Case Study: Metso Corporation

The history of

Metso Corporation goes all the way back to 1750’s when it started as a small shipyard in Viapori. Later in the early 20th century it ended up in the ownership of the Finnish state and become part of Valmet. At least three of the companies forming part of the present Metso Corporation date back to the 19th century. These companies are The Karlstad foundry (Sweden 1865), Sunds Bruk (Sweden 1868), and the Nordberg Manufacturing Company (United States 1886). Metso, as we know it today, was created after a long period of internationalization and acquisitions and through the merger of Valmet and Rauma in 1999. Metso is a world-leading industrial company offering equipment and services for the sustainable processing and flow of natural resources in the mining, aggregates, recycling and process industries. they have operations in more than 50 countries and 175 locations on six continents, have over 12,000 employees from 82 nationalities. ("Our history – We shape and make history every day | Metso 150 years - Metso," 2018)

- Metso and services (Servitization of manufacturing)

The increasing importance of services in manufacturing firms is a phenomenon whose antecedents stretch back 150 years (Schmenner, 2009) and there are several reasons for the transfer of industrial business towards services. For instance, economic reasons, customer needs, and the competitive advantage that services can provide. Economic reasons include the observation that services have higher margins than goods, and they provide a more stable source of revenue than goods due to their resilience against the economic cycles. Customer needs are linked to servitization in many ways. One of the most important factors is increasing specialization: customer organizations want to focus on their core competences and outsource noncore functions, such as maintenance, to the provider of the capital equipment (Oliva & Kallenberg, 2003). Competitive reasons are based on several specificities of services as an example, they are difficult to imitate, they are less capital dependent, and they are a way for manufacturers to escape the typical problems of mature business (Gebauer, Gustafsson, & Witell, 2011). In early 2000, Metso had all three reasons that addressed above which encouraged them to change their strategy, and now the service portion counts already for a significant part of the turnover since, in 2017, Metso’s sales were about EUR 2.7 billion, and 65 percent of that came from services-related businesses (

Metso’s Annual Review, 2017). Also, in 2017 Metso announced its decision to split its mineral services business area, which focus on the aggregates industry, as well as mining and recycling customers, into two separate units: Minerals Services and Minerals Consumables. The changes, which will come into effect at the start of 2018, as president and CEO Nico Delvaux said, “The new structure will allow a natural split of the services business and a clearer focus to drive further growth for services in close co-operation with the minerals equipment businesses” (CeciliaJamasmie, 2017). As I mentioned earlier in this paragraph, the first special attention to the service sector in Metso corporation came back to the beginning of the 21st century when the minerals and ores industry has boomed because of the increasing Asian demand, especially in China. For example, the minerals and ores are needed in order to build roads, houses, and railways in all developing countries. The high demand for metals contributes to that the prices are increasing. Based on this fact there is no doubt that the mining business is growing which gives the mining equipment producers great opportunities. A problem that arises with the growth and profitability is that it makes the business more attractive to competitors. As a result of the growing mining business, Asian manufacturers of mining equipment have emerged. This is a problem for companies that are producers of mining equipment and actions are about to be taken. It is still a matter of continuously improving their machines, but they identify highest potential for future growth within the service and aftermarket segment. Therefore, Metso, was in a turnover stage in its history; new sales were getting difficult and global competition was tough. To improve the situation, Metso developing a mindset to include a services business in its offering. For this change, the structure and culture appear to be in a central role, since Metso is a machinery manufacturer and the service culture does not flourish because, as firm shifts from focusing on manufacturing goods to becoming a service provider, it must change from being product-centric (and geographically structured) to customer-centric (Kowalkowski, Kindström, & Witell, 2011). However Metso was quite successful since, in the middle of the economic slowdown in 2009, when the mining segment was one of its bigger verticals and the extracting industry was already feeling the heat of falling prices (UNCTAD, 2009), compared to their rivals, Metso had a better position, based on the Joao Ney (headed the services division of the mining and construction segment on that time), this success related to the decision, taken back in 2007 to change the business model and focus on services. Because, during the slowdown, Metso saw a change in its clients' priority. "Capital expenditure was falling, and the emphasis was to repair, rebuild and increase the efficiency of the installed capacity," says Ney. The company was able to benefit from this approach (Thomas, 2013). It was a step away from the company's traditional business model that centered around supplying technology and creating processes for new installed capacity.

Blue Ocean Strategy is a modern theory used to interpret why competitive changes occur and how a company can influence these changes. The possibility to influence a market is a very important aspect in the Blue Ocean Strategy because it reveals the chance to foresee new market opportunities and a new way to conduct business. This theory describes that companies will be successful if they create “blue oceans” of unchallenged market space instead of competing with other companies in so-called “red oceans”. This strategy focuses on value innovation, which is primarily about increasing the value for the customers. Value innovation is explained as: “Instead of focusing on beating the competition, you focus on making the competition irrelevant by creating a leap in value for buyers and your company, thereby opening up new and uncontested market space” (Ulaga, 2003). we can observe Metso took this strategy in order to cope with the new situation and improve its competitive advantage, since customer value creation are important sources for it.

Furthermore, the theoretical framework for this study mainly is the resource-based theory that views firms, as the source of competitive advantage that resides in the resources (assets and capabilities) available to the firm and is a structure for understanding how competitive advantage is achieved within the firm and how this advantage can be sustained over time.

In line with Metso's strategy to deliver customer value solutions and grow the scope of the services business globally, acquired new companies to develop solutions and services to improve the efficiency, usability and quality of customers' production processes through its entire life cycles and achieve its new goal which was to transform into a long-term partner for customers. Acquisition entails lower information and management costs, as well as lower risk, relative to a greenfield investment and Metso had lots of experience from acquiring new companies all over the world. Additionally, reference to (Hennart & Park, 1993) and based on a wide range of Metso’s activities, more diversified firms are assumed to prefer acquisitions, because they have developed sophisticated control systems that can be exploited through foreign acquisitions, providing organizational efficiency; Also all the largest Finnish companies have traditionally preferred acquisitions to greenfield investments as noted in Handbook on small nations in the global economy (Van den Bulcke, Verbeke, & Yuan, 2009).

Metso has indeed recognized the need for new kinds of technological competencies to build the new applications. Its aim is to understand and take into use technologies that are currently owned by subcontractors, customers etc. Metso also seeks to use IT as a part of existing solutions, in order to build services around them. Therefore, acquired EPT Engineering Services Private Limited an Indian engineering company providing design, detail engineering and value added services such as conceptual design and 3D modeling to the power, pulp and paper, oil, gas and petrochemical industries (news, 2012) and ExperTune Inc. a US software company founded in 1986 and their products are widely used as software tools to analyze and monitor the performance of industrial processes and to identify the associated maintenance and improvement opportunities. The acquisition expands and strengthens Metso's ability to globally provide business-enhancing services to customers. The combination of ExperTune's products and Metso's services portfolio extends their capability to offer solutions targeted to improving process and business performance. ExperTune's products will be sold as stand-alone solutions that can be used in any automation system environment and as part of Metso's performance business solutions, targeted to optimize plant performance (news, 2013).

Organizational knowledge is essential for the future success and competitiveness of the company on the ever-accelerating market. This knowledge also plays an influential role in the service activities and Metso by more than hundred years’ experience from different projects around the world and expertise in subsidiaries could obtain a competitive advantage even in the service field with managing its knowledge through subsidiaries. Because, value-based selling involves deep knowledge of customers and their value. It also requires a reactive posture to support the customer react to environmental changes in and showing them how the adapted offering can help them create value (Töytäri, Brashear Alejandro, Parvinen, Ollila, & Rosendahl, 2011) and all these will be feasible by transferring and sharing knowledge between units. On the other hand, Knowledge and experience as form of intangible assets that has no physical presence but can still be owned by the company, unlike physical resources, built over a long time and is something that other companies cannot buy from the market. Intangible resources usually stay within a company and are the main source of sustainable competitive advantage. But how Metso manage and transfer this knowledge across its territory.

The units within Metso Mining share each other’s knowledge by allocating the experts within a specific field among the entire region, to gain superior experience in every project. The cooperation between different sites is often intensive and they act like internal consultants to each other. All factories within Metso Mining have the same needs and they strive to share information and technologies even on a global scale by having global manufacturing meetings. There is no or very little rivalry between different sites and they ask for help or advice if a plant demands it. And when a new plant is opened they bring in expertise from a lot of countries in the world in order to secure quality and exchange knowledge ("Metso Life Cycle Services," 2018).

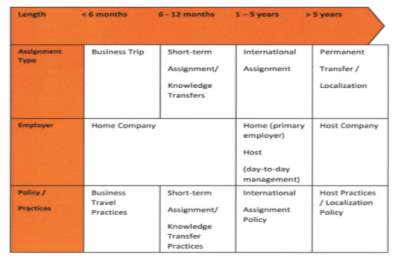

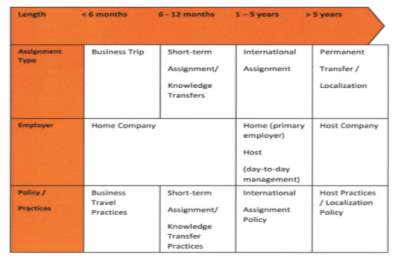

However, one of the ways they apply in whole Metso corporation, are expatriates, a typical definition to an expatriate is a national of one country who is sent by a parent organization to live and to work in another country (Caligiuri, Tarique, & Jacobs, 2009). In this study an expatriate is defined by benefiting Metso’s own framework for assignment types (figure 1), meaning that whenever discussing about Metso’s expatriates, they are included into the frames of ‘international assignment’ by length from one to five years ("Metso’s Internal Report,," 2011).

Figure 1. Framework for assignment types by Metso

Expatriates gain a vast and deep range of knowledge when working and living abroad. This knowledge enables organizations to understand and manage culturally diverse and turbulent conditions in a world that requires global awareness and local sensitivity and as we can see they have a short-term assignment only with the purpose of knowledge transferring. Moreover, they are critical for aligning a new acquired with organization policies and objectives, according to (Riusala & Smale, 2007) the presence of expatriate has been empirically demonstrated to positively affect host resemblance of parent organizational practices, the diffusion of strategic organizational practices over borders, and high levels of shared values between parent and subsidiary. In addition, expatriates are prominent senders of organizations, tacit knowledge. As can be deduced from the internationality of the company, the role of expatriatism plays a major role at Metso. In May 2011, Metso had over 100 expatriates working in 20 countries. Most of the expatriates have been sent from Finland, but several other nationalities are represented as well. Metso has long traditions in sending expatriates abroad, and their convention has been to do so particularly after acquisitions and joint ventures to increase the level of internal trust. ("Metso’s Internal Report,," 2011, slide 7.)

Another way of knowledge sharing is Metso’s Performance Management Tool, in practice, Performance Management Tool refers to Metso’s Annual Review Process, which has been created in 2011 to all Metso employees, teams and units in order to draw a clear picture of what is expected of them, how their performance is measured or evaluated and how good performance will be rewarded and is divided into two parts: the Performance Review and the Development Review. Development Review is a framework for sustainable employee development and company performance, where Metso’s values, leadership principles and strategic capabilities are linked to the employee’s personal competences (Metso’s Intranet release 2011). In addition, they have Metso's global training programs and the overall goal is to enable people from different businesses and areas to network and to gain new perspectives and solutions for the challenges of everyday work; their program also was supplemented with the new Services Management program in 2012. As the services business has a central role in Metso’s business strategy, the training program was designed to build a shared view of the business across the company (mining, 2016).

Furthermore, recently in 2017, they run a Metso Innovation Hackathon event a one-day event where new ideas were developed in collaboration with different areas of Metso organization. It is an internal innovation challenge and collaboration event. The hackathon provided an opportunity to develop new ideas and to accelerate existing development projects (

Metso’s Annual Review, 2017).

One of the critical issues faced by multinational enterprises involves the establishment and maintenance of legitimacy in their multiple host environments. Besides the two acquisition which associated to the new strategy of Metso according to the 2017 financial annual report, it owns more than 70 subsidiaries in 46 countries (

Financial Statements and investor information, 2017); As a result, dealing with the liability of foreignness would be an important issue for Metso. Based on the Institutional theorists that organizational legitimacy is shaped by three sets of factors: (1) the characteristics of the institutional environment, (2) the organization's characteristics and actions, and (3) the legitimation process by which the environment builds its perceptions of the organization. following to the OECD’s definition, over 60% of Metso’s net sales were classified as environmental business already in 2007 (Vaartimo, 2008), and the number is rising so they face various regulations have been put in place to protect the environment from governments and international organizations, especially in the last decades.

Metso to some extent has been successful by adding sustainability in their vision and currently, their environmental portfolio includes customer solutions for recycling, water management and process optimization, energy efficiency, clean technology solutions, and waste management. Also investing on its green and sustainable strategy and its commitment towards green practices and sustainability is so much that one section of their three sectioned annual report is devoted to sustainability, moreover 84 percent of Metso's R&D projects had sustainability targets in 2017 (

Sustainability Supplement, 2017). Additionally, Metso has been able to use green marketing practices strategically where it is able to showcase how green its products are and how much environmental benefits they will bring to their customers' business. they have come up with an online eco-calculator in which one can create scenarios as to which selected Metso technologies to improve the cost and environmental efficiency of certain industrial processes ("Eco-efficient mining research project - Metso," 2018). Lastly, Metso has been cooperating with Plan International, an independent development and humanitarian organization that advances children's rights and equality for girls, for several years and its current contribution with Plan India helps to develop education in local schools in Alwar, Rajasthan state including 8,000 children.

Conclusion:

Based on the evidence from Metso annual reports and other sources, we can see this company was successful in its new strategy in services which still attempting to improve it. In the beginning service operations had started hand in hand with product manufacturing, the first step being the provision of repair and maintenance services and separate units for service development and delivery were established later (decision to divide the service business from manufacturing in the mining sector) and even acquired new firms. Also, Metso seeks to advance its knowledge management system by using various methods of communication, policies, and events. Finally, Metso increasingly uses CSR activities to strengthening and building competitive advantage and reach legitimacy.

References:

Caligiuri, P., Tarique, I., & Jacobs, R. (2009). Selection for international assignments.

Human Resource Management Review, 19(3), 251-262.

CeciliaJamasmie. (2017, 2017-08-18T03:40:24-07:00). Metso searches for top execs, as it splits minerals services business | MINING.com. Retrieved from

http://www.mining.com/metso-searches-top-execs-splits-minerals-services-business/

Eco-efficient mining research project - Metso. (2018). Retrieved from

https://www.metso.com/solutions/eco-efficient-mining/

Financial Statements and investor information. (2017). Retrieved from

https://www.metso.com/siteassets/documents/2018/english/metso_2017_fs_en_2.pdf

Gebauer, H., Gustafsson, A., & Witell, L. (2011). Competitive advantage through service differentiation by manufacturing companies.

Journal of business research, 64(12), 1270-1280.

Hennart, J.-F., & Park, Y.-R. (1993). Greenfield vs. acquisition: The strategy of Japanese investors in the United States.

Management science, 39(9), 1054-1070.

Kowalkowski, C., Kindström, D., & Witell, L. (2011). Internalisation or externalisation? Examining organisational arrangements for industrial services.

Managing Service Quality: An International Journal, 21(4), 373-391.

Metso Life Cycle Services. (2018). Retrieved from

https://www.metso.com/solutions/life-cycle-services/

Metso’s Annual Review. (2017). Retrieved from

https://www.metso.com/siteassets/documents/2018/english/metso_2017_ar_en_3.pdf

Metso’s Internal Report,. (2011). In. PowerPoint slides-presentation by an anonymous author.

mining. (2016, 2016-08-22T13:54:07-07:00). How Metso shifted its service offerings to customer outcomes | MINING.com. Retrieved from

http://www.mining.com/giuseppe-campanelli-vice-president-life-cycle-services-at-metso-minerals/

news, M. g. w. (2012). Metso strengthens its global engineering capability by acquiring EPT Engineering Services in India - Metso. Retrieved from

https://www.metso.com/news/2013/8/metso-strengthens-its-global-engineering-capability-by-acquiring-ept-engineering-services-in-india/

news, M. g. w. (2013). Metso strengthens its plant optimization services by acquiring U.S. software company ExperTune Inc - Metso. Retrieved from

https://www.metso.com/news/2013/1/metso-strengthens-its-plant-optimization-services-by-acquiring-u.s.-software-company-expertune-inc/

Oliva, R., & Kallenberg, R. (2003). Managing the transition from products to services.

International journal of service industry management, 14(2), 160-172.

Our history – We shape and make history every day | Metso 150 years - Metso. (2018). Retrieved from

https://www.metso.com/company/about-us/history/

Riusala, K., & Smale, A. (2007). Predicting stickiness factors in the international transfer of knowledge through expatriates.

International studies of management & organization, 37(3), 16-43.

Schmenner, R. W. (2009). Manufacturing, service, and their integration: some history and theory.

International Journal of Operations & Production Management, 29(5), 431-443.

Sustainability Supplement. (2017). Retrieved from

https://www.metso.com/siteassets/documents/2018/english/metso2017_gri.pdf

Thomas, P. (2013). Surviving Slowdown- the Metso Way | Forbes India Blog. Retrieved from

http://www.forbesindia.com/blog/business-strategy/surviving-slowdown-the-metso-way/

Töytäri, P., Brashear Alejandro, T., Parvinen, P., Ollila, I., & Rosendahl, N. (2011). Bridging the theory to application gap in value-based selling.

Journal of Business & Industrial Marketing, 26(7), 493-502.

Ulaga, W. (2003). Capturing value creation in business relationships: A customer perspective.

Industrial marketing management, 32(8), 677-693.

UNCTAD. (2009).

Global economic crisis: implications for trade and development. Retrieved from

http://unctad.org/en/Docs/cicrp1_en.pdf

Vaartimo, O. ( 2008). Metso in renewable energy and energy-efficiency. Retrieved from

http://www.metsoautomation.com/corporation/ir_eng.nsf/WebWID/WTB-080616-2256F-B3990/$File/020608_Glitnir%20energy%20seminar.pdf

Van den Bulcke, D., Verbeke, A., & Yuan, W. (2009).

Handbook on small nations in the global economy: The contributions of multinational enterprises to national economic success: Edward Elgar Publishing.

However, one of the ways they apply in whole Metso corporation, are expatriates, a typical definition to an expatriate is a national of one country who is sent by a parent organization to live and to work in another country (Caligiuri, Tarique, & Jacobs, 2009). In this study an expatriate is defined by benefiting Metso’s own framework for assignment types (figure 1), meaning that whenever discussing about Metso’s expatriates, they are included into the frames of ‘international assignment’ by length from one to five years ("Metso’s Internal Report,," 2011).

Figure 1. Framework for assignment types by Metso

Expatriates gain a vast and deep range of knowledge when working and living abroad. This knowledge enables organizations to understand and manage culturally diverse and turbulent conditions in a world that requires global awareness and local sensitivity and as we can see they have a short-term assignment only with the purpose of knowledge transferring. Moreover, they are critical for aligning a new acquired with organization policies and objectives, according to (Riusala & Smale, 2007) the presence of expatriate has been empirically demonstrated to positively affect host resemblance of parent organizational practices, the diffusion of strategic organizational practices over borders, and high levels of shared values between parent and subsidiary. In addition, expatriates are prominent senders of organizations, tacit knowledge. As can be deduced from the internationality of the company, the role of expatriatism plays a major role at Metso. In May 2011, Metso had over 100 expatriates working in 20 countries. Most of the expatriates have been sent from Finland, but several other nationalities are represented as well. Metso has long traditions in sending expatriates abroad, and their convention has been to do so particularly after acquisitions and joint ventures to increase the level of internal trust. ("Metso’s Internal Report,," 2011, slide 7.)

Another way of knowledge sharing is Metso’s Performance Management Tool, in practice, Performance Management Tool refers to Metso’s Annual Review Process, which has been created in 2011 to all Metso employees, teams and units in order to draw a clear picture of what is expected of them, how their performance is measured or evaluated and how good performance will be rewarded and is divided into two parts: the Performance Review and the Development Review. Development Review is a framework for sustainable employee development and company performance, where Metso’s values, leadership principles and strategic capabilities are linked to the employee’s personal competences (Metso’s Intranet release 2011). In addition, they have Metso's global training programs and the overall goal is to enable people from different businesses and areas to network and to gain new perspectives and solutions for the challenges of everyday work; their program also was supplemented with the new Services Management program in 2012. As the services business has a central role in Metso’s business strategy, the training program was designed to build a shared view of the business across the company (mining, 2016).

Furthermore, recently in 2017, they run a Metso Innovation Hackathon event a one-day event where new ideas were developed in collaboration with different areas of Metso organization. It is an internal innovation challenge and collaboration event. The hackathon provided an opportunity to develop new ideas and to accelerate existing development projects (Metso’s Annual Review, 2017).

However, one of the ways they apply in whole Metso corporation, are expatriates, a typical definition to an expatriate is a national of one country who is sent by a parent organization to live and to work in another country (Caligiuri, Tarique, & Jacobs, 2009). In this study an expatriate is defined by benefiting Metso’s own framework for assignment types (figure 1), meaning that whenever discussing about Metso’s expatriates, they are included into the frames of ‘international assignment’ by length from one to five years ("Metso’s Internal Report,," 2011).

Figure 1. Framework for assignment types by Metso

Expatriates gain a vast and deep range of knowledge when working and living abroad. This knowledge enables organizations to understand and manage culturally diverse and turbulent conditions in a world that requires global awareness and local sensitivity and as we can see they have a short-term assignment only with the purpose of knowledge transferring. Moreover, they are critical for aligning a new acquired with organization policies and objectives, according to (Riusala & Smale, 2007) the presence of expatriate has been empirically demonstrated to positively affect host resemblance of parent organizational practices, the diffusion of strategic organizational practices over borders, and high levels of shared values between parent and subsidiary. In addition, expatriates are prominent senders of organizations, tacit knowledge. As can be deduced from the internationality of the company, the role of expatriatism plays a major role at Metso. In May 2011, Metso had over 100 expatriates working in 20 countries. Most of the expatriates have been sent from Finland, but several other nationalities are represented as well. Metso has long traditions in sending expatriates abroad, and their convention has been to do so particularly after acquisitions and joint ventures to increase the level of internal trust. ("Metso’s Internal Report,," 2011, slide 7.)

Another way of knowledge sharing is Metso’s Performance Management Tool, in practice, Performance Management Tool refers to Metso’s Annual Review Process, which has been created in 2011 to all Metso employees, teams and units in order to draw a clear picture of what is expected of them, how their performance is measured or evaluated and how good performance will be rewarded and is divided into two parts: the Performance Review and the Development Review. Development Review is a framework for sustainable employee development and company performance, where Metso’s values, leadership principles and strategic capabilities are linked to the employee’s personal competences (Metso’s Intranet release 2011). In addition, they have Metso's global training programs and the overall goal is to enable people from different businesses and areas to network and to gain new perspectives and solutions for the challenges of everyday work; their program also was supplemented with the new Services Management program in 2012. As the services business has a central role in Metso’s business strategy, the training program was designed to build a shared view of the business across the company (mining, 2016).

Furthermore, recently in 2017, they run a Metso Innovation Hackathon event a one-day event where new ideas were developed in collaboration with different areas of Metso organization. It is an internal innovation challenge and collaboration event. The hackathon provided an opportunity to develop new ideas and to accelerate existing development projects (Metso’s Annual Review, 2017).