What is Impact Investing? Green Investments in Climate Change

Info: 3307 words (13 pages) Introduction

Published: 26th Nov 2021

Introduction

In the first chapter of this thesis, the background of finance and climate change will be discussed. Following this, a basis of understanding will be built on how this ties into the importance of impact investing and decisions making. The main problem will then be outlined including any research questions to be drawn from this.

Climate change and finance

Alongside the rising issues of climate change and the huge amount of publications and journal providing research over the last decades, there has also been the undeniable growing question on not just how to come up with the solution, or solutions, but how these will be funded. The stern review commissioned by the UK government attempted to clearly lay out the path to a lower carbon future, stating that strong initial investment and early action would outweigh the costs, in comparison to the potential unabated cost of climate change. Which according to stern could lead to at least a 5% reduction in GDP annually, while costs could also be much higher at up to 20% (Stern, 2007).

There is clear evidence that the need for green investment in tackling climate change is critical. According to a report by the World Economic Forum (WEF) there are projections that by 2020, approximately $5.7 trillion will be required annually in green infrastructure, this will require a huge shift in the “business as usual” investment field into a more impactful and sustainably focused norm (World Economic Forum, 2013). This is no small challenge, as climate policy initiatives 2014 report put this at $331 billion a very long way from the estimated requirements. However the cost of investment is falling rapidly due to cost saving technologies (Buchner et al., 2014). However, there is a growing shift especially with a rapid growth of new industries, and the fact that by shifting onto a lower carbon path the global economy could benefit by up to $2.5 trillion annually and by 2050 the markets for zero or low carbon technologies could be worth at minimum $500 billion (Stern, 2007).

While stern was at its time one of the most comprehensive attempts to look into the potential costs of mitigating climate change it did not come without critique, one particular issue was the discount rate used to calculate the cost now relatively to mitigate for the future. One critic suggested a rate of 3% rather than 0.1% as this is more commonly observed in today’s current markets and suggests that reductions in emissions should not happen nearly as fast as suggested in the stern report (Nordhaus, 2007). A similar line is taken by Tol, (2006) stating that the 1% of GDP stern recommends spending on mitigating climate change would not mitigate his estimated 5-20% GDP damage but only some unsettled amount of this, and more modest mitigation should be undertaken now, increasing sharply in the future. So, while these final figures are still up for debate, it is in agreement that some action is needed (Schneider, 2007).

One of the key factors in driving this shift towards a more sustainable capitalism and way of doing business is a number of global efforts and initiatives set up by larger institutions.

The sustainable development goals

The United Nation’s (UN’s) recent launch of the sustainable development goals (SDG’s) (United nations, 2016), with a focus on 17 goals including a number of environmental ones are roadmap to a more sustainable future and the UN has called upon the private sector to help succeed with the challenge something a number of impact investors are already aligning with (GIIN, 2016). It is, therefore relevant to be able to measure the impacts that investments have in tackling and overcoming these issues, as well as, building a great understanding of what drives this. Considering the literature, there is a limited amount currently available with much of that not being centralised or easily available, this is most likely due to the fact that the SDG’s have only been released for a short period of time. As such, there has been limited activity into measuring impact in relation to them or tracking focus or progress in achieving them.

Furthermore, there is also relatively little currently available that directly addresses impact investment (the focus of this study) and its relation to the SDG’s as well as best approaches to assessment. There are many methods currently employed to assess impact and value gained from investment, for example, the Hirmer-wheel (S.A Hirmer, 2016) can be used to ascertain the social impact of projects. The United Nations Development Program meanwhile utilises “transformational change” that incorporates a number of tools and indicators, measuring from an original baseline of data collected, using indicators like the Human Development Index (HDI) (United Nation’s, 2011). While, cost benefit analysis (CBA) and cost effectiveness analysis (CEA) are common methods for assessing the value of an investment in relation to its cost. However, these are merely parts and do not cover a more holistic approach to reviewing investment impacts, more specifically also encompassing the SDG’s.

There is a need for understanding the investment in this area, as well as building up a knowledge base and developing a clearer understanding of priorities and processes from within the private sector specifically relating to impact investors. Not only this but a framework that allows flexibility from such a wide range of sectors and transparency on investor activities, motivations and impact information reported by differing entities (financial or non-financial), should be based on actual impacts achieved, the rate and variety of impact and include scale and levels of additionality (Sustainable development solutions network, 2015).

What is Impact Investing?

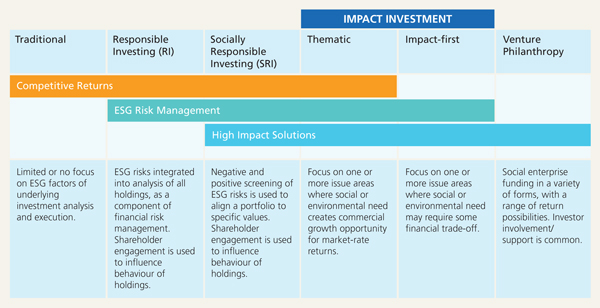

As mentioned one of the growing private industries aimed at tackling the SDG’s and helping to fill the funding gap in climate finance is impact investing, the term itself has been around since around 2007 (Höchstädter and Scheck, 2015). Impact investing itself is commonly defined as an investment that is specifically intended to create positive social impact beyond financial return’ (Brandenburg and Jackson 2012; Freireich and Fulton 2009). This can be seen in the figure below as well as how it fits within the surrounding industries.

Figure 1. Showing impact investments place within the investment industry as a whole, (https://www.marsdd.com/wp-content/uploads/2014/09/Impact-Investing-in-Canada-State-of-the-Nation-2014-EN.pdf)

Impact investment, unlike traditional investment, aims to create value for stakeholders in the impact investment ecosystem, mobilise greater capital to increase the overall impact and increase transparency and accountability when delivering on the intended impact (Social Impact Investment Taskforce, 2014). There has been a rapid growth in the industry of impact investing over the last decade with a number of big name investors now becoming involved in the market, including J.P Morgan, Deutsche bank and Goldman Sachs to name but a few (Höchstädter and Scheck, 2015).

That said, there is still a great deal to develop with regards to research into the industry. More specifically around impact measurement and that of social and environmental returns (Reeder et al., 2015). While traditional investment has had many decades to develop metrics and measure its effectiveness in a purely economic approach, there has been little activity in comparison to effectively measure the impact on social and environmental return. According to Jackson, (2013) the industry needs frameworks and tools that allow understanding of complexed social, environmental and political systems. As well as, to extract the impact made by specific interventions.

The importance of understanding the field and measuring impact

Following the steady shift towards impact investing and the socially responsible investment (SRI) field, it is key to be able to assess the impacts created by these fields accurately. This requires an understanding of the field and its innovations, including primary research utilising both qualitative and quantitative research methodologies (Daggers and Nicholls, 2016). This will allow a more in depth look at any prevalent differences across geographies, asset classes or various stakeholders (Höchstädter and Scheck, 2015).

Regarding the assessment and impact created by impact investment specifically, OECD defines it as “an assessment of how the intervention being evaluated affects outcomes, whether these effects are intended or unintended. The proper analysis of impact requires a counterfactual of what those outcomes would have been in the absence of the intervention.” (OECD, N/A p.1). It is important in the theory surrounding impact evaluation to measure not in a before vs after scenario but a with vs without, this being known as counterfactual analysis (idib.).

There has been a gradual move away from more traditional methods of analysis such as CEA and CBA to more holistic approach especially when looking at more social ventures, as seen in other analysis tools such as social return on investment, which is one methodical approach to include social, environmental, financial values into decision-making processes (Arvidson, M. 2013). Another key piece of literature is a report published by the social impact investment taskforce (Francis, 2014) that outlines that, as impact investment is still emerging as a practice there is little consensus on a best practice for this, as such it is necessary to build an understanding of what drives these investors, as well as trying to define both what is impact investing and what constitutes a successful impact investment.

Problem statement

Some of the main problems include the lack of academic level research into the subject area, as well as, how it differs from a more traditional investment approach. Another relevant factor to include in creating barriers is the rapid growth of the industry and market, decision-making processes are changing constantly and understanding this is likely hindered by shifts towards a more sustainable focus (Jackson and Ltd, 2012). Further to this, there are difficulties in clarifying intent in measurement and effectively measuring as well as the rapid exchange of information available to today’s investors.

Purpose of the thesis

The purpose of this thesis is to provide insight and knowledge into the decision-making processes of impact investors. The research aims to deliver an understanding of investor priorities in the impact created through their investment choices. Thereby allowing further research to help contribute to the development of more accurate and relevant impact assessment frameworks. The research also looks to provide a more in-depth look at preferences within the industry. The information would also provide feedback allowing industry groups further insight into how to push the industry and potentially which areas to develop next.

Research questions

In this thesis, the impact investor and their decision-making and priorities, are the key part that is of interest for the study, including how this could be relevant to developing the industry. Other studies (Saltuk, 2012; Best and Harji, 2013; Purpose Capital, Best and Harji, 2013), thus far, have been focused on what methodologies are currently in use and the investment selection and screening processes. While this study aims to start at an earlier step in this process taking an exploratory approach and providing insight on the priorities of these investors as well as the value they may place in, for example, the impact theme.

The main research question is therefore:

How do impact investors value key attributes when undertaking impact investments?

Sub Questions

It is well understood that the aim of impact investing is to bring people out of poverty and provide a positive impact on society, as such, It is expect that investors will prioritise their investment choices based on a number of common attributes. Further detail, as well as the reasoning behind choosing these specific attributes and how they will be quantified can be found in the methodology.

One of the main aspects of any investment is where investors choose to place their capital in order to maximise their impact within a chosen region, industry surveys have shown that one of the highest priority areas for investment is in emerging markets (Impactbase, 2015).

A large majority of these investments take place in regions such as Asia, Latin America and Sub-Saharan Africa. Thus, leading to the sub question;

SQ1: Are investors more likely to invest in emerging market regions than those that are more developed?

Together with where geographically an impact investor chooses to invest, there are a number of other factors they must consider, with one factor that appears often in a number of industry reports being the impact theme or area. With some common examples including access to finance and employment generation. When looking at what is reported it is clear that a larger majority of investors prefer to focus on social themes (Impactbase, 2015; Mudaliar et al., 2017), as such this leads to the sub question;

SQ2: Are impact investors more likely to choose investments with a greater social impact over environmental impact?

Another common factor to take into account coming from utility theory (Manski, 1977), is that traditionally investors seek to maximise their utility, while impact investors also aim to make a return on their investment, as such, it could expect them to seek to choose options displaying a larger potential returns, leading to the sub question;

SQ3: Are investors more likely to choose investments that have a higher IRR?

Finally, it could be assumed that investors are less likely to invest in choices requiring large investment amounts due to the increased risk this would bring through the assumption that they would seek to diversify their portfolios and investing large amounts of capital would limit this, therefore increasing risk (Markowitz, 1952), leading to the sub question;

SQ4: As the investment amount increases, are investors are less likely to choose thatBest, H. and Harji, K. (2013) Guidebook for impact investors: Impact Measurement.

References

Buchner, B. et al. (2014) ‘The Global Landscape of Climate Finance 2013’, Climate Policy Initiative Report, (December), pp. 14–31.

Daggers, J. and Nicholls, A. (2016) ‘The Landscape of Social Impact Investment Research: Trends and Opportunities’. Available at: https://www.sbs.ox.ac.uk/sites/default/files/research-projects/CRESSI/docs/the-landscape-of-social-impact-investment-research.pdf (Accessed: 13 June 2017).

Francis, P. (2014) ‘Impact investment: The invisible heart of markets’. Available at: http://www.socialimpactinvestment.org/reports/Impact Investment Report FINAL[3].pdf (Accessed: 5 August 2017).

GIIN (2016) ‘ACHIEVING THE SUSTAINABLE DEVELOPMENT GOALS: THE ROLE OF IMPACT INVESTING’. Available at: https://thegiin.org/assets/GIIN_Impact InvestingSDGs_Finalprofiles_webfile.pdf (Accessed: 17 June 2017).

Höchstädter, A. K. and Scheck, B. (2015) ‘What’s in a Name: An Analysis of Impact Investing Understandings by Academics and Practitioners’, Journal of Business Ethics. Springer Netherlands, 132(2), pp. 449–475. doi: 10.1007/s10551-014-2327-0.

Impactbase (2015) ‘IMPACTBASE SNAPSHOT AN ANALYSIS OF 300+ IMPACT INVESTING FUNDS’. Available at: https://thegiin.org/assets/documents/pub/ImpactBaseSnapshot.pdf (Accessed: 24 March 2017).

Jackson, E. and Ltd, A. (2012) ‘Accelerating Impact Achievements, Challenges and What’s Next in Building the Impact Investing Industry’. Available at: https://assets.rockefellerfoundation.org/app/uploads/20120707215852/Accelerating-Impact-Full-Summary.pdf (Accessed: 13 June 2017).

Manski, C. (1977) ‘The structure of random utility models’, Theory and Decision. Dordrecht, 8(3), pp. 229–254. doi: 10.1007/BF00133443.

Markowitz, H. (1952) ‘Portfolio Selection’, The Journal of Finance, 7(1), pp. 77–91. Available at: http://links.jstor.org/sici?sici=0022-1082%28195203%297%3A1%3C77%3APS%3E2.0.CO%3B2-1 (Accessed: 28 June 2017).

Mudaliar, A. et al. (2017) ‘Annual Impact Investor Survey THE SEVENTH EDITION Authored by the GIIN Research Team About the Global Impact Investing Network (GIIN)’. Available at: https://thegiin.org/assets/GIIN_AnnualImpactInvestorSurvey_2017_Web_Final.pdf (Accessed: 14 July 2017).

Nordhaus, W. D. (2007) ‘A Review of the Stern Review on the Economics of Climate Change’, Journal of Economic Literature, XLV, pp. 686–702. Available at: http://www.econ.yale.edu/~nordhaus/homepage/documents/Nordhaus_stern_jel.pdf (Accessed: 2 July 2017).

Purpose Capital, Best, H. and Harji, K. (2013) ‘Social Impact Measurement Use Among Canadian Impact Investors’, (February). Available at: http://purposecap.com/wp-content/uploads/social-impact-measurement-use-among-canadian-impact-investors-final-report.pdf%5Cnhttp://purposecap.com/portfolio/social-impact-measurement-canadian-impact-investors/.

Reeder, N. et al. (2015) ‘Measuring impact in impact investing: an analysis of the predominant strength that is also its greatest weakness’, Journal of Sustainable Finance & Investment. Taylor & Francis, 5(3), pp. 136–154. doi: 10.1080/20430795.2015.1063977.

Saltuk, Y. (2012) A Portfolio Approach to Impact Investment.

Schneider, N. (2007) Economists Respond to the Stern Review on the Economics of Climate Change – ProQuest. Available at: http://search.proquest.com.ep.fjernadgang.kb.dk/docview/229300212/D0ACC8E4180F4F01PQ/4?accountid=13607 (Accessed: 2 July 2017).

Stern, N. (2007) Stern review, The economics of climate change . Edited by N. Stern. Cambridge: Cambridge University Press.

Sustainable development solutions network (2015) Indicators and a Monitoring Framework Sustainable Development Goals Launching a data revolution for the SDGs. Available at: http://unsdsn.org/wp-content/uploads/2015/05/150612-FINAL-SDSN-Indicator-Report1.pdf.

Tol, R. S. J. (2006) ‘THE STERN REVIEW OF THE ECONOMICS OF CLIMATE CHANGE: A COMMENT’. Available at: https://www.fnu.zmaw.de/fileadmin/fnu-files/reports/sternreview.pdf (Accessed: 2 July 2017).

United Nation’s (2011) ‘United Nations Development Programme SUPPORTING TRANSFORMATIONAL CHANGE’. Available at: http://www.undp.org/content/dam/undp/library/Cross-Practice generic theme/Supporting-Transformational-Change.pdf (Accessed: 2 July 2017).

United nations (2016) SDGs .:. Sustainable Development Knowledge Platform. Available at: https://sustainabledevelopment.un.org/sdgs (Accessed: 12 June 2017).

World Economic Forum (2013) The Green Investment Report: The ways and means to unlock private finance for green growth. Available at: http://www3.weforum.org/docs/WEF_GreenInvestment_Report_2013.pdf.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Climate Change"

Climate change describes large changes in global or local weather patterns and global warming generally considered to be largely caused by an international increase in the use of fossil fuels from the mid-20th century onwards.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation introduction and no longer wish to have your work published on the UKDiss.com website then please: