Analysis of Johnson & Johnson’s Strategic Framework

Info: 7978 words (32 pages) Dissertation

Published: 1st Nov 2021

Tagged: Business Strategy

Introduction

Founded in 1866 as a family business, Johnson & Johnson now has over 130,000 employees in 60 countries worldwide (Johnson & Johnson Services Inc, 2017). What started off as a small, three-person business, the company has now expanded across the globe and was named a “2017 Fortune’s Most Admired Company” (Bell, 2017). One may wonder, how did brothers Robert, James, and Edward Johnson set the foundation for the next 130 years to come? This success can be attributed to Johnson & Johnson’s Strategic Framework, which is at the root of all decision-making. The company’s Strategic Framework is comprised of three main components: The Foundation, Strategic Principles, and Growth Drivers (Johnson & Johnson Services Inc, 2017). All three sections of the Strategic Framework include insight to Johnson & Johnson’s Management Approach, which guides the company’s philosophy for continuous success.

The Foundation includes the Credo, which establishes the values incorporated into the decision-making process (Johnson & Johnson Services Inc, 2017). The Credo can be seen in every single office and corner of Johnson & Johnson facilities. The Credo is a reminder of the standards that are upheld in correspondence with the company’s aspirations. The Strategic Principles include the company’s organizational approach, which is a decentralized structure in management for the long-term (Johnson & Johnson Services Inc, 2017). Lastly, the Growth Drivers are the areas of focus for growth and innovation, which include the Leadership Imperatives of Connect, Shape, Lead, and Deliver (Johnson & Johnson Services Inc, 2017). These four Leadership Imperatives are considered the “4 Pillars” of Johnson & Johnson, and are the main attributes the company looks for when seeking employment. The company is leadership driven, and needs leaders of employees to act as such. These three components support why Johnson & Johnson’s Strategic Framework is at the core of the business’ continued success for the past 130 years.

Mission and Vision

The mission of Johnson & Johnson is to, “Make diversity & inclusion how we work every day” (Johnson & Johnson Services Inc, 2017). The purpose of a mission statement is to outline the foundation of the company’s goals and objectives (Nickels & McHugh, 2015). This mission is supported by the company’s vision of, “Be yourself, change the world” (Johnson & Johnson Services Inc, 2017). Johnson & Johnson’s vision is a broader representation of where the firm plans to go in the future (Nickels & McHugh, 2015). These two statements validate why the company is listed as #16 of “The Happiest Companies to Work For in 2017” (Kauflin, 2016). Johnson & Johnson aspires to bring in natural born leaders who are comfortable being themselves across a multitude of diverse backgrounds. Being comprised of 130,000 employees, the company wants to advance its unique culture to “spark solutions that create a better, healthier, world” (Johnson & Johnson Services Inc, 2017, para. 5). According to Forbes’ Patrick Hull, there are 4 essential questions that need to be answered in a mission statement (Hull, 2013). These four questions include the what, how, whom, and value brought (Hull, 2013). Johnson & Johnson’s mission is lacking half of these qualities because of how short and simple its statement is. The statement includes the what- diversity, and the value- inclusion; however, the statement does not go into the how or whom it addresses. Yet, one can imply the “how “by working across a range of diverse nations and the “whom” by those included in The Credo (patients, employees, communities, and shareholders). The statement is clear and concise, but requires more implication than other traditional missions.

Johnson & Johnson is a company that is constantly pursuing its mission. This can be seen in its “Health for Humanity 2020 Goals” (Kelly, 2017). The company’s “Health for Humanity 2020 Goals” are 15 goals that should be completed in a 5-year term to make “the places we live and work in healthier” across the world (Kelly, 2017, para. 5). These objectives are already being completed as seen in making and donating more than 160 million doses of medicine to children in underprivileged communities (Kelly, 2017). These actions support the company’s mission by providing medicine to various societies and prioritizing physical well-being. The company’s mission, vision, and goals for 2020 align with The Foundation of the Strategic Framework, by always putting the people first.

Form of Organization

Johnson & Johnson converted from a private to public corporation in 1944 (Gurowitz, 2009). Converting to a public corporation gave its shareholders and the public more visibility to the operations of the firm. Johnson & Johnson’s information can now be viewed on sources such as the NYSE. According to Zacks Investment Research, “being publicly traded is a two-edged sword” (Zacks, n.d., para. 2). This statement is due to the visibility that can put the company at a higher risk of failure exposure. If operations are not going as well as planned, this could reflect negatively in the company’s annual report and be used to a competitors’ advantage. Disclosing information that private firms are not required to do can have its perks as well as its downfalls. Shareholders appreciate the creditability as it allows them to access their day-to-day return, but this can also be put into a negative perspective if their return happens to plummet. Fortunately, Johnson & Johnson has had a consistent dividend growth for 55 years (Stamm, 2017), which helps ensure its 2,419 shareholders (valued at $236 billion) that the company is in constant growth (Nasdaq, 2017).

Besides being publicly traded, there are also advantages and disadvantages to being a corporation. The top three advantages of a corporation include limited liability, ability to raise more money for investment, and size (Nickels & McHugh, 2015). Johnson & Johnson optimizes its limited liability and size capacity. Having limited liability is crucial for a large corporation like Johnson & Johnson. Since the company is in the consumer, pharmaceutical, and medical devices markets, it is vital for its owners to have limited losses in the company. This extra protection for its owners is extremely necessary right now with the issuance of lawsuit claims against the company for as much as $417 million (Rabin, 2017). If the owners were liable for all the losses exceeding their investment, the owners may be entirely wiped out by now. Not only could this include the owners’ investment in the company, but it could also include their houses, cars, retirement funds, etc. Johnson & Johnson also leverages its size against competitors in its markets. Since the firm is so massive, it can accumulate enough profit and power every year to invest, acquire, and grow assets in the company (MarketWatch, 2017).

On the other hand, the top three disadvantages of a corporation include extensive paperwork, double taxation, and difficulty of termination (Nickels & McHugh, 2015). Johnson & Johnson’s most evident disadvantages are double taxation and difficulty of termination. Since the company is a corporation, it is required to pay taxes twice: first, before it can distribute its income as dividends and second, once the shareholders receive the dividends (Murray, 2016). Double taxation decreases the original net income that the firm annually earns. However, Johnson & Johnson acquires enough income to steadily grow every year, even with being taxed twice (PR Newswire, 2017). It is almost impossible for the company to terminate now that it has expanded worldwide. The main downfall of impossible termination is if the company goes into large sums of debt, and ends up abandoning its employees as a result. The closing of the company would devastatingly leave over 130,000 people unemployed. Therefore, the firm needs to ensure profitable growth every year. Luckily, bankruptcy should not be a problem for Johnson & Johnson anytime soon, as it is currently one of the two AAA rated companies in the United States for exceptional credit (Williams, 2015). Understanding the advantages and overcoming the disadvantages of being a corporation is why Johnson & Johnson has been so successful the past 130 years. The execution of its organizational form corresponds with the Strategic Principles in the Strategic Framework by managing for the long term.

Organization Size and Scope

The most recent data of 2017 Second-Quarter Results details Johnson & Johnson to currently have approximately 132,500 employees (PR Newswire, 2017). These 132,500 employees are distributed among 250 different operating units with over a dozen research facilities in North America, Europe, Asia, and the Middle East (Vault, 2017), to “touch the lives of over a billion people every day, throughout the world” (Johnson & Johnson Services Inc, 2017). The company operates on a multi-divisional organizational structure, which is the most common organizational structure of large companies with multiple business units (Investopedia, n.d.). The 250 operating units are restructured to incorporate leadership designed for each facility. A multi-divisional structure is the best way for Johnson & Johnson to maximize return and results, as the appropriate leadership can focus its expertise on its specific segments and business lines within the company.

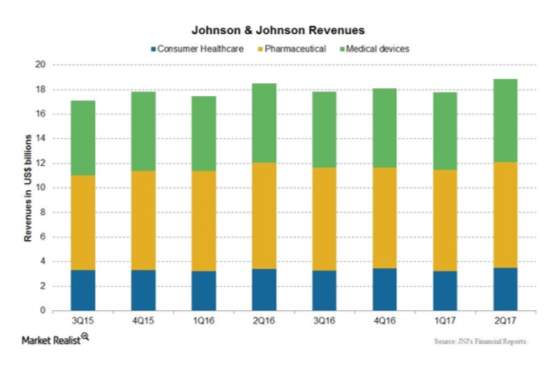

Johnson & Johnson accumulated $18.8 billion in sales for Q2 which is up 1.9% versus year ago (PR Newswire, 2017). The $18.8 billion sales were broken down by $3.5 billion in consumer, $8.6 billion in pharmaceutical, and $6.7 billion in medical devices. The annual sales revenue of Johnson & Johnson in 2016 was $71.94 billion, and the company is projected to surpass this revenue at $76.1 billion by the end of 2017 (PR Newswire, 2017). The company utilizes its size and scope capacity to extend its services to the rest of the world, which resembles the Connect and Lead of the Growth Drivers in Johnson & Johnson’s Strategic Framework by being a leading provider in the consumer health, pharmaceutical, and medical devices industries.

Operations

One crucial element to a successful business is executing proper operational activities. Johnson & Johnson has recently extended its company base to include Supply Chain Management (Johnson & Johnson Services Inc, 2017). For example, less than one year ago the Supply Chain Team in Buffalo Grove for major retailer Walgreens Co. started out as a two-person team. Within one year, the team now has over ten members and plans to grow by the year. Supply Chain now makes up 45% of employees working for Johnson & Johnson (CareerBuilder, 2017). Supply Chain has become crucially important to Johnson & Johnson’s Strategic Framework in the Foundation of the Credo. It is essential for the firm to not only allocate its resources efficiently, but also environmentally friendly. Given a highly competitive atmosphere, Johnson & Johnson wants to advance its company with eco-friendly sustainability, which provides aid to the community aspect of the Credo.

For Johnson & Johnson to provide eco-friendly resource measures, the company must sustain proper inventory management. One tactic the company uses to handle its inventory is the FIFO valuation method (United States Securities and Exchange Commission, 2013). Johnson & Johnson implements a “first in, first out” inventory management approach to ensure proper product chain allocation. This means that the first goods purchased are the first ones sold. The advantage to this method is it reduces the risk of items becoming obsolete or outdated (Kimuda, 2008). Since Johnson & Johnson manufactures thousands of products with expiration dates, it is important for the company to use this resource measure when managing its inventory.

When the company produces its primary products, it also tries to implement end-to-end supply chain optimization (Medical Design Technology, 2017). The end-to-end tool is used to eliminate as many “middle layers” as possible to increase efficiency and costs (Kolenko, 2017.). The company is partnered with approximately 80,000 suppliers, broken down to 30 categories and grouped into 5 families (Johnson & Johnson Services Inc, 2017). Johnson & Johnson has enrolled the “Sustainable Procurement Program” to focus on supplier efficiency with regulatory system assessments (Johnson & Johnson Services Inc, 2017). The hope for the company is to become as efficient, effective, and eco-friendly as possible. In 2016, 58% of packaging, 46% of marketing materials, and 61% of furniture was derived from forest materials (Johnson & Johnson Services Inc, 2017).

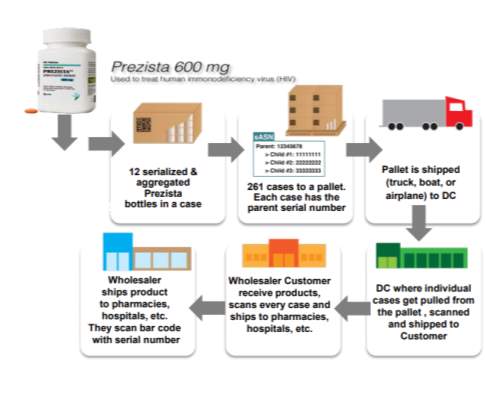

Johnson & Johnson’s resource process begins with obtaining the raw materials and components needed for product configuration by outsourcing from one of its 80,000 suppliers (Johnson & Johnson Services Inc, 2017). Once the materials are received, the product is created by one of its of manufacturing plants worldwide. The product is sorted in a case, that is then put with others on to a pallet. The pallet is then shipped by truck, boat, or airplane to one of the major 14 distribution centers. From the distribution center, the product’s case is pulled from the pallet, and then shipped to the customer warehouse distribution center. The customer distribution center then receives the products, and ships to the appropriate store locations, who finally sells the product to the end consumer (Rose, 2016).

As an example, Johnson & Johnson sources its raw materials for its 8 Hour Tylenol 24 count pack from its supplier, produces the pack at its manufacturing plant in Puerto Rico, then ships by boat or airfreight to its three major US consumer distribution centers located in Tobyhanna PA, Mooresville IN, and Fontana CA (York, 2017). The distribution center then sends the product to Walgreens’ two distribution centers located in Woodland CA and Marino Valley CA. Walgreens’ warehouse distribution centers further ships the product by truck to its brick and mortar store locations nationwide. The distribution center the product ships from is dependent on its proximity to the retail store. Once receiving the product from the closest geographical warehouse distribution center, the store places the product on the shelf, for a Walgreens customer to purchase (York, 2017). See Exhibit 1 for a similar flow representation of the drug Prezista.

Organizational Structure

Since the company has vastly widened geographically to 250 different operating units, it makes sense for Johnson & Johnson to delegate more freedom to its managers and employees in each unit (Vault, 2017). Johnson & Johnson’s facilities incorporate a decentralized structure with more empowerment for its workers in various levels of management (Bedeian, 1993). Implementing a decentralized structure allows each operating unit to adapt to the needs of the people in each differing location (Schwenker & Botzel, 2007). In a decentralized structure, authority is delegated down the organizational chain. Since Johnson & Johnson is so massive with over 130,000 employees, the pyramidal structure is also quite tall. Having a tall organizational structure means that there are various levels of management and reporting relationships (Nickels & McHugh, 2015). Generally tall, decentralized structures are inefficient because of the lack in communication across multiple segments and levels (Nickels & McHugh, 2015). However, Johnson & Johnson is one of the few large companies that has used this structure to its advantage by adapting to the local needs in proximity to each operating unit. The company’s diversified organizational structure is affiliated with the Strategic Principles of Johnson & Johnson’s Strategic Framework of a long term decentralized organizational approach.

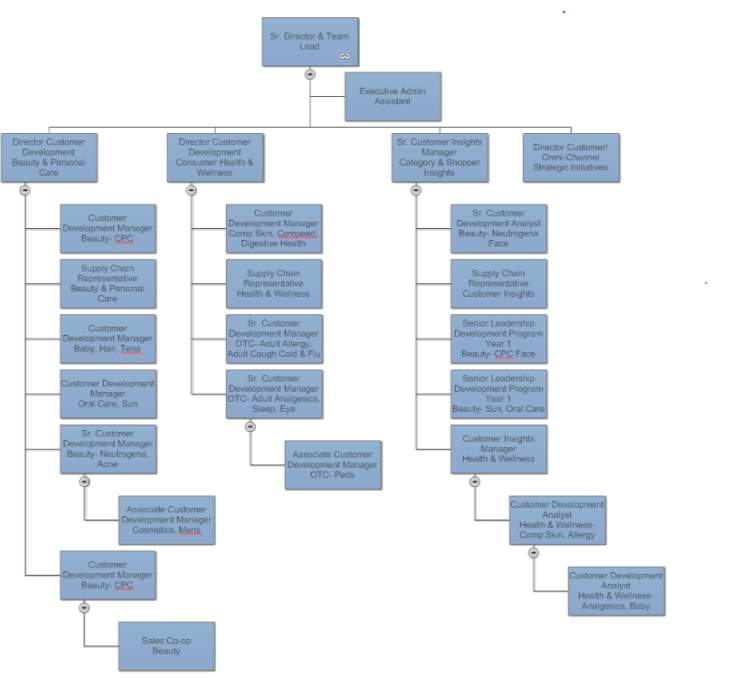

The two main advantages of a decentralized structure include higher morale and faster decision making (Nickels & McHugh, 2015). Imagine if a low-level manager had to ask its boss’ boss’ boss’ boss for approval on a decision. Increasing empowerment in its various levels of employees improves time management and provides employees with higher levels of satisfaction (Bedeian, 1993). The two main disadvantages of a decentralized structure include less top-management control and weakened corporate image (Nickels & McHugh, 2015). However, these two disadvantages are in fact advantages for Johnson & Johnson as the company leverages its decentralized structure for a happier working environment which increases their corporate image to the public. It can also be assumed that Alex Gorsky, CEO of Johnson & Johnson, does not want nor has the time capacity to oversee 130,000 employees on his own. Instead, the decentralized structure includes multiple operating units that have differing functional and divisional groups within (Lumen, n.d.).

For example, the Customer Focused Team in Buffalo Grove IL, is divided between Health & Wellness and Beauty & Personal Care. Within each division, there are differing functions and responsibilities by each employee. Both divisions have Customer Development Managers that oversee specific brand lines, as well as Supply Chain Representatives that have the task of managing inventory allocation for specific brand lines. Exhibit 3 includes a representative example of an Org Chart in one of the 250 operating units nationwide.

Financial Condition

Johnson & Johnson is labeled as one of, “The 10 Most Profitable American Companies in the Fortune 500” (Wieczner, 2017). For a company to be profitable, it must sustain substantial cash flow. One of the most relevant indicators of wealth in financial statements is the statement of cash flows. Johnson & Johnson’s statement of cash flows provides crucial insight to the success of the company’s profitability. The statement of cash flows is segmented by operating, investing, and financing activities. Currently for Q2 2017, Johnson & Johnson has $5.77 billion, -$12.25 billion, and -$1.92 billion in operating, investing, and financing activities, respectively (Wall Street Journal, 2017). These numbers in Q2 2016, were $4.99 billion, $1.32 billion, and -$1.46 billion in operating, investing, and financing activities, respectively. When comparing the differing activities, the operating and financing segments seem relatively similar versus prior year. However, there is a huge difference between Q2 2017 investing activities (-$12.25 billion) versus prior Q2 2016 investing activities ($1.32 billion). This can be explained by Johnson & Johnson’s quarterly report. In Q2 2017, Johnson & Johnson finalized the acquisition of Actelion Ltd. for $30 billion in cash (PR Newswire, 2016). The acquisition of a leading biopharmaceutical company such as Actelion Ltd. is substantial compared to the prior year acquisition of Vogue International LLC for $3.3 billion in cash (PR Newswire, 2016).

Both purchases appear in the investing activities section under the statement of cash flows (Wall Street Journal, 2017). The range of purchase is the main reason behind the difference in investing activities versus prior year (Nasdaq, 2017). Nevertheless, this is not a bad sign to be negative in investing activities (Minnesota Libraries Publishing, 2016). In fact, it is a positive sign to see a negative in the investing portion of the statement of cash flows because growing companies spend increased amounts of money on new assets (Minnesota Libraries Publishing, 2016). In this case, Johnson & Johnson bought out Actelion, which is an immense contribution to the company’s assets. For a company to grow substantially, it must acquire more power and ownership in the market. In this case, Johnson & Johnson acquired a much larger company this quarter versus prior year which will propel growth and profit in the future.

In regard to the other two sections of the statement of cash flows with operating and financing activities, there is not a significant difference between the two quarters. Both sections indicate a positive, stable growth for the company. The operating activities increased $.78 billion versus prior year (Wall Street Journal, 2017). It is always a good sign for the company to attain positive operating activities (Minnesota Libraries Publishing, 2016). This data showcases that Johnson & Johnson is making money off its goods and services. The increase can be explained by new technology and the entrants of new products. In Q2 2017, new products DARZALEX® (daratumumab) and IMBRUVICA® experienced rapid growth, resulting in the increase of operating activities for the quarter (PR Newswire, 2017). On the other hand, financing activities can fluctuate on positivity versus negativity (Minnesota Libraries Publishing, 2016). The company’s financing activities of Q2 2017 are similar to Q2 2016 in the respect of both requiring the payment of cash dividends and the repurchase of common and preferred stock (NYSE, 2017). This payment and repurchase allows Johnson & Johnson to diminish its debt and advance capital. Having sustainable flows of cash corresponds to Deliver of the Growth Drivers in the Strategic Framework by delivering the best results and maintaining a stable statement of cash flows.

Industry/Competitive Environment

With a highly competitive industry, Johnson & Johnson is focused on the segment that contributes the most to the overall success of the company. As shown in Exhibit 2, Johnson & Johnson’s pharmaceutical industry has reported continued growth for Q2 2017 and amounted to roughly 46% of the company’s total revenue (Benson, 2017). Pharmaceuticals has continued to account for the largest segment of revenue within the company for the past three years (Statista, 2017). In the pharmaceutical industry, Johnson & Johnson’s three main competitors include Pfizer, Novartis, and Eli Lilly & Co. Considering the pharmaceutical business includes more than two major competitors owning significant market share, Johnson & Johnson is considered an oligopoly (Cabral, 2017). According to Cabral, “An important characteristic of oligopolies is the strategic interdependence between competitors” (Cabral, 2017, p. 101). This statement means that any change in one influences the other- especially when it comes to products or prices. Johnson & Johnson, Pfizer, Novartis, and Eli Lilly & Co create similar medicines designed to cure and treat specific diseases. Therefore, price reliance is not as much of a focus as the differentiation of advantages and benefits associated with its products (Hackner, n.d.). Each company heavily relies on innovation within its own laboratories to out-do rival firms. Introducing new products to the pharmaceutical market can heavily impact competitor profits (Mankiw, 2015). One way these four oligopolies expand their market share in the industry is by using their size capacity to facilitate large research and development budgets to create new drugs and medicines (Reynolds, 2015).

Over the course of the past ten years, Johnson & Johnson has increased its research and development budget, giving them a competitive advantage over the other three firms (Statista, 2016). This supports Johnson & Johnson’s Credo to support its doctors and patients in the Foundation section of its Strategic Framework. According to Endpoints News, Johnson & Johnson is #2 on the list of “The 15 Top R&D Spenders in the Global Biopharma Business” in 2016 (Carroll, 2016). The company’s research and development budget has increased significantly over the years, where their budget originally was lacking behind competitors at $6.4 billion in 2005 (Statista, 2016). Ever since, Johnson & Johnson has made it a priority to improve innovation by increasing the budget. As of 2016, the company’s budget spend was $9.1 billion, followed by #3 Novartis at $8.4 billion, #4 Pfizer at $7.8 billion, and lastly #9 Eli Lilly at $5.4 billion (Carroll, 2016). Allocating more money on research and development provides Johnson & Johnson with a competitive advantage by enabling the company to create more product differentiation with the entrance of new products (Reynolds, 2015).

The competitive advantage of an increased research and development budget is shown in Johnson & Johnson’s announcement to introduce at least ten new products by 2019 that each have the potential to generate over $1 billion in sales (Bomey, 2017). The new products also include, “more than 40 line extensions of existing and new medicines” (PR Newswire, 2017, para. 1). Another competitive advantage Johnson & Johnson has over competitors Pfizer, Novartis, and Eli Lilly & Co, is protection of its diversified product portfolio. While the company’s competition has other various pharmaceutical products, Johnson & Johnson has much more intellectual property on its inventions. In “Top 300 Organizations Granted U.S. Patents in 2016”, Johnson & Johnson had 932 patents, whereas Pfizer had 152, Novartis had 247, and Eli Lily did not even make the list at less than 110 patents (Intellectual Property Owners Association, 2017). The competitive advantage Johnson & Johnson gains from obtaining the most patents for the recent year is its exclusivity to create, use, and sell its products for up to twenty years (Hollowell, Miller & Clarkson, 2009). There is a direct relationship between its research and development budget with its intellectual property. By prioritizing a larger emphasis on research and development, Johnson & Johnson can produce more innovative processes and patent them, giving the company a step ahead of its competition in the marketplace.

Marketing

One promise Johnson & Johnson makes time after time is quality assurance (Bhasin, 2016). The company strives to achieve the most efficient yet effective products as displayed in Deliver of the Growth Drivers in the Strategic Framework. One way the company executes this is by segmenting its market (Bhasin, 2016). It creates products for all ages, genders, and races. It targets each segment by providing a solution to a particular need. For example, teenagers are prone to have more acne- so Johnson & Johnson creates products specifically designed for acne treatment and launches “solvemyacne” on its Neutrogena website. “Solvemyacne” includes a personalized questionnaire for a teenager to fill out that ultimately recommends a suitable regimen. This segmentation can be seen across multiple markets, but one market the company is continuously trying to capture and deliver to is its mothers.

Product

Johnson & Johnson assumes that mothers are willing to go the extra mile to provide the best care for their children as stated in their Johnson’s® Baby mission: “We’re helping moms and dads like you safely care for your babies. We know you don’t want to take any risks” (Johnson & Johnson Consumer Inc, 2017, para. 1). Therefore, Johnson & Johnson, owner of Johnson’s® Baby, creates products at premium quality for those mothers that want the best for their child. The company manufactures all the necessary products a mother may want created with the gentlest ingredients (Johnson & Johnson Consumer Inc, 2017). This is supported by “Johnson’s® 5-Step Safety Assurance Process” that constantly tests and evaluates its formula ingredients (Johnson & Johnson Consumer Inc, 2017). The company’s product line contains baby shampoos, oils, body washes, wipes, powders, lotions, etc. Johnson & Johnson knows mothers will pay for the premium product, and therefore designs its products to include the most pure, eco-friendly, non-chemical ingredients, that are proven to be the safest and least harmful to children.

Price

Since Johnson & Johnson labels its products to maintain the “highest standards”, its prices reflect this as well (Johnson & Johnson Consumer Inc, 2017). Johnson’s® Baby products are set at a premium yet affordable price, usually higher than private-label or other generic brands (Bhasin, 2016). The company utilizes its scientific development and research to provide the safest products while still sustaining an affordable price. Known as cost-based pricing, Johnson’s® Baby products require higher retail prices due to increased material costs associated with better quality (Nickels & McHugh, 2015). An example of this can be seen with Johnson’s® Baby Head-to-Toe Wash Original Formula 15 oz priced at $5.49 on Walgreens.com, versus Walgreens private-label brand Well Beginnings Baby Wash 15 oz priced at $3.99 (Walgreens Co, 2017). The difference in pricing between the private-label brand and the name brand is evident, but not extensive. The company also captures the mother market by using psychological pricing, which sets its product at price points of .49 or .99 (Nickels & McHugh, 2015). This deceives the mother into thinking she is getting the item for $5, when $5.49 versus $5.50 is essentially the same price. However, if the pricing was $5.50 instead, the orders would not be sufficient as the mother then perceives the price as more expensive at $6.

Place

Johnson & Johnson guarantees product placement with its Johnson’s® Baby products to further incentivize mothers to purchase its items (Hagensen, Lock & Williams, n.d.). First, the company confirms its products are readily available in the baby section of every large major retail store. These stores include nationwide locations of Walgreens, CVS, Rite-Aid, Kroger, Target, and Walmart. The company ensures its products are an option for the mother. To begin with, the company pushes for product purchasing by implementing on-shelf availability (Quri, 2017). The company negotiates thousands of dollars to place its baby care products at eye level and within reach on the shelf, for both the mother and the child (Hagensen, Lock & Williams, n.d.). This product placement is essential to its marketing technique. By placing the product at eye level for the mother, it is the first baby brand the mother looks at when debating a purchase. Secondly, by placing the product at eye level for the child, the child is then able to grab the product and ask his/her mom to buy it (Hagensen, Lock & Williams, n.d.). Allocating on-shelf availability in an accessible manner motivates the mother to purchase the product, whether that be by the decision herself or the pressure from her child.

Promotion

Although Johnson & Johnson’s pricing is at a reasonable premium level, it allows for the expense of discounts and bundles. The markup on pricing gives the company wiggle room to promote its products at lower prices. Promotions include BOGOs (buy one get one), coupons, or FSIs (free-standing insert). All three promotions lessen the purchasing prices of the items (Nickels & McHugh). If vendors expense a promotional spend, the price can be less than the generic brand. This can be seen with the same Johnson’s® Baby Head-to-Toe Wash Original Formula 15 oz priced at $5.49 that currently has a $2 off coupon (Walgreens Co, 2017). This coupon brings the retail price down to $3.49, which is less than the generic Walgreens Well Beginnings Baby Wash 15 oz priced at $3.99 (Walgreens Co, 2017). In this case, Johnson’s® Baby is utilizing a high-low pricing strategy, where it is cheaper to buy the name brand than to buy the generic brand when on promotion (Nickels & McHugh, 2015). Promoting discounts and deals builds a relationship that returns mothers back to the Johnson’s® Baby brand and stimulates growth in the company (Hagensen, Lock & Williams, n.d.).

Summary and Conclusion

As shown, Johnson & Johnson continues to outpace the market by delivering maximum benefit across the globe. From the organization’s mission to its size and structure, Johnson & Johnson has proven to be one of the leading healthcare providers in the consumer, pharmaceutical, and medical devices industries. Back in 1866, brothers Robert, James, and Edward Johnson set the foundation of what was at the time a small family business. Today, this business has expanded worldwide and makes an impact on more than a billion lives every day. This advancement of Johnson & Johnson for the past 130 years can be attributed to its core Strategic Framework of the Foundation, Strategic Principles, and Growth Drivers for ultimate success.

Exhibits

Exhibit 1

Exhibit 2

Exhibit 3

References

Bedeian, A. G. (1993). Management. Retrieved from https://books.google.com/books?id=N_bsAAAAMAAJ&pg=PA276&lpg=PA276&dq=j%26j%2Bdecentralized%2Bstructure%2Bmore%2Bempowerment&source=bl&ots=89z55nXvdi&sig=-FpeyVU8qRHzXcvntcZy8gAvJoM&hl=en&sa=X&ved=0ahUKEwjvrLK-nt_WAhXB4yYKHYJfCGEQ6AEIKTAA#v=onepage&q&f=false

Bell, J. (2017, February 21). J&J leads pharma in Fortune’s most admired companies list. Retrieved from http://www.biopharmadive.com/news/Fortune-most-admired-pharma-2017/436592/

Benson, M. (2017, August 28). Johnson & Johnson’s 2Q17 Performance, by Segment. Retrieved from http://marketrealist.com/2017/08/johnson-johnsons-2q17-performance-by-segment/

Bhasin, H. (2016, July 24). Marketing mix of Johnson and Johnson – The 4P’s of Johnson & Johnson. Retrieved from https://www.marketing91.com/marketing-mix-johnson-johnson-4-ps-jj/

Bomey, N. (2017, May 17). J&J says 10 new drugs could bring in $1B each in sales. Retrieved from https://www.usatoday.com/story/money/2017/05/17/johnson-johnson-pharmaceuticals/101783338/

Cabral, L. M. (2017). Introduction to Industrial Organization (1st ed.). Cambridge, MA: The MIT Press.

CareerBuilder. (2017). 2018 Johnson & Johnson Supply Chain/Operations Co-Op Jobs in New Brunswick, NJ – Johnson & Johnson. Retrieved from https://www.careerbuilder.com/job/J3G6296XCHZSHL6QDVS

Carroll, J. (2016, June 13). The 15 top R&D spenders in the global biopharma business: 2016. Retrieved from https://endpts.com/top-pharma-biotech-research-development-budgets/

Gurowitz, M. (2009, August 03). 1944: From Private to Public. Retrieved from https://www.kilmerhouse.com/2009/08/1944-from-private-to-public/

Hackner, C. (n.d.). Oligopoly. Retrieved from https://learning.hccs.edu/faculty/charles.hackner/slide-sets/micro-slide-sets/micro-part-2-slide-sets/oligopoly/at_download/file

Hagensen, R., Lock, F., & Williams, N. (n.d.). Johnson and Johnson. Retrieved from http://faculty.washington.edu/sandeep/old/teaching/conmkt/j&j.htm

Hollowell, W. E., Miller, R. L., & Clarkson, K. W. (2009). Study guide to accompany Business law: text and cases: legal, ethical, global, and e-commerce environments, eleventh edition Kenneth W. Clarkson (11th ed.). Mason, OH: South-Western Cengage Learning.

Hull, P. (2013, January 10). Answer 4 Questions to Get a Great Mission Statement. Retrieved from https://www.forbes.com/sites/patrickhull/2013/01/10/answer-4-questions-to-get-a-great-mission-statement/#4ead2be867f5

Intellectual Property Owners Association. (2017, May 30). Top 300 Organizations Granted U.S. Patents in 2016. Retrieved from http://www.ipo.org/wp-content/uploads/2017/05/2016_Top-300-Patent-Owners.pdf

Investopedia. (n.d.). Organizational Structure. Retrieved from http://www.investopedia.com/terms/o/organizational-structure.asp

Johnson & Johnson. (2017, March). Johnson & Johnson Annual Report 2016. Retrieved from https://jnj.brightspotcdn.com/88/3f/b666368546bcab9fd520594a6016/2017-0310-ar-bookmarked.pdf

Johnson & Johnson Consumer Inc. (2017). JOHNSON’S® Safety Standards. Retrieved from https://www.johnsonsbaby.com/safety-standards

Johnson & Johnson Services Inc. (2017). Our Management Approach | Johnson & Johnson. Retrieved from https://www.jnj.com/about-jnj/management-approach

Johnson & Johnson Services Inc. (2017). Johnson & Johnson Mission and Vision Doc. Retrieved from https://www.jnj.com/_document?id=00000159-6a3b-d7d5-abdd-ea3f92360000

Johnson & Johnson Services Inc. (2017). Procurement & Supplier Management | Johnson & Johnson. Retrieved from http://healthforhumanityreport.jnj.com/procurement-and-supplier-management

Kauflin, J. (2016, December 02). The Happiest Companies To Work For In 2017. Retrieved from https://www.forbes.com/sites/jeffkauflin/2016/12/02/the-happiest-companies-to-work-for-in-2017/#2ebc4d4e19d6

Kelly, A. (25, June 2017). How Johnson & Johnson’s Health for Humanity 2020 Goals Can Help Improve the Well-Being of the World. Retrieved from https://www.jnj.com/latest-news/johnson-and-johnson-health-for-humanity-2020-goals

Kimuda, D. W. (2008). A Textbook of Financial Accounting. Retrieved from https://books.google.com/books/about/A_Textbook_of_Financial_Accounting.html?id=T-DPARKZXOwC

Kolenko, S. (2017, February 13). Why you need an end-to-end procurement solution. Retrieved from https://blog.procurify.com/2014/09/02/need-end-end-procurement-solution/

Lumen. (n.d.). Factors to Consider in Organizational Design. Retrieved from https://courses.lumenlearning.com/boundless-management/chapter/factors-to-consider-in-organizational-design/

Mankiw, N. G. (2015). Principles of Economics (7th ed.). Cengage Learning.

MarketWatch. (2017). Johnson & Johnson. Retrieved from http://www.marketwatch.com/investing/stock/jnj/financials

Medical Design Technology. (2017, January 09). Johnson & Johnson Medical Devices Companies Launch CareAdvantage. Retrieved from

https://www.mdtmag.com/news/2017/01/johnson-johnson-medical-devices-companies-launch-careadvantage

Minnesota Libraries Publishing. (2016, March 22). Financial Accounting. Retrieved from http://open.lib.umn.edu/financialaccounting/

Murray, J. (2016, June 08). Double taxation for business owners explained. Retrieved from https://www.thebalance.com/what-is-double-taxation-398210

Nasdaq. (2017). Johnson & Johnson (JNJ) Ownership Summary. Retrieved from http://www.nasdaq.com/symbol/jnj/ownership-summary

Nickels, W. G., McHugh, J. M., & McHugh, S. M. (2005). Understanding business (11th ed.). Boston, Mass.: McGraw-Hill/Irwin.

NYSE. (2017). Johnson & Johnson income-statement 2017 Q2. Retrieved from

https://amigobulls.com/stocks/JNJ/cash-flow/quarterly

PR Newswire. (2017, July 18). Johnson & Johnson Reports 2017 Second-Quarter Results:. Retrieved from http://www.prnewswire.com/news-releases/johnson–johnson-reports-2017-second-quarter-results-300489759.html

Quri. (2017). Measuring On-Shelf Availability (OSA) Key to Merchandising Success Ahead of Labor Day. Retrieved from https://pointofsale.com/2016080413170/Point-of-Sale-News/Measuring-On-Shelf-Availability-OSA-Key-to-Merchandising-Success-Ahead-of-Labor-Day.html

Rabin, R. C. (2017, August 22). $417 Million Awarded in Suit Tying Johnson’s Baby Powder to Cancer. Retrieved from https://www.nytimes.com/2017/08/22/health/417-million-awarded-in-suit-tying-johnsons-baby-powder-to-cancer.html

Reynolds, B. (2015, August 11). Johnson & Johnson Offers High Returns and Stability for a Bargain. Retrieved from https://www.thestreet.com/story/13251710/1/johnson-johnson-offers-high-returns-and-stability-for-a-bargain.html

Rose, M. (2016, October 14). Johnson & Johnson Supply Chain’s Experience: Implementing DSCSA’s Product Identification Requirements. Retrieved from https://www.fda.gov/downloads/Drugs/NewsEvents/UCM529578.pdf

Schwenker, B., & Botzel, S. (2007). Making Growth Work: How Companies Can Expand and Become More Efficient. Retrieved from http://ebookcentral.proquest.com/lib/butler/reader.action?docID=302075

Shen, L. (2016, April 26). Now There Are Only Two U.S. Companies With the Highest Credit Rating. Retrieved from http://fortune.com/2016/04/26/exxonmobil-sp-downgrade-aaa/

Stamm, W. (2017, April 28). Johnson & Johnson: 55 Years Of Increasing Dividends, A Company For All Seasons. Retrieved from https://seekingalpha.com/article/4066947-johnson-and-johnson-55-years-increasing-dividends-company-seasons

Statista. (2016). Novartis R&D spending by business 2016 | Statistic. Retrieved from https://www.statista.com/statistics/265845/novartis-spending-on-research-and-development-by-division/

Statista. (2016). Johnson & Johnson R&D expenditure 2005-2016 | Statistic. Retrieved from https://www.statista.com/statistics/266407/research-and-development-expenditure-of-johnson-und-johnson-since-2006/

Statista. (2016). Pfizer R&D expenditure 2006-2016 | Statistic. Retrieved from https://www.statista.com/statistics/267810/expenditure-on-research-and-development-at-pfizer-since-2006/

Statista. (2016). Eli Lilly R&D expenditure 2007-2016 | Statistic. Retrieved from https://www.statista.com/statistics/266591/eli-lilly-and-company-expenditure-on-research-and-development-since-2007/

United States Securities and Exchange Commission. (2013, December 29). JOHNSON & JOHNSON. Retrieved from http://www.investor.jnj.com/secfiling.cfm?filingid=200406-14-33

Vault. (2017). Johnson & Johnson|Company Profile. Retrieved from http://www.vault.com/company-profiles/personal-care/johnson-johnson/company-overview

Walgreens Co. (2017). Search Engine “babywash”. Retrieved from https://www.walgreens.com/search/results.jsp?Ntt=baby%2Bwash

Wall Street Journal. (2017). JNJ Quarterly Cash Flow. Retrieved from http://quotes.wsj.com/JNJ/financials/quarter/cash-flow

Wieczner, J. (2017, June 07). These Are The Fortune 500’s 10 Most Profitable Companies. Retrieved from http://fortune.com/2017/06/07/fortune-500-companies-profit-apple-berkshire-hathaway/

Williams, S. (2015, August 19). 8 Things You Probably Don’t Know About Johnson & Johnson. Retrieved from https://www.fool.com/investing/value/2015/08/19/8-things-you-probably-dont-know-about-johnson-john.aspx

York, L. (2017, September 29). Interview on J&J Supply Chain [Interview by M. Eisenhut & L. York].

Zacks. (n.d.). What Does It Mean if a Company Is Publicly Traded on the New York Stock Exchange? Retrieved from http://finance.zacks.com/mean-company-publicly-traded-new-york-stock-exchange-2294.html

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Strategy"

Business strategy is a set of guidelines that sets out how a business should operate and how decisions should be made with regards to achieving its goals. A business strategy should help to guide management and employees in their decision making.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: