Costs and Benefits of Target's Expansion into Asia

Info: 8684 words (35 pages) Dissertation

Published: 3rd Dec 2021

Tagged: BusinessInternational Business

Introduction

Target Corporation, based in Minneapolis, Minnesota, operates a chain of big-box stores throughout the United States. It is the second-largest discount store retailer in the country, after competitor Wal-Mart. While successful in the United States, Target has had difficulty expanding outside the country. In 2015, Target announced the closing of 133 stores in Canada and the elimination of its Canadian subsidiary. This failure provided the company with valuable insights into how not to implement an international development plan, and the experience can be drawn upon when exploring entry into other foreign markets.

In this report, we aim to evaluate the costs and benefits of a potential Target expansion into Asian markets, specifically Singapore, Hong Kong, India, and coastal China. These countries offer Target the opportunity to reach new customers in areas with considerably higher population density than Canada or the United States, and with high enough income per capita to support big-box retail outlets. Our report will provide detailed market analysis for China, Singapore, and Hong Kong, competitive analysis for Target Corporation, and strategies for successful entry into Asian markets. We will then describe the method of entry we have deemed most appropriate to take advantage of Target’s core competencies and that will develop in a way that interacts synergistically with the company’s current operations. Finally, we will outline potential pitfalls of this venture and how they can be avoided or mitigated.

The four countries we have decided to enter that we believe would be the most successful for the Target Corporation are China, Hong Kong, Singapore, and India. After thoroughly analyzing the MPI (Market Potential Index) from 2010-2016 as well as taking into account other various factors, it was highly evident that China, India, Singapore, and Hong Kong were the foremost unsurpassable markets to enter at this time. In addition to their superior rankings on the Market Potential Index, China and India are the two most populous countries in the world. China is currently ranked the most populated country in the world with 1,388,232,693 inhabitants with 18.47% of the world’s total population. India has a population of 1,339,382,431 with 17.86% of the world’s total population; therefore, the Target Corporation would be saturating a market containing 36.33% of the world’s total population if Target successfully enters the market in these two countries alone (Worldometers.com). Additionally, India, China, Singapore and Hong Kong have experienced economic growth over the past years. China and India both have the largest amount of growth since 2016 compared to Hong Kong with 2.4% and Singapore at 1.9 % with China at 6.9% and India at 7.9% economic growth.

The Ten Criteria Used For Selecting Our Four Countries

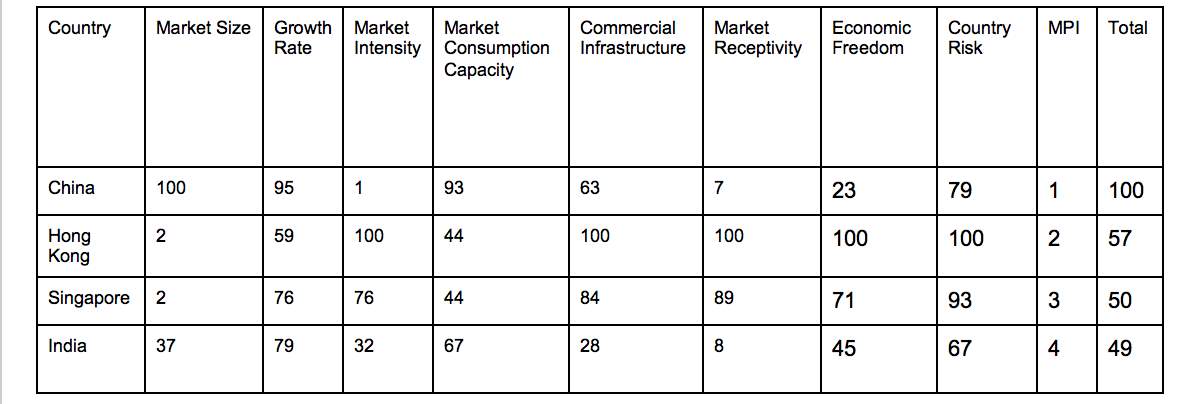

The ten criteria used for measuring the potential countries of market entry for the Target Corporation were based off the Market Potential Index’s own criteria, this includes: Market Size, Market Intensity, Market Growth Rate, Market Consumption Capacity, Commercial Infrastructure, Market Receptivity, Economic Freedom and Country Risk. In addition, our group also added the total from the eight dimensions, and the country’s MPI (Market Potential Index) ranking in the criteria for potential entry. MPI has been in use since 1996 and was originally used to only calculate the twenty-six “Emerging Market” countries. Then in 2014, the number changed from twenty-six to eighty-seven countries. The Market Potential Index is conducted by Michigan State University-International Business Center to provide companies the ability to compare and contrast the market potentials of individual countries. The eighty-seven countries are selected based off of the following criteria: 1. Countries that are in the top 100 top performers in relation to Total GDP 2. Countries with a population of one million or more. 3. Countries that can provide reliable data for the majority of the indicators used. (Cavusgil, 2004).

The first dimension measured in the Market Potential Index is Market Size, and is based off of electricity consumption and urban population. The data provided for Market Size is accessed from the World Bank’s World Development Indicators and the U.S Energy Information Administration’s International Energy Annual Report. The weight of Market Size for the Market Potential Index’s total is weighted at 25%. The next dimension measured in MPI is Market Intensity, which accounts for 15% for the Market Potential Index’s total. This dimension measures the Gross National Income (GNI) per Capita Estimates using Purchasing Power Parity (PPP). Purchasing Power Parity (PPP) is a theory that states when the purchasing power is the same in two countries, then the exchange rates are in equilibrium. In addition to GNI per Capita, Market Intensity also measures Private Consumption as a percentage GDP. The Gross National Income per Capita is measured by “the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP) plus factor incomes earned by foreign residents, minus income earned in the domestic economy by nonresidents” (Todaro & Smith, 2011: 44). Market Intensity’s data comes from the International Telecommunication Union’s ICT Indicators and Euromonitor International’s Global Market Information Database.

The third dimension that is measured in MPI is Market Growth Rate (MGR). Market Growth Rate measures the Compound Annual Growth Rate (CAGR) of Primary Energy Use and the Compound Annual Growth Rate of GDP. MGR weights 12.5% of the MPI total. MGR uses the same databases as the previous dimensions when collecting the data.

The fourth dimension of MPI is Market Consumption Capacity (MCC) which includes the following measurements: Consumer Expenditure, Income Share of Middle-Class, and Household Annual Disposable Income of Middle-Class. MCC is 12.5% of the MPI total, and also uses the same databases as the previous three dimensions.

Commercial Infrastructure is the fifth dimension of MPI and it measures Cellular Mobile Subscribers, Households with Internet Access, International Internet Bandwidth, Number of PC’s, Paved Road Density, Population per Retail Outlet, Available Airline Seats, and Logistics Performance Index. Commercial Infrastructure is 10% of the total MPI rating with data provided by the World Economic Forum’s Global Competitiveness Report and the World Bank’s Logistic Performance Index. The sixth dimension in MPI is Market Receptivity and weights 10% of the total MPI. This dimension weights Per Capita Imports from US and Trade as a Percentage of GDP. The seventh dimension is Economic Freedom, weighing in at 7.5% and is measured from the Economic Freedom Index and the Political Freedom Index.

The eighth and last dimension in MPI is Country Risk, and weights at 7.5% of the total MPI. Country Risk includes Business Risk Rating, Country Risk Rating, and Political Risk Rating. The data collected to measure these ratings are provided by Swiss Export Risk Insurance’s Country Risk Survey, Coface’s Country Risk Survey, and Credimundi’s Country Risk Survey. All of the dimensions add up to equal one-hundred percent.

The table above lists the ratings for each of the eight dimensions as well as the MPI total and rankings between China, Singapore, Hong Kong, and India. China in 1st, Hong Kong in 2nd, Singapore in 3rd, and India in 4th for the total MPI rankings.

Market analysis

Pestel Analysis

PESTEL Analysis is a common method utilised for the analysis of the external environment wherein it divides the overall environment into four areas and covers the factors that could affect the organisation. It is a analysis tool used for business to track the environment they are operating in or planning to. It gives them a better idea of the environment through different aspects it develops an overall look at the main external impacts on the company, PEST stands for Political, Economic, sociological ,technological, environmental and legal in Target Corporation.

For a better analysis of the market we will therefore study the company in order to establish the PESTEL.

Political factors

The political environment plays very important role in the changes and transformation overtime in the regulations and the share of the retail stores in the healthcare bill. The political environment has huge impact on the business of Target Corporation. The regulations in retail industry has negative trend on the businesses of market players because the regulations tend to change the industry very easily and can affect the business adversely in terms of increased cost.

Target must have a strong working relationship with China since the majority of their products come from Chinese markets. If a conflict between China and the US arises, it can negatively affect Target’s operations. Additionally, Target’s Policy Committee is behind the decision-making for political activities the company participates in. This committee oversees Target Citizens PAC, which is funded by team members. The Policy Committee decides the use of corporate funds to support business interests.

Economic factors

Consumers are hunting, they’re after the best deals for every product. Competitors like Wal-Mart, consistently price match and lower product prices. To keep up with the fluctuating demands, Target must analyze prices to stay competitive.

The American economy affects Target, but the company is still a major shopping choice in the United States. Unfortunately, Target didn’t fair as well during its northern expansion.

Target opened 133 stores in Canada beginning in 2013. But in 2015, Target decided to close the doors of all its Canadian stores, taking a $5.4 billion quarterly loss. Over 17,000 employees were left jobless.

While it was a smart choice to shut down the operation rather than tossing money into a sinking ship, the closures hit Target hard.

Social factors

Target Co. prides itself on fostering a positive company culture especially since other stores lack in this department. Target also extends its hand to the community by supplying a percentage back to the people. This is one of the reasons shoppers support Target; the way they treat their employees and community rests well for consumers.

Target offers a variety of services. On top of their website giving consumers online access to their catalog, they also offer Target Financial Services (for credit cards) and Super Target.

Their products are diverse for many ethnicities. People adore their selection of hair styling products, which provide a diverse selection for African American hair.

Target eliminates pain so customers have a positive shopping experience.

Environmental factors

Target is trying to be a responsible corporation in terms of environmental safety and protection initiatives. It seeks to understand the impact of carrying out business practices on the environment. They try to offer natural, organic and eco-friendly products to their customers, influence their vendors to embrace practices that are in coherence with the environment, avoid the use of technology or practices that are source of carbon dioxide, and the use of resources effectively and efficiently in order to meet the environmental challenges

Target may suffer from product recalls and liabilities, as they are safety concerns for consumers. They also must be adamant about reducing food and drug contamination from their produce and pharmacy.

Additionally, Target must abide by several laws to conduct business correctly. Such as:

- Environmental laws

- Labor laws

- Privacy and security laws

- Employment laws

Technological factors

Target strives to be technologically and social media savvy. They talk to consumers through social media platforms like Twitter, Facebook, Instagram, Linkedin, and Tumblr. They have several Twitter and Facebook accounts for news, trends, and guest services.

User content — reviews and product images — are social proof showcasing the quality of Target’s products. And they offer exclusive deals to consumers through print, website, and email.

Target is a great example of a retail chain using the internet to connect with users where they hang out online.

Legal factors

There are incidences that the Target Corporation was alleged for various lawsuits. Among them are the racial discrimination suit against Target Corporation (NFB, 2008), racial discrimination lawsuit (2007) and fines paid for selling outlawed aerosol confetti string to US EPA .The company is trying hard to save its face by paying off all the expenses and fines incurred for the lawsuits against it. These negative promotions have severely damaged the face of organization and its public dealings.

Porter’s Five Forces Model

Threat of New Entrants

China

First of all, it takes time and money to enter any foreign market. It takes time to set up store locations and establish a feasible distribution network in new countries. It takes time to establish customer trust and loyalty in a new country. It shouldn’t be too costly to enter the Chinese market for Target, considering a majority of Target’s products have manufacturers already operating in china, and it may even be cheaper towards Target’s distribution costs because it will save on shipping expenses.

Target generally mass produces a vast variety of products which it sells in its stores. China is the world’s largest manufacturing base as well as the world’s largest consumer of energy. Manufacturing in china accounts for 70% of china’s total energy consumption. With both energy and manufacturing demand growing in China, economies of scale shouldn’t be a barrier for a company like Target in China.

Within China, rapidly changing demographics, rising incomes, increased consumer spending and an increasingly open business environment have all helped to make the Chinese market increasingly attractive to Western businesses across a variety of industries. Similarly, declining sales in their home markets has forced many US and European companies to relocate China firmly to the center of their long-term global growth strategies. Breaking into the China market successfully can seem like an almost impossible task to foreign companies with limited or no experience of doing business there.

With a population that exceeds 1.3 billion people and a landmass larger than the United States, China’s sheer size and scale presents challenges uniquely distinct from any other market.

The first realization that foreign companies often need to make is that China is in no way a uniform and homogenous market. Although China is unified in the geo-political sense, socially and economically the picture is much more disparate and fragmented. Uneven rates of economic growth in different parts of China over recent years have served to exacerbate many of the economic and social differences that already existed between different provinces. For example, there are huge variations between different provinces in terms of population levels, per capita GDP, average income levels, consumer spending habits, education levels, literacy rates, lifestyles and so on. As such, it is certainly no exaggeration to state that rather than representing a single, unified market, China is actually a collection of individual sub-markets defined by vastly differing demographic, economic and cultural characteristics.

Singapore

For the most part, US companies have had success using agents or distributors to function in the Singapore market. There are over 3,700 US firms who have set up operations in Singapore.

Singapore is said to be one of the most competitive markets for businesses in Europe. Target, entering as a foreign business, will find some difficulty entering the market with the large amount of already sustained competitors in the country.

An article by Euromonitor International about Retailing in Singapore reported that: “Singapore’s economy grew by 1.8% for the full year 2016, the slowest economic expansion in the country since 2009. 2016 saw consumer prices drop by 1% from the previous year; nevertheless, major retail channels registered further slumps in sales, including jewelry and watch specialist retailers, apparel and footwear specialist retailers, home and garden specialist retailers, grocery retailers and department stores. The rapid growth being seen in internet retailing has led to the channel capturing a higher share of store-based retailing value sales.” Target happens to sell all of these products in it’s stores. This drop in consumer demand and a damper in economic growth may serve as a strong barrier to entry for Target.

Target will not have much product differentiation while competing with the high volume of e commerce businesses in Singapore where shoppers are among some of the most tech-savvy in Asia. There is such a large resource for consumers in Singapore who have shown to “channel-hop” to multiple different suppliers and use “webrooming” to check online reviews and make price comparisons. Target has recently invested a billion dollars into its e commerce growth and could use its new platform to it’s advantage Singapore.

Finding a distribution channel in Southeast Asia will be key for Target. The local consumers highly appreciate availability and speediness with their shopping, and with their tendency to use “webrooming”, Target will be competing with very low prices and won’t be able to charge Singaporeans extra for shipping costs and such.

Building physical stores too rapidly has caused failure for Target’s global expansion in the past with countries like Canada.

Buyers expect good after-sales service. Selling techniques vary according to the industry and product and are comparable to the techniques used in most other sophisticated markets. With high levels of traffic through Target stores, the extent of customer service most Singaporeans desire may be too much for Target to keep up with.

Government policy in Singapore is more supportive for new entrants than other countries. Policies including:

- Singapore’s network of over 50 comprehensive Double Taxation Avoidance Agreements.

- Singapore’s many free trade agreements and the Investment Guarantee Agreements.

- Protection for your ideas and innovations thanks to Singapore’s strict enforcement of its strong intellectual property laws

Hong Kong

Hong Kong is globally considered as a “shopper’s paradise”. There has been a steady growth of tourists in Hong Kong who shop for everything from basic necessities to high end luxury items. With the retail landscape changing and rental rates skyrocketing, marketing strategist, Lawrence Chia, wrote in “Hong Kong Business” that he believes “only global brands and large chain stores are able to maintain a presence” in Hong Kong.

Target doesn’t have any physical stores in Hong Kong yet, so it’s low brand awareness will be a barrier for its expansion.

It will be extremely costly to enter the Hong Kong market. Most of the shopping done in Hong Kong is in shopping malls with outrageous rent, and Target locations are on average, 135,000 square feet.

Just like the Chinese and Singapore markets, Hong Kong shoppers have made a heavy shift towards e commerce. Hong Kong consumers enjoy a leisurely type of shopping and browsing a wide variety of shops. Locals will likely avoid the madness of shopping in crowded malls and purchase online.

Target should expect retaliation from competitors among entering this extremely competitive market.

India

India is the fourth largest country in the world in terms of purchasing power parity. This creates great opportunities for American based companies looking to expand. American exports to India in 2012 exceeded $22 billion. India’s rapidly developing $1.8 trillion economy holds a high demand for consumer products like Target sells. Although, the growth of India’s economy combined with the wide acceptance of new and foreign business in the country will attract many competitors.

A successful Go-to-market strategy is necessary for entry in India’s market. The influx of foreign businesses and smaller entrepreneurs makes initial impression in a fast moving economy like India imperative. Barriers for Target’s entry will be competition ranging from global businesses to privately owned shops.

For the last decade India has been putting much effort towards Economic Liberalization. The government entities are attempting to still make changes to encourage private businesses to be the primary fuel of the economy. This is good and bad for Target. On one hand targets barriers to entry a demanding market are small, but it will be the same for competitors as well.

Based on research of India market entry, “Amritt Ventures” believes that the most effective way to prevent new incumbents entering the industry is by early market entry. Moving in quick but carefully will create many advantages:

- Ability to lock-up access to key resources and create higher entry barriers for later entrants

- Ability to set the pattern of buyer preference in both consumer and industrial markets

- Ability to avail of government concessions and incentives

- Ability to observe and learn market attributes for a longer time period

Negotiation power of suppliers

China, Singapore, Hong Kong, India

Asia has an enormous number of suppliers towards Agriculture and food, Apparel and Accessories, Arts and Crafts, Furniture etc. All of which are sold by Target. Target’s suppliers will have little power because there are so many substitutes for its products so monopoly power is nonexistent.

Asia has a surplus of manufacturers which Target could inexpensively switch to, because none of it’s products are specialty or customizable items. Targets generic products could be easily produced by Asian manufacturers across the continent. If Target needs to switch its supplier for groceries, sports equipment, books, clothing, bed and bath products or children’s toys, it’s core business wouldn’t take a hard hit because the other product categories would still be operating ‘business-as-usual’.

Target’s suppliers could theoretically shorten their distribution channel. They could use forward vertical integration and sells their products through the extremely prominent e commerce platform in Asia.

Negotiation power of buyers

China, Singapore, Hong Kong, India

There is high demand for the products that Target sells in China, Singapore, Hong Kong and India. There are so many people in these countries that it seems like mostly everything is in high demand. In this foreign market, most of the negotiation power lays in the hands of the buyers. Target is a great resource for Americans to efficiently shop for various things, however, in these particular Asian countries, this kind of culture isn’t as present. There has been a huge spike in e commerce in these areas and although target has an online shopping resource, it’s main point of sale is through its physical store. The ability for buyers in these given markets to substitute Target’s products is high.

Considering China holds the most manufacturers in the world, buyers would be easily able to skip targets distribution and but straight from the source, via online most likely. The consumers in all of these countries have so many resources through the internet for Target-like merchandise, giving the buyer power over Target.

With ecommerce based companies heavily advertising through social media and other online resources, buyers have full exposure to other offers on the market which could beat Target’s prices or serve as a more convenient substitute.

Threat of Substitute

China, Singapore, Hong Kong, India

As mentioned multiple times, there are easily accessible substitutes for Target’s products in China/Singapore/Hong Kong/India.

The price elasticity of demand is relatively high for the items sold in Target’s stores. Target’s mission statement says: “Our mission is to make Target your preferred shopping destination in all channels by delivering outstanding value, continuous innovation and exceptional guest experiences by consistently fulfilling our Expect More. Pay Less. brand promise.” The ‘Pay Less’ portion of their commitment must remain consistent in the eyes of the buyer. If Target begins raising prices, then the demand for their merchandise will be negatively affected.

When evaluating the level of substitution threat in this foreign market, Target has to consider what part of its business is most desirable by the new culture: cheap prices, innovation, guest experience or the variety of shopping channels. This will determine whether there are other companies already in the area who have established customer loyalty and offer the same guarantee.

Rivalry

China, Singapore, Hong Kong, India

According to “Business Insider” in a recent report, Target was rated as the 2nd most powerful retailer in America. However, based on retail sales in 2015, there are plenty of potential rivals for a retailer like Target in China:

Successfully established and potential rivals of Target in Singapore include:

- Best Denki, Isetan, John Little (department store), Marks & Spencer, Metro (department store), Robinson & Co., Takashimaya, Tangs, Yue Hwa

The top department stores in Hong Kong:

- Lane Crawford, Shanghai Tang, Sogo, Harvey Nichols, Yue Hwa

India also has an extensive list of possible rivals for Target:

- Big Bazaar, Shoppers Stop, Lifestyle, Marks & Spencer, Walmar

CAGE Distance Analysis

The CAGE Analysis addresses four distances between countries that companies need to address when deciding which international strategy to use. The four differences or distances CAGE identifies includes Cultural, Administrative, Geographic and Economic. CAGE Framework can be used to understand patterns of trade, capital, information, and people flows ( Ghemawat, 2011).

The first difference in the CAGE framework is Cultural. Harvard Business School defines Cultural Distance as “the attributes of a society that are sustained mainly by interactions among people, rather than by the state (as law-giver or enforcer)” (Olugsen, 2014 ). Examples cultural differences include: different languages, ethnicities, religions, norms, values and dispositions, and a lack of trust. The Cultural Distance is comprised of six different cultural dimensions which includes : power distance, individualism, masculinity, uncertainty avoidance, long term orientation, and indulgence. This is referred to as the six dimensions of national culture, developed by Professor Gert Jan Hoftstede.

The first Cultural dimension is power distance, and is described as “the extent to which the less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally.” (Hoftstede, 2001). China and Hong Kong both rank very high at eighty and sixty-eight in the power distance index, and additionally both have the same societal beliefs when it comes to power distance. China and Hong Kong’s society believes that “inequalities amongst people are acceptable” (Hoftstede, 2001). Also, individuals are heavily influenced by formal authority and there is no defense against power abuse by superiors. India and Singapore both also rank very high at 77 and 74, but both countries have different power distance beliefs. Singapore being very religious when it comes to the Confucianism, and follow the practices and teachings of Confucian very heavily when it comes to unequal relationships between people, especially the five basic relationships. Power is also very centralized and workers rely on their bosses and on the rules. There is also a very strong sense of “ Nation before community and society above self.” (Hoftstede, 2001). ). In India the power dimension is at seventy-seven, which again is very high in relation to the other three countries. With a very strong belief in Hinduism throughout the country, there is a lot of emphasis on the caste system; therefore the acceptance of un-equal rights between those with privilege and the less fortunate. In a business standpoint, the only communication between higher powers is when negative feedback is given.

The second dimension in the cultural distance for the CAGE Framework, is individualism. Hoftstede defines this dimension has “the degree of interdependence a society maintains among its members. It has to do with whether people´s self-image is defined in terms of “I” or “We”. In Individualist societies people are supposed to look after themselves and their direct family only. In Collectivist societies people belong to ‘in groups’ that take care of them in exchange for loyalty.” (Hoftstede, 2001). With this being said, China, Hong Kong, and Singapore all have have relatively low scores at twenty, twenty-five, and twenty compared to India with forty-eight for this dimension. China, Hong Kong, and Singapore all have cultures where they act in the interest of the group and not for the individual even when it comes to hiring. This can be good when it comes to conflict since conflicts are avoided since the groups threat each other as family. India has some opposing views when it comes to individualist views in their society. They have both collectivistic and individualist traits. They are expected to be able to work in groups as well as treating each other like family in immediate groups, but they believe they are fully responsible for their actions and the way they lead their life based on their strong belief in Hinduism.

The third cultural dimension is masculinity, and is explained by Hoftstede with the “fundamental issue here is what motivates people, wanting to be the best (Masculine) or liking what you do (Feminine)” (Hoftstede, 2001). Surprisingly, China, Hong Kong, and India all have very high masculine scores at sixty-six, fifty-seven, and fifty-six. This means these three countries are very success driven countries and spend lots of time at work. Opposite to the other three countries, Singapore ranks at forty-eight, making them more of a feminist society meaning they value and encourage the underdogs as well as respect humility. Another main focus here is community support especially in government issues.

The fourth cultural dimension is uncertainty avoidance, and is defined as “the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these.”(Hoftstede, 2001). China, India, and Hong Kong all have medium-low scores at thirty, twenty-nine, and forty. This means that they tend to follow rules with ease. Singapore on the other hand is ranked at eight for this dimension; therefore they are a very rules based society and are very strict about following the rules and cultural norms.

The fifth cultural dimension in the cultural dimension of the CAGE Framework is long-term orientation. Long-term orientation is defined as “how every society has to maintain some links with its own past while dealing with the challenges of the present and future, and societies prioritise these two existential goals differently.” (Hoftstede, 2001). ). All four countries rank fairly high on this scale, with Singapore at seventy-two, India at fifty-one, China at eighty-seven, and Hong Kong at sixty-one. This number shows that all four countries are able to adapt to traditions easily, prefer to keep long term investments, slowness and thrift.

The sixth and final cultural dimension in the CAGE Framework is indulgence, and Hoftstede defines this as “the extent to which people try to control their desires and impulses, based on the way they were raised.” (Hoftstede, 2001). All four countries have ranked low in this dimension for indulgence. India, China, and Hong Kong ranked extremely low at twenty-six, twenty-four, and seventeen meaning that they are very pessimistic societies and do not have much leisure time or emphasize on gratification. Like the other three countries, Singapore also ranks low but not as low on indulgence at forty-six; therefore, they have the same indulgence qualities as the others, but not as intense.

The second distance in the CAGE Framework is Administrative, and is defined as “ attritbutes that encompass laws, policies, and institutions that typically emerge from a political process and are mandated or enforced by governments.” (Olgusen, 2014). China’s administrative framework has become increasingly stricter over the past decades. China has rules against corruption and stealing intellecutal property,The US and China signed five separate trade contracts for intellectual property rights (Lawrence, 2012), technology, energy, trade statistics and business cooperation. While there are some tensions in China-US relations. China remains the United State’s largest foreign creditor and both of them are also major trade partners and have common interests in the prevention and suppression of terrorism and nuclear proliferation. The China-US trade relationship is the second largest in the world, behind the US’ trade relationship with Canada.”(Lawrence, 2012). Additionally, China has been increasingly active on the regional trade agreement since the creation of the WTO; therefore China would be a great market for entry for the Target Corporation. Hong Kong like China, also has close administrative ties with the United States. “The U.S government statistics reported that The United States has substantial economic and social ties with Hong Kong. There are some 1,100 U.S. firms, including 881 regional operations (298 regional headquarters and 593 regional offices), and about 54,000 American citizens in Hong Kong . Also, U.S. exports to Hong Kong totaled $17.8 billion in 2006. U.S. direct investment in Hong Kong at the end of 2006 totaled about $38.1 billion, making the United States one of Hong Kong’s largest investors.” ( Lawrence, 2012). Because of the affirmative progress in Hong Kong- U.S relations over the past years, the U.S now cites Hong Kong as an example for other countries to follow. Singapore just like China and Hong Kong also has strong administrative ties with the U.S. According to the U.S. Global Leadership Report, 77% of Singaporeans approved of U.S. leadership under the Obama Administration “in 2010, and while this approval rating decreased slightly down to 75% in 2011, it nonetheless remains one of the highest rating of the U.S. for any surveyed country in the Asia-Pacific region.” (Lawrence, 2012). The growth of U.S investment has also increased drastically since 2003 when the bilateral free trade agreement was signed May 6th 2003, and put into use on January 1st 2004. It takes only 1-2 days to incorporate a company in Singapore, with this being said Singapore is the easiest country in the world to set up a business and would be beneficial and effortless to enter in for the Target Corporation. In addition, the government is there every step of the way to provide assistance; therefore making the process even easier for market entry. India, like Hong Kong, Singapore, and China also has very strong administrative ties to the United States. “Since 2004, Washington and New Delhi have been pursuing a ‘strategic partnership’ that is based on shared values and generally convergent geopolitical interests. Numerous economic, security, and global initiatives – including plans for civilian nuclear cooperation – are underway”, and in addition, India and the United States signed ten-year defence framework agreement, with the goal of expanding bilateral security cooperation, and in 2005, an Open Skies Agreement was signed between the two enhancing relations and increasing tourism and the number of flights between the two nations. All four nations have strong administrative ties with the United States, and have fairly strict, strong governments.

The third distance in the CAGE Framework is Geographic, and is defined by Harvard Business as in addition to physical difference between the two, this includes differences in time zones and climates, topography, and within-country distance between borders.” (Ghemawat, 2012) All four countries are similar concerning distance from the U.S. China already does 6.5 times more business with the United States compared to business with Hong Kong; therefore intensity is inversely related concerning geographic distance with China. Hong Kong and China both share geographic advantages since they are right next to each other. These geographic advantages include “ The Pearl River Delta (PRD) region is immediately to the north of Hong Kong and business people commute regularly and easily between the two.The PRD, as it’s commonly known, is China’s largest and most productive manufacturing region. It is home to tens of thousands of factories owned or managed by Hong Kong and overseas companies. As a result of its manufacturing success, the major cities of the PRD – Shenzhen, Guangzhou and Dongguan – are now among the wealthiest in China and have become.” (InvestHK, 2012). Singapore, in close proximity to China and Hong Kong, is located in the heart of Southeastern Asia, and has one of the busiest airports and maritime ports in the world. Unlike China, Hong Kong, and Singapore, India is not only close to Southeast Asia and the Indian Ocean, but also is situated near the Middle East. I wish also to mention that many resources and manpower reserves are situated in India. All four countries have geographic importance for the Target Corporation concerning entry into the Asian market.

The fourth and final distance in the CAGE Framework is Economic, and is defined as “ differences that affect cross-border economic activity through economic mechanisms distinct from the culture, administrative, or geographic ones already considered.”(Ghemawat, 2012). Economically, China relies heavily into their import and export market with forty-one percent of it accounting for their total GDP. As well as removing the minimum capital requirement, it has made it much easier to start a new business in China. China in comparison to the other three countries would be the hardest to enter due to government regulations, and would contain the most risk. Contrary to China, Hong Kong is a highly attractive market for FDI. According to the UNCTAD World Investment Report 2016, global FDI inflows to Hong Kong amounted to US$175 billion in 2015, behind only the US (US$380 billion). In terms of outflows, Hong Kong ranked third with US$55 billion in Asia, after Japan (US$129 billion) and the Chinese mainland (US$128 billion). (InvestHK, 2012). Additionally, Hong Kong is a founding member of the WTO( World Trade Organization), an active member of the Asia-Pacific Economic Cooperation and Pacific Economic Cooperation Council, and belongs to Asian Development Bank and the World Customs Organization. Singapore’s low effective personal and corporate tax rates give it an economic advantage. As reported by Deloitte International Corporate Tax Rates 2017:

“ Personal income tax has a tier system that starts from just 0% and goes up to 20% for income above S$320,000.Similarly, effective corporate tax rate for Singapore private limited companies for profits up to $S300,000 is below 9% and capped at a flat rate of 17% for profits above $S300,000. There are no capital gains taxes in Singapore, which follows a single-tier tax policy; for income that has been taxed at the corporate level, dividends can be distributed to its shareholders tax-free.In an effort to move away from a dependency on income taxes and to make the economy even more competitive, the government has adopted a more broad-based consumption tax called Goods and Services Tax (GST). Singapore maintains one of the world’s lowest GST rates (currently 7%), ranking below the global average VAT/GST rate of 16.4%, and the Asia-Pacific average of 10.5%.:” (Deloitte, 2017) .

Furthermore, registering for a trademark is fairly easy in Singapore and IP protection is taken very seriously, and “The World Economic Forum (WEF), the Institute for Management Development (IMD) and the Political Economic Risk Consultancy (PERC) have all ranked Singapore top in Asia.” (Deloitte, 2017). India like Hong Kong and Singapore is a very free market and has little to no restrictions. “Foreign companies can readily raise equity capital in India and many foreign companies have subsidiaries traded on Indian stock exchanges.” (Thomas, 2010). India’s consumers has played a significant role in India’s growth and is expected to continue to grow. India’s wealthiest consumers will increase by 40 million in the next 10 years. Every sector within India’s consumer market is growing at an expediential rate.

Competitive analysis

Competitive Life Cycle Analysis

Target is in the “Mature” phase of the competitive life cycle. Returns have been decreasing, as evidenced by the failure of the company’s Canadian subsidiary. The industry, led by Wal-Mart, has consolidated into a cost-leadership model, with Target attempting to differentiate by offering slightly trendier and more upscale products at cost-leader competitive prices. To progress to a new emergent phase, Target must seek new markets. Expansion in Canada failed, so we are suggesting a market with a much larger potential customer base in Asia.

VRIO

The VRIO (Value, Rarity, Imitability, Organization) method consists of a cumulative question about the company’s resources and competencies to determine whether they provide a competitive advantage.

When you set out to analyze your business and its strengths and weaknesses, using VRIO analysis is one of the best tools for the job.

It is essential to be constantly evaluating the capabilities that your company has on hand, as it is those capabilities that you will use to compete out in the market.

To better understand how VRIO Analysis can help you as you are putting together a strategic plan for your company, we will walk through the four points one by one below.

Value

The Target Corporation’s resources and capabilities have continued to change throughout the years and has been one of their biggest strengths. Their innovation skills are undeniable by far. The Corporation isn’t known for sticking to tradition, but changing as the market changes. They are known to be trendsetters in the industry with fashion, services and quality products with affordable prices.

Rarity

They have maintained to be top competitors to their rivals for decades. They are ahead of the game when it comes to 3d printing. They are the only retailer with “rapid-prototyping capabilities”. Not only do they stay ahead of the fashion trend, but they also appeal to a new generation year after year by finding out exactly what their consumers want and producing just that.

Imitability

The Target Corporation’s strategy may be imitated, but the company will always remain unique. The Corporation has its own unique style. They have over 200 patent products. Not only that, the quality of their brands differ from their competitors.

Organization

Target set themselves aside by allowing their consumers to “Expect More. Pay Less”. They refer to their customers as “guests” instead of customers. They want the consumers to feel welcomed and invited. Their strategy will continue to give them an advantage over their competitors.

Value Chain Analysis

Value chain analysis is used to assess a firm’s internal operations and capabilities when developing a strategic action plan. It aims to determine which processes create the most value in the end product or service, and which processes lag behind in efficacy. This analysis can reveal the company’s competitive advantages and disadvantages, and the results should align with the generic strategy management has chosen to pursue.

Inbound Logistics: Target promotes development using imaginative and innovative improvements on existing ideas. While designing new products and exploring new store sites, Target works to build responsibility and sustainability into each new project. In addition to new product development, Target’s inbound logistics consists of shipments to distribution centers, of which there are 38 in the United States.

Operations: Target’s everyday operations are intended to ensure that design and raw materials become products with strong market appeal. Target works with many high-quality vendors and desires to employ production methods suitable for maintaining a healthy planet. Target’s inventory turnover is slower than competitors Amazon and Wal-Mart.

Outbound Logistics: Target’s outbound shipping moves goods from distribution centers to retail stores, or directly to customers in the case of online orders. In order to improve efficiency in shipping, Target has reduced load weight and miles traveled to save fuel and reduce carbon emissions, yet maintains promptness in delivery time.

Marketing and Sales: Target’s marketing and product line strategy focuses on offering trendier and more upscale goods to customers, in contrast to competitors whose focus is solely on price reduction. Target retail stores tend to be cleaner, with wider aisles and more attractive advertising.

Customer Service: One of Target’s customer service mottos is, “Use and Reuse.” Customers purchase products from Target for a certain use, and Target provides additional tools, information and incentives to help reduce waste and repurpose old items.

Human Resources: Target works to cultivate a mix of qualified team members, contractors and temporary staff. Support functions depend on the company’s ability to attract, train and retain competent employees. Target has a division of support functions in India, but the labor market in that country is less predictable than in the United States.

Information Technology: Target, like all other businesses, is increasingly reliant on technology investment, especially in logistics and ecommerce. The company plans to continue making significant investments to support multichannel distribution and sales, and to implement improvements to their information technology systems to remain competitive.

Overall, analysis of Target’s value chain shows a commitment to its strategy. Target has opted for Cost Leadership, but has chosen to differentiate slightly from competitor Wal-Mart by offering slightly more upscale products at still Cost Leadership level prices. The company’s marketing department is very effective at projecting that image to potential customers. The combination of Cost Leadership and positive consumer view of Target’s products is a distinct competitive advantage. Conversely, Target’s operations are not as efficient as Wal-Mart’s or Amazon’s, as evidenced by a slower inventory turnover rate. Target should work to improve its logistical functions, with a focus on concepts like just-in-time inventory management and shipping optimizations.

In order to fully realize this benefits of this strategy, management should opt for a sprinkler approach to entry into the new markets. Target already has the capability to supply a vast array of hypermarkets with products in every category, so there is no need to moderate the speed at which it enters the Asian market. Moreover, the huge customer base this strategy would reach requires a large enough number of stores to serve effectively. Choosing a waterfall approach would be to invite overcrowding, and would cause poor customer opinion of the brand as a result.

Successful entry into Asian markets can prove difficult for Western companies unprepared for the task. Differences in cultural predispositions and styles of doing business abound between firms on opposite sides of the world, and mastering the art of cross-cultural negotiation and management must be a top priority when preparing an Asian expansion. Additionally, Target must prepare for difficulties in dealing with governmental entities, such as corruption and preferential treatment for domestic companies, and for challenges in customer perception of foreign businesses. These complications can be mitigated somewhat with careful planning and consultation with a local contact who can help shepherd the project to fruition in a way that works with the cultural contrast instead of against it.

Conclusion

In conclusion, we believe that Target could be greatly successful in Asia. We have presented data and analysis to support our position, and further expanding on that research our we suggest an expansion into coastal, urban China and Hong Kong. with the waterfall entry method. First, entering into Hong Kong based off of their placement on the ease of doing business index (4th) compared to China’s ranking of 78th out of the 190 countries. In Hong Kong, Target will be able to establish brand awareness, research the market more indepthly, and make necessary modifications before attempting to enter the Chinese market. Target does not expect this to be a quick process since the Chinese market is difficult to enter, and the main goal is establishing a solid position in Hong Kong before planning to expand into China. Once the market entry is successful in Hong Kong, Target will begin to work on entering the Chinese market. Such a venture would be able to benefit from Target’s existing supply chain network, which moves goods from suppliers in various southeast Asian countries to the United States. Distribution centers for the Asian expansion could be stocked by ships that are already relatively close by before the ships make the long journey across the Pacific. In this manner, slight detours from established shipping lines could supply an entire new region while causing minimal disruption to the old. This locational synergy is a potentially exploitable competitive advantage that not only makes sense logistically, but serve to open major new markets at the same time.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "International Business"

International Business relates to business operations and trading that happen between two or more countries, across national borders. International Business transactions can consist of goods, services, money, and more.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: