A Study on ICICI Bank Merger with the Bank of Rajasthan

Info: 10384 words (42 pages) Dissertation

Published: 4th Oct 2021

Tagged: Banking

Abstract

Mergers and acquisitions are more of a strategy to reduce the competition in the market. This research will also look at one of the mergers in the banking industry and what were their strategies before the merger and how much they benefitted with the merger. Also, if it created any value to the shareholders for both of the firms or not. This research is presenting the Study of ICICI bank merger with the Bank of Rajasthan.

The research was carried out by using the secondary source of data. The literature review shows the secondary data gathered from the external and internal sources.

The findings of the research confirm the significance of the expertise product knowledge and the service quality in the Banking Industry and how it effects on the individual firm and the shareholders and employees of that firm.

It is difficult to explain and elaborate everything that I have learned during this study however, I have attempted to many examples in details about working in the following pages.

I have accumulated the desired information by studying the existing documents

Contents

CONTENTS PAGE NUMBER

- ACKNOWLEDGEMENTS …………………………………………………………………………………. 2

- ABSTRACT ……………………………………………………………………………………………………… 3

- TABLE OF CONENTS ………………………………………………………………………………………. 4

- INTRODUTION (Chapter 1) ……………………………………………………………………………. 5

- WHY MERGERS IN THE BANKING INDUSTRY ……………………………………… 5-6

- OBJECTIVES OF THE MERGER AND ACQUISITON

- RESEARCH BACKGROUND …………………………….………………………………………………. 6

- LITERATURE REVIEW (Chapter 2) …………….……………………………………………………. 7 – 9

- PURPOSE OF THE MERGERS AND ACQUISITIONS ……………………………… 9

- OBJECTIVES OF THE STUDY

- RESEARCH METHODOLOGY

- DATA COLLECTION

- RESEARCH DESIGN

- PROFILE OF THE BANKS

- BACKGROUND DETAILS OF THE MERGER

- IMPORTANT DATES OF THE MERGER

- PROPOSED AMALGAMATION WITH ICICI BANK LIMITED

- STRATEGIES OF BOTH BANK BEFORE THE MERGER

- ANALYSIS OF THE MERGER

- VALUATION OF THE MERGER DEAL

- PROTFOLIO THROUGH THE ACQUISITION

- INTEGRATION PROCESS

- ANALYSIS OF THE FINANCIAL FINDINGS

- SHARE PRICE MOVEMENTS BEOFRE AND AFTER THE MERGER

- SYNERGY

- BENEFITS OF THE MERGERS

- DATA FINDINGS AND ANALYSIS

- CONCLUSION

CHAPTER 1 – INTRODUCTION

In banking sector, Mergers and acquisitions have the capacity to ensure the efficiency, profitability and synergy. They are controlled or regulated by the apex financial authority of the country. For example: the mergers and acquisitions in the banking sector India are overseen by the Reserve Bank of India.

The term merger can be defined in broad and narrow contents. This broad definition of merger characterizes it as a takeover in which the strong banks or companies take over the weak banks or companies. Acquisitions are very different from the mergers to some extend but they always go along because both pursue similar goals (McClure, 2009). However, many authors put a clear parallel between the two concepts. An acquisition is the takeover of the ownership and management control of one company by another (Coyle, 2000) in which the buyer purchases an asset such as plant a division or even an entire company (Sherman & Hart, 2006).

Why Mergers in the Banking Industry?

In the banking sector Mergers and acquisitions have become very popular because it helps them to achieve the cost reduction through economies of scale, economy of scope, rationalization of the man power, possible reduction in tax obligations etc. Bank mergers can increase value by reducing the costs or by increase in the revenue (Houston 2001). Mergers and Acquisitions helps bank to reduce the credit risk as when they will merger with the other bank they will then be operating in the wider geographies or product range. If they are merging with a business they will have cheaper sources of inputs with the increase in the bargaining power with the vendors and suppliers and will also have the ability to enter the new businesses with the reduced cost as compared to a new set up.

From the model of Prager and Hannan (1998), it says that the impact of bank Mergers and Acquisitions on deposit interest rates, they found that although the mergers generate efficiency gains, these benefits are passed on to mergers banks consumers only in the form of higher deposit interest rates. For the borrowers, consolidation tends to increase the cost of borrowing. This can be seen from the positively and statistically significant lending price which is charged by the merged banks.

If we see from the shareholder’s point of view, investment made by them in the business subject to merger should enhance the value as that’s how they will earn the profit. The sale of the shares from one company’s shareholder to the one holding investment in shares should give rise to the greater values that’s the opportunity for the gains in the alternative investments for them. Shareholders must gain from the mergers and acquisitions in different ways which can be the realization of the monopoly profits, economies of scales, diversification of the product line, acquisition of human assets and other resources should not be available and the better investment opportunity in the combinations. There will always one or the other features that would generally be available in each merger and acquisitions for the shareholders which can attract them and is in their favour.

However, if we see through the managers point of view, they are concerned with improving the operations of the business and managing the affairs of the business effectively for all round gains and the growth of the business. The reason behind this that it will provide them better deals in raising their status, incentives and marginal benefits. The mergers where all these requirements are the guaranteed outcome are in the favour of the managers and definitely get supported from them. However, at the same time they have the fear to get substituted in the hands of the new management in amalgamated company and also resultant depreciation from the merger then support from them becomes difficult.

http://www.academia.edu/7380761/A_STUDY_ON_MERGERS_and_ACQUISITION_IN_BANKING_INDUSTRY-_A_GLOBAL_PHENOMENON

OBJECTIVES OF MERGER AND ACQUISITION

Most of the times Merger and Acquisitions are uses a synonymous. Both the terms merger and acquisitions means slightly different things. When a company takes over another one and clearly becomes the new owner, the purchase is called an acquisition. As Per the legal point of view, the target company ceases to exist and the buyer ‘swallows’ the business and stock of the buyer continues to be traded.

In the pure sense of the term, a merger happens when two firms, often about the same size, agree to go forward as a new single company rather than remain separately owned and operated. This kind of action is more precisely referred to as a merger of equals. Both the companies’ stocks are surrendered and the new company stock is issued in its place.

RESEARCH BACKGROUND

In Indian Banking industry, Mergers and acquisitions is a very common phenomenon across the world and not the new concept for the Indian Banking Industry. It has become an admired trend in the country. The main objective behind this is to grow in the industry at the strategic level and this can be in terms of the size and customer base. In Indian Banking Industry mergers and Acquisitions aims towards Business restructuring and increasing the competitiveness ad shareholders value by increasing the efficiency. This helps them to increase the credit-creation capacity of the merged banks enormously. Small banks than fearing the acquisitions by the large banks, take the step to merge to increase the market share and to protect themselves from the possible acquisitions. They also prefer mergers and acquisitions to reap the benefits of economies of scale by reducing the costs and maximization of both economic and non-economic benefits.

Also, the most important vantage of Mergers and Acquisitions is that it eliminates competition from the banking industry. In the past years, in the sector Merger and Acquisitions has ensured the efficiency, synergy and profitability that’s why it has been proven an act of corporate action. Other than efficiency, synergy and profitability the driving force behind the growing trend of mergers and acquisitions can be the deregulation in the financial market, economic reforms, market liberalization and many others. After all, RBI is the only one who has the authority to regulate all the mergers and acquisitions related activities pertaining to banking sector in the recent proposed amendments in the Banking Regulations.

The Indian banking industry consists of different categories. These categories are public sector banks, private sector banks and foreign banks. The public sector control a major share of the banking operations.

CHAPTER 2 – LITERATURE REVIEW

Globally, Mergers and Acquisitions have become a strategic alternative for restricting and the banking industry has also experienced major merger waves which leads to the creating of the large banks and financial institution. The movement in the merger has been widely debated in the policy reports. Furthermore, mergers help the financial institutions diversify their portfolio or increase their market share (Amel et al. 2004). Mergers have the potential possible to create the value for both the banks merging with each other. For example: shareholders in the target banks may gain the value as the premium offered to induce acceptance of the merger offers much more price than the book value of the shares. Similarly, shareholders of the bidder bank may gain in the long run with the growth of the company not only due to economies of scale but also due to many other factors.

The wealth effect can be seen from right at the beginning when the merger is being announced and the share price would generally reach to such announcements affecting the stock characteristics of the company. This impact can be good or bad for both the banks but it is a matter of concern and the confusion to for the shareholders of the bidder bank. The reaction of the market to such merger announcement has examined that it impacts the stock return but very little attention is given to the other stock characteristics. Mergers result in the overall benefits when the consolidated entity is more valuable than the aggregate of the two separate banks (Pilloff, 1996). Mergers announcement being an important piece of information for the banks which result in the significant impact on the share prices of both the banks the bidder and the target bank. Such an impact may be reflected in positive abnormal re-turns for the bidder banks, on merger announcement, if market perceives positive gains from the merger. Such announcement may also impact other stock characteristics such as volatility and liquidity of the stock.

The wave of the merger and Acquisitions is not new in the Indian Banking Industry. It is constantly reforming the global financial landscape in the past years. Having the read through the past available mergers and acquisitions activities, it has been analysed that there are various conclusions and view to all the different Mergers and Acquisitions that took place. Prior to the Merger and Acquisitions, many banks have made non-value maximising choices with respect to the small businesses. This paper will examine the Merger of ICICI Bank with the Bank of Rajasthan (2010). The reaction of the market to the announcement of the merger in developing countries may be quite different to the regulatory framework. The Merger of ICICI Bank with the Bank of Rajasthan was the seventh voluntary merger and the latest in Indian banking industry after the merger of HDFC bank – Centurion Bank of Punjab (2008). Mergers in the Indian Banking Industry have not necessarily been driven but have taken place at the initiative of the regulator. Dirk et al (2009) explained the relationship between the bank reputation after merger and acquisitions and if effects on shareholder’s wealth.

The possible impact on the bidder bank and the premium to be paid to the shareholders of the target bank would generally be expected to influence the share price of the banks. The findings of US event studies that look at share prices around the time of merger announcement reveal that, on average, total shareholder value (i.e. the combined stock returns of the bidder and the target) is not affected by the announcement of the deal since, on average; the bidder suffers a loss that offsets the gains of the target. Studies by Baradwaj, Fraser and Furtado (1990),Cornett and Tehranian (1992), Hannan and Wolkan (1989), Hawawini and Swary (1990), Neely (1987), Trifts and Scanlon (1987), Siems (1996), Houston and Ryangert (1994) and Becher (2000) also report positive reaction in the stock prices of target banks and negative reaction in the stock prices of bidding banks to merger announcements.

On the other hand, in their study of mergers in European banking markets, Cybo-Ottone and Murgia (2000) find positive and significant gains in shareholder’s value of bidder banks and Campa and Hernando (2006) also report positive returns to shareholders of target banks and zero returns to bidder banks. Scholtens and Wit (2004) examines the short-term wealth effects of bank mergers in the US and European market to both the target and bidder banks shareholders. The study finds that there are many significant differences in the shareholder wealth effects of US and European bank mergers but there are situations in which market reactions do not significantly differ. Both targets and bidders show positive cumulative abnormal returns in Europe whereas in the U.S. only target show positive abnormal returns. The overall value of bank mergers is positive in Europe and neutral in the US. Gayle de Long (2003) uses event study methodology to find out if bank mergers create value. The results indicated that although market reacts positively upon announcement of mergers that focus activities, geography and partner’s earning stream, focusing mergers do not necessarily produce long-term benefits. Another interesting study is made by Annalisa Caruso and Fabrizio Palmucci which conducts an event study on Italian banks and is of the view that choosing announcement date as the event date may only give partial reactions of the market because of outflow of the information.

The future of Indian Banking Industry looks quite thrilling with the competition escalating which would lead to consolidation, even though foreign banks are likely to jump into the dispute. From the Public sector dominated scenario, Indian Banking has come a way far to the current scenario where private banks co-exist with their public banks counterparts who have adjusted themselves with the change in the time. Although the Indian Banking has, system has performed really well in altering to the change in the dynamics and the superior challenges yet to be come.

In terms of Mergers and Acquisitions, Consolidation in the Banking sector is very vital for the growing Indian Banking Industry which they could achieve with the cost reduction and by increase in the revenue. The important factor that need to be considered is that what is the need of consolidation in the Indian Banking Industry and what can be challenges ahead. Also, the role of the central government is very important and necessary to be analysed in the entire process as a crucial role is played by them in the policy formation required for the growth of the Indian Banking Industry.

To be relevant to the proposed study the literature will focus on the merger of the Bank of the Rajasthan with ICICI bank.

MERGER OF THE BANK OF RAJASTHAN LIMITED WITH ICICI BANK

The Bank of Rajasthan Limited (Bank of Rajasthan), a banking company incorporated within the meaning of Companies Act, 1956 and licensed by Reserve Bank of India (RBI) under the Banking Regulation Act, 1949 was amalgamated with ICICI Bank Limited (ICICI Bank/the Bank) with effect from close of business on August 13, 2010 in terms of the Scheme of Amalgamation (the Scheme) approved by RBI vide its order DBOD No. PSBD 2599/16.01.056/2010-11 dated August 12, 2010 under sub section (4) of section 44A of the Banking Regulation Act, 1949. The consideration for the amalgamation was 25 equity shares of ICICI Bank of the face value of ` 10 each fully paid-up for every 118 equity shares of ` 10 each of Bank of Rajasthan. Accordingly, ICICI Bank allotted 31,323,951 equity shares to the shareholders of Bank of Rajasthan on August 26, 2010 and 2,860,170 equity shares, which were earlier kept in abeyance pending civil appeal, on November 25, 2010.

Another merger in the India Banking that was extra-ordinary merger was between the Bank of Madura to integrate with ICICI Bank in year 2001. This merger was one of the remarkable merger as it was totally different from the other mergers. This merger was between the Banks of two different generations. This merger marks as the beginning of the acceptance of merger of new generation with the old generation banks, which seemed to be out of place with the numerous embedded problems. ICICI is one of the largest financial institution which was formed in 1955.

Purpose of the Mergers and Acquisitions

The basic purpose of the mergers or combining the two business is to achieve the faster growth of the corporate business. Faster growth can lead the business to improvement and competition position. For the offeror company, the purpose for acquiring the other company is reflected in the corporate objectives. Offeror firm need to decide some specific objectives that they want to achieve from the merger or Acquisition. General purpose of the merger and acquisitions are to generate more profit for the built business and to diversify their organisational domains but at the same time, to expand the business in different geographical region is also a big reason for merger and acquisition to take place.

There are other possible purpose of Mergers and Acquisitions which are as follows:

- To limit the competition

- To displace the existing management

- To reap speculative gains attendant upon new security issue or change P/E ratio.

- To diversifying the risk of the company, particularly when it acquires those businesses whose income streams are not correlated.

- To reduce tax liability because of the provision of setting off accumulated losses and unabsorbed depreciation of one company against the profile of another.

- To limit the severity of competition the company’s market power.

- To utilise the under-utilised resources and it can be human, physical and management skills.

- To utilise the under-utilised market power.

- Ton overcome the problem of slow growth and profitability in one’s own industry.

Objectives of the study

In past, it is seen that the analysis of the mergers and acquisitions have not been given much importance in the Indian banking industry, in the way the trends, framework or the other policies have been given. The present study will be investigating the detail of the ICICI Bank merger with the Bank of Rajasthan. The objective of the study is to make a comparative analysis of the pre – post performance of the selected entity, discussing the impact and the benefits that the banks had after merger and acquisitions taking place.

This project was undertaken to analyse why the merger and acquisition is necessary from a bank’s point of view or when two or more of them agree to combine their operation and form an single entity and then what will happen to the merged entity and the surviving business. It shows the need of the merger and acquisition in the banking industry and public/private sector.

RESEARCH METHODOLOGY

Data collection

The chosen method of the collection of data is from the secondary sources. To conduct a study properly designing of the process is essential because consistency and legitimacy of the consequences of a study depends on the reliable data and information. In this connection, some activities have been carried out to collect data and information. For the purpose of evaluation of investigation data is collected from merger and Acquisition (M$A’s) of Indian Banking Industry.

The data is collected from secondary sources such as:

- Website of the banks

- Annual reports of the company

- Other existing cases in the industry

Research Design

In order, to make my study effective and to discuss the impact clearly if Mergers and Acquisitions, I have undertaken the following steps:

- First of all, I searched different banks like ICICI, HDFC BANK, STATE BANK OF INDIA etc.

- Then I collected the data from the top banks who provide the fundamental research to its customers.

- After that, I searched for the modes of collecting the information for the research regarding the Merger and Acquisition which is provided by the above-mentioned banks.

- Then I selected these modes for the completion of this project.

- The method used for collecting the data was the Secondary Data such as the annual reports and the banks website.

- At last after collecting all the data needed, I omitted the incomplete/unnecessary data.

Methodology

To analyse the post and pre-merger financial performance of the banks various financial ratios and common size financial statements are used for comparison. Post-merger, ICICI bank’s branch network would go up to 2,463. This is the third merger for the bank after it took over bank of Madura and Sangli Bank.

Limitations of the study

Though very humble attempt is made to analyse the pre-and post-merger financial performance of the selected banks and if the shareholders of both the bank will receive any wealth from the merger or not. It is difficult to narrate all incidents and change brought up due to merger and acquisitions. Secondly, the study is based purely on secondary data which are taken from financial statement of the case through Internet only and therefore cannot be denied for any ambiguity in the data used for the analysis

Profile of the banks

Profile of ICICI BANK

ICICI bank started as an owned subsidiary of the ICICI limited which is an Indian multinational banking and Financial Institution. It was established in the year 1994 and became the first bank to be listed on the New York Stock Exchange. In terms of the assets ICICI bank was the second largest in India and third in terms of the market capitalisation. ICICI bank offers wide range of banking products and other financial services for both corporate and the retail customers which they distribute to them though their different variety of channels and specialised subsidiaries in the areas of investment banking, life or non-life insurance, venture capital and the asset management.

| MERGER HISTROY | ||

| BANK MERGED WITH | YEAR OF THE MERGER | |

| ICICI BANK | TAKEOVER OF ANAGRAM FINANCE | 1998 |

| ICICI BANK | BANK OF MADURA | 2000 |

| ICICI BANK | ICICI LTD | 2002 |

| ICICI BANK | ACQUIRES RUSSIA’S IVESTITSIONNOKREDITNY BANK | 2005 |

| ICICI BANK | SANGLI BANK | 2007 |

AIM OF THE BANK

ICICI bank aims to create the wealth in long0term through the four Cs strategy of Current Account Savings Account (CASA) growth, the credit quality, cost control and the capital preservation.

Corporate Profile

The bank has the network of 4,450 branches and about 14,404 ATMs in India and is also have a presence in other 18 countries.

http://www.iloveindia.com/finance/bank/private-banks/icici-bank.html

Profile of BANK OF RAJASTHAN

Bank of Rajasthan was a private sector bank of India which was set up in year 1943 in Udaipur with the initial capital of Rs. 10.00 Lakhs

Corporate Profile

Bank of Rajasthan has network of 466 branches out if which 280 were situated in Rajasthan and had about 400 employees.

| TROUBLES FOR BoR | |

| 09 NOV 2010 | RBI APPOINTS ADDITIONAL DIRECTOR ON BoR BOARD |

| 10 FEB 2010 | RBI IMPOSES RUPEES 25 LAKH PENALTY ON BoR |

| 10 MAR 2010 | RBI ORDERS AUDIT OF BoR’s BOOKS |

Bank of Rajasthan has a market capitalisation of Rupees of Rs 1,600 crore compared with the ICICI Bank’s Rupees 99,000 crore. It reported a net loss of Rupees 44.7 crore for the quarter ended December 2009 with the revenue of Rupees 344.83 crore. In terms of the assets ICICI bank is around 25 times larger than the Bank of Rajasthan and In the terms of branch network, Bank of Rajasthan have 463 branches and is less than one fourth of the ICICI bank’s network.

REASON OF THE MERGER

During the period 2002-2004, Through the close relative of the promoter Mr. P K Tayal Bank of Rajasthan acquired the properties in Mumbai. Promoters were under the huge pressure of the Bank of Rajasthan the from the regulatory authorities for the restructure of the bank for variety of problems from year 2009 onwards. BoR controlled by Tayal Group was asked to lessen their shareholding to bring down to 10% from 28% by RBI. As per the SEBI, the promoter’s shareholding in the old private sector bank accounted to 55%. On February 26th 2010 the RBI imposed a penalty of 25 lakhs for a series of violations including irregular property deals, actions against money laundering norms, deletion of corporate records from the information systems, irregularities in the accounts of corporate groups, extension of repayment period over permissible limits on intra-day overdraft and also the lack of enough credit communities and poor corporate governance. ICICI bank was learnt to indicate that they are willing to pay more than the present market valuation of the Bank of Rajasthan.

Important dates of the Merger

- 26th Feb 2010 – Due to serious violation penalty of 25 lakhs was imposed on Bank of Rajasthan by RBI

- 8th March 2010 – 100 Entities allegedly holding the shares of Bank of Rajasthan were banned by SEBI

- 18th May 2010 – News of Merger on Newspaper

- 23rd May 2010 – Meeting of Board of Members approved the Amalgamation

- 20th June 2010 – EGM was cancelled by Bank of Rajasthan on Calcutta civil court order

- 21st June 2010 – Meeting of shareholder’s convention

- 23rd June 2010 – information to Stock Exchange

- 24th June 2010 – Merger Application was submitted to RBI

- 12th August 2010 – Merger Approved by RBI

PROPOSED AMALGAMATION WITH ICICI BANK LIMITED

The meeting between the banks Board of Directors help on 23rd May 2010 and they approved the scheme of Amalgamation of the Bank of Rajasthan with ICICI Bank Ltd. The ratio of the share exchange was approved at 25 shares of ICICI bank Ltd for 118 share of the Bank of Rajasthan which on a swap ratio works out to be the ratio of 1:4.72.

Also, the shareholders of both the banks approved the scheme of amalgamation at their respective general meetings. The application of the merger or the scheme of amalgamation was approved by RBI on 12th August 2010 with the effect from the close of the business.

STRATEGIES OF BOTH BANK BEFORE THE MERGER

Before the merger took place ICICI bank was totally focused their attention toward the positioning of their balance sheet for growth and focusing on the 4c’S which are CASA, Cash, Capital and the Credit. Main aim of ICICI bank before the merger was to defend the market leadership through consolidation and improve their presence in the northern India. ICICI wanted to improve the top-line through the increase customer acquisition and reduce non-performing assets from the current levels of 5.06% and to improve the Asset-liability management. They were also focused on the retail finance, services, petroleum, infrastructure, iron and steel in the terms of the composition of the advances.

However, Bank of Rajasthan was totally focused on their internal troubles in the year before the merger took place and had strategies aligned to the same as well. Strategy of Bank of Rajasthan was to improve the Corporate Governance and cut down on the high credit costs and on the employee costs. This was to improve the bottom line and improve the CAR to regulatory minimum. Their strategy was also to improve the presence of the branch. Bank of Rajasthan had strongly focused their attention towards the infrastructure and metals & mining in the terms of the composition of the advances. By virtue of, the location advantage of its branches and because of the strong link ups with RRB, BoR had the strong presence in SMEs and especially in the sector of textiles pharmaceuticals and chemical and gems and jewellery.

ANALYSIS OF THE MERGER

ICICI bank approved to merge with the Bank of Rajasthan on 18th May 2010 and the swap ratio was announced at 25:118 which was 25 shares of ICICI bank for 118 shares of the Bank of Rajasthan. The Reserve Bank of India gave their decision to carry on with the merger on 13th August 2010 and by following the sanctioning of the scheme of amalgamation of Bank of Rajasthan with ICICI bank, all the branches of Bank of Rajasthan should start operating as the new entity with effect from August 13th. It was a no cash deal and the value of the deal was 30.41 billion. The deal gave ICICI bank a sizeable presence in the northern Rajasthan.

VALUATION OF DEAL

Valuation is the critical part of any Merger and Acquisition activity. It totally depends on the negotiations that are entered between the buyer bank and the seller bank. However, it is also important for the shareholders of both the bidder and the target bank. Each and every step taken is very crucial at every stage and failure in one stage can spoil the whole deal. For example: you can see in the Federal Bank – Catholic Syrian Bank merger, which got deflected on the valuation disputers in September 2009. In the financial terms, valuation for a merger is a comprehensive task and is done to find out the numerator and denominator of the following equation:

Exchange Ratio (Swap Ratio) = Share value of the ICICI Bank

Exchange Ratio (Swap Ratio) = Share value of the ICICI Bank

Share value of the Bank of Rajasthan

Exchange ratio is the ratio that the target bank receives shares of the bidder bank in exchange of the shares in the target bank. This ratio can be found by the applications of the different valuation models like dividend discounting model, discounted earnings model, future maintainable profit method or the combination of these models. However, practically valuation models are approximations and the simplifications of the valuer based on the rational choices and demonstrations (Luca Francesco Franceschi, 2008). On the basis of branch valuation in this case the swap ratio was announced as 1: 4.72. In comparison to the average of the old private sector bank’s market capitalization to branch value of Rupees 5.4 crore the value of the Bank of Rajasthan branches was valued as Rupees 6.6 crore. This was the reason that this transaction appeared very expensive for ICICI and the premium paid was Rupees 88.5 for per share.

Financials that need to be considered for the fixation of Swap Ratio.

| Particulars | ICICI BANK | BANK OF RAJASTHAN |

| MARKET VALUE OF SHARE | Rs901.00 | 82.85 |

| BOOK VALUE | Rs462.15 | Rs58.04 |

| EPS | Rs36.14 | Rs-6.33 |

| NPA (%) | 1.87 | 1.6 |

| CRAR (%) | 19.40 | 7.74 |

| NET PROFIT AFTER TAX | 40249.83 | -1021.30 |

| Value of the deal | ||||

| Particulars | Swap ratio (Crores) | Outstanding Shares (crores) | Market Capitalization (crores) | Deal Value (crores) |

| ICICI | 25 | 111 | 889.35 | 3041 |

| BoR | 118 | 16 | 99.5 | 1597 |

| Source: Annual Reports of the bank and the calculations were based on the secondary data | ||||

From this merger, we can determine the fair market value of the Bank of Rajasthan on the price to book ratio. According to ICICI, the valuation implied by share exchange ratio is in line with the market capitalisation per branch of the old private sector banks in India. It also compares favourably with the relevant precedent transactions. The final determination of the share exchange ratio is subject to due diligence independent valuation and the approvals.

After the board meeting, Bank of Rajasthan’s Managing Director said that Haribhakti & Co has been appointed jointly by both the banks to assess the valuation. As this merger has been executed through the transfer of the shares, so the amount of goodwill will be transferred to the Bank of Rajasthan in the form of premium of 90 per share.

| Value of Deal – A comparable approach | |

| BANK | P/B RATIO |

| DHANALAKSHMI BANK Ltd | 2.2 |

| KARUR VYSYA BANK Ltd | 2.0 |

| CITY UNION BANK Ltd | 1.9 |

| ING VYSYA BANK Ltd | 1.7 |

| DEVELOPMENT CREDIT BANK Ltd | 1.6 |

| UNITED WESTERN BANK Ltd | 1.4 |

| JAMMU AND KASHMIMR BANK Ltd | 1.2 |

| SOUTH INDIAN BANK Ltd | 1.1 |

| FEDERAL BANK Ltd | 1.1 |

| KARNATAKA BANK Ltd | 1.1 |

| LAKSHMI VILAS BANK Ltd | 1.1 |

| AVERAGE | 1.5 |

| Source: Annual Reports of the bank and the calculations were based on the secondary data | |

The average price to book ratio comes to around 1.5. Using the above ratios and the calculated book value of the 1048.8 crore we can calculate the Bank of Rajasthan which is 1.5 x 1048.8 and it gives the value of 1573 crore. This merger deal value of more than 3000 crores is quite expensive in the regard which values Bank of Rajasthan at almost the twice the current value.

Therefore, the goodwill from the merger is as follows:

Goodwill = price paid – Market Value of target firm (BoR) Equity

= 30.41 billion – 15.97 billion

= 14.45 billion

PORTFOLIO THROUGH THE ACQUISITION

INTEGRATION PROCESS

An integration process is an executable cross-system process for processing the messages and all the process steps are defined to be executed and the parameters relevant for the controlling of the process.

The integration process started after the final approval of the amalgamation of the Bank of Rajasthan by ICICI bank took place on 12th August 2010. The integration of IT systems and employees were the main part of the amalgamation. ICICI bank agreed to implement the systems that they already use in their existing branches to the branches of Bank of Rajasthan so that they can deliver the similar services to their customers and now the IT and the ATMs have established their connectivity customers in the northern Rajasthan need to be update with the others similar to the customers of ICICI bank in other areas. Deposit mobilization from retail customers and advances processing is currently being done, while maintaining the continuity in products and charges.

The main worries were about taking the Bank of Rajasthan employees as the part of the ICICI, because around 4000 employees of the Bank of Rajasthan were ready to join the ICICI bank but they raised some concerns in May 2010, the time when the merger deal was initially announced. They had the fear of their future as the average age of the employees in Bank of Rajasthan was around 53. However, in ICICI bank it was very much lower to the Bank of Rajasthan. So, the employees of Bank of Rajasthan were about their jobs in the future after the merger. But as per it was agreed in the amalgamation scheme, ICICI bank promised to take in all the employees of Bank of Rajasthan, although they did have the choice of staying and working for ICICI or leaving if they don’t want to. Overall, the integration process was successfully and smoothly complete and now all the employees of Bank of Rajasthan are officially the employees of ICICI.

ANALYSIS OF THE FINANCIAL FINDINGS

SHARE PRICE MOVEMENTS BEOFRE AND AFTER THE MERGER

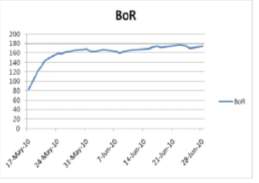

The Graph shows the share price movement between 26th Feb to 6th May.

The graph above shows the share price movement of the ICICI bank and The Bank of Rajasthan after the merger was announced from the period May6th to May17th in year 2010.

Share Movement

Shares of BoR jumped close to 20 percent on Tuesday to a 52-week high on the back of reports of the merger. The shares were locked in at the upper circuit at Rupees 99.5 at around 2 p.m. close to three crores. In 1990, the ICICI institution started diversifying its operations and end up at the wholly owned subsidiary called ICICI bank.

Before the merger on February 26th, 2010, the closing price of Bank of Rajasthan was 61.8 and on 6th of may the price was 84.7. during the period of 26th Feb to 6th may the Bank of Rajasthan’s scrip value was appreciated by 20.9% against the Bank nifty return of 9.9%.

Later, on 6th May Scrip value of the Bank of the Rajasthan 84.7 and the ICICI bank was traded at 902.85. On May 17th, the ICICI bank and the Bank of Rajasthan recorded their prices as 901.1 and 82.25 respectively. This indicated that the negotiation of the merger has a zero effect on the price of the merging entities. The Bank Nifty return for the period was 2.7%.

However, later after the announcement of the merger price increased drastically. On May 16th Bank of Rajasthan was 82.85, which later moved to 99.45 on 17th, 119.35 on 18th, 131.30 on 19th, 144.45 on the 20th, 158.9 on 21st and 162.3 on the 24th. Bank of Rajasthan gained about 77% during the period whereas ICICI lost 1.7% of its value. But the interesting fact to note here was that Bank Nifty showed a decline of 4.6% during the period. Also the price of ICICI reduced from 901.10 to 809.35. But Bank of Rajasthan created wealth in the short time period with the valuation and fixation of the swap ratio.

The swap also indicated that ICICI bank is paying a 90 percent premium over stock’s closing price of Rupees 99.50 on the Bombay Stock Exchange. ICICI bank shares closed with 1.45 percent lower at Rupees 889.35 on the day when the benchmark Sensex rose by 0.24 percent. The valuation implied by the share exchange ratio is in line with the market capitalization per branch of old private sector banks in India.

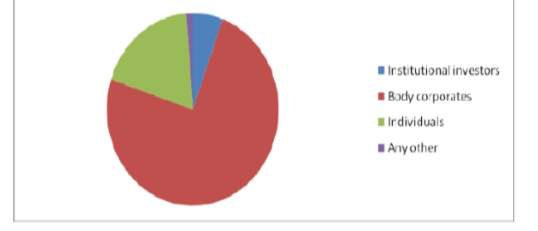

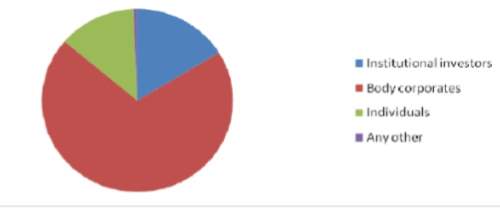

Shareholdings

The chart above shows the shareholdings pattern of Bank of Rajasthan on March 31st 2010 and the chart below shows the shareholdings pattern of the Bank of Rajasthan in 30th June 2010.

It was valuable to analyze the pattern of the shareholdings of the Bank of Rajasthan for the 4th quester of the fiscal year of 2009 and the first quarter of the fiscal year 2010 in the context of the unusual actions from the authorities.

| Strategic Variables | ICICI Bank (in %) | Bank of Rajasthan (in %) |

| Return on loan | 12.71 | 16.30 |

| Liquidity ratio | 49.85 | 48.15 |

| Financial leverage | 14.21 | 5.40 |

| Cost to income ratio (CIR) | 87.86 | 106.86 |

| Efficiency ratio | 34.85 | 38.09 |

| Loan to deposit ratio | 89.71 | 55.31 |

| CRAR | 19.41 | 7.75 |

| NPA | 1.88 | 1.60 |

| Source: Annual Reports of the bank and the calculations were based on the secondary data | ||

Mergers and Acquisitions are important events in the life for any firm doesn’t matter if they are small of big and so does the merger announcements. Merger announcements have a significant impact on the share prices of both the bidder and the target banks. Following are some of the evidence for the wealth shifting in the global arena form the bidder bank shareholders to the shareholders of the target bank and the target bank shareholders to the bidder bank shareholders. This merger is totally appearing to be more in the favour of Bank of Rajasthan as their shareholders gained almost 90% between the time of the announcement of the merger until the Board Meeting approved the merger.

| ICICI BANK | BANK OF RAJASTHAN | |

| Swap ratio | 1:4.72 (25:118) | |

| Price day before the merger announcement | 901.10 | 82.85 |

| Price of the day of the merger announcement | 809.20 | 99.45 |

| Price day after the merger announcement | 824.45 | 119.35 |

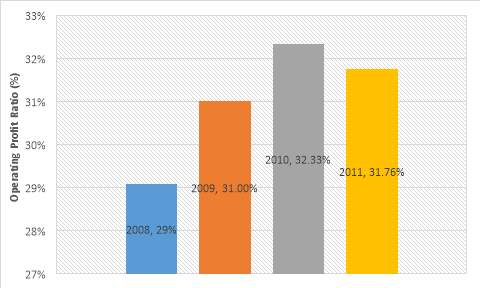

The above chart shows the operating profit ratio of ICICI bank before the merger and after the merger. In the year 2008, it is 26% and 2009 it is 26.22, in year 2010 it increased to 29.05% which are the pre-merger period. However, later in year 2011 it dropped to which is he post-merger period. When we compare the ration of both the banks pre and post-merger, the important ration that everyone can see and is indirectly telling the strength of the companies operation is operating ratio 29.05% for ICICI bank however, it was 36.34% for the Bank of Rajasthan.

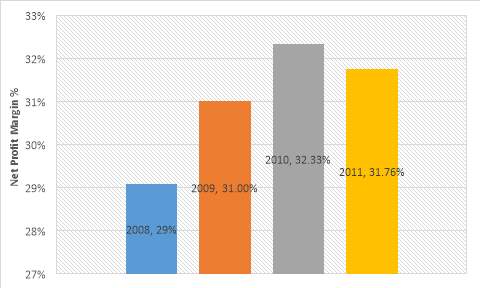

The Graph above shows the net profit margin between the year 2008 to year 2011 pre-merger and post-merger period. The net profit ratio for the acquirer company before merger was12.17% while the net profit for the acquired bank was 10.04%. However, after the merger the Net profit for the acquirer ICICI bank increased to 15.91% which shows that the significant increase from 12.17% to 15.91% and a clear message that the ICICI bank made the profits after the merger. This can be said that the bank has gained the monopoly and the goodwill advantages are helping them to gain the substantial profit.

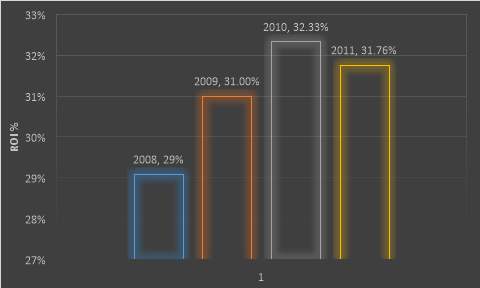

The ROI is expressed as the percentage and is used for personal financial decision to compare the company’s profitability or to compare the efficiency of the different investments. The formula to calculate ROI is Net (Profit/Cost of investment) x 100. In this case, the pre-merger ROI for the acquirer bank was 44.72% while the return on investment for the acquired company was 177.48%. However, after the merger ROI decline to to 42.97% and the average of the net worth was 7.79% for the acquiring before the merger while the return on net worth for the target bank was -18.86% which increase to 9.35% after the merger for the acquired bank. So overall it tells us that loss was incurred at the time of the merger.

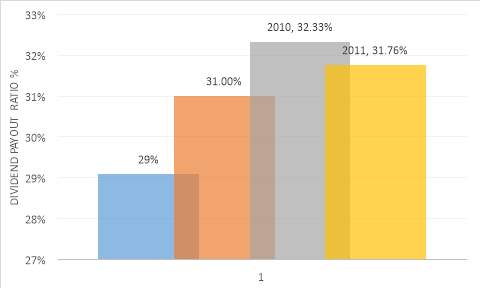

The table above shows that the dividend payout ratio for the acquirer bank was 32.33% whereas its was 2.91% for the target bank. However, after the merger it changed to 31.76% which clearly indicates that the acquirer bank had a slight decrease in the post-merger period from 32.33% to 31.76%.

The WACC Calculation for Bank of Rajasthan

Rf – 7.22%

Rm – 11%

Required rate of return – 0.89

SYNERGY

Synergy is the interaction of them elements which are when combined produce a total effect which is greater than the sum of the individual element, contribution. In today’s time a trend of discussion is going regarding the merger that which one of them will be rewarded from the merger deal and what will be the happening with the employees of the target bank and also whether the merger deal will add any value to the shareholder’s wealth or not.

The value of synergy then helps to indicate the additional value created from the merger. Value of synergy is created from the economies of the integrating target and the acquiring bank both and the amount by which the value of the combined bank exceeds the sum value of the individual bank. Synergy is determined from the following formula:

ΔV=VA-T – (VA + VT)

Where,

ΔV = additional value created

VT = the premerger value of the target firm

VA = the premerger value of acquiring firm

VA-T = value of post- merger firm

On 12th August 2010, the total assets of the Bank of Rajasthan were represented as 4.0% of the total assets of the ICICI bank. On the day, Bank of Rajasthan had the total assets of 155.96 billion, deposits of 134.83 billion and the loans of 65.28 billion and the investment of 70.96 billion. Due to which it incurred a loss of 1.02 billion in the fiscal year 2010. The results for fiscal year 2011 have the results for the Bank of Rajasthan for the period from August 13th, 2010 to March 31st, 2011. The liabilities and assets of the Bank of Rajasthan was accounted at the values at which they were appearing in the books of the Bank of Rajasthan on 12th August 2010. Provisions were made of the Bank of Rajasthan because of the differences between the book value that was appearing in the books of Bank of Rajasthan and the fair value that was determined by the ICICI bank. The addition in the value after the merger is as follows:

ΔV=VA-T – (VA + VT)

= 1160.407 billion – (980.089 billion + 13.707 billion)

= 166.611 billion

The results were showing that the ICICI bank had incremental net gain from the merger with Bank of Rajasthan. This then means that the merger created the synergy.

During the Fiscal year 2011, the total focus of the ICICI bank was on leveraging their rebalanced funding mix and the strong capital position to grow the portfolio of loan, by substantially reducing their provisions for the losses of the loan to improve their profitability.

Although, the networks of the branches of the ICICI bank did increase after the merger but the interest income did not increase to the extent it was expected to. The reason behind this was the decrease in the yield on advance, loss on the securitized assets of pools and the reason behind decreasing the yield on the advances was mainly due to the decrease in the proportion of the high yielding unsecured retail portfolio in the total advances and the decrease in profit on the domestic non-retail advances which were reflecting the decline in the trend of the interest rates during the fiscal year 2010 which continued to the first half of the fiscal year 2011.

RBI increased the CRR by 75 basis points to 5.75% in February 2010 and further by 25 basis points to 6.00% effective April 24, 2010. As the balance of the CRR do not earn any interest income that’s why the increases had the negative impact on the yield on the interest earning assets in the fiscal year2011. However, on the other hand income on the interest earning investment increased mainly because of an increase in the investment in higher yielding credit substitutes like corporate bonds and debentures, certificate of deposits and the commercial paper.

BENEFITS OF THE MERGERS

After the merger ICICI bank expanded its network of branches. The position of the ICICI bank has strengthen in the north and west India and they would also strengthen their rural marketing which is delivered to public through their 98 branches of Bank of Rajasthan which are in the rural area. With the help of the merger Bank of Rajasthan will be able to improve their services for example: ICICI banks internet and telephone banking is being implemented for the Bank of Rajasthan. Also, ICICI bank will be able to improve the efficiency of the Bank of Rajasthan branches and thus improve profitability.

The main result of the amalgamation is the geographical expansion in ICICI branch network in the north-western region of the country, by only diluting 3% of it’s equity stake. The tough part of this merger would be to start the new branches for BoR it was change to merger itself with India’s biggest private sector bank. So, from the point of view of ICICI, the strategy is an expansive strategy and for the Bank of Rajasthan it is to improve their results in the operations and the quality of their service. Therefore, the merger benefitted both the bank in their own different ways.

There is the increase in the deposit after the

After the merger, the deposit of ICICI bank has also increased and without this merger it would have taken them next three to four years to increase the deposits upto this level. So clearly, the merger saved the time for ICICI bank and helped them to gain the benefit in the terms of time to market. The merger benefited Bank of Rajasthan more than ICICI bank as they gained almost 90% between 7th May 2010 when the mergers negotiations started and 23rd May 2010 when the Board meeting approved the merger.

CONCLUSION

In India, Mergers and Acquisitions of the banks are major outcome for the financial transformation process. From the above study, it can be concluded that the primary reason for the merger of ICICI bank with the Bank of Rajasthan is a major landmark in the history of Indian Banking industry and took place due to the regulatory interventions of the authorities. In the above study, Both the strategic similarity and the dissimilarity are discussed for both ICICI bank and the Bank of Rajasthan and are analysed in detail. It has been observed from the findings that both the banks are not at all similar in most of the key parameters. Therefore, main aim of the management of acquiring firm (ICICI bank) was to focus on this intrinsic issue in the post-merger period so that they can boost the level of their performance of the merged entity. During the merger from the negotiation period, there are movements in the prices of both ICICI bank and the Bank of Rajasthan. However, the most surprising fact was that when the RBI and SEBI were originating the actions against the irregularities in the Bank of Rajasthan, the bank the major rise in the price of 20.9% whereas there was only 9.95 increase in the Bank Nifty.

Henceforth, the reason for the share price being treasured can be acknowledged due to the information asymmetry or the insider trading or both of them.

REFERENCES

“ICICI Bank.Com : About Us | Investor Relations”. Icicibank.com. Web. 1 Mar. 2017.

“Strategic Report, Directors’ Report And Financial Statements”. N.p., 2014. Web. 2 Mar. 2017.

Scribd. (2017). Pre Merger and Post merger position of ICICI Bank | Mergers And Acquisitions | Banks. [online] Available at: https://www.scribd.com/document/176485672/Pre-Merger-and-Post-merger-position-of-ICICI-Bank [Accessed 3 Mar. 2017].

Ninan, Oommen. “Bank Of Rajasthan To Merge With ICICI Bank”. The Hindu. N.p., 2010. Web. 1 May 2017.

“Company Overview Of ICICI Bank UK PLC”. Bloomberg. Web. 10 Mar. 2017.

“Sitemap”. Icicibank.com. Web. 10 Mar. 2017.

“M&A Statistics By Countries – IMAA-Institute”. IMAA-Institute. Web. 10 Mar. 2017.

“M&A Statistics By Countries – IMAA-Institute”. IMAA-Institute. Web. 10 Mar. 2017.

“ICICI Bank | ICICI Bank Inaugurates Its 4000Th Bank Branch”. Icicibank.com. N.p., 2015. Web. 14 Mar. 2017.

Team, BS. “SBI-Associate Banks Merger: All You Need To Know”. Business-standard.com. N.p., 2016. Web. 15 Mar. 2017.

UKEssays. (2016). Analysis of ICICI bank and Bank of Rajasthan merger. [online] Available at: https://www.ukessays.com/essays/finance/analysis-of-icici-bank-and-bank-of-rajasthan.php [Accessed 2 Apr. 2017].

Reporter, B. (2010). Bank of Rajasthan to merge with ICICI Bank. [online] Business-standard.com. Available at: http://www.business-standard.com/article/finance/bank-of-rajasthan-to-merge-with-icici-bank-110051900028_1.html [Accessed 4 Apr. 2017].

Icicibank.com. (2010). ICICI Bank | ICICI Bank Board gives in-principle approval for merger of Bank of Rajasthan. [online] Available at: https://www.icicibank.com/aboutus/article.page?identifier=news-icici-bank-board-gives-inprinciple-approval-for-merger-of-bank-of-rajasthan-20131912165144456 [Accessed 10 Apr. 2017].

UKEssays. (2015). Study On Icici And Rajasthan Bank Merger Finance Essay. [online] Available at: https://www.ukessays.com/essays/finance/study-on-icici-and-rajasthan-bank-merger-finance-essay.php#ftn14 [Accessed 10 Apr. 2017].

Jindal, S. (n.d.). A STUDY ON MERGERS & ACQUISITION IN BANKING INDUSTRY- A GLOBAL PHENOMENON. [online] Academia.edu. Available at: http://www.academia.edu/7380761/A_STUDY_ON_MERGERS_and_ACQUISITION_IN_BANKING_INDUSTRY-_A_GLOBAL_PHENOMENON [Accessed 10 Apr. 2017].

Help.sap.com. (n.d.). Defining and Managing Integration Processes (SAP Library – Defining and Managing Integration Processes). [online] Available at: https://help.sap.com/saphelp_nwpi711/helpdata/en/3c/831620a4f1044dba38b370f77835cc/content.htm [Accessed 2 May 2017].

Business perspectives.org. (2013). Wealth effects of bank mergers in India: a study of impact on share prices, volatility and liquidity. [online] Available at: https://businessperspectives.org/media/zoo/applications/publishing/templates/article/assets/js/pdfjs/web/viewer.php?file=/pdfproxy.php?item_id:5069 [Accessed 2 May 2017].

Jelies, I. (n.d.). How to calculate synergies in M&A | Alpha Gamma. [online] Alpha Gamma. Available at: https://www.alphagamma.eu/finance/how-to-calculate-synergies-in-ma/ [Accessed 4 May 2017].

Nseindia.com. (n.d.). Corporate Home. [online] Available at: https://www.nseindia.com/corporates/corporateHome.html?id=eqBoardMeetings&radio_btn=company¶m=ICICIBANK [Accessed 10 May 2017].

Nseindia.com. (n.d.). NSE TAME. [online] Available at: https://www.nseindia.com/ChartApp/install/charts/mainpage.jsp [Accessed 10 May 2017].

Shah, A. and Deo, M. (2013). BANK MERGERS AND SHAREHOLDER VALUE CREATION IN INDIA. [online] Available at: http://www.ijbs.unimas.my/repository/pdf/Vol14No2paper6.pdf [Accessed 3 May 2017].

Anon, (2013). Impact of Bank Mergers on the Efficiency of Banks: A study of merger of Bharat Overseas Bank with Indian Overseas Bank. [online] Available at: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.686.3069&rep=rep1&type=pdf [Accessed 3 May 2017].

Venkatesh, M. (2016). Govt to merge banks, this is how it effects you. [online] http://www.hindustantimes.com/. Available at: http://www.hindustantimes.com/business/govt-to-merge-banks-this-is-how-it-effects-you/story-fX0IqTLwjwz3iipuHwSxRN.html [Accessed 3 May 2017].

Deely, M. (n.d.). The Benefits (And Dangers) Of Bank Mergers And Acquisitions. [online] Bigskyassociates.com. Available at: http://www.bigskyassociates.com/blog/the-benefits-and-dangers-of-bank-mergers-and-acquisitions [Accessed 6 May 2017].

Appendices 1

The fruits of Merger and Acquisitions for banks are reducing unhealthy competition amongst banks, sound financial position, huge business, large assets, benefits of core banking solutions, networking and technological advancements at low cost, low cost of maintenance and human resource management, large profits, larger customer coverage. Moreover, recapitalization of weaker banks in the lights of Basel II Norms.

BUSINESS REVIEW During fiscal 2011, the Bank focused on 5Cs strategy – Credit growth, CASA mobilisation, Cost optimization, Credit quality improvement and Customer centricity. We believe that we have achieved substantial success on all the parameters of this strategy and are well placed to leverage on the growth opportunities in the economy.

The Board of Directors in it’s meeting held on 23.05.2010 have approved Scheme of Amalgamation of the Bank with ICICI Bank Limited. The share exchange ratio has been approved at 25 shares of ICICI Bank Limited for 118 shares of The Bank of Rajasthan Limited which works out to a swap ratio of 1:4.72. Extraordinary General Meeting of Shareholders has been convened on 21st June, 2010 to approve the amalgamation scheme in terms of Section 44A of Banking Regulation Act, 1949. After approval by shareholders, application for necessary approval would be submitted to RBI.

Further, the RBI appointed anew CEO and nominated 5 directors for the Bank. Following this, SEBI banned 100entities holding BoR Shares for the sake of their promoters from stock market activities.The RBI then asked the

BoR to perform an audit of „internal delegation of sanctioning powers followed by the banks‟

and the provisioning procedure of bad debts. Due to aseries of actions from the regulators, the Tayal family decided to merge the bank withICICI Bank, the second largest bank in India which was looking for a target to increasetheir customer base and geographical reach in northern India.In the probability of RBI favoring the decision, ICICI Bank will get the control of 83 branches of Mewar Aanchalik Gramin Bank (MAGB), a regional rural bank sponsored by the BoR.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Banking"

Banking can be defined as the business of a bank or someone employed in the banking industry. Used in a non-business sense, banking generally means carrying out activities related to the management of one’s bank accounts or finances.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: