Expansion Plan and Evaluation for SME

Info: 8405 words (34 pages) Dissertation

Published: 9th Dec 2019

Tagged: BusinessBusiness Strategy

Bettaserve ltd. expansion plan

FINAL GROUP REPORT

EXECUTIVE SUMMARY

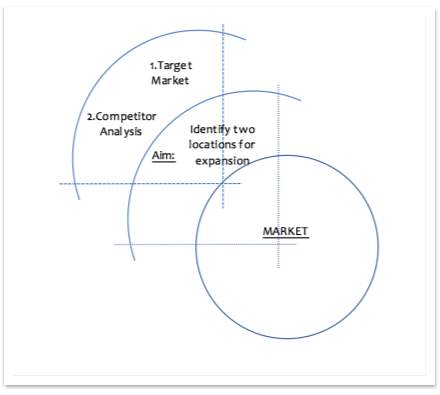

Section 1 begins by introducing the aim of this document as trying to aid Bettaserve with its expansion plans by providing analysis on expansion location options previously presented to the company. The main areas the secondary research focuses on are marketing, internal management, resource distributions and finance with a general focus on market conditions.

Section 2 focuses on the market landscape and investigates locations for expansion possibilities through structured research methods. It concludes that of the seven locations being investigated, only 3 are viable; Rotherham, Ashbourne and Sheffield.

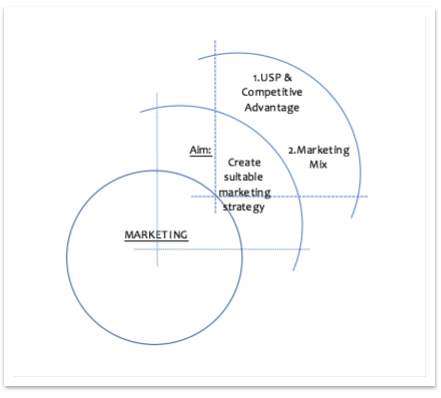

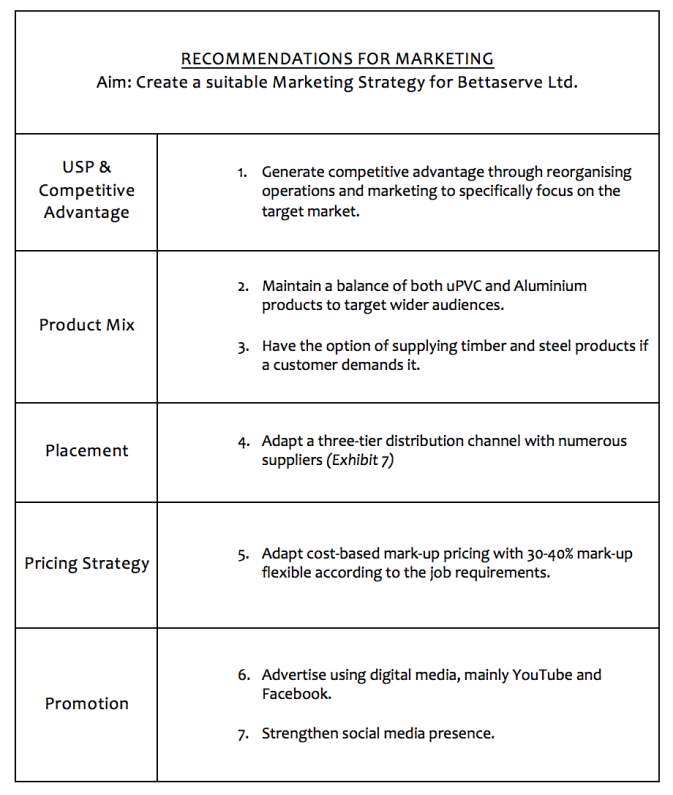

Following the information gathered, section 3 outlines the marketing methods and routes to market Bettaserve could use in their approach, using the traditional 4P method. The competitive nature of the industry indicates a necessity for product differentiation to be strong and a succinct table on page 19 highlights the marketing recommendations made for Bettaserve throughout this section.

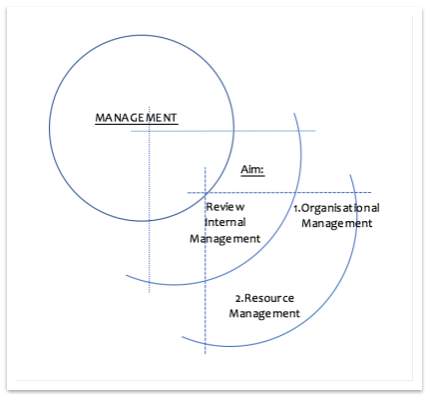

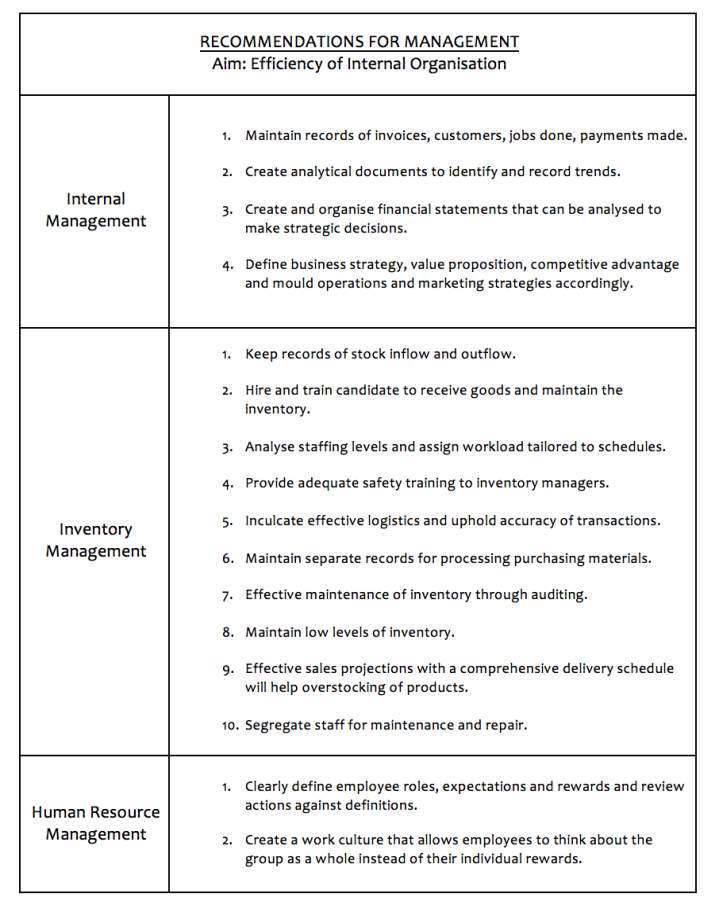

Section 4, Management, highlights the necessity for formal documentation. It concludes a set of recommendations based on two focussed areas; organisational management and resource management. Roles must be clearly defined and communicated to all those within the business and the formal record keeping and training in key areas will help sustain any growth that may occur due to more structured operations.

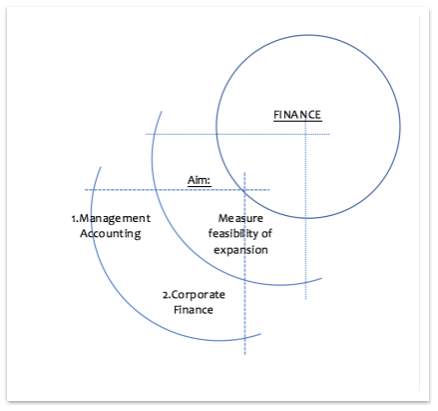

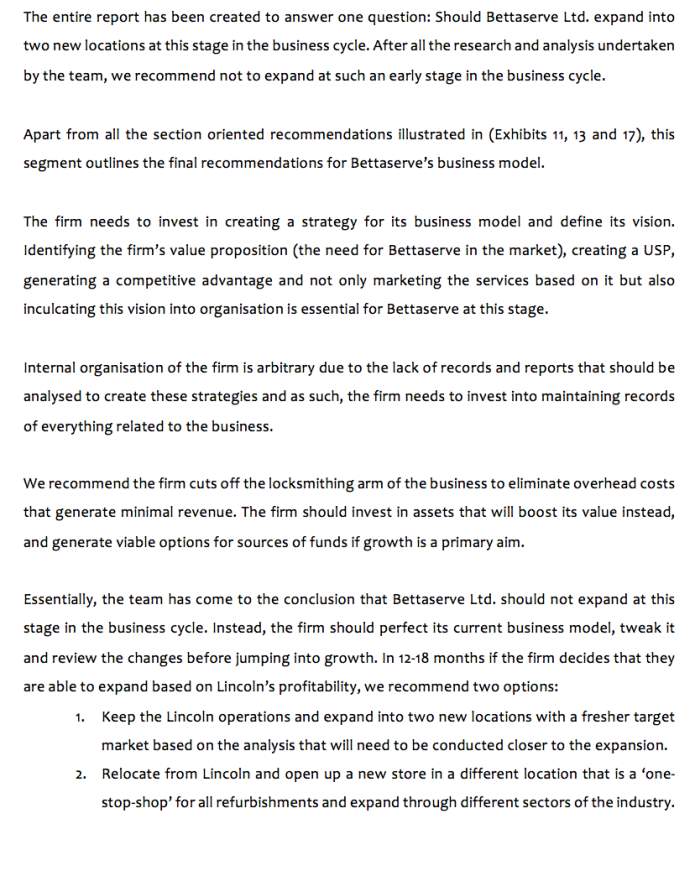

Section 5 concludes that the viable options for new sites would be Rotherham and Ashbourne, and recognises that most start-ups fail due to mismanagement (Kaplan Financial, 2012). It is therefore critical to create an organisation ready to duplicate before expanding. The financial analysis concludes that before expanding, there are inefficiencies that need to be addressed; costs cut and revenue generated all before Bettaserve can spend on advertising – a key requirement before expansion.

Finally, the report is finished off with a recommendations and limitations section. This takes into account all the research undertaken and the optimal conclusion the report reaches is that Bettaserve would be best served if they put on hold their expansion plan for another 18-24 months, until their primary location stabilises and operates with growing profits. The reasoning being, that once this occurs, the operations can be duplicated into another location and can be duplicated many more times once it is in fact an effective operation.

CONTENTS

INTRODUCTION 4

MARKET 7

Target Market

Competitor Analysis

MARKETING 13

USP and Competitive Advantage

Marketing Mix

MANAGEMENT 21

Organisational Management

Resource Management

FINANCE 24

Management Accounting

Corporate Finance

RECOMMENDATIONS 31

LIMITATIONS 32

APPENDIX 34

REFERENCES 54

1. INTRODUCTION

- Company Overview

Bettaserve Ltd. is a start-up door and window replacement company primarily based in Lincoln, credited by CERTASS, a UKAS accredited certification body. It commenced trading in October 2015 but was majorly a mobile locksmithing company operating within a 100-mile radius of Lincoln. Since April 2017 however, the company has reconfigured itself as a door and window replacement firm and has continued to operate from a new showroom in Lincoln under the brand – Guardian Homestyle. The company now offers services ranging from boarding up to repairing broken windows, leading to replacement glass work and glazing.

- Project Brief

The firm is aspiring to expand operations to two new locations along the M1 corridor in the next 12-14 months by duplicating the existing business model. They wish to focus on products such as bi-fold doors, composite doors and windows, with significant emphasis on aluminium based products. The company is keen to identify and evaluate the market gap and requires an insight into the general market conditions in locations including, but not restricted to, Chesterfield, Derby, Leicester, Loughborough, Mansfield, Nottingham, Rotherham and Sheffield.

- Research Approach

The approach taken in terms of problem solving for the project allocated primarily included identification of major areas of research – Market conditions, Marketing techniques, Internal management, Resource management and Finance. Given that the nature of research is mostly industry based, the research undertaken is predominantly secondary and uses secondary sources of data including databases, websites and journal articles. The analysis undertaken is primarily internal to the firm and hence uses data retrieved from Bettaserve at request. The research and analysis together allow identification of two potential locations appropriate for expansion. The rest of the report attempts to outline requirements for expansion and the feasibility of this project.

- Report Outline

The report is divided into four major sections – Market, Marketing, Management and Finance. These sections are further split into tasks according to the steps that need to be taken to finally recommend whether or not expansion along the M1 corridor is a feasible option for Bettaserve Ltd. A series of illustrations has been used to describe the section wise task breakdown below.

Exhibit 1: Market Outline

Exhibit 2: Marketing Outline

Exhibit 3: Management Outline

Exhibit 4: Finance Outline

Along with a set of recommendations after each of these sections, the penultimate section of this report will discuss the final recommendations for the firm and the final section will discuss the limitations of this report.

2. MARKET

This segment of the report is divided into two major sections that include the task of defining the target market and a competitor analysis to examine the conditions of the market that Bettaserve Ltd. wish to tap into through this expansion. An industry overview highlighting the impact of Brexit on the sector can be found in (Appendix 1) for context.

- Target Market – The Elimination Method

This section outlines the process undertaken to shortlist Ashbourne (Derbyshire), Rotherham and Sheffield as potential locations for expansion. It includes the method of elimination used to narrow down potential locations from the list of 8 cities given to us based on the target demographic.

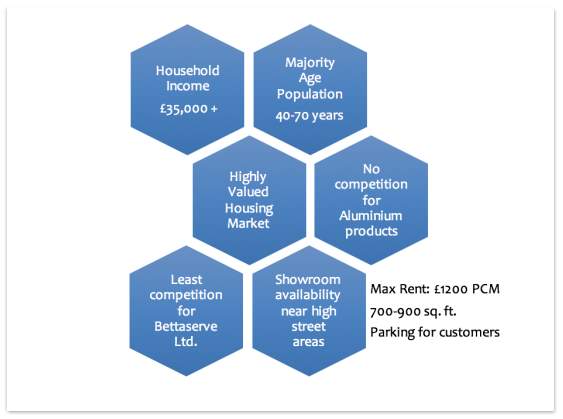

To determine locations for the expansion plan, the team analysed data pertaining to several criteria illustrated in (Exhibit 5). These criteria were based on the client’s description of the target market. Each location on the list provided to us was examined under these criteria and the analysis allowed elimination of 5 out of 8 locations.

To determine locations for the expansion plan, the team analysed data pertaining to several criteria illustrated in (Exhibit 5). These criteria were based on the client’s description of the target market. Each location on the list provided to us was examined under these criteria and the analysis allowed elimination of 5 out of 8 locations.

Exhibit 5: Target Market Criteria

Chesterfield and Mansfield were eliminated as they are financially stretched areas (Acorn, 2017). According to the median gross weekly earnings in Great Britain, people in Chesterfield earn £17,940 and in Mansfield earn £16,224 (Ons.gov.uk, 2017). The products and services offered by Bettaserve are highly valued and prices will potentially distress customers. Further research regarding the housing market in potential locations is illustrated in (Appendix 2). Chesterfield and Mansfield have the lowest averages compared to other cities considered, providing further conviction to eliminate these locations.

Nottingham, Leicester and Loughborough were eliminated due to high student populations. Higher student density translates to a smaller target age population for Bettaserve, making potential demand for products and services offered by the firm minimalistic. Nottingham recorded a population of 325,282 in 2016 (Ons.gov.uk, 2017). The University of Nottingham has an estimated population of 33,500 students and 30,000 at Nottingham Trent University in 2015/16 (Zumpe, 2016), contributing to 20% of the city’s population. Leicester recorded a population of 348,343 in 2016 according to ONS. Both universities in Leicester have an estimated population of 30,000 (2016), contributing to 18% of the city’s population. Loughborough had an estimated population of 64,014 in 2015 according to ONS, with Loughborough University accumulating 16,500 between 2014-15. Therefore, contributing to 26% of the city’s population (Zumpe, 2016).

This left the list with three names – Ashbourne, Rotherham and Sheffield. The next section outlines the next step to narrow down the locations furthermore.

- Competitor Analysis

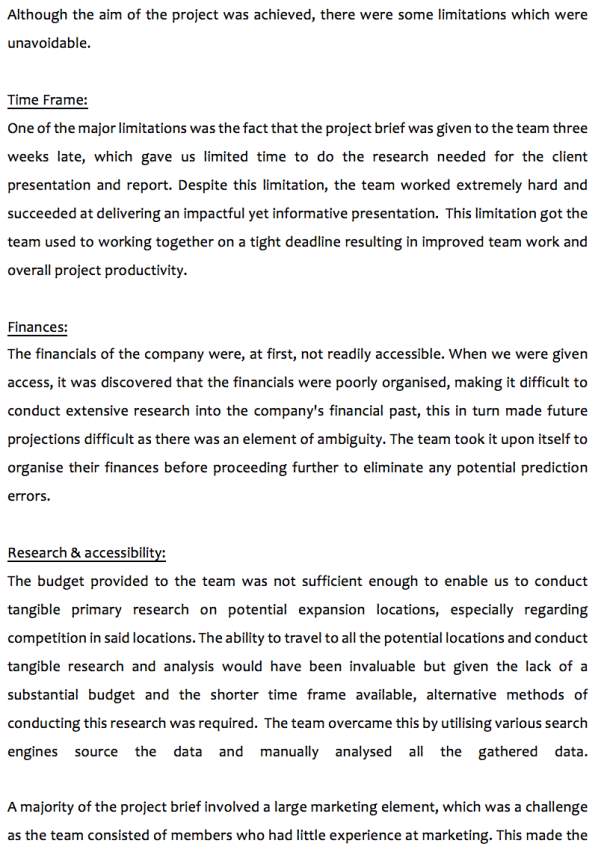

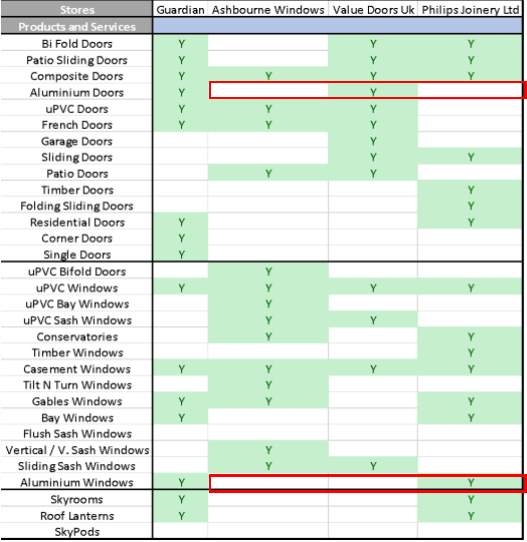

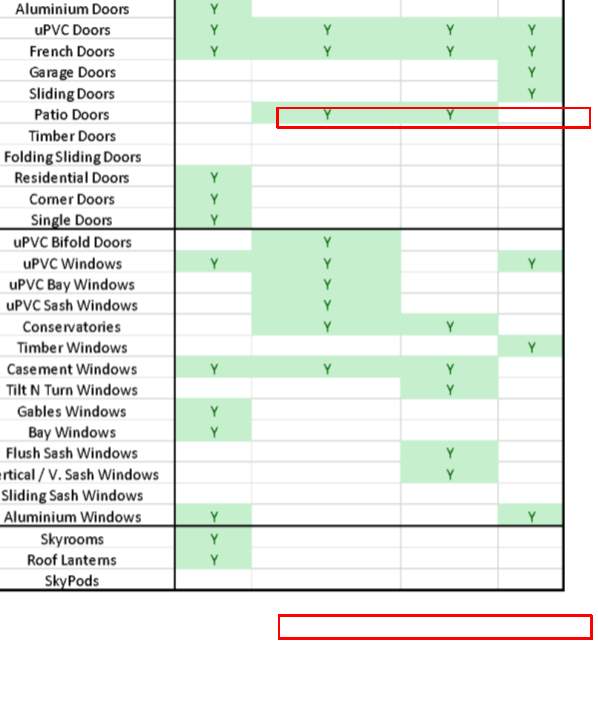

After the elimination process three areas were shortlisted as potential locations for expansion. These included Ashbourne, Rotherham and Sheffield. A thorough competitor analysis was undertaken to narrow this list from three to two locations. This section outlines why each of these locations passed the target market test and Bettaserve’s potential competition if these locations were chosen for expansion. The section also includes an outline of the distribution channels (sales funnels) used by the biggest competitors to allow Bettaserve to compare its business model to its competitors.

- Ashbourne (Derbyshire)

Target market:

Ashbourne was not on the list provided to us by the firm but was the only location that ticked almost all boxes in terms of the criteria that defined the target market for Bettaserve’s expansion. With high income households, highly valued properties and no aluminium competitors, Ashbourne is extremely suitable for this expansion.

Competitor analysis:

Value Doors UK is essentially the only competition to Bettaserve in Ashbourne as it distributes its products to end consumers (Appendix 3). While it operates as a manufacturing firm and does not specialise in aluminium products, it is a major market leader and needs to be considered before expansion.

The firm offers products including arched doors, back doors, composite doors, door accessories, electronic garages, uPVC doors and uPVC double glazed windows but its USP lies in its ability to design these products. The firm’s competitive advantage is its aim to provide environmentally sustainable products (Value Doors UK, 2017).

Distribution channels:

Value Doors UK operates with a more complex distribution channel than a straight forward three-tier model that most firms use (Manufacturer – Distributer – End Consumer). The firm manufactures its own doors and windows and also distributes these products. However, the firm treats its distribution arm separate to its manufacturing arm and hence supplies products manufactured by two other brand partners, Synseal Group and Pilkington. Value Doors UK receives products manufactured by these firms through two wholesalers, Rock Door and Yale. Essentially the firm operates on a four-tier distribution channel.

- Rotherham

Target Market:

The target age demographic was 40 – 70 years. According to Rotherham’s Joint Strategic Needs Assessment in 2016, 39.4% of the population were aged 30 to 59 years and 24.6% of the population were aged 60 and over. These facts make Rotherham a prime location for the client’s needs.

A google search for door and window replacement companies in Rotherham shows eight companies who provide similar services as the client and a Yell search shows four similar companies, indicating low concentration of competition and low barriers to entry in that particular location.

Competitor Analysis:

Many firms that offer similar services in Rotherham are involved in manufacturing of some or all of the products available (Appendix 4). Only a few companies engage in simply supplying and installation like the client does, one of such companies is DG Doors and Windows Ltd.

This is a family run business, specialist in supplying and installing garage doors. The company has over 40 years’ experience in the supply and fitting of garage doors and offers a 10-year warranty on all doors and windows supplied and installed. They also offer a free home survey to their customers. Aside from garage doors, the company offers composite doors, bi fold and patio doors and uPVC windows.

The firm plans to release a smartphone app that allows customers to select the type of door and visualize what the new door would look like as well as provide customers with an instant quote. The firm also offers up to £200 buyback for each garage door for a limited time.

Distribution Channels:

The distribution channel used by the firms Roundbrand Ltd and DG Doors and Windows Ltd (DG Ltd) is used to highlight how similar firms in Rotherham deliver their products to the final consumer.

Roundbrand Ltd. manufacture their products as well as distribute them. The company possesses two factories and a ‘glass toughening plant’ while Armthorpe Glass, its parent company which it has now merged with, manufactures vacuum formed infill panels and double-glazed units. DG Ltd. supply doors made by CRB doors and provide installation services to consumers.

Roundbrand Ltd. and DG Ltd. appear to use google SEO as one of their digital marketing strategies as they appear on the first page of google search results for ‘door and window replacement Rotherham’ and similar keywords. Roundbrand Ltd. engages sparingly in social media marketing through the use of Facebook, twitter and YouTube with sporadic but meaningful posts including several installation videos. DG Ltd. does not engage in social media marketing. The lack of overt online advertising may indicate that both firms prefer to market their products locally through newspapers, etc. DG Ltd supports local organisations such as the Rotherham Hospice, this indicates that the firm is more involved in advertising locally.

- Sheffield

Target Market:

As the average salary per person in Sheffield is £22,000 (Ons.gov.uk, 2017), and the housing market in the area is booming, (Appendix 2) it is safe to assume that many household owners will be available to afford the highly valued products offered by Bettaserve Ltd.

A general google search for doors and window replacements in Sheffield produces numerous competitors including Sheffield Window Centre, NuLife Window Company, Eurocell etc. as it is the 3rd largest city in the UK (Appendix 5).

Competitor Analysis:

Sheffield Window Centre can be considered the main competitor for Bettaserve in Sheffield due to the sheer size of the range of products and services it offers. The firm operates in locations including Sheffield, Rotherham, Chesterfield, Barnsley and Doncaster. It focuses on products such as uPVC doors, windows and conservatories while maintaining its USP – a security service range of products.

Its social media presence is sparse with 1833 followers on twitter and raging 5-star reviews on Facebook. The firm is known to collaborate with local charities, supporting local sports teams.

Distribution Channels:

Sheffield Windows Centre has had a number of suppliers over the years (Sheffield Window Centre, 2017). The firm’s main supplier, REHAU, is an internationally recognised company that connects more than 170 locations in over 50 countries whilst distributing products to major market leaders including BMW, Mercedes and Airbus. The firm is also the main distributor of uPVC products to Basford Windows, a market dominant in Nottingham.

3. MARKETING

This segment of the report discusses the most important aspects of creating a marketing strategy. The segment is divided into two distinct sections, USP & Competitive Advantage and Marketing Mix, both essential to a successful marketing strategy.

- Unique Selling Point and Competitive Advantage

The highly competitive nature of the replacement industry makes product differentiation and business differentiation a necessity for firms operating in it if they want to succeed. Firms differentiate products or services through their USP and use it to strategize their business and create a competitive advantage (Lim, 2005). The current market is so competitive that a firm’s competitive advantage has to be at the core of its business model.

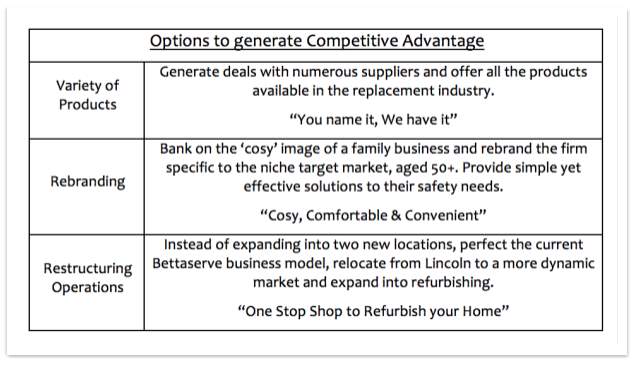

As Bettaserve Ltd. is a start-up firm, it has the opportunity to define its value proposition and generate a competitive advantage before it establishes and grows itself. (Exhibit 6) outlines the options open to Bettaserve to generate this competitive advantage.

As Bettaserve Ltd. is a start-up firm, it has the opportunity to define its value proposition and generate a competitive advantage before it establishes and grows itself. (Exhibit 6) outlines the options open to Bettaserve to generate this competitive advantage.

Exhibit 6: Generating Competitive Advantage

- Marketing Mix

While generating a competitive advantage for a firm has become a necessity for firms, due to the driven and dynamic nature of markets and industries, using that advantage and creating a marketing strategy around has become just as important. A marketing mix revolving around the 4 P’s – Product, Place, Price and Promotion allows a firm to create a marketing strategy that exploits its competitive advantage to generate profits. This section of the report outlines the 4 P’s that Bettaserve can use to plan its marketing strategy.

- Product: Aluminium

As the firm wishes to focus on Aluminium products according to the project brief, this section discusses whether or not aluminium is a profitable niche market.

There are numerous benefits of using aluminium in doors and windows. With excellent air and sound filtration properties, design flexibility, energy efficiency, sustainability, durability and insulation properties, aluminium is definitely the best replacement material in the market today. Its corrosion resistant property gives it a competitive edge over timber products as it is suitable for any weather conditions (Dardalis, 2012), and its quality gives it a competitive edge over uPVC products. The polyester coating on aluminium products gives it a guaranteed life of at least 25 years while uPVC windows start to fade in about 10 years (Dardalis, 2012).

While it is clear that aluminium is the most cost-effective material available in the replacement market, uPVC seems to have replaced aluminium in the residential sector (MINTEL, 2017). This may be due to the fact that uPVC is the cheaper option as its raw materials cost a lot less than aluminium (Dardalis, 2012). It is hence important for Bettaserve to maintain a balance of aluminium and uPVC products to tap into the larger potential target market.

- Place: Potential Locations and Distribution Channels

The second of the 4 P’s in the marketing mix, Place, is not restricted to the physical location of the showroom where the product will be sold but refers to the distribution channel a firm should use suitable to the product mix.

The competitor analysis in the previous section outlines the distribution channels used by Bettaserve’s potential competitors. To avoid repetition, this section of the report will discuss the recommendations for Bettaserve’s distribution strategy and then mention locations and properties that may be ideal for the new showrooms in Ashbourne and Rotherham.

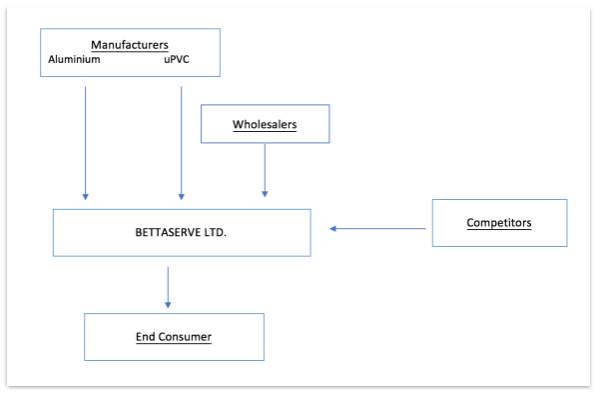

Distribution Channel:

The team recommends the adoption of a three-tier distribution channel illustrated in (Exhibit 7). The illustration suggests a model where Bettaserve receives products from more than one supplier not only from direct manufacturers but also from wholesalers and direct competitors to expand the variety of products offered by Bettaserve, finally reaching the end consumer through promotional strategies discussed in section 3.2. IV.

The team recommends the adoption of a three-tier distribution channel illustrated in (Exhibit 7). The illustration suggests a model where Bettaserve receives products from more than one supplier not only from direct manufacturers but also from wholesalers and direct competitors to expand the variety of products offered by Bettaserve, finally reaching the end consumer through promotional strategies discussed in section 3.2. IV.

Exhibit 7: Recommended Distribution Channel

Properties and Locations:

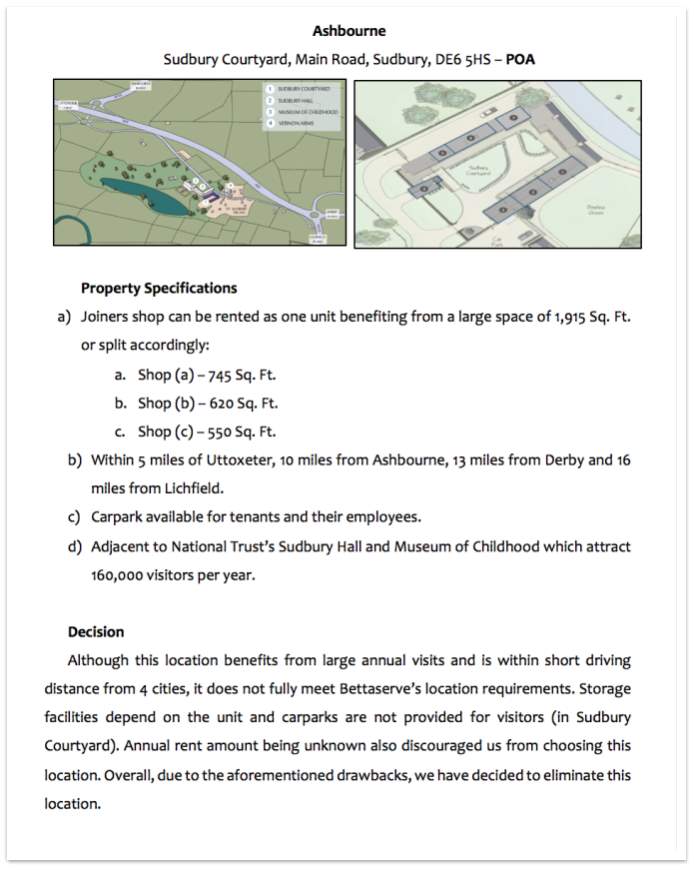

It is clear from the previous section that the team recommends expansion in Ashbourne and Rotherham. (Exhibit 8) and (Exhibit 9) outline the two properties we recommend you should look at based on the needs of the firm discussed in meetings with Laurie Smith. A description of other potential properties can be found in (Appendix 6).

It is clear from the previous section that the team recommends expansion in Ashbourne and Rotherham. (Exhibit 8) and (Exhibit 9) outline the two properties we recommend you should look at based on the needs of the firm discussed in meetings with Laurie Smith. A description of other potential properties can be found in (Appendix 6).

Exhibit 8: Property in Ashbourne

Exhibit 9: Property in Rotherham

- Price: Pricing Strategies

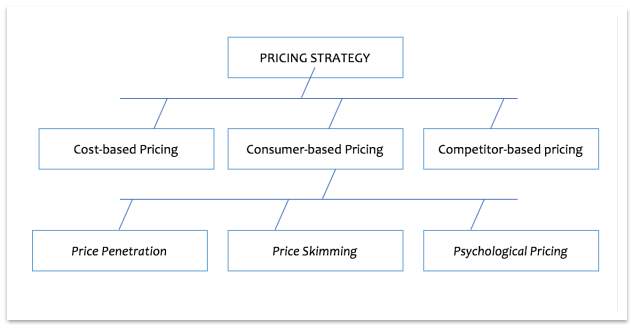

Bettaserve Ltd. currently do not have an established pricing strategy in place. On an average, the firm makes a 20% gross profit margin (80% of sales revenue is cost of sales). A pricing strategy is extremely important and needs to be established as it is closely linked to the financial performance of any company.

We outlined three pricing strategies (Exhibit 10) Bettaserve could use to overturn and renovate the financial performance of the firm. This section will only discuss strategies most appropriate for Bettaserve’s existing model. Details regarding all the potential strategies illustrated below can be found in (Appendix 7).

We outlined three pricing strategies (Exhibit 10) Bettaserve could use to overturn and renovate the financial performance of the firm. This section will only discuss strategies most appropriate for Bettaserve’s existing model. Details regarding all the potential strategies illustrated below can be found in (Appendix 7).

Exhibit 10: Potential Pricing Strategies

Cost-based Pricing:

This strategy involves price determination by adding the cost of the product to a fixed percentage of the cost (mark-up) (tutor2u, 2017). For example, if the cost a product is £100, and the mark-up is set at 40%, the firm prices the product at £140. A cursory online search has allowed us to believe that most installers/ contractors charge a 20-50% mark up (Door&Window, 2012). We recommend a 30-40% mark-up flexible based on the size of the job, labour required and quality of the products used to ensure some breathing room for the firm to cover its fixed costs whilst not losing clients due to high prices.

Competitor-based Pricing:

This strategy involves benchmark pricing against the firm’s closest competitors. Competitor based pricing requires thorough research of competitors’ prices and your position in the market (tutor2u, 2017). We recommend this strategy as most customers are mindful of other prices and know what to expect. Charging the “going rate” will eliminate pricing matters but the firm would have to differentiate its products based on the services provided or through suggestions listed in the above section.

- Promotion: Advertising Approach

The fourth component of the marketing mix, Promotion involves research of advertising options and an in-depth analysis of the target market. This section outlines these aspects of promotion concluding with a set of recommendations for Bettaserve’s business model.

Target Market:

Bettaserve’s product of focus is aluminium. The fact that aluminium products cost more puts them in the luxury category. A Euromonitor report has found that the global spending power of the baby boomer generation will reach $15tn by 2020 (Jacobs, 2014). Essentially, Bettaserve’s consumer market has the required funds to purchase the products.

Advertising Options:

The Activeage project has found that 47% of internet users aged 50-64 are on social networking sites, and Immersion Active has found that the most efficient way of promoting products online is via Facebook and YouTube (Boehman, 2016). Their research concluded that Facebook has one of the best audience targeting capabilities especially when targeting older consumers. While according to their user testing, YouTube is seen as a strong visual marketing platform as older consumers have more patience when viewing videos compared to younger audiences. Other advertising options can be found in (Appendix 8).

Recommendations:

We recommend using social media, as an advertising medium, in the form of Facebook and YouTube for video marketing. We believe that YouTube is the best way to show customer testimony as well as work-in-progress videos. This will build a relationship with the consumers as it shows actual work and testimony from people they can relate to. We also recommend sponsoring local events as this approach has been seen as an effective way of reaching the older consumer audience and strengthening your brand locally.

Exhibit 11: Marketing Recommendations

4. MANAGEMENT

This segment of the report discusses the management aspect of Bettaserve’s business model, and is divided into two distinct sections, Organisational Management and Resource Management. The aim is to recommend improvements internal and external to the firm’s core management.

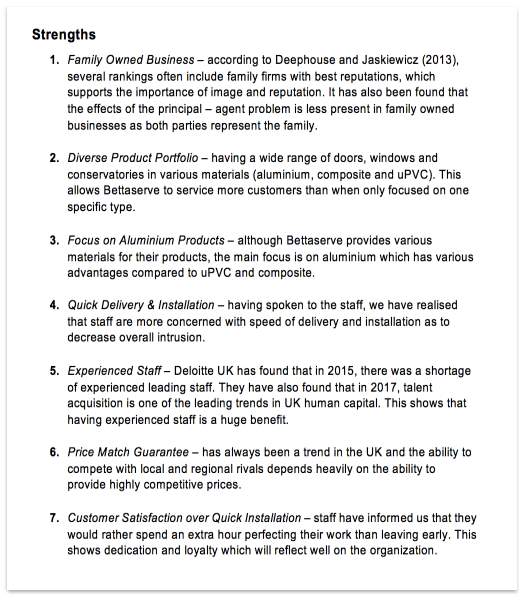

- Organisational Management

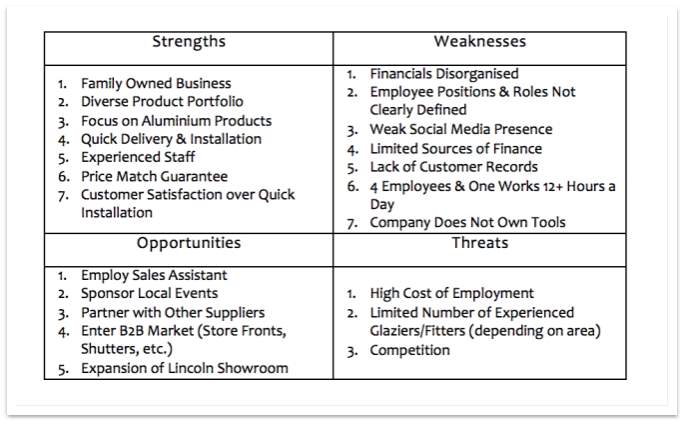

Internal management of a firm is essentially the most important and continuously ongoing process that can be illustrated with the simple ‘Plan – Act – Review – Redo’ model. This section analyses Bettaserve’s business model through a SWOT model (Exhibit 12). A detailed description of the research and analysis undertaken to create this SWOT can be found in (Appendix 9).

Internal management of a firm is essentially the most important and continuously ongoing process that can be illustrated with the simple ‘Plan – Act – Review – Redo’ model. This section analyses Bettaserve’s business model through a SWOT model (Exhibit 12). A detailed description of the research and analysis undertaken to create this SWOT can be found in (Appendix 9).

Exhibit 12: SWOT Analysis

Throughout this report recommendations have been made using this SWOT analysis as a foundation. To avoid repetition, this section only mentions the SWOT. It is necessary to read the extended SWOT in Appendix 9 as it provides clear insight into the business and its operations.

- Resource Management

The importance of resource management is derived from the importance of efficiency in a business. Optimum utilisation of resources available to a firm ensures efficient and effective operations allowing the firm to generate optimum returns (Bowen, 2009). Bettaserve’s existing business model seems to lack a clear and coherent strategy for resource management. This entire section of the report hence indulges in recommendations imperative before growth becomes the main aim of this business.

- Inventory Management

Inventory control is vital to the survival of a business as without it, a firm cannot measure the true account of how a business is doing (Carr, 2015). Bettaserve currently operates with a Just-In-Time model as its inventory strategy. While this strategy ensures efficiency and decreased waste, it also has its risks. Bettaserve risk the chance of a disrupted supply chain if Origin cannot deliver on time. This aspect of resource management will get more complex when Bettaserve have more than one supplier. To ensure that the firm is prepared to tackle inventory control issues a set of recommendations have been outlined in (Exhibit 13).

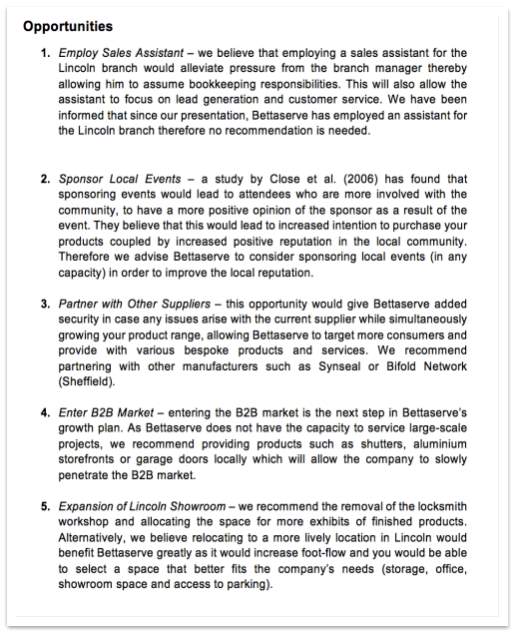

- Human Resource Management

Bettaserve is part of the service industry and people are the most important aspect of service. Human Resource Management is not restricted to creating reward systems and hiring and firing recruits for the firm. It is about creating a strategy to ensure effective communication between all the stakeholders of firm – business owners, managers, customers and the wider society (CIPD, 2016). It is hence necessary to create a strategy to manage human resources that is parallel to the business strategy outlined. Bettaserve’s aim of growth will bring together a larger network of people and it will be imperative to create a work culture that motivates individuals to work towards a larger goal – the business strategy. A set of human resource considerations have been outlined in (Appendix 10) that offer hiring specifications for expansion in Ashbourne and Rotherham.

Exhibit 13: Management Recommendations

5. FINANCE

Based on the research and analysis presented in the report so far, it is clear that Ashbourne (Derbyshire) and Rotherham seem to be viable options for expansion if the current Bettaserve model is to be duplicated. However, apart from analysing the operational logistics of this project, it is also necessary to measure the feasibility of this project in monetary terms.

This section of the report concentrates on the financial aspect of the expansion plan and outlines elements of management accounting and corporate finance that need to be considered before leaping into expansion or relocation.

- Management Accounting

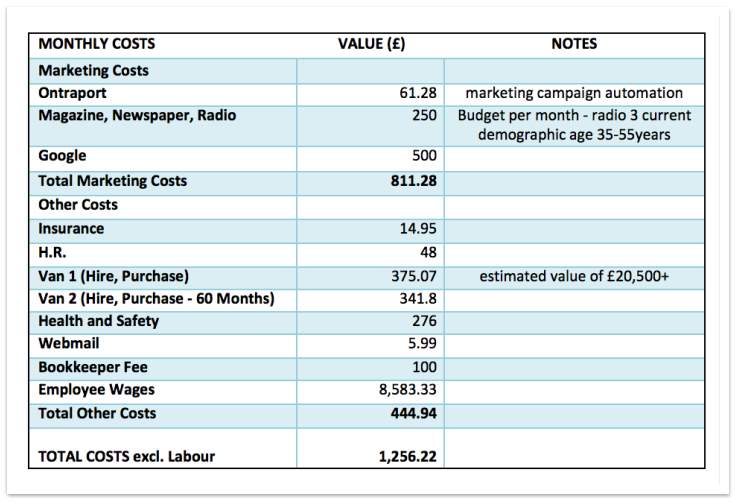

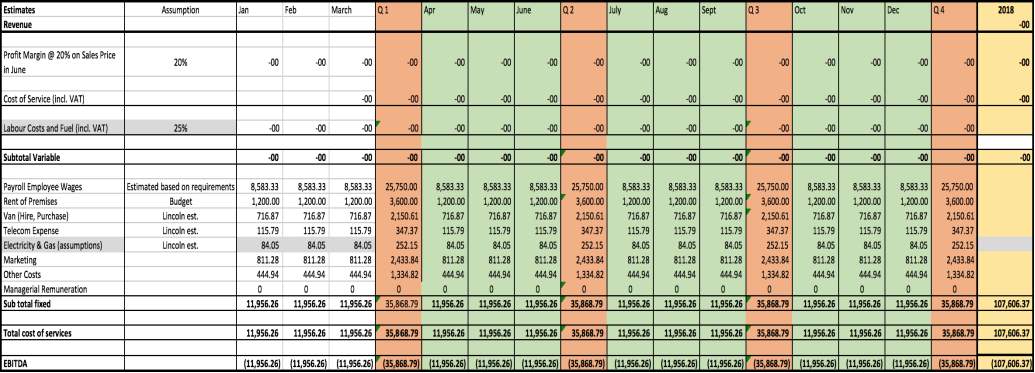

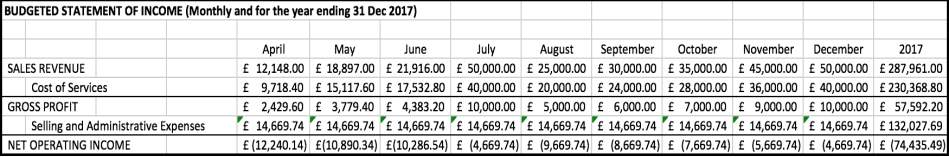

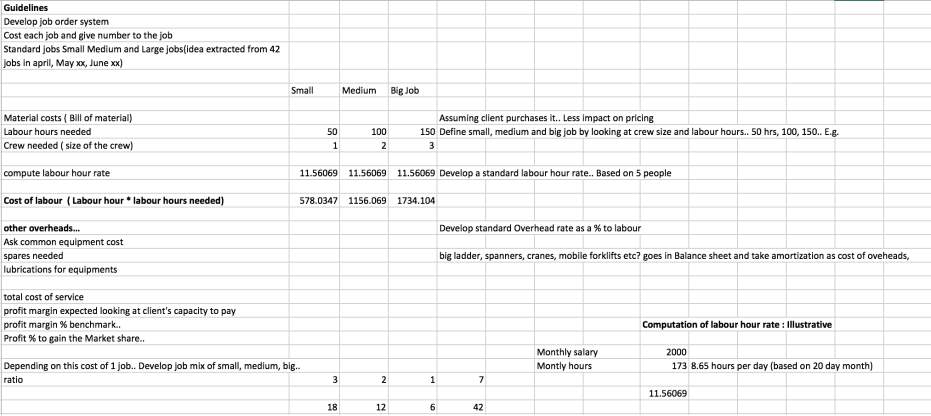

This section first discusses the current financial position of the Lincoln operations through a cost structure created with extremely basic information within a template customised for Bettaserve’s current operations. It then outlines assumptions made for forecasting costs for the rest of this financial year, ending 31 December 2017. This information is then used to create a cash budget for the Lincoln operations. Finally, this section provides estimates for costs for the new locations if expansion is expected.

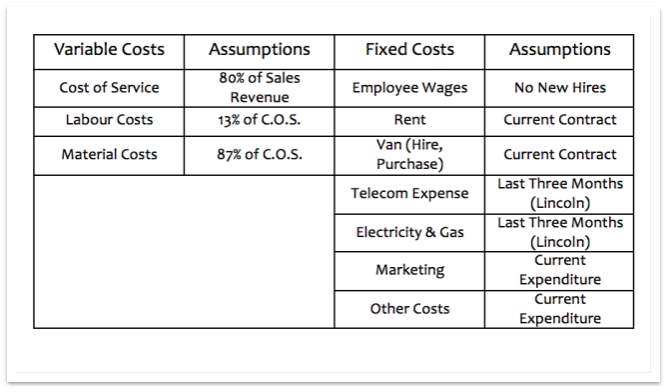

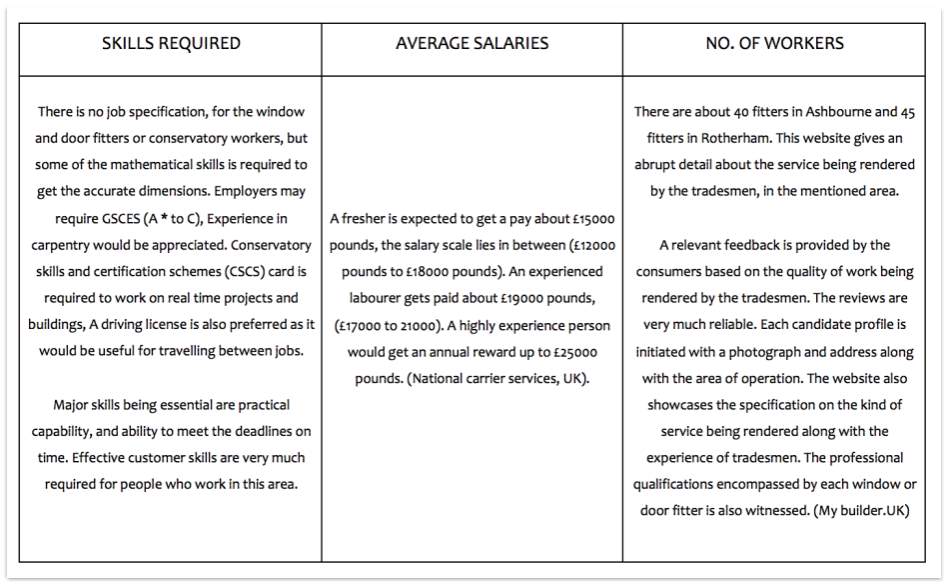

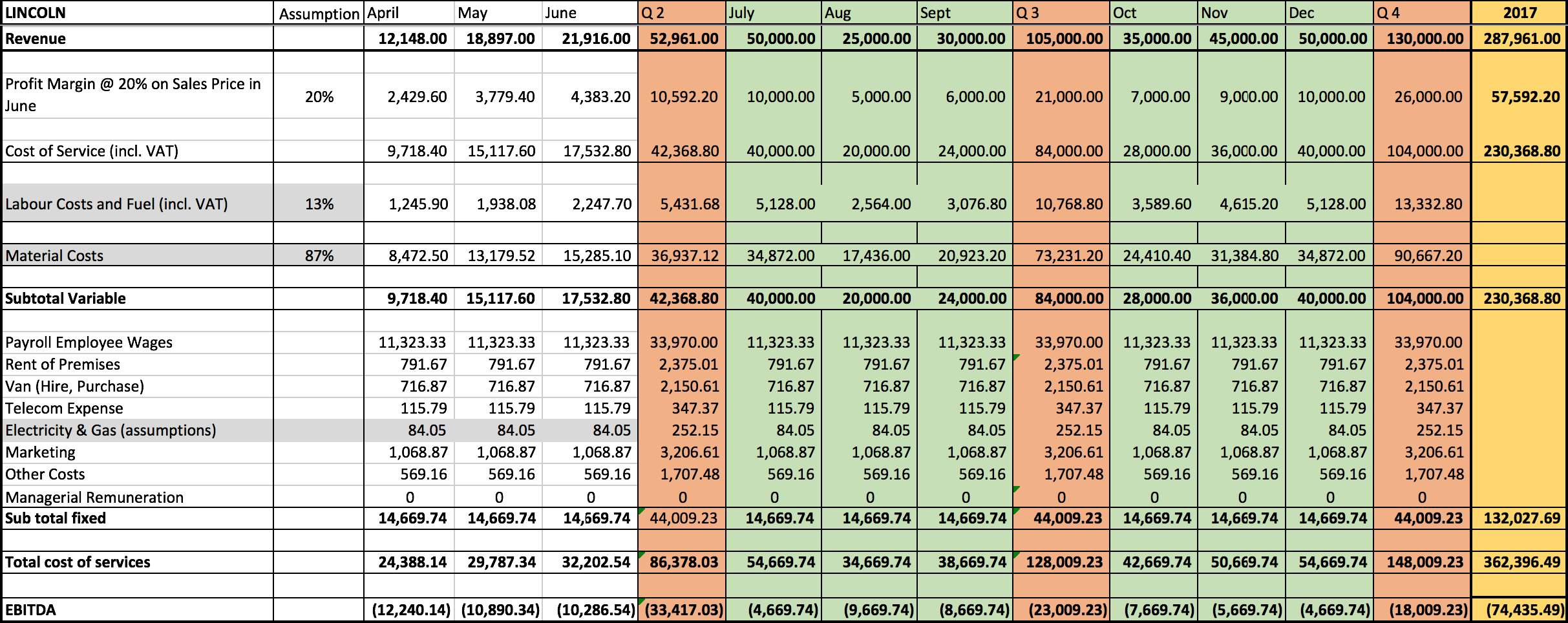

- Cost Structure

The firm currently operates as an installer of replacement doors and windows and functions at a 20% sales margin on every job, making Cost of Services (C.O.S.) 80% of sales revenue. According to an example of a job given to us via email, approximately 87% of this cost can be allocated to materials supplied by Origin and the rest 13% is allocated to labour costs. Based on this assumption and other cost data provided to us for the second quarter of 2017, costs can be divided into variable and fixed costs to then calculate the break-even revenue required for the Lincoln operation as illustrated in (Exhibit 14). A detailed breakdown of the costs can be found in (Appendix 11).

Exhibit 14: Cost Assumptions (Lincoln)

Using these assumptions and costs, the fixed costs were calculated to be approximately £15,000 and with the variable component being 80% of Sales Revenue, the break-even revenue for Lincoln was calculated to be approximately £73,000 per month. Essentially, the Lincoln operation would have to generate sales worth at least £73,000 to cover all costs (Appendix 12).

Using this data, and the estimated revenue figures provided by Bettaserve, we forecasted future earnings for the financial year ending 31 December 2017 and the firm is expected to make a loss of around £74,000 at the end of this year. Furthermore, estimates were made for Ashbourne and Rotherham based on assumptions outlined in (Appendix 13). The firm is expected to incur fixed costs of around £12,000, making the break-even revenue around £60,000 per month (Appendix 14).

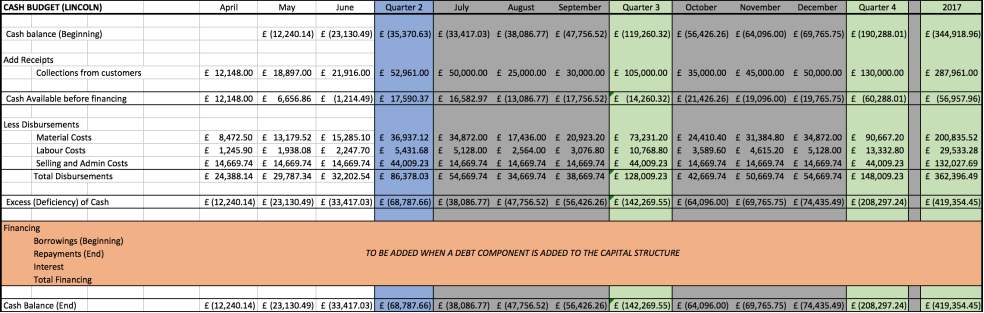

- Cash Budget

While cost analysis is an important aspect of strategizing and decision making, cash-flow implications of this operational structure are equally if not more important as 90% of all start-up companies fail and the second most predominant reason for start-up failure is poor cash-flow management according to CB Insights (Griffith, 2014). To ensure that cash flow problems aren’t being ignored, a cash budget has been created for the Lincoln showroom for the financial year ending 31 December 2017 and the firm is expected to experience a cash deficit of almost £420,000 at the end of this year. The cash budget can be found in (Appendix 15). Using all the data provided and the analysis conducted, we created a budgeted income statement supplement the cash budget. This can be found in (Appendix 16).

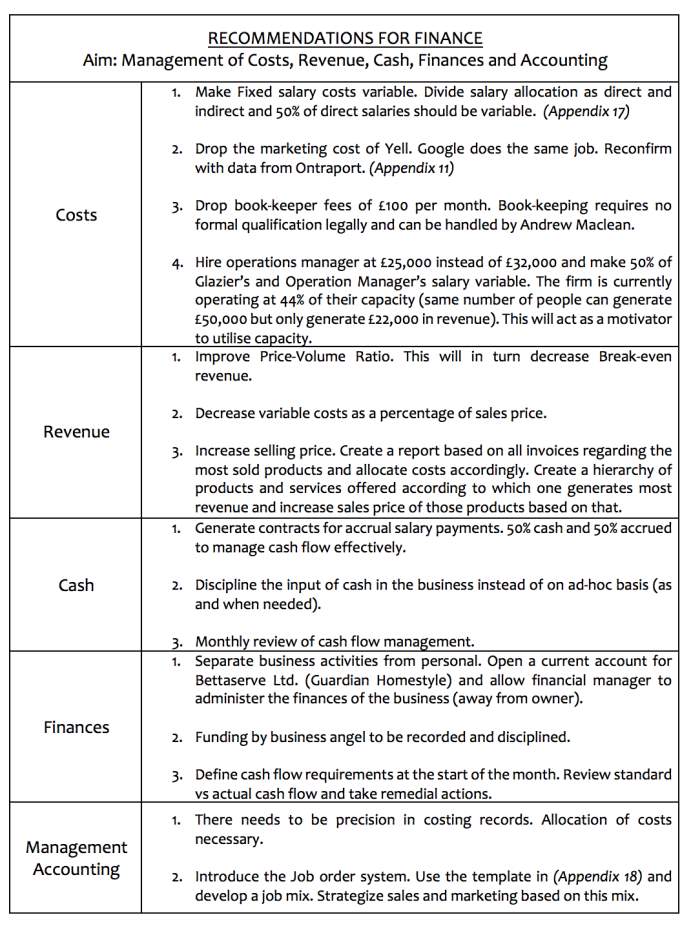

- Corporate Finance

It is clear from the analysis above that there is a dire need to cut costs and increase sales revenue. There is also a need for a boost in the capital of the firm to fix the current issues with operations and to invest in advertising. This section of the report addresses the importance and availability of debt financing and the importance of financial management.

- Capital Structure

Literature suggests that most small firms operate with debt heavy capital structures but do so majorly due to necessity as other sources of finance are inaccessible (Harris & Raviv, 1990). With Bettaserve however, this is not the case as Andrew Carruthers acts as a business angel. The firm is also not large enough to fund operations through external shareholders by holding an IPO and as such, most advantages of debt may not be applicable for Bettaserve. For instance, debt being cheaper than equity resulting in reduction of financial costs or even profit retention is inapplicable to Bettaserve as there are no shareholders that take a pay-out. However, there are two essential roles of debt that make it a necessity in Bettaserve’s capital structure.

Debt acts as a disciplining device and plays an informational role that enables firms to address issues regarding liquidation and reorganisation (Harris & Raviv, 1990). Debt will force Bettaserve’s management to create and maintain regular records of operations and finances allowing informed strategies to be made when expanding. Also, if Bettaserve opts to expand to new locations or relocate and expand into new sectors of the same market to create a one stop shop for refurbishment, debt will allow the core management team to discipline the managers in the new locations.

The other advantage of debt would be tax saving that has been suggested by most literature regarding capital structures starting from Modigliani and Miller (1963). As interest payments are tax deductible, when the operations are profitable, the firm will be able to save and pay 19% of income after interest payments as corporate tax.

Having established the importance of debt, it is now important to look at the availability of debt to Bettaserve Ltd. The simplest form of debt that the company has access to is in the form of bank overdrafts. This will allow the firm to smoothen work in progress cash flow disruptions through the year and also smoothen cash flow irregularities caused due to the seasonality of sales. Bettaserve can also access government grants if it redefines the company as an SME according to government requirements and employ young entrepreneurs. These funds can be invested in sales growth.

- Management of Working Capital Issues

There are extensive implications of financial management to the operations of a business, and this section outlines why Bettaserve needs to administer its finances and take heed of the caution that numbers give, by focusing on working capital issues that need to be managed.

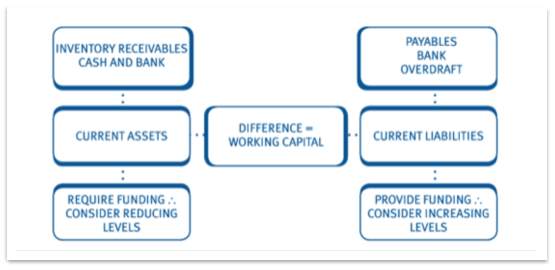

Working capital management is crucial to minimise the risk of insolvency for a business (Kaplan Financial, 2012). (Exhibit 15) illustrates the definition of working capital and provides a clear outline of what elements of the business need to be managed for a healthy working capital.

Exhibit 15: Defining Working Capital

Mismanagement of these elements of a business is a common cause for start-up failures (Kaplan Financial, 2012). For instance, this may cause the inability to pay bills when required, the demand for cash may be too high in the growth period of a business cycle (overtrading) and there may also be overstocking of inventory when unnecessary. While these may seem irrelevant to Bettaserve’s current business model due to its Just-In-Time inventory management system or its access to cash on an ad-hoc basis (provided by business angel as and when required), these issues need to be considered and dealt with at this stage of the business (before expansion).

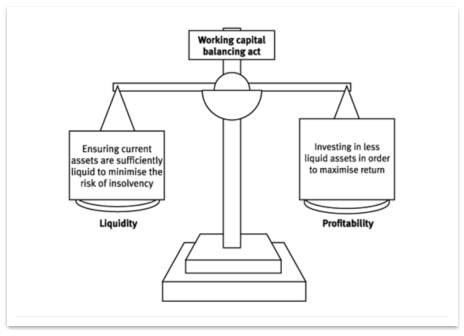

Managing working capital is essentially a cost/benefit trade-off between liquidity and profitability as illustrated in (Exhibit 16).

Managing working capital is essentially a cost/benefit trade-off between liquidity and profitability as illustrated in (Exhibit 16).

Exhibit 16: Working Capital Balance

Bettaserve need to invest in managing cash flow and working capital as judging from the cash budget in (Appendix 15) the firm is expected to end this financial year with a cash deficit of almost £420,000. A set of recommendations has been provided in (Exhibit 17) to manage this situation. Also, the recommendations provide an insight into what can be done regarding the financial situation of Bettaserve’s Lincoln operation.

Exhibit 17: Finance Recommendations

6. RECOMMENDATIONS

6. RECOMMENDATIONS

7. LIMITATIONS

7. LIMITATIONS

market research aspect of the project slightly difficult to get accustomed to at first. However, the team quickly adapted to this new sector by studying current market research techniques and utilising marketing databases such as MINTEL and ACORN.

Size and nature of the company:

Bettaserve Ltd is a start-up company that has only been properly functioning for only a few months. The project brief specified that government grants be looked into as potential sources of finance for the company’s expansion plan. Research into this revealed only a few government grants targeted towards the replacement industry and the few that existed were targeted towards firms that have been trading for a longer period of time. This lead the team to recommending measures that when carried out, would allow Bettaserve Ltd to be eligible for relevant government grants.

8. APPENDIX

Appendix 1: Industry Overview (MINTEL, 2017)

Appendix 1: Industry Overview (MINTEL, 2017)

Appendix 2: Housing Market Prices

Appendix 3: Competitors to Bettaserve (Ashbourne)

Appendix 4: Competitors (Rotherham)

Appendix 5: Competitors (Sheffield)

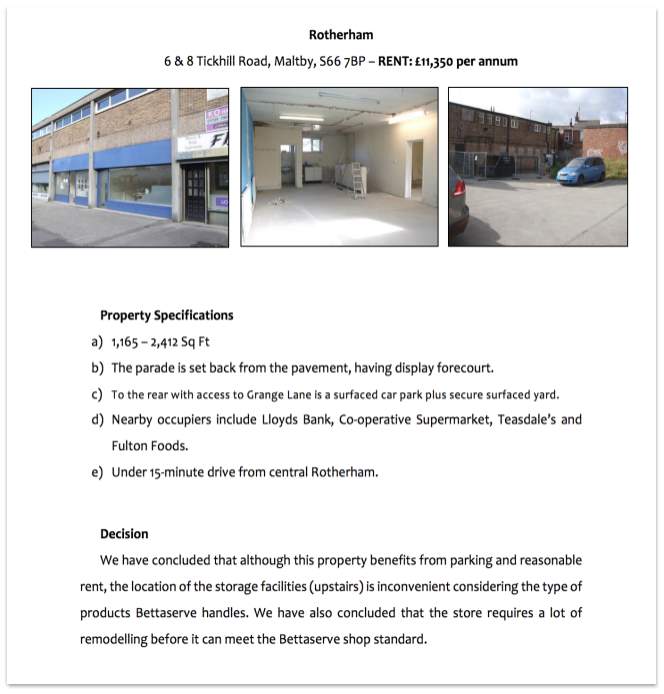

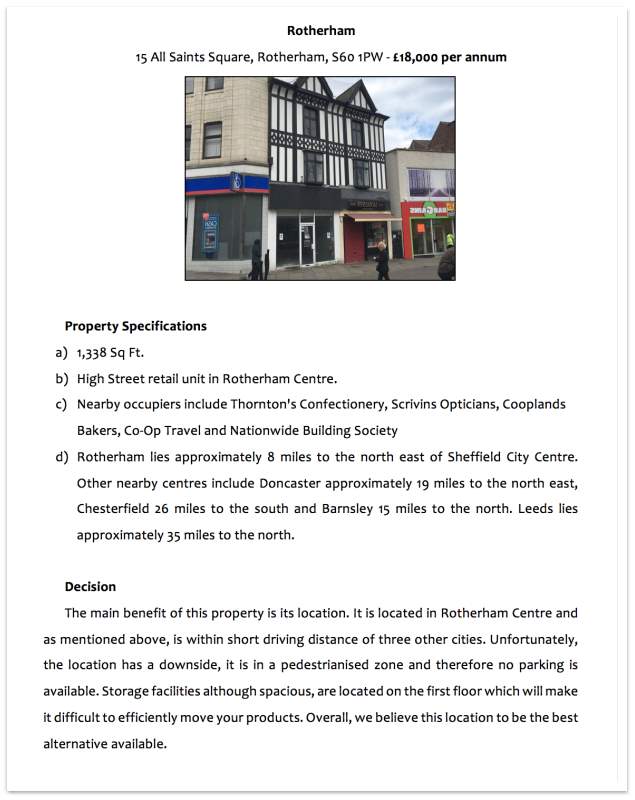

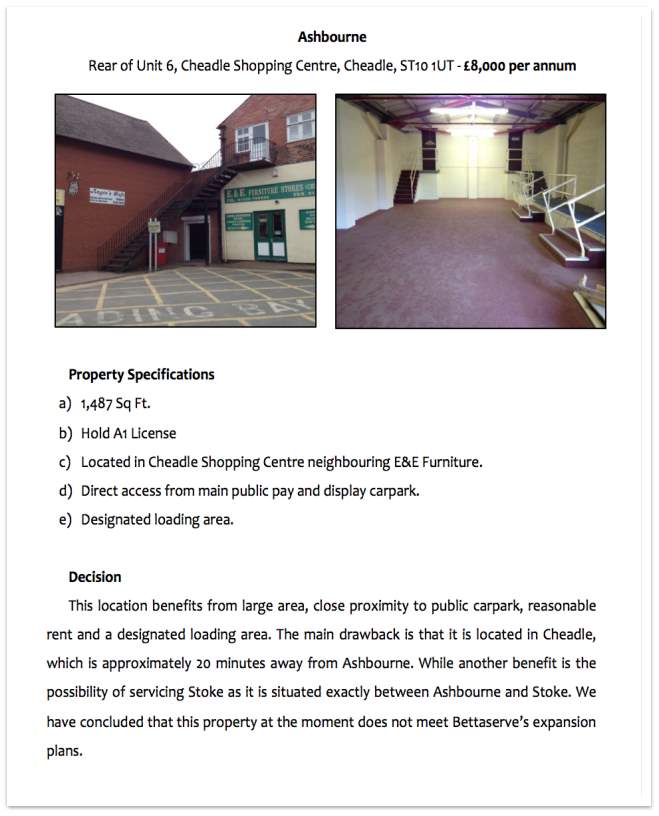

Appendix 6: Potential Properties

Appendix 6: Potential Properties

(SMCommercial, 2017)

(Pearl-coutts, 2017)

(Property Brochure – Unit 6 (Cheadle) , 2017)

(Sudbury Courtyard, 2017)

Appendix 7: Consumer-based Pricing Strategies (tutor2u, 2017)

Appendix 7: Consumer-based Pricing Strategies (tutor2u, 2017)

Appendix 8: Advertising Options

Appendix 8: Advertising Options

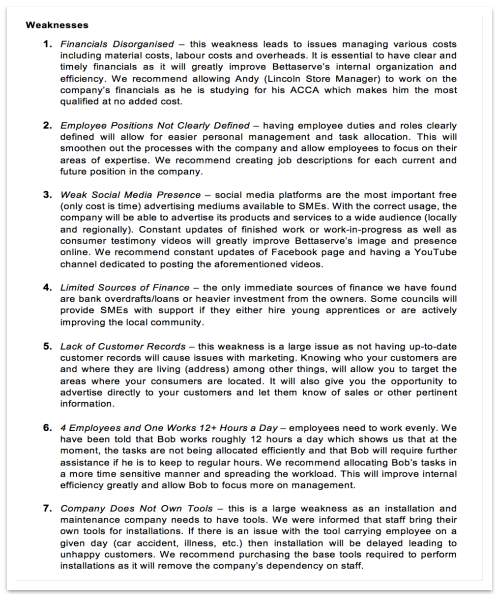

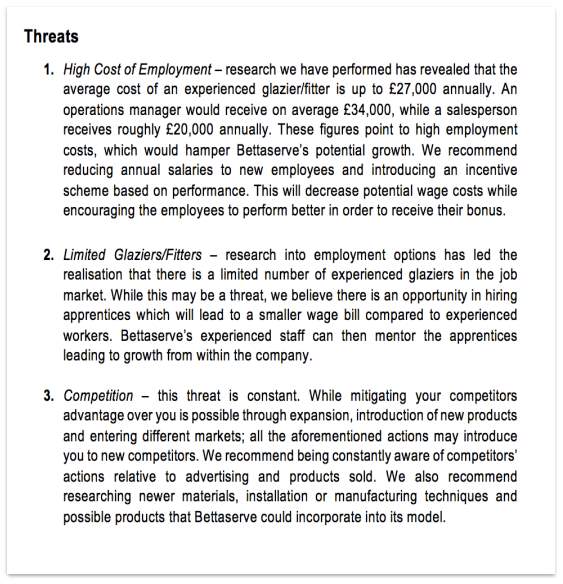

Appendix 9: Extended SWOT Analysis

Appendix 9: Extended SWOT Analysis

Appendix 10: HR Considerations

Appendix 10: HR Considerations

Appendix 11: Cost Breakdown (Lincoln)

Appendix 12: EBITDA Forecasts (Lincoln)

Appendix 13: Cost Breakdown (Estimates for Ashbourne and Rotherham)

Appendix 14: EBITDA Forecasts (Estimates for Ashbourne and Rotherham)

Appendix 14: EBITDA Forecasts (Estimates for Ashbourne and Rotherham)

Appendix 15: Cash Budget (Lincoln)

Appendix 16: Budgeted Income Statement (Lincoln)

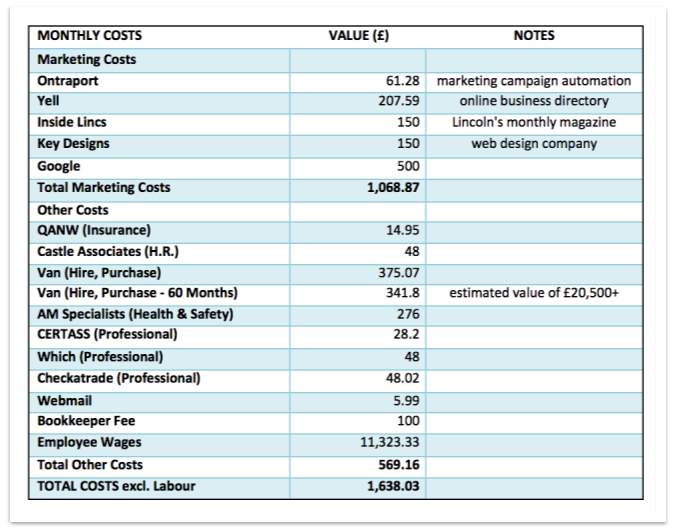

Appendix 17: Direct vs Indirect Salaries

| Employee | Wage (per annum) | Allocation | Treatment |

| Andrew Carruthers | 0 | ||

| Robert Carruthers | 11,000 | Salary | Full monthly payment |

| Andrew Maclean | 16,380 | Salary | Full monthly payment |

| Andrei Glazier | 25,000 | Semi-variable @ 50% | 50% payment based on no. of jobs |

| Martin Brookes | 32,000 | Semi-variable @ 50% | 50% payment based on no. of jobs |

| Rosie Gissing | 15,500 | Managerial Remuneration | Profit sharing |

| Laurie Smith | 36,000 | Managerial Remuneration | Profit sharing |

| TOTAL | 135,880.00 | ||

| Monthly | 11,323.33 |

Appendix 18: Job Order System Template

Appendix 18: Job Order System Template

9. REFERENCES

Acorn, 2017. Financially Stretched – Modest Means – Summary, London: CACI International Inc..

Boehman, J., 2016. Targeting Older Consumers THrough Social Media Marketing. [Online]

Available at: https://www.immersionactive.com/resources/targeting-older-consumers-on-social-media-marketing/

[Accessed 4 August 2017].

Bowen, R., 2009. Key Elements of Resource Management. [Online]

Available at: http://www.brighthubpm.com/resource-management/14438-key-elements-of-resource-management/

[Accessed 6 August 2017].

Carr, S., 2015. What is Inventory Control?. [Online]

Available at: https://www.handshake.com/blog/what-is-inventory-control/

[Accessed 1 August 2017].

CIPD, 2016. Strategic Human Resource Management. [Online]

Available at: https://www.cipd.co.uk/knowledge/strategy/hr/strategic-hrm-factsheet

[Accessed 6 August 2017].

Dardalis, N., 2012. What is better? Aluminium or PVCu?. [Online]

Available at: https://www.aluminiumtradesupply.co.uk/5099/what-is-better-aluminium-or-pvcu/

[Accessed 31 July 2017].

Door&Window, 2012. Cost Control: How to avoid high window mark-ups. [Online]

Available at: http://www.doorandwindow.com/windows/cost/avoid-high-window-cost-markups.html

[Accessed 31 July 2017].

Griffith, E., 2014. Why startups fail, according to their founders. [Online]

Available at: http://fortune.com/2014/09/25/why-startups-fail-according-to-their-founders/

[Accessed 31 July 2017].

Harris, M. & Raviv, A., 1990. Capital Structure and the Informational Role of Debt. Journal of Finance, June, 45(2), pp. 321-349.

Jacobs, E., 2014. Advertisers’ Ageing Dilemma. [Online]

Available at: https://www.ft.com/content/7bb881d2-5915-11e4-9546-00144feab7de

[Accessed 4 August 2017].

Kaplan Financial, 2012. Working Capital Management. [Online]

Available at: http://kfknowledgebank.kaplan.co.uk/KFKB/Wiki%20Pages/Working%20capital%20management.aspx

[Accessed July 2017].

Lim, L., 2005. Unique Selling Proposition – Your Competitive Advantage. [Online]

Available at: https://www.marketingsphere.com/marketing-articles/unique-selling-proposition.html

[Accessed 4 August 2017].

MINTEL, 2017. Residential Windows & Doors – UK – June 2017, London: Mintel Group Ltd. .

Modigliani, F. & Miller, M., 1963. Corporate income taxes and the cost of capital: A correction. American Economic Review, Volume 53, pp. 433-443.

Ons.gov.uk, 2017. Annual Survey of Hours & Earnings – Map. [Online]

Available at: https://www.ons.gov.uk/visualisations/nesscontent/dvc126/

[Accessed 31 July 2017].

Pearl-coutts, 2017. Shops to Let – Shops to Rents – London & UK. [Online]

Available at: https://www.pearl-coutts.co.uk/shops-to-let

[Accessed 29 July 2017].

Property Brochure – Unit 6 (Cheadle) , 2017. Newcastle: Rory Mack Associates Ltd.. [Online]

Available at: http://www.rightmove.co.uk/propertyMedia/redirect.html?propertyId=51601666&contentId=955353202&index=0

[Accessed 29 July 2017].

Sheffield Window Centre, 2017. uPVC Windows, Doors, Conservatories, Roofline and Stained Glass in Sheffield.. [Online]

Available at: https://www.sheffield-window-centre.co.uk/about-us/progress/

[Accessed 31 July 2017].

SMCommercial, 2017. SMC Chartered Surveyors. [Online]

Available at: http://www.smcommercial.co.uk/

[Accessed 29 July 2017].

Sudbury Courtyard, 2017. Property Brochure – Lichfield: Savills Lichfield. [Online]

Available at: http://docs.novaloca.com/130726_636015768912230000.pdf

[Accessed 29 July 2017].

The Marketing and Growth Hacking Publication, 2017. Connect with your target market. Why sponsor an event?. [Online]

Available at: https://blog.markgrowth.com/connect-with-your-target-market-why-sponsor-an-event-5339f1ea988e

[Accessed 4 August 2017].

tutor2u, 2017. Pricing Strategies GCSE. [Online]

Available at: https://www.tutor2u.net/business/reference/pricing-strategies-gcse

[Accessed 31 July 2017].

Value Doors UK, 2017. About Us – The Value Doors UK Team. [Online]

Available at: https://www.valuedoors.co.uk/about-us-online-quotes

[Accessed 31 July 2017].

Zumpe, J., 2016. Population Estimates for UK, England and Wales, Scotland and Northern Ireland- Office for National Statistics.. [Online]

Available at: https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/bulletins/annualmidyearpopulationestimates/latest

[Accessed 1 August 2017].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Strategy"

Business strategy is a set of guidelines that sets out how a business should operate and how decisions should be made with regards to achieving its goals. A business strategy should help to guide management and employees in their decision making.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: