Total Cost of Ownership (TCO) and Cost-Differential Frontier Calculator for Suppliers

Info: 10900 words (44 pages) Dissertation

Published: 9th Dec 2019

Tagged: Supply Chain

SOURCING LOCALLY MATTERS

The choice of the competent suppliers is a vital issue for the majority of the companies. In Gulf States Toyota’s (GST) business, the automotive accessory supplier plays a critical role because the supplier creates the majority of the value-adds. Nevertheless, it is worth mentioning to highlight that the most cost-effective supplier may not be the supplier with the lowest purchase price. The cost-effective supplier is the one that depicts the lowest cost to the company, after being weighed in several aspects of supplying, such as quality, supplier performance, the reliability of deliveries, its financial condition, location, etc. The objective of this paper is to discuss the methodology of using the Total Cost of Ownership (TCO) and Cost-Differential Frontier calculator as a tool to support supplier’s selection. The study provides an understanding of the global sourcing challenges and demonstrates the value creation created by lower risk and vulnerabilities associated with shorter supply chains.

TABLE OF CONTENTS

Introduction and management dilemma

Risk Associated with sourcing from foreign countries

Cost-Differential Frontier calculator

list of figures

Figure 1 GST Dealership in Five States

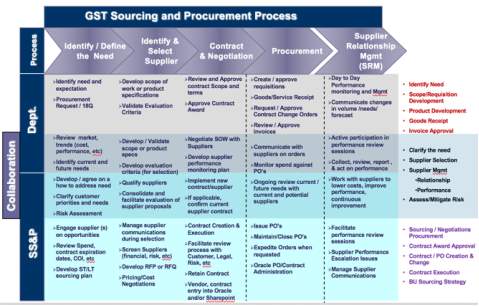

Figure 2 GST Sourcing & Procurement Process

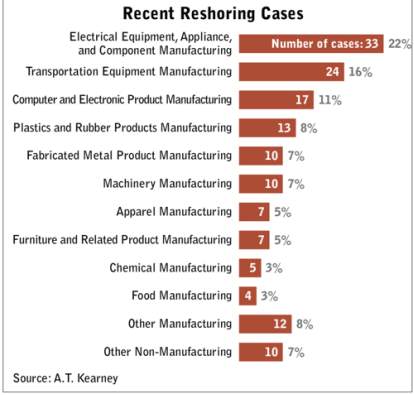

Figure 3 Recent Reshoring Cases

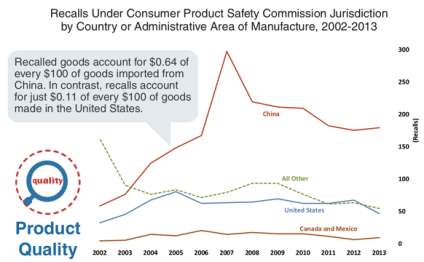

Figure 5 Product Quality over time

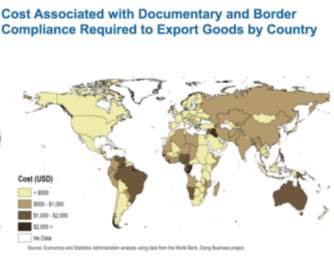

Figure 6 Cost associated with export goods

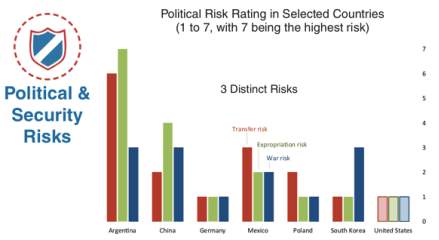

Figure 9 Political Risk Rating

list of tables

Table 4 Cumulative Cost by category

Table 5 CDF calculator analysis

Based in Houston, Texas, Gulf States Toyota (GST) is a privately held distributor of Toyota vehicles and genuine Toyota parts in a five-state region including Texas, Oklahoma, Arkansas, Mississippi, and Louisiana. The Gulf States Toyota Distributors is one of the largest franchised distributors of Toyota vehicles. The 157 dealers in the five states account for 13% of Toyota sales in the United States. Since inception, GST has remained a privately held company. GST’s primary business is providing finished vehicles and parts to the dealer community within the region.

Based in Houston, Texas, Gulf States Toyota (GST) is a privately held distributor of Toyota vehicles and genuine Toyota parts in a five-state region including Texas, Oklahoma, Arkansas, Mississippi, and Louisiana. The Gulf States Toyota Distributors is one of the largest franchised distributors of Toyota vehicles. The 157 dealers in the five states account for 13% of Toyota sales in the United States. Since inception, GST has remained a privately held company. GST’s primary business is providing finished vehicles and parts to the dealer community within the region.

At Vehicle Processing Center (VPC), GST accessorizes all Toyota products distributed to its dealer network. Our processing operations are widely acknowledged as one of the finest and most efficient in the automotive industry. These accessories include, but are not limited to, air-conditioning, radios, CD players, speed control and wheels.

GST also supplies parts to the processing center and its dealer network with a 302,000 square foot Parts Distribution Center (PDC) located in San Felipe, Texas, near Houston. This center stocks over 55,000 different parts such as aluminum wheels, cruise controls, auto security systems and protectant chemicals.

Introduction and management dilemma

The automotive industry is competitive when it comes to selling a car; but when it comes to car accessories, there are many products that come to mind. From tire shine to holders for sunglasses, the automotive accessory market is overloaded with gadget for one of our most commonly occupied areas:

Because new-vehicle buyers are uniquely excited at that moment of purchase, and because accessories can often be easily added into the overall vehicle financing package, dealerships actually have a significant ‘timing’ advantage versus chains and independents when it comes to accessories sales.

GST’s Vehicle Processing Center processes and accessorizes an average of 1000 retail and 40 fleet vehicles per day utilizing advanced processing and inventory systems that use barcodes to track the vehicles through over 25 different accessory installation stations and quality check-points.

VPC installs accessories ordered by dealers such as leather seats, spoilers, roof racks, running boards, alloy wheels, entertainment systems, security systems and more. The sourcing and selecting the right accessories go through the below five-stage process.

Stage One: Ideation – New accessory ideas must be presented to the Accessory Portfolio Manager within the Model Line Team for initial review. This review considers relevance to the series portfolio, applicability, marketability, feasibility, and profitability. Ideas should be supported by a part sample/rendering and information such as part specifications, installation requirements, cost, lead time, and other information that may be requested by Product Development.

Stage Two: Feasibility– New accessory ideas will be studied in depth for feasibility. An analysis is performed to determine whether the supplier is capable of meeting the expectations and whether the product can meet financial expectations.

Stage Three: Development and Final Evaluation – The supplier, in partnership with Product Development, will develop the product manufacturing process, installation equipment/tooling, installation instructions, production-level part approval samples, product packaging and supporting documentation.

Stage Four: Launch – The first purchase order for the product is placed. The Vehicle Processing Center prepares the facility and associates for installation of the product.

Stage Five: Product Life Cycle – Product quality and performance is continuously evaluated by all GST stakeholders. Succession planning and/or end-of-life analysis is performed.

Stage Five: Product Life Cycle – Product quality and performance is continuously evaluated by all GST stakeholders. Succession planning and/or end-of-life analysis is performed.

In GST’s business, the automotive component suppliers play a critical role because the suppliers create the majority of the value-adds. Outsourcing within Chinese automotive component manufacturers is a common strategy which creates an opportunity to reduce cost. However, these cost savings comes with its challenges due to operational gaps: things like quality, physical distance, culture, logistical issues, as well as the language. Domestic sourcing can take over the global sourcing challenges, but management dilemma is to demonstrate the value creation created by lower risk and vulnerabilities associated with shorter supply chains.

In today’s global business market, supplier selection guidelines have traditionally focused on metrics that influence product costs. Sourcing from China has increased tremendously, and lower cost has stated as a significant reason towards this supplier selection criteria. The actual cost of sourcing from China is still to be discovered and should include social, economic and environmental performance. This capstone project aims to investigate the risk of disruption which can cause in operation and real costs of global sourcing from China by recognizing and measuring the different costs contributing to the total purchase cost.

In today’s market, global sourcing through Asian markets is promising alternatives to local sources. In this section, we review literature related to both cost and risk of global sourcing and total cost ownership.

A substantial geographical distance between China and US does not only increase transportation costs but complicates decisions because of inventory cost tradeoffs, different cultures, languages, and practices, that complicate business processes for demand forecasting and material planning. Cost transparency in China sourcing is a challenging task, as the initial production price of a sourced product contrasts with numerous hidden costs for supplier relations, information, intercultural competencies, and supplier relationship management (WETZEL, 2012).

The potential barriers and adverse outcomes of global sourcing have also been well documented (Herbig and O’Hara, 1996). The disadvantages of global sourcing include political risks, exchange rate fluctuation, brokers’ and agents’ fees, cash flow issues and communication. Meixell and Gargeya (2005) argue that “substantial geographical distances not only increase transportation costs but complicate decisions because of inventory cost tradeoffs due to increased lead-time in the supply chain.”

Cost savings are found by many researchers as a primary reason for global sourcing, especially sourcing from developing countries Brodowskya, Tan, and Meilicha (2004). According to Mol et al. (2005), international outsourcing is a balancing act between lower transaction costs locally and lower production costs abroad. Based on Zeng and Rossetti (2004), the manufacturing cost is significantly lower in developing countries; however, the extended distance and many other difficulties associated with international trade often complicated the earnings. In addition, outsourcing to China involves the increased problems related to differences in culture, language, poor inland transportation, and antiquated customs procedure. Han, Dresner and. Windle, (2008). Pinsker (2015) explains the impact of striking port workers caused leading to considerable economic losses. The effect of such port shut down creates billions of dollars’ worth of business disruption. It also delays months’ worth of supply and jeopardizes manufacturing and production.

According to Weber, Current and Benton (1991), supplier selection criteria literature covers a wide array of topics including the benefits of using selection criteria, specific criteria used for the assessment of suppliers, and decision-making models. Based on Fu-Bin Pan (2015), research reflects changing trends seen in supplier criteria, with a heavy concentration by academics starting in the late 1990s until the present. The patterns move from an emphasis on quantitative approaches to the inclusion of qualitative attributes, then environmental factors and now social criteria. It reflects many different methodologies such as empirical studies, mathematical models, and research about characterizing and quantifying different supplier criteria.

A total cost model is required, to calculate the true cost of the products bought globally (WETZEL, 2012). Though, the methodologies for evaluating the total cost of global sourcing are rare in the academic paper (Fu-Bin Pan, 2015). The exceptions include contributions from WETZEL (2012) and Ken and Song (2000). Based on the research, the cost elements of global sourcing include: unit price, international transportation costs, export taxes, foreign exchange rates, insurance and tariffs, cost of rejects, brokerage costs, damage in transit, inland freight cost, risk of obsolescence, inventory holding costs, employee travel costs, technical support, etc. Despite, this list is far from complete. Some of the other cost include such as the supplier selection and negotiation, the setup costs, etc. are not covered. This paper research on testing the complete framework and investigate the breakdown of all cost contributing to the total procurement cost of sourcing from China.

Product advancement in the car business has for the most part been a reaction to client requests, in spite of the fact that item situating is an essential vital variable for automakers. As far back as General Motors started creating distinctive sorts of vehicles for various item sections, in this manner finishing the rule of Ford’s low-cost, monochromatic Model T, the capacity to fluctuate items on a few measurements has been the key variable of automakers. U.S. automakers have for the most part been receptive to clients’ wants for solace, speed, and wellbeing, and have created rough drive trains, extravagant suspensions and insides, and a la mode skeleton and bodies. Interestingly, European automakers have concentrated their considerations on execution and nimbleness highlights of vehicles, for example, steel-belted radial tires, plate brakes, fuel infusion, and turbo diesel motors. For Japanese makers, the scaling down culture and the shortage of fuel, materials, and space to a great extent decide the particulars of autos (KUSABA, MOSER & RODRIGUES, 2011).

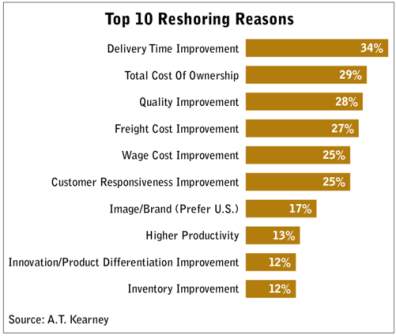

In merely the most recent few years, supply chains the world over have been shaken up by a progression of surprising occasions and advancements. Volcanoes in Europe and South America have disturbed airfreight courses and timetables. The Japanese seismic tremor, wave, and atomic power catastrophe affirmed the delicacy of broadened supply chains. Political insecurity keeps on wracking the Middle East. Wages and monetary forms have been ascending in China and other moderately low-work cost nations (LLCCs). Transportation costs have taken off alongside raw petroleum costs. Those are only a couple of the stuns and interruptions that are driving a few organizations to reconsider their sourcing models. The inquiry for some is whether to seaward (source from far off abroad providers), nearshore (source from providers found nearer to end markets) or “re-shore” (source inside a devouring business sector that has lost assembling to bring down cost nations) (Kumar, Andersson & Rehme, 2010).

Add up to cost of proprietorship (TCO) ought to be a key component in the choice to embrace new sourcing models. A TCO investigation will help to dispassionately recognize the sources that limit add up to cost, incorporating those related to the danger of other production network stuns and interruptions. At the point when the more significant part of the necessary expenses and risks are considered, organizations may find that assembling near the purpose of utilization—” getting back home,” one may state—is the best decision.

Numerous organizations still settle on sourcing choices construct just in light of cost. Others choose given the money related idea “cost of merchandise sold” (CGS), which may likewise incorporate cargo, obligation, and bundling for large, discrete items. Landed cost by and large is like the cost of merchandise sold for acquired parts or items. Add up to cost of proprietorship is significantly more extensive. It incorporates those expenses and also others that are frequently disregarded; for instance, costs influencing income, for example, crisis airfreight and go to review a provider. TCO likewise considers stock is conveying costs and unsurprising future costs, for example, out of date stock. Different costs that factor into TCO are not found in monetary explanations. For instance, there is an “open door cost” related with the powerlessness to react rapidly enough to clients’ requests for specific amounts or highlights. Harder to anticipate are chance related costs, for example, those caused by political shakiness or catastrophic events. These are only a couple of illustrations; the rundown of possibly significant expenses is lengthy. That, and the way that vast numbers of the expenditures are independently little, can’t be found in monetary proclamations, or can’t be effortlessly evaluated by a bookkeeping framework, are among the reasons why numerous organizations settle on sourcing choices in light of components that are far less demanding to quantify yet don’t give an entire cost picture. Before the current state of the production, network stuns, numerous organizations were happy with settling on sourcing choices construct just in light of wage rates or buy costs. They were ready to disregard various expenses because the wage/value hole between ease nations and other assembling areas was so extensive. In any case, since they principally thought about costs and did not consider the whole cost of offshoring, that procedure might not have been as beneficial as they accepted. His oversight is a typical one. A 2009 review directed by Archstone Consulting, for instance, found that 60 percent of producers overlook 20 percent or a more significant amount of the cost of offshoring.1 Similarly, 61 percent of respondents to a 2010 study led by the worldwide counseling firm Accenture recognized the need to execute TCO.2 This state of mind may at long last be beginning to change. One sign is that IDC Manufacturing Insight investigator Simon Ellis incorporated “a more extensive perspective of aggregate cost” that will support close shoring and reshoring in his “Main 10 Supply Chain Predictions for 2011” rundown. “With regards to taking a more extensive perspective of aggregate cost, inventory network associations will pick up another gratefulness for shortening lead times through gainful closeness sourcing systems,”

The rundown of store network “stuns” toward the start of this article recommends why organizations are progressively keen on TCO as an instrument for deciding the best sourcing methodology. Apparently, the related expenses and dangers of offshoring have changed, and subsequently, some offshoring that was painful in the past could now be productively re-shored.

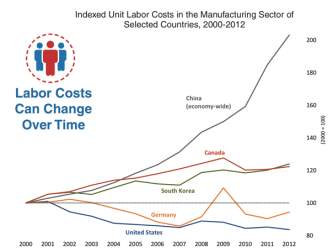

Business conditions are changing so rapidly, indeed, that some long-held presumptions about minimal effort sourcing are quickly getting to be old. For instance, organizations are currently addressing whether China is as yet the most lucrative area for assembling. Boston Consulting Group4 and Accenture5 as of late announced that net per-unit fabricating costs in China are quickly merging with those in some U.S. states. One motivation behind why is that Chinese wages are rising 15 percent to 20 percent for every year, except profitability stays beneath that in U.S. manufacturing plants.

Business conditions are changing so rapidly, indeed, that some long-held presumptions about minimal effort sourcing are quickly getting to be old. For instance, organizations are currently addressing whether China is as yet the most lucrative area for assembling. Boston Consulting Group4 and Accenture5 as of late announced that net per-unit fabricating costs in China are quickly merging with those in some U.S. states. One motivation behind why is that Chinese wages are rising 15 percent to 20 percent for every year, except profitability stays beneath that in U.S. manufacturing plants.

Furthermore, the Yuan is bit by bit acknowledging (roughly 6 percent for each year). It is required to rise quicker as China battles a swelling rate that is a few times the U.S. rate and advances a more grounded cash keeping in mind the end goal to diminish the cost of imports. The reality of the matter is that crude material expenses are about the same in the two nations, and Chinese time-based compensation rates are relied upon to stay far underneath U.S. levels for quite a while to come. In any case, if organizations take an aggregate cost of possession see that incorporates both immediate and aberrant expenses and dangers, at that point much of the time it won’t bode well for them to source from China. Be that as it may, China isn’t the central seaward assembling area where costs are quickly rising, in this way those sources likewise justify reevaluation.

The Reshoring Initiative, a charitable association, devoted to helping organizations decide the practicality of assembling in their nation of origin (fundamentally the United States, however, the gathering’s methodology applies to any country), has built up a technique for ascertaining the aggregate cost of possession. The Reshoring Initiative’s trademarked Total Cost of Ownership Estimator programming is situated partially on the components that roused many U.S. organizations to effectively re-shore items extending from little shopper gadgets, for example, headphones to more significant, more work escalated things like water radiators and car parts.

To decide the aggregate cost of proprietorship, the client doles out an incentive to each factor that is pertinent to the particular case and afterwards collects an only value an encouragement for an item sourced from a specific provider. The client at that point rehashes the procedure, substituting different sellers. Along these lines, it is conceivable to promptly and dispassionately analyze the TCO for a similar item from numerous merchants, regardless of whether neighbourhood or seaward.

Risk Associated with sourcing from foreign countries

In the auto parts sector, rising labor costs have put more pressure on manufacturers and distributor like us, whose profit margins have been much thinner, giving low-cost manufacturing the winning edge. The auto parts sector in China benefits directly from rising manufacturing and transportation costs. However, the path to development of a product should consider the below cost and risk factors before considering a low-cost manufacturing option. The auto parts sector, rising labor costs have put more pressure on manufacturers and distributor like us, whose profit margins have been much thinner, giving low-cost manufacturing the winning edge. The auto parts sector in China benefits directly from rising manufacturing and transportation costs. However, the path to development of a product should consider the below cost and risk factors before considering a low-cost manufacturing option.

In the auto parts sector, rising labor costs have put more pressure on manufacturers and distributor like us, whose profit margins have been much thinner, giving low-cost manufacturing the winning edge. The auto parts sector in China benefits directly from rising manufacturing and transportation costs. However, the path to development of a product should consider the below cost and risk factors before considering a low-cost manufacturing option. The auto parts sector, rising labor costs have put more pressure on manufacturers and distributor like us, whose profit margins have been much thinner, giving low-cost manufacturing the winning edge. The auto parts sector in China benefits directly from rising manufacturing and transportation costs. However, the path to development of a product should consider the below cost and risk factors before considering a low-cost manufacturing option.

- Labour cost

If hourly labour costs at a given point in time were the only measure of the cost of operating overseas, then the decision to go abroad would be straightforward. The perception that labour costs are decisive helped fuel movement of U.S. manufacturing abroad in recent decades, and businesses continue to cite labour costs as a top factor driving the decision about where to locate production. Indeed, raw hourly labour costs are significantly lower in some other countries.

However, this assessment of the cost of manufacturing outside the United States can be short-sighted. The expected savings from inexpensive foreign labour can be whittled away over time in numerous and unexpected ways. Labour costs can change quickly and substantially. Labour turnover in some countries can be particularly high, which directly leads to additional spending on recruiting new workers and indirectly to wage increases in order to maintain existing staff. Labour cost savings also may be partly offset by the risks of labour unrest and increasingly restrictive labour laws.

- Product Quality

China’s automotive components industry faces many quality-related challenges. China lacks access to high-quality domestic raw materials. Many companies are being forced to import raw materials at an increased cost to meet quality requirements. While we use agents when manufacturing in China, who is responsible for assuring the efficiency and quality of the manufacturing of our goods along the process. Companies still lack the crucial engineering know-how needed to comply with federal vehicle safety standards. For GST, Chinese manufacturer does not have access to Toyota Cars or Trucks to test the products, which means the manufacturers have to depend on third-party testers/suppliers who are available domestically. It adds on to the testing time, and any product deficiency adds additional time and cost of the product.

China’s automotive components industry faces many quality-related challenges. China lacks access to high-quality domestic raw materials. Many companies are being forced to import raw materials at an increased cost to meet quality requirements. While we use agents when manufacturing in China, who is responsible for assuring the efficiency and quality of the manufacturing of our goods along the process. Companies still lack the crucial engineering know-how needed to comply with federal vehicle safety standards. For GST, Chinese manufacturer does not have access to Toyota Cars or Trucks to test the products, which means the manufacturers have to depend on third-party testers/suppliers who are available domestically. It adds on to the testing time, and any product deficiency adds additional time and cost of the product.

- Energy

There are many physical inputs to consider in the manufacturing process, and their relative costs can sway cross-country comparisons considerably. The discussion below focuses on three – energy, raw materials, and land – and underscores how quickly costs can change. Over the last few years, the United States has experienced a boom in natural gas production, lowering prices and dramatically increasing the availability of natural gas as both raw material and a source of energy. Meanwhile, the United States remains among the most attractive locations for energy infrastructure and efficient real estate markets. Inexpensive U.S.-produced natural gas has multiple industrial uses ranging from onsite electricity generation to process heating, space heating, steam generation and petrochemical processing. The low cost of natural gas mixed with its flexible use are factors in the United States’ favor when firms make total cost assessments.

-

Logistics and Distribution system

Logistics and Distribution system

Logistics is a critical element to the total acquisition cost for any part sourcing. With sea transportation, risks of quality and safety increase and inventory levels increases. A longer supply chain will frequently involve long lead time which will result in less reliable forecasts, reduced production versatility, more significant challenges to adjust to order changes and higher levels of inventory. Shipping by sea takes approximately thirty days, and domestic shipping can make it in one day. So if there is any forecast error, this may turn in to lost sales of reasonable twenty-nine day period when there are no goods in stock.

- Intellectual Property

The difficulties of moving business operations to a foreign country are complicated when intellectual property (IP) considerations are involved. Intangible assets, such as IP, are inherently abstract and are often difficult and expensive to define and value. Also, IP systems vary considerably from one country or territory to the next and judging which foreign countries offer the best IP protection is difficult. Economists have struggled with these comparisons and can still offer only approximate measures of IP protection in various countries. Because of this, protecting and enforcing IP effectively in an unfamiliar jurisdiction can create considerable cost and risk.

The difficulties of moving business operations to a foreign country are complicated when intellectual property (IP) considerations are involved. Intangible assets, such as IP, are inherently abstract and are often difficult and expensive to define and value. Also, IP systems vary considerably from one country or territory to the next and judging which foreign countries offer the best IP protection is difficult. Economists have struggled with these comparisons and can still offer only approximate measures of IP protection in various countries. Because of this, protecting and enforcing IP effectively in an unfamiliar jurisdiction can create considerable cost and risk.

U.S. companies are encouraged to take the necessary steps to protect their IP, both in the United States and in foreign markets. IP protection is territorial, so taking steps to secure IP in one country or territory does not automatically confer protection in another.32

However, for U.S. companies operating abroad, there are several initial, ongoing and potential costs and risks to offshore manufacturing that stem from their IP resources. Some issues related to IP are obvious, such as the cost of obtaining patent or trademark rights. Other issues are difficult to quantify, such as the ways in which patent infringement can erode a company’s competitive advantage. Moreover, costs and risks can change over time, raising the potential for currently viable ventures to become less viable in the future. Companies should consider these costs and risks carefully before offshoring their operations.

- Increased purchasing risk

International purchasing always involves a series of purchases, and companies usually buy the materials on a larger scale, which requires higher monetary transactions. Larger scale transactions expose to more significant risks due to currency fluctuations. Moreover, the cross-border trade results in complicated procedures and processes, which presents the company with lots of additional existing potential risks.

- Inventory

Long, cross-border supply chains usually increase the lead time between when an order is placed and when the product is received – leading to increased inventory costs.

Inventory costs due to long lead times often add 20-30% to product costs. These additional inventory costs often outweigh the benefits of offshoring – even without considering other hidden costs of far-flung supply chains.

Inventory costs due to long lead times often add 20-30% to product costs. These additional inventory costs often outweigh the benefits of offshoring – even without considering other hidden costs of far-flung supply chains.

The expected mismatch cost arising from a long lead time between ordering product and knowing the final market demand for that product needs to be considered when comparing unit costs. An offshoring supplier with low direct costs may seem initially compelling before considering the cost of overstocks or stockouts, but a far-flung supply chain will often turn out to cost more than responsive local production.

The Cost Differential Frontier available from the University of Lausanne makes it possible to estimate the expected mismatch cost so that it can be included in deciding whether to produce locally. The tool shows that the cost offered by a supplier offering a long lead time needs to be over 25% cheaper to cover moderate mismatch costs. Alternatively, the tool shows that it is worth paying a premium of over 35% to eliminate a very long lead time.

Firms hold inventory to meet short-term demand surges and buffer against delayed or defective deliveries. Having a far-flung supply chain increases the risks of these contingencies, thus requiring more inventory. According to The Economist, companies importing from abroad may have to hold up to 100 days of inventory in the United States. Authors of another academic study calculated that, when companies in their dataset increased the international share of their supply chain by 10 percent, it corresponded to an average increase of 8.8 percent in their inventory investment costs. This drives up not only the cost of acquiring the larger inventory of goods but the carrying costs as well.

A key reason why inventory rises with off-shoring is that the lead time between ordering and receiving components increases.

- Socio-economic and political issues

China has many socio-economic challenges like a shrinking workforce, aging population, the absence of openness to its political system and matters of competitiveness in an economy reliant on high capital spending and the extension of credit. Situations such as civil disturbance, capital controls, armed conflict, and expropriation can be challenging to assess. Fortunately, various institutions and insurers provide means to help assess the related risks across countries. Disaster preparation is another factor to consider – companies must evaluate such costs and the ability of its economy to quickly and adequately respond to earthquakes, hurricanes, and other natural disasters. The United States continues to offer stable and anticipated conditions for business investment and consistently ranking among the countries with the less political and security risks for companies and their workers.

China has many socio-economic challenges like a shrinking workforce, aging population, the absence of openness to its political system and matters of competitiveness in an economy reliant on high capital spending and the extension of credit. Situations such as civil disturbance, capital controls, armed conflict, and expropriation can be challenging to assess. Fortunately, various institutions and insurers provide means to help assess the related risks across countries. Disaster preparation is another factor to consider – companies must evaluate such costs and the ability of its economy to quickly and adequately respond to earthquakes, hurricanes, and other natural disasters. The United States continues to offer stable and anticipated conditions for business investment and consistently ranking among the countries with the less political and security risks for companies and their workers.

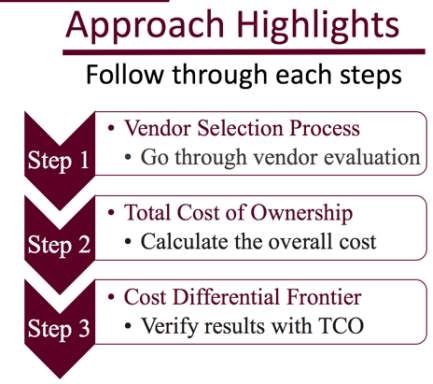

Amongst the existing cost-based methodologies it is essential to maintain the importance of methods that are appropriate in the final stage of the decision process such as the Zero-based pricing (ZBP), Cost-based supplier performance evaluation, Life-cycle costing (LCC), and also the Total Cost of Ownership (TCO). The life-cycle costing considers the purchase price and the costs the organization incurs to use, maintain, and eventually get rid of a particular material, equipment, product, or part (Ell ram, 1995). The cost-based supplier performance evaluation and the zero-based pricing are two methods used to analyze the total costs incurred by a particular supplier. These methods give specific consideration to the costs of “doing business” with each supplier, including costs before the purchase moment (Ell ram, 1995). For this project, the TCO methodology will be applied to the suppliers of electronic parts, plastic components, and metal.

Amongst the existing cost-based methodologies it is essential to maintain the importance of methods that are appropriate in the final stage of the decision process such as the Zero-based pricing (ZBP), Cost-based supplier performance evaluation, Life-cycle costing (LCC), and also the Total Cost of Ownership (TCO). The life-cycle costing considers the purchase price and the costs the organization incurs to use, maintain, and eventually get rid of a particular material, equipment, product, or part (Ell ram, 1995). The cost-based supplier performance evaluation and the zero-based pricing are two methods used to analyze the total costs incurred by a particular supplier. These methods give specific consideration to the costs of “doing business” with each supplier, including costs before the purchase moment (Ell ram, 1995). For this project, the TCO methodology will be applied to the suppliers of electronic parts, plastic components, and metal.

An increasing number of factors in global markets have motivated organizations to search for competitive advantages considering their entire supply chain. Among the various activities involved in supply chain management, supplier selection is regarded as one of the most important decisions because it enables organizations to reduce costs, and thus, increase profits. Suppliers can also be involved in product design at an earlier stage, and, in doing so, generate more cost-effective design choices, develop alternative conceptual solutions, select the best components and technologies and assist in design assessment (Monczka, Trent, and Callahan 1993).

Supplier selection is regarded to be one of the most significant activities of purchasing managers in a supply chain. Selecting the right suppliers significantly decreases the purchasing cost and increases corporate competitiveness. Several methods have been developed to date, which addresses the needs of the supplier selection process. Studies on supplier selection focused on 23 supplier attributes that managers consider when choosing a supplier. The study concluded that quality, on-time delivery and performance history were the three most important criteria for supplier evaluation. Several studies emphasized the relative importance of various supplier criteria such as price, quality, on-time delivery and performance (Lehmann and O’Shaughnessy 1974; Wilson 1994; Kannan and Tan 2002).

- Requirement definition

First of all, establish the requirements for the product or service. The scope of the product or service must be defined along with a team and should cover both functional and non-functional requirements.

- Market research and first vendor filtering

The objective of this step is to get a short list of vendors, for which you want to start a Request for Proposal. Study the market for potential vendors that could meet your requirements. If you need further information from vendors to be able to generate a short list, you might perform a ‘Request for Information’ (RFI).

- Request for Proposal (RFP)

Based on the requirements in step one you conduct an RFP by making a formal request to bid with the selected vendors. To compare apples to apples, the RFP needs to have a definite structure and make it clear to the vendors to what and how to respond.

- Evaluate responses and Vendor Risk Assessment form

Before reviewing and assessing the replies of the vendors, build an evaluation sheet based on the RFP. The evaluation sheet will be the basis for the decision for objective criteria; its goal is to minimize human emotions and bias, which can occur in this phase very often.

- Optional: Proof of Concept (PoC)

With a PoC you can verify the vendor’s actual capability to deliver. It is possible to do PoC all the time and should be mentioned in RFP when requesting for one.

- Enterprise Quality Manual

Quality Manual provides standard procedures for delivering and managing the procedures, policies, documentation, and responsibilities, that must be in place for the vendors to comply with their regulatory duties.

- Optional: Site Visit

With a site visit, you can verify vendors facility and manufacturing process.

- Product Testing

Product testing can be conducted either in-house or sourced to a third party testing agency.

- Supplier Selection and local install

Select the vendor, based on the ranking of the evaluation sheet and results from the PoC. Provide the change management documents and training to install the new product or accessories.

The Total Cost of Ownership (TCO) is a methodology developed to manage the total cost of ownership of a service or product provided by a supplier, through a comprehensive study of the different cost items which made the true value of procuring from a specific supplier. According to Ferrin and Plank (2002), the Total Cost of Ownership (TCO) is a methodology used in leading companies in worldwide supply chains. TCO aims to determine the true cost of buying a particular good or service from a particular supplier, accounting for it all costs associated with the purchasing activity (Degraeve et al.,2005). The TCO method considers additional costs such as expenses on the implementation of an order, costs with searching activities and qualification of the supplier, transportation costs, insurance costs, warranties, product inspection and quality costs, replacement possibilities, downtime caused by failures, etc.

The study has been done focusing all around in the United States, yet the aggregate cost of possession idea and system can enable organizations in any nation to comprehend and measure the estimation of nearby sourcing. For some items, the base cost of those sourced in low-work cost nations will quite often be lower than the value for a similar thing produced in higher-work cost areas. At the point when organizations concentrate just on cost and work, they minimize every single other need. Organizations that utilize TCO, notwithstanding, more often than not find that the more significant part of other expenses would support generation near the end client. TCO unwinds a few imperatives on organizations. When it turns out to be certain that there isn’t much contrast between the aggregate cost of possession for privately made and fresh items, an organization could choose to put more accentuation on an item separation or brand-picture methodology. It may seek after neighbourhood cost-decrease programs, for example, lean, the hypothesis of requirements (TOC), plan for make and gathering (DFMA), snappy reaction fabricating (QRM), or computerization that may have appeared to be inadequate to close the valve hole previously.

Equitably re-assessing sourcing choices utilizing all out the cost of possession speaks to a stable, viable reaction to recently comprehended store network delicacy and the changing intensity of lower-work cost nations. At the point when organizations verify that the most beneficial hotspot for vast numbers of their items is nearby, they will be capable of lessening their expenses as well as to unwind requirements on advancement and item methodologies while limiting their presentation to the stuns of neighbourhood calamities and world fiscal emergencies.

U.S. examples of reshoring

| Company and location | Product | Offshore source | Benefits of re-shoring |

| Freeman Schwabe Machinery, Cincinnati, Ohio |

Hydraulic die-cutting presses | Taiwan | Reduced warranty claims by 90% Cut speed to market by 30 days |

| Master Lock, Milwaukee, Wisconsin |

Combination locks | China | U.S. productivity 6x higher Lower total cost |

| Morey Corporation, Woodridge, Illinois |

Circuit board component | China | Better quality Reduced inventory by 94% |

| Bailey Hydropower, West Knoxville, Tennessee |

Hydraulic cylinders | India | Fast delivery versus five weeks Fewer supply chain problems Eliminated shipments of poor-quality units |

| Intex Technologies, Hudsonville, New York |

Foam arm pads for furniture | China | Can now ship just-in-time Reduced one customer€™s inventory from 13 weeks to 2 hours |

| Peerless Industries, Aurora, Illinois |

Audiovisual Mounts | China | Shorter lead time Better control of processes Reduced carbon footprint Faster product launches |

Customarily, Total Cost of Ownership (TCO) has been a computation proposed to enable purchasers and proprietors to decide the immediate and aberrant expenses of acquiring an item. In-store network administration, merchant oversaw stock projects include dealing with the procedure up to and including the purpose of utilization of a mechanical production system. For this situation, the count incorporates the immediate and roundabout cost of acquiring an item, however, reaches out past the acquisition procedure to incorporate the expenses brought about all through the production network to guarantee a smooth reconciliation into the last gathering.

The materiality and estimation of every part of the TCO in Supply Chain Management will differ essentially by thing relying upon particular qualities, some of which include:

- Value of the item

- Least amounts of order

- Material constituent

- Physical qualities

- Technique for conveyance/lead time/cargo and coordination

- Survey of resource

- Unpredictability of demand

- Life-cycle of the order or item/ depreciation

- Progress management expenses

- Submission

- Order handling costs

- Opportunity costs

Value of the product or item, minimum order prerequisites, material constituent, physical qualities, strategy for conveyance and lead time, the wellspring of supply, instability of interest, and item life cycle all impact gathering and stocking choices in a legitimately managed production network. Understanding these segments and their individual effect on speculation necessities and venture chance is basic to comprehension the TCO. These parts affect the stock-preparing and holding costs, for example, warehousing work, inhabitance, and financing costs. For instance, high esteem things result in higher financing costs while littler, lightweight things (physical qualities) can require next to zero extra offices or work to deal with.

These segments additionally can affect venture hazard, a frequently under the assessed segment of TCO. Lead time, the unpredictability of interest, and item life cycle all effect venture hazard as lethargic or out of date stock. The lethargic stock is stock with no action for drawn-out stretches of time and the outdated stock is stock that has achieved the finish of its item life cycle. A detailed examination is basic to advance stock for these segments.

Order processing expenses may appear like a conspicuous part of TCO, however, the materiality of its effect on TCO can change significantly in view of the already specified segments and considerably more altogether starting with one association or industry then onto the next. For instance, a capital equipment producer might not have similar frameworks and efficiencies in its request preparing approaches as an electronic assembly house with frameworks intended to deal with a higher number of segments and buying exchanges. Supply chain management frameworks drive order handling philosophies concentrated on opportune and proficient correspondence with providers improving request preparing costs disposing of the weight on producers. The span of request handling ought to be incorporated into the lead time of a decent and is specifically connected to the request preparing cost. Improved frameworks with the correct part profiles finish arranging forms momentarily.

The application for a thing specifically impacts the aggregate cost of possession. Understanding the application characterizes a building, quality, and specialized necessities. The best in-store network administration organizations take part in understanding applications to add skill particular to item classes outsourced. For instance, items used in high temperature or destructive situations may require confirmation of providers and materials joined with particular plating all with next to zero resilience of fluctuation in the assembling forms.

Seller oversaw stock expenses are the single greatest variable in understanding the aggregate cost of proprietorship in inventory network administration once getting by the item qualities. Creating customized programs that match client necessities and desires expects scrupulousness as does understanding the cost of those administrations. A few clients might confront limit issues restricting accessible space bringing about offsite stockpiling and varieties in the kind of program expected to encourage the smoothest stream of products to mechanical production systems. Others may have abundance limit and want higher volumes of on location stock requiring lower renewal costs. Store network specialists dissect your procedures and build up a program to enhance the aggregate cost of possession for your circumstance.

The cost of opportunity lost is the utmost overlooked section of the collective price of ownership. Where do you create the most esteem? What is the lost opportunity on the off chance that you are removing time from your centre abilities? The extra work and scrupulousness to precisely quantify and streamline the aggregate cost of proprietorship takes the centre and an accomplice who perceives the procedure as a major aspect of their competency so you can centre on yours.

The calculation of the Total cost of ownership (TCO) has been around for quite a long time in its least complex shape. For inventory network administration organizations, the condition has been stretched out alongside combination in clients’ forms, enhanced examination, and the want to be the best in our centre abilities.

Total Cost of Ownership (TCO) is the lone most vital value in all of supply chain management. It measures and processes expenditures. The value of TCO has wedged profitable discussions by increasing the thin limitations of Value to a massive field of chances for achieving Win-Win consequences. Anybody can get a lesser value. The objective of worthy trade is to achieve the lowermost TCO.

In specialized procuring, we can decrease the spirit of the whole thing that we do to a lone term – Cost. Any castigation dwindling underneath the canopy of Supply Chain Administration can be understood and articulated in relations of Cost. Price and rate are connected in that the Finest Price means the lowermost TCO. Many commercial businesses executives sloppily confuse the notions of value and price, using them interchangeably. To describe them basically, the value is the cash coming in, the charge is the cash going out and income is the variance. Income is the residue after deducting the cost of price. For this cause, cost administration is vital to corporate accomplishment. For two businesses vending at modest values, the upper-cost business recognizes lesser incomes. Rudimentary finances display that high costs are evil for the industry.

Well, what exactly is TCO, how is it calculated and how does it distress cooperation?

First, let us recognize the four basics of cost and validate the influence of all on TCO.

The four basics of cost are:

Quality, Service, Delivery, and Price (QSDP)

TCO =the summation of the cost essentials in QSDP, or TCO = Quality + Service + Delivery + Price

Numerous details about TCO must be acknowledged and valued to demeanour an operational cooperation:

Each part of QSDP has an influence on the TCO

The prominence of each part differs with the merchandise or service being bought

The comparative burden of each component hinge upon our valuation of the TCO effect on our corporate.

The uniqueness and mass of each component is a continuous portion of the unremitting cooperation procedure.

Online training in purchasing, negotiation, and sales

Price is not only diverse from cost but the price, in fact, is just one component of cost. The influence of the other basics typically dwarfs the influence of price.

Cost-Differential Frontier calculator

Many companies have been offshoring manufacturing production to lower-wage countries. As a result, the need to make production determinations before understanding demand has exposed these companies to demand volatility, and managers have seen predicted profits melt away. Offshore suppliers may propose a unit cost that is up to 30% lower than that of a local manufacturer but that while requires the order be placed far in advance before knowing the demand. The decision between an offshore or local supplier thus often gets down to how much is known about demand when the order is placed.

Setting the order volume in the front of uncertain demand results in mismatch risk. Ordering fewer amount results in lost sales and unhappy customers. If demand turns out to be more than what was needed, then it may be necessary to sell products at a discount.

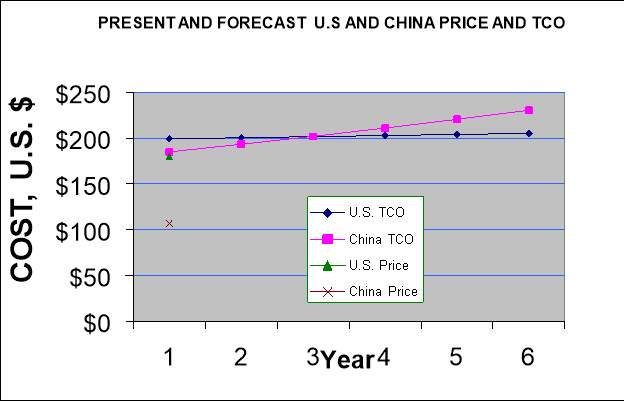

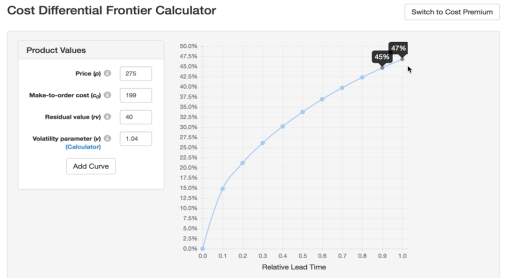

The Cost-Differential Frontier calculator developed by Professors Suzanne de Treville and Norman Schürhoff of the University of Lausanne’s Faculty of Business and Economics (HEC) takes a quantitative-finance approach to calculating the true cost of extending the supply chain. This tool calculates the cost savings that offshoring needs to offer to compensate for the increased risk of stock-outs or oversupply based on a company’s expected demand volatility, lead time, and the residual value of the product when held in inventory over an extended period. This estimation of the required cost differential complements the TCO estimator results: the two tools together provide a full picture of the cost of extending the supply chain (Treville, Suzanne de, 2014).

The critical result of the analysis is that these unknown inventory mismatch costs frequently exceed the benefits of offshoring even before other risks associated with extending the supply chain are considered.

The automotive industry has traditionally focused on vehicle marketing and sales. However, in light of declining vehicle sales and evolving customer purchasing habits, OEMs and distributors have taken an active interest in promoting and enhancing accessory sales because of their high-profit margin. The retail model for accessory sales increases profitability and is vital for boosting automotive dealerships demonstrate their value to existing and potential customers.

Studies indicate that 80% of accessory purchases take place at the time of buying of a new vehicle. This symbolizes our strategic position for accessory sales is a necessary sales process while being at dealership rather than being positioned in an after-sales strategy.

In this case study, we are discussing the sourcing process behind the running boards for Toyota Highlander. Running boards are found on everything from larger pickup trucks and SUVs to smaller crossovers, providing a comfortable step and added aesthetic value. Running board provides a stepping surface to the vehicle. Unlike sidebars that mount down and away from the vehicle, running boards typically offer more ground clearance, making them an excellent choice for lower vehicles like Highlander.

Running boards historically have been sourced from a Chinese manufacturer, where the accessory is usually cost-effective. For Highlander, running boards have two options, sourcing either through a Chinese Manufacturer for which the lead time was sixty days or the US Manufacture where the lead time was twenty days. Table 2 provides pricing submitted by vendors for the same product. The pricing includes the cost of the product, shipping, packaging, and labor.

| TCO Tool Inputs | |||

| U.S. | Offshore | ||

| Unit Price $ | $180.00 | $107.00 | |

| Units/ | 12,000.00 | ||

| Unit Weigh, packaging, lbs. | 57 | 58 | 54 |

| Shipments/year | 30 | 6 | |

| Packaging, % of price | 3% | 6% | |

| Shipment time, mos. | 0.04 | 1 | |

| Annual carrying cost, in transit, % of price | 8% | ||

| Annual carrying cost, in warehouse, % of price | 22% | ||

| Delivery time from order to receipt mos. | 1 | 2 | |

| Quality, rework, warranty, % of price | 1% | 3% | |

When selecting the best vendor for each product, the company uses a TCO computation method in which are inserted different data about the component, their prices, and other external factors. The result of the TCO calculation details the purchase cost, i.e., the price of the part, the initial cost of tools and molds, the price of packaging, inventory costs, quality, shipping costs, and other costs.

The TCO method requires several inputs for the computation of the final cost. The TCO tool needs data of five different levels: Cost of goods sold, risk, strategic, green and other hard costs. The outputs produced by the tool are summarized in same five categories as it is shown in Table 3. The detailed results for the first three years of the product and the overall results of the TCO by the supplier is presented in Table 4.

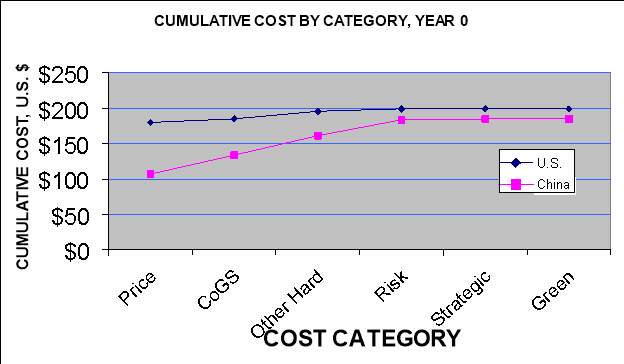

Table 4 Cumulative Cost by category

As the figure shows, the cost of running board manufacturing in the United States is approximately 19 percent lower than the cost of manufacturing in China.

The vital source of savings from coming back to the U.S. is in reduced inventory costs. Since the demand for the running board has a strong seasonal component, the summer shopping season causes a heavy demand spike every year. However, estimating the demand spike’s size and timing makes ordering and storing the right amount of inventory an expensive, risky endeavor. Because of its long supply chain, we had to carry extra inventory, which meant spending on goods that might never be needed, and these costs were substantial.

| Price per unit sold: | $275 |

| Unit cost to make in US (make-to-order cost): | $199 |

| Offshore unit cost (make-to-stock cost): | $185 |

| Residual value: | $40 |

| Residual value: | 1.04 |

Table 5 CDF calculator analysis

The CDF analysis (blue curve) confirms that the unit cost offered by the offshore supplier must be 47% cheaper than a local supplier that can manufacture to order once demand is known. The offshore product cost does not include a demand volatility exposure. Thus, the value of producing locally is expected to offset offshore cost advantages. The CDF and TCO tools thus combine to provide a compelling case for the value

The CDF analysis (blue curve) confirms that the unit cost offered by the offshore supplier must be 47% cheaper than a local supplier that can manufacture to order once demand is known. The offshore product cost does not include a demand volatility exposure. Thus, the value of producing locally is expected to offset offshore cost advantages. The CDF and TCO tools thus combine to provide a compelling case for the value  of responsive local production.

of responsive local production.

47%

Conclusion

In GST’s business, the automotive component suppliers play a critical role because the suppliers create the majority of the value-adds. Outsourcing within Chinese automotive component manufacturers is a common strategy which creates an opportunity to reduce cost. However, these cost savings comes with its challenges due to operational gaps: things like quality, physical distance, culture, logistical issues, as well as the language. Domestic sourcing can take over the global sourcing challenges, but management dilemma is to demonstrate the value creation created by lower risk and vulnerabilities associated with shorter supply chains. In conclusion, the application of TCO and CDF can contribute to higher levels of sourcing efficiency, by reducing business costs and therefore increasing company’s profit.

References

Chaodong Han, Martin Dresner, Robert J. Windle, (2008) “Impact of global sourcing and exports on US manufacturing inventories”, International Journal of Physical Distribution & Logistics Management, Vol. 38 Issue: 6, pp.475-494, https://doi.org/10.1108/09600030810893517

F. (2015, September). The Optimization Model of the Vendor Selection for the Joint Procurement from a Total Cost of Ownership Perspective. Retrieved November, 2017, from https://upcommons.upc.edu/bitstream/handle/2117/84210/Fubin%20Pan.pdf

Herbig, P. and O’Hara B. (1996) “International procurement practices: a matter of

relationships”. Management Decision Vol. 34, No. 4, pp. 41-45.

Holweg, M. (2010, May 01). On risk and cost in global sourcing. Retrieved November 18, 2017, from http://www.sciencedirect.com/science/article/pii/S0925527310001234

Kusaba, K., Moser, R., & Rodrigues, A. (2011). Low-Cost Country Sourcing Competence: A Conceptual Framework And Empirical Analysis. Journal Of Supply Chain Management, 47(4), 73-93. http://dx.doi.org/10.1111/j.1745-493x.2011.03242.x

Kumar, N., Andersson, D., & Rehme, J. (2010). Logistics of low cost country sourcing. International Journal Of Logistics Research And Applications, 13(2), 143-160.

Karsak E, Dursun M. Taxonomy and review of non-deterministic analytical methods for supplier selection. International Journal Of Computer Integrated Manufacturing [serial online]. March 2016;29(3):263-286. Available from: Computer Source, Ipswich, MA. Accessed April 8, 2018.

“Managing country-of-Origin choices: competitive advantages and opportunities.” International Business Review, Pergamon, 10 Nov. 2004, www.sciencedirect.com/science/article/pii/S096959310400099X#tbl1

Meixell, M.J. and Gargeya, V.B. (2005). “Global supply chain design: a literature

review and critique”. Transportation Research Part E Vol. 41, pp. 531-550.

Mol, M. J., van Tulder, R. J. M. and Beije, P.R. (2005). “Antecedents and performance

consequences of international outsourcing.” International Business Review Vol. 14,

pp. 599-617.

Pinsker, J. (2015, February 24). How 14,000 Workers Managed to Slow Down the Entire Economy. Retrieved November 18, 2017, from https://www.theatlantic.com/business/archive/2015/02/how-only-14000-workers-briefly-slowed-down-the-entire-economy/385858/

Platts, Ken, and Ninghua Song. The True Costs of Overseas Sourcing. May 2009, www.pomsmeetings.org/ConfPapers/011/011-0643.pdf.

Su, Ping and Shuguang Liu. “Dual Sourcing in Managing Operational and Disruption Risks in Contract Manufacturing.” International Journal of Production Research, vol. 53, no. 1, Jan. 2015, pp. 291-306. EBSCOhost, doi:10.1080/00207543.2014.957876.

Treville, Suzanne de. “Valuing Lead Time.” Journal of Operations Management, vol. 32, 9 July 2014, pp. 337–346., pdfs.semanticscholar.org/db46/2bd0b3c44f5aa533028de94452f6994b86bc.pdf.

“Vendor selection criteria and methods.” European Journal of Operational Research, North-Holland, 22 May 2003, www.sciencedirect.com/science/article/pii/037722179190033R.

Walker, R. & Wilson, J., (2012). Nokia’s supply chain management. In SAGE Business Cases. 2017. 10.4135/9781473970984

WETZEL, SHANNON. “Calculating Total Cost.” Modern Casting, vol. 102, no. 11, Nov. 2012, pp.36-42.EBSCOhost,

libezproxy.tamu.edu:2048/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=egs&AN=835

.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Supply Chain"

A Supply Chain is a system in place between companies and their suppliers, from producing a product to distributing it ready to be sold. An effective and smooth running supply chain can contribute to the successful running of a business.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: