Impact of Capital Restructuring on Business Performance

Info: 7494 words (30 pages) Dissertation

Published: 6th Sep 2021

Tagged: BusinessBusiness Strategy

Contents

Chapter 1 – Introduction and Background Study

A. Capital restructuring through demergers:

B. Capital restructuring through share repurchase / buyback

C. Capital restructuring through debt reduction

2.1 What is capital restructuring?

2.2 When does the need for capital restructuring arise?

2.3 What are the forms of capital restructuring?

2.4 How is financial restructuring success measured?

2.5 What are the common pitfalls to avoid?

2.6 Past restructuring stories

Chapter 3 – Research Methodology

Need for study – Statement of Problem

Chapter 4 – Analysis and Interpretation

Data Analysis and Interpretation

Debt- Restructuring Case Analysis:

Debt-equity restructuring: Data:

Capital Restructuring: An overall summary:

Chapter 1 – Introduction and Background Study

Introduction

Markets and economies today are dynamic. Companies today are challenged with ever changing external realities to sustain and grow and truly enhance shareholder value in the longer term. As many economies move from periods of high growth to moderate / sustained growth (read China, India); Companies are increasing required to relook their capital structure from a high debt scenario to a sustained balance between debt and equity to maximize shareholder value.

Companies enter various phases in their life cycle – from high growth periods, to periods of stability and the need to sustain certain level of operations and periods of economic hardship.

Capital restructuring is a tool that more and more companies are adopting to course correct a downward trajectory of declining returns. The course essence being to enhance shareholder value.

Capital restructuring takes various forms and can be applied based on the needs of the Company and the phase in which it finds itself.

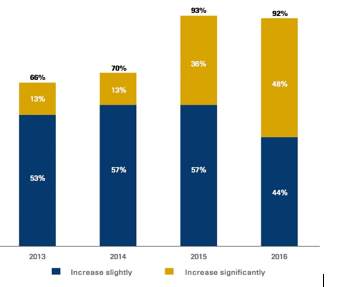

The rise in uncertainty and dynamic business environment has resulted in increase in capital restructuring cases in the recent years. As seen in the graph below capital restructuring is on rise.

(Graph source: http://www.consultancy.uk/news/)

According to the business dictionary: Altering or changing the capital structure of a company in response to the changing business conditions, or as a way to subsidize the company’s development arranges. (Dictionary, n.d.).

The need for a capital restructuring may arise because any of the following:

- Expanding the business

- Cost reduction

- Enhancing shareholder value

- Improving the debt-equity ratio

- Overcoming adverse financial difficulties

Capital restructuring essentially refers to redesigning the capital structure of the Company. The core objective to bear in mind – the activity should result in enhancing shareholder value.

Scope of the study

The scope of our study is:

- To understand the capital restructuring process

- Analyse and present the past success and failure stories in enhancing shareholder value

- Explaining the common pitfalls of the process and advice on how corporate management needs to avoid them.

Objective of the study

By the end of this study, the reader should:

- Understand the capital restructuring process

- Understand the forms of restructuring: Common techniques applied

- Be able to articulate the past success and failure stories

- Be able to avoid common pitfalls

- Draw inferences and conclude on the impact of restructuring on business performance

Research issue under study

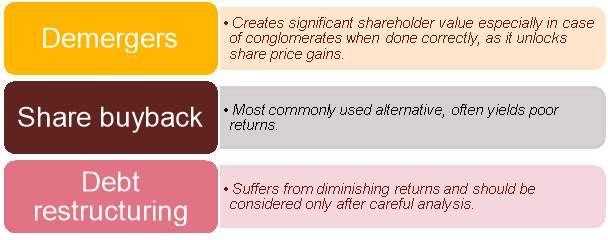

Capital restructuring takes various forms, in our study we have brought out three major alternatives that have been employed by various companies with varying degrees of success:

A. Capital restructuring through demergers:

Creates significant shareholder value especially in case of conglomerates when done correctly, as it unlock share price gains. The activity is also knows as spin-off. It is particularly beneficial when negative synergies exist or diseconomies of scale exist in a company / conglomerate (It also manages to bring more focus to separate business and allows them to benchmark themselves against relevant industries.

B. Capital restructuring through share repurchase / buyback

Most commonly used alternative, often yields poor returns.

A company usually uses a share repurchase route when it has surplus cash. Surplus cash is applied for buying back its own shares and thus reducing the total number of outstanding shares, which consequently results in a higher earnings per share (EPS). A share repurchase may also help avert a hostile takeover bid.

C. Capital restructuring through debt reduction

Suffers from diminishing returns and should be considered only after careful analysis.

A debt restructuring is especially suitable when a Company suffers from cash flow problems or struggles to service interest payments / debt repayments. Debt restructuring is relatively less expensive than a bankruptcy protection. It helps enhance cash flows available to shareholders, improves the debt-equity ratio and brings down the interest cost.

Chapter 2 – Literature Review

2.1 What is capital restructuring?

Business Dictionary defines capital restructuring as “Altering the capital structure of a firm; in reaction to the changed business conditions, or as a means to fund the firm’s growth plans”.

H. Kent Baker and Halil Kiymaz in their book on ‘The Art of Capital Restructuring: Creating shareholder value through Mergers and Acquisitions’ define restructuring as “an act of partially dismantling or otherwise reorganizing a Company for the purpose of making it more profitable”. The book broadly categories restructuring in to forms – physical restructuring and capital restructuring – which refers to alteration in the capital structure. (H Kent Baker, 2011) (https://www.bookdepository.com/Art-Capital-Restructuring/9780470569511).

In the paper on the ‘Study of implication of corporate restructuring’ by Dr. Bernadette D’silva and Mrs. Annie Beena Joseph have described the process of corporate restructuring as redesigning the Company. The authors point out that corporate restructuring is applied based on needs of an organization and it invariably differs in each case. Organizations apply restructuring in the form of mergers, acquisitions as well as demergers, while some companies use it to carry out structural changes in the origination to attain resource optimization. (Joseph, 2013)

(http://pjitm.com/Doc/issu%20jan%20june%202013/Sanchayan%20Vol%202(1)%20paper%204.pdf)

Seattle, Washington based consulting firm – Revitalization partners – explains us that restructuring capital can make the business more appealing to the prospective stakeholders. The reason for the above statement is because financial restructuring usually: Decreases expenses, improves operational efficiency, raises the EPS of the business and provide a base for much better overall operational results. A primary method of organizing the capital can be share repurchase. The business can do share repurchase only when it is got extra money.

Share repurchase can present many advantages to the company. It can offer tax benefits to the shareholders, it can be an effective way to make acquisitions less attractive to potential but undesirable purchaser. Share repurchase can also be pursued as a negative step. It can send out signals in the market that the companies do not have any lucrative business as repurchase reduces the liquid cash. Also, if capital restructuring is not done effectively it can also lead to bankruptcy. Capital repurchase is done in three ways according to revitalization partners, they are: a) Capital restructuring through repurchase tender offer, b) capital restructuring through open markets, c) capital restructuring through privately negotiated repurchases. (Revitalizationpartners, n.d.).

Esupportkpo a consulting and secretarial compliance firm in Mumbai published a learning page on “Corporate Restructuring, Mergers & Acquisition”. In the publication, the authors describes capital restructuring as ‘a process of redesigning one or more aspects of the Company’ (http://www.esupportkpo.com/images/Learning%20Pages%20-%20Articles%20-%20Corporate%20Restructuring.pdf).

2.2 When does the need for capital restructuring arise?

Companies enter various phases in their life cycle – from periods of high growth, to periods of stability which require Companies to sustain certain level of operations; and to periods of economic hardship.

Revitalization partners explains – The need for capital restructuring arises when the company investigates business expansion, asset divestitures and change in corporate control, debt modifications and alterations in the ownership structure. (Revitalizationpartners, n.d.) (http://revitalizationpartners.com/capital-restructuring/capitalrestructuring-three-most-common-techniques).

Esupportkpo explains – that the Company must have a strong and clear understanding of the underlying objective of corporate restructuring. The authors describes various situations in which a restructuring may be necessary such as – expansion of business, cost reduction, tax benefits of merging companies, improving debt-equity ratio, etc.

In the paper on the ‘Study of implication of corporate restructuring’ by Dr. Bernadette D’silva and Mrs. Annie Beena Joseph have described the process of corporate restructuring as redesigning the Company. The authors point out that corporate restructuring is applied based on needs of an organization and it invariably differs in each case. Organizations apply restructuring in the form of mergers, acquisitions as well as demergers, while some companies use it to carry out structural changes in the origination to attain resource optimization. (Joseph, 2013)

(http://pjitm.com/Doc/issu%20jan%20june%202013/Sanchayan%20Vol%202(1)%20paper%204.pdf)

2.3 What are the forms of capital restructuring?

Capital restructuring takes several forms, in our study we have tried to three major three major alternatives that have been employed by various companies with varying degrees of success:

- Demergers

- Share buyback’s

- Debt reduction resulting in better debt-equity multiples

A Study of Different Modes of Corporate Restructuring by Rakesh Kumar Sharma, the author has described various restructuring methods such as sell-offs, equity carve outs, spin-offs and tracking stocks. Sell-off: The study describes a sell-off as an outright sale of a Company’s subsidiary. Sell-off are done because the subsidiary doesn’t form part of the parent’s strategy. Sell-offs are used to generate cash which is then used in the core businesses and to pay off debt.

Equity carve-out: To unlock value, the parent offers stock of a subsidiary in an IPO. It is usually done when one of the subsidiaries is growing faster than the rest. However, the parent would retain the majority holding in the subsidiary and also effectively its control over the subsidiary, through common board members etc., in order to push through the parent’s board business strategy. The activity also enhances the shareholder value of the parent.

Carve-outs however if not handled well may result in to conflict between the parent and subsidiary, as the subsidiary now also has responsibility towards its public shareholders.

Spin-offs: Spin-offs usually occur when a subsidiary requires separate management focus and is usually no longer dependent on the parent. In such cases, the shares of the subsidiary are issued to the parent’s shareholders as stock dividend. Post which the subsidiary becomes a separate legal entity with independent Board and management team. These transactions are generally rare.

Tracking stock: In cases where companies have two or more separate business, out of which one business represents a fast-growing business, the Company might issue a tracking stock. The stock allows the fast-growing business to be valued separately and will result in a higher valuation for the Company overall.

A tracking stock is preferred to a spin-off or a sell-off as this allows the management to have control over the business unit as well as use benefits of synergies and common functions with other business units.

Usually, these stocks are described as class B stocks and do not carry the same weightage as the main stock nor are the voting rights equivalent to the main stock (Sharma 2003) (http://www.indianmba.com/faculty_column/fc699/fc699.html).

Dr. Bernadette D’silva and Mrs. Annie Beena Joseph in their paper – ‘Study of implication of corporate restructuring’ argue that organizations apply restructuring in the form of mergers, acquisitions as well as demergers, while some companies use it to carry out structural changes in the origination to attain resource optimization. (Joseph, 2013).

(http://pjitm.com/Doc/issu%20jan%20june%202013/Sanchayan%20Vol%202(1)%20paper%204.pdf).

Robbins and Pearce (1992) suggest that as the seriousness of financial decline enhances, restructuring options move away from cost reduction to asset reduction.

Slatter (1984) argues that aggressive reduction of cost and assets is difficult due to the resistance to take such action.

Jongsoon Shin in his paper restructuring and its macro effects explains that it is not necessary that a restructuring will have a positive effect on restructuring. A weak balance sheet of a company can have a negative effect on the corporate’s investments. He states that debt overhang has a negative effect and explaining this he finds the impact of debt hanger on the investment to capital ratio proxied by debt to equity interest coverage ratio. Further he goes on explaining the approach that must be followed in corporate restructuring. He says that financial restructuring is taken place to enhance the value of the firm and to increase the competitiveness of the firm in the market. Restructuring can take place at the whole economy level or at the industry level or at the firm level. He explains the different types of restructuring can be operational, investment and financial. (Shin, 2017)

(file:///C:/Users/Shivani%20Pandey/Downloads/wp1717.pdf).

2.4 How is financial restructuring success measured?

- Economic value added (EVA)

- Surplus generated from operating activities over and above cost of capital

- Francisco J. López Lubián. (Lubian, 2014) argues that economic value added (EVA) is a better indicator of business performance compared to the return on investment (ROI)

- Increase in ROI is not necessarily good for shareholders, whereas increase EVA is always positive for shareholder value

(http://www.forbesindia.com/article/ie/corpo-rate-restructuring-fivecommon-pitfalls/39003/1).

- Economic profitability is a better measure than accounting profitability

- Economic profitability is measured through internal rate of return (IRR) of the free cash flows

- Francisco J. López Lubián argues that IRR is a superior measure to return on equity (ROE), since IRR measures the free cash flows generated for the shareholders (Lubian, 2014) (http://www.forbesindia.com/article/ie/corpo-rate-restructuring-fivecommon-pitfalls/39003/1).

2.5 What are the common pitfalls to avoid?

Francisco J. López Lubián (2007) asserts that while corporate restructuring implies financial changes, it is not just about refinancing or altering the terms and conditions of the debt, it is important to understand the underlying causes of the liquidity problem. A successful corporate restructuring is an arduous task and takes up a great deal of senior management’s time.

The study identifies and elaborates the common pitfalls:

- Restructuring does mean financial changes but that is not all, there are other aspects related to it like asset management, improving the scope of firm and capital structure.

- Economic profitability that is measured by the internal rate of return of FCF to shareholder must be chosen over accounting profitability that is measured with return on equity.

- Preparation is an essential before starting a negotiation. The managers should be prepared as to what guarantee the company can offer, how the refinancing is going to be distributed, what are the conditions and the limits that the guarantees are subjected to.

- There has to be consistent plan to improve the company’s liquidity, financial planning has to be consistent, debt negotiation and restructuring should not be equated, etc.

- The final advice is one should not get lost in the process of the complex legal, technical and tax complexities (Lubian, 2014) (http://www.forbesindia.com/article/ie/corpo-rate-restructuring-five-commonpitfalls/39003/1).

2.6 Past restructuring stories

Case of Reliance Industries

Deepika Dhingra and Nishi Aggarwal are trying explain us through their paper the diverse issues that are associated with corporate restructuring. They then go on and explain the general framework that are related to the framework of corporate restructuring and reformation. The authors also analyze how corporate restructuring can be used as a tool of competitive advantage. All this is then finally depicted by referring to the Reliance Industries Limited (RIL). The main reasons that are required for restructuring in India are: Execute strict MRTP arrangements and new government approach of relicensing, fierce rivalry is another key component for offering ascend to corporate restructuring and all round asset advancement in dynamic organizations to revamp working benefit and to remain fit in rivalry. Lot of companies in India undergo financial restructuring so that they can create value for the shareholders. There are some more companies that undergo financial restructuring because they have tall wealth investments and get affected by global depression. The reason that corporates are reorganising their capital and retiring debts for reducing the interest commitments. Reliance Industries Limited (RIL) restructuring through acquisition, merger, demerger, diversification and strategy to combine the finances of the company with the subsidiary really enhanced the value of the shareholders (Aggrawal, 2014) (http://www.ripublication.com/gjfm-spl/gjfmv6n9_02.pdf).

Various Cases

Arvind Mills Case

The paper has tried to analyze the success of a corporate restructuring program based on a case study approach. In the paper, the authors have described the case of Arvind Mills, a leading textile Company in India, which went through restructuring exercise.

Facts of the case –

- Arvind Mills invested in a massive expansion of its denim facility in the 1990’s, although other producers were diversifying away from denim fabrics due to slowdown in demand. Arvind Mills had funded this expansion through significant debt on its books.

- The Company ran into deep financial trouble and was unable to service its debt and interest burden.

- Eventually it reported a loss in the year 2000 as against profits up to 1999.

Recognizing the failure of its expansion, the Company went into a debt restructuring activity in Feb 2001. By mid-2001 the Company got approval for debt restructuring from majority of its lenders with several banks taking deep discounts on principal and interest, and in some cases banks agreed to 5 to 10 year’s rollover period for interest. The restructuring reduced the Company’s interest burden by 50%. The Company also became the first Indian company to restructure its entire debt in one go. Post the restructuring, the Company returned to profits in the year 2002 with a net profit of Rs 10 crores in the first quarter of 2002, representing a return to profits after 3 years. (Joseph, 19 2013)

(http://pjitm.com/Doc/issu%20jan%20june%202013/Sanchayan%20Vol%202(1)%20paper%204.pdf).

Essar Case Study

Article published in the Caravan magazine ‘The Financial Situation of the Essar Conglomerate’ by Krishn Kaushik and article published in Business Standard “Debt restructuring: Ruia stake in Essar Steel to fall to 40%” by Dev Chatterjee & Abhijit Lele

Essar Steel is a privately held enterprise of the Ruia family in India. The entity has accumulated debt of up to Rs 40,000 crores and has entered in to dent restructuring negotiations with the lenders.

Post the restructuring, the stake of the Ruia’s in the Company would come down to 40%. State Bank of India, would take over 34% of the shareholding by converting part of its debts into equity. While Ruia’s will sell 26% of the Company to private equity investor Farallon Capital for Rs. 1,700 crores.

In the article written by Krishn Kaushik, the author investigated the nature of influence the Ruai’s exercised with support of politicians, bureaucrats and media. The author was quoted by a senior financial analyst that the Ruia’s had a deep understanding of how the Indian banking system worked and the attitude of the Ruias’ in general, which he described as “upside is theirs, downside is the banks”.

The restructuring represents a significant win for the banker who have for long been pushing for one. Currently the bankers are working on a restructuring plan and the cut they intend to take on their exposures. Also, the lender is drawing up a corporate governance mechanism for increasing their control over the Company. The conversion to equity gives a significant say to the bankers in any future of the Company.

For the banks, it also means that they could potentially remove it from the NPA in the future which would be a significant boost to their balance sheets.

This equity sale comes on the back of another major sale which the Ruia’s made – sale of 98% stake in Essar Oil to Rosneft, Russia for USD 13 bn which helped reduce debt by more than half. (Kaushik, 2016).

(http://www.caravanmagazine.in/vantage/finances-essar).

Chapter 3 – Research Methodology

Aim

Research paper on Capital restructuring and its impact on business performance.

Objective

- To get a holistic view of the capital restructuring process

- Understand the commonly applied techniques for restructuring

- Review past success and failure stories and understand the drivers for success and failure

- To understand the common pitfalls in the process

- Finally, to draw inferences from past case studies and conclude on the impact of restructuring on business performance.

Need for study – Statement of Problem

Existing strategic management literature focusses on organization restructuring and / or dwells only on certain aspects of financial restructuring without providing a more holistic view. As economies move from period of high growth / boom period to more sustained periods of growth, present day managements are constantly required to innovate and reevaluate business models to ensure greater focus and maximize shareholder value.

Hence, there is a need for a paper that elaborates the three major forms of financial capital restructuring namely – share repurchase, demergers and debt reduction. The study further goes on to evaluate the success rate of these restructuring measures by evaluating past success and failure cases, drawing inferences from these case studies and highlighting things that were done correctly and those that were not. Additionally, the study also talks about the common pitfalls in the restructuring process and provides advice on how to avoid such pitfalls.

Another important aspect that we will try and cover is measuring the real value gain to shareholder post the capital restructuring process. There is a need for outcome to be measured quantitatively, in order to make to evaluate and conclude, whether capital restructuring resulted in any tangible gains to the shareholders.

Techniques for measuring the outcome of capital restructuring process on business performance:

Economic value added (EVA)

Economic value added (EVA) is defined as any excess generated from operating activities over and above the cost of capital.

Economic value added (EVA) is a better indicator of business performance compared to the return on investment (ROI).

He argued that ROI is not always practical and understandable – an increase in ROI is not always good for the shareholders, while an increase in EVA is always good for the shareholders. Debt- equity restructuring is done to increase profitability and to improve or restore liquidity. Hence ROCE is a relevant measure as stated by revitalization partners(2013).

Economic profitability / Internal Rate of Return

Economic profitability is measured through internal rate of return (IRR) of the free cash flows.

Francisco J. López Lubián argued that IRR is a superior measure to return on equity (ROE), since IRR measures the free cash flows generated for the shareholders.

Research Methodology

(Figure 1)

The whole research can be divided into four major stages namely Background Studies, Data Collection, Analysis and Conclusion. Background studies include literature survey relating to capital restructuring in in general, major forms of restructuring and studies relating to measuring the success of capital restructuring. The literature review will provide the foundation for the research wherein gaps will be identified.

The next stage is data collection which will include sources such as annual report of Companies before and after restructuring, stock market information and other published data.

The Analysis stage will include analysis of the collated data during the previous stage with focus on measurement of success determinants. This stage will conclude with the inferences drawn from the analysis.

In the final stage, based on inferences drawn from the previous stage, we will highlight things that were done correctly and those that were not and the common pitfalls in the restructuring process and provides advice on how to avoid such pitfalls.

Hypothesis

H1 – Capital restructuring in the form of demerger will result in greater value creation for shareholders

H2 – Capital restructuring in the form of demerger will not result in greater value creation for shareholders

H3 – Capital restructuring in the form of debt reduction will result in greater value creation for shareholders

H4 – Capital restructuring in the form of debt reduction will not result in greater value creation for shareholders

H5 – Capital restructuring in the form of share buyback will result in greater value creation for shareholders

H6 – Capital restructuring in the form of share buyback will not result in greater value creation for shareholders

After reviewing the literature, we have identified 2 cases each of companies having employed capital restructuring through demerger, debt reduction and share repurchase of successful as well as unsuccessful companies.

Data Collection Approach

Secondary sources have been used for data collection by gathering financial information of sample companies before and after restructuring. The data sources which were used for data collection are as follows:

• Company financial statements from public domain

• Stock market information from Reuters

• Other published statistical date: Newspaper articles, books on restructuring/

Sample Selection

The present study includes the three major techniques of capital restructuring commonly employed by companies. While selecting sample companies for our study, the following points were considered:

- Only those companies have been considered which were publicly listed prior to going into the restructuring exercise, so that we have necessary data available in the public domain to analyse the effects of restructuring on shareholder value creation.

The final sample size for the study comprises of 6 companies across the three commonly used techniques for capital restructuring as shown in the table below:

| Share repurchase / buyback | Demergers | Debt reduction |

| GlaxoSmithKline | Dabur India | Titan Industries |

| Bajaj Auto | Bajaj Auto | Nirma |

(Figure 2: Selected Case Studies)

Data Analysis Technique

The following steps will be followed in conducting the research:

- Reading of the cases in order to identify the companies having undergone restructuring and strategies used for enhancing shareholder value.

- Choosing sample companies in each major category of restructuring (refer Figure 2: Selected Case Studies above).

- The analytical framework of the study will include two major components

Economic value added (EVA) – It is the measure of a Company’s financial performance. It represents the excess of operating profits of the Company over and above its Cost of Capital.

EVA = Net Operating Profit after Taxes (NOPAT) – Invested Capital * Weighted Average Cost of Capital (WACC)

Return on capital employed (ROCE) – It measures the Company’s profitability and the efficiency with which the capital is employed.

ROCE = Earnings before Interest and Tax (EBIT) / Capital Employed

Market share price of the Company pre and post restructuring

The analysis is expected to provide insight on the impact of capital restructuring on shareholder wealth. The analysis will be done for each company separately and then be compared with companies adopting similar form of restructuring in order draw inferences on success or failure of such restructuring.

Limitations of the study

Restructuring takes several forms, however in our study we have covered only the three major or commonly used techniques of capital restructuring viz. Demergers, debt reduction and share repurchase / buyback.

Also considering the paucity of time to analyze, we have considered instances of only two companies under each form of restructuring to demonstrate the effect of capital restructuring on shareholder value creation.

Chapter 4 – Analysis and Interpretation

Data Analysis and Interpretation

Demerger Case Analysis

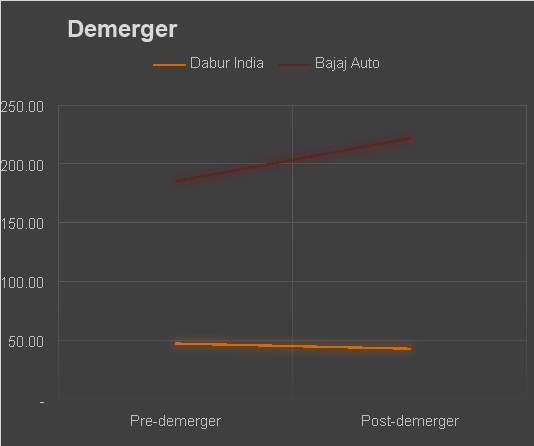

On 17th May 2007 the board of directors of Bajaj Auto Limited approved a scheme of demerger of the automobile and financial services ltd. The automobile sector of Bajaj was its core competency hence they thought that the demerger will allow Bajaj Auto limited to concentrate and raise more capital for its core business. In this scheme of demerger Bajaj Auto limited was to be renamed as Bajaj Holding and Investment Limited and two new subsidiaries were to be formed Bajaj Auto Limited and Bajaj Finserv Limited The automobiles business was transferred to Bajaj Auto whereas the consumer finance and insurance businesses and wind power project business was transferred to Bajaj Finserv. The existing shareholders of the Company were issued one share each of the new Bajaj Autoand Bajaj Finserv for each share held in the erstwhile Bajaj Auto.

For the purpose of the analysis, we have compared with EVA pre and post merger and drawn inferences therefrom.

| Bajaj Auto, erstwhile Company | Bajaj Auto, new | Bajaj Finserve | Bajaj Holding | EVA Total | |

| EVA | 140.17 | 478.98 | -132.50 | -165.63 | 180.85 |

In January 2003, Dabur India Limited announced its plans to demerge the pharmaceuticals business into a separate company called Dabur Pharma Limited, to being greater focus to individual businesses Post the demerger, Dabur India would focus on its core businesses such as healthcare, ayurvedic specialties and personal care, whereas Dabur Pharma would focus on its pharma competencies – oncology formulations and drugs. For the purpose of the analysis, we have compared with EVA pre-and post-merger and drawn inferences therefrom

| Dabur India, erstwhile Company | Dabur India, new | Dabur Pharma | EVA Total | |

| EVA | 49.08 | 53.33 | -9.29 | 44.04 |

Demerger: Effectiveness

In case of Bajaj Auto, the total EVA post-demerger was much higher than the pre-merger EVA of the single company, which meant significant shareholder value unlocking. The higher EVA was mainly caused due to the significant value unlocking in the Auto business. Auto business’s EVA much more than the pre-merger composite EVA of the single entity Bajaj Finserv and Bajaj Holding reported negative EVA clearly indicating poor utilization of capital. Overall, the demerger of Bajaj Auto was value accretive to the shareholders.

In case of Dabur India, negative synergies existed between the two businesses, hence the total EVA post-demerger was lesser than the pre-merger composite EVA.Lower total EVA was caused by the pharma business – which indicated that capital was poorly applied in the pharma business (a more capital intensive business), whereas the FMCG business did manage to unlock shareholder value. To conclude, the demerger of Dabur India, was not value accretive to the shareholders.

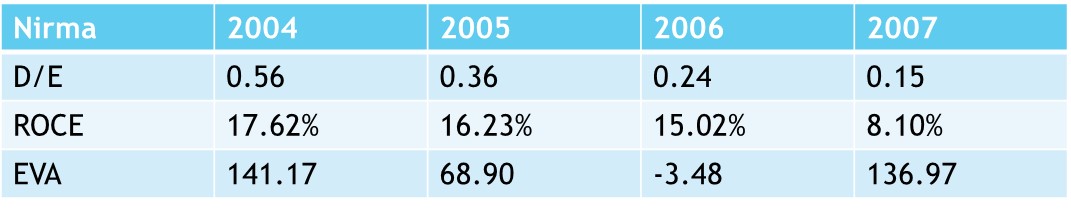

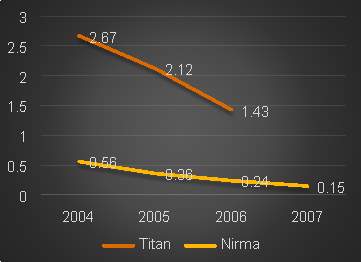

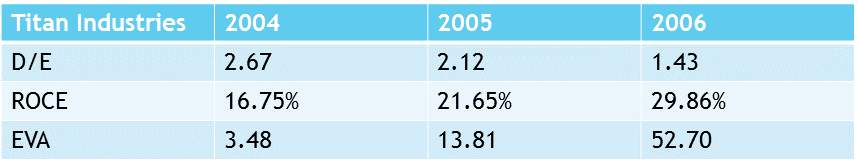

Debt - Restructuring Case Analysis

In the year, 2004, Titan Industries and Nirma adopted debt restructuring with the intention of reducing debt and enhancing shareholder value.Inferences drawn from the relating between debt-equity ratio and ROCE of the two companies: It can be observed that debt restructuring is generally beneficial to companies with very high debt equity ratio.As Titan effectively reduced its debt ratio from 2.67 to 1.43, it can be observed that the corresponding ROCE increased from 16.75% to 29.86% – a direct result of reducing financing cost.On the other hand, while Nirma reduced its already low debt-equity ratio from 0.56 to 0.15, its ROCE eroded from 17.62% to 8.10%, which was not beneficial to the Company due to operational inefficiencies and increased tax burdens.

Hence reducing debt through cash surpluses is not always beneficial to the Company.Management’s target to materialize positive effects of debt restructuring over a short to medium term period and hence a three to four-year period for the analysis is considered reasonable.

Debt-equity movement

ROCE:

Debt-equity restructuring: Data

Management’s target to materialize positive effects of debt restructuring over a short to medium term period and hence a three to four-year period for the analysis is considered reasonable.

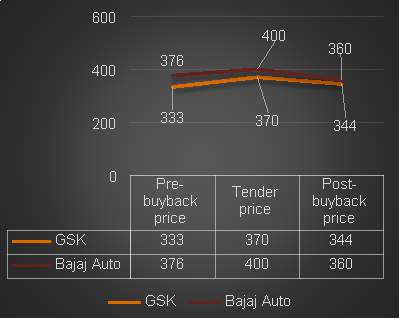

Share Buy Back Case Analysis

In the year 2000, Bajaj Auto announced buyback of shares of over Rs. 720 crores at a tender price of Rs 400, the prevailing market price at that time was only Rs 376 per share and represented a premium more than 6%. The core purpose of the buyback as stated by the management was to provide a good exit to investors looking to do, while at the same time protecting the interest of the existing shareholders. However, the post buyback share price of the Company was Rs. 360, which was even lower than the pre-buyback price indicating shareholder wealth erosion and a negative overall return. The overall rate of return was a negative 2.7%.

Similarly, in 2004, GSK announced a share repurchase at an offer price of Rs 370 per share. At that time the traded share price of the stock was Rs 333 per share and represented a premium in excess of 11%. The Board approved the over Rs 120 crores buyback on the stated objective of maximizing shareholder wealth. The post buyback share price of the Company was Rs 344 per share, although much below the tender price, was still higher than its pre-buyback price of Rs 333 per share. The overall rate of return was a positive 3.85%.

Although share buybacks have resulted in shareholder value creation and safeguarding of existing shareholders. The overall rate of return has been low. In most cases, post-buyback prices have been below the tender price and in some cases even below the pre-buyback price, hence defeating the purpose of significantly expanding shareholder wealth. Resulted in significant outflow of capital from the Company for buying back only a small portion of the issued capital. Represents a poor investment choice and takes away funds from ambitious, path-breaking and high risky projects.

Capital Restructuring: An overall summary

List of References

Francisco J. López Lubián (2014): Corporate restructuring: Five common pitfalls

Rakesh Kumar Sharma: A Study of Different Modes of Corporate Restructuring

Dr. Bernadette D’silva and Mrs. Annie Beena Joseph: A Study On The Implications Of Corporate Restructuring

Capital Restructuring – Three Most Common Techniques by Revitalization partners

Deepika Dhingra and Nishi Aggarwal (2014): Corporate Restructuring in India – A Case Study of Reliance Industries Limited (RIL)

Laura Corb and Timothy Koller (2007): When to break up a conglomerate: An interview with Tyco International’s CFO

Desai, Klock, & Mansi (2011) On the Acquisition of Equity Carve-Outs

Robbins and Pearce (1992): Turnaround: Retrenchment and recovery

Slatter (1984): Corporate recovery: Successful turnaround strategies and their implementation

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Strategy"

Business strategy is a set of guidelines that sets out how a business should operate and how decisions should be made with regards to achieving its goals. A business strategy should help to guide management and employees in their decision making.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: