Supply Chain Management and Economic Factors Affecting SMEs in the UK Fashion Industry

Info: 17893 words (72 pages) Dissertation

Published: 20th Dec 2021

Abstract

The purpose of this study is to research, evaluate and make recommendations for SMEs, giving them guidance on how they can manage their supply chain effectively. Current and future trends have been discussed and ways in which SMEs can be ethical when sourcing. In addition the study investigates into the various different finance options that may be used to initially fund the business and to help it grow. Furthermore various CSR activities are analysed to show the benefits and recommendations required to help create a traceable supply chain. Global risks within the supply chain and ways to manage inventory levels have been identified in order to guide SMEs into making accurate decisions. Primary research in the form of a representative sample of 30 SMEs has been conducted and interviews to help make recommendations for controlling and managing the supply chain successfully. The study gives in depth information and analysis on ways SMEs can obtain finance, source ethically, responsibly, control the inventory, and evaluate economic factors, which could prevail over the next few years due to Brexit.

Contents

Click to expand Contents

Chapter 1 – Introduction

1.1 Background

1.2 Rationale

1.3 Research Aim’s & Objectives

1.4 Scope

1.5 Limitations

1.6 Beneficiaries

Chapter 2 – Methodology

2.1 Research Approach

2.2 Secondary Research Methods

2.2.1 Internal

2.2.2 External

2.3 Primary Research Methods

2.3.1 Qualitative Methods

2.3.1.1 Interviews

2.3.2 Quantitative Methods

2.3.2.1 Survey

Chapter 3 – Supply Chain Management

3.1 Supply Chain Evolution

3.2 Global Supply Chain

3.2.1 The Role of Big Data and Analytics

3.2.2 Trends

3.2.3 Forecasting

3.3 Fashion Revolution

3.4 Sourcing in Bangladesh

3.5 Finance

3.6 Ethical Fashion

3.6.1 The Ten Principles

3.7 Corporate Social Responsibility

3.7.1 Traceability

3.7.2 Case Study – Everlane

Chapter 4 – Logistics

4.1 Logistics Evolution

4.2 Logistics performance Index

4.3 Global Risks

4.3.1 Supply Chain Risks

4.3.2 Risk Mitigation

4.4 Inventory Management

4.4.1 Case Study – OTK

4.4.2 Inventory Flow

4.5 Supply and Demand

4.5.1 The Law of Supply

4.5.2 The Law of Demand

4.6 Transportation

4.6.1 Sea Freight

Chapter 5 – Economic Influences

5.1 Brexit

5.1.1 Trade Agreements

5.1.2 Free Movement of People

5.1.3 Funding for Education

5.1.4 Intellectual Property

5.2 Effect on SMEs

5.2.1 Survey Results

5.2.2 Risks

5.3 Free Trade Area

5.4 Single Market

5.5 Outsourcing

5.5.1 SMEs

5.5.2 Choosing the right supplier

5.5.3 Case Study – Genius Clothing

Chapter 6

6.1 Conclusion

6.2 Recommendations

6.2.1 Beneficiaries’

6.2.2 Further Research

References

Bibliography

Appendices

List of Tables

Table 2.3.2.1 Key Literature

(Authors own, 2016)

Table 3.2.1 Membership and Employment in Bangladesh

BGMEA (2016a) Available at: http://www.bgmea.com.bd/home/pages/TradeInformation (Accessed: 26 November 2016).

Table 3.3.1 The Ten Principles of the United Nations Global Compact

UN Global Compact Office and Business for Social Responsibility, Sisco, C., Chorn, B. and Pruzan – Jorgensen, P.M. (2010) Nokia Logotype Nokia Logotype Nokia Logotype Nokia Logotype Nokia Logotype. Available at: https://www.bsr.org/reports/BSR_UNGC_SupplyChainReport.pdf (Accessed: 6 December 2016).

Table 4.2.1 Logistics Performance Index

Global Rankings 2016 (2015) Available at: http://lpi.worldbank.org/international/global?sort=asc&order=LPI%20Rank#datatable (Accessed: 2 December 2016)

List of Figures

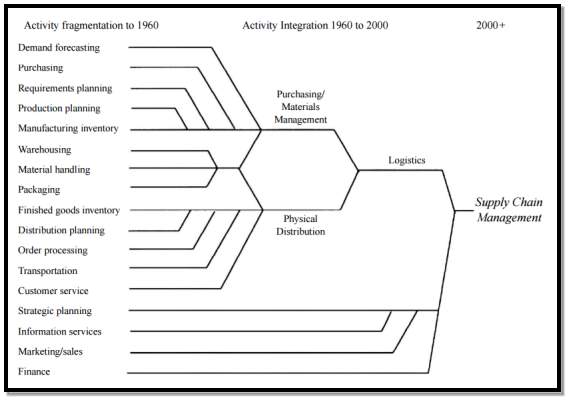

Fig. 3.1.1 Evolution of Supply Chain Management

Ballou, R.H. (2007) ‘The evolution and future of logistics and supply chain management’, European Business Review, 19(4), pp. 332–348. doi: 10.1108/09555340710760152. (Accessed: 25 November 2016).

Figure 3.2.1 Fashion Revolution Campaign

Join the fashion revolution (2014) Available at: http://www.beesandtaylor.com/join-fashion-revolution/ (Accessed: 6 December 2016).

Figure 3.2.2 Join the Fashion Revolution

Fashion revolution (no date) Available at: http://fashionrevolution.org/ (Accessed: 6 December 2016).

Figure 3.2.3 Rana Plaza Factory Collapse

Yardley, J. (2014) Report on Bangladesh building collapse finds widespread blame. Available at: http://www.nytimes.com/2013/05/23/world/asia/report-on-bangladesh-building-collapse-finds-widespread-blame.html (Accessed: 26 November 2016).

Figure 3.3.1 Top 3 Reasons Why Companies Participate

How will I benefit? (no date a) Available at: https://www.unglobalcompact.org/participation/join/benefits (Accessed: 6 December 2016).

Figure 3.3.2 CEO’S agree, sustainability matters

How will I benefit? (no date b) Available at: https://www.unglobalcompact.org/participation/join/benefits (Accessed: 6 December 2016).

List of Acronyms

BRICS – Brazil, Russia, India, China and South Africa

COO – Country of Origin

CSR – Corporate Social Responsibility

EU – European Union

FTA – Free Trade Agreement

GDP – Gross Domestic Product

JSTOR – Journal Storage

LPI – Logistics Performance Index

PPP – Purchasing Power Parity

RMG – Ready Made Garments

RFID – Radio-Frequency identification

SC – Supply Chain

SCM – Supply Chain Management

SMEs – Small to Medium-Sized Enterprises

SSCM – Sustainable Supply Chain Management

WTO – World Trade Organisation

Chapter 1.0 Introduction

1.1 Background

The European Commission (2017) has defined SME’s as the “the main factors determining whether an enterprise is an SME are:

- Staff headcount and

- either turnover or balance sheet total.”

| Company category | Staff headcount | Turnover | or | Balance sheet total | |

| Medium-sized | < 250 | ≤ € 50 m | ≤ € 43 m | ||

| Small | < 50 | ≤ € 10 m | ≤ € 10 m | ||

| Micro | < 10 | ≤ € 2 m | ≤ € 2 m | ||

In today’s interconnected global economy, efforts to streamline, speed up and coordinate trade procedures, as much as efforts to further liberalize trade policies, will drive the expansion of world trade and help countries to integrate into an increasingly globalized production system, rather than being left on the margins of world trade (WTO, 2015).

Currently the effect of Brexit has been the topic of conversation in all industries as the uncertainty of how and when it will effect businesses. A lot will change for the way the global markets in the fashion industry trade with the UK due to the decision of leaving the EU.

“The EU market is often considered the easy option because it’s close by, there are no tariffs and there is one set of product rules and standards” (The Guardian and Cherry, 2016). Being a part of the EU ensured that all members are ensured of the free movement of goods within the market (European Commission, 2014).

Fashion is one of the world’s most important industries, with it driving a significant part of the global economy. 2016 projections have shown that it is estimated to reach a staggering $2.4 trillion in total value (Schafer, Gove, and Lamos, 2016).

Rick Horwitch, VP Strategy and Solutions Business Development, has stated that the traditional approach to business has been based on a Supply and Demand model. The problem is we now live in a Demand and Supply world (Barrie, 2016). The world economy consists of 194 nations with a population of 6.6 billion and a gross domestic product output totalling US$61 trillion purchasing power parity (Doole and Lowe, 2008).

“The proportion of British trade accounted for by the rest of the EU is falling, and non-European markets are becoming more important for British exporters.” (Springford and Tilford, 2014). The increase in trade from the Asian markets has occurred due to its technological advancements, competitive production prices and the ability to mass produce garments at a quick rate. More so, The World Trade Organization,

“2016 press release in April 2016 stated that they predict that trade growth should accelerate to 3.6% in 2017, still below the average of 5.0% since 1990. Risks to the forecast are tilted to the downside, including further slowing in emerging economies and financial volatility”.

1.2 Rationale

The primary motivation for this dissertation is to evaluate and recommend ways SMEs can run their business successfully. SMEs have been chosen specifically as they face various different obstacles in comparison to large, national and multi-national businesses. Key issues and risks will be highlighted along with looking into management strategies and evaluating how best to react to difficulties they may face in the entirety of their business operation including investment decisions. This research will underline the crucial issues and concurrent SCM, logistical and economic factors. Theories and models will be included to and suggested for ways in which to create a more efficient, dynamic and sustainable supply chain. Identifying solutions and evaluating primary research; will be carefully considered in order to make informed decisions to help run and maintain a strategic, growing and successful business.

1.3 Research Aims & Objectives

The two aims of this research project are to examine how current issues in the UK fashion industry affect the supply chain for SMEs and to analyse the economic factors and how they affect trading in the UK for SMEs.

The objectives to achieve the aims are:

- To research into Supply Chain Management strategies and solutions using theory models to underpin new ideas.

- To consider ethical fashion and ways in which a business can be traceable and promote CSR.

- To identify the key logistical issues and risks that SMEs may face when managing and transporting product and choosing a supplier to work with.

- To assess how Brexit has affected the current economy and the risks it may pose to the UK fashion industry.

1.4 Scope

The dissertation will specifically look at global trends, management techniques and how they will affect SMEs in the fashion industry. The three main chapters will discuss supply chain management models and ideas for sourcing finance and the role of big data and analytics software. Along with analysing ways in which SMEs can use CSR models to ensure a completely traceable supply chain. The logistics chapter will look into global risks that affect SMEs, how to mitigate risk and efficiently manage inventory levels. A variety of economic factors such as Brexit, the FTA and single market shall be discussed to discern ways in which each of these may affect SMEs in the future.

1.5 Limitations

The biggest limitation for this project will be time as the time limit given is from October 2016 to April 2017. Due to the current nature of this topic and the ever-changing global economy, some sections surrounding the issue of Brexit will be written in the latter stages due to the recent news of President Elect Donald Trump whom revise the trade deal between the USA and GB which is consequent to Britain’s withdrawal from the EU.

Primary research limitations will include the fact that some answers to the survey may be subjective or biased. Over 150 SMEs were sent the survey but only 30 responses were received; ideally, more responses would be better to give a broader perspective of their current views of SMEs. To gain more accurate results a large number of industry professionals could be interviewed to help elaborate and back up recommendations.

A lack of recently published books may be of difficulty to source. Therefore a number of academic journals, reports and websites will be used to gain views from other researchers.

1.6 Beneficiaries

The beneficiaries for this dissertation will be SMEs in the fashion industry that are in the process of starting up a business or are in the first year of growing and establishing themselves in their chosen market. Exploring management strategies and solutions for logistics and supply chain management will be identified, along with the effect of current and emerging trends on big data and analytics software. Analysis and recommendations of big data, risk mitigation, inventory flow, ethical sourcing and outsourcing, will be given as ideas to SMEs, for ways in which they could improve or implement strategies to better control processes within their business. This will enable businesses to gain an overview into the various risks and strategies’ that they can implement within their business structure. Risks include outsourcing to unknown suppliers, quality issues and the uncertainty surrounding Brexit. Strategies include risk mitigation, DSCM and CSR activities.

Chapter 2.0 Methodology

2.1 Research Approach

The approach for this cross-sectional study will be inductive, analysing data obtained from a variety of primary sources and secondary research methods. A variety of methods including ethnographic will be used to obtain data inform decisions on the specified topic areas. The topic areas will include:

- Supply Chain Management

- Logistics

- Economic Factors

The survey is the most appropriate method of data collection to explore SMEs opinions and gather information on risks and issues they face within the SC. The primary purpose of the survey is to explore what key themes arise from the written responses. To ensure a variety of responses a combination of multiple choice, drop down, ranking and single text box response choices have been used.

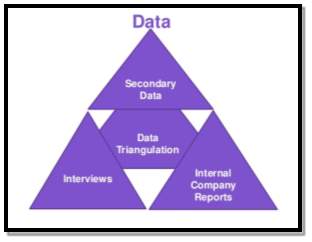

“Triangulation facilitates validation of data through cross verification from more than two sources. It tests the consistency of findings obtained through different instruments and increases the chance to control, or at least assess, some of the threats or multiple causes influencing results” (Triangulation, 2014). The data triangulation model shown above will be used where possible to validate my results and to identify ideas and concepts to substantiate points.

Source: (Kumar, 2014)

2.2 Secondary Research Methods

A time span of 25-35 weeks has been spent conducting primary research and sourcing secondary research. Mixed methods will be used to obtain primary research and source secondary research, to gain a variety of different types of data that can be integrated and concluded further on in the report. Secondary research methods used to support the dissertation will include the following two methods:

2.2.1 Internal Secondary Data

Internal data sources such as reports from Fashion Revolution, PWC and various other companies will be used to support the analysis and theories. Sales and financial data will be sourced from a variety of websites including government websites and databases such as JSTOR, World Economic Outlook to obtain relevant statistics regarding the UK’s textile and manufacturing industry. An advantage of internal data used is that results are accurate and up to date to a certain point.

2.2.2 External Secondary Data

External data sources such as published works; including books, journals, articles, case studies, academic papers, literature reviews and reports will be used to support the writing. Key literature used to in this dissertation is stated in table 2.2.2.1. Along with Census data, statistic’s and figures and databases such as Emerald, Mintel, Google Scholar and Nomis will be used to find resources. The advantage of secondary data is that it helps to generate new insights and back up chosen theories. Data can also be filtered on websites and databases to narrow down specific topics and locate the relevant data quickly.

| Title | Author | Year | Type |

| Lean Supply Chain & Logistics Management | Paul Myerson | 2012 | Book |

| International Logistics: The Management of International Trade Operations (4th Ed.) | Pierre David | 2013 | Book |

| Research Methods for Business Students | Mark Saunders, Philip Lewis & Adam Thornhill | 1997 | Book |

| Fashion Transparency Index | Bryony Moore & Sarah Ditty | 2015 | Report |

| The Evolution and Future of Logistics and Supply Chain Management | Richard Ballou | 2007 | Journal |

| Regionalism, trade and economic development in the Asia-Pacific region. | Muhammed Abu B. Siddique | 2007 | Book |

| International marketing strategy: Analysis, development and implementation. | Isobel Doole & Robin Lowe | 2012 | Book |

| Research opportunities in supply chain management, Journal of the Academy of Marketing Science | James R. Stock, Stefanie L. Boyer & Tracy Harmon | 2009 | Journal |

| The State of Fashion 2017 | Business of Fashion & McKinsey | 2016 | Report |

Table 2.2.2.1 Key Literature (Authors own, 2017)

2.3 Primary Research Methods

2.3.1 Qualitative Methods

2.3.1.2 Interviews and Case Studies

Qualitative methods such as interviews and case studies have been used to obtain in depth results on supply chain management, logistical risks and the impact of difficult economic factors. Numerous interviews conducted with industry professionals and SMEs, focused on gaining an insight to their experience and opinion on current issues faced by the fashion industry.

Two case studies have been written on SMEs, they will “investigate important topics not easily covered by other methods” (Yin, 2004). One other case study has been conducted on a 100% transparent company called Everlane

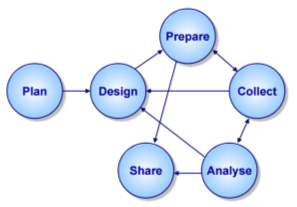

Described by Robert K. Yin, the case study process comprises six interdependent stages as shown in the FIGURE BELOW (Baškarada, 2013). This method ensures accurate and methodically recorder results.

FIGURE… The Case Study Process

Source: (Baškarada, 2013)

2.3.2 Quantitative Methods

2.3.2.1 Survey

Quantitative methods such as a survey have been used to find and analyse data concerning SMEs opinions regarding common trading issues within the UK and overseas and how Brexit will affect their business.

A survey of 30 SMEs in the UK has been conducted which includes a variety of questions on trading, sourcing and finance. The advantages of using this method of research is that the data collected can be used to support generalisations and to help back up theories and identify key themes.

Chapter 3 – Supply Chain Management

3.1 Supply Chain Evolution

“Manufacturers spend more than 50 percent of their revenue in their supply chains, their aim is to find as much value as possible from those relationships, according to CGN & Associates. Emphasis on the collaboration with the suppliers is key at the moment with the interest continuing to intensify within companies” (The top 6 supply chain logistics trends for 2016, 2016b).

Although SCM has been in existence for many years, “the term, ‘supply chain management,’ has risen to eminence over the last ten years” (Habib, 2011). One of the many challenges of supply chains, is the fact that these need to be constantly managed and adapted in order meet today’s consumer demands and the ever increasing rate of speed to market for products.

Supply Chains within the fashion industry are essentially very long and complex. Brands and retailers often work with a number of factories and suppliers in order to produce their garments. It is key to have management strategies in place in order to maximise business efficiency and profitability. The challenges are to ensure that production, sales, finance, marketing, and distribution operate in concert to focus on the movement and availability of finished goods (Laseter and Oliver, 2003).

The Evolution of SCM in FIGURE shows the two main areas of management within the supply chain. These are purchasing/materials management and physical distribution. Purchasing/Materials Management “encompasses procurement, transportation, and inventory management of the actual products from manufacturer to storefront” (Materials management’s five critical processes and people). In contrast, physical distribution is in relates to the logistics of transporting the products from COO to stores worldwide.

Fig. 3.1.1 Evolution of Supply Chain Management

Throughout the entirety of SCM, coordination is needed through all channels to ensure everything runs effectively. In the 1950’s logistics was primarily thought of in military terms (Ballou, 1978). Expanding from this, today the key competitive requirements in the supply chain are flexibility, responsiveness, reliability and agility (Gonzalez-Loureiro, Dabic, and Kiessling, 2015). This idea originated in the 1960’s where each activity was fragmented by sections. The integration of all of these activities led to the deviation of all operations being titled ‘Supply Chain Management’ which has been defined over the years by many research enthusiasts.

Walton and Gupta (1999) argue that,

“supply chain management is the integration of various concepts such as extended enterprise, the virtual organization, the virtual value chain and green supply chain. These aspects are important from the perspective of strategy and operations for an industry” (Parkhi, Joshi, and Sharma, 2015).

Whilst Ballou (2007) believes that,

“supply chain management encompasses the planning and management of all activities involved in sourcing and procurement, conversion, and all Logistics Management activities. Importantly, it also includes coordination and collaboration with channel partners, which can be suppliers, intermediaries, third-party service providers, and customers. In essence, Supply Chain Management integrates supply and demand management within and across companies”.

Mack (2015) contends that

“Supply chain management involves optimizing your operations to maximize both speed and efficiency. Speed is important because customers value fast service. Increasing speed, however, can cause costs to skyrocket, so maximizing efficiency is equally important. The most effective supply chains deliver products as fast and as cheaply as possible without sacrificing quality.”

3.2 Global Supply Chain

“The global economy is rapidly evolving and becoming more interconnected and diverse with production processes growing ever more complex, resulting in more serious business interruption implications when things do go wrong” (Needle, 2016).

“Global supply chain challenges are not new although the last fifteen years have been particularly dynamic with the emergence of economic opportunity across South and Southeast Asia, as well as in select locations in Eastern Europe, South America, and even Africa.” (University of Tennessee, 2014).

In particular, there has been a dramatic increase in manufacturing in regions such as China, India and various other developing countries including BRICS. This is due to the vast amount of skills and manufacturing capabilities along with the quicker rate that they can get products to market. Some of the key trends in the industry that are being used to help monitor changes and risks, are the use of big data and analytics, adapted for use into current businesses in order to be able to react quickly to consumers and meet the demand.

“Over the past three to five years, growth in big data and analytics technology has led to improvements in dozens of other industries. In terms of supply chain management, there’s a lot of noise regarding the promise of new technologies changing how organizations do business forever” (Alton, 2107).

Roy (2017) claims that the three successful things all supply chains needs are people, processes and technology. People are the primary function of any business, the workforce who have the skills and knowledge to control the supply chain. The processes involve aiming to achieve customer satisfaction and meet the demand. It involves all functions from the conception of the product, to the very end where the product is distributed to stores and bought by customers. Technology is used to connect the people and processes together to work harmoniously to achieve success and drive profit within the business.

3.2.1 The role of big data and analytics

“Gurus among us have proclaimed 2017 will be the year big data goes mainstream” (Newman, 2017). “Big data analytics is the process of collecting, organizing and analysing large sets of data to discover patterns and other useful information” (Beal, 2017). Currently big data and analytics software is

“expected to further simplify Big Data analytics for small companies and inexperienced users, and skip the unnecessary learning curves many users struggled with so far” (NT, 2017).

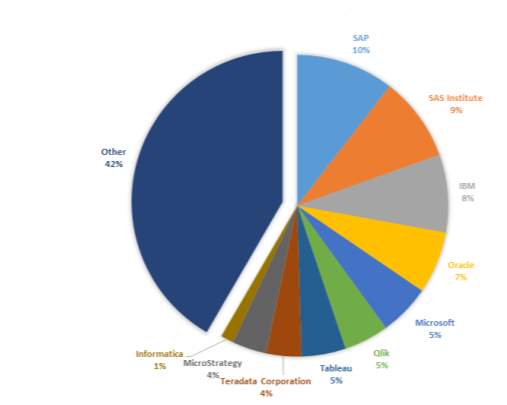

There are many companies that offer all types of analytical services for SMEs, large and global companies. What the retailer wants can be tailored in a unique package specifically to suit their needs. The use of the data collected can protect retailers from reputational risk by helping them become more efficient and saving them money. Cost savings immediately increase profit, which is always a key driver for any business (Needle, 2017). The top 10 analytic companies in 2015 by market share are shown below.

Source: (Markovski, 2016)

The role of big data in the fashion industry is becoming increasingly valuable to help make decisions using selective data to suggest product lines to customers. It explains, “when customers make purchases, how large their purchases are and how many items are sold, it could mean the difference between success and failure” (Sutter 2016).

“By tracking how customers behave while shopping, data analytics can also help to improve the design and management of shops and department stores” (Murray, 2016).

“Like many new information technologies, big data can bring about dramatic cost reductions, substantial improvements in the time required to perform a computing task, or new product and service offerings” (International Institute for Analytics, 2013).

Fashion retailers are increasingly turning to data analytics to keep up with the latest trends and client demands. Customers want the latest catwalk trends but it isn’t easy to price the items, decide how much to stock to order, how many colour variations, fabrics, sizes, when to reduce them and how many to have in stock available to sell. The sets of data gathered by big data software can “reveal patterns associations, and trends that play a pivotal role in the fashion industry” to help make accurate predictions (Sharma, 2016). By knowing the customer’s purchase history and recently viewed products, you can create a more personalised experience through sending out tailored emails and recommending similar items. SMEs could greatly benefit from using data analytics to understand how quickly their products sell out and to track when they need to replenish stock.

3.2.2 Trends

“Logistics and supply chain management are now firmly established as critical business concerns. Many companies have appointed Directors and Vice-presidents who are responsible for ensuring the cost-effective operation of the ‘end-to-end pipeline’ that links the supply side of the business with the end market” (Christopher, 2016).

It is vital that the rate of speed to market and ability to respond to trends quickly in order to meet consumer demand are managed efficiently. Doing this properly will avoid surplus stock in stores, warehouse and the DC’s.

“By Embedding big data analytics in operations, it can have an impact on organizations’ reaction time to supply chain issues and can lead to a 4.25x improvement in order-to-cycle delivery times” according to Accenture (Renner, 2016). Rob Jarvis, Head of the SQ UK office believes that the top three upcoming trends for 2017 will be the increase in 3D printing of a variety of products, the IOT and “augmented reality – the high street retailers will have to make store visits more exciting to compete with online” (Jarvis, 2017). SMEs are at a disadvantage as most only operate online as they cannot afford premises. Oxborrow (2017) agrees that there is a future for augmented reality especially “in terms of sampling, but these things tend to be very slow to take off.”

Oxborrow (2017) has recognised that “robotics has been struggling unless you make very standard things such as jeans and shirts.” Whilst Wallwin (2017) also agrees that “robotics could be possibly used for automation of production and/or picking and packing from the warehouses.”

Big data is a key trend and it “with 70% of the world being online it provides an opportunity to engage an audience and the fashion-eccentric crowd, through effective content” (Sharma, 2017). One of key trends Needle (2017) has noticed is that

“more and more retailers are turning to RFID which means that individual garments can be uniquely tagged. The story of their creation can then be shared will ever increasing ethically-minded consumers”

Gemma Wallwin, Supply Chain Manager at Sainsbury’s contradicts Jarvis stating that in her “experience, none of these trends are going to hugely affect the fashion industry during 2017” (Wallwin, 2017).

3.2.3 Forecasting

Manufacturers spend more than 50 percent of their revenue in their supply chains, with the aim of finding as much value as possible from those relationships, Emphasis on the collaboration with suppliers is key with the interest continuing to intensify within companies (The top 6 supply chain logistics trends for 2016, 2016b).

Figures from Hepworth (2016) have shown that 90% of companies say that agility and speed are important to their business with the need to be able to quickly and flexibly meet consumer demand. This is currently one of the biggest drivers of competitive advantage across the fashion industry. In comparison to Accenture who are aware that “97% of supply chain executives report having an understanding of how big data analytics can benefit their supply chain” but only a small proportion, 17% have actually implemented analytics into supply chain functions (Accenture, 2014).

“Agile retail companies use Big Data analytics to identify consumer trends, utilize highly efficient production and distribution systems, with only selling online. The result is products that people want, at prices they can afford, without having to go to a mall.” (Costa, 2016).

With so many variables constantly changing it is difficult to forecast product quantities, but with the use of analytics it can help to give a better idea to avoid risks, waste and large amounts of stock held in warehouse and DC’s. Due to the large and continuous fluctuation rate in consumer demand, big data and analytics would be useful to all business’ so as to identify consumer behaviour.

3.3 Ethical Fashion

The EFF defines ethical fashion as representing “an approach to the design, sourcing and manufacture of clothing which maximises benefits to people and communities while minimising impact on the environment. Striving an active role in poverty reduction, sustainable livelihood creation, minimising and counteracting environmental concerns.”

A major problem for many brands is that they do not control the supply chain, and hence may not know if ethical problems may tar their reputations (Rodrigo, 2013). The TABLE below shows Needle (2017) top four steps for reducing ethical and reputational risks within a SME. It is vital to know your suppliers and have detailed information on how they conduct business and run their factories. Knowing if they outsource to any other companies is sometimes of difficulty to find out, Needle recommends turning up at the factories unannounced to conduct random checks on how the production is going.

| 1 | Know your suppliers. Most SMEs will not have procedures in place to check that their suppliers are good and ethical. Asking for simple information on previous audits and financial information will help. |

| 2 | Know the suppliers of your suppliers. It is all well and good having a great garment manufacturer producing high quality clothing, however, if they procure your care labels and swing tickets (which have your brand printed on them) from sweatshops that may have children or slaves working in them, your brands reputation will immediately be damaged. |

| 3 | If you can’t afford a supply chain system. Rationalise your suppliers to the fewest possible. |

| 4 | Turn up at the factories unannounced. |

Ethical and Reputation Risk

Source: (Needle, 2017)

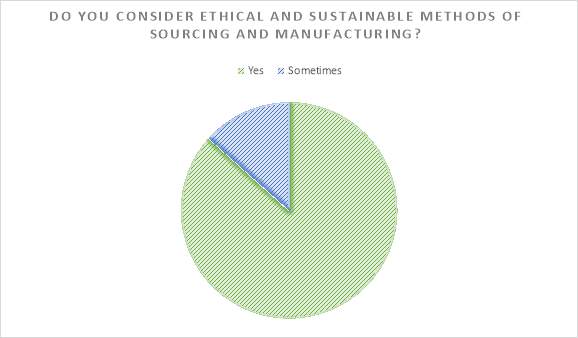

FIGURE show’s that

3.6.1 Fashion Revolution

Sustainable supply chain management has emanated from the recognition of the strategic importance of purchasing and supply activities both in achieving the firm’s long-term performance, and in addressing sustainability issues within business capabilities (Burgess et al., 2006; Hall and Matos, 2010). SMEs can join organisations and various different campaigns such as Fashion Revolution to promote ethical production and sustainability, to help expand awareness to all consumers.

Ensuring that workers and factories meet government standards is sometimes difficult. This is especially so when workers do not have freedom of speech and companies are using other factories to help achieve their order in time. Since the Rana Plaza factory collapse in Dhaka on 24th April 2013, one non-profit company that is helping to “raise awareness of the true cost of fashion” is Fashion Revolution (Fashion Revolution, 2016).

Figure 3.2.3 Rana Plaza Factory Collapse

They are a “global movement that wants to radically change the way fashion is made, sourced and consumed,” (Moore and Ditty, 2016) they believe in a fashion industry that values the people, environment, creativity and profit in an equal measure. Their mission statement stipulates that they “believe in fashion – an industry which values people, the environment, creativity and profits in equal measure, and it’s everyone’s responsibility to ensure that this happens.”

Figure 3.2.1 Fashion Revolution Campaign (Join the fashion revolution, 2014)

“This is of particular concern as SMEs are a leading driver of trade, employment and economic development. Research shows that SMEs face these hurdles in both developed and developing countries, but the challenges are greatest in lower income countries” (Trade finance and SMEs Bridging the gaps in provision, 2016).

3.6.1 The Ten Principles of the United Nations Global Compact

The Global Compact’s ten principles cover the areas of Human Right’s, Labour, the Environment and Anti-corruption. Today,

“it is more evident than ever that making them a reality requires collaboration across the supply chains that define global business in the 21st century” (Supply Chain Sustainability, 2010).

SMEs can use these principles as a guideline to ethically conduct their business and processes.

The principles are derived from:

- The Universal Declaration of Human Right’s

- The International Labour Organization’s Declaration on Fundamental Principles and Rights at Work

- The Rio Declaration on Environment and Development

- The United Nations Convention against Corruption (The ten principles of the UN Global Compact, 2016).

The UN Global Compact asks companies to embrace, support and enact with their influence in order to set core values in the four key areas of Human Right’s, Labour standards, the Environment and Anti-Corruption (The ten principles of the UN Global Compact, 2016). Currently the UN Global Compact has a total of over 12,000 signatories in 170 countries that are both developed and developing (UN Global Compact, 2016).

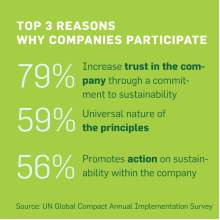

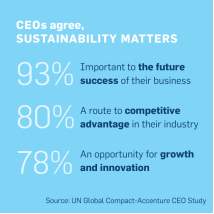

Through the ten principles as stated below in table 3.3.1, it outlines the ways in which a business should run itself in order to promote corporate sustainability and help to sustain long term success in the global economy. Figure 3.3.1 and 3.3.2 give key statistics on the reasons why companies are a part of the UN Global Compact and why CEO’s agree that sustainability matters.

Figure 3.3.1 Top 3 Reasons Why Companies Participate

Figure 3.3.2 CEO’S agree, sustainability matters

|

Principle 1: |

Human rights

Businesses should support and respect the protection of internationally proclaimed human rights; and |

|

Principle 2: |

make sure that they are not complicit in human rights abuses |

|

Principle 3:

Principle 4:

Principle 5:

Principle 6: |

Labour

Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining; the elimination of all forms of forced and compulsory labour; the effective abolition of child labour; and the elimination of discrimination in respect of employment and occupation |

|

Principle 7:

Principle 8:

Principle 9: |

Environment

Businesses should support a precautionary approach to environmental challenges; undertake initiatives to promote greater environmental responsibility; and encourage the development and diffusion of environmentally friendly technologies |

|

Principle 10: |

Anti-corruption

Businesses should work against corruption in all its forms, including extortion and bribery. |

Table 3.3.1 – The Ten Principles of the United Nations Global Compact

3.4 Corporate Social Responsibility

The last few years has seen an increase in the adoption of an understanding and application of CSR activities to companies. Corporations are encouraged to behave in a socially responsible way (Dahlsrud, 2008). This is seen as an “expansion of the concept of human rights across several generations, with special attention to communication rights in the new media environments” according to Brysk and Stohl (2017). Whilst Blowfield and Murray (2011) would argue that, the response is often negative, with people being discouraged to work on CSR. Negative connotations surrounding whether or not SMEs should enlist in CSR are views that it is too costly, irrelevant to their business and unwarranted with no real business benefits.

Today the “generation of the millennials has driven a shift on a different outlook than previous generations. Global spending from millennials is estimated to account for one third of global spending by 2020” (Schawbel, 2015).

The change in consumer behaviour and spending is because more so today than ever people are interested in where their clothes originate from and how a company portrays its social responsibilities in the media. “Elite Daily interviewed 1,300 millennials and 75% said that it’s either fairly or very important that a company gives back to society instead of just making a profit.” (Fashion Revolution, 2015).

Figure … Areas of SME management where corporate responsibility issues are relevant

Source: (Adapted from People and Profit, 2007)

Being unaware of fully what it means and to enlist in corporate social responsibility, companies may already be being acting socially responsible when sourcing and manufacturing without realising it. When the terms are substituted for other simpler meanings as shown in FIGURE it becomes more understandable with detailed sub-sections expanding on the management, mission and values. Some SME managers have started to see that managing the business-society relationship not so much as a cost burden but a source of competitive advantage (Blowfield and Murray, 2011). FIGURE shows ways in which companies can actually work and promote CSR through the various different headings as described in FIGURE.

At first for SMEs, it can seem daunting to think about including CSR within the business as most have limited money and resource’s to spend. One way as mentioned by Henshaw (2011) is to incorporate the role into a current team member’s role who is passionate about sustainability and will encourage others to get involved and assist.

| Responsibility | Action/Skills | Benefit |

| Communication |

|

|

| Stakeholder Management |

|

|

| Employment Conditions |

|

|

| Innovation |

|

|

| Customer Relations |

|

|

| Environmental Activities |

|

|

| Community Activities |

|

3.7.1 Traceability

As customers demand greater transparency in sourcing and textile prices fluctuate, retailers are looking harder at where to source their raw materials (Hounslea, 2017). Being one of the world’s most polluting industries, with highly complex global supply chains, it remains a challenge for the fashion industry to ensure good CSR and environmental sustainability practices are present throughout the supply chain (Perry and Towers, 2013). “As one of the biggest players in the global economy, the fashion industry has a responsibility to help protect the environment” (Singer, 2015). Many retailers are trying to improve the traceability of all its manufactured components, which often is of difficulty due to suppliers outsourcing unknowingly.

“If brands don’t comply with legislation covering their international supply chains, pressure from their consumers is only likely to grow. Recent research, commissioned by Intel, found that 8 in 10 millennials believe that, as consumers, they have a responsibility to make sure the products they buy don’t use resources that harm society or the environment” (Metreweli, 2016).

Supply chain visibility means to have the knowledge and understanding of what is going on all the way down the supply chain from product conception to store.

“Increased supply chain visibility helps companies react sensibly to unplanned events, ensures the supply of needed parts, and avoids unwittingly supporting practices in the supply chain that violate the company’s principles” (Rathke, 2015).

Companies such as Segura and Which PLM both help to ensure traceability and constant tracking of all processes within a business. Which PLM is owned by Mark Harrop who is “leader and renowned industry blogger who believes in opening channels of communication and building strong relationships with suppliers” (Which PL, 2014). “His company focuses on helping clients to achieve maximum on their ROI. “Specialising in a range of processes including: Voice of the customer insights, merchandise & assortment planning (Financial & Graphical), trend & creative design, 2D & 3D, product development, costing, sourcing, CSR, supply chain collaboration and IOT” LinkedIn.

“Segura’s cloud-based software allows businesses to understand, map, monitor and control their supply chains, helping them to mitigate risk and save money” (Segura, 2017). CEO, Peter Needle (2017) believes that for any SME that wants to gain clarity within their supply chain and “know every component in their garment and that it has been sourced from good and ethical suppliers”, needs a system like Segura. Needle (2017) regards the importance of nominating suppliers across your supply chain to using a system like Segura. One American brand called Everalne is 100% transparent, showing custoemrs every single step and cost that went into amking their products. Including labour and exact material costs, as illustrated in CASE STUDY presented below.

“The proliferation in recent years of transparent, sustainably conscious companies” has increased, brands such as Everlane and Honest By, they have “initiated a radical shift in the retail industry” (Vend, 2017).

3.7.2 Case Study

Everlane is a brand born in San Francisco and was founded in 2011 by Michael Preysman. It is “one of the most interesting, innovative companies in the industry, and reportedly seeking a valuation upwards of $250 million” (Avins, 2016).

“Everlane sells minimalist basics—like T-shirts and sweaters, hoodies, and weekend bags—made with high-quality fabrics but sold at low prices. The brand’s offerings, for both men and women, have thus far all articulated a very specific, even unmistakable aesthetic” (Friedlander, 2015).

“To dramatise its approach and engage consumers, Everlane embraced the notion of “radical transparency,” disclosing on its website exactly how much each of its products cost the company to make — breaking out figures for materials, hardware, labour, duties and transport — alongside Everlane’s price and what these products would likely cost at “traditional” retailers. The company was also transparent about the specific factories where each of its items were manufactured” (Kansara, 2016).

FIGURE 1 and 2 display all of the [product information that is available for the customer to look at, it displays the mark-up as you can see the price difference between cost of goods and retail price.

https://www.bloomberg.com/features/2015-everlane-ethical-fashion/

Screenshots

https://www.everlane.com/products/womens-breton-rib-ctn-swtr-dress-whitenavy

Chapter 4 – Logistics

4.1 Logistics Evolution

“Logistics management is the part of SCM that plans, implements, and controls the efficient forward and reverse flow and storage of goods, services, and related information between the point of origin and point of consumption in order to meet customer requirements.” (Ballou, 2007)

Physical distribution of products across the globe has dramatically improved over the years, with it now being easier to manage the flow of materials from COO to the distribution to retail stores and reaching the consumer. The Council of Logistics Management changed their name from the National Council of Physical Distribution Management as to “reflect the evolving discipline that included the integration of inbound, outbound and reverse flows of product, service and related information” (Robinson, 2015).

Logistical strategies and processes were not considered as much as they are today. Within the last 67 years everything has changed dramatically, it is still considered by Tudor (2012) as an “evolving concept.” The reason why logistical planning wasn’t widely used was due to the

“prevailing economic and technological conditions, as well as the state of the development of management thought, did not provide and environment in which business logistics could be recognized” (Ballou, 1992).

“The period of the mid 1950’s to the 1970’s was the developmental time for the logistical theory and practice” (Ballou 1992). Robinson (2015) contradicts with Ballou (1992) arguing that it was the

”1980’s marked the sea-change in logistics in the history of SCM. The emergence of personal computers in the early 1980’s provided tremendously better computer access to planners and new graphical environment for planning” (Robinson, 2015).

The importance of being able to analyse and strategically plan all processes involved in logistical management has really evolved since the 2000’s, in which corporations sought a competitive advantage over. New roles such as “Chief Supply Chain Management Officer” and “Supply Chain Analyst” emerged with the emphasis on risk management, sustainability and globalization (David, 2013).

It has been predicted by Etim (2016) that within the next ten to twenty years “global logistics supply chains are likely to be unrecognisable from those of today, because of disruptive technological advances and worldwide concern for the environment.” Disruptive technologies including the worldwide use of big data, analytics and the IOT are all going to help increase the speed to market of products and allow all businesses to be able to make and predict better options for managing the distribution process. There are various types of big data and analytical software today that can help SMEs to gain a better understanding of what data they can collect and the ways in which it can be analysed and predicted, to remain competitive against much larger competitors.

4.2 Global Risks

“The latest Chartered Institute of Procurement & Supply (CIPS) Risk index shows global supply chain risk increased to a level of 80.8 in the 2nd quarter of 2016 – extending a trend of rising risk that has been prevalent during the past decade” (Barraco, 2016).

Due to the unclear fallout from Brexit weak oil and commodity prices, political uncertainty, economic instability and the impact of terrorism have contributed as high risk factors for businesses. This is hardly surprising or uncommon as risks and threats constantly pervade throughout all global supply chain operation’s (Barraco, 2016).

The world population was projected by the United Nations to “grow from 6.1 billion in 2000 to 8.9 billion in 2050, increasing therefore by 47 per cent” (United Nations Department of Economic and Social Affairs’ Population Division 2004). Whilst Roland Berger (2016) believe that by 2030 “over 8 billion people will live on earth. That’s around a billion more than in 2010, and 95% of this increased population will be born in developing and emerging markets.” With an ever expanding population more management solutions and techniques need to be put into practice in order to be able to cope with the needs of the world population.

Demographic changes pose a dramatic threat to the business models of many transportation and logistics companies. It remains to be seen if the industry can cope and attract a skilled workforce (PWC, 2012). Hobbs (2016) has said that in her opinion part of the problems is that skilling institutions do not offer any relevant courses anymore. In 2017 about a third of the technical workforce in the UK will have retired, leaving a skill gap.

SMEs often struggle to gain a workforce due to people viewing them as to having a lack of prospects along with not realising the benefits or potential the company has. After all every business starts off small sized until it has the workforce, finance and facilities to grow and expand. Cooney (2015) has pointed out the advantages of working for a small company are the varied workload and being able to work across all sectors in the business, faster career advancements due to increased responsibility and being noticed more due to departments being more interconnected, helping to provide effective communication internally.

Another increased risk is cargo theft. As reported by Bloomberg, criminals are stealing a wider range of goods from trucks and warehouse such as foodstuffs, alcohol and clothing.

“Cargo thefts in Europe, the Middle East and Africa have jumped almost three-fold in five years, with 85 percent of 2015’s incidents occurring in Britain, Germany, Belgium and the Netherlands, the leading hubs for distribution and cross-border trade, Transport Asset Protection Association data shows” (Weiss, 2016). FIGURE shows the steady rise in cargo theft from June 2015 to June 2016.

Source: (Weiss, 2016)

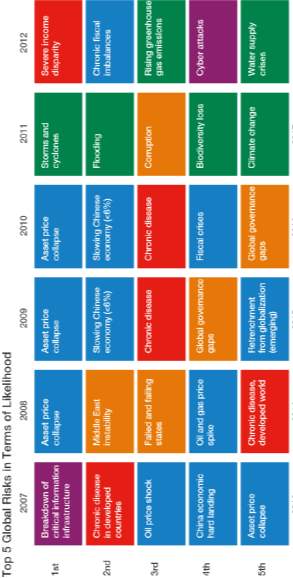

FIGURE from the Global Risks Perception Survey 2016 shows the top five risks by likelihood from the last 10 years. In 2015 the most common risks were geopolitical with the number 1 risk being interstate conflict with regional consequence’s. In 2016 environmental risks were key concerns with 3 out of the 5 relating to extreme weather conditions, climate change and natural disasters that occurred mainly in Asia. For 2017 the top 3 predicted risks are extreme weather events, large-scale involuntary migration and major natural disasters (World Economic Forum, 2017).

Source: (WEF, 2017)

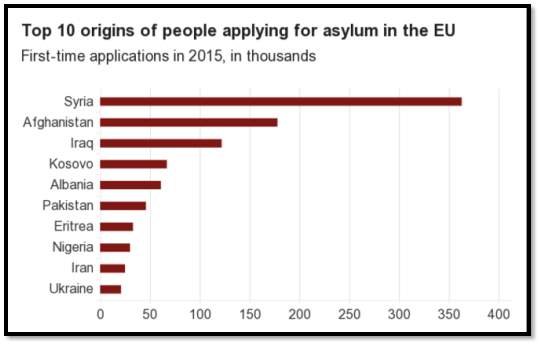

Globally in 2015-2016 one of the main threats facing Europe was the migration principally from Syria due to all the corruption. FIGURE shows the top 10 countries where migrants have come from to seek asylum in Europe.

Source: (BBC News, 2016)

Currently on a global level from 2016, the biggest threat facing the following countries is listed below:

- Europe it is still migration.

- US it is cybercrime

- Africa and South America it is failure of national governance.

- The MENA (Middle East and North Africa) region faces the greatest threat from water crises and unemployment

- Central Asia, including Russia, it is energy price shocks and interstate conflict.

- South Asia is water crises

- East Asia it is natural catastrophes (CIPS, 2016).

4.2.1 Supply Chain Risks

Needle (2017), Jarvis (2017), Oxborrow (2017) and Wallwin all have similar views on what the top three supply chain risks are. See TABLE for a list of interviewees response to the top three supply chain risks Needle (2017) believes that quality is the number one issue, in relation to fabric and quality checks which often can be difficult when sourcing overseas. He has also stated five ways in which SMEs can help to mitigate risk within the supply chain.

| 1 | Widen your supplier base where possible, so you can avoid capacity issues and therefore production delays. |

| 2 | Use a deep supply chain visibility tool like Segura. |

| 3 | Use ad-hoc unannounced auditing. |

| 4 | Check factories production capacity and record volumes each month to highlight areas of unauthorised subcontracting. |

| 5 | Pay reasonable prices to remove incentives for factories to cut corners |

Source: (Needle, 2017).

Jarvis (2017) also thinks that quality and more so customs are an issue due to theft and the delays which can be caused when items are incorrectly declared. Whilst Oxborrow (2017) is “most familiar with new product delay because a lot of organisations really struggle to make a decision about what new product they actually want and to agree on all of the same design features of it and then redesigning it to fit the cost. By that time, they’ve eaten into the supply chain big time. It’s just a recurring theme almost whichever business you talk to.”

The TABLE below shows all of the top three responses.

| Interviewee | Which do you think are the top 3 supply chain risks that cause the most delays within the fashion industry? |

| Peter Needle | Quality

Inventory Management Customs |

| Mark Harrop | Big Data |

| Rob Jarvis | Customs

Quality Political Instability |

| Lynn Oxborrow | Product Delay

Inventory Management Big Data |

| Gemma Wallwin | Quality

Inventory Management Political Instability |

Source: (Authors Own, 2017)

4.2.2 Risk mitigation

To successfully mitigate risk in any business it is key to try and prepare to eliminate the possible problems which may occur within transport, logistics or the supply chain. Supply Chain Risk Management (SCRM) is a priority in procurement as Dittmann (2014) has recognised that “organizations lose millions because of cost volatility, supply disruption, non-compliance fines and incidents that cause damage to the organizational brand and reputation.” Root (2015) and Scheid (2013) both have similar views because for them, there are three steps to successfully managing a supply chain and mitigating risk. The first step is to identify the internal and external risks, by listing all the potential problems which may pose a threat to the business and operations. Secondly the risks need to be clearly defined and prioritized into how likely they are to occur, a ranking system on a scale could be used with the following options put against each risk

- Very low

- Low

- Probable

- High

- Very high

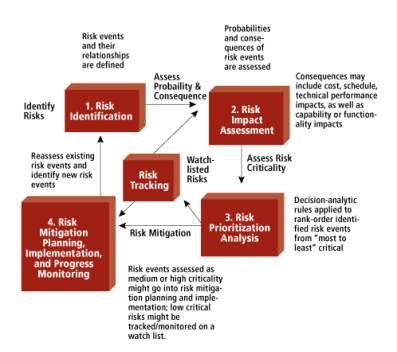

Lastly the third step is to mitigate risk, FIGURE be used to track the progress, monitor and evaluate the key risks in any business. This tool can be very valuable to SMEs by helping them consider and really think about the possible risks they may experience with transportation, supply chain, manufacturing, shipping, suppliers and various other uncontrollable factors such as weather conditions.

Source: (The Mitre Corporation, N.D)

4.3 Inventory Management

“Big companies that generate lots of data just in sales and the fact that they don’t use it very well to manage their inventory and too forecast ahead is a big problem. It does impact on their inventory levels and their ability to turn things around quickly” (Oxborrow, 2017).

Businesses in the past have had a tendency to order large quantities of stock in bulk to get a discount and better offer. Simon Monaghan a consultant from the Business Doctors network of SME experts agrees that “holding big stocks is very old school” (Aldred, 2016). Having a large quantity of stock in an inventory is inefficient as it is in effect money just sitting there waiting and holding up space for other products. Mr Hugh Williams, Hughenden Consulting, also agrees that

“producing things just because you have capacity is old thinking. It’s often more profitable to leave equipment idle, and send people home early, than it is to produce inventory that never gets sold and has to be written off. Buying items in bulk just to get a discount is as bad” (Aldred, 2016).

“Inventory Management is the supervision of non-capitalized assets and stock items. A component of supply chain management; IM supervises the flow of goods from manufacturers to warehouses and from these facilities to point of sale. A key function of IM is to keep a detailed record of each new or returned product as it enters or leaves a warehouse or point of sale” (Rouse, 2011).

One of the common high costs is the holding of stock and inventory, when the stock has value but might not sell or could become obsolete (Fernie and Sparks, 2014). The modern way to manage and control inventory is to have “the right amount of inventory when and where it’s needed is a key element of corporate success” (Randall et al, 2016). If not managed efficiently losing control of the inventory can decrease profit margins and lose customers. An advantage that SMEs have over larger companies is the ability to adapt, be flexible and create personal relationships with suppliers and buyers all over the world. MOVE TO BEGIINNIG

One of the key challenges is being able to realise and see the real demand for the product. With the right software, you can analyse and identify that consumers are purchasing, when and where which can help you to identify the items the consumers want. “Most supply chains are driven by forecasts and inventory replenishments, individual parties in the chain will have no real visibility of the final market place” (Fernie and Sparks, 2009).

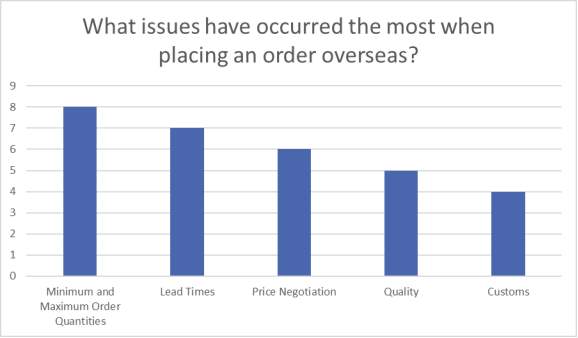

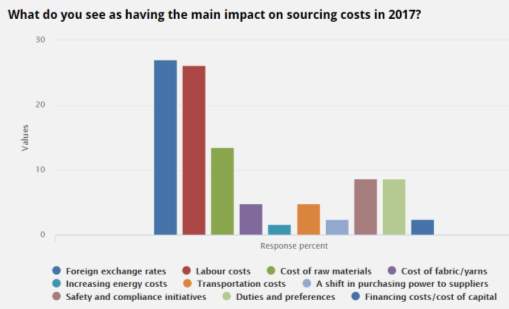

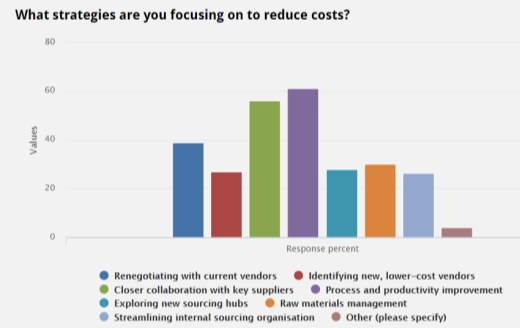

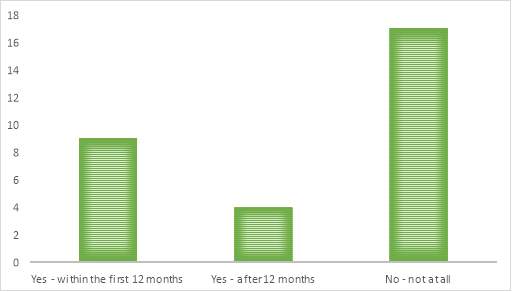

Survey results have shown that the top five risks occurring for placing orders overseas for SMEs are as shown in FIGURE below. Minimum and maximum order quantities have tended to be a running theme as one of the main issues in the industry that companies face on a regular basis, whether they source products from overseas or the UK. Crum (2017) owner of the UK based clothing brand OTK, struggled in the beginning to find a suitable manufacturer for his products in Britain, which would allow him to order small quantities such as five to ten items. As he found most companies had minimum orders of fifty or a hundred. Currently he uses GS Mahal, a manufacturer in New Basford for the manufacture and embroidery of his clothing brand. See CASE STUDY B for more detail on PAGE.

In comparison to the most common trading issues with UK manufacturer’s there was a variety of different answers from respondents. Some of the key responses to the issues faced are the fact that it can be more expensive to manufacture in the UK due to labour costs and the high minimum orders, which are required. Additionally there are communication problems, limited range of suppliers and difficulty in negotiation payment terms. (See APENIDIX for full response’s from the survey). The FIGURE below shows the top five issues that have occurred for UK based SMEs when placing orders. Lead times is always a recurring issue, suppliers in Asia take a long time to ship products to the UK by sea freight in comparison to Europe. If you are looking for product fast without the risk of quality and customs issues then the best option is to source from the UK and pay a slightly higher price, meaning you can be in full control of the supply chain and trace all of your products. Hammer (2016) states that the key benefits of manufacturing in the UK are the “low prices; quick response, from point of order to delivery to the store. It can take as quickly as 10 days as opposed to 3 months if sourced from South East Asia.”

4.3.1 Case Study

Edd Crum is micro business owner of the unisex brand OTK. Founded in 2015 he designs “simple and fresh streetwear clothing in lots of variations”. His target customer is mainly men around the age of 20, but has a lot of women buying his products too. In 2016 his revenue was £500 from various products including t-shirts, crew necks, hats and other accessories ranging from £15 to £30 per item.

As a micro business Crum manufacturers, his products at GS Mahal’ which is a clothing supplier located in New Basford, Nottingham. His products are sent to the manufacturer for the embroidery of his logo as shown in the PICTURE below. Once embroidered Crum picks up his products himself and takes them home to sew in his labels. Crum states that the advantage of living close to supplier means he can “check the quality and high thread counts and physically touch it, in comparison to ordering off the internet and being stuck with bad quality products.”

The products are advertised primarily through word of mouth. Not relying on a website or any form of social media his brand is designed to be “off the grid” as he gets his business mainly from family and friends who have seen the brand being worn around Nottingham. Recently the OTK brand has been sold in the skate shop in Nottingham called 42, and previously the vintage store Backlash which is no longer in business. Mostly sales are made “through me to friends and people that know me.”

The biggest challenge Crum has faced in relation to sourcing is the problem with a lot of local manufacturers stating that a minimum order of fifty or one hundred is required. This is a problem for a micro business as stock rotation is much less in comparison to larger business. Crum replenishes his stock when one of the colour drops then ever half month he would sell out completely.

Crum chose to work with a supplier close by as he can “visit the warehouse to check it all physically, then they call me when its ready and I get a bus and go and collect it cheaper than getting it delivered to my house.” Crum has experienced quality control issues before as the embroidery design was incorrect but as he has a good relationship with the supplier, which is key, he could rectify the issue straight away as he personally collects his products directly from the manufacturer instead of being delivered possible incorrect or faulty items.

The future of OTK is to introduce “more jackets and leather works, including branded little leather good such as keychains, possibly belts – nice low key products.”

4.3.2 Inventory flow

“In the modern interconnected and interdependent world, we need seamless global visibility and fluidity of the flow of goods” (Etim, 2016).

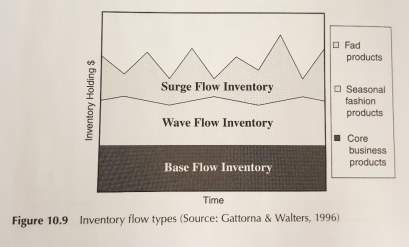

Source: (Gattorna and Walthers, 1996)

Inventory flow is quite complex to control as a big company, but as a SME it is more manageable as you import, export and sell smaller quantities making it easier to track all core, seasonal and fad items at all times. The flow of inventory can be categorised into three types as illustrated by Gattorna and Walters in FIGURE.

Stockholding each of these types of inventory requires different levels of product to satisfy the consumer demand. Base flow inventory requires regular replenishment of the product as it will continue to sell every week. Wave flow inventory products will have peaks and troughs within the amount purchased, due to how long the trend is around for and whether it continues for more than one season. Surge flow inventory requires stock at speed once the fad has been identified the retailer can react quickly by presenting the product in different colourway’s if they predict the fad to continue for an amount of time that allows them to replenish the stock.

4.4 Supply and Demand

The fashion product supply chain is quite complex and time consuming, often consisting of many different phases, therefore meeting the market demand is challenging. “Today the reality is that most supply chains are based on a production-driven rather than a demand-driven perspective” (Christopher and Ryals, 2014). The supply and demand model is more so leaning towards being renamed the ‘demand and supply’ model. To remain competitive companies must be able to adapt and react at speed to produce consumer desire products to market effectively (Hilletofth and Eriksson 2011).

To create a sustainable world Christopher and Ryals (2014) believe that the SC is more beneficial if designed from the customer backward (demand pull) instead of from the traditional outward of supply (push), making it responsive to customer demands and reducing waste and returns.

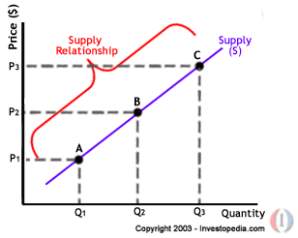

4.4.1 The Law of Supply

“The law of supply, in short, states that ceteris paribus (other things equal) sellers supply more goods at a higher price than they are willing at a lower price” (Law of supply, 2015). It is an economic principle that states there is a direct relationship between both the price of the product and how much producers are willing to supply to consumers.

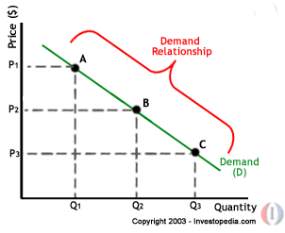

The supply relationship in FIGURE is shown to increase steadily. As the price of the product increases so does, the quantity supplied to the market. The positive correlation of the supply versus price is based on the potential increase in profitability that occurs when the price is raised.

If the cost of production is held at a constant then the supplier is able to further increase the return per unit of the product. This means that the net return to the supplier will increase with the difference between the price and cost of product incrementally higher than previous (Boundless, 2017).

4.4.2 The Law of Demand

The Economic Times (2013) has defined the Law of Demand

“explains consumer choice behaviour when the price changes. In the market, assuming other factors affecting demand being constant, when the price of a good rises, it leads to a fall in the demand of that good.”

Integration between both demand and supply is all about creating value within an outside the business at all relational links from the beginning of supply through to demand, in order to provide products that are valuable to customers (Esper at al. 2009).

Today the world we live in is based more on a ‘demand and supply’ basis. Millennial’s want what they see on celebrities, the catwalk and bloggers the day the see after it. They are impatient and want to be able to purchase fad and fashion items instantaneously. It puts a lot of pressure on SMEs to be able to react with the small budget they have available. They have to make accurate decisions and quick before the products are no longer desirable. The use of software such as Segura and Which PLM would be useful to assist them with these decisions.

4.5 Transportation

Although there is a need to analyse the entire value chain, as sometimes even long-distance transport might be less carbon intense than local production, tightening the supply chain in many cases saves energy and emissions. Hence, the trend towards localisation and regionalisation helps with resources and the environment. However, new technology and digitisation can go well beyond the simple shortening of the supply chain. For SMEs sea freight is more cost effective than air freight.

“According to the World Bank, air freight is typically priced four to five times that of road transport and 12-16 times that of sea transport, ranging from US$1.50 to US$4.50 per kilogramme, while the value of air cargo typically exceeds US$4 per kg” (Deschamps, 2014).

4.5.1 Sea Freight

SMEs in today’s world are not fully aware of the substantial risks involved with shipping overseas and what the best method would be for their business. One of the main things SMEs can do to reduce losing money to risks are by being insured.

“Containerization is a shipping technique that now dominates most modes of transportation. Containers allow for a quick transition of freight between different vehicles in the intermodal transport chain” (Global Shipping: Choosing the Best Method of Transport, 2014).

One of the main things SMEs can do to reduce losing money to risks are by being insured.

“Around 600 to 2000 containers are lost at sea per year on average, depending on catastrophes reported, according to the World Shipping Council, lost cargo still costs the insurance industry and companies billions of dollars in losses globally” (Green, 2017).

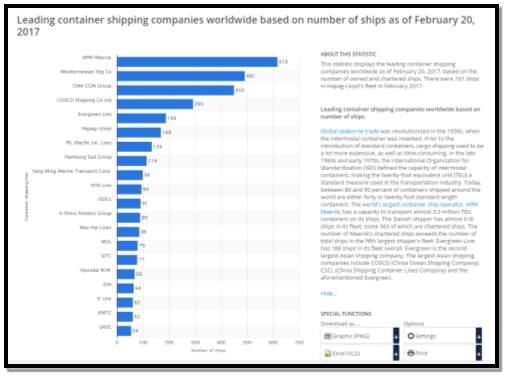

The leading container shipping companies are listed in FIGURE. Shipping cargo without insurance could quite easily bankrupt an SME as they tend not to have a large amount of finance available to spend as it is usually tied up in other areas of the business. Buying cover for legal fees need also be factored in, as there is a risk that the cargo could be damaged on arrival, meaning the shipping company would cover the loss.

Source: (Statista, 2017)

Chapter 5 – Economic Factors

5.1 Brexit

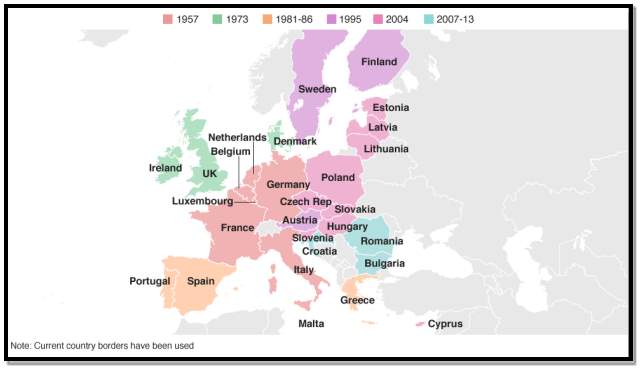

“The European Union (EU) was created by the Maastricht Treaty on November 1st 1993. It is a political and economic union between European countries which makes its own policies concerning the members’ economies, societies, laws and to some extent security” (Wilde, 2016).

The map in the FIGURE below shows the 28 countries that joined the EU and in what year. In 2015 the EU budget was €145 billion, Germany France, UK and Italy were the top four countries to contribute. Germany contributed 21.36%, France 15.72%, UK 12.57% and Italy 11.48% (BBC, 2016).

What countries are in the EU?

Source: (BBC, 2016)

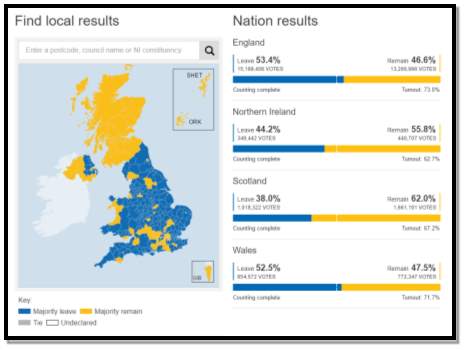

On June 23rd 2016 Britain voted whether to remain or leave the EU. The majority vote was to leave the EU with 51.9% of votes to leave and 48.1% voted to stay. FIGURE shows the percentage of people that voted in England, Northern Ireland, Scotland and Wales. Northern Ireland and Scotland were the two with the majority votes to remain.

Source: (BBC News, 2016)

5.3 Free Trade Area

“SMEs benefit from growth and investment opportunities generated by free-trade agreements, bearing in mind that cross-compliance costs to international standards are usually higher for SMEs than for multinational corporations,” (EU’s trade agreements should focus on SMEs, cities and regions say, 2016).

It is unsure whether or not Britain will be able to negotiate a FTA with the EU.

“FTAs are designed to reduce the barriers to trade between two or more countries, which are in place to help protect local markets and industries. Trade barriers typically come in the form of tariffs and trade quotas” (Grimson, 2014).

One issue that is critical for apparel importers is the prospect of tariffs and new custom procedures. It will disrupt the flow of goods for the beginning part until systems have been put in place.

One of the main benefits of being part of the EU is trading to other countries without any restriction such as tariffs. Once leaving the EU that deal will no longer be in use and we will have to re-assume direct responsibility for all trading relations. A negotiation for a new tariff will have to be agreed on which is likely to cause additional costs. Many business’ are concerned about paying higher duties on import and exports especially as the value of the pound has decreased.

SMEs are more affected by customs without a FTA as they don’t have as much money spare in comparison to larger retailers, whom have more money readily available to spend on imports and exports. It means the SMEs would have to increase their margins if they only wanted to import or export a small quantity such as 10-50 products. The increase on checks within customs can increase lead times and reduce margins for truck freight, as once outside of the single market all clothes manufactured in Europe would

“have to go through a Customs post as they enter the UK. Just as trucks entering the EU from the UK will have to go through a Customs post on entering France, Belgium or the Irish Republic” (Flanagan, 2017).

Gibson (2016) also believes that the reduced free freedom of movement around the continent will impair operating efficiency, and inevitably reduce hauliers’ margins, until a trade agreement is in secured in place.

5.4 Single Market

“The single market is based on the four principles of free movement of goods, people, services and money. This means member states can trade freely within the single market without having to pay tariffs while operating under shared rules and standards” (Beattie, 2017).

The UK Prime Minister has confirmed in January 2017 that the UK will be leaving the single market as part of her vision for Brexit. New relationships with countries need to be ensured so that UK businesses do not lose out too much and have to pay extortionate prices for importing and exporting products. Being part of the single market has given UK businesses many benefits such as ease of access to customers worldwide. Chapman (2017) agrees that it is very beneficial to be able to have

“unfettered access to 500 million customers in all states within it and in turn allows UK consumers and companies to purchase goods and services from across the continent. It eliminates tariffs and reduces costs and administrative burdens by applying one set of rules across all member states.”

One issue that could cause trouble for SMEs in the fashion industry is if a FTA is made and only some but not all UK exports are covered. This would become cumbersome for SMEs as it could increase lead times if product’s have to be individually checked to see if they are compliant with the EU regulations.

“Low-cost manufacturing in China and the Indian subcontinent has hammered the UK industry. The number of jobs has fallen from about 800,000 in 1980 to 100,000 today” (Powley, 2014). By upskilling British citizens it will help the economy and put the made in Britain name on products.

5.2 Survey Results

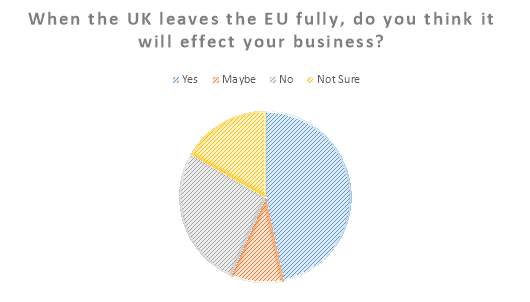

Thirty SMEs were asked whether they believe that leaving the EU will affect their business, FIGURE displays the results. Almost 50% of respondents agreed that it would in some way, nearly a third believe that it would not.

The top three responses were:

- Currency fluctuations and exchange rate

- Tariffs in and out of the EU

- Customs charges

Respondents that answered yes to the above question have given more detailed reasons to what they think may directly affect their business. TABLE shows some of the key responses given by the SMEs.

A key response raised by micro- business Grace Gordon, a UK accessories brand, is hoping that the effect of Brexit will have a positive impact by changing consumer shopping habits towards SMEs. As Gordon believes that SMEs “are in a position to be versatile enough to notice and adapt their business models accordingly quicker than larger companies.” Sourcing in Italy, Spain, Switzerland and Belgium, Grace Gordon has a variety of suppliers that she can use to adapt quickly to key colour, fabric and print trends.

The distinct advantage of being a SME is the ability to adapt quickly and change the structure or plan for your products. It is easier for SMEs to get product to market quick as they have less people and processes to manage. From the design to the end product, the speed they can produce their products much quicker with shorter lead times in comparison to large organisations. Whom have to wait for the product to be approved by numerous different departments and people within the business. Product can also be adapted more easily, based on feedback from customers as SMEs often sell a lot of product face to face.

| Responses given when ‘Yes’ was selected: | |

| Increase price of imports and decrease cost of exporting so expecting a net effect. | Cost of materials. |

| Less state interference. | Price increase for European garments. |

| Currency is weak and we will probably have to pay more taxes. If costs rise even more then we may be less attractive for business and buyers may well source from elsewhere. | Tariffs and currency issues (strength of the pound) could affect some components that are sourced within the EU. |

| Hopefully British sourced product will be better priced as the GB Pound competes with the Euro and Dollar. | It’s too early to say yet but we are coming out a free trade area – we rely on Europe inc. the UK for over 2/3 of our turnover. |

| Customs delays/ Uncertainty in GBP from international partners. Hopefully if it does change consumer shopping habits SMEs are in a position to be versatile enough to notice and adapt their business models accordingly quicker than larger companies. | Fashion clients are already feeling the effects with falling pound, tariffs in and out of EU supply chain, research grants with EU partners are already stopping and slowing. |

| Exchange rate / customs charges. | More difficult to supply EU customers. |

5.2.1 Risks

From the survey results a question asked was ‘can you think of three trading risks or problems you have faced in the last year,’ the top five responses were:

- Brexit

- Currency fluctuations

- Product quality

- Cash flow

- Rise in cost of materials

Brexit is expected to be the top response as this is the main issue surrounding a lot of concerns with how the UK is to trade with other countries’, the unknown risks that may be presented and are cannot be prepared for. Currency fluctuations are also given as global economies are closely connected, impacting both sales prices and cost prices globally.

“Which in turn impact shareholder value. Most companies develop a competitive advantage by differentiating product quality and value, offering better service levels, or achieving a lower cost. If the customer does not recognize product differentiation and value, the company is left primarily with the lower-cost alternative” (Mishler, 2017).

Jarvis (2017) stipulates that the value of the £ against the $ is causing any UK retailer that buys in $ and sells in £ a massive issue. By eroding their intake margin and causing excess pressure on suppliers who are expected to drop prices to unrealistic levels to help the retailer achieve intake margin.