Market Expansion Plan for Consulting Company

Info: 18509 words (74 pages) Dissertation

Published: 11th Dec 2019

Tagged: BusinessBusiness Strategy

Table of Contents

1. Company competitive analysis

1.2. Competitors and SWOT analyses of competitors

2. Potential Clients in Africa

3. Development and Humanitarian Projects in Africa (Ghana)

4. New market selection and analysis

4.1. Analysis of the market in Ghana

4.2. Regions/provinces/demographic characteristics/languages

4.3. Culture, religion and customs environment (Commisceo Global, 2016)

4.4. Political and legal environment

4.5. Company registration and operation

4.6. Infrastructure and transportation environment

4.7. Banking rules and regulations

5. Operating Costs Analysis, Ghana

6. Staffing, recruitment and selection analysis, Ghana

Executive summary

The presented report is a comprehensive new market expansion plan for Forcier Consulting, as a result of a complete and in depth analysis of Forcier, its competitors, the consulting industry in Africa, its potential clients across the industry, current major projects in the markets of interest, operating costs in the potential new market, and staffing in the new markets for entry. Our initial analysis of Forcier reflected a strong and vibrant organization with high gain potential in the M&E arena, a solid and diversified portfolio of activities, high potential scope for customers, a competitive position among its rivals, and a vast opportunity for expansion.

After our initial analysis of Forcier and its current position in the market, we identified several key competitors in the African M&E services market that have a long and established record (Section 1), including Africa Business Group (ABG), Khulisa Management Services, and the International Business and Technical Consultants, Inc. (IBTCI). We also identified six major potential clients for Forcier that operate throughout Africa (Section 2). These include, The World Bank, the Africa Development Bank (AfDB), Africare, the Bill and Melinda Gates Foundation, and The International Fund for Agricultural Development (IFAD), and the International Fund for Agricultural Development (IFAD). Among the potential clients, we researched and present data and statistics on ten (10) active projects that involves our selected new market that total more than USD $12 billion (Section 3). The potential for success for Forcier, in a new market, will depend on several factors. These success criteria include: Entry into a new market with a high degree of international and local investments, including aid projects, an established client pool with a lengthy record of activities and success, a relative political, economic and social stability in the region, relative distance and difference between present market in which Forcier operates, and the new potential market, as well as a non-repeat market criteria.

After analyzing all criteria relative to possible new markets, we closely compared the two new markets with highest similarity meeting the above success criteria: Nigeria and Ghana. After a complete analysis (data and graphical), which includes review of the region’s geographic profile relative to current market, demographics, language, culture and society (high levels of diversity), political environment, infrastructure (including transportation), and financial and commercial regulations our team selected Ghana as the new market for entry. Ghana reflected a high degree of promise for success of Forcier due to its strong development and economic activities, its relatively high rank for Ease of Doing Business Report, its available infrastructure, including a diverse source of transportation and financial institutions, including commercial banks and money transfer entities (Western Union), and its relative convenience of business registration and low costs of operation (Section 5), including its tax structure. Most importantly, however, is the fact that Ghana is conveniently situated in a geographic position that can serve as Forcier’s major gateway to the Western Regions of Africa. Our next consideration for selecting Ghana for our new market includes the available staffing (Section 6). Ghana requires employment contracts, which protects both employers and employees, as well as rights of all parties involve. Since Forcier prides itself on hiring talent from the local environment, it will benefit from available recruiting resources in Ghana, including the universities, popular websites, including LinkedIn and JobsGhana. Our final discussion includes recommendations for Forcier to succeed in Ghana, which includes recommendations to promote Forcier to the local academic market, partnerships with institutions of scholar or government to secure pipeline for project communications, among others.

1. Company competitive analysis

1.1.Company description

Forcier Consulting is a research and consulting firm that operates within a wide range of disciplines, in post-conflict and logistically challenging environments across Africa. The company was started in 2011, in Juba, South Sudan, and supports the efforts of clients on projects ranging from evaluations of emergency response programs, to ethnographic mapping of indigenous tribes in South Sudan utilizing on-the-ground data collection, methodological design, and rigorous data analysis.. It has grown to more than 180 staff members working in offices throughout Eastern and Northern Africa, including Somalia, South Sudan, Sudan, Egypt, Democratic Republic of Congo (DRC), Kenya, and Mozambique. Forcier serves a large variety and types of clients; and in Africa, its main types of clients include (a) Government Represented Organizations, (b) Non-Governmental Organizations (NGO), (c) large international firms operating in Africa, including international aid organizations, and also (d) profit-based organizations, including investment banks and companies.

1.2. Competitors and SWOT analyses of competitors

The SWOT analysis (Strength, Weaknesses, Opportunities and Threats) is an “analytical framework that can help a company face its greatest challenges and find its most promising new markets.” (Taylor, 2016).

| Competitor Name #1: | Africa Business Group (ABG) | Office location(s):

Home Office: The Business Centre Fourways, Leslie Ave, Design Quarter, Sandton, 2191, Johannesburg, South Africa |

|

| Telephone: | +27 11 513 4117 | ||

| Fax: | N/A | Email: | info@abghq.com |

| Website: | www.abghq.com | Year founded: | Established 2005 |

Key Characteristics/Specialization

- Consulting

- Economic Development Consulting (international trade promotion, investment attraction, domestic resource mobilization, local content enhancement)

- Business Development Consulting.

- Strategic Planning (export promotion, environmental development, micro-enterprise finance programming, local economic development, rural and urban development)

- Policy Development

- Project Monitoring and evaluation

- Finance, Investment and Technical Assistance Support Mobilization. Focus is on assisting clients in identify and securing resources to expand their company.

- Legal Consulting (commercial agreements, company incorporation).

- Energy, agriculture, tourism, real estate, manufacturing, extractive industries. Activities:

- Project Design, Development and Management.

- Value Chain Development and expansion

- Investment Strategy and Facilitation.

- Capacity Development. Support is given to:

- Community of Practice Development (digital / physical knowledge-sharing platforms)

- Executive Education/ Short Course Design and Facilitation.

Past projects

- City of Joburg Local Economic Development Infrastructure Assessment → Assessment of local economic development strategy developed within the City of Johannesburg Economic Development Unit and review of existing infrastructure.

- Water and Sanitation Africa November 2012 – November 2013 → In collaboration with Mikaty, ABG developed governance structures and related documents to support establishment of WSA Foundation, WSA Research Centre and Enterprise and Investment Group.

Current projects

- UN- ICGLR Great Lakes Private Sector Investment Conference

Under a contract with the UNDP Africa Facility for Inclusive Markets, and the patronage of the International Conference for the Great Lakes Region and the UN Special Envoy to the Great Lakes Region, ABG has been engaged to support the convening of a Great Lakes Private Sector Investment Conference and the preparation of a related Investment Opportunities Brief.

- UNDP FMARD Nigeria

The Federal Ministry of Agriculture and Rural Development of Nigeria in collaboration with the United Nations Development Program and Bill and Melinda Gates Foundation held a 6-day strategic workshop on the Nigeria’s Agricultural Transformation Agenda (ATA). The workshop featured analytical presentations and group exercises that were part of an internal capacity development workshop held in Abuja from 10 – 12 and 17 – 19 November 2014. ABG was engaged to co-facilitate the sessions and support the final report preparation.

Africa Business Group (ABG) SWOT Analysis:

| Strengths:

|

Weaknesses:

|

| Opportunities:

|

Threats:

|

| Competitor Name #2: | Khulisa Management Services | Office location(s):

South Africa: 26 7th Ave, Parktown North, Johannesburg, 2193 USA: 4630 Montgomery Ave, Suite 510 Bethesda, MD, 20814 |

|

| Telephone: | +27 11 447 6464 (South Africa)

+1 301 951 1835 (USA) |

||

| Fax: | +27 11 447 6468 (South Africa) | Email: | info@khulisa.com |

| Website: | www.khulisa.com | Year founded: | Established 1993 |

Khulisa’s work spans across the African continent and the globe. Since 2012, we have completed work for 60 clients on 91 projects in 54 African countries. We have conducted 1622 Data Quality Assurance (DQAs) for 294 organisations.

Key Characteristics/Specialization (Khulisa Management Services, website)

Khulisa management focuses on sectors such as Health, Education, Agriculture, Youth and Socio-economic Development, Business Intelligence & Data Visualisation, Media and journalism, Safety and security, Radio and ICT, International law. In these sectors, offers include

- Evaluation and Research

- Impact and Outcome Evaluations

- Performance Assessments

- Process Evaluations

- Monitoring Support

- Monitoring/Performance Frameworks, Indicators and Plans

- Data Quality Audits/Assessments

- Capacity Building

- Training and Workshops

- M&E Systems Development and Support

- Mentoring

- Data Visualization

- Business Intelligence

- Management Systems Reengineering and Streamlining

- Database Design

- Software Development

- Organisational Systems Development

- Knowledge Management

- Curriculum Design

Past projects

- Khulisa’s has done some projects in Ghana, but the major focus has been in South Africa.

- Nutrition interventions in South African.

- The South African Department of Health and its efforts to coordinate a health promotion project.

- Evaluating the smallholder farmer sector for the South African Presidency

Current projects

- Conducting Scoping and Field Research Studies for GALVmed

- National Library of South Africa Country-wide Survey

Khulisa Management Services SWOT Analysis:

| Strengths:

|

Weaknesses:

|

| Opportunities:

|

Threats:

|

| Competitor Name #3: | International Business & Technical Consultants, Inc. (IBTCI) | Office location(s):

Home Office: 8618 Westwood Center Drive Suite 400, Vienna, VA 22182 |

|

| Telephone: | +1 703 749 0100 | ||

| Fax: | +1 703 749 0110 | Email: | N/A (contact form on website) |

| Website: | www.ibtci.com | Year founded: | Established 1987 |

IBTCI started in 1987 supporting and facilitating economic and industrial development. Initially, focus was toward improving operational efficiency and management of public and private sector enterprises. Since the firm grew, larger scale projects and increased quantity contracts have been handled involving both technical assistance and training activities to meet development assistance needs of emerging markets

Key Characteristics/Specialization (ibtci, 2017)

- Monitoring, Evaluation & Learning

- Human & Institutional Capacity Building

- Knowledge Management, Learning & Outreach

- Democracy/ Governance, Crisis & Conflict

- Health, HIV/ AIDS, and WASH

- Education, Economic Growth & Environment

- Agriculture & Food Security

Projects (ibtci, 2017)

- Projects completed throughout Africa (Including Ghana):

- Capital Market Program (Throughout Africa)

- Evaluation of USAID/Africa’s Textbook and Learning Program

- Evaluation Services and Program Support (ESPS) (East Africa)

- Monitoring, Evaluation, & Coordination Contract (MECC) (DRC)

- Review of Payment Systems Laws (Ghana)

- Development of Consultancy Networks (Ghana)

IBTCI SWOT Analysis:

| Strengths:

|

Weaknesses:

|

| Opportunities:

|

Threats:

|

2. Potential Clients in Africa

2.1. Organizations

Client 1: World Bank

- Sectors of Operation (worldbank.org, 2017):

- Agriculture, Fishery, and Forestry

- Information and Communications

- Education

- Finance

- Infrastructure and Transportation

- Health and Social Science

- Geographical locations of focus, years of operation, budget (World Bank, 2017):

- The World Bank was founded in 1944 (73 years)

- Supports development in all African countries

- Invested/committed over USD $60 billion on active projects.

- Contact Information (The World Bank Contacts, 2017):

- Ghana field office resident representative: Mr. Kennedy Fosu

- Address: No. 69 Dr. Isert Road North Ridge, Accra, Ghana

- Telephone: (233) 30-221-4142/ Email: kfosu@worldbank.org

Client 2: African Development Bank Group (AfDB)

- Sectors of Operation (AfDB.org, 2017):

- Energy & Power

- ICT

- Infrastructure & Transportation

- Education

- Agriculture & Agro-industries

- Economic & Financial Governance

- Women empowerment

- Health

- Geographical locations of focus, years of operation, budget (AfDB Countries, 2017):

- AfDB was founded in 1964 (53 years)

- Supports development in all African countries

- Invested over USD $7 billion in 2016.

- Contact Information (AfDB Field Office Contacts, 2017) :

- Ghana field office resident representative: Ms Akin-Olugbade, Marie-Laure

- Address: No.1 Dr. Isert Road – 7th Avenue – Ridge, Accra, Ghana

○ Telephone: (233) 302 66 28 18/(233) 302 66 28 35

○ Fax: (233) 302 66 28 55

Client 3: The Bill and Melinda Gates Foundation

- Sectors of operation (GatesFoundation.org, 2017):

- Agriculture

- Information & Communications Technology

- Education

- Health

- Financial Services

- Human Development

- Geographical locations of focus, years of operation, budget:

- The foundation began working in Africa in 2006 (11 years).

- They have offices in South Africa, Nigeria, and Ethiopia, as well as representatives in Kenya, Tanzania, Ghana, Senegal, Zambia, and Burkina Faso.

- Budgets and projects information (Bill and Melinda Gates Foundation, 2017).

- Contact Information:

- African Team Director: Ayo Ajayi

- Address: Bole Sub City, Kebele 12/13, Addis Ababa, Ethiopia

Client 4: International Fund for Agricultural Development (IFAD)

- Sectors of operation (IFAD.org, 2017):

- Agriculture

- Geographical locations of focus, years of operation, budget:

- More than 45 countries throughout Africa

- Founded in 1977 (40 years).

- Opened offices in Ghana in 1980.

- 17 ongoing projects (budget US $791 million).

- Contact Information:

- Ghana Country Program Address: IFAD Country Office No. 69 Dr. Isert Road, North Ridge 8th Avenue Extension P.O. Box CT 11184, Accra, Ghana

○ Phone: +233 (0)302610945

○ Fax: +233 (0)302610945

- Country Program Manager: Esther Kasalu- Coffin; E-mail: e.kasalu-coffin@ifad.org

Client 5: Africare

- Sectors of Operation (Africare.org, 2017):

- Agriculture & Food Security

- HIV & AIDS

- Malaria Control

- Maternal & Child Health

- Nutrition

- School Construction & Electrification

- Water, Sanitation, & Hygiene

- Gender Empowerment

- Geographical locations of focus, years of operation, budget (Africare, 2017):

- Started operations in Ghana in 1989 (28 years).

- Currently operates in 34 African countries

- Ongoing projects in 15 countries.

- Budget, 2015, USD $48.6 million.

- Contact Information:

- Ghana Country director: Ernest Gaie

- Address: Box HH 92, Hohoe, Republic of Ghana

○ Phone: +233 36 272 0616

- Email: egaie@africare.org

Client 6: Self Help Africa (Merged with Gorta, 2014)

● Sectors of operation (Self Help Africa website.):

- Gender empowerment

✓ Business Expansion

✓ Humidity Transformation

✓ Food Cultivation

✓ SME investment initiatives

✓ Integrated Cooperative Actions

✓ Micro-Financing

● Geographical locations of focus, years of operation, budget (Self Help Africa website):

● Founded in 1984

● Currently operates in nine (10) countries in Africa, including Ghana (2012)

● Budgets, 2016, amounted to almost USD $21 million.

● Contact Information: For West African countries of Benin, Burkina Faso, Ghana and Togo-

○ West Africa Regional Office Address: 12 B .P. 418 Ouagadougou 12, Burkina Faso

○ Telephone: +226 25-37-57-45

○ Email: westafrica@selfhelpafrica.org

3. Development and Humanitarian Projects in Africa (Ghana)

3.1. Projects

| Project Title | Ghana Agricultural Sector Investment Program (GASIP) | Water Mobilization Project to Enhance Food Security in Maradi, Tahoua and Zinder Regions (PMERSA-MTZ) | Rural Enterprises Programme (REP) | Eskom Investment Support Project | Regional Disease Surveillance Systems Enhancement (REDISSE) |

| Purpose | Improve the agriculture sector | (a) Water collection and mobilization infrastructure

(b) Strengthening agricultural production and beneficiaries support (c) Project management. |

Increasing the number of rural enterprises that generate profit, growth and employment opportunities | Enhance its power supply and energy security in an efficient and sustainable | Strengthen national and regional cross‐sectoral capacity for collaborative disease surveillance and epidemic preparedness in West Africa |

| Funding Source | IFAD | Global Agriculture and Food Security Programme (GAFSP) | IFAD | AfDB | ECOWAS |

| Sector | Credit and Financial Services | Water Supply | Credit and Financial Services | Transmission and Distribution of Electricity | Health |

| Implementing Organization | IFAD | AfDB | IFAD | Eskom | WEST AFRICA HEALTH ORGANIZATION (WAHO) |

| Project budget (USD) | $113 million | $404.43million | $185.1 million | $10750 million | $230 million |

| Timeline | 2014-2020 | 2011-2017 | 2011-2020 | 2010-2019 | 2017-2023 |

| Source | Ministry of Food Agriculture, 2017 | GAFSP, 2017 | IFAD, 2017 | The World Bank, 2017 | The World Bank, 2017 |

3.2. Additional Projects

| Project Title |

West Africa Regional Communications Infrastructure Project – SOP3 |

Development Response to Displacement Impacts Project in the HoA |

Strengthening coordination, planning and policy advisory capacity |

AFCC2/RI-Regional Great Lakes Integrated Agriculture Development Project |

Second Regional Trade Facilitation Competitiveness Credit |

| Project Budget | USD$ 35.00 million | USD$ 175 million | USD$ 1.28 million | USD$ 1.75 million | USD$ 100 million |

| Timeline | 2017-2022 | 2016-2021 | 2016-2019 | 2016-2018 | 2016-2017 |

4. New market selection and analysis

According to the Source Global Research, 2016, the demand for global market research consulting in Africa grew more than 4.8% to US$2.1 billion in 2015. Much of this growth taking place in the east and west of Africa, compared to the slowing of the, typically dominant, southern region (source, 2016). With the south dominated by South Africa, and the eastern African region, including Ethiopia and Sudan growing increasingly challenging for international firms, mostly due to the difficulty of obtaining visas, the consulting market in the western reaches of African countries continues to grow and is emerging as the new frontier for ever-increasing demand for services provided by firms similar to Forcier.

Regional Demand for Services

According to Source Information Services, 2016, the overall market for consulting services will continue to grow and expand in the eastern and western African countries, while slowing in the south. In addition to this trend, there will be a demand for organizations that place an emphasis on developing available local talent. Foreign investments in the western regions are expected to grow significantly surpassing previously set highs; mostly due to the increasing investment sources post-financial crisis of 2008, including aid agencies, big multi-national corporations, institutional investments, and private equity interests.

Figure 4.1 The relative levels of active projects by region in Africa (World Bank, 2017)

Based on analysis of data from The World Bank’s Global Outreach Project, there are currently 590 active projects in Africa, totaling USD $58.78 billion; USD $3.5 billion of which is operating in Western Africa, excluding Nigeria (USD $8.2 billion); Cameroon, USD $1.48 billion, and Burkina Faso, USD $1.21 billion (worldbank.org, 2017). The western region provides the best market opportunity for Forcier Consulting to expand, and satiate demand for its services.

4.1. Analysis of the market in Ghana

In determining the Western African country of Ghana as the best and most suitable new market opportunity for Forcier Consulting, we compared data with the comparatively most significant alternative market in the region, Nigeria. In fact, Nigeria has almost three times higher active project investments than Ghana, totaling USD $8 billion; however, comparing the risks to multi-national firms, in the form of political instability, high cost of doing business (MNE vs. local entities), and the high levels of corporate and government corruption, it is prudent for Forcier to enter Ghana, and then observe and consider future expansions into Nigeria based on sociopolitical stability (See Appendix 1 – Tables and Figures).

According to data from The World Bank, there are more than twenty-three significant active projects in Ghana at the start of 2017, totaling USD $2.5 billion, and an equally significant number of alternative initiatives being undertaken to improve socioeconomic conditions for its citizens (worldbank.org, 2017). Many of these projects focus on environmental (including agriculture) and natural resource management, energy, and social issues, including poverty.

4.2. Regions/provinces/demographic characteristics/languages

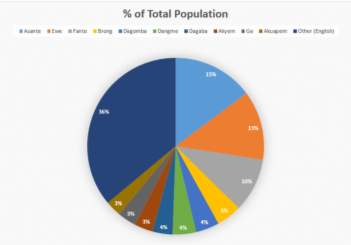

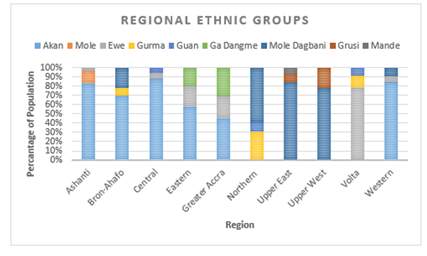

Ghana is located in West Africa, with bordering neighbors Cote D’Ivore to the west, Togo in the east, and Burkina Faso to the north. It is also bordered by the Atlantic Ocean to the south. It is divided into ten subnational government administration regions, which is further divided into 216 administrative local districts. Regions: Ashanti, Brong-Ahafo, Central, Eastern, Greater Accra, Northern, Upper East, Upper West, Volta, and Western (Wikipedia, 2017). The ethnic make-up consists of Ghana consists of mainly seven groups, in addition to other non-represented groups (commisceo-global, 2017). See figure 2 in Appendix 1 for ethnic groups based on region, and of total population. The demographic characteristics of Ghana is typical for a Western African country reflecting a developing economy. Total population is 27 million, with a growth rate of 2.18% (2016). A majority of citizens live in the urban centers (54%), and this reflects a change at an annual rate of +3.4% (indexmundi.com, 2017). Even with significant improvement in social infrastructure, there still exists a very high risk of major infectious diseases due to “improved” but not great sanitation systems. There is a high degree of literacy in Ghana, especially among the male population, so this reflects the gender make-up of major business ventures. The table below (Table 4.2) highlights several significant characteristics that are specific to the ten administrative regions of Ghana. As reflected in table 4.2, the major industry of a majority of the regions include Agriculture, forestry and fishery. The significance of this is also reflected in the types of international support projects, and available clients who operate in Ghana that will benefit Forcier. For example, major investments are made in improving food agricultural practices by improving technology and world-wide technical support. For example, The Ghana Agricultural Sector Investment Program (GASIP) is a USD $113 million project to improve the agricultural sector of Ghana, with significant implications for future development initiatives (see table 3.1).

Ghana is located in West Africa, with bordering neighbors Cote D’Ivore to the west, Togo in the east, and Burkina Faso to the north. It is also bordered by the Atlantic Ocean to the south. It is divided into ten subnational government administration regions, which is further divided into 216 administrative local districts. Regions: Ashanti, Brong-Ahafo, Central, Eastern, Greater Accra, Northern, Upper East, Upper West, Volta, and Western (Wikipedia, 2017). The ethnic make-up consists of Ghana consists of mainly seven groups, in addition to other non-represented groups (commisceo-global, 2017). See figure 2 in Appendix 1 for ethnic groups based on region, and of total population. The demographic characteristics of Ghana is typical for a Western African country reflecting a developing economy. Total population is 27 million, with a growth rate of 2.18% (2016). A majority of citizens live in the urban centers (54%), and this reflects a change at an annual rate of +3.4% (indexmundi.com, 2017). Even with significant improvement in social infrastructure, there still exists a very high risk of major infectious diseases due to “improved” but not great sanitation systems. There is a high degree of literacy in Ghana, especially among the male population, so this reflects the gender make-up of major business ventures. The table below (Table 4.2) highlights several significant characteristics that are specific to the ten administrative regions of Ghana. As reflected in table 4.2, the major industry of a majority of the regions include Agriculture, forestry and fishery. The significance of this is also reflected in the types of international support projects, and available clients who operate in Ghana that will benefit Forcier. For example, major investments are made in improving food agricultural practices by improving technology and world-wide technical support. For example, The Ghana Agricultural Sector Investment Program (GASIP) is a USD $113 million project to improve the agricultural sector of Ghana, with significant implications for future development initiatives (see table 3.1).

Figure 4.2a: Map of administrative regions of Ghana

| Region | Capital City | Districts | Population | Major Ethnic Groups | Specific Characteristics |

| Ashanti | Kumasi | 27 | 4,780,380 | 1. Akan (74.2%)

2. Mole Dagbani (11.3%) 3. Ewe (3.8%) |

Agriculture, forestry & fishery (39%); cultural heartbeat of Ghana |

| Brong-Ahafo | Sunyani | 22 | 2,310,983 | 1. Akan (58.9%)

2. Mole Dagbani (18.2%) 3. Gurma (6.9%) |

Agriculture, forestry & fishery (66%); “breadbasket of Ghana” |

| Central | Cape Coast | 17 | 2,201,863 | 1. Akan (81.7%)

2. Ewe (6.2%) 3. Guan (5.3%) |

Agriculture, forestry & fishery (53%); historical regions |

| Eastern | Koforidua | 21 | 2,633,154 | 1. Akan (51.1%)

2. Ewe (18.9%) 3. Ga Dangme (17.9%) |

Agriculture, forestry & fishery (52%); tourism center of Ghana |

| Greater Accra | Accra (Ghana capital) | 10 | 4,010,054 | 1. Akan (39.7%)

2. Ga Dangme (27.4%) 3. Ewe (20.1%) |

Services, sales, crafts (35%); commercial, administrative, and sports hub |

| Northern | Tamale | 20 | 2,479,461 | 1. Mole Dagbani (52.7%)

2. Gurma (27.3%) 3. Guan (8.6%) |

Agriculture, forestry & fishery (77%); islamic region |

| Upper East | Bolgatang | 9 | 1,046,545 | 1. Mole Dagbani (74.7%)

2. Grusi (8.6%) 3. Mande (5.6%) |

Agriculture, forestry & fishery (77%); shares borders with two countries; unique cuisine and architecture |

| Upper West | Wa | 9 | 702,110 | 1. Mole Dagbani (73.0%)

2. Grusi (20.6%) |

Agriculture, forestry & fishery (75%); largest producer of cotton; high islamic history |

| Volta | Ho | 18 | 2,118,252 | 1. Ewe (73.8%)

2. Gurma (11.3%) 3. Guan (8.1%) |

Agriculture, forestry & fishery (54%); richest cultural heritage; high diversity |

| Western | Sekondi | 17 | 2,376,021 | 1. Akan (78.2%)

2. Mole Dagbani (8.6%) 3. Ewe (6.2%) |

Agriculture, forestry & fishery (53%); strong history of trade; tropical beaches |

Source: National Commission on Culture (ghanaculture.gov.gh)

Languages (percent of total population):

English is spoken in Ghana as the official language, at more than 36% of the total population. However, there are over ten additional languages and dialects widely spoken and accepted outside of official business. The second most dominant of which is Asante (15% of total population).

Figure 4.2b: Pie chart showing major languages spoken Ghana, total of population

4.3. Culture, religion and customs environment (Commisceo Global, 2016)

Culture and Customs:

When it comes to cultural diversity, Ghana is highly represented on the continent. There are over 100 ethnic groups in the country, with a very large spread of communicable languages and dialects spoken between groups. The largest are Akan, Moshi-Dagbani, Ewe, and Ga. Even though the culture is rather modern in way of thinking, in a majority sense, there still exists minority groups and traditional tribal ethnic groups throughout the far regions outside of the capital, Accra (Commisceo-global.com, 2017). Ghanaian society is hierarchical in nature, and people are respected because of their age, experience, wealth and/or position. Preferential treatment is often given to the eldest member, and the most senior person (business or personal) is expected to make decisions that is in the best interest of the entire group. Family is a very important in Ghana, and it is the primary source of individual identity, loyalty, and responsibility. Family obligations are more important, and will take precedent over all else. An important point as it relates to business is that dignity, honor and good reputation is very important. Loss of honor is shared by the entire family, so face is typically saved by decisions and actions being done with decorum and unity.

Some important customs and etiquette (including business etiquette) include:

Meeting Etiquette

- Christians will generally shake hands between the sexes; practicing Muslims often will not shake hands with people of the opposite sex.

- Address Ghanaians by their academic, professional, or honorific title and their surname.

Communication Style

- Ghanaians are more indirect communicators. This means they take care not to relay information in any way that could cause issues, whether that be giving someone bad news, turning down an invitation, refusing a request or any other such matter.

- Ghanaians always want to protect their own and others’ face as well as maintain harmonious relationships; as a result, they tend to use proverbs, wise sayings, analogies readily. This allows ideas or messages to be convened in a manner that does not seem so blatant.

- Silence is a common means of communication. If someone is uncomfortable with a question or do not think the asker will appreciate response, they will say nothing rather than make the other person uncomfortable.

Business Meetings

- Initial meetings are about finding out about one another and if a personality fit allows for future, more business specific meetings. One should therefore expect to spend quite a good deal of time in relationship and rapport building.

- First meetings may also tend to be a little more stiff and formal although once a rapport has been built this will soon dissipate. It is important to maintain a polite and somewhat reserved demeanor.

- Hierarchy is respected so the most senior person is greeted first. He/she may be the spokesperson for the group or may deputized key stakeholders to speak.

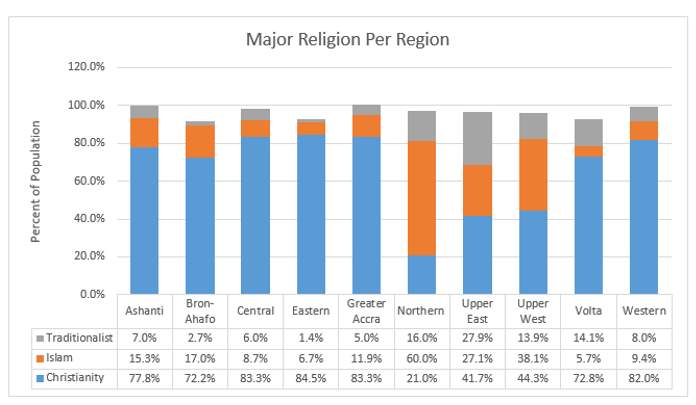

Religion:

There are two major religions practiced throughout Ghana: Christianity and Islam; however, traditionalist beliefs are still strong in many tribal areas of the country. The graph below illustrates the dominant religion practiced in each region of the country. This graph was created from data compiled from various sources, including (Nyanten, et. al, 2013).

Figure 4.3: Major religions practiced in Ghana

Highlighting the types of religions practiced in Ghana is important to businesses operating in specific regions, as miscommunication and misunderstandings between foreigners and local tribes can create difficulties. Refer to section Culture and Customs for examples of etiquette when interacting with Ghanaian population.

4.4. Political and legal environment

Organizations operating as a multi-national firm, or which opted to do business in a foreign are subjected to the legal and political systems of the host country. Ghana is a multi-party, constitutional democracy, with a constitution that reflects a separation of powers, and which also emphasizes human rights and freedom. According to the Ghana Investment Promotion Center (GIPC) Ghana is invested heavily into programs to improve the investment climate for international firms, and as a result, the country is ranked as best place to do business in West Africa, ahead of Nigeria and Cote d’Ivoire (gipcghana.com, 2017). In addition to this, Ghana prides itself in guarantees to international investments and multi-national corporations that include, constitutional guarantees that protect the rights of foreign companies, laws which guarantee 100% transfer of profits, dividends and other, bilateral investment promotion treaties and double taxation agreements. These protections will be significant benefits for Forcier in regards to entering this market as a wholly-owned, or joint venture partnership.

4.5. Company registration and operation

Registering a Business/Company in Ghana (The World Bank, doingbusiness.org, 2017) DB – Starting a Business

DB 2017 Rank: 110

DB 2016 Rank: 103

Change in Rank:  7

7

| Step | Agency | Time to Complete | Associated Costs |

| 1. Acquire a Tax Identification Number | Registrar General Department or Ghana Revenue Authority | 2 days on average | No charge |

| 2. Check for company name availability & submit documents to obtain certificate of incorporation | Customers Service Office of the Registrar General’s Department | 1 day | 1. Name search GHC 25

2. Name reservation GHC 50 3. Incorporation forms GHC 15 4. Registration fees GHC 230 5. GHC 5 per certification of regulations (respect to 3 certificates) |

| 3. Commissioner of Oaths authenticates forms required for the certificate to commence business | Commissioner of Oaths | 1 day (simultaneous with previous procedure) | GHC 10 |

| 4. Obtain certificate to commence business | Registrar General Department | 2 days (Simultaneous with previous procedure) | 0.5% of the stated capital as commencement tax + GHC 10 (registration fee with Ghana Revenue Authority) + GHC 100 form fees |

| 5. Deposit (paid-in capital in an account) | Bank | 1 day | No charge |

| 6. Apply for business licenses at Metropolitan Authority | Metropolitan Authority | 7 days | GHC 270 |

| 7. Work premises inspected by the Metropolitan Authority | Metropolitan Authority | 1 day (simultaneous with previous procedure) | No charge |

| 8. Apply for social security | Social Security Office | 1 day | No charge |

4.6. Infrastructure and transportation environment

Good infrastructure is vital for the economic development of Western African countries, including Ghana. For firms like Forcier to operate effectively, it is important to have access to good infrastructure that includes good transportation. In this regard, Ghana has implemented the Ghana Poverty Reduction Strategy (GPRS I and II) that aims to reduce poverty by improving infrastructure throughout the country with a goal to “facilitate both intra-regional trade and to open up areas outside of the capital, Accra, to investments. Targeted areas include: Information and communication technology, energy, transportation, accommodation, and education; all of which are impactful to Forcier’s success (gipcghana.com, 2017). The following is a list of local transportation around Ghana.

Forms of public transportation (Local Transportation in Ghana, 2017):

- Taxis – Taxis can be spotted by the orange corners on the car. They are available run in the cities as well as between cities and can often be rented for the day.

- Shared/passenger taxi – These are taxis with government set fairs that run from a transport station to a specific destination with a minimum of 4-6 people.

- Hurry cars – These are the same as shared taxis except these are private cars without a government set rate, so they generally cost more than shared taxis.

- Private car – This is when a person with a car offers transit. Be wary and make sure you check the driver’s license and insurance before traveling.

- Tro Tro – Usually just the shell minivan which carries 16-24 people, have low government set rates, and are available at specified stations, Tro Tros travel every bit of road in Ghana so they may be the best option for rural routes.

- Bus – Buses are good options for travel between major cities. They generally only travel paved major routes and it is a good idea to book tickets in advance.

- Ferry – Ferries are available at various port locations to cross Lake Volta

- Train – Train service is limited and generally not a recommended form of travel

- Domestic air travel – Limited domestic flights on propeller driven planes available

4.7. Banking rules and regulations

Major Banks/Western Union/Dahabshiil:

There are 2400 Western Union locations in Ghana where money can be picked up (Western Union, 2017). Dahabshiil is available in the capital city of Accra where there is a registered agent (Dahabshiil Agents, 2017).

List of the 10 largest banks in Ghana, as of 2015 (Obiorah, 2017):

| Bank Name | Branches | Services |

| Access Bank Ghana | 39 | universal banking services; 43 ATM |

| Agricultural Development Bank | 50 | state-owned; commercial and development |

| ARB Apex Bank | 10 | Rural connect |

| Bank of Africa Ghana | 23 | commercial bank |

| Barclay’s Bank of Ghana | 59 | local and corporate; ATM |

| CAL Bank | 26 | corporate and individual |

| Ecobank Ghana | 53 | Microfinancing; local corporate |

| Fidelity Bank | 43 | local businesses |

| First Atlantic Merchant Bank | 27 | |

| Home Finance Company (HFC) Bank Ghana | 42 | large commercial bank; investment and wealth; |

Private and business banking rules and regulations:

The Bank of Ghana implements monetary policies that include the operation of payment systems, the overall financial markets, and the regulatory operations of the regional banks, including opening and closing bank accounts, transferring of money in and out of the country, mobile banking, consumer protection, and more. (Bank of Ghana, 2017).

- Opening bank account requirements: According to the listed requirements for starting a business in Ghana, it includes the criteria for opening a bank account to deposit paid-in capital.(doingbusiness.org):

- Copies of company regulations

- Certificate of incorporation

- Certificate to commence business

- Signatures of the authorized company representatives

- Introductory letters from the company solicitors

- May conduct physical inspection of the company address

- Closing bank accounts: Customers are required to give one week’s notice before closing a bank account. This may vary per bank.

- Transferring money in and out of country: Money can only be picked up and sent at approved agent locations or can done via bank to bank transfer.

- Mobile banking availability: Mobile banking is available, along with Mobile Financial Services as a focus of most consumer transactions throughout the country (Bank of Ghana, 2017).

5. Operating Costs Analysis, Ghana

Daily compensation rates:

- National Researchers: USD 20.62(GHS 86.76)

- Enumerators: USD 17.54 (GHS 73.91)

- Translators: USD 21.33 (GHS 89.61)

(Source: africapay.org)

The daily compensation rates vary from different years of work since initial job opening. We used the average rates for each position to calculate daily compensation rates for each category. Daily compensation rates may also vary based on working/immigration status. For example, recommendations by the Ghanaian government suggests a limit of USD $588/2337 GHS daily compensation for foreigners working in Ghana (perdiem101.com, 2017).

Per diem pay for researcher: in USD (GHS)

| Region | Lodging | Meals & Incidentals | Meals only | Proportional Meals | Incidentals |

| Accra | 232 (963) | 99 (411) | 80 (332) | 46 (191) | 19 (79) |

| Kumasi | 90 (373) | 53 (220) | 42 (174) | 27 (112) | 11 (46) |

| Takoradi | 200 (830) | 82 (340) | 66 (274) | 39 (162) | 16 (66) |

| Other | 90 (373) | 53 (220) | 42 (174) | 27 (112) | 11 (46) |

(Source: perdiem101.com)

National Currency, conversion to USD and projected exchange rate:

- National Currency: Ghanaian cedi (currency code: GHS) is the fourth and the only legal currency in the Republic of Ghana. One Ghana cedi can be divided into 100 pesewas (Gp), and USD $1 is converted to 4.15 GHS.

- Projected Exchange Rate: The economic growth in Ghana slowed down from 2014 to 2015 but expected to recover to 8.7% in 2017 as the consolidation of macroeconomic stability and implementation of measures to resolve the crippling power crisis (AfDB, 2016). The increasing trend in the economy will contribute to the rise of import and this will further lead to the pressure of currency (Dzawu and Wallace, 2016). The government can manage the foreign exchange reserves to keep cedi stable. The persistent volatility was also concluded by Luguterah et al. (2015). Adetunde and Appiah (2011) believe that the government can play an important role to stabilise the exchange rate and Cedi will show an upward trend against US dollar.

- As indicated, the exchange rate declined dramatically from nearly 1 in 2007 to 0.2 in 2017 (XE (2017).

Figure 5: Ghanaian cedi currency rate change 2007 to 2017

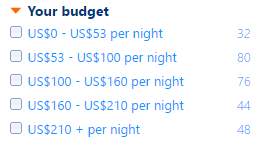

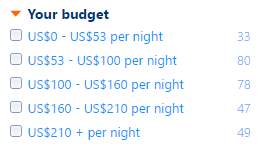

Average daily rate hotel in capital city (Accra):

To determine the average daily hotel accommodation rate in Accra, we searched the hotel prices on two separate dates at possible peak times of bookings at Bookings.com. We searched on the 30th April 2017 and 30th May 2017 (30 days after searching) for one adult. We used the figures on 30th April to calculate the average price. To make the result accurate and reduce the impact of the extreme ones, we abandoned the data in the least and the most expensive interval and just use the figure between 53 USD to 210 USD (see Appendix 1).

53+1002×80 +100+1602×76+160+2102×4480+76+44

=120.7 (GHS 501.0)

As calculated, the average price for one night is 120.7 USD (GHS 501.0).

All GHS/USD exchange rates are from www.xe.com

Average monthly rent for a one bedroom apartment in capital city (Accra) (Airbnb, 2017):

- Outside of city (suburbs/villages):

- Option:

- One bedroom apartment located in the serene environment of LAKESIDE ESTATE Com 8.a – USD $893 per month (GHS 3,691.2).

- In city (downtown): An apartment in the capital city of Ghana – Accra for a month:

- Option 1:

Design b+b is a unique guest house located in Adjiringanor East Legon, Accra. Designed and built by architect Joe Osae-Addo, the house in a true gem in tropical modern architecture. We offer breakfast inclusive of the room and shared common spaces.

USD $1181 per month (GHS 4,881.7)

- Option 2:

Fully equipped and functional studio in Cantonments, 5 minutes from the US Embassy. Located in a new and very quiet development with access to the swimming pool, gym and parking, with 24 hours security. Free Wi-Fi and cable TV.

USD $1501 per month (GHS 6204.4)

The average monthly rent for a one bedroom apartment in capital city: (1181+1501) = USD $1341 /(GHS 5543)

Average car rental price in Accra (daily rate): The cheapest option is MAZDA 3 or similar at a cost of USD $58 /239.7 GHS per day (europcar, 2017)

Price of a tourist/business visa for an American citizen (Ghana Embassy, 2017):

- Single Entry Visa: (must be used within 3 months from date of issue) $60 USD/248 GHS

- Multiple Entry Visa: $100 USD/413.4 GHS

- Single Expedited: $100 USD/413.4 GHS

- Multiple Visa Expedited: $200 USD/826.7 GHS

Procedures for obtaining aGhanaian work permit for foreign nationals (Expat, 2017)

The process is not typically complicated. Due to Ghanaian dependence on foreign investments and aid, foreign nationals from Western countries, including the United States, experience little resistance in obtaining work permits to carry out business in Ghana. Applications are submitted to the Immigration Department in Accra, Ghana, and are generally issued within 18 days of a submitted application. The following must be submitted:

- An application by the employer or employee along with a signature

- A passport

- An ID from the home country

- A police and medical report from national country

- A cover letter addressed to the Director of Immigration in Ghana

Restrictions on a Ghana work permit

There are some restrictions on a work permit from Ghana:

- Foreigner cannot accept employment in Ghana unless first granted a Ghanaian work permit or Immigrant quota work permit.

- Only spouses with special skills may obtain work permit

- Work permit does not grant immediate residency

6. Staffing, recruitment and selection analysis, Ghana

Key suggestions with respect to the staffing and personnel management (if applicable)

For Forcier to enter Ghana as a new business, it will experience immediate staffing needs. Of course, the involvement of local employees represents a necessary aspect to be leveraged. In this sense, 2 main paths can be followed:

- University and local institutions to hire junior profiles.

- Competitors/other companies to hire senior profiles

Both paths are necessary since junior profile will grant lower costs and high motivations while senior profile will bring guidance and knowledge of the market.

A further significant aspect to be considered and that enhance the importance to leverage universities is the brand reputation. To hire high quality resources, it’s essential that corporate brand is known and valued. Universities represent a low-cost alternative to get this result.

Need of staffing

Among recognized profiles, all of them should be hired locally with the notable exception of the head of the office. To grant a proper sharing of Forcier way of working and a good knowledge of company’s processes, a highly motivated and experienced Forcier employee should be identified for this role and moved from Forcier headquarter to be the head of the new office. In table below are reported necessary profile types and hypothetic quantities.

| Department | Profile | Qty | Where to hire |

| Finance, administration & secretary | Experience in account management and knowledge of local regulations | 2 | University / Local companies |

| Purchasing department | Experience in negotiation | 1 | Local companies |

| Human resources | Local human resources representative | 1 | Local companies |

| Pre-sales | Experience in sales and project management | 1 | University / Local companies |

| Project Management | Program manager / senior Project manager experienced of the sector | 1 | Competitors |

| Project Management | Junior Project manager to support Senior function in documentation management | 1 | University |

Before entering into details, let’s focus on possible channels to be used in recruiting:

- Collaboration with Universities for

- Identification of new profiles graduates in different fields

- Participation in carrier day to present the new company on the territory

- Usage of LinkedIn for:

- Profiling research publication

- CV research

- Partnership with the Local Recruiting Company for most difficult profiles research

Analysing options, 1 and 2 represents the best path to be followed for research for administrative staff and support to business management. On the other hand, option 3 is best suited for research for experts in the target market (Program manager).

Here-below a list of major universities in Ghana

| Institution | Founded | Students | Location(s) |

| University of Ghana (ug.edu.gh) | 1948 | 38,000 | Legon, Accra, Korle Bu and Atomic, Greater Accra |

| Ghana Institute of Management and Public Administration (gimpa.edu.gh) | 1961 | – | Legon, Greater Accra |

| Kwame Nkrumah University of Science and Technology (knust.edu.gh) | 1952 | 23,591 | Kumasi, Ashanti |

| University of Cape Coast (ucc.edu.gh) | 1961 | 15,835 | Cape Coast, Central |

| University of Education, Winneba (uew.edu.gh) | 1992 | 16,879 | Winneba, Central |

| University for Development Studies (uds.edu.gh | 1992 | – | Tamale, Northern |

| University of Professional Studies (upsa.edu.gh) | 1965 | 10,000 | Accra, Greater Accra |

| University of Mines and Technology (umat.edu.gh) | 2001 | – | Tarkwa, Western |

| University of Health and Allied Sciences (uhas.edu.gh) | 2011 | – | Ho, Volta |

| University Of Energy And Natural Resources (uenr.edu.gh) | 2012 | – | Sunyani, Brong Ahafo |

Among them, main focus, not to disperse energy and resources should be on “University of Ghana”, the oldest university in the country, established since 1948. This is the best choice since:

- High number of subscribers

- Close connections with “Public institute professional” and “Ghana Institute of Management and Public Administration

The other interesting institution, which is, as mentioned, linked with “University of Ghana” is Ghana Institute of Management and Public Administration (GIMPA). It is a Public University spread over four campuses and made up 4 schools and 4 research centres. Established in 1961 offers masters, and executive master degree programs in business administration, public administration, development management, governance, leadership and technology. It represents an excellent source to identify and recruit promising young candidates but also more experienced profiles.

In Ghana, there are many recruiting agencies. Considering the relative experience of the company in the market, focus should be more on performances and experiences rather than on costs. For this reason, focus should be on structure agencies that provide a complete range of recruiting services.

| Jobhouse Ghana | ||

| Phone: 0302 999 234 | Mobile: 024 67 507 87 | |

| Email: info@jobhouseghana.com | Web: http://JobhouseGhana.com | |

| Location: East Legon, Accra, Ghana | Description: One Ghana’s leading employment company. Provides several services including Recruitment Consulting, HR Development and Job Placement services. | |

| Ghana HR solution | ||

| Phone 1: +233-302-797-657 | Phone 2: +233-200-181-695, | |

| Email: info@ghanahrsolutions.com | Web: http://ghanahrsolutions.com | |

| Location: La Rd, Accra, Ghana | Description: Recruitment agency focusing on West Africa. Provided several services including, Recruitment, Training and development and HR outsourcing | |

Both agencies provide a database of candidates. In research phase, recruiting company selects from the data base the best CVs, contact the candidates and carry out pre-selection interviews. Those who pass the pre-selection are proposed to the customer, which is given support in the organization of the interviews. The choice fell on these 2 specialized agencies since present and focused on the area. They resembled a better choice compared to agencies operating worldwide that claim also a presence in Ghana. The goal in this case is to have more on-site support and greater commitment.

LinkedIn usage allows extensive research of necessary profiles through keywords. Also, free version, can be particularly helpful for finding people working for competitors. Furthermore, it allows selecting the country where to research. Using this tool, a set of potential candidates has been prepared. In Appendix 1, a set of candidates retrieved from LinkedIn is reported.

The selection of candidates should follow a path like:

- Preparation of a pre-set of profiles. This can be done by:

- Recruiting company

- Forcier itself (in case of applications identified for example through LinkedIn). In this case, it’ll have to be developed through:

- Analysis of CV

- Telephone interview for a first general check on the motivations in seeking a new job and the adequacy of expectations than the company may propose

- For candidates passing pre-selection, it’ll be held a selection on-site or via Skype. In general, following scheme can be followed:

- Set of general questions to assess the candidate’s personality, such as:

- Tell me about a goal or a project that has achieved during his career

- What it was the toughest decision I had to take (personal life or work)

- What do you like about your current job?

- What you do not like the present job?

- What are your strengths?

- What is your biggest weakness?

- Why or want to change your current job?

- Why have you applied for this position / company?:

- Where you see yourself in a few years?

- Why should we choose you?

- Set of tests necessary to assess the capacity (potential) of a person to perform a given task. In the specific case, since the most critical positions will be Program Manager and Project manager ones, it is reported a set of questions (see Appendix 2) to assess the skills of Program Management captured from the typical questions of PMP certification (CMMI).

- Set of general questions to assess the candidate’s personality, such as:

Market Salary Analysis (salaryexplorer, 2017)

Important parameter to be considered while performing HR activities is the salary to be proposed.

Average and Median Yearly Salary Comparison in Ghana

| CEDI Ghana | Euro | USD | |

| Maximum | 120000 | 25200 | 27700 |

| Median | 24600 | 5160 | 5650 |

| Minimum | 4200 | 880 | 970 |

* 1 Cedi Ghana = 0,21 € 1 € = 1.1 USD

Salary Comparison By Job Category (Average Yearly Salary)

| Job Category | CEDI Ghana | Euro | USD |

| Customer Service and Call Center | 7080 | 1487 | 1640 |

| Cleaning and Housekeeping | 7800 | 1638 | 1805 |

| Advertising / Grapic Design / Event Management | 10800 | 2268 | 2495 |

| Human Resources | 15000 | 3150 | 3465 |

| Engineering | 16200 | 3402 | 3745 |

| Administration / Reception / Secretarial | 18000 | 3780 | 4160 |

| Information Technology | 24000 | 5040 | 5545 |

| Banking | 27200 | 5712 | 6285 |

| Pharmaceutical and Biotechnology | 28800 | 6048 | 6655 |

* 1 Cedi Ghana = 0,21 € 1 € = 1.1 US

7. Other suggestions/Recommendations

Promotional Opportunities in New Market

- Create promotional videos for the new market that include the following information:

- New developing plans in new region reflecting the contribution to socioeconomic growth in the region.

- Highlight Forcier’s core competences and past contribution to local economic development.

- Showcase Forcier’s commitment to hiring local staff

- Highlights Forcier’s strengths and community involvements relative to the local community.

Training and Development

- Host professional learning and development workshops to network and engage with local scholars in the region and to share information about Forcier’s efforts.

- Partner with the local universities to help develop the local talent and workforce. This will help with local recruiting and cost savings.

8. Appendix

APPENDIX 1 – TABLES AND CHARTS

Figure 1

Figure 1: Results from hotel prcing search on Bookings.com (30th of April and 30th of May)

Figure 2: Ethnic Groups in Ghana by percentage

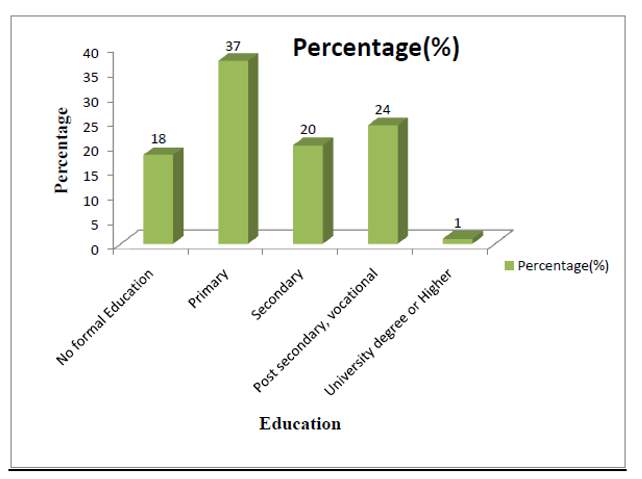

Figure 3: Education vs. Population of Ghana (2015)

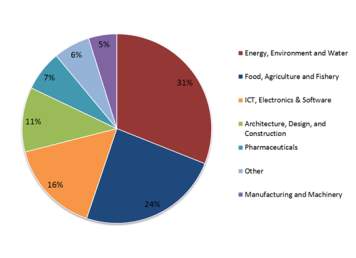

Figure 4: Economic Sectors of Ghana (2015)

| Key Characteristics | West Africa | Nigeria | Ghana |

Geography and Demographics

|

++++

++++ +++ |

++++

++++ +++ |

++++

++++ +++ |

Economic Environment

|

++ | ++ | ++ |

Political and Legal Environment

|

++ | ++ | +++ |

Cultural Environment

|

++++ | ++++ | ++++ |

Competitive Environment

|

++++

++++ |

+++

+++ |

+++

+++ |

Table 1: Key comparisons between selected West African M&E markets

APPENDIX 2 – SET OF CANDIDATES (from LinkedIn)

Key for Research: Project leader

Current job: Project Manager at theSOFTtribe Ltd

Education: Coventry University, Ghana

I am a young woman with a background in Economics and Finance. I have special people relationship skills as a result of having worked with, and under, people from very diverse backgrounds. I am particularly interested in People and Business Development, Public Policy and International Relations within Africa.

Current job: Managing Consultant/Project Manager at Swifta Systems and Services International

Managing Consultant/Project Manager

Company: Swifta Systems and Services International

Duration: 6 years

Location: Accra,Ghana

Project coordination

Company: Agrexco

Duration: 4 years

Location: Accra,Ghana

Project officer

Company: Mills Construction Company

Duration: 2 years

Location: Accra,Ghana

Harvard Business School

Executive Education – Managing & Transforming Professional Service Firms

University of Birmingham

Master’s Degree – Project Management

Kwame Nkrumah’ University of Science and Technology, Kumasi

Bachelor of Science – Architectural and Building Sciences/Technology

Current job: Country M&E Officer at 4-H Ghana.

Professional, Agriculture and Hunger Griot, and M&E Specialist with focus on agricultural youth development in Ghana. Specialties: Hunger issues, School Gardens, Agriculture and Global Food Systems, International Development Policy, International Institutions designed to end hunger, Sustainable Solutions to Hunger and Advocacy Skill-building

Project: Gates Foundation and 4-H Empowering Girls Project Company

Description: Empowering Girls through 4-H Methodology of “Learning by Doing” supported by Bill and Melinda Gates Foundation

Business Owner

Company: Ofasu Asamoah Agribusiness

Founder

Duration: 7 years (till present)

Project Coordinator, DuPont and Ghana 4-H Enterprise School Garden Project

Current job: M&E at MINISTRY OF HEALTH,GHANA

I am a well-organized, reliable and adaptable individual with a wide variety of skills, shows keen interest in my work and performs excellently either as part of a team or an individual. I am seeking a challenging and interesting job or volunteering opportunity that is target-driven and will enable me develop my acquired skills and also help me make an impact in organizational development and the society as a whole.

Company: Ministry of Health, Ghana

Duration: 3 years and 10 months

Company: Ministry of Health, Ghana

Duration: 5 years and 11 months

Master of Business Administration (MBA) – Project Management

Bachelor of Arts (B.A.) Psychology with Philosophy

Current job: M&E Manager at PW Ghana

I am currently M&E Manager for a Civil and structural Company, with a roll as Acting Project Manager. I have 30 years’ experience in large, complex projects EPCM FIDIC contracts. Facility management experience. I have been fortunate enough to have been involved in most projects from Conceptual design stage, Definitive estimate, Plyearsng and construction through to commissioning, hand over and facility management. I am an experienced professional with sober habits and a unique combination of technical expertise, managerial experience, business leadership, and design, build, commissioning and production support to lead the delivery and implementation of mission-critical systems. industries I have been responsible for the SMEIP Construction and commissioning were Airports, Micro-electronics, Mining industry, Petrochemical, Steel mills, Pharmaceutical and Buildings. I am a self-starting, safety and schedule driven, computer literate team player

Location: Intel, Ireland Lexlip

Company: Continental Conveyors and System

Location: Boksburg South Africa

Current job: Assistant Manager, M&E, Competitor and Media Analysis at Expresso Telecom Ghana

Company: Expresso Telecom Ghana

Current job: Senior Research Analyst at Ghana Cocoa Board (COCOBOD)

Company: Ghana Cocoa Board (COCOBOD)

Master of Science (MSc) – Local Economic Development

Bachelor of Arts (B.A.) – Economics and Statistics

Current job: Assistant Director, PPP Advisory Unit, Ministry of Finance, Ghana

I have over 10 years professional experience, working in different capacities both locally and internationally. I have also worked closely with people from different national, racial, cultural, social, and religious backgrounds which has helped me to develop such skills as problem-solving, flexibility, versatility, strategic influencing ability, good communication skills, team commitment, confidence and integrity. My knowledge, skills and experience encompass such areas as monitoring and evaluation, financial analysis, cost benefits analysis, economic development, project management, organisational management, financial analysis, policy analysis, telecommunications management, information systems management and strategic planning. I am currently an Assistant Director in the Public Private Partnership (PPP) Advisory Unit of the Ministry of Finance, Ghana where I am responsible for providing technical advisory services and support to Contracting Entities in the preparation of their PPP projects for the market, and promoting PPPs in Ghana. In my immediate past, I was an Assistant Director in the Monitoring and Evaluation Unit of Ghana’s Ministry of Finance where I facilitated the development and implementation of integrated corporate plans, programmes and projects to fulfill Government directives, priorities and the Ministry’s mandate; designed and implemented appropriate monitoring and evaluation mechanisms to assess the performance and effectiveness of programmes; and coordinated the development of the Ministry’s Sector Medium-Term Strategic Plans, quarterly performance evaluation of the Ministry’s Divisions and Agencies, and the preparation of the Annual Progress Report of the Ministry. I am also a proud member of the inaugural group of Mandela Washington Fellowship. My dream is to pursue a career in International Development, aspiring to the top echelons of an international organisation of repute

Current job: Data Manager at AngloGold Ashanti (AGAMal)

Company: AngloGold Ashanti (AGAMal)

Location: Obuasi, Ashanti Region, Ghana

Notable Accomplishments:

- Consolidate the PCS and IRS field data from 25 operational sites/districts for analysis

- Design Data Collection tools for IRS and PCS operations

- Attends to all data request issues for both management and public consumption.

- Successfully monitors the M&E activities in 25 operational districts across Ghana.

- Acts in the absence of the M&E Manager / part of the team that prepared the M&E Plan

- Prepared monthly malaria statistical report on AGA mine workers for AGA management

- Operationalized the Malaria Information Surveillance System (MISS) – Database

- Coordinate in the establishment of Sentinel Sites in some IRS operational districts

- Trained 28 M&E zonal and district staff on monitoring and evaluation systems.

- Prepare M&E annual report for Global Fund and other stakeholders

- Analysis of root cause of malaria prevalence among Anglo-gold Ashanti mine workers.

- Statistician/Head, IT Infrastructure Manager

Company: Ghana Statistical Service

Duration: 8 years 4 months

Location: Accra, Ghana

Certificate Program – Monitoring and Evaluation

- Don Bosco University

Master of Business Administration (MBA) – Technology Management

- Ghana Telecom University College

Post Graduate Diploma – Management Information Systems(MIS)

Current job: Freelancer – Strategy, Research, Project Management and Monitoring/Evaluation – Raymond KD Limited

An experienced and result-oriented management consultant with excellent organizational, supervisory, plyearsng, communication and coordinating skills and core competence in business development and investment analysis with an extensive experience and capabilities in social and marketing research, survey instruments designing, community development, project plyearsng and management.

Have experience in team building, leading and motivation, risk analysis and management with excellent inter-personal skills as well as the drive to achieve results within specified time and the agility to learning new concepts.

Possess capabilities in conducting; Tracking and Ad hoc studies, Market Sizing and Segmentation, Concept/Product Test, Ad-Tracking, Pricing and Competitor Analysis, Retail Audit etc.

Specialties: Business Analysis, Development and Strategy, Brand Management, Project Plyearsng and Management, Marketing and Social Research, Stakeholder Management and Community Development, Report Writing, Business Consulting and Energy, Oil and Gas Management.

- Managing Partner

Company: Raymond KD Limited

Duration: 2 years

Location: Accra

We provide services in marketing and social research, strategy design, project management and monitoring and evaluation.

- Programmes M&E Officer

Company: United Purpose

Duration: 3 years

Location: Accra

- Senior Research Executive

Company: Ipsos

Duration: 1 year

Location: Ghana

- Research / Project Manager

Company: Marketing Support Consultancy Ltd

Duration: 9 months

Location: Accra

- Project Coordinator

Company: Marketing Support Consultancy Limited

Duration: 9 months

Location: Accra, Ghana

- The University of Dundee

MBA International Oil and Gas Management – Strategy, Project Management and Oil/Gas Mgt

- University for Development Studies

BA Integrated Development Studies – Development Studies

APPENDIX 3 – EVALUATION TEST (from CMMI)

(1) A business case, which helps to determine whether a project is worth the investment, is created on the basis of the following except for

- Market Demand

- Ecological Impacts

- Social Need

- Availability of Funds

Answer:D

Hint: Availability of funds is not a criterion for a business case.

(2) You are in charge of developing a new product for an organization. Your quality metrics are based on the 80th percentile of each of the last three products developed. This is an example of:

- Statistical sampling

- Metrics

- Benchmarking

- Operational definitions

Answer: C

(3) Which of the following models of conflict resolution allows a cooling off period, but seldom resolves the issue in the long term?

- Problem solving

- Withdrawal

- Forcing

- Smoothing

Answer:B

Hint: Withdrawal is a temporary solution that evades problem-solving as much as possible.

(4) How much time does the typical project manager spend communicating both formally and informally?

- 40-60%

- 50-70%

- 60-80%

- 75-90%

Answer: D

Hint: with and among all the stakeholders including sponsor, customers, vendors, project team, PMO and upper management.

(5) Group brainstorming encourages all of the following except:

- Team building A project manager facilitates communication

- Analysis of alternatives

- Convergent thinking

- Uninhibited verbalization

Answer: C

Hint: The objective of Brainstorming is to generate diverse ideas.

(6) The critical element in a project’s communication system is the:

- Progress report

- Project directive

- Project manager

- Customer

Answer: C

Hint: A project manager facilitates all project-related communication

(7) System integration consists of:

- Assuring that the pieces of a project come together at the right time

- Plyearsng for contingencies that may occur throughout the life cycle of the project

- The pieces of the project function as an integration unit

- a and c

Answer: D

Hint: Integration means bringing together of the components.

(8) Performance reviews are held to:

- Correct the project manager’s mistakes.

- Provide for answers for upper levels of management

- To assess project status or progress

- To apprise the project costs and cost trends of the project

Answer: C

(9) A complex project will fit best in what type of organization?

- Functional

- Cross-functional

- Matrix

- Balanced

Answer:C

Hint: A matrix organization is best for complex projects because of the mix of functional expertise and project management focus.

(10) In which type of organization is team building likely to be most difficult?

- Functional

- Projectized

- Matrix

- Project expediter

- Project coordinator

Answer:C

Hint: The team members report to multiple managers in matrix organizations.

9. Bibliography

Adetunde, I.A., Appiah, S.T., (2011) Forecasting Exchange Rate Between the Ghana Cedi and the Us Dollar Using Time Series Analysis. African Journal of Basic and Applied Sciences 3(6), 255–264.

Africa Business Group. (2017). Retrieved March 31, 2017 from http://www.abghq.com/

Africare – Sustainable Community Development in Africa. (2017). Retrieved March 31, 2017, from https://www.africare.org/

AfDB Countries. (2017). Retrieved March 31, 2017, from http://www.afdb.org/en/countries/

AfDB Field Office Contacts. (2017). Retrieved April, 2017, from

http://www.afdb.org/en/about-us/organisational-structure/complexes/country-regional-programs

-policy/field-offices/field-office-contacts/

AfDB Sectors. (2017). Retrieved April, 2017 from http://www.afdb.org/en/topics-and-sectors/

Africa Pay. (2017). Compareyoursalarywithpeopleinthesameoccupationinthreesteps.Retrieved April, 2017, from http://www.africapay.org/ghana/home/salary/salary-check?job-id= 2643010000000#/

Africa Studies Center (2017). University of Pennsylvania. NGOs & Community Health Organizations in Africa (2017). Retrieved April, 2017, from https://www.africa.upenn.edu/health/ngos_org.htm

Bank of Ghana. (2017). Retrieved March, 2017, from https://www.bog.gov.gh/

Bill and Melinda Gates Foundation. (2017). OurWorkinAfrica.Retrieved April, 2017, from http://www.gatesfoundation.org/Where-We-Work/Africa-Office

Bookings. (2017). Accra Hotel Accommodations. Retrieved April, 2017, from https://www.bookings.com.

Buzzghana. (2017). Top 10 Biggest Banks in Ghana. Retrieved March, 2017, from https://buzzghana.com/top-10-biggest-banks-ghana/2/

Demand and Supply: Monitoring, Evaluation, and Performance Management Information and Services In Anglophone Sub-Saharan Africa: A Synthesis of Nine Studies. (2013). Retrieved from https://www.theclearinitiative.org/sites/clearinitiative/files/2016-04/Demand_and_Supply_Angl ophone_Africa_2013.pdf

Development Tracker. (24 Oct. 2016). Forest Governance, Markets and Climate. Retrieved April, 2017, from https://devtracker.dfid.gov.uk/projects/GB-1-201724

Embassy of the Republic of Ghana The Hague. (2017). WhatisthecurrencyofGhana?Retrieved April, 2017, from http://www.ghanaembassy.nl/index.php/faqs-mainmenu-25/119-what-is-the-currency-of-ghana.html

Ghana Embassy. (2017). Visas.Retrieved March, 2017, from http://www.ghanaembassy.org/ index.php?page=visas

Ghana Guide. (2017). Retrieved March, 2017, from http://www.commisceo-global.com/ country-guides/ghana-guide

Ghana Investment Promotion Center (GIPC) (2017). Retrieved, April, 2017, from http://www.gipcghana.com/invest-in-ghana/why-ghana/infrastructure.html

Ghana payroll and tax overview. (2017). Retrieved April, 2017, from https://www.activpayroll. com/global-insights/ghana

Global Research Business Network (GRBN). Launch of the African Market Research Association Exceeds Expectations (2017). Retrieved April, 2017, from:

http://grbnnews.com/launch-african-market-research-association-exceeds-expectations/

IBTCI – International Business & Technical Consultants Inc. (n.d.). Retrieved March, 2017, from http://www.ibtci.com/

Index Mundi (2017). Ghana Demographics Profile 2016. Retrieved, April 2017, from http://www.indexmundi.com/ghana/demographics_profile.html

International Fund for Agricultural Development (2017). Retrieved April, 2017 from https://www.ifad.org/

Khulisa Management Services. (n.d.). Retrieved March, 2017, from http://www.khulisa.com/

Languages of Ghana. (2017). Retrieved April, 2017 from http://www.ghanaembassy.org/

Local Transportation in Ghana. (2017). Retrieved March, 2017, from http://easytrackghana.com/ travel-information-ghana_local-transportation.php

LinkedIn Business Solutions. (2017). Retrieved April, 2017, from https://business.linkedin.com/

Luguterah, A., Akumbobe, R. A. and Yaan, E. A. (2015) Modelling Exchange Rate Volatility of the Ghana Cedi to The US Dollar Using Garch Models. Mathematical Theory and Modeling. 5(8), 2224-5804

Market Research Reports, Ghana (2017). Retrieved April, 2017, from http://www.marketresearchreports.com/countries/ghana

Numbeo. (2017). CostoflivinginAccra.Retrieved March 30, 2017, from https://www.numbeo. com/cost-of-living/in/Accra

Nyanteng, V., Peprah, P.T., Acheamfour, L.B., & Okang Tawiah, E.N. (2013, June). Ashanti Region: 2010 PHC Report – Ghana Statistical Services (S. Gaisie & N. Bentsi-Enchill, Eds.). Retrieved March 30, 2017, from http://statsghana.gov.gh/docfiles/2010phc/2010_PHC_Regional_ Analytical_Reports_Ashanti_Region.pdf

Obiorah, C. (2016). Top 10 Biggest Banks in Ghana 2016. Retrieved March, 2017, from http://buzzghana.com/top-10-biggest-banks-ghana/

Oregon State University (2017) Recent per diem rates for international localities. Available from: http://oregonstate.edu/dept/fa/businessaffairs/travel/tres/per_diem_foreign. [Accessed on 20th April].

Per Diem Rates for Ghana. (2017). Retrieved April, 2017, from https://www.perdiem101.com/ oconus/2017/ghana

Schools & Universities-Ghana. (2017). Retrieved from http://www.ghanaembassy.org/index.php?page=schools-universities

Starting a Business in Ghana. (n.d.). Retrieved April, 2017, from http://www.doingbusiness.org/ data/exploreeconomies/ghana/starting-a-business

Self Help Africa (n.d.) Retrieved April, 2017 from https://selfhelpafrica.org/us/

Sourceglobalresearch (2016). The Africa Consulting Market in 2016. Retrieved April, 2017, from:

http://www.sourceglobalresearch.com/report/download/1292/extract/0/The-Africa-Consulting-Market

West Africa Profile. (2017). Retrieved April, 2017, from https://issuu.com/self_help_africa/docs/west_africa_country_profile__jan_20

Western Union. (2017). SendMoneyOnlinetoGhanawithWesternunion.com.Retrieved March, 2017, from https://www.westernunion.com/us/en/send-money-to-ghana.html

Wikimedia Images. (n.d.). Retrieved March, 2017, from https://commons.wikimedia.org/wiki/ File:Regions_of_Ghana_en.svg

World Bank. (2017). Doing Business 2017: Equal Opportunity For All. Retrieved from http://www.doingbusiness.org/~/media/WBG/DoingBusiness/Documents/Annual-Reports/Engl sh/DB17-Report.pdf

Wikipedia (2017) Ghanaian cedi. Abailable from: https://en.wikipedia.org/wiki/Ghanaian_cedi#/media/File:Ghana_Cedi_banknotes.jpg. [Accessed on 20th April].

World Bank. (2017). Projects and Programs 2017. Retrieved March and April, 2017 from http://www.worldbank.org/en/region/afr/projects

XE (2017) XE Currency Charts: GHS to USD. Available from: http://www.xe.com/currencycharts/?from=GHS&to=USD&view=1Y. [Accessed on 20th April].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Strategy"

Business strategy is a set of guidelines that sets out how a business should operate and how decisions should be made with regards to achieving its goals. A business strategy should help to guide management and employees in their decision making.

Related Articles