Prolyte: Entry in the U.S. and Market Analysis

Info: 19080 words (76 pages) Dissertation

Published: 11th Dec 2019

Tagged: BusinessInternational Studies

Executive Summary

Mission and Vision

The company’s vision is centered on using their products to create, construct and connect not only structures but relationships with its customers. Prolyte provides innovative design that offers time saving solutions with outstanding quality and reliability.

Situational Analysis

Company

Prolyte is a European Manufacturing and Distribution Company for advanced modular aluminum supporting systems, (trussing) used to build stages and mounting light fixtures, scenery and speakers.

The company specializes in four specific areas. Prolyte Structures is the main part of the business, as the truss producer. ProlyteSystems provides commercialized structures created by the individual pieces from ProlyteStructures. With StageDex and ProLyft, the company also produces mobile stages and rigging material.

Collaborators

The collaborator in this case is CPI Wirecloth and Screens Inc., a Pearland, TX based private company who has provided their warehouse to Prolyte.

Customers

The U.S. Live Entertainment and Concert Promotion Industry is roughly $25 billion in revenue. It has also been growing steadily 5% each year.[1] Prolyte’s customers are rental companies and distributors. End users/customers are: Audio/Visual companies, Event Coordinators, Festival Production Managers and Online Retailers.

Competitors

Prolyte’s competitors are scattered throughout the major market areas in the United States. The total annual revenue of competitors is added to be $58.2M. This is one of the market sizing approaches that is explained in detail in the Financial Impact section of this report.

Context

There are several factors affecting the context of the industry such as the U.S. and exporting countries’ politics, the U.S. economy and economic policy, social landscape, and safety regulations. This report outlines the most pressing issues in these respective fields.

Objective & Scope

The objective is to understand the market in the United States and devise how Prolyte can enter the market successfully.The scope of the project encompasses the marketing plan, the business plan and the financial analysis.

Key Deliverables

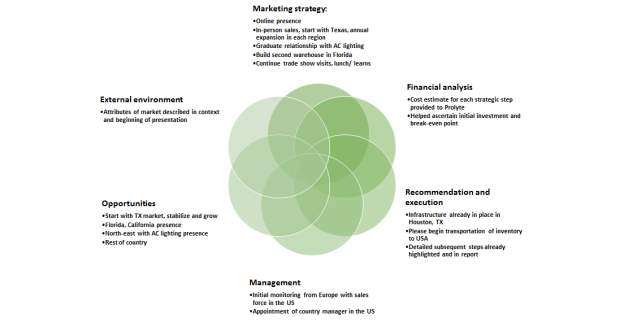

The following is an overview of the deliverables.

- Marketing Strategy

- Financials

- Business Plan

Methods and Process

Data Collections & Research

Data used in this project was mainly collected from communications with the customer, Prolyte and in-depth research using various sources from the internet and databases available through the University.

Marketing Plan

Place

Prolyte has decided to use local warehouses and shipping resources when the products arrive to the U.S. from overseas. They made this decision in order to minimize upfront and initial set up costs. Jay Jenkins at CPI Wirecloth and Screens Inc., has agreed to help house some initial inventory while Prolyte establishes itself in the U.S. market. Indirect distribution should be employed. Placement recommendations have been highlighted in the online and physical positioning sections. Creating an online presence with the staging distribution community is also advised.

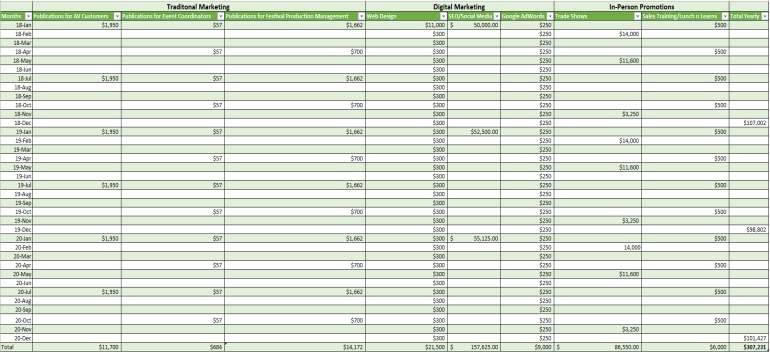

Promotion

In promotion, the team covers: traditional marketing methods such as customer related publications (trade magazines), digital marketing methods such as social media, web design, Search Engine Optimization, and YouTube content, and in-person promotions such as trade shows/expos, and sales trainings.

Price

The team has carried out a price comparison with currently present competitors and online retailers to present Prolyte’s relative standing. The pricing strategy used on the website should be based on zip-code location services and re-routing customers to appropriate distributors, resellers, or selling the product to the end customers directly. The list prices tend to be on average about 35%-40% more expensive than those of other competitors.

Product

Prolyte is looking to import to the U.S. market their full range of product offerings. The team recommends Prolyte to phase in their products starting with their truss and stage portfolio.

Segmentation

Prolyte is recommended to choose Distributors and Rental Companies as their segment to focus on. The business model that Prolyte currently uses

is mainly based on sales through Distributors. Nevertheless, we recommend that Prolyte includes sales through Rental Companies too. Between Rental Companies and Distributors, it is estimated that the whole size of the market is $58 million with $3.19 million located solely in Texas.

Targeting

The primary target in the market are the Rentals Companies in the Live Entertainment Industry, with a parallel strategy to create new deals with Distributors along the way. The team recommends tackling the Live Entertainment Industry, focusing at first on Houston local events and then branching out as they begin seeing a profit. There are 5.5% of the business establishments located in Texas which means out of 71,174 businesses in the U.S., 3,914 are based here.

Positioning

The team recommends the positioning statement to be as follows:

“At Prolyte, we’re providing you with simple, reliable and affordable solutions. From the mega festivals, to the intimate DJ shows, we provide you with durable, light, and easy to assemble aluminum trusses and components.”

Physical Positioning

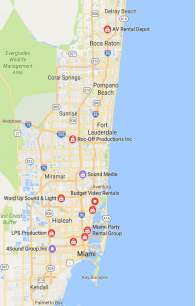

Prolyte will initially use the warehouse space offered by CPI Wirecloth and Screens Inc. in Houston. After realizing the anticipated growth, the team recommends Prolyte to invest in a second warehouse in Miami, FL for the following reasons:

- Florida is home to 20 million people, also has 6% of Prolyte’s target market.[2]

- It has one of the busiest ports in the United States. Hence, the shipping infrastructure is already present and will be useful to Prolyte.

- There is potential to tap into the already strong distributors and rental market.

In addition, the team also includes a strategy for the dedicated sales team, which markets to target first and at what space to do so.

Online Positioning

The team recommends a consorted effort which includes Google AdWords, a U.S. specific website, increased activity on social media, and direct sales through website.

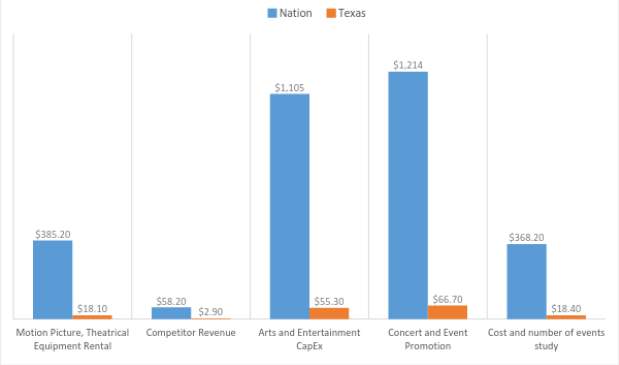

Financial Impact

For a better understanding of the current market size, the team adopted five different approaches of revenue estimation. Due to a highly fragemented market, one approach would not accurately determine the market size. Hence, the team viewed the market from the immediate customer, the end user of the products, the large competitors, and capital expenditure of the end user market. The final approach was an independent analysis from the foundation; where product pricing and number of events was used to estimate revenue.

Our analysis begins with the Motion Pictures and Theatrical Equipment Rental market size. According to an industry report, consumers buy equipment they rent out to the movie and stage productions. Texas contains 4.7% of the businesses in this industry and we estimate this to be the total Texas market share.

The second approach examines the revenues of major competitors in the U.S. The revenues are combined to estimate the ‘big players’ market size. In the U.S., big players control about 15% of the market. Based on these assumptions we estimated revenue at 5% revenue base due to the population percentage of the U.S. that resides in Texas (8%, 26M/319M) and discounting part of the population that may not be interested in live entertainment.

The third approach reviews the market research report on the Arts and Entertainment market. The capital expenditure ratio here is correlated to the target market size. The 7.6% of the revenue is the capital expenditure. Typically, capital expenditure for this market is the entertainment hardware and infrastructure, i.e., stages, roof systems, and lifts.

The fourth approach yields the highest market size but the team believes that this is closer to the upper limit of the market size spread. This is because the cost percentage to the businesses in this industry is not limited to the entertainment infrastructure, but also to other expenses associated with setting up the event such as food and apparel vendors.

The fifth and last approach begins by analyzing the end customers. An educated assumption of percentage of small, medium, and large stages required in each event and the revenue associated with these stages based on the cost of the trusses given to us by Prolyte. That, multiplied by the number of stages per event and the events per year provided the team with market size assumption.

The percentage share of market in Texas, consistent with the other approaches, is estimated at 5%. This is based on the already existing market research reports placing the number of events and end customers in Texas between 4.7% and 5.1%. An initial assumption of market size penetration by Prolyte is made. It is also assumed, in line with our recommendation, that each year, Prolyte will increase its market share by 0.5%-1% nationwide.

Marketing Cost Breakdown

The team describes in detail about the associated costs in order to execute the marketing strategy illustrated in this report.

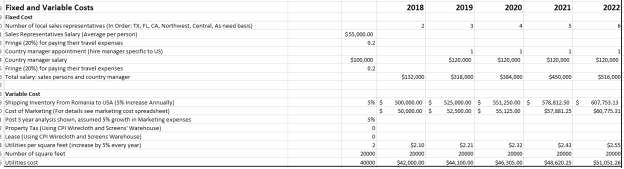

In the fixed and variable cost estimate, the team lists in detail, the approximate costs for 2018 through 2022. Costs of salaries, travel expenses, shipping inventory, marketing and utility costs are taken into account.

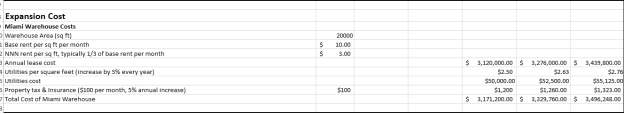

Based on the recommendation for Prolyte to expand to Florida, the team calculates the costs associated with this expansion. The costs for warehouse space, utilities and insurance are explicitly highlighted.

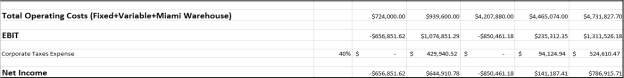

Lastly, the team lists total costs based on all previous assumptions and produces an approximate net income.

Recommendations & Execution

Recommendations

Portfolio – The team recommends Prolyte to initiate with their truss and stage portfolio, targeting the distributor and rental segment, particularly the latter. As seen in the appendix on the sales summary and Prolyte’s classification of sales, trusses and stages are the highest sold product families. Further, the ‘low hanging fruits’ in Texas are the Rental Companies that purchase these products. The team recommends a step by step inclusion of the entire portfolio in the U.S., starting with the best sellers. Once revenue generation begins and the local market is familiar with Prolyte, we recommend introducing ProlyteSystems into the U.S. starting year 3 of operations. That would complete bringing stage, trusses, and lift solutions into the U.S. The team recommends 1 year for each product category to establish itself in the U.S. As a next step, Prolyft should be brought to the U.S. starting year 4.

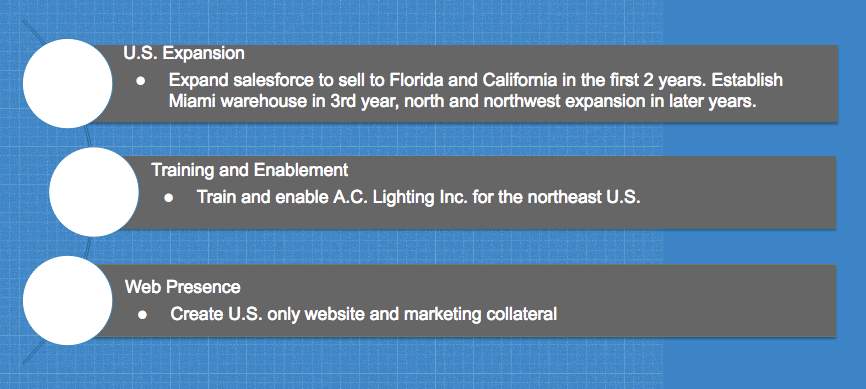

Digital Presence – Prolyte is advised to create a U.S. only website like one of its competitors. The possibility of direct sales through website can be investigated. The team suggests that there is a strategic shift in commerce causing more customers to look to the internet to purchase products.

Market Size and Segment – Prolyte is recommended to concentrate on the Concert and Event Promotion market coupled with the Motion Picture and Theatrical Rental market. The report specifically mentions the accuracy of revenue estimation, the products that constitute Prolyte’s portfolio, and represents the direct customers of Prolyte. Further, the independent analysis carried out by the team utilizing foundational information, results in a market size of similar order of magnitude as this approach. Thus, this recommendation is made.

Location – The market is fragmented nationwide with a few regions of high population. Thus, the sales force is required to be positioned in those regions. Further, since the first year will be spent in entering and establishing in the Texas market, the second year is recommended to be the ‘expansion year’. Before building infrastructure elsewhere, placing sales representatives requires less upfront capital investment. Hence, hiring salesforce and allocating regional responsibilities is recommended in the second year. Consequently, footprint outside of Texas is expected to occur from the second year. Expansion to Florida in the third year and California in the fifth year is also recommended. Prolyte is advised to engage A.C. Lighting Inc. and support their relationship as sales partner for the northeast market.

Execution

Prolyte should concentrate on the Texas market for the first year. A 5% rule of thumb is recommended for future Texas market sizing according to the market research reports of this industry. The team recommends Prolyte hire sales representatives for the Texas market. While inventory is being shipped, Prolyte’s sales representatives should begin contacting local distributors and rental companies. Prolyte should start scheduling Lunch and Learns with prospective customers. Preparation for local trade shows should also begin.

Market size and cost has been researched and provided for Concert and Event Promotion, Motion Picture, and Theatrical equipment segments nationwide. Two layers of costs of that market have been correlated to the market size for Prolyte’s products. The percentage of Texas businesses has been researched and provided.

Prolyte should hire sales representatives for the respective markets. The sales representative should contact local distributors and rental companies. In addition, Prolyte should begin establishing relationships with local trucking companies to bundle costs of shipping into expanded markets in the U.S.

Florida market size and events schedule is expected to cover the costs once sales begin in that market. The steps of expansions here are also similar to initial steps in Houston. In parallel to the warehouse lease, hiring sales representatives, contacting local distributors and rental companies, and introduction of products through Lunch and Learns need to be carried out.

Mission and Vision

Prolyte was founded in 1991 and developed its innovative conical system in 1993. This revolutionized trusses and the industry by reducing installation time and labor costs. Today Prolyte is a world renowned brand and a trusted producer of trusses and equipment. Prolyte’s mission is to deliver product excellence and maintain a close bond with its customer community. The operations and company’s structure work to serve their vision through leveraging relationships and manufacturing outstanding products.

The company’s vision is centered on using their products to create, construct and connect not only structures but relationships with its customers. Prolyte provides innovative designs that offer time saving solutions with outstanding quality and reliability.

The purpose of our project is to analyze the market and present Prolyte with opportunities and resources needed to utilize their competitive advantage and penetrate the U.S. market.

Situational Analysis

Company

Prolyte is a European Manufacturing and Distribution Company for advanced modular aluminum supporting systems (trussing) used to build stages and mounting light fixtures, scenery and speakers.

The company specializes in four specific areas. Prolyte Structures is the main part of the business, as the truss producer. Prolyte Systems provides commercialized structures created by the individual pieces from Prolyte structure. With StageDex and ProLyft, the company also produces mobile stages and rigging material. They provide all of the elements required to build many different kinds of staging structures, from the individual DJ playing in a party to the music festival with a capacity of over 100,000, they have all the componentry necessary.

After an extensive investigation on products and services, U.S. structures markets, and their competitors, it was possible to determine that Prolyte does have the right product line and meets the necessary criteria to commercialize the products within the current market.

SWOT

SWOT, as we are aware, stands for Strengths, Weaknesses, Opportunities, and Threats. While strengths and weaknesses are internal, opportunities and threats are external to a company. The company is expected to enhance its strengths to capitalize on the opportunities, and improve its weaknesses to nullify threats.

Please find below the SWOT analysis with specific details under every area.

| SWOT Analysis | |

| Strengths |

|

| Weaknesses |

|

| Opportunities |

|

| Threats |

|

Collaborators

The collaborator in this case is CPI Wirecloth and Screens Inc., a Pearland, TX based private company who have provided their warehouse to Prolyte. This is approximately 20,000 square feet. This will alleviate the cost of the first warehouse, which in Houston could be anywhere from $8 per square foot- $22 per square foot. The existing infrastructure of CPI Wirecloth and Screens Inc. will also be used for ‘first and last mile’ shipping and receiving of all the Prolyte products in the U.S.

Customers

The U.S. Live Entertainment and Concert Promotion Industry is roughly $25 billion in revenue. It has also been growing steadily 5% each year.[3] In Texas there are at least 30 live entertainment events, with about 5 major festivals with attendance of over 100,000 people.[4] Since the Live Entertainment and Concert Promotion Industry has been a more stable industry than Oil and Gas in America in recent years, we suggest that Prolyte continue to focus on the Live Entertainment Industry as their primary customer segment. The justification is that the Live Entertainment Industry is stable and growing and is seeing no volatile shifts downward. Prolyte also has the added benefit of already targeting the segment in Europe so they understand some of the needs that may arise in the U.S. segment.

Prolyte’s Customers

Rental Companies

Rental Companies can provide the following services that could be met by Prolyte equipment:

- Provide lighting, sound, and truss rentals for various events.

- Party supply rental is a $5 billion dollar national industry and is growing at 4.3% annually.[5]

- Rental company customers could relate to any of our end customers below as well as: graduation services, weddings, etc.

- Rental companies could be targeting many different segments depending on the logistics.

Distributors

Distributors can provide the following services to Prolyte that would enable the selling of their equipment:

- Act as partners to Prolyte to sell their products to end customers.

- Distributors could sell to any of our end customer sets as well as rental companies.

- Distributors are there to enable that Prolyte’s products have shelf space, visibility, and people trained to sell them.

Who are the end customers?

Audio/Visual Production Companies

- Provide audio visual technology systems, systems design, and installation services.

- Audio/Visual industry is a multibillion dollars global industry.

- Customers of Audio/Visual Companies could range from weddings, to conferences and trade shows, and major events like Rodeos and music festivals.

- Audio/Visual Companies can target many different demographics depending on the event.

Event Coordinators

- Provide planning and set up of many different types of events including but not limited to: weddings, corporate, social, non-profit, festivals, sporting events, and catering services.

- Event coordination/event planning is a $5 billion national industry. [6]

- Use a preferred vendor list for all of their events.

- Event coordination target audience can be many different age groups depending on the type of event.

Festival Production management

- Synthesize production and operations to satisfy customer expectations building out incredible customer live music experiences.

- Festival production management can encompass many different services such as: marketing, festival operations, sponsorship, and production.

- 32 million people attend at least one U.S. music festival per year.[7]

- Festivals are particularly appealing to those in the Millennial age group from 18-30.

Online retailers (Amazon, EBAY)

- The reach for online retailers is virtually endless.

- Any product could be sold through this distribution model.

- Some of Prolyte’s major competitors like Global Truss are already available in this marketplace.

Specific Customer Profiles

An example of a rental company to target would be: R&R Staging Inc. R&R Staging Inc., is a mobile stage rental company in Houston, TX. R&R Staging Inc. has had past contracts with the Houston Rodeo, the County Fair, and various sports broadcasts. This would be a reputable company to partner with to sell their products as they already have strong contracts with many of the big events in Houston and its surrounding area.

An example of a distributor that Prolyte already currently supplies is A.C. Lighting Inc. in Toronto, Canada. Prolyte should continue to try to nurture this relationship and identify the incentives that A.C. Lighting Inc. needs to be presented with in order to motivate them to really push Prolyte products above all else.

Another example of a distributor that Prolyte could potentially go after is Famous Stages Lighting and Sound. Famous Stages Lighting and Sound is a distributor of staging, lighting, and sound equipment in Houston, TX. They are already a trusted distributor for truss needs in Houston and Dallas so Prolyte beginning a distributor relationship with them could be very lucrative.

Specific End Customer Profiles

An example of an Audio/Visual production customer to target would be: TXE Productions. TXE Productions is an Audio/Visual company located in Pearland, Texas. TXE Productions already has a solid reputation in Houston for live event stage design, and audio/visual support. They also have partnered with The Houston Rodeo and Livestock show and this would be a good company to assist Prolyte in getting in with the Houston Rodeo and Livestock show to build the relationship and a long term contract.

An example of an Event coordination customer to target would be: A Fare Extraordinaire. A Fare Extraordinaire is an event coordination company located in Houston, TX. Some of its clients include large fashion designers, oil and gas companies, as well as hospitals, park conservancies, and arts institutes. Building a relationship with A Fare Extraordinaire would allow Prolyte to get on the preferred vendor list and have access to A Fare Extraordinaire’s wide array of client base.

An example of a Festival Event Production management customer is C3 Presents. C3 Presents is a festival event production management company located in Austin, TX. They produce massive scale music and entertainment events globally. Two of their extremely well known clientele are Austin City Limits, a music festival with attendance over 100,000 in Austin at Zilker Park and Lollapalooza, a music festival with attendance over 300,000 in Chicago. Working with C3 Presents would allow Prolyte to break into the massive music festival industry allowing them access to two very well-known customers in the US.

An example of an online retailer is Amazon. Amazon sells a variety of different products on its marketplace. Distributing Prolyte products through Amazon would give Prolyte access to the Amazon pipeline. In addition, other Prolyte products can also show up in suggestions for customers who previously purchased items that are similar. Utilizing Amazon’s warehouse model, Prolyte may be able to decrease freight costs transferred ultimately to the customer.

Competitors

Presented in Appendix A are the competitors to Prolyte as the organization makes its entry into the United States.

This table also provides an idea of the estimated annual revenue for the product portfolio for Prolyte. The competitors have been chosen based on their product portfolio, national outreach, and distributor network.

The total annual revenue is $58.2M. This is one of the market sizing approaches that is explained in detail in the Financial Impact section of this report. Hence, the table provided has an accurate estimation of Prolyte’s revenues and direct competitors.

With a sales revenue target of $3 million in 3 years, the Financial Impact section of this report demonstrates the annual growth in market share, expressed as a percentage that Prolyte is required to achieve.

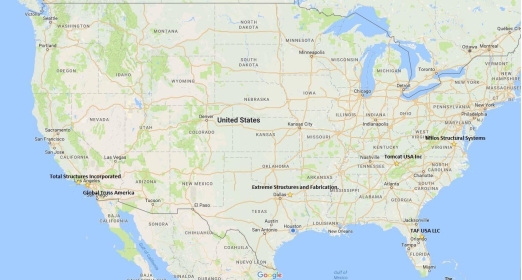

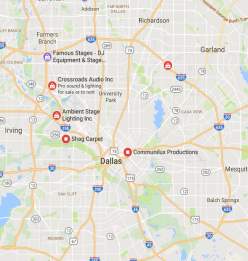

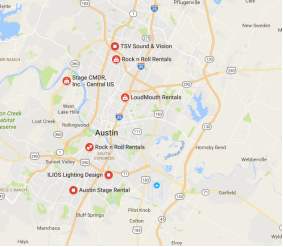

Appendix B shows a map of the biggest competitors in the market and where they are located.

The location of distributors, some of whom are manufacturers themselves, are shown in Appendix C.

The map of main manufacturers and distributors of U.S. trusses is shown in Appendix G. The mentioned organizations are competitors. They are predominantly located across the Central U.S. since the revenue up north is seasonal at best.

| Competitor- Global Truss SWOT Analysis | |

| Strengths |

|

| Weaknesses |

|

| Opportunities |

|

| Threats |

|

Context

Prior to 2017, the political climate changed dramatically with the United Kingdom’s decision to leave the European Union and the inauguration of the President of the United States. As the Entertainment Industry is not directly related to governmental policies, policy change shouldn’t have a major direct impact on it. However, governmental policies could affect the general future business environment. Since Prolyte has no intention to invest in a manufacturing plant in the U.S. initially and will instead, manufacture the products in Europe and ship them to the U.S., shipping cost and tariffs might increase under the campaign promise of “American first”.

According to the Commerce Department, the U.S. economy grew at an annual rate of 1.6% in 2016, the slowest growth rate since 2011. The new government promises to get growth up to 4% a year by cutting corporate and individual taxes, building more domestic infrastructures and cutting away some financial regulations.[8] Though there are some political uncertainties, it is the appropriate time for Prolyte to enter the U.S. market based on the macroeconomic environment.

As for the social environment, the Entertainment Industry is evolving to recognize that the customer experience is extremely crucial to the production and selling of goods. This is good news for Prolyte as the fans extend media experiences into physical experiences. Touring, festival and live events are becoming more critical to build and strengthen fandom. Traditional publishers such as the New York Times Company and CNBC have announced plans to expand their participation in live events focused on small business, entrepreneurship, and startup innovation[9]. Live experiences remain a key differentiator in the digital world. Our team agrees with this analysis, and expects an even larger increase in the U.S. Live Entertainment market. From this aspect, it is desirable for Prolyte to expand business in the U.S. market. In addition, the team does not foresee any new technology that would enable the replacement of traditional staging structures. The innovation in this industry might decrease the manufacturing or installation cost, but would not totally change the game. Therefore, we expect technological environment will slowly make progress towards greater effectiveness and efficiency with no drastic changes.

The staging and rigging industry are subject to various federal and state safety regulations, such as OSHA (Occupational Safety and Health Administration).[10] In general, the regulation is not well defined and Prolyte should continue to rely on industry standards. Moreover, the team does not expect any new regulations or changes affecting the industry in the near future. There are international and local associations and unions related to the Entertainment Staging Industry, including International Association of Venue Managers (IAVM),[11] International Alliance of Theatrical Stage Employees (IATSE),[12] Professional Lighting and Sound Association (PLASA),[13] etc. The Convention and Trade Show Industry has been steadily increasing its reach. Over the last forty years IATSE members have been responsible for the putting up and taking down of all kinds of convention and trade show structures. More recently, the International Tradeshow Department has strengthened its network with diverse companies by organizing nationwide contracts and regulating standards for employees in the industry.[14]

Objective

The objective is to understand the market in the United States and devise how Prolyte can enter the market successfully. The team achieved this objective by engaging in the following activities:

- Researching the current Live Entertainment market.

- Creating a marketing analysis that outlines who Prolyte should be targeting, who their competitors are, and how to mitigate risks entering a new market. (4P’s, STP, and SWOT Analyses).

- Calculating a break-even analysis to inform Prolyte of how much money they need to make in order to be profitable.

Scope

The team analyzed many different aspects of Prolyte’s business as well as competitive strategy, and health of the U.S. market. Shown below are the steps the team took in order to arrive at the outcome desired by the client

- Marketing Plan

- 5C’s Analysis (Customers, Company, Context, Competitors, Collaborators)

- STP (Segmentation, Targeting, Positioning)

- 4P’s (Product, Price, Place, Promotion)

II. Financial Analysis

- Analysis of revenue growth rate

- Initial cost of expansion

- Calculation of the Net Present Value

- Internal Rate of Return

- Break-even analysis

III. Business Plan

- People

- Context

- Organization

- Deal

The team proposes consolidating all the information described in the Scope section to deliver a marketing and business plan that may potentially include the following sections:

- Marketing Strategy

- Analysis of the company, its collaborators, customers, competitors and the market environment.

- Provide the segmentation, targeting and positioning for Prolyte.

- Study of products, a detailed pricing strategy, strategic locations and promotions.

- Financials

- Investment required for start of operations.

- Expected revenue and expenses for a scope of 3 years.

- Business Plan

- Management

- Opportunities

- External environment

The concert and revenue market in the United States is classified as mature. The expected revenue and growth rate is shown in the analyses in this report.

Data Collection

Data used in this project was mainly collected from communications with Prolyte and in-depth research utilizing various sources from the internet and databases available through the University of Houston. Details of each method can be found below.

Interviews & Conversations

Starting in January 2017, the team frequently communicated with Prolyte, including an on-site interview, group conference calls and emails. The team travelled to Pearland, TX to meet the key representatives from Prolyte and CPI Wirecloth & Screens Inc. The critical information from Prolyte includes but is not limited to:

- Scope of business in the U.S.

- Mission, vision and objectives

- Current marketing strategy

- Target customers

- Challenges in the U.S. market

- Expected outcome

Research

Besides the information from the customer, more data was collected from various online and offline resources to help the team analyze and research. The data includes but is not limited to:

- IBISWorld Industry Reports

- Hoover Reports

- Publications for A/V Customers

- Publications for Event Coordinators

- Publications for Festival Production Management

- Trade shows

The collected information was thoroughly reviewed by the team and then was utilized in the analyses. Some numbers and information may be time sensitive and should be updated during strategy execution.

Marketing Plan

Place

Place, also known as distribution, is defined as the process and methods used to bring the product or service to the customer. Since Prolyte’s products are manufactured internationally, the decision made in this step of the marketing mix is to use local warehouses and shipping resources when the products arrive to the U.S. from overseas. Considering Prolyte’s successes and the characteristics of the products (high quality and highly specialized), direct selling is not an appropriate means of going to market. Direct selling means providing the products to the customers without utilizing a distributor. Instead, indirect distribution which uses an intermediary distributor to sell the products to the customers should be employed in the U.S. market.

Placement recommendations have been highlighted in the online and physical positioning sections. In addition to that, it is recommended that Prolyte carries out a) Lunch and Learns, and b) trade show visits to show its products. Starting locally in Houston and then spreading to the rest of the country is recommended. Creating an online presence with the staging distribution community is also advised. Distributors and renters will be the main customers. Hence, networking with them is highly suggested. A list of such contacts has also been provided in this report.

Potential Risks of Distributor Model

Although there are many advantages to utilizing a distributor model, Prolyte needs to consider some related costs and make relative decisions in the other 2Ps, price and promotion. Because intermediaries need to be either paid for or allowed to resell at a higher price in order to make margins, the company may potentially lose out on some revenue. Pricing needs to remain consistent, so the company will have to reduce its profit margin to give a cut to the distributors. To quickly penetrate the U.S. market and gain market share, different pricing strategies or higher discounts are recommended in U.S. market. Along with revenue, the information being received by the end consumer is direct from distributors instead of the producer Prolyte. There is a risk of an inconsistent brand message being communicated to the consumer regarding product features and benefits which can lead to dissatisfaction. This issue needs to be addressed in promotion by the company. The last concern is ensuring that the distributor makes Prolyte products top priority or exclusively sells Prolyte. The distributors may have incentives to push another product first at the expense of others. Therefore, the company needs to be careful when selecting a distributor and ensure that they are incented appropriately to elicit the response they wish to have.

In addition, another selling issue that Prolyte might encounter is the introduction of wholesaling at undercut prices on the Internet. Mitigating these risks will be necessary.

Promotions are the specific communication avenues for the product. In the marketing mix, promotion is a combination of activities such as advertising, public relations, digital, and person to person strategies. In the next sections we will cover: traditional marketing methods such as customer related publications, digital marketing methods such as social media, Search Engine Optimization, and YouTube content, and in-person promotions such as trade shows/expos, and sales trainings.

Traditional Marketing Methods

Minimal efforts and budget should be allocated to traditional media sources with the exception of specific industry and trade magazines. For the highly specialized products that Prolyte manufactures and distributes, the traditional generic media promotional avenues are not sufficient and cost effective. Prolyte does not need to insert itself into all media sources as a, “hit them all” marketing tactic but instead, they should be focused intensely on marketing to their customers specifically. Listed below are the industry and trade magazines that the team suggest Prolyte advertise in or be featured in.

Publications for A/V Customers

AV Magazine

- Reaches over 8.5 million Audio/Visual professionals globally.

- Helps connect Audio/Visual professionals to other distributors, manufacturers, resellers, and partners.

- Inclusion of Prolyte in the Live Events News category could get them high visibility among the community.

- Advertising in the magazine could increase collaboration between local Audio/Visual companies and Prolyte.

Rental & Staging Systems

- Reaches over 300,000 Audio/Visual professionals globally.

- Specific news, industry events, and case studies on the rental and staging industry.

- Inclusion of Prolyte in the Installations Features category would help them to expand their network.

- Advertising is also encouraged as it will increase visibility.

- Cost of advertising included in budget section.

Publications for Event Coordinators

BizBash

- Reaches over 225,000 Event Coordinators nationally.

- Created to help connect Event Coordinators to vendors, suppliers, and provides up to date news about the industry and fresh technologies that make events better.

- The team suggests Prolyte list their business in Bizbash. Doing so would allow them to come up in a search of the online publication in the section of Find Suppliers, allowing all Event Coordinators that are looking for a staging company to find Prolyte.

- The magazine and website serves Event Coordinators who spend on average $750,000 and plan over 200 events per year.

- Being part of this network could be extremely beneficial because of its reach.

- Cost of listing on BizBash: Free for basic listing that includes: coming up in search results for certain queries pertaining to the services offered by Prolyte, company information, and lead generation email requests.

Special Events Magazine

- Reaches approximately 100,000 Event Coordinators globally.

- Media source for event planning news, events, designers, producers and suppliers.

- The team suggests Prolyte list their business in the, “Classified” section which helps connect customers to the businesses, vendors, and suppliers.

- Cost of listing in the “Classified” section: $57 per month.

Publications for Festival Production Management

Mobile Production Pro

- Reaches Festival Production Management looking for mobile stages, rentals, and other necessary staging equipment.

- Created to help Festival Production Management connect to the necessary companies that can help them make their festival a success.

- The team suggests Prolyte advertise in the magazine as well as be included in the Business Listing Directory so they can be included in searches for staging equipment in the future.

- In addition, they could also be included in the News section under equipment rental including case studies of when Prolyte was used.

- Cost of listing in the online directory: Free.

- Cost of advertising (banner ad): $700.

Total Production International

- Reaches approximately 10,000 decision makers across production such as: show designers, technical crews, investors, production managers, promoters, and suppliers.

- Created as a business to business publication to educate, entertain, and inform about all of the aspects that go into festival production, design, and technology.

- The team suggests Prolyte advertise in the magazine as well as have some of their stage experiences included in the Production Profiles section.

- They can also be featured in Event Focus.

- Cost of advertising (¼ page color): $961.20

Digital Marketing Methods

Digital marketing methods, such as: Search Engine Optimization, Pay Per Click Google AdWords campaigns, social media promotion and engagement, and YouTube videos, are strongly recommended considering its high efficiency and limited budget requirements. The digital marketing strategy is broken down into its respective strategic parts below. The team also recommends that Prolyte build a website and landing page strictly for their U.S. operations.

To compete successfully in the U.S. market, Prolyte needs a website strictly for its U.S. operations. The website should mirror the current Prolyte website with a few minor changes. The News Section should focus primarily on case studies and current events coming out of the U.S. Web design can range around $7,000-$13,000 for initial setup fees and $300 monthly maintenance.

The team has noticed that Prolyte’s website could do a better job with their search engine optimization. The keywords are not included in web page Meta keyword data. Search engine optimization can increase the chances of being found during organic or unpaid search efforts. Without this data, it is extremely difficult for Google algorithms to find the website and make it easier for searchers to find. Statistically, the first page of search gets over 90% of the traffic so if Prolyte is not on the first page, it is likely that customers will go with competitors instead. Page authority also has a score of only 53 out of 100.

To attain high visibility in search, Prolyte needs to ensure that the best keywords are being used to amplify and promote their business. They should also make sure that they are weaving their keywords throughout all their relevant content on the website, including their news section. Prolyte can utilize Google Keyword Planner to discover how their keywords are performing and which ones display low relevance to actual searcher’s terms. Once, Prolyte has discovered their highest performing keywords they should include those in the following places: page title, page description, news content, and image/video file names. Some of the words below are some of the suggested keywords to include and their cost per click if Prolyte were to invest in PPC:

- aluminum truss ($1.22)

- Event Staging ($2.24)

- lighting truss ($1.38)

- aluminum stage truss ($2.09)

- Verto truss ($0.90)

- chain hoists ($3.35)

- truss tower ($0.73)

- Aluminum truss manufacturers ($2.38)

- aluminum roof truss ($1.22)

- best trusses in ($0.73)

- best stages ($1.10)

- stage technicians ($0.57)

- truss system ($1.84)

Pay Per Click Google AdWords Campaign

More and more often, customers are searching and purchasing products and services online. Without a strong web presence, Prolyte is going to lose customers to competitors that are readily accessible on the web. Google AdWords campaigns are an effective way to land yourself on the first page of search results as well as in the top three positions on the search page. Paid search is cost effective because it is only based on pay per click. In other words, Prolyte will only have to pay for the keywords that people use to search and if their website is clicked on after search takes place. Since aluminum truss has high competition the average cost of bidding on it is about $1.22. Similarly, the keyword stage truss costs around $1.27 per click. Google AdWords also has the added benefit of driving traffic to Prolyte’s website which will increase their ranking on Google as well as increase their likelihood of being included in organic search even when their ads are not running or are on pause.

Social Media Promotion and Engagement

Prolyte has employed an “every network” social networking strategy but it would be more effective were they to choose the sites where their customers are. For instance, Pinterest is tailored to arts, crafts, cooking, fashion, and DIY home and garden projects. It is not an efficient use of Prolyte’s bandwidth and space to be on this platform as it doesn’t fit their business model or the mission and vision of their business. There are other platforms however, that would best serve the interests of Prolyte. The team will cover a list of the appropriate platforms as well as a brief strategy of each below.

Prolyte Group Facebook has around 8,600 likes and a service rating of 4.9 of our 5 stars. To keep interest high, drive traffic, and encourage engagement Prolyte should be posting on average two times per day, five times a week. Since the promotional strategies are based on market entry in the U.S., Prolyte should build a separate Facebook profile for the U.S. market called, Prolyte Group US. They should also be posting during standard U.S. hours, between 10 am-4 pm. The logic behind a U.S. Facebook is that they can start sharing content that appeals to their U.S. audience and build reputation, recognition, and increase word-of-mouth in the U.S. branch.

Content that is posted should be varied from blog content to pictures to statuses that ask questions to encourage responsiveness from their audience. To grow their business in the U.S., feedback from customers in that geography will be invaluable. The team recommends more effort to develop a community of truss, staging product and hoists on social media sites. The consumers, technicians and people in related industries can have a place to communicate, which leads to brand promotion and loyalty. Ultimately, people buy from people they know, like, and trust so building an American presence is critical to being successful in this market.

Prolyte has been running a marketing campaign across multiple platforms to build feedback and testimonials called “What’s Your Story”? This is an extremely effective way to gain feedback, have positive testimonials to post on the website, and increase your customer service quality. The one suggestion that the Team has for Prolyte is to choose a different hashtag to represent this campaign. When looking up #whatsyourstory, I have seen several other groups use this hashtag for their campaigns, rendering Prolyte’s less effective as it gets classed in with the others. Using a more tailored hashtag like #Talk2Prolyte would allow them to more easily search for their feedback in the sea of hashtags.

@Prolyte has a little under 2,000 followers and less than 1,000 tweets. Engagement on posts is also very limited. The team proposal is that Prolyte does not make this a priority in their digital strategy moving forward. Moving forward, tweets should be either directed towards a blog that was written, the website, or a Facebook post. The goal is to drive the customer engagement to the other platforms that Prolyte is currently deployed on.

Prolyte has its own channel on YouTube. However, the channel does not have as many subscribers or views than would be expected of a company of this magnitude. Methods, such as video advertising, are strongly recommended to increase YouTube views. On Prolyte’s YouTube channel, there are a lot of demos of the product which is very important. In addition, the team suggests that Prolyte use their YouTube channel to promote case studies or customer testimonials. This is a very effective way to build a strong reputation and trust in the community.

In-person promotions will be vital to supporting the go-to-market strategy in the U.S. because of the unique products that Prolyte sells. Since, Prolyte’s coupling system is different from how truss systems in the U.S. are constructed, it will be important to put it in the hands of potential customers to show that it is just as reliable, secure, and even more affordable than standard American truss systems. Here are the following ideas for in-person promotions to build customer base and eventual loyalty.

Trade shows

Trade shows are going to give Prolyte the ability to get in front of potential customers, showcase their products, and field any questions that might come from attendees. Bringing the Verto Truss and allowing customers to see how it works, understand its technical specifications, and how it can benefit its businesses will give Prolyte a substantial competitive advantage. The team recommends that Prolyte procure a booth at the following trade shows:

The Rental Show (Orlando, FL)

- American Rental Association’s trade show for the equipment rental industry- one of the focuses being entertainment/party rental manufacturers and distributors.

- Around 5,000 attendees.

- The team suggests Prolyte bring Verto Truss assembly for a live demo and explain the shorter assembly and takedown time to attract rental companies that would sell or rent out Prolyte’s product portfolio.

- Cost of exhibiting at The Rental Show: $14,000 for 20X20.

Live Designs International (Las Vegas, NV)

- Penton Media’s trade show for professionals in live entertainment construction and design.

- Around 8,000 attendees.

- The team suggests Prolyte include live demos of their most popular products and be able to field technical questions from potential collaborators and customers.

- Cost of one day demo at exhibition: $3,250.

USITT (United States Institute for Theatre Technology)

- The United States Institute for Theatre Technology’s tradeshow to professionals and students involved in all aspects of theatre production including staging, lighting, set design, etc.

- Around 10,000 attendees.

- The team suggests Prolyte pay for booth space on the exhibition floor.

- Cost of booth: $11,600

Sales Training/ “Lunch and Learns”

Enabling distributors by educating them with training on the products is going to be vital to success in this market. Live demos should be conducted where customers are given the opportunity to put the product together and then offer their feedback. Deep understanding of the product will come from the customers getting to use it and see it in action. They will be able to experience the product and be able to derive value from what it can offer ultimately to their end customer, whether that be durability, strength, or easy setup and takedown. $5,000 should be budgeted for 10 lunch and learns/sales training sessions.

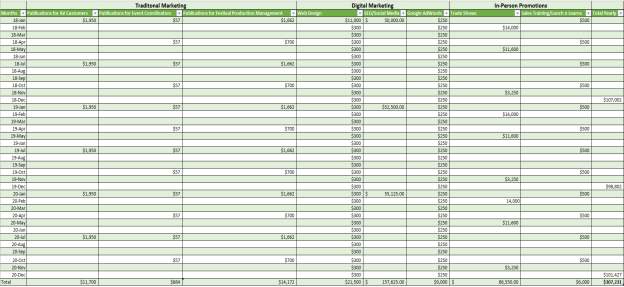

The prices associated with the various aspects of the marketing strategy are outlined in Appendix D.

Prolyte has presented the team with its U.S. price list. The team has carried out a price comparison with currently present competitors and online retailers to present Prolyte’s relative standing. This will enable Prolyte to anticipate the amount of market share it will be able to capture. Since Prolyte will be selling primarily to distributors and renting to the respective equipment rental locations, it is recommended that before listing an online list price, appropriate mark-ups need to be added.

Pricing strategy: This should initially be based on location. Hence, the Prolyte website should request a zip-code before re-directing to appropriate distributors, resellers, or selling the product to the end customer directly.

The prices for the products are already set by the manufacturer as list prices and distributor prices. The list prices tend to be on average about 35%-40% more expensive than those of other competitors such as Global Truss or TRUSST.

They are comparable to plated truss, slightly higher in price but have the advantage of savings in cost of labor.

There is a large upfront investment for distributors, approximately $1 million in inventory to sustain operations.

Buying Verto and Prolytes. The systems are separate and cannot be mixed together so if the distributor wants to carry both products they are not interchangeable and would mean a higher overall investment.

Markup from distributor to seller or renter is 20 – 40% depending on the market environment. Houston has a competitive environment and many lighting and truss renting companies, which means their markup is lower. The advantage will come once the companies reach economies of scale which emphasizes the need for high upfront investment.

Prolyte is looking to import to the U.S. market their full range of product offerings. Their current line of products is divided into the following branches:

- ProlyteSystems – which are fully designed systems and constructions.

- ProlyteStructures – which is their full array of trusses.

- ProLyft – hoisting equipment and controls.

- StageDex – offering stage solutions and flooring systems.

- Accessories to support these products.

Prolyte has expressed interest in bringing their entire portfolio to the U.S. The team recommends Prolyte to phase in their portfolio. For the first stage, lasting 3 years, the team recommends Prolyte bring their truss and stage portfolio. This statement is made based on 2 observations. The truss market will be easily accessible in Houston and onward to other locations. The stage market, based on sales data from Canada and Mexico, is second only to trusses in terms of sale-ability.

Marketing Strategy for Prolyte: Key Yearly Focuses

| Year | 2018 | 2019 | 2020 | 2021 | 2022 |

| Operations

/Salesforce |

Set-up in Houston. Hire 2 sales representatives (North and South Texas) | Expand salesforce. Start with Miami. Then California. Hence hire 2 more salespeople this year | Complete training and enablement of A.C. Lighting Inc. | Bulk of CapEx will be spent in second warehouse in Miami this year. | Sales expansion in California. Activate growth here. |

| Promotions | Advertising, SEO, Lunch and Learns, and Trade shows in FL, NV, and MO | Advertising, SEO, Lunch and Learns, and Trade shows in FL, NV, and MO | Advertising, SEO, Lunch and Learns, and Trade shows in FL, NV, and MO | Advertising, SEO, Lunch and Learns, and Trade shows in FL, NV, and MO | Advertising, SEO, Lunch and Learns, and Trade shows in FL, NV, and MO |

| Place | Connect with local distributors | Nurture relationship with A.C. Lighting Inc. to concentrate them in the northeast | Start thinking about second warehouse; location Miami. | TAF is present. Market size for live event (IBIS) | If not a warehouse distribution center, at least a cost center for fast turnaround. |

| Products | Tap into the distributor network of XSFT Dallas (competitor) | Still market trusses and stages | Start looking at Prolyte Systems | Prolyte systems already here. Start bringing in Prolyft | Complete portfolio here |

Segmentation

The team recommends that Prolyte focuses on the Distributors and Rental Companies. Based on the type and size of customers available in the U.S. and more specifically in Texas, the segment is mainly divided into Distributors and Rentals. There are other small market players like productions companies, schools, etc., however, this segment is small in comparison with the Distributors and Rentals.

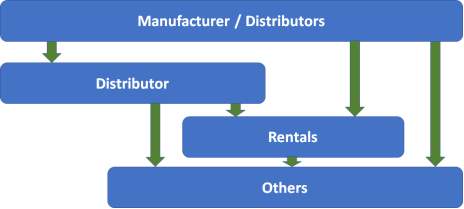

Distributor, by definition is an entity that buys noncompeting products or product lines, in this specific case, aluminum structural pieces and warehouses them to resell them to retailers or direct to the end users or customers. However, because of the nature and flexibility of the entertainment business, Distributors are also Rentals, therefore they are part of the Rentals segments.

Rentals by itself, is defined as the type of clients or companies from which the owner receives payment from the tenants, in return for occupying or using the property that for this specific case, qualifies as aluminum structural pieces.

The main idea of segmenting the market this way is to take advantage of all of the players within the market. The business model that Prolyte currently uses is mainly based on sales through distributors. Nevertheless, we recommend that Prolyte includes sales through Rental Companies too.

Based on the U.S. Live Entertainment and Concert Promotion Industry statistics from 2016, the team established that Texas owns 5.5% of the market. Between Rental Companies and Distributors, it is estimated that the whole size of the market is $58 million with $3.19 million located solely in Texas.

The revenue generated in Texas comes directly from sales to Distributors and Rental Companies in the area. However, due to the overlap existing between them, it is almost impossible to determine the portion corresponding to each segment.

In general terms, Prolyte as a manufacturer, has the opportunity to participate with all levels of segments. Appendix E outlines the relationship.

Targeting

One of the sales strategies used by Prolyte’s competitors is based off the creation of exclusivity agreements with Distributors. Therefore, some of the main Distributors in the U.S., specifically Texas, already have exclusive contracts to distribute one specific brand of structural pieces and systems.

With that precedent, our main targets in the market are the Rentals Companies in the Live Entertainment Industry with a parallel business strategy to create new deals with Distributors along the way.

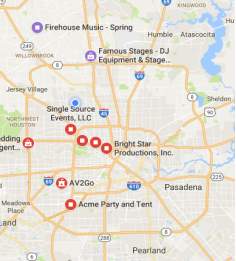

The team recommends Prolyte try to tackle the Live Entertainment industry, focusing at first on Houston local events and then branching out as they begin seeing a profit.

Events in this area include live music performances at clubs, music theaters, arenas and amphitheaters, as well as local and regional music festivals. Events can range in size from an attendance of fewer than 500 people in local clubs to more than 80,000 in arenas. As a proportion of industry revenue, this segment has experienced stable increases over the five years up to 2017.

There are 5.5% of the business establishments located in Texas which means out of 71,174 businesses in the U.S, 3,914 are based here. Texas is currently the second most populous state in the U.S., boasting a population of about 26.4 million. This market is due for expansion since currently Texas has seven of its cities listed in the top 50 most populated areas in the U.S. Therefore we recommend Prolyte to start by targeting the Distributors and Rental Companies shown below:

Distributors to target:

- High Energy Lighting

- Guitar Center

- National Ladder & Scaffold Co.

- Famous Stages

- Full Compass

- Stage Lighting Store

- Venue Supply Company

- Epicenter Productions

Truss Rentals Companies to target:

- Single Source Events, LLC (Houston)

- AV2Go (Houston)

- Bright Star Productions Inc. (Houston)

- Acme Party and Tent

- Ambient Stage Lighting Inc. (Dallas)

- Crossroads Audio Inc. (Dallas)

- Communilux Productions (Dallas)

- Famous Stages DJ Equipment & Stage

- TSV Sound & Vision (Austin)

- Stage CMDR Inc. (Austin)

- LoudMouth Rentals (Austin)

- Rock n Roll Rentals (Austin)

- ILIOS Lighting Design (Austin)

- Austin Stage Rental (Austin)

- DPC Event Services (San Antonio)

- JSP Entertainment (San Antonio)

- BP Lighting Sound & Video (San Antonio)

In addition, in Appendix E you will find a list of the distributors used by one of the main competitors and their gross sales.

Positioning

The team has developed a positioning statement for Prolyte. It is as follows:

“At Prolyte, we’re providing you with simple, reliable and affordable solutions. From the mega festivals, to the intimate DJ shows, we provide you with durable, light, and easy to assemble aluminum trusses and components.”

The components of positioning are: physical, sales force, and online.

Physical Positioning

Prolyte will initially use the warehouse space offered by CPI Wirecloth and Screens Inc. in Pearland. It is approximately a 20,000 square foot space where all the inventory to be shipped will be stored. After realizing the anticipated growth, the team recommends Prolyte to invest in a second warehouse in Miami, FL for the following reasons:

- Florida is home to 20 million people, also has 6% of Prolyte’s target market.

- It has one of the busiest ports in the U.S., hence the infrastructure to ship and receive components from the European warehouses or the factory located in Romania.

- One of Prolyte’s competitors, TAF is also located there. Hence the potential to tap into the distributors and rental market there is also strong.

The second aspect of physical presence is that of a dedicated salesforce in strategic locations. The team identifies strategic locations as: Texas, Florida, California, and the northeast at this time. A timeline to recruit sales persons is recommended for Prolyte. The order of recruiting should be Texas -> Florida -> California. The primary task in addition to sales should be attendance of trade shows, to carry out Lunch and Learns, nurture current customer relationships, and foster new ones.

The team recommends Prolyte deepens their relationship with A.C. Lighting Inc. This will enable Prolyte to use the already existing infrastructure and expertise of A.C. Lighting Inc. to expand into the northeast, and not have to hire a dedicated salesperson. The opportunity cost of initiating a new relationship is not justified.

Online Positioning

This will be performed by hiring a Digital Marketing Specialist and purchasing Google AdWords. The costs of both are highlighted in the marketing cost spreadsheet. A U.S. specific website should be created. This coupled with the recommended approaches will ensure a digital presence for Prolyte. Increase in activity on Facebook, and instructional videos on YouTube are also recommended. Further, keeping the direct sales online via list price is also recommended for any customers who choose that route.

Financial Impact and Analyses and Findings

The objective of this section is to estimate time before break-even. To do that the following methodology, in order, shall be applied:

- Revenue estimation approaches and annual growth

- Cost approximation

- Translation of net income to cash flow

- Discount cash flow to present value to obtain net present value (NPV) of investment

- Break-even point adjudication

Revenue Estimation via Market Sizing:

Five approaches have been reviewed for revenue estimation. Each has been articulated here. The first approach provides information on the Motion Pictures and Theatrical Equipment Rental market size. According to the report, the industry players buy all the equipment they rent out to the movie and stage productions. Hence, the cost percentage of this industry is closely correlated to the market size that Prolyte will be attempting to enter. According to the report, Texas contains 4.7% of the businesses. Hence, 4.7% of the total nationwide market size has been quantified as the market size of Texas.

Approach 1: IBIS Report on Motion Picture and Theatrical Equipment Rental[15]

| IBIS: Motion Picture and Theatrical Equipment Rental | |

| Total Market Size | $1,900,000,000 |

| Motion Picture and Theatrical Equipment Rental % | 97% |

| Market Size MP and TE Rental | $1,843,000,000 |

| Cost % of rental companies (assumed to be cost of equipment) | 20.90% |

| Estimated Market of Equipment (United States) | $385,187,000.00 |

| % Of Businesses in Texas | 4.70% |

| Texas Market | $18,103,789.00 |

| Growth Rate of the Market | |

The second approach examines the revenues of major competitors of Prolyte in the U.S. The revenues are then combined to estimate a ‘big players’ market size.[16][17][18] The nature of the market in the U.S. is similar to Europe and the rest of the world in that the big players only control about 15% of the market. Thus the estimated revenue in this case is lower than the other approaches. A 5% revenue base has again been estimated for Texas due to the population percentage of the U.S. that resides in Texas (8%, 26M/319M) and a discount taking into account the percentage that may not be interested in Live Entertainment. The resultant market size obtained is undersized since it does not take into account the approximately 85% of the U.S. market that is comprised of revenue of small firms in this business.

Approach 2: Hoover Market Research on Competitor Revenues

| Hoover Market Research: Competitors Revenues | |

| Total Revenue of Major Competitors (United States) | $58,200,000 |

| Market Share Held By Big Players (Globally Consistent) | 15% |

| Texas portion of it (5%) estimate | 5% |

| Texas portion of Major Competitors Revenue | $ 2,910,000.00 |

The third approach reviews the market research report on the arts and entertainment market. The capital expenditure ratio here is correlated to the target market size. The 7.6% of the revenue is the capital expenditure. Typically, capital expenditure for this market is the entertainment hardware and infrastructure, i.e., stages, roof systems, and lifts. These are the core products that Prolyte will sell in the U.S.

Approach 3: Hoover Market Research on Capital Expenditures in Arts and Entertainment [19]

| Hoover Market Research: Capital Expenditures: Arts and Entertainment | |

| Large Firms Revenue (Average) | $50,000,000 |

| Number of Large Firms | 152 |

| Medium Firms Revenue (Average) | $5,000,000 |

| Number of Small Firms | 1388 |

| Total Revenue | $14,540,000,000 |

| Capital Expenditure Ratio | 7.6% |

| Capital Expenditure Amount (US Revenue for Stage HW and Equipment) | $ 1,105,040,000.00 |

| Approximate % of Texas Businesses | 5% |

| Texas Capital Expenditure | $ 55,252,000.00 |

The fourth approach yields the highest market size but the team believes that this is closer to the upper limit of the market size spread. This is because the cost percentage to the businesses in this industry is not limited to the entertainment infrastructure, but also to other expenses associated with setting up the event. Since that has been overestimated, the consequent market has been oversized.

Approach 4: IBIS Report on Concert and Event Promotion Market[20]

| IBIS Report: Concert and Event Promotion | |

| Event Promotion Industry Revenue Growth | 1.20% |

| Event Promotion Industry Revenue (Nationwide) (Annual Growth 1.2%) | $28,500,000,000 |

| Cost Distribution (21.3%, IBIS report, 21.3% of 20% of Rental Mkt Cost) | 4.26% |

| Estimate of equipment spending (United States) | $1,214,100,000 |

| Texas % estimate based on number of companies | 5.50% |

| Event Promotion Industry Revenue (Texas) | $1,567,500,000 |

| Cost Distribution (21.3%, IBIS report, 21.3% of 20% of Rental Mkt Cost) | 4.26% |

| Estimate of equipment spending (Texas) | $66,775,500 |

The fifth and last approach was attempted by the consulting team. The team started from scratch. First, the end customers of this equipment was analyzed. These are the various festivals, concerts, live events, and trade shows that have at least one or more stages.

The next step was to state educated assumptions of percentage of small, medium, and large stages required in each event. This was done via online research for small, medium, and large events based on user attendance.[21] The size of the event obviously determines the number of stages in each. Most medium and large events have combinations of small, medium, and large stages.[22]

The price for the H30V and Verto family of trusses has been provided by Prolyte. Research was done and calculations demonstrated here in the report were carried out to understand the number and kind of trusses required to build a small, medium, and large stage.

Armed with the stage size, cost per unit, and number of stages, the total revenue per stage was first calculated. That, multiplied by the number of stages per event and the events per year provided the team with market size assumption.

The following pages show the calculations in detail, arriving at a market size manually.

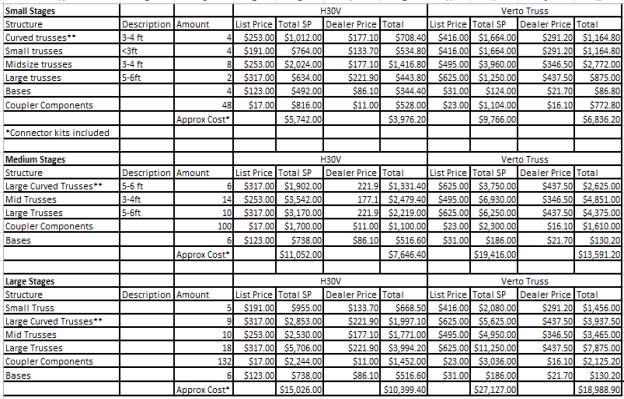

Approach 5: Independent Analysis Based on Cost of Stage & Events Held

Cost of Stages Based on Size and Number of Trusses: H30V Example

| Small Stages | H30V | |||||

| Structure | Description | Amount | List Price | Total SP | Dealer Price | Total |

| Curved trusses** | 3-4 ft. | 4 | $253.00 | $1,012.00 | $177.10 | $708.40 |

| Small trusses | <3ft | 4 | $191.00 | $764.00 | $133.70 | $534.80 |

| Midsize trusses | 3-4 ft. | 8 | $253.00 | $2,024.00 | $177.10 | $1,416.80 |

| Large trusses | 5-6ft | 2 | $317.00 | $634.00 | $221.90 | $443.80 |

| Bases | 4 | $123.00 | $492.00 | $86.10 | $344.40 | |

| Coupler Components | 48 | $17.00 | $816.00 | $11.00 | $528.00 | |

| Approx. Cost* | $5,742.00 | $3,976.20 | ||||

| *Connector kits included | ||||||

| Medium Stages | H30V | |||||

| Structure | Description | Amount | List Price | Total SP | Dealer Price | Total |

| Large Curved Trusses** | 5-6 ft. | 6 | $317.00 | $1,902.00 | 221.9 | $1,331.40 |

| Mid Trusses | 3-4 ft. | 14 | $253.00 | $3,542.00 | 177.1 | $2,479.40 |

| Large Trusses | 5-6 ft. | 10 | $317.00 | $3,170.00 | 221.9 | $2,219.00 |

| Coupler Components | 100 | $17.00 | $1,700.00 | $11.00 | $1,100.00 | |

| Bases | 6 | $123.00 | $738.00 | $86.10 | $516.60 | |

| Approx. Cost* | $11,052.00 | $7,646.40 | ||||

| Large Stages | H30V | |||||

| Structure | Description | Amount | List Price | Total SP | Dealer Price | Total |

| Small Truss | 5 | $191.00 | $955.00 | $133.70 | $668.50 | |

| Large Curved Trusses** | 9 | $317.00 | $2,853.00 | $221.90 | $1,997.10 | |

| Mid Trusses | 10 | $253.00 | $2,530.00 | $177.10 | $1,771.00 | |

| Large Trusses | 18 | $317.00 | $5,706.00 | $221.90 | $3,994.20 | |

| Coupler Components | 132 | $17.00 | $2,244.00 | $11.00 | $1,452.00 | |

| Bases | 6 | $123.00 | $738.00 | $86.10 | $516.60 | |

| Approx. Cost* | $15,026.00 | $10,399.40 | ||||

Cost of Stages Based on Size and Number of Trusses: Verto Example

| Small Stages | Verto Truss | |||||

| Structure | Description | Amount | List Price | Total SP | Dealer Price | Total |

| Curved trusses** | 3-4 ft. | 4 | $416.00 | $1,664.00 | $291.20 | $1,164.80 |

| Small trusses | <3 ft. | 4 | $416.00 | $1,664.00 | $291.20 | $1,164.80 |

| Midsize trusses | 3-4 ft. | 8 | $495.00 | $3,960.00 | $346.50 | $2,772.00 |

| Large trusses | 5-6 ft. | 2 | $625.00 | $1,250.00 | $437.50 | $875.00 |

| Bases | 4 | $31.00 | $124.00 | $21.70 | $86.80 | |

| Coupler Components | 48 | $23.00 | $1,104.00 | $16.10 | $772.80 | |

| Approx. Cost* | $9,766.00 | $6,836.20 | ||||

| *Connector kits included | ||||||

| Medium Stages | Verto Truss | |||||

| Structure | Description | Amount | List Price | Total SP | Dealer Price | Total |

| Large Curved Trusses** | 5-6 ft. | 6 | $625.00 | $3,750.00 | $437.50 | $2,625.00 |

| Mid Trusses | 3-4 ft. | 14 | $495.00 | $6,930.00 | $346.50 | $4,851.00 |

| Large Trusses | 5-6 ft. | 10 | $625.00 | $6,250.00 | $437.50 | $4,375.00 |

| Coupler Components | 100 | $23.00 | $2,300.00 | $16.10 | $1,610.00 | |

| Bases | 6 | $31.00 | $186.00 | $21.70 | $130.20 | |

| Approx. Cost* | $19,416.00 | $13,591.20 | ||||

| Large Stages | Verto Truss | |||||

| Structure | Description | Amount | List Price | Total SP | Dealer Price | Total |

| Small Truss | 5 | $416.00 | $2,080.00 | $291.20 | $1,456.00 | |

| Large Curved Trusses** | 9 | $625.00 | $5,625.00 | $437.50 | $3,937.50 | |

| Mid Trusses | 10 | $495.00 | $4,950.00 | $346.50 | $3,465.00 | |

| Large Trusses | 18 | $625.00 | $11,250.00 | $437.50 | $7,875.00 | |

| Coupler Components | 132 | $23.00 | $3,036.00 | $16.10 | $2,125.20 | |

| Bases | 6 | $31.00 | $186.00 | $21.70 | $130.20 | |

| Approx. Cost* | $27,127.00 | $18,988.90 | ||||

With the cost of stages using H30V and Verto Truss presented, the number of festivals and trade shows held annually is used to calculate the market size. The percentage share of market in Texas, consistent with the other approaches, is estimated at 5%. To calculate the revenue estimates, the team chose the first approach, which was the Motion Picture and Theatrical Market cost. It is also worthwhile to note that the fifth approach, independently calculated by the team, came close to the market size estimated in the first approach. Others were either under or overestimates of the same metric.

| Based on Cost Of Stage & Events Held | |

| Revenue from Festivals | $ 205,486,680.00 |

| Revenue from Trade Shows | $ 6,004,269.60 |

| Revenue from Festivals (Verto) | $ 357,647,959.20 |

| Revenue from Trade Shows (Verto) | $ 10,585,409.52 |

| Texas Revenue Based on Cost of Stage & Events Held | |

| Texas % | 5% |

| Revenue from Festivals | $ 10,274,334.00 |

| Revenue from Trade Shows | $ 300,213.48 |

| Revenue from Festivals (Verto) | $ 17,882,397.96 |

| Revenue from Trade Shows (Verto) | $ 529,270.48 |

An initial assumption of market size penetration by Prolyte is made. It is also assumed that each year, Prolyte will increase its market share by 0.5%-1% nationwide. The positioning is aligned to achieve that and has been described in the marketing strategy section. Here, the revenue is calculated based on the assumed market share penetration and the size of the market calculated earlier. Revenue growth factors are: capture of greater market share, placement of sales resources in the areas where the market has a concentrated presence of customers, and strategic placement of the second warehouse.

The chart provided below demonstrates the market sizes obtained through each method. The nationwide and Texas size of market under each approach is also shown. The red oval indicator shows that the first and fifth approach yielded sizes in similar orders of magnitude and figures that were sensible in nature.

Prolyte has provided the sales summary for various nations in the Americas in the Years 2010 to 2017. A snapshot of that is provided in the following page. It can be seen that depending on the nation where the final sale is made, the COGS varies. Depending on the nation, it can be anywhere between 33% and 58%. The team has obtained a weighted average of COGS based on sales revenue, as an assumption for our analysis.

It is also observed that sales in the United States has been sporadic. This was mentioned during one of our client calls as well. Regardless, the weightage was not affected negatively. The financial analysis has been broken down into sections to enable Prolyte to understand how the team arrived at net income estimates.

Prolyte Sales Summary: COGS Weightage

Revenue and Cost of Goods Sold (COGS) Estimate

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Revenue | ||||||

| Prolyte’s Market Share Attempt | 1.00% | 1.5% | 2.5% | 3.5% | 4.5% | |

| Prolyte’s Revenue | $105,745.47 | $3,172,364.24 | $5,287,273.74 | $7,402,183.24 | $9,517,092.73 | |

| COGS | ||||||

| % of Revenue COGS (Sales Summary Provided By Prolyte, Weighted Average Based on Revenue) | 36.5% | |||||

| From data provided by Prolyte on their previous sales, the COGS is quantified as a certain % of revenue. | $38,597.10 | $1,157,912.95 | $1,929,854.92 | $2,701,796.88 | $3,473,738.85 | |

| Gross Profit | $67,148.38 | $2,014,451.29 | $3,357,418.82 | $4,700,386.35 | $6,043,353.88 | |

| Gross Profit Margin (Based on COGS estimation) | 63.50% | 63.50% | 63.50% | 63.50% | 63.50% |

Marketing Cost Breakdown

Marketing Cost Breakdown

The 3-year marketing cost projection has been broken down below. The three categories articulated are: traditional marketing, digital marketing, and in-person promotion. The costs associated with each step have been provided for reference, and included in the financial analysis. Post 3 years, a 5% increase in marketing costs is assumed, staying 2 points ahead of inflation.

Fixed and Variable Cost Estimate

The fixed and variable costs consist of salaries of people and the country manager, utility costs, and other fringe costs. The advantage of partnership with CPI Wirecloth and Screens Inc. is that the warehouse floor space lease and other initial infrastructure setup is minimal, which works in Prolyte’s favor. As Prolyte’s footprint in the U.S. grows more sales people need to be employed. That is coupled with marketing costs already mentioned. The salesforce needs to be equipped with tools, freedom to travel to potential customer sites, and tangible entities like brochures, presents etc. The costs have been incorporated here as well.

Expansion Costs

The team has recommended expansion to Florida in the third year. There, unlike the CPI Wirecloth and Screens Inc. case, a presence must be initiated from scratch. Warehouse location identification, budget for leasing cost (which in many cases is not just a base rent but a three-tiered cost), utility, and insurance needs to be allocated. This is in addition to the cost of transporting inventory to Florida. Expansion costs have been detailed in the table below.

Total Costs, EBIT, and Net Income Estimates

Total costs, based on criteria above, EBIT, and net income have been calculated, with an upper corporate tax estimate in mind.

Prolyte is expected to break even in the second year of its U.S. operations. The net income in the third year is expected to suffer a setback due to expenses associated with a warehouse in the Miami-Dade area. This recommendation has been articulated in the ‘Marketing Strategy’ section of the report. Henceforth, with nationwide expansion of sales personnel, Prolyte’s revenue is expected to grow annually, as shown for years 4 and 5. Prolyte reaches its sales target of $3 million in the second year. However, the costs associated with the initiation of the operations and consequent expansion mean that steady growth is expected starting year 4.

Recommendations

Portfolio

The team recommends Prolyte to initiate their U.S. campaign with their truss and stage portfolio. Prolyte is recommended to target the distributor and rental segment, particularly the latter. The list of rentals to immediately target has already been provided. It is recommended to initiate Prolyte Systems into the U.S. starting year 3 of operations. Prolyft should be brought to U.S. starting year 4.

Digital Presence

Prolyte is advised to create a U.S. only website like one of its competitors, TAF. The cost to perform this task has been incorporated in the digital marketing cost section.

Market Size and Segment