Sole Proprietorship Features, Advantages and Disadvantages

Info: 12244 words (49 pages) Dissertation

Published: 9th Dec 2019

Tagged: Business

Chapter 6: Schedule C

Overview

Chapter Description

Upon completion of this chapter, students will understand the federal tax responsibilities of the sole proprietor. Students will recognize the advantages and disadvantages of operating a sole proprietorship. Students will understand each part of the Schedule C (Form 1040). Students will have working knowledge of cost of goods sold, inventory valuation, beginning and ending inventory, and uniform capitalization rules. Students will also be able to identify the various types of income earned by a sole proprietor.

Learning Objectives

- Understand the advantages and disadvantages of sole proprietorship.

- Recognize the various types of income earned by a sole proprietorship.

- Identify deductible and nondeductible business expenses.

- Discuss detailed business expenses, such as depreciation, section 179 expenses, entertainment expenses, and travel and transportation expenses, etc.

- Discuss cost of goods sold and inventory. Explain inventory valuation and the methods used to value the ending inventory, etc.

Objective #1: Advantages and Disadvantages of Sole Proprietorship

A sole proprietorship is a business entity owned by one individual. It is the most basic and least expensive business structure to establish. The business owner decides the type of business he wants to operate (i.e. retail, service, and wholesale), chooses a name, complies with local or state license or registration requirements and opens his doors. The owner manages the business and is responsible for all business transactions. The owner is also personally responsible for all debts and liabilities incurred by the business. The business does not exist separately from the owner.

Most are usually very small and have either very few or no employees. The sole proprietor is not considered an employee of the business. Any money withdrawn for personal use is recorded in the “Owner’s Drawing Account” and is not a deductible expense. Business profits (or losses) are reported on the owner’s individual tax return (Schedule C).

Owners should always maintain a separate bank account for their business. In reality, many do not. As tax practitioners, always advise the client to maintain a separate business checking account. “Co-mingling” of funds is not an acceptable method of operation to an IRS auditor.

Although most sole proprietorships are very small businesses, there is no requirement for a business to choose another type of organization. A sole proprietorship may have any number of employees, more than one location and millions of dollars in revenue.

The choice of business entity is extremely important. In order to advise clients in this area, the tax preparer must understand the various types of structures and the advantages and disadvantages of each. The best choice for one client is not always the best choice for another. Each business should make this decision after carefully considering the facts and circumstances of the business and the individuals involved. Factors influencing the decision regarding the business organization include:

- Liabilities assumed

- Type of business operation

- Earnings distribution

- Capital needs

- Legal restrictions

- Number of employees

- Tax advantages and disadvantages

- Length of business operation

There are advantages and disadvantages to each form of business entity. Ideally, the client will discuss this choice with their tax practitioner and fully understand the advantages and disadvantages of each type prior to making a commitment.

Advantages of Sole Proprietorships

- Sole proprietorships are easy to form and have low organizational costs.

- Sole proprietorships enjoy a tax benefit because profits are taxed only once on the proprietor’s tax return, and a separate business return is not filed.

- Sole proprietorships can work alone or hire employees.

- Sole proprietors make and control all business decisions.

Disadvantages of Sole Proprietorships

- The owner assumes all risks and has unlimited liability. Creditors may attach his personal assets (home, car, bank accounts) to satisfy business debts.

- A sole proprietorship does not have a separate legal status (entity), so the business will cease to exist if the owner becomes incapacitated or dies.

- It is often more difficult to raise capital for a sole proprietorship than it is for other types of business entities.

- In a sole proprietorship, the owner is responsible for paying self-employment taxes.

It is not unusual for a sole proprietor to suddenly decide that he needs to “incorporate” because he has heard from a friend, relative, his barber, or even an attorney that his business should be a corporation. In fact, many of these clients sign the incorporation papers and pay the registration fees without understanding any of the implications of making such a change in their business organization. The owner may casually inform their tax preparer (after the end of the year) that they “changed their business name and incorporated”. Often, they did not make any of the required changes in accounting or operational procedures after establishing the new “entity”.

One of the most difficult things for a small business owner or tax practitioner to understand is the concept of “entity”. An entity, by definition, is an “actual or conceivable being”. Partnerships and corporations are entities that are separate and distinct from their owners and as such, have their own legal status. Sole proprietors do not have the advantage of separate legal existence.

| Review Question 1

Andrew operates his own heating and air conditioning business, ABC Heating & Air. Although he is a sole proprietor, he often pays his friend, Mark, to help on larger jobs. In which of the following situations would Andrew not be liable?

|

Objective #2: Types of Income

By IRS definition, gross income is “all income from whatever source derived”, e.g. cash, credit card charges, checks as well as bartering property and services. Income from a trade or business includes the following types:

Business Income is income received when products or services are sold. Fees collected from clients are business income to a professional person. Rents are business income to someone in the real estate business. Dividends are business income to a securities dealer.

Business owners need to keep accurate records to identify the source of business income. In an audit situation, the IRS will consider any checking account deposit as income unless the taxpayer can adequately identify the true source of the funds. Sole proprietors often transfer funds from their personal checking account into their business accounts to pay necessary expenses. It is extremely important that these transferred funds are properly recorded as advances from the owner and not part of the gross receipts of the business.

Bartering is when property or services are exchanged and the parties agree on the Fair Market Value of the property or services, this is called bartering. Income received as property or services must be included as income at its fair Market Value on the date received.

Interest Received on Loans is considered business income if one is in the business of making loans. In any business, however, the interest received on notes receivable accepted in the normal course of business is business income.

Capital Gains are from the sale or exchange of capital assets are included in gross income.

Franchises, trademarks, and trade names for which income is received or accrued are generally included in gross income.

Canceled Debt is usually considered income to the debtor.

Damages consist of compensation received as a result of patent infringement, breach of contract, or antitrust injury must be reported in gross income.

Kickbacks received are included in income, except if it was a reduction of a related expense, part of the cost of goods sold, or a capital expenditure.

Bribes – If the taxpayer receives a bribe, it should be included as income.

Recoveries of Items Previously Deducted are included in income unless the portion or total recovered did not result in a “tax benefit” in a previous year.

Recapture of Depreciation and Section 179 Deductions – If business use falls below 50% in a tax year after the year in which the property was placed in service or before the end of the asset’s recovery period, it may be necessary to include in income the deduction previously taken.

Items That Are Not Income

The following items are not income:

- Loans are not considered income.

- Leasehold Improvements – the increase in property value after an improvement, is not income.

- Consignments – leaving merchandise with a consignee does not realize income until merchandise is sold.

- Sales tax – collected and paid to local governments, is not income.

- Appreciation occurs when property value increases. Income is only realized when property is sold.

- Construction allowances – is not income if the total amount received is spent on improvements or construction.

- Exchange of property for like-kind property – neither the gain is not taxable nor the loss is deductible.

- Cash discounts from suppliers.

- Contribution to capital.

| Review Question 2

Andrew kept receipts and records for all his income for ABC Heating & Air. He has presented these information to his tax preparer, Carol. Carol must sort through the paperwork and eliminate certain items that are not considered income. Which of the following would not be considered income to ABC Heating & Air?

|

Objective #3: Deductible and Nondeductible Business Expenses

Deductible Business Expenses

Expense is defined as the cost of the goods and services used in the process of obtaining revenue (gross income). Expenses are commonly considered the “cost of doing business”. To be deductible, the expense must be considered ordinary and necessary to carry on that trade or business.

The following is a list of common expenses; however, expenses are not limited to those listed:

- Advertising

- Amortization

- Automobile expenses

- Bad Debts (when previously included in income)

- Bank charges on business account

- Commissions paid

- Depletion

- Depreciation

- Education for employees

- Employee benefit programs

- Employer’s share of FICA taxes

- Insurance

- Legal and professional services

- Licenses

- Office supplies

- Business meals and entertainment

- Salaries and wages

- State and Federal Unemployment

- Rent on business property

- Repairs to business property

- Taxes

- Telephone expenses for business

- Business travel

- Utilities

Many of these expenses have restrictions on the amount or type that can be deducted on the tax return. Tax practitioners should examine each expense carefully to determine its deductibility.

Nondeductible Business Expenses

The taxpayer generally cannot deduct the following as business expenses:

- Bribes and kickbacks;

- Charitable contributions;

- Demolition expenses or losses;

- Dues to business, social athletic, luncheon, sporting, airline, and hotel clubs;

- Lobbying expenses;

- Penalties and fines taxpayer pays to a governmental agency or instrumentality because he broke the law;

- Political contributions;

- Repairs that add to the value of his property or significantly increase its life.[1]

Deductible Business Insurance Premiums

The taxpayer can generally deduct premiums he pays for the following kinds of insurance that is related to his trade or business.

- Insurance that covers fire, storm, theft, accident, or similar losses;

- Credit insurance that covers losses from business bad debts;

- Group hospitalization and medical insurance for employees, including long-term care insurance;

- Liability insurance;

- Malpractice insurance;

- Workers’ compensation insurance set by state law;

- Contributions to a state unemployment insurance fund are deductible as taxes if they are considered taxes under state law;

- Overhead insurance that pays for business overhead expenses taxpayer has during long periods of disability caused by his injury or sickness;

- Car and other vehicle insurance that covers vehicles used in taxpayer’s business;

- Life insurance covering his officers and employees if he is not directly or indirectly a beneficiary under the contract;

- Business interruption insurance that pays for lost profits if his business is shut down due to a fire or other cause.[2]

Nondeductible Business Premiums

The premiums on the following kinds of insurance is not deductible :

- The employer sets money aside, as a reserve to pay claims as they arise. These amounts/premiums are a self-insurance reserve fund; and are not deductible.

- Premiums paid for a policy that reimburses loss of earnings cannot be deducted.

- If the taxpayer is the beneficiary of a life insurance contract; the premiums are not deductible.

- If the taxpayer takes out insurance to secure a loan, the premiums are not deductible.

| Review Question 3

Andrew has detailed records of each job and the expenses incurred. He also has a box of miscellaneous receipts that he gives to Carol to sort. Of the following receipts she found, which are generally not deductible as a business expense?

|

Objective #4: Business Expenses

Depreciation

If the taxpayer owns his home, that portion used for business should be depreciated as the taxpayer would any other business property. The business-use percentage would apply. Additionally, any assets purchased or placed in service for that business should also be depreciated. In the case of a home used for day care, this could include furniture used by the children, a washing machine and dryer if the taxpayer washes the children’s clothes regularly, as well as any items specifically purchased for the day care, such as swing sets.

Electing the Section 179 Deduction for Purchases of Business Property

The Section 179 deduction, allows the taxpayer to deduct all or part of the cost of qualifying property, up to a certain limit. This deduction must occur in the first year the property is placed in service. Instead of recouping the cost of the asset by claiming depreciation deductions over the life of the asset, the taxpayer can choose the Section 179 deduction

The total amount a business taxpayer can elect to deduct under Section 179 for most property in 2016 generally cannot exceed $500,000. The deduction is reduced dollar for dollar by the amount that the cost of qualified property placed in service during the tax year exceeds $2,010,000.

| Example 1: Judy placed machinery in service in 2016. The machinery cost $2,200,000. The cost of the machinery exceeds the $2,010,000 limit, therefore the section 179 deduction must be limited to $310,000 ($500,000-190,000) |

| Note: The allowable deductions for Section 179 property are not necessarily the same amounts for state tax purposes. It is important for business taxpayers to be aware of the rules in their state when making decisions regarding the Section 179 deductions. |

The total cost the taxpayer can deduct each year after the dollar limit applied, is limited to the taxable income from the trade or business for the year.

Under Section 179, if the taxpayer does not deduct all allowable costs in a single year, it can be carried to the next year.

| Example 2: Lionel Jackson operates an auto repair shop. His gross income (prior to any Section 179 deduction) is $250,000. He has purchased $400,000 in new equipment during the year. This equipment is eligible for the Section 179 deduction. What is the maximum amount Lionel can deduct as a Section 179 expense for this tax year?

$ 500,000 Section 179 deduction limit $ 400,000 Equipment purchase $ 100,000 The purchase meets the dollar limit $ 400,000 Equipment purchase $ 250,000 Gross income and amount allowed for Section 179 deduction $ 150,000 Carry over to the next tax year |

Leased Property Improvements

Many sole-proprietors lease real property for their businesses. Sometimes the spaces need to be adapted for the special needs of a business. When a business makes qualified improvements to leased property, he can elect to treat certain qualified real property placed in service during the tax year as section 179 deduction, such as qualified restaurant property, qualified leasehold improvement property, and qualified retail improvement property. Or he is allowed to claim an annual depreciation deduction for those improvements. The taxpayer is allowed to depreciate the costs of the improvements over the length of the lease or the MACRS class life of the improvement (15 years straight-line); whichever is shorter. If the taxpayer vacates the property before the improvements are fully depreciated, he may claim a loss on abandonment on the unrecovered costs.

Qualified leasehold improvement property

Qualified leasehold improvement property is generally any improvement to an interior part of a building which is nonresidential real property if it meets all the following requirements:

- It is made according to or under a lease by the lessee or the lessor of that part of the building.

- It is placed in service more than 3 years after the date the building was first placed in service.

- It is section 1250 property.

- That part of the building is to be used exclusively by the lessee.

However, any expenditure is attributable to any of the following items is not a qualified leasehold improvement:

- The enlargement of the building;

- Any elevator or escalator;

- Any structural component;

- The internal structural framework of the building. [3]

Qualified restaurant property

Qualified restaurant property is any section 1250 property which is a building or an improvement made to a building placed in service during the year. In addition, more than 50% of the building’s square footage must be used for preparation of meals and seating for on-premise consumption of prepared meals.

Qualified retail improvement property

Qualified retail improvement property is generally any improvement to an interior portion of nonresidential real property if it meets the following requirements:

- The part is open to the public and used in the retail trade or business of selling tangible property to the public.

- It is placed in service more than 3 years after the date the building was first placed in service.

- The expenditures are not for the enlargement of the building, any structural components benefiting a common area, any elevator or escalator, or the internal structural framework of the building.

Automobile Expenses

Vehicle owners are entitled to deduct either the actual expenses or the standard mileage rate for business. The standard mileage rate for tax year 2016 is 54 cents per mile for business miles. In 2017 the standard mileage rate is down to 53.5 cents per mile.

Standard Mileage Rate

In order to take the standard mileage rate, the taxpayer must meet the following requirements:

- Own the car;

- Have elected to use standard mileage the first year the car was placed in service.

The standard mileage rate cannot be used if the taxpayer operates five or more cars at the same time, has ever used ACRS, MACRS, Section 179 expense deduction, claimed special depreciation allowance, or claimed actual car expenses for a leased car. The taxpayer cannot use the standard mileage rate if he is a rural mail carrier that received a qualified reimbursement.

If the taxpayer wants to use the standard mileage rate for a car he leases, then he must use it for the entire lease period.

Taxpayers can elect to use the standard mileage rate if a car was used for hire, such as a taxi. The taxpayer cannot use the standard mileage rate if he uses five or more vehicles at the same time for business (as in fleet operations). If the taxpayer is alternating use between five or more vehicles, he may use the standard mileage rate.

The standard mileage rate usually results in a better deduction for the taxpayer and it requires less record keeping. A taxpayer who takes the standard mileage rate may also deduct business parking and tolls.

| Note: Self-employed taxpayers can deduct, as a business expense, parking fees, tolls, the business percentage of vehicle loan interest, and the business percentage of personal property tax. This is an advantage to the self-employed person who does not itemize deductions. Deductions against self-employment income, reduce self-employment tax in addition to income tax. |

Actual Auto Expense

Actual auto expenses include fuel, oil, tolls, parking, garage rent, lease payments, rental fees, depreciation, repairs, licenses, tires, and insurance. If the taxpayer leases the vehicle, he may use either actual auto expenses or the standard mileage rate for the entire lease period including lease extensions.

Taxpayers often think that they can claim both depreciation and mileage. Tax preparers must be sure to point out that they cannot. Tax preparers must also explain how to divide actual expenses based on the percentage of use of the vehicle that is for business versus personal use.

| Example: Jason used his car for his daily business. He drove a total of 43,010 miles for the year of which, 29,525 miles were business and 3,412 miles were commuting. Jason’s total nonbusiness mileage is 13,485. The business percentage of Jason’s vehicle expenses that may be deducted is 68.6%. If Jason’s total actual expenses were $4,835, he would be allowed to deduct $3,317 as a business expense ($4,835 x 68.6% = $3,317). |

Taxpayers who use actual expenses may be eligible to recover the cost of the vehicle using depreciation or the section 179 expense deduction. The allowable deduction depends on when the vehicle was placed into service and what percentage of time it was used for business purposes.

Travel and Transportation

Business travel by airplane, train, or bus is generally deductible. The following expenses can be deducted:

- Taxi fares,

- Airport limousines,

- Buses or other types of transportation used between the airport or station and hotel, including those used between the hotel and the clients visited, can be deducted.

- The hotel costs of necessary trips are also deductible.

- Cleaning expenses, business calls, tips, and other necessary expenses related to the trip are also deductible.

Exhibit 6-1

Deductible Travel Expenses

| Expense | Description |

| Transportation | The cost of travel by airplane, train, or bus between the taxpayer’s home and his business destination. |

| Taxi, commuter bus, and limousine | Fares for these and other types of transportation that take the taxpayer between the airport or station and the hotel, or between the hotel and the work location away from home. |

| Baggage and shipping | The cost of sending baggage and sample or display material between the regular and temporary work locations. |

| Car | The costs of operating and maintaining a car when traveling away from home on business. The taxpayer may deduct either actual expenses or the standard mileage rate, as well as tolls and parking if it is business related. Expenses for a rental car while away from home on business, can be a deductible business-related expense. |

| Lodging | The cost of lodging if a business trip is overnight or long enough to require the taxpayer to get substantial sleep or rest to properly conduct his business. |

| Meals | The cost of meals only if a business trip is overnight or long enough to require the taxpayer to get substantial sleep or rest to conduct his business. |

| Cleaning | Cleaning and laundry expenses while away from home overnight. |

| Telephone | The cost of business calls, use of fax machine or other devices are deductible when used for business. |

| Tips | Tips are considered business expenses if paid for any expenses in this table. |

| Other | Ordinary and necessary expenses that is related to business travel such as public stenographer’s fees and computer rental fees would be deductible. |

Entertainment

An entertainment expense has to be directly related to the active conduct of business either before, during, or after the entertainment, or associated with the active conduct of business.

Entertainment expenses must be ordinary and necessary. This includes activities generally considered to provide entertainment, recreation or amusement to clients, customers, or employees. Expenses for entertainment that are lavish or extravagant are not deductible. An expense is not considered lavish or extravagant if the expense is reasonable based on facts and circumstances relating to the business. Deductions for entertainment expenses are limited to 50% of the actual expense.

Club dues and membership fees (including initiation fees) are not deductible entertainment expenses if one of the principal purposes of the organization is:

- Provide entertainment for members, or

- Providing admission to entertainment location for members.

The deductibility of dues is determined by the purposes and activities of the organization, not by its name. Dues are not deductible if paid to an organization for recreation, business, or pleasure. Therefore, membership fees or dues may not be deducted if paid to country clubs, airline clubs, or dinner clubs.

Entertainment Facilities

An entertainment facility is any property that the taxpayer owns, rents, or uses for entertainment such as a yacht, hunting and fishing lodges, pools, bowling alleys, vacation resort homes, airplanes, hotel suites, or apartments. Expenses for the use of an entertainment facility are not generally deductible. However, out-of-pocket expenses such as food and beverages, catering, gas, and fishing provided during qualified entertainment at the facility are deductible. These items must satisfy the directly-related or associated entertainment tests and are subject to the 50% deductibility limit.

Expenses for entertainment for spouses are generally not deductible. However, if the taxpayer can prove a clear business purpose, and not a personal or social purpose, for the attendance of the spouse, the expenses may be deducted.

| Example: David invited John, who is a customer to dinner to discuss a new product David developed. John is visiting from out-of-town and is staying in a local hotel. John said that he could not attend the meeting unless his spouse, Susan could attend as well. David invited Susan and asked his wife, Joan to join them for dinner. David can deduct the cost of the entertainment for John and Susan as well as for his wife, Joan. |

Gifts vs. Entertainment

Some items may be considered either as a gift or an entertainment expense. The IRS will generally consider these items to be entertainment expenses. Packaged food or beverages given to a customer to use later should be treated as a gift.

| Example: Fred gave his client, Mary, tickets to a theater performance. Fred did not attend the performance. He can treat the tickets as either a gift or entertainment expense. He should choose the method most advantageous to his business.

If Fred had attended the performance with Mary, he would be required to treat the tickets as an entertainment expense and not a gift. |

Entertainment Tickets

Deductions for entertainment tickets are generally limited to the face value of the ticket even if the taxpayer paid more than that amount. An exception exists for tickets for an event that benefits a charitable organization. Taxpayers can take into account the full cost paid for the ticket (even if it exceeds face value) as long as all of the following conditions apply:

- The main purpose of the event is to benefit a qualified charitable organization.

- The charity receives the full amount.

- The event is staffed by mostly volunteers.

| Note: When a taxpayer buys a ticket, to a charitable sports event, the 50% limit on entertainment expenses does not apply if the ticket is part of a package deal. |

| Example: Bill purchased tickets to a golf outing to benefit a local volunteer fire department. The proceeds will be used to purchase new equipment. The volunteers will conduct the tournament. Bill may deduct the entire cost of these tickets as long as they meet the normal rules to qualify as a business entertainment expense. |

Skyboxes and Other Luxury Boxes

If a taxpayer rents a skybox or private luxury box for more than one event, the deduction is limited to the price of a non-luxury box seat ticket. To determine whether the skybox has been rented for more than one event, the taxpayer must count each game or performance as one event. When the taxpayer rents a skybox for World Series playoff games, which is normally played over three or four games, the skybox will be rented for more than one event. Taxpayers must consider all skyboxes rented in the same arena as well as any skybox rentals by a related party when making the determination. In this case, related parties include family members, parties with reciprocal arrangements for sharing the skybox, related corporations, a partnership and its partners, and a corporation and partnership with common ownership.

| Example: ABC Company paid $10,000 to rent a 10 seat skybox for four baseball games at the local stadium. The cost of regular non-luxury seats at this stadium is $50. ABC Company can deduct (10 seats x 4 events x $50 per non-luxury ticket) x 50% or $1,000 for these tickets. The remainder of the costs is nondeductible. |

Reasonable amounts paid for food and beverages at these events may be deducted subject to the 50% limit as long as the event meets the directly related or associated tests. Taxpayers will need to keep separate receipts for the food and beverages in order to prove that they did not inflate the cost of the refreshments to avoid the deduction limits for the skybox rental.

Meals

The expense deduction for meals provided for employees is normally limited to 50% of the cost. However, if an employer conducts a business meeting and provides lunch for employees, the cost of the meal is fully deductible because the main purpose of the meeting is the active conduct of business. Employers may deduct 100% of the cost of the following meals:

- Meals that qualify as de minimis fringe benefits. This includes meals furnished at your place of employment if more than half of the employees are provided the meals for the convenience of the employer. Example: Employees are furnished dinner because they must work overtime.

- Meals whose value are included in the employee’s wages.

- Meals furnished at the work site to employees of a restaurant or catering service.

- Meals provided to employees as a part of a recreational event or social function such as a company picnic.

- Meals furnished to crew members of commercial vessels.

- Meals furnished to employees on an oil or gas platform or drilling rig located offshore in Alaska.

Meals with employees or co-workers are generally not deductible. A casual business discussion during the meal will not qualify for a meals deduction unless the main purpose of the event is the active conduct of business.

Exhibit 6-2

Deductible Entertainment Expenses[4]

| What Entertainment Expenses Are Deductible? | |

| General Rule |

|

| Definitions |

|

| Tests to be Met | Directly Related Test

|

Associated Test

entertainment directly precedes or follows a substantial business discussion. |

|

| Other Rules |

|

| Review Question 4

Joseph owns a construction company. He has already purchased $1,755,000 in new equipment in 2016. After depreciation (exclusive of Section 179), his company will make a pre-tax profit of at least $800,000 this year. He plans to take advantage of the Section 179 deduction to reduce his tax liability. What will happen to his plan to use the Section 179 deduction if he purchases another piece of new equipment this year costing $300,000?

|

| Review Question 5

Ned leased a space for his plumbing business. The lease is for 5 years with a 5-year option. He spent $5,500 to make qualified leasehold improvements to make the space useful for his business. Which of the following statements is correct?

|

Objective #5: Cost of Goods Sold and Inventory

Cost of Goods Sold

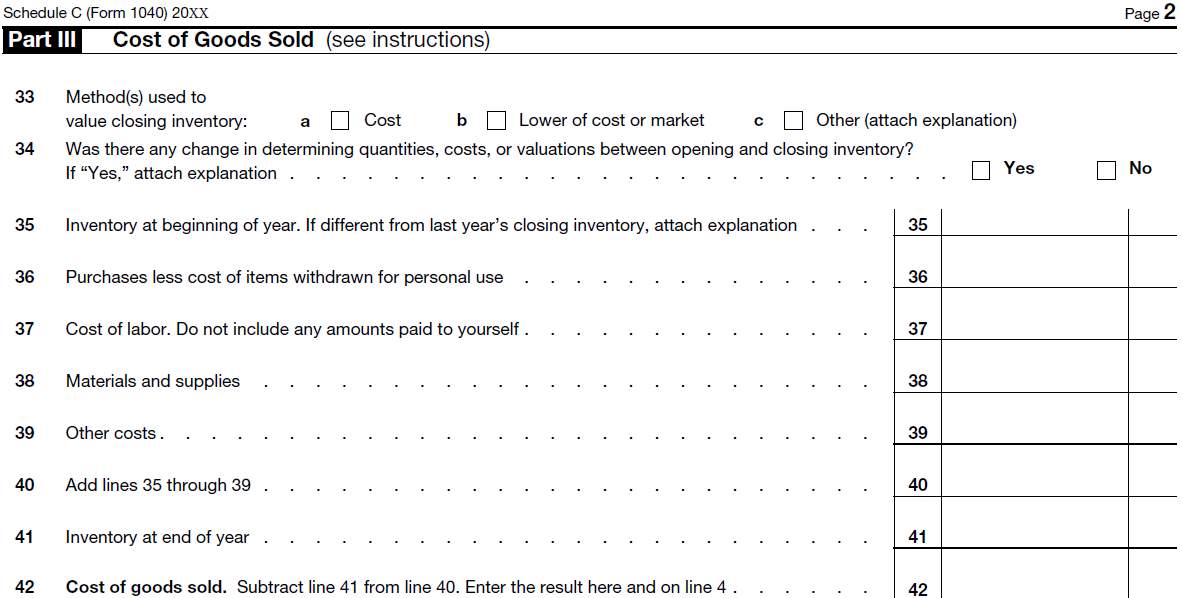

The cost of goods sold is the price of buying or making an item that is sold. All manufacturing businesses and all businesses that have inventories should have a cost of goods sold account. For manufactured goods, the cost of goods sold is the direct material, labor, and factory overhead costs associated with the production of the finished product to be sold. In retail sales, the cost of goods sold is the purchase price of the items they sell. Sole proprietors would deduct the cost of goods sold calculated in Part III of Schedule C from the gross receipts reported in Part I of their Schedule C.

| Preparer Note: If the business owner purchases and uses supplies for a specific job or contract, it is perfectly acceptable to list the cost of these supplies on Line 38 of Part III Cost of Goods Sold. However, all of the supplies listed as Cost of Goods Sold must be used. It could also be entered on Line 22 of Part II Expenses. Either way is acceptable.

What difference does it make? By entering the cost of supplies on line 38 as part of the Cost of Goods Sold, it lowers the taxpayer’s Gross Income on Line 7. In some areas where the taxpayer has to pay local taxes on their business income, the taxes are based on the Gross Income from Line 7. However, you should only list on Line 38 those supplies purchased and used for a specific job or contract. |

Inventory Valuation

When the sale, purchase, or production of merchandise produces income for the taxpayer, it is necessary for the taxpayer to show his inventory in an effort to clearly explain his income. Taxpayers who must account for an inventory in their businesses must generally use the accrual method of accounting for purchases and sales. In order to properly determine taxable income, the business must assign value to its inventory at the start and end of each tax year. The taxpayer will determine that value, by choosing a method for identifying the items in the inventory and a method for valuing those items.

Since not all businesses are alike, each business will value inventory differently. The valuation process for similar companies must follow generally accepted accounting principles (GAAP) and must clearly show their income. The business’ inventory practices must be consistent from one year to the next.

Personal service businesses such as lawyers, doctors, painters, and carpenters are not required to use inventories unless they also sell or charge for the material and supplies that are normally used in their businesses or professions. Businesses such as hair styling salons, barbers, or nail salons usually have merchandise available to sell to their clients. These establishments are required to follow the rules for valuing the inventory they keep for resale.

Basis of Assets

Basis is the amount of investment in property for tax purposes. Basis is used to determine the deduction for depreciation, amortization, depletion, casualty losses and the gain or loss from the disposition of property. Taxpayers are required to keep accurate records of any items that affect the basis of property. The basis of purchased property is normally its cost. However, certain other costs related to buying or producing the property might have to be capitalized (added to basis). The cost of property is the amount paid in cash, debt obligations or other property or services.

Cost includes:

- Excise taxes

- Freight

- Installation and testing

- Legal and accounting fees (when they must be capitalized)

- Real estate taxes (if assumed for the seller)

- Recording fees

- Revenue stamps

- Sales tax

Business Assets

The basis of business assets that are purchased to use in a business is usually the cost paid for that asset (as described above). However, businesses that construct, build, or otherwise produce property may be subject to the uniform capitalization rules (Uncap) to determine the basis of this property. By definition, businesses are considered to produce property if they:

- build, develop, improve, or maintain

- Manufacture, install, or create,

- elevate or grow the property.

The term property would include such items as films, sound recordings, videotapes, books, artwork, or other similar property.

Uniform Capitalization Rules

The uniform capitalization rules were established in the tax code to identify the costs that must be added to the basis of business assets in certain circumstances. Businesses for profit, must use the uniform capitalization rules if they do any of the following:

- Produce real or tangible personal property for use in the business activity;

- Produce real or tangible personal property for sale to customers;

- Acquire property for resale. [6]

The uniform capitalization rules, stipulates that all direct costs must be capitalized and part of the indirect costs must be allocated in accordance to the production or resale activities of the business. To capitalize means the taxpayer must include certain expenses in the basis of the property produced or in inventory costs rather than deduct them as current expenses. These costs are then recovered through depreciation, amortization, or cost of goods sold when the property is used, sold, or disposed of. There are certain exceptions to these rules which can be found in Section 263A of the Internal Revenue Code.

There are several exceptions that are not subject to the uniform capitalization rules. One of the exceptions is for businesses that acquire property for resale whose average annual gross receipts for the last 3 years do not exceed $10 million.

Items Included in Inventory

In order to calculate the cost of goods sold, the business must first determine the value of its inventory. To determine the inventory value, the business must choose a method for identifying the items in the inventory and a method for valuing those items. The following items should be included in the valuation of the inventory: stock in trade or merchandise, the purchases of raw materials, the value of work in process, the value of finished products, as well as any supplies that becomes a part of the product that will be sold.

Merchandise Included in Inventory –

- Merchandise purchased if title has passed to the taxpayer regardless if the merchandise is in transit or the taxpayer does not yet have physical possession for whatever reason.

- Goods under contract that have not yet been separated and applied to the contract.

- Goods that happen to be out on consignment.

- Goods held for sale that happen to be in a different location, e.g. in display rooms, merchandise rooms, or booths located away from the place of business.

Merchandise not Included in Inventory –

- Goods that have been sold, and the title has passed to the buyer.

- Goods consigned to the taxpayer.

- Goods ordered for future delivery for which the taxpayer does not yet have a title.

Assets that should not be included in inventory

- Accounts receivable, notes receivable, and similar assets.

- Buildings, land, and equipment used in the taxpayer’s business.

- Real estate held for sale in the normal course of business by a real estate dealer.

- Supplies that do not physically become part of the product intended for sale.

Purchases for a retail merchant include the cost of all items purchased for resale. Manufacturers should include the cost of all raw materials they purchase and manufacture the raw material into a finished product. Purchase returns and allowances should be deducted from total annual purchases. Trade discounts are the differences in the stated price of an article and the price actually paid for the item. Trade discounts should not be a separately stated item included in gross income. Purchases should be recorded at the actual price paid for the item.

| Example: Automobile dealers must record their cost of an automobile in inventory net of any manufacturer’s rebate that represents trade discount. |

Cash discounts are amounts that purchasers can deduct from invoice prices for paying their account timely. These discounts may be either credited to a separate discount account or deducted from total purchases for the year. The taxpayer must use a consistent method of recording these discounts. Cash discounts that are recorded in a separate account are not included in the cost of goods sold computation. They are used to adjust business income at the end of the year.

Any merchandise withdrawn for personal use must be deducted from purchases prior to calculating cost of goods sold. These items should be charged to the owner’s drawing, withdrawals, or personal account. This account should also be used to record any business income withdrawn to pay for personal or family expenses.

Manufacturers are also required to include direct labor costs, materials, and supplies related to the manufacturing process as part of their inventory costs. The costs of containers or packaging that becomes an integral part of the product produced must be included in valuing inventory. The cost of freight to get supplies or raw materials to the business is part of the cost of goods. Overhead expenses (utilities, rent, depreciation, taxes, insurance, etc.) are also part of the cost of goods sold.

Cost of goods purchased during the year includes:

- Invoice price of the items;

- Less discounts;

- Plus freight-in (delivery charges).

Identifying Cost

Taxpayers may use any of these generally accepted methods to identify the cost of items in inventory.

The Specific Identification Method may be used when the identity and the actual cost of items in inventory can be accurately identified.

The FIFO or LIFO method must be used if:

- The taxpayer cannot accurately match items with their actual costs

- The taxpayer has similar types of items in inventory and cannot link the items to specific invoices

For example, an automobile dealer will normally be able to value the cars in inventory from the actual invoice for each vehicle. This would be more difficult for a retailer that offers a larger variety of merchandise such as Wal-Mart. Universal pricing codes (UPC) and computerized inventory systems have made the identification process easier for these large businesses, but most of these types of businesses do not use the specific identification method.

The FIFO (first-in, first-out) method assumes that the first items sold were the first items purchased or produced. The items left in inventory (determined by a physical count) at the end of the year, are valued based on the actual costs of the last items purchased or produced.

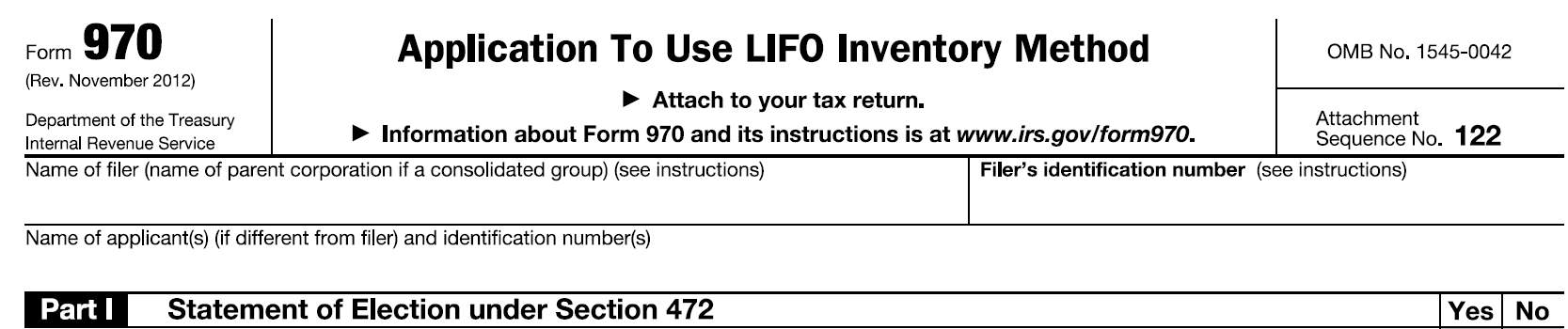

The LIFO (last-in, first-out) method assumes that the inventory items purchased last are the first items sold and ending inventory is valued based on the opening inventory. The rules for LIFO are very complex. There are several methods of applying the LIFO valuations to ending inventory such as the dollar-value method, simplified dollar-value method, or dollar-value retail methods. These methods will not be discussed further in this course.

Taxpayers choosing to adopt any LIFO inventory method must file Form 970, Application to Use LIFO Inventory Method with their timely filed tax return for the year in which they first use LIFO.

FIFO and LIFO produce different income results depending on the economy. In inflationary times, LIFO will produce a greater cost of goods sold and a smaller ending inventory because prices are increasing. Alternatively, when prices are falling, LIFO will produce a smaller cost of goods sold and a higher ending inventory.

The taxpayer needs IRS approval when making changes in the following accounting methods:

- Any change from a cash to an accrual method or vice versa.

- Any change used to value inventory.

- Any change in the depreciation or amortization method.

Valuing Inventory

The value of inventory is a major factor in determining the taxpayer’s taxable income. The most common methods used by taxpayers to value non-LIFO inventories are the lower-of cost or market method, the cost method, and the retail method. New businesses not using the LIFO method may choose the method they wish to use to value ending inventory and may not change to another method without IRS permission.

Lower-of Cost or Market

Under the lower-of cost or market method each inventory item must be valued separately. It is not acceptable to value the entire inventory at cost and compare that figure to market value. Businesses using this method compare their actual cost of the merchandise on hand at the end of the year to the current replacement cost (market price) for the same items.

Example: Using the lower of cost or market method, the following items would be valued at $600 in closing inventory.

In this example, the correct value of ending inventory is $600 and not the aggregated cost of $1250 |

Cost Method

If the same taxpayer (in the example above) had been consistently using the cost method of inventory valuation, his ending inventory would be valued at $1250. The value of inventory at cost includes direct (e.g. labor, raw materials, shipping) and indirect costs (e.g. utilities, advertising).

Retail Method

Under the retail method, the total retail-selling price of goods on hand at year end in each department or class of goods is reduced to approximate cost by using the average markup expressed as a percentage of the total retail selling price.[8] The average markup percentage is calculated as follows:

+ Retail selling prices of the goods bought during the year + Markups – Markdowns = Total retail value of the goods

– Cost of goods included in the opening inventory – Cost of goods bought during the year = Total markup value of the goods

÷ Total retail value of the goods = Average markup percentage |

Then calculate the estimated cost using the next three steps.

– Sales at retail = Closing inventory at retail

× Average markup percentage = Markup in closing inventory

– Markup in closing inventory = Closing inventory at cost |

The following example shows how to calculate the closing inventory using the retail method.

Example: The taxpayer’s records show the following information on the last day of the tax year.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Markup Percentage

The markup percentage is calculated as follows:

- The difference between cost and the retail value equals markup.

- The markup should be divided by the total retail value to get the markup percentage.

The taxpayer cannot use random standard percentages of purchase markup to calculate the markup. The markup must be calculated accurately using office records for the period covered by the tax return.

Markdowns

At the end of the year, when the taxpayer calculates the retail selling price of goods, markdowns are included in the calculation, if the goods were offered to the public at a lower price. Markdowns based on depreciation and obsolescence, and not on an actual reduction of retail sales price, are not allowed.

Retail Method with LIFO

If the taxpayer uses LIFO with the retail method, he must adjust his retail selling prices for both markdowns and markups.

Price Index

If the taxpayer is using the retail method and LIFO, he should adjust the inventory value, that was calculated using the retail method, and indicate how prices have changed since the close of the preceding year. To make this adjustment, the taxpayer must invent his own retail price index using analysis of his own data under a method acceptable to the IRS.

Retail Method without LIFO

If the taxpayer does not use LIFO and has been calculating his inventory under the retail method and in an effort to estimate the lower of cost or market, he has regularly adjusted the selling prices of goods for markups (but not markdowns), then the taxpayer can continue that practice. It is imperative that the adjustments must be real, consistent, and uniform and the taxpayer must also exclude markups made to cancel or correct markdowns.

If the taxpayer does not use LIFO and he calculated inventories without reducing markdowns in adjusting to retail selling prices, then he can continue to do this provided he first gets IRS approval. The taxpayer can use this practice for the first business tax return, he files, subject to IRS approval.

Figuring Income Tax

Retailers who use the retail method when pricing inventories can calculate their tax on that basis. To use this method, the taxpayer must comply with the following:

- Indicate that the retail method is being used on the tax return.

- Retain accurate records.

- Unless the IRS allows changes to another method, use this method each year.

The taxpayer must maintain records for each department or category of goods attributing to the different percentages of gross profit. Records of purchase must show the company’s name, invoice date, invoice cost, and retail selling price. The taxpayer should keep records of all purchases, markdowns, sales, and stock, for each department.

Perpetual or Book Inventory

Taxpayers may figure the ending inventory by the perpetual or book inventory method as long as they follow comprehensive accounting practices. This is a difficult method to maintain because every transaction (purchases, sales, returns and allowances) must be recorded at its actual cost and inventory accounts adjusted accordingly.

Physical inventory: Taxpayers must perform a physical inventory count at realistic intervals for their business type. The book amount for inventory must be adjusted to agree with the actual physical count of inventory.

Loss of Inventory

Casualty and theft losses of inventory items are appropriately recorded through increases to the cost of goods sold. Taxpayers are not allowed to claim the loss as a casualty or theft loss. Any insurance reimbursement received for the loss is taxable as other income. The taxpayer may choose to record these losses separately. If this method is chosen, the beginning inventory or purchase accounts must be adjusted to eliminate the missing items. The loss must be reduced by any insurance reimbursement received or expected to be received.

If creditors or suppliers forgive part of any amount the taxpayer owes to them due to the inventory loss, the amount is treated as a reimbursement and is taxable income.

Sale of Entire Inventory

The total amount received from the sale of a company’s entire inventory must be included on the tax return as ordinary income, not capital gains.

| Review Question 6

Andrew operates his own heating and air conditioning business, ABC Heating and Air. He keeps a supply of parts and materials for his heating and A/C jobs. Which item(s) are not considered inventory?

|

| Review Question 7

Figure the closing inventory using the retail method.

Closing inventory at cost:

|

| Review Question 8

Using the lower-of cost or market method, what is the value of the closing inventory?

|

This page intentionally left blank.

[1] Pub 334 page 40

[2] Pub 535 page 18

[3] Publication 946, page 32

[4] Publication 334, page 38

[5] Schedule C (Form 1040)

[6] Pub 551 page 4

[7] Form 970

[8] Publication 538

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business"

The term Business relates to commercial or industrial activities undertaken to realise a profit including producing or trading in products (goods or services). A general business studies degree could cover subjects such as accounting, finance, management and increasingly, entrepreneurship.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: