Analysis of Tesco Plc Losses from 2014-16

Info: 10454 words (42 pages) Dissertation

Published: 2nd Sep 2021

Tagged: Business Analysis

Table of Contents

4. Proposed research Methodology design and approach

5.1 Analysis of Porter’s 5 Forces

5.2.1 Return on Capital Employed (ROCE)

5.3.3 Inventory Turnover Ratio

5.6 Equity Comparison/ Changes in Total Equity over the year

1. INTRODUCTION

The research paper is primarily focused on the huge annual loss of £6.4 billion in April 2015 incurred by Tesco PLC, a British multinational grocery company (U.K.2016). The report is going to entail reasons why such a big loss was faced by the company which took the retail world by surprise as Tesco been setting examples since its birth (Adewuyi, A. 2016).

Tesco was started by Jack Cohen, who started selling fish paste and golden syrup in 1919. The Tesco name first appeared in 1924, after Cohen purchased a shipment of tea from T. E. Stockwell and combined those initials with the first two letters of his surname, and the first Tesco store opened in 1931 in Burnt Oak. By 1939, over 100 Tesco stores were operating across the country. Tesco has diversified into areas such as the retailing of books, clothing, electronics, furniture, toys, petrol, software, financial and internet services. Throughout the 1990s, Tesco has undergone many changes and it has targeted and made its appeal across many social groups, by offering various range of products. The diversification has been so successful that the number of stores grew from 500 stores in the mid-1990s to 2,500 stores fifteen years later, (Hin, 2016).

For a supermarket like Tesco, retaining its customers is the only way for its long term survivability. But, in recent times, it has been losing customers and one of the reasons why this happened is the unwillingness to change according to market conditions. Although Tesco controls about 28% of the UK grocery market, its competitors- Sainsbury, Aldi and Lidl is proving to be a threat in its path of success (Butler and Farrell, 2018). The company’s profit was overstated by £263 million in 2014 (Felsted and Oakley, 2016). Its financial team and auditors were put under investigation by the accounting governing body. Later on in 2015, the company’s net debt increased by £1.9 billion and the pension deficits increased to £1.3 billion (Oxlade, 2015).

2. Objectives

- In spite of the large market concentration dominated by Tesco alone, why has there been a decline of their performance in terms of losing customers and a falling profit margin. Analyse factors that have contributed to this alarming situation.

- Analyse the financial performance of last 3 years (2014 To 2016) of Tesco

- Analyse the financial performance of Sainsbury of last 3 Years (2014 To 2016)

- Assess whether it is adaptability issues with market changes, keeping up with technological advancements, or other internal staff-administration matters that has led to the downfall of its performance. One needs to delve into the matter to really see why there has been a performance failure by the company. Therefore, the main objective is to identify the significant issues that might be the reason for the company’s demise.

3. Literature Review

Tesco is a large U.K grocery firm and retailer whose main competitors are Sainsbury’s, ASDA and Morrison’s, which are often called the ‘Big Four’ in the United Kingdom. Waitrose is another large chain that trails the Big Four. Besides these stores, in recent years, German grocers Aldi and Lidl have also become strong competitors in this sector.

Tesco is the U.K. grocery market leader with about 28.4% market share, followed by Sainsbury’s and ASDA, where each holds just under 17% of market share. Tesco’s downfall had already started in 2012 from where it started to drop its profit levels (Shapland, 2015). Initially, its innovation and catering to individual customer needs were remarkable. Gradually, the innovation and ideas about customers’ mentality started to fade away. The growth of the competitors can never be underestimated and the way the products are being marketed has to be kept in notice as Simms explains in the article (Williams 2018). This is where Tesco lagged behind and could not cope with the current trends. The next paragraph highlights the timeline of Tesco’s performance in the last few years highlighting the main changes that it underwent.

In 2012, Tesco wanted to expand its business with the US, costing it 1.8 billion pounds loss (Williams 2018)It had put 1 billion pounds into US business, and its plan was to expand a significant amount of stores on the west coast, which ended very badly, which eventually led to a massive loss for the company. In 2013, Tesco revealed its first annual drop in profit in 20 years and made it clear that they would not involve in hypermarkets. In 2014, Tesco made a 200 million pounds price cut campaign, in order to evade the price cutting competition from its competitors, namely Aldi, Lidl and Morrison’s, which operated at much lower prices and therefore gained popularity amongst the people and they started shifting from Tesco to these retailers (Stephen and Billy, 2016). One other thing that Tesco fell behind gradually was customers’ preference of value for money for the products they are buying (Erickson, 2015).

In September 2014, Tesco revealed that there was an overstatement of profit by £250 million, that later summed up to be a revised figure of $326 million for the first half of the year (Felsted and Oakley, 2016).The UK’s supermarket watchdog later found out that Tesco deliberately and repeatedly withheld money owed to suppliers to falsely boost its sales performance. The company was sued as a result, alleging they lost millions because they bought shares on the basis of misleading accounts, (Telegraph 2016).The new chief executive, Dave Lewis, promised to work with integrity and with complete transparency regarding the issue (Rusbridger, 2015).

A research was carried out by Daily Mirror in 2016 and found that a basket of 80 popular items at Sainsbury cost £162.11 which cost £165.37 in Tesco. Sainsbury realized that the decision was better since the product was being sold more when they changed to selling one item and not as a deal (Graeme, 2015). These sort of bulk selling strategy needs to be undertaken by Tesco as well if they want to change their game of attracting customers. They need to find out new ways to hold onto their existing customers, as well as increase the visits of first-timers.

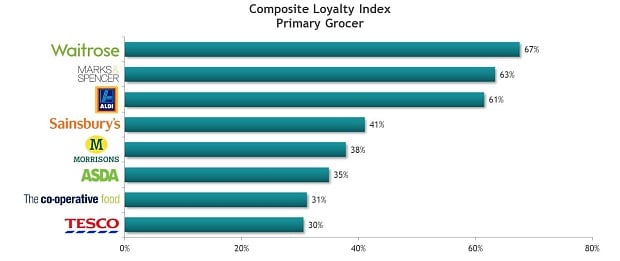

Therefore, with all of these pressures combined, Tesco surely needed to regain customers’ trust. Although Tesco is dominant grocery retail, it did not bring much changes that could really help them (Mark, 2016). This could have been minimized, according to Mark, by bringing in changes in its business model and marketing strategies. In 2015, Telegraph conducted a survey among 6800 British shoppers and Tesco was ranked at the bottom of a list of eight grocery chains that included, in ascending order, the Co-operative, ASDA, Morrison’s, Sainsbury’s, Aldi, Marks and Spencer and Waitrose as the top market holders.

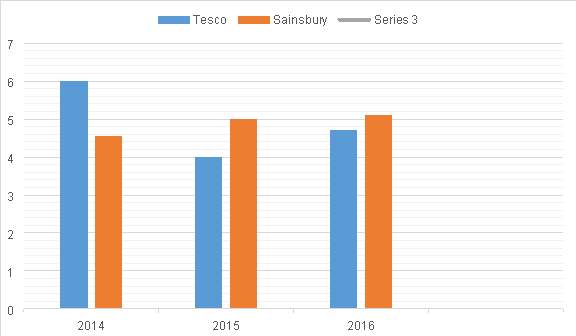

The following bar graph illustrates the results more clearly.

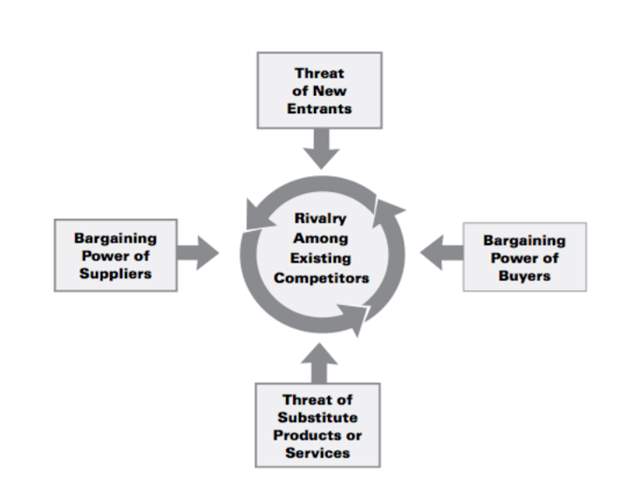

Competition between supermarkets is extremely fierce, and in this report Porter’s 5 forces framework is a suitable framework to analyze the level of competition in the UK grocery market. Porter’s Five Forces is a business analysis model that will help to explain why different industries are able to enjoy different levels of profit. The model is extensively used to study industry structure as well as its corporate strategy. Porter, in his book in 1980, ‘Competitive Strategy: Techniques for Analyzing Industries and Competitors’ discusses five different forces that play a part in shaping competition intensity and the profitability in a market and also each factors have been analyzed in details with the context of the research.

Competitors’ discuss five different forces that play a part in shaping competition intensity and the profitability in a market.

- Rivalry among the competitors- This strategy tells us how much rivalry is good and how much is harmful for a company’s survival. If level of competition is too high and the products offered by the firms are similar in nature, the lesser will be the hold of a company in the market and vice versa.

- Infant industries and its power- The less time and money it costs for a competitor to enter a market, the more a company’s position is likely to be threatened. An industry with strong barriers to entry is an attractive feature for companies that would prefer to operate amongst fewer competitors.

- Power of Suppliers- The lower the number of suppliers and the higher the company depends on one for the supplies of goods and services, the more power will the supplier have over the company.

- Power of Customers- Customers has the ability to drive prices down under certain circumstances. It is affected by how many customers a company has, how significant each customer is, and how much it would cost a customer to switch from one company to another.

- Threat of Substitutes- The availability of substitutes is often good news for the consumers but may be bad news for companies. If consumers can find easy and quick substitutes for the company’s product, it will be harder to keep them away from switching when prices go up or under other adverse situations.

Therefore, this strategy can tell us where Tesco’s position relatively is and the annual reports of two companies, Tesco’s and Sainsbury’s data are going to be used to determine different ratios to carry out the performance analysis. However, there are a few limitations of the framework that needs to be kept in mind as it deals with firms from the same industry background (Harvard Business Review, 2006):

- It can be hard to define the concerned industry

- Market structures are mostly viewed to be static and does not consider the consistent changes taking place every other day

- The framework does not ensure a competitive advantage

- The Five Forces does not evaluate the assets and abilities of an organization

4. Proposed research Methodology design and approach

This research project aims to find out the reasons that have caused Tesco to incur a loss of 6.4 billion in the year of 2015 and also aims to analyze the data of its competitor Sainsbury that Tesco could have undertaken in order to avoid the loss. Case studies and online articles are the main sources of data used to understand the situation of Tesco and the underlying reasons that have caused this loss.

Annual reports of the organization from official website have been used as secondary data. Data from Tesco’s financial statement and statement of profit and loss have been studied and analyzed carefully in order to point out the reasons of what went wrong and also have been compared with the data of Sainsbury’s annual report to develop a better understanding. Both qualitative and quantitative method have been used in this research. Since data from financial statement is being used to deduce the loss of 6.4 billion in 2005, this is considered as a quantitative approach as well as qualitative because the journals, articles and case studies back up the quantitative approach of the research project.Although quantitative approach is considered to be used primarily in exploratory research, but our research is primarily explanatory (Qualitative vs Quantitative, 2015).

5. Analysis

After 2012 loss Tesco’s downfall started. The CEO of Tesco Phillip Clarke took over. The CEO has inherited a bad hand but ever since he has taken over from Sir Terry Leahy he has performed very poorly, even after undertaking so many different procedures he still failed to make profit (The Guardian 2015)

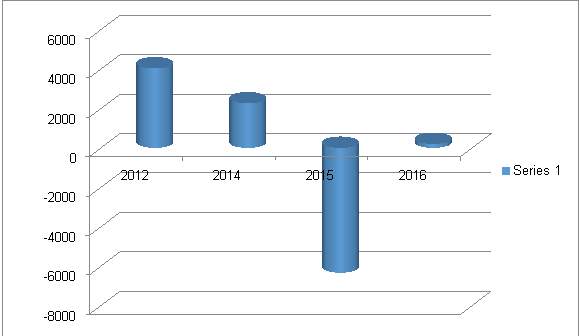

Tesco Profit/loss (Yahoo Finance 2016)

As from the above table in 2012, there was a profit of around 4 billion pounds, which portrays Tesco as very profitable but it was from 2012 Tesco underwent profit warnings. During 2012, it has been good start for Clarke after he was appointed as anew CEO of the company, however, it didn’t take a while for things to go wrong. The company started to receive profit threats which were equal to half the profit the company made in 2012.

Clarke tried several ways to uplift Tesco during his 3 years time in Tesco, but seems like it didn’t work out, mostly because the UK stores were heavily underinvested and overall was an unpleasant place for shopping. The entire Tesco shopping experience had become so poor that within a year of taking over Clarke was forced to come up with £1bn programmed to fix the core UK estate – hiring more shop staff and improving ranges, quality and stores (The Guardian 2014). Also some problems were beyond Tesco’s control, such as trading performance being impacted by political and economic problems and failing to spot the changes of shopping trend among the customers. 2015 was disastrous year for Tesco, reporting a loss before tax of £6.4 billion pounds (Tesco Plc, 2015).

In this part of the report, analysis of the financial reports of Tesco and Sainsbury’s is carried of the years 2014, 2015 and 2016 in order to find out the pointers to the loss in the year of 2015. Also, an analysis of 2016 has been done when Tesco has seen profit coming in compared with Sainsbury’s. The reports are given in the official website of Tesco and Sainsbury’s. Ratio analysis is done which gives us a comparison factor to find out if the company was going in its right path or the numbers indicate a loss. The Porters five forces framework have been used for further understanding of the research objectives and ratios are discussed in the next part of the report and then.

5.1 Analysis of Porter’s 5 Forces

Competition among the rivals.

Competitive rivalry is very high among the groceries; Tesco faces high competition from its direct competitors, which is actually the primary reason for Tesco falling back. From the analysis section of the financial report done on this research, it can be seen that Sainsbury was maintaining a constant value in the ratio of return on capital employed, asset turnover ratio and equity gradient etc., whereas Tesco’s ratio was decreasing. Thus it can be concluded that the competitors were doing better in providing better prices, services and deals to the customers. This took away many customers from Tesco who started preferring to buy products from other retailers (Catherine, 2015).

The financial analysis which was shown at the beginning shows that other competitors had lower market share at the beginning, but they were slowly leading forward to lead in the market. The competitors were not only competing with prices but were also providing better customer satisfaction for long term profitability. Tesco was leading the market and was performing very well initially but later on failed to catch up with the trend and also when it should have thought about its long term profitability (Radick,2016). As the competition is very high, competitors have undertaken different techniques and employed strategies to lure customers away from each other. If this competition increase more, it will be harder for Tesco to maintain its competitive position in the marketplace in the near future.

Infant industries and its power / Threat of New Entrants

Tesco, Sainsbury, ASDA, Waitrose, LIDL, have already occupied the 80% of the market (Mintel, 2010). Each of them are in very hard competition with each other to be best among themselves and retain their customers.

The threat of new entrants in the grocery industry seems to be quite low, as it requires large amount of capital to establish a brand name and put a good competition with others. In order to establish their brand value, the new competitors have to produce high quality products at a low price compared to the competitors already leading the market. To establish a new supermarket in United Kingdom requires government authorization, which takes a considerable amount of time to obtain the authorization.

Power of suppliers

Since Tesco alone holds 28% of the market share which is highest among the other retailers (Grocery Market Share, 2015) during the earlier years, Tesco made the suppliers feel that they are being privileged by doing business with Tesco. As if the suppliers have got no other choice, Tesco charged its suppliers extra payments for product stocking, products display at particular places, extending the contract (Simpson, 2015). These actions did not make the suppliers happy. Tesco was unaware of its competitors. They were rising slowly offering suppliers better deals through mutual respect for the things Tesco charged (Downie, 2015). Also Tesco was known to be late in making payments to the suppliers, creating an overstatement in the revenue and profit in financial statements.

In the later part of the report in the analysis section it can be seen how Sainsbury was keeping up with a constant and increasing rates of the ratio, also was able to keep the cost of inventory low. Supplier power is shown when suppliers demand for a certain price for their goods to the retailers. Hence Tesco has an upper hand on the suppliers compared to other retail stores, since suppliers would not want to be left with a very smaller market.

Power of the customers

This is a very significant part of the 5 forces model and also for Tesco’s analysis. Here the buyer’s negotiation power is very high when compared with retailers’ negotiation power. As the competitors like Sainsbury, Asda, Lidl provide same set of standardized products, it causes the customers to move easily from one market to another. It is seen that customers are more attracted to low prices and as the customers have easy access to internet, they can compare the prices of the products more easily

In the case of Tesco, they followed a very standardized set of marketing strategies (Vizard, 2016). This affected the sales a lot because of high competition, and same marketing strategies won’t work where the competitors like Sainsbury are always up with different idea to attract customers. Also the customer needs and preferences change over the year, as a result, different strategies both in marketing and product pricing should have been undertaken by Tesco. Customer’s mentality and preferences should also be taken seriously. It is important to put one self in the situation and judge whether he or she would buy the product if particular conditions or deals were being offered during a particular time. Standardized strategies maintenance is an idea that might save the time for the marketing strategy makers but it is not what attracts a high sale. In (LucenaMatamalas and Santandreu Ramos, 2009), a few discussions about the customer behaviour towards products are given where it says how visual effects, music, and lighting etc. affects the customer behaviours and the sale of products. Retail stores like Aldi were offering discounts, and other traditional retailers like Sainsbury’s, Asda were offering better prices to customers. The market share of Tesco is not a matter of interest to the customers, they are only after better price, service and quality of products.

Threat of substitutes

Threat of Substitutes- The availability of substitutes is often good news for the consumers but may be bad news for companies. If consumers can find easy and quick substitutes for the company’s product, it will be harder to keep them away from switching when prices go up or under other adverse situations.

The product collection of the retailers have been very wide, threat from substitute products is not much of an issue with companies like Tesco with large market shares and also it is not relevant to the reason as to why Tesco underwent a loss.

5.2 Profitability Ratio

5.2.1 Return on Capital Employed (ROCE)

It is the primary ratio of earnings before interest and tax to shareholders’ equity and long term liability that is debt expressed in percentage. Actually it is the measure of the company, how well it uses its resources to the generate profit. (Lexicon.ft.com, 2016)

The higher the percentage, the better the business is performing (Lexicon.ft.com, 2016)

Return on Capital Employed = (Profit before tax/total assets –Current Liabilities) * 100 %

| Year | 2014 | 2015 | 2016 |

| PBT/LOSS | 2259 | (6339) | 202 |

| Total Asset | 47677 | 44075 | 43668 |

| Current Liability | 20206 | 19805 | 17866 |

| ROCE | 8.22% | (26.11)% | 0.78% |

Figure: Tesco ROCE Table

| Year | 2014 | 2015 | 2016 |

| — | |||

| ROCE | 9.30% | (.97)% | 6.53% |

Figure; Sainsbury ROCE table (Financial Morning Star 2017)

From the above table it can be seen that Tesco’s performance in relation to ROCE was decreasing as the ratio went from below 10% to negative figure.

Increasing the ROCE requires increase in revenue or decrease overall entity’s expenditure on cost of sales and other expenses so that operating profits and profit after tax increases. Unfortunately, the loss suffered in 2015 brought about a negative ROCE.

Shareholders and prospective investors are interested in Tesco’s ROCE as they want to know if entity’s returns are high enough to cover its cost of capital. In order to have a positive ROCE Tesco could have:

paid off non-current liabilities which is probably the best strategy in this case. It not only reduces the capital employed but also improves entity’s debt-equity ratio, thus reducing financial risk. Another significant benefit can be savings interest cost savings as entity’s profit won’t be burdened with borrowing costs and thus improve profit figures (Lexicon.ft.com, 2016).

5.2.2 Gross Margin

It is the percentage of the profit the company makes after deducting the direct cost associated with the product or services it sells. The higher the margin the higher the company retains on every dollar of sales

Data from Financial Morning Star 2016 has been used in order to compare between Tesco and Sainsbury. 2017 is considered to be constant as of 2016.

| Year | 2014 | 2015 | 2016 |

| Gross Margin | 6.31 | -3.87 | 5.27 |

Fig: Tesco Gross Margin

| Year | 2014 | 2015 | 2016 |

| — | |||

| Gross Margin | 5.8 | 5.1 | 6.5 |

Fig: Sainsbury Gross Margin

From the above data it can be seen that Tesco’s gross profit started to decrease gradually from 2014 and ultimately in 2015 showed a negative figure. This is also an evidence that shows Tesco losing the customers and due to their pricing policy on products incurred a loss also it shows poor sales performance. On the other hand, Sainsbury has been constant with its gross profit and shows an increase from 2016 onward. Possible reasons are: Sainsbury lowering the product prices with good supplier relation as discussed above in Porter’s analysis which eventually led to the increase in number of sales.

5.2.3 Asset Turnover Ratio

This ratio shows how profitable an entity is in connection to its total assets. Asset Turnover ratio is used to understand how efficient the company is using its assets in order to generate revenue. This ratio is considered a general measure of profit as it quantifies how much net pay was created for each £1 of resources the organization has (Financial Morning Star 2016).The formula for calculating assets turnover ratio is simple:

Assets Turnover Ratio = Revenue/(Share Capital + Reserves + Long-Term Borrowings)

Data from Financial Morning Star 2016 has been used in order to compare between Tesco and Sainsbury.

| Year | 2014 | 2015 | 2016 |

| Average Asset Turnover (ATR) | 1.27 | 1.32 | 1.24 |

Fig: Tesco Asset Turnover Ratio

| Year | 2014 | 2015 | 2016 |

| — | |||

| ATR | 1.64 | 1.44 | 1.4 |

Fig: Sainsbury Asset Turnover Ratio

From the above tables, it can be seen that Tesco was not being able to use its assets properly to generate revenue compared to its competitor Sainsbury. Although the asset turnover ratios were quite high but still Tesco made a huge loss because of administrative expenses, losses from property-related items and other expenses and mainly losing customers. The more the asset is being utilized, the more profit the company makes and thus the ratio increases. In terms of that, Sainsbury’s seems to have better profit from its assets than Tesco. More detailed market research should be taken in order to give a conclusion.

5.3 Liquidity Ratio

It is the measurement of a company’s cash that is available and the securities against outstanding debt. Liquidity ratio is mainly used to understand the company’s ability to pay its short term debts. A company with high Liquidity ratio indicates that there is a low risk to default by the company, (Business Dictionary, 2017).

5.3.1 Current Ratio

It is a ratio of the current asset to the current liability. When the ratio figure has a value more than 1, then the company is considered good, which also means company is using its assets properly to pay the current liabilities. But when it gets below 1, then its bit concerning for the company. (Ready Ratios, 2017). Ideal Current ratio is 2:1. The calculations for the current ratio of Tesco are done below and the formula is also given:

Current Ratio = Current Asset/Current Liability

| Year | Current Asset (£m) | Current Liabilities (£m) | Current Ratio |

| 2014 | 13085 | 20206 | 0.65 |

| 2015 | 11819 | 19805 | 0.59 |

| 2016 | 11819 | 17886 | 0.81 |

Fig: Tesco’s Current Ratio

| Year | Current Asset (£m) | Current Liabilities (£m) | Current Ratio |

| 2014 | 4362 | 6765 | 0.64 |

| 2015 | 4421 | 6923 | 0.64 |

| 2016 | 4444 | 6724 | 0.66 |

Fig: Sainsbury Current Ratio

From the above table, it can be seen that the current ratio of Tesco is 0.65 in 2014 which is not much of a good value and decreased gradually to 0.59 which is an alarming indicator pointing that the company does not have enough ability to pay off its current debts with the current assets it has. Generally the reason of decrease in ratio is because of problems with inventory management, ineffective in collecting receivables, or an excessive cash burn rate (Staff, 2015). The ratio started to gradually increase a bit from 2016 which can allow the investors and shareholders to worry less. The ideal value for the current ratio should be 2:1. The current ratio of Sainsbury’s is also far behind the ideal value, but it has been increasing from 2014.

Tesco can take possible ways to improve the Current Ratio, first rolling of money via debtors will keep the current ratio in control, then current liabilities should be paid off as often and as early as possible. It would decrease the level of current liabilities and therefore, improve the current ratio. Early payments to creditors can save interest cost and earn discount which will have a direct impact on the profits of the firm.

5.3.2 Acid Test Ratio

Acid test ratio is almost similar to the current ratio but with a slight difference. That is, the assets is considered as quick current asset, which means the inventory is not included into the current asset. Acid test ratio is used as a strong indicator for a company whether it has sufficient short term assets to pay off its immediate liabilities (Staff, 2015). It is calculated as follows:

| Year | Quick Current Asset (£m) | Current Liabilities (£m) | Acid Test Ratio |

| 2014 | 13085 | 20206 | 0.59 |

| 2015 | 11819 | 19805 | 0.45 |

| 2016 | 11819 | 17886 | 0.67 |

Tesco Current Ratio

| Year | Quick Current Asset (£m) | Current Liabilities (£m) | Acid Test Ratio |

| 2014 | 4362 | 6765 | 0.50 |

| 2015 | 4421 | 6923 | 0.51 |

| 2016 | 4444 | 6724 | 0.52 |

Sainsbury’s Acid Test Ratio

An ideal value of acid test ratio should be 1:1 (Adeyuwi, 2016) but the results for Tesco can be seen that 2015 has the lowest acid test ratio compared with other years. This shows that in 2015, Tesco did not have the ability to pay off the urgent debts with its quick current asset. Even in earlier years, Tesco was not in the position to pay the current liabilities which is a very risky position for a big company like Tesco where it should have had a ratio greater than 1. This is an alarming sign since the investors are more interested in a company which has more cash in its hands indicating it as strong enough to support itself. Possible reasons for the ratio to decrease are maybe because Tesco is over-leveraged, struggling to maintain or grow sales. For Sainsbury’s, the ratio is also not closer to the ideal value, but it has an increasing figure every year which is a positive sign for the company.

5.3.3 Inventory Turnover Ratio

Inventory turnover is being used to measure how well a company is performing in selling the inventory and how it is replaced over time. A higher turnover than the industry average means that inventory is sold at a faster rate, proving that management is effective. Also, a high inventory turnover rate means less company resources are tied up in inventory.

This ratio is being used to see how Tesco performed compared to Sainsbury over the year in processing and selling their products (inventory)

| Year | Inventory Days | Average Inventory Days |

| 2014

2015

2016 |

16.23

18.36

17.2 |

17.26 days |

Source: Tesco Plc’s Financial Reports: 2014, 2015, 2016

| Year | Inventory Days | Average Inventory Days |

| 2014

2015

2016 |

16.1

16.25

16.88 |

16.41 days |

Source: Sainsbury Financial Reports: 2014, 2015, 2016

Tesco on average takes 17.26 days to sell their products, whereas Sainsbury takes 16.41 days. Although the difference is not much but Tesco taking long to sell their products is not a good sign especially in terms of perishable products.

Data (Chart) (Appendix 2)

From the above Chart and tables we can come to a conclusion that Tesco’s inventory turnover decreased massively in 2015 when compared to prior year 2014. On the other hand, Sainsbury’s was constant and gradually increased from 2015 onwards. Possible reason for decrease in inventory turnover ratio means. Tesco is holding up the inventory for long compared to sell and this is also an indicator that there is loss in customer and salesthis plays a major role in bad cash flow and also detailed research need to be done in order to comment on the efficiency of the liquidity management.

5.4 Creditors Day Ratio

Creditor day ratio measures average days its takes a company to meet its obligation to trade creditors. The longer the days are, the better the credit purchase is.

| Year | Creditor Days | Average Days |

| 2014

2015

2016 |

64.94

56.88

56.09 |

59.33 days |

Source: Tesco Plc’s Financial Reports: 2014, 2015, 2016

| Year | Creditor Days | Average Days |

| 2014

2015

2016 |

66.89

65.78

66.65 |

66.44 days |

Source: Sainsbury Financial Reports: 2014, 2015, 2016

From the above tables it can be seen that on average, Tesco has a credit day of 59.33 days and Sainsbury has 66.44 days. On 2015 the credit days for Tesco decreased by almost 12% from last year, this indicates the suppliers were not willing to allow more credit days which Tesco previously had. Possible reasons for the loss suffered by Tesco could be because they made the suppliers feel inferior; moreover, the suppliers got better deals by the competitors. This did put Tesco’s management under question that is whether they are maintaining an efficient liquidity management.

On the other hand Sainsbury had a decent creditor days over 3 year period.

5.5 Gearing Ratio

It is the financial ratio that measures the financial leverage, signifying by which the firms activities are funded by the owner’s fund versus creditor’s funds (McLaney and Atrill 2012). In this case higher the company’s degree of leverage the more the company is considered to be risky because the company must continue to service its debt regardless of how bad its sales are.

| Year | 2014 | 2015 | 2016 |

| Gearing ratio | 62% | 69% | 65.03% |

Source: Tesco Plc’s Financial Reports: 2014, 2015, 2016

| Year | 2014 | 2015 | 2016 |

| — | |||

| Gearing Ratio | 53% | 55% | 53.2% |

| Source: Sainsbury Financial Reports: 2014, 2015, 2016 |

From the above tables it can be seen that Tesco’s gearing ratio over the 3 years were high compared to Sainsbury’s. This denotes that Tesco is considered to be more risky. Between 2014 and 2015, Tesco’s gearing ratio was almost 14% higher than Sainsbury’s which signifies Sainsbury was in better position regarding the financial leverage.

5.6 Equity Comparison/ Changes in Total Equity over the year

| Year | Total Equity (£m) |

| 2014 | 14,722 |

| 2015 | 7,071 |

| 2016 | 8616 |

Tesco’s total Equity records from 2014-2016

| Year | Total Equity (£m) |

| 2014 | 6,005 |

| 2015 | 5,539 |

| 2016 | 6365 |

Sainsbury’s total Equity record from 2014-2016

Tesco’s total equity has been falling from 2014. The total equity is the figure derived after subtracting the total current and long term liabilities from total current and long term assets. So, a decreasing figure shows that the company is not being able to hold much of equity over the time specific period. Although 2014 shows a decent figure but still it is less than the total equity of the previous years. But 2015 has shown half the equity compared to 2014. The total equity of Sainsbury’s has not significantly increased; it has rather maintained an average figure throughout the years. Total equity decrease when dividends are being paid to the shareholders, but for Tesco the decrease in equity was for the net loss that was incurred in 2015 (BizFluent, 2017).

6. Conclusion

The purpose of this research was to find a gap about a company whose performance has changed over the years and why this has happened. Choosing Tesco as the company and why there was a huge loss in 2015 made this a good topic for research. The study sheds light on those specific factors which led to the demise of Tesco’s golden years and what factors should not be overlooked if they would want to retain their market share in the upcoming years. In the last part of the report, the research objectives that were targeted have been addressed. The main few findings are discussed below in detail.

Assessment of factors that led to the loss for Tesco and its performance in the last few years

In “The Guardian” Andrew Simms writes that there are two types of chancellor,” as Gordon Brown once joked- “Those who fail and those who get out in time.” Tesco’s former chief executive, Terry Leahy, got out just in time but some of his decisions surely cost the company a lot.

The latest blow to the company is the ‘extraordinary overestimate of expected half-yearly profits’ – amounting to a quarter of what was expected for the period, which resulted in a downfall equivalent to a tenth of its actual value. It’s an unfortunate greeting for the new chief executive, Dave Lewis, who has only just taken over from Philip Clarke who left because he was unable to get the company out of the crisis it was already in.

On the other hand, one of the main reasons for its downfall was because it underestimated the power of its competitors. Many stores like Sainsbury, Asda, Lidl and other big shots came into the picture and gave Tesco a run for their share of market, but little did Tesco take these changes into account. They could have been better equipped had they been aware of other competitors dominating the market. Tesco invested heavily in large edge-of-town and out-of-town stores, which were taken over by the rising use of internet shopping. The supermarket tried to make changes by bringing in the concept of a family outing to Tesco Extra. Yoga classes, child-friendly restaurants and independent-style coffee chains were brought in to make the place more lucrative for shopping, which also increased their costs significantly (Andrew Simms, 2014).

The next problem was the accounting scandal about its profit that got public which somewhat tarnished their reputation as a company. Tesco also failed to cater to the needs of the customers by failing to offer them low priced but high quality products. Unnecessary high pricing and poor attention towards customers took away a lot of their loyalty customers and these people could easily switch to other substitutes because of the higher competition in the market. A lot of wrong decisions were taken, that is, even after the odd figures in its previous reports pointing that the business needed change, it went for further investments in developing stores which had to be closed later. All of these problems are inter-related and none can be overlooked when it comes to performance analysis for Tesco over the years.

Starting from the year 2013 Tesco was struggling with its assets and liabilities ratio where liabilities seemed to surpass their asset ratio. In the year of 2015, the liabilities seemed to have increased further than the previous years where current borrowings and derivative financial instruments and other liabilities had a substantial increase in their figure. Starting from 2012, the inventories and finished products of Tesco went down in number and finally in 2015, the inventories which are mainly the raw materials, work-in-process products and finished goods had a much lower percentage than the previous years. Short term investments in 2015 were half as compared to previous years indicating its short term investment asset was decreasing too. Therefore, it is safe to say that Tesco’s outflow of money was higher than their inflow because of the imbalance in the asset to liability ratio. The total equity of the company also decreased and hence it was very hard to attract new investors at that point since equity is what investors look forward to. The equity of the company dropped to half than that in 2015. For shareholders to invest more in a business, they always look at the equity primarily, and the unpromising figure of their equity demotivated investors from investing into the company.

The value of the property Tesco owns started falling too. Tesco gathered excess stock levels which was a burden and also gave rise to extra costs for the company which further deteriorated their performance. Some of the stores were reconstructed which required more money to be put into the business and some of the stores that were yet to be developed were stopped since the store plan at those locations got cancelled. These added incurred costs could not be matched by broadening their customer base which would have offset the rise in costs.

Tesco’s overconfidence led to overdoing of activities. Seeing their limitations in the UK, Tesco began spreading overseas. But as its initial adventure in the US began to dwindle, so did its ambitions in China and Japan too (The Guardian, 2014). There was a time when it was believed that Tesco could do no wrong; now investors began to question whether it knew what it was doing.

Factors that could have stopped the loss from occurring

Business analysts suggested that Tesco should try to have a flexible model about its business (Alex, 2016). No business can have any hard and fast rules and it needs constant change according to its environment and business needs. As it could be seen in the Porters 5 forces analysis, the buyers’ power and the rivals power seems to have put Tesco under threat. Moreover Tesco was very rigid about its business strategies where it overlooked the growth of its competitors. Business analysts confidently blamed Tesco’s business model to be one of the reasons for what has happened to Tesco. Lower prices, discounts and other such opportunities in favor of customers could have stopped Tesco from incurring such a huge loss. The scope of this paper only gives us access to secondary data. Further research with primary data could give insights to the company’s actual state. However, Tesco still remains one of the biggest retailers in the UK despite its sudden downfall in performance. This can be overcome if attention is given to specific factors as discussed in the paper, moreover, Tesco needs to weigh out its pros and cons before expanding business overseas.

7. References

U.K. (2016). Tesco counts cost of decline with record 6.4 billion pound loss. [online] Available at: https://uk.reuters.com/article/uk-tesco-results-idUKKBN0ND0FB20150422 [Accessed 14 Nov. 2017].

Williams, H. (2018). US failure costs Tesco £1 billion as store calls time on American. [online] The Independent. Available at: https://www.independent.co.uk/news/business/news/us-failure-costs-tesco-1-billion-as-store-calls-time-on-american-venture-8386199.html [Accessed 14 March 2018].

Adewuyi, A. 2016. Corporate Ratios of Tesco. [ONLINE] Available at: http://file.scirp.org/pdf/OJAcct_2016072913405902.pdf [Accessed 30 December 2017].

Hin, H. (2016). Tesco is best performing big supermarket in latest sales figures. [online] Campaignlive.co.uk. Available at: https://www.campaignlive.co.uk/article/tesco-best-performing-big-supermarket-latest-sales-figures/1435036 [Accessed 14 Nov. 2017].

Ahmed, K. 2015. Tesco, what went wrong? – BBC News. [ONLINE] Available at: http://www.bbc.co.uk/news/business-29716885. [Accessed 08 January 2018].

Butler, S. and Farrell, S. (2018). Tesco reports record £6.4bn loss. [online] the Guardian. Available at: https://www.theguardian.com/business/2015/apr/22/tesco-suffers-record-64bn-loss [Accessed 14 March 2018].

Alex, P. 2016. The decline of Tesco is a good old-fashioned morality tale – Telegraph. [ONLINE] Available at: http://www.telegraph.co.uk/men/thinking-man/11351115/The-decline-of-Tesco-is-a-good-old-fashioned-morality-tale.html. [Accessed 21 December 2017].

Anderson, R. 2016. Tesco turns stale as competitors freshen up ideas – BBC News. [ONLINE] Available at: http://www.bbc.com/news/business-29310445. [Accessed 23 December 2017].

Catherine N. 2015. Moody’s to Tesco: Sales and profit performance must improve if you want to retain your credit rating | City A.M.. [ONLINE] Available at: http://www.cityam.com/226220/moodys-to-tesco-sales-and-profit-performance-must-improve-if-you-want-to-retain-your-credit-rating. [Accessed 08 January 2017].

Dalken, F. 2012. Are Porter’s Five Competitive Forces still Applicable? A Critical Examination concerning the Relevance for Today’s Business

Downie, R. 2015. Who Are Tesco’s Main Competitors? | Investopedia. [ONLINE] Available at: http://www.investopedia.com/articles/markets/092315/who-are-tescos-main-competitors.asp?lgl=bnull-right-rail-partial-sticky. [Accessed 08 December 2017].

Dudovskiy, J. 2015. Tesco Porter’s Five Forces Analysis – Research Methodology . [ONLINE] Available at: http://research-methodology.net/tesco-porters-five-forces-analysis/. [Accessed 08 December 2017].

Eric, R. 2016. What does Tesco need to do to win shoppers back? | This is Money. [ONLINE] Available at: http://www.thisismoney.co.uk/money/markets/article-2607297/City-Focus-Tesco-boss-Philip-Clarke-faces-difficult-time-ahead-attempts-turnaround-troubled-supermarket.html. [Accessed 08 December 2017].

Erickson, H. 2015. Tesco: five reasons it went so wrong – CMI . [ONLINE] Available at: http://www.managers.org.uk/insights/news/2015/april/tesco-five-reasons-it-went-so-wrong. [Accessed 08 December 2017].

Felsted, A and Oakley, D. 2016. Subscribe to read. [ONLINE] Available at: https://www.ft.com/content/ce49c8a4-5a7b-11e4-b449-00144feab7de. [Accessed 08 January 2018].

Graeme, W. 2015. The decline of Tesco: how did the world beater end up in crisis? – The Journal. [ONLINE] Available at: http://www.thejournal.co.uk/north-east-analysis/analysis-news/decline-tesco-how-world-beater-8407620. [Accessed 08 January 2018]

Staff, I. (2015). Financial Analysis: Solvency Vs. Liquidity Ratios. [online] Finance.yahoo.com. Available at: https://finance.yahoo.com/news/financial-analysis-solvency-vs-liquidity-153700383.html [Accessed 6 Dec. 2017].

Lexicon.ft.com. (2016). Return On Capital Employed Roce Definition from Financial Times Lexicon. [online] Available at: http://lexicon.ft.com/Term?term=return-on-capital-employed–ROCE [Accessed 14 March 2018].

Yahoo Finance, (2016a) Tesco PLC (TSCO.L)

Available from : http:// finance.yahoo.com/q/hp?s=TSCO.l+Historical+Prices [Accessed 08 January 2018].

Yahoo Finance, (2015a) Tesco PLC (TSCO.L)

Available from : http:// finance.yahoo.com/q/hp?s=TSCO.l+Historical+Prices [Accessed 08 January 2018].

Graham, B. 2014. Tesco’s decline laid bare: The true scale of the supermarket’s disastrous mismanagement | The Independent. [ONLINE] Available at: http://www.independent.co.uk/news/business/news/tescos-decline-laid-bare-the-true-scale-of-the-supermarkets-disastrous-mismanagement-10197046.html. [Accessed 08 January 2018].

Haddock-Milliar,J. and Rigby, C. 2015. Business Strategy and The Environment: Tesco PlC’s Declining Financial Performance and Underlying Issues

Atrill, M. (2012). [online] Available at: http://www.jackierizzorealestate.com/financial/financial_accounting_for_decision_makers.pdf [Accessed 11 Dec. 2017].

Tescoplc.com. (2014). [online] Available at: https://www.tescoplc.com/media/1322/prelim_2014-2015_results_statement.pdf [Accessed 14 March 2018].

Tescoplc.com. (2016). [online] Available at: https://www.tescoplc.com/media/264194/annual-report-2016.pdf [Accessed 12 Dec. 2017].

Tesco (2015) Annual Report 2015 (Online). Tesco Plc. Available from

www.tescoplc.com/media/1426/tescoar15.pdf [Accessed 14 January 2018].

Sainsbury (2015) Annual Report 2015 (online). Sainsbury. Available from

www.about.sainsburys.co.uk/investors/results-reports-and-presentations/2015 [Accessed 14 January 2018].

Sainsbury (2014) Annual Report 2014 (online). Sainsbury. Available from

www.about.sainsburys.co.uk/investors/results-reports-and-presentations/2016

[Accessed 14 January 2018].

Appendices

Appendix 1

Tesco Gross Margin

| Year | 2014 | 2015 | 2016 |

| Revenue (£m)

Cost of Sales (£m) Gross Profit (£m) |

63557

(59547) 4010 |

56925

(59128) (2803) |

54433

(51579) 2854 |

| Gross Margin | 6.31 | -3.87 | 5.27 |

Sainsbury Gross Margin

| Year | 2014 | 2015 | 2016 |

| Revenue (£m)

Cost of Sales (£m) Gross Profit (£m) |

23949

(22567) 1208 |

23775

( 22562) 1387 |

23506

(22050) 1456 |

| Gross Margin | 5.8 | 5.1 | 6.5 |

Appendix 2

Inventory turnover ratio

| Year | Inventory Turnover ratio |

| 2014 | 6.01 |

| 2015 | 4.01 |

| 2016 | 4.71 |

Tesco

| Year | Inventory Turnover ratio |

| 2014 | 4.56 |

| 2015 | 5.01 |

| 2016 | 5.11 |

Sainsbury

Tesco Inventory Days

| Year | 2014 | 2015 | 2016 |

| Inventory (£m) | 3756 | 2975 | 2430 |

| Cost of Sales (£m) | 59547 | 59128 | 51579 |

| Inventory days | 16.23 | 18.36 | 17.2 |

Sainsbury Inventory Days

| Year | 2014 | 2015 | 2016 |

| Inventory (£m) | 997 | 1005 | 1024 |

| Cost of Sales (£m) | 22562 | 22567 | 2248 |

| Inventory days | 16.1 | 16.25 | 16.88 |

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Analysis"

Business Analysis is a research discipline that looks to identify business needs and recommend solutions to problems within a business. Providing solutions to identified problems enables change management and may include changes to things such as systems, process, organisational structure etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: