Nigeria's Economic Growth: An Over-reliance on Oil?

Info: 19105 words (76 pages) Dissertation

Published: 17th Feb 2022

Tagged: EconomicsInternational Studies

ABSTRACT

The aftermath of Nigeria’s independence in 1960 put the country on a global stage as one grappling with the adverse effects of corruption, inequitable use and management of resources, low literacy levels and mass unemployment. However, the biggest challenge, which Nigeria brought upon itself and has severely, affected her growth and development, following the oil boom in the 1960’s is the over-reliance on oil and failure of the state to diversify into other beneficial resources.

The monopolization of oil as the mainstay of the Nigerian spurred on vices such as greed, corruption and the embarrassing reliance of the country on imports and even imports pf refined oil which it exports to other countries in raw form. Nigeria only boast of the title for being Giant of Africa not by its economic scales of GDP but by the size of its population and this has left the country with so much wasted potential, huge economic crises and even the deep recession it is currently facing.

The biggest factor in the crumbling of an economy that was among the MINT nation. A country that had always talked about potentials long before my parents were born but never got close to realizing such huge potentials due to the biggest factor which has put the country into a recession, and with the risk of a double deep recession looming, alongside inflation at its highest rate in the country’s history.

This dissertation looks at the biggest factor, which is the non-diversification of the economy and the overzealous reliance on Oil. A subject the country’s leaders have spoken about for several years but never put any strategy in place.

In this dissertation, I will be showing the links between Nigeria overreliance on oil. In addition, to how this has affected the country economic growth. I will also be looking at the way forward for the country, which is in serious problem without realizing it.

In other word, I will be effectively answering the question; does crude oil have a NUISANCE VALUE in Nigeria?

NUISANCE VALUE: The value of an entity contribution to the disorderliness, underdevelopment and irritation of the society.

LIST OF ACRONYMS

FAO Food and Agriculture Organization

ISS Institute of Social Studies

UNDP United Nations Development Program

WB World Bank

GDP Gross Domestic Product

IMF International Monetary Fund

NNPC Nigerian National Petroleum Corporation

OPEC Organization of Petroleum Exporting Countries

NEEDS National Economic Empowerment and Development Strategy

EDA Exploratory Data Analysis

FSDH First Securities Discount House

NPC National Planning Commission

CBN Central Bank of Nigeria

IFPRI International Food Policy Research Institute

OFN Operation Feed the Nation

NAFPP National Accelerated Food Production Program

UNIDO United Nations International Development Organization

EPZ Export Processing Zones

TI Transparency International

UAE United Arab Emirates

FTZ Free Trade Zone

HO Heckscher Ohlin

EFCC Economic and Financial Crime Commission

TABLE OF CONTENTS

Click to expand Table of Contents

Chapter 1: Introduction

1.0 Background

1.1 Problem Statement and Justification

1.2 Hypothesis

1.3 Methodology and Limitation in carrying out the research

1.4 Organisation

1.5 Limitations

Chapter 2: Literature review

2.0 Overview

2.1 Literature review

2.1.1 Mainstream Economists view on resource-based growth

2.1.2 New Institutional Economics

2.1.3 Structural Economists view

Chapter 3: Overview of Nigeria’s Economy

3.0 Introduction

3.1 Structure of Nigeria Economy

3.2 Alternatives to an oil-based economy

3.2.1 Arts

3.2.2 Agricultural

3.2.3 Telecommunication

3.2.4 Taxation

3.2.5 Tourism

3.3 Potential revenue generator

3.4 Policies towards Industrialization

Chapter 4: Analysis and Findings

4.0 Introduction

4.1 Nigeria’s dependence on Oil

4.2 Corruption and Growth

4.3 Diversification and Growth

4.4 Resource dependence countries

4.4.1 United Arab Emirates (U.A.E)

4.4.2 Indonesia

4.4.3 Singapore

4.4.4 Norway

Chapter 5: Conclusion and Policy Implication

Bibliography and Reference

LIST OF TABLES/FIGURES

Table 1:Exports of fuel, manufactured and agriculture as percentage of merchandise exports (1996-2011)

List of Figures Figure 1: Nigeria GDP Growth and Oil Price Shocks (1961-2011)

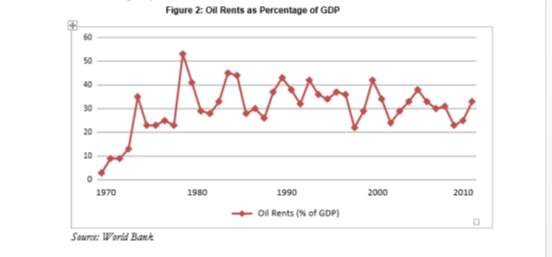

Figure 2: Oil Rents

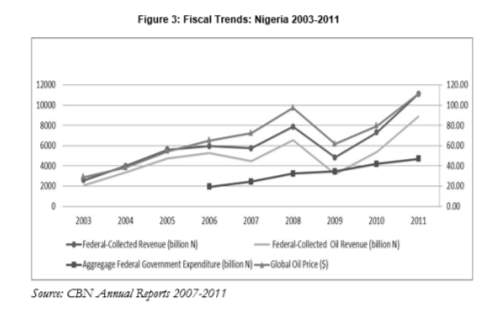

Figure 3: Fiscal Trends: Nigeria (2003-2011)

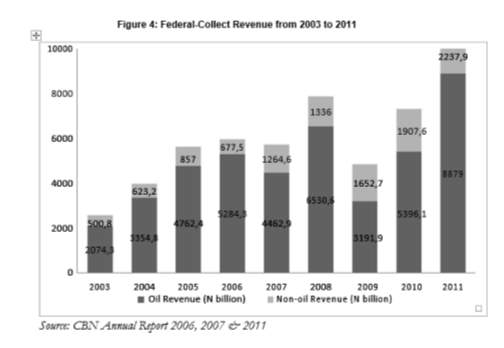

Figure 4: Federal-Collect Revenue from (2003 to 2011)

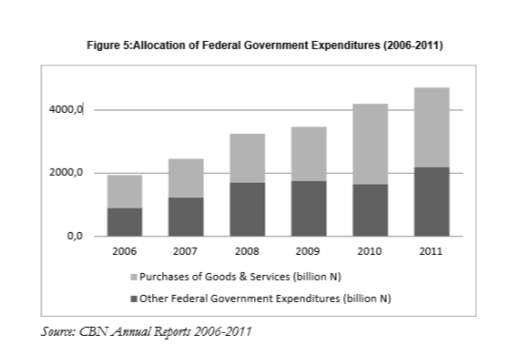

Figure 5:Allocation of Federal Government Expenditures (2006-2011)

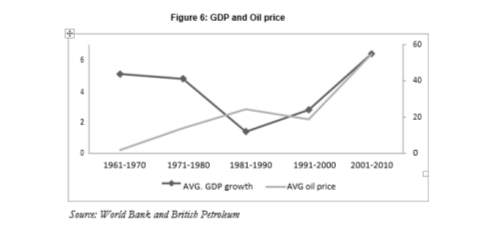

Figure 6: GDP and Oil price

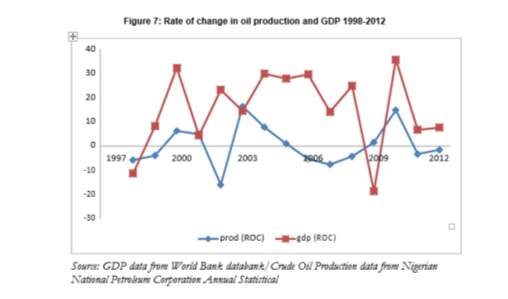

Figure 7: Rate of change in oil production and GDP (1998-2012)

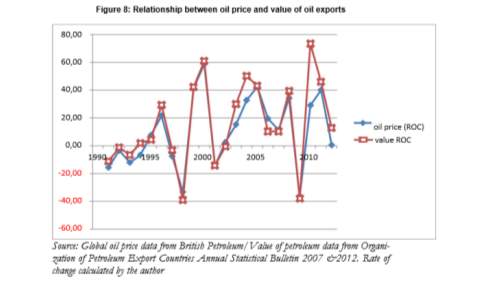

Figure 8: Relationship between oil price and value of oil exports

Figure 9:1990-2012 value of oil exports and gdp

Figure 10: Corruption Perception Index (CPI) and Annual percentage growth rate of GDP of Nigeria from (1996 to 2012)

Figure 11: Exports of fuel, manufactured and agriculture as percentage of merchandise exports (1996-2011)

Figure 12: Average Annual GDP Growth: Indonesia, Nigeria and United Arab Emirates (1976-2011)

Figure 13: UAE GDP vs. Global Oil Price (1976-2011)

Figure 14: United Arab Emirates Economic Structure (1976-2011)

Figure 15: Indonesian GDP and Global Oil Prices (1976-2011)

Figure 16: Structural Change in Indonesia’s Economy (1976-2011)

Relevance to Development Studies

This topic falls under the microeconomics branch of Economics; hence, I will be focusing on the macroeconomics studies of resource based growth strategies and if natural resources can aide or hinder economic growth. At the end of my dissertation, I want to be able to provide a clear understanding to how a country blessed with so much resources, could be so heavily reliant on just one and how it has impacted on its economic growth.

Following previous research by different scholars and organisations about Nigeria dependence on oil, they have made a case for a powerful and positive relationship between two variables. By doing this, the research has put a spotlight on the Nigerian government to increase production in other sectors of the economy in order to gain more economic growth. Similar studies in the past have discussed oil dependency and its effect on Nigeria’s economic growth and power, which have provided evidence that there is indeed a relationship between the two. However, those studies did not clearly emphasize the importance of diversification and industrialization; hence, there is a question to be, answered by this research. As I believe, it is time for Nigeria to forget about crude oil and look into other non-oil based sector to save a crumbling economy, hence discussion about oil dependency and economic growth is most useful when discussed with diversification and industrialization.

This dissertation will be focusing on the study on resource-based growth emphasising the need for diversification and industrialization. This analysis will also be assessing how international oil prices and the volatility of oil prices affect Nigeria’s economic growth. Therefore, this dissertation adds more literature to understand the influence of global commodity prices and economic growth in country’s with resource based growth strategies. This provides a consideration for policy studies to promote economic diversification and industrialization.

CHAPTER 1: INTRODUCTION

1.0: BACKGROUND

Nigeria is the most populous country within OPEC and the seventh most populous country in the world (2016 WorldOmeters data), a 2.63% rise from previous year. A country located on the Gulf of Guinea on Africa’s western coast. The country covers an estimated area of 924,000sq kilometers, with its capital in Abuja and currency in the Nigerian Naira.

Apart from petroleum, Nigeria’s has 34 other solid natural resources include natural gas, coal, niobium, lead, limestone, iron ore, tin, zinc and arable land, However the oil and gas sector accounts for over 35% of its gross domestic product (GDP), while petroleum exports revenue represents over 90% of its total export revenue.

Nigeria discovered oil in 1956, in Oloribiri in the southern state of Bayelsa.

| Population (million inhabitants) | 183.173 |

| Land area (1,000 sq. km) | 924 |

| Population density (inhabitants per sq. km) | 198 |

| GDP per capita ($) | 2,646 |

| GDP at market prices (million $) | 484,635 |

| Value of exports (million $) | 45,365 |

| Value of petroleum exports (million $) | 41,818 |

| Current account balance (million $) | -15,439 |

| Proven crude oil reserves (million barrels) | 37,062 |

| Proven natural gas reserves (billion cu. m.) | 5,284.3 |

| Crude oil production (1,000 b/d) | 1,748.2 |

| Marketed production of natural gas (million cu. m.) | 45,148.1 |

| Refinery capacity (1,000 b/cd) | 445.0 |

| Output of refined petroleum products (1,000 b/d) | 24.1 |

| Oil demand (1,000 b/d) | 407.8 |

| Crude oil exports (1,000 b/d) | 2,114.0 |

| Exports of petroleum products (1,000 b/d) | 18.0 |

| Natural gas exports (million cu. m.) | 26,703.5 |

Nigeria is the 12th largest producing oil country in the world and the largest oil producing Africa nation in the world and has the ninth largest gas reserve in the world.

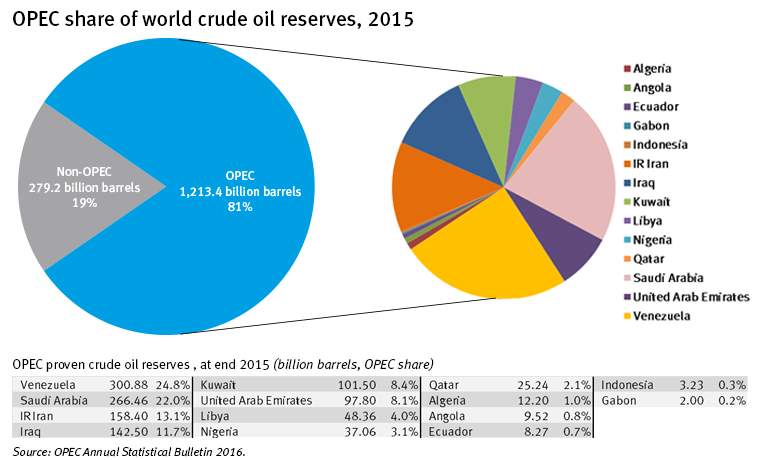

OPEC share of world crude oil reserves, 2015.

Nigeria, is not only blessed with natural resources, it is also blessed with large hectares of arable land, (Roughly 84 million hectares). Behind only the USA, India, Russia and China.

The country is also blessed with a large population of 177 million people, with an average age of 18.

1.1 PROBLEM STATEMENT AND JUSTIFICATION

Nigeria has a proven oil reserve of 37.06 billion barrels (OPEC 2015) and produces an average of 2.4 million barrels per day (NNPC 2015). The hydrocarbon sector also accounts for more than 75 per cent of the federal government’s revenue. This shows that Nigeria is heavily dependent on the oil sector for the majority of government spending, infrastructure and most economic development activities. With the increasing volatility of oil prices, the discovery of oil in other parts of the world and the instability of the global economy, oil imports from Nigeria to major economies such as the United States has been declining.

The U.S once imported 9-11% of its crude oil from Nigeria but in the first half of 2012, the share of imported oil from Nigeria to the U.S has dropped to 5% (EIA 2013). The resource based growth strategy followed by Nigeria and many developing countries with an abundance of natural resources appear to have fizzled out. Most Latin American and African countries still struggle to develop, while developed countries follow industrialization strategies, which have led to economic growth. The issue of Nigeria’s oil dependence is closely linked to the issue globalization and commodity prices. While globalization is inevitable, Nigeria and other such countries must find ways to protect its economy from the global shocks including commodity-pricing shocks not controllable by the domestic market.

1.2 HYPOTHESIS

Nigeria’s oil dependency will continue to cause unstable growth in Nigeria’s economy. Oil dependency, will not lead to sustained economic growth, therefore Nigeria must diversify its economy to achieve its higher growth potential. This dissertation intends to argue that:

- Oil dependency is the main cause of Nigeria’s unstable economic growth rates

- Nigeria’s unstable and rapid growth is the effect of the fluctuating global oil prices set by the market

- Nigeria’s economy is dependent on oil rents and revenue

- Oil dependency as a growth strategy is not sustainable

- Diversification and industrialization are necessary for sustained growth of Nigeria’s economy

1.3 METHODOLOGY AND LIMITATION IN CARRYING OUT THE RESEARCH

During the cause of this dissertation, I made us of qualitative and quantitative data, but will be rooted in a quantitative approach, focusing on macroeconomic data from 1960 to 2015, which relate to the topic of discussion. Some econometric methods was used for the research; however, I focused more on using exploratory data analysis. EDA was appropriate for both quantitative and qualitative data, as it allows me to summarize the important characteristics of the country’s economy. This approach also allows me to give my readers the ability to gain insight into data in a clear and concise manner and extracts the most important factors from the data. However, I believe some econometrics model would be useful in demonstrating my ability, to use data’s. Quantitative secondary data was collected from international and national data sources including:

- World Bank

- Transparency International

- Nigeria National Bureau of Statistics

- Central Bank of Nigeria

- United Nations

- National Planning Commission

- Nigerian National Petroleum Corporation

- Organization of Petroleum Export Countries

Many limitations surfaced during the research of this topic. Macroeconomic data was not always available years. This may be due to the lack of data collection and lack of an institutional body to record the statistics prior to 1970. However, in some cases, data was available from 1961 onwards. Because of this limitation, I was unable to analyze the research question prior to 1960.

I also used data’s, from Transparency International but finds their methodology in calculating corruption to be very flawed. However, it is important to note that I still used the data in the research, as they were helpful. However, I cannot confirm the validity of Transparency International’s practices.

1.4 ORGANISATION

The structure of the dissertation, have been broken down into five different chapters.

Chapter 2 reviews the literature from mainstream and structural economists on topics of natural resource dependency, economic growth and industrialization, which are directly related to the topic of this dissertation. The result of the literature review is linked into a brief summary.

Chapter 3 gives an overview of the Nigerian economy and an overview of the natural resource and industrialization-based policies. Which are meant to promoted economic growth and development.

Chapter 4 analyzes the macroeconomic data available for Nigeria regarding GDP, oil prices and manufacturing. The chapter also includes a country comparison of Nigeria with Indonesia and United Arab Emirates.

Chapter 5 presents the conclusion and recommendations

1.4 LIMITATIONS

Most of the diagrams and researches were limited to the year 2011 and 2012 and hence there is not enough evidence to give accurate data’s from 2013 upwards, however the trends remain the same.

CHAPTER 2

2.0 OVERVIEW

In this section, I will talk about two perspectives on asset reliance and monetary development. Standard financial analysts trust that all together for a nation to encounter monetary development, they should proceed to create and exchange products in which they have a similar preferred standpoint. Inside standard financial matters, there are new institutional business analysts who likewise have confidence in similar preferred standpoint yet relate low development rates to institutional disappointments. Auxiliary financial analysts who trust that broadening and industrialization, not asset reliance will prompt fast development display the last view examined in this segment.

2.1 LITERATURE REVIEW

The wonder of moderate development in immature nation’s remains a subject looked into by numerous financial experts throughout the years. It is this wonder has made financial specialists take sides on understanding and in addition taking care of the issue of poor development. While Adam Smith, David Ricardo and standard financial specialists contend the regulation of similar preferred standpoint, basic market analysts contend against relative preferred standpoint and for enhancement and industrialization.

This writing audit will cover past reviews by standard market analysts that reference relative preferred standpoint as indicated by the Heckscher-Ohlin model of element enrichment. This writing will likewise inspect new institutional market analysts who have confidence in similar favorable position yet concentrate on the part of powerless foundations, lease chasing and defilement. The writing on basic business analysts will concentrate on the impacts of product value unpredictability, instability of terms of exchange and specialization on development.

2.1.1 MAINSTREAM ECONOMIST VIEW ON RESOURCE BASED GROWTH

Standard financial aspects contends that nations ought to deliver and send out as indicated by their similar leeway. The hypothesis of near preferred standpoint recommends a nation pick up the best monetary advantage with respect to different nations by creating at lower general cost wares, which a nation has in wealth or can be effortlessly delivered. Other exchanging nations will subsequently profit on the off chance that they acknowledge the cost favorable position of the exchanging nation and concentrate on creating a ware in which they have leeway. It is this hypothesis, which guides standard financial expert’s faith in facilitated commerce, specialization and the global division of work. This is their thinking behind why a few nations create rural and mineral items while others deliver mechanical products (O’Toole 2007:620).

The teaching of near preferred standpoint as indicated by the HeckscherOhlin (HO) hypothesis expresses that nations deliver and send out the wares which requires the utilization of its bounteous gainful elements seriously (Feenstra 2003: 32). This model depends on two nations, two products and two variables and expect that both nations have indistinguishable advances, indistinguishable tastes, organized commerce in merchandise and diverse element enrichments (Feenstra 2003: 31).

For whatever length of time that two nations have distinctive element blessings, they will profit in terms of professional career. It is the distinction in element gifts that prompts specialization and sending out products in which a nation has a near favorable position. Standard market analysts trust that this procedure takes into consideration effective utilization of assets, which prompt more, picks up from exchange (WTO 2010). Heckscher and Ohlin recommended that nations with a plenitude of capital would send out capital-escalated products and import work serious merchandise, while nations with a wealth of work would trade work concentrated products and import capital concentrated merchandise (Clarke et al. 2009: 114).

Numerous financial analysts including Leontief (1953), Trefler (1995) and Davis and Weinstein (2001) have endeavored to clarify the HO hypothesis of similar, nevertheless, most tests have performed inadequately. By the by, market analysts keep on testing the hypothesis modifying for various factors which enhances the aftereffects of near preferred standpoint. Leontief (1953) concentrates the U.S economy keeping in mind the end goal to demonstrate the regulation of near preferred standpoint. He used U.S. economy information on input output records and U.S exchange information from 1947 to assess the HeckscherOhlin-Samuelson (HOS) demonstrate (Feenstra 2003: 35). He initially measures the work and capital utilized specifically and in a roundabout way in each trading industry keeping in mind the end goal to decide the measure of work and capital required in the generation of one million dollars of U.S fares and imports (Feenstra 2003: 36).

Leontief finds that every individual utilized works with $13,700 worth of capital in delivering the fares and every individual utilized works with $18,200 worth of capital in creating the imports. Despite the fact that the U.S was capital plenteous in 1947, Leontief’s discoveries seem to negate the HO hypothesis and his review would come to be known as the Leontief Catch 22 (Feenstra 2003: 36). Nonetheless, Stern and Maskus (1981) reproduced Leontief’s model representing regular assets. The work concentrated products Leontief incorporated into his test were common asset escalated wares; in this manner, the Leontief Conundrum was illuminated (Clarke et al. 2009: 117).

A further investigation of the HO demonstrate Kemp and Long contrived concerning normal assets (1984). They ran a three-situation test and in the primary situation, the great is delivered by just modest assets, the second situation, the great is created by one expendable and one no exhaustible asset and in the third situation, the great is created by two non-modest assets and a modest asset. They found that nations, which are plentifully supplied in expendable assets, would have some expertise in that asset division and create merchandise identified with the asset. This discovering construes that exchange is yet determined by near preferred standpoint and the distinctions in element gifts (World Exchange Report 2010).

Clarke and Klkarni (2009) utilized information from Asia to test the legitimacy of the HO demonstrate. Singapore which is a capital inexhaustible nation is contrasted and Malaysia a moderately work wealth nation with minimal capital. Clarke et al’s. Point was to see whether the fares of both nations are what one would expect in view of the HO hypothesis (Clarke et al. 2009: 123). They estimate that the capital bottomless nation will send out more capital merchandise and the work-escalated nation will trade more work concentrated products (Clarke et al. 2009: 114).

Information is gathered from Joined Countries Comtrade with respect to exchanged wares between the two nations in 2007 (Clarke et al. 2009: 123). When contrasting the information between the two nations, they find that Singapore’s fares are moderately capital concentrated in contrast with Malaysia’s fares, which are generally work serious. In any case, when taking a gander at the proportions, they locate that capital escalated fares were 32 for each penny of every one of Singapore’s fares, which is moderately low by HO hypothesis principles. Nevertheless, Clarke et al. still presumes that the Singapore-Malaysia exchange 1997 acted by the hypothesis of near preferred standpoint and along these lines they will both experience development (Clarke et al. 2009: 127).

Wood and Berge (1997) contend that the main component between whether a nation sends out made or essential products relies on upon the measure of talented work in respect to normal asset enrichment (Berge et al. 1997: 35). They bring up the issue of why East Asia has developed so quickly with assembling yet Africa has performed ineffectively delivering essential products and infers that the distinction does not originate from the organization of fares but rather the accessibility of human capital and regular assets. They test their speculation utilizing the HO display however supplant the factors capital and work with ability and land (Berge et al. 1997: 36). The model is assessed utilizing exchange information from the UNCTAD Handbook of Exchange and Improvement Insights.

Ability is measured by years of tutoring and common assets are measured via arrive range separated by grown-up populace (Berge et al. 1997: 42). As per Berge et al., a nation with a plenitude of common assets and untalented work will deliver work serious merchandise. Since the aptitudes required for assembling is more prominent than for essential products, in a nation with a low expertise/arrive blessing proportion, the similar favorable position lies in agribusiness and asset extraction (Berge et al. 1997: 38). Berge et al’s. Discoveries recommend that there is a cross-country connection amongst’s improvement and fare structure. Nevertheless, they likewise find that assembling exporters become quicker than essential great exporters.

In any case, they property this relationship on the significance of aptitude as a determinant of similar favorable position (Berge et al. 1997: 54). Writing on relative favorable position and the HO display endeavors to show prove that development is subject to a nation’s near leverage. For standard financial analysts, the length of creating nations proceed to deliver and send out the items in which they have and can create strongly, a nation will definitely develop. Nonetheless, financial analysts on the writing of near preferred standpoint raise many inquiries since business sectors and data are not impeccable as the majority of the past reviews accept.

Likewise, huge numbers of the reviews on relative favorable position perform inadequately unless modified to incorporate different factors. The following area examines the writing by new institutional financial experts who represent the part of organizations as the way to monetary development and recognize that business sectors and data fluctuate.

2.1.2 NEW INSTITUTIONAL ECONOMICS

New institutional financial matters (NIE) is a sub gathering of standard financial aspects which recommends that standard business analysts suspicions of immaculate data, no exchange costs, consummate rivalry and unbounded discernment are not generally substantial. NIE rather concentrates the composed and unwritten standards and laws that oversee society and government and are intended to control society and decrease instability. They expect people do not have idealize data and because of their constrained mental limit make formal and casual establishments to diminish the danger of instability and exchange costs.

People create frameworks of association to persuade specialists. In this way, the execution of the economy is reliant on the formal and casual foundations (Menard et al. 2008: 1). While standard financial aspects concentrate on costs and result, NIE considers the impact of organizations. As per NIE, exchange expenses are subject to the institutional setting; in this manner, the political establishments are compelling in standards, laws and contracts (Menard et al. 2008: 4). Nevertheless, both NIE and standard acknowledge the suppositions of rivalry and shortage (Menard et al. 2008: 2).

NIE endeavors to answer the question encompassing the powerlessness of nations to cultivate feasible development and seeks the part of organizations for the appropriate response. As per NIE, nations with high exchange costs have less exchange, specialization, venture and efficiency (Shirley 2008: 613). In the accompanying segment, I take a gander at NIE writing which plans to clarify the underdevelopment of asset bounteous nations which as indicated by standard financial experts are in a perfect world expected to become quicker than asset poor nations. Nevertheless, this has not been the situation.

As Sachs and Warner (1999) brings up, per capita pay of asset, poor nations grew three times speedier approximately 1960 and 1990 than asset plenteous nations. NIE at last trusts that the nature of establishments will essentially decide the nations, which encounter great financial development, and the nations, which do, and not (Frankel 2010: 15). Sachs and Warner (1997) give exact proof to clarify the moderate development in Sub Saharan Africa from 1965-1990. They theorize that components, for example, geology, monetary arrangement, demography and introductory conditions all clarify the development in Africa in late decades (Sachs et al. 1997: 2).

Subsequently they run relapses utilizing an assortment of factors as determinants of development and gauge an assortment of variables, which were appeared to impact development in Africa. Characteristic asset gifts were found to correspond with slower development as the work from Sachs and Warner (1995) additionally appeared. The relapse demonstrated that as common asset sends out expanded Gross domestic product by .1, development was anticipated to diminish by .33 rate focuses yearly (Sachs et al. 1997: 14). Government reserve funds was likewise assessed in the relapse and found to have a positive connection with development. Furthermore, finally, the creators find that the institutional quality file is noteworthy to development in every relapse (Sachs et al. 1997: 15).

The list is contained 10 five sub-records which incorporate the lead of law list, bureaucratic quality file, debasement in government file, government denial of agreement list and danger of seizure file (Sachs et al. 1997: 7). The relapse demonstrates that as the institutional quality list increments by one unit, the yearly development rate will increment likewise by .28 for every penny (Sachs et al. 1997: 15). Their discoveries propose that the low quality of the establishments and arrangements in Africa clarify a great part of the moderate development. In any case, Sachs and Warner trust this is an issue which can be tackled (Sachs et al. 1997: 2).

Mehlum et al. (2006) concurs with Sachs and Warner and contends that the common asset revile just applies to nations with powerless establishments. They utilize information from 87 asset plentiful nations with over 10% of their Gross domestic product from asset trades and their normal yearly development from 1965 to 1990 (Mehlum et al 2006: 1). They estimate that common asset wealth is destructive for monetary improvement in nations with foundations which are ‘grabber benevolent’. Grabber well disposed foundations have contending creation and lease looking for exercises while maker cordial organizations have reciprocal generation and lease looking for exercises. They test their speculation utilizing an indistinguishable information and philosophy from Sachs and Warner.

The needy variable is Gross domestic product development and informative factors incorporate starting wage level, openness, asset plenitude, speculations, and institutional quality (record which ranges from zero onwards) (Mehlum et al 2006: 12). They run a progression of relapses including the cooperation term: asset wealth x institutional quality the relapse demonstrates that the collaboration term is noteworthy and solid implying that the asset revile debilitates as the institutional quality expands (Mehlum et al., 2006:13). They infer that the uniqueness in development washouts and development victors comes about because of the nature of organization.

Another review by Robinson et al. (2006) contends that the effect of asset blasts is largely subject to the political motivations created from the asset blessings. To demonstrate their theory, they set up a two-period probabilistic voting model with two gatherings. The primary period included races toward the finish of the period (Robinson et al. 2006: 451). The thought is that the officeholder legislator looking for re-race must choose if to concentrate assets and how to redistribute rents to secure re-decision votes through support (Robinson et al. 2006: 452). Comes about because of the review demonstrate that within the sight of a lasting asset blast it turns out to be more significant for the government official to stay in power later on consequently prompting expanded effectiveness of the extraction way (Robinson et al. 2006: 458). They presume that the decision picked is controlled by the nature of foundation, which oversees the assets.

Bhattacharyya et al. (2010) explore the connection between characteristic assets and debasement and the impact of the nature of equitable organizations on the relationship. They display an amusement theoretic model with one economy with an officeholder president and challenger. In balance, an awful challenger can copy a decent officeholder just within the sight of 11 great popularity based foundations. The bigger the distinction in likelihood, the better the fair organization (Bhattacharyya et al. 2010:608). They test their claim utilizing board information from 1980-2004 for 124 nations. Debasement, characteristic asset, wage and vote based system are factors incorporated into the model (Bhattacharyya et al. 2010:612). They initially find that asset rents have a factually noteworthy negative impact on characteristic assets and pay. This proposes characteristic assets identify with elevated amounts of defilement (Bhattacharyya et al. 2010:613).

They then include a communication term including slacked majority rules system measure and asset rents to appraise if debasement is affected by the nature of equitable establishment. They find that asset rents prompt debasement unless the majority rule government score is over .93 and a POLITY2 score of 8.6. They affirm their discoveries by demonstrating that in 2004, Bolivia and Mexico had a POLITY2 score of eight while Botswana had a POLITY2 score of nine (Bhattacharyya and Hodler, 2010:614).

Path and Tornell (1998) concentrate financial development, legitimate and political establishments and various intense gatherings in their development display. They contend that the mix of feeble establishments and fractionalization prompts lease looking for conduct and poor development execution (Path and Tornell 1998, 22). They consider a two-area development show with a formal division, which is effective, and a wasteful shadow part. This speaks to what likely occurs in many economies. The formal segment is assessable while the shadow area is not saddled (Path and Tornell, 1998:25).

Another review by Hodler (2006) contends that battling exercises (counting rent chasing) between different opponent gatherings prompts useless exercises and thusly-moderate development. He sets up a model to dissect characteristic assets and fractionalization and its impacts on property rights and livelihoods (Hodler 2006:1370). World Bank intermediaries and “the share of common capital in the aggregate of physical, human and regular capital as an intermediary for per capita characteristic assets” measure normal assets (Hodler, 2006:1375).

Fractionalization is measured by the file of ethnic fractionalization as an intermediary for the quantity of adversary gatherings. Property rights are measured by the Legacy Establishment and the Fraser Organization records of monetary opportunity (Hodler 2006:1376). Hodler’s discoveries demonstrate that as ethnic fractionalization expands, the salary impact on common assets diminishes (Hodler 2006:1382).

Auty (2007) built up the staple trap show and the hypothesis of lease cycling. Auty contends that characteristic asset rich economies encounter monetary development when asset rents are reused again into effective, beneficial exercises and not thought inside a gathering of political specialists (Auty 2007: 9-10). He additionally contends that asset poor nations have low leases, which constrains the legislature to concentrate on riches building exercises, though governments in asset rich nations are centered on lease chasing. The redistribution of rents between political specialists makes asset rich nations depend longer on essential great fares than asset poor nations. This impact postpones an asset rich nation’s capacity to enhance and industrialize (Auty 2007: 9-10). 12

The writing by new institutional business analysts fluctuates in the route in which confirmation is introduced; in any case, they all concur that the part of foundations is basic. They quality the absence of monetary development in creating nations to the feeble establishments representing the nations. For new institutional financial experts, nations with solid foundations ought to have a positive development rodent

2.1.3 STRUCTURAL ECONOMIST VIEW

Basic financial experts advance the possibility of industrialization and less dependence on the generation of essential items (O’Toole 2007: 422). They disprove a large portion of the cases of standard financial specialists. In contrast with standard business analysts, basic financial experts trust that the economy is affected by power and governmental issues and markets were controlled by the first class who did little to make development. Additionally while standard financial specialists contended with the expectation of complimentary exchange, basic market analysts contend that facilitated commerce prompts high advancement in the inside (created nations) while hurting less created nations.

As an answer with the expectation of complimentary exchange, auxiliary market analysts urge creating nations to exchange among themselves to diminish dependence on industrialized economies. The hidden topic of auxiliary financial aspects is the idea that creating nations are altogether described by free market disappointments hence there is a part for the state to play to guarantee improvement (O’Toole 2007: 426).

Prebisch and Artist (1950) concentrated on enhancement into assembling as the way to development. They contend that mineral and rural great costs take after a descending evaluating pattern over the long haul contrasted with produced products. The thought behind this theory is that the interest for essential merchandise is inelastic yet relative with family wage. As family unit pay expands, the interest for made merchandise turns out to be more versatile and rises more quickly than essential products request and essential products as a share of Gross domestic product will lessen (Frankel 2010: 5).

Along these lines, nations depending on essential merchandise develop slower than nations that depend on made products. Prebisch and Artist in this manner prescribe shutting ones economy to completely build up the assembling business (Polterovich et al. 2010: 3). For Prebisch and Artist and every single auxiliary financial specialist, enhancement is critical to development however, expansion into made products will prompt long run reasonable development. While the quick development in East Asian nations has been related with the locales change from an essential ware exporter to mechanical segment trades, nations in Latin America and Sub Saharan Africa have not moved towards assembling and are fundamentally still asset based economies (Gelb 2010: 1).

Gelb (2010) takes a gander at the contentions encompassing why asset bottomless nations particularly rich in minerals ought to differentiate when they have a relative favorable position in an item. He takes a gander at a review by Hesse (2008) who gives exact 13 prove that differentiated economies perform better over the long haul. He contends that fare broadening can take care of the issues of item ward nations who regularly experience the ill effects of fare precariousness accordingly of inelastic and insecure worldwide request (Hesse 2008: 1).

Hesse embarks to test the connection between fare broadening and gross domestic product per capita development. He appraises an enlarged Solow development demonstrate with an informational collection of normal fare focus and total Gross domestic product per capita development (5 year interims) from 1961-2000. In a disperse plot, he finds that large portions of the East Asian nations show up in the lower right corner and in this manner have moderately low levels of fare fixation while poor development entertainers show up in the upper left corner and have elevated amounts of fare focus (Hesse 2008: 10).

When he prohibits OECD nations and incorporates an openness variable to catch add up to exchange in respect to Gross domestic product, send out fixation has a strong negative impact on Gross domestic product per capita development and nations which have expanded in the previous decade experienced higher per capital pay development (Hesse 2008: 11). Subsequent to testing for non-linearity between the two factors, Hesse finds that the impact of fare focus is more nonlinear for poorer nations than wealthier nations (Hesse 2008: 12).

Financial specialists have additionally looked to concentrate the negative connection between asset reliance and monetary development. In the case of Lederman and Maloney (2007) who concentrated the connection between regular asset exporters and Gross domestic product per capita in the vicinity of 1980 and 2005 to gauge the connection between asset reliance and financial development. They find that Gross domestic product per capita developed slower in common asset exporters than in characteristic asset bringing in nations (Gelb 2010: 7).

One translation of this could be that nations which work in mineral assets, for example, oil think that it’s hard to enhance into different items because of the capacities required for oil creation which requires diverse abilities than most different items (Gelb 2010: 8). Other basic business analysts contend that ware value instability is a reason for the unstable development and at the end of the day contend that differentiating outside of common assets will help development issues.

Blattman et al. (2007) contended that it is item value instability not ware value slants that causes low development in ware subordinate economies. Value patterns and unpredictability of essential items clarify the uniqueness of worldwide salary. The insecurity of wage causes inside unsteadiness, lessened speculation and reduced monetary development (Blattman et al. 2007: 160).

Another contention originates from Eichengreen (1996) who contends that negative patterns and unpredictability of terms of exchange makes cycles of present and capital record stuns prompting poor development and money related emergency. (Blattman et al). Value stuns make capital inflows diminish prompting lessened enthusiasm of remote speculations (Blattman at al 2007: 158).

Basic market analysts contend against a hefty portion of the presumptions of standard and new institutional financial expert however do not differ with the significance of establishments. Nonetheless, this writing centers on their contention for industrialization and assembling as the answer for poor development. For basic business analysts, asset based development systems will prompt poor develop. It is important for nations to industrialize and enhance its economy 14 into assembling segment keeping in mind the end goal to guarantee maintained monetary development. They stress the significance of maintained development and concede that exclusive in the short run can development be accomplished through asset reliance.

Nevertheless, like different tenets, there are financial specialists which address the significance of assembling however concur in the need of industrialization. However, the greater part of the created nations, which have quickly developed in light of their responsibility regarding industrialization and assembling.

Chapter 3 OVERVIEW OF NIGERIA’S ECONOMY

3.0 INTRODUCTION

This part gives a knowledge of Nigeria’s economy since it got her freedom from England in 1960 until the present. The main segment will talk about the structure of the economy and advancement changes inside the nation and incorporates a discourse on a portion of the difficulties confronted by Nigeria’s economy. While area two will examines the looking past oil to enhance the economy. Area 3 will discuss potential pay generator to help the nation Gross domestic product while segment four will discuss improvement arrangements that can be set up by the administration to help industrialization. Inside segment two and four, themes of examination incorporate Nigeria’s national improvement arranges built up by the administration to build advancement and the approaches set up by the legislature to advance essential products and industrialization.

3.1 STRUCTURE OF NIGERIA ECONOMY

Nigeria has the biggest economy in Africa with a Gross domestic product of $478bn, subsequent to dislodging South Africa from the highest point of the positioning. The nation is additionally one of the quickest developing economies on the planet, guaranteeing a normal long haul development rate of 7.7% since 2004.

The world seventh most populated nation, Nigeria has a tremendous populace of 177 million individuals, with a normal age of 18. Not exclusively, is the nation populated and young, it is additionally Africa biggest market. The nation has a Gross domestic product for each capita of $2,702.15.

It can possibly be a main 10 worldwide economy by 2050 on the off chance that it keep to a genuine development rate of 6.6% for every annum. This will see its Gross domestic product rise enormously from $478bn to $8.6trn.

The Nigerian economy entered a subsidence in Q2 without precedent for more than 20 years. Prospects of a financial recuperation in the second 50% of the year are distressing, as still-low oil costs and the deterioration of the naira have hampered the oil and non-oil segments. Albeit forward-looking markers indicate a change, information stay powerless. Business certainty bounced back from September’s multi-year low and the Assembling PMI enhanced yet at the same time indicates a compression. While President Muhammadu Buhari met surprisingly with pioneers from the activist Niger Delta Justice fighters gathering to arrange a suspension of threats, the nation secured a USD 600 million advance from the African Improvement Bank for spending support in November. An extra USD 400 million payment is subject to the execution of changes

3.2 LOOKING BEYOUND OIL

3.2.1 ARTS

In this section of my dissertation, I have decided to draw comparison between Nigeria and Dubai, and I have chosen Dubai, due to the incredible transformation, they have achieved between 1990 until date. Dubai as a country only have oil as its core natural reasons, however the transformation they have achieved have been incredible. Unlike Nigeria they did not have land, they reclaimed from the sea. They did not have limestone, bitumen, granite, steel, rubber and so on. They did not even have people. They invited people to come and build for them, while in Nigeria we had more than oil compared to Dubai we had just oil and desert.

During the course of writing up my dissertation, I met one of the people, who went to Dubai to work on sounds in the new Dubai Opera House; he has been working in Dubai for 14 months, working with a consortium on the acoustics of the halls. After showing me some pictures and told me he will be relocating to Dubai, from the Royal School of Music, and history, reminded me of growing up and visiting the National Arts Theatre located in Iganmu, Surulere, Lagos back as a year 4 student in Nigeria. The memories will remain with me forever, the flooded hall; lack of electricity is what I will call a show of national disgrace. Even now I thought to myself, the National Arts Theatre in Lagos has been established before they started developing Dubai, where is the National Arts Theatre now? It soon began to dawn on me that the Dubai Opera House would be drawing tourist, concerts, awards, and the likes to Dubai, while Nigeria will still be depending on crude oil to booster a failing economy.

3.2.2 AGRICULTURE

Promoting agricultural policies to drive self-reliance and ultimately reduce imports

Nigeria as a nation spends about $10 billion every year on the importation of horticultural and woodland items. Which adds up to just about 19% of the nation add up to imports. While it is respectable for the present government to put forth the defense for Nigerians to look inwards, talking alone will not carry out the employment. Nigeria cannot take out the $2.2 billion every year we spend on creature items and subsidiaries on the off chance that they keep on relying only on Fulani herders that need to stroll over the entire nation searching for grass for their dairy cattle. They cannot wipe out the $1.5 billion every year the nation spends on the importation of wheat alone in the event that they do not revive this part.

Wheat ranchers in Northern Nigeria can create all the wheat Nigeria needs if the approach is ordered to bolster them by presenting assortments that can improve yields from the present 2 tons for each hectare to worldwide benchmarks of 4-5 tons for every hectare. Financing must be given to the ranchers to bolster the motorization of their homesteads. The administration should venture in but briefly, to make advertising loads up that will help set up market trades that will guarantee that agriculturists are coordinated with buyers. Rather than making “touching hallways” over all of Nigeria as the Agribusiness Serve as of late reported, Nigeria ought to work to motorize and market the work of Fulani wanderers. The migrants meander the nation searching for grass for their cows.

Nevertheless, grass can be cultivated year-round along the banks of the Niger and Benue, in Northern Nigeria. Also, incidentally, those a large number of youth that the administration anticipates giving N5000 every month as unemployment installments can be profitably sent to bolster these agrarian activities.

3.2.3 TELECOMMUNICATION

The telecoms segment is maybe the clearest option accessible and ought to be empowered overall, viewed as the quickest developing part of the Nigerian economy. The segment is in fact ending up being the quickest developing supporter of the Total national output (Gross domestic product) of Nigeria. The telecoms business has seen a fortunate development with over $32 billion venture, more than 152 million supporters and near 100 million Web memberships as per accessible measurements from the Nigerian Correspondences Commission (NCC), the industry controller.

Information discharged by the Nigerian Agency of Insights (NBS) likewise uncovered that the broadcast communications area contributed 8.88 percent to the Gross domestic product in the last quarter of 2015. Imperative is the way that toward the finish of 2014, Nigeria alone had around 136 million enlisted lines from the four noteworthy administrators (Etisalat, MTN, Glo and Airtel) and Nigeria telecom administrators represented 35 for every penny of the aggregate Outside Direct Speculation, FDI, into Nigeria in 2014 alone.

This advancement has upgraded takes-up in monetary exchanges innovation and installments frameworks, Internet business assistance, change and expansion of transport administrations and for all intents and purposes all administrations offerings that can be enhanced by digitalization. As placed by numerous specialists the globalization driven by ICT makes it basic for Nigeria as a developing business sector to truly consider the application and advancement of ICT to encourage it fast development and improvement.

MTN Nigeria likely the greatest remote financial specialist in Nigeria throughout the most recent decade has driven the telecoms business to accomplish its colossal commitment to the Nigerian economy. The organization has contributed an abundance of 15 billion dollars in Nigeria, gave a large number of work openings and has exclusively represented 4.5 for every penny commitment to the nation’s GDP (Gross domestic product). Aside the way that the organization had contributed more than N3.2 trillion in the course of recent years; it is additionally gladly affecting several groups decidedly the nation over to improve things. Taking after this improvement, numerous specialists have required an ideal usage of accessible contrasting options to the Oil part trying to decidedly restore the economy.

3.2.4 TAXATION

While the administration owes it as an obligation to empower the subjects by giving employments, foundation and so forth. The subjects are typically obliged to compensate by playing out their own particular commitments, which incorporates paying expenses. The new reality, considering the current circumstance in Nigeria, is that at all levels; the administration should increase current standards by developing and extending its assessment accumulation drive through a forceful duty framework, considering the diminishing income profile because of the drop in oil costs. Thusly, Nigerians need to grapple with this present unforgiving reality.

Charges come in various structures, running from individual wage expense, organizations’ salary duty and esteem included assessment among others. Nigeria Esteem Included Assessment, which is the most minimal on the planet, can be multiplied, creating another $3billion for the income profile. Additionally a higher assessment on extravagance things, will not just give more salary from duty income, additionally energize purchasing merchandise delivered in the nation, which will thusly help household exchanging make strides. The casual part, which makes up half of the nation Gross domestic product, must be saddled and if this is legitimately done, charge income this could increment by 33%.

With forceful assessment laws and implementation, there is most likely Nigeria can surmount the stuns of the vulnerabilities in the oil showcase. This means there will be greater income accessible for the administration to take into account the necessities of the Nigerian individuals, making this the best time for Nigerians to welcome the expense framework. Through this strategy, Nigerians can be included in the contributory social shrink by paying their expenses consistently, of which just 13.4 million Nigerians, which is comparable to 16% pay charge out of an expected populace of 180 million Nigerians, where around 80% of the populace are grown-ups

3.2.5 TOURISM

The Nigerian Tourism industry has maybe a more prominent potential than whatever other single industry, because of its multiplier impacts to bolster financial development and occupation creation. The pervasiveness of a few characteristic and noteworthy traveler destinations add to the areas potential to be one of the successful generator of income for the nation when completely created. Two of these (Sukur World Legacy site at Adamawa and Osun Oshogbo Hallowed Woods are as of now in the prestigious UNESCO World Legacy list). Also, the stimulation subsector especially the film business, being the (third) biggest on the planet, as of now contributes more than two percent (2%) to total national output (Gross domestic product) with tremendous potential for extension.

Perceiving its monetary potential Government of Nigeria has organized tourism as one of its key drivers of development and enhancement, while a few Expresses that have concentrated on its advancement have gone with the same pattern. Act 81 of 1992 highlights in the different Improvement Techniques of the nation and in addition the advancement of a National Tourism Approach (NTP) and the foundation of Nigerian Tourism Improvement Partnership (NTDC) the acknowledgment of tourism potential. Tourism speculation environment in Nigeria is favorable given the rich assets accessible, vast market, enthronement of continuing vote based system, and a bundle of motivating forces set up together by government.

Arrangement Push:

- The strategy push is to create supportable tourism by gaining by legacy-assorted qualities as a reason for advancing local and worldwide tourism.

- This is gone for being focused (manageable tourism advancement) inside the limits of the World Tourism Market and open up Nigeria as a noteworthy traveler goal in Africa through improvement of global tourism and advancement of local tourism.

- The arrangement will create outside trade, energize smooth advancement, advance tourism based provincial ventures, produce work and quicken urban and country social legacy.

- Nigerians will be urged to spend their occasions in Nigeria and to find out about the nation.

- The arrangement is additionally gone for forming Nigeria into the provincial carrier fundamental center point with a view to planning and encouraging air goes to all parts of Africa and coordinating all blacks, especially those of Nigerian inception.

Venture Openings:

- Development of Climbing Trails and Jeep Tracks in the National Parks

- Construction of Visitor Cabins and Inns

- Development of Event congregations, Stimulation Offices and Shopping Administrations

- Construction of gathering Global Presentation Focuses and Tradition Corridors

- Provision of link transport framework to take visitor through the extremely tough yet picturesque territory of the mountains particularly in Kanyang, Obudu and Mambilla Level

- Construction of hotel lodge for endeavor visitors and officers

- Establishment of inns and resorts close waterfalls, springs hollows and calm atmosphere zones, for example, Obudu, Jos and Mambilla Level

- Establishment of Sculling and Game Angling Offices

- Establishment of Occasion Resorts along the Coasts

- Provision of methods for Transporting Sightseers, for example, Carrier, Transports, and Ships and so on

3.3 POTENTIAL REVENUE GENERATOR

- Investing in transportation

- Investing in quality education

- Investing in quality health care services

- Patronizing and encouraging the manufacturing and use of Made in Nigeria products

3.4 POLICIES TOWARDS INDUSTRALISATION

Restoring the power, health and education sector to boost investment

- In order to accrue revenue from the non-oil sector, the government needs to tackle electricity issues throughout the country. This will help attract global investments for massive industrialization, which will subsequently increase our internally generated revenue. In a similar vein, the Buhari administration should revamp and carry out major reforms in our education and health care systems so that our tertiary institutions will churn out graduates who will be employers of labor instead of going abroad looking for better opportunities.

- If the health system is revamped, worthy services will be rendered to Nigerians, the productive capacity of our human resources will be optimized and life expectancy will increase.

- Similarly, good road infrastructure should be built and existing ones properly maintained to facilitate inter-state commerce and mobility. If President Buhari and his administration are able to implement all of these changes, then we can be sure to make a robust revenue from the investments.

Recovering looted funds

- In the meantime, funds looted and stashed in foreign accounts should be recovered by the federal government, these stolen monies run in billions of dollars, which is enough to sustain an economy for a couple of years.

- Buhari, who must have thought in this line, just recently asked the United States for help in returning stolen Nigerian assets stashed in American banks. In March, the US said it had frozen more than $458million, which the late military ruler, Sani Abacha, had stolen.

- The stolen funds recovered should be used to rebuild other dying sectors in the economy such as the manufacturing and mining sectors.

CHAPTER 4: ANALYSIS AND FINDINGS

4.0 INTRODUCTION

These section investigations the information on worldwide oil costs, Nigeria’s oil generation, oil send out income, Gross domestic product development and assembling trades. The primary segment examinations to what degree does Nigeria’s reliance on oil influence development. The second area investigations the effect of foundations, all the more particularly the effect of debasement on financial development. Besides, the third segment investigations the impact of the absence of industrialization on maintainable monetary development. The fourth segment gives a contextual investigation on the economies of Indonesia and Joined Middle Easterner Emirates. 26 The information examined in this segment is from 1990 to 2012. Likewise, was gathered from both national and global sources. National sources incorporate the National Bank of Nigeria, National Department of Measurements and Nigerian National Oil Organization. Global sources incorporate the World Bank, Straightforwardness Universal and the Association of Oil Sending out Nations.

4.1 NIGERIA’S DEPENDENCE ON OIL

These section investigations the information on worldwide oil costs, Nigeria’s oil generation, oil send out income, Gross domestic product development and assembling trades. The primary segment examinations to what degree does Nigeria’s reliance on oil influence development. The second area investigations the effect of foundations, all the more particularly the effect of debasement on financial development. Besides, the third segment investigations the impact of the absence of industrialization on maintainable monetary development. The fourth segment gives a contextual investigation on the economies of Indonesia and Joined Middle Easterner Emirates. 26 The information examined in this segment is from 1990 to 2012. Likewise, was gathered from both national and global sources. National sources incorporate the National Bank of Nigeria, National Department of Measurements and Nigerian National Oil Organization. Global sources incorporate the World Bank, Straightforwardness Universal and the Association of Oil Sending out Nations.

These section investigations the information on worldwide oil costs, Nigeria’s oil generation, oil send out income, Gross domestic product development and assembling trades. The primary segment examinations to what degree does Nigeria’s reliance on oil influence development. The second area investigations the effect of foundations, all the more particularly the effect of debasement on financial development. Besides, the third segment investigations the impact of the absence of industrialization on maintainable monetary development. The fourth segment gives a contextual investigation on the economies of Indonesia and Joined Middle Easterner Emirates. 26 The information examined in this segment is from 1990 to 2012. Likewise, was gathered from both national and global sources. National sources incorporate the National Bank of Nigeria, National Department of Measurements and Nigerian National Oil Organization. Global sources incorporate the World Bank, Straightforwardness Universal and the Association of Oil Sending out Nations.

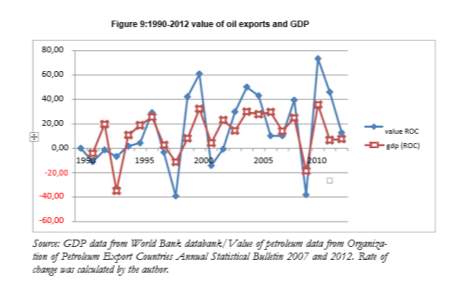

For standard business analysts, years of expanded Gross domestic product must be credited to expanded oil generation. They would guess that in years of expanded oil creation, Nigeria’s economy should likewise develop. Nevertheless, the precept of near preferred standpoint for this situation has all the earmarks of being inacceptable, as oil generation does not seem to significantly affect the instability appeared in Nigeria’s development near 1998 and 2012. To clarify the development in Nigeria’s economy, estimation of oil fares is examined against oil costs. Figure eight represents the adjustment in estimation of oil fares and oil cost near 1990 and 2012 to recognize if there is a relationship.

What’s more, in fact the chart demonstrates that estimation of oil fares has a positive association with Gross domestic product. In years when oil costs dropped, the estimation of oil created likewise dropped. This was normal. In the event that oil costs diminished, the estimation of oil fares ought to likewise diminish. However, 2002 was the main year that accomplished a reduction in the estimation of oil fares yet oil costs expanded. The oil challenges in the Niger-Delta district could have ascribed to the lessening in fare esteem. It can be reasoned that oil costs have a positive and critical relationship with estimation of oil fares. The development of worldwide oil costs impacts the estimation of oil fares

Since it has been demonstrated that the estimation of oil fares positively affects Gross domestic product, we should now take a gander at the connection between estimation of oil fares and oil costs. Figure 9 delineates the relationship. In the times of low development, the estimations of oil fares additionally diminished. It is imperative to note that in a few years of diminished estimation of oil fares, development would in any case increment. The impact of oil reliance on Nigeria’s Gross domestic product gives off an impression of being influenced by the worldwide oil costs, which decide the estimation of oil fares in Nigeria. The precept of relative favorable position is in this manner not substantial because adjustments underway did not influence the monetary development. However, the estimation of oil fares appears to impact financial development. In addition, in light of the fact that the estimation of oil fares is controlled by oil costs, oil costs have made Nigeria’s economy encounter unpredictable yet quick development.

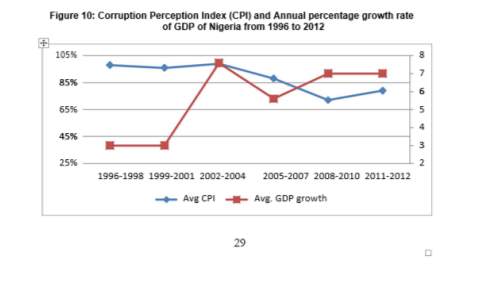

4.2 CORRUPTION AND GROWTH

A current report by PwC assessments Nigeria’s 2030 Gross domestic product figures could be 37% higher on the off chance that it lessens debasement to Malaysia’s levels. The anticorruption drive was a key player in the nation 2015 general races, which saw of the decision of Buhari into office. The present government plans to diminish debasement and recover stole supports through the revamping of hostile to defilement bodies to a solitary office known as the EFCC, and the presentation of a supplication deal framework that empowers authorities to return stolen assets to stay away from indictment and an auxiliary change program for the oil and gas segment. Taking after nearly from this are the changes at the Nigerian National Oil Company (NNPC).

Throughout the years, there have been unsuccessful endeavors to rebuild the NNPC. As of late, the administration has found a way to change this establishment in perspective of cost funds that could gather from running a more effective open foundation. There are late signs that the NNPC will be rebuilt into seven elements; five new center divisions including the upstream, downstream, refining gathering, gas and power, and in addition the endeavors’ gatherings. The other two are fund and administrations gatherings.

Source: GDP growth data from World Bank Databank/ CPI data from Transparency International (www.transparency.org). CPI data calculated to percentage by author.

So as to check defilement, the new government presented the idea of the TSA is straightforward – the National Bank is the administration’s financier. The TSA gives one perspective of the administration’s record, giving a compelling checking of receipts and installments along these lines advancing straightforwardness, responsibility and appropriate money administration. In addition, there is lucidity on the measure of liquidity accessible to the administration, which counteracts superfluous obtaining in the capital markets at over the top rates. Full execution started at the Government level since 2015 and it is gradually being reached out to the states.

Correspondingly, the IPPIS is gone for making a unified database framework for people in general administration with a solitary, precise wellspring of representative data. As far as effect, the then Back Priest revealed that about N185.4 -13824 had been spared through the usage of IPPIS. Late reports likewise indicate some accomplishment in execution as 60,450 phantom laborers were apparently expelled crosswise over MDAs. Strikingly, the 2016 spending focuses up to NGN 1.51 trillion in autonomous incomes to a great extent by guaranteeing strict consistence to these measures which ought to diminish income spillages.

This objective is substantially higher than the NGN820 -13824 assessed for oil related incomes and NGN1.45 trillion from non-oil incomes. A recently set up proficiency unit is focused at decreasing overheads by no less than 7%, faculty taken a toll by 8% and other administration wide expenses by 19% while saddling the advantages of these activities and additionally the Legislature Incorporated Money related and Administration Data Framework (GIFMIS).

4.3 DIVERSIFICATION AND GROWTH

A review conveys startling discoveries on the utilization of extractives incomes in Nigeria. At the point when Nigeria began executing the EITI ten years, back the desire of Nigerians was that the activity would prompt quick and unmistakable effects in their lives. Nigeria was the first of the EITI nations to institute a law particular to the EITI, giving us the self-governance expected to channel and address basic worries on asset administration from our residents. After four revealing cycles covering 13 years, a few of these have emerged. What has changed? What are the consequences of the EITI usage on asset administration? Has the plenteous assets in oil and gas meant enhanced nature of lives, and if not – why not?

Review covers five years and nine states

To answer some of these inquiries, Nigeria’s EITI (NEITI) authorized a review into the distribution of spending of extractives assets (Monetary Designation and Statutory Dispensing (FASD) Review). The goal of the review was to track how the incomes from the extractive segment were designated, where they were exchanged, and how they were used by the elected, state, and nearby governments. The review secured the period 2007-2011 and concentrated on nine asset rich states in Nigeria blessed with oil, gas and mining assets. It investigated the exchange and administration of exceptional advancement reserves setup by the legislature to put resources into and enhance its economy, clean the earth and fortify its social and training administrations. The assets are, among others, the Niger Delta Improvement Commission, the Characteristic Assets Advancement Finance, the Tertiary Instruction Trust Support and the Adjustment Subsidize. The review likewise secured assignment and usage of oil and gas income in key areas in the states.

What amount of cash would we say we are discussing?

The discoveries and suggestions of the review and their association with national monetary improvement are very uncovering, sharp and locks in. For example, the review revealed the aggregate income dispensed to the elected, states and neighborhood governments, including the recipients of the 13% deduction, (a selective safeguard just for oil delivering states). From 2007 to 2011, N22.35 trillion (US $125 billion) of oil, gas and mining incomes landed in state coffers. That entirety is identical to just about 15% of the Gross domestic product in that same period, or US $780 per individual living in Nigeria.

The salary diminished essentially from year to year: while N9.75 trillion (US $54.5 billion) was dispensed in 2007, the installments shrank to N5.42 trillion (US $30 billion) in 2008, to N4.28 trillion (US $24 billion) in 2009 and to N2.80 trillion (US $15.5 billion) 2010. Promote, now natives know what amount went to what level of government. From the sharing recipe under the Nigerian monetary elected rule, the Government took 56% of the aggregate income, states 24%, while the nearby governments gathered 20%. Districts depend intensely on salary from oil, gas and mining. One noteworthy disclosure of the review is the high level of reliance on oil incomes in the nine states tested. The pattern is probably not going to be distinctive in all the 36 conditions of the Alliance. This has prompted a troubling circumstance where the States and nearby governments give careful consideration to different wellsprings of income including inexhaustible human capital and different open doors for inside created incomes in their different states.

From the reports, while States like Akwa-Ibom is 91% ward, Bayelsa State is 96% ward, Ondo 85%, Waterways 76%, Delta 75% ward, Nassarawa 75% and Kano 74% reliant on its share of the oil income. The issue hailed by the review is that the proceeded with reliance on oil income is unsustainable as well as that the primary purpose behind expanding rate of defilement, lease chasing, absence of inventiveness, diligent work and Nigeria’s cycle of neediness amidst bounty.

Cash is not spent on enhancing the personal satisfaction

The review likewise attracted open thoughtfulness regarding another negative pattern in the utilization and designation of income to real divisions. The vast majority of the states secured by the review neglected to channel the assets to vital zones that specifically enhance the living states of our nationals. These incorporate social administrations like wellbeing and instruction, lodging and employment creation. For example, Imo State designated just 2.3% of its aggregate income amid the period under audit to instruction and wellbeing; however, 72% of incomes that accumulated went to intermittent consumption taking care of government running costs, wages and overheads.

Just two states, Akwa Ibom and Streams directed more than 70% of their incomes to the arrangement of capital undertakings. However, here as well, the allotment of these two states to social administrations was likewise under 10%. The issue here is that in a creating nation like Nigeria where difficulties of essential social foundation, for example, streets, power, healing centers, schools, sustenance and lodging are genuine, the capacity to channel assets to the arrangement of these pleasantries through uncommon need on capital undertakings obviously separates a decent government from the other.

US $41 million unaccounted for

The most striking component of the review maybe is the divulgence that an incredible whole of N7.4billion (US $41.4 million) distributed to the nine state workplaces of the Niger Delta Improvement Commission (NDDC) for the fulfillment of ventures cannot be represented. The NDDC was set up as an extraordinary mediation office to build up the oil-rich Niger Delta and reclaim the region from long years of disregard and natural debasement. From the review report, the greater part of the undertakings were either copied, or nonexistent. The report likewise raised normal instances of poor organization of assets distributed to the NDDC. Stores utilized in opposition to their motivations. The review affirmed that the aggregate moves into the Common Assets Improvement Subsidize added up to N365 billion (US $2 billion) in the years secured. Before this review report, very few Nigerians knew that this store existed. It was set up to create elective wellsprings of income from normal assets.

In any case, in opposition to the destinations for which the store was set up, the Review found that the Regular Assets Improvement Reserve was definitely not near its unique targets. Actually, the Reserve even had an extraordinary obligation of N339 billion (US $ 1.9 billion) accordingly of withdrawals for reasons other than its targets. Comparable discoveries trailed exchanges of oil incomes into the Adjustment Store to the tune of N110 billion (US $616 million) amid the period secured by the review. The utilization of the store was likewise anything besides towards accomplishment of its unique targets.

We should put into what has to come

The review additionally found that, when Tertiary Training in Nigeria was in critical need of assets to build up its foundation, a whooping entirety of over N200 billion (US $1.1 billion) was caught in the coffers of the Tertiary Instruction Put stock in Reserve (TETFUND), an office set up fundamentally to bolster improvement of tertiary training. While we put resources into building limit and information through instruction, our techniques ought not to disregard that, our extractive assets are not inexhaustible – generation will fall additional time and its commitment to national income will lessen. Assets and establishments have been set up to bolster reasonable improvement activities – however our review demonstrates that the destinations of these activities are being overlooked and finances assigned to these organizations are being twisted.

With this review, we give a real premise to have a genuine discussion with our pioneers. Presently, we can consider them responsible for their activity or possibly better in real life.

4.4 RESOURCE DEPENDENCE COUNTRIES

4.4.1 UNITED ARAB EMIRATES

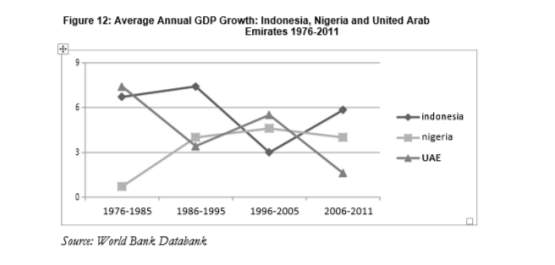

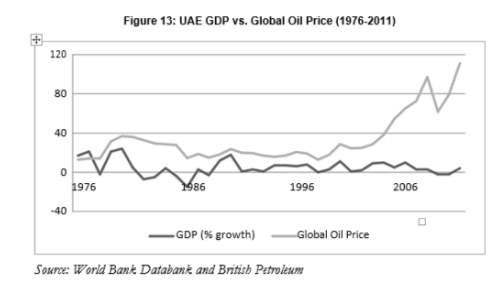

UAE is an oil-rich nation, which started trading oil in the 1970s post freedom. With an expected 10 percent of the world’s oil saves, oil incomes have brought about unlimited social and monetary changes enhancing the welfare of UAE residents (Shihab 2001:250). Dissimilar to Nigeria who was not able transform oil income into financial advancement, UAE utilized oil income to build compensation, social administrations and the way of life for its kin (Shihab 2001:250). Nevertheless, globalization and oil value stuns made UAE differentiate its economy to guarantee managed development because of future emergencies (MPRA 2013). As indicated by the IMF, the nation has gone from being oil subordinate in 1980 (90 percent) to one of the minimum oil subordinate nations in 2004 (50-60 percent) (IMF 2005).

This change came following quite a while of an asset based development technique, which concentrated on subsistence horticulture and other regular assets as the essential supporter of the economy. Figure 13 demonstrates the connection between UAE’s Gross domestic product and worldwide oil costs from 1976 to 2011. The diagram recommends that UAE’s Gross domestic product has been unpredictable because of the instability of oil costs. It creates the impression that as oil costs increment, UAE’s gross domestic product likewise increments. Within the sight of oil stuns, UAE’s Gross domestic product diminishes proposing that both variable associate. To guarantee enhancement, UAE embraced an outward-situated advancement technique including exchange progression, enhanced business condition and the improvement of foundation (IMF 2005).

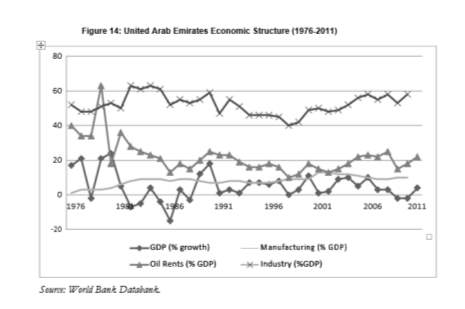

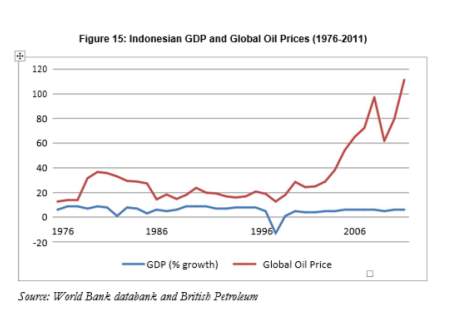

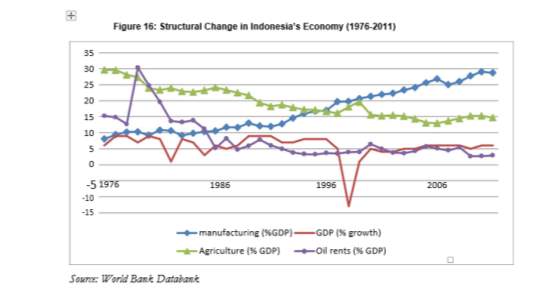

Enhancement initially started with local industry (composts, aluminum, concrete and petrochemicals) yet later moved to more expanded items, for example, hardware, apparatus and transport gear (IMF 2005). Its non-hydrocarbon division was additionally pushed by the advancement of the Unhindered commerce Zones (FTZs) which pulled in organizations delivering electronic items and fabricated products (IMF 2005). In the 1990s, while most oil-trading nations were encountering unpredictability in oil costs, UAE arrived at the midpoint of Gross domestic product development of 7 percent. Development amid that period was because of the broadening of the non-oil segment as appeared in Figure 14.