Impact of New Accounting Standards for Leases and Revenue Recognition on Real Estate Strategy of Listed Banking Companies

Info: 9039 words (36 pages) Dissertation

Published: 9th Dec 2019

Tagged: AccountingReal Estate

The Impact of New Accounting Standards for Leases and Revenue Recognition on the Real Estate Strategy of Listed Banking Companies

Table of Contents

- Introduction 3

- Literature review 5

- Methods 14

- Results 17

- Conclusion and Discussion 27

- Bibliography 31

Abstract

The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) issued their new lease accounting standard in 2016, the clock began ticking on a general arrangement of changes that organizations will need to execute in the following two years. The analysis will evaluation of the impact of the new standards and the future changes in the lease and revenue recognition. Be that as it may, the alterations will be required past the accounting department on the grounds that the new principles will affect any office that arrangements with leases—including obtainment and corporate land—and for all intents and purposes the good part of the frameworks and procedures that organizations use in dealing with their lease information. This paper will give detail information about the impact of new accounting standards for the real estate strategies of listed banking firms. This thesis will focus on the how new accounting standards change buying back leased assets and replacing them by companies or management agreements. This article will focus on how the standard defines and specifies a contract as a lease or containing a lease, and how the respective parties classify their lease transactions, providing examples of how the standard will affect their accounting. By examples having good understanding where and how the standards impact has been changed in the real estate companies. This thesis provides an industry level comparison for investors. By applying positive accounting theory and quantitative methods, which gives better understanding as well.

Introduction

Leasing is defined as a method for giving access to finance and might be characterized as an agreement between two parties wherein one person (the lessor) gives an asset for use to another person (the tenant) for a specified timeframe as a result of determined payments. Leasing, as a result, isolates the lawful responsibility for resource from the financial utilization of that asset. Leasing is a term of financial instrument for the obtainment of machinery, equipment, vehicles as well as properties. On a very basic level, it is asset-based financing with the asset giving the security for the financing. Leasing organizations (lessors)— regardless of whether banks, leasing organizations, insurance agencies, equipment makers or providers, or nonbank financial organizations—buy the equipment that has normally been chosen by the resident, and afterward permit the resident utilization of that equipment for a selected timeframe. For the length of the lease, the resident makes intermittent payments to the lessor, at an agreed rate of interest and in a concurred cash. At the finish of the lease time frame, the ownership (title) in the equipment is transaction to the tenant at a leftover value, or the equipment is returned to the lessor, which may then sell it to an outsider or then again announce it useless and outdated.

Revenue is recognized just when a particular basic occasion has happened and the measure of revenue is quantifiable. Notwithstanding, there are a few circumstances in which special cases may apply. Revenue is at the core of business accomplishment. Everything relies on the deal. All things considered, controllers know how enticing it is for organizations to push the cutoff points on what qualifies as revenue, particularly when not all revenue is gathered when the work is being finished. Development directors regularly charge customers on a level of-consummation strategy. Thus, investigators jump at the chance to realize that revenue recognition arrangements for an organization are generally standard for the business. This additionally guarantees consistent correlation is being made between measurements utilizing details from the income statement.

In 2016, FASB distributed a new lease standard that speaks to an entire upgrade of financial reporting around that department. The new standard ends up powerful for open new businesses, certain not-for-benefits, and certain representative advantage gets ready for yearly periods starting after 2018, and for every single other element, yearly periods starting after 2019. The standard gives a long progress period; nonetheless, it expects elements to take after an altered review approach, under which the required changes would apply to leases existing toward the start of the most punctual relative time frame introduced in the money related proclamations of the year the new standard is received.

This study explores the impact of the new accounting standards for leases and revenue recognition on the real estate strategy of listed banking agencies. The new standards require continuous assessment of leases to decide when an occasion happens that may change the acknowledgment or estimation of the lease, for example, an adjustment in the lease term or an alteration to a current understanding. In a few cases, these developments will oblige a substance to recognize changes that are fundamentally alterations of a current lease and those that constitute new lease arrangement demanding separate accounting. Among the additionally difficult parts of the new standard are prerequisites that the gatherings isolate lease segments inside an agreement and recognize and isolate non-lease segments. The standard is packed with cases of how the gatherings may make such judgments (Singer, Pfaff, Winiarski, & Winiarski, 2017).

In spite of the fact that accounting leasing arrangements under the new standard for the lessor won’t be substantively not quite the same as existing models, a lessor’s acknowledgment of offering benefit and revenue from lease transactions must fit in with a piece of Topic 606 in regards to revenue recognition; if control isn’t transaction, the lessor won’t be permitted to perceive offering benefit forthright (Singer, Pfaff, Winiarski, & Winiarski, 2017). The standard gives various functional catalysts that will enable gatherings to stay away from a portion of the all the more difficult regions of usage. However, the issues identified with new revenue recognition standards which apply to establishment and management understandings are not considered.

Corporate acknowledgement about the evaluated effect of new accounting standards and the acknowledgement of future system are looked at, by methods for content examination, to discover an answer to the question: What is the merged impact of new accounting principles for leases and revenue recognition on the real estate strategies of listed banking organizations?

Lease classification will still have significance for earnings: Operating lease expense will be straight-line, while for finance leases, it’s more front-loaded and shown as interest and amortization expense. This difference in treatment might be outweighed by traditional business factors — financing cost, risks and rewards of ownership, new technology, etc. — which will now determine whether companies opt for an operating lease or finance lease, or conventional purchase. Acquiring long-term assets will now focus on business benefit instead of accounting advantage.

As a result of research, it can be guessed that this point of view has not been included so far in former research. The supposed of the two measures on leases and revenue recognition becomes a knowledge of the difficulties of the new standards merged. Most examinations inside positive accounting hypothesis apply quantitative measures and spotlight on gatherings. The strategy for investigate on operating lease in such examinations depends on valuable capitalization. As opposed to that, a subjective and somewhat interpretive approach is connected in this thesis. Content examination goes past valuable capitalization.

Under existing direction, leases are audited on a lease by-lease premise to decide if the risk and rewards of the leasing development and the utilization of the benefits incorporated into the lease changed hands as a major part of agreement. As of now, the standards are: If the risk and rewards were transaction, the lease would be characterized as capital lease and assets and related liabilities would be accounted for on the balance sheet of the resident. On the off chance that the risk and rewards were not transaction, the lease is characterized as an operating lease – and all costs identified with the lease seem just on the tenant’s income statement.

From an accounting standard, unless leases incorporated certain things such as bargain purchase in other words, purchase the asset below existing business rates—or different words, currently characterized as operating leases. For example, a few airlines opted to lease planes rather than owning them inside and out. Even though these aircrafts utilized their leased planes all the time, they were characterized as operating leases, which means the utilization of the assets and related liabilities were not considered on their balance sheet. Subsequently, the investor of the related financial statement was not getting a full snapshot of the expenses acquired by these substances in maintaining their organizations.

The improvements in real estate in the banking business are clarified and factors impacting the real estate description are inspected. From now on the updates of accounting for leases and contracts with clients are explained and the literature review on the implications of the strategy is reviewed into in chapter 2. Chapter 3 will give research questions academic style and the substance of the new standards in accounting. Chapter 4 having detailed information about methods. The results are described in chapter 5. At last the conclusion gathers together this thesis in chapter 6.

Literature Review

2.1 Factors influencing Real Estate Strategy

There are four key factors influencing real estate strategy market. Demographics, interest rates, economy, and government policies. First, factors influencing real estate strategy is demographics. Location are the information that portrays the organization of a population, for example, age, race, sex, pay, migration patterns and population growth. These measurements are a regularly ignored however huge factor that influences how real estate is valued and what categories of properties are preferred. Major shifts in the demographics of a country can large affect real estate patterns for quite a few years.

Second, important factors influencing real estate strategy is interest rates. In case someone thinking about purchasing a home with a home loan it is useful to examine financing costs utilizing a mortgage calculator. Changes in loan costs can extraordinarily impact a person’s capacity to buy a private property. That is because the lower interest rates go, the lower the cost to get a home loan to purchase a home will be, which makes a higher interest for real estate, which again drives costs up.

Another key factor, that influences the estimation of real estate is the economy. This is for the most part estimated by monetary markers, for example, the GDP, employment information, making movement, the costs of merchandise, and so on. In short, when the economy is slow, so as real estate business.

Lastly, the government policies are another factor that affecting real estate strategy. Performing is additionally another factor that can sizably affect property demands and costs. Tax credits, deductions and donations are a helping of the ways the government can incidentally help interest for real estate for whatever length of time that they are set up. Monitoring current government motivations can enable you to decide changes in free market activity and recognize possibly false patterns.

A similar thinking in view of genuine choices hypothesis can be connected to approach the adjustment in accounting standards. A conceivable change in accounting principles is a case of regulations. On the off chance that, started by new accounting strategy, one or a few of the systems end up being less positive, the organization can choose to stop or decrease the interests in that specific undertaking. This is relying upon the adaptability of that specific procedure.

In the last, explanations behind picking operating lease and charge construct systems can be based with respect to the fundamental normal for the nation, condition and the firm. Firms can incline toward non-value procedures because of artful conduct keeping in mind the end goal to build up cockeyed sheet financing. Restricting reasons are organization objectives, for example, control, benefit, firm esteem, stable wage and business or to adjust to requests of outsiders. New accounting standards are a factor also since they can influence the choices in real estate strategy in light of genuine alternatives hypothesis as an exogenous helplessness.

2.2 New Accounting Standards for Leases and Implications

In the financial statements all the more loyally speak to the substance of financial geniuses of operating leases, the Financial Accounting Standards Board and International Accounting Standards Board bundled their activities (FASB, 2016). According to FASB issued new guidance, a lease will be required to recognize assets and liabilities for leases with lease terms of more than twelve months. Consistent with current Generally Accepted Accounting Principles (GAAP), the recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on its classification as a finance or operating lease. However, unlike current GAAP which requires only capital leases to be recognized on the balance sheet the new accounting standards will require both types of leases to be recognized on the balance sheet.

The new accounting standard also will require disclosures to help investors and other financial statement users better understand the amount, timing, and uncertainty of cash flows arising from leases. These disclosures include qualitative and quantitative requirements, providing additional information about the amounts recorded in the financial statements. The accounting by associations that own the assets leased by the tenant also known as lessor accounting will remain largely untouched from current GAAP. However, the new accounting standards contains some focused-on upgrades that are proposed to adjust, where important, lessor accounting with the lessee accounting model and with the refreshed revenue recognition direction issued in 2015.

FASB and IASB boards presented almost same kind of guidance, except two statements, which is income statements and cash flow statements. The both boards concur that a right-of-utilization asset and a lease liability should be accounted for on the announcement of financial statement position, independently from the list of leases. This implies all lease gets that surpass a year development will be promoted. Vital to note is the way that variable lease payments in view of performance obligations, for example, income or benefit are excluded morally justified of-using asset and are expensed about.

According to Arimany (2015) transaction about remark letters of nine banking networks on the recommended lease standards with the financial statement ramifications in view of a valuable strategy. This investigation inferred that the themes talked about in the remark letters line up with the normal effect on budgetary proportions. Use, liquidity and return are altogether influenced when helpfully promoting operating leases and adding one more point, Arimany (2015) additionally proposed a conceivable lessening in operating leases and a conceivable increment in management contracts in the banking business.

To combined it up, the banking business’ budgetary proportions, for example, leverage and liquidity are probably going to be harmful influenced by capitalizing operating leases. Earlier research did not give indisputable discoveries about return on assets (ROA) and return on equity (ROE). The particular discoveries for the banking business identify with the discoveries of concentrates with a more extensive illustration. Later, for this Thesis it can be expected that the accounting rules and regulation for leases will negatively affect the accomplishment percentages of banking networks.

2.3 New Accounting Standards for Revenue Recognition and Suggestion

In 2016, the FASB and IASB issued a few alterations and illuminations to the new revenue recognition standard, essentially because of issues raised by share owners and talked about by the Transition Resource Group. Revisions were made to the direction identified with the central versus specialist appraisal, recognizing accomplishment commitments, representing accounting licenses of protected bank endorsement, and different issues. An element can apply the new revenue recognition standard reflectively, including utilizing certain useful catalysts. On the other hand, a substance can perceive the aggregate impact of applying the new standard to existing contracts in the opening balance of retained earnings on the viable date, with appropriate exposures.

The unit of record for revenue recognition under the new standard is a performance obligation. An agreement may contain at least one performance obligations. Albeit characterized in an unexpected way, the nearest similarity in the present vernacular to a performance obligation would be a “deliverable” under the numerous component arrangement revenue direction. Performance obligations will be represented independently on the off chance that they are unmistakable. A good or management is particular if the client can profit by the good or management either all alone or together with different assets that are promptly accessible to the client, and the good or management is unmistakable with regards to the agreement. Generally, performance obligations will be joined with other guaranteed products or managements until the point when the element recognizes a heap of merchandise or managements that is unmistakable.

The transaction cost is dispensed to all the different performance obligations in an arrangement. It mirrors the measure of transaction to which a substance hopes to be entitled in return for exchanging merchandise or managements, which may incorporate a gauge of variable transaction to the degree that it is likely of not being liable to noteworthy inversions later on in view of the element’s involvement with comparative plans. The transaction cost will likewise mirror the effect of the time estimation of cash if there is a noteworthy financing part show in a course of action. The transaction cost prohibits sums gathered for the benefit of outsiders, for example, a few deals charges.

Revenue will be perceived when a substance fulfills every performance obligation by exchanging control of the guaranteed merchandise or managements to the client. Products or managements can transaction at a point in time or after some time contingent upon the idea of the arrangement. Particular criteria are accommodated when a performance obligation is fulfilled after some time.

FASB has kept up a double approach for money articulation arrangement for the two lessees and lessors. Lease characterization will be resolved comparatively to existing lease prerequisites, which call for deciding if some lease transaction significantly every one of the dangers and prizes of proprietorship to the lessee. The new standard will expect lessees to represent most existing capital lease as finance leases, where amortization of the right-of-utilization resource will be perceived independently from the enthusiasm on the lease obligation. Most existing operating leases will stay operating leases for income statement recognition under the new FASB direction, with acknowledgment of a solitary lease cost for the most part on a straight-line basis over the rest of the lease term. FASB and the IASB utilize comparative models for order by lessors, however the IASB has a solitary model for tenants, with all leases represented as financings on resident pay proclamations. By the by, FASB and the IASB concur that leases make right-of-use assets and lease liabilities that should to be perceived on the balance sheet.

There is a special case to balance sheet recognition for leases with a term of one year or less, or one year with a renewal choice if the alternative isn’t sensibly sure to be worked out. Under U.S. GAAP, lessees can make an accounting standard decision to keep on accounting for these like current operating leases and recognize lease expense straight-line over the lease term. The boards allow lease direction to be connected at a portfolio level in specific cases, however FASB’s direction is in its reason for conclusions while the IASB’s is in its application direction and gives express quantitative exclusions. The IASB likewise will have a special case for little esteem leases.

Under FASB’s model, lessors should to perceive benefit toward the banking of the lease when the leasing arrangement is adequately an offer of the advantage by the lessor. FASB requires that the benefit be conceded and perceived over the lease term if the tenant does not acquire control of the leased asset. Under the IASB’s model, a maker merchant lessor should to perceive benefit toward the banking of the lease, paying little heed to whether the lessor transactions the underlying asset.

Finally, in literature review on the effect of the new revenue recognition standards is uncommon contrasted with scope about the new standards for leases. According to Rutledge, Karim, and Kim (2016) expect a higher shot for profit management to happen by means of conceded expenses, judgements and standards because of the new revenue recognition standards. Besides, the likeness inside the business is diminishes with the new standards since direction is less particular.

Finishing up, the management examination comes from estimations when a performance obligation is incorporated into the agreement with a client. This could prompt pioneering conduct and a hazard for the organization of misquotes.

Methods

This study followed a quantitative pre-experimental model, using one-group pretest-posttest design. The new strategy is to be connected later on and changes in methodologies must be seen in the announcements of the organizations. Henceforth, this research has a subjective nature and the information is generally account. Theory can’t be tried like a quantitative investigation. Rather, this examination gives direction to future research on the connection between the accounting modifications and procedure once the principles are connected. Because of this explorative character, investigate questions are produced to show signs of improvement comprehension of the impacts. The conceivable changes in land methodology and the examination questions are inferred by joining results of previous research. In view of honest another hypothesis, accounting standards are a factor of weakness as it has a place with the legitimate condition of an organization. The restored accounting standards on leases and revenue recognition are an appearance of weakness. Accordingly, a re-evaluation of the real estate strategy is normal.

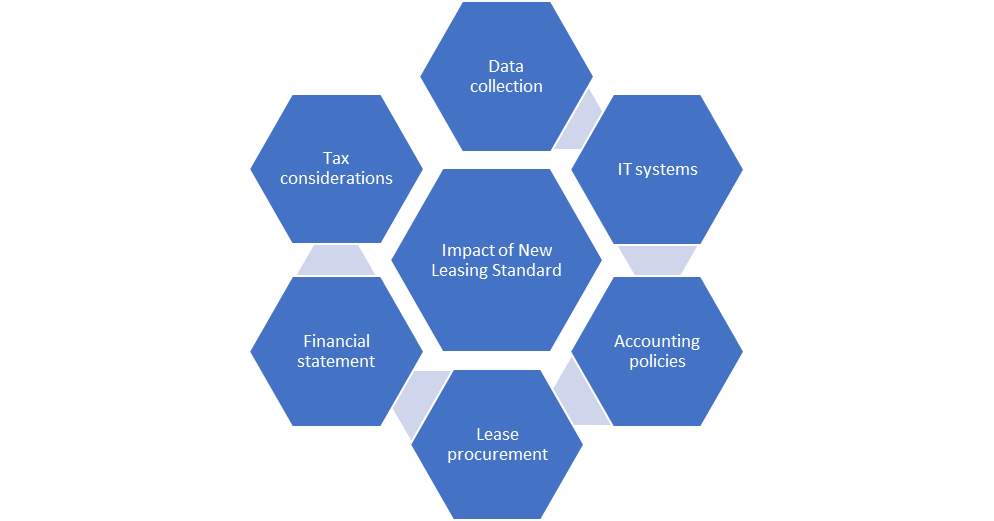

Table 1 shows how the new leasing standard affect all six departments. This thesis will explain how impacting new leasing standard and where the effect by each department. First department, is affect by impacting new leasing standard is data collection and ongoing data management. To figure out what changes are important to apply the new standard, a good part of the preparatory work will spin around surveying the condition of an organization’s present lease contract information service (i.e., its frameworks, approaches, procedures and controls), counting the information required for financial reporting purposes.

Organizations that as of now have efficient lease organization also, accounting capacities may basically need to assess whether their current frameworks, approaches, procedures and controls require adjustment to accommodate the adjustments in the new standard. Be that as it may, while existing frameworks (e.g., spreadsheets and programming) may incorporate some lease data, they might not have all of the data required to make the estimations, judgements (counting on-going evaluations) and data for exposures important to conform to the new standard. Accordingly, huge exertion could be required to physically assemble missing lease data. Different organizations (e.g., those with lease acquisition, lease organization and lease accounting capacities that are goodralized relying upon the specialty unit, geographic area, or sort of leased resource) could have a testing venture ahead. For such organizations, deciding the culmination of the lease portfolio, and the precision and fulfillment of the lease information, may require significant exertion.

Second department, is affect by impacting new leasing standard is IT systems. The present lease related IT frameworks are frequently composed fundamentally to help with lease organization, and numerous are centered around genuine home leasing or a lessor’s interest in leased resources. In any case, lessors generally utilize spreadsheets to supplement necessities for current lease accounting and announcing in light of the fact that the present lease related IT frameworks frequently do not have the abilities to play out the figuring required for accounting.

To fulfill the new monetary articulation introduction and divulgence necessities, organizations should assess whether to refresh their current frameworks or to actualize another framework. Choosing or on the other hand refreshing a lease IT framework will presumably require input, not just from accounting, yet in addition from the lease organization furthermore, IT capacities, contingent upon the organization’s endeavor asset arranging (ERP) condition. While actualizing any IT framework, it is essential to characterize framework necessities and the desires of important partners before choosing a business.

In the event that an organization applies the new standard on a full review premise, upon application, it will be required to repeat relative revealing periods. Moreover, organizations may need to keep isolate books for outer detailing, neighborhood statutory prerequisites and duty purposes. This will expand the IT framework prerequisites, and may likewise additionally convolute procedures what’s more, controls. Distinguishing, creating and actualizing changes to IT frameworks are difficult activities, and the measure of time fundamental would rely upon the inheritance frameworks set up. Organizations that are by and by planning or updating IT budgetary detailing frameworks would be all around encouraged to consider the new standard as a feature of their present IT improvement endeavors. This could decrease the danger of exorbitant re-work and upgrade at a later date. Organizations additionally should to be careful that despite the fact that IT projects can help aggregate information and perform computations required by the new standard, they are not an entire arrangement; no program can make the basic assessments or judgements required by the new standard.

Third department, is affect by impacting new leasing standard is accounting policies. The new standard requires the utilization of judgment and estimates. For instance, assessing whether a plan meets the meaning of a lease could require judgment for certain plans, for example, those with a critical service segment. The updated meaning of a lease could bring about a few game plans accepting diverse accounting standard analyzed to current guidelines. Other key choices requiring judgment include lease payment and the lease term, including the continuous assessments of the lease term and the representing lease alterations. While the IASB expects a large number of the conclusions to be the same under the new standard, a considerable lot of the judgements what’s more, evaluations may get expanded examination since lease resources and liabilities will be accounted for on the asset report for generally leases.

Forth department, is affect by impacting new leasing standard is lease procurement. Under the new standard, renters will perceive the present esteem of lease payments over the lease term as a risk on the monetary record. Like current accounting, the meaning of lease payments rejects certain variable payments, and the lease term incorporates just those lease term choices that are sensibly sure of being worked out. All things considered, residents may reassess their needs while arranging their lease terms and payments. A higher extent of variable payments contrasted with settled payments or shorter lease terms may bring about littler lease liabilities. A few residents may reassess in the case of purchasing a benefit would be more favorable than leasing it. At any rate, organizations going into new lease today should to know about the potential effect of the new standard on their money related articulations. Albeit some of these ways to deal with limiting the lease risk seem beneficial from a budgetary explanation introduction point of view, residents should to comprehend that there are sure monetary and business dangers related with such approaches. In this way, organizations should to think about any progressions to their way to deal with lease contracts with regards to their fundamental business prerequisites. For instance, an organization may consider adjusting a lower lease risk from a shorter lease term for a property against the security of longer-term get to the premises. Further, lessors might be reluctant to go up against the extra hazard related with variable payments and shorter introductory lease terms.

Fifth department, is affect by impacting new leasing standard is financial statement. For most tenants, the new standard will bring about a gross-up of the accounting report. This could cause a decomposing of obligation proportions also, return on resources contrasted and current accounting. Certain administrative proportions may likewise be affected. An organization must to survey the potential effect on its financial measurements and assess how this may influence the way partners see its financial statement position and performance. Organizations will probably need to teach inward and outside partners on financial statement of the new standard. A few organizations envision the need to better oversee the correspondence of key execution pointers to partners under both current lease accounting and the new standard among the change time frame. Also, organizations must to recognize whether compensation (e.g., rewards) and obligation plans must to change in light of the new standard.

Last and sixth department, is affect by impacting new leasing standard is tax consideration. Appropriation of the new standard will bring about extra assessment related contemplations. These incorporate understanding the effect of the lease accounting changes on existing expense positions, introductory acclimations to conceded charges and following book/impose contrasts. Organizations should decide vital changes to tax-related procedures and controls required to recognize and track charge alterations. The effect on duties will, obviously, rely on the fundamentals of the particular assessment purview and whether and how they are changed to mirror the fundamentals of the new standard.

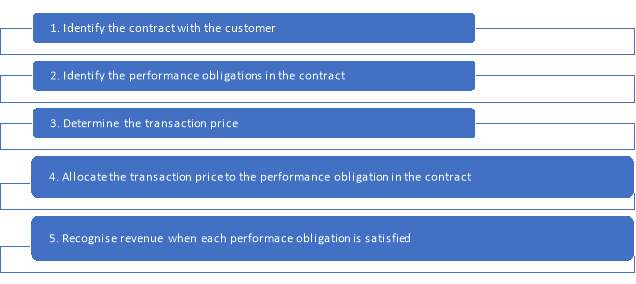

Table: 2 Five steps of New Revenue Recognition Standards

Table 2 shows the five different steps of new revenue recognition standards. This thesis will show detail in each step. First step, is identified the contract. This is very straightforward step whereby particular criteria must be met to have a contract. In particular, the contract must have business substance, the guaranteed products and ventures must be recognized and endorsed, and the installment terms distinguished.

Second step, is identified performance obligations in the contract. This is appropriate when an element transaction in excess of one good or service to the client and the extra good or service is unmistakable. All together for a good and service to be particular it could be sold independently or the client can profit by the good or service either all alone or together with promptly accessible assets. However, a good or service isn’t particular if it’s packaged with different products and ventures; if the business services are exceedingly interrelated; and if the merchandise and enterprises are fundamentally adjusted or customized.

Third step, is determined the transaction price. As per the new revenue recognition standards, the transaction cost “is the measure of transaction to which the substance hopes to get for the transaction of the guaranteed merchandise and services.” In conclusive the transaction value, service should consider over the variable transaction, time, estimation of cash, non-money transaction, and transaction payable to the client. The assurance of variable transaction will require critical measure of judgment. Variable transaction incorporates things, for example, rebates, discounts, refunds, and royalties. In assessing the transaction value, the substance would use the expected value method.

Forth step, is allocated the transaction price to the separate performance obligations. A business decides this in view of the relative independent offering price of every performance obligation. In deciding the independent offering value, service needs to recognize performance obligation. On the off chance that none exist service should utilize a technique for estimation to decide the independent offering price. When this has been resolved they dispense the measure of transaction anticipated that would every one of the different performance obligation.

Last and fifth step, is recognized revenue when the entity satisfies a performance obligation. The new model requires that management make more measures and judgments in grounds of recognizing separate performance obligations, deciding the transaction value, variable consideration, the portion of the transaction cost, and when control has been transferred. This expansion in appraisals and judgments imply that service should evaluate and refresh inward controls and procedures to stay away from fraud or misrepresentation. Also, management should figure revenue changes to decide any critical changes in the financial statement to maintain a strategic distance from any pledge violation. These progressions in future revenue should be broke down for any potential assessment arranging openings when the standard become effective.

This qualitative case study described the boards expectation to reduce off-balance sheet accounting. Then again, earlier research gave confirm on non-deft utilization of operating leases as it is an after-effect of productive contracting. If off balance sheet accounting isn’t the inspiration for a firm to utilize operating leases, the firm may demonstrate a “negligible reaction” to the new lease principles. Contradicting to that, regardless of whether banking organizations engaged in operating contracts without acting artfully, the effect of the new standards can influence the monetary record fundamentally. This was demonstrated by valuable capitalization, which would be a contention for changing the land standard regardless of whether it was a consequence of proficient contracting. Banking organizations are relied upon to diminish the effect of capitalization of operating leases. Accordingly, the main expected response is: The measure of operating leases is lessened later on (Spence and Webb, 2015).

This study took place in organizations changed parts of existing contracts to change from financial leasing to operating leasing. The adaptability inside the standard gave motivation to change the authoritative document of the agreements. This could occur with the new lease accounting standards also. Both IFRS and US GAAP don’t commit capitalization of variable payments in view of offers. Short-term lease is excluded from capitalization also. It isn’t practical to lease properties for one year, from a control viewpoint. Consequently, here and now lease contracts are not anticipated that would be utilized for land methodologies. Henceforth, the second expected response is: Operating lease contracts incorporate more factor payments in view of accomplishment later on.

A move towards variable lease contracts is normal, the progression towards a banking management agreement winds up smaller. This implies administrators acquire a level of the income and benefit, rather than paying the lessor for the utilization of the property. Based on money streams, variable establishment understandings are practically identical to banking management agreements, the two payments are depending on execution as far as income as well as benefit. A move towards management agreement is more probable contrasted with a move towards diversifying since the level of control of management understandings is like leasing (Ivanova, 2016). The new revenue recognition standards require underwriting variable payments. The potential danger of confusion and debilitation could be moderated by building up less factor payments. Be that as it may, from a rule operator perspective this would risk the certainty of the proprietor of the property about the long-term duty of the managing the banking network. Also, the new revenue recognition standards are relied upon to make more noteworthy investigation for the directors because of the judgmental rule for execution subordinate income (Rutledge, 2016), which could bring about an inspiration for administrators to decide for management understandings over leasing. Consequently, the third expected response is: Operating leasing is displaced by management understandings later on. In view of the three expressed expected responses over the accompanying examination question is inferred. RQ 1: Does the real estate strategy of banking organizations change because of the accounting standard changes for leases and revenue recognition in any of the accompanying ways? a) reducing operating leasing, as well as b) replacing settled installment operating leasing by factor installment operating leasing, as well as c) replacing operating leasing with banking management.

According to Smith and Toffler, Agency theory give the framework between expected changes in strategy and narrative voluntary about these progressions. The connection between the accounting standards and real estate strategy is relied upon to be detectable in account divulgence. Banking organizations with moderately numerous leasing, diversifying and management agreement are influenced more. Such banking organizations will probably expect more extreme and negative ramifications of the new accounting standards. Divulgence about the negative impact of the new measures would influence the capital suppliers’ suppositions about the prosperity of the firm. This would constrain the organizations to adjust to the new standards and convey their standard to win back the certainty of the capital suppliers, in spite of the conceivable issues of introducing sensitive data. In this manner, the disclosure about the ramifications of the accounting corrections are relied upon to identify with revelations about the real estate strategy. Thus, the second research questions include a relationship: RQ 2: Are banking organizations that convey expected negative ramifications of new accounting rules more motivated to disclose changes in the real estate strategy?

According to the Staff Accounting Bulletin “the divulgence of the effect that as of late issued accounting standards will have on the financial statements of the registrant when received in a future period” (SEC, 2016). This can positively affect the exposure amount and nature of firms receiving US GAAP. Because of more exposure about the effect of new accounting rules the capital suppliers of US GAAP embracing firms are better educated and could have more worries about the prosperity of the firm. Accordingly, US GAAP receiving firms are compelled to unveil more about the procedure of changing in accordance with the new principles. Thus, the third research question focusses on the administrative management: RQ 3: Are US recorded banking organizations which convey negative implications of new accounting rules more inclined to change the real estate contrasted with non-US recorded banking organizations which impart negative ramifications of new accounting rules?

The exploration questions are replied by utilization of a substance examination strategy. This is a for the most part subjective approach and is somewhat in view of subjective judgements, yet in addition some quantitative measures are utilized to investigate the result of the substance examination. Content investigation on organizations account exposures gives the benefit of surveying forward-looking ramifications. As a rule, quantitative methodologies are practiced by scholastics to discover the impact of accounting arrangements on the financial statement proclamations. Indeed, even before the execution, quantitative methodologies, for example, valuable capitalization or accrual-based methods are utilized frequently. The utilization of a substance examination gives an extra advance past these quantitative methods.

Quantitative Research is used to quantify the problem by way of generating numerical data or data that can be transformed into usable statistics. It is used to quantify attitudes, opinions, behaviors, and other defined variables – and generalize results from a larger sample population. Quantitative Research uses measurable data to formulate facts and uncover patterns in research. Quantitative data collection methods are much more structured than Qualitative data collection methods. Quantitative data collection methods include various forms of surveys online surveys, paper surveys, mobile surveys, and kiosk surveys, face-to-face interviews, telephone interviews, longitudinal studies, website interceptors, online polls, and systematic observations.

Various sources of data can be utilized for social event data about corporate correspondences that think about the distinctive advances. The 10K-filings and yearly reports are hotspots for the acknowledgment of changes in the accounting models and its normal effect. Yearly reports likewise offer understanding in unveiled future standards. Extra material from official statements and investor introductions is used as hotspot for future system divulgence. This data is found on the home page of the chose organizations, particularly in public statements and speculator relations areas. The time degree is on the financial years 2015 and 2016. Search information sources and sources are basically recorded to ensure straightforwardness of the information gathering process. With a specific end goal to decide the land methodology the sources have been perused in look for data about the future land system. This has been executed as though the perused was a concerned financial specialist searching for the planned bearing as articulated by the administrators. Divulgences about the effect of the two principles are gathered independently. Three measurements are utilized per standard: 1) regardless of whether the standard is examined, 2) how this effects the firm and 3) whether purposes behind this effect were imparted.

| Information Questions | Answers |

| New Standard Discussed? | Yes/No |

| Will apply New Accounting Standards? | Yes/No |

| What are the reasons? | Significant/Insignificant |

| How its impact? | Negative/Neutral/Positive |

| Are current strategy changes? | Yes/No |

Table 3: Data Collection Framework

The codes were created already for a few measurements, for other more entangled issues, for example, the conveyed expected effect, imparted reasons and the future system, starting coding is connected. After all sources were gathered they were broke down deliberately in the request as displayed in Table 1 above. To start with, it was confirmed whether the standard was incorporated into a section of the 10K/yearly report that arrangements with the effect of recently issued accounting standards. The codes for the answer yes or no. The second measurement, will company apply new accounting standards? The codes for the answer is yes or no. The third measurement, what are the reasons? The codes for the answer is “Significant” or “Insignificant”. The froth measurement, How its impact? The codes for the answer is “Negative”, “Neutral”, or “Positive”. Last and fifth measurement, is strategy changes? The codes for the answer is yes or no.

The initial example included 30 recorded banking agencies in the US and Foreign with FASB/IASB as standard. The sample of US firms is chosen in view of the file of banking organizations of NYSE reached out by firms that were incorporated into the business benchmark file of NYSE Banking Stocks (US Banks, 2018), barring on the grounds that those are not working banking. For foreign banking firms, the yield the search entry “Bank” on website of Seeking alpha created the great part of the example. This was stretched out with particular surely understood Bank firms that don’t convey “Banking” in their name. Among the information gathering process additional data was gathered about the organizations in the underlying dataset. The rundown was narrowed to 30 organizations. For the IFRS test organizations that were recorded in Foreign were picked. Subsequently, Achievement, IFA and Well-designed were evacuated because of the area (Asia, Kuwait and Canada). The banking companies was evacuated in light of the fact that every single yearly report was in German. HDFC Bank has just a single bank and was accordingly expelled too. For the US GAAP test Wells Fargo Bank was evacuated as it converged. Banking was evacuated since the organization is Chinese.

Research question 1 is replied by concentrating on data about the future procedure. Research question 2 is replied by looking at discoveries about the assessment of the effect of the two norms and the future standard. Research question 3 is replied by part the example by year and accounting standard compose.

Results

4.1 Data description

The dataset comprises of data extricated from corporate interchanges of 30 recorded bank organizations with 45 years perceptions about the assessment of the two recently issued accounting principles. The last permits to contrast the interchanges of 2015 and those of 2016. Three organizations did not report about the monetary year 2016 yet. For each organization the future system for land is noted. This brshould about 30 outlines.

The example by administrative management is organized beneath. The example comprises of 14 US GAAP adopters and 10 IFRS adopters.

The wellsprings of data for the organizations included yearly reports, monetary reports and friend’s introductions. For particular points of interest of the sources utilized please observe Appendix 2. The Tables 2 and 3 demonstrate an outline of whether the new standard was said and a rundown of the bank organizations in the example (see Appendix 1 for the entire rundown of assessments). Part titles that were utilized for the segments communicating the effect of new accounting benchmarks have been noted per organization, these are recorded in Appendix 4. Crude notes, begbanking and optional coding are displayed in the connected Excel record and STATA Data File. The majority of the outcomes depend on an investigation of the engaging measurements. Facilitate engaging insights are in this way introduced in the accompanying passages.

4.2 Results RQ 1 – Changing Strategies

RQ 1: Does the land system of bank organizations change because of the accounting standard amendments for leases and income acknowledgment in any of the accompanying ways? a) lessening working leasing, as well as b) supplanting settled installment working leasing by factor installment working leasing, as well as c) supplanting working leasing with lodging management assertions.

The announcements of the organizations have been screened for passages that particularly express the future standard concerning land. Five organizations in the example have expressed particular designs about lessening leases, variable leasing as well as supplanting lease contracts. Outlines of these procedures are given beneath. The organizations don’t frequently determine whether the (declared) lease payments are variable on execution. What’s more, in some cases the possessed and leased properties are considered all in all, notwithstanding the distinctive hidden standards.

Air conditioning: has framed a vehicle to turn off properties. The backup contains claimed and leased properties. The organization declared that the backup will be sold, this procedure is known as the promoter venture. All leases are incorporated into the sponsor venture with the exception of the variable leases in light of EBITDAR. The control over the backup will be not as much as the larger part, consequently the value standard will be relevant. The advantages are not solidified any more. Management contracts between administrator AC and the to be sold auxiliary are arranged as AC will remain the administrator.

HLT: has shaped a REIT so as to turn off for the most part claimed resources and five leases. It was not determined whether the leases are working or money related leases. The banking are to be worked by HLT through management contracts and diversifying contracts between the administrator and the proprietor.

NHH: has renegotiated and ended lease contracts with horrible conditions before and is resolved to keep doing that. The poor execution of the properties is the

conveyed explanation behind this choice. A few assentions were transformed into establishment understandings. The organization additionally conveyed the sense of duty regarding increment the heaviness of variable leases since this enables the income to be stronger to industry cycles. In addition, NHH has define itself the objective to build management contracts. Some lease assentions are still in the pipeline.

DHG: tries to purchase leaseed properties back. They conveyed that ominous components in contracts are the reason, as the lease payments are relying upon the market costs.

SHOT: every single declared opening by SHOT depend on factor lease contracts.

Every other organization in the example did exclude articulations about leaseing contracts in their advancement designs that particularly managed issues, for example, depicted previously. Be that as it may, most organizations have recommended to expand establishment and management contracts and two organizations, in particular PPH and BEL, have reported to build the leases without indicating whether these are to be founded on factor lease payments. Along these lines, the relative measure of working leases is by and large anticipated that would diminish in the lodging business.

Singer, R., Pfaff, A., Winiarski, H., & Winiarski, M. (2017, November 02). Accounting for Leases Under the New Standard, Part 1. Retrieved April 11, 2018, from https://www.cpajournal.com/3017/08/23/accounting-leases-new-standard-part-1/

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Real Estate"

Real estate consists of land and the buildings and natural features or resources upon it or attached to it, such as trees, water, bridges, fences etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: