Business Analysis of Patanjali Ayurveda

Info: 7965 words (32 pages) Dissertation

Published: 25th Aug 2021

Tagged: EconomicsInternational Studies

ABSTRACT

Subject area - The case focuses on the revenue growth of Patanjali Ayurveda and how it has managed to create thunders in the FMCG market. Analysis on its business model and how Patanjali positions itself in the market as well as its marketing strategy. The competitive pricing and distributorship, with its foray into e- commerce and big retail with Future group has been analyzed. It also highlights the tax exempt status of Patanjali and how it will impact the FMCG market. Emphasis on “Make in India” and how it can be an asset to India’s economy, yet a monopoly threat in the FMCG market. It also analyses the symbiotic relationship between Yoga and Ayurveda, which is indigenous to India, capitalized in the commercial market. It also discusses the potential threat to evidence based medicine, whereby it claims to cure diseases like AIDS and cancer. The case examines the changing trend of the Indian consumer which is inclining towards swadeshi products than foreign products. The case has been studied by employing the usage of strength, weakness, opportunity and threat analysis (SWOT), political, economic, sociological, technological analysis (PEST), BCG matrix, and Porter’s five forces model and competitor analysis.

Study level/ applicability - This case can be used as a teaching tool in the following courses: MBA/Post Graduate Program in Management in Business Model Innovation, Management accounting, Strategic Cost Management, Marketing, IT Management. It can also be used to teach concepts like SWOT analysis, Porter’s five forces analysis, PEST, BCG Matrix. Executive training programs for mid and senior level to teach business strategy. Undergraduate and post graduate program to teach strategy and entrepreneurship.

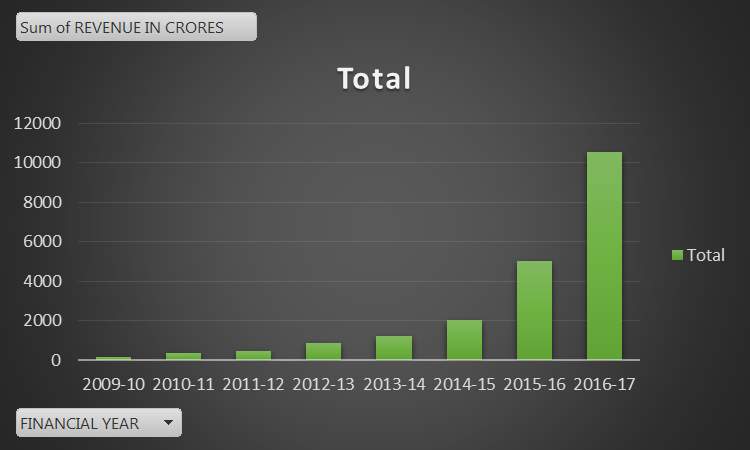

Case overview - At a time when fast moving consumer good (FMCG) companies are still skeptical about a pick-up in consumption, bringing an improvement in revenues and profitability, Patanjali has become a stalwart, inching its way up in the past decade. Originally started as an Ayurvedic pharmacy, the company now holds a firm grip in the FMCG market. Patanjali Ayurved Limited (PAL) has achieved the revenue of 10,561 crore in the financial year ended in march 2017 with scorching growth in revenues at a 55 percent annual rate when FMCG market was inching 8-9 percent. Backed by its efficient marketing strategies PAL is planning to expand its basket of products. Although not listed, the company’s growth curve is rather impressive. It has ventured into retail with Future group, and e- commerce enjoying tax benefits from the government, becoming a house hold name. When big pharmaceuticals are under the scanner, Patanjali seems to be the choice not only for FMCG products but a dependable name in the near virgin territory of Ayurved medicine. The case highlights the popularity and growth of a “swadeshi” company in the today’s competitive market, driven by a saffron clad man who has changed the market dynamics with his business strategy. In this study we also come to know about PAL’s future strategy and innovations which will help it sustain and grow further to become an Indian multinational.

Expected Learning outcomes - SWOT analysis can be used to understand the strengths, weaknesses, opportunities, threats of a company. Similarly PEST analysis acts as a tool to assess markets for a particular product or business and can help organizations to take important strategic decisions. Cost pricing, Income tax benefits, revenue, profit, projected growth, marketing, are some concepts which can be understood with this case.

Practical implications - With the growth in revenue, and Patanjali spreading its wings in the FMCG market, the consumer is flooded with substitutes for possibly all the products in the FMCG market at 10-20% cheaper market price. The pricing leads to increased user base, which is the reason companies like HUL, Nestle, and Emami feel the tectonic plates of their business drifting away. The consumers perceive themselves to be a part of a cult and further act as captivated marketing tools, taking up Patanjali’s distributorship and cascading its effect down to the ground level. Today each household has a Patanjali advocate/ brand ambassador promoting the brand and its value at dinner tables, tea breaks and even at waiting areas outside their doctor’s chamber. The consumers trust and acceptance has sown the seeds of “word of mouth marketing (WOMM)” harnessing its full potential. Political interests need to be understood/ analyzed as Patanjali easily gets a tax exempt status due to the yoga tag, when all the big pharmaceutical industries are under the scanner and Medical Council of India (MCI) propagates generic medicines.

Social Implications - The rise and growth of Patanjali Ayurved Ltd is largely attributed the Baba Ramdev, seen as yoga guru, who has put the marketing world into a tizzy. It was after Baba Ramdev’s yoga lessons on Aastha channel gathered a lot of followers, these followers soon became the consumer base of the Patanjali products. People have embraced the idea of a “swadeshi” product as an answer to all their needs. The user is promised chemical free herbal preparations safer than other products, yet instances of poor quality products with heavy metals found in medicines have been previously pointed out. Does the consumer really have an option of substitutes or will soon cater to a monopoly is yet to be seen. Ayurveda and yoga provides holistic care with minimal side effects is the idea that has captivated the consumer. With western countries embracing yoga whole heartedly, Patanjali now also eyes the international market using tools of e-commerce. It envisions a disease free and medicine free society, shunning away allopathy and claims to treat all diseases. It’s important that in the garb of consumerism, the society is not mislead and suffers health risks. Scientific research, study and approval is equally important rather than just growth revenue. There have been instances when shipments of the Ayurvedic medicines has been rejected by the US Food and Drug Administration (FDA). It thus questions whether these are serving as a placebo to the captive consumer.

CASE STUDY

TITLE - Patanjali: Poised and prowling

Patanjali Group became the 3rd largest fast moving consumer goods (FMCG) in business at Future Retail, when it docked Rs 10, 561 crore in FMCG and ayurveda sales during 2016-17, an increase of over 100 per cent from Rs 5,000 crore the previous year. The loved yoga guru, Baba Ramdev was in full spirits along with Acharya Balkrishna while declaring the thumping victory, jitters of which shook several FMCG boardrooms. Many questioned as the Baba announced his roadmap ahead, with 100% increase in growth revenue and target to generate Rs 20,000 crore of business next year. Beating the traditional and established companies such as HUL, Colgate, Nestle, Emami, Himalaya and Dabur, Patanjali is poised and prowling in the FMCG jungle.

Riding on the brand image of Baba Ramdev, Patanjali has become a household name that consumers trust and self-advocate. Analysts are shocked by the meteoric rise of the company’s revenue and have questioned the same. While the Baba claims the success to be due to consumers who were blinded by hazardous products and have now found a brand they can trust for all their needs.

While other FMCGs are trying to find a footing after the earthquake caused by PAL, the company doesn’t seem to deter. In fact PAL is marking its footprint in the international market with its products and promise of holistic care and yoga.

COMPANY BACKDROP

Patanjali stands on 2 strong pillars, Baba Ramdev and Acharya Balkrishna. Born into a farmer’s family, the agile Baba claims that he was paralyzed at the age of two and later was in fact cured by practicing Yoga. He is qualified in Indian scripture, Yoga and Sanskrit, which he studied in various Gurukuls (schools).Balkrishna is a scholar in Ayurved, Sanskrit and Vedas and is thus fondly called Acharya.

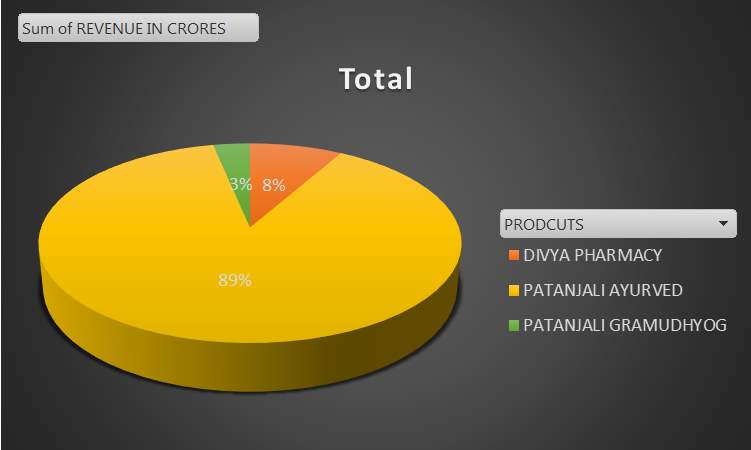

In 1995, they founded an Ayurvedic Medicine-manufacturing unit – Divya Pharmacy in Haridwar. The pharmacy grew gradually, by initially distributing the medicines for free, to later manufacturing. Later in 2003 when money started coming in, Acharya Balkrishna was made as head of the pharmacy.

Baba Ramdev laid the foundation of Patanjali Yogpeeth, aimed for the promotion and practice of Yoga and Ayurveda. It has two Indian campuses in Haridwar and Uttarakhand. At present, the locations include UK, US, Nepal, Canada and Mauritius.

It was in 2006, that Patanjali Ayurved Ltd was founded with help of Baba Ramdev’s followers (Sarvan and Sunita Poddar) who gave them the initial funding. Today they hold 8% of the stakes while Acharya Balkrishna who is the CEO hold 92%. Baba Ramdev, who doesn’t have any stakes in the company, is its mascot, skyrocketing the company to new heights putting the analysts, marketing maestros, and other FMCG companies into a tizzy.

PAL , ventured into ayurvedic medicines and ayurvedic over the counter products like aloe vera, ghee and honey and established a strong customer base, who were the followers of Baba Ramdev, and had been enlightened by his lectures about chemicals being used in common products giving rise to all the possible ill health effects. When PAL established a footing, it moved to the FMCG market, with the promise of giving un- adulterated, safe, herbal products in 2012. Over 100 products were introduced simultaneously at the time when other FMCG giants were trying to cut costs, products due to a lurking market. The FMCG giants, didn’t seem to be perturbed back then, little did they know what was in store. Patanjali began expanding in terms of customer base, revenue and over all nearly 400 products.

Today, PAL boasts of an increase in growth revenue of 100%, PAL is the lion who is killing its preys with each fiscal year. The growth over the past years is phenomenal and what many say threatening.

THE SAFFRON CLAD BABA SWEEPING THE MARKETS

Patanjali could not have scaled the heights, that it has today, had it not had a face like Baba Ramdev. It is because of his brand value, that Patanjali became a household name. Baba Ramdev gained momentum, with his yoga sessions and spiritual sermons, which were telecasted live on Astha channel, every morning. Soon the middle aged middle class consumer was a follower, attending those sermons and yoga sessions, introduced to herbal preparations like aloe vera, honey with its enticing benefits. Yoga became a cult and Baba Ramdev, the cult guru. With its tentacles spreading, Patanjali managed to engage the average middle class Indian consumer. It established faith in its products, as it was introduced as the only alternative to chemicals and poor quality products. Baba Ramdev served as the best marketing tool, hidden under the saffron, gliding its way into the FMCG market. When giant FMCGs spent 10-15%on advertising and marketing, Baba Ramdev managed to do the mammoth task with his image of a Yoga Guru. When revenues rose, Baba Ramdev did not shy away from commercials, endorsing Patanjali as a blanket brand as a solution to over 400 products used on a daily basis. The followers had now become brand ambassadors, vocalizing their opinions about the benefits of Patanjali products to everyone around them. Baba Ramdev in all his humility has been ranked “5th in India’s 50 most powerful people of 2017” list, by India Today in 2017.

SYMBIOSIS BETWEEN YOGA AND PATANJALI

Baba Ramdev re- introduced yoga with a holistic approach. He presented yoga as an answer to all lifestyle diseases like hypertension, diabetes, cardiovascular problems. He also claimed that severe asthma could be treated by yoga alone. The idea struck to the middle class Indian who did not want to spend, out of his pocket on healthcare. Aasans like “kapaal bharti”, “anulom viyom” and “pranayama” became popular. Soon people were seen huffing and puffing, in front of their tv screens or in mass sessions. Yoga was rebranded. Along came PAL products that were synergistic with yoga. Meanwhile the west, also embraced yoga with open arms. Baba Ramdev had several sessions in various countries and he was hugely accepted and loved, where he preached yoga. Yoga was packaged well for the new Indian consumer, available on every media platform, including television channels, YouTube, social media, DVDs etc. The popularity of yoga grew by leaps and bounds, which benefitted a great deal to PAL. It was in 2014, when Indian Prime Minister Narendra Modi, suggested the idea of celebrating International Yoga Day, due to its universal appeal at the UN. 21st June, 2015 marked the birth of International Yoga Day. This established Baba Ramdev as its mascot in India and increasing his reach further. PAL benefitted tremendously as its revenue sales climbed the ladders leaving several company giants behind. Moving ahead with his friendly ties with the government, Baba Ramdev sought for what may be called as the last nail in the coffins of several FMCGs.

In early 2017, The Income Tax Appellate Tribunal (ITAT) gave a tax-exempt status to Patanjali Yogpeeth. The ruling based its understanding that-“Patanjali Yogpeeth is involved in providing “medical relief” and imparts “education (yoga)”, and it can be exempted from paying tax under the Income Tax Act”. The order also made references to the 2006 amendment in the Income Tax Act under which “yoga” was specifically inserted within the definition of “charitable purpose”. This made Patanjali reap the benefits because of the yoga tag, defining their vision, “Keeping Nationalism, Ayurved and Yoga as our pillars, we are committed to create a healthier society and country. To raise the pride and glory of the world, we are geared up to serve people by bringing the blessings of nature into their lives. With sheer dedication, scientific approach, astute planning and realism, we are poised to write a new success story for the world.” The ruling was termed skewed in favor of one, and its threat to become a monopoly in the Indian market.

PAL’S STRATEGY

REDUCED ADMINISTRATIVE COST

PAL offers quality products at a lower price. In order to achieve the same, several initiatives were adopted from an early start. This included getting on board people who had altruistic, humanitarian traits in the top management. This enabled PAL to get leaders working through the clock without demanding fat paychecks as seen in other MNCs. They embodied the spiritual and cultural philosophy, working towards the mission of the company, “Making India an ideal place for the growth and development of Ayurveda and a prototype for the rest of the world.” Patanjali’s administrative cost is only up to 2.5 per cent of revenue, as against 10 to 15 per cent in large companies, as quoted by CEO Acharya Balkrishna.

PRODUCT PORTFOLIO AND PRICING

PAL’S portfolio started out with aloe vera juice which was promoted in Baba Ramdev’s camps. Today it offers nearly 400 products under the brand name Patanjali. The products range from- natural food products, natural healthcare, natural personal care, herbal home care, ayurvedic medicines as well as Patanjali publications. It has also collaborated with Tetra pack International to create contemporary product packaging targeting several market leaders in the business domain.

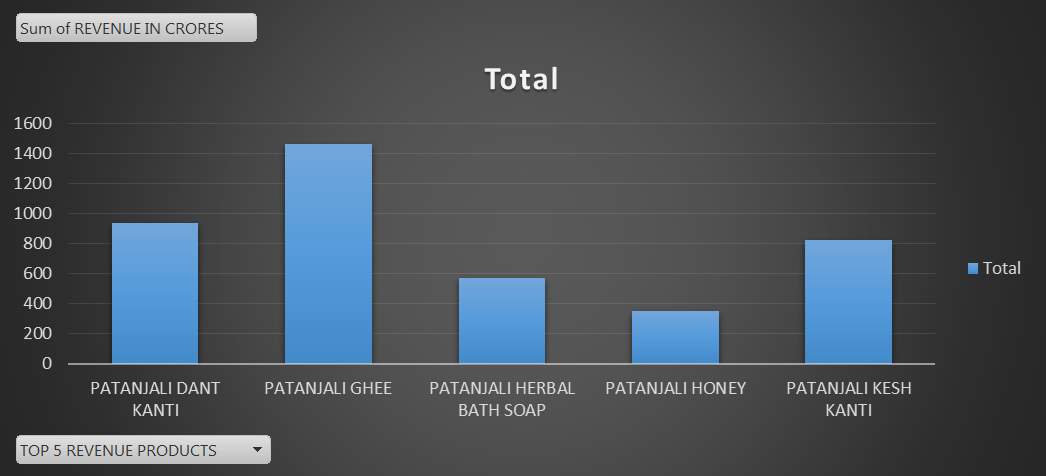

Patanjali’s largest selling product was cow ghee which earned a revenue of Rs 1,467 crore and accounts for 44% of volumes in the overall market. Dantkanti toothpaste earned a revenue of Rs 940 crore. Patanjali earned a whopping Rs. 870 crores from ayurvedic medicines out of which approx. 550 was from stand alone, and the other from shop- in a shop. Keshkanti shampoo contributed a revenue of 825 crore while its herbal soap segment cleansed out a net Rs 574 crore revenue. (See exhibit 1).

(Exhibit-1)

The pricing of PAL products which is approximately 15-20 percent less than the market leaders has created a humungous demand in the Indian Market. The company sources its materials directly from farmers and thus eliminates margins. It also takes raw materials from its own farmland which further boosts their profits.

MARKETING

Many believe, Baba Ramdev is the tycoon of the marketing industry as he single handedly has propelled PAL to its epitome today. Patanjali treaded its marketing strategy with caution. The products were introduced under the umbrella of brand Patanjali, strengthening its brand image.

PAL relied initially on Baba Ramdev’s reach and brand image, which gathered a lot of mascots and brand ambassadors for the company which helped to build the brand image. It was after long, did the marketing pandits see someone harnessing the power of WOMM (word of mouth marketing).

It was only when PAL established its ground in the market and its revenue doubled, did it decide to invest in advertising and promotion. In 2015, it allocated Rs 200 crore for marketing and advertising. This saw television commercials being flooded with Baba Ramdev, propagating the natural products and their benefits and highlighting the ill effects of chemicals being used in other products.

The content based marketing was its biggest strength. According to a report by the Broadcasting Audience Research Council, in November 21-25, 2015, Patanjali surpassed Fair and Lovely and Cadbury becoming the brand with most broadcasted television commercial. The reach was increased in print media, radio.

PAL relied heavily on psychographic factors like health consciousness and patriotism, targeting people who were health conscious and wanted value for money. Their product portfolio catered to all, from children to adults to elderly, thus positioning itself as a “family brand for all needs”

It worked with reputed creative agencies such as DDB Mudra and McCann, Vermillion.

Patanjali’s strategic partnership with Future Retail group helped to increase its reach in the ever growing market and combat competition.

DISTRIBUTION

Where FMCG firms follow a whole-saler distributor and retail model, PAL adopted a franchise model to start with. Interestingly, the franchisee were themselves were brand ambassadors and acted as salesmen as well for Patanjali due to their faith in the brand. Gradually PAL saw a gradual increase in the number of outlets and thus increase in revenue. By 2016, they managed to have 15,000 PAL franchise, not only in India’s tier 1 but also tier 2 and tier 3. Of these approximately 5000 were stand alone, remaining were shop- in shop stores.

In order to scale up their revenues and increase their reach, PAL adopted a diverse distributorship strategy through modern retail formats like supermarkets, hypermarkets and e-commerce. Partnership with Future Group, Reliance Fresh, and DMart was a calculated strategic decision.

In the age of digitalization, Patanjali was not coy and embraced e-commerce like a young avid learner. They not only sold their products through their own website, Patanjaliayurved.net, but also ensured that commerce biggies like Snapdeal.com, Amazon.in, and Bigbasket.com sold their products. “Today PAL has more than 47000 retail counters, 3500 distributors, multiple warehouses in 18 states and proposed factories in 6 states”-as claimed by their website.

Due to its unique initiatives in every realm of their business strategy, PAL managed to become the fastest growing FMCG, in such a short span of time.

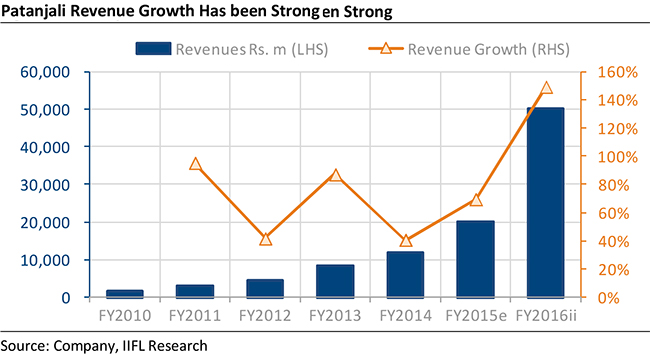

REVENUE

The epic rise of PAL and its phenomenal growth may be inspiring to some and disturbing for others. The revenue graph is rather impressive and the numbers speak for themselves. (see exhibit). Especially when the FMCG growth is in single digits (average of 4%- 6%), PAL clocked in a whopping 100% growth revenue with a turnover of Rs 10,561 crore for 2016-2017. Further, Baba Ramdev claimed that Patanjali is poised to cross 20,000 crore mark for 2017-2018. While analysts are skeptical and explain, that PAL has already established its reach and will not continue to have such a steep rise, at max 20-25% growth is foreseeable. However Baba Ramdev aims to make Patanjali the top most FMCG and make other giants leave the ground. PAL aims to become an Indian MNC with wings spread across the globe. It would be interesting to see how loyal the Indian customer stays in this fast changing economy.

COMPETETION

Patanjali entered the FMCG market well aware of the giants it was going to take heads on, the likes of HUL, Colgate, Emami, Hamdard, Dabur, Himalaya and Khadi gram udhyog. These were well known names that people had trusted for over years. Yet Patanjali was firm, that it would not only establish its position but also make its mark in the FMCG market. Baba Ramdev’s plan to remove MNCs and replace it with “swadeshi companies” no longer seems just a threat as it becomes the 3rd largest FMCG in business in 2017.

HIDUSTAN UNILEVER LIMITED

HUL has over 80 years of existence in India. The revenue it recorded in FY2016/17 was ₹338.95 billion. The product portfolio of HUL is massive and includes categories such as food and beverages, cleaning agents, personal care items, and water purifiers. It covers as many as 20 categories, and over 700 million Indian consumers used its products. Three of its brands were featured in the top five of The Economic Times Brand Equity most trusted brands in 2013.

Threatened by Patanjali’s rising market and its own declining revenues HUL planned to revive its forgone division LEVER AYUSH having a line of ayurvedic products .HUL claimed and marketed its products being ayurvedic and having natural and ayurvedic ingredients which help in skin, hair and respiratory ailments .On this path HUL also taken over Indulekha a brand owned by Mosons group to increase its product range.

COLGATE

An American multinational head quartered in new York introduced its first toothpaste in 1873 and ever since it is a leader in toothpaste segment along with Procter and gamble co.it recorded revenue of Rs.44.89 billion in FY 2016/17.It has been voted as India’s most trusted brand across all categories in economic times brand equity survey- an annual consumer survey conducted by Nielsen for six consecutive years from 2011-16.

Colgate’s revenue growth has been halted by Patanjali’s Dant kanti toothpaste. In January 2016 Colgate incurred its worst sales growth in 44 quarters. According to a report it is predicted that by 2020, many MNCs including Colgate would lose around 3-8 percent market share to Patanjali. In view of continuous threat from Patanjali, Colgate has increased its advertising budget by 14 percent in the financial year 2016-17. Its market share in tooth paste category is around 55.1 percent in for 2016-17.In response to Patanjali, Colgate started investing in Colgate active salt-neem toothpaste, which operated in the herbal space. Backed by the prime minister’s “make in India” vision it also has established new toothpaste manufacturing unit in Andhra Pradesh in 2016.

DABUR

Dabur is widely known as the world’s largest ayurvedic and natural health care company. Dabur introduced India’s first ayurvedic toothpaste- Dabur red paste. Its product portfolio includes five of its flagship brands namely Dabur, Vatika, Hajmola, Real and Fem. It recorded sales of Rs.76.8 billion and profit of Rs.12.77 in 2016-17.It also established most modern manufacturing unit of ayurvedic medicines and products in Assam with an investment of Rs.250 crore in FY 2016-17.

Dabur’s portfolio of products are quite similar to Patanjali. The most affected products are Dabur honey and chyawanprash, where it was a market leader by the introduction of Patanjali’s products. Eyeing the threat, Dabur also planned to revamp its portfolio by adding new products and by modernizing its already established ayurvedic line of products. It also expand its umbrella of products by launching products in women health care and baby care segments.it also has modified its business strategy by adding new flavors in its tonics like ashokarishta. Now its core strategy is to appeal to modern customers.

NESTLE INDIA

Nestle India, is a subsidiary of the parent company Nestle. A of Switzerland, which has its presence over nearly a century. It encompasses a product portfolio of milk products and nutrition, beverages, prepared dishes and cooking aids, chocolates and confectionary. Some of its key products like Maggi, Maggi ketchup, Nescafe, KitKat, and multiple dairy products are actually market leaders or serious competitors. Nestle suffered huge losses after the Maggi ban, but gradually reclaimed its position, despite the introduction of Patanjali’s Atta- noodles at their most critical moment. Patanjali even launched their health bar chocolate to combat competition. Seeing the threat and learning from their past setbacks, Nestle plans to launch 30 new products with their emphasis on health products.

EMAMI

Emami is a well-known name in hair care, skin care and ayurvedic health care products. Its brand navratna oil is the leading player in cooling oil segment which has been extended to extra cool oil, almond cool oil and cool talc. It recorded the revenues of Rs.25.32 billion in FY 2016-17. Fair and handsome continues to dominate the category with a share in excess of 65%. With a similar portfolio to that of Patanjali and increased faith in Patanjali products, Emami continues to innovate and market its products in order to stay market viable.

HIMALAYA

Himalaya has been one of the leading ayurvedic health care companies in India for years. It recorded the sales of around Rs.21 billion in FY 2016-17 and eyes 25 billion in 2020. This Bengaluru based firm has six business verticals spanning therapeutics, personal care, wellness, nutrition and recently introduced baby care products. Its flagship product neem face wash was a market leader in the face wash segment.

SET BACKS AND CONTROVERSIES

Ever since the launch of Patanjali products, Baba Ramdev has advocated and promised safe, chemical free and quality products along with their herbal essence. As the tag line of Patanjali speaks ‘prakriti ka ashirwad’ it wants the consumer to believe that all the products are delivered right from nature to our households. But the million dollar question is- Does it really deliver what it promises?

Back in 2011, The Indian Medical Association, appealed to the government of India to take action against Patanjali for making claims of curing cancer, AIDS. It appealed that these were marketing strategies, not substantiated with any scientific base. However with the change in the ruling government in 2014, Patanjali Group prospered. Many attribute this to friendly ties between Baba Ramdev and the prime minister of India.

In 2012, food samples from PAL (salt, mustard oil) failed quality tests and were also charged with misbranding.

Patanjali has also been fined for misbranding its products and claims which are not substantiated.

In 2015, Patanjali received a show cause notice from FSSAI, for launching its Atta- noodles without approval or license. Shockingly no action was taken, thereafter.

According to recent report by the leading media house Hindustan times, Nepal authorities have asked Baba Ramdev to recall 6 medical products they were found to be of ‘substandard quality. All six medicines failed microbial tests.

This isn’t the first time that Patanjali’s products have been questioned. They have failed laboratory tests earlier in India and the company was accused of misbranding. The Indian defense ministry’s canteen stores departments, suspended sales of Patanjali’s amla juice after the product was declared unfit for consumption by a local food-testing lab.

Baba Ramdev also faced wrath from the opposition, Congress over irregularities in allotment of over 6000 acres of land to the company.

However, the latest round of quality trouble could dampen its plan to expand its footprint in foreign markets. Ramdev even recently made public his plans to take Patanjali, to countries like China and Pakistan, while expanding its distribution in Bangladesh, Nepal, and some middle-eastern countries.

Patanjali has been aggressive about its “swadeshi identity” while labelling MNCs as `thieves’. Patanjali has compared its global rivals to the East India Company, which has since become a symbol of colonization and oppression in India. In Baba Ramdev’s words-“Though we got political freedom 70 years back, economic freedom is still a dream, “The way East India Company enslaved and looted us, multinational companies are still doing the same by selling soap, shampoo, toothpaste, cream, powder and similar daily items at exorbitant price.”

With such setbacks and failed quality tests, will Patanjali sustain itself in the long run? When the raised the basic concern for chemicals being used in products unfit for consumption, can Patanjali really afford to fail itself in the eyes of the consumer?

TRAJECTORY AHEAD

Baba Ramdev has set the pace and agenda not only for the next financial year, but years to come. Patanjali aims for a 100% increase in revenue by 2017-2018 with a revenue target of over Rs20, 000 crore. While it plans to add more products in its existing portfolio like herbal cosmetics, it will soon venture into baby care products.

It has also announced its plans of entering the apparel market by making “swadeshi jeans”.

It aims to replace fast food joints like KFC and Mc Donald’s and bring in food parks and restaurants. Patanjali also plans to enter the dairy market, by setting up major plants in Maharashtra, Karnataka and Uttar Pradesh to start with.

It aims at the revival of Ayurveda through their medicines and promote holistic care. It also plans to take its trade across borders, contributing to India’s GDP. While the dreams are big, so is the investment and planning involved. It realizes the potential to scale up its production due to increasing demand and thus plans to raise Rs 1000 crore for the same. It has been offered loans by ICICI and HDFC banks. As far as the public sector is concerned, SBI and PNB have offered credit facility to Patanjali so far.

It will be interesting to see if PAL can maintain its low cost model, with increasing investments in A&P. Also in order to maintain its faith in the eyes of the consumers, it must pass the safety standards, which it is stumbling at present. Will the Indian consumer stay loyal to products just because they are swadeshi or demand better quality and packaging? With the rivals rolling out their new products and revamping their strategy, will Patanjali face the backlash of the disruption it caused in the Indian FMCG market? Will the millennials adopt Patanjali and stay loyal or demand for a better quality product even if it is highly priced? Big pharmaceutical giants have seen the threat and have ventured into ayurvedic medicines and its testing, will Patanjali be able to withstand the results? …..only time will tell.

SYNOPSIS

Patanjali Ayurved Limited (PAL) clocked in a whopping 100% growth revenue with a turnover of Rs 10,561 crore for 2016-2017, becoming the 3rd largest fast moving consumer goods (FMCG) in business. As a manufacturer and marketer of a plethora of products ranging from natural food products, natural healthcare, natural personal care, herbal home care, Ayurvedic medicines as well as Patanjali publications, it is poised to enter the international market and claims to surpass the 20,000 crore mark for 2017-2018. It has made key market players such as Hindustan Unilever, Colgate- Palmolive, Proctor and Gamble Co, Emami Limited, Dabur India Private Limited as well as The Himalaya Drug Company bite their nails, as it has taken the market share in such a short span of time since its inception in 2006. While many may talk about its swadeshi approach and health benefits, there is enough evidence of the jolts PAL has faced in terms of quality and evidence based medicine. It will be interesting to see how it will face the wrath from the health conscious consumer, who shall question its claims of being “free from chemicals, premium quality as well as providing cure” for many diseases it claims. Also will PAL prove the analysts wrong in churning up a 100% revenue for 2017-2018, or will exemplify as a steep rise and short sustaining company?

TEACHING NOTES

LEARNING OUTCOMES

Key objectives:

- Understanding Patanjali’s growth curve

- Importance of brand equity

- Sustaining a low cost model

- Role of e- commerce

- Scope of digital marketing

- Marketing approach

- SWOT Analysis

- PEST Analysis

- BCG Matrix

RELEVANT READINGS

Patanjali Takes on Industry Giants- Ivey publishing

Brand Equity: An Overview-CASE STUDY Paul W. FarrisEric A. GreggBrandon ChinnMariela Razuri

QUESTIONS

1. Analyze Patanjali brand and factors responsible for its success

2. Discuss and evaluate PAL’s marketing approach

3. Develop and discuss PESTEL analysis for PAL

4. Develop and discuss BCG matrix for PAL

5. Enlist and evaluate growth and expansion strategies for Patanjali

6. Discuss the role of e- commerce in PAL’s growth

7. What is the scope of digital marketing for Patanjali?

8. What recommendations would you suggest for Patanjali to sustain itself in the market?

ANALYSIS

1. Analyze Patanjali brand and its key success factors

A clear understanding of Patanjali as a brand can be determined and discussed with the help of it’s SWOT analysis.

The key factors for Patanjali’s success can be discussed as follows:

- Baba Ramdev’s brand image and appeal is immense, and has not only helped the company to introduce their products but also develop faith in them.

- People have been smitten by the “swadeshi concept” and relate more to the products.

- It follows a unique mix of cost leadership model, also providing differentiation to it through marketing strategies.

- Strategic partnerships for growth and expansion.

- Creating brand ambassadors taking up the franchised stores and distributorship.

- Foray into product mix for children as well as adults.

- Promoting ayurvedic medicines and highlighting its benefits with better marketing

- Getting a tax exempt status due to the yoga tag.

- Promoting Patanjali as a means to a holistic life.

SWOT ANALYSIS

2. Discuss and evaluate PAL’s marketing approach

This can be discussed by highlighting its product portfolio and pricing which fuels its marketing engines.

Product portfolio and pricing

PAL has nearly 400 products under the brand name Patanjali. The products range from- natural food products, natural healthcare, natural personal care, herbal home care, ayurvedic medicines as well as Patanjali publications. The initial products launched by Patanjali did not have a serious competition, thus helped in its initial brand building like aloe vera juice, amla juice. With consumer education it highlighted the dangers of chemicals being used in day to day products and entered the FMCG market with a basket full of products, thereby providing an alternative to the consumer. The consumer established faith in the company, thus making Patanjali draw chunks of its revenue from basic products like Patanjali Ghee, Dant Kanti Toothpaste and Kesh Kanti Shampoo.

The low price approach of Patanjali has been rewarded well in terms of the company’s revenue over the last few years. It ensured that the products were 10-15% cheaper than the market, thereby establishing penetration not only in the metropolitans but also in tier 2 and tier 3 cities. Administrative costs were placed low and a humanitarian approach adopted in order to invest more in the product and distributorship. Direct trade with farmers, and also growing raw materials in their own farmland had paid Patanjali rich dividends. The franchise model was adopted for the same and proved even more beneficial as it provided brand ambassadors and advocates.

Marketing

Initially PAL did not invest in A&P, and relied on Word of mouth marketing (WOMM). However it was only after it established its ground, and increase in revenues, PAL forayed into active advertising and promotion with its own mascot Baba Ramdev. This was easy as people already trusted him and he was the obvious choice and face of Patanjali. He featured in content based advertising, educating the people about ill effects of chemicals and Patanjali’s position in a quality herbal product. Strategic partnerships with Future group and other retailers saw more of Patanjali products at megastores. PAL soon realized the importance of e- commerce and thus was available in the inventories of e- commerce giants like Amazon, Snapdeal and many more. PAL targeted health consciousness, patriotism as the psychographic factors as well as chose the middle class population for its success.

3. Develop and discuss PESTEL analysis for PAL

The external factors influencing PAL are discussed as follows:

Political

The political environment was, and still is conducive for PAL’s growth and expansion. Baba Ramdev shares a friendly equation with the Prime Minister of India (Shri Narendra Modi). Both share a nationalistic approach, and the Prime Ministers’ “Make in India” initiative has been favorable to PAL and its ideology.

Government’s taxation policies impact on the cost of the input products and hence impacting on the final price of the products. Pal now enjoys a tax exempt from the government of India, placing it a step ahead of other FMCGs.

Government of India has a separate “Ayush – Ministry” to promote Yoga, Ayurved and other traditional and complementary medicines.

With The UN declaring 21st June as the International Day, due to initiatives of Prime Minister of India, the international appeal of PAL is bound to grow due to its association with yoga and Baba Ramdev.

Economic

Keeping the inflation rate in mind, the consumer prefers low cost products with low taxes, especially when it scores high in terms of benefits.

As the thrust is on – make in India, and raw products being procured from the local market, it contributes to the country’s economy with key focus on export.

With GST being implement, it favors PAL.

Social

PAL claims to provide chemical free, herbal products, thus benefitting the society. It also promotes herbal products which may help prevent lifestyle diseases like diabetes, hypertension and dyslipidemia thus decreasing the burden of such diseases in the current scenario. The promotion of yoga along with these products provides a holistic approach, similar to the ancient times of Ayurveda. It promotes awareness as well as instills health consciousness in people.

Technological

Patanjali Research Foundation was started in August 2010. This Research Foundation is a part of Patanjali Yogpeeth and is located in Haridwar, in the north of India. The institute aims at using scientific data in collaboration with ancient texts to provide quality products and medicines. Automation to produce large quantity of ayurvedic medicines without losing their efficacy has been adopted besides being used for other products.

PAL still needs evidence based medicine to authenticate its claim. For the same Patanjali has further invested 1000 crore in research and development.

Better communication, digitalization, digital marketing and e-commerce have all proven to provide technology enabled business model.

Environmental

As PAL’s ideology is based on chemical free products, it contributes to a clean- green environment.

Legal

Ayurved as an alternative medicine, falls under the Ministry of Ayush, its acts and rules and good clinical practices and guidelines for clinical trials.

It also faces legal implications under FSSAI and its clearance.

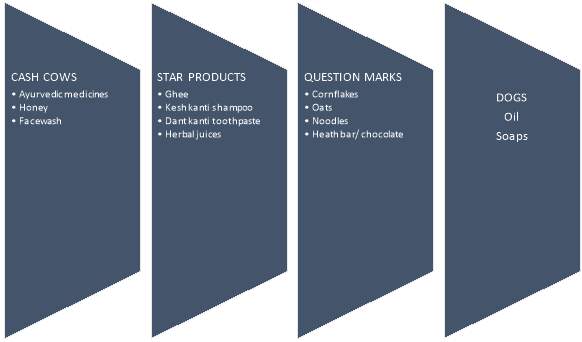

4. Develop and discuss BCG matrix for PAL

BCG analysis is usually used for multi-category products

Cash cows (most profitable)

Ayurvedic medicines, honey, facewash, fall into this category. These are the products that have a high market share in a low growing market. These are essential for the company as they are the ones which have high customer satisfaction and help in customer retention.

Stars (best products)

Ghee, Kesh kanti shampoo, Dant kanti toothpaste, herbal juices all contribute to the company’s star products as they contribute to a good market share as well as growth rate.

Question markets (uncertain products)

Cornflakes, oats, noodles, health bars/ chocolates are products which have an initial increase in growth rate but hold a questionable place in terms of market revenue.

Dogs (low market share and low growth)

Patanjali oil and soaps are products which neither generate large revenues nor require investment, but if they are revamped through rebranding/ innovation and marketing can generate large revenues.

5. Enlist and evaluate growth and expansion strategies for Patanjali

Market penetration: With its franchise model opening up not only in the metropolitans but also in tier 2 and tier 3 cities, Patanjali gained wide penetration coupled with Baba Ramdev’s reach and appeal.

Product development: The aura of swadeshi herbal products has gained mass appeal. This enables Patanjali to foray into new products using innovation and technology.

Market development: Soon after it established its ground in the market, Patanjali has already developed its market into retail with Future group as well as e commerce giants. It is also exploring its avenues in the international market due to its growing appeal.

Diversification: Patanjali has not only diversified in the FMCG market but also stepped its game with ayurved hospital and medical college. Baba Ramdev also claims to enter the apparel industry with “shudh desi swadeshi jeans”, kurta, pyjamas, caps and electronic items.. With the current rate of growth Patanjali has, it aims to diversify in terms of its product portfolio as well as other business verticals.

6. Discuss the role of e- commerce

E- Commerce is the biggest platform any company can get in today’s digital age. When customers demand their products to be delivered at their doorstep with no nuisance, e- commerce is the most promising platform to increase a company’s reach and revenue. Products can be bought from the company’s own website, patanjaliayurved.org. PAL saw the trend of the market and in early 2017 entered a partnership with e- commerce giants like Amazon, Snapdeal, Flipkart and Big basket, .Amazon enabled Patanjali its visibility on Amazon global with their products entering into US, UK and a total of 9 countries. With the boom in e- commerce, PAL aims to cash in with this opportunity to reach its projection of 20,000 crore for 2017-2018.

7. What is the scope of digital marketing for Patanjali?

Besides selling their products through their own website and e- commerce biggies, Patanjali uses the tool of digital marketing for sending emails/ advocacy materials to its consumers. In the time to come, it can use the power of digital marketing to engage consumers with ayurved doctors online, providing consultations/ advice.

8. What recommendations would you suggest for Patanjali to sustain itself in the market?

With a steep growth, it is also important that Patanjali sustains itself in the years to come or may exemplify as a small bubble. In order to do so, it has to ensure that the consumer becomes loyal. This can be achieved through their marketing strategy but it has to be backed up by good quality products. With the recent cases of Patanjali products failing the quality/ safety tests, it might dent the brand image in the eyes of the consumer. Emphasis on research, food/ medicine approvals are equally important, especially if it is eyeing the international market. Moreover the marketing propaganda has to be backed by evidence based medicine, or else the consumer may feel cheated when such tall claims fall flat on the face. Holistic approach with yoga and ayurved benefits continues to be PAL’s backbone. It is important that the company realizes its weakness and strengths before diversification of products. A youth connect with the brand is important if they want to sustain in the long run. Content advertising has proven beneficial for PAL, but at the same time, educated the consumer who will question the efficacy of all products through standard bodies, including PAL. Time will tell, whether this lion continues to prowl or is hunted by other competitors.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "International Studies"

International Studies relates to the studying of economics, politics, culture, and other aspects of life on an international scale. International Studies allows you to develop an understanding of international relations and gives you an insight into global issues.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: