Demonetization in India

Info: 9486 words (38 pages) Dissertation

Published: 13th Dec 2019

DEMONETIZATION IN INDIA

METHODOLOGY:

The research paper is based on primary and secondary data- sources that was collected from various published newspapers, reports, online sources and Financial Institutions,

HISTORY AND BACKGROUND OF DEMONETIZATION IN THE WORLD:

Investopedia has defined Demonetization as “the act of stripping a currency unit of its status as legal tender”.[1]

It is said to have taken place when the current form of a country’s currency is replaced with new currency and the old currency is no longer recognized as an official mode of payment.

There are various reasons for a government of any country to resort to such extreme measures. Some of the most common reasons are to curb the menace of Corruption, fake currency or to control inflation and boost the economy.

History of Demonetization:

Demonetization is not a new concept. Many nations have embraced demonetization and changed their currency in the past for various reasons. Some countries met the purposes whereas some failed miserably.

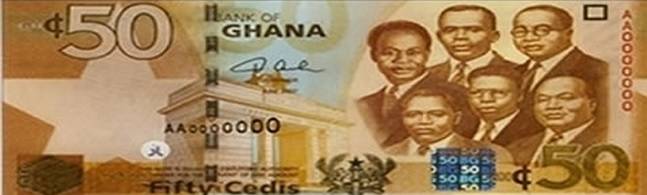

- Ghana

In 1982, Ghana demonetized its 50 cedi currency notes to tackle tax evasion, money laundering, corruption and get rid of excess liquidity. The move led to chaos across the country and people started investing in physical assets and foreign currency thus weakening the economy.

2) Nigeria

In 1984, Nigeria decided to go for demonetization. The then military government in Nigeria introduced different coloured notes and banned the old currency to fight black money.

However, the debt-ridden and inflation hit country did not take the change well and Nigeria’s economy collapsed.

3) Myanmar

In 1987, Myanmar’s military government demonetized 80% of Myanmar’s currency to curb black money. There were mass protests and it led to economic disruption.

4) Soviet Union

In 1991, the then Soviet Union, under the leadership of Mikhail Gorbachev demonetized the ruble bills of higher denominations, 50s and 100s. The move was not successful and resulted in change of leadership and led to Soviet breakup.

5) North Korea

In 2010, North Korea demonetized their currency. The reform knocked off two zeros from the face value of the old currency notes to banish black market. It led to major economy breakdown and people were without food and shelter.

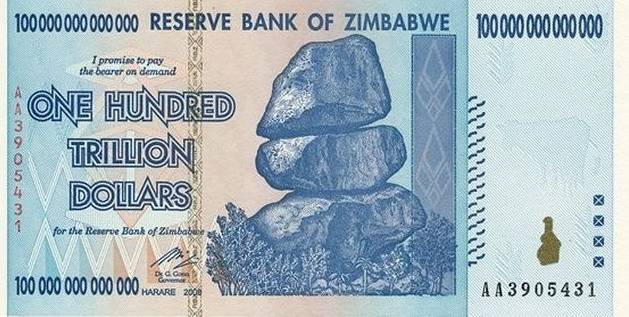

6) Zimbabwe

Zimbabwe used to have $100,000,000,000,000 note. The Zimbabwean economy went for a toss when the President issued edicts to ban inflation and demonetized its hundred trillion dollar note. After demonetization, the value of trillion dollars dropped to $0.5 dollar.[2]

7 Australia

Australia replaced its paper currency with polymer (plastic) notes to stop counterfeiting. Since the purpose was only to replace the material of the currency, it did not have any side-effects on the economy.

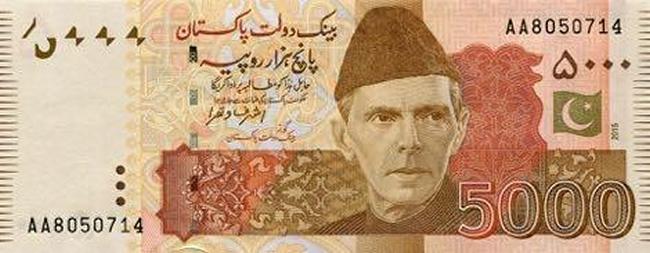

8 Pakistan

Pakistan legally issued the tender in 2015 and started phasing out the old notes gradually from December 2016 as the new currency were introduced. The citizens had time to exchange the old notes and get newly designed notes, therefore, no impact was witnessed on economy.

9 Britain

In Britain, before 1971, pond and pens currency were in circulation. To bring uniformity in currency, in 1971, government stopped circulation of old currency and bought coins of 5 and 10. This move failed in other countries except Britain.

10 Congo

During 90s, the then Dictator made changes in currency of Congo for the better performance of economy. However, these changes didn’t improve economy and prices of necessity goods increased.

Demonetization in India

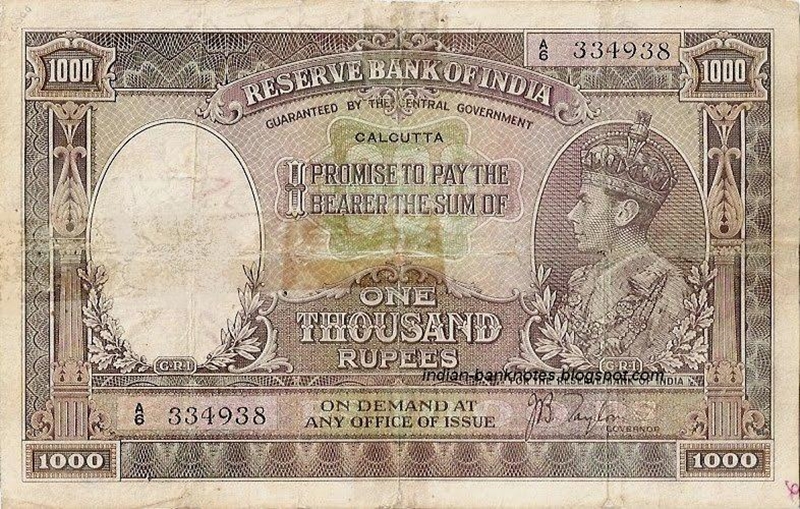

In the light of history of demonetization in the world and its effect on the economy of the country, the recent move of the Prime minister of India on November 8, 2016, to demonetize its high value currencies in the denominations of Rs. 500 and Rs. 1,000 with immediate effect, took the world and the nation by surprise. The concept of demonetization is not new in India. The Indian government had demonetized bank notes twice in the past —once in 1946 and then again in 1978—and in both cases, the objective was to tackle black money outside the formal economic system also termed as parallel economy and to curb counterfeit money.

The first currency ban in India in 1946:

In 1946, the currency note of Rs. 1,000 and Rs 10,000 were removed from circulation.

1954:

However, both the notes were reintroduced in 1954 with an additional introduction of Rs. 5,000 currency.

In 1978, the then Prime Minister of India announced the currency ban of Rs. 1000, Rs. 5000 and Rs. 10,000 and took it out of circulation. The main purpose of the ban was to drive away black money out of circulation in the economy.

Currency Demonetization in India in 2016:

On 8th November 2016, Prime Minister of India Narendra Modi announced the demonetization of high currency banknotes of denomination ₹500 and ₹1000, in an unscheduled live televised address. In the announcement, Government declared that old banknotes would be invalid past midnight with immediate effect and announced the issuance of new ₹500 and ₹2000 banknotes in exchange for the old banknotes. It was a huge shock to the nation and the Indian Economy. The Indian Prime Minster action resulted in scrapping 15.4 trillion rupees ($220 billion) in one stroke. [4] The total currency scrapped was equivalent to 86 percent of cash in circulation.[5]

Quoting the Indian prime minister Mr. Modi:

“For years, this country has felt that corruption, black money and terrorism are festering sores, holding us back in the race towards development,”. “To break the grip of corruption and black money, we have decided that the currency notes presently in use will no longer be legal tender from midnight tonight.” [6]

In the world’s largest democracy, the demonetization was a revolutionary move.

The entire plan for demonetization was executed in strict confidentiality and even the cabinet was taken into confidence on the same day when the demonetization was announced. Very few bureaucrats were kept in confidence and were sworn to utmost secrecy. Secrecy was of paramount significance. Because of the strict confidentiality people of the country were completely taken by surprise and hoarders of Black Money got no chance to convert the old invalid currency into gold, property and other assets.

Objectives of current demonetization:

India ranks 76 out of 168 countries in the latest Corruption Perception Index 2016 by Transparency International (TI). Corruption is rampant in India and its negative effects are evidenced in social, economic and political system. It reduces the role of market economy and the role of the government. It increases income inequality and allocation of resources and increases disregard for Rule of law. Study has proved that corruption has significant negative impacts on investment(FDI), competition, ease of doing business and equity (income distribution).

World Bank has defined corruption as” abuse of public power for private benefit”.[7]

Corruption and opaque regulations are major hurdles in the growth of Indian economy. Corruption, black money, parallel economy funded by black money, fake currency notes used in terror funding are considered serious impediments to economic growth of India. Money laundering provides funding for antisocial activities like smuggling, terror funding and escalates tension at the border and disrupts peaceful negotiations and existence between nations.

Demonetization of high value currency notes of 500 and 1,000 denomination on November 8th, 2016 by the Indian Government is being considered a landmark and revolutionary move to eradicate corruption and black money. Demonetization is aimed to deal a severe blow to the black economy, corruption, inflated pricing, tax evasion and terrorism. Demonetization is expected to raise the tax revenue, system liquidity and decrease the fiscal deficit. The decision to demonetize high value currency notes is expected to clean the economic system and introduce more transparency in the economic system and eliminate black money and stall circulation of counterfeit currency in the country which is funding terrorist activities. Since the old currency is now no longer a valid legal tender, people are forced to deposit the old bank notes in the Bank which will increase the size of economy and revenue base and get rid of the parallel economy. It is expected to boost e-commerce.

Various sectors will reorganize themselves in the wake of cashless economy and become more transparent and corporatized leading to more efficiency and long term sustainable economic growth. It is aimed to cripple money laundering, corruption and terrorism.

The government has announced that while removing black money, demonetization of notes of Rs. 500 and Rs. 1,000 will also address the issue of terror funding and it will also curb the circulation of fake currency. Fake Indian Currency Notes trade across the border was considered the financial “lifeline of terror modules” working in India and it perpetuated terror financing. Terrorist outfits routed the illegal cash in the form of big currency notes or fake currency into the nation. That money has rendered invalid after demonetization. The new currency note has some inbuilt high security features coupled with latest technologies like Nano chips which make it difficult to counterfeit.

Finance minister of India announced in a recent press conference announced:

“We are likely to see some decline in inflationary pressures as demand comes down in the short term,”[8]“all this will impact the size of the GDP itself because more transaction that were happening outside the (formal) economy will get into the economy itself”.

Increase in government revenue due to conversion of the black money to white—increased tax compliance and better revenues for government— is another positive aspect of demonetization. Demonetization, coupled with the government’s other major tax reform to introduce a single-window clearance system(GST), will reduce artificial price inflation of properties in India and make property affordable for the masses. It will make the system more accountable and efficient.

The response of the International media to India’s high value currency ban shows its significance over world economy. Many international organizations including IMF, European Union and World Bank supported this move. The sudden move by the Indian Prime Minister has brought respect for him by Government leaders.

The International Monetary Fund (IMF) voiced its support in favor of demonetization-

“We support the measures to fight corruption and illicit financial flows in India,” said a spokesperson. “Of course, given the large role of cash in everyday transactions in India’s economy, the currency transition will have to be managed prudently to minimize possible disruption.”

The Independent

A senior Indian government official equated Mr. Modi to Singapore’s first Prime Minister Lee Kuan Yew who was recognized as a “lion among leaders”.

New York Times

The top-secret demonetization move was hailed by financial analysts as bold and, potentially, transformational for India. It was stated as a high-stakes experiment: which had not only withdrawn the two bills but reduced the country’s supply of cash drastically and abruptly by around 80 per cent of the cash in circulation.

Wall Street Journal

Wall Street Journal reported that If the reforms work, it could broaden the government’s tax base. It observed that Indian government bonds, a favorite among emerging-market investors, have rallied since the announcement. That may be a bet the reforms will work or economy may slow down. It could take Mr. Modi’s plan a while to come together.

“Prime Minister Narendra Modi has long made fighting black money a priority — as the country moves to legitimize its shadow economy, change an age-old culture of corruption and attract foreign investment. A voluntary disclosure program has netted $19 billion, a fraction of the estimated $400 billion to more than $1 trillion in black money.”

Sydney Morning Herald

The step by Modi, who is approaching the half-way mark of his term, is an attempt to fulfil his election promise of curbing tax evasion and recovering illegal income, locally known as black money, stashed overseas. Modi’s unprecedented move follows a similar step taken by the European Central Bank, which is discontinuing the use of 500-euro notes to stop their use in “illicit activities”.

Benefits would include reduced crime and welfare fraud, increased tax revenue and a “spike” in bank deposits.[9] Deposits in Banks will enhance the liquidity positions which could be further utilized for lending purposes. At the same time diversion of fund from parallel economy to the main economy will increase the resource base of India and provide capital for many infrastructural projects undertaken by the government.

Interest rates for lending are expected to come down with liquidity at the disposals of the banks, making buying of property more affordable. Demonetization is expected to benefit the government in fulfilment of its mission ‘housing for all’.

THE IMMEDIATE IMPACT OF DEMONETIZATION ON THE COMMON MASSES OF INDIA

The ripple effect of demonetization cannot be understated. After discussing the objectives of demonetization and its aimed impact on the economy, it is pertinent to study the impact of Demonetization on the lives of the common masses of India. Finally, it is the common masses who must bear the brunt of all the transitional woes. They have to pay cash to the daily vendors. The Indian PM’s sudden announcement came as a huge shock and resulted in absolute pandemonium. It was beginning of a period of absolute chaos and uncertainty. People were given a small window of time during which they could exchange their invalid notes with new legal tender in banks. People rushed to convert their invalid notes. Newspapers and TV channels reported huge queues outside banks, ATMs and Forex counters.

IMPLEMENTATION OF THE DEMONETIZATION:

The entire implementation of Demonetization was beset with problems and it resulted in great inconvenience to common mass. The majority of the problems faced by people emerged due to extremely patchy implementation of the move. The majority in the country welcomed the move hoping that it would bring more transparency in the system and help in a more equitable distribution of wealth by curbing illegal hoarding of cash but problems faced by the people were extremely disruptive in nature and could not be underestimated. To keep the whole exercise secret, preparedness to meet the demand of new currency was not met and there was not enough new currency printed in preparation for the upheaval. To overcome the problem of cash crunch, withdrawal limit from banks was imposed on cash. Small denomination notes were in short supply and the new Re 2000 notes were incompatible with the existing ATMs which had to be recalibrated. The poor and the elderly were most inconvenienced by spending the entire day standing in queues in spite of the fact that they were not the ones that hoarded black money. There were several reports of elderly dying while waiting in queues in the scramble to change old notes. The Cash at the banks and ATMs would get over quickly as there were short supply of legal tender. There was a major deflation in the country for initial few weeks. While the poor spent entire nights outside ATM Queues, the black money hoarders had safely invested their cash in other financial assets like gold, property, shares and in foreign accounts.

Because of the cash crunch even medical treatment and travel became difficult. There was no money, no food. People’s money was deposited in the banks and they were unable to withdraw their own money because of the limitation on cash withdrawal. It was an emergency like situation. Some hospitals refused to accept payments in old currency resulting in death of sick people. The demonetization inflicted more pain and agony on the poor than on rich.

The main issues that emerged in the aftermath of the announcement were

- Shortage of cash in the ATM’s: _ Many a times people would stand whole day in the queue to find out that the ATMs had run out of cash. This lead to frustration and in some cases violence in some places. Adequate number of new notes had not been printed to replace the old notes.

- The ATM’s were not ready for the Rs. 2000 notes. A complete recalibration of ATM’s had to be done to accommodate the new Rs. 2000 Notes which took time.

- The post office network that has a very extensive reach extending even in remote rural areas, was never used. It would have helped the rural population immensely in making the transition smoothly.

Majority of the problems faced by the people would have improved if the cash situation at ATMs and Banks was taken care of. There is no doubt that the implementation of the move was a major mess. The move was announced and implemented overnight which resulted in so much chaos in the country. The primary aim of the shock was to deny the black money hoarders any chance to plan and convert the illegal cash. The veil of secrecy impacted the banks’ ability to plan and disburse the new notes in a more organized manner. They were not ready for such a large-scale load on the banking system. It was really frustrating to see so many ATM’s not in working condition. Even the ones that were working would see their cash dry up quickly.

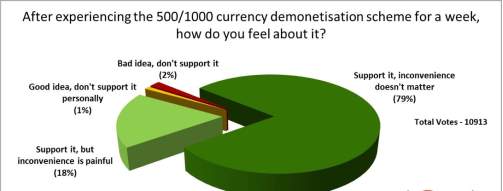

It goes to the credit of the countrymen that even in the face of severe problems they still supported the decision of the government in the hope that the end result will be good.

It is a well- known fact that a major component of the Indian economy is the informal sector which is heavily cash dominant. For a few weeks after the demonetization it became virtually impossible for the daily wage earner and laborers to even earn their livelihood. Laborers were unpaid and produce rotted in markets as cash stopped changing hands. There was flight of number of daily wage earners and laborers namely street vendors, cab drivers, vegetable and milk vendors back to their native villages as there was not sufficient cash with people to conduct business. The daily wage earners were seen standing in queues for most of the time to convert their money and it left them no time for their daily work.[10]

In spite of the problems of extreme nature, the common masses of the country, the economically middle and lower classes supported the demonetization move and bore the pain stoically in the hope that it would streamlines their lives in future by eradicating the menace of black money.

Another major section of the population who had planned major event like marriage, suffered through the ignominy of cancellation of the function because of the cash crunch. It was a harrowing time with no relief in sight for such families who had planned the event for months in advance.

Another major problem for vast majority of masses in rural and remote areas was the lack of accessibility to the banking system. It is true that the government had started the PMJDY in 2014 to extend the reach of the banking to the rural and remote areas but somewhere along the line they overestimated the levels of connectivity to banking that resulted in such hardships to the majority of the people. In spite the Prime Minsters Jan- Dhan- Yojana Scheme, majority of the population had a bare minimum access to the banking sector. Demonetization put them to major hardship. There were many cases in rural areas where the saved cash for years as an emergency fund, stashed away secretly. It was not possible for the rural population to get trained in e-money concepts in such a small window of time.

The worst sufferers were the small and medium businesses for whom there were not enough small denomination notes.

The plethora of problems faced by the countrymen after the demonetization move led to filing of a number of cases in the Supreme Court of India to restrain or even roll back the demonetization. There were several petitions and Public Interest litigations in this regard. The court could not stay the decision. It simply asked the government to file an affidavit justifying its notification of demonetization. The court further asked the government machinery to ensure that the common masses of the country were not severely affected by the new policy.

Some of the opposition parties staged a protest marches in the capital city of Delhi against the move. Even the parliaments speaker mentioned the hardships faced by the people.

Due to the hardships faced by the common masses, even the court questioned the manner of implementation of demonetization.

The former Finance Minister of India, Mr. P. Chidambaram came down harshly on PM’s claim that the move would not affect the common man. He said that people faced difficulties in buying medicines and travelling because 80% of the notes in circulation were high denomination notes.

The former Indian prime minister and globally respected economist Dr. Manmohan Singh who is widely credited for launching India’s economic reforms in 1991, dubbed the demonetization exercise as “organized loot and legalized plunder”.[11]

The Knowledge at Warton site described the demonetization in a unique way. It said that there is a ‘demon’ in the beginning of demonetization which sums up the massive problems faced all over the country by the citizens. It said that the ‘demon’ had started surfacing from the very next day after the demonetization announcement when long winding lines started appearing outside the banks and ATM machines.

One of the stinging criticisms of the Demonetization came from the development economist Jean Drèze –

“Demonetization in a booming economy is like shooting at the tyres of a racing car”.

Initially, the move received support from some international organizations but as the cash shortages and inconveniences grew, the demonetization was heavily criticized by prominent economists and by world media.[12]

OBJECTIVES OF DEMONETIZATION VERSUS ACTUAL PERFORMNACE APPRAISAL IN THE LONG TERM:

Narendra Modi, the Prime Minister of India is considered a very dynamic, dedicated and determined person, who believes in the inclusive development of every Indian citizen. He is regarded as ‘People’s Leader’.

The demonetization decision was in continuation of a series of measures taken by the Government of India during last two years of leadership of Modi(2014-2016). Modi launched the Pradhan Mantri Jan Dhan Yojana in 2014 to integrate every citizen in the financial system of the Nation. In July 2015, the Prime Minister initiated the Digital India Mission to create a Digital economy.

The demonetization decision was in continuation of the earlier measures taken by him aimed at eliminating corruption, black money, counterfeit currency and terror funding. The potential medium-term benefits were perceived to be in the form of greater formalization of the economy, greater digitization of the economy, increased flow of financial savings and reduced corruption.

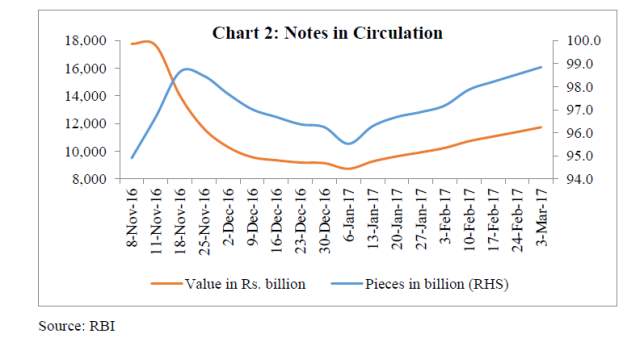

In the aftermath of the demonetization, the performance of the economy was evaluated. The was a definite slowdown in the months of November and December 2016, but by the end of February 2017, re-monetization picked up and the various indicators of the growth started to show positive improvement.

REMOVAL OF BLACK MONEY:

One of the primary aims of the Demonetization was the removal of black money from the Indian economy which was estimated to be around 25% of the GDP as per one of the World Bank Estimates. It was expected that the black money hoarders would not be able to deposit the invalid notes in banks as they were required to provide the source of noted being held or pay a 200% penalty. It was expected that the illegal cash would be removed from the system.

The Reserve Bank of India has not released the official figure of amount of demonetized cash deposited and how much Black money was eliminated in the move. According to an RBI report collected by end of December 2017, about 9% of the black money was eliminated from the system. The figure is highly debatable. According to Bloomberg news service, 97% of the invalid Rs 500 and Rs 1,000 notes has been deposited with banks as on December 30, 2016.

Bloomberg further reported that banks had received Rs 14.97 lakh crore by the last date for depositing old cash out of Rs 15.44 lakh crore, which was declared void. [13]

Therefore, the objective of removing the black money from the system could not be achieved as most of the currency found ways back to the bank. People found creative ways to convert the illegal cash by finding loopholes in the system. Government allowed the hospitals and gas stations to accept payments in old currency. People found innovative ways to convert their invalid notes through gas stations and hospitals with the help of CPA’s.

Critics of demonetization pointed out the futility of the demonetization exercise. They claimed that only 6% of the black money is held in cash in India and the bulk of the cash is stashed in Tax havens all over the world like the Swiss bank, Panama and a major share is also invested in real estate and equity and in bullion and is very difficult to track down without help of Governments of those nations.

According to a report published by the Swiss Bank in 2012 the amount deposited in Swiss bank by nationality is as follows: [14]

Country Money Deposited

INDIA $ 1,456 billion

RUSSIA $ 470 billion

UK $ 390 billion

UKRAINE $ 100 billion

CHINA $ 96 billion

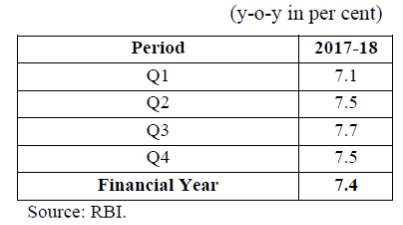

GROWTH:

It was believed by the Government that all the measures would lead to a strong economic growth for the country. There would be a higher GDP growth in medium and long term.

A survey done by the Reserve Bank of India in Mar 10, 2017, accepts that there was a liquidity crunch immediately after the Demonetization was announced and it negatively affected the gross value added (GVA). The paucity of cash reserve resulted in decline of demand as people’s capacity to pay diminished in the absence of cash. Even the workers in the unorganized sector are paid in cash and this announcement impacted their livelihood as there was no cash to pay them. Hence the production activity in the unorganized sector was also disrupted initially. [15]

There are a lot of sectors which depends upon daily wagers /migrant workers. Prominent among these sectors are – the construction sector and some of the labor-intensive manufacturing sectors such as textiles, leather, gems and jewelry and the transportation sector. These sectors were affected by the cash crunch and disruption of production activity.

According to a Reserve Bank of India report published on 10thMarch 2017, the medium term positive benefits of demonetization resulted in improving the overall business atmosphere in the country.

Projected Gross Value Added (GVA) Growth :

However, In Jan 2017, The IMF cut India’s growth rate for the current fiscal year to 6.6% from its previous estimate of 7.6% due to the “temporary negative consumption shock” of demonetization. The World Bank also decelerated India’s growth estimates. [16]

A World Bank report said that the Indian economy is expected to grow from 6.8% in 2016 to 7.2% by 2017 and the growth is expected to further gather momentum by 2019.[17] Therefore, it is evident that demonetization has slowed down the growth rate of Indian economy but if the other measures undertaken by the government is properly implemented, the desired growth rate may be achieved.

Effect on Demand:

The following sectors which are traditionally depended on heavy cash transaction are expected to be affected due to shortage of cash.

- Consumer goods – Lower demand due to lack of cash.

- Real Estate and Property – Prices were expected to go down eventually boosting the housing segment. According to a March report by RBI, new sales and launches declined till December but showed some signs of picking up by March.

- Gold and luxury goods – initially gold prices were supposed to go up as people would have more faith in gold.

- Automobiles (only to a certain limit)

All these mentioned sectors are expected to face certain moderation in demand from the consumer side, owing to the significant amount of cash transactions involved in these sectors.

INFLATION:

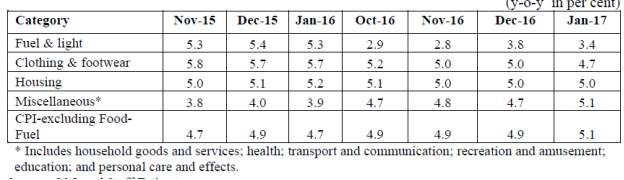

Visible impacts of post demonetization was Food inflation and Fuel inflation. Most of the other sectors like health, transport and communication and education remained largely unaffected.

CPI INFLATIOH in Select Groups (Source RBI)

FINANCIAL SECTOR:

Effect on Money Supply

It was believed that the unaccounted or the black money would not be able to re-enter the system and eventually the proportion of black money would reduce and money supply will shrink. It was claimed by the Reserve Bank of India that by the end of December 2017, about One lakh 45 Thousand crores of black money was eliminated from system. However, the official figure of the demonetized amount deposited in Bank has not been declared yet by Reserve Bank of India.

With the stepped up efforts of the Government and the different arms of the Government like income tax and Enforcement Directorate, turning up heat on the corrupt and black money hoarders, it is believed that about 3 to 4 lakh crores of black money would eventually be removed from the system. The money supply will thus eventually diminish from the economy.

DEMONETIZATION EFFECT: Nov 8 2016 – JAN 8 2017

DECLINE IN CURRENCY in CIRCULATION – 8,800 billion

Surge in aggregate Bank Deposits – 6,720 billion

REMONETIZATION EFFECT: End December 2016 — Mar 10 , 2017

Increase in currency circulation – 2,600 Billion

DEMAND FOR GOLD:

When the Demonetization was announced on November 8, 2016, the demand for gold jumped considerably as people scrambled to purchase gold in exchange for their old currency notes. However, the demand declined in December 2016 and in January 2017.

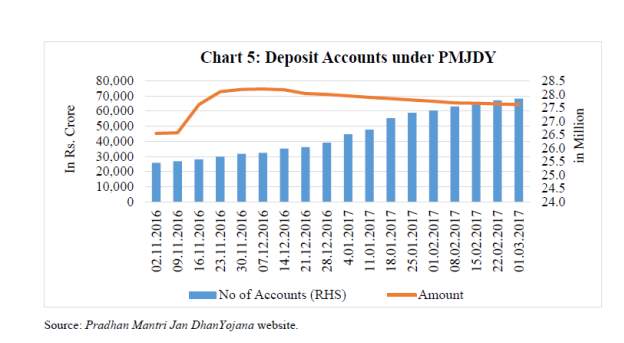

THE Pradahan Mantra Jan Dhan Yojana

The main target of the Jan Dhan Yojana scheme started by the Indian Prime Minister Mr. Narendra Modi is the population in the remote/rural areas with no access to the banking sector. Its mission is the financial inclusion of every Indian citizen in economy. It is trying to provide banking facilities and insurance cover to every individual in the country including the poor.

Demonetization led to a major spurt in deposits in the PMJDY accounts

In November the PMDJY accounts swelled by 88% after the announcement.

On November 9, 2016 , The total balance in PMJDY was pegged at Rs 456 billion which peaked at 746 billion by December 7, 2016. There was a sharp increase of 63.6 percent as shown in the chart below.

These deposits may highlight the dubious methods used by black money hoarders to convert their illegal money into white by depositing cash in PMJDY. The government has announced the scrutiny of money deposited in these accounts post demonetization and penalization of defaulters.

Digital Modes of Payments:

The digital modes of payments skyrocketed after the demonetization announcement on Nov 8 2016. The Government of India initiated a series of measures to take the economy towards a cashless one with a major thrust towards digital mode of payments.

The three-major e-wallet services players were Paytm, Oxygen and Mobikwik. Their combined daily transaction was around 17 lakhs on Nov 8, 2016. By December 7, 2017 reached to 63 lakhs – A jump of about 271%. The strong trend is expected to continue in the coming days as the Finance Minister Mr. Arun Jaitley announced a number of incentives to encourage digital payments.

The latest in the series of the Government’s efforts to digitize the economy has been the launching of the BHIM-Aadhar app on 14th April, 2017 by the Prime Minister . This app has an inbuilt fingerprint scanner and it authenticates a customer’s biometrics linked to his Aadhar account. BHIM Aadhaar works on National Payments Council of India’s (NPCI’s) existing product — Aadhaar Enabled Payment System (AePS). “This will directly cater to about 40 crore bank account customers spread across the country whose account is linked with Aadhaar. It is a huge opportunity for enabling digital transactions as about 99 percent of adult population is now Aadhaar-enabled,” said AP Hota, Managing Director and Chief Executive, NPCI. [18]

Fund liquidity:

Since most of the cash in circulation are being converted to bank deposits, banks are the biggest beneficiaries of the demonetization move. Banks are having improved liquidity following currency demonetization. “The total cash deposited in banks since the announcement of the withdrawal of the old Rs 500 and Rs 1,000 notes has crossed Rs 1.5 lakh crore, according to estimates received from different banks”[19]

“India’s largest lender State Bank of India said on Friday banks received deposits worth Rs 53,000 crore since the government put out of circulation high-value banknotes in a bid to drain illegal wealth.”[20]

DEMONETIZATION A SUCCESS OR A DISASTER:

The demonetization took the country by storm. The initial euphoria of the well wishes soon evaporated when people on the streets started dying. The international community especially the economists and the financial institutions watched keenly the travails of a country going through a momentous phase of history. The country went through a roller coaster ride in the process of demonetization and then a gradual and painful re-monetization.

It is difficult to say whether the demonetization has failed or succeeded in its primary aims of curbing the black money and the counterfeit currency.

As quoted earlier, according to Bloomberg news service, 97% of the invalid Rs 500 and Rs 1,000 notes has been deposited with banks as on December 30, 2016 and banks had received Rs 14.97 lakh crore by the last date for depositing old cash out of Rs 15.44 lakh crore, which was declared void. [21] Therefore, the objective of removing the black money from the system could not be achieved as most of the currency found ways back to the bank.

The demonetization could not have eliminated corruption and the scourge of black money by itself but demonetization combined with the continuous efforts of agencies like Enforcement Direcorate/IncomeTax, CBI, ACB, is making it more and more difficult to hoard cash. The agencies have been busy scanning all the accounts for any suspicious activity during the months after the demonetization announcement. The government had made it sufficiently clear that as more and more news laws, digitization and greater transparency will make it very difficult to deal with black money in India.

One of the aims of the demonetization move was to tackle terrorism that mainly flourished on fake currency. When demonetization was announced, a huge stash of fake as well original currency in the hands of terror outfits were rendered useless. Severe blow was dealt to the paying capacity of many terror outfits. Similarly, the financial strength of the naxal outfits were also hit with the demonetization. Even in Kashmir there was a lull in the stone pelting mobs, who were dependent on fake currency supply from across the border, according to some sources because financing is a prime driver of terrorism.

Fake Indian Currency Notes (FICN) is not only used for funding terrorism, but also to subvert Indian economy by enemy countries. The demonetization move disrupted the flow of FICN from Pakistan, but the challenge was to ensure that Pakistan does not replicate the new series of high denomination notes. However, within two months since the demonetization policy was announced, Official Sources reported Pakistan-based counterfeit Indian currency of Rs. 2,000 notes citing seizures and arrests made by the National Investigation Agency (NIA) and Border Security Force (BSF) in January 2017and February 2017. They were smuggled through the porous India-Bangladesh border. A study by investigators and experts of the seized notes revealed that at least 11 of the 17 security features in the new Rs 2,000 notes had been replicated.[22]

Therefore, demonetization alone failed to curb black money or fake currency.

But going by all the economic indicators, the country seems to have survived the demonetization and is back on the track with a high rate of growth. It may not have been able to eradicate the black money or the counterfeit currency completely but the demonetization combined with some other schemes of the government is making it very difficult for the corrupt to hoard property and illegal cash. The demonetization should be seen as one of the major steps in a series of steps that is taking the country towards greater digitization and hence greater transparency. It will help assess the impact of demonetization with a wider perspective. A tidal shift from hard currency to digital money will need to be accompanied by an equally massive effort on securing the systems, educating millions of technology challenged users and setting up of cyber defense capabilities.

It is true that the replenishment of the new currency went much slower than its demand. Due to this, the lines outside banks went on even 50 days after the demonetization announcement. However, the economists who warned that India’s progress would be derailed and growth would slow down, had to grudgingly take back their words. Most of the adverse effect was transient and was felt only during November and December 2016. The governor of the Central Bank, Mr Urjit Patel also accepted some loss of economic momentum and short term disruption but he expressed optimism that the currency ban would have ‘far reaching changes ’.

Goldman Sacks was very optimistic about the long term positive impact of the currency ban – “Eventually, the currency reform should help to move economic activity into formal channels, accelerate financial inclusion, and increase government revenue.

One of the strongest support of the demonetization came from the team of Jagdish Bhagwati, Vivek Dehejia and Pravin Krishna ( respectively, University Professor at Columbia University; Resident Senior Fellow at IDFC Institute; and Deputy Director of the Raj Center on Indian Economic Policies at Columbia University) who had argued that contrary to popular perceptions, the demonetization would be expansionary rather than contractionary. [23] The slowdown effect was short lived due to government’s efforts to spread digital payments and the re-monetization. The drop in demand affecting the GDP growth was very minor and it took place only in November. There was no sign of the economic disaster that was predicted by a number of eminent economists. The move was considered a political hara-kiri by the opponents of the PM Modi. This was a common refrain during the month of November 2016 when the country was struggling to cope up with the massive economic transition process. the ruling party’s super success in the month of march 2017 vindicated the Prime Minister’s bold initiative on demonetization.

Some critics of the move have pointed out that the at best the demonetization was unnecessary. The economic growth was 7% at the ends of Dec 2016 which implied that the demonetization did not have any effect whatsoever. In that case there was no need to implement such a high stakes, high risk and very disruptive tool of demonetization. If corruption was the main target, then demonetization is not the best tool to root out corruption.

The demonetization has evinced a keen interest by all sections of the society and has attracted very strong opinions for or against the move. The correct way of judging it is to see it in a wider perspective. As the Forbes issue of December 30, 2016 sums it up aptly – ‘Not perfect , but moving in the right direction……It needs to be seen as a part of a much more general campaign’.

It was never meant to be a great success but is a concrete step towards a more transparent and fair system . It is the psychological effect of the move which is more important. The move has to be seen in conjunction with some other concrete steps that include getting every household in the country into the banking systems and the concerted move to eliminate benami properties ( either in fictitious name or nominee names) from the Indian social and economic machinery. It is generally believed that the government will not rest on its laurels but will bring a series of newer steps to further curb illicit transactions and make efforts to bring wealth stashed away in off-shore heavens. It is the bigger narrative that mattered the most for the masses of India. They believed the government was acting decisively for the ordinary people to fight corruption.

There is no doubt that this demonetization has been a momentous event in India’s economic history and will be subject of study for a long time to come.

ACKNOWLEDGEMENTS:

- https://www.scribd.com/document/332910720/Effects-of-Demonetization-of-500-and-1000-Notes

- Its not a war on corruption .. https://sabrangindia.in/article/it%E2%80%99s-not-war-corruption-or-black-money-de-monetization-extreme-measure-serve-corporate

- Present Status of Black Money in India and the Future Challenges: International Journal of Academic Research ISSN: 2348-7666; Vol.3, Issue-12(4), December, 2016

- Macroeconomic Impact of Demonetisation- A Preliminary Assessment: https://m.rbi.org.in/Scripts/PublicationsView.aspx?ID=17447

- Success and failures of Demonetization/ Objective Evaluation: Part-I (Effect over terrorism, black money and corruption) –

- Demonetization – Jan Dhan Accounts deposits double to Rs 87000 crore

http://www.livemint.com/Industry/Tqd25EMjYp53bce3qOFazO/Demonetisation-Jan-Dhan-account-deposits-double-to-Rs87000.html

- PM Jan Dhan Yojana

9. Demonetisation effect: Deposits in Jan Dhan accounts swell by 88% in November Deposits-in-Jan-Dhan-accounts-swell-by-88-in-November/articleshow/55840301.cms

- Digital payments soar up to 30% after demonetization.

- PM Narendra Modi launches BHIM-Aadhar app:

- 5 Effects of Note Ban on common man : http://www.dnaindia.com/india/report-5-effects-of-note-ban-on-the-common-man-2276007

- A study on the Impact of Demonetization on Common Man;

International Journal of Academic Research

ISSN: 2348-7666; Vol.3, Issue-12(4), December, 2016

- https://www.linkedin.com/pulse/how-ban-rs-500-1000-notes-affect-common-man-mohan-y

- Demonetization In India : Who will pay the price.. http://knowledge.wharton.upenn.edu/article/demonetization-india-will-pay-price/

- Demonetization would only affect common man; http://knowledge.wharton.upenn.edu/article/demonetization-india-will-pay-price/

- Success and Failure of Demonetization: An Objective Evaluation Part1:

- FORBES- India’s Demonetization 50 Days In: Not Perfect But Moving In The Right Direction.

- Harvard Business Review: Early lessons from India’s Demonetization Move

https://hbr.org/2017/03/early-lessons-from-indias-demonetization-experiment

[1] http://www.investopedia.com/terms/d/demonetization.asp

[2] http://mumbaimirror.indiatimes.com/news/india/history-of-demonetisation-in-the-world/articleshow/55622670.cms

[3] Sand artist Sudarshan Pattanaik in Puri, Odisha. PTI photo

[4] ECONOMIC NEWS, Fri Dec 9, 2016, http://in.reuters.com/article/india-modi-corruption-insight-idINKBN13X2PY

[5] India pulled out 86% cash out of circulation, http://www.vox.com/world/2016/11/29/13763070/india-modi-cash-demonetization-protests

[6] demonetization and the price, http://knowledge.wharton.upenn.edu/article/demonetization-india-will-pay-price/

[7] IOSR Journal of Humanities and Social Science (IOSR-JHSS)

[8] Chakravarty, Lead Economist, Deloitte, India

[9] http://indiaarising.com/mind-blowing-response-international-media-demonetization-will-shut-mouth-opposition/

[10] http://in.reuters.com/article/india-modi-corruption-insight-idINKBN13X2PY

[11] https://qz.com/845609/organised-loot-legalised-plunder-manmohan-singh-the-man-who-opened-up-indias-economy-trashes-narendra-modis-demonetisation-move-in-the-rajya-sabha/

[12] http://www.indiatimes.com/news/india/economist-jean-dreze-says-demonetisation-in-a-booming-economy-is-like-shooting-at-the-tyres-of-a-racing-car-265960.html

[13] 97% of scrapped notes deposited with banks as on Dec 30: Report, http://timesofindia.indiatimes.com/toi-features/business/97-of-scrapped-notes-deposited-with-banks-as-on-dec-30-report/articleshow/56344692.cms

[14] Present Status of Black Money in India and the future challenges;International Journal of Academic Research ISSN: 2348-7666; Vol.3, Issue-12(4), December 2016

[15] Macroeconomic Impact of Demonetization- A Preliminary Assessment: https://m.rbi.org.in/Scripts/PublicationsView.aspx?ID=17447

[16] IMF cut India’s growth rate, http://www.dnaindia.com/money/report-imf-cuts-india-s-growth-rate-from-76-to-66-over-demonetization-impact-2293105

[17] India will grow at 7.2% this year: World Bank, April 2017, http://timesofindia.indiatimes.com/business/india-business/india-will-grow-at-7-2-this-year-world-bank/articleshow/58214269.cms

[18]PM Modu launches BHIm Aadhar appa: here is how it works: http://www.moneycontrol.com/news/india/pm-narendra-modi-launches-bhim-aadhaar-app-heres-how-it-works-2258495.html

[19] Times of India, November 14,2016

[20] Hindustan Times, November 14,2016

[21] 97% of scrapped notes deposited with banks as on Dec 30: Report, http://timesofindia.indiatimes.com/toi-features/business/97-of-scrapped-notes-deposited-with-banks-as-on-dec-30-report/articleshow/56344692.cms

[22] Fake Currency and Pakistan, February 2017, http://indianexpress.com/article/india/fake-rs-2000-notes-from-pak-reach-india-via-bangladesh-border-4521505/

[23] Lookning back at demonetization ; THE concern of legion of its critics have been proven wrong

http://blogs.timesofindia.indiatimes.com/toi-edit-page/looking-back-at-demonetisation-the-concerns-of-its-legion-of-critics-have-all-been-proven-plain-wrong/

[24] Indias Demonetization 50Days In – Not perfect but moving in the right direction

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "International Studies"

International Studies relates to the studying of economics, politics, culture, and other aspects of life on an international scale. International Studies allows you to develop an understanding of international relations and gives you an insight into global issues.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: