Strategies for Affordable Housing in India: 2021 'Shelter for All' Goal

Info: 11419 words (46 pages) Dissertation

Published: 12th Jan 2022

Tagged: HousingInternational Studies

INDEX

Click to expand Index

CHAPTER 1: INTRODUCTION

1.1 BACKGROUND

1.2 OBJECTIVES

1.3 METHODOLOGY

CHAPTER 2:

2.1 GLOBAL CONTEXT OF AFFORDABLE HOUSING

- CANADA

- CHINA

- UNITED KINGDOM (UK)

- UNITED STATES OF AMERICA (USA)

- BRAZIL

- THAILAND

2.2 DEFINITION OF AFFORDABLE HOUSING IN INDIA

CHAPTER 3: THE NEED FOR AFFORDABLE HOUSING

CHAPTER 4: FEATURES OF AFFORDABLE HOUSING

CHAPTER 5: VICIOUS CYCLE OF LOW INCOME HOUSING

CHAPTER 6: GOVERNMENT INITIATIVES TOWARDS AFFORDABLE HOUSING

6.1 NATIONAL URBAN HOUSING AND HABITAT POLICY (NUHHP), 2007

6.2 PRADHAN MANTRI AWAS YOJANA (PMAY)

CHAPTER 7: DATA ANALYSIS

7.1 STATEWISE PROGRESS OF PRADHAN MANTRI AWAS YOJANA (PMAY)

7.2 DEMAND, SUPPLY AND MAJOR AFFORDABLE HOUSING PROJECTS IN VARIOUS CITIES OF INDIA

7.3 PROGRESS OF PRADHAN MANTRI AWAS YOJANA (GRAMIN) – PMAYG

7.4 FACTORS AFFECTING DEMAND OF HOUSING IN URBAN INDIA

CHAPTER 8: HOUSING SUPPLY BY VARIOUS HOUSING SUPPLIERS TO DIFFERENT INCOME GROUPS IN INDIA

CHAPTER 9: CHALLENGES INVOLVED

9.1 ISSUES FACES BY CUSTOMERS

9.2 ISSUES FACED BY REAL ESTATE DEVELOPERS AND PRIVATE INVESTORS

9.3 ISSUES DUE TO POLICY AND REGULATORY CONSTRAINTS

9.4 TECHNICAL ISSUES

CHAPTER 10: HUDCO’s ROLE IN AFFORDABLE HOUSING

CHAPTER 11:

11.1 CONCLUSION

11.2 SUGGESTIONS

CHAPTER 12: REFERENCES

Chapter 1: Introduction

1.1 Background

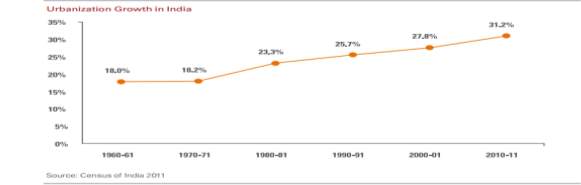

As an emerging market, India saw growth and development and urbanization in recent years. Urbanization in India is not as it should be, but “Indian Census” showed that the city’s population of 27.82 percent have changed in 2001 to 31.16 percent in 2011, while the rural population was 72.18 per cent in 2001 to 68 per cent in 2011, suggesting that urbanization in India rose 3.34% among 2001-11. In addition, it is estimated that until 2031, urban residents in 2011 rise by 59 per cent.

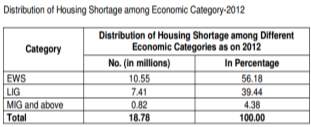

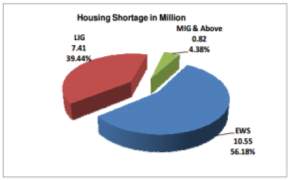

This growing urbanization is difficult to manage at at any time, and it makes difficult for other parameters such as infrastructure, population, pollution, etc. which grows faster than the urban population in India. The biggest problem arising from the problem of urbanization is “housing”. There’s a big gap between supply and demand for real estate in India. According to a report from the 12th 5 year plan (2012-2017), the housing shortage in India is 18.78 million. It is important to meet the needs of economically weaker section and low income group, which now account for 95 per cent of the housing shortage in urban areas in India. While this is too much, there is also a second category of MIG i.e the middle class, that require decent living conditions and has shortage of about 400000 houses. Political and financial restrictions and technical barriers to trade that may be caused by the housing shortage.

Affordable housing with a healthy lifestyle is right for every citizen. Therefore, the Government of India “came” to solve the housing problem, with a different view of “housing” housing for all “by the year 2021. “In India,” the ability to afford houses based on three parameters consisting of: a potential buyer’s monthly household income (in between), the size of the enclosure, and the ability to afford home buyers (the ratio between the price of the House, and the annual income or monthly income report IME).

Moreover, in this paper is a detailed discussion about affordable housing standard in India and in other countries, steps taken by the Government to offer affordable housing to all its citizens, challenges and finally suggested what could be done to complete the goal of “shelter for all” by the year 2021.

1.2 Objectives

- to understand the concept of affordable housing Indian and Abroad

- to discover the Government’s affordable housing initiatives

- to assess progress in PMAY (urban and rural)

- Identify factors that affect the demand for housing in urban areas in India, through regression analysis.

- To identify the challenges involved in providing affordable housing

1.3 Methodology

Qualitative and Quantitative data has been used in this research.

Qualitative data has been mainly used to study the concept of affordable housing in India and abroad, role of stakeholders, government schemes and initiatives towards affordable housing, demand and supply gap, housing shortage, state wise schemes and ongoing affordable housing projects, challenges involved, and HUDCO’s role, etc.

Quantitative data has been many used for the estimation of progress of PMAY (urban and rural), housing shortage, trends of urbanization, population, etc.

Microsoft Excel has been mainly used for the estimation and calculation of trends, changes, percentages, graphs and bar plots etc.

In data analysis, regression is done using EViews to analyze the factors affecting demand of housing in urban India. The dependent variable was incremented home loans and independent variable is interest rate, repo rate, urban population, unemployment, total rented dwellings etc.

Source of quantitative and qualitative research, and uses mentioned above include various publications from the Department of housing and urban poverty reduction (MHUPA), housing and urban development company limited (HUDCO) and Prime Yojana (PMAY) and the National Housing Bank (NHB), KPMG, Jones Lang Lasalle (JLL) and different other articles and research. A detailed list of sources has been included in the reference.

Chapter 2: Global Comparison

2.1 Global Aspect related to affordable housing

Affordable housing refers to homes that are affordable to segments of society, who earn less than the median household income. Different countries identify affordable live differently.

2.1.1 Canada

According to the Canadian Mortgage and housing (Enterprise) community of affordable housing, if one Household spend less than 30 percent of income before taxes on housing. People need of simple housing shouldn’t spend more than 30 percent of their income on housing. Who spend 50% or more on lodging in severe housing need. Affordable housing is a broad term and includes accommodation and from the private sector and the public sector and nonprofit and all forms of occupation (rental and cooperative ownership existed) set available. There is also temporary accommodation.

Ontario

Social housing services Corporation, with an annual budget of $4.500002 million businesses, insurance program offers financial company dedicated to social housing providers, buy wholesale gas and review innovative energy efficient rehabilitation program, energy and expertise and coordinates funding and purchase large amounts of energy-efficient products, education and training, and assessing data. Shask management, advises invest in housing more than $390 million in estimated capital reserve provider.

British Colombia

There was a shift towards affordable housing in the housing market and other applications. The legislation was adopted, to contribute to that home ownership accessible to middle-class families and other measures, to ensure that the work is alive, “the British Colombia, and British Colombia province family building still to increase security of supply.

2.1.2 China

In China, the concept of affordable housing with the housing reform. Under Carter, former central planning provided the rental rate set by the Government and the business units to the kind of care, not a commodity.

And looked affordable housing important reform introduced in China during this period, as a means of subsidized housing. But under a temporary status in China, official means housing affordable Gallery, as well as the purposes and means of development, and no change in the last two decades.

Affordable housing program (often called “economic and comfortable housing program) intended for the affordable housing property to medium or low-income families to encourage. In 1998, the Ministry of construction and Ministry of Finance jointly announced, “urban governance of affordable housing”, marking the start of the program. This program provides for social housing for low-especially households with an average income (annual income less than 30 000, 70 000 Yuan depending on the size of the budget and the special zone), housing (usually 60 to 110 m ²) affordable (usually the market price 50-70 per cent). The advantage for developers to maintain less than 3%, prices of flats at reasonable levels.

Housing Provident Fund (HPF) program the concept of affordable housing, and housing Provident Fund program led China (HPF) in the country in 1995. HPV provides a mechanism for those interested, to save, and finally a building housing (which previously could be public housing unit) contains a linked HPV subsidized retirement account provide mortgages subsidised interest rate reductions in price for purchase of housing.

2.1.3 United Kingdom (UK)

Affordable housing mentioned under the “British Government”‘ Leased and tenanted social identification of eligible households, average needs are not met by the market “. ”

A tradition of social housing in the United Kingdom

United Kingdom has a long tradition of affordable deals Social housing. This can be established by City Councillor housing associations. There are also many affordable housing options, including Have a property (where the tenant portion of rent share in building social and owner owns the rest), and the Government also has tried to make the owners inhabited cheap stocks to buy, mainly from System Planning Department require that housing developers part of low priced housing in new developments, and this approach known as urban planning registration.

The Council includes

The proportion of households in the United Kingdom so far. The Council-owned, but in 1980 the Government conservative Margaret Thatcher introduced the right tariff, provides purchasing tenants Council on home with a discount of up to 60% (70% on rental properties such as flats) buy. In addition to the law to buy the Board of Creative Commonspassed percent rejected more properties in housing and in some cases, may transfer property management tenant’s long distance nonprofit arm. In some areas, a large number of Council houses were demolished, urban renewal programs, because of the poor quality of bearings, lower demand with social problems.

In rural areas, where wages are low, rising house prices (especially in areas where holiday homes), there are special problems.

2.1.4 United States of America (USA)

The United States has identified as; the cost of houses that not more than 30 per cent of total household income should the level of affordable housing . The cost of homes in this definition includes the cost of taxes, insurance and utilities. Beyond thirty to thirty five per cent of total household income, and keep the monthly cost of home housing unaffordable.

“The Government of the United States Federal Government for subsidizing housing more affordable thanks to the owners ‘ financial assistance. The mortgage interest tax deduction for families through housing subsidy programs, and.

The housing can be divided into the “Federal Government” assistance for low income households into three parts:

- Grant “tenant based” as a separate House, in Section 8 program

- ‘Project ‘ grants to the owner, which must be rented to low income families and affordable and

- HLM, are the ones which are usually owned and operated by the Government.

On Department of housing and urban development in the United States(HUD), Department of agriculture Rural development of these programs to manage. Stop hood and rural development programs in the Ministry of agriculture to produce many units since the 1980s. Since 1986 the low-income housing tax credits program was the capital of the Federal Republic of Yugoslavia, to produce affordable housing.

“In the United States, many households in relation to specific amount Achieved their income relative to the area median income for or a friend. Subsidies for housing in the United States, households by federal law and are classified as follows:

- Moderate income households earn between 80% and 120% of Ami.

- Dual low concentration of active ingredient earns between 50% and 80% Ami.

- Earning not more than 50% of AMI.

Some States and some cities in the United States, follow a variety of programs for affordable housing, including supportive housing programs, transitional housing programs and grants for rent within the public funding programs. Regional Governments and adjusts these income limits to accomplish affordable housing programs; however, the program must comply with “us Federal” definitions above.

2.1.5 Brazil

- Minha Casa - Minha Vida Vida, has been developed for housing, and improve the quality of life for low income families across the country. Currently, in low and middle income families more than 9.6 million people in a residential area in the program, urban and rural. Started in 2009 by the Federal Government in Brazil, about 2.2 million homes mcmf built in five years, and he arranged the largest affordable housing project in the nation’s history-the Brazilian Government promised more than 1 million Single-family homes for low income through various programs. Advantages of the deposit to the buyer, and backed by interest rates on mortgage loans and 100 per cent funding, including 25%.

2.1.6 Thailand

Population and housing census 2010 show that home ownership in Thailand 81 percent to the highest in the world. In fact, in 1995-1996, before the economic crisis of 1997 there are no serious housing deficit in the country and the problems faced by increasing production. In the past five decades, Thailand has successfully reduced slum and shanty towns.

Subsidized flats or public housing:

NHA and decency are the two most important government organizations that provide affordable housing for low income groups. Two different approaches were:

The National Housing Authority (NHA)

Founded in 1973, the Government company that promotes affordable homeownership, Thai people. In response to Government policy, the low income groups-and way of buying their own homes, encourage, and NHL began in 2003 to develop supported-housing on the most cost effective BEA program which was originally developed to build 600 000 housing units across the country for five years from 2003 to 2007. House prices was Bt390, 000 with government subsidies from Bt80Units. After 8 years, and have completed NHL 253 164 (67 per cent) in greater Bangkok and 84 713 units (33 per cent) in the provincial areas of housing 168 451

Community organizations Development Institute (CODI)

Founded in 2000, to support its mission and support the financial community assistance organizations and career development, housing development and improving the environment. In 2003, “the Thai Government” CODI Baanhousing as part of its efforts to the housing problems in the country’s poorest residents, who live in the slums. Receiving housing and infrastructure grants programs in government loans since inception Baanmade housing program 76 provinces of the country, with more than 54 000 families about 1,000 communities in 69.

Board of investment (BOI) of Thailand:

Is each control, exceptions (30 per cent), ranging from five to eight years depending on investment incentives, where they will be based. In the past five years (2007-2011), 149, housing projects offered 63 718 total units (on average 12 743 units per year) with built in BOI.

Affordable housing:

According to the latest population and housing census 2010 life 12 percent of Thai households in rental housing, which plays an important role in the capital Bangkok (about 37 per cent of housing). Outstanding loans for rental housing onlyBt14, 666 million ($US489million) increased by an increase of about 34 per cent per year, in 2006 to Bt63, 214 million ($US2-1billion) 2011, on average.

The State Housing Bank:

Government Housing Bank is created in 1953 as a financial institution, versatile, according to Ministry of finance by the end of 2011, total assetsBt712Billion (US23.7billion) and the Bank’s role can be summarized in China for low income home buyers-and priced as follows:

- Lowest mortgage rates.

- Get a larger share of the real estate market.

- The leader in granting loans for 30 years.

- Housing in crisis environments ready.

- And focuses on more affordable loans the lowest income groups.

- Cheap loans to buyers of home.

- Zero-percent loans for first-time buyers.

- Low cost rental apartment building loan.

2.2 Indian Aspect of Affordable Housing

The “Confedrationof Real Estate Developers’ Associations of India (CREDAI)”, provides a much broader definition for affordable housing: Affordable housing is provided for usually three sections of society: the economically weaker, lower income and middle income segment.

- EWS can afford homes of area 30 square meters with income less than INR 3, 00000 per year

- 3, 00001-6, 00000 per year income people fall in LIG. They can afford dwellings upto 60 square meters.

- 6, 00001- 12,00000 rupees per year income people fall in MIG-1 band, with affordable apartments upto 90 square metres.

- INR 12, 00001, 18,00000 per year people fall into MIG-II band and can get accommodations of carpet area upto 110 square meters.

The other parameter is used to define affordable housing in India is the possibility of getting home. To buy a home, all the 3 above mentioned band shouldn’t spend more than thirty to forty percent of their income as EMI.

In addition, affordable housing definition is not limited to above entered three bands.

instead, it applies to people across the country.

| SIZE | EMI OR RENT | |

| EWS |

Maximum of 30 square meters carpet area |

Not exceeding 30- 40% of gross monthly income of buyer |

| LIG |

Maximum of 60 square meterscarpet area |

|

| MIG 1 |

Maximum of 90 square meters carpet area |

|

| MIG 2 |

Maximum of 110 square meters carpet area |

Chapter 3: The need for housing in India

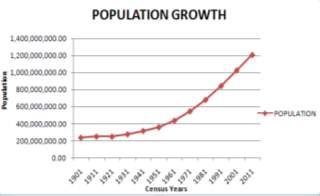

3.1 the rapid increase in population

According to the census in the year 2011, the population of India, 1210.2 million homes inhabitants more than the combination of these six countries including Pakistan, United States, Indonesia , Bangladesh, Japan & Brazil at 1214.3 million . The population of India 2001-2011 raised by 181 million.

Source: World Bank

3.2 growth of urbanization

With the rapid increase in population, farming country, disguised employment relationships, seasonal and limited capacity, there is a bulky growth of urbanization which should be the result of migration from the countryside to the cities. After liberalization the economic sector has seen growth of rural youth employment. With the anticipated rapid industrialization is the trend to migrate from rural to urban areas may never stop.

India’s urban population increased by an annual growth rate of 2.8 per cent over the course of 2001-2011, led to an increase in the rate of improvement from 27.8% to 31.2% compared to 2001-2011. 377 million people of the population of Indian cities 1.21 billion. Association of Chambers of Commerce of India estimates that the country’s urban by the year 2050, a net increase of 900 million people. In addition, 2012-2050 expected, the pace of urbanization is rising at an annual rate of 2.1 per cent-twice as China.

3.3 Iminent housing crisis

Increasing concentration of population in urban areas have caused problems of shortage of land and housing deficit and a busy crossing, also called for the existing basic amenities such as water and electricity and the open spaces of the cities and towns.

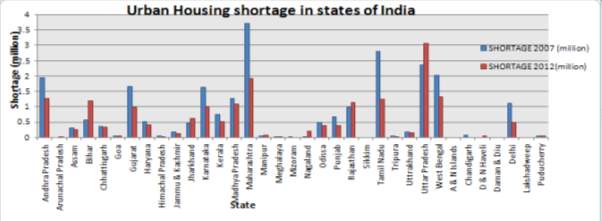

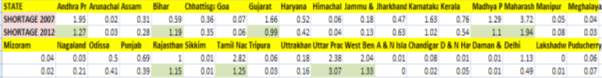

According to the year 2011 housing census, total apartments available was 78.48 million for urban households, 78.86 million. Combined with rising prices of homes, led people to live more and more in the slums and shanty towns. According to estimates by the technical group constituted by the Ministry of housing and urban poverty alleviation revealed that the housing shortage in urban areas of the country is 24.71 million for 66.3 million families.

The Group estimates that more than 88% of this lack of economically weaker section homes and 11% applies to low income groups.

Note: 76 per cent of housing shortage is accounted by these ten states.

Chapter 4: Features of affordable housing

1 Basic Amenities

Well-built home in adequate sanitation for planned development, security, confidentiality, playgrounds for children, and supplies of water and electricity is an important statement of intent value for clients and their current living standards are likely to be affected. It fulfils the the main requirements of social infrastructure such as schools and hospitals.

2 The size of the House

Population increases, the pressure on the country. Affordable housing in India was a significant shift in the past decade. It should match the set standards and size of houses given by national building regulations and architects. In addition, the use of appropriate devices and construction method is encouraged.

3 Household Cost

Customer in search of affordable housing will expect maximum return from its investment. Low income has difficulty obtaining a loan. Therefore, the affordable House should be feasible combination of cost of purchase and maintenance, and should be based on the concept of sustainability.

4 Location of House

Is one of the main features of affordable housing, AH should be within a 20-kilometre radius of the workplace with a decent connection to transit centers.In the case of affordable housing, industrial node buttons can serve as a hub for business. Affordable housing, a compromise between the cost of the country, and transport costs in the following job Center, which generally increases as the distance from the city center. Measurement of affordability addresses the affordability of housing from the perspective of the total cost.

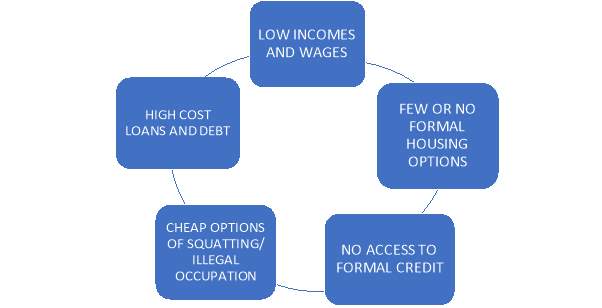

Chapter 5: A vicious circle of low income housing

Chapter 6: Government’s Affordable housing initiatives

“The Government of India recognized the need, and DD-SS gap in urban homes and came out with affordable housing projects. Therefore, the Government announced an ambitious project. It aims to provide housing for all by the year 2020. ” Initiatives to this end, which were taken by the “Government of India”, are discussed in the following:

6.1 National Urban Housing and Habitat Policy, 2007

It was urban housing and Habitat policy national 2007 (we award 2007), taking into account the socio-economic development parameter in urban areas with more demand for housing and related infrastructure. This policy aims to encourage different types of public-private partnerships to achieve the goal of providing housing for all, with particular emphasis on the urban poor.

That program objectives:

- Facilitate access to land and housing service with an emphasis on economically vulnerable and low income groups.

- The General Assembly of the country, development and getting rid of the private sector, publicly funded;

- Is a strong partnership between the public and private sectors and the cooperative for accelerating growth in the region and promote sustainable development of Habitat;

- Acceleration of the rate of development for housing and related infrastructure;

- Establishment of decent housing, whether on the basis of rental and ownership with a focus on economically weaker populations through appropriate capital or interest rate subsidies;

- Technology in the housing industry to update and improve the quality, productivity and energy and cost savings.

And identified by MHUPA, managing to put long term guidelines and applicable in the NUHHP 2017 to make changes lately and taking direct agenda of the Government of India “housing for all” in 2022. We present several components includes revised policy under different chapters according to the current position of the Indian Government. “These include shelters, development of social rental housing affordable housing.

Housing for all by the year 2022

Habitat and urban living State policy (we present), 2007 put on affordable homes for all the goals as an essential element. The Government has in 2022 aimed at achieving it through one of the initiatives to promote housing in urban areas.

6.2 Pradhan Mantri Awas Yojana - PMAY

It was created by the Indian Government, aimed at housing for the poor in rural areas is a major program of social welfare program. India should grow within 10 years, 34 per cent of slum growth, reaching 18 million homes in the slums. Therefore, the lack of housing total index provided in the Mission is to reach a height of 20 million houses.

The goal: Implemented in 2015-2022 and the overall objective of the program is an update of the financial support to the weaker sections of society, or build a House of decent quality of their personal lives. The Government vision is to replace all temporary houses in Indian villages until the year 2017.

6.2.1 Components of PMAY

Reform in the land of existing slum dwellers with private sector participation

An important part of the rehabilitation of slums “on situ” is to give homes to eligible people through the participation of the private sector is a mission of Pradhan Mantri Awas Yojana -housing for all (urban area). This approach has the potential to finish all slums, using customized transmission to the urban village. The slums, whether on public land for Central Government /ULB/private land has to restore houses in situ for everyone in the slums.

Credit Linked Subsidy Scheme

CLSS is a program under which interest rate subsidy is provided to eligible customers through the Central Government, who meets the criteria of the Scheme.

- Loans for purchase/construction of real estate in some cities, covered by MHUPA.

- Atleast one owner is a woman.

- Household income of the applicant, is not higher than 600 000 rupees per annum for EWS segment, INR 1200000 annually for MIG1 and INR 1800,000 rupees for MIG2

- Applicants without any other homes in any other part of the country can apply for the subsidy.

Affordable Housing in Partnership (AHP)

The third element of the affordable housing is partnership mission. The supply side will provide financial support for the mission. Environmental management systems to provide homes with different partnerships of UTS/States/cities, agencies, in partnership with the private sector, including industry, affordable housing can plan projects aimed at increasing the availability of housing for EWS class at affordable prices. Encourages partnerships between different cities/States/uts and provides financial support of INR150 000 rupee/ House. Affordable housing project can be a mixture of houses for different categories but can take place right, only if at least 35 per cent of homes in the project are for EWS section.

Subsidy for beneficiary-led individual house construction/enhancement

Within the Urban Local Body (ULB) recipient individual House leadership Pradhan Mantri Awas Yojana (urban) is the central support, provided to all eligible families in the category of EWS by the State Government/UTTo build new homes or improve existing houses that have coverage that recipients are unable to make use of the other components of the mission. The central support 150 000 rupee per house EWS under the item UBL from the Mission. It covers Kachhaa homes in the slums, which didn’t renew within an item under ULB. Urban local bodies (ULB) is required in order to ensure ownership of the land to prepare the economic situation of the recipient’s eligibility and individual housing project in integrated city.

CHAPTER 7: DATA ANALYSIS

7.1 STATEWISE PROGRESS OF PRADHAN MANTRI AWAS YOJANA (PMAY)

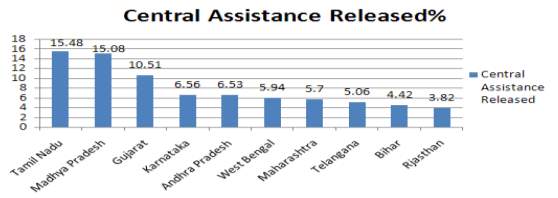

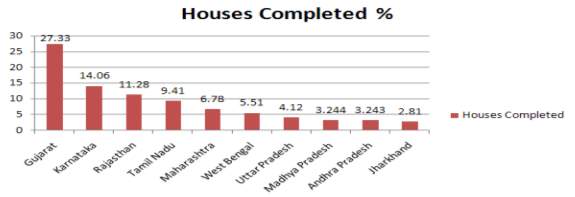

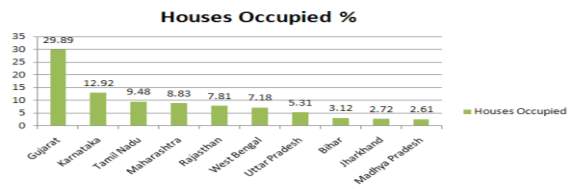

The following observations can be drawn for the status of PMAY (Urban):

| CENTRAL ASSISTANCE RELEASED | NUMBER OF HOUSES COMPLETED | HOUSES OCCUPIED | |

| MAXIMUM | Tamil Nadu15.48% | Gujarat27.33% | Gujarat29.89% |

| MINIMUM |

Sikkim 0.0002% |

Arunachal Pradesh, Sikkim 0.0009% | Arunachal Pradesh, Sikkim 0.0012% |

7.2 DEMAND, SUPPLY AND MAJOR AFFORDABLE HOUSING PROJECTS IN VARIOUS CITIES OF INDIA

City-wise DD-SS (2016-20) Source: Economic Times

- From the above plot, it can be seen that the maximum cumulative demand-supply gap is in the city of Delhi-NCR of 747 thousand houses.

- From the above plot, it can be seen that the minimum cumulative demand-supply gap is in the city of Pune with 82 thousand houses.

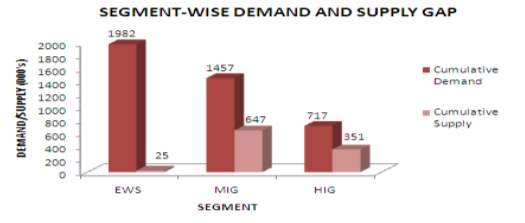

Segment-wise DD-SS (2016-20)

Source: Economic Times

- From the above plot, it can be seen that the maximum segment-wise cumulative demand-supply gap is for EWS segment of 1957 thousand houses.

- From the above plot, it can be seen that the minimum segment-wise cumulative demand-supply gap is for HIG segment of 366 thousand houses.

The Scenario of Affordable Housing Program (homes priced less than INR 10 Lakhs) in Indian Cities:

| CITIES | LIG

Gap 000’s |

MIG

Gap 000’s |

HIG Gap 000’s | No. Of housing schemes | LOCATION | MAJOR DEVELOPERS |

| AHMEDABAD | 128 | 57 | 10 | 15 | New Maninagar |

Santosh Associates, Foliage, Galaxy Developer, Dharmadev Builders, DBS Affordable Home, Shree Ram Developers |

| 15 | Narol | |||||

| 20 | Vatwa | |||||

| 30 | Kathwada | |||||

| MUMBAI | 281 | 308 | -6 | 65 |

Ambivali |

Tata Housing, HDIL, S Raheja, Matheran Realty, Haware Builders, Neptune Group, Poddar Developers, Usha Breco Realty, Nirman Group, Sriram Properties, Karjat Land Developers, Panvelkar Group, Recharge Homes |

| 80 | Karjat | |||||

| 100 | Palghar | |||||

| 110 | Boisar | |||||

| PUNE | 140 | -63 | 5 | 30 | Uralikanchan | Trishul Builders, Dreams Group, Vastushodh |

| 45 | Yavat | |||||

| DELHI-NCR | 462 | 194 | 91 | 75 | Bhiwadi |

Ashray Homes, Surefin Builders, Avalon Group, Arun Dev Builders, Ajnara Group, Samridhi Group, Migsun Group,Aditya Group, Gaursons India Ltd |

| 100 | Bawal | |||||

| Noida, NH24, Yamuna Expressway | ||||||

| KOLKATA | 214 | 39 | 17 | 20 |

Sonarpur |

BGA Realtors, Magnolia Infrastructure, Pushpak Infrastructure, Shapoorji Pallonji |

| 25 | Barasat | |||||

| CHENNAI | 221 | 66 | 59 | 25 |

Nanmangalam |

VBHC, TVS Housing, Marg Constructions, Annai Builders |

| 45 | Oragadam | |||||

| 95 | Cheyur ECR | |||||

| BANGALORE | – | 90 | 111 | 30 | Anekal Road | VBHC, Janaadhar |

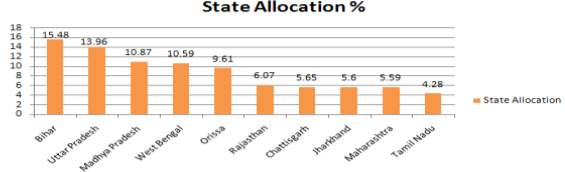

7.3 PROGRESS OF PRADHAN MANTRI AWAS YOJANA (GRAMIN) – PMAYG

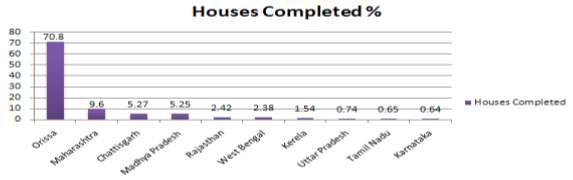

- In 2016-17, most of the funds 15.48% were allocated to the state of Bihar.

- In 2016-17, most of the houses 70.80% were completed in Orissa.

7.4 FACTORS AFFECTING DEMAND OF HOUSING IN URBAN INDIA

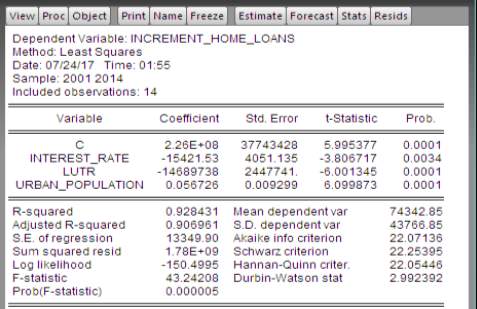

THE EMPERICAL MODEL

A time series regression analysis is used to examine the various factors which influences the demand of housing in urban India. A qualitative analysis has also been done for the factors which are equally important in affecting the housing demand in urban India, but cannot be expressed quantitatively. The time period used for the regression analysis is between 2001-2014.The dependent variable used in this analysis is the increment in home loans, which is obtained by taking the difference of housing loans disbursed for each present year and its preceeding year. The independent variable used in the model includes; interest rate, repo rate, urban population, unemployment rate, urban total rented dwellings and inflation. The major sources of data includes; census publications of 2001 and 2011, World Bank, State Bank of India, Reserve Bank of India and Ministry of Urban Developmet etc.

The model can be expressed as:

Y= 226286076.4 – 15421.5 X1 – 14689738 X2 + 0.056726 X3

Where, Y = Increment home loans, X1= Interest rate, X2= Log of Total Urban Rented Dwellings and X3= Urban Population

The model can be interpreted as:

With every 1 unit decrease in Interest rate, the increment in home loans raised by 15421.5 units. Which means, when interest rate went down people demanded more home loans, increasing the demand of housing in urban India. Therefore, there is an inverse relationship between housing loans and interest rate.

With every 1 unit decrease in Urban Rented Dwellings, the incremented home loans raised by 14689738units. As the demand of home loans increases, people start to migrate and shift from rented dwellings to their own homes, reducing the occupancy in rented dwellings. Therefore, there is an inverse relationship between rented dwellings and home loans.

With every unit increase in Urban Population, the incremented home loans raised by 0.0567726units. With the rise in urbanization, and growing urban population, people put more pressure on fewer resources. The overcrowded cities, slums and unhygienic conditions with lack of services, increase their demand of home ownership with access to basic facilities and a decent lifestyle. Therefore, gives a positive relationship between demand of home loans and urban population.

Also, the results shows that Durbin-Watson Statistic is 2.99>2, hence there is no autocorrelation among the residuals in the model. The value of the adjusted R2 is 0.90 or 90%; therefore, we can say that 90% of the total variation is explained by this model, which is quite good. The Probability of F statistic is 0.0005%

All the individual p-values are significant (

The best model should have the following characteristics:

- R2should be high

- No serial correlation in the residual

- No hetroscedasticity in the residuals

- Residuals are normally distributed

To check if our regression model possess these characteristics, following assumptions are made:

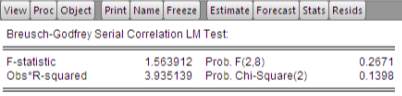

Null Hypothesis: Residuals are not serially correlated.

Alternate Hypothesis: Residuals are serially correlated.

To check the validity of the above hypothesis, Breusch-Godfrey Serial Correlation LM Test was run in EViews and following results were obtained:

The result shows that Probability Chi-Square statistic is 13.98% > 5%, therefore we fail to reject the null hypothesis and accept that, residuals are not serially correlated.

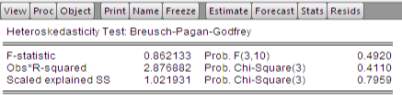

Null Hypothesis: Residuals are not hetroscedastic, that is, they are homoscedastic.

Alternate Hypothesis: Residuals are hetroscedastic.

To check the validity of the above hypothesis, Breusch-Pagan-Godfrey Test was run in EViews and following results were obtained:

The result shows that Probability Chi-Square statistic is 41.10% > 5%, therefore we fail to reject the null hypothesis and accept that, residuals are not hetroscedastic.

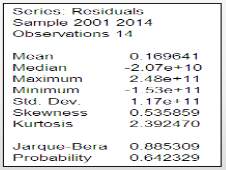

Null Hypothesis: Residuals are normally distributed.

Alternate Hypothesis: Residuals are not normally distributed.

To check the validity of the above hypothesis, Jarque-Bera Normality Test was run in EViews and following results were obtained:

The result shows that Probability statistic is 64.23% > 5%, therefore we fail to reject the null hypothesis and accept that, residuals are normally distributed.

Since our model fulfills all four conditions of a best model, we can say that this regression model is a best one.

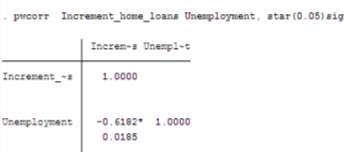

Also, in the above multiple regression model unemployment was showing insignificant relationship, due to presence of many variables. Therefore, a correlation test was done between Unemployment rate and Incremented home loans, using Stata with 5% significance level and following results were obtained.

The results, shows that at 5% significance level, the relationship between unemployment and home loans is significant. There is a perfect negative relationship of 61.82% between incremented home loans and unemployment. It means, as unemployment decreases and employment increases in the economy, there is an increase in saving and investment level of the people, which may create multiplier effect in the economy. Also, employment increases credit worthiness of people and improves their ability to repay. Thus, with the reduction in unemployment, people increase their demand of home loans to live comfortably in their own homes.

CHAPTER 8: HOUSING SUPPLY BY VARIOUS HOUSING SUPPLIERS TO DIFFERENT INCOME GROUPS IN INDIA

| INCOME GROUP | HOUSEHOLD INCOME (PER YEAR) (Rs.) | AFFORDABLE HOUSE PRICE | SUPPLIERS |

| HIG AND ABOVE | More than Rs.18,00,001 | More than 40 Lakhs | Real Estate Developers |

| MIG 2 | Rs.12,00,001- Rs.18,00,000 | 20 Lakhs | PMAY, Housing Boards and Development Authorities, Real Estate Developers |

| MIG 1 | Rs.6,00,001- Rs.12,00,000 | 8 Lakhs | PMAY, Housing Boards and Development Authorities, Real Estate Developers working on affordable housing. |

| LIG | Rs. 3,00,001- Rs.6,00,000 | 6 Lakhs | PMAY, Housing Boards and Development Authorities, Real Estate Developers working on affordable housing |

| EWS | Less than Rs. 3,00,000 | Less than 4 Lakhs | PMAY |

Source: PMAY, CLSS guidelines 2017

CHAPTER 9: Challenges Involved

India is seen, as a big emerging economies with accelerated urbanization. According to the figures in Indian census, in the year 2001 popultion was approximately 72 per cent of the population who lives in rural areas and 28 per cent in urban areas. These figures have changed by 31 per cent to 69 per cent of the rural and urban population in 2011. In fact, according to the population census in 2011 for the first time since India’s independence, the absolute increase in population in cities than in rural areas more.

An estimated 600 million homes in 2031, India has massive urban growth of 59 per cent in 2011. Thus, it brings pressure on existing infrastructure, which must remain at least in line with the growing demand, if it doesn’t stand in the foreground. The current deficit in housing in India amounted to 19 million units, which is expected to double to 38 million units by the year 2030 in the absence of any meaningful intervention.

95% of this deficit is from the EWS & LIG segments, and technically is a stunning 18 million units in this category (almost). While this number is huge, it’s also an important part of the upper end of the “weaker” and lower to medium income group, we say as emerging middle class, they’re deprived of decent living conditions. The deficit in this category is approximately 400,000 units, which, if not addressed, will ruin the proliferation of planned urbanization and result in unsustainable conditions and and will worsen even more. Statistics show that more than 80% of this category are acccomodating in crowded homes.

Lack of housing options available along with low incomes and minimum access to mortgage. Millions of Indian families are currently living in confined areas, poorly constructed houses/neighborhoods/residential barracks, with no access to a clean and healthy environment, with zero access to basic amenities such as sanitation, drinking water and, waste and electricity often absent. “Housing” should be a permanent sign of urbanization by default and not by choice.

9.1 customer issues

Connectivity: Affordable housing is really important for development. but the lack of affordable apartments and adequate dimensions in urban villages has led slow internal development of affordable housing in marginal urban areas. this is often challenging for customers to get affordable housing, and requires physical access to workspaces, develop effective mass rapid transit systems is the solution to make the transition easier and reduce travel times.

Lack of loans to lower income group: As it offers rare resources because of non-performing assets sense of danger for Housing Finance Corporation (HFC) huge demand after loans up to RS 300000 to 10, 00000 rupees, and that because they are not organizing 65-70% population under the current loan between square brackets in the area as it is, and the lack of official documentation and processing, income paid is deemed risky profile HFCs. Although marketed to monitor included, 300 000 rupees to 10 finance market, an amount roughly equal to rupee 220 00000 billion, the fact is that HFCs does not explicitly give credit to people with low income part because of the high risk area.

Financial literacy: In EWS there is no heavy and formal wage and other relevant documents for the identification to show to finance ompanies. They face difficulties financing credit to get the formal housing. funding and training in financial management is the need of the hour by the finance companies.

Cost of ownership: Lack of affordable land and various forms of taxes and fees such as VAT and service tax, stamp duties, etc costs between 30 and 35 per cent of household costs, increasing operating costs. in addition, the lack of opportunities for affordable land in the the city, makes it hard to make important decision by customers for affordable housing and getting their first House.

9.2 problems real estate developers and private investors

Private investors is still far from affordable housing, citing the thin edge. Enterprise Developer. They agree only to projects that are financially viable. They avoid all social duty or national mission project, that gives them a relatively low profit margins.

Lack of available land: The Government lacks in fulfilling land shortages, and pulled the trigger on the increase in land prices in India and had raised huge demand by high population in urban areas. The shortage of land in urban areas makes it not viable for affordable housing developers, hence through better planning and monitoring, and the effective use of land this can be solved.

Switch to approve several municipalities: Estimates show that real estate developers should be subject to the approval of the 150 tables in about 40 central departments and State Governments and municipal corporations. can add delays in project approval 25 to 30 per cent cost. coordination between the authorities and approvals in time for the developers of these real estate projects to stimulate more expected.

The high cost of building: While the price of land is already high, the projects costs or luxuriate property construction costs are even higher, which plays an important role in affordable housing projects.

Lack of skilled labor: Half the population of 1.2 billion is less than 25 years, industry estimates a quarter of graduates are able to work and about 80 per cent of job seekers for employment are with of non-degree. Therefore, India is suffering from a shortage of labor.

Limited possibilities for financing developers: High cost and low demand, along with funding challenges make it difficult for developers and banks to fund real estate. High cost of funding for such developers, leave no Bank (such as) and private equity (PE) as the sole source of funding, the prohibition of low prices.

Reviewing tax and laws and regulations: Bend real estate transactions in India has been the subject of debate and litigation represented the Government of the Union, national Governments and local authorities direct taxes on developers, and there is also a growing need for regulations like rent control act review, which are dissuasive effect in the development of apartment buildings and renovating old properties surfaces.

9.3 Questions because of the political and regulatory framework

Long approval process: Development in the lengthy approval procedures projects Indian cities, which then must be subject to delays in projects, an increase in the construction costs incurred by the buyer or user to allow India to develop 177 of 183 countries for the management of the building shows the developer challenge India in real estate development.

A wave of regulations and directives: There are some policies that interfere with real estate development, putting space systems and rules for the word index (FSI) and urban planning and urban development plans of local bodies (aulb) and municipal administrations (ODUs was) in India. planning becomes difficult construction projects such as the purchase of land, land with long-term vision and regulations sometimes take you radically starts executing it.

Follow the laws outdated: Some ancient laws such as rent control laws affect fabric city, deteriorated housing, particularly in Bombay. disrupts the rehabilitation of areas with aging old properties and congestion, increase not. therefore, you must set a limit and plan such acts, and to enact new laws to win affordable housing developers, and rapid growth in the program.

9.4 technical questions:

Lack of marketable parcels: She has vast tracts of land in urban areas, State authorities or public bodies such as railways and harbors belong negotiable land on the non-proliferation of slums and shanty towns since the authorities are often not in a position to monitor their operations on a regular basis.

Calibration to the questions and lack of information: India lacks a strong system to protect land rights-corruption and lack of transparency in times of transaction information to a search term and the high costs involved in buying land.

Chapter 10: The role of the affordable housing HUDCO

HUDCO was implemented as a financial institution for sectoral development (Development Fund for Iraq) in 1970 for the financial needs of the housing sector, especially for low income Department and weakest economically. HUDCO’s mandate was there, this group with loan under the maximum interest rates and longer repayment terms.

In 2015/16 67% of the housing stock of social housing, and housing needs of excellent early warning uses classes and 79 per cent of total payments for housing for excellent early warning systems and partitions. The family of her ear, 457 000 housing units affordable, early warning systems wolns boat classes.

Affordable housing in the private sector:Corresponding to special projects and proposals Builder accepted and appropriate and approved by the Ministry of housing and urban poverty to “affordable housing partnership (AHP). These projects are assessed in detail in accordance with the guidelines for action for affordable housing, and some distractions project proposal of measuring lines but if policies must appreciate worth HUDCO taking funding approval to the Council.

Credit-related support program (stack):(I)corresponding to Isrelease lower the interest rate on the second part concerning money issued by MU/Hiba “the Government of India,” according to the chart, after receiving information on the loan from the party of the second part of the eligible borrower/beneficiaries paid, raising the amount of the grant, the second part of HUDCO directly

Central nodal agency (African National Congress):

1 HUDCO junction Central Agency (the ANC) is working on a memorandum of understanding with 40 banks banking/(INP).

2 There are public banks 2, 40 banks 6 private banks and banks 15 weraivaiznbankn 17 way Grameen.

3 A total of 60 recipients of loan amount of donation received and paid 37027000 rupees and 8413000 rupees.

4 2-3 days of treatment/payment HUDCO to meet all requirements.

Urban housing: HUDCO and encourages the development of serviced land and part of the loans that give the general public for the building itself. these apartments/houses/public or sell plots by making available, according to the actual need.

In urban housing, expanded HUDCO yet help to support 5 677 000 housing units. HUDCO is an important factor in housing in the latter almost four decades emerged. On housing for distinct layers of society, and in the context of HUDCO, and there was a great importance. Soft financing terms for housing excellent early warning systems and include lower interest rate compared to other income of living communities, a broader measure of the cost of the House as a loan and the longest extension.

Rural housing: Financial support for all provincial government agency as a Council housing, rural housing Council, and local governments, Pris, Taluka Town Development Board, etc, with the provincial government to the company that these plans are set with financial support, HUDCO.

The following types of HUDCO funded projects in rural areas.

- Rural living patterns of early warning systems for the destitute.

- Early warning systems and patterns of rural housing scheme of Earth village class Abadie, including repairs.

Slum upgrading: Loan under these plans are given boards of housing, slum clearance Board, development, improving confidence and local authorities to help the urban poor to raise efficiency and improve the slums, but also housing in inner cities, mostly inhabited by lower income groups.

For the acquisition of land: That complement the efforts of housing organizations to encourage the housing activities in the country, provides financial support for the purchase of land corresponding to ordinary housing as commissions and authorities, and development loans. preferred proposals to control the economically benefit more low lying areas and groups in low income urban areas and mainly used in countries where projects are funded land acquired HUDCO.

Jawaharlal Nehru national urban renewal Mission (gnorm): The Ministry’s technical arm HUDCO HOBA. Moba HUDCO title, plays an important part in the following activities:

Evaluation: HUDCO one of rating agencies to Governments to match India’s Government directives “,” guidelines for review of the sentence “gnorm management” because/aihsdb project evaluation framework.

Capacity building program: since talented era begin, HUDCO organize at State/regional/national capacity-building programs by focusing on drafting reports detailed design and preparation of project management implementation of besob & aihsdb.

Monitoring:monitoring agency has been named HUDCO central monitoring application because (since November/December 2010)/aihsdb projects.

Rajiv Awas Yojana (Ray):

Evaluation: HUDCO began to expand its services such as assessment and other forms of technical assistance, and provide to the Agency, allowing him an important role in keeping with social mission to provide housing for low income and disadvantaged population.

Chapter 11: Conclusion and suggestions

11.1 CONCLUSION

In India, there is a rapid increase in population, and it is estimated by a new UN study of global population trends that India will overtake China to become the world’s most populous nation by 2022. With a growing population, over 2012-2050, the pace of urbanization is likely to increase at a CAGR of 2.1 percent – double than that of China. The increase in population and urbanization puts a high demand-supply pressure on housing shelter, leading to the problem of land shortage, apartment shortfall, congested transport facilities and severely challenges the existing basic services like water, electricty, and parks of the towns and cities, mostly for the EWS, LIG & MIG section of the society. As per the studies by the “Ministry of Rural Development and the Ministry of Housing and Urban Poverty Alleviation (MHUPA)”, it was revealed that approx. 1/4 of Indian families lack proper housing facility.

To solve these problems and fill the gap between housing demand and supply, Affordable housing is a widely used term these days. Affordable housing is based on income and is given to three segments of society: The EWS, LIG and MIG. It allows the facility of basic services like electric supply sanitation, schools, and hospitals etc. With this, it provides the facility of low Early monthly installments of 30%-40% of individual’s income and location within twenty km radius of workplace and decent availability to public transit systems.

To fulfill this mission of AH, the govt. has to evaluate various existing policies and laws promoting better coordination & integration between housing providers, examine the locally available building materials and construction technologies, give power to ULB, compulsories a slow down in project gestation period, bring forth rational utilization of fees and taxes, revaluate development proposals, empower EWS and LIG household. The govt. also introduced various initiatives like National Urban Housing and Housing Policy, 2007 and Pradhan Mantri Awas Yojana which was implemented by Modi back in 2015, with a goal of “Housing for All” by 2022. Within the PMAY, it is aimed to construct two crore houses for the EWS/LIG segment in urban India by 2022.

PMAY program targetted to construct 3 lakh houses per year, however even after almost 2 years, the total number of houses created in India under this scheme are only 1,02,676 which is much lesser than the aimed target. Other than this, the policy also does not try to resolve the property rights problem that is one of the primary reasons for poor conditions of the existing slums.

AH has attractive returns like government. funds can be spent on the needy, transformation of financial conditions, as EMI requires savings, rent control and reduction, improves living quality by giving provision to better sanitation, water supply, hospital, education, parks, etc. AH has alternative to slums and reduces unemployment, increment in GDP and develops a multiplier effect in the whole economy.

Different stakeholders involved in construction of affordable houses include government, financial institutions as well as real estate developers.

However, there are various issues in the development of affordable housing, which includes policy level barriers, financial constraints and technical issues, which is the need of an hour and should be solved as soon as possible for the smooth and quick progress of affordable housing policy in India. Unless these problems are addressed, affordable housing would be far from the reach of the urban poor.

11.2 SUGGESTIONS

There are a lot of opportunities to support affordable housing in India. Not only are the poor and real estate are willing to promote this market, policymakers have also realized the need for affordable housing, for India to solve its urban infrastructure issues. Opportunities are many to take use of, and the market is not properly developed, providing sufficient chances for players to play..

Based on this study, following are the suggestions which can be considered for the effective implementation of affordable housing scheme in India:

According to the study, possible proposals for the effective implementation of the affordable housing program in India are listed here:

It’s urgent to solve, various issues related to affordable housing to encourage the involvement of the developer.

It’s an excellent opportunity to introduce new technologies to build fast and affordable.

And also a chance to introduce technologies and ecological materials.

Page feed, motivated by politics (index extra space and free sales regions, and so on), and slum rehabilitation and rehabilitation plans, and ensure sufficient availability of land, the rationalization of the country and covered include residential areas of plan (CDP), encouraging private sector participation, partnership and removing the only window for small enterprises as major township enterprises.

In addition, with regard to subsidies, despite continuing subsidies to lower-income segments aligned advisable, cheap loans to developers of low-income housing finance companies would be an advantage (HFCs).

Affordable housing calls for cooperation and concerted efforts by all stakeholders. Must also be to provide better training for customers, increase transparency and improve communication. Associations, business organizations and international development professionals together on a regular basis in the market, and the dissemination of information and your observations of the industry and the general public to observe.

Under my land in litigation and dispute and ownership should betried, the problem of property rights one of the main reasons for the poor conditionsin the slums.

Necessary to understand the questions that subjective/quality/basic programs by analyzing the complexity rule associated with reasonable prices. Examine problems in the context of the holistic programs complicate the problem not only quantitative, but also qualitative data.

It creates a need to better understand the underlying problems at the root of the problem of affordable housing programs.

No doubt the Indian Government “has started in the right direction, to make housing a reality. The magnitude of the problem requires radical thinking though the efforts of the Government to the private sector and cheap eco system to give basicimpulses for the development of affordable housing in this country. According tosome countries, adequate support from Government policy is very important. In addition, the role of other actors such as micro-credit agencies, Governments, financiers and end-users is also important. Not onlyfocus on profits, adopting innovative business models social mentality and private developers to provide affordablehousing.

Affordable housing, everyone in India is still a dream, and is far from reality, but always an integrated and holistic approach by the person concerned would help the country develop, and making housing a reality.

CHAPTER 16: REFERENCES

Ministry of Housing and Urban Poverty Alleviation (MHUPA)

Housing and Urban Development Corporation Limited (HUDCO)

National Buildings Organisation (NBO)

Prime Minister Awas Yojana (PMAY)

Economic Times

Jones Lang LaSalle report on affordable housing, 2012

KPMG report on Urban Housing Shortage in India

SPA report on Role of Real Estate Developers in Affordable Housing and Climate Change

Development Alternatives Newsletter

Delhi government shelter report

Policy note by housing and urban development department, Chennai, 2016-17

Maharashtra State New Housing Policy & Action Plan, 2015 by Government of Maharashtra

Housing and Urban Planning Department, Uttar Pradesh

Bharati Hollikeri Presentation on Andhra Pradesh

Department of Urban Development & Department of Local Self Government Housing, Rajasthan, 2015

CREDAI, West Bengal

Affordable housing: Policy and practice in India by Kalpana Gopalan, IIMB Bangalore

IBEF report on Affordable Housing in India, 2012

Housing and Development Board, Singapore

Good Governance and Provision of affordable Housing in DKI Jakrata, Indonesia, by Danang Widoyogo

The City Fix’s blog, “Six features that make Brazil’s affordable housing program good for people and environment”

Asia-Pacific Housing Journal, “Affordable Housing in Thailand”

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "International Studies"

International Studies relates to the studying of economics, politics, culture, and other aspects of life on an international scale. International Studies allows you to develop an understanding of international relations and gives you an insight into global issues.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: