International Trade Policy Assignment

Info: 7493 words (30 pages) Dissertation

Published: 20th Aug 2021

Table of Contents

Question 2……………………………………………….5

Question 3……………………………………………….6

Question 4……………………………………………….7

Question 5……………………………………………….8

Question 6………………………………………………10

Question 1……………………………………………….18

Conclusion……………………………………………….19

References……………………………………………….20

INTRODUCTION

The assignment comprehends the International Trade Policy and the advantages, destructiveness and the distinctive courses under which the theory of trade would be characterized successfully. Non-tariff obstruction and its distinctive ways, tariffs and its hindrances all have been talked about adequately.

PART – A

QUESTION: 1

Definition of International Trade and explaining economic pros of embracing mercantilism as an international trade policy along with cons.

International Trade permits organizations should compete in the global market and to employ competitive pricing for their products and services. As more items become handy to the market, purchasers meet their necessities, hence it increase customer satisfaction. Also, trade of items on worldwide level has an evident impact on a national economy as exports grow, as a result of this, expanding the balance of international payments and importantly contributing to a country’s gross domestic product (GDP). It hugely influence the political and social aspects of a nation. Global exchange need been in vogue starting with time immemorial. With expanding require from entire markets business sectors organizations search different strategies to smoothen the trade across international markets. Different hypotheses need been postulated that assistance to comprehending those global exchange mechanisms and policies related to it.

Economic advantages of embracing mercantilism as an international trade policy:

Mercantilism the primary hypothesis for universal trade, may be an investment particular idea to the reason for building a wealthy and capable state, which accepts that those riches of a country could only be achieved through legislature controls and regulation for trade, business and financial exercises. It includes riches accumulation, establishment of positive trade with other countries and the improvement of internal resources in the manufacturing and farming field. The budgetary arrangements that pursued by the Mercantilists, for example, like Governmental control of the utilization and exchange of precious metals, which is frequently referred to as Bullionism.

Adam smith defined the term “mercantile system” to depict those framework of political economy that looked for should improve the organizations in the nation. This framework commanded Western European budgetary thought and policies, including Portugal, France, Spain and Great Britain from those sixteenth of the late eighteenth centuries. Its utilize might have been favored by journalists for example, Jeanbaptiste Colbert, who at once was the French Finance Minister.

The important benefits of this trade policy are as follows:

- Mercantilism leads to benefits and prepares for a nation to become prosperous.

- Mercantilism leads a greater amount trade, which will result into financial development. The increasing trade will absolutely spike interest, hence modern development will take after. Export of foods will lead to growth in agriculture.

- The Growth will need an immediate effect for employments. Employees will do work, they will get paid and the unemployment issue will stop with stay an issue. Mercantilism will likewise support entrepreneurship. With more exchange and higher profits, more yearning business people will get the funds and have the capacity to get risks to run their own businesses.

- Mercantilism prompts more excellent impact to a locale and over continents. Countries relying upon the goods and services of a country will be indebted in different ways. Foreign relations “among different countries will enhance and makes them stronger.

This theory has some drawbacks as well which are following:

- Mercantilism is a one way traffic. Colonialism was a direct fallout of mercantilism and everyone knows how that panned out from the United States to India. The focus being entirely on money, everything else takes a backseat, from human rights to will of people. Trade and commerce cannot be the only benchmarks for a country’s well-being. There are many other aspects of life. Mercantilism leads to constant strife among counties. Every country will want the best for itself and that will lead to protectionism, military conflict, sabotage and all kinds of heinous games in the international arena.

- The strict rules on government interventions as a method of the theory may result to inefficiency and corruption.

- The monopoly policies provided to certain firm frequently tends to increased copyright.

- It causes deflation in the wages of the workers in order to amend greater amount of profits.

QUESTION: 2

Comparison and contrast theory of absolute and comparative advantage:

Absolute vs Comparative Advantage: Fariha Ahmad

| Absolute Advantage Theory | Comparative Advantage Theory |

|

|

|

|

|

|

|

|

|

|

Explanation of the comparative theory in context of New Zealand attempt of bolstering its economy:

With the Trans Pacific Partnership Agreement (TPP) New Zealand, it opened new limits for working smooth and safe international trade. The TPP opened up new business sectors for the nation and with this the industries of the nation of New Zealand get a great chance in establishing out their goods and services in 11 important markets both across Asia and across The Pacific (Nunn & Trefler, 2013). By the comparative advantage, theory the profits related to the TPP agreement could easily comprehend. With increment in the manufacturing of volume of goods, the organizations might try to seek competitive advantage. The products of the organizations of New Zealand would be fabricated at a much more low opportunity cost. This might thereby expand the market share of the New Zealand enterprises (Onyemelukwe, 2016). In addition to this since the theory incorporates in expanding the product of goods at an overall basis therefore the increment would be marked in the increase in production of goods of the nation. The companies have also gained easy access in the diverse markets as they have fabricated better goods in comparison to others within the limited period and with the same available resource.

QUESTION: 3

Explanation of rationale behind the two agreements using Factor Endowment theory:

The Factor Endowment theory is used to determine the comparative advantage. In this segment, the theory is used to depict the logic behind New Zealand’s signing of the free trade agreement and the Trans Pacific Participation Agreement in the context of comparative advantage the nation has incorporated (Feenstra, 2015). Since New Zealand masters in producing primary goods therefore using this as an abundance factor has enhanced the comparative advantage in those primary goods and gained the nation easy access in international trade. The nation of New Zealand is heavily endowed in better service exports and foreign investments. All of these therefore overall led the nation in expanding its market in cross borders and territories. The Factor Endowment Theory explains that a country possess diverse amount of resources but there are certain factors whose perfect utilization result in comparative advantage. New Zealand in comparison to other countries largely relied on trade to boost its economy. Therefore, their exports of goods and services in comparison to other countries were much better and the signing of the two agreements made their companies to make an easy access in the foreign markets. With the help of the factor, endowment theory the abundant resources of the New Zealand could easily identified and the main reason behind the signing of the two agreements could be determined. The TPP agreement signing of the nation with other 11 countries enabled companies of New Zealand to import their goods in some of the world’s biggest consumer markets. The factor endowment theory determined the significance New Zealand market gained due to the increment of production of goods at a low opportunity cost in comparison to other countries. The abundance factor that is the better goods at a larger volume made by the same resources in the limited time frame were utilized in the most effective form.

QUESTION: 4

Explanation of five reasons for trade barriers:

The reasons behind the implementation of trade barriers are as follows Prabhat S. (2011)

1. Protecting Domestic Employment:

The levying of tariffs is often highly politicized. The possibility of increased competition from imported goods can threaten domestic industries. These domestic organizations may fire workers or shift production abroad to cut costs, which means higher unemployment and a less happy electorate. The unemployment argument regularly shifts to domestic industries complaining about cheap foreign labour, and how poor working conditions and lack of regulation allow foreign companies to produce goods more affordably. In economics, however, countries will continue to produce goods until they no more have a comparative advantage (not to be confused with an absolute advantage).

2. Protecting Consumers:

A government may levy a tariff on products that it feels could endanger its population. For example, South Korea may place a tariff on imported beef from the United States if it thinks that the goods could be tainted with disease.

3. Baby commercial industries:

The utilization of tariffs to secure new born child commercial industries could be seen by the Import Substitution Industrialization (ISI) method employed by many developing nations. The government of a developing economy demand levy tariffs on foreign products in industries in which it needs to encourage growth. This inflation in the prices of items and generated a domestic market for domestically produced goods while protecting those industries from being forced out by more competitive pricing. It decreases unemployment and allows developing countries to shift from agricultural products to finished goods.

Criticisms of this sort of protectionist methodology revolve around the cost of subsidizing the development of infant industries. If a business develops without competition, it could wind up producing lower quality goods, and the subsidies required to keep the state-backed business afloat could sap economic growth.

4. National Security:

Barriers are also employed by developed countries to protect certain industries that are deemed strategically important, for instance the individuals supporting national security. Defence industries are frequently seen as vital to state interests, and often enjoy important levels of protection. For example, same time both Western Europe and the United States are industrialized, both are very protective of defence-oriented organizations.

5. Retaliation:

Countries may also set tariffs as a retaliation technique if they think that a trading partner has not played by the rules. For example, if France believes that the United States has allowed its wine producers to call its domestically produced sparkling wines “Champagne” (a name specific to the Champagne region of France) for too long, it may levy a tariff on imported meat from the United States. If the U.S. agrees to crack down on the improper labelling, France is likely to stop its retaliation. Retaliation can also be employed if a trading partner goes against the government’s foreign policy objectives.

QUESTION: 5

Meaning of Non-tariff barrier and its types:

A nontariff barrier is a form of restrictive trade where barriers to trade are set up and take a form other than a tariff. Nontariff barriers include quotas, embargoes, sanctions, levies and other restrictions and are frequently used by large and developed economies. Nontariff barriers are another way for an economy to control the amount of trade that it conducts with another economy, either for selfish or altruistic purposes.

There are four types of non- tariff barriers which are as follows: Saqib Shaikh (2003)

1. Quantity Restrictions, Quotas and Licensing Procedures:

Under this system, the most extreme amount of different commodities which would be allowed to be imported over a period of time from various countries is fixed in advance.

The quantity allowed to be imported or quota fixed normally relies upon the relations of the two countries and the need of the importing country.

Quotas are very often joint with Licensing System to regulate the flow of imports over the quota period as also to allocate them between various importers and supplying countries. In this system a license or a permit has to be obtained from the Government to import the goods mentioning the quantity and the country from which to import.

2. Foreign Exchange Restrictions:

Under this system the importer must be sure that adequate foreign exchange would be made available for the imports of goods by obtaining a clearance from the exchange control authorities of the country before concluding the contract with the supplier.

3. Technical and Administrative Regulations:

The imposition of technical production, technical specifications etc. to which an importing commodity must conform. Such type of technical restrictions is imposed in case of pharmaceutical products etc. Besides technical restrictions, administrative restrictions such as adherence to certain documentary procedure are adopted to regulate imports. These measures impede the free flow of trade to a large extent.

4. Preferential Arrangement:

The member countries of the group negotiate and arrive at a settlement of preferential tariff rate to carry on trade amongst themselves. These rates are much lower than the ordinary tariff rates and applicable only to the member nations of the small group. This preferential arrangements made outside the purview of the GATT and EEC etc.

Trade barriers, for example, government approaches and directions that support neighbourhood providers are called the non-tariff barriers. New Zealand would need to identify the trade deficiencies in its company and would need to work according to it in an efficient way. New Zealand would need to take up the barriers and consider its use towards it. Sometimes these measures are not well designed to help the works and protect the health of the consumers effectively. The government of New Zealand tries to decrease the tariffs so that consumers may get on the business effectively which may help them to grow their business in a beneficial way. Some of the information may need to be used by the government of New Zealand are:

a. Identify the opportunities and the gaps that may be helpful in addressing the works effectively in international regulatory system.

b. It helps a business to be more aware of the market challenges that may organize at any moment of trade and how it may be beneficial to help reducing the tariffs effectively.

c. Enable a company to organize diagonally over government organizations to determine complex non-tariffs measures that are altogether affecting your fare organizations.

d. Maintaining the standards of the product, labelling and packaging may be helpful in maintaining the non-barrier tariffs effectively.

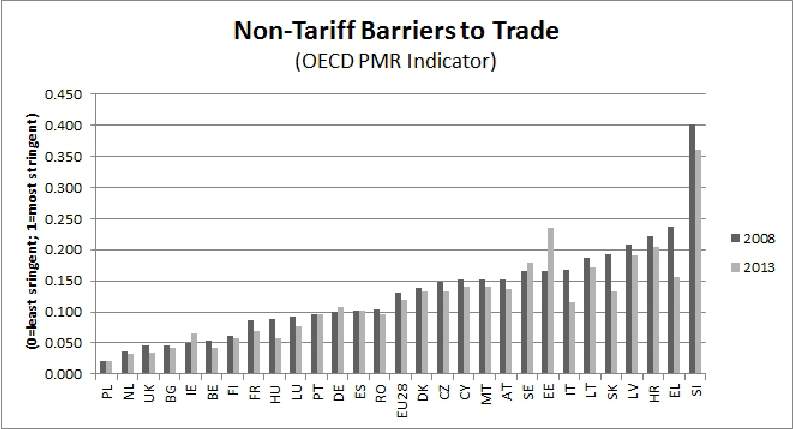

Fig 1. Non-Tariff Barriers to Trade

(Source- Zhu, 2016)

QUESTION: 6

A. Price Based Barriers:

Price Based Barriers are the presence of high start-up expenses or different disheartening that keeps new contenders from effectively entering an industry or range of business. It may also be known as the barrier option, which becomes active or inactive. Barriers entering the benefit existing organizations officially working in a business since they secure a setup association’s incomes and profits from being whittled away by new contenders. Some of the common barriers that include special benefits on tax implied on the existing firms, customer loyalty, patents, and customer high shift cost and brand identity (Nagy, 2013). A knock-in barrier choice may not be practiced until and unless the cost of the basic resource achieves the barrier value, which may be mentioned in the agreement. In the meantime, the current increment in chance sharing contracts proposes that organizations will participate in these agreements to the degree at present permitted under existing laws and directions. So, these price based barriers may affect in the following ways given to which would be necessary to work effectively without any issue.

B. International Price Fixing:

The company according to its preferences is determining a value of an item. Cost setting is building up the cost of an item or administration, as opposed to enabling it to be resolved normally through free showcase of power. These setting up of price may act harmfully for some of the countries. Some legislations makes it illegal to keep the price same under some circumstances. However, there is no safety against the fixing of price. It would be the choice of the business to set up a cost, which may be of their choosing and keeping the cost intact, which may force the consumer to, but that particular product at the same value (Chiarella & Di Guilmi, 2015). Therefore, if a country decides to impose a tariff on a particular product or a service it can be assumed that the country is trying to restrict the circulation of the specified product or service within the country. If consumers think that the price is unfairly high then the following points could be done:

1. Purchasing a particular goods or services of lower price

2. Diminishing the consumption of the product making it unprofitable for the business to keep the prices fixed.

3. Purchasing the product from other country

These points may be effective in the context of the consumer if the companies does not compromise on its base cost. Through, this it may happen that business may rebuild the value according to the consumers.

C. Financial Limits:

A Financial limits can be characterized as the maximum amount of price exchange that can be done throughout a trading day. Limits are commanded by the trades on which prospects contracts exchange and exist keeping in mind the end goal to lessen instability in the market. It is likewise called an exchanging limit. There is number of maximum trading that can be done in a day. These limits may vary place by place. The greatest number of trading that can be done throughout a day, profit and loss that may occur through some security or also may be unoriginal through the day (Bell, Filatotchev, & Aguilera, 2014). There may be few advantages that may beneficial in extending the Financial Limits are as follows:

1. Lower of Credit Utilization and increasing credit score

2. Simpler to get additional credit

3. Provide assistance in the time of emergency

4. Increasing of getting rewards

5. Have the power to purchase large amount efficiently

6. Helps in avoiding the credit score

These points may be helpful in effectively understanding and using the financial limits that may cause hazards in trading daily and using it effectively. If, the daily trading are being done effectively then it may be helpful for the business implementing it.

D. Foreign Investment Controls: The fundamental target of the foreign investment controls may be said to be the diminishment of the investments that come from foreign to improve the New Zealand payments. These controls may be done through powerful use of the monetary items that the country would be using to make efficient working of the investment (Chizari, Assadollahpour & Hosseini, 2013). This objective ought to be sought after under two general requirements: one may be the impartial treatment of capital-trading organizations secured by the controls, and the other is shirking of pointless impedance in business hone.

QUESTION: 7

A. Import tariff:

Import tariff is the tax that is normally imposed on the goods as well as services that are imported from any place outside the country. Import tariff generally changes the value of the products that are imported from any area outside the country. Thus, imposing of tariff on particular good increases the cost of the same making it hard for the citizens to buy. However, as a general matter, tariff is used to restrict the trade within a country. Therefore, if a country decides to impose a tariff on a particular product or a service it can be assumed that the country is trying to restrict the circulation of the specified product or service within the country (YANG & WEI, 2014). However, on the other hand, the import tariff is also intended to protect or save the domestic economy. Import tariff is also known as import duty.

B. Export tariff:

The duty or the tariff that is levied over a specific product or service exported from the country is known as export tariff. Such kind of a tariff can be recognized as a strategy of the government to gather foreign revenue. Higher export tariffs help the government to earn foreign currency through selling of a particular product or service (with greater export tariff) in other countries. Similarly, lowering of the export tariff is connected with the strategy of enhancing export to an outside economy making greater recognition of the economy to other outside economies (Sorkin, 2016). However, the putting a higher export tariff while exporting goods (services or products) might prove to be a risk of decrease in demand of the specific item (or service) in the international economy. Lowering the same might be taken as a step to encourage export from within the country.

C. Transit tariff:

Transit tax is a kind of tax or tariff that is charged to an item or a commodity passing through a custom area. However, this kind of tariff is allowed only on those products that are en route to any other country. Therefore, the transit tariff is imposed on the product or a commodity that is exported from within a country to any other country. This kind of tariff or duty is also known to provide certain insurance to the local business sector as well as the domestic industry (Bishop et al 2016). However, there is also a scope for the legislature to win income (as any other form of tariff) while providing an effective business beyond the worldwide limits.

D. Specific duty:

As the name suggests, the specific duty is the tariff that is forced on a specific item that is being imported in a country from over the boundaries. The tariff or the duty is imposed as a specific amount over a specific quantity of the product that is imported in the country. For instance, the specific duty (or specific rate duty) is levied on a product that is as per the unit such as cents per kilogram. This kind of tariff can be imposed on the products that can be weighed as a quantity (Irwin, 2014). This is in opposite of the promotion valorem duty that is taken or measured over a fixed percentage.

E. Ad valorem duty:

This sort of duty is also forced on an item that is imported in a particular country. As has been mentioned in the above discussion Ad valorem is a tariff or duty that is imposed on imported products in a country. The tariff is mainly dependent on the amount of the item that is imported. The charge levied under this kind of tariff is characterized in terms of the percentage value that is fixed (Liu et al. 2016). Therefore, it can also be described in the way that such a tariff is imposed on the products that do not have any fixed weight but is counted as numbers or as values.

F. Compound duty:

The compound duty or compound tariff is imposed on each item that is imported within the national boundaries of a country. The compound duty can be simply explained as a combination of the two entities, the specific (rate) duty and the Ad valorem duty. This kind of duty is imposed based on both the weight of goods as well as the value of the good that is imported. Compound duty is therefore imposed the products that possess both the value as well as can be measured as weight.

Tariff is an essential factor of an economy as it helps in characterizing the vitality of the domestic products in the national or domestic market (Baccini & Urpelainen, 2014). The most necessary implication of tariff is that it helps in securing the domestic market along with saving the infant industries that are flourishing in the domestic economy. However, tariffs have certain effects over the prices of the commodity sold and bought in the domestic economy.

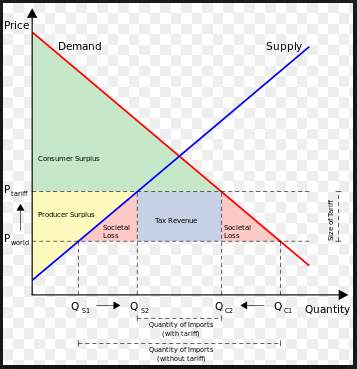

Figure 2: Supply-Demand Graph in a normal economy

(Source: Self-developed)

When a tariff is levied on imported products the procedure remain higher in the local business. As a result, the domestic producers need not decrease their prices. Thus, the cost remains higher forcing the customers to pay such higher amounts. On the other hand, such higher process in the market results in reduction of the efficiency of the producers. This is because; businesses that would not have survived in high competitive market would remain functional in such a situation.

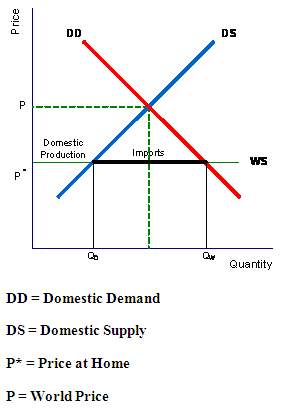

Figure 2: Price without tariff

(Source: Self-developed)

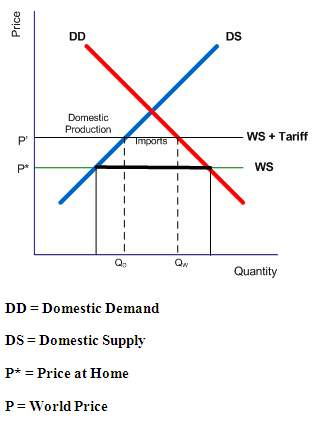

Figure 3: Price under the effect of Tariff (Source: Self-developed)

In figure 3, due to inflation in cost of the items, the process increases in the domestic market hence limiting the volume of imports. Moreover, the domestic producers are forced to produce items that are of higher quality in order to survive in the market (Davis, 2014). However, this also results in inflation in prices that the customers end up paying.

The major cause for attenuation of tariff by NZ government is that they had an outlook to enter into the international trade. Such reduction in tariffs has allowed the country to have direct foreign investment along with exporting subsidies and availing other industry supports.

QUESTION: 8

Explanation of two techniques to promote international trade

Different strategies could be implemented to promote international trade in New Zealand and support its small economy. The two strategies that are discussed in this section are as follows:

1. Foreign Trade Zones: A zoned out geographic arena imposes low custom duties on the manufactured products and foreign stock. Alongside this, the segmented out area also gives a less awkward custom methods. The implementation of a FTZ zone empowers an organization to decrease extensive measure from claiming scrap as they do not must pay duty on the products that are destroyed. This in turn reduces the production loss of a company and thereby increases the economy (Wagner, 2014). The establishment of FTZ even reduces the trade custom duty that increased the firm’s total production cost. There are beneficial aspects related to the FTZ like no quota chatters on re exports, low tariff rates on foreign inputs. All benefits might profit New Zealand as they are tending more towards elaborating their markets by signing agreements like the free trade policy and the Trans Pacific Participating Agreement.

2. Subsidies: The government of a country gives help to its domestic producers in the form of cash payments. Tax breaks, low interest loans etc. this is called as subsidy. Subsidiary largely prevents international competition and enhances the competitiveness locally or regionally as well as internationally by the export process. The benefits related to subsidies clearly determine its positive impact on the international trade of New Zealand. Since the major abundance factor of the nation is the primary goods produced by the domestic industries (Bieler & Morton, 2014). Therefore, granting relief in the above stated form would clearly motivate the producers to exaggerate their production units and operate more effectively in comparison to before. The improvisation in the local business would strengthen their roots and would help them to maintain their viability among the tough competitors of the international market. In addition to this the domestic markets would be able to retain their identity in the international market without compromising on the production quality of the goods. There are diverse industries of the nation that would get benefited on the implementation of the certain subsidies by the government.

QUESTION: 9

Role of WTO in modern international trade:

In this progressively globalized scenario, organizations need to be globally competitive in order to survive. Knowledge and understanding of different countries’ economies and their market is a must for creating oneself as a worldwide player. Now the business has gone beyond the limits of a country and has transformed into the worldwide business. It’s quite necessary to understand the meaning of international trade and the international organization popularly known as World Trade Organization (WTO) and its contribution towards the international business and smooth trading between countries.

International trade is defined as an agreement where two parties (These parties may operate their business in different countries trading in goods and services) enters into the transaction of buying and selling of goods and services irrespective of national boundaries. This involves the import and export trade where one country either sells goods or service to other country or buys goods and service from other country. Followings are the five essentials for such international trades –

- The agreement of sale of products.

- The agreement of carriage of products.

- The agreement of insurance for the products.

- The agreeability with exports and imports authorities in terms of formalities and documentation required.

The role of WTO in international trade is as stipulated in the Agreement establishing it (Article III of the Agreement establishing WTO) and includes:

1. Facilitating the implementation, administration and operation and furthering the objectives of the agreement establishing it and other Multilateral Trade Agreements and providing the framework for the implementation, administration and operation of the Plurality Trade Agreements. (Article III of the Agreement establishing WTO).

2. Providing the forum for negotiations among its Members concerning their multilateral trade relations in matters dealt with under the agreements in the Annexes to the Agreement setting it up and for the results of such negotiations as may be decided by the Ministerial Conference. (Article III of the Agreement establishing WTO).

3. Administering the Understanding on Rules and Procedures Governing the Settlement of Disputes or the Dispute Settlement Understanding which is Annex 2 to the agreement setting it up. (Article III of the Agreement establishing WTO).

4. Administering the Trade Policy Review Mechanism in Annex 3 of the agreement setting it up. (Article III of the Agreement establishing WTO).

5. Cooperating as appropriate with the International Monetary Fund and the International Bank for Reconstruction and Development [a.k.a. the World Bank] with a view to achieving greater coherence in global economic policy making. (Article III of the Agreement establishing WTO).

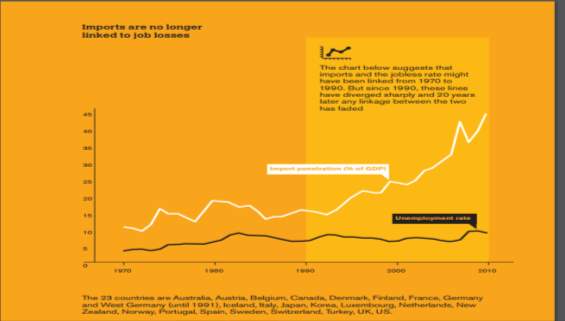

Figure 4: Employment Ratio

(Source: Laufs, & Schwens, 2014)

PART: B

QUESTION: 1

Entry mode beneficial to Walmart for international expansion:

For an easy access in the markets of New Zealand, the best market entry mode for Walmart would be Acquisition mode of market entry. It is one of the most favourable vehicles for foreign market investments. Acquisition is the process by which one organization acquires another organization by mutual acceptance by both the firms. The major benefits Walmart would get on implementing this mode is reduction in competition levels. Competition is one of the biggest threat in any marketing expansion whether it is international or domestic expansion. In addition to this the entry mode would help the organization to adapt to new technologies and make effective outcomes. This would also increase their distribution network in the new marketing arena.

Recommendations for the company to reduce risks associated with the entry mode:

Despite of being advantageous in nature there are certain critical risks attached to the Acquisition market entry mode. However, these risks could be mitigated by following the understated recommendations.

The recommendations are as follows:

Avoidance of Sick units: While selecting organizations for acquisition it is essential to opt for business units that are healthy in nature. The business is prospering in the current market and is effective in terms of its operational exercises.

Acquisition of Strong base company: Acquiring a company that has a strong customer base would reduce the competitiveness with others in the market and the acquisition would turn out be a successful option.

Avoiding of business units with high liabilities: In order to retain a strong hold in the international market it is essential to acquire organizations that although have mediocre profit rates but have no liabilities. As this increase the failure risks and setbacks in the global market.

Consistent performers: Business units that are consistent performers in global market provide an additional profit to the acquiring business.

Risk Management plan For Walmart:

For effective management of risks Walmart needs to implement a risk management plan:

Risk identification: It is one of the initial method of the risk management plan. In order to reduce risks it is essential to identify it. Interviews, checklists, direct observations etc. could identify it.

Risk Analysis: Risk could be evaluated by two methods qualitative and quantitative. Quantitative risk analysis involves the probability with which a particular risk could analyse.

There are majorly three questions related to quantitative analysis:

➔ What can happen?

➔ How acceptable could happen?

➔ What will be the consequences?

While in case of Qualitative risk analysis the probability of the risks are analysed by risk rating scales, interviews etc.

Risk response planning: It is the process by which opinions are formulated and actions are suggested to increase opportunities and mitigate risks

Risk monitoring: It is the method by which the identified risks are tracked or monitored. It also monitors the future upcoming risks that could arise

CONCLUSION

The impact of the global operating entity and the modern business practices have been discussed in the topic. Hence, it may be concluded that the risks that are being faced both in the national and international level have to be identified effectively. So that the harmful effects that may be faced by the country may get a bit effective.

REFERENCES

Azab, C., Key, T. M., & Clark, T. (2017). Country Market Sequential Order-of-Entry: A Learning Effects Approach. Journal of Global Marketing, 1-18.

Baccini, L., & Urpelainen, J. (2014). International institutions and domestic politics: can preferential trading agreements help leaders promote economic reform?. The Journal of Politics, 76(1), 195-214.

Beghin, J. C., Maertens, M., & Swinnen, J. (2015). Nontariff measures and standards in trade and global value chains. Annu. Rev. Resour. Econ., 7(1), 425-450.

Bell, R. G., Filatotchev, I., & Aguilera, R. V. (2014). Corporate governance and investors’ perceptions of foreign IPO value: An institutional perspective. Academy of Management Journal, 57(1), 301-320.

Bieler, A., & Morton, A. D. (2014). Uneven and combined development and unequal exchange: the second wind of neoliberal ‘free trade’? Globalizations, 11(1), 35-45.

Bishop, G. A., Stedman, D. H., Burgard, D. A., & Atkinson, O. (2016). High-Mileage Light-Duty Fleet Vehicle Emissions: Their Potentially Overlooked Importance. Environmental science & technology, 50(10), 5405-5411.

Chiarella, C., & Di Guilmi, C. (2015). The limit distribution of evolving strategies in financial markets. Studies in Nonlinear Dynamics & Econometrics, 19(2), 137-159.

Chizari, A. H., Assadollahpour, F., & Hosseini, S. (2013). Social welfare impacts of imposing an import tariff on maize market in Iran compared to an export tax in China and Brazil using: a game theory approach. Journal of Agricultural Studies, 1(2), 1-12.

Dabla-Norris, E., & Duval, R. (2016). How Lowering Trade Barriers Can Revive Global Productivity and Growth. IMF Blog.

Davis, L. W. (2014). The economic cost of global fuel subsidies. The American Economic Review, 104(5), 581-585.

Egger, P., Francois, J., Manchin, M., & Nelson, D. (2015). Non-tariff barriers, integration and the transatlantic economy. Economic Policy, 30(83), 539-584.

Fariha Ahmad, Mercantilism, Feenstra, R. C. (2015). Advanced international trade: theory and evidence. Princeton university press.

Feenstra, R. C. (2015). Advanced international trade: theory and evidence. Princeton university press.

French, S. (2016). The composition of trade flows and the aggregate effects of trade barriers. Journal of International Economics, 98, 114-137.

Heckscher, E. F. (2013). Mercantilism. Routledge.

Investopedid, LLC (2017), Irwin, D. A. (2014). Tariff Incidence: Evidence from US Sugar Duties, 1890-1930 (No. w20635). National Bureau of Economic Research.

Laufs, K., & Schwens, C. (2014). Foreign market entry mode choice of small and medium-sized enterprises: A systematic review and future research agenda. International Business Review, 23(6), 1109-1126.

Laursen, K. (2015). Revealed comparative advantage and the alternatives as measures of international specialization. Eurasian Business Review, 5(1), 99-115.

Li, Y., & Beghin, J. C. (2014). Protectionism indices for non-tariff measures: An application to maximum residue levels. Food Policy, 45, 57-68.

Liu, Z., Li, L., Ding, Y., Deng, H., & Chen, W. (2016). Modeling and control of an air supply system for a heavy duty PEMFC engine. International journal of hydrogen energy, 41(36), 16230-16239.

Nagy, C. (2013). Resale price fixing after the revision of the EU vertical regime—a comparative perspective. Acta Juridica Hungarica, 54(4), 349-366.

Nunn, N., & Trefler, D. (2013). Domestic institutions as a source of comparative advantage (No. w18851). National Bureau of Economic Research.

Onyemelukwe, C. C. (2016). The science of economic development and growth: The theory of factor proportions. Routledge, Parbhat S. (2011)

Saqib Shaikh (2003) Sorkin, S. (2016). Freight Charge Liability. Goods in Transit, 4.

Vaggi, G., & Groenewegen, P. (2016). A concise history of economic thought: From mercantilism to monetarism. Springer.

Wagner, M. (2014). Regulatory Space in International Trade Law and International Investment Law.

YANG, S. H., & WEI, S. D. (2014). Export Subsidy or Export Tariff? A Game Analysis of Trade Policies and Timing Choices Based on Carbon Tariff. International Economics and Trade Research, 2, 004.

Zhu, J. J. (2016). Analysis of New Zealand Specific Electric Vehicle Adoption Barriers and Government Policy.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "International Relations"

International Relations are the partnerships, connections and relationships between countries and different cultures. Such relationships within the subject of International Relations can relate to laws, economics, policies, and more.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: