial collapses.

Thanks to the Single Market roles, the controls on flows of cross-border capital were dismantled at EU level, it happened in 1988.

The main reason was to give the access all the members of EU in the market and for that increase the competition. UK’s retail banking market became more concentrated, as mergers and acquisitions lead to the dominance of few large banks over mortgage and business lenders in the decade leading up to the global financial crisis. When UK took the decision to do not accept the Euro circuit, some expected that London could lose ways and competitively, but it didn’t happen and London became the largest euro centre for its trading.

With the introduction of the euro, the EU set up TARGET, a real-time gross settlement system, which allowed funds to move smoothly across the EU(Sophie Vasbo, 2015).

The UK managed to gain access to TARGET, which established the principle that institutions based in the Single Market should have equal right to conduct transactions in the common currency and the international financial markets became more integrated.

Thanks to the UK activities, the liberalisation of European capital markets was gained, but the global financial crisis has generated a pressure to regulate financial markets. The UK banks have been obligated to raise capital and hold more liquidity, draw up recovery and resolution plans.

2.2 The allure of the City

London, is now a big hub, where investment, business firms, and the most skilled people in the world are attracted. Important elements that have allowed London to became so important, are the best performing environment, the capacity and predictability of the legal system, the English language as world concept, the structure of the financial industry that can engage every day with a huge numbers of activities. Each skill is the soul of London and also after Brexit it will not change. But what about all these as a whole?

With the introduction of the euro, there was the fear of losing business and attractiveness for London, and with the growth of Frankfurt from the second to the first financial centre, due to the fact that the ECB, and hence the future monetary policy for 11 member countries, were to be located in the German city. But, as told before, London gained in trade with the Euro, more than other financial centre in the EU group. The reason is that there was an intense competition for highly qualified labour between the two cities. The highly skilled and ambitious people preferred to live in London, as it is perceived as a more cosmopolitan city where more career possibility can be taken.

Another point in favour for London is the big network gained for firms and employees. Behind all this there is an history, especially the comparison to US market. To conclude cross-border governance was found to be a key issue. Institutional conflicts are very damaging in the financial services sector and representatives of the transnational businesses emphasised the hope that the UK would continue to have access to the Single Market and to implement EU directives going forward.

There are a variety of factors that define the City of London’s competitiveness, the most important of which has nothing to do with EU agreement. For this reason, i think it will hard to remove the business flow and investments in London and companies within the financial sector have more reasons to keep both their offices and central decision-making in London.

2.3 The Strength of UK influence

The new financial legislation, has not scratched the UK importance and power and losing sovranity. As the UK has had an opt-out clause in the TEU, it has not been affected by decisions and regulations adopted by the ECB or the European System of Central Banks, because the ECB has the mandate to supervise banks and other financial actors. On the other hand, the UK’s voting rights in the European Council are suspended for issues solely regarding the Eurozone.

As proposals in co-decision are adopted by QMV, new financial legislation has to be approved by a majority of member states.

The worry is that future financial legislation will be favouring Eurozone interests rather than EU-wide interests. The ECB proposed that euro-denominated business should be cleared within the Eurozone; thus, any “central counterparty” that handled more than 5% of euro-denominated product should be based within the Eurozone, and clearing of euro-denominated trade would be limited to a maximum of £4.2m outside the Eurozone. London could be damage from that. Not only, London is home to 75% of the EU’s foreign exchange trading, and financial centres within the Eurozone could look forward to considerable increases in their foreign exchange trading.

While, the ECB proposed the initiative in order to increase oversight and secure prudential regulation over clearing-houses, Eurozone countries will benefit form that. So, the UK Treasury took the ECB to the CJEU and argued how the proposal contravened with the free movement of services and capital, and in March 2015, the CJEU pronounced in favour of the UK, and ECB was to annul the policy. Furthermore, under the provision of the banking union, the ECB has been given the ultimate supervisory responsibility for all EU banks so the ECB will favour those banks at the cost of UK bank with setting the liquidity and capital requirements for the biggest banks in the Eurozone.

The UK still has considerable power over financial legislation and as long as membership is retained.

2.4 Brexit Effect for London

There will be a lot of consequences for London due to the withdrew of EU membership, some are very important. There can be a reduction of the market for firms, its reduction and also there can be higher issues with tariff barriers. Another important point is that third countries have regulation and supervision of their financial sectors equivalent to that of the EU, and for this UK firms have to open a branch in the country part of the single market to sell their products and services in EU area. This branch has to be regulated by the authorities of country where it has the base. Furthermore, UK supervision and regulation would be subject to continuous assessments.

Moreover, to standardise market-access for non-member countries, Eu are trying to establish an EU-wide regime for financial services. The EU could recognise foreign regulatory to be equivalent to the corresponding EU framework. The Commission would make the decision, based on an assessment on if the third country framework demonstrates equivalence to EU frameworks on having effective supervision by authorities, legally binding requirements, and an outcome-based analysis of the regulation. Once the UK’s framework is accepted, UK-based firms should face less barriers to trade, just as their services and products would automatically be considered acceptable for regulatory purposes in the EU.

The UK would recognise EU rules as equivalent to its own, and banks from the EU can continue to have branches in the UK with domestic regulation; so, the transition may not be too damaging for businesses in the UK financial sector.

For Foreign Financial Institutions, the rules will be more demanding. These institutions can no longer maintain access to the Single Market by getting far from a subsidiary in London, but will need to have a subsidiary within the Single Market. The Foreign Financial Institutions will maintain also their European headquarters in UK just for the path dependency and the costs will be paid by foreign companies. Also if the UK can avoid implementing EU directives by having its regulatory framework recognised, the UK will be highly affected by EU decisions. As the CJEU ruling can be appealed, and Eurozone authorities have made it clear that they prefer wholesale activities to be conducted within their oversight. As a non-EU member, the UK would have to rely on EU members outside of the Eurozone to protect the Single Market, but no other member state outside the Eurozone have an evident reason to protect their financial sectors, because no one is important to the national economy as London is to the UK.

The best scenario is that UK will have the full access to the EU financial market and face less problem with the trade if it will join the EEA after all the Brexit process because it could lead to less problem for the Uk firms (Sophie Vasbo, 2015). But on the other hand, UK will have to accept all the rules for fiancial servicies of the EU, with no influence in the decision making. As Lonodon is to important centre for the UK financial activity and also, it can be argued that London will mantain this importante role. EU legislation will come to affect the UK, regardless of its future arrangement with the EU.

The actual economic consequences are more difficult to determine. Even though the Single Market is central to much of the City’s business, it is evident that as long as UK regulation and supervision are counted as equivalent to that of the EU, London business should not incur major losses. The greatest impact would be if London were cut-off from certain markets, as for instance euro-denominated trade; the future for the City of London is much more uncertain outside EU membership, than inside.

CHAPTER 3

FUTURE CONNECTION BETWEEN UK AND EU

3.1 Structure for Exit and Future Evolution

As UK has an important ramification and network with all the EU members, it means that, UK economy, withdrawing EU with Brexit will depend to the best relation built with EU. When a member states informs the Council of its decision to leave the EU, the negotiations process begins. The treaties will continue to apply to the exiting state until the withdrawal agreement is signed or until two years after the notification if the negotiations fail. During these two years, the UK can not participate in discussions or decision-making in the Council or the Commission in matters concerning its exit (The Lisbon Treaty, 2013).

The trade negotiations are conducted by the Commission. It works in conjunction with a committee that will monitor the negotiations and ensure that it is in accordance with the mandate given by the Council, which is the primary force in the exit negotiations.

Moving after the Brexit is important and challenging for UK to build the future participation to the Single Market and what EU will demand to UK and what UK will willing to concede. The UK government has made it very clear that going forward they wish less integration and to increase national sovereignty. The UK could distance itself from the EU and focus on trade with the rest of the world. The EU is falling behind in the global race, and as I have argued, there is much to be won by reducing barriers to trade with countries that show increasing interest in UK goods and services.

3.2 EU: How the Economy will Change

In 2014 UK gived a direct contribution of 10.97% to the EU budget, so its absence will be felt. The remaining 27 member states would have to raise their contributions or accept a reduction in the EU’s total spending. That sais, depending on the future arrangement the UK may have to contribute to the EU budget, for instance if it joined EEA. Economically, membership of the EEA seems to be the better solution for all parties. The UK will have full access to the Single Market and would avoid current and future tariff and non-tariff barriers to trade. As a UK Foreign Affairs Committee expressed it, EEA membership effectively involves integration without representation. While the UK would have Single Market rights, it would have to depend on the other member states to ensure these rights; negotiating a basket of bilateral agreements would be a much more available solution for the UK.

The UK would only have to follow regulation in the sectors covered by the agreements. With this model, Switzerland has gotten the closest trade relationship with the EU next to the EEA countries. It is, however, not as extensive as an EEA agreement, because Switzerland only has sectorial agreements for trade in services with the EU and the UK should expect to see limited access for vital areas of business.

Another important point is that the UK could negotiate a FTA with the EU. The UK would have the freedom to pursue its own external trade deals, while enjoying tariff free trade in the Single Market. Indeed, this agreement would be structured as trade-off between depth and sovereignty; this will not be in the best interest of EU member states.

The complexity of the framework for EU negotiation, allowing individual member states more power. The UK is not facing one single member, but many different parties with different political activities and, for that, increases the chances of a early close of the negotiations but in negative. For instance, while the EU has an interest in allowing financial services across the borders, the Eurozone countries have their own agenda, increasing the oversight of financial services and maintaining euro-denominated trade within the Eurozone; for this the UK is facing the same political obstacles outside the EU as it did as a member.

3.3 The Results

I have wrote in all the research that the best scenario for the UK economy after Brexit, would be participation as an EEA member. It will impose the least changes to a very beneficial economic arrangement especially for UK and with a good results also for all EU members. With regards to the relationship with the EU, the UK’s political and economic interests do not line up, what is most beneficial for the UK political activates, is the most damaging economically. There is little doubt that the UK will be better off than if WTO obligations set out the framework. With an FTA the UK will gain further access and lower barriers to trade.

However, it is uncertain whether the City of London maintains access to the Single Market, and whether the UK will have to allow an unlimited inflow of EU migrants. The first uncertainty could be very high in cost for the financial sector, although, the City of London has strongly advantage that ensures that it will maintain most of its market and power. The second uncertainty could be seen in positive and negative point of view. If the EU succeeds negotiating the free movement of labour, the UK economy would be better off. If it is clear that the UK government is not willing to allow the considerable loss of sovereignty an EEA agreement would incur, it is questionable if they will allow for free movement of labour.

All in all, only three things are certain:

- EU and UK both have a strong interest in negotiating an open trade relationship;

- UK will strongly oppose losses of sovereignty;

- EU will demand something in return for its concessions on access to the Single Market.

Conclusion

Whit this project my intention is to understand the changes to the UK economies following Brexit. In my investigation of the trade relationship between the UK and the EU, I found that the trade with the EU is vital to the UK economy. If the UK leaves without a trade agreement, its total volume will fall drastically as an effect of not only tariff barriers, but also significant non-tariff barriers to trade.

The UK financial sector has strong comparative advantages and is not likely to be affected so much also after Brexit, though UK will incur a major loss of sovereignty, regardless of the future arrangement between the two parties. This in turn has unknown consequences, as future EU decisions will affect UK financial markets.

For London, as financial centre, it can be argued that it is deeply integrated in the EU financial system. European banks situated in the UK would incur high costs of relocating their activities, and businesses and households would suffer from the loss of liquidity and the higher charges for financial services. On the other point, a few European financial centres might benefit from more inward FDI from non-EU banks looking for a new way in to the Single Market, as Frankfurt, Paris; they stand especially to benefit from euro-denominated trade, as it must take place in the Single Market.

EU banks face significant costs, since they would have to move their wholesale banking activity within the Single Market. EU businesses may migrate to London instead, and some areas like the derivatives trade might move outside of the Single Market altogether.

For the EU side, Brexit will firstly have a direct and tangible effect on the EU budget, which is relevant at a time where most member states are still reeling from the crisis. The EU’s total trade, as well as the financial sector, will incur significant losses if special trade arrangement with the UK are not made. The majority of the individual member states will either be severely affected on trade, financial commerce or immigration. It would make economic sense to press for the UK to join the EEA. Trade and financial commerce would go on, largely and the UK would partially contribute to the EU budget. If the UK joined the EEA, a political goal would also be reached, in that the UK would have to allow the free movement of labour across its borders, and political unrest on behalf of migration would be diverted. On the other hand, there may be broader political implications of Brexit.

The UK will come to set an example for exiting the Union and anti-EU forces will gain ground; for this, the EU has a political interest in raising the costs of exit by refusing special agreements or access to parts of the Single Market. This in turn, would raise the economic costs of Brexit for the EU, which would not incite a positive public attitude towards the EU.

Several have tried to produce a number that could quantify the economic consequences of exiting the EU; but can be at this stage uncertainty. Open Europe went one step further and included scenarios for increased UK trade with the rest of the world. In a worst-case scenario, where the UK fails to reach an agreement and reverts into protectionism, they estimated a fall in UK GDP of 2.2% by 2030. In scenarios with different UK-EU trade agreements, they estimated the economic consequences to be between 0.8% and 0.6% of permanent loss to GDP by 2030.

The most favourable scenario is where the UK receives similar status as Switzerland, where the effects are estimated to bring a loss of 0.6% of GDP by 2030. In the least favourable scenario, the UK loses all trade privileges arising from EU membership and run to protectionism, where GDP would be 3% lower by 2030. It gets worse when the dynamic effects (e.g. loss of competitiveness and innovative power) are included. In this scenario, UK’s GDP in 2030 could be 14% lower than if it had remained in the EU. However, they give no estimation for a positive scenario of open trade policy that includes the dynamic effects. With estimates giving both positive and negative outcomes, it is hard to depict the fallout. Does it even make sense to do? But also the economic consequences of a change of terms, where the future framework is still unknown, and the future terms for the economy, how can one calculate the setback? It can be argued that the Swiss and EEA approaches will not be possible, as either one or both parties will not agree to them. The goal of the negotiations will be to protect the level of openness that the UK and EU already share, rather than breaking down existing trade barriers.

As a result, Brexit will incur a permanent annual net loss between 2-5% of national GDP; from an economic outlook, it can be concluded that Brexit cannot be motivate.

Moving outside the EU, UK will have to give up sovereignty in exchange for market access, and it will have to keep up and adopt harmonising legislation in exchange for market access. Nonetheless, the future integration will be limited to Single Market legislation.

Of course, the ramifications of Brexit reach much further than this analysis. For instance, Brexit are reopening the question of Scottish independence. The economic and political consequences of losing Scotland in the medium of withdraw the EU treatment would indeed be an interesting area for future research. Moreover, it is highly relevant to study how the image of the EU will change and if the EU will lose influence in global affairs.

BIBLIOGRAPHY

Armstrong, A., Portes J. (2016). Commentary: The Economic Consequences of Leaving the EU. NATIONAL INSTITUTE ECONOMIC, [Online]. REVIEW NO. 236, 1-5. Available at: http://journals.sagepub.com/doi/pdf/10.1177/002795011623600101 [Accessed 15 July 2017].

Baker D., Schnapper P. (2015). Britain and the Crisis of the European Union. 1st ed. London: Palgrave Macmillan UK.

Blanchard O. (2015). Macroeconomics. 5th ed. New Jersey: Pearson Economics.

Chow D., Shoenbaum T. (2008). International Trade Law: Problems Cases & Materials. 2nd ed. New York: Aspen Publishers.

Dhingra S., Ottaviano G., Sampson T. (2016). The consequences of Brexit for UK trade and living standards. Centre for Economic Performance, London School of Economics and Political Science, [Online], pp 3-10. Available at: http://cep.lse.ac.uk/pubs/download/brexit02.pdf [Accessed 10 July 2017].

Dhingra S., Ottaviano G., Sampson T. (2016). The impact of Brexit on foreign investment in the UK. Centre for Economic Performance, London School of Economics and Political Science, [Online], pp 3-10. Available at: http://cep.lse.ac.uk/pubs/download/brexit03.pdf [Accessed 10 July 2017].

European Commission (2015). EC (2015d) EU Negotiation Texts in TTIP. Available at: http://trade.ec.europa.eu/doclib/press/index.cfm?id=1230 [Accessed 13 July 2017].

European Commission (2015). EC (2015f) Trade: Investment. Available at: http://ec.europa.eu/trade/policy/accessing-markets/investment [Accessed 13 July 2017].

Eurostep – EEPA (2013). Treaty on the Functioning of the European Union; Title 6: Final Provisions, Article 50. [ONLINE] Available at: http://www.lisbon-treaty.org/wcm/the-lisbon-treaty/treaty-on-european-union-and-comments/title-6-final-provisions/137-article-50.html. [Accessed 21 July 2017].

Financial Times (2015). The City avoids Brexit from trading in euros. Financial Times, [Online]. 1, 1. Available at: http://www.ft.com/cms/s/0/4b5df80a-c26a-11e4-ad89-00144feab7de.html#ixzz3qWDtWQCZ [Accessed 12 July 2017].

Forthomme C. (2015). The ugly side of Brexit. [Online] Available at: http://impakter.com/ugly-side-brexit/[Accessed 8 June 2017].

Holmes P., Rollo J., Winters L. A. (2016). Negotiating the UK’s Post-Brexit Trade Arrangements. NATIONAL INSTITUTE ECONOMIC, [Online]. REVIEW NO. 238, 1-9. Available at: http://journals.sagepub.com/doi/pdf/10.1177/002795011623800112 [Accessed 15 July 2017].

Irwin G. (2015). Brexit: The impact on the UK and the EU. London: Global Counsel.

S. Vasbo. (2015). Economic consequences of Brexit for the United Kindgdom [ebook] Available at: http://studenttheses.cbs.dk/bitstream/handle/10417/5728/sophie_vasbo.pdf?sequence=1 [Accessed 21 Aug. 2017].

Politico Magazine (2016). How Brexit Will Change the World. [Online] Available at: http://www.politico.com/magazine/story/2016/06/brexit-change-europe-britain-us-politics-213990. [Accessed 7 June 2017].

Springford J., Tilford S. (2016). The economic consequences of leaving the EU. [ebook] Centre for European Reform, pp.21-77. Available at: http://www.cer.eu/sites/default/files/smc2016_26april2016.pdf [Accessed 23 Jul. 2017].

Trade & Investment Department, (2015). London: UK Trade & Investment. London: UK Government, [Online]. Available at: https://www.gov.uk/government/publications/ukti-inward-investment-report-2014-to-2015/ukti-inward-investment-report-2014-to-2015-online-viewing [Accessed 10 June 2017].

Velthuijsen J., Bernard L., De Beule N. (2016). Brexit Monitor The impact of Brexit on (global) trade. [Online]. PricewaterhouseCoopers B.V, pp.2-10. Available at: https://www.pwc.nl/nl/brexit/documents/pwc-brexit-monitor-trade.pdf

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Brexit"

Brexit refers to the withdrawal of the UK from the EU on 31st January 2020 following a UK wide vote in 2016 in a referendum held by David Cameron’s pro-Europe government. 51.9% of voters voted in favour of leaving.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: