Red Star Macalline Business Model Transformation

Info: 30813 words (123 pages) Dissertation

Published: 11th Dec 2019

A STUDY ON BUSINESS MODEL TRANSFORMATION OF RED STAR MACALLINE

ABSTRACT

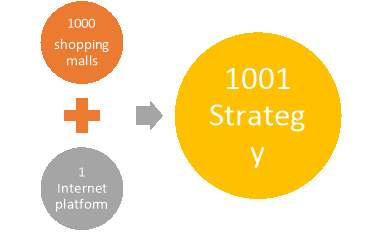

Red Star Macalline is the leading Chinese home furnishing and service brand and the largest national furniture retail chain in China. Founded in 1986, Red Star Macalline targets the rapidly growing middle class in China and offers furniture and home decoration materials such as flooring, bathroom and kitchen fixtures through its shopping malls. At the time of writing, the company started to implement new Strategy 1001 which is supposed to transform Red Star Macalline business model into omni-channel model where the combination of an online shopping platform and increased number of shopping malls in new provinces in China will allow the company to increase its business strength in the industry.

This thesis researches the market potential for Red Star Macalline in China to implement Strategy 1001 and further prepares the steps to overcome challenges that can be met while implementing this strategy. The following research questions were developed:

“Why should RSM adjust its original business model into a new one among many business models and new era of China Economics Situation?”

“How a retail business model of Red Star Macalline integrates its conventional business model to an internet business model?”

“What are the suggestions to overcome the possible problems during implementation of Strategy 1001?”

Through research findings and additional analysis, covering both external and internal company aspects, conducting interviews with different level managers of Red Star Macalline including top management, interesting information regarding both the Chinese market and the Chinese consumer was identified. The findings revealed information about current trends in furniture industry in China which were fundamental in the further strategic recommendations.

There is therefore an opportunity to return to the case at a later stage to explore more completely the shift to multichannel business model. Moreover, as the research is based on a single-case, transferability to other retail companies should be explored.

KEY WORDS: home improvement, furnishing industry, retail, business model transformation, strategy, omni-channel

Table of Contents

1.3 Research methodology and data collection

II Literature review on Retail Business Model and its types

2.3 Channel re-design challenges

III Qualitative analysis on Red Star Macalline

3.1. Introduction of Red Star Macalline

3.1.1 Brief company description

3.1.2 Generations of Shopping Malls

3.1.3 IPO Situation in HK Stock Market

3.2 Environment Analysis of Red Star Macalline

3.2.1 External Analysis PESTEL

3.2.2 Internal Analysis VRIO Model

3.2.4 Comparison with competitors

IV Red Star Macalline Business Model Transformation

4.1 Red Star Macalline Business Model summary

4.1.1 Red Star Macalline core capabilities

4.1.2 Boston Consulting Group-Matrix

4.1.3 GE Multifactor Portfolio Matrix

4.2 New Trends of Business Models in China

4.3 Today’s challenges of Red Star Macalline

V Evaluation of 1001 Strategy of Red Star Macalline

5.2 The Pros and Cons of 1001 Strategy

5.3.1 Supply chain Strategy Modification

5.3.2 Marketing Strategy Modification

5.3.3 Human Resources Strategy Modification

6.2 Theoretical and managerial implications

6.3 Limitations and suggestions for further research

I Introduction

Drawing on existing literature on channel management and retailing, our research questions concern the challenges faced by the retail company when going omni-channel and the decisions they take to address these challenges.

1.1 Research background

The aim of this study is to analyze the transformation of Red Star Macalline business model to the omni-channel business model and to analyze how it can be modified according to the current conditions on the Chinese market.

The retail boom in China has brought along a massive influx of new retail outlets, leading to rapid and intense competition. For a larger extend, retail sales of consumer goods in China quadrupled within last 15 years. Meanwhile, the home improvement and furnishings industry in China had recorded sales revenue of RMB 3,704.1 billion in 2015. It was forecast to grow at a compound annual growth rate (CAGR) of 10 per cent over the next five years (Frost& Sullivan, 2015).

The boom in home ownership has led to demands for home goods and furniture. The huge market potential has given an opportunity for local players, same as attracted new foreign retail companies.

Demand for furniture and home decorations in China has grown at a fast pace in the past decade. It is predicted that in the next decade, both production and demand will continue to grow. The Chinese economy maintains a high-speed growth which has been stimulated by the consecutive increases of industrial output, imports and exports, consumer consumption and capital investment for over two decades.

Meanwhile, the growing number of Internet users makes retailers switch from traditional business models to the multichannel strategy. The retail landscape is set to be changed with e-commerce. In a situation of slowing economic growth in China and competition from online Red Star Macalline had to adjust its strategy accordingly.

1.2 Research questions

Given the limited number of studies about how cross-channel strategy affects the different aspects of retail business models and a very few studies on Chinese furniture retailer Red Star Macalline, we have chosen a case study method to gain in-depth understanding of the changes in a retail business model after the adoption of a multi-channel strategy that was recently announced by Red Star Macalline, while taking into account which outcomes this new strategy can bring and how retailer can overcome them. In our research, we will analyze retail business model in home retail sector, competitive landscape in China and suggest possible modifications for corporate strategy of Red Star Macalline.

With the number of research paper dedicated to the question of how to switch to multichannel strategy and adopt hybrid business model, we have chosen one of the most challengeable and interesting areas, home retail. We want to analyze the existing trends in home retail sector in China, factors that influence the shift from old brick-and-mortar business model to a new cross-channel strategy. Important fact is that the retailer we have chosen for our case study, Red Star Macalline, already announced its new Strategy 1001 which is based on the implementation of Internet 2.0, upgrading of physical stores, enhancing design recourses and shopping experience (information is taken from the interview with the Chairman Che of Red Star Macalline conducted in May 2016). We will take a single case study, but different data recourses which will enable us to be more objective and be capable to make suggestions on new strategy implementation.

Our research aims to identify the impacts of shifting to a newly announced Strategy 1001 of Red Star Macalline on each aspect of a retailer’s business model. The main question of the research can be announced as follows:

1. Why should Red Star Macalline adjust its original business model into a new one among many business models and new era of China Economics Situation?

2. How a retail business model of Red Star Macalline integrates its conventional business model to an internet business model?

3. What are the suggestions to overcome the possible problems during implementation of Strategy 1001?

Fist part of the research will be dedicated to the background information on Red Star Macalline business situation and home retail business models in China with new trends in the industry. Next, we will look closer at the new Strategy 1001, followed by our suggestions for the challenges that might come from its implementation. First research question will be investigated in chapter 3 “Qualitative Analysis on Red Star Macalline”, second question is described in chapters 4 and 5, “Red Star Macalline Business Model Transformation” and “Evaluation of 1001 Strategy of Red Star Macalline”, and the last research question is explained in chapter 5 “Strategy Modification”.

We will try to analyze how retailer will expand its business through new channels and how it will upgrade its existing shopping mall network in order to optimize the whole business to respond effectively on consumers’ expectations of a seamless shopping experience and not losing its competitiveness to face diverse competition. The framework can be shown as follows: Issue – Challenge – Modification (Table 8: Key challenges and solutions for Red Star Macalline during new strategy implementation). We will identify the major changes and suggestions in three aspects of the retail business model design: supply chain strategy modification, marketing strategy modification, human resources strategy modification.

1.3 Research methodology and data collection

This study will follow a case study approach. Case study approach is built on “How” question, and it helps to understand the process of changes present within single settings, collect unstructured data and do qualitative analysis of those data (Eisenhardt, 1989). A single-case study is particularly appropriate as it allows us to build an understanding of the phenomenon from an internal point of view thanks to full immersion and longitudinally embedded participant observation (Yin, 2013).

There is therefore an opportunity to return to the case at a later stage to explore more completely the shift to multichannel business model. Moreover, as the research is based on a single-case, transferability to other retail companies should be explored.

Data was collected from the Chinese government publications, Chinese language newspapers and magazines, industry associations, local governments’ industry bureaus, industry publications. Interviews were conducted with Chinese industry experts and producers in China. We will use a multi-method data gathering strategy combining primary internal data and secondary external data. More precisely, our data sources consist of: non-structured interviews with the Chairman and other executives of Red Star Macalline, primary internal data (reports, strategic plans, performance data), secondary data over a period of five years (press articles, websites, social media).

II Literature review on Retail Business Model and its types

To proceed to our research, we defined the literature review into 3 main groups: retail business model concept, digitalization in retail, challenges faced during the re-design of the channel strategy and how these challenges can be overcome.

2.1 Retail Business Model

Business Model concept became popular in the late 2000s, while most authors define business model as the way how an organization creates and delivers value to the customer (Osterwalder and Pigneur, 2010; Sorescu et al., 2011; Bock et al., 2011; Zott et al., 2011).

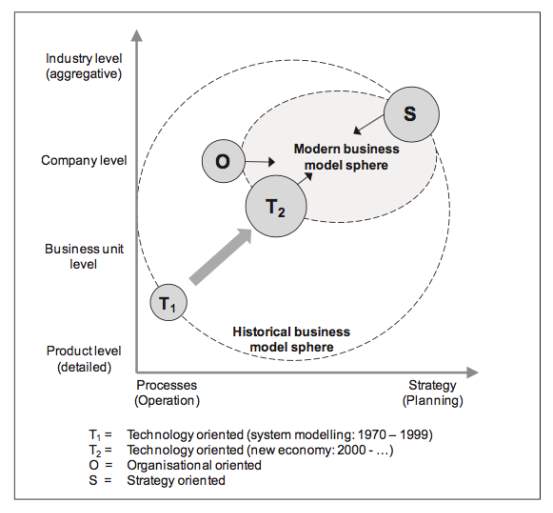

Accroding to Wirtz et al. (2016) in the research literature about business models there are three main focuses of the articles: technology oriented business models, strategy-oriented business models some organization-oriented models. Between the years 2000 and 2002, the technologically oriented business model articles have been very dominant. From 2002 on, more and more strategy-oriented articles have been published. These two currents in scientific discourse play more significant role than the organization-oriented models. During last years an increasingly converging view and conceptual understanding of the business models in the literature has been established, in can be seen from the views on classification of business models in the areas of processes and strategy and levels aggregated in the business model concept (Wirtz et al., 2016).

Figure 1: Development of the three basic theories into the direction of a converging business model view[1]

As identified by the Boston consultancy group, a retail business model is built on two basic pillars of a business model: The Customer Value proposition and the Operating Model. A Retail Business Model integrates two distinct yet connected dimensions: 1) Customer value proposition, 2) Operating Model (Esquivias P. et. Al., BCG perspective, 2010).

In their work “From strategy to business models and onto tactics” Casadesus-Masanell and Ricart (2010) define the difference between business model, business strategy and business tactics as follows. The business model is the way the organization operates and how it creates value for stakeholders; the business strategy states for the choice of business model through which an organiation will compete; the business tactics which means the choices open for the organization in applying the business model. According to Casadesus-Masanell and Ricart (2010) “business model is a reflection of a firms realized strategy”.

As a point of view that combines two previous definitions, a business model enunciates how a retailer creates value for its customers and adopts value from the market according to Sorescu (2011). As a result, the value creation purpose of business activities aims to satisfy customer needs and values through the products and services provided by the organization (Burt et al., 2016). There are many definitions of a business model, the one we choose in our study says that a retail business model is “a well-specified system of inter-dependent structures, activities, and processes that serves as a firm’s organizing logic for value creation (for its customers) and value appropriation (for itself and its partners)” (Sorescua et al., 2011).

While applying retail specification for the generic business model the main particularities of retail should be defined. According to Dawson and Mukoyama (2014) the place of transaction, which can be a physical store or a virtual place, is an extension of the established retail format. Burt and Davies (2010) suggest that the retail brand makes overall promises to customers about the retail format so is a fundamental part of a retailer’s value proposition.

Retailing Business Model is built under two key characteristics of retailing: 1) Retailers sell products manufactured by others and 2) Retailers engage in direct interactions with the end customers (Sorescu et al., 2011). A successful retail business model should not only focus on what retailers sell but also how they sell and how the retailer will enhance successful customer relationship.

2.2 Digitalization in retail

One of the most significant and influential driving forces of contemporary society is definitely digitalization, it influences many elements of business and our lives. In connection to the retail sector, digitalization can transform: retailing exchanges (various ways of exchange between the customer and retailer, including communications, transactions, distribution), retail offer (the term to express the actual retail offer, can be product or service, how it is priced), retail settings (i.e. place), the actors (i.e. retailers, consumers, etc.) (Hagberg, 2016).

As one part of this on-going transformation we can investigate changes of communication channels not only between the retailer and consumer, but also among the consumers (i.e. through social media). Digitalization involves the change of forms of distribution, of traditional settings, including intermixing of settings, extension of offerings, intermixing of humans and technologies (Hagberg, 2016).

Furthermore, new technologies implies that information through various aspects of the exchange becomes available and increases transparency for the flow of the products or services offered (Egels-Zanden et al., 2015).

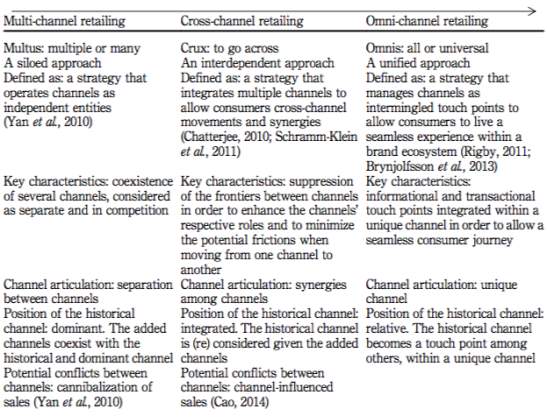

The concept of multichannel, cross-channel and omni-channel is not new to the retail industry and the increasing importance of new sales channels has given new relevance and topicality to issues concerning the impact of multichannel systems on retailers. When retailers use multiple channels as part of their distribution policy, they face the basic choice of combining or separating alternative channels (Schramm-Klein, H., 2006).

Based on the intensity of channel integration we can divide retailing as following: multi-, cross- and omni-channel retailing (Lewis et al. (2014); Cao and Li (2015)). Based on Verhoef et al., 2015 classification omni-channel retailing suggests four key differences in channel organization. First, it involves more channels. Second, it implies a broader perspective as it includes not only channels but also customer touch points. Third, it induces the disappearance of borders between channels. Fourth, the main differentiator of omni-channel retailing is the customer brand experience which is highly specific in this case. While multi- and cross-channel retailing focus on retail channels, the emphasis of omni-channel retailing is on the interplay between channels and brands. As such, shifting to an omni-channel strategy commits a brand to a process of optimizing customer experience and redesigning channels and touch points in the best way possible.

Table 1: Different characteristics and channel articulation of multi-, cross- and omni-channel retailing[2]

2.3 Channel re-design challenges

In the research literature we can see that challenges faced during channel re-design were covered mostly for multi-channel and cross-channel re-design, while there were not yet so many managerial solutions proposed, including the fact that not yet so many empirical evidence was provided on how to effectively manage a channel re-design process (Picot-Coupey, 2016).

Concerning the strategic challenges, Cao (2014) provides evidence that shifting to a cross-channel strategy requires retailers to change their business model. In a cross-channel perspective, retailers need to de-compartmentalize the different structures within the organization (Cao and Li, 2015). Moreover, adding, integrating or blurring channels raises marketing challenges concerning the degree of coordination of the retail mix across channels (Van Baal, 2014; Verhoef et al., 2015).

Changing the channel strategy requires the support of senior managers, and impacts the staff in general (Lewis et al., 2014). Additionally, the technical staff could have a lot of work ahead of them as the sixth challenge is a technological – IS one, due to the need to integrate or merge databases, manage big data and re-design the supply chain (Lewis et al., 2014; Cao and Li, 2015). Among other changes, this fusion of IS is resource consuming and consequently leads to a financial challenge (Lewis et al., 2014). Finally, the challenge of performance tracking is reported as being delicate when channels are integrated (Lewis et al., 2014).

The intensity of these challenges is reported to differ depending on the degree of integration (Lewis et al., 2014; Cao and Li, 2015). Lewis et al. (2014) identify three stages in going multi-channel: the early, middle and late implementation stages. Resource constraints and board level and senior management issues diminish along these stages, while cultural issues increase. Channel integration obstacles and staff support difficulties are highest in the middle implementation stage. In contrast, Cao and Li (2015) identified four different levels of integration (none, minimal, moderate and full), each with their own respective challenges. According to these authors, strategic issues such as the alignment of fundamentals and the transformation of the organization have only to be dealt with at the full-integration level, contrasting with Lewis et al. (2014) findings.

If the challenges induced by channel re-design have received attention, at least for multi-channel and cross-channel, the solutions to overcome them – the “how” questions – remain largely unexplored. We could find two very broad recommendations about what to do when addressing the challenges in the shift to omni-channel retailing: first, revamping the retail business model (Cao, 2014; Piotrowicz and Cuthbertson, 2014); and second, engaging in a change process (Verhoef et al., 2015).

Lewis et al. (2014) propose the involvement of store employees as technology users through equipment with mobile devices solutions as well as specific training of staff to promote technology in store as a means to bridge online and offline experience.

As far as marketing challenges are concerned, Cao (2014) suggests that shifting to cross-channel retail requires retailers to optimize the product assortment, price and communication policies across channels, rather than merge them. She also advocates reinforcing the strengths of the physical store, with a store layout focusing on the consumer experience rather than the products.

Cao and Li (2015) indicate that the merging of Information Systems (IS) concerns not only consumer-related information, in order to recognize the consumer at every touch point, but also marketing information, such as prices, product assortment and logistics, that need to be synchronized across channels.

Picot-Coupey (2016) observed five strategy-related challenges dominated by organizational, cultural, managerial and marketing issues, and three development-related challenges encompassing retailing mix, IS and CRM issues. As the convergence process between bricks and clicks takes place, an e-retail company faces various challenges of varied intensities in relation to all of its organization’s elements. Initially, the key challenge concerns the organizational culture and consists of developing a respective understanding of each person’s expertise as well as gaining staff engagement. In particular, various systems (logistics, information, sales, marketing, training, product management) have to be unified. Channel re-design from an omni-channel perspective is likely to prompt complete company re-design, and to connect previously unconnected parties.

The research paper “Channel design to enrich customers’ shopping experiences” (Picot-Coupey, 2016) emphasizes the importance of organizational learning and trial-and-error learning for channel re-design. We have mapped out a two-phase process in the strategic shift to omni-channel retailing: an explorative phase during which challenges to omni-channel retail are identified and solutions tested, followed by an exploitative phase during which these solutions are implemented.

III Qualitative analysis on Red Star Macalline

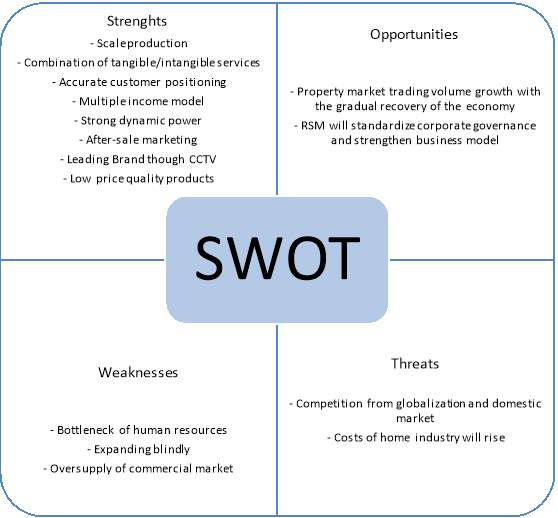

In the third chapter we will talk about background of the company, its history and core values. Later we will proceed with the external and internal analysis using common marketing tools like PESTEL, SWOT and VRIO model.

3.1. Introduction of Red Star Macalline

In this part we will investigate the company background, as its core values, history, financial situation and other important facts.

3.1.1 Brief company description

Red Star Macalline is the leading Chinese home furnishing and service brand and the largest national furniture retail chain in China. Founded in 1986, Red Star Macalline targets the rapidly growing middle class in China through the operation of malls that offer furniture and home decoration material such as flooring, bathroom and kitchen fixtures. By June 30, 2016, Red Star Macalline had 181 stores in 129 Chinese cities including Beijing, Shanghai, Tianjin, Nanjing, Changsha, Chongqing and Chengdu. The big-name brands include: QMq, Landbond, IREST, Natleer, Royal, Cityw, Beson, Hettthi, JiaHouse, Beking, Maiso.

“Home Furnishing Transforms Life, Creating the Beauty of Home” is the motto of Red Star Macalline[3]. The Company witnessed the development of the home furnishing industry during Chinese economic reform and opening up. In the meantime, the company has been influencing the lifestyle of Chinese people and has been improving consumers’ awareness of home furnishings design. Consequently, innovation and modern design are the core values of Red Star Macalline brand. Red Star Macalline says: “Customers are the basement of the corporation, Innovation is the core of the development” [4].

3.1.2 Generations of Shopping Malls

Red Star Macalline is a home chain store was founded in 1986. Being market-oriented Red Star Macalline divides its brands and puts them separately in the shopping malls to form the perfect combination of the layout design and the efficient management. Please, refer to the Table 1 for the timeline of nine generations of shopping malls of Red Star Macalline.

| 1993 | The first generation: renting factory for furnishing business. |  |

| 1994 | The second generation: purchasing land for building malls. |  |

| 1996 | The third generation: market-oriented operation, shopping mall management system. |  |

| 1998 | The fourth generation: retail chain. |  |

| 2000 | The fifth generation: shopping mall fully responsible for all products sold. |  |

| 2003 | The sixth generation: Jiangnan garden-style and environmentally friendly furniture malls. |  |

| 2005 | The seventh generation: customer experience furniture mall. |  |

| 2008 | The eighth generation: park-style home furniture mall. |  |

Table 2: 9 Generations of Red Star Macalline Shopping Malls[5]

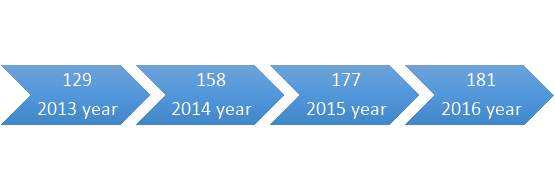

By June 30, 2016 Red Star Macalline is the largest home improvement and furnishings shopping mall operator in China in terms of number of shopping malls (181), operating area (11,814,928 square meters) and geographical coverage (129 cities). By that time it had 17,086 full-time employees. Its tenants had their own employees only at the sales counters[6].

| Regions | Self-Operational | Mandatory Administration | Total Number | Percentage |

| Beijing | 4 | 1 | 5 | 2.8% |

| Shanghai | 7 | 0 | 7 | 3.9% |

| Tianjin | 4 | 1 | 5 | 2.8% |

| Chongqing | 3 | 0 | 3 | 1.7% |

| North-East | 8 | 8 | 16 | 8.8% |

| North-China | 3 | 20 | 23 | 12.7% |

| East-China | 13 | 69 | 82 | 45.3% |

| Central-China | 7 | 9 | 16 | 8.8% |

| South-China | 3 | 3 | 6 | 3.3% |

| North-West | 1 | 8 | 9 | 5.0% |

| South-West | 3 | 6 | 9 | 5.0% |

| In total | 56 | 125 | 181 | 100% |

Table 3: Number of Self-Operated and Mandatory Administration Shopping Malls[7]

The future development strategy will prioritize the self-operation malls in the tier 1 and tier 2 cities particularly in the heart of the cities. During the past two years, the growth rate of super-shopping mall specialized in the home furniture sales between 20% and 30% annually.

Figure 2: Number of Red Star Macalline shopping malls

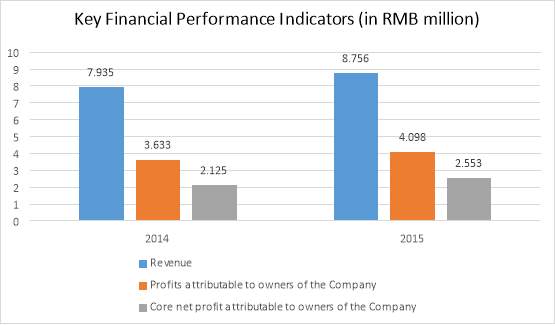

Figure 3: Red Star Macalline Group revenue and net income (2013-2015)[8]

3.1.3 IPO Situation in HK Stock Market

According to the 2015 annual report, the company had generated the revenue of RMB 8.76 billion and the net profit of RMB 4.37 billion by the end of 2015. Compared to the previous year, the growth rate is 10.3%.

| December 2015 (in million RMB) | 2012 | 2013 | 2014 | 2015 |

| Revenue from Portfolio Shopping Malls

Revenue from Managed Shopping Malls

Other Revenues |

3,852

527 719 154 2 |

4,199

988 855 272 47 |

4,884

1,014 1,093 679 265 |

5,260

1410- 1268- 464- 354 |

| Total Revenues | 5,254 | 6,361 | 7,935 | 8,756 |

| Cost of Sales and Service | (1,452) | (1,789) | (2,054) | (2,242) |

| Gross Profit | 3,801 | 4,571 | 5,881 | 6,514 |

| Other Income

Changes in Fair Value of Investment Other Gains and Losses Selling and Distribution Expenses Administrative Expenses Other Expenses Share of profits of Associates Share of Results of Joint Ventures Financial Costs |

222

1,112 (48) (809) (654) (6) 45 (14) (554) |

192

2,055 (30) (922) (771) (27) 42 (10) (631) |

170

2,415 (187) (1,055) (923) (113) 14 4 (856) |

194

2,382 (206) (1,197) (882) (121) 62 50 (854) |

| Profit Before Tax | 3,095 | 4,469 | 5,350 | 5,942 |

| Income tax | (839) | (1,200) | (1,428) | (1,573) |

| Net Profit | 2,257 | 3,269 | 3,922 | 4,370 |

Table 4: Red Star Macalline, Income Statement[9]

Red Star Macalline has been listed on the H-Share market in 2015 mobilizing RMB 5.6 billion. In mid-2016, it announced an initial public offering (IPO) on the A-Share market to mobilize an additional RMB 3.95 billion. The company had set aside RMB 1.45 billion towards the construction of an exhibition mall, RMB 600 million for the construction of a unified logistics service system, and RMB 500 million for upgrading O2O platform projects[10].

Company decided to come back to A-share Market due to the following factors. The industry is facing difficulty in rental issues, including the high rental costs, the pressure from United States, inside and outside network, pressure from other electricity providers and Internet platforms for home decoration. Second, most of the Red Star Macalline projects are in developing stage and financial pressure is huge with large precipitation funds. However, in mid-to-short term, the company will benefit from the loosened property policies. Better property policies, demand in lower tier cities and will increase the demand for furniture and home decoration products (Asia Securities Company, 2015).

3.2 Environment Analysis of Red Star Macalline

In this section, we want to analyze the external and internal environment for Red Star Macalline with the help of useful marketing tools like PESTEL, SWOT and VRIO model, including comparison with the competitors.

3.2.1 External Analysis PESTEL

The PESTEL analysis contains political, economic, social, technological, environmental and legal factors. The PESTEL analysis is a macro-environmental framework used to analyze the industry, where a company operates or wants to operate in (Gillespie, 2007). The macro environment affects markets and industries where organizations operate that is why PESTEL analysis gives us an overlook over the factors in the market that Red Star Macalline has to take into consideration.

Policy and Legal Environment

In recent years, the Chinese government has introduced a number of policies which are closely related to pan-home industry.

New urbanization. New urbanization in China started to be promoted by the government from 2013. Differently from the previous times, the new urbanization concentrates on intensive, inventive, and environmental-friendly methods to help to move rural population into the cities. During this process, the second and the third industries gather towards cities and towns to enlarge the quantity, and to develop dividends for China economy due to social productivity development, science, and technology improvements, and industrial structure adjustment. From January 2015, a pilot program was issued to assign the tasks and procedures for authorities.

Formulating regulations for furniture industry in China. On March 5, 2015, Premier of the State Council Li Keqiang announced The Report on the work of the Government delivered at the Third Session of the Twelfth National People’s Congress, which has a number of contents closely related to pan-home industry[11].

The key points of the report include the following actions: encouraging local building materials and home industry companies to go global, prudent fiscal policy, stabilizing exports and increasing imports, vigorously developing energy-saving and environment protection industries, green tax legislation, continuing to prevent and control of atmospheric pollution, the importance of big data and e-commerce, transformation and upgrading of furniture manufacturing industry. From the key points of the government work report and the introduction of the new policy, it can be seen that the focus of China’s home industry in the future mainly includes the following aspects.

To sum up, the favorable policies for furniture industry mean that the future development of the home industry should comply with the newly introduced standards and pay attention to the requirements in environmental protection and safety. Moreover, the home industry players should also focus on technological progress and make use of the Internet, artificial intelligence and big data.

Economic Environment

GDP and income growth. The Chinese economy expanded for 6.9 percent in the first quarter of 2017, compared to a 6.8 percent growth in the fourth quarter of 2016 and slightly above market consensus of a 6.8 percent growth. (National Bureau of Statistics of China, 2017). It was the strongest expansion since the September quarter 2015, supported by faster rises in industrial output, retail sales and fixed-asset investment while fiscal spending surged. For 2017, the Chinese government expects the economy to grow by around 6.5 percent compared to a 6.7 percent expansion in 2016. However, it is the slowest growth during last 26 years. Economic and national income growth are the key drivers o consumption including expenditures on home improvement and furnishing products.

Figure 4: China GDP Annual Growth Rate[12]

Rapid urbanization. The rate of urbanization in China was rising steadily. At 771 million, the urban population had exceeded the rural population of 603 million in 2015 (Frost & Sullivan, 2014) leading to demand for home improvement and furnishings products as migrants from the interior settled into their new urban locations.

| Primary Chinese Cities GDP Figures (2015) | ||||

| Rank | City | GDP (bln yuan) | Growth rate (%) | Population (mln) |

| 1 | Shanghai | 2,530 | 6.8% | 24.25 |

| 2 | Beijing | 2,300 | 6.7% | 21.68 |

| 3 | Guangzhou | 1,810 | 8.3% | 16.67 |

| 4 | Shenzhen | 1,750 | 8.9% | 10.77 |

| 5 | Tianjing | 1,720 | 9.4% | 15.16 |

| 6 | Chongqing | 1,610 | 11.0% | 30.01 |

| 7 | Suzhou | 1,440 | 7.5% | 10.60 |

| 8 | Wuhan | 1,100 | 8.8% | 10.33 |

| 9 | Chendu | 1,080 | 8.0% | 14.22 |

| 10 | Hangzhou | 1,010 | 11.0% | 8.89 |

Table 5: Primary Chinese Cities GDP Figures (2015)[13]

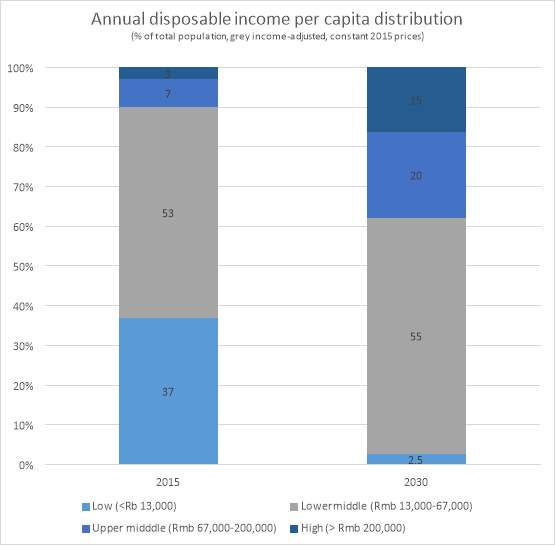

Figure 5: Annual disposable income per capita distribution[14]

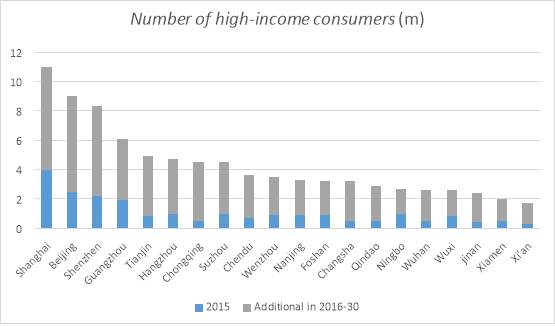

Figure 6: Number of high-income consumers[15]

Note: High-income consumers refer to individuals with a grey income-adjusted disposable income of above Rmb 200,000 per year at 2015 constant prices.

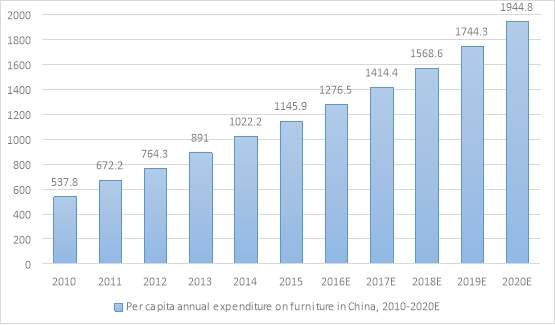

Annual expenditure on furniture. Urban per capita disposable incomes were rising in China. They are leading to a demand among individual families for larger and well-furnished living spaces. Per capita annual expenditure on furniture in China rose sharply over last five years at a CAGR of 16,3% and it is expected to grow at a CAGR of 11,2% in the next five years with per capita annual expenditure on furniture in China expected to reach RMB 1,944.8 million in 2020 (Frost & Sullivan, 2015. Overview of the office furniture market in China).

Figure 7: Per capita annual expenditure in China[16]

Social Environment

Change in generations. In recent years, the population growth in China has slowed. Meanwhile, the proportion of urban population is increasing every year. Now China’s population is olivary in structure, and the change of population structure has diversified impacts on pan-home industry. First, the proportion of population between 40 and 50 years old is in its maximum and the improved decoration market arises. Second, the marriageable population is from 20 to 24 years old, so China will usher in the blowout period of housing and decoration in the next five years. Third, with the advent of aging population, the segmented house decoration market targeting at “seniors” merits attention. Fourth, the third generation of the “baby boom” arises, so the infants, children and home products become new demand point (Own representation based on National Bureau of Statistics of China, 2017).

Rising middle-class consumer. Upgrading needs fueled by growing lifestyle aspirations and focus on quality, innovation and environmental credentials. An important trend in the consumer profile of China is the growing weightage of the “mainstream” consumer (defined as having an annual income of between $16,000 and $34,000) accompanied by shrinking weightage of the “value consumer” (defined as having an annual income of between $6,000 and $16,000). The mainstream consumers would comprise 167 million households or close to 400 million people. They would be the trend setters for consumption (McKinsey, “Meet the 2020 Chinese Consumer”, 2012).

Technological Environment

E-commerce and the Internet of Things. According to McKinsey research “China’s iConsumer 2015: A Growing Appetite for Change” Chinese consumers enjoy the options and transparency available online, they are also becoming increasingly choosy. China’s online retail market was already the world’s largest, with e-commerce accounting for more than 13 percent of the country’s total retail sales of consumer goods. In top-tier cities, roughly 90 percent of Internet users and 70 to 80 percent of consumers in total were shopping online.

Furniture companies need to develop their products and give their products greater added value by raising the level of technology innovation in production process. Main directions in furniture industry upgrading process are advanced manufacturing and the application of information technology.

New materials. The future development direction is environmentally friendly manufacturing when the whole life cycle of products must be conducive to environmental protection and the reduction of energy consumption. Particularly, greater attention should be paid to the protection of the ecological environment, human health and home safety in the production process of the furniture industry.

Summary of Industry Environment

Overall, we can see that Red Star Macalline is facing the following advantages for its further expansion as huge room for industrial development, economic background, social change, technological progress as well as favorable governmental policies.

3.2.2 Internal Analysis VRIO Model

Identifying the core resources and capabilities that generate value to the customers provides a better understanding for the management about what customers value most about the company’s products.

The VRIO analysis is a four-step analysis of a company’s strategic capabilities: Value,

Rarity, Inimitable and Organizational aspect of resources and capabilities. These variables need to be measured to determine the competitive potential of a resource or capability (Barney and Hesterly, 2010).

To get a better understanding of Red Star Macalline valuable resources and capabilities it is necessary to make a distinction as who is regarded as the customer in this analysis. Red Star Macalline most valuable capability could be the value-chain providing reliability for the brands presented in their shopping malls. However, in the long run, it is the end customer who are the ones who create demand of the product and, in the long run, provide cash flow.

Value of strategic capabilities – Medium/high

The value of a capability is characterized by its creation of value to the customer. The level of value it creates determinates if it can be seen as a competitive advantage (Barney and Hesterly, 2010).

Red Star Macalline is focusing on providing the right customer experience. It is vital for Red Star Macalline to consider its marketing insights, internal expertise and knowledge as key competitive advantage generating value to its customers. As the most famous brand in market, Red Star Macalline attracts large number of consumers. Red Star Macalline has the direct access to the related consumers. Red Star Macalline proactively manage and control every session of the shopping experience to bring the customers the extraordinary experience through attractive shopping environment, wide choice range of products, exclusive service.

Red Star Macalline has been awarded many times. The efficient and strong marketing capability enable Red Star Macalline to receive many award in the industry. In 2013, Red Star Macalline was recognized by China Building Decoration Association as the “China famous brand in the building material”.

Rarity of strategic capabilities – Medium/high

It is necessary to evaluate the competitiveness of the capability in terms of how many of a company’s rivals possess the same capability, or in other words; the rarity of the capability. One of the distinguishing traits of Red Star Macalline is that they it has built aggregation, at the point of sale, of diverse product categories from diverse manufacturers. The system had evolved in China because product manufacturers were finding it expensive to develop their own distribution channel or invest heavily in their own brands. They pooled their resources to build a one-stop shop, a mall in its own right, to attract foot traffic and generate sales volume that would justify large investments in marketing. As a result, the mall, rather than the company, was the brand. Consumers recognized and trusted brand malls over individual product brands.

This way, the unique intangible competence behind these high variety of products and strong brand image represents the valuable competitive advantage.

Inimitable strategic capabilities – High

Inimitable strategic capabilities are hard to imitate, they also represent a competitive advantage. The business model of Red Star Macalline was built upon a combination of Portfolio Shopping Malls and Managed Shopping Malls. This hybrid expansion model has created high barriers to entry. It is difficult to replicate, so for Red Star Macalline competitors, present or potential, it harder to source new opportunities in the market. Success with the hybrid model has led to a virtuous growth cycle for Red Star Macalline in general and for its customers.

Organizational Embedding

To fully realize its potential, company must be organized to exploit these resources and capabilities. The internally optimistic and proactive approach represents an organizational strength that will be beneficial in this process. The new strategy is regarded as something top-management wants to push forward and make a top priority, and thus it is evident that it is embedded throughout the management.

On the physical front, Red Star Macalline had shown evidence that it could deliver. In 2002, for example, it had set a target of opening 200 malls by 2020. Having already built a total of 181 malls by mid-2016, Red Star Macalline opened 200th mall at the end of 2016.Now, the company had set a new target of building 1,000 malls.

On the digital front, Red Star Macalline had already designed an app for its malls in Shanghai and a peer-to-peer platform for furniture buyers, commercial tenants and factories partnered with the malls. The way ahead would involve replicating it enterprise-wide.

Conclusion

Red Star Macalline possesses internal capabilities regarding hybrid expansion model, high level of expertise and the development of a strong brand. These capabilities represent important capabilities and experience that could be useful in further Red Star Macalline expansion.

3.2.3 SWOT analysis

In this section, we will describe some of Red Star Macalline most important strengths, weaknesses, opportunities and threats. SWOT analysis is commonly used as a key component of the marketing planning process. The SWOT matrix depicts the marketing strategy process through bringing together the external and internal evaluation of the organization’s situation (Kotler and Keller, 2009).

Strengths

1. Scale Production

Scale production is the important action for the development of the business. Generally speaking, retail industry is limited on acquiring the resources. After the competitive advantage is obtained by one company, the following companies have to consider the advantages of the competitor and the market size. For example, after the opening of one supermarket in a residential area, the other competitors will lag behind. The nature attractiveness of occupying the market has driven the retail chain company to expand their business from time to time until the completion of scale production. Since the establishment of Red Star Macalline in 1986, it developed from a small company into a hyper shopping mall specialized on home furniture. Finally, the scale production was achieved. Even the financial crisis occurred in 2008, the company survived, moreover, it was a new opportunity to accelerate the scale production. The benefits of scale production are obvious, and Red Star Macalline has obtained its competitive advantage. It was beneficial for the integration of industry resource.

2. Perfect combination of tangible and intangible services

Red Star Macalline created a platform which is different from the other business models in the industry. It seems attractive for the small size furniture brands. Red Star Macalline is ready to introduce the design resources and facilitate the design for the brands. Through the cooperation with different brands presented at Red Star Macalline shopping malls, not only the close relations has been strengthened, but their mutual interest has been binding through the agreements they signed, consequently, the alliance is achieved.

3. Clear customer positioning

The positioning of Red Star Macalline is to build a shopping mall platform according to USA experience. Red Star Macalline attracts the factories and distributors to complete the direct sales. The home furniture brands are the first class with good reputation in China and abroad, they position themselves as brands for the middle-income customers. Red Star Macalline offers the “Standard marketing, Standard after sales service and Standard training” for the suppliers and makes profit through renting the properties. This business model is different from the traditional relations between the retailer and suppliers.

4. Multiple income model

Red Star Macalline adopts the mode of pure leasing, store leasing, promotion, marketing, public property management, etc. Meanwhile, it also has its own properties, designs, and construction sites. This “workshop-style development strategy” ensures the steady growth of the company’s estates. Red Star Macalline starts with retailing and culminating in capital management, amplifying the assets of the company. The source of income for Red Star Macalline comes mainly from three sources: a. comprehensive services (mainly leasing, property management fees), b. income from investment (not dependent on enterprises’ income), and c. other incomes.

5. Strong dynamic power

The dynamic power of an enterprise is primarily determined by the soundness of its internal systems and of its team. The soundness of the system is evaluated by whether an enterprise is qualified to become a tenet, the condition of its graduation, and the procedures of its services. The soundness of the team is evaluated by whether it is adequately staffed and by the learning abilities of its staff members. The brands which are presented in Red Star Macalline shopping malls mean that it is not merely a business circulation manager but more importantly its role lies in spreading a culture and leading a high-quality life philosophy and lifestyle for the mass-market. Red Star Macalline is devoted to creating enterprises with learning potentials, and to major developments in common vision, teamwork, and systematic thinking.

6. After-sale marketing

Red Star Macalline ensures the quality customer service. It has realized the inevitable trends of future development: the psychology of customers, the class and status of the mall, including situational exhibition and experiential shopping environment. Home experiential shops have diversified the modes of marketing. Not only will it not affect traditional marketing, it also presents a richer and deeper marketing mode.

7. Leading brand through CCTV

The brand Red Star Macalline is oriented to “serve thousands of homes, promoting home-style culture and home-style art, even creating home-style art, and enhancing home-style taste.” This high brand orientation needs to be matched by the platform of a strong quality media as only the happy marriage between enterprise and media can effectively promote the former’s image as a brand. Among the many TV media, CCTV brags the most influential and powerful in China because of its unique position. Red Star Macalline started cooperating with CCTV from 2008. Hiring XuXiyuan and XuXidi as its representatives on TV, Red Star launched its home-style advertisement during the golden hours of the day. Red Star name reached many houses all over China and established a reputation as a renowned home-style chain store brand among the customers. This has changed its old public image as only a local brand.

8. Low price quality products

The Chinese market is highly sensitive to prices and a low price forever draws attention of customers. That is why many enterprises in China are constantly engaged in price wars. Compared to international brands, Red Star Macalline offers a slightly lower price for the same products. As a matter of fact, Red Star Macalline has made a promise in many cities: for the same brand, same type, same size and same class product, we promise the lowest price in the city and guarantee a double refund if the product is found for a lower price elsewhere. Red Star Macalline is able to keep the costs, and therefore the price, low through lower land prices, reduction of transitional procedures etc.

Weaknesses

1. Bottlenecks on human resources

The scale expansion of retail chain business looks like cell division: one divides into two and two divide into four. The more businesses there are, the higher requirements to talents will be. On the one hand, companies need time to cultivate talents; on the other hand, it is utmost urgent for companies to use human resources. Therefore, we witness the phenomenon that companies hire employees without selection, and that employees have to be at important posts after a short-time training. Various training methods (such as rotation, transfer, training, practice, and etc.) have to compromise to scale expansion. The bottlenecks on human resources will be constantly accumulated with the scale expansion. Companies will be lacking talents and can sometimes choose a wrong person for the job.

2. Expanding the business blindly and being caught in his own trap

The boom in the real estate industry offered the great opportunity for the business expansion of Red Star Macalline. The expansion of its shopping mall experienced dramatic booming since 2009 from only 20 stores to 181 stores. The fast growth rate planted hidden danger of its own business. The embarrassing situation now Red Star Macalline is confronting now is the worse business revenue and the increasing operational cost. Due to the bad business results, the revenue generated is decreasing significantly. Even the trend is small but the result is fatal. If this situation will continue in the future, the revenue chain will deteriorated and may result in a dilemma for the company.

3. The oversupply of commercial market

As a result of the mismanagement, lack of objective and accurate investment information, scientific evidence, consequently, some investors from China and abroad expanded the business blindly without the careful consideration on the sufficient information of the local investment environment and project development. The bubble in the industry is obvious in terms of markets size and scale.

Opportunities

In this section, we will analyze the Red Star Macalline opportunities under the influence of economic globalization. First, the property market will show a turnaround in the trading volume with the gradual recovery of the economy. Ending the downturn of property market in China, home industry will pass through the recession and eventually develop into a blooming industry. At the same time, as home retail chain get listed in China, Red Star Macalline will standardize corporate governance and strengthen business model in preparation for embracing various opportunities after listing. Red Star Macalline will draw on its successful transition, consolidate the leading edge and move towards.

Threats

First of all, under the influence of economic globalization, foreign home retail chain will compete with Red Star Macalline in China’s market or even in the global market. With the sudden emergence of new domestic home industry chain, Red Star Macalline got hindered in promotion, and thus the company has to confront bottlenecks. Moreover, the cost of home industry will rise dramatically due to the gradual reduction of resources and poor forest.

Figure 8: Red Star Macalline SWOT analysis

3.2.4 Comparison with competitors

China’s home and furnishings retail market is dominated by mall operators and is highly segmented. As compared to domestic industry participants foreign players using DIY (Do-it-yourself model) only occupy a small portion of the market share (Frost & Sullivan, 2014). In 2015 the top five home improvement and furnishing retailers, including Red Star Macalline, Easyhome, Jinsheng Group, Yuexing Furniture and Wuhan Ouyada contributed a total retail turnover of RMB 126.8 billion accounting for 9,2 % of total market share (Frost & Sullivan, 2014). Red Star Macalline leads the chain retail format with a market share of 10,8% by retail turnover (Frost & Sullivan, 2014).

| Retail channel | Home improvement products (textiles, decoration, small storages, etc.) | Home furniture (sofa, tables, beds, chairs, tables, ets) |

| Speciality stores including manufacturers gallery stores and concession counters in department malls | Beyond, Fuanna, Mercury, Luolai, Mendale, Sunvim, Kaisheng, Violet, Sewboffin, Jalice, Veken, Heng Yuan Xiang | Quanyou, Huafeng Furniture, Red Apple Furniture, Qumei, Huari, Royale Furniture, M&Z, Landbond, Markor |

| Furniture marts | IKEA, Hola, Joyhere, llinoi, Francfranc, B&Q, Home Depot | |

| Mono-brand furniture malls | Red Star Macalline, Easyhome, HOBA, Yuexing furniture, AYD, Kinhom, JSWB | |

| Online platforms | China Home Products city (www.zgjjc.com), Meilele (www.meilele.com), Taobao Mall-Home Furnishing Gallery (jia.tmall.com), 360buy (www.360buy.com), Dangdang (category.dangdang.com), Paipai (life.paipai.com), Yihaodian, mybugu, Yokowoo, TG, | |

Table 6: Major retail channels for home products in China[17]

The following table illustrates the operation size of the top five home improvement and furnishing retailers in China in 2014.

| Total number of malls (2014) | Total Operating Areas (2014 in millions of m2) | |

| RSM | 158 | 10.77 |

| Easyhome | 106 | 6.97 |

| Jeshing | 15 | 1.95 |

| Yuexing Group | 16 | 1.36 |

| Ayd | 20 | 1.53 |

Table 7: Operation size of the top five home improvement and furnishing retailers[18]

Retailers are also having to deal with the booming online shopping trend. TMall, the B2C platform added to Taobao’s initial C2C marketplace, and focusing on quality-brand name goods in China. We can see that there is a trend on the furniture market: e-commerce website is gradually emerging to be another sales channel (Hong Kong Trade Development Council, 2016).

3.2.4.1 Easyhome

Easyhome was founded in 1999. The stores of Easyhome include almost all premium brands and products, and integrated with furniture, construction material, construction, decorating accessories, hardware, and painting.

Strengths

The implementation of business model, where many furniture brands have unified management, allows Easyhome to have a clear customer positioning and unified procurement, marketing and settlement for the brands. The store is a theme shopping center for furnishing products, it was integrated with stalls, brand specialty stores, and material supermarkets, consumers can find all products through the one-stop experience. This integration differs from the general furniture stores with stall system, or some construction material supermarkets.

Easyhome is targeting high-end income group, offering customized purchasing experience with premium furnishing products. Easyhome has strict controlling mechanism on the in-store shops to protect the unified store image. At present, Easyhome has introduced imported brands, national chain brands, and regional brands. On the service side, Easyhome offered commitments about post-service, shipping, product guarantee, and environment protection to satisfy customers. Moreover, Easyhome is using a rich in content service help, like “compensation in advance”, “zero delay in delivery and installation”, “return without reason due to non-quality problem”, have built up a good reputation of the company allowing its further expansion and development, as well as upgrading management and service level of furniture industry.

Weaknesses

Due to the chosen business model Easyhome has weak dynamic capability and value chain, also a single income model. Both with relatively scarce network of resources it makes it more difficult to provide additional services besides the sales of home products.

Opportunities

Easyhome has developed the website Juran.cn and wants to add the online shopping experience to offline stores. It targets consumers who like the brand but wish to select products online. Meanwhile, Easyhome plans to establish ten to fifteen stores every year. By the end of 2015 it has launched in total 125 stores in large- and medium-sized cities of China.

Threats

More sophisticated consumers in China, especially those who Easyhome is targeting, are becoming more willing to find something unique and showing their lifestyle. It is clear that it is harder to compete without paying more attention to the design of the furniture, while competitors, including Red Star Macalline, or like foreign brand IKEA, are collaborating with foreign designers. In terms of business model, it can be harder to compete with single income model as before. Furniture enterprises need to upgrade their products and give their products greater added value by raising the level of technology innovation to achieve the aim of “low cost, high quality and high efficiency”.

3.2.4.2 Yuexing Furniture

Yuexing has hospitality and residential furniture business, owing 100 furnishing malls, 10 large-scale Urban Complexes and insurance company. Yuexing is also the only Top 500 Chinese Enterprise in the furnishings industry.

Strengths

The business model of Yuexing Furniture is based on leasing the booths for furniture brand manufacturers, while having cooperative relationships with the stores, which means that stores and furniture manufacturers share the risks and costs with the company. In order to bring extra profits, this business model uses financial capital to home industry, therefore forces the investments in stores and well-known manufacturers. This business model also includes supporting services like after-sales service, catering and leisure.

Yuexing is focusing on the domestic business, and is working to raise its image by improving design. They have different brands targeted at different customers. For youth-oriented and creative lines, they cooperate with Western designers, for traditional styles they use their own designers.

The professional and internationalized management team as well as high-quality technical talents owned by Yuexing strongly guarantees Yuexing to straightly face the market competition and keep on developing at a high speed.

Weaknesses

However, the business model gives the above-mentioned advantages, it is harder to have a clearer customer positioning and target the right customer. Moreover, Yuexing has a lower shopping mall penetration that Red Star Macalline or Easyhome.

Opportunities

Yuexing Furniture has established an O2O service platform, which provides navigation in the offline store in 3D format to enhance customer experience.

Previously, Yuexing group had plans for going abroad. By 2009 Yuexing Group has a partnership with the Spanish furniture company Antico. The two firms have created a high-end series called “Empire Craftsman.” This furniture line, which is aimed at the Chinese middle class, is also sold in some Antico stores overseas, such as in Japan. There were also plans to enter the U.S. market either through partnership with local companies or open own stores. However, China’s furniture market till has vast room for expansion.

Threats

Commercial property development is picking up in the face of the argument that brick-and-mortar retailers are being squeezed by online shopping taking market share from them.

3.2.4.3 IKEA

Up to the third quarter of 2015, global furniture retail giant IKEA had opened 18 stores in China (HKTDC, 2016). Thanks to its brand reputation and premium quality IKEA in China led sales in home furnishings with a 2% value share in 2015 (Frost & Sullivan, 2015. Overview of the office furniture market in China). Its expansion from tier 1 cities to tier 2 and tier 3 cities helped it to gain access to potential customers in low-tier cities.

The company intends to expedite its pace of expansion in China to take the number of stores in the country to 34 by 2020.

IKEA is a privately held Swedish company. This company is the world’s largest furniture retailer founded in 1943. It is known for its modern architectural designs on various types of appliance and furniture, often related with a simplified and eco-friendly style. The first retail store of Ikea was opened in Shanghai in 1998. And another one was opened in Beijing next year. It is the first chain furniture retailer in China.

IKEA has set up its furniture production bases in Dalian, Tianjin, Shanghai and Chengdu. Dalian IKEA Furniture Manufacturing Co., Ltd is IKEA’s largest furniture manufacturing base in China, mainly producing tables and chairs which will be exported to international market. IKEA has 370 suppliers in China and it is predicted that IKEA purchasing volume in China will take up 20% of its global total. China has been IKEA’s largest supply base in the world.

Strengths

The business idea of IKEA is to offer various, beautiful and easy-to-use home products that anyone can buy. This idea is different from those developed by domestic players. IKEA has positioned its business offering away from high-quality and high price, and also a way from low quality, low price. It is in a very enviable position.

IKEA is able to develop design requirements based on functionality, price, shape, moreover, it has an efficient supply-chain through using out-contacting model and selecting appropriate supplier.

Moreover, the core values of brand allowed it to build strong brand image providing a stronger brand loyalty. IKEA likes satisfied customers. The business manages to score highly in customer satisfaction surveys. Many marketing research companies rank IKEA in their top 10 companies for customer satisfaction. They managed to enhance their brand association with such great results.

Weaknesses

IKEA’s flagship stores are not located in city center, more often they are out-of-town stores. Their customers have to not only cost their travelling expenses, but they also have to collect large packages and take them home. Currently, the business is experiencing problems in one or two home markets.

Opportunities

IKEA is traditionally famous for its diversification strategies. For example, in the past they have sold food products and opened restaurants in their stores. The online opportunity through highly advanced e-commerce technologies is an option for IKEA. This can help the business to overcome problems with out-of-town stores.

Another opportunity lies within the low-cost manufacturing in China and India. Costs can be reduced and margins possibly increased by reducing labor costs.

Today, furniture brands in China are no longer fighting for first-tier cities but are gradually shifting their focus to the furniture market in second- and third-tier cities. While the economic and consumption scale is smaller in second- and third-tier cities, the market offers more room for development. So, tapping into the medium- and low-end market will become a key marketing strategy.

Threats

IKEA can struggle against the larger portfolio suppliers. For example, Tesco’s sells not only groceries, but TV sets and mobile phones, so it is only a matter of time before the business diversifies into a range of bedroom furniture or kitchens. The changing economic environment will also impact and influence IKEA’s furniture business.

| Brands | Strengths | Weaknesses |

| Easyhome | Clear customer positioning

Unified procurement, marketing and settlement for the brands Effective control mechanism One-stop experience and rich service formats |

Weak dynamic capability and value chain

Single income model Relatively scarce network of resources Difficult to provide additional services besides the sales of home products |

| Yuexing Group | Human capital resources

Business model with shared risks Possibility to force investment Services and design |

Not clear customer positioning

Lower shopping mall penetration than RSM or Easyhome |

| IKEA | Customer satisfaction

Brand loyalty Efficient supply-chain Functional design at low price |

Stores not in the city center

Problems in home market DIY model |

| Brands | Opportunities | Threats |

| Easyhome | Online platform

Expansion to smaller cities in China |

More sophisticated customers

Harder to compete with single income model |

| Yuexing Group | Online platform with 3D modeling

Grow domestically Go international |

Online retailers |

| IKEA | Diversification strategies

E-commerce Low-cost manufacturing Medium- and low-end market |

Larger portfolio suppliers

Changing economic environment Regulation in China |

Table 8: Competitors SWOT analysis

IV Red Star Macalline Business Model Transformation

The fourth chapter will introduce the Red Star Macalline business model, its core capabilities, also it describes the new trends in the furniture industry continuing with the challenges Red Star Macalline can face at this period of time.

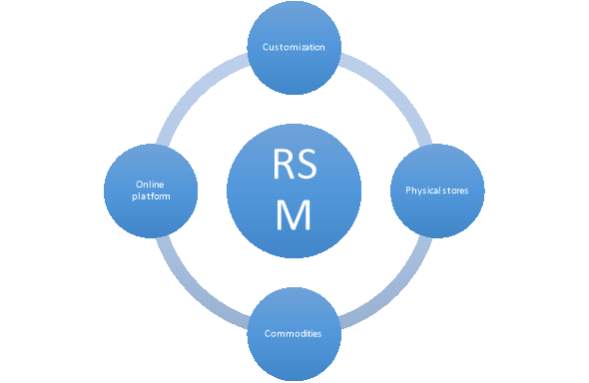

4.1 Red Star Macalline Business Model summary

Red Star Macalline provides unified marketing, unified service, unified training and other services, and makes profit through rent. This incubator model makes the relationship between brands and Macalline different from manufacturers model where is mostly suppliers relationship.

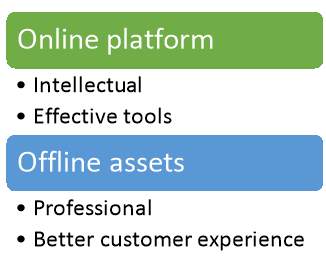

4.1.1 Red Star Macalline core capabilities

1) Tangible and Intangible Services Combination

During the development of the company, the western style of business model, the supermarket and mall, were introduced. This is how Red Star Macalline was able to gather and arrange the diverse products from different brands under one roof, moreover, it adopted product bundling strategy in sales. The firm clarifies its responsibility as selecting the brands, controlling the product quality as well as providing the whole range of services, such as distribution and after-sales marketing. Now the leading furniture chain retailer offers new creative shopping concepts. For instance, it constructs the in-house metro train inside one shopping mall instead of the elevator. Another example is developing interior design with trees and water landscapes whhic was claimed to China‘s first park-style shopping complex.

The product portfolio includes home furniture, kitchen tools, bathroom accessories, construction materials as well as office furniture and so on. The products in the shopping mall cover nearly a hundred of renowned national and international brands.

Macalline mainly plays the role of a platform, unlike other chain supermarket model where brand manufacturers sell products themselves. This model is very attractive for the small revenue brand manufacturers. After the brand manufacturers are settled, Macalline will help them to find a designer to help design the booth and exhibition hall. Through this collaboration between brand manufacturers and Macalline it can achieve win-win sustainable profit model.

2) Clear customer positioning

In shopping malls in cities like Beijing, Red Star Macalline imports the high-class furniture from Italy and Spain as alternative options to national products. They intend to make the product portfolio more comprehensive and diversified. According to their analysis, customers in such metropolitans present the demand for high-class product, mostly, globally renowned brands.

Senior manager in Red Star Macalline, Mr. Shen comments they were the first company which considers attracting this group of people and gaining their consumption loyalty. Together with the majority middle-class products, thus, customers in different income range can choose the goods both preferable and affordable.

3) Strong Brand

Macalline is a Lifestyle brand, it created brand chain stores, not just a simple commercial distribution of property. Macalline vigorously creates a learning-oriented enterprise to actively carry out self-mastery, shared vision, team learning and systems thinking and enhances the brand’s reputation and corporate image. Red Star Macalline, focusing on customer psychology, provided an integrated service of experiencing shopping.

4) Operation

The company operates Portfolio Shopping Malls and Managed Shopping Malls. It provides comprehensive services in Portfolio Shopping Malls and charge a fixed monthly rent, other management fees. Many Portfolio Shopping Malls are located in the first and second tier cities and contribute to the biggest part of the company’s revenue. By June 30, 2016, Red Star Macalline had 56 Portfolio Shopping Malls and 125 Managed Shopping Malls. The former were spread over a total area of 4,457,050 square meters at an average occupancy rate of 95.4 per cent. The latter were spread over a total area of 7,357,877 square meters, at an average occupancy rate of 92.2 per cent[19].

Most of the Portfolio Shopping Malls were located in Tier I and II Cities, providing recurring and predictable operating income through rent and management fees. Most of the Managed Shopping Malls were located in Tier III and other cities. They were asset-light. This kind of Commercial Real Estate Business Model has advantages in low initial store opening costs (leasing) and low operational costs. Revenue model is based on buying or leasing a property and renting it out to suppliers, where is assets appreciation. An intact hybrid business model of owning malls and managing malls that it does not own enables Red Star Macalline to expand with little capital outlay and minimum investment risk. Red Star Macalline builds shopping malls on its self-owned land and rents stores out to its selected tenants, who are famous for their domestic or foreign brands. Red Star Macalline, as the owner of the mall, manages administrative task in the daily business and provides the premises for the tenants. All the tenants are involved in an intra-organizational coopetition, in which the cooperative side of the coopetition is passively led by the landlord, Red Star Macalline.

Profit Model

Red Star Macalline adopts a new form of profit model named “pure lease”, including shops leasing, marketing fees, public property management and other expenses. Moreover, it has its own proprietary rights – self-built property – independent design construction – investment. This “workshop mode” has driven its real estate property value continually. Red Star Macalline began with retail trade, then finished by structurally adjusting its capital operation, and enlarging wealth management entities.

Red Star Macalline main source of its cash flow is consisted of three main parts:

1) Rental income: mainly based on the rent and property income.

2) Service income: mainly charged through the designers services for brand manufactures and value-added services to customers.

3) Other income: mainly investment. From the above analysis, Red Star Macalline is based on commercial sales, but meanwhile diversifies its business by providing different services for the brand manufacturers, then gains revenue or cash flow to support the sustainable development of the enterprise. This is a business development model that the home retail industry can learn from.

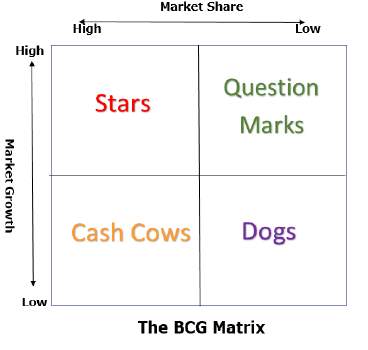

4.1.2 Boston Consulting Group-Matrix

BCG matrix classifies a firm’s products to its cash usage and its cash generation, using market growth and relative market share to categorize them in form of a box matrix. This is an important tool in order to evaluate the company’s preparedness for the future strategic changes. There are two variables: market growth and relative market share in the reference market, and thus it can enlighten the effect Red Star Macalline’s relative market share has on its further growth capability.

A star is a product, which have high market share, and operates within a market characterized by high market growth. Cash cows have a high market share and operate in a market with low growth. The dog is characterized with low market share and is present in a market with low growth. Question marks have high market growth but suffer from low market share. The BCG matrix indicates that Red Star Macalline’s products either have not reached its dominant market position and thus a high cash flow, or perhaps it once had such a position but has slipped back. The market growth is also high, and therefore, the investments need to be great to turn the trend around and in the future become a star.

Figure 9: the BCG Matrix

4.1.3 GE Multifactor Portfolio Matrix

GE Multifactor Portfolio Matrix uses multiple measures to assess business strength and industry attractiveness of the company. Each of these two dimensions are a composite of a variety of factors that each firm must determine for itself given its own unique situation.

Low Market attractiveness High

Selective Expansion

Invest in Expansion

Defend position

Select for profit orientation

Selective Expansion

Expand and Harvest Expansion

Defend position and reorientate

Profit orientation

Divest

Low Market Share High

Figure 10: GE Multifactor Portfolio Matrix

Industry attractiveness can be determined as follows:

1) Number of Competitors in Industry. There is huge number of competitors in the furniture industry in China, all with different formats and business model. However, we can see that there is no clear benchmark in the industry.

2) Rate of Industry Growth. The home improvement and furnishings industry in China had recorded sales revenue of RMB 3,704.1 billion in 2015. In 2015 home improvement and furnishings industry in China had recorded sales revenue at the range of RMB 3,704 billion (Frost& Sullivan, 2015). According to factors mentioned above, we can assume that the industry will continue to grow.

3) Weakness of Competitors in the Industry. According to our SWOT analysis of competitors we can see that competitors can have weaker dynamic capability and value chain, single income model, relatively scarce network of resources, less clear customer positioning or lower shopping mall penetration in comparison with Red Star Macalline.

Therefore, we can say that industry attractiveness is High.

Business Strengths might be determined by such factors as:

1) Company’s Financial Solid Position. Red Star Macalline’s revenue in December 2015 stated as RMB 8.76 billion and net profit of RMB 4.37 billion[20]. Company had been listed on the H-Share market in 2015, and in mid-2016, it announced an initial public offering (IPO) on the A-Share market, which allows to get investment for future expansion.

2) Competitive advantage of Red Star Macalline. Hybrid expansion model of Red Star Macalline which consists of Portfolio Shopping Malls and Managed Shopping Malls has created high barriers to entry, it is difficult for the competitors to replicate it. Moreover, the company was also getting into three non-core sectors which are aimed to reinforce its core offerings.

3) Brand Strength. Through its long history Red Star Macalline has built a strong brand with a strong network of shopping malls. By June 2016 it the largest home improvement and furnishings shopping mall operator in China in terms of: number of shopping malls (181); operating area (11,814,928 square meters), and geographical coverage (129 cities)[21].

Thus, we can say that Business Strength is Medium.

GE Multifactor Portfolio Matrix determines that Red Star Macalline stands in the “Invest in Expansion” cell. Therefore, the desired outcome is to shift to Strong Business Strength position to save its competitive advantage and get a position of “Expand or Harvest”.

Low

Medium

High

Market attractiveness

N

High

Medium

Low

E

D

Market Share

Figure 11: GE Multifactor Portfolio Matrix for Red Star Macalline

N – current situation

D – Desired outcome after new Strategy

E – Expected outcome if no change

4.2New Trends of Business Models in China

Green Marketing

With the high demand from consumers for better living conditions, companies will invest in developing more healthy, green and functional products (Hong Kong Trade Development Council, 2016). For instance, home textiles will can be developed with health care or protection functions, such as including antibiosis, anti-mite magnet therapy, aromatherapy, etc. The end product is a functional furnishing item with a high added value.

Medium and low-end market

Targeting the medium- and low-end market can become a key marketing strategy for further expansion. While China aims to increase the proportion of affordable housing during the 12th Five-Year Plan period, we can see the emergence of home markets in second- and third-tier cities. Moreover, the market for furniture markets and brands is almost saturated in first-tier cities. Overall, it prepares a vast room for further development. Today, furniture brands are shifting their focus to the furniture market in second- and third-tier cities.

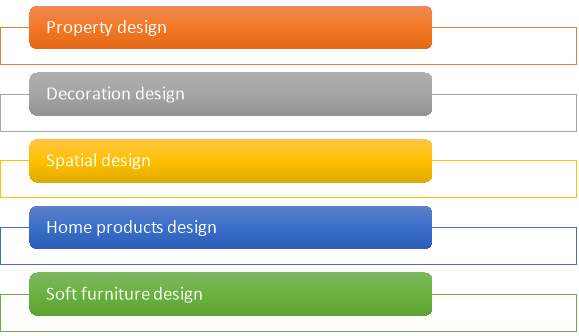

Mass Customization