Digitalization of Retail Branch Banking and its Impact on Customer Satisfaction

Info: 9048 words (36 pages) Dissertation

Published: 25th Oct 2021

Tagged: TechnologyBanking

ABSTRACT

This era is predominated by the hyper-connected, highly informed, value driven young customers who expect real-time responses and quick services. The concept of going to a physical bank for teller-controlled transactions might seem old and archaic. On the other end of the spectrum are the people who believe in the age-old method of pen-paper banking where everything is written down. With time, however, there is a major growth in the first segment and a decline in the number of the second segment. To entice the former segment, banking sector has created their own digital banking program to reinvent branch model and also to remodel the customer engagement. Banks in India are no longer only a brick and mortal delivery channel. With the inclusion of Internet banking and other technologies, it has revolutionized the concept of “Anytime, Anywhere”.

Digitalization is essentially worried about what all banks are required to do to improve services to the customers. There are different innovations which are to be embraced for digitalization of back office. It additionally guarantees independence to the customers in whichever way that could be available. The major significance of digital banks lies in their capacity to be ubiquitous. Digitization of retail banking is now becoming the competitive edge for each bank within and out of India. With similar products and little differentiation from other competitors, the only way to capture and acquire a larger share of the market is by providing maximum customer satisfaction. One of the avenues in which this can be enhanced is through digital banking which includes Internet Banking, Mobile Banking, SMS Banking, ATMs, Self-service kiosks and the physical branch too.

There has been a sea of changes in the banking industry in the past two decades including the entry of private players to increased regulatory surveillance to changing the delivery channels to implementing technology. These changes have made the industry more agile, efficient and resilient. With the entry of payments bank and the increasing focus on the digital side of things, we are yet to see further transformation in the industry.

TABLE OF CONTENTS

INTRODUCTION

BACKGROUND

BANKING INDUSTRY IN INDIA

PORTER’S FIVE FORCES ANALYSIS OF THE BANKING INDUSTRY

DIGITAL BANKING

IMPORTANT DIMENSIONS AFFECTING CUSTOMER SATISFACTION

LITERATURE REVIEW

RESEARCH DESIGN AND METHODOLOGY

RESEARCH DESIGN

FORMULATION OF HYPOTHESIS

DATA COLLECTION

GENERATION OF SCALE

PROFILE OF RESPONDENTS

GENERAL INFORMATION

DATA CLEANSING

FACTORIAL ANALYSIS OF DATA FROM CUSTOMERS

STRUCTURAL EQUATION MODEL

CONCLUSION

REFERENCE

ANNEXURE

LIST OF FIGURES

Figure 1 Structure of Banking Industry in India……………………….

Figure 2 Growth in number of ATMs…………………………….

Figure 3 Changes in the Usage of ATMs…………………………..

Figure 4 Number of Worldwide Non-Cash Transactions for North America, Europe, Mature APAC, Latin America, Emerging Asia and CEMEA in 2010, 2011, 2012, 2013, 2014 and 2015E (Capgemini, 2016)

Figure 5 Porter’s Five Forces Analysis of the Banking Industry……………..

Figure 6 Factors affecting New Entrants in the Banking Industry (0- low, 5-high)…..

Figure 7 Retail Banking Products……………………………….

Figure 8 Wholesale Banking Products…………………………….

Figure 9 Treasury Products…………………………………..

Figure 10 Awards and Accolades……………………………….

Figure 11 Structural Equation Model of Customer Satisfaction in Digital Banking…..

LIST OF TABLES

Table 1 Profile of Respondents…………………………………

Table 2 Factorial Profile…………………………………….

INTRODUCTION

BACKGROUND

Before initiating a study on Digitalization of Retail Banking and Its Impact on Customer Satisfaction, an attempt has been made to summarize the relevant concepts for the study, viz., the Banking Industry in India, Digital Banking and Customer Satisfaction. The important dimensions for this study which directly or indirectly measure the impact of digitalization of retail banking on customer satisfaction have been summarized, viz., trust, service quality, ease of use, usefulness and commitment. Also the profile of the company has been summarized along with its product offerings and recent awards and accolades.

BANKING INDUSTRY IN INDIA

Banking is one of the most important industries for any economy. Without a sound and effective banking system, India cannot have a healthy economy. As per the Reserve Bank of India, India’s banking sector has sufficient capital and is well-regulated. The economic conditions as well the financial conditions in India is superior to that of any other country in the world. Various studies like credit, market and liquidity risk analysis have shown that Indian banks have done well in the times of global downturn.

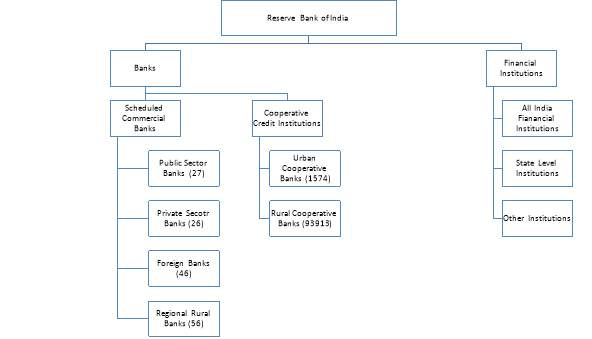

The Indian banking sector is a mix of nationalized banks, private banks, foreign banks, regional banks and cooperative banks. However, the sector is majorly controlled by the public sector banks which account for more than 70% of the banking system assets, thereby leaving a relatively smaller piece of the pie for its private competitors. ICRA has estimated the credit growth in the FY 2017-18 will remain at 5-6% (ICRA, 2017).

Figure 1 Structure of Banking Industry in India

India has witnessed a major growth in the number of smartphone users and internet users over the past few years. India is ranked third in terms of smartphone users after USA and China, while in terms of Internet users, India is ranked second only after China. One of the major enablers for all industries has been “Technology”. The same is the case with the Banking Sector. The current digital world places the customer at the very center, creating webs of value chain to satisfy all the needs of the customer. Today’s customers are connected via their phones using the internet, social media, etc. The needs of this customer is continuously evolving which affects the dynamics of the market disrupting the present business models, forcing companies to reinvent the traditional strategies to stay relevant in the marketplace. The Banking and Financial Services industry, in the last few years, has seen significant transformation, prompting the companies to use technology as the major enabler in their strategies.

Indian banks and even the public sector banks are improving their technological capabilities and infrastructures to better the customer experience & gain an edge over the offerings from its peers. Customer Relationship Management (CRM) and data warehousing is becoming one of the important aspects of the digital banking scenario and is driving the latest wave in the banking industry. Indian banks are also focusing on concepts like SMAC (Social, Mobile, Analytics & Cloud) techniques to gain more customers and in turn to grab a larger portion of the market. In the last few years, technology has been increasingly adopted by the Indian banking sector as it has allowed them to scale faster than before, increase their business transaction volumes without increasing the manpower significantly and at reduced operational costs. They are re-engineering their business processes to include technology at various levels, for example, back-office data processing, convergence of multiple delivery channels and communication with the customers. Currently Indian banks are using about 15 per cent of their total spending on technology and this is expected to increase at the rate of 14.2 per cent annually. Indian banking & securities companies have spent USD8.89 billion on IT products & services in 2015, an increase of nearly 15.2 per cent over what they spent in the year 2014. Use SMAC techniques allow the banks to offer highly targeted products by getting deeper insights in to their needs (PWC).

The ease of banking online has led to paradigm shift from traditional branch banking to online banking. Net banking has become the most used mode of payment among Internet users which account for approximately 44 per cent of the bank’s customers. Branch footfall has reduced due to the extensions offered by online channels and ATMs for transactions like Fund Transfers and Bill payments. The increase in number of ATMs would lead to increase in the number of ATMs per million population from 199 thousand units in 2016 to about 207 thousand units by 2017 (Reserve Bank of India (RBI)).

Figure 2 Growth in number of ATMs

There has been a huge surge in the in card usages and online modes of transactions since the announcement of demonetization by the Government of India on 8th November 2016.

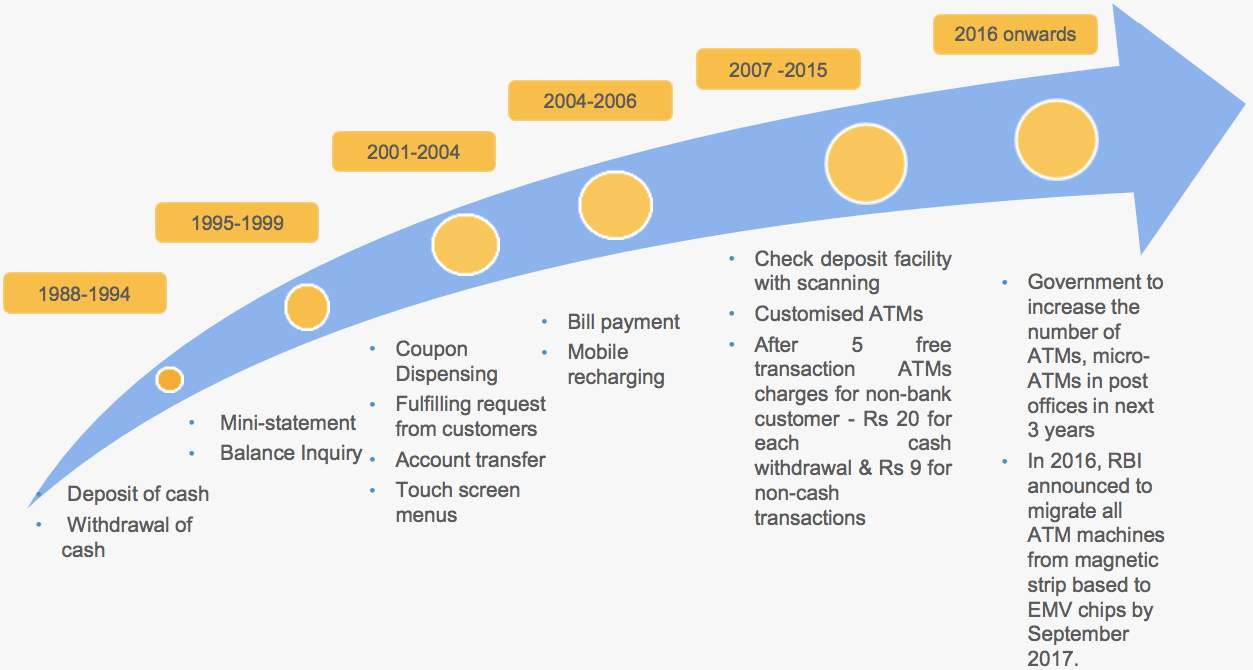

Figure 3 Changes in the Usage of ATMs

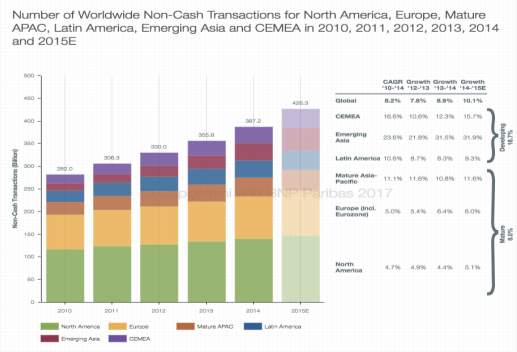

A record year on year growth of 8.9% was recorded in the number of worldwide non-cash transactions and was expected to grow another 10.1% in 2015.

Figure 4 Number of Worldwide Non-Cash Transactions for North America, Europe, Mature APAC, Latin America, Emerging Asia and CEMEA in 2010, 2011, 2012, 2013, 2014 and 2015E (Capgemini, 2016)

Digitalization keeps on offering incalculable opportunities, while at the same time throws new difficulties to banks around the world. The BFSI constantly witnesses no less than one new leap forward in some corner of the world that can possibly reclassify how banking services might be offered in the future. With worldwide web infiltration taking off to 43% in 2015, given the administrative and policy push on financial inclusion and intense rivalry from banking as well as the non‐banking players, the requirement for banks to go onboard the digital journey has been further accelerated.

Profiting by these digital opportunities might not give banks more productive channels to serve their clients, however can help them to investigate more cost‐effective innovations for back‐end operations and improve clients’ involvement with unexplored value‐adding services. Given these potential advantages, there are be sure to be difficulties along the path. These issues might range from infrastructure, client choice and strategy system of the region. Advanced expertise gaps in digital platforms, absence of customer awareness and readiness to adopt, administrative confinements and constrained infrastructural bolster push banks to always alter their computerized methodology. For managing an account administration to develop as real‐time, context‐driven and fully‐automated, banks should enhance, design and effectively actualize their ideas. This report tries to throw some light on the worldwide computerized scene and the different progression that exist inside it. It highlights how the Indian keeping money division has seen noteworthy transformational changes because of components, for example, passage of private players, expanded administrative reconnaissance, changing client channels and executing innovation. The rise of installment banks and the changing concentration of conventional banks towards the advanced side of things is yet another blast that might be seen. It focusses on the worldwide difficulties and also the major computerized developments in the monetary administrations part, both in India and additionally around the world.

PORTER’S FIVE FORCES ANALYSIS OF THE BANKING INDUSTRY

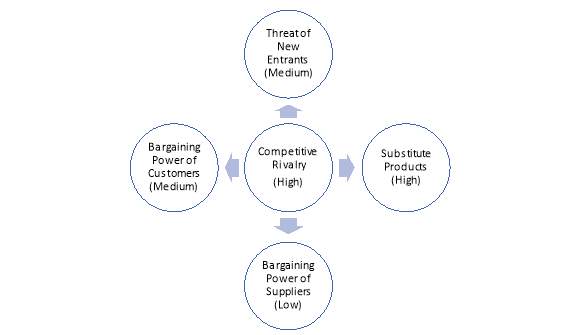

Figure 5 Porter’s Five Forces Analysis of the Banking Industry

Rivalry among the industry: Rivalry in banking industry is high. There are so many private, public, co-operative and non-financial institutions operating in the industry. They are fighting for same customers. Due to government liberalization and globalization policy, banking sector became open for everybody. So, newer and newer private and foreign firms are opening their branches in India. This has intensified the competition. The factors that have contributed to increase in rivalry are:

- Number of players: There are so many banks and non-financial institutions fighting for the same pie which has intensified competition.

- High market growth rate: India is seen as one of the biggest market place and growth rate in Indian banking industry is also very high. This has ignited the competition.

- Low switching cost: Customer switching cost is very low. They can easily switch from one bank to another bank and very little loyalty exists.

- Undifferentiated services: Almost every bank provides similar services. No differentiation exists. Every bank tries to copy each other’s services and technology, which increases the level of competition.

- Low government regulations: There are low regulations to start a new business due to the LPG policy adopted by India post 1991. So, sector is open for everybody.

Bargaining power of suppliers: Suppliers of banks are depositors. These are those people who have excess money and prefer regular income and safety. In banking industry suppliers have low bargaining power. Following are the reasons for low bargaining power of suppliers:

- Nature of suppliers: Suppliers of banks are generally those people who prefer low risk and those who need regular income and safety as well. Bank is best place for them to deposit their surplus money. They believe that banks are safer than other investment alternatives. So, they do not consider other alternatives very seriously, which lowers their bargaining power.

- Few alternatives: Suppliers are risk averters and want regular income. So, they have few alternatives available with them to invest like Treasury bills, government bonds. So, few alternatives lower their bargaining power.

- RBI Rules and Regulations: Banks are subject to RBI rules and regulations. Banks have to behave in the way that RBI wants. So, RBI takes all decisions relating to interest rates. This reduces suppliers bargaining power.

- Suppliers are not concentrated: Banking industry’s suppliers are not concentrated. There are numerous suppliers with negligible portion to offer. So, this reduces their bargaining power. If they were concentrated, then they can bargain with banks or can collectively invest in other non-risky projects.

- Forward integration: Forward integration is possible like mutual funds, but only few people now about this. Only educated people can forwardly integrate where as a large number of suppliers are unaware about these alternatives.

Bargaining power of customers: Customers of the banks are those who take loans, advances and use services of banks. Customers have high bargaining power. Following are the reasons for high bargaining power of customers:

- Large number of players: Customers have very large number of alternatives. There are so many banks, which fight for the same pie. There are many non-financial institutions which have also jumped into this business. There are foreign banks, private banks, cooperative banks and development banks together with the specialized financial companies that provide finance to customers. These all increase preferences for customers.

- Low switching cost: Cost of switching from one bank to another is low. Banks are also providing zero balance account and other types of facilities. They are free to select any bank’s service. Switching costs are becoming lower with internet banking gaining momentum and as a result consumers’ loyalties are harder to retain.

- Undifferentiated service: Banks provide merely similar services. There is not much difference in services provided by different banks. So, bargaining power of customers increases. They cannot be charged for differentiation.

- Full information about the market: Customers have full information about the market. Internet has increased the customer’s access to information. So, banks have to be more competitive and customer friendly to serve them.

Threat of substitutes: Competition from the non-banking financial sector is increasing rapidly. The threat of substitute products is very high. These new products include credit unions and investment houses. One feature of using an investment house is that the fees that the investment house charges are tax deductible, whereas for a bank it is considered a personal expense, which is not tax deductible. The rate of return with using investment houses is greater than a bank. There are other substitutes as well for banks like mutual funds, stocks (shares), government securities, debentures, gold, real estate etc. so, there is a high threat from substitutes.

Threat of new entrant: Barriers to entry in banking industry no longer exist. So, lots of private and foreign banks are entering in the market. Product differentiation is low and exit is difficult. So, every bank strives to survive in highly competitive market. So, we see intense competition and mergers and acquisitions.

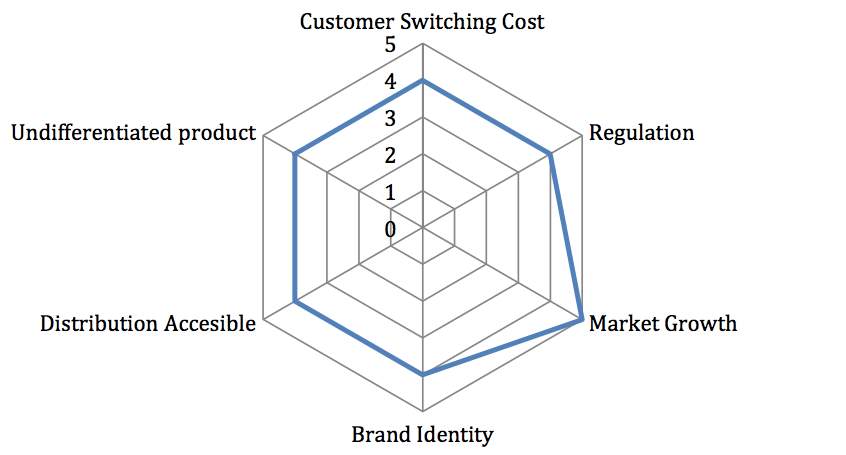

Figure 6 Factors affecting New Entrants in the Banking Industry (0- low, 5-high)

INTRODUCTION TO THE COMPANY

HDFC Bank Limited is a private sector bank incorporated in August 1994 and is headquartered in Mumbai, Maharashtra. It was among the first companies to receive an ‘in principle’ approval from the Reserve Bank of India to set up a bank in the private sector. It commenced operations as a Scheduled Commercial Bank in January 1995. It was promoted by the parent company, Housing Development Finance Corporation, a well-known housing finance institution set up in 1977. As per the Brand Trust Report of 2014, HDFC was ranked as the 32nd most trusted brand in India. It was ranked at the 45th position of the top banks in the World in terms of market capitalization. HDFC Bank has a huge network of 3,251 Branches and 11,177 ATM’s in 2,022 Indian towns and cities and all branches of the bank are linked on an online real-time basis. The Bank likewise has 3 foreign branches in Bahrain, Hong Kong furthermore, Dubai. The aggregate number of ATMs expanded to 12,000 in the year finished March 31, 2016 from 11,766 in the year finished March 31, 2015. The aggregate client base remained at 3.77 crore as on March 31, 2016. Net profit rose by 30.2 per cent Rs 6,726.28 crore (US$ 1.07 billion) in FY13. Total income increased to Rs 41,917.49 crore (US$ 6.72 billion) in FY13.

Portfolio

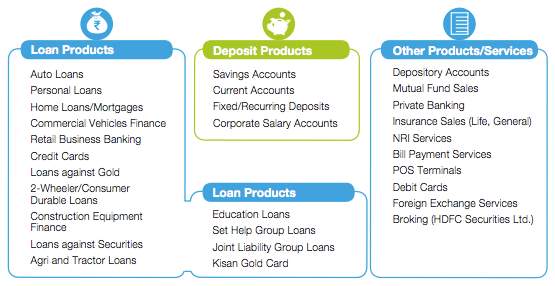

HDFC currently offers products in three categories, viz., Retail Banking, Wholesale Banking and Treasury.

Retail Banking

The Retail Banking section gives clients an extensive variety of items and administrations at their comfort through various channels. There has been steady development in this fragment because of endeavors on two noteworthy fronts – expanding geological reach through the broad network of branches and improving client encounter through development over different channels. Speedier and more productive stage conveyances crosswise over ATMs, Internet, Phones and Mobiles have been the foundation of the development in Retail Advances. The Bank additionally concentrates on bleeding edge investigation and Customer Relationship Management (CRM) to comprehend client needs better and offer them items custom-made to their necessities. It is this section of the business that has been at the foundation of the Bank’s advanced system, empowering it to make client please while adding to sustainability.

Figure 7 Retail Banking Products

Wholesale Banking

The Wholesale Banking section gives an extensive variety of business and value-based managing an account items to corporate and institutional customers. It gives items to the best corporates as well as to Emerging Corporates, SMEs and Rural Clients. The Bank’s Financial Institutions and Government Business Group (FIG) offers items to financial institutions, mutual funds, insurance companies, public sector undertakings, central and state government departments. The scope of items/administrations offered by the Bank incorporate Working Capital Finance, Term Finance, Trade Services, Cash Management, Investment Banking, Foreign Exchange and Electronic Banking.

Figure 8 Wholesale Banking Products

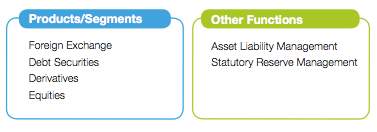

Treasury

The Treasury segment manages the Bank’s investment portfolio, money market borrowing cum lending programs and trades in foreign exchange and derivative contracts.

Figure 9 Treasury Products

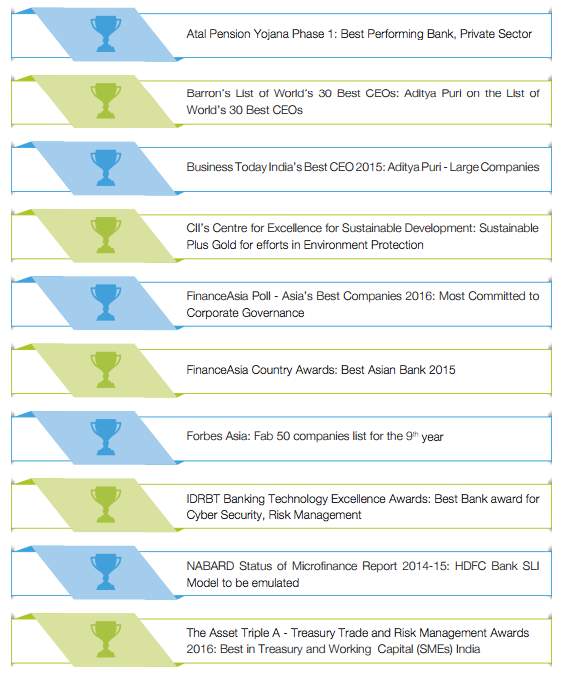

Awards

Our accomplishments regarding effort and infiltration with an extensive variety of items and administrations has helped us enhance our business execution year on year. This has driven us to all-inclusive acknowledgment as honors and awards.

Figure 10 Awards and Accolades

Mission and Vision of the Company

- To be a World Class Indian Bank

- To be benchmarked against international standards

- To build sound customer franchises across distinct business

- To use the best practices in product offerings, technology, service levels, risk management and audit & compliance

The vision of the company is to be a ‘World Class Indian Bank’ achieved through their five core values:

- Sustainability

- People

- Operational Excellence

- Product Leadership and

- Customer Focus

DIGITAL BANKING

The life of every individual is being affected by technology both quantitatively and qualitatively in today’s age. The fast extension of data analysis and technology has imbibed into the lives of a large number of individuals and presented significant changes in the overall financial and business atmosphere. Developments in technology have sped up transactions and communications for customers (Booz, 1977). Digital banking is the digitization (or moving online) of all the traditional banking activities and programs that historically were only available to customers when physically inside of a bank branch. This includes activities like Money Deposits, Withdrawals, and Transfers, Checking/Saving Account Management, applying for Financial Products, Loan Management, Bill Pay and Account Services. There are two major methods of delivering the digital experience to customers. The first is offering digital banking services as an extension of traditional branch banking services, also known as the “Bricks and Clicks” model. The second way is to create all channels of delivery online, where there is no physical bank branch and everything is taken care online using internet, telecommunication network and wireless networking. Providing digital banking services have gone from the stage of being something “nice to have” to “must have” for all banks. The digital revolution in India was started by ICICI Bank Ltd., which started its online services under the name “Infinity” in 1998. However, today every bank offers a digital banking experience and also extending their presence in rural regional markets to acquire more customers by educating them about the advancement in technology and helping them adopt digital banking.

IMPORTANT DIMENSIONS AFFECTING CUSTOMER SATISFACTION

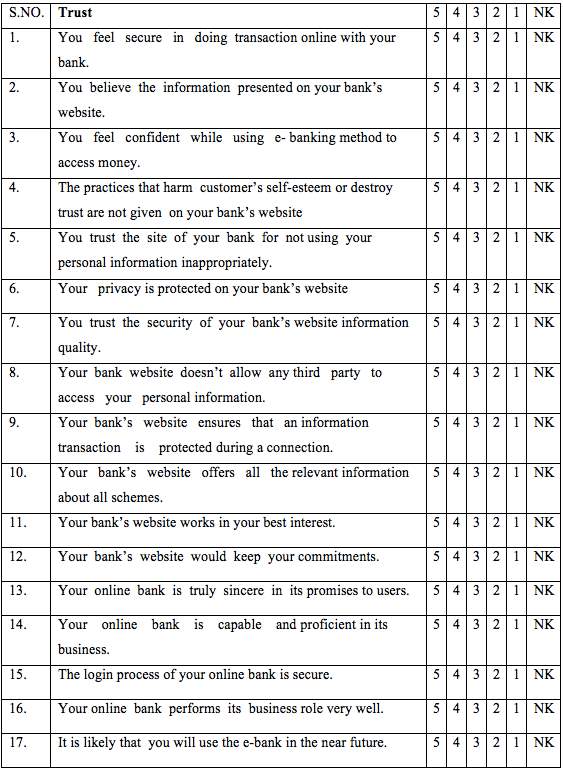

Trust

Service is essentially an intangible offering from one part to another which does not result in the ownership of anything. Due to this dimension of intangibility, trust plays an important role in any service as consumers are not sure of what to expect until they consume the service and hence might perceive the service as risky. Subsequently, requirement for trust emerges as it is the management of risk, instability and powerlessness and incorporates unwavering quality, genuineness, consistency, commonality, desire where a partner is similarly dedicated. Trust and security got extraordinary consideration in the showcasing writing because of the prominent impact that it has on the fulfillment of enduring and beneficial connections (Morgan, 1994). Customers perceive trust as one of the greatest challenge to adopting digital banking methods as it contains exchange of sensitive information. It is a complex and include multiple dimensions like trusting beliefs, familiarity, disposition of trust, institutional based trust, benevolence, competence and integrity.

Service Quality

Service quality is the distinction between client desires for the service experience and the view of the services received (Oliver, 1980). Service quality can likewise be characterized as “the consumer’s by and large impression of the relative mediocrity/prevalence of the association and its services” (Bitner, 1990). Accordingly, service quality is characterized as how well a conveyed service level matches client desires. Clients see the quality of services of internet managing an account in view of the execution of online delivery frameworks and not on the forms in which the conveyed service is created and delivered.

Perceived Ease of Use

The Internet offers an opportunity with innovative new virtual environment that stimulates and enhances the learning of the bankers and the customers and the operative process. The intent to adopt digital banking is primarily determined by the ease of using the new technologies. An important factor in studying informational acceptance has been the perceived ease of use of the said technology. Perceived ease of use can be defined as the degree to which an innovation is perceived not to be difficult to understand, learn or operate (Rogers, 1983). Further (Rogers, 1983) stated that perceived ease of use is the degree to which consumers perceive a new product or service as much better than its substitutes. In the case of digital banking, perceived ease of use refers to the ease of using the digital services and is an indication of how intuitive the service and offering is. System adoption and information systems success can be measured by ease of use. In applying this construct in online banking setting, banks should concentrate on website and relevant capacities to provide to the needs of their clients with the goal that an application seen less demanding to use by clients than another is more liable to be acknowledged by them and improves their goal or ability to utilize the innovation. On the off chance that the arrangement of utilizing an online channel for banking transactions does not exceed client deprival occasioned by components, for example, indifferent correspondence, specialized troubles and learning endeavors, the client may basically switch its support back to customary channel. In this way, it is evident that a channel which is anything but difficult to utilize can assume an essential part in consumer loyalty with online banking services.

Perceived Usefulness

Information technology quickly changes the textures of modern development and advancement nowadays and along these lines online banking has turned out to be increasingly enhanced and complex. Conventional banking in numerous nations including India (Williamson, 2006) has made difficulties before the bankers. There are a few factors that foreordain the consumer attitude towards online banking, for example, demographic background, motivation and conduct towards various banking innovations and individual inclinations and desires from the new technology (Abdullah, 2011). Consumer attitudes towards online banking are impacted by the related knowledge of computers and new technology (Laforet, 2005) and other environmental components (Davis, 1989). In the context of digital banking, customers have to worry about password integrity, privacy, data encryption, hacking and the protection of personal information. If the perceived usefulness of the service is not greater than the concerns, then it cannot lead to large adoption or customer satisfaction with the services. Perceived usefulness might increase other dimensions such as loyalty, commitment and recommendation to others. The greater the level of perceived usefulness, the greater will be the adoption of these newer delivery channels through digital banking.

Customer Satisfaction

The measure of how a company’s products or services meet or exceed the customer expectation is known as customer satisfaction. It is one of the important metric that business owners and marketers use to manage and improve their businesses. Customer satisfaction is very important for any business because it is one of the most valid metrics which show the tendency of a customer to repurchase or recommend the product or service. It is always easier to retain a customer than to acquire a new one. Customer satisfaction can be a point of differentiation when the products or services from different competitors are largely the same with similar features and offerings. It also increases the customer lifetime value and reduces customer churn. In the banking industry, these days all banks offer similar products and services. This makes it confusing for the customer to be loyal towards the bank. However, exceeding the customer expectations can help them differentiate from the rest of the herd and this can only be done by increasing the level of customer satisfaction. The existing customers will also be likely to purchase more products from the bank if they are delighted.

Commitment

Commitment, just like trust, is one of the most important factors that explain the strength of a marketing relationship. In the context of banking industry, marketing relationship refers to the building of long term relationships between the bank and the customers so that they regularly make transactions with the respective banks. One of the important constructs of digital banking is relationship banking. According to the commitment-trust theory, both commitment and trust must exist for a successful relationship. As opposed to pursuing quick benefits, organizations following the standards of relationship marketing build dependable bonds with their customers. Thus, customers put stock in these organizations, and the shared unwaveringness enables the two parties to satisfy both their necessities. Customers not only get the product or service they have paid for, but they also feel valued which in turns increases the loyalty towards the company.

Indian banks have been forced by globalization, growth and use of technology and fast competition to adopt newer channels for delivering their products and services to gain an edge over the competition, reduce operating costs, better their offerings, grow their market share to generate customer satisfaction and increase trust and commitment towards their organizations. Low switching costs make this difficult. Variables that contribute towards commitment include service quality, trust, perceived ease of use and usefulness and all of these have a direct impact on the customer satisfaction and subsequently towards the profitability of the bank. Hence it has become important for banks to understand which of these variables is the most important for performance of the business.

LITERATURE REVIEW

(N., 2014) refers to a few suppositions of what computerized banking implies. He says, what advanced basically does is that it utilizes innovation to configuration encounters, both seen and inconspicuous. Advanced is tied in with making what can be seen inconspicuous – making administrations so smooth and consistent that it ends up noticeably undetectable to the customer. It includes making arrangements for computerized activities which requires something other than the mechanization of administrations, however to likewise taking into account the enthusiastic part of banking – how do customers feel about cash and what do they do with it? Enthusiastic necessities must be at the focal point of the whole customer experience. Customer satisfaction is a measure of how cheerful customers feel when they work with an organization in this setting a bank. Advanced correspondence should feel normal for computerized customers, and banks have a pivotal open door here to introduce themselves in another light and to another gathering of people acclimated to a totally extraordinary method for associating with companions and for whom obtaining on the web is second nature. Extending the customer relationship, in a consistent manner and in venture with the client’s way of life, blocks any contemplations of being excessively present – this is the key of knowing customer inclinations and considering, how much nearness, when and in what ways. Taking care of business receives rich benefits over the long haul; failing to understand the situation forecasts a potential lost era of customers.

The computerized banking offering ought to be founded on a strong comprehension of advanced buyer behavior and additionally thought of how to fabricate and expand bank mark an incentive for advanced customers. Essentially, great customer benefit is significant to the estimation of long haul customer reliability. The computerized tipping point is an essential open door and one that offers generous advantages to the individuals who abuse it well. Notwithstanding appropriately tending to the applicable mechanical and security angles, computerized banking procedure for private banks ought to be produced with a reasonable concentrate on present and future customer behavior and necessities (Villers, 2012). The move of the banking business in the course of recent decades has been chronicled, following the way from online empowered abilities, to multichannel reconciliation, to more consistent full-work arrangements that use cell phones and huge information investigation. As indicated by the Cisco look into, the following phase of banking development will make exchanges so advantageous and robotized that they will show up for all intents and purposes undetectable to the shopper, however will convey esteem included advantages past the exchange (J., 2014). Another view is that characterize customer encounter as a cooperation between an association and a customer as saw through a customer’s cognizant and intuitive personality. It is a mix of an association’s sane execution, the faculties animated and the feelings evoked and instinctively measured against customer desires over all snapshots of contact. A decent customer encounter prompts a fulfilled customer. Banks are giving new inventive methods of fulfilling customers, for example, online framework and internet banking, phone and call focus. The two critical components of banks which impact the general satisfaction of customers are aggressiveness and simplicity. So with a specific end goal to expand the productivity of the association it is essential measuring the customer satisfaction. What makes a difference most to them is the means by which they encounter the bank’s image. There are different channels the extent that advanced banking is concerned. Internet Banking gives you a chance to deal with many banking exchanges by means of your PC. For example, you may utilize your PC to see your record adjust, ask for exchanges amongst records, and pay bills electronically. Internet banking framework and strategy in which a PC is associated by a system specialist co-op straightforwardly to a host PC arrangement of a bank to such an extent that customer benefit solicitations can be handled naturally without requirement for intercession by customer benefit representatives. In the long run a bank can save money on cash by not paying for tellers or for overseeing branches. Additionally, it’s less expensive to make exchanges over the Internet. Customer Base-the Internet enables banks to achieve a radical new market-and a well off one as well, on the grounds that there are no geographic limits with the Internet. The Internet likewise gives a level playing field to little banks who need to add to their customer base. Effectiveness Banks can turn out to be more proficient than they as of now are by giving Internet access to their customers. The Internet furnishes the manage an account with a nearly paper less framework. Customer Service and Satisfaction-Banking on the Internet not just enable the customer to have a full scope of administrations accessible to them yet it additionally permits them a few administrations not offered at any of the branches. The individual does not need to go to a branch where that administration could possibly be offer. A man can print of data, structures, and applications by means of the Internet and have the capacity to look for data effectively as opposed to holding up in line and asking a teller. With all the better and speedier alternatives, a bank will most likely have the capacity to make better customer relations and satisfaction. Image-A bank appears to be more best in class to a customer in the event that they offer Internet get to. A man might not have any desire to utilize Internet banking but rather having the administration accessible gives a man the inclination that their bank is on the cutting picture.

RESEARCH DESIGN AND METHODOLOGY

Multiple aspects of the scope and the nature of the study, along with the formulation of the hypothesis, collection of data, design of the samples and the statistical tools used have been summarized below.

RESEARCH DESIGN

This study is both evaluative and descriptive and tries to understand the impact of various factors on customer satisfaction in digital banking at HDFC Bank Ltd. This study is based on data gathered from HDFC Bank Ltd. customers in different cities. This study aims to provide useful insights to bank officials, management responsible for framing policies that can induce customers to use digital banking while satisfying the customers and provide gainful business to the bank.

FORMULATION OF HYPOTHESIS

Repurchase intent of the customer is highly affected by their level of satisfaction with the product or service they are using. Most of the times, satisfaction works as an indicator for commitment. This should indicate that if customers of the bank are satisfied with the offerings from the bank, which includes the digital services, they will be using the products and services from the same bank instead of switching to another and be committed to the bank. Along these lines, it is sensible to anticipate that clients who are happy with the digital banking make more prominent reuse of the same. Thus, it can be hypothesized that:

H1: Customer Satisfaction influences commitment to digital banking.

Trust and satisfaction have been shown to be associated with the formation of long-term relationship between organizations and their customers (Anderson and Marus, 1990). As explained previously, adoption and attitude towards digital banking services are mostly driven by trust, given the sensitive nature of the information shared during the transactions. Various studies have shown the impact of trust on customer satisfaction. Thus, it can be hypothesized that:

H2: Trust in digital banking positively affects customer satisfaction.

Variables like service quality and satisfaction are both results of the comparison of the customer expectations versus actual performance. This means that there should be a dependency between the two constructs. In the context of digital banking, higher service quality should lead to higher customer satisfaction. Thus, it can be hypothesized that:

H3: Service quality positively affects customer satisfaction in digital banking.

Customers are likely to use services that are easy to learn and use. Other studies asserted that drivers of development in digital banking are controlled by the apparent usability which is a mix of convenience provided to those with easy access to Internet, the accessibility of secure, exclusive requirement of banking services usefulness and the need of saving money administrations, which impact a customer intention to adopt that innovation and enhances work performance. Thus it can be hypothesized that:

H4: Perceived ease of use positively affects customer satisfaction in digital banking.

H5: Perceived usefulness positively affects customer satisfaction in digital banking.

DATA COLLECTION

Data for this study was collected from both Primary and Secondary sources. The primary data was collected from 100 digital banking users including online banking users, ATM users and mobile banking users through convenience sampling. Secondary data has been collected from journals such as Journal of Internet Research, Journal of Internet Banking and Commerce.

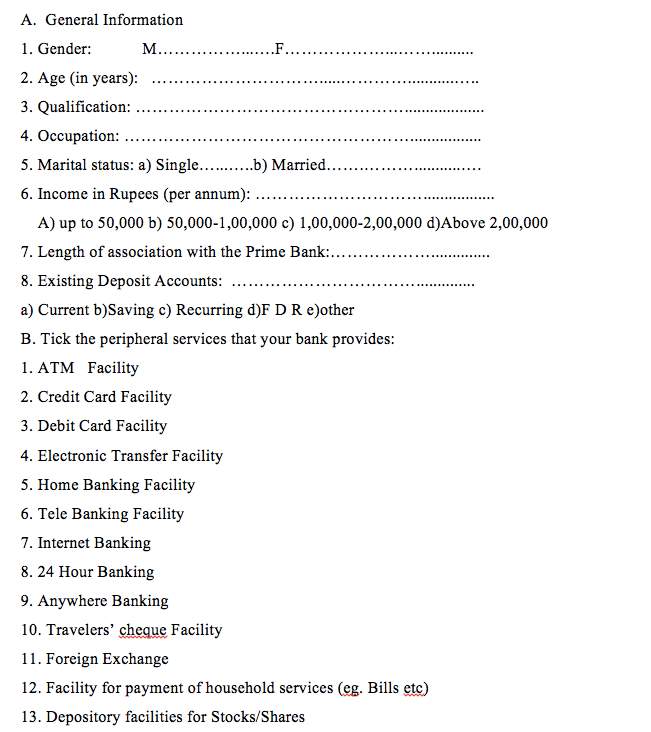

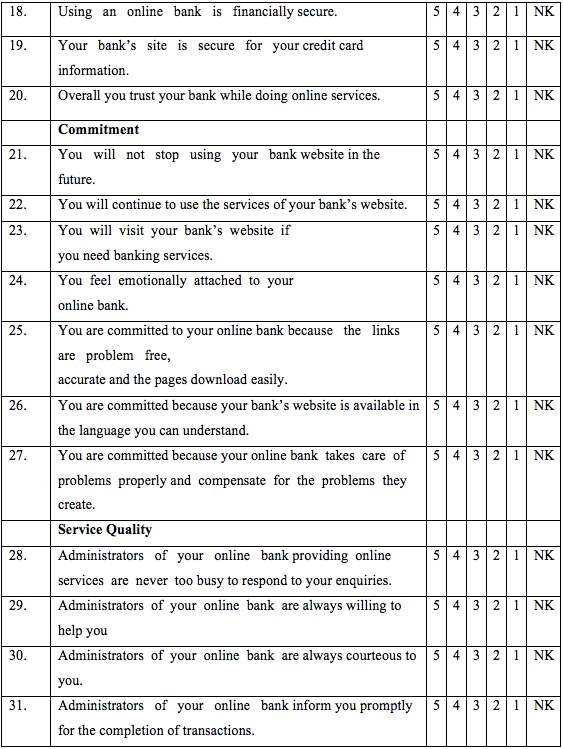

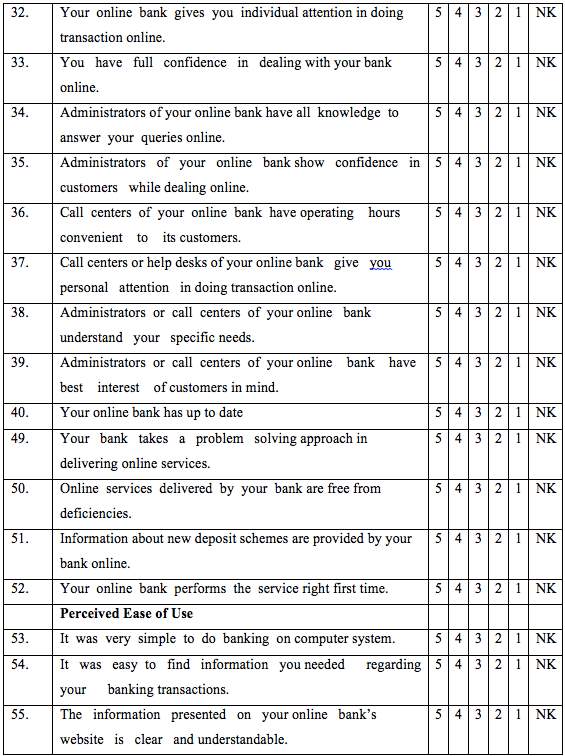

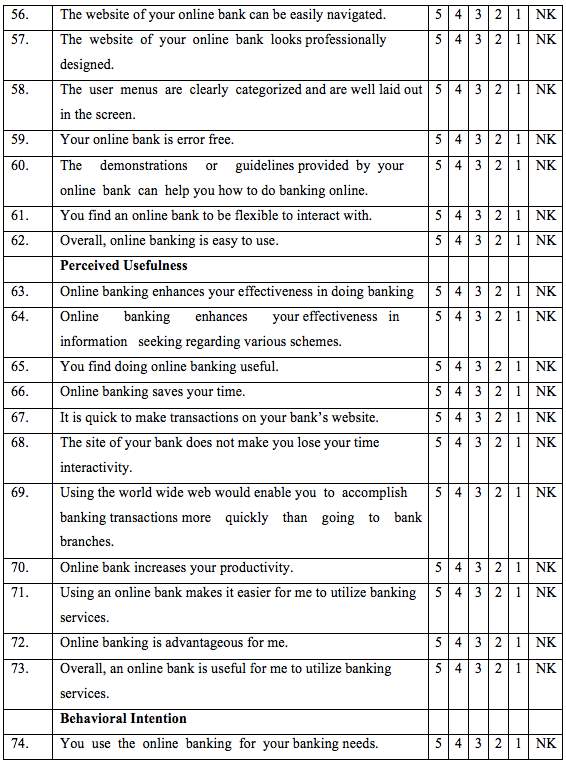

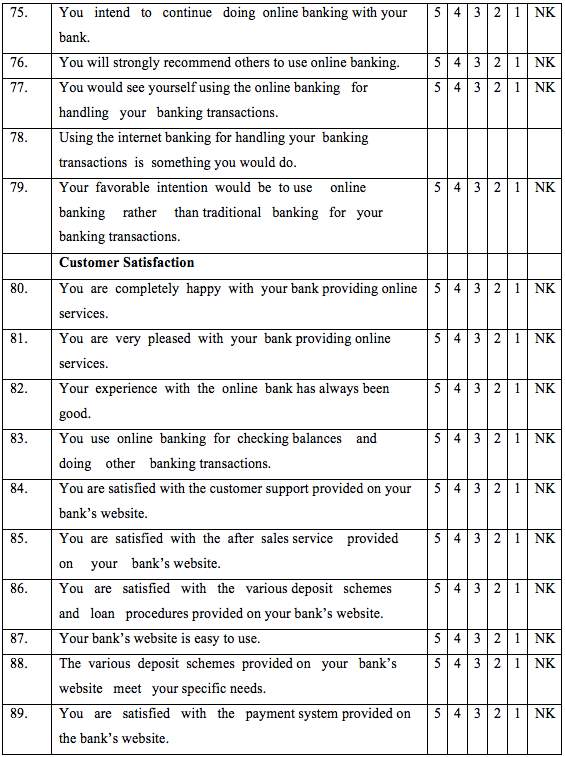

GENERATION OF SCALE

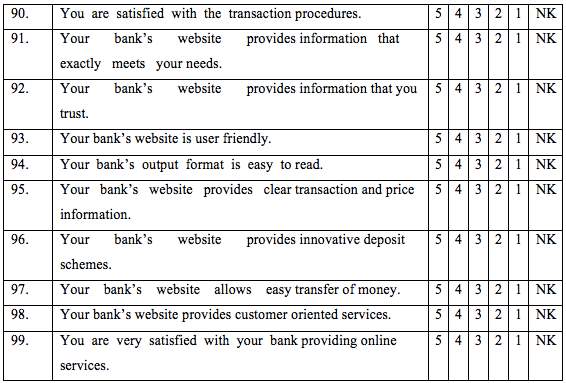

The primary data was collected through a specifically developed questionnaire. It consists 10 general items, 13 items of related services that HDFC provides and 99 items based on the Likert scale ranging from 1 to 5 where 1 denotes the “strongly disagree” and 5 denotes “strongly agree”.

PROFILE OF RESPONDENTS

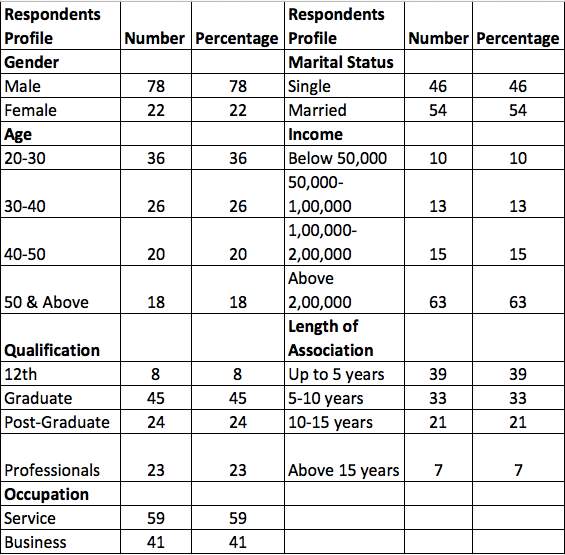

Table 1 Profile of Respondents

GENERAL INFORMATION

The study found that the majority of users (39%) have been using digital banking services for the last 5 years, 33% since the last 5-10 years, 21% for 10-15 years and 7% for more than 15 years. Out of the 100 correspondents, 59 had a savings account, 38 of them had current account, 2 had only recurring deposits and 1 had only fixed deposits. Almost all respondents were using ATM facilities, 63% were using credit cards. 66% preferred using online transactions compared to traditional branch transactions.

DATA CLEANSING

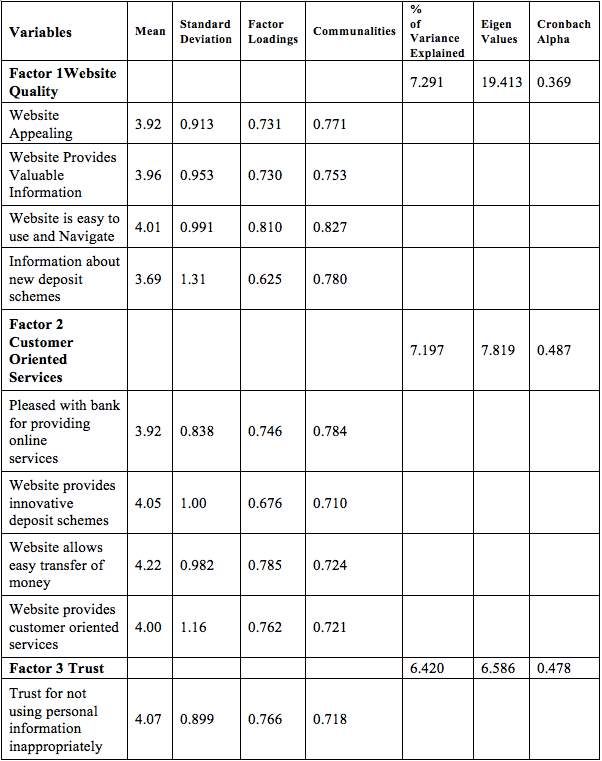

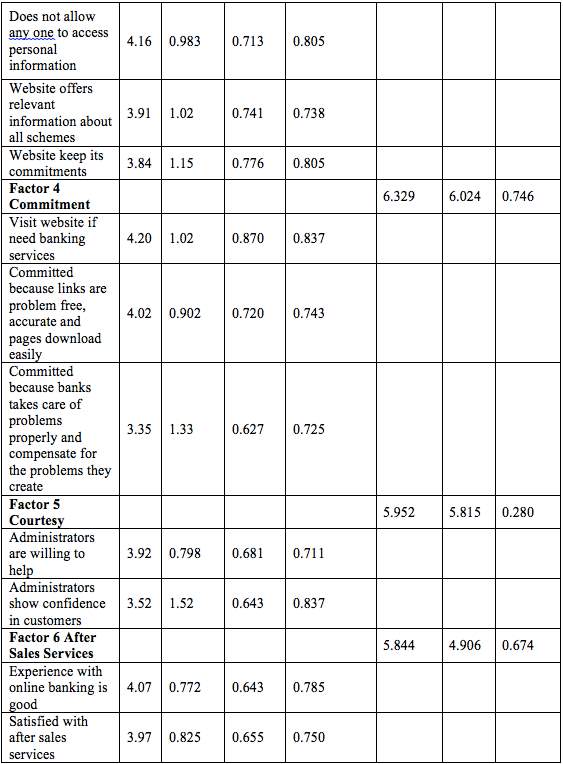

The process of removing as many inaccurate or incorrect items as possible from a mass of data before automatic data processing is begun is known as data cleansing. A huge number of variables had to be reduced to smaller number of variables, into factors such that there is negligible loss of data. Principal Component Analysis was used for this purpose. Exploratory factor analysis was used to study the correlations between the variables. Variables that had factor loading more than 0.5 were considered good and variables having Eigen value equal or more than equal to one were retained. The indicators related to digital banking are trust, commitment, service quality, perceived ease of use, perceived usefulness, behavioral intentions and customer satisfaction.

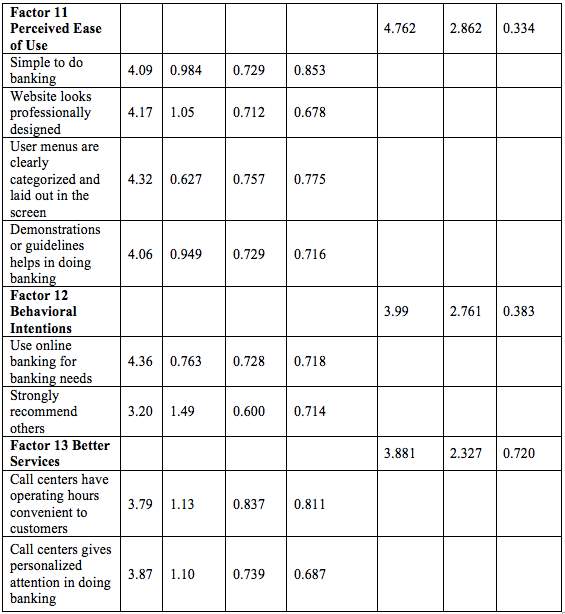

The twenty items used to measure trust in digital banking were run through factor analysis, resulting into only seven items inside two factors, viz. ‘trust’ and ‘security’. The four items of commitment were removed for further analysis due to very low loadings. The service quality consists of 25 items and after running Exploratory Factor Analysis only 12 items got grouped into four factors namely ‘website quality’, ‘responsiveness’, ‘better services’ and ‘courtesy’. Six items of both perceived ease of use and perceived usefulness have been removed and remaining items converged in three factors viz. ‘perceived ease of use’, ‘perceived usefulness’ and ‘interactivity’. The four items of behavioral intention have also been removed and remaining items resulted into one factor as ‘behavioral intention’. Lastly, twenty items of customer satisfaction, when factor analyzed, resulted in the removal of 14 items and remaining got grouped in two factors viz. ‘customer oriented services’ and ‘after sales services’.

FACTORIAL ANALYSIS OF DATA FROM CUSTOMERS

Table 2 Factorial Profile

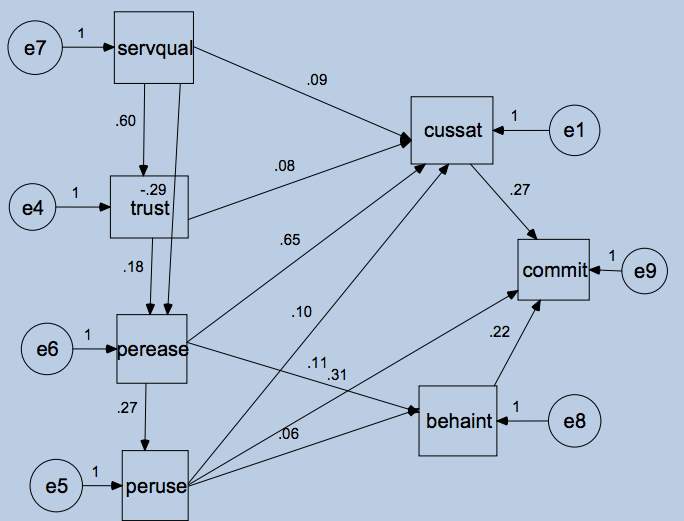

STRUCTURAL EQUATION MODEL

Structural Equation Model is a combination of both factor analysis as well as multiple regression and is generally used to study and analyze the structural relationship between measured variables and latent constructs. Since it can estimate multiple and inter-related dependence in a single analysis, it is preferred by many researchers and academicians.

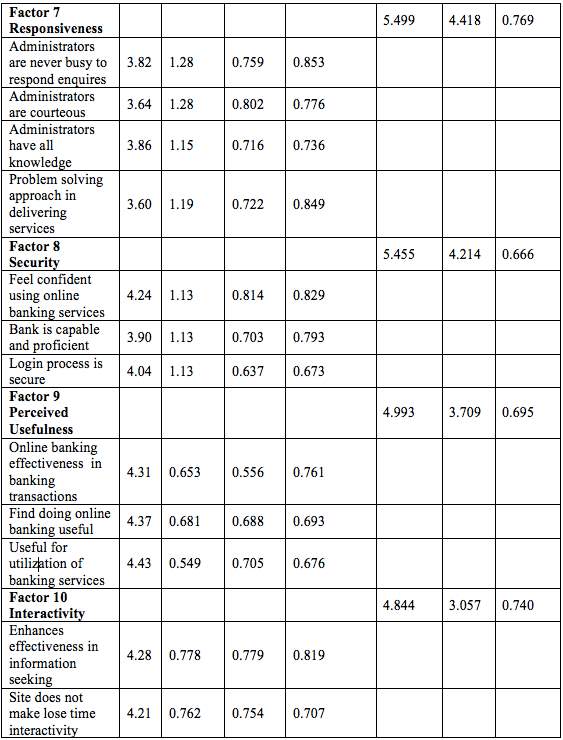

The first model was proposed with all seven constructs which included Service quality, trust, behavioral intentions, perceived ease of use, perceived usefulness, customer satisfaction and customer commitment. Customer satisfaction and commitment were proposed to be affected by service quality and trust. Behavioral intentions of the customers to use digital banking services were proposed to be affected by the perceived ease of use and usefulness, which in turn affects the customer satisfaction. But, this model was not a good fit as value of chi-square was 32, Root Mean Square Residual value of 0.077, Goodness of Fit Index value of 0.768, Adjusted Goodness of Fit Index of value of 0.593, Comparative Fit Index of 0.05 and Root Mean Square Error of Approximation value of 0.279.

After few iterations of modifying the paths as per the modification index, a proper model was arrived at. CMIN/df= 3.834, RMR= 0.023, GFI= 0.979, AGFI= 0.926, TLI= 0.886, CFI= 0.957, NFI= 0.944 and RMSEA= 0.084.

Figure 11 Structural Equation Model of Customer Satisfaction in Digital Banking

From the above model, it is clear that customer satisfaction has a positive effect on customer commitment towards the bank. Similarly, we can see the positive effect of trust, service quality, perceived ease of use, perceived usefulness on customer satisfaction. Also perceived ease of use and perceived usefulness has a direct positive effect on the behavioral intent to use digital banking services.

Thus all our hypotheses have been accepted.

H1: Customer Satisfaction influences commitment to digital banking.

H2: Trust in digital banking positively affects customer satisfaction.

H3: Service quality positively affects customer satisfaction in digital banking.

H4: Perceived ease of use positively affects customer satisfaction in digital banking.

H5: Perceived usefulness positively affects customer satisfaction in digital banking.

CONCLUSION

Customer satisfaction has for quite some time been found as assuming a basic part for progress and survival in the present focused environment. Generally speaking, comes about demonstrate that very taught people who are workers, representatives and have a place with higher pay gatherings and more youthful are real clients of internet banking. The discoveries of the examination uncover that customers are happy with their separate bank for internet banking offices which spare their time and cost and empower them to know their record adjusts and dispatch stores starting with one place then onto the next anyplace and whenever. The consequences of SEM demonstrate that customer satisfaction is not just impacted by better administration quality and trust additionally through different factors, for example, saw simplicity of utilize and saw value, which are not just forerunners of behavioral aim yet, likewise the wellspring of creating customer satisfaction and commitment. Further, trust which is produced through security and protection of customer’s close to home data is the minimum imperative measurement for anticipating customer satisfaction, along these lines recommending the managers of web based banking administrations to guarantee their individual customers that their webpage is free from a downpour of spam and that customers individual data (particularly credit what’s more, platinum card points of interest) is not presented to any false utilize. Keeping in see restricted effect of online administration quality on customer satisfaction, bank managers must embrace techniques as to advancing saw benefit quality. In addition, it is moreover discovered that customers append more significance to worker behavior, their agreeableness state of mind, respectfulness, collaboration, quickness in noting enquires on the web. Thus banks must prepare their workers to adequately deal with customer issues, so they create trust in the psyches of customers about bank work force and administration bundle accessible on the web. Therefore, offering of internet banking administration is fundamental for bank’s survival and therefore required to contend viably.

REFERENCES

Abdullah, R. S. (2011). Customer perspectives on ebusiness value: Case study on internet banking. Journal of Internet Banking and Commerce, 1-13.

Bitner, M. B. (1990). The service consequences of satisfaction decisions. Journal of Marketing, 71-84.

Booz, A. a. (1977). Internet banking: A study of potential. INC, New York.

Capgemini. (2016). Capgemini Financial Services Analysis. Bank for International Settlements Red Book.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use and user acceptance of information technology. MIS Quartely, 319-340.

ICRA. (2017, January 31). Banks credit growth to remain subdued at 5-6% in FY17: Icra. Retrieved from Times of India: http://timesofindia.indiatimes.com/business/india-business/banks-credit-growth-to-remain-subdued-at-5-6-in-fy17-icra/articleshow/56888913.cms

J., M. (2014). Despite Digital Banking Growth, Traditional Channels Survive. Retrieved from The Financial Brand: http://thefinancialbrand.com/45577/online-mobile-digital-banking-channel-usage-research/

Laforet, S. a. (2005). Consumer‟s attitudes towards online and mobile banking in China. International Journal of Bank Marketing, 362-380.

Morgan, R. a. (1994). The commitment trust theory of relationship marketing. Journal of Marketing, 20-38.

N., C. (2014). What’s Your Definition of ‘Digital’ in Banking? Retrieved from The Financial Brand: https: thefinancialbrand.com/defining-digital-in-banking-next bank-face book

Oliver, R. (1980). A cognitive model of the antecedents and consequences of satisfaction decisions. Journal of Marketing Research, 460-470.

PWC. (n.d.). Searching for new frontiers of growth. TechSci Research.

Reserve Bank of India (RBI). (n.d.). IBA statistics. TechSci Research.

Rogers, E. (1983). Diffusion of Innovations. The Free Press, New York.

Villers. (2012). Banking will mean digital banking in 2015. Retrieved from PWC: http://www.pwc.lu/en/pressarticles/2012/banking-will-mean-digital-banking-in-2015.jhtml

Williamson, L. S. (2006). Understanding consumer adoption of internet banking: An interpretive study in the Australian Banking context. Journal of Electronic Commerce Research, 50-66.

ANNEXURE

Note: Please tick any no. from 5 to 1 on the basis of your experience with your prime bank. Here 5 means strongly agree, 4 means agree, 3 means neutral, 2 means disagree, 1 means strongly disagree and NK means not known.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Banking"

Banking can be defined as the business of a bank or someone employed in the banking industry. Used in a non-business sense, banking generally means carrying out activities related to the management of one’s bank accounts or finances.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: