Benefits of Implementation of Six Sigma in Service-based Settings

Info: 10572 words (42 pages) Dissertation

Published: 9th Dec 2019

Tagged: Business Strategy

Six Sigma is a way of thinking, a set of management techniques in order to enhance business processes by greatly eliminating the probability that an error or defect will occur (Anthony, Anthony, Kumar &Cho, 2007), which improves customers’ experiences, lowering the costs, improve productivity, increased market share, business profitability and building better leaders after successful implementation from areas in phases of manufacturing to transactional (banking) and from products to services. There are two methodologies in Six Sigma, they are: DMAIC and DMADV. In this project, we will look at DMAIC, (Define, Measure, Analyse, Design, and Control).It is an improvement system for existing processes that do not meet the requirement and looking for a rise in improvement. DMAIV is an improvement system that is used to develop new processes or products (PEUSS, WMG 2017).The reason we focused on DMAIC isthat in the research, we aimed to improve people development in a commercial business environment, service organisations such as banking and insurance sector. In this research, I am going to shed light on the benefits of implementation of Six Sigma in service-based settings, how it would benefit employee development and to create a suitable training plan for employees in Macau.

Six Sigma is a methodology that can be applied across any business or organisation anywhere for almost any process. As Six Sigma methodology provides very specific and clear goals, each member of the organisation can get involved into the process of implementation of the project that is to provide outstanding quality to the customer (Taner, 2013).

Pantano et al (2006) found that one third of the studied automotive sector representatives desire the UK government to provide a higher level of industry support in people development and productivity improvement (Society of Motor Manufacturers and traders, 2005). The evolutionary quality approach developed by Webb & Sheeran (2003) is a specific and focused system approach, designed to meet SMEsrequirements. There are three main activities in the application of this approach, first, it is to identify performance based problems in quality; second, resolve the problems through applying quality tools and techniques; finally, to develop a procedural system based according to the previous activities (Pantano et al, 2006).

1.1 Six Sigma in service-organisations

Over the past fifteen years, Six Sigma implementation has been popular among many service organizations such as Bank of America; Citibank in USA and also it is also a popular tool in European countries (Chakrabarty & Tan, 2009)

A number of studies had been conducted regarding the common issues faced within the banks such as complaints of customers to the banks and their services, and how to fix it by using Six Sigma tools and techniques. Below, are some of the examples, Roberts (2004) found it is very likely to have avoidable defects, mistakes which leads to unpredictable outcomes in any credit union process. In the case of dealing with customer service problems in Citibank (Rucker, 2000), consulters from Motorola University first used Pareto chart to identify problems which occurred in the highest frequencies or that caused the highest. The results was astonishing as they reduced 73% of the unnecessary internal and external call backs and also reducing the unacceptable credit processing time (such as opening an account, handling different payments, etc.)

Recently, there are a high number of flaws in online banking and payment problems in NatWest, Lloyds Bank, Halifax. (The Sun, 2017), customers have been having problems related to disappearing payments, being locked out of the accounts and not able to get access to their cash which possibly linked to some cyber-attack problems which also could be dealt with the help of Six Sigma project.

There are also high numbers of errors in customer-facing processes such as setting up an account, payment handling, etc. (Curry & Penman, 2004); trading errors resulting from excessive market losses, high costs related to electronic order corrections etc. in an investment bank (Stusnick, 2005) which could be eliminate as the technology advances. However, even the service provide by the technology can help process all the customer queries more efficiently, a company would still only be “as good as its people” (Curry & Penman, 2004; Gronroos, 2001).

Starbird (2002) suggested that Six Sigma processes as an essential part of a management system that facilitates organisational business excellence and providing solutions to Six Sigma success with process management which includes identifications of fundamental processes, customer demands and measures. Six Sigma can also be used to motivate performances through reporting from the leaders/ supervisors, they must sustain and report any opportunity lists, conditions of active projects, status of the resources, and reporting results from finished projects (Starbird, 2002).

Traditionally, Six Sigma has been related to reducing errors and costs in many manufacturing industries The following are the benefits accomplished from service-oriented businesses that successfully implemented a Six Sigma project in the survey carried out by Anthony et al, (2004) & (2007):

- Increase morale of the employees and reinforce cross-functional teamwork within the organisation.

- Increased market share.

- Reduced defect rate and unnecessary steps in key service processes through systematic elimination;

- Reducing excessive cost of poor quality service (e.g. late deliveries, customer service related complaints) and improved customer satisfaction;

- Transformation of organisational culture: “Fire-fighter” mode to “Fire prevention” mode.

After an implementation of Six Sigma project in the Bank of America, it was found that there were significant reduced customer complaints by 24%, which enhanced customer satisfaction by 10.4% (Roberts,2004), reduction in both internal and external call backs by 80%, improved process efficiency thus reduces credit processing time and reduced errors in all customer-facing processes (Rucker,2000); significant reduction in the number of returned renewal credit cards; reduced trading errors significantly ; reduced costs associated with order corrections, etc. and also reduced the cycle time by over 40% defect rate (from 13,500 DPMO to 6000 DPMO) (Defects by million opportunities is a measure of process performance). All these improvements led to several millions of dollars in saving and improving morale of the employees within the working environment.

Currently, Six Sigma is being implemented successfully in a wide range of services among enterprises. In this research, we are going to look at an implementation of a Six Sigma project in an Asian city, Macau. Six Sigma is a dominant methodology developed to speed up improvement in service quality by focusing persistently on reducing process variation and eliminating excessive steps or tasks in U.S.A,U.K and Europe (Kwak and Anbari, 2004). Six Sigma offers a systematic approach for improving service effectiveness and service efficiency. Traditional manufacturing companies are currently applying their Six Sigma experiences to their service operations (Anthony et al, 2004). For example, in banking sector, while banks have been relatively slow in adapting the changing environment, how fast you respond to the changes and the speed of resolution to customer’s problems are measures of service effectiveness, whereas the customer satisfaction is a measure of service efficiency (Kwak and Anbari, 2004). It would be interesting to see how banks and insurance companies in Macau might respond to this management technique implementation.

1.2 Six Sigma applications in China

Researchers suggested that Six Sigma can be implemented to non-manufacturing processes and also it is not restricted to corporations that are US-based where it was originated, but it is applicable to all ranges of organizations worldwide (Chakrabarty & Chuan,2009; Lee-Mortimer, 2006; Does et al., 2002) To apply Six Sigma methodologies in the banking industry in Macau, since many banks in Macau have already had the background of China Banks as it is part of China, we will have a look at the current practise of Six Sigma in China.

Quantitative analysis of Literatures shows that Six Sigma is more frequently applied in service areas than in manufacturing areas in China nowadays. Six Sigma was introduced into China in 2000 (Su et al, 2008) without being carried out, at the beginning they were only following the trend of the foreign organisation, the Chinese organisation however started implementing it in a systematic way from 2004 onwards.

China Construction Bank (CCB) is the first bank in the Chinese banking industry to implement Six Sigma management to improve business performance (Buchanan, 2014). Under the influence of Bank of America as they hold 10% sharing in CCB at that time in 2005 (Buchanan, 2014), Bank of America managed the customer-delight measurement and analytics processes for CCB. James Buchanan – a Six Sigma expert of the Bank of America then spent times in the capital of China – Beijing, introducing Six Sigma to improve quality and business performances. When CCB started to implement Six Sigma in 2006, they trained their employees with 50 Six Sigma professionals (Black Belts and Master Black Belts of Bank of America) as they realised the real significance of the necessity of this effective management method in driving continuous improvement in its service quality and achieving higher customers’ satisfaction (Wang & Hussain, 2011; Buchanan, 2014). The two banks went on a mutual agreement on upgrading the following aspects of CCB worldwide: financial services, retail operations, online banking services, information management, employees’ training management, etc. (Hope, Laurenceson & Qin, 2008). Other Chinese banks that implemented Six Sigma include China Union Pay, China Merchants Bank, HSBC, Shanghai Pudong Development Bank, Industrial Bank, China Minsheng Bank, etc. (SBTI, 2017).

Hong Kong

In Hong Kong, which is 1 hour on ferry away from Macau, making both culture and language are almost identical, Hong Kong is approximately 10 times larger than Macau. As an international city, which many foreign banks are locating their oversea branches in, Hong Kong banks must improve their business performances and enhancing their customer’s’ satisfaction in order to get in a better place to compete with the international competitors and most important of all to maintain profitable (Wang & Hussain, 2011; Buchanan, 2014). As Bank of America has supervised and offers training programmes for the employees in CCB, CCB also implemented Six Sigma management to all other branches of Bank of America in Hong Kong, and successfully uplifted the customer loan ranking by seven places, from 16th to 9th. Banks implemented Six Sigma include, HSBC, DBS, Bank of China (HK), etc. (Buchanan, 2014).

1.3 Six Sigma training

The foundation of the practical Six Sigma system is to be developed after the identification and resolution of the root causes of the problems (Raisinghani, 2005). Employees will first investigate and identify the root causes of the problem and then solve it by using different quality tools and techniques, before developing the actual system (Wilson, 1993). The application of this approach is to be learning centered as the benefits are demonstrated through contextual application, in which it is work based where employees gain everyday experience in an informal way, thus they actually learn about the problems and successfully solve them before creating the procedural system (Webb & Sheeran (2003); Pantano et al, (2006)). The followings are some of the existing Six Sigma models.

1.3.1 SME Learning Clusters approach (documented by Reynolds & Caley, 2008)

The SME Learning Clusters approach is a work based learning model developed by Pantano et al, and documented by Reynolds & Caley (2008) to enhance and maximise the benefits of contextual learning in the workplace. It is an approach designed to help Green Belts to help them preventing all the errors when implementing new processes and technologies, should be applied during the commencement on significant business improvement programmes (e.g. Six Sigma, Total Quality Management, etc.)

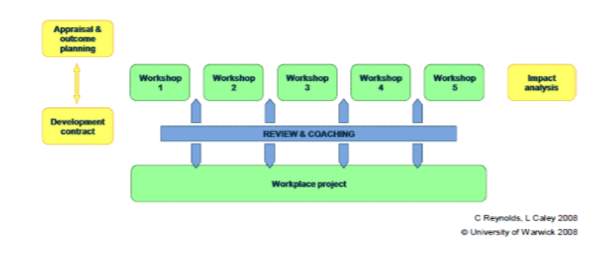

Fig 1. SME Learning Cluster approach

The outcome is expected to be cost-effective and time-efficient with the use of business improvement techniques; allowing the participants to apply the learning from each learning clusters to the business improvement project. Also, increased assimilation as sharing of experiences with the members in team, with behavioural development and individual company-centred coaching (Please refer to Appendix A for more details).

1.3.2 An implementation model (Satya S. Chakravorty, 2009)

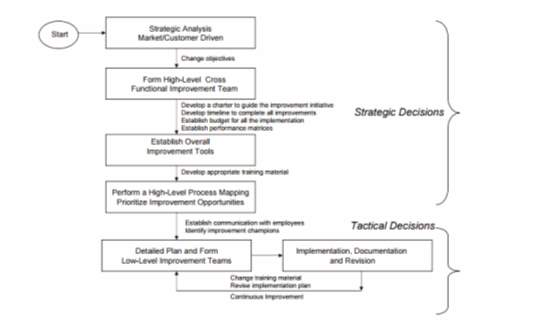

This model is created in the concern of the increasing rate of failures in Sig Sigma project implementation. A model for effectively guiding the implementation of Six Sigma programs is not available. It is case study based – provider of Network Technology services in US. Stake (2000) real world studies are valuable for refining theory and suggesting complexities for further investigation Gopal (2008) found that many Six Sigma models has failed because of lack of commitment from management. The program was developed in cooperation with internal resources and by levering best practises from the private industry. DMAIC proceeded in a sequential and rational manner – beginning with phase one and ending with phase four.

Fig 2. Six Sigma implementation model (Satya S. Chakravorty,2009)

During the third step of the implementation: To identify overall improvement tools it is where the training takes place, Foster (2007) recommended four different levels:

- First level of training for upper level management and engineers for 1 day. The one day course will be on the overview of Six Sigma concepts including “how and why” to apply Six Sigma models to the company.

- Second level is for directors and managers working directly as champions of Six Sigma projects in the service backgrounds for 2 days, it will be about the Six Sigma concepts including DMAIC applications to reduce waste and variations from the process.

- Third level is for Green belt (1 week course) and is focused on product production excellence, it covers the philosophy and tools of Six Sigma, and learn the basic level of application to their manufacturing process.

- Fourth level is for black belt (2 week course), this course is similar to the third level, and students joining this course will learn the basic and statistical level of DMAIC methodology and to apply to their projects at a basic level. (Please refer to Appendix B for more details)

1.3.3 Q-skills for Six Sigma training (E-learning quality product)

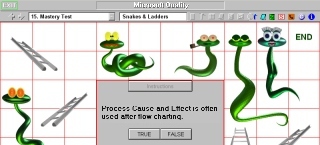

E-learning is a vital element in any learning environment as internet and computer technology rapidly advances nowadays (Ho, Kuo & Lin 2010). Everyone in the workplace in banking and insurance industries have access to the internet and companies provide employees with personal laptops or computers too. Researchers found that adults learning are more comfortable learning with computers or digital screens rather than note taking on a paper (Frand, 2000). Q-skills is an E-Learning quality product developed by Anthony Burns and Michael McLean (Q-skills, 2017). Using Q-skills will be beneficial to the employees as they learning through phones, tablets, ipad,etc. and can run on networks and intranet within the organisations, too. It has been used by companies for training purposes like: Advance Bank. Union Pacific, Australia Post Energy Australia, Zurich Insurance, The NCR Corporation, NationsBank, etc. (Q-Skills, 2017). It is a software that evade well documented errors, vague concepts, misconceptions in the foundations of the Six Sigma theory by using the most common and practical Six Sigma problem solving tools. It also helps leading the users in choosing and using the correct Six Sigma tools interactively where appropriate in one of the DMAIC module in Q-skills.

This software is an online training tool that can be used by everyone within the organisation; it is time and cost effective as it can be used to train a large group of employees within a short period of time. It is cost effective which enable employees to get a further insight into the core of Six Sigma, ensure understanding in the quality tools in the easiest way by using entertainments, learning how to apply quality tools includes “Business Process Mapping”, “Flowcharting”, “ISO9000 documentation generation”, “Survey”, “Brainstormer”, “Scattergrams”, “Cause and Effect Diagrammer”, “Check Sheets”, “Control Charter/Charts”, “Pareto Charts”, “Pie Charts” and “histograms”, etc.

Learning about these tools with combination of games, graphics such as animations, photos and music which creates enjoyable and consistent way of learning, employees often go on phones when they are bored at work, this software could eliminate the off-the-job time as they could be trained while having fun at the same time at their own pace according to the reviews on the website (Q-skills, 2017).

Fig 3. Example of how “Q-skills”

Q-skills basically makes things easier as they simplify the training and express the logic of Six Sigma in the simplest form when training new employees in a consistent and encouraging manner. It is most useful for members to use before proceeding to join a Six Sigma project team.

1.4 Success factors of implementation of the Six Sigma Model:

Six Sigma has been a powerful tool in identifying waste and drive out variability in the processes with the specific tools and techniques. With the benefits identified in Chapter 1, we are going to look at some critical success factors to implement a Six Sigma project successfully in organizations. Henderson and Evans (2000) suggest the following critical factors as major components for a successful Six Sigma implementation:

- Continuous education, training and statistical tools (Henderson and Evans (2000); (Kwak & Anbari, (2006)).

- Encouraging and accepting cultural variation (Kwak & Anbari, (2006)).

- Making decision based on data (Keller, 2005)

- Project selection, management and control skills (Kwak & Anbari, (2006)).

- Upper Management Involvement and organisational commitment/infrastructure (Henderson and Evans (2000); (Kwak & Anbari, (2006); Keller, (2005)).

- When there is enough resources allocated to improvement teams (Keller, 2005)

Training is a major component in contributing to the success of Six Sigma implementation in an organization. It is important to identify “how do we do this” and “why do we do this” as an initial step, as it provides the employees the comfort level to familiarize themselves with this newly introduced technique (Coronado & Anthony, 2002). The ranking system of Six Sigma should be applied to the top management system then rank accordingly to the organizational hierarchy.

According to Mr M.G. (UK commercial organisation), Six Sigma training is suitable for people with a number of different roles within banking and insurance. It would be suitable for those in the management role within operation so they can focus on the demand, processes, how they make it different for people that falls into them, those who manage projects, deliver project so there’s an understanding of the end customers then continues to improve things, those people that are looking into agile project management- building something new, measuring it and then improving it.

1.5 Challenges of introducing Six Sigma

- Issues in implementing the strategy without fully understanding

Six Sigma, as one of the most popular management technique, has been critically targeted as the general quality community argued that the Six Sigma method is simply a repackage of the techniques and principles of Total Quality Management (Catherwood, 2002) and regard it as being a “TQM on Steroid” (Hammer &Goding, 2001).

Organisation should come to a realisation that the Six Sigma is not an omnipotent method to solve every single business problem, this particular management method might not be the most effective strategy to use as every company has different problems, and using this technique without fully understand the principles and idea behind it, by using it just to keep up with the trend of the society, implementation without the resources required will cause failure (Kwak & Anbari, 2006).

To ensure effective use of the Six Sigma methodologies, organisations should commit to the process fully, they should analyse and take into account the strengths and weaknesses of the technique; so that they can apply the methodology appropriately (Keller, 2005). Organisations should also hire Six Sigma experts to keep track of the progress and ensure the organisation is deploying the Six Sigma methodologies properly and effectively on core operations where most changes could be easily noticeable (Anbari, 2002).

- Issues in organizational culture and poor implementation

Once decided to implement Six Sigma methodologies in an organisation, its quality concepts are required to be implanted into the designing procedure instead of just doing quality checks at the manufacturing process (Benedetto, 2003).

The most essential initial change in implementing Six Sigma method is to consider quality into the planning procedure. It is deceiving when organisations address problems that are unchallenging to rectify and claiming success with help from implementing Six Sigma methodologies. Organisations that have not got fully understanding of the challenges to apply the Six Sigma method or the urge of changing the management plan are most certainly lead to failure (Kwak & Anbari, 2006).

The strong commitment, leadership and support from the management team will form a fundamental base to deal with cultural differences and problems, challenges arise in the execution of Six Sigma project, when all these factors are presented, the chances of Six Sigma project success will increase vividly. However, if these factors such as the full management commitment and support of applying various resources are not presented, organization should perhaps consider other alternatives to Six Sigma (Kwak & Anbari, 2006).

If Six Sigma is not under proper execution such as having the right resources, right commitment, not aligned with the goals of the organisation, focusing on solving problems rather than meeting the strategic objectives, placing too much emphasis on the results rather than the inputs of the process; even with the help of Six Sigma experts (Champions, Master Black Belts), the results of the project might be disastrous (Kwak & Anbari, 2006).

- Issues in training (Belt Program)

Training is the key to success in the Six Sigma projects execution, training in Six Sigma refers to the Belt program from Champion, to Master Black Belt, Black belt, Green belt and Yellow belt, it could be applied throughout the entire company (Kwak & Anbari, 2006).

The training program should be customised to fit in with meeting the needs and requirements of the company, also be beneficial to the economic and management incorporation. Qualitative and quantitative measures and methodologies and any of those factors mentions above should be included in the training (Chakravorty, 2009). Employees should be acknowledged of the most updated trends, popular Six Sigma techniques and tools and how to interpret the data gained from the analysis, different level belt experts would be formally trained as part of the development plan to differentiate the Belt level program (Kwak & Anbari, 2006; Keller, 2005). Kwak & Anbari (2006) found that when placing unqualified employees for Black Belt training assignments, it is most likely that that they would cause challenges to the Six Sigma project

1.6 Problems of implementing Six Sigma in China

As Macau is part of China, problems of implementing Six Sigma will be similar. Although research on Six Sigma experiences in China is relatively limited, Lee et al. (2011) pointed out some problems regarding the implementation of Six Sigma within the Chinese organisations:

- Low education and lack of intellectual capacity.

Educational background of the Chinese labour is poor, around 77% of the Chinese labour just hold junior or low level education, only 21 % of the labour graduated high school and 2 % with diploma or higher educational level (Lee et al. (2011), Sung (2000)).

- High staff turnover rate

After the employees are trained under Six Sigma methodologies, they are always very likely to resign and look for jobs that offer high salaries or benefits, which put the companies in a impotent situation of retaining the talent established, and to effectively implementing the Six Sigma projects. This leads to company to be in doubt whether to put in resources to train employees with Six Sigma or not (Lee et al., 2011).

- Financial and time resources

To implement a Six Sigma project, a company needs to put in an sufficient amount of financial resources and time in order to adopt the Six Sigma methodologies fully, such as the commitment of appointing a manager on a full time-basis to check and co-ordinate the Six Sigma processes, and did not put in enough time for the internal training (Thomas and Barton, 2006), these are considered as the major causes of poor Six Sigma implementations when the financial and time resources are insufficient (Lee et al.,2011).

- Lack of strategic vision/long term goals formulations

Almost always, Chinese companies choose to implement Six Sigma as to reduce the operation cost of the companies and to recover from project costs quicker. However, as mentioned above, they always do not commit to the quality improvement process and lack of organization culture, they generally focus on short term outcomes rather than planning on long term strategy, vision and goals (Lee et al., 2011).

- Resistance to change

Agricultural industry is one of the major industries in China, and many companies are originated from it. Due to the mindset and education background of agricultural works, some of the companies would be less likely to accept new management methodologies (Lee et al. (2011), Chan and Sun (2004)).

2 Scoping interviews- Six Sigma experience

Mr M.G is a manager from Company A in the United Kingdom which is a mutual financial institution and Mr. Y.H is the head of the I.T department from a commercial bank in Macau. Semi-structured interviews were also carried out to supplement the findings of the Literature Review and to assist in developing this project.

2.1 Mr. M.G – Company A (UK)

Within large-scale size enterprises like banking and insurance, it is a very big part of continuous improvement of efficiency, driving down cost, adding value through end customer experience, for SMEs. Mr. M. G thinks that it is an opportunity for them not enough understanding, however, it depends of the what SMEs organisation is, if they are at the very beginning of the stage, not sure about the benefits for them for using Six Sigma apart from maybe defining what it is offering to the market so be able to have the right measuring kind of tools, techniques of Six Sigma may bring to and analysis where the market is, market position and there’s not so much for improvement and control. If the SMEs is in the state of decline, there might be maturity of decline for whatever reason they’re losing customers they’re having a product that are not competitive within the market then he thinks at that stage Six Sigma could be valuable. It depends on where the maturity lies in the company.

It is important to understand what the problem statement is, and that problem could be two forms, it could be either there is a risk of something uncertain happening or it could be something initial something has happened or it could be an opportunity that might come in additional cost or more experts more labor intensive, additional steps within the process, understanding and learning the statement objectives are, scopes, to achieve certain goals, what it is required and the specification and understand what the problem may lead us to about, then form that plan on how we going to resolve whatever the problem statement is by what means what long and what resources we need and what benefits we get in delivering and what cost it will be and the risk and the quality out there.

The best way to teach Six Sigma is by the right medium, workshop, interactive based practise, not the online computer based training course, not prescriptive, not serious or text book, it will be taught best in causal environment, also linking the importance of Six Sigma to their job roles and responsibilities, he specifically mentioned that in his opinion Six Sigma training is suitable for those in the management role, it could make their jobs more efficient and the Six Sigma benefits to the end customers. How Six Sigma improve day to day process and make them better for the end customers, values added to Six Sigma, making it fun and interactive, face to face, lots of visuals.

When applying the technique to the real world settings, this is challenging as the problem between the learning techniques and learning behavioural problems is complicated. It is hard to apply Six Sigma in the real world setting as it is very technical, employees must have to be in the real world in order to have the experience of the end-customers of processes, they have to have the basic understanding about the building blocks for suppliers input process and the output of the customers so then be able to apply the Six Sigma effectively. The problem mentioned here could be solved by the SME learning clusters approach in Chapter 3, which the business improvement project are run with the workshops, employees can apply their learning to the improvement project, and thus, it is real world application. The employees’ willingness in learning the techniques is a crucial factor, then it comes to the base of original understanding, understanding the style of behaviour may require learning or teaching, coaching Six Sigma in different ways, it could be to coach in a visual way rather than an academic, text or tabula way of coaching. Workshops, discussion, interview various way of teaching the employees and using a wide range of method. Combination of discussion and online, a very interactive style is ideal, continuous kind of confirmation that the end user understand what is happening and what the results will be.

Also, Six Sigma is used to identify waste stipulation by clearing out inefficiencies and how it can support in continually drive pro-efficiencies customers and satisfaction, improving customer service, for employee motivation by moving unnecessary steps and waste, and providing statistical tools such as the statistical process control and blocks plots and scatter plots which point out the root causes of the problems clearly.

As it is an ever-changing environment within banking and insurance, we are in a period of time now that is adapting and responding to change. It is about working efficiently at a fast pace and it is all about being agile and mechanical from what we do. What he would do differently is that to adapt to what business is run in a banking and insurance is which is more agile, more organic and at a fast pace, it is about adapting to very prescriptive Six Sigma technique in a way that is more in-tune with the ever changing environment in banking and insurance.

2.2 Mr.Y.H – Company B (Macau)

According to Mr. Y.H. (Company B), in his experience, it is important to teach the employees about the idea that there is a KPI the company wants to achieve. As there are five steps in Six Sigma, it would not be necessary to apply all 5 implementation steps in Chakravorty et al., (2008) ‘s study on the cyclical DMAIC method. In his experience, he may just use two of the steps and after the effect has established, that is the time when they stop applying the Six Sigma technique.

As they are doing management of the I.T section in the bank, he placed more emphasis on the actual effect, but not about finishing the whole DMAIC technique. Once they got the results that they wanted, they stopped the project. In Company B, not everyone is required to know the process and practise the Six Sigma concept. As each person’s role is different from the other, the supervisor will divide the roles among themselves, they should be clear what they are doing in each step and work towards a common target. Not everyone needs to familiarise with the technique as too much and too in-depth information is useless and difficult to understand for the ones below manager level.

From the perspective of I.T, they run this Six Sigma project for business growth, but in fact this thing is not too much operability, because there is not enough time to evaluate things in this project as it was evaluated after a year it being implemented so it is not efficient. We can measure improved organisation performance on two measures, first, if the company has met its target on time during the time on evaluation; secondly, if it is error free or not. These are the two main indicators for improved organisational performance.

2.3 Six Sigma in collaboration with agile development

In Company B, they are using Agile development to achieve the set goals of the bank. Agile Development is a systematic process that builds software from the start of the project, rather than trying to deliver the whole software all at once at the end. Agile development breaks down the project into smaller project, prioritising them and continually delivers them in two weeks cycle called “iterations”. It required lots of planning and doing very simple steps and adding into the project over time.

To enhance the rate of successful implementations, companies should ensure sufficient training in Six Sigma tools and techniques; adequate management commitment of resources; and education of the employees’ mindset; these are the factors that facilitate application of Six Sigma tools and techniques in organisations effectively (Basu, 2004).

Commentary Section

According to Mr M.G. (Company A), Six Sigma training is suitable for people with a number of different roles within banking and insurance, which contradicts the situation in the I.T department of Company B, Macau. Mr Y.H (Company B) has suggested that not everyone needs to know about the technique but only those in higher positions. However, they both agreed on Six Sigma training being suitable for the employees at managerial level. They could assign work to them and tell them what is required. It is not necessary to teach all skills to every employee as it will be time-consuming and they will not understand the theory behind. The author agree with Mr. M.G of the Six Sigma training being suitable for different roles in the company as Six Sigma, Six Sigma should be a company management culture and should be applied to the whole company since everyone should participate in order to get the best results and to improve overall quality.

2.4 Conclusion

Six Sigma has been a useful technique which is being used worldwide and organisational wide, to Macau, it will be a newly introduced technique, however, it is believed that Macau is still developing city and is a potential market to implement the Six Sigma project. There is only a little amount of research; almost none of the research is done on Six Sigma in Macau. This is an indication that Macau is still new to this technique and there is potential in the market to introduce this Six Sigma technique. In this research, we are going to investigate the learning style of the people in Macau and to design a training plan which suits and beneficial to the employees in banking and insurance sector.

3 Research Methodology

Six Sigma has been a well-known and popular management technique, particularly in Europe and the U.S. Research in Asian countries has not been sufficient. This research aims to create an effective training plan for people development using Six Sigma within the commercial environment. Through the current body of Literature and carrying out interviews with the related experts of the field, we aimed to analysis the benefits of implementing a Six Sigma project to a service-based company and how the designed Six Sigma training would be taught best to the employees. We would also look at the psychology behind the learning style of people and identify the individuals that are suitable for Six Sigma training. Results obtained were anticipated to help enhancing the labour quality in Macau and provide a guide in identify and attract potential employees in Macau which helps with the problem of over-populated foreign labour in Macau as there are a shortage of local skilled labour in Macau.

The way employees works in Macau is based on the shaped reality of the society, in the research, we aimed to bring in European elements (implementing an Six Sigma training) to the workplace in order to change the way of working into a smarter and more efficient way with less defects in the workplace. This is related to the learning style of the employees after the training plan has been designed. Through the training plan, employees gain more experiences in what is required and use the gained knowledge to help improve their working quality. To implement this training plan means that workers will get a fuller understanding of the logic and reason behind the training plan, which makes it more effective.

Research Approach

When doing a research, the major questions that requires the authors reflections are “How” and “What” to research, however, the core of these questions is: “Why research” (Remenyi et al.,1998), a philosophical solution to these questions. In this project, this topic was researched as the author wanted to bring the knowledge learnt in U.K back to her hometown- Macau to help to enhance labour quality and business performance. The two main philosophical approaches to research are being subjective or objective.

After reviewing the Literature of Six Sigma and the scoping interviews, the author has identified that Six Sigma management technique is relatively new and will take time to reach consensus for the acceptance of this set of management method into service organisations in Macau. Based on the subjectivistic/objectivistic continuum, views are set in the middle of the continuum, showing a small preference to qualitative methods; as a result, mixed methods are needed to investigate this project. This has led to the decision that a case study approach will be taken.

In order to research into a new topic in Macau and having a small sample size, a case study approach would be appropriate to investigate detail and in-depth into the current status of quality management and allow us to explore complexity of introducing Six Sigma in the service organisations in Macau. In this project, we have decided to include survey questionnaires, interviews, follow-up phone calls to identify into how the managers and employees react to quality management system- Six Sigma and current quality problems experiencing.

Online Survey questionnaires

Due to the majority of the research subjects are based in Macau. While the author is in UK, online survey questionnaires are conducted. The survey questionnaires allow us to give insight of the quality problems the employees are experiencing, their usual learning style in training, benefits seen in their company, their views on Six Sigma, etc. Advantages of using survey questionnaires are time-efficient, cost effective, etc. (Wright, 2005). Limitations of online survey questionnaires include the sampling issue that self-reported data might be inaccurate and cannot test the truthfulness in the answers they have provided (Dillman, 2000).

Interviews & Semi-structured interviews

Conducting interviews with the staffs in managerial roles working in the bank/insurance in UK/Macau allow us to get the first-hand information about feasibility of implementing or introducing Six Sigma to their companies and assist in developing this project by face-to-face interviews, telephone calls and email responses. Advantages of the interviews and semi-structured interviews are: information obtained are more accurately presented since all the interviews are tape recorded in this project (with consent), this allows the author to not miss out any information that might be important to the project comparing to hand-written notes (Opdenakker,2006). Limitations of face-to-face interviews take effort, time and cost (Opdenakker,2006).

Telephone interviews and follow-up phone calls

As for the follow-up-phone calls, it is for the supplementary information for the results obtained, allow the interviewees to expand on the answers and tell us more about the situation. Advantages include easy access to people that are all over the world, in this project, telephone interviews have been really helpful in obtaining information for developing this project from people in Macau (Opdenakker,2006). Limitations are lack of social cues and situation the interviewee is in, so standardisation of the interviews are less likely to be achieved as different interviewees are in different environment and experiencing different things (Burke & Miller, 2001).

First, we have designed a Survey Questionnaire that consists of statements that were extracted from Literature of practitioners and academics. An analysis of organisational needs (performance improvement, error elimination, quality problems experiencing etc.) is required as a basis for training needs analysis, before a training plan can be designed. As we are just planning to gain an initial sight into implementing Six Sigma training into the service organisation in Macau, a small sample were used, 10 employees from bank and 10 employees from insurance company. Since the sample is so small, a statistical analysis will not be possible because of the lack of prior experience of Six Sigma in Macau, responses would be limited. We have decided to take the case study approach, with a combination of quality and quantity analysis that allow us to get a clearer picture of the feasibility of Six Sigma implementation in Macau.

Six Sigma is a popular set of management technique worldwide and by introducing it into Macau, it would be interesting to see how people might respond to Six Sigma implementation and the adaption to the Six Sigma training comparing to UK employees. It will be verified through interviews from the upper management roles. Ways of implementation should be detailed explored and designed as cultural differences might exist and ways of thinking and working are different between European and Asian countries.

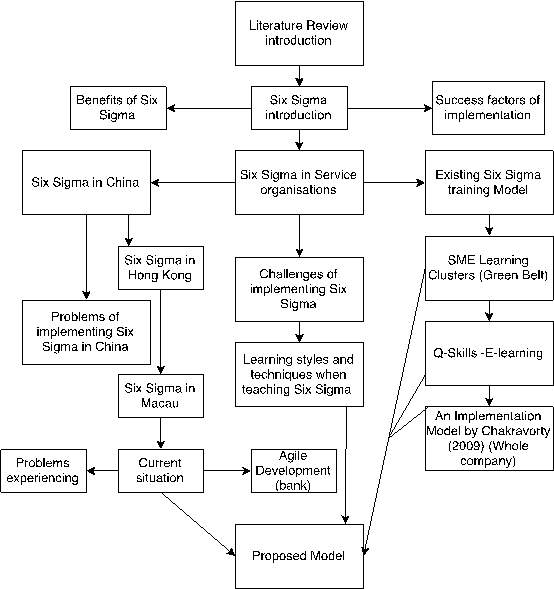

Figure 4.1 Literature Review Flowchart

This flowchart was created out of the Literature Review structure and content, it shows how the various elements of the project link and relate to each other and how the elements would form the basis for the proposed training model in Chapter 6.

Data collection methods and tools

This project will take the case study approach as the literature of Macau using Six Sigma is limited, the quality of the responses related to Six Sigma will also be restricted. A case study approach will allow in depth understanding of an uncommon quality management system in Macau which will be value adding to the Literature. However, the generalizability from this one case to another is hard. After all, Six Sigma is an unfamiliar management method, a case study approach would be best to investigate current situation and provide ideas and as a reference for future research into this subject.

Before setting up the questionnaire, a lot of research has been done on the current status of Six Sigma in banks worldwide, the benefits and challenges of implementing Six Sigma and the best teaching style of Six Sigma methodologies. The survey questionnaire was created based on the current Literature and interviews with some of the experts in the field. The questionnaire consisted of mainly close-ended questions and a few open questions asking about the learning styles and rating-scales. The questionnaires were sent through email, and were presented on a Google Form. Please see Appendix G for further details. In depth interviews and semi-conducted interviews were also used by phone-calls, face-to-face and email. After collecting the data, we would analysis the results in order to design a suitable Six Sigma training plan for employees in Macau. The research would be a combination of Literature Review Strategy (Theoretical work) and Data collection methods (Empirical research) similarly to Antony., Frenie., Kumar.,& Cho., (2007).

Sample selection

A total of 23 workers from bank and insurance company participated in this study, this includes 10 employees and the Head of Human Resources from the Company B (bank),a senior manager from Company C (bank), 10 employees and a manager from the insurance company (Company D). They are local Macanese workers, except for the Head of Human Resources from Company B, he was from Mainland China. All participations were on a voluntary basis and no payment was offered upon completion.

Ethical issues (Appendix C & D)

This project has raised no ethical issue. All responses would be anonymous and responses are recorded with numbers and initials. All data would be stored in the author’s laptop securely. Before completing the questionnaire, participants were asked to read and sign the informed consent (Appendix C) and Participants Information Leaflet (Appendix D). Each participants has read and understand that they participation is voluntary, they are free to withdraw at any time they want and they have the right to ask to remove their data from the research.

Research Procedure

Firstly, sending out the survey questionnaires through email, there will be a cover letter indicating the purpose of the research, informing the participants about their right to withdraw at any-time and the participation is solely voluntary basis. No harm or deception would be presented. Data collected will remain anonymous securely and privacy protected. All data will be identify by their given ID. No risk would be involved. The survey questionnaire will take no longer than 10 minutes to complete, once they have submitted their responses through Google Form, the responses will automatically generated on a Excel Spread sheet.

Scoping interviews in Chapter 3 were done on a telephone call and face-to-face interview. 3 Semi-conducted interviews were also conducted on the managers and head of HR from Company B, Company C and Company D. 3 Follow- up phone calls were made in order to have a better understanding in the results obtained in Chapter 5. The author first contacted them through email to gain acceptance to book for an appointment for their participation (either face-to-face, telephone call or email responses). All questions were sent to them prior to the interviews. All data collections were done from March till mid-July of 2017. Scoping interviews last for 30 minutes approximately for each of them. The semi-conducted interviews were conducted in July through emails, the author sent a list of questions to them, and they responded through email as they were in Macau.

Data Analysis

This project will take the case study approach, the results obtained are mainly qualitative results, analysis and pattern identification do not start until all the data has been collected. Qualitative data are often words that require deeper analysis in order for us to make a good use of. While the open- ended questions are qualitative data, that are often words, which are relatively imprecise, context-based and should take a deeper insight in order to fully understand the statement participants gave. 3 Semi-conducted interviews from a sub-set of respondees were carried out to get improved qualitative data and expanded responses (one from Company B – bank and one from Company C- insurance company), they would be essential to get a more complete picture of the result. Quantitative responses will be analysed using SPSS and graphs. Qualitative responses will be analysed through content analysis. Responses that have the same meaning will be sorted into groups and the author will analysis and understand what value of these responses bring to the Literature. Then according the results obtained and analysed by using SPSS, graphs, pie charts and content analysis (for qualitative results), and the analysis of the organisational needs (quality problems experiencing, areas of improvements, etc.) a training plan is then put in place with reference to a combination of the training plans which has been used in UK and USA will also be considered which is designed to suit the learning style people in Macau. We will create a training plan with the implementation of Six Sigma for local bank/insurance employees in Macau and to demonstrate how the individual goals and enhanced skills can be linked to measures of sustainable enhanced business performance.

3.1 Expected benefits that will bring to the service organisations in Macau when applying this integrated training program?

E-learning (Q-Skills)

It is applicable to all belt status. The first step is to introduce quality tools. With the quality problems identified in the bank and insurance, Q-skills can help employees to be familiarised with the common quality tools to resolve most of the problems and identify root causes in a cost effective, time-efficient and in a fun way. From the results obtained from last Chapter, employees mainly use Check Sheet to resolve problems, with the help of Q-skills, this software will help the employees to learn to use different quality tools properly and effectively in own pace, it can run on any tablets, laptops, computers, ipads and on network/ intranet. This suits the trend of intranet and technology advancement both in the bank and insurance. This element would be an on going process. By using Q-skills, it promotes E-learning, adapting to the rapid change of environment (internet advancement), in a fun but useful way. Common quality problems identified in the previous chapter are Call Backs; Credit processing, Account locked and Difficulties in accessing to cash and only mainly use Check Sheets to solve problems. Using Q skills will teach them how to use each quality tool properly and selecting them to suit their needs while having fun. But not only using Check Sheet all the time but using other tools to solve more problems.

An integrated model of the combination of Keller (2005)& Chakravorty (2009)’s training program

The proposed model will be an integrated version of Keller (2005) and Chakravorty (2009)’s training program, with added elements that suits the situation of Macau. As there is limited knowledge about Six Sigma is identified in the employees and according to the data collected, there is no Six Sigma practitioners in Macau. By using a validated training model by Keller (2005), it helps the company to gain more knowledge of Six Sigma, level of knowledge that suits their role. This could apply to the whole company, from the upper management team; directors, managers, Black Belts, Green Belts and employees (Yellow/White Belts). When implementing, the company should first to select a leader or hire a Six Sigma (black belt) practitioner from Hong Kong or China. Leaders should be already in the higher management role. Picking up assisting members according to their functional role, how they behave in working history or through recommendations. In this training, Champions workshops are provided as to the Champions to help them claim the ownership of the Six Sigma program (Keller,2005). Workshops helps them to establish their understanding and to be commit to the role, responsibilities, leadership, resources required for the Successful implementation; also helps with aligning the business objectives with the definition of the Six Sigma project selection. Champions could also attend Green belts training as it allows them to learn more about the tools and techniques, which helps them to understand how to use the basic tools in Six Sigma project teams and limitations of the tools to maximise the whole Six Sigma experience. However, they can also use Q-skills to improve their knowledge to the quality tools at the own time and at own pace.

SME Learning Clusters Approach

The SME Learning Clusters Approach is designed for the Green Belts in the company; they are trained with the basic concept of Six Sigma and provide assistances in a Six Sigma project. As the SME approach has two different developments, behavioural and technical, we will focus on the Personal Development (Behavioural), it is to increase employees motivation, improve attitude, cross-functional training, experience sharing, project based & experience sharing- combination of the two most opted learning styles. It includes Modular behavioural development workshops. This model will deploy once the Six Sigma program starting to become mature, when green belts has completed the training program (proposed training program), as the training gives them an overview of the Six Sigma projects, the SME learning clusters – a project based model will help them solve their problems in their projects step by step. This program will help improving with the lowest ranked benefits such as cost, new practise/processes, employee motivation and reduced recycle times, etc. identified in previous chapter. Customer facing issues like customer complaints and customer queries occur most frequently and the reason behind it is often the attitude and the quality not being on standard, and this behavioural model can help deal with these types of problems.

Secondly, after the potential champions are selected, they should start Six Sigma training by familiarise themselves with Six Sigma, their training will be based on what the overall deployment strategy decided by the executives. Champions training will be a 4-day course. Keller (2005) has introduced four major topics for Champion training, three hours for each topic: “Deployment strategy”, “Personnel and training requirements”, “Customer focus” and “Project selection and sponsorship”. In “Deployment strategy”, the content of this topic is highly similar to the executive’s training. In addition to the executives’ training, Champions should understand and apply the business performance measurements identified in Chapter 5, they are required to develop a good understanding of these metrics ROA, ROE, net interest margin, cost-to-income rate and non-interest income (performance measurement metrics) as these are how the business improvement will be measured and identified according to the results obtained. There will be a workshop on the “Issues contributing to successful deployment” suggested by Keller (2005) which are the success factors identified in Chapter 2.5, 2.6 & 2.7.

In “Personnel and training requirements”, Chakravorty (2009) and Chakravorty & Atwater (2006) has pointed out that a cross-functional team is crucial step to Six Sigma implementation for guiding and monitoring the process, this cross functional team will provide a constant involvement in the management commitment to the Six Sigma project and to make sure the project process is aligned with business objectives (Pande et al., 2000), it is important for the Champions to set up the management and organisation infrastructure for Six Sigma. Champions should carry out a training need analysis, please refer to Chapter 5 Results section for further details and regimen. Then to select potential Black Belts and Green Belts(Chakravorty,2009). Keller(2005) have suggested having to workshops for this topic, understanding training needs (please refer to Chapter 5); Methodology for selecting Black Belts (please refer to Chapter 6.1).

For “Customer focus”, champions should understand that a service organisation is customer focused, about satisfying customers’ needs. Champions should develop an understanding of the customer dashboard (Figure 6.5) about the customer satisfaction score, requirements with the help of customer feedbacks and how to improve customers’ retention rates by having a working on “Increasing customer focus” by Keller 2005. Finally for “Project selection and sponsorship”, Chakravorty (2009) suggested that to prioritise projects with the Theory of Constraints and a workshop on “Project selection”.

After the selection of Black Belts from the company and also the company might hire Black Belts from Hong Kong or China for project leader, the Black Belts’ training course are usually 1 week per month over 4 months (Keller, 2005). They will learn about Six Sigma philosophy and tools (DMAIC methodology) at a basic and statistical level.

Week 1

Black Belts should start off by defining resources and stakeholder analysis according to the Six Sigma deployment dashboard (Figure 6.5). Black Belts training are a project-based training (Keller, 2005), just like the SME Learning Cluster but with different contents. This training model follows the DMAIC methodologies and the use of quality tools (Q-skills is used to help them to choose the appropriate tools to apply at different stages). First, they will be assigned a project in this training and that will allow them to be benefited from contextualised learning. They have to project leadership on their teams since they are leaders of the projects (Chakravorty, 2009). Their group members are often green belts. They can pick their members from the selected green belts by the Champions to assist them in their projects. Week 1 of training is about deployment of the strategy, defining and managing projects, Black Belts will be taught about the consensus building methods to manage teams and the change management. They will learn about the Six Sigma goals and performance measurement and to monitor the process by control charts and process capability analysis, Pareto charts, statistical process control, etc. (Keller, 2005; Foster, 2007).

Week 2

In the second week, it is about the Measure objectives, they will be trained to do an analysis on the measurement system, with defining the critical Xs and Ys (Chakravorty, 2009), example, what causing the problems experienced by Value stream analysis. To develop an understanding foundation of statistics, analysing the sources of variations such as statistical inference and determine process drivers by designed experiments and finally to proposed a solution with the data obtained (Keller, 2005).

Week 3

After all the analysis done in Week 2, Black Belts will define new processes and evaluate the benefits of the proposed solutions. They should establish the causal relationships using regression analysis, process failure modes using FMEA, Design for Experiment, etc; to visualise the problem experiencing and determine what the root causes are. The statistical analysis in Week 2 allows Black belts to support their concepts and proposed solutions; they are data-driven solutions (Keller, 2005). Finally, they implement and confirm with the results generated (Chakravorty, 2009).

Week 4

After implementing the proposed solution and getting positive outcomes, their new methods will be standardised, results will be documented and measure bottom-line impact by solution effectiveness. Lastly, Black Belts will develop transfer plan and to close the project. That will be the end of the training, usually takes around 4 months to complete (Keller,2005).

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Strategy"

Business strategy is a set of guidelines that sets out how a business should operate and how decisions should be made with regards to achieving its goals. A business strategy should help to guide management and employees in their decision making.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: