Impact of AI and Blockchain Technology on Accountants and Auditing

Info: 3990 words (16 pages) Introduction

Published: 1st Sep 2021

Abstract

Since last couple of years, the ongoing development in the area of artificial intelligence and blockchain technology has been creating a chaos about the future role of accountant and audit professional. Comparing to other industries it’s a relatively a new concept in accounting arena but gaining a momentum at very fast pace. Big four accounting firms are already deploying the artificial intelligence in some of the areas. Lately, they have invested heavily in the research and development of these technologies with the sole objective of introducing these technologies in day to day accounting and audit operations. The aim of this paper is to provide an overview, the implications these technologies will have on accountants, auditors and auditors/audit process. And also to shed a light on the skills that the professionals will be required to equip with to survive in the industry. A comprehensive review is impossible and beyond the scope of this paper, due to the pace of development in the technology and limited access to the literature. The real life industry examples discussed here should provide the impetus to accounting students/professional to get ready for the changes and to equip themselves better with the skills that will be sought after in the period ahead.

Introduction

Since the inception of accounting, the role of accountant has undergone several changes from counting and keeping the stock records to predict future financial trends of the entity. But till date the professional are treated as a compliance specialist. Lately, in the wake of financial frauds that happened across the countries, the profession is losing its reputation. Peterson (2017) mentioned that “A conventional wisdom is gradually developing that the audit is largely irrelevant to the investment process today”.

Accountants and auditor work has been defined as the post mortem of the past transactions which has a little impact on the future operations of an entity. In the globalised trade the businesses generally prefer problem-avoidance and problem-containment to problem-solving. But currently the professional are reactive in nature rather than proactive. However, the latest trends in technology have the potential to automate most of the recording aspect which may lead to change the job profile of accountant. When technology will take over the mundane task, the professional has to be proactive to survive in the industry (Susskind 2015, p. 108, ACCA, 2016). These technologies could prove a helping hand to boost/maintain the confidence in audit process which had waned since 2008 in the wake of the global financial crisis. The blockchain and artificial intelligence are forward looking technologies that provide real time data and can contribute to change the future course of action (Smith, 2017).

Nixon (2016) is of the view that since the introduction of double entry system, innovation was stalled in accounting. The only change according to him is “things that used to be done on papers, shifted to computer”. However, the new technologies have the potential to take this profession to new level that has never witnessed before. Researchers and developers had termed it as the ‘Fourth Industrial Revolution’. The notable components of fourth industrial revolution are ‘Artificial Intelligence’ and ‘Block Chain’ technology (Schwab, 2018). The Blockchain has been labelled as the fifth pillar in IT revolution after mainframes, personal computers, Internet, and social media (Thakkar, 2017).

The Institute of charted accountants in England and Wales (ICAEW, 2017) commented that “in short to medium term AI will deliver more value to the business, aligned with opportunities for accountants to improve their efficiency. However, in long run radical changes will happen and machines will be replacing the human beings by taking over the decision making tasks”. In the wake of these technologies public perception about this profession will be change from ‘part of the problem ‘to ‘guardians of integrity’.

As per the survey conducted by Association of Chartered Certified Accountants (ACCA) there will be various factors (e .g. Globalisation, Regulation and governance, Social Accounting, Offshoring etc.) that will be effecting the accountants/audit professional works and will be requiring them to comply with the rules framed by various governing bodies. However, introduction of smart technology will effects the job profile of the profession. Regulatory framework is the second key factor that may have effect accounting professional but to most extent it’ll be embedded in the new technology (Oliver, 2000). By 2025, new technologies will transform the practice and competencies requirements. Susskind (2015, p.109) has categorized the technology impact on the profession in terms of automation and innovation. Means automation will lead to innovation in the required skills. To survive in the industry professional will have to acquire new set of skills i.e. gain more technical, social, marketing and communication skills (Ketz, 2016, ACCA, 2016). To foresee the impacts on the professionals, an overview on the working of these technologies, the applicability and impacts on current business scenarios has been discussed. Consider the cost factor the entities may prefer one technology over other so the Impacts on the profession has been discussed separately.

BACKGROUND

Basically accountants are the product of the needs and demands of the contemporary commerce and industry. Jones and Abraham (2007) stated that “accounting has always been the servant of wealth” while “maintain orderly functioning of commerce”. To meet the demand of industry, the role of accountant has evolved a lot since its inception, so its education implications.

History of accounting can be traced back to the origin of the trade in ancient civilization. In different parts of the world the sole purpose of accounting was just limited to counting and recording of the stock. With the advancement of economy, removal of trade barrier, introduction of money as a mean of exchange and to meet the industry demands, more responsibilities added under accountant’s umbrella from time to time. To meet the industry requirements accountants and audit professional had embraced the changes in the profession with open arms. It started in Bronze Age when the records were kept physically, then evolved to manual record keeping, then to excel sheets then to different accounting software’s and now the current one is cloud computing (Deloitte, 2016). Over the time period this profession has led to specialization in accounting branches and the accountant role has evolved into financial accountant, cost accountant, management accountant, auditors, forensic accountant, tax accountant etc.

Dabor (2008) had identified four stages in development of accounting profession as follow:

Pre-capitalist Period (4000 BC-1000 AD): In this period accounting solely was used for keeping the stock records, so was limited to counting and recording. No special qualification was required to keep these records.

Commercial Capitalism (1000-1750): Accounting profession evolved and flourished during this period. An Italian scholar Luca Pacioli (known as father of modern accounting) laid the foundation of accounting as practiced today and wrote a book on modern form of accounting i.e. double entry book keeping in 1494. Accountants were required to have some basic knowledge to keep and verify the records.

Industrial Capitalism (1760-1830): This period witnessed industrial revolution in Britain so the idea of capitalism emerged. Doubled entry system of book keeping flourish in this period. Demands for more in-depth knowledge of accounting practices were required.

Financial Capitalism (1830 onwards): First professional accountant body established in Scotland in 1854 and businesses started to demand a qualified accountant. To frame the accounting roles and assurance at large, American Institute of Certified Public Accountant professional body established in in 1887. Industry and business demanded accountant to provide in-depth knowledge of the account and the business demanded to separate capital and revenue, valuation of fixed assets, calculating periodic profit, publish appropriate contents of financial statements for investors and shareholders etc.

Till 1979, accountant work as very laborious as all the work had to be done on paper which was also an obstacle to get the timely information. The advent of first spreadsheet programme ‘VisiCalc’ in 1979 gave some relief to accountant and made their work much easier, efficient and quicker (Cooke, 2015). Till the advent of VisiCalc accountant needed to be well versed in mathematics formulas but it automated the calculation process and accountant didn’t need to have the root knowledge of mathematical formulas. The first accounting software named ‘Quickbook’ introduced in 1998 followed by different accounting software’s across the countries. Accounting software’s not only made the job easy but also helped the professional to expand their business. Accountant were required to upskill to meet the demand of technology. Public perception about the accountant began to change and more services added to accountant umbrellas like; interpretation of data, financial advice and involvement in tax matters etc. It required accounting professional to equipped with the computational and communication skills. The latest trend in accounting industry is cloud computing which was introduced in 2014. It didn’t require accountant to acquire any special kind of qualification nor has added any other service to accountant profile. However, on client side it has positive effects in forms of availability of real time information.

Technological advancement in the field of accounting has proven an augmented tool to assist accountants and had enabled them to take efficient and faster decisions e.g. variety of data analysis techniques in Excel, features of accounting software’s (like Xero, Quickbook etc.) to perform almost all the bank reconciliation by itself and availability of accounting information anytime and anywhere in cloud computing etc. In big organization most of transaction are recorded by itself in the system at the point of sale (i.e. scanning of barcode) and all the relevant ledgers are gets updated by itself, like inventory, cash, debtors, account receivable etc. However, till date all the technological advancement in accounting field have just proved a tool that can’t make any kind of decisions because of the fact that all these machine are working on rule-based programming and can process the structural data only (Baldwin, 1995). In-spite of faster and efficient processing of the data and software’s characteristics to analysis the data in different dimensions, still human input is the first requisite that is required to derive any meaningful information that can be relied upon. The ongoing research and developments in the field of technology is expected to bring robust changes the way all we work. The advent of computers changed the scope and the methods of examination. The advent of analytics will change the time scope of the audit (more proactive than reactive), the efficiencies, and the cost and benefit of the work (Issa et al., 2017)

Technology is spreading its wings at fast paced that never happened before and is already bearing its effects in some of the industries. In Sep 2016, Walmart laid off 7000 position dealing with management of cash flows and processing of vendor claims. In 2000, Goldman Sach’s was employing 600 traders in New York to buy and sell the stock, by 2017 it reduced to only 2 traders, rest of the people got replaced with machine (Byrnes, 2017). The study conducted by Xero in 2017 covering 600 accountants and SME owners (South African) concluded that technology will evolved the job profile of accountants, from number crunchers to consultants and specialist in strategic business review. However, 31% of the SME see don’t think they’ll need an accountant in a decade. The advance technologies like artificial intelligence coupled with blockchain and Internet of Things (IoT) will lead to automation of transactional data and compliance report (Ketz, 2016).

Artificial Intelligence

Before touching upon how Artificial Intelligence can disrupt the accounting field, it is imperative to understand the working and origin of artificial intelligence. The term ‘Artificial Intelligence’ was coined by computer scientist, John McCarthy in 1955 (Marsden, 2018). As per John McCarthy “Artificial Intelligence is the science and engineering of making intelligent machines, especially intelligent computer programs”. Wikipedia defines it as as an intelligence exhibited by machines. In computer science, an intelligence machine/device that perceives its environment and takes actions that maximize its chance of successfully achieving its goals. Colloquially, the term “artificial intelligence” is applied when a machine mimics “cognitive” functions that humans associate with other human minds, such as “learning” and “problem solving”.

In simple words Artificial Intelligence is the learning power of machine from its own past experience i.e. data feed and decision taken by it in the past. It is not a new concept but gain a momentum since last couple of decades due to availability of the resources/technological advancement in the other fields of technology e.g. exponential increases in computing power.

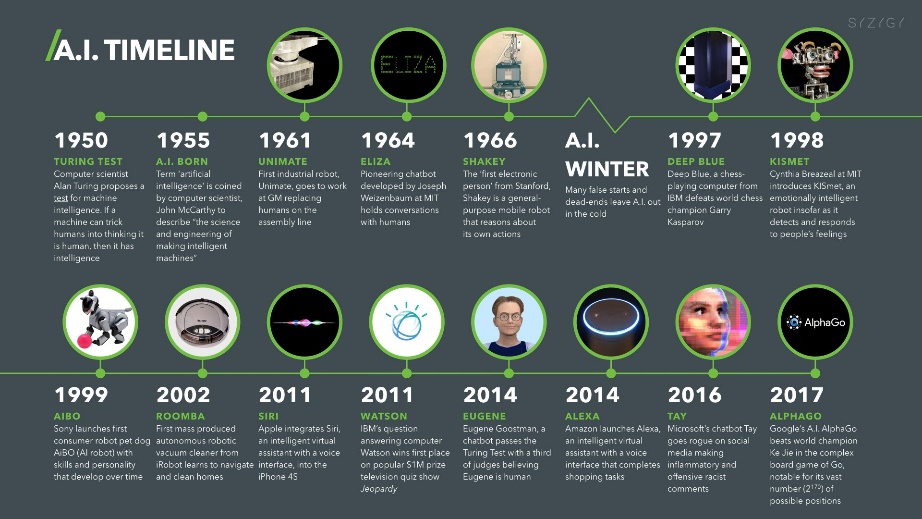

Deep Blue computer that defeated chess champion Gary Kasparov in 1997 and Watson AI that defeated two champions in Jeoparday game in 2011 are classic example of AI. Following picture showing the different stages in the development of AI.

Pic Source: https://digitalintelligencetoday.com/artificial-intelligence-timeline-infographic-from-eliza-to-tay-and-beyond/

Nowadays, directly or indirectly, we encounter with ‘Artificial Intelligence’ but not aware how it is interfering/assisting us in daily life e.g. computer showing the trends/material by itself based on past research, Facebook suggesting friends based on tag sharing service/school, university attended. Virtual assistants Siri, Alexa, Cortana can find all sorts of information for people, and they can talk to other machines such as alarm systems, climate control, and cleaning robots (McCollum, 2017). As per Isuru Fernando, Artifical Intelligence/machine learning is the way to improve the common behavioral mistakes on part of humans. While rationing, human are biased in observing, interpreting and evaluating so the mistakes happen. However, machine learning/artificial intelligence which learns from initial data feed does not possess the human attributes of biasness so least chances of mistake.

Main features

- Data Ingestion: It stores the vast amount of data

- Adaptive/Learning: Depending upon the situation and decision that made in the past it tries to adapt itself to the new scenario

- Unbiased: Processing of information and reasoning to arrive at a particular decision unbiased.

Artificial Intelligence can be classified as a structural or non-structural depending upon the functionality of the machine. Structural AI is unable to learn from itself rather works on the defined patterns. It’s the structural Artificial Intelligence that is playing a crucial role in couple of industries. Google self-driving car project that started in 2009 (Waymo, n.d.), the United Kingdom digital tax return platform launched in 2016 (Susskind, 2015) etc.

Non-structural AI or as it is called neural network has the ability to rationale. US justice department tool to assist lawyers in deciding the punishment is a classic example of non-structural AI. It’s combatively new in accounting arena and has not spread its wings to the fullest so is used in the limited working. For example, in United Kingdom, Deloitte is using AI tool ‘Revatic Smart’ to recover foreign VAT payments. It scans client’s document using OCR (optical character recognition) and automatically files the correct forms with little human input. (Susskind, 2015, p. 87). EY is using machine learning to identify fraudulent invoices, to review the lease accounting standards for the clients. EY fraud detection system has accuracy a 97% accuracy and been rolled out to over 50 companies. (Zhou, 2017).

As per Baldwin, Brown and Trinkle (2007) the concept of AI technology is not new to audit and assurance services. The expansion of research into expert system and other AI applications for accounting task, taxation, management accounting, financial accounting and analysis began in the 1980s. However, it’s limited to rule based expert system e.g. IRD, NZ personal tax calculator, online mortgage repayment calculator, determine eligibility of the applicants for welfare benefits etc. Rule based expert system can only handle the structural information but non rule based expert system is able to handle the non-structural information as well.

The area of accounting, auditing and taxation has lagged behind in adoption of AI due to the range of decision structure and involvement of non-structural information. However, non rule based expert system/neural network is getting momentum since last couple of years due to availability of resources in the field of technology. These developing technologies can serve as motivators of automation as well as change of accounting and auditing methodology. With the effective implementation of cognitive technologies, the audit process will become smarter, more insightful, and more efficient. This is the future of the audit profession, and the users of financial statements deserve it (Issa et al., 2017).

With the introduction of this system managers will be relying less on the accountants and auditors to have the timely information. On a click or by a giving a simple command, managers will be able to have the required information e.g. to have the sale turnover figures for different products based on tertiary, AI just be requiring a verbal command, a reminder letter to the aging account receivable could be send by just giving a command etc. Like that there are countless functions that can be implemented by a verbal command. It could prove superior to human in concluding any information.

Blockchain

Blockchain technology was conceived and initiated by Nakamoto Satoshi in 2008. Originally it was designed to transact the digital currency and recording of the transactions between two or more parties efficiently, without the approval of centralized agency and in a verifiable and permanent way (Wikipedia, 2018). Most of us have the misconception when we think about Blockchain, the only idea comes to mind is the bitcoin because originally it was invented for Bitcoin (Dai & Vasarhelyi, 2017). Blockchain is the mechanism that is behind the execution of bitcoin and other crypto currencies. Blockchain enables to generate an accounting information system that chronologically records validated transactions (Dai, 2017)

Peter (2016) has identified the following four principles of blockchain mechanism.

- Distributed: Blockchain is decentralized, and all participants in the network has a copy of same records.

- Public: The participants are hidden i.e. a participants may not know other participant by face but everyone can see all transactions by involved participants.

- Time-stamped: Each transaction and block is time stamped.

- Persistent: Blockchain transactions can’t catch fire, be misplaced or get damaged by water. Even if one participants system is stolen or catches fire the data is not lost.

Distributed ledger has been categorize into public and private. In public distributed ledger mechanism every party in the network has the right to read, verify, and update transactions to the chain. In private distributed ledger access can be restricted to certain level. Distributed ledger are having the followings attributes:

- It is a decentralized digital ledger which has collection of records with verifiable integrity. The entries are called block which can be seen by anyone on the network.

- The records are kept over number of stations i.e. each computer in the shared network have its own copy of record.

- The validated blocks/record have the time stamp and the trail of previous events.

- In public distributed ledger everyone in the network have the access to record.

- The records/blocks are immutable and indestructible.

- To establish a record each piece of block needs to be verified/validated by the nodes in the network. Once the record is establish it can’t be altered (Kokina, Mancha, Pachamanova, 2017).

- Blockchain is immune to manipulation as each new block of the transaction is linked to the prior block. Any attempt to manipulate the prior transaction necessitate a reprocessing of all subsequent blocks in the chain (Coyne, McMickle, 2017).

It is indestructible and incorruptible ledger that store and share the data in such a way that it’s simultaneously interoperable. Blockchain can make it easier to understand what assets are available in real-time in an entity, along with their values and can provide information on any other commitments that could affect cash flow in the future. Distributed ledger could rule out of the possibility of illegal practices in book keeping and also could help to overcome on illicit structuring of transactions and financial database manipulations. Since the inception lots of new features has been embedded into Blockchain technology e.g. ‘Internet of Things (IoT)’ and ‘Smart Contracts’. Unlike the centralize ledger the data is stored on various locations but rather is dispersed over a network of interconnected computers (Ernst & Young, 2015).

As per Peck (2017), this technology is poised to change nearly every aspect of human lives, from the way we send the money to the way we heat our home and mentioned that during the first half of 2017 alone, over 1 billion dollars was directed to the funding of block chain. Even the largest financial institutions; including J.P.Morgan, Goldman Sachs, and Barclays—joined forces in 2014 to explore how blockchain might increase efficiencies in the banking sector.

Till the advent of Blockchain mechanism all the data (electronic) was stored in a centralized system irrespective whether the machine is in local network/public network/or aligned with cloud computing. In centralized storage of data, control remains with the administrators who frames various policies to grant the access level to view or alter the data. Depending upon the access level whenever a change is made, the master copy gets updated and everyone in the network have the updated copy. There are too many risks and cost involved in protecting the data form natural and deliberate phenomenon e.g. keeping the backup of data, framing and updating security codes to protect it from hackers etc.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Artificial Intelligence"

Artificial Intelligence (AI) is the ability of a machine or computer system to adapt and improvise in new situations, usually demonstrating the ability to solve new problems. The term is also applied to machines that can perform tasks usually requiring human intelligence and thought.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation introduction and no longer wish to have your work published on the UKDiss.com website then please: