Payroll Management's Role in Company Development and Operational Efficiency

Info: 9692 words (39 pages) Dissertation

Published: 8th Sep 2021

Tagged: Accounting

Contents

Introduction

In 1920, a group of business men launched The Slough Trading Company Ltd. In 1926, the company was renamed Slough Estates Ltd (SEGRO, 2018). The company started out with a 243-hectare site but by the end of the 1930’s boosted two sites and a workforce of approximately 23,000 people (SEGRO, 2018). Since its humble beginnings, SEGRO has continued to grow within the UK through various mergers and expanded globally with operations in Australia, Canada, USA and Europe (SEGRO, 2018). Today, it is the leading owner-manager and developer of modern big box and urban warehousing property within the UK and nine European states with £9.3 billion in assets (SEGRO, 2018).

SEGRO (2018) states on its website that it’s goal is to be the “best owner-manager and developer of warehouse properties in Europe and a leading income-focussed REIT”. To achieve this SEGRO has developed a three-pillared strategy which involves: disciplined capital allocation, operational excellence and efficient capital & corporate structure (Figure 1). This report will focus on the importance of operational excellence and the important role payroll management plays in the company’s development and operational efficiency.

Payroll is managed by the payroll manager and the payroll administrator. There are seventeen different payrolls to manage across the UK and Central Europe (Appendix 4). SEGRO has outsourced payroll processing to ADP for Italy, the Netherlands, Luxembourg, Germany, France, Poland and the UK. Payroll for the Czech Republic is outsourced to Mazars, and Belgium’s to Partena (Appendix 4).

All processes are documented to reduce payroll errors which will not only serve as a reference document for the payroll function, but for all key departments involved in all payroll processes. Payroll processes constantly change with the introduction of new legislation, policies, and technology. It is important that the organisation keeps procedures up-to-date to allow for better continuity planning and reduction of business risk. Having a small Payroll team without formalised procedures is a great risk to the operations of the business.

Figure 1: SEGRO’s Business Strategy

It has been identified that existing payroll procedural documents needs development within SEGRO. This report seeks to evaluate the management skills and techniques which are important when updating these documents and recommend ways in which to improve them. Also, it will outline a timeline in which these improvements can be effectively implemented.

Rationale

Even the most well-made processes and procedures require evaluation, because over time simpler, more efficient means of undertaking processes manifest (CIPP, 2018). Apart from the ability to make processes much simpler, quicker and more effective; outdated processes can lead to potential issues and errors in SEGRO’s payroll.

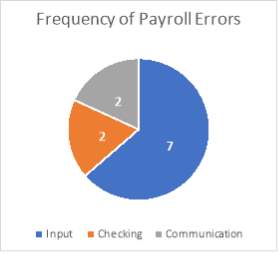

Appendix 1 illustrates all logged payroll errors between April and June 2018. These errors ranged from human input errors, communication errors, to checking errors. This is the further highlighted in Figure 2. The chart shows that of the eleven logged errors, seven were due to human input errors. This indicates that there is an underlying issue with the data the payroll department is being provided with by the Human Resource (HR) department.

Figure 2: Types of Payroll Errors & Their Frequency

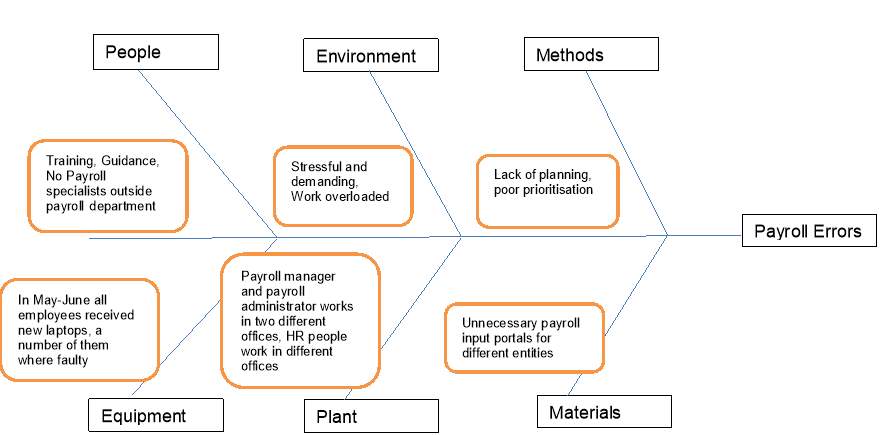

Appendix 3 depicts a fishbone graph as a means of uncovering the underlying causes for the high number of input error logs. The graph highlights that there is a loss of payroll knowledge and lack of communication outside of the payroll department, yet the Financial and Human Resource departments are heavily involved in the monthly payroll process. Secondly the fishbone graph indicates that there is also insufficient guidance. In conjunction, this rules out the personnel as the root issue and puts the blame on the procedural document, or lack thereof. Without employees receiving comprehensive material and guidance to carry out their task, consequently the payroll processes cannot be carried out as efficiently or effectively as required by SEGRO. To add to this point, without comprehensive procedures and policies employees are unable to learn from their mistakes and employees cannot be held accountable for their mistakes because they were not provided with the necessary procedures to carry out their duties.

The most practical solution to eliminate this unceasing issue is to implement new procedural and process documentation, allowing for the employees carrying out the individual processes to have their input into the structuring of the processes being re-developed. Who best to co-facilitate the development of new procedural documents than the various departments using it daily.

Payroll remains a highly tactical function, requiring endless support from personnel, and more often than not, accounting for the highest proportion of an organisations total expenses (Barack, 2016). With that being said, there is a need to make the payroll procedure and processes more efficient and effective in order to assist in achieving one of SEGRO’s three pillars- operational excellence.

Improvement Proposal

SEGRO’s payroll challenges, as seen in the SWOT analysis below (Table 1), include a lack of standardized payroll processes and procedures, lack of integration across departments, no continuity or review of processes, few payroll staff and a high work volume. From the SWOT analysis, the opportunities for improvement far exceed the strengths of the existing framework. It is also apparent that there are some considerable threats to maintaining the status quo which would include damage to the reputation of the payroll function as well as the company’s overall strategy.

It is important that a more comprehensive payroll management be implemented to enable the SEGRO’s multinational payroll function to contribute to the organisations goals. It is important that the procedural document is clear and unambiguous for all stakeholders (HR department, Finance department, IT department, HMRC, ADP, Mazars, Partena, and tax advisors), who are involved in the payroll processes.

| Strengths

|

Weaknesses

|

| Opportunities

|

Threats

|

Table 1: SWOT Analysis of SEGRO’s Current Payroll Procedural Document

Measurement & Benchmarking

Measurement is a method of control (CIPP, 2018). Metrics are used to measure the current state of an organisation, whereas benchmarks tells the company where they want to be (HR Resource, 2012). The discrepancies uncovered between the two illustrate to the organisation areas that need improvement and act as a spur for improvement (ibid.). There is a continual need for organisations to improve their operational performance, thus any way of improving processes should be acted on as they are fundamental in increasing the organisations efficiency, and thus impacting the organisations bottom line and the achievement of its strategic goals.

Benchmarks

A benchmark is a representation of the ideal, of where a company wants to be. It sets the goal for a process that the company will strive to meet (HR Resource, 2012). For instance, if SEGRO’s benchmark for payroll errors is to keep errors under five occurrences per quarter but the actual number of errors at the end of the quarter are eleven, as with the case of the April-June 2018 quarter, then this tells SEGRO that improvements need to be made, and processes need to be implemented to improve the payroll department’s efficiency and get the number of errors within a closer range of the benchmark.

Balanced Scorecard Approach

The balanced scorecard, developed by Kaplan and Norton in 1992, is a performance metric developed to identify and improve internal processes of a business and their outcomes, providing invaluable feedback to the organisation (Investopedia, 2018). In today’s competitive environment, looking at an organisations financial metrics isn’t enough, but rather a multi-faceted approach needs to be adopted when analysing an organisations operational metrics (Kaplan & Norton, 1992). Thus, Kaplan & Norton (1992) contributed their balanced approach, considering both its financial and operational measures, to provide a clearer image of how an organisation’s performance.

The balanced scorecard allows a manager to perform a cross-functional analysis and look at problems from multiple perspectives, enabling he/her to make a well-rounded decision (DeBenedetti, 2018). The scorecard focuses on four areas in particular- learning & growth (training), business processes, customers (in this case- the various departments and external stakeholders) and finance (Investopedia, 2018).

Summary

When there is a range of metrics that measure and assess key points on several processes, which are then measured against the benchmarks for those points, a detailed plan of action can be drawn up that will address the metrics that need to be improved in an order that is most logical and most beneficial for the company (HR Resource, 2012). Research has shown that better decisions are made after adopting Kaplan & Norton’s Balanced Scorecard tool to weigh options (DeBenedetti, 2018). With adopting the Balanced Scorecard approach, SEGRO will be able to identify the factors hindering their Payroll Department and its processes and outline changes to be made and track the effectiveness of these changes using future balance scorecards (Investopedia, 2018).

Considerations

The new procedural and policy document may be liable/subject to all sorts of ‘teeth trouble/problems’, which may in turn have an impact on the stakeholders and achieving the required output. The new document may clash with the engrained culture, values or strategy, resulting in obstruction of the change effort.

For these process changes to be successful certain criterion needs to be met:

- A structured framework for introduction,

- Executive level support,

- Readiness to change,

- Stakeholder engagement in the process,

- Understanding the risk and create a contingency plan

- Plan for continuous improvement once the process has been re-engineered (CIPP, 2018).

People

Processes cannot accomplish what they were designed to do without its human counterpart. But just as how processes have to be designed to complete tasks, so do employees. Employees require a combination of knowledge, skills and motivation to execute processes- all of which management can provide.

A major challenge the Payroll Manager will need to overcome is the interdepartmental divide among the departments involved in payroll. It will be the Payroll Managers job to incentivise tasks, break down resistances to working across departments and to motivate individuals to ensure that they are fully engaged for these processes to be successfully implemented.

It will be those who are performing the tasks and using the procedural document who will notice the issues in the new process, as such it is important that employees feel comfortable enough to give the feedback necessary to fine-tune the process. Employees should be empowered and encouraged, research suggest that task significance may influence motivation, it is important to highlight to employees and other stakeholders how important they are and how much of a difference their contribution is making to the success of the payroll process.

Culture

The aim of overhauling the procedural documents is to challenge and change the way payroll processes are carried out, however this change is implausible to take if it is conflicts with the organisations culture or rather the way stakeholders are used to getting things done. It is vital that management is committed to these changes. In addition to management, employees involved with processing payroll need to be educated and informed throughout the implementation, especially those that have grown comfortable in the way they carry out tasks, to limit the risk of the implementation failing (DeBenedetti, 2018).

Team Work

A challenge the Payroll Manager will need to overcome is the interdepartmental divide within the project team. The process owners of individual processes will cross over departmental boundaries and, as such, it will be the Payroll Managers job to encourage employees to break down resistances and work across departments to successfully complete the payroll process in the most efficient and effective way.

Training

Training employees is equally as important as the planning and implementation because the employees are the other half of the equation, without them the new procedures and processes cannot be implemented. (DeBenedetti, 2018)

Legislation

When considering the delivery of the new procedural document it is important that issues with liability, the ever-changing legal requirements of policy documents and the various payroll documents and data security be considered.

Cost

SEGRO should not just consider the financial cost to the organisation but also the cost of the time it takes to plan and implement the new procedural documents, as well as the time taken to train employees on the new procedures. Considerations need to be made the cost of delays in the project, and the unfortunate case of working out kinks in the newly implemented document or the unlikely instance that employees and stakeholders don’t take to the new document.

Implementation

The first step down this long path is seeking out approval from the Head of Finance to secure the financial backing necessary for the execution of the proposed plan. This is followed by assessing the current payroll processes and procedures and highlighting areas for improvements, using Kaplan & Norton’s Balanced Scorecard tool. For the plan to be successful, a lot of input is required from the various departments and stakeholders. As such relevant meeting times need to be scheduled in advance to avoid possible delays to the plans implementation. A committee, with members from the relevant departments and external stakeholders needs to be created (Holwegner, 2018). The committee will include employees from each department involved in the payroll processes, as they are in the best position to suggest how the processes should be carried out. By taking this approach it is anticipated that the desired results are more likely.

The proposed plan will take a continuous approach, otherwise known as the Kaizen, as the author does not wish to reinvent the organisation’s current payroll procedural documents but rather make subtle changes to the existing procedures and processes. Taking this approach enables allows for the creation of a cycle of improvement, which is needed due to the frequent changes to legislation, policies and technology involved with processing and preparing payroll, especially in multinational organisations such as SEGRO (Johnston et al., 2012). Adopting this approach also allows for employees to get involved in the process, which will prove vital for the project’s success as these individuals will be the ones to use such procedures (ibid.). The Payroll Manager will be the one responsible for rolling out the new procedural documents, and any future performance evaluations and adjustments that need to be made to documentation in future.

The project is meticulously outlined in the GAANT chart (Appendix 2). The GAANT chart shows that the projected completion time is twenty-four weeks, this is to allow for a thorough job to be done in laying a solid foundation for future improvements. With the Payroll Manager heading the task he/she will need to ensure there is a balance- ensuring that staff is not overworked, keeping the implementation plan on-time without sacrificing the quality of the processes. The Payroll Manager will need to make use of skills such as capacity planning and job design. Although a thorough plan has been curated, ultimately the successful execution of it is up to the leadership of the Payroll Manager and the Steering Committee.

Training

Implementing change costs an organisation both time and money because it requires a collation an array of inputs- from the time it takes to plan and design the new processes, to its implementation (Holwegner, 2018). Investment is needed in order to bring about the efficiency the organisation requires of its Payroll department. In addition to all the planning and the plans eventual execution, there is one key ingredient missing to assure its success- the investment in training employees on how to use the newly implemented processes and procedures (Van Alstine, 2016).

After the planning and implementing the new procedural document, a decision needed to be taken on how to introduce these new procedures and policies to the employees (Holwegner, 2018). Research suggest that retention is greatest through demonstration, practise and from there teaching others (ibid.). Given that the committee is made up of members from each relevant group of stakeholders and departments, they will be the best people to introduce and train the employees.

Evaluating Results

The process isn’t finished once the new procedural documents have been implemented. The procedural documents and the newly adopted processes will need to be compared with the previous system, using Kaplan & Norton’s (1992) Balanced Scorecard tool. By comparing the initial scorecard done when planning began and the one done after the documents implementation will illustrate how effective the new procedural documents are. Progress needs to be reviewed regularly to ensure that the processes and the department remain as efficient as they can, and contribute to SEGRO’s strategic goal of operational excellence. In addition to using the Balanced Scorecard metric, feedback from the employees using the new procedures and the involved stakeholders should be sought. Through this feedback, further improvements can be made. “One important aspect of performance management is performance improvement” (Johnston, et al., 2012). These improvements can lead to further reduction in cost and improved operational efficiency (ibid.)

Conclusion

The main goal of this proposal was to ensure that all departments would be satisfied with the Procedural documents while at the same time making efficient use of SEPRO’s resources. The overarching theme of the proposed procedural document is founded on CIPP’s (2018) approach of designing quality in, which results in payroll processes being optimised, specified and controlled and consequently leads to an increase in the consistency of the payroll process and minimise the amount out errors (CIPP, 2018).

Things and times are constantly changing and as a result processes and procedures will have to be revamped regularly (CIPP, 2016). This especially rings true for payroll processes as they change with introduction of new government legislations, policies and technology. Even the best developed systems require maintenance and upgrade, processes and procedures are no different.

For the project to be a success it requires engagement at every level of the business. The bigger the engagement in the project the greater the success will be yielded in delivering improvement to the operational processes and business strategies. Self-sufficient teams and maximisation of existing resources will deliver quality through cost minimisation but also knowledge sharing and optimisation will feature heavily.

There are many contributing factors to the success of the project. Ultimately it will be the people who drive this process forward and the management of the process improvement team and their input which will generate the best results. The people who are operating the functions within the business are arguably the people who know their processes best and so careful selection of these resources is imperative. It is also important that processes are documented quickly, breaking down any barriers or conflicts which are culturally embedded and replacing them with full engagement in the project. Once the benefits and personal gains can be seen and incentivised it will allow for improved partnership between all parties.

Recommendations

- Targets are agreed with senior management and rolled out,

- The procedural document needs to stipulate or provide standardized forms and worksheets for all relevant departments to use when providing information to the payroll team to cut down on the human input errors,

- Procedural document implemented as soon as possible,

- Payroll Manager needs to measure performance and support the process and employees throughout,

- Evaluate to results,

- Continuously improve, ensuring procedures and processes align with SEGRO’s strategic goals.

Reference List

Barak, D. (2016) The strategic importance of payroll. Available at: https://www.cloudpay.net/resources/the-strategic-importance-of-payroll/ (Accessed: 11 July 2018).

CIPP (2018) ‘Study Material’, FDPP2334: Improving services and operations. Chartered Institute of Payroll Professionals.

DeBenedetti, J. (2018) How the balanced scorecard affects project management. Available at: http://smallbusiness.chron.com/balanced-scorecard-affects-project-management-76180.html (Accessed: 13 July 2018).

Holwegner, T. (2018) Implementing a new process? dont forget to train people how to use it. Available at: https://www.lce.com/Implementing-a-new-process-Dont-forget-to-train-people-how-to-use-it-1313.html (Accessed: 14 July 2018).

HR Resource (2012) Using benchmarks and metrics in a payroll department. Available at: http://www.hrresource.com/articles/view.php?article_id=12546 (Accessed: 14 July 2018).

Investopedia (2018) Balanced scorecard. Available at: https://www.investopedia.com/terms/b/balancedscorecard.asp (Accessed: 14 July 2018).

Johnston, R., Graham, C., and Shulver, M. (2012) Service operations management: improving service delivery. 4th edn. Essex: Pearson.

Kaplan, R.S. and Norton, D.P. (1992) The balanced scorecard – measures that drive performance. Available at: https://umei007-fall10.wikispaces.com/file/view/Kaplan%26Nortonbalanced+scorecard.pdf (Accessed: 13 July 2018).

SEGRO (2018) Strategy. Available at: http://www.segro.com/about-us/our-business/strategy?sc_lang=en (Accessed: 10 July 2018).

SEGRO (2018) 1920’s & 30’s. Available at: http://www.segro.com/about-us/history/1920s-and-1930s?sc_lang=en (Accessed: 10 July 2018).

SEGRO (2018) 1940’s & 50’s. Available at: http://www.segro.com/about-us/history/1940s-and-1950s?sc_lang=en (Accessed: 10 July 2018).

SEGRO (2018) 1960’s & 70’s. Available at: http://www.segro.com/about-us/history/1960s-and-1970s?sc_lang=en (Accessed: 10 July 2018).

Van Alstine, S. (2016) ‘Payroll management no easy task’, Bottom Line, 32(13), pp. 19.

Appendices

Appendix 1

| Date | Location | Issue | Originating Team | Resulted in Pay Error | Resulting Action | Cause |

| April 2018 | Czech Republic | Acting-up allowance was entered as a separate element, instead it was a salary including acting-up allowance. | HR | Yes | To recover payments in three instalments. | Input |

| April 2018 | France | Duplicate holiday processed. | Payroll | No | To amend the holiday balance on payslip. | Input |

| April2018 | Poland | Civil law contract amount was taken as a gross but it was a net amount. | Finance | Yes | Correction in next month. | Input |

| May 2018 | Netherlands | Wrong salary amount entered- typing error. | Payroll Partner | Yes | Correction in next month. | Checking |

| May 2018 | France | Cheques have not been sent to leavers (shares related to payments). | Payroll | Yes | To send the cheques ASAP. | Comms. |

| June 2018 | France | Employee was not made a leaver in payroll. | HR | Yes | Correction in next month. | Input |

| June 2018 | SELP Finance | Late bonus instruction to payroll. | HR | Yes | Processing in following period. | Comms. |

| June 2018 | UK | Pensions: Employer’s percentage not entered. | Payroll | Yes | Correction in next month. | Input |

| June 2018 | SEGRO Non-Exec | Wrong middle name entered for new joiner. | Payroll | No | To amend next month. | Input |

| June 2018 | UK | Car rebate not updated following pay increase in April. | Payroll | Yes | To backdate the payments. | Input |

| June 2018 | SEGRO Non-Exec | Employee number for new starter was allocated wrongly by using another employee number. | HR | No | Corrected immediately. | Checking |

Appendix 2

| Task |

06/08/2018 |

13/08/2018 |

20/08/2018 |

27/08/2018 |

03/09/2018 |

10/09/2018 |

17/09/2018 |

24/09/2018 |

01/10/2018 |

08/10/2018 |

15/10/2018 |

22/10/2018 |

29/10/2018 |

05/11/2018 |

12/11/2018 |

19/11/2018 |

26/11/2018 |

03/12/2018 |

10/12/2018 |

17/12/2018 |

07/01/2019 |

14/01/2019 |

21/01/2019 |

28/01/2018 |

| Identify human resource requirements. | ||||||||||||||||||||||||

| Prepare focus group presentation. | ||||||||||||||||||||||||

| Schedule focus group meetings, identify locations for meetings book these locations and additional resources requirements. | ||||||||||||||||||||||||

| Initial focus group meeting. | ||||||||||||||||||||||||

| Review internal payroll processes. | ||||||||||||||||||||||||

| Gather feedback, input, requirements, constraints. | ||||||||||||||||||||||||

| Designate roles and responsibilities. | ||||||||||||||||||||||||

| Agree timings and ensure that deadlines can be achieved. | ||||||||||||||||||||||||

| Attend second focus group meeting. | ||||||||||||||||||||||||

| Collate information gathered from focus group review content and propose additional action points. Check on progress. | ||||||||||||||||||||||||

| Attend third focus group, collate processes and documentation to prepare first draft document. | ||||||||||||||||||||||||

| Send out first draft document for feedback/review. | ||||||||||||||||||||||||

| Put feedback from the first draft into action. | ||||||||||||||||||||||||

| Distribute second draft document for review. | ||||||||||||||||||||||||

| Collate feedback from second draft document and put any feedback into action. | ||||||||||||||||||||||||

| Produce final version. | ||||||||||||||||||||||||

| Establish access to the document. Schedule quarterly review meetings and process for updating document. | ||||||||||||||||||||||||

| Distribute versions to the appropriate teams. | ||||||||||||||||||||||||

| Establish processes and rules for updating the document when changes occur before the next scheduled review. |

Appendix 3

Appendix 4

CENTRAL EUROPEAN PAYROLL POLICY AND PROCEDURES

Documented by Payroll Services Manager

January 2018

Reviewed and approved by Head of Financial Reporting

The Central European payroll processing and services can be split into 3 areas:

Payroll processing outsourced to ADP and managed by UK Shared services

Ten European Payrolls are currently managed and processed by the Shared Services in the UK using ADP as the outsourced payroll provider. The payrolls for the countries processed by ADP are as follows:

(i) Germany

(ii) Netherlands (SEGRO BV Non Executive and SEGRO Netherlands B. V.)

(iii) Luxembourg (SEGRO Luxembourg Sarl and SELP Luxembourg)

(iv) Italy (SEGRO Italy employees only not the Vailog business)

(v) Spain

(vi) Poland

(vii) France (SEGRO France and SEGRO PLC Suc Francaise)

This Central European payroll policy and procedures document cover this payroll process specifically.

Payroll processing outsourced to providers other than ADP and managed by UK Shared services

Two European Payrolls are managed and processed in UK by the Payroll Services Manager and the Payroll administrator, using local payroll provider in the relevant country:

(i) Belgium – Outsourced to Partena (This is a pre-pension payroll for 1 ex-employees that will expire at the end of March 2021).

(ii) Czech Republic – Outsourced to Mazars (Under the umbrella of larger accounting services contract for this country).

For these payrolls please refer to country specific payroll procedures.

Payroll managed by the local country and not by the UK Shared services

The Vailog business was acquired in 2016, and the payroll process is still managed by the local country accounts team and no the UK shared services.

For this payroll please refer to country specific payroll procedures.

New corporate acquisitions will continue to operate within their existing payroll policy and processes (subject to Director of Finance / Group Finance Controller approval) until a decision is made to align with the SEGRO Central European Payroll Policy and Procedures.

Payroll processing outsourced to ADP and managed by UK Shared services

SEGRO has outsourced payroll processing to ADP, a payroll specialist, who through their own internal teams as well as 3rd party suppliers (who contracted to them) are responsible for:

- on-time and accurate processing of payroll service through the local country payroll software

- provision of an on-line secure portal (ADP Streamline) for submission of employee data

- compliance with statutory regulations

Access to the ADP Streamline is limited to the Payroll Services Manager, the Payroll Services Administrator and the Head of Financial Reporting. Any new user access to ADP Streamline must be approved by the Head of Financial Reporting and is requested by the Payroll Manager via email. Only ADP can set up the access and send the Username and Password by email to the new user.

This policy is to be read in conjunction with:

- CE Monthly Payroll Process Notes (Appendix 1)

- CE Monthly checklist

- ADP Streamline timetables

- ADP Streamline Standard Operating Procedure Manual

Data Source and responsibilities

The onus for the accuracy and the correctness of employee data lies with HR as such they must ensure that the data provided to UK Payroll (being Payroll Services Manager and Payroll Services Administrator) is accurate and correct. There are two types of data:

- Fixed data – This relates to ‘permanent data’ which includes information for new starters, leavers and employee salaries. HR are responsible for populating and maintaining employee records in the HR system (People Central). An authorised HR person (HR Business Partner / HR Business Associate) will produce an Excel file for all the changes to data in the month which will be provided to the UK Payroll for processing via email. UK Payroll produce a Flexifile with the data in Excel and upload to the ADP Streamline portal and notifies ADP within the portal that the information is ready for processing.

- Variable data – This relates to ad hoc ‘non-permanent data’ which includes information for employee expenses, changes to car allowance, pro-rata calculations, and redundancy payments. HR are responsible for providing all non-permanent changes to the UK Payroll Manager/Payroll administrator each month, this information is communicated via emails. The exception to this is for the following information,

- Shares based payment and dividend information which is communicated directly to the UK Payroll Manager by Group Secretariat via email with a password protected Excel file; and

- New company car information which is received from the local Office Manager of the country

- Meal Vouchers received from Business Unit Director’s PA for France; in Luxembourg the number of the vouchers is fixed (for Italy and Czech Republic the information is sent from the Office Manager). Only for new starters, the information will be provided by the Office Manager. All other countries do not receive meal vouchers.

The variable data is communicated to ADP in the same pre-approved Excel template containing the fixed data (‘Flexifile’). The template is produced by either the Payroll Manager or the Payroll Administrator on a monthly basis based on the information provided by HR, Secretariat and Procurement. Once prepared the template is reviewed by either the Payroll Manager or Payroll Administrator (who did not prepare the template) before submitting it to ADP via the ADP Streamline portal for processing. The template should be signed by the preparer and the reviewer to evidence this process.

A different process is for the following countries:

Belgium, please refer to a separate procedure;

Czech Republic: both Fixed and Variable data are sent to Mazars by email from UK Payroll;

Netherlands is run by ADP but has no flexifile agreed with the payroll provider therefore the inputs are sent via ‘comment’ in the Streamline portal from UK Payroll.

Draft Payroll Review and responsibilities

Once the data has been processed by ADP (or the 3rd party supplier contracted directly by ADP), they provide a draft payroll which includes; payslips, variance analysis, and pre commitment reports. UK Payroll are responsible for ensuring the correctness of the draft payroll through performing the following:

- For employees where changes are expected to their payroll in the month, the changes are checked back to the data provided by HR to ensure they have been processed correctly;

- For employees where no changes are expected to their payroll in the month, the payslip data is checked to ensure this remains unchanged from the last month.

This process is evidenced by the sign off of the CE monthly payroll checklist (see appendix 2).

If any errors are found then these errors communicated to ADP via by email and the payroll cycle is rejected in ADP Streamline by UK Payroll. ADP will correct errors and send new reports. The above process is then repeated until the information is correct.

It is the responsibility of ADP to ensure the employee tax and social security deductions have been calculated correctly in reaching Net Pay based on the Gross Pay information provided by UK Payroll.

Sign off

Generally, the payroll requires two persons to provide sign off before it can be committed to payment. The sign off can only be provided by the European HR Business Partner (or the UK HR Business Partner during their absence) and the Director of Finance (or the CFO during their absence). The Payroll reports send to the approvers are the Net Payments and/or Third Party payments Summary (where applicable) and the Gross to Net Variance summary and detail reports (see step 7 of the CE Monthly Payroll Process, Appendix 1).

Occasionally, it may not be possible to secure a two person sign-off due to holidays or sickness. In such circumstances, one person sign-off is sufficient with prior approval of the Group HR Director.

Commitment

Once approval and sign off has been gained in line with point 3, the payroll is ready to be committed. This process involves:

- Approving the payroll in the ADP’s streamline portal, this will ensure that the ADP system recognises the payroll for the month has been committed to and will prevent automated email reminders being circulated. Only the Payroll Manager, Payroll Administrator and the Head of Financial Reporting who have access to ADP Streamline portal can approve.

- Emailing ADP to confirm that the Payroll has been committed to in Streamline.

- Once payroll has been processed, ADP will send a journal file and a SEPA file. In most cases, the responsibility for processing journals and the payment file lies with the Business Unit Finance Director (BUFD) except in the case of Luxembourg (SEGRO and SELP) where the payment is processed in the HSBC banking portal by UK Payroll and the journals are processed by the Corporate Accountant for SEGRO Luxembourg and SELP Accountant for SELP. The payment in the HSBC system are out through a two stage approval process requiring the Director of Finance and the SELP Finance Director approvals.

Post payment checks and Activities

The following check is performed by Payroll once the payment has been made to ensure correctness:

Check the net values on the bank file provided by ADP matches the approved payroll file signed off in step 4.

Recording and posting of monthly payroll into the MRI system.

Details of European payrolls to be processed each month are shown in the schedule below.

| Country and payroll name | Pay Day | Number of payrolls to process | Payroll Partner’s contact details | Contact for absence data and non-confidential payroll data only | Main Contact for Payroll queries/and confidential payroll data | Payroll System Used to process payroll |

| Germany

SEGRO DE |

5 working days before end of the month | One | ADP Czech Republic

Managed Services Consultant Streamline |

Office Manager | European HR Business Partner

BUFD |

ADP Streamline |

| Netherlands

SEGRO Netherlands BV (employees) and SEGRO NL (non-exec) |

5 working days before the end of the month | Two payrolls

(One payroll is Non-Execs) |

ADP Netherlands | SEGRO European Business Partner only | SEGRO European HR Business Partner only | ADP Streamline |

| Luxembourg

SELP Administration Sarl (JV employees) and SEGRO Luxembourg Sarl (employees and Non Exec) |

28th or WDB | Two payrolls

(One payroll is Non-Execs) |

ADP Agent

IF Payroll & HR |

SEGRO European HR Business Partner

(SELP only – SELP Finance Director or / SELP JV Director but reconfirmed by HR) |

SEGRO European HR Business Partner

(SELP only – SELP Finance Director or / SELP JV Director but reconfirmed by HR) |

ADP Streamline |

| Poland

SEGRO Poland |

28th or WDB | One | HR and Payroll Specialist

TMF Group |

Chief Accountant -SEGRO Poland and

SEGRO HR European Business Partner |

Chief Accountant -SEGRO Poland and

SEGRO HR European Business Partner |

ADP Streamline |

| Spain

SEGRO Spain Management |

28th or WDB | One | Sl1-Smart

ADP Employer Services Iberia |

SEGRO HR European Business Partner only | SEGRO HR European Business Partner only | ADP Streamline |

| Country | Pay Day | Number of payrolls to process | Payroll Partner’s contact details | Office Manager Contact for absence data and non-confidential payroll data only | Main Contact for Payroll queries/and confidential payroll data | Payroll System Used to process payroll | |||||

| Italy

SEGRO Italy |

28th or WDB | One |

|

Office manager – SEGRO Vailog | SEGRO HR European Business Partner only | ADP Streamline and Studio Arlarti HR Portal | |||||

| France

SEGRO France and SEGRO PLC Suc Francaise |

28th or WDB | Two | ADP France |

PA to BUD and Head of Corporate Acquisitions / Office Manager and

SEGRO HR European Business Partner |

SEGRO HR European Business Partner | ADP Streamline | |||||

| Czech Republic | On or before 15th of month following the pay month (eg 15th April for March) | One |

|

Office Manager > | SEGRO HR European Business Partner | Mazars (by email correspondence only)

Please refer to country specific details for this payroll attached as addendum 1. |

|||||

| Belgium

SEGRO Belgium |

4 working days before month end | One

(pension payroll) |

Partena Professional

|

SEGRO HR European Business Partner | SEGRO HR European Business Partner | Partena (SAM) for payroll processing and MyPartena for downloading reports

Please refer to country specific details for this payroll attached as addendum |

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Accounting"

Accounting is the profession or activity of keeping financial records and statements. In business this usually includes bookkeeping, the preparation of financial statements including profit and loss, balance sheets and management accounts.

The following essays and study material all relate to the topic of accountancy.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: