Asset Management Industry Analysis: AlterDomus

Info: 7674 words (31 pages) Dissertation

Published: 16th Dec 2019

Tagged: Business Analysis

ALTERDOMUS

Contents:

Introduction to Asset Management Industry………………………………………………2

Irish Fund Industry ……………………………………………………………….…………7

AlterDomus*…………………………………………………………………………………12

Services Offered at AlterDomus*………………………………………………….……….17

AlterDomus* In Ireland ……………………………………………………………………25

Exhibits ……………………………………………………………………….…………….29

Bibliography …………………………………………………………………….………….31

Introduction to Asset Management Industry

Introduction:

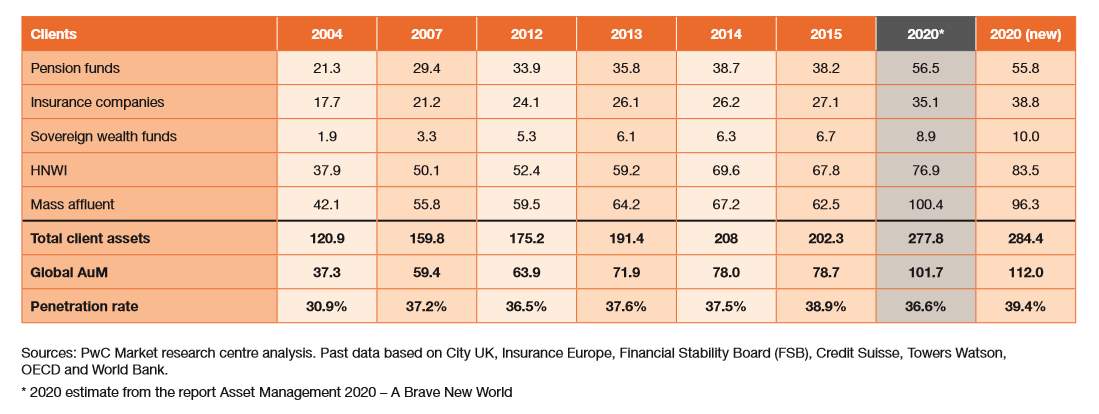

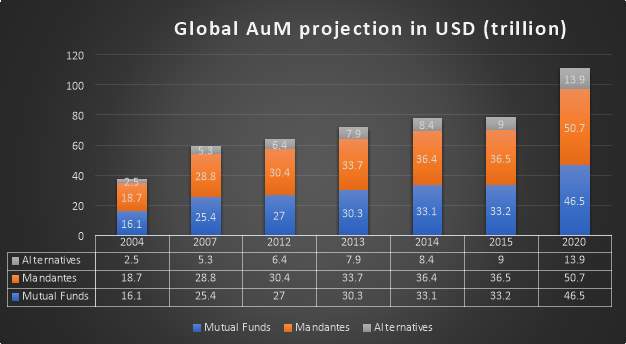

The global asset management industry has been growing by many folds through the last three decades and has some staggering numbers set for the year 2020. The projections show that the assets under management would amount up to $111.2 trillion by 2020 across the globe which also beats the estimates from the last three years (PwC, 2017). Although the industry has been experiencing challenges with changes in regulation, products offered and markets post the global financial crisis.

The industry has been expanding in terms of jurisdictions and the investment strategies used with the shift in the trends of the investor base. More recent studies have shown that there would be faster growth in the jurisdictions of South America, Asia, Africa and the Middle East rather than the developed nations of the world. However, most of the assets would be in US and Europe region but there has been a changing trend in the purchasing power of the nominal income. There has been an increase in the mass affluent and High Net Worth Individuals (HNWI) over the later years coupled with the push from the major players such as the pension funds and insurance companies.

Along with the positive outlook of the industry comes the challenges which are a concern in a larger spectrum. There has been this drive for improving transparency since the global crisis with regulators, investors and tax legislation trying to move the things towards a more open and transparent environment in order to avoid the throttles. This has also been showing its after-effects on the transformation of the fee model.

There has been the drift in the investment strategies from an active management towards a more passive and alternative strategy. Upon which there would be a serious step up in the alternatives management whereby the real assets, private equity and new types of private debt funds would have a stronger hold in the driving the growth within the industry.

Prime Locations:

In the fund industry, there are a number of benefits for moving offshore and a few nations across the globe have taken a spotlight as the “tax havens” for the funds domiciled. These nations offer favourable tax terms in order to draw new business and provide a healthy corporate environment by which they can lure intercontinental wealth across their borders. Along with the above incentives which generate greater profits, it also gives the opportunity for a class of non-traditional investments which may have been restricted at the domestic locations.

The following are the prime locations for the fund industry and are the centres for the majority of the investment activities.

Cayman Islands:

These islands have been the essential base for most of the investment banks through the history for the fund servicing activity. It has been regarded as the top destination for the offshore hedge fund domiciles. Although these have come from the various cushioning implementations from the stable government which ensured that they have advanced legal and business policies which could draw in the business and also the various tax-free incentives with minimal financial regulation and oversight.

The Bahamas:

This nation has earned to be the first nation among the Caribbean islands to have been accredited with the IOSCO A status by reaching a multinational memorandum of understanding with the International Organisation of Securities Commissions. By which it has agreed on the terms of cooperation and the exchange of information. Added to this, the island has bagged in a couple of advantages including complete anonymity and confidentiality to investors, exemption from the local taxes and stamp duties, a minimum requirement of one shareholder and one director and ease of company incorporation have made the island nation an attractive spot.

Latin America:

Uruguay:

Establishment of multiple free trade zones and hosting a vast number of key services such as financial institutions, warehouses and logistics operations etc. have made Uruguay a popular offshore destination. It has reputation for the sound protection of banking secrecy such as of Switzerland. The nations hold on the privacy and a robust economy are the main reasons behind its reputation as a tax haven.

Panama:

Similar to the likes of Uruguay, Panama is the largest free trade zone in the western hemisphere drawing in major investments across sectors. It has been an international banking hub through years and with the likes of a stable government, favourable tax laws and a strong economy has made this nation an attractive hub for the offshore investment activities.

United States:

Delaware:

This place in the United States has been a titan with respect to private equity and also the favoured domicile for real estate funds. Global investors are drawn to its advanced business statues which is reviewed and updated on a regular basis providing an ease and flexibility with respect to the business entity formation and transactions.

Europe:

Luxembourg:

With the highest ratings from the leading agencies such as Moody’s and Fitch and also the country’s top S&P rating has evolved Luxembourg as the largest base for European union fund domicile and has placed it as the leader in the financial sector among its European counterparts. The nations stability in terms of economy, tax policies and economy has drawn a strong appreciation from the investors.

Ireland:

Ireland has been known widely for its favourable tax rates and as the global leader in aircraft leasing. It also packs in the advantage with its strategic location for accessing the massive European consumer market. With the country offering fund servicing operations within the global asset management industry and its business-friendly laws have turned the country into an attractive offshore location.

The Channel Islands – Jersey and Guernsey:

The Channel Islands are among the finest regulated and well-established offshore locations with respect to the areas of private equity and real estate. The largest among the two, Jersey has a history as a strong financial centre offering low-tax business formats and specialising in a variety of fund categories.

Asia:

Hong Kong:

Hong Kong provides extremely friendly tax laws without the requirement of capital gains, withholding or dividend tax. Hong Kong has good ties with China which gives the ability to hold funds in different currencies, along with attractive interest rates and favourable tax laws for foreign investors.

Singapore:

The country possesses one of the fastest growing wealth management industry and has also credited itself as a worldwide leader in financial services with favourable tax rates which can also be said that the tax rate is the lowest in Asia. Singapore provides an easy access to the Asian market.

Irish Fund Industry

Ireland’s Fund Industry:

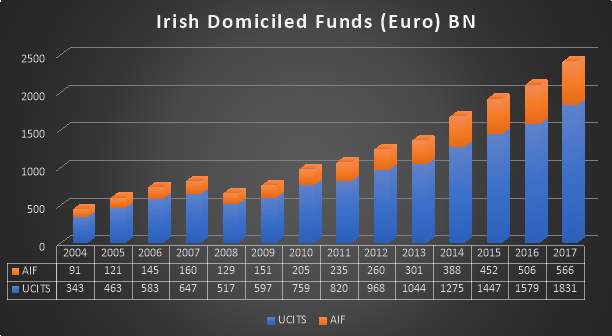

The establishment of the fund industry in Ireland dates back to 30 years in time and has evolved from strength to strength providing investment managers across the globe to develop and expand their international footprint. With respect to the stats, over 900 of the global managers have their funds domiciled in Ireland and the country has been serving a client base both retail and institutional investors with a span of 70 countries. In 2017, the Irish fund industry has surpassed 4 trillion euros mark in assets under management with net assets domiciled In Ireland surpassing 2 trillion euros (Pwc Ireland, n.d.). The following points have been the key parameters in driving the rapid growth in the fund industry in Ireland.

- Regulatory Excellence

- Tax Efficiency

- Innovation

- Experience and Skilled Professionals

Regulatory Excellence:

Ireland has an excellent reputation as a location with robust and efficient regulation. It has been the first centre in Europe to provide regulated Hedge Funds. The regulatory environment for investment funds has been laid on the principles of openness, transparency and investor protection. The Central Bank of Ireland’s guidelines on the prospectus disclosure and counterparty risk are considered as advisable. With this framework of regulations paved the way to facilitate and product development while ensuring protection for the investors. The Irish fund industry has always ensured in leading and responding to the regulatory developments in the European Union and National level.

Tax Efficiency:

Ireland has been committed to tax transparency and international co-operation. Its stable tax regime has been the cornerstone for its economic policy and is also the first country to sign the agreement of the FATCA Inter Governmental Agreement Model 1. It has been trying to expand its reach with tax treaties with over 70 countries till date and continues to build a strong network ahead (Irish Funds, n.d.). The country adopts a tax neutral regime with respect to the funds industry and been the backbone for evolving the industry.

There are tax exemptions for the investment income and gains from the investments for the Irish regulated funds along with no net asset value tax. And as the regulations implemented have ensure investor protection as the prime agenda. The non-Irish investors aren’t levied with any net asset, transfer or capital taxes on the issue, withholding tax and the transfer and redemption of their investment units.

Innovation:

Through the years Ireland has offered innovative and world class product solutions closely working with a spectrum of investment strategies. It has taken the steps to be the first regulatory framework with respect to the alternative investment funds industry. With its quick responsiveness on reacting to the regulatory developments it has accelerated the activities of the clients in bringing innovative products to the market and has given the ease of doing business with having the regulatory terms under check.

Experience and Skilled Professionals:

Along with the open, transparent and well-regulated environment, efficient tax- structure and innovative business culture the other aspect that draws the investment promoters to Ireland is the expertise of the people serving in the industry with exposure with a wide variety of activities such as fund administration, transfer agency, depositary, legal, tax and audit services, stock exchange listing, compliance and consulting services which include over 16,000 professionals as per the recent record base.

These parameters discussed above have collectively contributed for evolving Ireland into an extremely competitive and strategic location for both investment managers and investors point of view.

Industry orientation and Outlook:

As discussed in the earlier section, the key drivers have complemented in the rapid transformation of the industry and its orientation with respect to the overall activities in Ireland. Ireland has taken the second place in Europe in terms of the fund domiciled. European investment funds are either regulated as UCITS funds under the UCITS directive or as alternative investment funds (AIF) under the alternative investment fund managers directive (AIFMD).

The UCITS product has been a success since its start and has over 30,000 UCITS funds which amount up to 9 trillion euros in assets whereas the alternative investment funds which are moving aggressively with an annual growth rate of 7% and amounting to a total of close to 6 trillion euros in assets.

Ireland has been the place for UCITS with over 75% of its assets in the Irish domiciled funds have been UCITS. The country has been the fastest growing major cross border UCITS domicile with the net assets of the Irish UCITS grown by 212% (Pwc Ireland, n.d.). The data shows that around 1.5 trillion euro of UCITS assets are located in Ireland. On the other hand, alternative investment fund which has a greater risk appetite and wide range of possible investments has provided the investors to explore other investment options with the same range of regulatory benefits as of UCITS. The country has been the first in Europe to publish a detailed regulatory regime related to AIFMD. Around 550 billion euro of assets under management for AIF’s in Ireland and has a growth rate of around 11% (Pwc Ireland, n.d.).

AlterDomus*

AlterDomus*:

Alter Domus is a leading provider of Fund and Corporate Services dedicated to international private equity and infrastructure houses, real estate firms, private debt managers, capital market issuers and private clients. The firm offers a vertical integrated approach with tailor-made administration solutions across the entire value chain of investment structures, from the fund level down to local Special Purpose Vehicles. It has been established in 2003 after a spin off from tPhe big four audit firms and has been continually expanding its reach at the global level with its presence at 39 locations across the globe with offices and desks.

This chain of international network benefits the clients globally with the interaction with over 1,800 experienced professionals actively servicing across the domains of fund administration, corporate secretarial, accounting, consolidation, tax and legal compliance, depository services and debt administration services. Since the early 2017 the firm has been making plans to expand its presence and the range of markets it would serve with the push from Permira- a global investment firm.

The company’s biggest acquisition of “Cortland Capital Market Services LLC” (Cortland) in the United States which has been closed in March, 2018. Cortland is a leading independent investment servicing company providing third-party fund administration and middle and back office outsourcing to financial institutions including alternative investment managers, real estate, private equity and credit funds. Apart from this, the firm has acquired “Luxembourg Fund Partners” a Luxembourg management company in the same year.

All these recent acquisitions have ensured that the company has grown from strength to strength with the total assets under administration as over $425 billion USD and providing services to over 8,200 structures under administration (AlterDomus, n.d.).

The firm’s values and goals which it shares with its clients have a strong influence on the conduct of business. People coupled with knowledge and experience of over 20 years handling local administrative and compliance issues provide a strong hold for assisting the clients to focus on their strategic objectives. This approach has ensured the association with the following:

- 17 of the 20 Largest Private Equity houses in the world

- 17 of the 20 Largest Private Debt managers in the world

- 15 of the 20 Largest Real Estate firms in the world

Apart from these Alter Domus also offers depositary services which it has started in 2011 at Luxembourg, United Kingdom and Malta initially and has expanded to a total of eleven jurisdictions and holds around $20 billion assets under depository.

Sector Expertise:

The following are the sectors across which the company offers its service to the clients:

- Private Equity & Infrastructure

- Real Estate

- Debt Administrative Services

- Corporates

- Capital Markets

- Private Clients

Private Equity & Infrastructure:

As Private Equity is about the fund’s life cycle, portfolio management and successful realisation of the strategic goals. The company offers expertise across each stage of the company from the venture capital to the mega buyout. Assistance from the setting up of the fund to the fund administration. The following points are a brief up related to the private equity clients serviced by the company.

- Over 2,900 Special Purpose Vehicles which are the holding companies and financing vehicles as part of Private Equity & Infrastructure structure

- Over 340 regulated Private equity funds and 59 Infrastructure funds

- Production of 40 Private Equity & Infrastructure funds consolidations under Lux-GAAP, IFRS, US GAAP

Real Estate:

The company provides tailor made solution in order to meet the clients needs and the following are the range of clients to whom the firm extends its service in the real estate domain.

- International Real Estate Investment Managers

- Institutional Investors

- High Net Worth Individual Investors

These clients have their investments into assets such as offices, retail shopping malls, high street retail, hotels and resorts, logistics and industrial, residential, student housing, development projects etc. The following points are a brief up related to the real estate activities serviced by the company.

- Over 2,500 Special Purpose Vehicles which are the holding companies and financing vehicle being a part of the real estate structure

- Over 500 property companies which are holding direct real estate assets throughout Europe and Asia

- Over 70 real estate funds serviced and production of over 130 real estate funds consolidations under the IFRS, US GAAP, Lux-GAAP etc.

Debt Administrative Services:

During the time of low yields and challenging economic environment the investment managers have come across increasing interests in the investments opportunities in the debt market varying from the corporate loans to the opportunistic investment in distressed assets. The client base includes a number of large debt funds and entities investing in Europe, Asia and the United States. The following points are a brief up related to the debt administrative activities serviced by the company.

- Over 400 entities under administration which include regulated funds, regulated and unregulated securitisation vehicles, Special Purpose Vehicles, Limited Partnerships, General Partners and carried interest entities

- Debt assets under administration amount to a total of over $30 billion

- Portfolio servicing focused mainly among the senior debt, mezzanine debt, non-performing bank loan portfolios

Corporates:

In the last decade due to the significant changes in the regulatory environment across the globe the multinational companies have been facing a stiff tide with increase in the levels of the corporate governance and reporting compliance standards. For such corporate clients alterDomus provides the assistance for meeting and administering these local statutory obligations with the large network globally. The following points are an oversight into the corporate activities under the firm.

- Over 1,200 Special Purpose vehicles which are the holding companies and finance vehicles being part of multinational corporation structures

- The company’s clients are close to 500 multinational corporations and alternative investment firms of which many are listed on the major stock exchanges in the world

- These corporations are across the sectors of energy, materials, industries, utilities, consumer, health care, finance and technology

Capital Markets:

Financial stability, Financial services and Capital Markets has been the key concerns with respect to the central banks and the regulators. Securitisation has been a key funding tool within the capital markets which gives the scope of diversification in the funding and providing opportunity for investors. With respect to private equity, debt, infrastructure and real estate funds the key elements of structured finance and securitisation which provide the investment manager with a wider scope of solutions for their investments across different jurisdictions.

Services Offered at AlterDomus*

Services Offered:

As we have covered related to the sectors which are serviced by alterDomus in the earlier section. This section provides us the insight of the set of services which are actually performed on the respective sectors. AlterDomus offers a wide range of services through the vertically integrated model. The following as the set of services which are offered by the company:

- Fund Services

- Depositary Services

- Corporate Services

- Consolidation

- IFRS Services

- Regulatory Services

- Regulatory Watch

- Liquidation

- Middle Office Services

- Transfer Pricing

- Management Company

- Co-sourcing Services

- Technology

Fund Services:

The firm has over $425 billion of assets under administration (AUA) for Fund Administration Clients. The teams have a rich experience and understand of the requirements of the fund managers for getting the fund up and running at various jurisdictions. The teams are trained to be familiar with the applicable systems, processes, rules and best practices with respect to each jurisdiction and also try to accommodate the fund manager with recommending various service providers which are required for having a smooth flow of the activities (AlterDomus, n.d.). The following is an insight into the day to day activities of the fund services:

Fund Launch:

- Reviewing of the fund documentation

- Coordination with the advisers and the service providers (lawyers, banks, auditors etc.)

- Due diligence of the KYC and anti-money laundering (AML) process on the funds and the related parties

- Reviewing of the fund documentations such as the Private Placement Memorandum and transaction documents with respect to various parties

Accounting and Bookkeeping:

- Production of financial statements and fund reporting

- Preparation of Net Asset Value (NAV) statements for the investors

- Portfolio and Partnership accounting

- Supervision of audit process

Administration:

- Capital call and subscription management, including monitoring of the bank accounts movement

- Management of distributions and drawdowns notices

- Coordination with cash management and treasury services

- Performing the complete KYC on the investors

- Preparation of the necessary documentation such as acknowledgement, contact note and statements

Reporting:

- Generation of valuation reports for fund mangers

- Statements such as Net Asset Value, Fund Operation, Portfolio Holding, Cash and Carried Interest

- Reports can be customised per client’s reference and other agreed valuation packages

Investor Communication:

- Maintenance of investor contact information

- Customised investor reporting and mailing

Middle and Back Office Services:

- Performing full middle office service in order to bridge the gap between the fund and the other service providers

- Assistance with the operation of the funds

Limited Partner (LP) Services:

- Assistance in the implementation and administration of LP’s own investment vehicles in coordination with advisors

- Monitoring of cash transactions (investments, distributions, invoices)

- Consolidation

Depositary Services:

Private Equity & Infrastructure, Real Estate, Debt and Fund of Funds which fall under the scope of AIFMD are required to appoint a depositary in order to be compliant with the directive. As a part of its vertically integrated governance model AlterDomus provides depositary as a part of the other services to the management of local companies or at times stand-alone depositary services for non-EU funds (AlterDomus, n.d.). The company offers depositary services at Luxembourg, United Kingdom and Malta and looks after more than 100 alternative investment funds.

The structured teams in the company work in hand in hand with the clients after agreeing on an operating memorandum and providing the clients with seamless and non-intrusive services. The key activities performed are as follows:

Oversight Duties:

- Reviewing processes of valuation of assets and limited partnership interests

- Ensuring the timely settlement of transactions which include the income distribution

- Monitoring the activities of subscriptions and redemptions

- Ensuring periodic due diligence is carried out and review of key operational processes

Cash Monitoring:

- Monitoring of the cash flows at the fund level

- Identification and reviewing of significant cash flows

Safekeeping:

- Holding the records of the investments

- Performing the periodic asset reconciliation

- Verification of the ownership of the assets

Corporate Services:

The key activities performed are as follows:

Incorporation:

- Setting up legal entities and implementation of cross border corporate structures

- Coordination of ongoing relations with local tax, banks and legal professional service firms and other financial professionals

Management:

- Organising broad meetings and shareholder meetings

- Maintenance of shareholder’s register and any legal formalities

Tax Compliance:

- Preparation of corporate tax returns, tax balances, VAT returns and maintenance of VAT records

Other Services:

- The corporate services team also assists the fund services team in activities such as consolidation, liquidation services, administration and accounting.

Consolidation:

A systematic approach is adopted for providing a tailor-made solution with respective to the client’s specific priorities. The company has been performing consolidation services for over 100 clients with total assets amounting to 86 billion euros. The following are the key aspects of the consolidation service provide by the firm.

Assessment:

- Assessment of the full impact of preparing the consolidated financial statements

- Reviewing of the group accounting manual and group structures

- Identification of the potential GAAP differences between the local and consolidation GAAP

- Developing an effective approach and providing solutions for implementation

Implementation:

- Preparation of customised group reporting packages and proposed timelines

- Assistance in the calculation of the goodwill and purchase price allocation

- Conversion of the local GAAP accounts to consolidation GAAP

- Conversion of local currency reporting to consolidation reporting currency

Reporting:

- Reviewing of local reporting packages

- Preparation of periodic consolidated reports under main accounting GAAP

- Preparation of a proforma consolidated financial statements or annual accounts

- Calculation of the periodic NAV in various GAAPs

Multiparty Communication:

- On-going communication and coordination with the accounting team

- Liaising with external auditors

- Communication of audited financial statement/annual accounts to third parties

The consolidation services offered as per the current client status are 63% – IFRS, 36%- Other GAAPs, 1% – US GAAP (AlterDomus, n.d.).

IFRS Services:

The last economic crisis has ensured that the regulatory bodies push on the setting down a single set of standards to allow the comparability of financial reporting. For which the solution has resulted in the use of International Financial Reporting Standards (IFRS). With many countries already adopting it into their local regulations and many others in the process of converging with IFRS has evolved it into an international bench mark. The work flow designed with the IFRS implementations is similar to the process of consolidation where by examining the areas where the current GAAP and IFRS will have a significant difference and providing the guidance in selection of the IFRS accounting policies and preparation of the IFRS financial statements.

Liquidation:

During the times of the liquidation of the fund and trying to find the exit strategies or restructuring of a range of products to fit the market requirements. The company offers to act as a liquidator on behalf of the client or assist the liquidator in the liquidation process (AlterDomus, n.d.). The following steps are ensured to provide a smooth flow of services to the clients.

Preparation of the liquidation:

- Identification of all the assets and reviewing their liquidity

- Identification of the liabilities

- Reviewing process of the commitments and the tax situation

- Estimation of the costs

Liquidation Operations:

- Realisation of the assets

- Termination of all the agreements with service providers

- Payment of the debts and pending invoices

- Coordination with the various interveners (auditors, tax advisors, notaries and banks)

- Payment of advances on liquidation proceeds

Closure of the Liquidation:

- Preparation of the liquidator’s report

- Communication with the shareholders, the auditors and regulated bodies

- Final payments and distribution to the shareholders

- Deregistration

Regulatory Services:

Post the global financial crisis there has been a dramatic increase in guidelines from the international regulators, so that it would ensure that they can stir away from another crisis as such and to increase they tax revenues as well. As these would regulatory changes and keeping things up to date with the process flows and setting up the required IT framework would be serious hurdles for the fund managers (AlterDomus, n.d.). In order to the assist the clients with these challenges and set their focus on their core business, AlterDomus has some dedicated solutions towards the following:

- AIFMD Reporting

- CRS Services

- FATCA

- KYC Services

AIFMD Reporting:

Alternative Investment Fund Managers Directive (AIFMD) has already brought some drastic changes in the alternative investment framework and it has been working towards a few more through the near future. The company has special teams dedicated towards this exercise and have been monitoring the activities from the very initial stages. And with the firm’s close collaboration with the industry and the regulators has ensured that it can provide the assistance to the clients with the directive’s challenges. The services which are offered under these are related to the procedures which would support the fund managers in areas such as central administration, investor services, corporate services and depository services.

FATCA:

Foreign Account Tax Compliance Act (FATCA) is a checkpoint for tracking all the accounts held by the US citizens outside the US and has been designed to prevent tax evasion by the US tax payers. This act requires all the foreign financial institutions to report globally related to the accounts of the US tax payers and has failing to do which would subject these institutions with 30% withholding tax on the revenue from US. With respect to the fund the responsibility for FATCA rests with the board of the fund or an entity. And at AlterDomus there is an integrated approach designed to assist the client at any level of the structure pertaining to the FATCA compliance right from the investor level to the fund and entity level.

Regulatory Watch:

This section has been a unique space within the firm with respect to other peers in the industry. There has been a timely updation of the all the recent regulatory modifications and changes which are to be acted upon through the globe updates which are readily accessible to the clients and which helps in providing the client with a more open and transparent working which has been an asset for the company.

AlterDomus* In Ireland

AlterDomus* in Ireland:

As mentioned earlier in this report about the significance that Ireland has gained in the funds industry through the years has always made a destination for fund managers and the scope it has driven for the business from the company’s point of view. The firm has a history of expanding its operations and has been on that global reach working along with the clients and has set up offices in Jersey, Guernsey, Malta etc. in order to service the client with more attention to detail with also having the collaboration of the expertise from the local domain and the firm’s head office at Luxembourg. With all these parameters in view the company has started its association with Ireland in the year 2011 with an office in Dublin but for with the activities where limited to the corporate service offered with a plan to create a reputation for its own in the country.

In the year 2016, they have set up another office at Cork with the strategy that it would be the centre of excellence for knowledge which serves not only the Irish domiciled funds alone but also provides it supports the services for the funds domiciled at other locations such as Luxembourg, Jersey, Malta etc. As the firm is in its expansion stage with its acquisitions in US and China, which has opened doors for working in line with those locations as well. Along with these activities the firm has its eyes to expand its space in the terms of its size and also wining more Irish funds to be served which has been an accelerated path till date.

Major Competitors:

In terms with the competitors in the industry this report discusses the insight with respect to the Irish fund industry. There are over 40 fund administrative service providers based in Ireland who have been serving both the Irish and Non-Irish based funds of which the below mentioned are the close competitors with respect to the size of assets under administration and also the services offered at both the ends.

- Apex Fund Services

- CITCO

Apex Fund Services:

Apex Fund Services has been established in the year 2003 at Bermuda. Around the same time alter Domus was established. Apex has spread itself globally and has a staff of close to 2000 people based at 24 jurisdictions and has around $560 billion in assets under management (Apex Funds, n.d.). It has been providing the services such as fund accounting services, regulatory solutions to middle office services. Apex also has a strong base in the Irish market with its presence in four locations in Ireland and has been associated with different Irish funds. So, with respect to the services delivered and the assets under management brings this company as a strong competitor for alterDomus in Ireland.

CITCO:

CITCO has been a very experienced company in this domain with over 70 years of service delivery and has a broader range of financial services under offer from the firm. It has 60 offices across the globe and has a strength of around 6,200 professionals supporting its activities. Its experience has gained a major number of Irish funds under its scanner and has been trying to pick up its numbers. The company holds around $950 billion assets under administration (CITCO, n.d.). With all these challenging metrics it shows this firm has a strong competition with alterDomus in the Irish market.

Impacts and Challenges at the Job:

As the report gives an insight about the global fund industry and the prime locations which have been the driving points for the business with the view of where the firm stands in that space both in regards to international and Irish market respectively. The challenge it throws is respective to the fund, one would be associated with and the key aspects of rendering high quality work would be adopting to the various locations regulations which are in place and constantly getting in line with the changes in those regulations, although most of the jurisdiction have been trying to adapt the IFRS structure they still have areas related to be familiar with their local GAAP. So, the key point which I would like to put forward is that it has the challenge of getting the exposure to various activities related to other domains and doesn’t strict the learning with only the Irish related funds.

During my three months period with the firm I have got the opportunity to work on a project which was a migration of a client from the head office Luxembourg to Ireland. As a part of this project I have gained a wide range of exposure towards the Lux-GAAP and other related activities of the fund which has been domiciled in Luxembourg. This has paved the way for consistent learning at the workplace. And as discussed in the earlier sections that Ireland has been the destination for the fund administration service of over 4 trillion euros in assets out of which half have been the fund domiciled at other regions and administered from here which shows the evidence that this trend of a challenging role is at the industry level.

Exhibits:

Source: PwC Ireland, Asset & Wealth Management Insights: Asset Management 2020: Taking stock

Source: Central Bank of Ireland, Dec 2017

Source: Central Bank of Ireland, Dec 2017 and Irish Funds

Bibliography(Apex Funds, n.d.)(CITCO, n.d.)

ALFI, n.d. Luxembourg the global funds centre. [Online]

Available at: http://www.alfi.lu/sites/alfi.lu/files/files/Publications_Statements/Brochures/Luxembourg-the-global-funds-centre.pdf

AlterDomus, n.d. [Online]

Available at: www.alterdomus.com

Anon., n.d. Private Equity fund accounting essentials. [Online]

Available at: https://quickstep.ie/about/private-equity-fund-accounting-essentials

Apex Funds, n.d. [Online]

Available at: www.apexfunds.ie

BVCA, n.d. [Online]

Available at: https://www.bvca.co.uk/Portals/0/library/documents/Guide%20to%20PE%20Fund%20Finance/Debt%20Fund%20Guide-May14-web.pdf

Central Bank of Ireland, n.d. Regualtory requirements and guidance. [Online]

Available at: https://www.centralbank.ie/regulation/industry-market-sectors/funds-service-providers/fund-administrators/regulatory-requirements-and-guidance

CITCO, n.d. [Online]

Available at: www.citco.ie

Ctcorporation, 2016. A guide to the top 20 offshore fund locations, s.l.: s.n.

EY, n.d. Global Private Equity. [Online]

Available at: https://eyfinancialservicesthoughtgallery.ie/2018-global-private-equity-survey/

Financial Times, n.d. [Online]

Available at: https://www.ft.com/content/b887b072-d691-11e7-8c9a-d9c0a5c8d5c9

Forbes, n.d. Ten predictions for private equity in 2018. [Online]

Available at: https://www.forbes.com/sites/antoinedrean/2018/01/24/ten-predictions-for-private-equity-in-2018/#4bcb255e319e

Investopedia, n.d. Understanding private equity funds structure. [Online]

Available at: https://www.investopedia.com/articles/investing/093015/understanding-private-equity-funds-structure.asp

IPE, n.d. [Online]

Available at: https://www.ipe.com/reports/special-reports/credit/credit-debt-markets-and-private-equity/10007791.article

Irish Funds, n.d. Getting started in Ireland. [Online]

Available at: https://www.irishfunds.ie/getting-started-in-ireland/why-ireland

Irish Times, n.d. Irish administered funds by 2020. [Online]

Available at: https://www.irishtimes.com/business/economy/irish-administered-funds-expected-to-top-4-7tn-by-2020-1.3009008

Matheson, n.d. Ireland is the leading european funds location. [Online]

Available at: https://www.matheson.com/news-and-insights/article/ireland-is-the-leading-european-funds-location-according-to-a-survey-of-glo

Mckinsey, n.d. [Online]

Available at: https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and%20principal%20investors/our%20insights/the%20rise%20and%20rise%20of%20private%20equity/the-rise-and-rise-of-private-markets-mckinsey-global-private-markets-review-2018.ashxnsey

Pwc Ireland, n.d. Ireland- The ideal location for your funds. [Online]

Available at: https://www.pwc.ie/publications/2017/ireland-ideal-location-for-your-funds-november-news.pdf

PwC, 2017. Assest & Wealth Management Insights : Asset Management 2020: Taking stock , s.l.: s.n.

Statista, n.d. [Online]

Available at: https://www.statista.com/topics/1454/private-equity/

World Economic Forum, n.d. Alternative Investments 2020 : The Future of Alternative Investments, s.l.: s.n.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Analysis"

Business Analysis is a research discipline that looks to identify business needs and recommend solutions to problems within a business. Providing solutions to identified problems enables change management and may include changes to things such as systems, process, organisational structure etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: