Bodegas Xaló: Entry Strategies and Marketing Mix for the Polish Market

Info: 7251 words (29 pages) Dissertation

Published: 25th Jan 2022

Tagged: MarketingInternational Business

Table of Contents

Click to expand Table of Contents

Introduction and Company Background

The Area Being Investigated: “Bodegas Xaló: Entry Strategies and Marketing Mix for the Polish Market”

Data and Information collected

Poland

Poland’s Alcoholic Drinks Market

Poland’s Wine Market

Consumer Profile

Wine Prices and Distribution Channels

Promotion Instruments

Legal Requirements

Packaging

Analysis of Data and Interpretation of Results

Winery’s Strengths and Weaknesses

Market Analysis

Market Entry Strategy

Marketing Mix

Conclusions

Recommendations

Reference List

Appendix

Project Proposal

Brief background to the company

- Bodegas Xaló is a cooperative located in Alicante, Spain.

- A winery was founded in 1962 by the cooperative to produce and keep wine.

- Hard work and new technologies have helped to improve the quality of the product and customers’ awareness of it.

- The cooperative now has 12 employees, and an annual turnover of approximately 3 million euros.

Brief background to the project

- This project will focus on the cooperative’s potential entry into the Polish wine market, analysing past patterns, current influences, and possible future trends.

- I intend to use the learned material in the International Marketing Strategy module. I will emphasise the importance of planning and researching to select an adequate method of entry and distribution. I am planning to study growth and opportunities within the Polish wine market, business culture and language, consumers’ expectations and how pricing affects their choices, position of Spanish wine within the Polish market, available distribution channels and relevant legislation.

- I aim to carry out interviews in the winery. I will ask the following questions:

- Is your winery growing more local grape varieties than internationally known ones like Chardonnay, or Merlot etc, and why?

- Why do you think your wines are winning international rewards lately?

- What differentiates your product from others in the same class?

- Do you research new markets/opportunities?

- Where do you currently export?

- Why and when did you start exporting?

- Which products do you export more of?

- Which distribution channels do you normally use?

- What problems did you have to face when you first began exporting?

- Have you ever changed a product or packaging for exporting purposes? If necessary, would you?

- How do you normally deal with new potential markets?

- Do you have any knowledge of the Polish market at all?

- I would hope completion of the project would lead me to be able to determine whether or not the winery has a good possibility of succeeding in the Polish wine market, and recommend the most suitable strategy to follow.

The main reasons for choosing the project:

- The cooperative has improved the local economy, encouraging landowners to cultivate abandoned vineyards again. Cooperatives, like Xaló’s winery, help reduce the migration of younger people to urban centres by providing a future for the rural economy.

Benefits to the company

The principal benefits to the company include:

- Increasing sales

- Increasing profit

- Minimising the effect of seasonal fluctuations in sales in the home market

Cost implications

- Researching and analysing the data will require time to carry out. The project will be done in my time off work. Consequently, no costs should be taken into account for this.

- There may be costs incurred for buying studies carried out by official bodies, like the Spanish embassy in Poland.

- To help and gather more information, I intend to interview the winery’s oenologist and the professional dealing with the winery’s exports. The cooperative does not have dedicated export department.

- If the winery decides to enter the Polish market, the cooperative will have to select the market entry mode. Choosing one mode over another can vary costs, control and risk. Every new market entry carries a cost and the companies need to make sure that they can afford the investment.

Overall project plan:

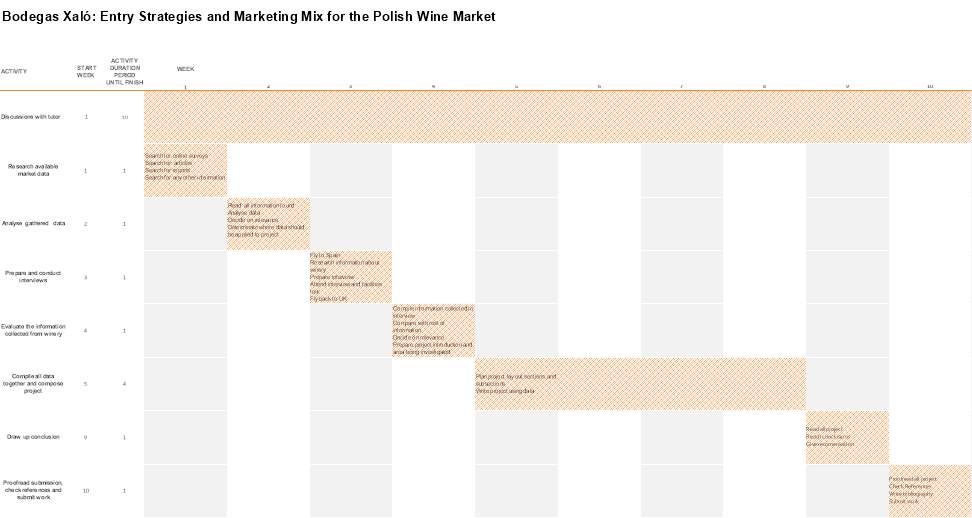

- Discussions with tutor Weeks 1–9

- Research available market data Week 1

- Analyse gathered data Week 2

- Prepare and conduct interviews in the winery Week 3

- Evaluate information collected from winery Week 4

- Compile all data together and compose project Weeks 5-8

- Draw up conclusions Week 9

- Proofread submission, check references and submit work Week 10

Approved Yes

Signature tutor

Project Plan (see Appendix 1)

Weeks 1–10 Discussions with tutor

Week 1 (26/06/17 to 03/07/17) Research available market data.

- Search for surveys, articles, reports and any other information available online free of charge or available with an affordable fee

- Make notes paraphrasing and take all references

- Start reference list

- Contact organizations if needed

Week 2 (03/07/17 to 10/07/17) Analyse gathered data.

- Read all information found

- Analyse all data

- Decide on relevance

- Determinate where should be applied within the project.

Week 3 (10/07/17 to 17/07/17) Prepare and conduct interviews.

- Fly to Spain

- Research information about winery and its history to prepare interview

- Attend interview and facilities tour at Bodegas Xaló to see in person how the winery works and gain products knowledge.

- Back to UK

Week 4 (17/07/17 to 24/07/17) Evaluate information collected from winery.

- Compile information collected in interview

- Compare it with rest of information I already had before the interview about the winery

- Decide on relevance

- Prepare project first two sections, introduction and area being investigated

Weeks 5-8 (24/07/17 to 14/08/17) Compile all data together and compose project.

- Plan project lay out with sections and subsections following the notes made in week 2.

- Write project using data and learning materials.

Week 9 (21/08/17 to 28/08/17) Draw up conclusions.

- Read all project

- Reach conclusions

- Give recommendations

Week 10 (28/08/17 to 04/09/17) Proofread submission, check references and submit work.

- Proofread all project

- Check References

- Write bibliography

- Submit work

Introduction and Company Background

Wine has been produced in Marina Alta, Spain since 1472. Between the 13th and 14th centuries, the industry flourished. However, by the 20th century, it had declined. In 1962, fourteen farmers and winemakers founded the cooperative winery Bodegas Xaló to revive production. Half a century later, their success made the cooperative well known within the province, and its vineyards have become a lynchpin of the local economy with over 400 partners, and 400 cultivated hectares (Bodegas Xaló, 2017).

The winery produces red, white, rosé, sparkling wines, vermouth and the sweet variety mistela. Their quality white wine Bahia de Denia is a bestseller (Bodegas Xaló, 2017).

At the turn of the millennium, the cooperative sought a wider customer base, and now has over a decade of export experience. They began selling cheaper wines and mistelas in bulk, but now also move high quality labels by the bottle (Bodegas Xaló, 2017). They currently trade in Germany, Holland, Sweden, China and the USA (Appendix 2).

Bodegas Xaló is classified as a cooperative in Spanish law; a voluntary union of citizens with common commercial purpose. The institution is composed of members and a board, which acts as governing and executive body.It is responsible for managing, supervising and representing the cooperative following the guidelines and agreements adopted at the General Assembly, composed of all members (Appendix 2 & Axesor, 2017).

This type of business arrangement has advantages and disadvantages. One advantage is its democratic decision process, which allows all members to decide on policy. Unfortunately, this can lead to disagreements and delays, and credit institutions can consider cooperatives high risk, as they do not have a standard company organizational structure, making access to external financing difficult (Infocif, 2015).

Xaló’s is a small to medium-sized business, so does not have a dedicated international trade department. Instead, they work with an international trade consultancy, which represents them in trade fairs abroad, contacts potential clients, and advises them on possible market opportunities, acting on commission basis. Commercialization in markets external to the European Union, such as China and the United States is done through importers distributors (Appendix 2).

The Area Being Investigated: “Bodegas Xaló: Entry Strategies and Marketing Mix for the Polish Market”

Bodegas Xaló´s decision to enter a new market can be influenced by several factors; They may wish to reduce the risks of being tied to one market, increase competitiveness, or simply exploit new opportunities (Institute of Export and International Trade, 2016a, pp.9-10).

This project aims to analyze the possibility of Xaló’s entering the Polish wine market and options for doing so. Research and planning processes will help determine whether they could thrive within Poland (Doole & Lowe, 2008, p.22).

Poland’s economy, market divisions and growth will be examined, alongside its ability to trade with a Spanish company. Data gathered on past patterns, and an analysis of it can help identify possible future trends. To reach a conclusion of which market entry strategy is most appropriate, the analysis will account for product type, available funds, market profile and trade barriers.

Marketing professor Jerome McCarthy’s marketing mix is a useful prism to analyze market entry issues through. This focuses on the ´Four Ps´: Promotion, Price, Product and Place. Promotion is the means available to reach a target audience. Price is how price setting affects buyer behaviors. Product concerns examining customers’ expectations and the best way to meet them. Place helps identify the most suitable distribution channels (Martinez-García, Ruiz-Moya & Escrivà-Monzó, 2014, p.13).

Data and Information collected

Poland

Poland joined the European Union in 2004. Private investment, EU funds, increased domestic consumption and exports have strengthened its economy, which has experienced consistent economic growth since 2008 (Cicuendez, 2014 p.3).

The country’s purchasing power is increasing with average gross wages. Between 2004 and 2015, GDP per capita increased from 49% to 69% of the EU average, and it is expected to reach 79% by 2020. Living standards are similar to other EU countries, while product prices are lower but equalizing. These factors have helped increase domestic consumption (Oficina Económica y Comercial de España en Varsovia, 2017 pp.5,10 &14)

Poland has not adopted the euro, instead retaining its native zloty. However, the Polish central bank tries to maintain a stable euro to zloty exchange rate, keeping inter-European trade viable (Oficina Económica y Comercial de España en Varsovia, 2017, p.59)

Poland’s Alcoholic Drinks Market

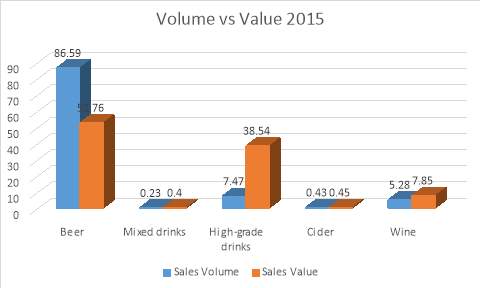

In 2015, Poles spent 13.8 billion euros on 4.5 billion litres of alcoholic drinks (Pascual Júdez, 2016, p. 7).

Figure 1. Alcoholic beverages bought and consumed by Poles.

This figure is expressed as volume and value percentages for the various beverage categories. In this table fruit wines are included with wine data( Pascual Júdez, 2016, p.7& 8) .

Table 1. Total sales progress by quantity from 2012 to 2015. The term wine here includes fruit wine. (Pascual Júdez, 2016, p.9)

| Total sales by millions of litres | Year | |||||||

| 2012 | 2013 | 2012-2013 Growth | 2014 | 2013-2104 Growth | 2015 | 2014-2015 growth | Total Growth | |

| Beer | 3823,5 | 3824,5 | 0,03% | 3867,5 | 1,12% | 3916,3 | 1,26% | 2,43% |

| Mixed drinks | 7,27 | 8,51 | 17,06% | 9,46 | 11,16% | 10,26 | 8,46% | 41,13% |

| Spirits | 356,4 | 356,29 | -0,03% | 338,62 | -4,96% | 337,65 | -0,29% | -5,26% |

| Cider | 0,12 | 2,02 | 1583,33% | 9,53 | 371,78% | 19,59 | 105,56% | 16225,00% |

| Wine | 234,2 | 233,9 | -0,13% | 235,3 | 0,60% | 238,9 | 1,53% | 2,01% |

| Total | 4421,49 | 4425,22 | 0,08% | 4460,41 | 0,80% | 4522,7 | 1,40% | 2,29% |

Table 2. Wine growth between liters consumed and zlotys spent.

This table includes fruit wine. Wine market grew 2.01% from 2011 to 2015, measured by litres consumed, and 18% by zlotys spent (Pascual Júdez, 2016 pp. 9-10).

| Wine progress from 2011- 2015 | ||||||||||

| 2011 | 2012 | Growth % | 2013 | Growth % | 2014 | Growth % | 2015 | Growth % | Total growth | |

| Total value by milions of zlotys | 3857,8 | 4088,1 | 6% | 4204,3 | 3% | 4395,2 | 5% | 4542,7 | 3% | 18% |

| Total sales by milions of litres | _ | 234,2 | _ | 233,9 | -0,13% | 235,3 | 0,60% | 238,9 | 1,53% | 2,01% |

Although it has not been the fastest growing alcoholic drinks sector, growth has seen a steady increase.

Poland’s Wine Market

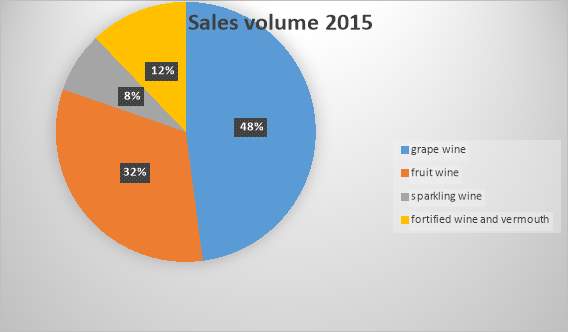

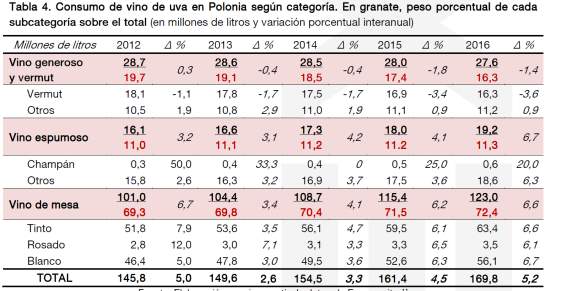

Wine classification generally consists of fruit wines (cherry, pear etc.) and grape wines, which are further divided into sparkling, fortified, and table wines (Pascual Júdez, 2016, p.6). This project will focus on Xalo´s core grape wine´s business, but within the Polish wine market fruit wines are also important.

Wine is not a traditional Polish favourite, with the country historically preferring beer and vodka but the 2004 EU entry led to Poles exploring new products (Pascual Júdez, 2016, p.7). Between then and 2013, their wine market grew 56%, capturing the international wine industry’s attention (Profundo, 2016a, p.2).

Poland´s wine production cannot meet demand, so imports have increased, reaching 219.78 million euros and 108 million litres in 2015. The countries that export the most grape wine to Poland are Germany and Italy followed by Bulgaria and Spain (Pascual Júdez, 2016, pp.12-15).

Figure 2. Percentage consumed according wine type in 2015 (Pascual Júdez, 2016, p.11).

The Polish grape wine market is expected to grow above 3.5 billion zlotys by 2020 (Olmedo López-Frías, 2017, p.39). Consumption of quality grape wine has gradually increased, and Spanish wine importation doubled between 2010-2016 (Olmedo López-Frías, 2017, pp.17-19). However, while wine consumption is increasing, it remains low compared with much of Europe (Pascual Júdez, 2016, pp.10-14).

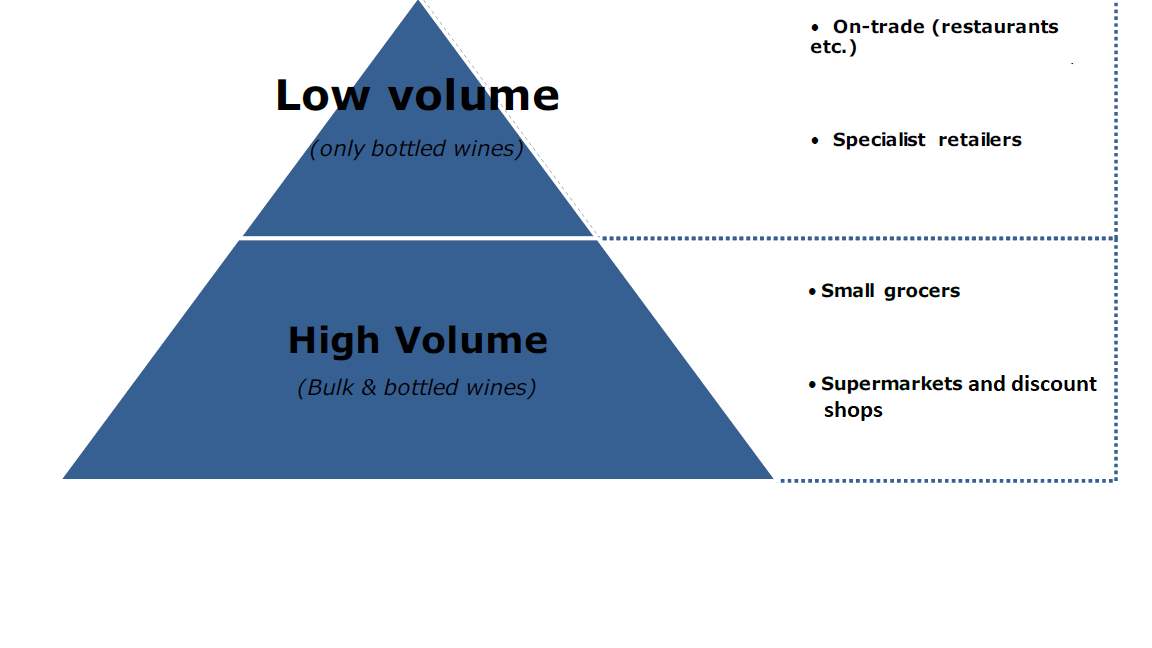

The market splits into low and high volume segments. Low volume refers to medium and high quality wines with unique features differentiating them from competitors, and quality trumps quantity. High volume refers to lower quality wines where competitive prices are prioritized to sell vast quantities (Profundo, 2016b, p.4 & Profundo, 2016b, annex 2, pp.7-8).

Figure 3. Market segments for wine in Poland (Profundo,2016b, p.4).

Consumer Profile

Although Poles increasingly consume more wine, only 41% of consumers drink it without any special reason (Pascual Júdez, 2016, p.22). KPMG’s survey revealed that middle-class women over 40 are the biggest buyers (KPMG, 2014, p.34)

Amongst table wines, red is the best seller, followed by white. In this premature market consumers are not sophisticated enough to favour dry over sweeter varieties (Pascual Júdez, 2016, p.12 & 23). However, the consumption of wine among young professionals in cities is expected to grow in future, and they prefer dry or semi-dry wine (Profundo, 2016c, p.2).

Poles often lack knowledge about Spanish local wine varieties and regions, tending only to recognize Rioja as high quality (Pascual Júdez, 2016, pp.22&27)

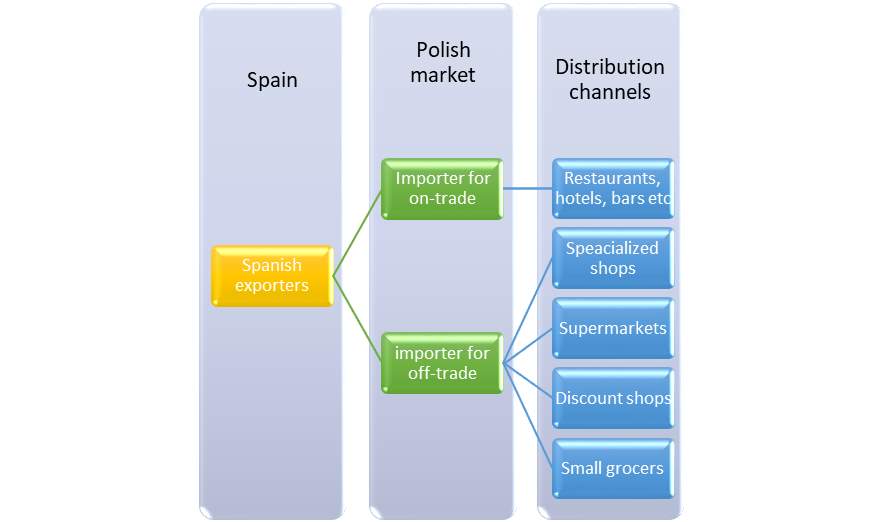

Wine Prices and Distribution Channels

The Polish grape wine market is fragmented compared with other beverage markets, consisting of large, medium and small importers. Only large distributors carry well-stablished wine brands while independent specialized distributors often use their own small retail channels (KPMG, 2014, p.43)

The market has two distribution channels, off and on-trade. Off-trade is when the product is not consumed on the premises while on-trade is the opposite (CBI ministry of affairs, 2017, pp.12-13). Off-trade establishments such as discount and specialist shops, supermarkets and convenience stores are the mainstay representing over 96% of sales volume (Pascual Júdez, 2016, p.30). On-trade wine accounts for just 3% of sales volume, as restaurants sell wines very expensively due to the high margin (Pascual Júdez, 2016, p.30). Specialist shops stock more varieties and sell low volume medium-high quality wines, while discount shops and supermarkets stock affordable lower quality wines in vast quantity (Pascual Júdez, 2016, pp.24-25). Discount chains are also gaining prominence, importing wines and educating consumers themselves (KPMG, 2014, p.44).

Figure 4. Poland wine most common trade channels (Profundo, 2016b, p.2).

Spanish wines are more expensive in Poland than in Spain due to transportation, intermediaries and taxes. Price ranges also change depending on distribution channels used (Pascual Júdez, 2016, pp.24-26).

Approximately, 90% of international movements of goods between Spain and Poland are transported by road (El Vigia, 2017).

Promotion Instruments

Restrictions on media advertising for alcoholic drinks other than beer makes wine promotion difficult. But alternative options could be specialized magazines, trade fairs, and event sponsorship (Pascual Júdez, 2016, p.34).

While local Spanish wine varieties are still unknown by Poles, the Spanish embassy in Poland plays an active role helping Spanish companies bridge cultural divides. They offer thematic tastings, organize trade fairs and have a blog illustrating the wine sector and upcoming events (Pascual Júdez, 2016, pp.27-29&42).

Legal Requirements

Companies trading in Poland must obey EU law and specific Polish regulations.All labels must be in Polish, and wines with less than 22% alcohol content are subject to 23% VAT and ACCISA tax, which costs approximately 38.5 euros per hectoliter (Pascual Júdez, 2016, p.35).

Packaging

0.75 cl colored glass bottles are the wine packaging most used in Poland. Bag-in-box and screw cap packages are linked with low quality drinks (CBI ministry of affairs, 2017, p.2).

Analysis of Data and Interpretation of Results

Winery’s Strengths and Weaknesses

Since credit institutions consider cooperatives high risk, Bodegas Xaló normally work with their own limited financial resources and must utilize more economical formulas (Fayos Gardó & Calderón García, 2013, p.18 & Appendix 2).

However, having reduced economic capacity does not prevent exporting, and the company has over a decade´s global export experience. They have promoted their wines through international trade fairs, but due to costs, only when they have strong chances of success (Appendix 1). Therefore, it is necessary to strongly evaluate any market and the possible success of a product within it (Institute of Export and International Trade, 2016a, p.24).

Market Analysis

Poland is an attractive market since it is the fifth largest EU economy and experiencing stable growth (Marín Ferrando, 2015, p.4). Their per capita income increase should encourage Poles to buy luxury, none-essentials such as wine (Olmedo López-Frías, 2017, p.4).

The grape wine market is immature but the spread of Western consumer lifestyles should help grow consumption of wine (Pascual Júdez, 2016, pp. 4-7). This, alongside the decline in popularity of spirits like vodka, as shown in table 1, should provide an opportunity for a more sophisticated lifestyle drink such as wine to take a larger share of the alcoholic drinks market. However, it would still need to compete with the popularity of beer and the emerging mixed drinks and cider markets (CBI ministry of affairs, 2017, p.6 & KPMG, 2014, p.66).

Market Entry Strategy

Wine is a product given value by its origin so export, as opposed to manufacturing within the target market, is the only realistic market entry strategy for selling Spanish wine in Poland (Peris-Ortiz, Rueda-Armengot & Benito-Osorio, 2013, pp.3-7).

Supplier and potential market are both within the EU, so import/export will benefit from the free movement of goods, and harmonized standards, making trading easier. However, they do not use the same currency, so exchange rate issues are worth considering (nibusinessinfo.co.uk, 2017).

Xaló´s could sell directly to shops and restaurants or choose an intermediary such as a distributor or agent. In Poland, there are large, medium, and small, specialized distributors, which supply both off and on-trade channels, so using a distributor seems customary in Poland (KPMG, 2014, p.43 & CBI ministry of affairs, 2017, pp. 13-15). Wine distributors take ownership of exporters’ goods, have contacts within the target market and actively promote their products, which means less financial risk for the exporter (Institute of Export and International Trade, 2016b, p.32-34).

Marketing Mix

Promotion

Xaló´s needs to make the Polish market aware of their products. Promotion involves good communication between exporter and target market and is vital for successful entry (Institute of Export and International Trade, 2016b, p.92). Translating winery promotional materials directly from Spanish without native Polish assistance could be misunderstood or even offend potential customers (Institute of Export and International Trade, 2016b, pp.100-110). Due to advertising restrictions on alcohol, the cooperative should consider affordable alternatives, like those provided by Spanish governmental organizations (Pascual Júdez, 2016, pp.27-28, 34 -35&42).

Price

To maintain profits, sales price must exceed the costs of winemaking, distribution, promotion and legal requirements. Export brings extra costs and dealing with a different currency can also effect profits (Institute of Export and International Trade, 2016b, pp.166-187).

In the Polish wine market, supermarkets, discount shops and specialized shops all sell different wines at different price ranges, so Xaló´s should price their product depending on which retail channel they choose to target (Olmedo López-Frías, 2017, pp.25-28).

Pricing wines too high low could lead to a loss in sales (Doole & Lowe, 2008, p.393). However, as shown in table 2, growth in Zloty has consistently outperformed growth by litres consumed, which suggests Poles are willing to accept increasing prices per litre of wine (Pascual Júdez, 2016, pp.9-10). Although individual Spanish wines are not well known in Poland, wine from the Rioja region is perceived as a high quality product in Poland, so Polish consumers might also associate other Spanish wines they don´t know with quality, providing a good entry opportunity for Xalo´s Baha de Denia perhaps (Olmedo López-Frías, 2017, p.29).

Product

The product must fulfill customers´ needs (Albaum & Duerr, 2011, p.581). Wine, brand, packaging and other intangibles like image are all key elements (Institute of Export and International Trade, 2016b, p.142)

To date, primary consumers have been middle-aged females, who prefer sweet wines but qualitative evidence for increased consumption among young urban professionals who prefer dry wines is notable (Profundo, 2016c, pp.2-3). This combined with an interpretation of appendix 3 suggests that sweet red wine is currently most popular, and expected to maintain positive growth, but dry white wine will increasingly gain prominence (Profundo, 2016c,p.3). Bodegas Xaló produces sweet and dry red, white and rose wines so should be able to cater to both sectors (Bodegas Xaló, 2017).

Another matter is the standardization or adaption of the core product or packaging to target markets (Albaum & Duerr, 2011, p.616). The cooperative has previously opted for product standardization, selling local varieties in international markets, but that could be a disadvantage considering Poles are unaware of them (Appendix 2 & Pascual Júdez, 2016, p.27)

Packaging should be adjusted in appearance and content to match the market and law (Institute of Export and International Trade, 2016b, pp.159-160). For example, labelling should be in Polish and using screw bottles could be a mistake as it is associated with cheap drinks (CBI ministry of affairs, 2017, p.2).

Place

Wine has to be accessible to the target audience at the right place at the right time (Martinez-García, Ruiz-Moya & Escrivà-Monzó, 2014, p.15).

Due to the proximity of Spain and Poland, road transport is probably most suitable, but the channels through which Xaló´s goods reach end-buyers might vary. As seen in figure 3, the Polish wine market is split into two segments and the appropriate distribution channel will depend upon which segment the winery is entering (Profundo,2016b, p.4). A comparison of figure 3, 4 and appendix 4 suggests that if the winery desires to export vast quantities of medium-low quality wine, it should look into supermarkets, grocers and discount shops. On the other hand, restaurants and specialized shops are better options for medium-high quality with less volume (Pascual Júdez, 2016, p. 24-25). Direct imports is another possibility, becoming increasingly common, which eliminate distributors and import directly (Profundo, 2016b, p.2).

Conclusions

Research has shown that Poland is an economically viable EU member state. Its wine market is relatively small but growing steadily as Poles seek out new forms of consumerism. However, it does face competition challenges, growth has not been as rapid as other drinks sectors such as cider but these represent a much smaller share of the overall alcoholic drinks market.

The nature of the goods dictate that import is the correct market entry strategy. Which size of importers and distributors to use will depend upon the target market segment. Supermarkets and discount chains opt for quantity, while small specialized shops focus on variety and quality. Direct sales are also possible, but use of distributors is still preferable due to their established customer base and market knowledge.

Pricing is important in the marketing mix, as wrong pricing decisions could reduce sales and viability. Xalós should find balance between what customers are willing to pay without damaging product’s image and company´s potential benefits.

Currently Poles prefer sweet over dry, and red over white wines. Statistics suggest that the Polish wine market will grow to match other Western markets, and with it sales of dry and white wines. So currently, the red and sweet wine markets are maturing, while the dry and/or white wine markets are still in their initial growth phase.

When trading internationally, companies need to think about standardizing the product or changing it to meet local requirements. Minor Spanish wine varieties are unknown by Polish customers. If a company like Xaló’s winery opts to trade their local varieties instead of internationally renowned ones, more effort will have to be made to attract buyers. Here, hiring a native speaker would help bypass cultural barriers when presenting a new product to the target audience.

Unfortunately, alcoholic drinks advertisement is banned in Poland, except for beer. But the internet is a good promotional tool and trade fairs are very important, they help establish contacts in the market, and allow companies to view their competitors offerings.

Recommendations

In light of the research and evidence gathered, Xaló’s should consider the following:

It is advisable for Xaló’s to export to Poland through a distributor intermediary, benefitting from the EU´s free movement of goods regulations. Packaging should comply with Polish regulations requiring labels to be in Polish.

Trade fairs are likely the best way to promote Xalós’ products, get to know the market and competitors closely. Among them are those organized by the Spanish embassy and ICEX. Here, it would be advisable to hire a native to oversee all promotional material.

Due to the company’s size and medium-high quality specialty wines, the winery should focus on the low volume market segment, emphasizing the quality and uniqueness of its wine. The most appropriate distribution channel would be in on-trade and specialty stores.

The price set by the winery will directly affect sales. It should exceed all costs. The winery should sell its quality red wine between 5 to 18 and its white from 5 to 12 euros.

If the winery wants to enter the market easily, it should begin with a sweet red wine like its Malvarrosa. If on the contrary they prefer to enter with their best product, the unique dry white Bahia de Denia, the market is still immature but growth is expected, so the benefits may not be immediate but represent a good opportunity to gain long term brand recognition.

Reference List

Albaum, G. & Duerr, E., 2011. International Marketing and Export Management. 7th ed. Harlow: Pearson.

Axesor, 2017. Información Mercantil e Incidencias. Cooperativa Virgen Pobre Xaló. [online] Madrid: Axesor. Available at: https://www.axesor.es/Informes-Empresas/2417669/COOP_V_VIRGEN_POBRE_DE_XALO.html [Accessed 3 Aug. 2017]. (Axesor, 2017)

Bodegas Xaló, 2017. bodegasxalo.com. [online] Available at: http://www.bodegasxalo.com/gb/ [Accessed 29 May 2017]. (Bodegas Xaló, 2017)

CBI ministry of affairs, 2017. Exporting wine to the Polish market. [online] The Hague: CBI. Available at: https://www.cbi.eu/node/2587/pdf/ [Accessed 1 Jun. 2017].

Cicuendez, G., 2014. Relaciones comerciales con Polonia. [online] Valencia: Cámara Valencia. Available at: http://club.camaravalencia.com/wp-content/uploads/2014/09/Polonia-Septiembre-2014.pdf [Accessed 24 May 2017]. (Cicuendez, 2014)

Doole, I. and Lowe, R., 2008. International Marketing Strategy. 5th ed. London: Cengage Learning EMEA.

El Vigia, 2017. ‘Polonia se vuelca en las infraestructuras para desarrollar todo su potencial logístico’. Elvigia.com. [online] Available at: http://elvigia.com/especiales/polonia-se-vuelca-en-las-infraestructuras-para-desarrollar-todo-su-potencial-logistico/ [Accessed 13 Aug. 2017].

Fayos Gardó, T. and Calderón García, H., 2013. ‘Principales problemas de internacionalización de las cooperativas agroalimentarias Españolas’. Revesco. [online] 111. Available at: https://revistas.ucm.es/index.php/REVE/article/viewFile/42675/40729 [Accessed 3 Jun. 2017]. (Fayos Gardó and Calderón García, 2013)

Infocif, 2015. Ventajas y desventajas de una cooperativa. [online] Infocif.es. Available at: https://noticias.infocif.es/noticia/ventajas-y-desventajas-de-cooperativa [Accessed 8 May 2017]. (Infocif, 2015)

Institute of Export and International Trade, 2016a. International Marketing Strategy module A. [online via internal VLE] Available at: http://www.ioecampus.co.uk/vle/pluginfile.php/6207/mod_resource/content/5/International%20Marketing%20Strategy%20module%20A.pdf [accessed 10th May 2017].

Institute of Export and International Trade, 2016b. International Marketing Strategy module B. [online via internal VLE] Available at: http://www.ioecampus.co.uk/vle/pluginfile.php/2701/mod_resource/content/2/International_Marketing_Strategy_Module_B6.pdf [accessed 15th May 2017].

KPMG, 2014. The alcoholic beverages market in Poland. [online] Warsaw: KPMG. Available at: https://assets.kpmg.com/content/dam/kpmg/pdf/2016/02/The-alcoholic-beverages-market-in-Poland-2014-online.pdf [Accessed 17 Jun. 2017]. (KPMG, 2014)

Marín Ferrando, S., 2015. Informe del país Polonia. [online] Murcia: Instituto de Fomento de la Región de Murcia (INFO). Available at: http://www.impulsoexterior.com/COMEX/servlet/MuestraArchivo?id_=2_219 [Accessed 3 Jun. 2017]. (Marín Ferrando, 2015)

Martinez-García, A., Ruiz-Moya, C. & Escrivà-Monzó, J., 2014. Marketing en la actividad comercial. Madrid: Mc Graw Hill.

nibusinessinfo.co.uk., 2017. Benefits of trading in the European Union. [online] Available at: https://www.nibusinessinfo.co.uk/content/benefits-trading-european-union [Accessed 30 Jun. 2017]. (nibusinessinfo.co.uk, 2017)

Oficina Económica y Comercial de España en Varsovia, 2017. Guía país. Polonia 2017. [online] Warsaw: Oficina Económica y Comercial de España en Varsovia. Available at: http://www.icex.es/icex/es/navegacion-principal/todos-nuestros-servicios/informacion-de-mercados/estudios-de-mercados-y-otros-documentos-de-comercio-exterior/DOC2017694782.html [Accessed 18 Jun. 2017]. (Oficina Económica y Comercial de España en Varsovia, 2017)

Olmedo López-Frías, E., 2017. El mercado del vino en Polonia. [online] Warsaw: ICEX. Available at: http://www.icex.es/icex/es/navegacion-principal/todos-nuestros-servicios/informacion-de-mercados/estudios-de-mercados-y-otros-documentos-de-comercio-exterior/DOC2017726375.html [Accessed 11 Aug. 2017]. (Olmedo López-Frías, 2017)

Pascual Júdez, L., 2016. El mercado del vino en Polonia. [online] Warsaw: ICEX. Available at: http://www.icex.es/icex/es/navegacion-principal/todos-nuestros-servicios/informacion-de-mercados/estudios-de-mercados-y-otros-documentos-de-comercio-exterior/DOC2016654959.html [Accessed 11 May 2017]. (Pascual Júdez, 2016)

Peris-Ortiz, M., Rueda-Armengot, C. and Benito-Osorio, D., 2013. Internacionalización: Métodos de entrada en mercados exteriores. [online] València: Universitat Politècnica de València. Available at: https://riunet.upv.es/bitstream/handle/10251/31217/Internacionalizaci%C3%B3n_submissionb.pdf?sequence=5 [Accessed 10th March 2015].

Profundo, 2016a. CBI Competition: Wine in Poland. [online] Utrecht: CBI. Available at: https://www.cbi.eu/sites/default/files/market_information/researches/competition-poland-wine-2016.pdf [Accessed 1 Jun. 2017]. (Profundo, 2016a)

Profundo, 2016b. CBI Market channels and segments: Wine in Poland. [online] Utrecht: CBI. Available at: https://www.cbi.eu/sites/default/files/market_information/researches/channels-segments-poland-wine-2016.pdf [Accessed 1 Jun. 2017].

Profundo , 2016c. CBI Trends: Wine in Poland. [online] Utrecht: CBI. Available at: https://www.cbi.eu/sites/default/files/market_information/researches/trends-poland-wine-2016.pdf [Accessed 1 Jun. 2017]. (Profundo, 2016c)

Appendices

Appendix 1

Appendix 2

Balaguer, S. and Costa, N., 2017. Interview to know more about winery. Interviewed by Nuria Torrent. [personal communication] Xaló, 5th of july 2017.

- Is your winery growing more local grape varieties than internationally known ones like Chardonnay, or Merlot etc, and why?

- 90% of the grape destined to make wine is of the local variety, Roman Muscat and Garnache. Only 10% is of the international variety. This is due to tradition, Roman Muscat he been used since the 18th century and is well established in the region.

- What differentiates your product from others in the same class?

- The taste of the wine cultivated in the region of marina alta due to its soil and proximity to the sea. All members of the cooperative have vines in the same area, those outside cannot be part of the cooperative.

- Do you research new markets/opportunities?

- The cooperative normally attends the most important trade fairs in Spain such as the Barcelona one, which is also attended by international distributors and business. From these fairs, the cooperative makes first contacts with new potential markets. If within those contacts the cooperative sees any new market entry possibilities, then it might attend trade fairs in that particular market. The winery has limited funds so we must use them wisely. We normally attend fairs abroad through ICEX.

- Where do you currently export?

- Germany, Netherlands, USA, China and Sweden.

- Why and when did you start exporting?

- We do not know exactly when and why the winery started exporting but it was to the USA and more than ten years ago. The product that the winery began to export was mistela.

- Which products do you export more of?

- Unlike other wineries in the area that mostly export red wine, Bodegas Xaló exports white wine, specifically our flagship wine Bahiha de Dénia.

- The winery produces 300,000 bottles of the Bahia de Dénia. If the market continued to grow, could the Winery increase production, considering all factors, especially the grape variety used?

- Yes, the winery produces 1,500,000 Kg of Roman Muscat (grapes). So we could use it to make Bahia de Dénia.

- Which distribution channels do you normally use?

- The cooperative has so far used small distributors in foreign markets.

- What problems did you have to face when you first began exporting?

- So far the only problem has been the label adaptation, which needs to meet market regulations.

- Have you ever changed a product or packaging for export purposes?

- The cooperative exports local variety grape wines. The only thing that has been changed is the labels. We produce, bottle up and label all products here in Xalo, then we distribute it.

- How do you normally deal with new potential markets?

- The cooperative does not have an international export department. We work with an international trade consultancy firm, which on a commission basis helps us to find new opportunities abroad and represents us in foreign trade fairs.

- Do you have any knowledge of the Polish market at all?

- No, we do not have any knowledge of the Polish market.

Appendix 3

Wine consumed in Poland by category (Olmedo López-Frías, 2017,p.12).

Appendix 4

Sales volume of wine within the off–trade distribution channel (Olmedo López-Frías, 2017,p.34)

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "International Business"

International Business relates to business operations and trading that happen between two or more countries, across national borders. International Business transactions can consist of goods, services, money, and more.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: