Formulation and Development of Performance Audit in the Public Sector in Vietnam

Info: 9419 words (38 pages) Dissertation

Published: 9th Dec 2019

Tagged: AccountingFinancePublic Sector

Abstract

Governments are evaluated through performance auditing by measuring efficiency, economy, and effectiveness. Unique planning, specialized staffing, government oriented scope and government management reporting constitute the parameters of a performance auditing model appropriate for government officials and stakeholders. In Vietnam, the State Audit Office of Vietnam (SAV) has just conducted the performance audit for few years, therefore performance audit is new subject for SAV. SAV is trying to complete the comprehensive study for performance audit. The purpose of this paper is to exploring and explaining factors influencing the formulation and development of performance audit in the public sector in Vietnam. This study will contribute to the understanding of why the SAV has expanded its functions to performance audit, but the implementing process developed slowly? What factors motivate the SAV to seek out this new function, and what factors impede the development of this type of audit in practice?

Key words:Performance audit, impacts, formulation, development, pubic sector.

Table of Contents

Declaration of Authorship of Master’s Thesis

1.1. Reason for choosing topic

1.6. New contribution of the thesis

2.2. Results achieved and issues continue to study

2.2.2. Issues that need further study

CHAPTER 3: THEORETICAL AND ANALYTICAL FRAMEWORK

3.1. Definitions and basic concepts related to performance audit in the public domain

3.1.1. Definition of performance audit

3.1.2. Basic concepts related to performance auditing

3.1.3. Role of performance audit

CHAPTER 4: RESEARCH METHODOLOGY

4.2. Data sources and methods of data collection

4.2.2. Data collection methods

4.3. Process and method of data analysis

5.1. Results of document analysis

5.2. Results of audit report analysis

5.3. Results of the audit case analysis

5.4. Survey results of in-depth interviews with experts

6.1. Factors affecting the formation of performance audit

6.1.1. The role of the sponsor

6.1.2. The role of the Auditor General

6.1.3. Change of laws and regulations

6.1.4. The role of the National Assembly and People’s Councils at all levels

6.1.5. Macroeconomic policy change

6.1.6. Weakness in management and pressure from the public

6.2. The trend and level of audit development activities in the public sector of the State Audit

6.2.1. About the development trend

6.2.2. About the level of development

6.3. Causes and challenges in development performance audit

6.3.1. Limits in public administration reform

6.3.2. Limited in the implementation of traditional auditing

6.3.3. Lack of performance audit knowledge

6.3.6. Characteristics of the audited entities

6.3.7. A point of view of the development of performance audit

CHAPTER 7: CONCLUSION AND POLICY IMPLICATION

7.1.1. Factors affecting the formation of performance audit

7.1.2. The level of development of performance audit of the State Audit.

7.1.3. The causes and challenges in developing performance audit

7.3.1. Increased support for performance audit

7.3.2. Enhance the ability to deploy performance audit

7.3.3. Improve the skills of AUDITOR

7.3.4. Increase the supply capacity to meet the demand for performance audit

7.3.5. Development of performance audit strategy

7.4. Significance, Limitations and Future Research

7.4.1. Significance of research

7.4.2. Limitations and suggestions for further study

CHAPTER 1: INTRODUCTION

1.1. Reason for choosing topic

Performance auditing began to appear in the public sector in several OECD (The Organization for Economic Co-operation and Development) countries in the late 1960s and rapidly developed in the early 1990s with deep reforms in public governance in these countries. Among them, some countries are believed to have succeeded in performance audit such as USA, UK, Canada, Australia and the Netherlands, but progress and development patterns have many differences (Pollitt et al., 1999). This prompted researchers to investigate the formation and development of this type of audit in order to understand the nature and theories of performance auditing. According to Lonsdale (2011), we are now close to a full understanding of performance auditing and most SAIs around the world recognize that developing auditing in the public sector is a necessity and to meet the expectations of the public. In addition, performance audit can contribute value added through the two basic performance audit objectives, namely enhancing accountability and enabling the audited entity to improve performance efficiency.

Many SAIs have also applied performance audit theory to their functions, but not all countries can successfully implement and develop this type of audit. Statistics of academic studies on performance audit are available as of July 2009, with nearly 400 articles and research related to performance audit, but only a few discoveries and explanations regarding formation and development of performance audit. The results show that the economic, political and social context; reform of public administration; weaknesses in the management and use of public resources and the ability of SAI, changes in the technical aspects of auditing affect the formation and development of performance audit.

In general, previous studies focused primarily on the formation and development of performance audit in OECD countries, which differed in their economic and social status from Vietnam, the country is developing in the direction of socialism. On the other hand, so far, no research has produced a model of the factors that influence the development of performance audit. Much of the research is limited to exploring and explaining the role that factors play in formulating and developing auditing in the public domain through qualitative research.

What motivates SAIs to decide to expand their functions from traditional audit (compliance audit, financial statements audit) to performance audit, which factors affect the development trend? Whether performance audit theories comes from developed countries that can be applied appropriately to developing countries with many socio-political, socio-economic differences such as Viet Nam.

Starting from the gap in theoretical and practical needs, the study of the formation and development of public sector auditing in Vietnam will contribute to the understanding of why the State Audit Office of Vietnam (SAV) has expanded its functions to performance audit, but the implementing process developed slowly? What factors motivate the SAV to seek out this new function, and what factors impede the development of this type of audit in practice? Therefore, this study aims to explore and explain the factors that influence the formation and development of public sector auditing in Vietnam.

1.2. Objectives of the study

General objective: Exploring and explaining the factors affecting the formation and development of performance audit in public sector in Vietnam.

Detailed objectives:

- Exploring the factors promoting the formation and influencing development of performance audit of some countries in the world;

- Determine the level of audit development activities in the public sector in Vietnam;

- Identify and explain the factors that influence the formation and development of performance audit in the SAV.

1.3. Research question

To achieve the above four research objectives, the following research questions help to establish the research process of the thesis:

Q1: Why are some SAIs in the world switching functions from compliance audit, financial statement audit (traditional audits) to performance audit?

Q2: What factors influence the formation of performance audit in public sector in Vietnam?

Q3: What is the stage of performance audit development in the public sector in Vietnam?

Q4: What are the factors that influence the performance audit development in the public sector in Vietnam?

1.4. Scope of the study

From the above research objectives, the subjects in this dissertation are factors influencing the establishment and development of performance audit in the public domain in Vietnam.

The research scope of the thesis is performance audit of the State Audit in the public sector in Vietnam and factors affecting and not performance audit in enterprises and other organizations.

1.5. Research Methods

The research method used in this thesis is a qualitative research method. Qualitative research aims to investigate the formation and development, as well as explore the factors that influence this process by combining three methods of data collection: (i) audit reports; (ii) case study, (iii) in-depth interviews.

1.6. New contribution of the thesis

– For theory:

+ Through qualitative research indicates that 33 factors influence the formation and development of performance audit in the public field in Vietnam;

+ In addition, the study also showed that developing countries, low levels of transparency and accountability, unmatched legal systems have “demand” performance audit more but performance audit develop slowly, due to the ability “supply” on the performance audit is low.

– For Practice: The research results show the factors influencing the formation and development of performance audit in public sector in Vietnam (transitional economy) with limitations and the challenges faced by the State Audit when carrying out performance audit. The results of this study will suggest SAV leaders choose a strategy to develop performance audit in line with their existing capabilities.

1.7. Thesis structure

The dissertation consists of five chapters, presented in the following order and main contents:

Chapter 1- Introduction:

The need for research, objectives, scope, method, contribution as well as the scientific and practical significance of the thesis.

Chapter 2- Literature Review

This chapter focuses on previous studies in the world and in Vietnam, the results achieved and the issues that need further study. From there, point out the theoretical gap that the thesis will focus on.

Chapter 3 – Theoretical and Analytical Framework

First, this chapter presents an overview of commonly accepted performance audit theory in the world, by systematizing the theoretical background of performance audit and the results from previous studies. Next, introducing theoretical framework explains the formation and development of performance audit. Finally, design the analytical framework for the thesis’s research purpose.

Chapter 4: Research Methodology

This chapter describes the data source, the process of recording and analyzing the data for each step of the study.

Chapter 5- Analysis

This chapter deals with the analysis of research results.

Chapter 6- Discussion

This chapter deals with the discussion of research results.

Chapter 7 – Conclusions and Policy Implications

This chapter introduces the results of the study, thereby proposing a number of recommendations and policy implications to promote the development of performance audit of SAV in the public sector in Vietnam. Finally, the significance and limitations of research and the further research direction are highlighted.

CHAPTER 2: LITERATURE REVIEW

2.1. Previous studies related to the formation and development of performance audit and the factors influencing

2.1.1. Studies in the world

2.1.1.1. Research on factors that motivate the formation and development of performance audit

Although performance audit have been established and developed over 40 years (beginning in the 1970s), however, there is not much academic research related to this topic in the early stages. Academic research on performance auditing is conducted only after this type of audit has been implemented at SAIs in some developed countries for the purpose of finalizing the theory of performance auditing, such as in England (McCrae & Vada 1997; Flesher & Zarzeski 2002); in the United States (Yamamoto & Watanabe, 1989; McCrae & Vada, 1997; Gendron et al, 2000; Flesher & Zarzeski, 2002; in Australia (Funnel, 1994; Guthrie & Parker, 1999; Flesher & Zarzeski, 2002); in Canada (Yamamoto & Watanabe, 1989; Radcliffe, 1998). Only a few studies in developing countries such as China (Hui Fan, 2012); Bangladesh (Ferdousi, 2012), Malaysia (Daud, 2007), Iran (Alireza Khalili et al, 2012) or study by Albert et al. (2009). These studies have also examined the challenges that SAIs in developing countries face when extending their functions to performance audit. The main objectives of these studies are to understand and explain (i) the relationship between public administration reform and the formation and development of performance audit; (ii) how the economic, political and social context influences performance audit; (iii) audit technique and methodology change in the development of SAIs; (iv) how the development potential and prospects of SAIs have affected the formation and development of performance audit. Summarizing the findings from these research shows that the following factors influence the formation and development of performance audit:

(i) For the first goal, governance reform and the restriction of traditional audit functions have driven SAIs into functional auditing. The findings in the studies show that radical changes in public administration since the 1970s have shifted from the traditional governance model (focus on input control) to the current governance model. New Public Management model (NPM) has been instrumental in promoting functional expansion into performance audit (Glynn, 1985; Holmes, 1992; Power, 1994, 2003; Leeuw, 1996; Barzelay, 1997; Radcliffe, 1998; Jacobs, 1998; Guthrie & Parker, 1999; Gendron et al., 2001; Pollitt et al, 1997, 1999, 2003; Pallot, 2003 …).

According to Holmes (1992), governance reform emphasizes attainment and enhances accountability that drives the development of performance audit. Similarly, Barzelay (1997) observes that the NPM model has been appropriately applied in the function of SAIs including performance audit. Jacobs (1998) and (Guthrie & Parker 1999), public governance reforms that have been widespread and a new trend towards the end of the 20th century have led to changes in accounting and performance auditing function is accompanied by this trend by focusing on outcomes in the public sector.

Similarly, Power (1994) observed that public administration reform under the NPM model led to an explosion of type of performance audit in the last two decades of the twentieth century. His thesis, Power (2003), adds that the limitations of traditional audit functions in the public sector have prompted the development of performance audit. His findings are also of great importance when pointing out that the diffusion of different governance models has made a difference in the development of performance audit in a number of countries. Thus, in addition to providing empirical evidence through surveys based on the supply-demand model in economics, to confirm the existence of a correlation between public administration reform and the formation and development of auditing. The thesis also shows that the formation and the level of development of performance audit depend on limitations in performing traditional audit functions.

(ii) For the second objective, the economic, political and social context influences the formation and development of performance audit. The summary in Nath (2005, 2011) shows that eight factors classified as economic, political and social factors influencing the formation of performance audit include:

– Role of Auditor General;

– Requests from the authorities;

– Fiscal policy;

– Pressure from interest groups (politicians, media …);

– The role of the committees in the parliament;

– Change of laws and regulations;

– Impacts of accounting profession, auditing;

– Change the organizational structure of SAI.

Of these eight factors, there are three factors (including the public accounting committees, the parliament and the media) that play an important role in the development of performance audit and increased demand for performance audit. The study (Hamburger, 1989; Funnell, 1998; Jacobs, 1998; Radcliff, 1999; English & Guthrie, 2000; Mulgan, 2001; Pallot, 2003; Barton, 2006; Dahanayake & Jacobs 2008; Nath et al., 2005, 2011) indicated that the demand for performance audit is influenced by economic, political and social changes. In order to adapt to these changes and meet social requirements, SAIs must convert traditional audit functions into new types of audits (later referred to as performance audit):

- Impact on Political Factors: Most studies on this subject acknowledge that political factors play an important role in the formation and development of public sector auditing such as supplementary adding performance audit functions, changing the organizational structure model in the direction of enhancing the role of performance auditing, selecting audit subject activities to meet the requirements of the parliament, restrict selection of “sensitive” topics to political issues (Hamburger, 1989; Funnell, 1998; English & Guthrie, 2000); Mulgan, 2001; Pallot, 2003; Barton, 2006; Dahanayake & Jacobs, 2008 …)

- Impact of Social Factors: Social factor is said to contribute in the direction of performance audit because of the increasing social demand for the allocation, management and use of public resources by national governments. Consequently, SAIs must adapt to meet this new need to meet the needs of the public. Performance auditing forms and takes on the function of connecting information between the auditor and the auditor (Jacobs, 1998; Radcliff, 1999)

- Impact of Political, Economic and Social Factors: Nath et al. (2005, 2011), in a thesis on the formation and development of performance audit in Fiji, summarized previous studies have shown that the formation and development of performance audit in the five US, UK, Canadian, Australian and New Zealand economies are influenced by the economic and political context and social. There are eight factors influencing the formation of performance audit, three of which are the public accounting, parliament and media committees, which play an important role in the development of performance audit.

x(iii) For the third objective, new changes in methodology and audit techniques also contribute to the development of performance audit, including the ability to develop or set up appropriate standards, capabilities measurement and evaluation, the ability to analyze, synthesize and write audit reports, the ability to apply other scientific methods to performance audit (Hatherly & Parker, 1988; Pollitt et al., 1999; Lapsley & Pong, 2000).

Pollitt et al (1999) argue that the functional audit function is not simply the application of appropriate new audit techniques but also covers the management aspects applied in the new governance model. Thus, on the one hand, the change in terms of audit techniques determines the type of performance audit and development process, but these changes only appear with the changes in governance reform.

(iv) For the fourth objective, the ability of SAIs (including the auditor’s capacity in SAI and the capacity to conduct independent audits) has a significant impact on the development and deployment of audits. Such as the ability to apply new auditing methods and techniques, the ability to take advantage of the support from the National Assembly, the ability to organize the implementation of audits, the capacity of technicians and the organizational characteristics of the audited entity (Shand & Anand, 1996; Berzelay et al., 1996; Warning & Morgan, 2007; Albert et al., 2009; Put & Turksema, 2011; Lonsdale et al., 2011; Ferdousi, 2012; Hui Fan, 2012.

2.1.1.2. Research relates to factors that interfere with the development of performance audit

In addition to the above-mentioned studies, there are a number of studies that focus on the barriers to the development of performance auditing, Ferdousi (2012) explores the challenges of conducting audits in the fieldwork in Bangladesh. The theoretical framework developed by the author is based on the supply-demand theory model, in which two factors belonging to the audited organization called the demand factor are: cognitive, operational goals, two factors belonging to the SAI is called ability, professional support. The findings in the study have identified challenges that include the lack of qualified technicians, the inability to receive technical assistance from experts when needed, and insufficient awareness of performance audit. Set up goals in the organization. The limitation of this study is that too few factors were investigated in Ferdousi (2012, 42).

Hui Fan (2012) has also explored the factors that influence the demand for performance audit from the audited entities. Applied research method is quantitative research method. Data collected through the survey were high-level executives in twenty eight provinces and cities in China, using the econometric model to test the hypothesis. The findings of the study show that in areas of low economic growth, the weak legal environment has higher operational demands, but lower auditing responsiveness (supply). Meanwhile, in economically developed areas, the legal environment is better, the demand for auditing is lower, but the supply (supply) is higher. Moreover, understanding of the auditor’s performance does not increase the need for performance audit.

Albert et al.,(2009) conducted a survey in a number of developing countries to explore the challenges and suggests ways to overcome when SAIs expand into performance audit. Based on this study, the challenges are classified into four main groups: (i) organization; (ii) expertise; (iii); politic; (iv) exchange of information. Albert et al. (2009) point out that although there are several factors that allow (assertive) factors and promote audit implementation in these countries, such as: of the law, the role of the Auditor General, issues related to the management and use of public resources. However, these countries can not carry out practical audit due to lack of budget, human resources, professional skills, limited work in the narrow (WB 2001, Albert et al. 2009, 11).

In addition to the paradoxes outlined, Albert et al.,(2009, 7) also argue that it is difficult to overcome all of these challenges but SAIs need to explain their broad mission to enlist the support of congresses, civil society organizations and the general public. To accomplish this, SAIs can enhance their tasks to achieve higher performance (Albert et al. 2009, 21).

The results from studies in developing countries show that seven main obstacles are:

– Restrictions on public administration reform;

– Traditional audit results are continuing to develop;

– Lack of understanding of performance audit;

– Limited accountability;

– Ability of SAI (ability of technician, ability to implement SAI’s audit);

– Characteristics of the object audited.

2.1.1.3. A study of the factors influencing the selection of strategies for the development of performance audit of SAIs.

– Selection of performance audit objectives:

In pursuit of accountability or performance improvement that influences auditing development strategies in each country, there is still debate about which goals are more important (Shand & Anand 1996). Some advocates of accountability function in account of accountability, for example, Glynn (1996), Pollitt et al.,(1997, 1999) and Lonsdale et al. (2011): Glynn (1996) , 125), the development of performance audit is important, but must be regarded as an integral part of the new public administration system and thus the functional audit function should be in favor of the accountability assessment. rather than evaluating results. Similar (Lonsdale et al., 2011), also agree that accountability and performance improvement are two objectives that performance audit need to achieve, but accountability goals are more important. Because if auditing works only to help the unit improve its performance thereby enhancing the ability to learn from experience through auditing, many other performance audit can perform this task better. auditing agencies. On the other hand, the impact resulting from helping the audited unit improve the performance is limited, not assessed and measured in detail. Therefore, he said that in order to avoid risks for AUDITOR, the SAI should pursue the goal of accountability. Thus, the choice of pursuing a goal depends on the economic and political context in that country by identifying the challenges faced by SAIs and the likelihood that they may be overcome, for example Put & Turksema (2011), if the audit body has a complete legal status with the government, then the objective of explaining the results should be given priority, as AUDITOR and SAI leaders feel less responsible for Help improve the efficiency of the audited units.

– Select topics, objects and scope of performance audit

The basis for choosing the subject, object and scope of the audit will determine the future trend of auditing development, such as selecting audits of some politically sensitive areas such as auditing Considering the effectiveness of policies (policy analysis) or the impact of government intervention (Lonsdale et al. 2011) will require SAIs to be more independent, competent and supportive. Stronger from both the legislature and the executive. Or by self-selecting SAIs subject, object and scope of performance audit or compliance with requirements from legislative and executive bodies also affect the development of performance audit.

– Select the methodology used in the performance audit

The methodology used in the performance audit is the basis for the use by the technician as a benchmark, applying appropriate methods and techniques to gather sufficient evidence to form a convincing audit opinion. high. Unlike traditional audits, the methodologies used in the audit are more diversified depending on the subject area, the subject of the performance audit and the approach to these topics. For example, modern management models Effective management practices that are successfully applied in practice will be used as a benchmark for evaluation purposes and help the audited entity improve its performance. Then, the methodology chosen in this case is based on the science of governance. There are many factors that influence the choice of auditing methodology, such as audit time constraints, the ability of technicians, costs and expectations of auditing evidences, auditing organization, math. Thus, if the performance audit approach depends primarily on the independence, authority and legal status of the SAI and the selection requirements of the annual audit subjects of the legislature and the performance audit methodology will continue to change in the future. This requires SAIs to constantly change to adapt and learn to improve the quality and effectiveness of this type of audit.

2.1.2. Studies in Vietnam

Performance audit in Vietnam are in the early stages of development. No scholarly research has been published regarding the topic of factors influencing the development of the Performance audit in Vietnam. Vuong Dinh Hue (2003), study of the ministerial-level scientific subject “Contents and methods of performance audit of investment projects funded by state budget” Similarly, Dinh Trong Hanh (2003) also studied The application of performance audit to non-business units with revenues. These two themes are the subject of the proposed process and methods of performance audit, for reference the experience of performance audit from countries around the world. Vu Huu Duc (2010), with the syllabus of performance audit, in which mainly focus on introducing process, methods and content of performance audit in practice. Le Quang Binh et al. (2013) studied the organization of performance audit in SOEs. This is also the subject of application of auditing methods and experiences in the world to Vietnam.

2.2. Results achieved and issues continue to study

Previous research in the world has explored the factors and explains quite well the role of factors influencing the formation and development of world-wide auditing, purpose, meaning, and development trends.2.2.1. Result

Previous research in the world has explored the factors and explains quite well the role of factors influencing the formation and development of world-wide auditing, purpose, meaning, and development trends.

Affecting Factors

Can be classified into 4 main groups:

– Governance reform, limited in the performance of traditional audit functions;

– Economic, political and social, including 8 factors: the role of auditor general, requirements from the authorities, fiscal policy, pressure from interest groups, the role of committees changes in laws and regulations, the impact of accounting profession, audit, organizational change of SAI in which there are 3 factors including the public accounting committees, parliament and media communication plays an important role in the development of performance audit (Yamamoto & Watanabe, 1989; Funnel, 1994; McCrae & Vada, 1997; Guthrie & Parker, 1999; Gendron et al., 2000; Flesher & Zarzeski, 2002; Nath, 2005, 2011);

– The ability of SAI consists of two main groups of factors: capacity of auditor, ability to implement SAI audit (Albert et al., 2009; Ferdousi, 2012; Alireza Khalili et al., 2012). In developing countries, these two groups of factors are the obstacle or challenge in implementing auditing. Inside:

+ Capacity of auditor is determined by 7 factors including skill, knowledge level, experience, ability to use audit method, ability to set up and developing auditing standards, ability to synthesize and analyzing and writing audit reports, complying with professional ethics standards;

+ The ability to implement SAI’s performance audit includes five factors: the ability to select audit topics, the use of audit methods, techniques, standards development, procedures, audit manuals, resources financial and auditing tools, methods of organizing the implementation of performance audit and the ability to conduct performance audit.

– The characteristics of the audited entity include six factors (scope of activity, complexity of activities, establishment, establishment of appropriate objectives, establishment and compliance standards and norms applicable to activities, knowledge of performance audit) that affect the implementation of SAI audits (Ferdousi, 2012; Hui Fan, 2012).

Purpose and significance of performance audit development

Assisting the audited unit to enhance accountability, improve performance efficiency and contribute value to the society through audits.

Trends in auditing development

Some researches point to the paradox of high need of performing auditing, but the SAI in some developing countries can not be implemented or the level of development of this type of audit is low and the gap exists compared with the accepted practice of auditing theory (Albert et al., 2009; Lonsdale et al., 2011; Ferdousi, 2012; Hui Fan, 2012);

Some countries have similar characteristics (economic, political and cultural) but still choose different auditing strategies with different priorities. Most studies, however, show that the trend of active audit development takes place around the process of governance reform in these countries (Pollitt et al., 1999; Lonsdale et al., 2011).

2.2.2. Issues that need further study

Studies in the world have been conducted in developed countries with different socio-economic and political characteristics than in Vietnam, while studies on auditing in Vietnam are mainly research on general performance audit, there is no scholarly study to clarify the nature as well as the factors affecting the formation and development of performance audit in the public domain. Thus, consideration of the existence of these factors in the context of developing countries such as Vietnam – a socialist-oriented country – is necessary to determine whether the development model audits in developed countries of the world fit into the context of Vietnam and how the differences in the economic, political and social environment in Vietnam affect the development of performance auditing.

CHAPTER 3: THEORETICAL AND ANALYTICAL FRAMEWORK

3.1. Definitions and basic concepts related to performance audit in the public domain

3.1.1. Definition of performance audit

Concerning performance audit in the public sector, there are many definitions presented in the regulations of the SAI and come from academic studies.

The two most commonly used definitions of performance audit, a definition most commonly used in academic studies, are the definitions used in the practical workings of SAIs.

First definition:

Performance auditing has been described as an independent evaluation of the economy and efficiency of auditee operations, and the effectiveness of programs in the public sector. (Nath 2011, McRoberts & Hudson 1985;Parker 1990; English 1990; O’Leary 1996; Leeuw.F 1996; Thompson 1996; Guthrie & Parker 1999).

Second definition:

ISSAI 3100 – Guidelines on Central Concepts for Performance Auditing : “Performance auditing carried out by SAIs is an independent, objective and reliable examination of whether government undertakings, systems, operations, programmes, activities or organisations are operating in accordance with the principles of economy, efficiency and effectiveness and whether there is room for improvement.”

3.1.2. Basic concepts related to performance auditing

Economy

Economics is defined as the thrifty use of inputs to achieve the goals. Inputs may include both volume and price or resource costs used to achieve the above objectives. Many studies confirm that economics is closely linked to efficiency in public audit practice (Nath 2011). This link is included in the procurement process of inputs, focused on minimizing costs and using inputs to achieve unit objectives. This view recognizes that inputs should be considered both economically and effectively as they relate to the management and use of resources in the public sphere (Persaud & McNamara 1993, 1994. Dittenhofer 2001; Nath 2011).

Efficiency

Most of the theoretical investigators on public sector auditing do not rigorously distinguish between economics and efficiency. Instead, they endorse the view that efficacy includes economic (Prasser 1985; Yamamoto & Watanabe, 1989; Jones & Pendlebury, 1992; Glynn 1989, 1991; O’Leary 1996; McCrae & Vada, Grendon, Cooper & Townley 2001, Nath 2011). The authors acknowledge that efficiency is related between inputs and outputs, but the main goal is to manage resources so that output maximization with constant resources is maximized.

Yamamoto & Watanabe (1989) argue that efficiency is known as the responsibility to manage resources in an efficient and effective way when they are given control over them.

From a theoretical point of view, efficiency is just as economically unspecified.

Effectiveness

The public-sector audit theory acknowledges that effectiveness relates to the consideration of success, achievement level, or desired goals of public sector entities (McRoberts & Hudson 1985; Glynn 1989, 1991; Yamamoto & Watanabe 1989; O’Leary 1996; Funnell & McCrae & Vada 1997; Cooper 1998; Nath 2011). In addition, efficacy also considers the relationship between the outputs and the goals of the public sector. Thus, AUDITOR can focus on the goals of the organization and measure how the outputs have contributed to achieving the goals in the organization.

According to Nath (2011), the effectiveness of public-sector programs and projects can be assessed and assessed against four fundamental issues, (1) the need for continuation of the program, (2) the degree of achievement of the program (attainment of program objectives), (3) evaluation of the impact and impact of the program (desirable or not) and (4) cost-effectiveness analysis the delivery of the program. With economy and efficiency, there are many means of linking with efficiency, some of which are related to political issues.

3.1.3. Role of performance audit

There are various views that explain how SAIs transform functions from financial information validation and legal compliance considerations into performance audit such as (i) the inability of traditional auditing The (ii) increased public expectations and expectations, increased responsibility for managers; (ii) the occurrence of major events also has implications for the transformation of audit models such as expansion of fiscal policy, increase of budget expenditures, public debt; (iv) performance audit is influenced by public administration reform and vice versa (Barzelay et al. 1996; Leeuw 1996; Shand & Anand 1996 …). However, both theory and practice of SAIs recognize that the fundamental role of performance audit is (1) enhancing accountability and (2) improving performance. Many points of view are the two basic objectives to be met during the audit.

3.2. Theoretical Framework

The results of the previous studies presented in Chapter 2 show that the majority of the studies explain only the fragmented factors affecting the formation and development of performance audit. Only the Pollitt & (1999) is the most complete and reasonable explanation of these factors when studying the formation and practice of auditing development in five different countries. Pollit et al. (1999) used an input-output model (logic model) in their own study and established a fairly well-defined model of performance audit and interpersonal relationships (Figure 3.1), specifically:

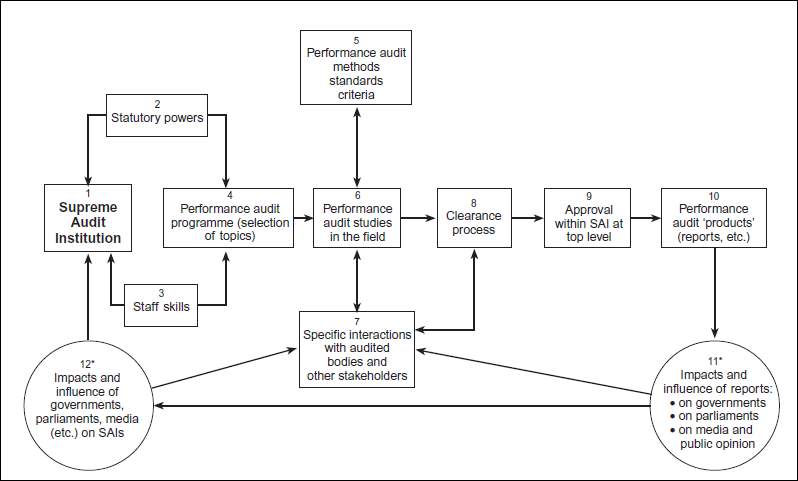

Figure 3.1. The process of performance audit (Source: Pollitt et al, 1999)

In Figure 3.1, the elements of the boxes from Box 4 to Box 10 indicate the performance audit process, starting with the selection of the auditor object (Box 4) and the end of the audit report (Box 10). The conceptual model is used to describe the factors influencing the performance audit process, which includes the organizational structure of SAI (Box 1), the authority of SAI (Box 2), the ability of AUDITOR (Box 3). In addition, the model illustrates the impact of factors on the trend of performance audit (Box 1-3 and Box 11, 12).

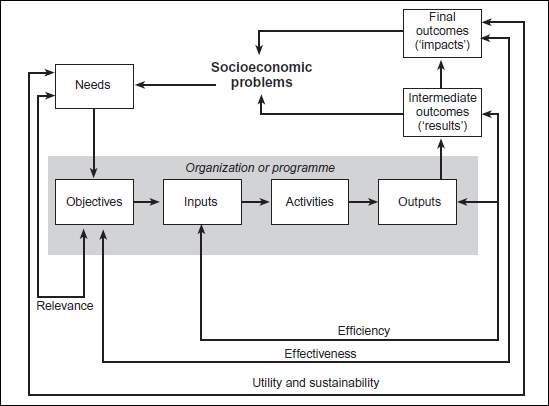

Pollitt et al (1999), setting up an analytical framework through the input-output model (Figure 3.2), shows the relationship between factors in the conceptual model (Figure 3.1).

Figure 3.2. The input-output model (Source: Pollitt et al, 1999)

Pollitt (et al, 1999) models help to solve two major problems:

First, the reform of public governance in some countries has prompted SAIs to shift functions to performance audit. The starting point in the logical model Figure 3.2 is “economic, political and social issues.” When economic, political and social problems arise, such as poor governance, corruption, waste, or the use of public resources that are not for the right purposes or ineffectiveness of government agencies or agencies Public service provision will appear to need innovation. Some OECD countries have applied the principle of management in the private sector to the public sector called NPM. According to Hood (1995), the initial use of the model was to reduce costs and prevent corruption, but then expanded to improve efficiency and effectiveness in the area of public administration. As a result, SAIs also begin to perform performance audit to measure outcomes against inputs and assess the effectiveness and effectiveness of public administration and have been as successful as the United States. , England, Australia and New Zealand. Thus, the logical model of Figure 3.2 not only shows the correlation between public administration reform and the formation of performance audit, but also explains how auditing is performed.

Secondly, performance audit as well as all other activities in social life with inputs are factors such as organizational structure, competence, capacity of technician … through the organization of auditing ( process of auditing) to achieve the main output is the audit report and the purpose of the audit to be achieved is the result obtained (impact from the audit results). Putting the logic model in the context of the public domain, there will be additional demand factors. Depending on needs, SAIs will choose the type of performance audit appropriate to the auditor’s choice, such as auditing efficiency, auditing the value of money, auditing the effectiveness of the program, auditing management performance … The logical model of Figure 3.1 will not only help explain how audits are performed in the countries surveyed, but also how the auditor development model works. . If the demand for performance audit is to overcome weakness and waste, SAIs need to implement performance audit to advise the audited units to improve their operational efficiency (usually the demand comes from the main the audited entity). On the other hand, if the need is to consider the responsibility of the manager or head of the unit in the allocation, management and use of public resources, then the audit results should provide information to the relevant third party rather than the entity audited, and the purpose of the audit is to achieve accountability. However, the pursuit of any purpose depends on the ability of SAI. Not all SAIs are capable of meeting this new task, so they must change to perform the new functions and tasks that the public requires. The results and values generated by the SAIs will contribute to addressing existing socio-economic issues. The level and ability to address social and economic issues through the contribution of SAIs will determine the role and development of SAIs.

Unlike many countries that have successfully developed the type of performance audit, there is a model of free market economy, typically the United States, the United Kingdom, Australia or the typical social-economic model are Germany, Sweden and Nordic countries; The political system consists of many parties, operating on the principle of direct democracy. In addition, the public sector in these countries has been restructured in a more narrow and flexible manner, including a uniform legal system, a transparent and accountable state regulatory system. The transition from the traditional governance model to the new governance model (UK, USA, Australia, New Zealand …). Meanwhile, Vietnam is a developing country with a socialist orientation, a state-owned economic institution (the state plays the leading role, and intervenes deeply in economic and social activities. to ensure high economic efficiency while ensuring better social justice); the political system is led by the Communist Party. It is because of such economic and political institutions and the public sector in Vietnam that coverage is widespread in most areas where money and property are used. However, compared to developed countries, the public sector in Vietnam is composed of a lack of uniform legal system, cumbersome state management apparatus, bureaucracy, transparency and accountability. Governance is still applying the administrative model (the traditional form of traditional public governance) leading to the wasteful, inefficient allocation, management and utilization of public resources. . So, the demand for this type of audit is quite large. However, the capacity of performance audit is limited, results of performance audit have not met the requirements and reasonable expectations from society. What factors influence the formation and development of public sector auditing in Vietnam? The research uses the analysis framework of Pollitt et al.,(1999) to find out and explain how the performance of the audit in Vietnam is affected by economic, political, social, or economic factors public administration in Vietnam or the ability of the State Audit …). Thus, the author will inherit part of the conceptual model and analytical framework in Pollitt & Associates’ (1999) study as the basis for further study of the thesis for the following reasons: First, Applying the analysis framework in Pollitt & Associates’ (1999) study in the context of Vietnam might help explain why some countries that do not have governance reforms in this trend can still develop active audits and succeed while others, especially developing ones, are the opposite. Second, shaping the trend of choosing audit development strategies works in each country in each stage.

3.3. Analytical Framework

The analytical framework of the thesis will be based on previous studies involving factors influencing the formation and development of performance audit such as Warning & Morgan, 2007; Albert et al., 2009; Lonsdale et al., 2011; Put & Turksema, 2011; Hui Fan, 2012; Ferdous, 2012; Alireza Khalili et al., 2012 …, these factors are classified based on the conceptual model and the input-output model established by Pollitt et al. (1999). Accordingly, the groups of factors influencing the formation and development of performance audit in the public sector in Vietnam into four main groups:

- The first factor is the economic, political and social factors. These are the groups of factors summarized in Nath (2011). Studies show that choosing the right topic and setting up appropriate audit objectives (the components that make up the performance audit) are influenced by the need for external performance auditing parliament, the government, and the general public) require state agencies to address and address these issues or the internal needs of SAIs to perform their assigned or responsive functions. Expected from the user. Accordingly, the authors categorize them as economic, political and social factors denoted by (A) in Table 3.1;

- The second group of factors is collectively referred to as inputs in the logical model. There are five groups of factors that make up the SAI’s legal status, the SAI’s competence, the technical capacity of the technician, and the ability to conduct SAI audits. In particular, the two groups of factors are the premise of this type of audit. Qualification, skills and ability to deploy SAI’s performance audit will determine the level of audit development activities. Therefore, these three groups of factors are used for classification in the performance audit development model. They are denoted by (B) in Table 3.1;

- A third group of factors, collectively referred to as “activity”, is the process of performance auditing performed in each SAI. There are four groups of factors that make up the concept of performance auditing that are categorized in Pollitt et al.,(1999), which may change adaptation to each audit subject or objective to be achieved. Each audit, so they are heavily influenced by the performance characteristics of audited audiences. Thus, the operational characteristics of the auditor are classified according to the operating procedure in the logical model, denoted by (C) in Table 3.1;

- A fourth group of factors is called output and results. The output of an audit process includes the auditor’s report and the impact of the auditor during the audit to the audited entity. Whereas, the obtained results depend on the audit report, the impact of the parties involved on the implementation of the audit proposal, and the impact of the parties involved on the SAIs in further implementation to perform their audit tasks. These three factors and the relationship between them constitute the concept of performance audit. The pursuit of improving the quality, effectiveness or effectiveness of performance audit in each audit, in addition to its dependence on economic, political and social issues, the selection of topics and auditing objectives the auditing process, the capability of the technician, and the ability to carry out the performance audit depends on the viewpoint of auditing development at each SAI, denoted by D in Table 3.1.

Table 3.1. Classification of factors affecting the formation and development of performance audit (Source: Pollitt et al, 1999)

| Elements in the input-output model | Classification of factors based on Pollitt et al.,1999 | Classification of factors based on synthesis of results from previous studies |

| Economic, political and social | (1) The topics appropriate for the implementation of the type of performance audit | (A) 03 groups of economic, political and social factors promoting the formation and development of performance audit |

| Purpose, goal | (2) Auditing objectives (accountability or performance improvement) in accordance with social requirements | |

| Inputs | (3) Legal status SAI,

(4) the authority of SAI; (5) Capacity of technician (qualification, skills) and ability to carry out auditing of SAI activities |

(B) 03 groups of factors (qualification, skills of technician, ability to carry out performance audit) |

| Activity (Audit Process) | (6) Auditing topic selection approach;

(7) Methods, standards, auditing standards; the method of organizing the audit; (8) decentralization in SAI; (9) Relationship, characteristics of auditor and related parties. |

(C) The characteristics of the audited entity affecting the implementation of the performance audit |

| Outputs | (10) Audit report, impact on the audited entity during the audit process | (D) views on development and development of performance audit |

| Results/Outcomes | (11) Impact from the parties involved in the audited entity;

(12) Impact from audit report to stakeholders and vice versa. Impact from SAI stakeholders. |

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Public Sector"

The Public Sector is home to all public services and any enterprises that are publicly funded. This includes all emergency services, the military, healthcare services, education, infrastructure, and more.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: