Export-led Growth Model: Importance of What is Exported

Info: 5127 words (21 pages) Dissertation

Published: 16th Dec 2019

Tagged: Business

Topic: In an export-led growth model what matters is not just how much you export, but also what you export”. Discuss this statement with special reference to the Latin American and East Asian experiences since 1980

- Introduction

It can be argued that growth is a complex process that is stimulated by numerous factors. One of the major factor in determining growth is trade. The theoretical links between trade and growth has been discussed over centuries and the controversies persist regarding their effect. The favourable arguments for trade by classical school of economics started with Adam Smith and the literature on the positive linkage between trade and growth is vast.

Prior 1980s, Latin American (LA) countries had been practicing Import Substitution Policies (ISI). ISI pursue the strategies aimed at getting benefits from the development of rich countries while at the same time protecting a country’s own domestic economy so that the residents can find their own way for development. However, the point of this policy is not to catch up with developed countries; rather it is to reduce the dependency of a country on the production of primary commodity by creating more flexible economy (Bruton 1989).

In 1980s, most politicians and economists in LA believed that the ISI caused the debt crisis in 1982. They abandoned the policy and started to undertake major economic reforms by shifting the policy to Export-Led Growth (ELG). As the name suggests, ELG is a strategy aimed to increase productive capacity of production by targeting foreign market. Instead of having goals to boost the economic growth, LA shifted the policy for the sake of reversing the previous development and political strategy, and this had led the region into a dead end. The LA’s economic performance has been slow relative to most of the rest of developing nations (Sawyer and Reyes 2015).

On the contrary, outward oriented policy has been proven to work well as the evidence of East Asian countries[1] (EA). The change in policy is more targeted and they are determined to overcome the constraints in the market rather than to reverse the previous industrialization strategy. As a result, by 1980s, the policy had been accompanied by impressive growth in export and output which then concluded by most of observers that export growth is the key feature to get higher and sustainable growth of output per capita.

This paper examines the argument that ‘in export-led growth models, what matters is not just how much you export, but also what you export’, centring the discussion with reference to LA and EA countries. The paper is organized as follows. Section 2 discusses ELG, ushering into third section which discusses the economic policies and progress in the periods of pre and post 1980 in both regions. The fourth section discusses the reasons the results differed across the two regions. The last section presents a conclusion of the paper’s discussion and sums up from the writer’s points of view, on why not only how much, but what it exports matters too.

- Export-led Growth

ELG hypothesis presents that the expansion of export sector is one of the main catalysts for economic growth. Palley (2012) define ELG as a strategy of development in increasing productivity by aiming foreign market. According to advocates for ELG, export can serve as an ‘engine of growth’ (Medina-Smith and CNUCED 2001) and the favour should be on the domestic production side. However, for most analysists, this strategy involves a neutral perspective, that is, the bias of ISI policy towards domestic market should be removed (Grabowski 1994). So, the incentives for both local and foreign production are equal.

2.1 Benefits of ELG

ELG focuses on accessing external markets at the same time getting the benefits of having open trade for developing countries by supporting product development such as R&D; exposing firms to competition to maximise the efficiency of firms; and supporting best practice (Palley 2012). It is part of the new agreement among economist about the benefit of having open trade and this consensus consist of three main strains (see Figure 1). Through export, a country can benefit from having a comparative advantage when it is specializing in production of some goods, because in the long-run the industry will increase in competitiveness[2]. By using ESI instead of import substitution strategy, a country can maintain its good political relationships with others and avoid ‘beggar-thy-neighbour’policy which is fatal for development of a country. Besides, it can control the problem of rent-seeking activity, which is the main critique of Krueger (1974) on import substitution industrialization. This will help to stabilize internal economy and promote the growth of the country. Furthermore, companies can enjoy the benefit of increasing return to scale by supplying production to larger market and this will increase profitability of market activity.

Figure 1 – Argument Supporting the New Consensus on Openness (Palley 2012)

However, these positive externalities only imply that once a country adopted this policy, the efficiency will be improved. Lal and Rajapatirana (1987) offer the explanation for the benefit of trade from more dynamic perspective. They argued that entrepreneur is the role key of success for this policy as they hold the economic decision making. They must consider the possible risk and return, so they must search out the investment opportunities. With ISI policy, governments are free to distort the market, however, with ELG, government cannot distort the market more than just providing subsidies for exporting firms. The subsidies come from the government budget and more explicit compared to subsidies provided in ISI. Thus, the amount spent to distort the market will be limited and entrepreneurial activities will be more intense hence stimulating growth.

- The critiques

However, few arguments have been developed that work against trade. One of them is Prebisch-Singer hypothesis. Prebisch-Singer hypothesis refers to the long run decline in the price of primary commodity relative to the manufactured goods. This hypothesis was approached from 2 sides of theories.

Singer offered demand side theory, where the advancement in technology has increased average income thus demand of goods in general. However, because of the price elasticity of demand and Income elasticity of demand for primary goods is lower than manufactured goods, the increase in income and the fall in price of goods causing the demand for agriculture good to increase by lower amount relative to manufactured goods Hadass and Williamson (2001). Thus, Singer anticipated that in the long run, price of food and raw material relative to manufactured goods will continue to fall in the long run.

While Prebisch used supply side theory using the UK’s imports and exports indexed Board of Trade price to represent the price of world’s raw materials and manufactured goods. He concludes from UK NBTT[3] that there was deterioration in the price of primary goods relative to manufactured goods over periods 1876-1947 (Hadass and Williamson 2001). He used Keynesian argument where excess demand in boom will increase the price, thus creating competition among producers to supply more (ibid). Because of the competition and the pressure of labour union, wage has increased during the boom. In the recession, wages are sticky (ibid). This has retched up the cost of manufacturing thus price of goods. However, union labour power is not so strong in developing countries, so wage is less-likely to increase for labour in developing countries during boom and more likely to decrease during recession (ibid). Thus, the price of manufactured goods increases more during boom and decline less during recession relative to prime commodity goods (ibid).

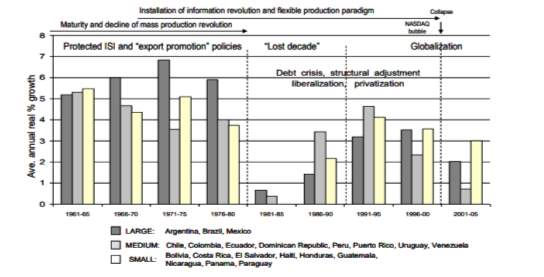

The aforementioned arguments may be the reason LA countries practiced ISI since 1950s and it produced significant growth up until mid-1980s when LA countries decided to abandon ISI and adopt ELG policy. (Refer Figure 2)

Figure 2 – Average Real Annual Growth of groups of lain American countries by relative size

Figure 2 – Average Real Annual Growth of groups of lain American countries by relative size

Source: Rise and fall of export-led growth(PEREZ 2015)

The average growth of LA countries prior to ELG was around 4.5% and the growth rate fell to 2.5% after the region abandoned ISI policy. Does that mean ELG is bad for growth? Not necessarily, because EA countries have been practicing the policy and it turned out great for the region. The next section will describe the evolution of trade in both region and the results of the policies.

- Background of these regions

3.1 East Asian

Just like LA, the Asian Tigers[4] had also starting to use ISI strategy in 1950s, but they quickly turned its focus on ESI in 1960s (i.e. Korea). ISI in EA experienced less success than in LA, partly because they were not supported by foreign fund.

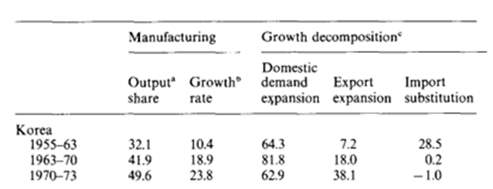

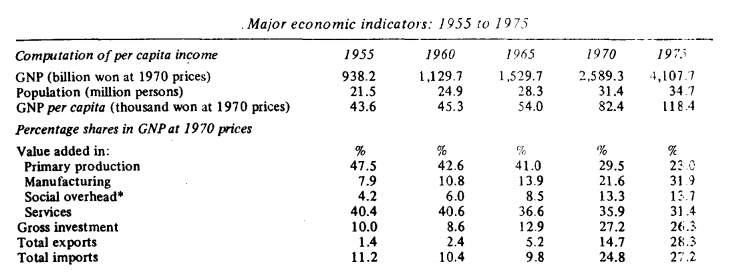

In the last-half of 1950s, the Korean export contributed 7.2% and import contributed 28.5% to growth of manufactured goods (see Figure 3). By less than two decades, the import fell to zero and by 1970 the rate was negative while the export has grown to 38.1%. Within 1973-80, Korean manufactured export grown 40% per year averagely, while GDP growth is almost 10% annually after early of 1960s (Bruton 1989). Within a period of 1965-1975, the ratio of total export to GNP per capita has increased by more than double (see Figure 4).

Figure 3 – Decomposition of Growth of Manufacturing Demand (percent)

Source: Trade policies and productivity change in semi-industrialized countries (Nishimizu and Robinson 1984)

Figure 4 – Major Economic Indicator

Source: The Republic of Korea’s Experience with Export-Led Industrial Development (Frank Jr, Kim et al. 1975)

The Korean government provides few incentives by 1967 to encourage exports in Korea including unlimited tax exemption for imported intermediate and capital goods for production; exemption from indirect taxes for intermediate good whether it is bought domestically or imported from abroad, and for export sales revenue; generous permit of disposal wastage; free-tax for imported raw materials; reduction few overheads inputs such as electricity and railroad transportation cost; 50 percent reduction in direct tax on income earned from exporting; immediate access for short-term credit to finance capital and medium-term credit for fixed investment (Westphal 1978). These incentives have boosted the export from 5.2 percent in 1965 to 14.7 percent within a half of decade (see Figure 4). By giving space for export industries to grow and develop, these industries became experts by 1980s, established relationship with multi-national corporations (MNCs) and became their suppliers of final exported goods with advanced-country quality, but at developing-country costs (PEREZ 2015).

The combination of high quality and low cost is one of the factor of succeeding the ELG, where it involves intensive technology training, aided by subsidies and protection when it is required (ibid). Apart from that, there is element of luck that the region had developed as a site to assemble electronics products, which was the core of the next revolution (ibid). Some also argued that the rapid expansion of export sector is due to massive devaluation in 1960s. Korean Won fell from 130 won to 255 won per US dollar, and the devaluation is immediately followed by export explosion in South Korea (Kuznets Paul 1984).

- Latin American

Less develop countries attempted to break out of division of labour after the nineteenth century through ISI. Under the division, less developing countries specialized in exporting commodity goods and foods while more developed countries specialized in producing the manufacture good. Considering the argument of Prebisch-Singer mentioned in the previous section, LA would like to get rid of dependency on Europe’s manufactured goods by facilitating domestic production of good which were previously imported. Apart from that, the interruption of shipping and the decline of the non-military goods in the US and Europe during the World War I created serious shortage of manufactured goods in LA and raised its relative price (Baer 1972). So, the investment on ISI become more profitable.

ISI policy was adopted in 1950s after they agreed that continued reliance on export of commodity goods and foods are not stable. It was thought that ISI policy will bring LA to self-sufficiency, increasing the dynamic elements of production and able to fulfil the demand from the increasing population and increase their rate of growth (ibid).

The policies used were the mainstream ones including: protection tariffs; special treatments towards domestic production; cheap loans from the governments for favoured industries, direct participation of government especially in heavier industries like steel and preferential exchange rate for industrial raw material. The ISI strategy helped many LA countries[5] achieve high growth rates for almost two decades.

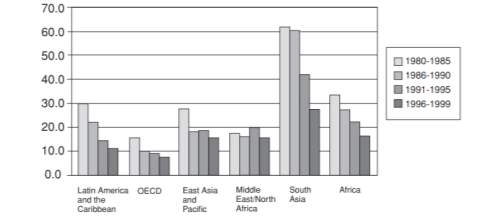

However, by 1980s, the model became obsolete. More and more view held by policy makers and conventional academics has been that liberalization will bring more benefit and will enhance the output growth. So, they started the structural adjustment and reform the trade policy including removing the trade barriers, privatization of firms, and liberalization of labour and financial market (CIMOLI and Correa 2005). Figure 5 shows the evolution of tariff in the region. From 1980 to 1999, the region reduced their tariffs of 30% to 10%, almost the same as OECD’s optimum rate of tariff.

Figure 5 – Trends in Average tariff

Source: Trade for Development in Latin America and the Caribbean(De Ferranti, Lederman et al. 2003)

Years after the structural changes, there was no clear relationship between trade liberalization and growth in LA. The changes also caused controversy due to mixed overall results of countries in a region, and between regions (De Ferranti, Lederman et al. 2003). After an era of strong market intervention and protectionism, it is expected that open economies would provide the platform for rapid economic growth in developing countries. LA is the perfect example on how these expectations have been frustrated, not only had trade liberalization been disappointing, but the economic growth was better in ISI era.

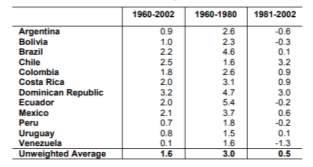

Table 6 by Solimano and Soto (2005) shows that the average per capita growth is higher in 1960-1980 (ISI era) compared to ELG era in 1980-2000. Solimano and Soto (2005) argued that stimulating economic growth, especially in developing countries through reformation in policy, has to be accompanied by reformation in institutional to support the change. The outcome also was anticipated by development economist like Prebisch due the same reason.

Figure 6 – Average per capita GDP growth rates

Source: Economic growth in Latin America in the late 20th century (Solimano and Soto 2005)

Thus, the effort of LA country to copy the success of the Asian Tigers failed. The factors contributed to the failure and what differentiate the reformation in EA and in LA will be discussed in the next section.

- Why they differ

- Selective Industrial Targeting Policy

The Asian Tigers adopted industrial targeting in various degrees. For example, Japan aimed steel, coal, power and input for these goods can be imported tariffs-free. Firms also enjoyed cheap loan from the government banks. The focus in Japan differed every decade. In 1950s, the target was automobile industry and in 1960s computer was the focus. Even though the trend of targeting sectors has been reduced, but Japanese government continued to give emphasis in order to promote and develop certain sectors (Glick and Moreno 1997).

While in Korea, with government policy of infant industry, started exporting the traditional export industries like textiles, garment and fish in 1950s, and later in 1960s they started to explore new sectors such as wigs, shoes and simple electronic product, of course, with massive help from the government, and some industries found dead end (Chang 2011). So, they started to develop new export industries such as steel, shipbuilding, and high end electronic product and that may explain on how Korea can sustain its growth over four decades despite not having comparative advantage in goods that they export. Taiwan adopted almost similar policy and this feature shared by the Asian Tigers is worth of highlighting.

Asia is densely populated continent with low endowment of natural resources. It is the opposite for the LA as they have much less population but bestowed with abundance of natural resources like gold, copper, silver, iron ore and petroleum. These conditions give comparative advantage for LA to produce capital intensive goods while EA countries can produce labour intensive goods and trade is assumed to be beneficial for both parties.

Coming back to the Prebisch-Singer hypothesis discussed above, the authors argued that in the long run, the price of food and commodity will fall relative to the manufactured goods because of the term of trade. Unlike LA, EA countries are not bestowed with natural resources, so it focuses more on manufactured goods while LA focuses on exporting commodity goods. However, according to (Rodrik (1997)) the change in the relative profitability induced by the change in relative price between the two regions is small in relation to the phenomenal change in export. So, this reasoning is not strong enough to explain the contrary results in both regions.

In EA, at least for Taiwan and South Korea, the export booms are accompanied by the explosion of investments, and of course, investment is one of the main determinant of economic growth. But, there is no theory in economics that shows export level will affect the investment activity in a country. Rodrik (1997) argued that the success of export orientation strategy in EA, was caused by the increase in the profitability of investment. This may explain why there is major difference in term of result between EA and LA after implementing ELG despite of insignificant changes in the relative price. In his explanation, he suggests that the development of domestic capital goods is poor in EA in the 1960s, so most of the raw industrial materials must be imported. Investment in manufacturing activities are possible by increasing import, but they must finance the import through export. This can be achieved by the intervention of the government on interest rate, encouraging the household to save more. An increase in saving that results in higher investment to the desired level will at the same time encourage both, export and import.

- Premature de-industrialization of Latin America

In the long run, the economic development in a country will change the structural employment due to the change in productivity in certain sector. For example in LA, the rise in productivity of agriculture reduces the labour requirement in the sector, but it also increases demand for both capital and intermediate input for agriculture (Palma 2005). The fall in labour demand is absorbed mainly into manufacturing and services sector, this is called the industrialization phase(ibid). The next phase: when the employment in manufacturing started to stabilize relative to employment in other sectors, and finally when the relative (eventually absolute) employment in manufacturing sector start to fall. The latter phase is called de-industrialization phase.

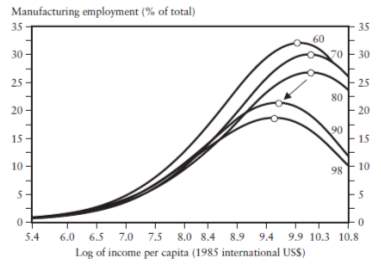

Most industrializing economies face the phase of de-industrialization when they reach certain level of high income per capita, including EA, but for LA, they started to undergo the de-industrialization despite of having far lower level of per capita income relative to other countries that gone through the similar process.

| Region | 1960 | 1970 | 1980 | 1990 | 1998 |

| Latin America | 15.4 | 16.3 | 16.5 | 16.8 | 14.2 |

| East Asia (NIE-1) | 10.5 | 12.9 | 18.5 | 21.0 | 16.1 |

Figure 7 – Employment in manufacturing (% of total)

Source: Four sources of de-industrialisation and a new concept of the Dutch Disease (Palma 2005)

Looking at Figure 8, the peak of percentage employment in manufacturing for LA is much lower compared to EA. The region has also face additional degree of de-industrialization which is associated the Dutch Disease. The word ‘disease’ was used because of the fact that the relationship between income per capita with manufacturing employment tend to have different pattern for countries that are undergoing industrialization agenda that seeks to generate trade surplus from manufacturing industries compared to countries that are satisfied having trade deficit in manufacturing, due to the fact that the surplus may come from another source, for example, UK has trade surplus in financial sector. It started in Netherland and the same pattern is observed in other countries that has just discovered natural resource. Weirdly, the disease spread to LA but not through the discovery of new natural resources, but it is induced by the drastic liberalization policy which was meant to reverse the previous policy. The drastic policy change obstructed their transition towards a more mature form of industrialization (Palma 2005).

Figure 8 – Changing the turning point of industrialization phase

Source: Four sources of de-industrialisation and a new concept of the Dutch Disease (Palma 2005)

- Conclusion

Export is beneficial for the economy in most of the cases. Countries now have more access to foreign market than before; stimulating production and growth. It creates more jobs for local community in the process and improve their welfare. However, by only focusing on the production of primary commodity cannot sustain the growth in the long term. Countries with rich natural resources should also expand their R&D on manufacturing goods instead of relying completely on the export of primary goods. Based on the rising of four ‘Asian Tigers’, it is undeniable that the strategy they have been working on is a success and contributing towards their high growth and how they manage to sustain the growth for decades. Even though the cause of growth is still unclear and cannot be said to be entirely from the strategy itself, we still can conclude that the strategy has helped their growth and development as this characteristic is shared by the Asian Tigers. So, even though these two regions adopted almost similar policy, the results are not similar. EA focused on manufacturing goods and adopted the policy to remove their balance sheet constraint, while LA made the reform for the sake of reversing the previous policy and specialised in commodity goods. The difference in their performance is enough for us to tell that not only how much, but what we export matters too.

- Reference

Baer, W. (1972). “Import substitution and industrialization in Latin America: Experiences and interpretations.” Latin American Research Review 7(1): 95-122.

Bruton, H. (1989). “Import substitution.” Handbook of development economics 2: 1601-1644.

Chang, H.-J. (2011). Industrial policy: can we go beyond an unproductive confrontation? Annual World Bank Conference on Development Economics.

CIMOLI, M. and N. Correa (2005). “Trade Openness and Technology Gaps in Latin America: A.” Low-Growth Trap””. En: José Antonio Ocampo, ed.(2005). Stanford: Stanford University Press and World Bank. Capítulo 2.

De Ferranti, D., et al. (2003). “Trade for Development in Latin America and the Caribbean.” World Bank Policy Research Working Paper.

Frank Jr, C. R., et al. (1975). Appendices to” Foreign Trade Regimes and Economic Development: South Korea”. Foreign Trade Regimes and Economic Development: South Korea, NBER: 245-257.

Glick, R. and R. Moreno (1997). “Government intervention and the East Asian miracle.” FRBSF Economic Letter.

Grabowski, R. (1994). “Import substitution, export promotion, and the state in economic development.” The Journal of Developing Areas 28(4): 535-554.

Hadass, Y. S. and J. G. Williamson (2001). Terms of trade shocks and economic performance 1870-1940: Prebisch and Singer revisited, National Bureau of Economic Research.

Kokko, A. (2006). Export-Led growth in East Asia: lessons for Europe’s transition economies. Emerging Multiplicity, Springer: 33-52.

Krueger, A. O. (1974). “The political economy of the rent-seeking society.” The American economic review 64(3): 291-303.

Kuznets Paul, W. (1984). “Korean Economic Development: An Interpretive Model Praeger Publishers.”

Lal, D. and S. Rajapatirana (1987). “Foreign trade regimes and economic growth in developing countries.” The World Bank Research Observer 2(2): 189-217.

Medina-Smith, E. J. and CNUCED (2001). Is the export-led growth hypothesis valid for developing countries?: a case study of Costa Rica, UN CNUCED.

Nishimizu, M. and S. Robinson (1984). “Trade policies and productivity change in semi-industrialized countries.” Journal of Development Economics 16(1-2): 177-206.

Palley, T. I. (2012). “The rise and fall of export-led growth.” investigación económica: 141-161.

Palma, G. (2005). “Four sources of de-industrialisation and a new concept of the Dutch Disease.” Beyond reforms: Structural dynamics and macroeconomic vulnerability: 71-116.

PEREZ, C. (2015). “A vision for Latin America: a resource-based strategy for technological dynamism and social inclusion. 2008.” Disponivel em:. Acesso em 2.

Rodrik, D. (1997). “Trade strategy, investment and exports: another look at East Asia.” Pacific Economic Review 2(1): 1-24.

Sawyer, W. C. and J. A. Reyes (2015). Latin american economic development, Routledge.

Solimano, A. and R. Soto (2005). Economic growth in Latin America in the late 20th century: evidence and interpretation, United Nations Publications.

Westphal, L. E. (1978). “The Republic of Korea’s experience with export-led industrial development.” World Development 6(3): 347-382.

[1] Like the work of Kokko, A. (2006). Export-Led growth in East Asia: lessons for Europe’s transition economies. Emerging Multiplicity, Springer: 33-52.

[2] Due to increase in productivity thus reducing average cost of production and price in the long-run

[3] Net Barter Term of Trade

[4] Hong Kong, Singapore, South Korea, Taiwan

[5] Argentina, Brazil, Mexico, Chile, Colombia, Ecuador, Dominican Republic, Peru, Puerto Rico, Uruguay, Venezuela, Bolivia, Costa Rica, El Salvador, Haiti, Honduras, Guatemala,

Nicaragua, Panama, Paraguay

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business"

The term Business relates to commercial or industrial activities undertaken to realise a profit including producing or trading in products (goods or services). A general business studies degree could cover subjects such as accounting, finance, management and increasingly, entrepreneurship.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: