Factors That Determine Commercial Bank Profitability

Info: 11734 words (47 pages) Dissertation

Published: 5th Jan 2022

Introduction

Goldsmiths and banking

The history of creation of money followed by bank notes and origination of banking suggests of the overall structural and technological changes that the banks have gone through over the centuries and therefore it is important to understand the initiation of banking. We have evidence that money was created before the Goldsmith-bankers started their lending activities. This was being done through illegitimate and illegal ways. Coin clipping and debasement were among these means of creation of money (Faure, 2013). However, the origination of actual bank notes took place followed by the barter system when Goldsmith revolutionised trade in the 16th century.

Before the invention of the receipts by Goldsmith, people used to engage in Barter trades where they used to exchange their possessions. This system was not a bad system, but it obviously wasn’t a good one either since it had its own impracticalities and limitations. Goldsmiths introduced the revolutionary idea that people can deposit gold coins with them and get a receipt in exchange to confirm their deposits. These receipts were easier to handle as compared to the bulky gold coins and were quickly accepted as a means of payment, resulting in the genesis of bank notes. The intrinsic value of these notes was dependant on the holdings of precious metals.

Many people think that the bank notes originated in the 16th century, but evidence suggests otherwise. Bank notes appeared in China for the first time in 118BC but shortly disappeared due to unknown reasons. These bank notes appeared 900 years later in China again in the form on paper, the former was known to be made from leather. The intrinsic value of these notes was based on copper and the reason these coins came in circulation is known to be because of shortage of copper. Goldsmiths in the year 1633 allowed people to deposit silver and gold coins and gave them a receipt in exchange which reflected the depositor’s wealth. This is what is recognise as the origination of bank notes as we have now (Faure, 2013).

Silver coins were initially used as the sole means of payment whereas gold coins were used as means of big payments, and later, as means of reserves. Banking emerged in the 17th when Goldsmiths started allowing people to exchange of foreign coins for domestic coins which is the origination of foreign exchange. Later, Goldsmiths started lending these precious metals and charged the borrowers an interest rate to generate profit, allowing them to pay a deposit rate to depositors so that they can attract more depositors. This is what we now know as saving’s rate in commercial banking. More deposits allowed them to lend more and therefore create more profit from this process of serving as an intermediary between lenders and borrowers.

The essence of modern day commercial banking suggests that the business model of Goldsmith still serves as the main purpose of commercial banks these days; however, evidence suggests that there has been substantial revolution in UK banking over the centuries (Davies et al., 2010).

Relationship between banks and economic growth

Previous researchers have emphasised on the relationship between stock markets, banks, and economic growth and there has been substantial amount of research on this topic. We know that banks and financial institutions help in efficient allocation of resources through the process of serving as a financial intermediary. Walter Bagehot in his book in 1873 highlighted the same point through his research and suggested that banking plays a vital role in the growth of the economy (Bagehot, 1873). This implies that banks boost economic growth by identifying and financing productive business opportunities and investments. Researchers also highlighted the fact that the level of financial intermediation can be helpful in forecasting the long run economic growth, which means that the higher the loans made by the bank, the more productive the economy will be in long run (Levine and Zervos, 1998).

The importance of UK banking sector

London is amongst the most major financial hubs in the world and the UK banking sector remains one of its strongest pillar in this aspect. UK banks enjoy rates of returns quite higher as compared to the international benchmarks (Quignon, 2000). Studies also suggest that banks in the UK also contribute in generating 3.7% of the total GDP of UK (British Bankers Association, 2004). UK banks also strengthen the UK labour market, especially in the financial services sector accounting for 40% of the total jobs in the financial services sector and 1.6% of the total jobs in the UK (Maslakovic and McKenzie, 2002). Taking these facts into consideration, studies that determine the factors that influence profitability of banks are of high relevance to senior bank managers, economists, and other participants in the financial market.

Objectives of this study

This paper focusses on:

- Discussing the empirical evidence that suggests the factors that may impact bank profitability

- Choosing bank-specific and macroeconomic variables and gathering data for regression analysis

- Examining the effect of chosen macroeconomic and bank-specific determinants on profitability of the chosen UK commercial banks across the period 2001-2015 with the help of regression analysis.

The result of the paper is structured as followed:

- Section 2 provides a brief review of the existent theories in banking as well as empirical evidence that suggests what factors are important in determining commercial bank profits and their suggested relationship and effect on bank profitability

- Section 3 discusses the theoretical framework of the study

- Section focusses on data characteristics along with data statistics

- Section 5 discusses the chosen econometric methodology and presents the results

- Section 6 which concludes this study

Literature review

The following review of the literature has been divided into two sections. The first section highlights the theories that have prevailed in banking in the following century. The second section focusses on empirical studies that have been conducted with regards to what factors determine the profits of banks and highlights the findings of the researchers.

Brief review of theories used in banking

This section briefly discusses the three different theories that have been held in banking in the last century.

Financial Intermediation theory of banking

Financial intermediation theory of banking says that banks are financial intermediaries and relates them to other financial institutions. This theory suggests that banks are merely intermediaries, that they collect money from depositors (surplus units) and lend this money to borrowers (deficit units). They charge a rate of interest to borrowers and provide a deposit rate to depositors (Werner, 2016). They may generate profits for themselves while serving as an intermediary between surplus and deficit units. Paul Krugman in his column called “The Rage of Bankers” wrote:

“For banks make their profits by taking in deposits and lending the funds out at a higher rate of interest. And this business gets squeezed in a low-interest environment” (Krugman, 2015).

According to economic theory when resources are allocated efficiently, the investment in the economy increases. It’s safe to say that banks contribute to efficient allocation of resources. This implies that banks play a role in the increase in investment in an economy. According to the demand for goods in economics:

Z=C+I+G+X-IM Eq(1)

Y=C0+C1(Y-T) +I+G Eq(2)

Where Z is the demand for goods, C is the consumption, I is investment, G is government spending and (X-IM) is the exports minus imports. The Y on the left-hand side of equation 2 represents production. The right-hand side of equation 2 represents the demand (Blanchard, Amighini and Giavazzi, 2010). We can see that the demand is positively related to investment “I” and so is production. Therefore, we can say that banks, through this process of intermediation, contribute to efficient allocation of resources which increases the investment in the economy and therefore the production which is the GDP.

Fractional reserve theory of banking

Fractional reserve theory prevails in most of the commercial banks of the world. This theory also sets standards for regulation, reserves, and capital requirements for the banks. This theory refers to all banks as financial intermediaries and argues that banks separately cannot create money (Werner, 2016). In fact, the banking system creates money altogether through the process of multiple loans and deposits. Samuelson in his support for this theory wrote:

“The banking system as a whole can do what each small bank cannot do!” (Samuelson, 1948).

Credit creation theory of banking

The credit creation theory of banking refers to banks as financial intermediaries. This theory suggests that banks do not rely on deposits and reserves for making loans, moreover, banks do not loan money, they loan a credit in the form of currency or cheques and for this service charge an interest rate for creating the loan for the customers (Werner, 2016). In literature, this phenomenon has been referred to as the most astonishing sleight of hand. Credit creation theory is the most prevalent theory in modern banking.

Empirical review

This section includes literature from the past studies that have been conducted on this topic. These studies will help to explain the variables that have been chosen for this study and will highlight the findings of the past researchers on this topic

Earlier researches on banking were solely focussed on examining the effect of financial market structure on bank profitability, but lately research and empirical evidences suggest that there is too much variation in bank profits to be explained by that alone. Therefore, a lot of emphasis is based on examining the effect of both external and internal factors when profitability of banks is being studied.

Macroeconomic, Industry and Bank specific determinants

There have been several studies that have tried to explain the profitability of the banks using different types of variables. Panayiotis P. Athanasoglou, Sophocles N. Brissimis, Matthaios D. Delis conducted a study in 2008 to find out the variables that influence profitability of the Greek banks. The study consists of three types of independent variables that examine the effects on the profits of the banks: Bank Specific, Industry Specific, and Macroeconomic determinants and covers the period from 1985 to 2001. A single linear equation was used in this study to take all three sets of variables into account at once and an unbalanced panel was used for regression analysis. The unbalanced panel fitted the data well and covered all the phases of the business cycles of the banks.

Results suggest that capital plays a vital role in explaining the profits of the Greek banks. These results are in line with the empirical evidence from the study by Tanna and co researchers who researched on UK commercial banks (Tanna, 2008). Labour growth was found to significantly impact the profits, operating expenses have a strong negative relation with the profits, macroeconomic variables have a strong impact on the bank profits, industry specific determinant which is ownership (whether private or public) did not have significant effect on the bank profitability in this case. Lastly, business cycle was found to have a positive correlation with bank profitability on the upper phases the business cycle. Credit risk was found to have a negative relationship with banking profits. Conclusively, bank specific and macroeconomic determinants had the most to do in explaining the profitability of the Greek banks. (Athanasoglou, Brissimis and Delis, 2008)

Evidence from the UK commercial banks

Even though after all the structural and technical changes in banking following all these years, research has only been carried out partially in this department, especially in the UK (Drake,2001). Banking regulations have also changed quite a lot in the following years, so Tanna, Kosmidou and co-researchers carried out a study in 2008 to find what factors determine the profitability of UK commercial banks. Their study uses an unbalanced panel that covers the period from 1995 to 2002. The panel consists of 32 banks amounting to a total of 224 observations.

Their model has a high R-squared value which suggests that the model used has a high explanatory power and that the data and variables chosen to examine the effect on bank profitability fit the model well. Their decision for covering this period was to examine the factors affecting bank profitability in more recent periods as very less empirical studies had been done previously on the UK banks using recent time periods.

Paper uses bank specific and macroeconomic variables as well as the financial structure of UK market to examine the effect of these variables on the profitability of UK commercial banks. They found that capital strength has a positive effect on bank profits which means that banks with plenty of capital enjoy more profits than banks with less capital.

Well capitalised bank need less external financing which makes it easier for them to firstly acquire external finance and secondly maintain an optimal capital structure. For instance, a bank with less debt will be able to acquire further debt easily as compared to a bank with high debt structure. This makes external financing cheaper for banks with a good capital strength.

The results from this empirical study were confirmed by an empirical study done by Berger in 1995 (Berger, 1995). The paper also signifies the importance of macroeconomic environment on the performance of the banks, suggesting that banks perform better in good macroeconomic conditions which relates macroeconomic variables to bank profitability positively. Evidence supports the claims that smaller banks are less profitable than banks with more total assets and that liquidity has no clear impact on the performance of UK banks (Tanna, 2008).

Evidence from European countries

A study by Molyneux and Thornton in (1992) determines the performances of banks across 18 European countries to find out what factors determine bank profitability. They were among the first people who carried out a multi-country analysis. They used several independent variables like concentration ratio, long term bond rate of the specific country, capital, and reserves as a percentage of total assets, CPI, staff expenses and the ownership structure of the bank given by a dummy variable.

The study covered the time periods between 1986 and 1989 and took after the study by Bourke which was carried in 1989. The methodology used by Bourke was based on the pooled time series approach and involved a linear equation to regress and estimate the effects of chosen internal and external independent variables on the bank profitability. The study by Molyneux and Thornton also used a linear equation and a pooled sample of European banks. Based on their sample and findings, they suggest that European banks exhibit expense preference behaviour. They also found a significant positive relation between bank profits and the ownership structure of the bank which suggests that state owned banks may enjoy higher returns on the deployed capital than private banks.

This is surprising because it is contrary to the empirical evidence provided by Athanasoglou and co-researchers who suggest that profitability of the Greek banks is independent of its ownership structure (Athanasoglou, Brissimis and Delis, 2008). It is interesting to note that the sample they have used throughout the chosen years in Greek banks is relatively small compared to other countries. Molyneux and Thornton have used a sample of 9 banks each in 1986 and 1987 followed by 10 banks in 1988 and only 3 banks in 1989. This implies that results found for Greek banks could be biased. On the other hand, nominal interest rates, staff expenses and capital ratios were also found to be significantly positively related to bank profits which confirms the results put forward by Bourke. Macroeconomic variables like CPI and long-term bond rates of the chosen countries were also found to be statistically significant at 5% level, suggesting that the bank profits can be influenced by these variables (Molyneux and Thornton, 1992).

Credit risk and bank profit

Both financial and non-financial institutions are exposed to different types of risks. Banks are the most exposed to 8 different types of risks themselves which are market risk, credit risk, operational risk, moral hazard, systematic risk, reputational risk, business risk, liquidity risk and operational risks. Liquidity risk and credit risk are among the most important risk types to be considered in banking. Recently banks have had a high number of non-performing loans in their credit portfolios. Credit risk can arise due to the inability or unwillingness of borrower to meet the payment obligations. Credit risk has not only been seen in bank loans, but also other various financial instruments offered by banks. Banks try to decrease credit risk by engaging in several hedging activities. Foreign currency derivatives are known to be one of the instruments that banks use in their hedging activities. Foreign currency derivatives are also suggested to be positively and significantly related to profitability and valuation of the firm in a study conducted by Allayannis and Weston (Allayannis and Weston, 1998). Similarly, there is also evidence that credit risk is linked to bank profitability.

Recently financial institutions have emphasised on the implication of credit risk management systems and therefore diversified their pool of credit portfolios for managing credit risk. This is being done through changes in the regulations as well as through technological changes. Using recent technological innovations, banks have implied complex credit risk systems to manage credit risk. Cebenoyan and Strahan carried out a study to observe whether banks can make themselves more profitable by actively engaging in buying and selling of loans in the loans sales market. They collected quarterly data on US banks ranging from the year 1987 to 1993 and then used this quarterly data to calculate yearly cash flows to be used for cross section regressions to test how management of bank credit risk affects profits and risk of the banks. They found that credit risk has a negative relationship with the performance of the banks meaning banks with lower credit risk are more profitable (Cebenoyan and Strahan, 2001).

These results are in line with the findings by Athanasoglou, Brissimis and Delis in their study which was conducted on Greek banks (Athanasoglou, Brissimis and Delis, 2008). However, it is interesting to note that banks that engage in risk management activities are not safer than banks that do not engage in risk management activities but rather these banks appear riskier. Cebenoyan and Strahan highlight that banks involved in active credit risk management tend to hold more risky loans in their credit portfolios than banks that don’t. This suggests that banks that buy and sell loans are attracted to more profitable but riskier loans. However, these banks when compared to their competitors with similar financial ratios appear less risky than their competitors. Therefore, through engagement in credit risk activities, banks can improve the quality of their assets, decrease the number of non-performing loans, leading to profitability and keep themselves safe from financial distress and uncertainty.

Capital and bank profit

According to empirical evidence, banks with more capital are argued to be more profitable. Several studies highlight the findings that the size of the banks determines its profitability matrix. This means that bigger banks should appear more profitable on balance sheets than smaller banks. A researcher named Smirlock conducted a study in 1985 on Greek commercial banks that determined the impact of bank size on it’s profitability. He found that bank size is positively related to the profits of that specific bank (Smirlock, 1985). It has been argued that bank size can be represented by its total assets or total capital.

There has been a study conducted on banking profits by Short in 1979 in which relates commercial banks market power to its profitability suggesting that banks with higher market power can enjoy higher returns than banks with relatively lower market power. Short also highlights that capital proxies for the size of the bank (Short, 1979). There has been a lot of emphasis on the role that capital plays in making banks profitable. Evidence from the study of Greek commercial banks is supported by the empirical evidences from other conclusive studies.

Results produced by the study of Molyneux and Thornton also confirm that banks capital ratios are positively related to bank profitability (Molyneux and Thornton, 1992). Same results have been found by a study on UK commercial banks which puts all its emphasis on the performance of UK commercial banks and the factors that influence this performance. The study highlights that the capital strength of the banks is positively related to its performance and is significant in explaining profitability of UK commercial banks because of the reason that banks with higher capital do not need as much external financing as compared to banks with less capital. This also reduces the cost of raising additional capital as well as bankruptcy.

Banks with lower cost of capital attract investors that are willing to finance a bank because their chances of bankruptcy. Ultimately these banks also appear profitable because of the risk adjusted returns they must pay to their investors/stakeholders which means that banks with sufficient internal capital do not need to pay their investors/stakeholders as much as banks with less internal capital. This is because investors who invest in banks with higher cost of capital know that these banks have higher chances of bankruptcy and therefore should be compensated for their risky stakes in the bank.

Loans, reserves, and bank profit

All the theories in banking have one thing in common, they all revolve around loans in some way or the other. We know that the essence of commercial banking is based upon loans, deposits, and reserves. Evidence suggests that banks can create money i.e they can make profits out of loan lending activities. They consider loans as investments. Banks take in deposits and issue loans based on interest rates, depending on the credit rating of the borrower. This implies that banks charge a higher rate of interest to the borrowers that they think are going to default. Since banks are financial intermediaries between deficit unit and surplus units, they are closely related to the economy.

Empirical evidence suggests that banks can help in identifying productive investment opportunities, therefore, banks prefer to make loans to finance productive business and investments which leads to greater economic activity in an economy. However, banks must keep reserves to finance operating activities. These reserves are kept with the central bank of the country. Certain activities in the bank can also be affected by the reserve requirements. In fact, reserve requirements affect loans according to the fractional reserve theory of banking (Werner, 2016). One of the duties of central banks is to regulate credit creation in order for commercial banks to meet its reserve requirements.

Macroeconomic indicators and bank profitability

Just like bank specific variables, there has been a lot of emphasis on macroeconomic indicators and its impact on profits of the commercial banks. Empirical evidence suggests that bank specific variables are not enough on their own to explain the variation in the performance of the banks. Studies have also emphasised on the importance of macroeconomic conditions in explaining the profitability of the banks. Typically, literature argues that banks thrive to be profitable under adverse economic conditions.

According to demand for goods in economic theory, interest rate hikes can result in slowdown in the economy. This can happen because the demand for goods slows down as the cost of borrowing increases. Therefore, firms borrow less and subsequently invest less. Ultimately, less loans are made by the banks as the demand for loans decreases. Due to reduced loan demand, the price level decreases. Decreased prices result in an increase in the demand for good which leads to an increase in price level in the medium run to long run. Therefore, inflation and interest rates have a close economic relation.

Along with credit risk and other risks, banks are exposed to the risk of volatility in domestic currency. Therefore, banks have holdings in foreign assets which also exposes them to the risk of volatility in exchange rate movements. Exchange rates can be both a blessing and a curse for the bank, depending on its holdings in foreign assets as well as movements in exchange rate. Favourable exchange rate movements can help banks make higher return on assets and vice versa.

Theoretical framework

This study comprises of two sets of variables which are bank specific variables and macroeconomic variables. Econometric techniques have been used to regress our independent variables on our dependent variable. Therefore, models have been developed to test the following hypothesis:

Hο: Our independent variables are significant in explaining our dependent variable

Ha: Our independent variables are not significant in explaining our dependent variable

Our first regression model would test the relationship between bank specific variables and bank profits. Panel Estimation would be used in Eviews to regress the bank variables for selected banks. Banks have been known to use derivatives like credit derivatives and other risk methods to hedge their risks along with implication of complex credit risk models. Therefore, our panel estimation includes credit risk to account for bad loans and test whether bad loans have direct relation with banks profitability. Similarly, bank’s size has been suggested to have influence on how profitable the bank can be, so, capital has been included in the panel model to account for the relationship between size of the bank and its impact on the banks performance. We also know as per evidence and various theories that banks allow customers to make deposit and then loan this money out at an interest rate to make more money. Therefore, it would be interesting to observe whether loans are significant in explaining bank profitability, hence its inclusion in the panel. Due to reserve requirements, banks must hold a fraction of its total deposits in reserves and therefore can not loan these reserves out. Reserves have been included in the panel to observe whether they slow down bank profits significantly by not allowing them to make loans on these deposits held as reserves.

Previously, studies have also stated that bank specific variables are not enough in explaining the performance of banks, therefore, our second model will regress the macroeconomic variables on bank profits to test whether macroeconomic indicators are useful in explaining the variation in bank profits as well as to test whether banks thrive under economic pressure. Therefore, we would have another regression model to account for the impact of chosen macroeconomic determinants on bank profit.

Least Squares model has been used to test the relationship between macroeconomic variables and bank profits. Additionally, we would incorporate a dummy variable that proxies for the impact of financial crisis. This gives us the following two equations:

Πit=βο+B1CRit+β2LNSit+β3RSVSit+β4CPTit+β5DummyFINCRISISt+αi+uit eq (1)

Where in eq (1) :

vit=ai+uit and is the stochastic error component

Πit=bο+b1ERt+b2INFt+b3GDPt+b4IRt+b5DummyFINCRISISt+uit eq (2)

Eq (1) and eq (2) depict our models where in eq (1) Π denotes bank profits, CR refers to credit risk, CPT denotes capital deployed by the bank, LNS and RSVS denote loans and reserves and FINCRISIS is financial crisis whereas INF in eq (2) denotes inflation rate, ER denotes exchange rate, GDP is the Gross Domestic Product and IR is inflation rate.

Data

This study aims in explaining the factors that determine the profitability of UK commercial banks, therefore, the first step required to perform regression analysis was the collection of data. Data has been collected through a lot of hard work and dedication as data for UK commercial banks wasn’t available for throughout 15 years for most of the banks. This is mainly due to financial crisis which has resulted in split of banking departments as subsidiaries of the holding companies. This is rather a management decision by the senior managers for better risk management, monitoring and reporting of financial data for individual departmental activities. Therefore, only commercial banks that had complete 15 years of data available are included in our panel.

Data has been collected for the years 2001- 2015 with the help of Osiris Bank Focus as well as by going through individual annual reports for selected commercial banks. One of the aims of the paper is to study the factors that determine bank profitability in the recent years as literature suggests the lack of studies on UK commercial banks using recent time periods. Time periods chosen for the study cover the recent period as well as period before financial crisis. Eviews software has been used for performing regression analysis with the collected data. Sample size for regression analysis has been chosen on the following basis:

- Availability of data: Data has been acquired for 15 years for each bank, therefore, banks that do not meet this criterion have not been included in the study

- As the study aims to determine the factors that affect bank profitability in UK, therefore, data has been collected on UK commercial banks

Our paper uses 8 dependent variables and 1 dependent variable. The variables have been divided into two categories, bank-specific and macroeconomic determinants. Bank-specific determinants chosen for the study are capital, credit risk, loans, and reserves. Data for these variables was gathered by going through individual reports for each bank for each year. To account for capital, data was collected on share capital/common stock from balance sheet. Share capital is the capital acquired by the banks through the issuance of shares. Previous studies have highlighted the significant relation between capital and bank profitability by mainly collecting data on total capital as well as total assets. It would be interesting to observe whether capital acquired by issuing shares plays an important role in explaining bank profitability.

To measure credit risk, data was collected on loan loss provision as well as loans from the income statement for each bank and a ratio was used to calculate the credit risk. Data on loans and reserves has been acquired from the income statement. Net profit before interest and tax has been used as bank profit and has been collected from the income statement. Macroeconomic determinants chosen for the study are GDP, inflation rate, interest rate and exchange rate. Macroeconomic data has been collected from Office for National Statistics.

TABLE 1

| Variable Measure | Notation Expected Effect |

| Dependent variable:

Bank profit Net profit before interest and tax π Dummy variable: Financial Crisis 0 for pre-crisis, 1 for post-crisis years Fincrisis – Determinants: Capital Share capital or common stock CPT + Credit risk Loan loss provision/loans CR – Loans Total loans LNS + Reserves Total reserves RSVS ? Exchange rate Exchange rate w.r.t US dollar ER ? GDP Total output produced by economy GDP ? Inflation rate Current period inflation rate INF – |

|

Bank-specific variables

Descriptive stats and graphs for bank-specific variables:

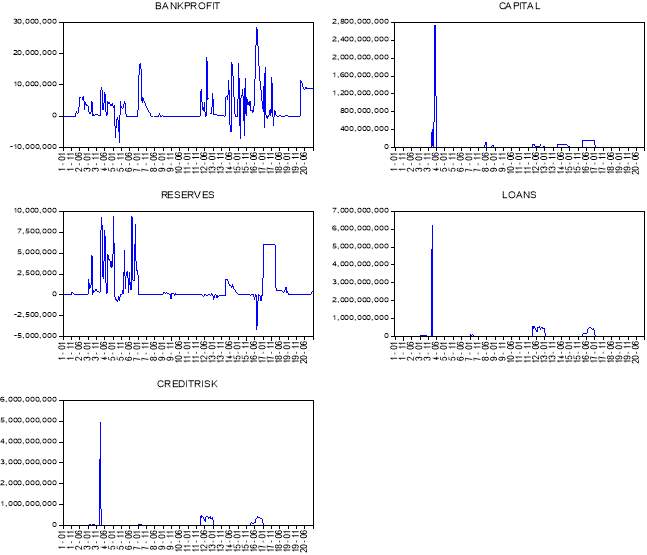

Table 1 and graph 1 exhibit the descriptive statistics for the five dependent and independent bank variables. Mean, median and standard deviation have highlighted great dispersion in the values of the bank related variables across the time series of 20 years.

Table 2: Descriptive Statistics – Bank Variables

| Bank Profit | Capital | Reserves | Loans | Credit Risk | |

| Mean | 2642720. | 34277071 | 810772.5 | 64974355 | 51979484 |

| Median | 224000.6 | 101819.0 | 20669.00 | 340443.4 | 272354.5 |

| Maximum | 28341480 | 2.74E+09 | 9474000. | 6.21E+09 | 4.96E+09 |

| Minimum | -8296000 | 11.70000 | -4228000 | 71.80000 | 57.40000 |

| Std. Dev. | 4883528. | 2.27E+08 | 1959517. | 3.78E+08 | 3.02E+08 |

| Skewness | 2.003537 | 11.39956 | 2.485598 | 14.45198 | 14.45198 |

| Kurtosis | 8.536254 | 135.6957 | 9.007625 | 233.5838 | 233.5838 |

| Jarque-Bera | 577.9961 | 225088.7 | 760.0545 | 675054.4 | 675054.4 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Sum | 7.85E+08 | 1.02E+10 | 2.43E+08 | 1.95E+10 | 1.56E+10 |

| Sum Sq. Dev. | 7.06E+15 | 1.52E+19 | 1.15E+15 | 4.27E+19 | 2.74E+19 |

| Observations | 300 | 300 | 300 | 300 | 300 |

Graph 1: Bank-specific variables

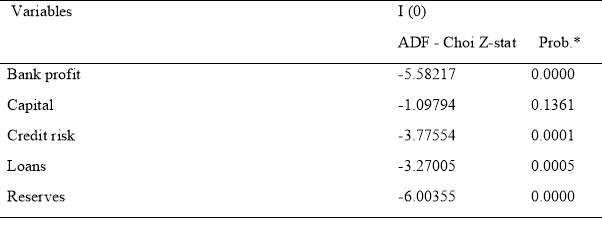

Unit root test for bank-specific variables

Unit-root analysis test was carried out for each individual bank variable. The calculation of the Augmented Dickey-Fuller (ADF) Test as used to measure the presence of stationary time series in the data sample selected. In case a time series possesses a unit root, the variable is non-stationary.

Probability statistics below 95% confidence interval i.e. 0.05 allow the rejection of the null hypothesis i.e. data is non-stationary. The tables (refer to appendix- unit root for bank related variables) present the unit root analysis for the bank related variables. It can be depicted that probabilities values for all the variables i.e. bank profit (p = 0.0000), reserves (p = 0.0000), loan (p =0.0005), credit risk (p = 0.0001) except capital are lower than 0.05. These results reject the null hypotheses about their unit roots and identify the data as stationary.

TABLE 3

Correlation matrix for bank-specific variables

Table 3 shows the significant or insignificant relationship between the research variables. It can be determined that all bank related variables i.e. capital (r=0.06), reserves (r=0.00), and loans (r=0.11) have positive but insignificant relationship with the bank profit while credit risk (r=-0.01) has negatively insignificant relationship with the bank profit. These results are confirmatory with the previous studies’ findings.

TABLE 4

| BANKPROFIT | CAPITAL | RESERVES | LOANS | CREDITRISK | |

| BANKPROFIT | 1.00 | 0.06 | 0.00 | 0.11 | -0.01 |

| CAPITAL | 0.06 | 1.00 | 0.02 | 0.12 | 0.10 |

| RESERVES | 0.00 | 0.02 | 1.00 | -0.07 | -0.02 |

| LOANS | 0.11 | 0.12 | -0.07 | 1.00 | 0.95 |

| CREDITRISK | -0.01 | 0.10 | -0.02 | 0.95 | 1.00 |

Macroeconomic variables

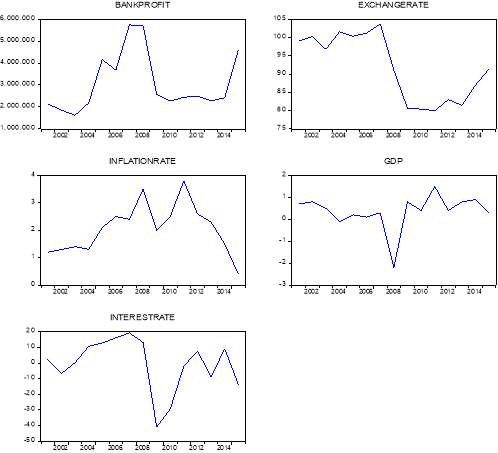

Descriptive stats and graphs for macroeconomic variables:

Table 4 and graph 2 exhibit the descriptive statistics for the five dependent and independent bank variables. Mean, median and standard deviation have highlighted great dispersion in the values of the bank related variables across the time series of 20 years.

TABLE 5

Graph 2: Macroeconomic variables (ON THE NEXT PAGE)

Before moving towards the regression analysis of this time series data, data was tested for its multicollinearity problem and unit root analysis.

Unit root test for macroeconomic variables

Probability statistics below 95% confidence interval i.e. 0.05 allow the rejection of the null hypothesis i.e. data is non-stationary. The tables (refer to appendix- unit root for macro-economic variables) highlight the unit root analysis for the bank related variables. It can be depicted that probabilities values for all the variables i.e. bank profit (p = 0.3562), inflation rate (p = 0.4696), interest rate (p= 0.1668), exchange rate (p = 0.4792) except GDP (p = 0.0197) are higher than 0.05. These results accept the null hypotheses about their unit roots and identify the data as non-stationary. However, this problem was solved by lagging these variables i.e:

Δxt=xt-xt-1and

Πt=Πt-Πt-1

TABLE 6

| Variables | I (0) | I (1) | ||||

| t-Statistic | Prob.* | Prob.* | Inference | |||

| Bank profit | -1.820603 | 0.3562 | 0.0937** | I (1) | ||

| Exchange rate | -1.547522 | 0.4792 | 0.0282* | I (1) | ||

| Inflation rate | -1.572339 | 0.4696 | 0.0028* | I (1) | ||

| GDP | -3.627529 | 0.0197* | I (0) | |||

| Interest rate | -2.367990 | 0.1668 | 0.0355* | I (1) | ||

Correlation matrix for macroeconomic variables

Additionally, Table 6 shows the significant or insignificant relationship between the research variables. All bank related variables i.e. exchange rate (r=0.29), inflation rate (r=0.25), and interest rate (r=0.39) have positive but significant relationship with the bank profit while GDP (r=-0.6) has negative and significant relationship with the bank profit. These results are confirmatory with the previous studies’ findings.

TABLE 7

| Bank profit | Exchange rate | Inflation rate | GDP | Interest rate | |

| Bank profit | 1.00 | 0.29 | 0.25 | -0.63 | 0.39 |

| Exchange rate | 0.29 | 1.00 | -0.39 | -0.26 | 0.62 |

| Inflation rate | 0.25 | -0.39 | 1.00 | -0.23 | 0.16 |

| GDP | -0.63 | -0.26 | -0.23 | 1.00 | -0.35 |

| Interest rate | 0.39 | 0.62 | 0.16 | -0.35 | 1.00 |

Econometric methodology

This section discusses the econometric methodology has been used to conduct regression analysis. One of the most important concerns when conducting a panel data regression is to determine the appropriate model to use. Hausman test was carried out to determine the best model to adapt for panel estimation. Least Squares model has been used to perform regression analysis for macroeconomic variables.

Hausman test for bank-specific determinants

Panel data analysis needs to consider the efficient model of analysis between the random and fixed effects. At the first stage, Hausman Test was carried out to differentiate between these two effects model. Hausman test tests the following hypothesis:

Ηο :Covxit,αit=0, t=1,…….,T

eq (3)

Table 7 below shows probability value = 0.8839, which means that result is insignificant and thus allowing the data to accept the null hypothesis i.e. random effects regression is appropriate in this case.

TABLE 7

| Correlated Random Effects – Hausman Test | ||||

| Equation: Untitled | ||||

| Test period random effects | ||||

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. | |

| Period random | 1.164491 | 4 | 0.8839 | |

| ** WARNING: estimated period random effects variance is zero. | ||||

| Period random effects test comparisons: | ||||

| Variable | Fixed | Random | Var(Diff.) | Prob. |

| CAPITAL | 0.000755 | 0.000624 | 0.000000 | 0.5769 |

| RESERVES | 0.142272 | 0.158537 | 0.000372 | 0.3989 |

| LOANS | 0.016230 | 0.016291 | 0.000000 | 0.7517 |

| CREDITRISK | -0.020420 | -0.020603 | 0.000000 | 0.5857 |

Panel regression for bank-specific determinants

After confirming the stationarity of the research variable and appropriateness of random effects regression, Panel EGLS (Period random effects) was calculated for the 20 commercial banks for their bank related variables. We developed the following model for our panel estimation:

Πit=βο+B1CPTit+β2RSVSit+β3LNSit+β4CRit+β5DummyFINCRISISt+αi+uit

Findings showed that among the five independent variables including dummy variable, only loans and credit risk have significant p values i.e. 0.0000 and 0.0000, which is lower than significant level of 5%. Therefore, loans and credit risks are significant in explaining the bank profits variable of the commercial banks over the period of 15 years (2001-2015). Furthermore, t-statistics with low p values have further confirmed the data as closer to its mean. From the results it can also be seen that all bank-specific determinants have a positive relationship with bank profitability whereas credit risk and financial crisis are negatively related to it. In contrary to the individualized statistics, weighted Prob (F-statistic) = 0.000000 have rejected the null hypothesis and accepted alternative hypothesis i.e. all the determinants (bank-related variables) have effects on bank profits. Furthermore, the value of Durbin-Watson stat = 0.845824 confirms the presence of autocorrelation but insignificant in the data since the value is near 0 (normal range (0-4) exhibits values near 0 as positive while values near 4 as negative).

| Dependent Variable: BANKPROFIT | ||||

| Method: Panel EGLS (Period random effects) | ||||

| Date: 01/20/18 Time: 10:19 | ||||

| Sample: 2001 2015 | ||||

| Periods included: 15 | ||||

| Cross-sections included: 20 | ||||

| Total panel (unbalanced) observations: 296 | ||||

| Swamy and Arora estimator of component variances | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 1945913. | 423299.4 | 4.597013 | 0.0000 |

| CAPITAL | 0.000624 | 0.001190 | 0.524138 | 0.6006 |

| RESERVES | 0.158537 | 0.137630 | 1.151906 | 0.2503 |

| LOANS | 0.016291 | 0.002368 | 6.879540 | 0.0000 |

| CREDITRISK | -0.020603 | 0.003101 | -6.643529 | 0.0000 |

| *FINCRISISDUMMYVARIABLE | -22450.33 | 538270.8 | -0.041708 | 0.9668 |

| Effects Specification | ||||

| S.D. | Rho | |||

| Period random | 0.000000 | 0.0000 | ||

| Idiosyncratic random | 4586255. | 1.0000 | ||

| Weighted Statistics | ||||

| R-squared | 0.144797 | Mean dependent var | 2649200. | |

| Adjusted R-squared | 0.130052 | S.D. dependent var | 4890519. | |

| S.E. of regression | 4561435. | Sum squared resid | 6.03E+15 | |

| F-statistic | 9.820162 | Durbin-Watson stat | 0.845824 | |

| Prob(F-statistic) | 0.000000 | |||

| Unweighted Statistics | ||||

| R-squared | 0.144797 | Mean dependent var | 2649200. | |

| Sum squared resid | 6.03E+15 | Durbin-Watson stat | 0.845824 | |

After the statistical analysis of the bank related variables, statistical analysis has been conducted to show how the macroeconomic indicators have affected the bank profits of the 20 UK commercial banks over the period of 15 years.

Variance Inflation Factor test for macroeconomic variables

A variance inflation factor (VIF) was calculated for the detection of the multicollinearity in regression analysis. There should not be any collinearity between the independent variables to compute the regression effectively. The presence of collinearity is the indication of adverse effects on regression. Table shows that most of the macro economic variables have low collinearity with each other, which is subsequently confirming their independence.

TABLE 9

| Variance Inflation Factors | |||

| Date: 01/20/18 Time: 12:05 | |||

| Sample: 2001 2015 | |||

| Included observations: 15 | |||

| Coefficient | Uncentered | Centered | |

| Variable | Variance | VIF | VIF |

| C | 1.14E+14 | 3325.334 | NA |

| INFLATIONRATE | 1.20E+11 | 17.37141 | 2.644677 |

| GDP | 1.38E+11 | 2.972150 | 2.452558 |

| EXCHANGERATE | 1.04E+10 | 2583.922 | 23.34086 |

| INTERESTRATE | 3.77E+08 | 2.970815 | 2.965646 |

| FINCRISISDUMMYVAR | 1.92E+12 | 29.78708 | 13.90064 |

Heteroskedasticity test for macroeconomic variables

Likewise, results of heteroskedasticity were measured before regression because Heteroskedasticity has serious concerns for the OLS estimator. Table 7 has shown that p-values for all the variables (0.1618, 0.2677, 0.1941, 0.1418, 0.3286, and 0.3628) are higher than 0.05 (95% confidence level). These results have rejected the null hypothesis i.e. there is Heteroskedasticity present in the macroeconomic variables.

TABLE 10

| Heteroskedasticity Test: Breusch-Pagan-Godfrey | ||||

| F-statistic | 1.371613 | Prob. F(5,9) | 0.3200 | |

| Obs*R-squared | 6.486982 | Prob. Chi-Square(5) | 0.2617 | |

| Scaled explained SS | 2.005486 | Prob. Chi-Square(5) | 0.8484 | |

| Test Equation: | ||||

| Dependent Variable: RESID^2 | ||||

| Method: Least Squares | ||||

| Date: 01/20/18 Time: 11:55 | ||||

| Sample: 2001 2015 | ||||

| Included observations: 15 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -8.95E+12 | 5.87E+12 | -1.524092 | 0.1618 |

| INFLATIONRATE | 2.25E+11 | 1.90E+11 | 1.181382 | 0.2677 |

| GDP | 2.86E+11 | 2.04E+11 | 1.403376 | 0.1941 |

| EXCHANGERATE | 9.03E+10 | 5.61E+10 | 1.610337 | 0.1418 |

| INTERESTRATE | -1.10E+10 | 1.07E+10 | -1.032956 | 0.3286 |

| FINCRISISDUMMYVAR | 7.29E+11 | 7.61E+11 | 0.958512 | 0.3628 |

| R-squared | 0.432465 | Mean dependent var | 3.09E+11 | |

| Adjusted R-squared | 0.117169 | S.D. dependent var | 4.20E+11 | |

| S.E. of regression | 3.94E+11 | Akaike info criterion | 56.52767 | |

| Sum squared resid | 1.40E+24 | Schwarz criterion | 56.81089 | |

| Log likelihood | -417.9575 | Hannan-Quinn criter. | 56.52465 | |

| F-statistic | 1.371613 | Durbin-Watson stat | 2.730126 | |

| Prob(F-statistic) | 0.320032 | |||

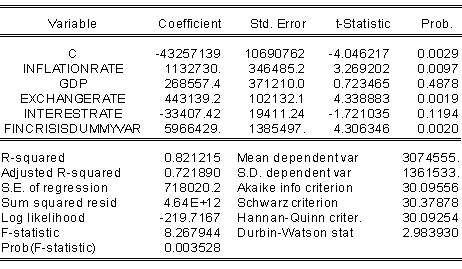

Least Square regression for macroeconomic determinants

The table below has further showed that among the five independent variables including dummy variable. The following linear equation has been used for LS regression analysis:

Πit=bο+b1ERt+b2INFt+b3GDPt+b4IRt+b5DummyFINCRISISt+uit

Exchange rate, inflation rate and financial crisis (dummy variable) have significant p values i.e. 0.0097, 0.0019 and 0.020, which are lower than significant level of 5%. Therefore, inflation rate and exchange rate have been found as significant in explaining the bank profits variable of the commercial banks over the period of 15 years (2001-2015). In contrary to the individualized statistics, weighted Prob (F-statistic) = 0.022315 have rejected the null hypothesis and accepted alternative hypothesis i.e. all the determinants (macro-economic variables) have effects on bank profits. Furthermore, the value of Durbin-Watson stat = 2.794680 confirms that there is no autocorrelation in the data since the value is near 0 (normal range (0-4) exhibits values near 0 as positive while values near 4 as negative).

TABLE 11

Conclusion

The importance of banking sector due to its association with economic growth and financial markets has caused it to be an important topic for research. Previous studies have highlighted the importance of studies that aim to find out the determinants of bank profitability and have suggested that bank-specific determinants alone are not so helpful in explaining in explaining bank profitability. Therefore, researchers suggest inclusion of other factors like macroeconomic determinants as well as business cycle, ownership structure and financial structure.

This paper has used bank-specific determinants and macroeconomic determinants to examine their effect on bank profitability. Results from empirical evidence suggests that the amount of capital that a bank acquires is significant in explaining bank profitability. Typically banks that have enough capital do not need external financing and appear to be more profitable than banks with relatively less capital. Furthermore, loans, reserves, and deposits are the heart of commercial banking.

Commercial banks take in deposits and make loans in the form of credit to make profits. We have evidence of positive significant relationship between loans and bank profits. Additionally, reserves were examined to observe how they might affect bank profitability as they go hand to hand with loans. By making loans, banks get exposed to credit risk which arises due to the inability of the borrowers the meet the payment obligations. Credit risk has been a debateable topic in the modern commercial banking and banks are taking extreme measures to hedge for credit risk and therefore are looking to diversify their credit portfolios.

Studies that determine commercial banks profitability suggest a strong negative but significant relationship between credit risk and bank profitability. In addition to all these factors, performance of the banks also depends on the economic conditions. This study aims in examining the relationship between chosen bank-specific and macroeconomic determinants. Data was collected for 20 commercial banks for the year 2001 until 2015. The results obtained through econometric analysis are interesting.

The results show that credit risk and loans have a significant relationship with bank profitability as the p value is less than 5% critical value. Credit risk has a negative relationship with bank profitability whereas loans are positively related to bank profitability.

These results are in line with the results from the previous empirical studies and existent theories in banking which confirms their relationship bank profitability. Therefore, careful measures should be adapted by banks in assessing the credit rating of its borrowers and loans should be preferred to be made to borrowers with good credit rating.

Results obtained for capital are contrary to the empirical studies which highlight that capital is a significant determinant of bank profitability. It would be worthy to highlight that we have collected data on share capital/equity capital to account for bank capital therefore results could have been different if we used return on equity (ROE) as profitability measure for share capital.

This suggests that net profit before interest and tax may not be the best profitability measure to determine the impact of share capital. Our study uses only one variable to account for bank profitability which is net profit before interest and tax whereas previous empirical studies have used several dependent variables for this purpose. Inclusion of macroeconomic determinants also helps in explaining the variability of bank profitability.

Our results suggest that exchange rate and inflation rate are significant in explaining bank profitability. These results are in line with the empirical studies which suggest the significant relationship of these variables with bank profitability. Empirical study by Perry suggests that each bank is affected differently by inflation changes and their profitability depends on whether the inflation rates were forecasted or not. Effects of forecasted inflation can be evaded by the banks by changes in the interest rates that banks offer on deposits and loans accordingly. Furthermore, exchange rate movements affect the value of the foreign assets held in the portfolio of a bank and hence have an impact on bank profitability.

Favourable exchange rate movements can help banks become more profitability by increasing value of foreign assets. Results for interest rates and GDP’s impact on bank profitability shows the insignificant relationship between the two independent variables and our dependent variable. Further studies on these variables shall include a bigger sample size to carefully study their relationship with bank profits. Overall, bank-specific, and macroeconomic determinants were helpful in explaining bank profitability. Due to low explanatory power of our panel model, inclusion of more bank-specific variables, bigger sample size and differentiation between foreign and domestic banks is advisable for further studies on this topic to produce more reliable results.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Banking"

Banking can be defined as the business of a bank or someone employed in the banking industry. Used in a non-business sense, banking generally means carrying out activities related to the management of one’s bank accounts or finances.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: