Influence of Business Reengineering on Customer Satisfaction in the Banking Industry

Info: 13052 words (52 pages) Dissertation

Published: 9th Dec 2019

Influence of Business Reengineering on Customer Satisfaction in the Banking Industry: A Case Study of Ecobank Ghana

ABSTRACT

Business Process Re-engineering (BPR) is a key component of success in which an organizational thrives on. As the service industry, which includes banks, faces strong competition in the 21st century, BPR has gained much more attention. Banks have come under immerse pressure to give out continuous quality improvement programs and quality service for the customer satisfaction. Even though banks are consistently making efforts to improve their service, there is a need for more innovative approach to draw more customers. It is in light of this that this research was conducted to analyse the influence of business process re-engineering on customer satisfaction in the banking industry, a case study of Ecobank Ghana. The purposes of this study were to identify the type of BPR used by Ecobank Ghana, establish the level of customer satisfaction with the introduction of BPR at Ecobank and find out the attitude of employees to the introduction of BPR. The study considered areas where other scholars have researched on which includes the importance of BPR, types of BPR and customer’s satisfaction. It was based on a survey where questionnaire and interviews was conducted. Findings of this research showed that BPR has an influence on customer’s satisfaction when it comes to software change. The researcher went on to recommend that employees as well as customers should be considered in the process of effecting change that may be engineered by an organization.

KEYWORDS: Business Process Re-engineering, Employees’ Responses, Customer Satisfaction and Banks

CHAPTER ONE

GENERAL INTRODUCTION

1.1 Background of Study

Organizational processes obviously do not look the way it used to be a decade ago. Drucker (1993) observes that the percentage reduction of nine out ten employees produced and moved material things by 70% was because of the workers shifting to the production of intangible products, mostly services and information. Currently the central core of an organization is represented by the people and the processes. As it was pointed out by (Peter & Sohal, 1999) Highly motivated and hardworking employees are not enough for good organization performance; the business process must be formulated with value-adding events. Linden (1994) asserts that organizations from both services-oriented and manufacturing-based are challenged with 1900’s climate of speed, quality, efficiency and increased productivity in the bid to be more competitive and meet industry standards.

The customer base of any company is extremely dependent upon in terms of their market survival. Customer service is critical and the customer has more prominence in determining the market performance of an organization (Guo, 2008). Customer satisfaction is one of the key factors that competitive environment is centered, with the end goal that organization’s viability in customer benefit delivery is viewed as a sign of dynamic association. Consequently, an essential component of customers being successful is that at the end of the day they are satisfied. Per Spathis (2004), service based organization must have as part of their strategic plan, their customer service quality to ensure a successful enterprise. There are several benefits of providing high quality service. It gives the maintenance of an ideal level of customer satisfaction. What’s more, it gives an aggressive edge over other industry players. Several scholars have shown that there is a strong positive correlation between excellent customer service and profit increase per employee (Duncan, 2004). Specifically, Duncan (2004) finds a 72% increase in profit brought by each employee for such organizations. Furthermore, he asserts that it is five times costlier to draw new customers than to retain present customers (Duncan, 2004).

In running a business customer satisfaction is seen to be imperative. It is a serious means of achieving a company’s objectives and goals. A company that has a firm grip on its customer’s satisfaction process has secured a place in the industry. It also provides for ensuring future operations and growth. Peng (2007) claims that one technique to provide a high level of satisfaction to customers and retention is by providing higher levels of service.

There are several terms used to describe business process reengineering (BPR), such as core process redesign, new industrial engineering or working smarter. They all convey a similar idea of understanding which includes the process of integrating business process upgrade and the utilization of IT to bolster the re-engineering work. Sherwood-Smith (1994) describes the aim of BPR as providing processes that enable organizations to achieve its goals by developing new ways of task organization, IT system redesign and organizing people. It is attained by identifying key business processes, examining and evaluating these processes and redesigning for effectiveness and gains. The re-engineering concepts involve four dimensions. Imagination reconsidering is a procedure that is itself completely dependent on innovativeness, motivation and good fortunes and nothing calculative. Drucker (1993) reasons that this irony is apparent only and unreal. He further argues that most of the results of successful innovations are not the eruption of a blinding insight but, on the contrary, the calculated implementation of discreet but methodical management discipline. Some typical processes of this include the ordering of organizational structure, development, production, manufacturing, invoicing, delivery etc.

The transformation of some structural constituents is a cardinal business process necessary for radical change. This change leads to innovative concepts, technology, improvements, etc. It makes it important that organizations make out the necessity for change and study to manage the process (Pamela, 1995).

To keep up guidelines and react emphatically to the weight of rivalry, a firm should consider its productivity and courses towards enhancing its levels of movement. This was termed as Organizational Development and Performance (Hammer & Champy, 1993). Comparing an organization’s performance with others in the same league, the market is a good way to judge its performance. However, comparing with outsiders can highlight best industrial practices and foster dynamism (Roberts, 1994).

Haven said that, the banking industry in Ghana has seen a lot of foreign banks coming in within the past 2 decades. According to (B&FT, 2006), several financial experts had seen it as a good fortune that would drive the banking division to over 70% of the Ghanaian population where banking service were not available. With the influx of several banks in the industry, there was a very keen competition between them making it a point for each of the banks to introduce more innovative approach to entice customers. Ecobank Ghana became the first bank in Ghana to receive a universal banking authorisation from the Central Bank of Ghana when Universal Banking was introduced in 2003.

Ecobank Ghana is managed and regulated by the Bank of Ghana (BOG), which is the Central Bank of Ghana. Ecobank Ghana currently has over 77 branches in Ghana and a head count of 1,463 as at December 2015.

1.2 Statement of the Problem

In the face of competition, it is necessary for an organization to offer new and innovative ways that can lure customers to their side. In so doing, the company as part of its commitment to its customers should make sure that this process has an influence on their customer’s satisfaction or not whether positive or negative. At a point when customers desire is not met with the introduction of a new procedure, the organization will intend losing its customers to other contenders. The introduction of BPR in an organization was assumed to improve the process workflow, to increase the market share of the organization, and to improve efficiency (Sherwood-Smith, 1994). Ecobank Ghana is increasingly focusing on e-Services and e-Banking to provide convenience to its clients. It is devoted to serving its customers with Speed, Accuracy and the highest level of professionalism. This study seeks to find out what the BPR has on customer satisfaction among their customers.

1.3 Research Objectives

The general objective of this study is to set to examine the influence of BPR on ECOBANK in customer satisfaction. This research seeks to:

1. Identify the type of BPR practice ECOBANK uses

2. Ascertain the level of customer and employee satisfaction with the introduction of BPR at ECOBANK Ghana

1.4 Research Questions

The following research questions are set to achieve the objectives of the study:

1. What type of BPR practice did ECOBANK Ghana use?

2. Were customers satisfied with the introduction of BPR?

3. Were employees satisfied with the introduction of BPR?

1.5 Scope of the Study

The focus of the study is to examine the result of BPR on the bank around customer service. The research was limited to customers of the ECOBANK University of Ghana campus branch which server other customers in that district as well. The study will cover this branch, because getting access to their customers is quite easy as compared to the other branches.

1.6 Justification of the Study

A great deal of research has been done on BPR and its impact on different industries, particularly in customer service. Once more, organizations can utilize BPR to obtain a customer retention and have an upper hand over their competitors.

This study will give premise to the potential entrepreneur and companies that intend to venture in the banking industry to comprehend the influence BPR process has on their organization. Numerous companies in their bid to reclassify their working procedures have landed themselves in misfortunes. This review will thus help sinking organization in their focused endeavours.

Besides, this research will aid ECOBANK management and other companies to cautiously select the kind of BPR that will be compelling to draw out the outcomes they anticipate. Being able to identify customers’ needs are vital if companies need to contend in the aggressive business condition and could be accomplished through customer retention strategies. This research for this situation, be exceptionally valuable in customer retention strategies when the company is experiencing the change.

Finally, it will be significant for scholastic purpose. The study will fill in as a base for further research for students, teachers and other people who are keen on comparable topic. It will likewise fill in as a scholastic reference in marketing and strategic management discipline.

1.7 Organization of the Study

The study is structured in five (5) chapters. Chapter one gives a background study captured together with the problem statement, objectives of the study, research questions, and justification of the study, a summary of the research methodology, scope of the study, and organization of the study. Chapter two reviews existing literature on relationship marketing and customer retention strategies in the banking industry. Chapter three discussed the methodology used to accomplish the study. Chapter four presented the research findings, analysis, and discussion. Chapter five provided brief discussions of the findings and presented the recommendations arising from this work and subsequent conclusion of the study.

CHAPTER TWO

LITERATURE REVIEW

2.1 Introduction

For companies to be counted among the best, they ought to touch on all aspects of the company establishment. In order to achieve this, these companies have to put processes and procedure in place so as to meet the needs of their customers effectively and address their problems and concerns in time. When customers are satisfied in terms of speed and time they use in transacting business, it will go a long way to improve the profitability of the company as well. According to (Hammer & Champy, 1993), process and procedure for workflow with time become outmoded and are not able to cope with the changing demands of the ever-erudite customers. Randle (1995) asserts that in an advanced world market, the keen edge for entities in this trade is the dynamic they bring to their operational process which outwits the contenders. In the situation where there are uncertainties in the financial environments, investors and account holders decides to either retain or withdraw their investment based on the bank’s performance. In developing countries, the banking sectors have come to appreciate the essence to improve customer’s service quality, reduce operational costs and enhance cost effectiveness (Randy, 1995).

In business process reengineering, diverse methodologies and frameworks have been proposed after several research findings (Heusinkveld & Benders, 2001). Different companies get their advantage of utilizing BPR from accomplishing the foreseen level of services and procedures. BPR can accomplish this by making strict changes and annihilating dull and insignificant procedures, which slacks in their frameworks. BPR started as a private sector technique, which enhances the relation of organization’s customer service to ascend through reducing the operational costs and hence overall cost to customers thereby increasing the competitiveness (Hammer & Champy, 1993). It has been taken over by both public and private organizations. BPR is essential because it helps the organization to be more effective and transformed to ride along existing trends. It is an essential tool which is used to shape the attitude of employees and work values of a firm. One established truth is that the people and process are what makes the organization (Hammer & Champy, 1993). Davenport, 2003, claim that the impact of minor fluctuation in the process can have a significant dent on cash flow, service delivery and customer satisfaction. BPR is well thoroughly considered as the proper measure for firms that relevant qualitative ascends in the procedure. There are pain and obstacles during the implementation because BPR involves successions of steps that change the state of business objectives (Riemer, 1998). The emergence of technology in the banking sector has led to stakeholders to think about re-engineering their processes. Numerous bank and financial institution have seen changes by restructuring to reduce operational cost, settlement systems and portfolio investment. Due to improved ways of banking which has been ushered in by current industry players, old fashion ways of banking such as dividing line between the service and products which were related to the banking sector in Ghana is no more.

2.2 Business Reengineering Process (BPR)

There have been several definitions brought forward by various scholars in relation to BPR. Hammer & Champy (1993) defined BPR as the fundamental rethinking and radical redesign of business processes to achieve intense improvements in critical modern measures of performance such as cost, quality service, and speed. Additionally, Davenport (1993) who is famous on this topic defined BPR as the envisioning of new work strategies that is the actual process design activity, the implementation of the change in all its complex technological, human and organizational dimensions. Subsequently, Johansson (1993) explains BPR as a radical rather than just an uninterrupted improvement. It pursues to empower process coordination a tactical tool and an essential skill of the organization. In this manner, BPR distillate on centres of business procedures and utilizations of distinct techniques within the nick of time and aggregate quality management as empowering influence while widening the procedure perception. Likening Davenport (1993) as well as Hammer and Champy (1993), it seems obvious that the first present a new thought into BPR which is the human factor. Nevertheless, the two scholars put into consideration the need for information technology as the component of BPR. Davenport (1993) does not just end on the information aspect, but goes on to add that human resources play a very significant role in this process. Davenport (1993) asserts the major differences between BPR and other approaches to organizational development is that businesses seek not fractional but multiplicative levels of improvement. Johansson’s (1993) definition tries to look at business process re-engineering in relation to other process-oriented views, such as Total Quality Management and Just in Time Systems. The errors seen as the traditional way to deal with management by separating the design of work from its execution and tends to lead to friction has been echoed by conventional re-engineering. To realize the anticipated benefits of BPR, there ought to be necessity for change in the structure and other means of managing and performing work as well as the use of information (Davenport, 1993). Stoddard and Jarvenpea (1995) describe Business Processes primarily as a cluster of events that altered the set of inputs into a set of outputs (goods or services) for another person or process by means of people and equipment. The business process includes an arrangement of legitimately interconnected tasks performed to accomplish a characterized business yield or result. BPR is not considered as an applicant to qualify as a scientific theory. This is because, among several other things, its duplicability is not viable and limited scope (Maureen et al, 2005). It could be asserted that the growth of an organization is seen as an unceasing process, but the pace of change has increased in various ways. For an organization to remain competitive in its implementation of BPR consistently and successfully, it involves the harvest of activities, procurement, order fulfilment, product development, customer service and sales (Sharma, 2006). Business Process re-engineering is said to have taken life from philosophical system. It fills in on continuous process improvement, re-designing expects that current procedure invalid and void so they will be the necessity to start with a new option. Having this viewpoint allows business process engineers to concentrate on the new process that will intend to improve workflow thereby rendering it more efficient and faster. The indispensable ethics of re-engineering include rethinking the theory of the business that involves a second look at the organization’s workflow to see which processes that need to be changed Thomas (1996). The necessity for digressing form traditional knowledge and parameters of the organization has been explained that the use of information technology is used to redesign the organizational workflows to generate value for customers. Thomas (1996), explains that as part of the essential element of re-engineering, the potentials of people must be harnessed and this could be achieved through training and development by building creative environment. Having said that, it is believed that BPR is not achievable if the general population in the company are not included in light of the fact that they shape a vital part of the process. Even though an organization is positive about the outcome of business process to go their way in terms of making a profit, the customer should at the end be satisfied with the outcome as well.

2.2.1 Importance of BPR

BPR is indeed one of the benefits customers always hope for and plays an integral role in the banking sector all over the world. BPR comprises processes, technology, infrastructure and restructuring of individuals to produce some formidable results. Going forward, will be looking at some benefits that BPR brings to the table for organizations. Organizations engages in BPR with the intentions of getting a better result or higher profit at the end of its execution. According to Sharma (2006), result is achieved when the organization is able to locate the right BPR and its implementation. Likewise, unprofitable task is taken away by BPR within an organization’s process which consequently gives the organization greater results with a less work effort. As what we discussed, BPR is a radical change that occurs within an organization to augment operations of the organization to increase output and lessen cost (Sharma, 2006).

Moreover, it could be agreed by all that customer loyalty and satisfaction are the end result of BPR. Customer satisfaction and value for money is attributed to a well-executed BPR process within an organization. Customers will always play an integral part in a company because without them they will not be in business. Customers become loyal to an organization when the organization is able to identify their needs and provide services to meet and even exceed their expectation (Vidgen et al., 1994). When customers are satisfied with the services being offered to them, it will go a long way to increase the number of loyal customers a company gets.

Furthermore, companies will derive a more competitive edge over another as a result of their introduction of BPR. BPR undertaken by companies is believed to redefine their process, thereby enhancing the corporate brand. BPR when implemented eliminates several out-dated processes which do not add any value to a company. BPR has vast rewards and is believed to promote a company’s path to attaining greater profits and image.

Nevertheless, Hammer (1990), who is greatly recognized as the forerunner in the field of re-engineering, speculates the conditions when BPR will not succeed. Conflict may arise in a process, thereby leading to failure in entirely if a BPR process is not fully understood by the people going to use it. The need for the BPR practice in the organization must be understood by all the parties that are involved (Hammer, 1990). Also, BPR can be destructive in two instances which can either be physically or psychologically. Its implementation could face some considerable amount of opposition as well as encountering extended working time. BPR may be unsuccessful if it doesn’t fit into an organization’s working culture. A significant requirement for a successful BPR is a good error free and winning strategy. According to Galliers (1998), if the strategy is defective and does not have detailed guidelines for the implementation, then the process may fail. Therefore, BPR should be well thought of and planed before it is executed or implemented.

2.3 Kinds of Business Process Reengineering

The banking industry has got several kinds of BPR. Here are some types of BPR in the industry.

2.3.1 Information Technology Change

A vital component of BPR which cannot be overlooked is an Information Technology (IT). IT is a utility for accessing the workflow of a company in order to identify which process best suit their customers. Hammer (1990) asserts that the idea of identifying outdated processes comes to play at this stage of implementing BPR. Whenever gaps are identified in current BPR, the future ones tend to be redefined to suit that time.

Furthermore, BPR includes a closer look at the connection between IT and business activities (Davenport & Short, 1990). There has been a continuously review to establish ITs relevance to business. A competitive edge of a company over other industry players should arise from the use of Information Technology which help in the enhancement of the process in the workflow.

2.3.2 Electronic-banking

E-banking is an aspect where BPR is also undertaken and it serves as an alternative way of banking which is different from the normal way of banking we know. Customers are able to transact business over the internet without having to visit the banking hall. Over the years, banks started to roll out e-banking as a way of implementing technology to their customer. Customers who were not in the position of visiting the banking hall to transact minor or cashless business could use e-banking in the comfort of their home or offices. Through the electronic banking, many banks have increased their profit margins over the years and also increased their portfolio of customers (Nathan, 1999). Banks in other words, have been able to satisfy their customers to bank electronically as well as migrating the majority of their customers to their internet banking platform thereby reducing operational cost (Wright & Ralson, 2002). Several advantages have been derived from electronic banking and they include, cutting down the number of employees by management, the time used in transacting business in the banking hall and reducing the time spent on cheque clearance since it can be done electronically with the emergence of e-banking. According to KPMG (1998), banks revenue increases from internet banking due to the following factors: increased account sales, new fee-based income, improved customer satisfaction, wider market reach, and new market opportunities. E-banking brings enormous benefit to the customers and the banks themselves. In view of the customers, it brings to an attractive option of having not to transact business in the banking hall, thereby making use of time wasted on the banks for other profitable ventures. This is because most transactions can be done with the help of e-banking. BPR in e-banking helps in banking process, saves time and reduce costs on the part of the customers as well as the bank. These are the main influence that BPR seeks to achieve.

2.4 Definitions of Customer Satisfaction

Customers recognize a service rendered as satisfying when they are satisfied (Oliver, 1997). There are various groups of customers. There are customers who purchase a service and are the tender users of the service. There are others who only purchase but are not the end users of the service purchased (Hammer & Champy, 1993). There are different indicators being used to measure satisfaction. In order to model a satisfaction for the groups, a researcher has to get their understanding. Satisfaction is best explained when a product or service has been used or experienced (Oliver, 1997). The depiction of satisfaction in a user’s mind is different from the one who is just purchasing. This explains that a consumer satisfaction may drop because of getting enough of a good thing. Corporate society focuses upon the lower threshold and abandons the prospects for an upper threshold (Davis & Heineke, 1998; Szymanski & Henard, 2001). The consumer’s fulfilment response is the definition that Oliver (1997) gives to satisfaction based on the behavioural viewpoint. With the progress in the fields of research for consumer satisfaction, the indicators for measuring customer satisfaction has still not been identified. The question keeps on resurfacing in the numerous researches on customer satisfaction. The difficulty experienced is because of the different groups of customers that exist. An indicator can be used to measure satisfaction in one group, but fail when applied to another group of customers. The market share of companies has seen a percentage increase because of their customers being satisfied as outlined by various researchers. They often concentrate on retaining their old customers by improving their service quality. The service they provide attracts more customers because they get satisfied as they patronize their service (Rust & Zahorik, 1993). Customers get stuck with a service provider because of the quality of service they experience. They will always want value for their money spent on any service or good (Hallowell, 1996). Customer retention thrives on customer satisfaction (Reichheld & Sasser, 1990).

With the influx of different banks entering the Ghanaian banking industry, several banks are making an enormous effort to keep their customers. Customers always want to compare products and services before sticking to one (Strategic Direction, 2007). In the banking industry, accessibility and convenience are the two basic indicators why customers would always want to bank with a bank (Anderson, 1994). Reichheld and Sasser (1990) indicate that banks generate more profits from loyal customers. It is believed that there is the tendency of loyal customers refereeing their business partners and friends, which goes on to increase the customer base of their bank.

2.5 Levels of Customer Satisfaction

Customer satisfaction can be attributed to how well a customer is received or attended to when doing business with a company. According to Hokanson (1995), customer satisfaction is informed by several factors. It becomes a bit difficult for customers to just walk away when they are comfortable to approach staff for assistance, complaints handled swiftly with professionalism and have enough idea about their products. Service industry thrives on a a good customer’s relationship which is the key tool for every company. Customers will walk away if there are delays in handling their concerns, slow service and increase in price of goods or service with no additional quality.

2.5.1 Service quality

Mangers are more particular when it comes to service quality. As Brown and Swartz (1989) asserts, a customer’s choice is informed of the value obtained and the quality of service rendered. Customers in recent times are more concern about the quality they get when service is being offered to them. The quality rendered distinguished one organization from the other. The organization that invests in research to improve the quality of service always attracts customers, and the customers become loyal to that organization (Gronroos, 1982). Service quality is deemed to be an intangible item because it cannot be measured as compared to goods. Per Parasuraman, Zeithaml, and Berry (1988), principal dimensions that customers use to judge service quality include reliability, responsiveness and assurance. Reliability is the ability of the organization to render as promised and sometimes even exceeding what was promised (Bovey & Hede, 2001). An organization’s willingness to help customers and to provide prompt service without delaying creates perceptions of good service (Bovey & Hede, 2001). If a service failure occurs, the ability to recover quickly and with professionalism can also create perceptions of quality. Assurance is a tool that informs a customer’s choice of bank (Bovey & Hede, 2001). It is the hope of every customer to transact business with a trusted bank or company.

2.5.2 Service charge

The service charge is a form of profit generation in the banking industry. Customers don’t mind paying more for a service if it is of high or good quality. Customers compare prices they pay for a service to another organization to see if they are obtaining a value for money. For a company to generate enough profit from service charges, the measuring tool is quality. The quality of service delivered determines the number of customers that will frequent that service (Lien & Yu-Ching, 2006).

2.5.3 Customer complaint handling

Customers always want their concern to be addressed and swiftly. Currently, there are a lot of banks in the industry and each one of them wants to draw customers to them. In the event where aggrieved customers are not attended to, they might lose them to other industry players. Customer complaint handling has become a tool in which other competitors use to draw in customers. This signifies that consumer satisfaction has a relation with complaint handling (Terrence & Gordon 1996).

2.6 Employee Reactions to Business Process Reengineering

Researchers generally agree that employee resistance is one of the leading causes for the failure of change initiatives (Bovey & Hede, 2001; Waldersee & Griffiths, 1996). Several of their conclusions indicates that change agents focusing on employee reaction together with resistance and acceptance during organizational change are of extreme importance to the success of the initiative. Several factors account to employee’s reaction to BPR i.e. they might be comfortable with their old fashion process since they’ve used it for a long time and wouldn’t welcome the change. It is reasonable to expect employees to react since the procedure of change entails going from the familiar to the unfamiliar, and when employees react, it is vital to distinguish between the indicators of their reactions and the causes behind them (Bovey & Hede, 2001).

2.6.1 Employees’ emotions and cognitions

Many change efforts fail as change agents undervalue the significance of the individual, cognitive-affective nature of change (Ertuk, 2008), and emotions and cognition are closely entwined (Pessoa, 2008). Employees will always react to change when they notice that they will be affected as outlined by various scholars. They try to get reasons to stop the change (Bovey & Hede, 2001). During the change, employees create their own interpretations of what is going to happen, how others perceive them, and what others are thinking or intending (Bovey & Hede, 2001). Employee reactions toward BPR are important for the success of the change. Employee reactions can be either positive or negative based on the communication process. It is very important that management communicates effectively to employees and involve all in the change process to have a successful change. Enhancing the skills of the employees with the necessary skills to match up with the change is an effective tool that builds the confidence of the employees to meet the change.

Haven looked at these previous literatures, we can deduce that BPR can play out well when all stakeholders which includes employees and customers take a centre stage in the re-engineering process. It is in view of this, that this study was conducted to assess the influence of customers and employees on BPR in Ecobank.

CHAPTER THREE

RESEARCH METHODOLOGY

3.1 Introduction

All research are based on some underlying philosophical assumptions about what constitutes valid research and which research method(s) is/are appropriate for the development of knowledge in each study. This chapter presents the research methods adopted in accomplishing the study.

3.2 Research Design

Per Saunders et al. (2009), inquiries can be classified in terms of their purposes as well as the research strategy used (Robson, 1993). Three categories of the inquiries are identified as exploratory, explanatory and descriptive. This study used the descriptive study method because it seeks to assess the impact of business process reengineering on customer satisfaction in the banking industry. Quantitative research is a research that entails the use of mathematical approach in explaining the results. Secondly, descriptive study was used since the researcher was not sure of the answers, but wanted to produce objective results.

There are two helpful research methodologies: quantitative and qualitative. Bryman and Bell (2003) point out that the connection between theory and research, epistemological considerations and ontological considerations, quantitative and qualitative research can be considered as two distinctive clusters of research strategy. A researcher using a qualitative method does not primarily seek statistical results, whereas in the quantitative method, the researcher makes use of statistics, surveys, and randomized trials to study given object, with the aim to generalize the findings (Shiu, 2009)

3.3 Purpose of the Study

In conducting this study, the researcher has the option of employing three methods or either of the methods to obtain information. Based on what the research seeks to obtain, the descriptive, exploratory or explanations can be used. A researcher who seeks to interview a sample of people who are directly related to the subject matter will employ an exploratory method to obtain his results (Marvasti, 2004). According to Robson (2002), descriptive research gathers information so that a description of what is happening is seen.

Explanatory research seeks to establish causal relationships between variables (Saunders et al., 2009). The exploratory research explores a whole new field of thoughts in the area of study to obtain more information on the subject matter. This exposure to new ideas and thoughts helps the research to gain a better understanding of the trend and also know which method will be appropriate in the next study. Descriptive research seeks to provide an accurate description of observations of phenomena. In research work, information about the population is gathered to know the size that the research is used to conduct the study.

This study, therefore, employed descriptive, exploratory as well as an explanatory approach to accomplish the objectives of the study. This study employs an explanatory approach because it sought to establish the relationship between BPR and customer satisfaction. The interview with management bequeathed a deeper understanding of the type of BPR practice ECOBANK has been employed in their operations. The interview with management portrays the exploratory aspect of the study.

3.4 Sampling Procedures

In research, a number is selected to represent the area of the research study. This method of choosing a certain group in the entire area to represent the masses is known as sampling. This carefully selected group describes the various units in the study. Sampling theory is important because without it research work will be difficult and not efficient. Using the entire population of an area will be stressful during the analysis stage (Henry, 1990). This section discusses the population of the study, sample size and sampling technique adopted in selecting the respondents for the study.

3.4.1 Population and Sample size

A study of Brynard & Hanekom (2005) explains that in research methodology the population does not refer to the population of a country, but rather to the objects, subjects, phenomena, cases, events or activities specified for sampling. Population in a research study is the specified section of the sample that is selected to conduct a research on to obtain findings to able to draw conclusions.

In choosing a sample size, some parameters are used to ascertain what the sample size should be. Sample size depends on the nature of the analysis to be performed, the desired precision of the estimates one wishes to achieve, the kind and number of comparisons that will be made, the number of variables that have to be examined simultaneously and how heterogeneous a universe is sampled. In non-experimental research, most often, relevant variables have to be controlled statistically because groups differ by factors other than chance. More technical considerations suggest that the required sample size is a function of the precision of the estimates one wishes to achieve, the variability or variance, one expects to find in the population and the statistical level of confidence one wishes to use. In conducting this research a sample size of 200 was used to access information for the study.

3.4.2 Sampling Techniques

The end result of the research is what informs the choice of the sampling technique and this is based on the questions the researcher asks. The purposive sampling technique as the name suggests, is a sampling technique in which the research decides on what information to use. In this technique, the researcher fishes out in informants based on the kind of information and analysis the researcher wants to get (Bernard, 2002). In selecting respondents for the survey, purposive sampling technique was adopted.

3.5 Sources of Data

Data can be explained as a set of information collected for a study. The data serve as proofs and thoughts and are recorded for the purpose of analysis. The data are usually stored to serve as a reference for future work (Saunders et al., 2007). Sources of data speak of the ingenuity of information. Primary and secondary are the two main sources of information.

3.5.1 Primary data collection

Primary sources of data include fresh data collected from staff and customers of Ecobank Ghana. This was done using questionnaires administered to employees as well as customers. The primary data was collected by requiring 90 employees and 110 customers to fill questionnaires concerning the research under study. Questionnaires were administered to customers of ECOBANK Ghana. The questionnaire entailed both open-ended and closed questions. The purpose for using the questionnaire to collect data is because it is the most effective instrument as far as field work is concerned.

3.5.2 Secondary data collection

Secondary data refer to existing information that was available for a study. Sources of secondary data can be from journals, textbooks, manuals, reports and publications and articles from the internet.

3.6 Data Analysis

The data gathered was examined. The questionnaires were all coded into the Statistical Program for Social Science (SPSS) software after which the analysis was performed. Descriptive results were presented in tables. The data were analyzed based on the responses received from the respondents.

3.7 Quality of the Research

The reliability and validity of the data collected and the response achieved depend on, to a greater extent on the design of the questions as a valid question will enable accurate data to be collected and one that is reliable will mean these data are collected consistently (Saunders et al, 2009).

3.8 Research ethics and limitation

Ethics can be explained as moral rules and behaviors, and research ethics that serves as a guide to the researcher conducts the research (String & stead, 2001). The ethics seek to prevent the researcher from engaging in scientific misconduct such as distorting data, plagiarizing the works of others failing to maintain the confidentiality of research respondents and others.

CHAPTER FOUR

DATA PRESENTATION, ANALYSIS AND DISCUSSION

4.1 Introduction

This chapter describes and gives detailed analysis of the data collected from the respondents on the influence of business re-engineering on customer satisfaction in the banking industry. The data were obtained from self-administered questionnaires and was completed by 200 respondents made up of 90 staffs from Ecobank Ghana and 110 customers with 100% response rate from diverse sectors of the bank by providing the essential response for the analyses. The data collected from the interview were analyzed with SPSS software and the results will be displayed and described in tables and chart to facilitate meaningful discussion. The data were analyses with the influence of the business re-engineering on customer satisfaction as the measuring tool. Based on the finding from the research data, the study started with the demographic data of the respondents by exploring the gender, age, educational level, length of services in the bank among others.

Findings from the respondents on their reaction of the software was also analyzed together with their perception on the business re-engineering at the bank have been analyzed from different perspective in a form of tables, charts and diagrams to facilitate a simplistic reader-friendly writing and understanding. The level of customer satisfaction with the introduction of the BPR was also accessed and analyzed.

4.2 Demography of respondents

Chart 1: Gender

The study opens with the demographic analyses of the respondents of the staff and customers. The gender of the respondents was analyzed as represented in the chart above, the male workers were the majority with 61% and female represented by 39%. This is an indication that there are more male workers in the bank compared to women. The data on the gender representation of the customers too, the male dominates with 51.8% over female of 48.2%

Table 1: Age

| Customers | Employees | |||

| N. | % | N. | % | |

| 18-30 years | 36 | 32.7 | 60 | 67.8 |

| 31-40 years | 53 | 48.2 | 18 | 20.0 |

| 41-50 years | 19 | 17.3 | 11 | 12.2 |

| 51 and above | 2 | 1.8 | 0 | 0 |

| Total | 110 | 100 | 90 | 100 |

The table above represents the age range of the respondents interviewed. This data is from the customer perspective and staff perspective. From the data representation of the chart, it is evident that the majority of the workers in the bank is between the age 18 to 30 years representing 67.8%, followed by 31 to 40 age group and then 41 to 50 years. The data also show that the majority of customers are between 31 to 40 years representing 48.2 % (53), this is followed by those between 18 to 30 years. The representation of the chart shows that many of the employees and customers are in their prime ages and this will may contribute to high productivity all things being equal.

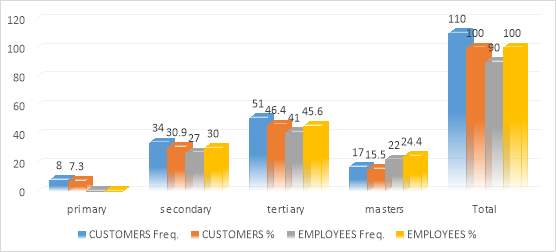

Chart 2: Educational background of Customers and Employees

The chart above represents the educational levels of the respondents. The respondents educational are measured at three levels that is Secondary, tertiary and masters. Out of the total of 990 respondents, 41 are tertiary level representing 45.6%. The secondary education level is next with 27 (30%) and then those with masters are 22 (24.4%). All the customers and the employees of the bank at least have primary education; most of the customers have also attained some level of education as evident in the chart above.

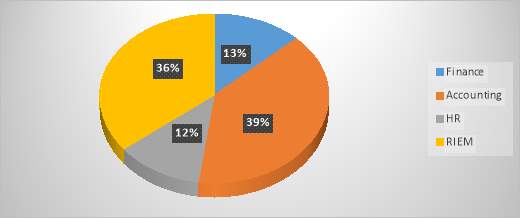

Chart 3: Departments

The table above shows the representation of the background or field of the respondents at the bank. The respondents are from four main departments in the bank that is Finance, Accounting, HR, and RIEM. The majority of the respondents are from the Accounting department with a total of 35 (38.9%). The RIEM department is second with 32 (35%) of respondents and then the Finance department also with 12 (13.3%). The HR department is the least with 11 (12.2%). The representation of the figures on the table will provide a good response to the conclusion of the study as they are all professionals and understands the issues investigated in the study.

| Table 2: Occupation of Customers | ||||

| N | % | |||

| No response | 1 | 9 | ||

| Teacher | 11 | 10.0 | ||

| Businessman | 20 | 18.2 | ||

| Sports teacher | 8 | 7.3 | ||

| Librarian | 3 | 2.7 | ||

| Gym instructor | 4 | 3.6 | ||

| Security | 8 | 7.3 | ||

| Secretory | 9 | 8.2 | ||

| Accountant | 6 | 5.5 | ||

| Nurse | 4 | 3.6 | ||

| Lecturer | 4 | 3.6 | ||

| Student | 10 | 9.1 | ||

| Cleaner | 7 | 6.4 | ||

| Manager | 7 | 6.4 | ||

| Market women | 6 | 5.5 | ||

| Doctor | 2 | 1.8 | ||

| Total | 110 | 100.0 | ||

The table above represents the various occupations of the bank customers. The respondents are can be categories into public sector worker, private sector workers and business owners. It is clear that most of the customers are public sector workers forming about 40% of the total respondent. The remaining are made up of the private sector workers and business owners. The section of customers’ demands a strategic view of the business re-engineering of the bank for customer satisfaction

Table 3: how long have you been working/doing business with Ecobank Ghana?

| Customers | Employees | |||

| N. | % | N. | % | |

| 1-12 months | 24 | 21.8 | 28 | 31.1 |

| 1-2 years | 30 | 27.3 | 49 | 54.4 |

| 3-4 years | 16 | 14.5 | 8 | 8.9 |

| 5-6 years | 18 | 16.4 | 2 | 2.2 |

| Above 5 years | 22 | 20.0 | 3 | 3.3 |

| Total | 110 | 100.0 | 90 | 100.0 |

Table 2 above, shows the numbers of years the respondents have been working with a bank. It is displayed in the table that 3 (3.3) of the respondents have worked in the bank for more than 6 years in their various departments. 49 (54.4%) as the majority of the respondents have worked in the bank between 1 to 2 years, followed by those who have worked for less than one year with the bank. 8 others have worked between 3 to 4 years and those who have worked between 5 to 6 years are 2. The statistics above show that most of the respondents have worked with the bank for less than 3 years, but have knowledge of the operations and much information on issues. There are other senior workers as well who may have much experience with the issues under investigation and therefore will provide the needed data for the study. It would also be agreed that the bank has a long relationship with customers. 22 of the respondents have saved in the bank for more than 5 years, 18 respondents have also saved with the bank between 5 to 6 years. However, the majority of 30 respondents have saved with the bank between 1 to 2 years. This may be as a result of the quality of service provided to satisfy the customers which is bringing more customers to the bank.

Table 4: Reaction of employees to BPR

| SD | D | N | A | SA | TOTAL | |||||||

| Variables | N | % | N | % | N | % | N | % | N | % | N | % |

| I am happy with the software change | 7 | 7.8 | 2 | 2.2 | 5 | 5.6 | 18 | 20.0 | 58 | 64.4 | 90 | 100.0 |

| I have been trained on the new software | 7 | 7.8 | 10 | 11.1 | 7 | 7.8 | 16 | 17.8 | 50 | 55.6 | 90 | 100.0 |

| Management communicated | 8 | 8.9 | 7 | 7.8 | 32 | 35.6 | 17 | 18.9 | 26 | 28.9 | 90 | 100.0 |

| I am not happy; I fear losing my job | 29 | 32.2 | 17 | 18.9 | 24 | 26.7 | 20 | 22.2 | 0 | 0.00 | 90 | 100.0 |

| The turnaround time for serving customers has improved | 10 | 11.1 | 9 | 10.0 | 20 | 22.2 | 37 | 41.1 | 14 | 15.6 | 90 | 100.0 |

From table 3, respondents were asked to indicate whether they strongly agree (SA), agree (A), neutral (N), disagree (D), or strongly disagree (SD) to the statements the researcher make on the reaction of employees towards BPR. When the respondents were asked whether they are happy with the software change, the majority of the respondents 58 (64.4%) agreed strongly to it. Another 18 (20%) of the respondents also agreed to the same statement whilst only a few of the respondents 7 (7.8%) disagreed with the fact that they are happy with the software change at the Ecobank Ghana.

Again, when the respondents were asked if they have been trained on the new software, more than half of the respondents strongly agree to the statement whilst another 16 (17.7%) also agreed to the statement that they have been trained on the new software in the Ecobank Ghana. However, 10 out of the 90 respondents also disagree that they have been trained on the new software, whilst only 7 out of the 90 respondents strongly agree with the statement.

On management, communication, most of the respondents 32 (35.6%) indicated that they are neutral and have no idea whether management communicated the change to them or not. 28.9% of the respondents also strongly agreed that the management communicated the change to them. However, some of respondents 7 (7.8%) disagree with the statement that management communicated the new change to them.

The findings of the study also indicated that most of the most of the employees29 (32.2%) at the Ecobank Ghana, strongly disagree with a statement made by the researcher that the employee are not happy; for they fear of losing their jobs. This was followed by another 17 (18.9%) of the respondents who also disagree with the same statement. However, few of the respondents also agreed and feel that they are not happy because they feel their job is not secure.

When respondents were asked if the turnaround time for serving customers has improved, a majority of 37 (41.1%) agreed that it has improved the turnaround time for serving customers, other 14 (15.6%) respondents strongly agree. 20 (22.2%) remain neutral on the issue, however, 9 and 10 other respondents disagree and strongly disagree respectively. This study, then shows that reaction of employees toward the BPR is positive. This confirms the asserting made by Bovey & Hede (2001) that during change, employees create their own interpretations of what is going to happen, how others perceive them and what others are thinking or intending. Employee reaction can be positive or negative based on the communication process.

Table 5: Level of customer satisfaction with introduction of BPR

| SD | D | N | A | SA | TOTAL | |||||||

| Variables | N | % | N | % | N | % | N | % | N | % | N | % |

| Satisfied with software change | 0 | 0.0 | 22 | 20.0 | 35 | 31.8 | 32 | 29.1 | 21 | 19.1 | 110 | 100.0 |

| Transactions at the banking hall are rapid | 37 | 33.6 | 12 | 10.9 | 0 | 0.0 | 41 | 37.3 | 20 | 18.2 | 110 | 100.0 |

| Comfort in banking electronically | 13 | 11.8 | 8 | 7.3 | 33 | 30.0 | 25 | 22.7 | 31 | 28.2 | 110 | 100.0 |

| Software change has an impact on service charges | 12 | 10.9 | 15 | 13.6 | 32 | 29.1 | 30 | 27.3 | 21 | 19.1 | 110 | 100.0 |

| Satisfied with the response to complaining with the introduction of new software | 0 | 0.0 | 19 | 17.3 | 36 | 32.7 | 36 | 32.7 | 19 | 17.3 | 110 | 100.0 |

| Ecobank has become more reliable | 0 | 0.0 | 11 | 10.0 | 42 | 38.2 | 31 | 28.2 | 26 | 23.6 | 110 | 100 |

When the customers were asked to indicate their Level of customer satisfaction with the introduction of BPR by indicating strongly agree (SA), agree (A), neutral (N), disagree (D), or strongly disagree (SD) to the statements the researcher made, the majority of the customers 35 (31.8%) indicated showed a neutral point of view that ticks the neutral option. However, 22 out of the 110 customers agreed that they are satisfied with the software that was installed. The findings also show that transactions at the banking hall are not rapid. This is confirmed by the majority of the customers 41 (37.3%) who indicated a strong disagreement in the statement made. Another 20 (18.2%) of the customers also disagreed to the same statement whilst 37 out of the 110 respondents also strongly agreed that the transactions at the banking hall are rapid.

Customers were also asked to indicate whether they are satisfied with software change has an impact on service charges. From the findings, 12 (10.9%) of the customers strongly agree, 15 (13.6%) of the customers agreed, 32 (29.1%) were neutral, 30 (27.3%) of the customers disagreed to the statement whilst 21 (19.1%) strongly disagree with the statement.

Again, customers were asked to indicate whether they are satisfied with the response to complaining with the introduction of the new software. 36 (32.7%) of the customers agreed to the statement, 36 (32.7%) were neutral to the fact that they are satisfied with the response to complaints with the introduction the new software.

Finally, the majority of the customers were of a neutral view, whether Ecobank has become more reliable or not. However, 31 (28.2%) of the respondents disagree with the statement that Ecobank has been reliable.

| Table 6: what is your perception of the business process re-engineering at Ecobank Ghana | ||||

| Frequency | Percent | |||

| Just ok | 11 | 12.2 | ||

| Good | 52 | 57.8 | ||

| The software change has improved customer services | 12 | 13.3 | ||

| Its ok, but can’t tell about its future performance on customer service | 5 | 5.6 | ||

| Can’t tell | 4 | 4.4 | ||

| Excellent | 1 | 1.1 | ||

| N/A | 5 | 5.6 | ||

| Total | 90 | 100.0 | ||

The respondents who are employees were asked to share their perception of the business process re-engineering at Ecobank Ghana. The response given were categorized as shown above. The majority of the respondents 52 (57.8%) indicated that the business process re-engineering is good at the Ecobank Ghana. 12 (13.3%) of the respondents also thinks that the software change has improved customer services with the Ecobank Ghana. Some of respondents 11 (12.2%) also think it is just ok, as in it is just normal. 5 (5.6%) of the respondents also thinks that is ok but cannot tell of its future performance on customer service. However, 1 (1.1%) of the respondents thinks the business process re-engineering at the Ecobank Ghana is excellent. The research finding is in line with the findings of Hammer (1990) which states that the need for the BPR practice in the organization must be understood by all the parties that are involved, furthermore, the BPR can be destructive both physically and psychologically. It can initially end up in extended working time and a substantial amount of opposition during its implementation. He stated that, if the total indulgence for the introduction of the BPR is against the working culture, the implementation may be unsuccessful. However, Galliers (1998) also asserted in his study that one significant requirement for a successful BPR is a good error free and winning strategy. If the strategy is defective and does not have detailed guidelines for the implementation, then the process may fail.

| Table 7: What recommendation will you give to the management of Ecobank to improve service | ||||

| N | % | |||

| Provide better and quicker services | 15 | 13.6 | ||

| No response | 6 | 5.5 | ||

| Ensure the software does not prevent people from coming to the bank | 12 | 10.9 | ||

| Management should create a comfortable online banking system | 17 | 15.5 | ||

| Transactions should be made faster | 7 | 6.4 | ||

| Keep improving the software interface | 17 | 15.5 | ||

| Staff should put up a lot of smiles | 2 | 1.8 | ||

| Should not introduce new product frequently since it gets consumers confuse | 2 | 1.8 | ||

| I am satisfied with the current operations | 12 | 10.9 | ||

| Introduce more innovative software | 20 | 18.2 | ||

| Total | 110 | 100.0 | ||

The table above depicts the responses of the customers on about some recommendations to improve the services at the Ecobank. The findings came up that the management of Ecobank should try and introduce more innovative software’s at the bank. This was evident when 20 out of the 110 respondents recommended that the management of Ecobank should introduce more innovative software. This was followed by another 17 (15.5%) of the respondents who recommended to management that they should create a comfortable online banking system. 17 (15.5%) of the respondents also suggested that management should keep improving the software interface. 12 (10.9%) of the customers who also recommended that management should keep up with the status because they are satisfied with the current operations of the Bank. 15 (13.6%) of the customers recommended that management should provide quicker and better services. This finding actually implies that some of the customers want management to really improve upon some of the services that they operate whilst others also want the management to maintain the current operational activities.

CHAPTER 5

SUMMARY, CONCLUSION AND RECOMMENDATION

5.1 INTRODUCTION

This chapter sums up the study with a summary of findings, conclusion from the analysis and objectives of the research and recommendations. The chapter also provides the reader with the findings’ theoretical contribution of the study as well as its practical contributions to the business world. It finally discloses the limitations of the study, an assessment of the quality of the work, and also possible future studies to conduct.

The introduction of BPR in an organization is assumed to improve the process workflow, to increase the market share of the organization, and to improve efficiency (Sherwood-Smith, 1994). Ecobank Ghana is increasingly focusing on e-Services and e-Banking to provide convenience to its clients. It is committed to serving its clients with Speed, Accuracy and the highest level of professionalism. This study seeks to find out what the BPR has on customer satisfaction among their clients. From this research gap the following research questions arose: What type of BPR practice did ECOBANK Ghana use? Were customers satisfied with the introduction of BPR?

5.2 Types of BPR Practices Ecobank Used

BPR is the fundamental rethinking and radical redesign of business processes to achieve improvement in critical contemporary measure of performance such as cost, quality and speed. Technology underpins the Ecobank Group’s strategy. The group’s One Bank concept is designed to ensure that it operates to the same consistent standards in terms of processes and service delivery anchored on its technology platform. Business process reengineering distillates on core business processes and uses specific techniques within just in time and total quality management as enablers while broadening the vision process. To this end, Ecobank engineered the use of technology and shared services centre to centralize and standardize middle and back office operation across their branches. They also upgraded their core banking system to meet higher operating standards. While Ecobank plays a leading role in the continued growth of the banking sector and increasing intra-Africa trade and investment banking, they can offer innovative solutions to all their customers. There are several types of BPR in the banking industry. Ecobank ensures that their system undergoes regular revisions to allow for innovation such as mobile banking. The bank seeks to give a uniform world-class practice and proprietary technologies, which will help the bank to reach and influence customers. Ecobank undertake all this process so as to provide and ensure that customers can transact and unlock opportunities with ease.

5.3 Summary of the findings

From the findings of the study, the demographic data of the respondents with the gender indicates that male workers were the majority with 61% and female represented by 39%. The data on the gender representation of the customers is also dominated by male with 51.8% over female of 48.2%. The responses represent the views of more males than female. In terms of age category, the study shows that the majority of the respondents were between the age 18 to 30 for the staff and 31 to 40 for customers. This show that they the respondents are matured enough to give their accurate opinion on the issues. With the educational background of the respondents, all the customers and the employees of the bank at least have primary education; most of the customers have also attained some level of education as evident in the chart above.

The professional background of the respondents on the bank are from four main departments that is Finance, Accounting, HR, and RIEM. Majority of the respondents are from the Accounting department who are professionals and understands the issues investigated and can provide useful information and also the customers are also made up of business owners, public and private workers who can also make good judgement on the services provided at the bank. It was revealed in the study that most of the employees have worked with Ecobank for over 2 years and also most of the customers saved with the bank for more than 2 years.

When the employees were asked whether they are happy with the software change, the majority of the respondents 58 (64.4%) agreed strongly to it. Another 18 (20%) of the respondents agreed to the same statement whilst only a few of the respondents 7 (7.8%) disagreed with the fact that they are happy with the software change at the Ecobank Ghana. The study also indicated that customers are happy with the software change, again, the study shows that the workers have been trained on the new software.

As for management communications, most of the employees 32(35.6%) indicated that they were neutral and had no idea whether management communicated the change to them or not. 28.9% of the respondents strongly agreed that the management communicated the change to them.

On the level of customer satisfaction, the majority of the customers 35 (31.8%) indicated showed a neutral point of view. However, 22 out of the 110 customers agreed that they are satisfied with the software installed. The study also indicated that 52 of the customers feel the software was good.

5.4 Conclusion

The following conclusions are drawn based on the findings of the study. For the first objective, it is concluded that employees at Ecobank Ghana are happy with the software change, the majority of the respondents 58 (64.4%) agreed strongly to it, again, the study shows that the workers have been trained on the new software and management communicated with them on the software change.

For the second objective, it is concluded in the study that some of the customers are happy with the software change, however, some also think there should be modification in the software so that there will be rapid service in business transaction. This is supported by the findings of Guo (2008) that customer base of any company is highly dependent upon in terms of their market survival. Moreover, customer service is critical and the customer has more prominence in determining the market performance of an organization. He emphasized again that customers’ satisfaction is seen as one of the key factors that competitive environment is centered, with the end goal that organization’s viability in customer benefit delivery is viewed as a sign of dynamic association. Consequently, an essential component of customers being successful is that at the end of the day they are satisfied. Studies done by Spathis (2004) also suggests that service based organization must have as part of their strategic plan, their customer service quality to ensure a successful enterprise.

5.5 Recommendations

Based on the findings from this study, the researcher proposes the following policy recommendation from the both the views of the respondents and the other empirical findings:

- The studies showed that the level of innovative software at the Ecobank are too few hence recommends that the management of Ecobank should try and introduce more innovative software’s at the bank.

- This study also finds out that customers are not satisfied with the current online banking system at the Ecobank and recommends that Management should create a comfortable online banking system so that employee can transact business through the online platform anytime and everywhere.

- This study also recommends that the management of Ecobank should provide quicker and better services.

- Management should change their software facilities by being more proactive and competitively towards new innovations.

- Speed up the implementation of their innovative ideas and plans on service delivery at the Eco bank.

APPENDIX I

QUESTIONNAIRE

This questionnaire seeks to collect data on the influence of business re-engineering on customer satisfaction in the banking industry. A case study of ECOBANK Ghana. The data collected will be used for academic purpose only. Please answer the following questions, ticking the appropriate boxes or providing your answer where applicable.

Please tick () or supply answers where appropriate

BACKGROUND INFORMATION

1. Gender: Male ( ) Female ( )

2. Age: 18-30 ( ) 31-40 ( ) 41-50 ( ) 51 and above ( )

3. Educational Background: Primary ( ) Secondary ( ) Tertiary ( ) Masters ( )

4. Occupation……………………………………………………………………………

5. How long have you been banking with Bank of China? 1-12 months ( ) 1-2 years ( ) 3-4 years ( ) 4-5 years ( ) above 5 years ( )

1= strongly disagree ( ) 2 = Disagree ( ) 3 = Neutral ( ) 4 = Agree ( ) 5 = strongly agree ( )

| Level of customer satisfaction with introduction of BPR | 1 | 2 | 3 | 4 | 5 |

| Satisfied with software change | |||||

| Transactions at the banking hall are rapid | |||||

| Comfort in banking electronically | |||||

| Software change has an impact on service charges | |||||

| Satisfied with response to complaining with the introduction of new software | |||||

| ECOBANK has become more reliable |

What recommendation will you give to management of ECOBANK Ghana to improve service?

………………………………………………………………………………………………

***THANK YOU***

APPENDIX II

QUESTIONNAIRE

This questionnaire seeks to collect data on the impact of business re-engineering on customer satisfaction in the banking industry. A case study of ECOBANK Ghana. The data collected will be used for academic purpose only. Please answer the following questions, ticking the appropriate boxes or providing your answer where applicable.

Please tick ( ) or supply answers where appropriate

BACKGROUND INFORMATION

1. Gender: Male ( ) Female ( )

2. Age: 18-30 ( ) 31-40 ( ) 41-50 ( ) 51 and above ( )

3. Educational Background: Primary ( ) Secondary ( ) Tertiary ( ) Masters ( )

4. Department ……………………………………………………………………………

5. How long have you been working with ECOBANK?

1-12 months ( ) 1-2 years ( ) 3-4 years ( ) 4-5 years ( ) above 5 years ( )

1= strongly disagree ( ) 2= Disagree ( ) 3= Neutral ( ) 4=Agree ( ) 5= strongly agree ( )

| Reaction of employees to BPR | 1 | 2 | 3 | 4 | 5 |

| I am happy with the software change | |||||

| I have been trained on the new software | |||||

| Management communicated the change | |||||

| I am not happy for fear of losing my job | |||||

| Turnaround time for serving customers has improved |

What is your general perception of the business process re-engineering at ECOBANK?

…………………………………………………………………………………………………

****THANK YOU FOR YOUR TIME****

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Banking"

Banking can be defined as the business of a bank or someone employed in the banking industry. Used in a non-business sense, banking generally means carrying out activities related to the management of one’s bank accounts or finances.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: