Integration of E-commerce and Traditional Supply Chain for a FMCG company

Info: 9015 words (36 pages) Dissertation

Published: 22nd Feb 2022

Tagged: BusinessE-commerce

Contents

Click to expand Contents

Research Methodology

Literature Review

Background and Motivation

Introduction

Swiggy and relevance of Third Party Logistics

Grofers and E-retail

Executive Summary

Examples of Companies who embraced digital in the FMCG space

Dabur

Airtel

Examples of companies who can do it in the near future

Zara

Starbucks

MAIN PROJECT

Case analysis for HUMARASHOP-HUL

Case Analysis-ZARA goes Online

Live Interviews

Results and Analysis

E-commerce penetration is not even

FMCG online shopping trends in India

Conclusion and Recommendations

Potential Implementation Platforms

Problems that companies face by adding ecommerce to their supply chain

Benefits of adding ecommerce to supply chain

Pathway to ecommerce implementation

Potential for synergy

Appendix (Attach the survey and the responses)

Primary Survey

List of Figures

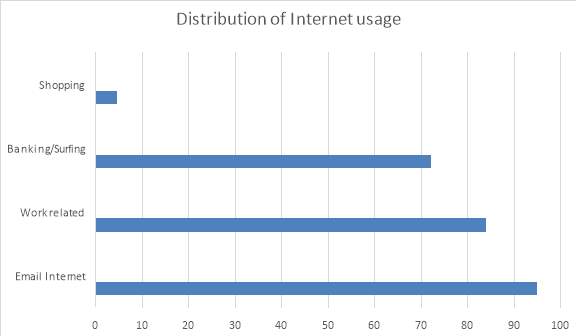

Figure 1 Distribution of Internet Usage

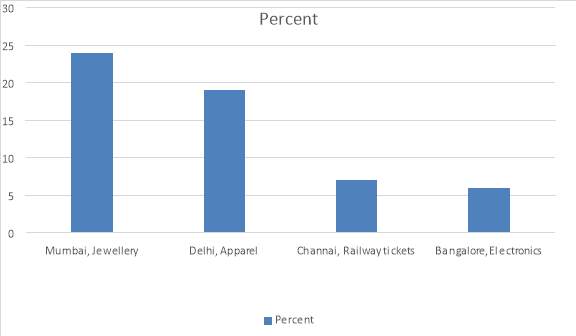

Figure 2 Citywide Shopping Trends

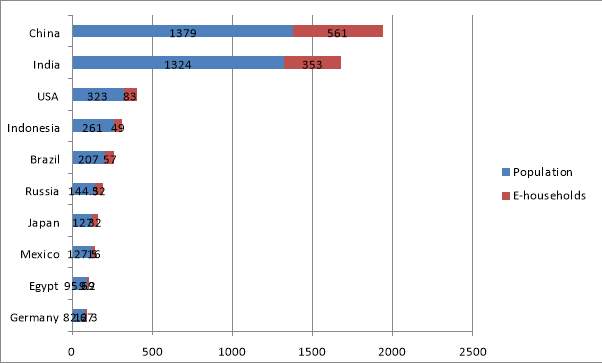

Figure 3 Top 10 countries in terms of population and e-households

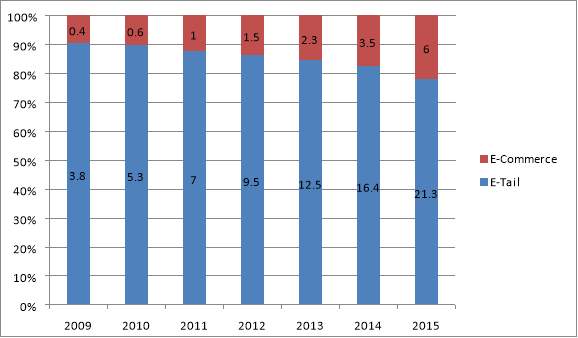

Figure 4 E- commerce E-tail

Figure 5 Share of e-tail in Indian retail

Figure 6 Orders per million

Figure 7 Survey of 1000 U.S. people revealing their favourite items online

Figure 8 E-Commerce Penetration by Category (in percentage)

Research Methodology

The focus of this research is on why and how FMCG companies can increase their penetration online. More internet usage by Indians coupled with increasing online shopping experiences, imply that more than ever number of people are interested in the potential of ecommerce as a service platform.

An exploratory research is carried out to get insights into the issue and situation. The purpose of this is to get clarification regarding concepts and acquiring insights into the current industry. An extensive literature review of published material relevant to the industry was also carried out to develop an in-depth understanding of electronic retailing in the country. Thereafter this paper looks at the current state of the art supply chain models adopted in the industry. Using this knowledge, this paper will try to explore the possibility of applying these models in the Indian FMCG industry.

We use a combination of interviews and secondary research to help us identify the current environment surrounding e-retail in the country. The research also uses surveys which we conducted with stakeholders who have worked in the industry. Two case studies on popular implementation of e-retail was also studied as a part of this project work, in order to establish key insights of implementing and running an e-retail business successfully.

Some of the questions that we are hoping to answer through all this

- Online market in India – Brief analysis

- How to enrich the eCommerce portal?

- How to improve online service?

- How to streamline the supply chain processes?

- How to retain customers trust for their personal information?

- How to build the online portal brand

Furthermore, we designed a survey to help map key factors, which we derived using the existing business strategy models, to help understand driving forces for adoption of E-retail specifically among the customers. Based on the survey results, and the insights we derived using the earlier steps, we establish a roadmap for e-commerce integration with the FMCG sector.

Literature Review

E-retail has emerged as one of the primary competitors for brick and mortar retail stores both in India and abroad. Older and traditional retail are facing a competition that they weren’t prepared for. However in their attempts to catch up with competitors most of these traditional brick and mortal retails have been caught up in supply chain complexities. Though an Omni-channel retail might look pleasing the truth is that in most of the cases, it has not been possible to implement efficiently.

The contrasting nature of both is one of the major concerns when it comes to developing an integrated solution. In traditional retail stores we see a sequential multi-tier structure allowing for the flow of goods from a manufacturer to a centralized warehouse, ultimately ending up with a centralized warehouse. In such a system movement of goods is slow and cost of operations are very high. The inventory is distributed across the chain resulting in high costs. The cost of logistics only extend to the point of delivery of bulk movement of goods right up to the main store and not beyond.

In contrast, e-retail does away with such a warehouse model and focusses instead on importing items directly to a warehouse without having to face any of the cost overheads. The typical consumers of such a service are also very different from the ones who prefer typical brick and mortar retail. They expect timely delivery, and the onus of last mile delivery rests with the e-commerce store and not the retailer.

In such a system, the delivery boys are the only point of contact between the company and the customer. Realizing this many of major e-commerce giants prefer to have their own instead of hiring third party logistics as was the norm in the past. As an industry, this model is yet to be proven to be profitable.

Integrating both of these models have proven to be difficult as for the traditional retailers ensuring online delivery often means picking up goods anywhere from the value chain in order to ensure timely delivery.

Similarly, for a pure e-retail store ensuring that a broken, defective item can be returned has also proven to be difficult. Across the world, big retailers who have made a late entry into the e-retail business are finding it difficult to establish a foothold in the Industry.

Figure 1 Distribution of Internet Usage

Figure 2 Citywide Shopping Trends

Figure 3 Top 10 countries in terms of population and e-households

The result of all the above graphs shows that online shopping is on the rise, and people are increasingly looking for e-commerce firms to satisfy their demands. Shopping online, from apparel to electronics, has become very convenient.

India’s growth potential

India’s e-commerce sector is one of the fastest growing in the country. The sector has shown a CAGR of 34% and is expected to rise to 16.4 billion USD by 2014. The sector is expected to be in the range of 22 billion USD by 2015.

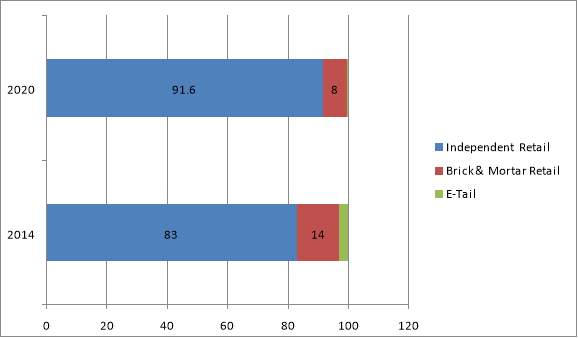

Figure 4 E- commerce E-tail

Figure 5 Share of e-tail in Indian retail

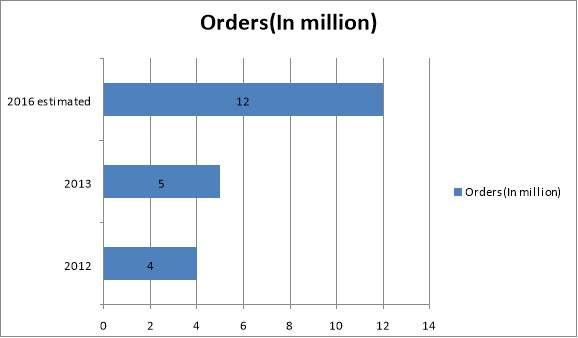

Figure 6 Orders per million

E-tailing sector in India is expected to reach 3 percent of the total retail in India by 2013.

Figure 7 Survey of 1000 U.S. people revealing their favourite items online

E-commerce offers manufacturers the choice of choosing a new direct channel to help reach their consumers. Since, consumers prefer shopping at online sites with the widest selection of products, as a result pure play e-tailers continue to stay relevant, and are the de-facto choice for most users.

Background and Motivation

Internet has revolutionized the way people communicate with one another. The online ecosystem provides a chance for customers to place an order in line with their personal requirements. The retailing industry, as with others in the sector have undergone huge change as more and more people have started to shop online. Now people can view catalogue, product details, check availability and order products online.

In the global scenario the market for FMCG online marketing is huge when compared to India. According to reports by IMRB, the forecasts for the Indian online shopping market are positive and FMCG has the potential to be at the forefront of this change.

With the coming in of internet the retailing industry underwent a huge transformation in the global landscape. E-retailing has become the norm globally, allowing global supply chains to become more automated and efficient. However, this growth was not shared universally.

Non-consumables like electronics have been the bread and butter for most ecommerce firms around the world. The market for grocery has had mixed fortunes. Overall online accounts for a small share (3.7%) of FMCG sales in the country. Although it’s a small figure, the potential for growth is immense, providing significant opportunities for traditional retailers. FMCG sector continues to grow at 31% CAGR, and ecommerce is expected to account for over 5% of FMCG sales by 2018.

The supply chain is a network used to deliver products and services right from raw materials directly to customers, along with a flow of information and cash. In essences the activities included within this model are the design, planning and implementation of all supply chain activities derived with an overall aim of achieving net value. Some of the key deliverables in supply chain are faster delivery, improved quality and reduced costs, all done with the primary purpose of satisfying customer’s needs. The existing supply chain ecosystem needs to be modernized in order to meet the growing needs associated with the sector.

Achieving global reach is the most important factor for a firm to survive in today’s competitive business environment. With the pervasive influence of the internet, enterprises must make use of internet in order to achieve integration within their supply chain models.

Introduction

The retail industry is going through a seas change in the country, with e-commerce emerging as a significant force in the sector. The successful integration of e-commerce with existing physical channels has become extremely important with time. The combined market for retail and online purchase has reached close to 25 billion this year alone. Some of the businesses that we analyzed as a part of this case are:

Swiggy and relevance of Third Party Logistics

Swiggy, the food ordering and delivering app based out of Bangalore is a success story in itself. Swiggy made an entry into the e commerce business in 2014, a time when e commerce businesses like Zomato had already made its mark. Swiggy had to come up with a differentiating factor. A business model that solves the customer’s pain of getting food delivered at doorstep and yet be unique in its own ways. Swiggy employs a single window for ordering food from a variety of restaurants present within a locality and get its delivered in an average of 37 minutes, a time duration which in itself was a huge improvement over Swiggy’s competitors like TinyOwl and FoodPanda. Swiggy has own fleet of delivery boys who are equipped with smartphones and the Swiggy app, which helps the user to track their delivery through routing algorithms. This not only enables swiggy to deliver food in time (duration of less than an hour in almost all the cases) but also have a no minimum order policy.

The differentiating features that Swiggy offers can be summarized a follows:

- It has its own fleet of delivery personnel who collect the food ordered by the consumer on one end. Once the order is confirmed by the restaurant and is under the preparation process, the Swiggy delivery executives reach the restaurant and pick up the order. The personnel then picks the order and use the tracking map to reach the consumer and hand over the food, all fresh and hot.

- Each and every status of the executive can be seen and tracked by the consumer. In case an executive is getting late for some reason or the other, the consumers are kept informed.

- There are no minimum delivery policy. This means that a consumer will be free to order one or even half a dish if he/she so wants and swiggy will deliver it. In the case where the order does not cross a minimum limit, Swiggy charges a delivery fee which ranges from 30 to 50 INR.

- The company claims that the reason why dominos is preferred for delivery of food is because it takes less time to deliver (30 minutes). This is precisely why Swiggy gives a huge importance to timing. Its average time is just 37 minutes. This is another differentiating factor of Swiggy.

- Swiggy has recently introduced Swiggy assured delivery where the customers are assured of delivery within displayed time with minimum fluctuations. This ensures sellers of no cancellation from the side of the consumer and ensures consumer of delivery within a time frame at the same or delivery price.

- Swiggy is very responsive to its user experiences. Its supply chain is quite small, starting from restaurants to delivery executive to final consumer. The two ends of the market it has to manage are taken care off by swiggy.

Grofers and E-retail

Grofers is an E-commerce business engaged in procurement of delivery of groceries and other household items to the doorstep of consumers. It was founded in December 2013 by Albinder Dhindsa & Saurabh Kumar. A mobile application is used by customers to order groceries which are delivered to them at a delivery charge of 30 INR within a stipulated time. Grofers business model requires it to have a well-managed supply chain.

Since Grofers is involved in order pickup and door to door delivery it has to maintain a huge stock ready to be picked up. Grofers gets an average of 2000 deliveries per day, with such a massive amount of orders, a good supply chain is a must. After the advent of Grofers, supplies of local retail stores gets over quickly and if they don’t maintain the inventory, Grofers will suffer the consequences. This is why Grofers has to contribute to the inventories of these retails from the supply side.

Grofers business model, in terms of supply chain is thus:

1. Customer places order

2. Delivery executive pick up orders at local retail store

3. Delivery executive packs the order in required quantities

4. Delivery to the final consumers

Warehouses

Grofers has partnered with local retail stores to open warehouses. These warehouses are different from the physical outlet of the store. These stores are called dark stores and it is open only to these delivery boys and not to public. A real time amount of inventory in these warehouses are in sync with the platforms which helps to identify which item is selling fast and what needs to be updated. The amount of floor space taken by each item is also accounted for.

In cities like Delhi, Mumbai and Bangalore these exclusive warehouses have already been set up. Grofers also ensures that the perishable items in these warehouses do not get wasted or rot to reduce wastage. Grofers will be second such company to work with inventory led model of E commerce after BigBasket. With 20000 order per day an inventory led model will fetch more profit and ensure timely delivery of goods.

Executive Summary

Examples of Companies who embraced digital in the FMCG space

Dabur

Dabur is India’s largest Ayurvedic medicine & related products manufacturer. Dabur was founded in 1884 by SK Burman. Its revenue in the 2015-16 fiscal year stands at ₹84.54 billion. The FMCG products of Dabur include Real Juices, Real Activ, Hajmola Yoodley, Lemoneez, Hommade and Real Burst. The company was one of the last big players in the FMCG sector to have shifted its attention towards online retailing. Once it entered in online retail, the share of revenue from online retail has been consistently increasing.

Airtel

Bharti Airtel Limited is an Indian global telecommunications company based in New Delhi currently operating in 18 countries in the world. It is the largest mobile operator in India and the third largest in the world with overall 400million subscribers. It was founded in 1992 by Sunil Mittal who is also currently serving as CEO of the company. It provides services such as fixed line telephone, Mobile phone, Broadband, Satellite television, Digital television, Internet television, IPTV. It has a total revenue of ₹966.021 billion (US$15 billion) as of 2016. It has 23.54% market share in the Indian telecom sector. When Jio entered the telecom sector in India it took many steps to ensure that the customers do not find any difficulty in accessing the service. One of its key initiative was to provide the customers of free delivery of the sim card. To compete with Jio, Airtel also started the same scheme. The process had to be started by the customer through an online request. After that the sales person will bring SIM to your doorstep and the rest of the process is same.

Examples of companies who can do it in the near future

Zara

Zara is a Spanish clothing and accessories retailer based in Arteixo, Galicia founded in 1975 by Amancio Ortega and Rosalía Mera. Its revenue stands as of 2016 at US$15.9 billion. Zara does not sell online. There are various reasons associated with it. – it has a policy of zero advertising. The revenue it saves from advertising is rather invested into a new store. Moreover it sees selling in an online site as detrimental to its positioning on the consumers mind. It also feels that apparels need to be first bought after having a feel of the product which is not possible in online retail. Extra cost of packaging and ratio of return order is also a daunting challenge. Zara also changes its product in every two weeks so that also makes it difficult to operate in an online market.

Starbucks

Starbucks Corporation is an American coffee company and coffeehouse chain. Starbucks was founded in Seattle, Washington in 1971. Though it has a high number of store worldwide but it has been totally absent from the online market. Starbucks merchandise are sold in online market but not the items which they sell. In a time when there are many startups providing fresh food through online retailer Starbucks still follows the trend of brick and mortar shops. The basic reason here is the freshness of the product being compromised. The other factors are same in this case. At present it seems here is no need for it to enter into the online segment. Though a better way of online retail may force it to change its mind.

MAIN PROJECT

Case analysis for HUMARASHOP-HUL

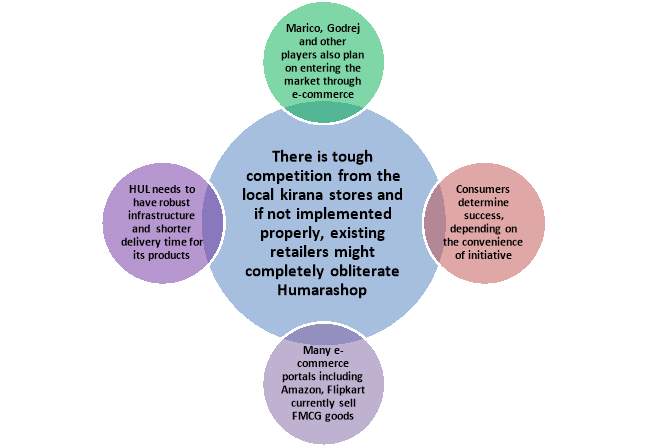

Fast moving consumer goods (FMCG) behemoth Hindustan Unilever (HUL) has changed the operations of its from physical servicing to an online ordering and fulfillment model. This could likely pave the way for the company’s e-commerce debut. It was reported that HUL would be looking to use its retail distribution reach across the country to deliver products to consumers at their doorsteps with kirana stores playing a key role in the project

While the newspapers keep talking about Flipkart and Amazon under the e-commerce topics, HUL has quietly launched its first e-commerce initiative. Today there is a lot of opportunity available in e-commerce business for newcomers and HUL probably realizes this and the factors required in this segment are innovative and creative decision making power. The consumer goods giant launched Humarashop.com recently as a pilot initiative to tap the grocery segment. The project has been rolled out in Mumbai to start with and has tied up with several neighbourhood ‘kirana’ stores to reach out to the consumers indirectly.

The strategists are experimenting different business models to learn the tricks of the trade. Humarashop.com, which connects shoppers with local retailers, is one such pilot to understand the changes in the consumer space and build a better understanding of this. Although HUL will push its own products by offering attractive incentives to the kirana store owners, it will also allow consumers to buy other brands. This aspect is thought to give the competitive advantage to them. HUL will not only help the ‘kirana’ retailers have an online presence by creating a different page for each store, but also carry out the delivery for them.

However, the company has not made it clear whether they would be owning the supply chain and logistics. If an informed estimate is made, HUL’s Humarashop is based on online ordering and fulfilment model, which means the company will not own any inventory. Also, the Humarashop.com site says it will deliver any product in just two hours anywhere in the city. Meanwhile, given the highly competitive nature of the industry, other players such as Godrej and Marico are also mulling an online play. In this regard, the maker of Dove soap and Surf detergent, HUL, is also contemplating rolling out the service to other metros soon.

Others existing players in this segment

It’s worth noting that many other online marketplaces such as Amazon, Flipkart and Snapdeal have begun selling everyday consumer products. For example, Amazon said categories such as skincare, baby nursing, make-up, deodorants and grooming products have grown by more than five times in the past year, as indicated by an Economic Times report. Snapdeal also expects the growth to be around 50 times in the coming three years.

Future Group has launched a B2C portal for Big Bazaar Direct recently. The web portal currently lists mobiles, electronics, appliances, fashion, home & living, kitchen & dining and luggage & travel categories. To place an order a user needs a franchisee code which can be obtained from franchisees close to the user.

Who can be the Competitors?

One cannot simply expect to be the only player around when the potential of the market is so high and e-commerce further exposes newer segments and widens customer base. Many giant competitors of HUL have begun taking steps but they are not the only ones trying their luck.

Online beauty products store Nykaa has raised Rs 20 crore through undisclosed private investors, earlier in July 2014. Nykaa currently offers beauty and wellness products across various categories like makeup, skin care, hair care, bath & body products, perfumes, colognes, and herbal products among others. It claims to offer products from more than 200 brands like Ponds, Dove, Gillette, Johnson & Johnson, L’Oréal, Garnier, Maybelline, Lakme, Revlon, Esprit, Jaguar, Axe, Braun and Park Avenue among others.

Other players in this segment include Purplle.com which had raised an undisclosed amount of investment in Series A funding from Blume Ventures, Mumbai Angels and Chennai Angels in August 2013, Bangalore-based VioletBag and Mumbai-based Beautykafe.com.

Mumbai-based Fab Bag (previously Vellvette) also offers a subscription based cosmetics service and had raised $500k from India Quotient and angel investors Nitin Agarwal and Siddharth Ladsariya in Feb 2013.

Case Analysis-ZARA goes Online

Zara expects to launch online sales in India in 2017 according to one of its leaders. In one of the fastest growing ecommerce markets in the world the Spanish giant will start selling online. To be sure, Zara started leveraging the online sales route only in March this year in just two countries Singapore and Malaysia. Zara, the world’s largest fashion retailer, can no longer stay off the burgeoning e-commerce market in India. It will start selling online in Thailand and Vietnam in next few weeks, the company said in the statement.

Undoubtedly, Zara began utilizing the online deals course just in March this year in only two nations — Singapore and Malaysia. It will begin offering on the web in Thailand and Vietnam in next couple of weeks, the organization said in the announcement. Zara’s intends to tap the online divert in India will grow the brand’s essence past the eight urban communities it is available in as of now. Littler urban communities and semi-provincial regions are believed to be the following development driver for web based business organizations. Zara is one of the quickest developing attire and way of life marks in India and had an income of Rs 842.57 crore in the year to 31 March 2016, up 17% from the earlier year. Comprehensively Inditex works 7,200 stores.

Zara’s opponent US attire retailer Gap Inc, which entered India in May 2015, began offering on the web in India a couple of months prior. Forever21, another American retailer, likewise offers through different online commercial centers in this market.

Inditex SA, Zara’s parent and the world’s biggest design retailer by deals, hasn’t said what number of such stores it will open. The organization’s technique, upheld by a fast fire generation framework that gives it a chance to renew its stores more rapidly than rivals, is gone for separating itself in an industry attempting to recognize the correct physical methodology.

Inditex looks to have full reconciliation of the physical stores and online organizations, with store openings that are progressively more applicable. In spite of a troublesome year for retailers, Inditex saw net benefit bounce 10% a year ago, while deals hit a record of EUR23.31 billion ($24.76 billion), as indicated by figures discharged Wednesday. That energy has proceeded with this year, with 13% development in store and online deals in consistent money terms in the course of recent weeks. Deals at Inditex stores open no less than a year rose 8% in the initial a month and a half of this monetary year, as per computations by Société Générale examiner Anne Critchlow. The Spanish retailer’s principle quick mold match, Hennes and Mauritz AB, revealed same-store deals fell 1% in February.

For quite a long time, H&M and Inditex hustled the world over opening stores. However, a year ago, Inditex began to back off its development. H&M, rather, kept up the pace, yet the push neglected to pay off, with the Swedish retailer turning around its extension designs in January in the wake of announcing a 2016 fall in benefit. Inditex, which additionally possesses the Pull&Bear and Bershka brands, on Wednesday said it intends to open in the vicinity of 450 and 500 new stores in 2017 while retaining 150 to 200 littler ones. In 2016, it opened a net 279 stores, bringing its aggregate to almost 7,300.

Investigators say Inditex’s new system leaves a lot of space for the online stage to grow without ripping apart the physical shops. By shutting littler stores and concentrating on leader stores, clients who aren’t near these stores could be nudged into shopping web based, as per examiners at Berenberg. Inditex, which doesn’t separate on the web and store deals, is attempting to incorporate the two administrations. For example, clients can get and return online locally acquired buys. They can likewise arrange online with the assistance of a store representative. “Inditex is the best-in-class omni-channel retailer, supplementing its lead stores with an exceedingly helpful online business suggestion,” Berenberg investigators wrote in a note.

For all of 2016, Inditex announced an ascent in deals at all of its eight brands, including Pull&Bear and Bershka, and over all areas. Zara alone was in charge of 66% of aggregate deals. Experts respected an arrangement to raise the profit payout by 13% to EUR0.68 an offer, mirroring the organization’s EUR6.1 billion money heap.

Live Interviews

Shrey Gupta

Internship at HUL

During the announcement of the company’s quarterly results, it was told that there would be an increased focus on HUL’s e-commerce. However, why is that we are yet to see concrete steps in that direction?

Compared to foreign-funded start-ups, HUL is taking cautious steps with expansion. When players such as PepperTap were aggressively expanding and burning cash to offer steep discounts, HUL was strengthening its position in the market. Over the last one year, the company has expanded to a few localities in Mumbai, Bengaluru, Mumbai, Delhi and NCR. It has also put in place a dedicated team to build e-commerce capabilities. According to some of my sources, besides tying up with local kirana stores for Humarashop.com, the Indian arm of Anglo-Dutch consumer major Unilever is also working with several other e-tailers such as Amazon and Flipkart.

Going forward with your opinion, how well do you think HUL will fare in its strategy?

In my opinion, HUL need not pay the kirana stores to get them on its platform. It already has a strong relationship with all of them. I would also like to add that many of the grocery portals had to pay huge amounts to convince the stores to come online. HUL has a surplus cash of INR 5,000 crore to spend on building technology or make small acquisitions that can strengthen its digital foray. The move could also help tackle rising competition from home-grown players such as Baba Ramdev-backed Patanjali.

We realize that FMCGs have begun taking steps to tap the ecommerce industry, according to you is the scope for such companies to thrive really that good?

That is a very good question. If you do some study on e-commerce, food and groceries retailing is, so far, not among the top five categories bought online. Still, food and beverage makers such as PepsiCo India Holdings Pvt. Ltd and Kellogg India Pvt. Ltd have started partnering with e-tailers.

The way I look at it, all large FMCG companies like HUL, Pepsi, Kellogg have started to look at digital advertising and selling online as their consumers are spending much of their time online in terms of seeking information first and subsequently also buying online. So the answer to your question is a resounding yes.

Kunal Chhabaria

Internship at Cloudtail

Hi Kunal! We would like to have some insight into how Cloud tail manages to integrate its supply chain and the e-commerce, since the area is relevant to the topic of our project?

There are basically different vendors who supply to cloud tail through 4 major centres across India. One of them in the North (Panipat), one is Mumbai, one is Bangalore and one in the East. If there is one product which has high demand in north and less in north cluster, the product shipments are manages such that the products from different clusters can be used to strategically satisfy demands in different parts of the country. Cloudtail is basically the one responsible for handling the entire working of Amazon. Payment happens to Amazon but the entire process is undertaken by Cloudtail.

A major reason for Cloudtail’s competitive advantage is the strategic positioning of Cloudtail warehouses and there are strict algorithms to how much inventory to hold, what kind of inventory to hold etc. Products are graded as per the damage to them or in amount of space they occupy as compared how much margin it sells for. However, this is a major area of improvement as Cloud tail is currently incurring losses in the sale of damaged good at prices significantly lower than MRP.

Amazon pantry has come up as an equally good example of ecommerce married to a robust supply chain and there is a lot to be learn by the FMCG sector. What are your views on this?

Amazon Prime is synonymous with free (two-day) shipping for the individuals who pay for the yearly participation. Yet, with another administration called Prime Pantry, Amazon is wagering that Prime clients will consent to horse up and pay for delivery for things, for example, 12-can packs of Coke or a six-move paper towel pack.

The administration gives Prime clients the capacity to arrange as highly canned sustenance’s, grain, snacks, refreshments and ordinary family unit things as can fit in a four-cubic-foot take care of that holds to 45 pounds. Regardless of how stuffed or exhaust the crate is, it costs $5.99 to convey it. As clients add Pantry things to their web based shopping basket, they are told what rate of the crate is full. For Amazon, the program gives them an approach to attempt to drive interest for a few items that would have been taken a toll restrictive to send for nothing. But if Pantry finds some success, it has the potential to build up the frequency of orders from Prime members. And that has the potential to make the economics of the AmazonFresh grocery delivery service, which includes perishable foods and drinks, look a lot better as it rolls out to more cities in the future.

Can you throw some light into the growth journey of Cloud tail in India?

Since it propelled as a vender on Amazon in July 2014, Cloudtail has extended forcefully. Its capital was expanded to Rs.500 crore a month ago from just Rs.500,000 last July, as indicated by records accessible with the Registrar of Companies (RoC). The value capital has been directed in together by Amazon Asia and Catamaran through an element called Prione Business Services Pvt. Ltd.

Aside from the Rs.500 crore in value capital, Cloudtail approaches secured credits totalling Rs.300 crore, RoC archives appear. Cloudtail is a free vender on the stage that offers items crosswise over different classes and gets an indistinguishable benefits from any of alternate merchants on our stage.

So we see that Amazon is highly dependent on Cloud tail for its revenue. How good or bad is it?

That’s a really good question. For all its success, Amazon is scrambling to reduce its dependence on Cloudtail which as of now accounts for over a third of the sales that take place on its shopping platform in India. That’s because government regulations announced earlier this year do not permit a single vendor to account for more than 25% of sales of an online marketplace where foreign money has been invested. Amazon, Flipkart and other similar marketplaces.

Over the last few months, Cloudtail has almost stopped selling mobile phones. Smartphones constituted the largest category of ecommerce sales and formed a big part of Cloudtail’s overall sales in previous years. But it continues to sell Amazon private labels in India. An Amazon spokesperson also said the company has put a process in place to assess the performance of the sellers on the platform and update sellers if they are close to or about to exceed the 25% threshold. Cloudtail is one of the 140,000 sellers that sell on the Amazon.in marketplace. The marketplace has grown tremendously in the last three years, and other sellers have also seen growth in business. The continued belief is that a robust marketplace cannot be built on a single seller focused strategy. There is a robust platform which is open to all.

Results and Analysis

E-commerce penetration is not even

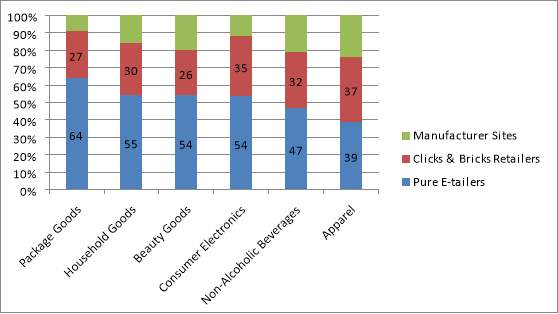

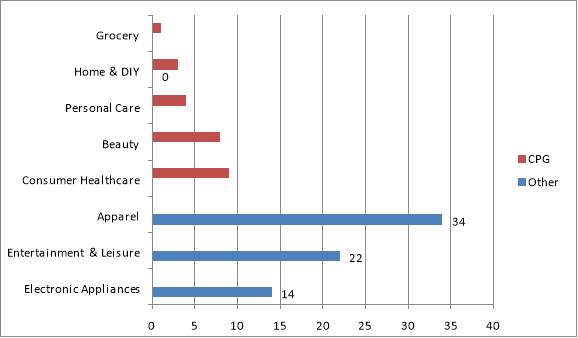

Figure 8 E-Commerce Penetration by Category (in percentage)

E-commerce penetration is not common across all categories. Some of the factors on which it depends are :

- Consideration : items that require substantial research before any purchase decision can be made, are naturally more inclined to e-retail.

- Timing : Immediate shopping needs will continue to be fulfilled online. Poor infrastructure coupled with long delivery times add to this.

- Price to shipping costs ratio : Low price items usually associated with the FMCG sector do not qualify for the added benefits of free shipping that an electronic device might enjoy.

- Sampling : Something that online sector misses out on when compared to a brick and mortar retail are the impulse decisions that one can get from it.

- Ease of transport : products that are naturally fragile or cumbersome are also difficult to transport.

Knowing these constraints it is clear the consumer health and beauty products have an advantage over others when it comes to online sale. Beauty products like cosmetics are relatively expensive, they are also easier to ship and have a long shelf life. Buying decisions on the buyer side are also more complex and are driven by extensive research that an online platform can service.

Dairy products in the other hand have some of the lowest e-commerce penetration. Short shelf lives, require refrigeration and thus are expensive to ship. In the current e-commerce supply chain model, goods such as these are not sustainable.

While the e commerce penetration rates in certain sectors like food and beverages is unlikely to match sectors such as electronics, with increasing investments in regional warehouses and growing integration between offline and online supply chain, the potential for E-retail to be a driving factor in their growth still persists.

Digital engagement through these platforms, might also help in facilitating in-store purchases among these segments. Though many of the buyers would still choose not to buy these products online, but their time online will help in influencing their decision to spend their money through offline purchases.

FMCG online shopping trends in India

The following trends were observed:

Internet Usage:

- Internet has become an integral and pervasive part of day to day life

- 96% of online shoppers have used the Internet for more than 1 year and 65% of shoppers have been using the Internet for more than 5 years

- 89% of online shoppers use the Internet for more than 5 hours a week and 42% for more than 20 Hours a week

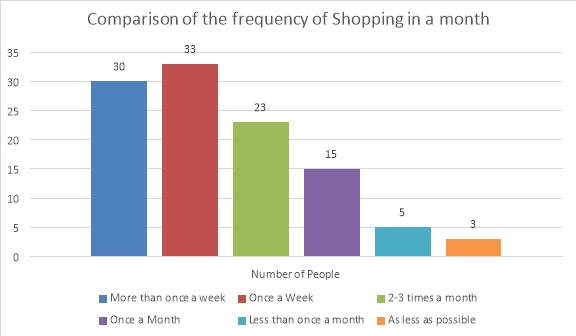

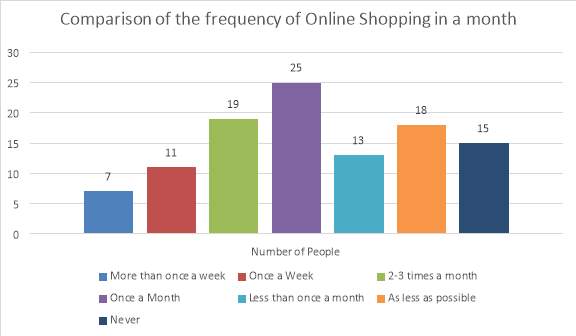

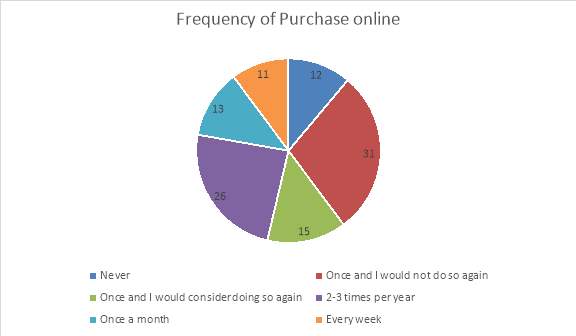

Frequency of Purchase

- 67% of online shoppers have shopped online as recently as 3 months showcasing the growing acceptance of ecommerce

- 53% of online shoppers have shopped online more than 5 times, 27% of online shoppers have shopped online more than 10 times

Wallet Spends:

- 93% of online shoppers have bought products & services above Rs 300, 89% above Rs 500, 74% above Rs 1000, 14% in the range of Rs 500-1000

- 38% have bought goods in the price range of Rs 1000-5000, 20% of online shoppers have bought goods in the price range of Rs 5000-10000 & 16% of online shoppers have bought goods in the price range above Rs 10000

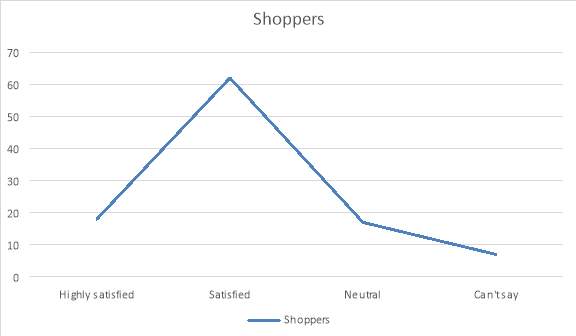

Satisfaction Index

- 18% of online shoppers are ‘Highly Satisfied’ with online shopping

- 62% are ‘Satisfied’ with their online shopping experience making a case for repeat purchases and peer to peer recommendations on this interactive medium

- 17% are ‘Neither Satisfied or Dissatisfied’ – An opportunity to convert them towards this increasingly high satisfying index

Top Reasons Shoppers Buy Online:

- 70% of online shoppers like ‘Home delivery’ about online shopping

- 62% like ‘Time saving’

- 60% of online shoppers like the ‘24×7’concept

- 45% like the ‘Ease of use’ & 39% of online shoppers like product comparisons.

Conclusion and Recommendations

Most FMCG companies are failing to leverage digital sales channel in an efficient and timely manner leading to the risk of them being unable of engaging with the market. Regardless of the strategy employed it is imperative that e-commerce firms approach digital with an open mind.

Indian online shopping prospects are extremely encouraging. Especially for FMCG firms there is an ever growing market in the E-retail space. According to IMRB’s syndicated report, the online selling in India currently stands at an estimated 1500 Crores. Some of the FMCG consumer categories, like beauty products have taken off online with close to 20% of them selling online.

By continuing with a renewed focus on other FMCG categories like Foods & Beverages, Home Provision and Grocery, Cosmetic & Perfumes, the FMCG companies can push their products online to customers.

FMCG companies have one of three strategies to go about the e-commerce integration. Choosing the correct strategy is entirely contingent on finding the right partner and the external factors that might be at play.

At present there is no significant online presence by any of the FMCG firms in the country. At present, the concept of FMCG online is being driven by external players with little to no collaboration with the FMCG firms.

Potential Implementation Platforms

E-commerce capability can be built either centrally or it can distributed for the firm. The choice is contingent on the size of a company and its maturity in the business.

- For small manufactures that are early in this business and have small operations in mind, it might make more sense to leverage existing platforms and services without having to add significant operational complexity.

- For larger manufacturers who are more mature or are planning to have significant stake in the sector, having a separate centrally run e-commerce team would make sense. A dedicated team would allow greater accountability, and flexibility in operations.

- Another alternative, is to go for a combination of the two strategies. While it would provide greater coordination across the teams, the added complexities would also require significant workarounds.

| Online Channel of Traditional Bricks & Mortar Partners | This two way approach ensures that existing customers are retained, and leveraged correctly in order to drive and fulfil e-commerce sales |

| Managed Partnerships with Dedicated eCommerce Retailers | Partnering with dedicated players in the space to leverage combines abilities and create synergies. These players would act as a 3PL provider charging the company for the services rendered |

| In-House eCommerce Capability | Developing you own e-commerce capabilities, right from order management to inventory planning and warehousing is key. |

Problems that companies face by adding ecommerce to their supply chain

Large FMCG Companies face a dilemma about which products to sell through ecommerce and which product to sell from stores. For example- Sunbeam is a coffee manufactured by ITC. It is a premium coffee brand costing 750 rupees for 100 gram pack. Now since it is a luxury product it cannot be sold online since the essence of a product is neglected in that case.

Similarly a simple 5 rupee biscuit packet cannot be sold in a online site since the quantity we need to purchase is small so we will not do online transaction of just five rupees. It will also be not feasible for the logistics to deliver that product.

Benefits of adding ecommerce to supply chain

Product can be seen by public. Also it is difficult sometimes to make the product more visible in a general store since there are many more products on the same shelf. If we sell it online then our product will get proper attention of the buyer and he can see the quality and other aspects of the product.

For retailers, it allows them to obtain orders online without having to wait for customer to step into the stores. Retailers can select products they want to sell from a digital catalogue and eliminate the need of maintaining and updating the same.

For customers, it is possible to experience a hyperlocal experience of having the confidence in buying from a trusted source, along with the seamless customer experience associated with a mobile application.

Pathway to ecommerce implementation

Omni channel retailing, a single platform that combines mobile, brick and mortar, and e-tailing solutions represents the future of the industry. A single channel, in this competitive environment is not enough which is why many of the e-tailers are looking at brick and mortar solutions and vice versa. Integrating synergy across these platforms is key

Companies need to make a balance between which product to sell online and which not to show. A optimal solution will be the one in which the product gains the attention of the buyer as well as sees the qualities of the product so that it can differentiate it from other products. Chances of building loyal customer is very high in this case.

Also in such a model, companies need to reconsider how their shopper marketing in organized and structured. For most of the firms, the experience is still sales led and aligned closely with trade promotion in the store.

However, in an omni-channel led ecosystem it is extremely important to have a digital first approach to derive engagement. Greater co-ordination and more structured approach to interacting with the customers is required.

At the back end, significant changes and investment in the supply chain are required to support integration with digital channels. Suppliers and distributers must use a combination of channels to help move and track material while also focussing on streamlining costs and operations.

An integrated and scalable technology architecture is needed, coupled with increased analytical capability to help improve shopper behaviour. Things like anytime/anywhere service which are still not that common in the FMCG space will become imperative if the business is to sustain itself. Fulfilment options like same day delivery, and online order pick up in store have to be implemented.

A distributed approach to order management services is needed, to help ensure that a perfect order is achieved. For manufactures this means distributing increasingly smaller load directly to the consumers. Factories and warehouses need new capabilities to deliver fast moving goods to consumers, as they continue to put strain on the existing infrastructure needs.

Potential for synergy

Omni Channel engagement driven by E-commerce integration will allow firm to have the sort of digital engagement that would provide the exponential growth that these firms are looking for.

Reach driven by the assets of online e-retail solutions as a digital publishing platform

Walmart.com has 66 million unique visitors daily, with most of them being the sort of segments interested in buying products. The value of such an audience is immeasurable.

Potential synergy benefits associated with advertising and content integration through collaboration between the digital marketing and e-commerce initiatives.

Appendix

Primary Survey

As a part of our academic research we conducted a primary research survey to analyse the current market for E-Retail in the country and the acceptability of the same among consumers.

Age: _________

Gender: M/F

City: __________

Occupation: _________

Marital Status: __________

1. How often do you go shopping on average? (Include in-store and online but excluding food shopping)

- More than once a week

- Once a week

- 2-3 times a month

- Once a month

- Less than once a month

- As little as possible

2. How often do you shop online?

- More than once a week

- Once a week

- 2-3 times a month

- Once a month

- Less than once a month

- As little as possible

- Never

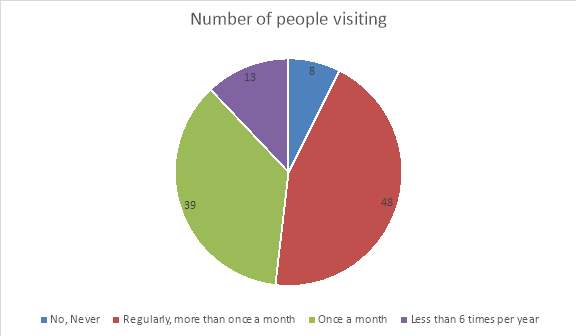

3. Do you shop at (a) department store(s)?

- No, never

- Regularly, more than once a month

- Once a month

- Less than 6 times per year

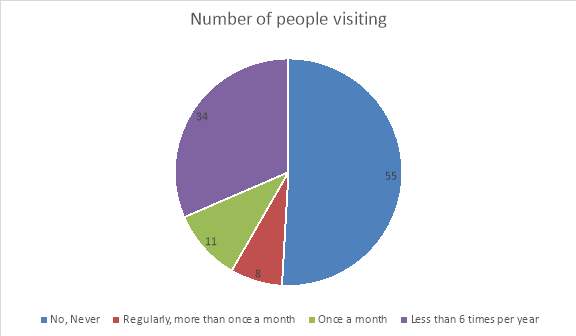

4. Have you ever shopped at a department store online?

- No, never

- Regularly, more than once a month

- Once a month

- Less than 6 times per year

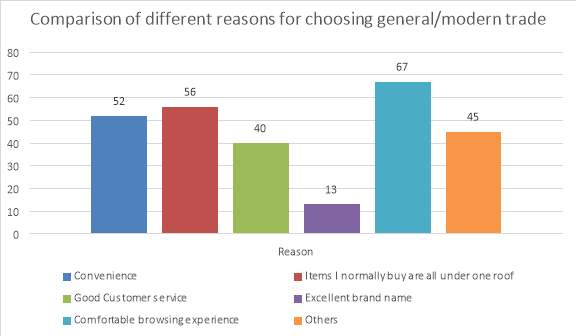

6. Why do you like shopping at a department store? Tick all that apply.

- Convenience

- Items I normally buy are all under one roof

- Good customer service

- Excellent brand name

- Comfortable browsing experience

- Other

If other specify: _______________________

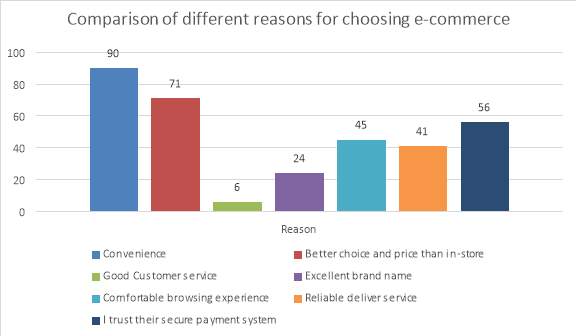

7. Why do you like shopping at an online department store? Tick all that apply.

- Convenience

- Better choice and price than in-store

- Good customer service

- Excellent brand name

- Comfortable browsing experience

- Reliable Delivery service

- I trust their secure payment system

9. How often have you bought products or services online

- Never

- Once and I would not do so again

- Once and I would consider doing so again

- 2-3 times per year

- 1 per month

- Every week

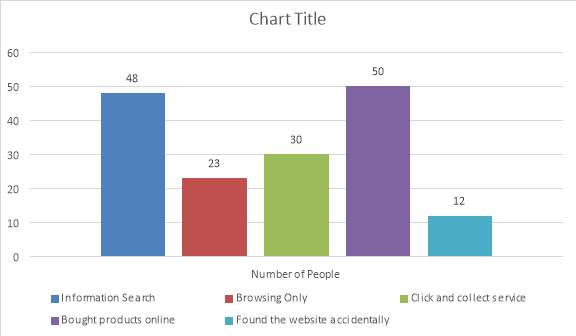

10. On your last visit to an online department store, which services did you use: (tick all that apply)

- Information search (including price comparison)

- Browsing only

- Click and collect service

- Bought products online

- Found the website accidentally

- None of the above

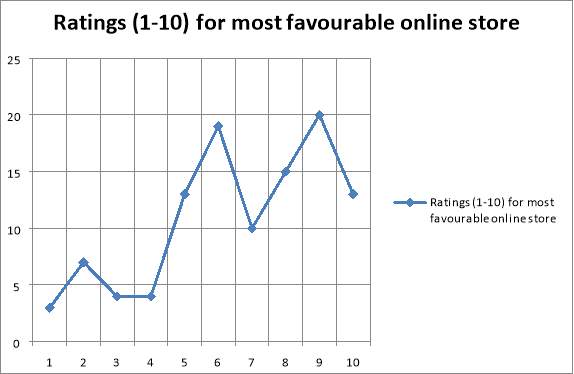

11. How do you rate your top preferred department store’s website(1-10)

Unfavourable(1) Neutral Favourable(10)

11. How do you rate your top preferred department store’s delivery(1-10)

Unfavourable(1) Neutral Favourable(10)

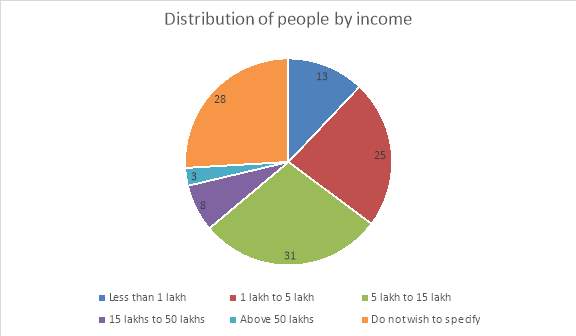

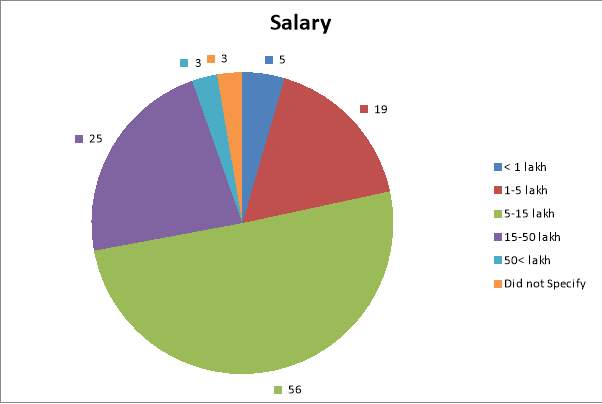

12. Average household salary, please choose which applies to your household.

- Less than 1 lakh

- 1 lakh to 5 lakh

- 5 lakh to 15 lakh

- 15 lakh to 50 lakh

- 50 lakhs and above

- Do not wish to specify

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "E-commerce"

E-commerce is process of buying and selling goods or services online. Some businesses only operate through E-commerce, whilst others have both E-commerce and physical stores to sell their products or services.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: