The Motives and Effects of Mergers and Acquisitions in U.S.

Info: 17839 words (71 pages) Dissertation

Published: 13th Dec 2019

Tagged: BusinessBusiness Law

The Motives and Effects of Mergers and Acquisitions in U.S. Banking Industry: Case Study of JP Morgan Chase & Co. and Bank One Corporation

Abstract

Mergers and acquisitions (M&A) has been a popular trend in different business corporations. This study aims to investigate the motives and effects of taking part in M&A activities, specifically in the U.S. banking sector. For the effects, this study focuses on the firm’s performance, customers, shareholder and employees. All motives and effects will be analyzed and critically discussed with the support of different theories suggested by Trautwein (1990)’s model in the literature review. A case study will be carried out on JP Morgan Chase & Co. (JP Morgan) and Bank One Corporation (Bank One). Comparing the financial performances of pre and post-merger integration could help in understanding the effects of merger activities and the corporate strategies that the firm accomplished. The strategies will then be compared to a merger succession model, assessing the factors that lead to successful integration.

The research is based on the case study, findings are established by ratio analysis, and financial data analysis, and all of the results are then presented in a table format. The study indicated that for a successful consolidation, the pre-merger planning and the post-merger integration process are very crucial. Firms should communicate with their staffs efficiently, guild and support them during the transition phrase. Failed to do so can lead to a high chance of merger failure.

The results also indicate that to a large extend, the motives of the firm is to achieve synergies and monopoly power. However, the effects of such would not always be reflected through accounting ratios, because there are other external forces such as the state of economy and inflationary rate that could affect the consistency of the data. Future study should focus more on using a mixed method to carry out the study, so that it can add more dimensions and insights to the work.

Table of Contents

Abstract…………………………………………………….

Acknowledgement……………………………………………..

Chapter 1

1 Introduction

1.1 Aims and Objectives of Investigation

1.2 Research Topic Justification

1.3 Structure

2 Literature Review on Mergers and Acquisitions

2.1 Definition of M&A

2.1.1 Types of mergers

2.1.2 Horizontal M&A

2.1.3 Vertical M&A

2.1.4 Conglomerate M&A

2.2 M&A in US. Banking Industry

2.2.1 Factors affecting U.S. banking industry

2.3 Motives for M&A

2.3.1 Efficiency Theory

2.3.1.1 Synergy…………………………………………………………………………………………..………….13

2.3.1.1 Other M&A motives associated with synergy…………………………………………14

2.3.1.1a Evidences of synergy in US. Banks…………………………………………………….15

2.2.2 Monopoly theory and market power

2.3- Effects of M&A

2.3.1 Effects on Employees

2.3.2 Effects on Shareholders

2.3.3 Effects on Management and culture compatibility

2.3.4 Effect on Customers

2.3.5 Effects on Firm’s Financial Performance

2.4 Reason for failure

2.5 Strategies leading to merger success

3 Research Purpose

3.1 Research approach

3.2 Data collection

3.2.1 Fundamental Analysis

3.3 Limitations

Ch. 4 Data analysis

4 Introduction

4.1 State of M&A activities in US. banking industry

4.1.1 Regulation influence

4.1.2 Overview of the case study

4.1.3 Corporate strategy

4.2 Financial data analysis

4.3 Effect of the merger

4.3.2 Capital Market ratio

4.3.3 Liquidity Ratio

4.3.4 Leverage Ratio

4.4 Comparing JPMorgan/Bank One merger to factor of succession model

5 Conclusion and findings

6. References…………………………………………………

7 Appendices…………………………………………………

Table of contents- Figures and Tables

Figure 2.1 Trautwein, 1990, model of merger motives…………………………… p.11

Table 2.1 Explaining different types of synergies………………………………..p.12-13

Table 2.2 Summary of findings in Accounting (Bruner, 2002)………………….p.20

Table 2.3 Six Keys to Merger Success…………………………………………………..…..p.22

Table 2.4 Eight Lessons for Merger Success………………………………………..p.22-23

Table 4.1 JP Morgan and Bank One business segment (2003)…………………..p.31

Table 4.2 No. of cards in circulation (million) 2004-2007………………….. .…..p.34

Table 4.3 Expected and actual cost savings ($bn) 2005-2007………….………p.37

Table 4.4 Earning before interest and tax ($mill) 2001-2007……….…………p.38

Table 4.5 No. of branches, ATMs and active online customers…………………p.39

Figure 4.5 Stock price of JP Morgan in 2004……………………………………….…..p.40

Table 4.6 Profitability and Efficiency Ratios………………………………………..….p.41

Table 4.7 JPMorgan earnings per share and P/E ratio (2004-2007)…………p.42

Table 4.8 Liquidity Ratios………………………………………………………………..….…p.43

Table 4.9 Leverage Ratios………………………………………………………………………p.44

Chapter 1

1 Introduction

Since the 1980, there is a large shift to the structure of the U.S. banking industry. The numbers of overall M&A activities has increased significantly and has reached a number of 10,000 consolidations with more than $7 trillion of assets involved. (Adams, 2012) This dissertation is to explore the reasons and motives that caused the vase number of consolidations in the U.S. banking sector, determined the factors which lead to a successful M&A, at the same time the effect that M&A could have on the firm’s performance, employees, customers, and shareholders will be critically evaluated. Later on in this study, a case study of JP Morgan Chase & Co. (JP Morgan) and Bank One Corporation (Bank One) will be constructed in light of explaining and for a better understanding about the motives and effects of carrying out consolidations.

1.1 Aims and Objectives of Investigation

The motives for the merger will be identified and reinforced by theories. Rather than the more common empirical approach used in other M&A studies, this study will focus on the corporate strategies. The strategies that the acquiring firm adopted during the post-integration process will be evaluated and compared to the factors illustrated in the merger succession model suggested by (De Nobel et al., 1988) and (Espein, 2004) in order to investigate whether the consolidation is successful or not. Ratio and financial analysis will be conducted in order to compare the pre and post-merger effects; the initial and actual impacts will be assessed as well, so that there would be clear evidence on the firm’s performance on M&A.

1.2 Research Topic Justification

This research question stems from the interest of the sudden burst of M&A activities in the U.S. banking industry. JP Morgan is one of the most well recognized banks in the U.S. and internationally for decades, it holds up to $ 2 trillion assets which is 13.1% of the whole U.S. banking industry in 2014 (Forbes, 2014). So that, studying the merger case of JP Morgan could help to understand the motives, gains and benefits of taking part in merger events. Since that most of the empirical studies on M&A are related to studying the trends of the U.S banking segment by investigating a large amount of merger cases in one whole study, the specific factors leading to merger success could not be precisely identified and contribution to the future integration process. Studying the case on JP Morgan and Bank One specifically will be useful in showing that through a well-managed merger; the firm itself, shareholders and customers could actually gain values and are beneficial from the integration, as well as the factors that lead to succession. Besides, the case has been highly favorable by the rating agencies after the merger announcement; it is under a high hope for success, therefore, this case is worth studying for the future development and success in M&As.

1.3 Structure

This study will begin with a literature review, combining all the previous researches conducted by different authors related to the U.S. banking industry, providing theories, background information and insights about the topic, followed by the motives and effects of taking part in consolidations. In methodology, the research purpose, approach, methods and limitations will be addressed, including the range of case study, sources and data used. During the case study, the motive, strategies and the effects adopted by JP Morgan will be analyzed and discussed, supporting with theories in the literature review, with findings presented along side. At the end, conclusion will be reflecting upon on the whole study, recommendations for future research and improvements will also be illustrated.

2 Literature Review on Mergers and Acquisitions

The objective of this literature review is to gather different ideas from distinct sources and backgrounds then critically evaluate the materials based on the driving forces that caused M&A activities and the performances of the firm during post-merger integration phrase. This chapter will be mainly divided into two parts, firstly, the motives, followed by the effects. It will initiate with a brief definition and types of M&A, following by the background information related to the U.S. banking industry and factors leading to M&A activities in this specific sector. After that, this chapter will continue on with some theories associated with explaining the motives of taking part in M&A, mainly focus on the efficiency theory and the monopoly theory. Lastly, the effects of M&A on employees; customers, shareholders and culture will be discussed.

2.1 Definition of M&A

There is a broad understanding when it comes to the study of definitions of M&A. Many authors agreed that M&A is a process when two companies merged together. It is believed that through M&A, companies can attain certain strategic and business objectives. According to (Dringoli, 2016), the writer describes M&A as a course that when two or more firms combine together, the firms share their assets and other resources, together working under the same objective to achieve common goals. Guaghan (2005) agrees with the concept, however he pointed out that at the end of the event only one corporation survives. Stated in the studies by (Forster Reed et al., 2007) and (Jagersma, 2005) that M&A is a process, which the buyer of the firm owns the assets and stocks of the acquired firm. Other writers like (Sudarsanam,2010) focus on the significance and the impact of the merger, saying that not only the companies themselves will be affected by the consolidation but many other parties will be involved, such as shareholders, managers, workers and competitors. Most of the studies include both merger and acquisition together, however under accounting terms, the term “merger” and “acquisition” could have very different interpretations.

According to FRS 6,“merger is a rare type of business combination in which two or more parties come together for the mutual sharing of benefits and risks arising from the combined businesses” (FRS 6, 1994). It also define acquisition as “transaction by which an entity seeks to increase the assets under another entity’s control” (FRS 6, 1994)

2.1.1 Types of mergers

There are mainly three types of M&A that could be distinguished, depending on the business activities and functionalities of the acquired company and the acquiring firm; they are Horizontal, Vertical and Conglomerate integrations. (Cartwright & Cooper, 2012).

2.1.2 Horizontal M&A

Dringoli (2016) defines Horizontal merger as two or more companies merge together within the same industry or business operation, aiming to expand its sales capacity and markets. Companies engage in such consolidation will be able to generate economies of scale and have better bargaining power of prices than smaller firms. Therefore, reducing the variable cost per unit during productions as the volume of output increases (Weston et al, 2004). Gaughan (2005) further stated that reducing the cost of production could past benefits to the consumer welfare, since lower production cost could possibility lead to a reduced selling price. Also with a horizontal merger, firms could reduce their competition by increasing their market share, referring as monopoly power (Franck& Meister, 2006).

However larger firms may result in diseconomies of scales since they are more difficult for management to handle. Guaghan (2005) further concludes that mergers could change the market composition of the industry, affecting the level of competition (Gaughan, 2005). Therefore, there is often anti-competition law i.e. antitrust law in the US to regulate market structure.

2.1.3 Vertical M&A

Vertical M&A is merger between firms in different states of production (Pepall et al., 2011). There are two types of Vertical mergers: backwards and forwards integrations. In a backwards-vertical integration, firms can have direct control over the production process by merging with suppliers, enhancing the quality of the products. In forward-vertical integration, firms gain control on the distribution process by merging with retail distributors. Sharan(2011) concludes that transaction costs could be eliminated through making upstream and downstream linkages, resulting in economies of scope. Such integration also helps to put both companies under central control management, ensuring that they work towards common goals.

2.1.4 Conglomerate M&A

Conglomerate M&A is integration of companies with unrelated industry or business operations to the existing ones (Kusstatscher and Cooper, 2005). The strategy for such merger includes: product diversification, which is producing related or unrelated products and expansion for entering different industries. The main economic effects will be increase in revenues by selling diverse products and entering a different market.

2.2 M&A in US. Banking Industry

According to a study conducted by Adams (2012) on the U.S. banking industry from 2000-2010 and he found out that there is an increase in consolidation trend in the past 20 years. The large numbers of bank mergers also has changed the industry and market structure to a large extends. The writer stated that back in 1980 the 10 largest banking organizations only held around 13.5% of the banking assets in the market. In contrast, in 2010, the 10 largest banking organizations held up to half of the banking assets (Adams, 2012). Furthermore, the merger between JP Morgan and Bank One which will be further studied in later chapters was ranked the second largest deals by target assets in 2000 to 2010.

2.2.1 Factors affecting U.S. banking industry

In U.S. banking industry, the antitrust policy plays an important part in transforming the industry composition. (Adams, 2012) At the same time, the author further elaborated that regulation such as the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 allows the banks to expand to different part with the country. Also the Gramm-Leach-Bliley Act of 1999 has granted banks to provide additional and diverse financial services through entering different financial markets (Adams, 2012). (Rhoades and Yeats, 1974) also agreed that all of the state laws and regulations have allowed banks to expand geographically and therefore, increasing integration activities.

2.3 Motives for M&A

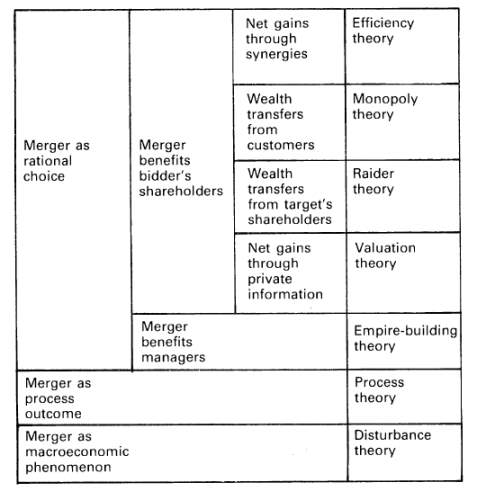

Figure 2.1 below illustrates Trautwein (1990) model of merger motives. The model consists of 7 different theories; they could be categorized mostly as behavioral and economic theories. This study will focus on two theories: efficiency theory and monopoly theory in order to help in explaining and understanding the motives of taking part in M&A.

Figure 2.1: Trautwein, 1990, model of merger motives

Source: from (Trautwein, 1990)

2.3.1 Efficiency Theory

Efficiency theory sees M&A as a planned process and the aim is to achieve synergy. There are mainly three types of synergy could be accomplished, which are financial, operation and managerial synergy. Table 2.1 below explains the ideas of different types of synergies in more detail.

In many accounting literatures, focusing in banking industry would use the method of calculating the return on assets and equity (ROA and ROE) to measure the efficiency (synergy) gained by the firms through M&A activities. For example authors like Akhavein et al. (1997), Amel and Rhoades (1989), they used those two accounting ratios to analyze the efficiency gain in overall operating performance in banking organizations. However, it fails to take into account of components such as taxes and loan loss provisions.

2.3.1.1 Synergy

Synergy is one of the main goals that companies wanted to achieve through M&A activities. The idea is often referred as the reactions occurred when two causes combined as one. When synergy is accomplished through a merger, it could generate a greater cost- saving effect than when the companies operating independently (Guaghan, 2005). The writer further uses a mathematical concept (2+2=5) to illustrate the situation of how synergy processes. So that, from the concept suggested by the author, it can be concluded that firms could possibly gain values through achieving different types of synergy effects (financial, operational and managerial synergy) in a merger.

However, the concept of financial synergy itself has received some criticism. This is because some researchers show that such synergy could not be achieved in an efficient capital market (Rumelt, 1986), (Montgonery and Singh, 1984). The idea of managerial and operational synergies have been questioned that it’s an evasive concept.

Table 2.1: Explaining different types of synergies

| Types of synergy | Description |

| Financial synergies | Financial synergy is the results of lowering the cost of capital. This could be achieved in three ways. Include lowering the systematic risk of a company’s investment portfolio by investing in non-related businesses. Secondly, it could be accomplished by increasing the company’s size, which then the firm could access to cheaper capital. Thirdly, another way to attain financial synergy is to establish an internal capital market that may operate on superior information and so that it could allocate capital more efficiently. (Trautwein, 1990) |

| Operational synergies | Operational synergy could be achieved through two ways, including combining operations units or from knowledge transfer. Either way could benefit the firm by lowering the cost of the involved business units or may enable the company to offer unique products and services. (Porter, 1985) (Guaghan 2005) Further stated that these revenue enhancements and efficiency gains or operating economies maybe delivered in horizontal or vertical mergers. |

| Managerial synergies | Managerial synergies could be attained by bidder’s managers possess superior planning and monitoring abilities that could actually benefits the target acquiring firm’s performance. (Jenson and Murphy, 1988) |

2.3.1.2 Other M&A motives associated with synergy

Other than cost-cutting benefits, through exploiting operational synergy of combining two firms together could also lead to growth and diversification, so firms could expand to different geographical areas to diverse their business operations. Which is another motive associated with synergy. According to Deng and Elyasiani (2008) accomplishing geographical diversification for banks could increase their chances for investment opportunities, thus increasing their revenue and also lower the cost of bank funding due to a larger customer and deposit bases (Deng and Elyasiani, 2008). Mishkin (1998) further suggested that through geographical diversification, it could increase the market competitions for banks, result in forcing any inefficient banks out of the market, leading to an improvement in efficiency for the whole banking industry. However the negative effect for bank expanding into different geographical areas would be it could increases their risk thus leading to banks failure (Mishkin, 1998).

Another motive related to synergy is technological improvement. Hagedoorn and Duysters (2002) mentioned that technological advance could have a long-term effect upon M&As and it is also a long-run incentive. New technology could possibly lead to innovation and therefore increasing the profitability of the firm, result in synergies. For example in the banking industry, improvements in technology ease the retail distribution networks. Banks can use online platforms to deliver banking services, which helps to save operating costs, achieving operational synergy (Mishkin, 1998).

2.3.1.2a Evidences of synergy in US. Banks

As mentioned above, operating synergy could be accomplished through combining business units, result in lowering the cost of business operation, thus increasing profits. Financial synergy could be achieved through increasing the size of business, so that firms can access to cheaper resources. Both types of synergies could be achieved through exploiting economies of scales and scope, especially in distribution-intensive industries with high fixed cost such as the financial and banking industries.

The empirical findings of Smith and Walter (1995) concludes that the benefits resulted from economies of scales could be further passed along to buyers with charging low prices and be absorbed by suppliers lead to rise in profitability. Other writers such as Benson et al, (1982), Berger (1987), Fields and Murphy (1989) have also conducted studies on economies of scales. 14 out of 19 empirical studies show signs of economies of scales. A study conducted specifically on Chemical Banking Corp. and Chase Manhattan Bank in 1996 has proven that the two banks achieved economies of scales after the merger, result in closing down more than 100 bank branches and cutting 12,000 jobs (Hoffman and Weinberg, 1998).

However, some mergers faced diseconomies of scales, Saunders and Walter, (1994) presented two sets of empirical studies using information from the world’s 200 largest bank in the 1980s, proving that larger banks have grown slower relatively than other smaller banks, since most of the larger banks is at higher risk of facing diseconomies of scales than other smaller banks.

2.2.2 Monopoly theory and market power

From Trautwein’s (1990) model, the author explains the monopoly theory views M&A as a planned procedure in order to attain greater market power. This not just can happen in horizontal mergers, it can also occur in conglomerate M&A. In conglomerate merger, firm could cross-subsidize products, meaning that the excess profit earned from one market could be used as subsidies to win over the market share in another market. Trautwein (1990) also suggested that the firm could also exploit the strategy of tacit collusion and try to combined business functions together, so that firms could limit the competition in more that one market (Trautwein, 1990). Smith &Walter (1998) has pointed out the benefit of increasing market power associate with the monopoly theory, he mentioned that by raising market share, the cost and price margin will be widen at the same time, so that firms could carry out larger transactions without the participation of other firms. Pilloff & Santomero (1998) also agreed that merger could gain value through increasing market power; furthermore, this can change the market structure and further reduce competition in the existing market. At the same time, he pointed out that banks that gain market power would be able to earn high profits by adjusting loan and deposit rate.

However Jensen (1984) has rejected the idea of the monopoly theory. He carried out a study on the effect of merger announcement, cancellation and competitors stock. By using the idea of monopoly theory, the competitors’ stock price should fall when the merger deal is cancelled and increase when during the merger announcement. The results turned out to be negative, leading Jensen to rejecting the idea of the monopoly theory.

2.3- Effects of M&A

The motives of M&As have been discussed in the previous part of the chapter. This following part of the chapter will mainly focus on evaluating the effects of mergers.

2.3.1 Effects on Employees

There is always a presumption that M&As will result in substantial workforce reduction. Conyon et al. (2002) carried out an investigation on the effect of merger activities with employee job loss. The results illustrated that the staff cutting issues depends on the merger entities and the post-merger market condition. Dutz (1989) also agrees with this point of view saying that horizontal mergers will cause more substantial job loss than vertical mergers, especially when the industry display significant economies of scales. Other than staff cutting issues, employees often increase their job dissatisfaction after the merger (Meeks, 1977; Sinetar, 1981; Altendorf, 1986). Conyon et al. (2002) even stated that mergers influence the psychological responses of employees due to uncertainties ahead. Schweiger et al. (1987) also suggested mergers could possibly generate stress and anxiety for some of the staffs, the reasons for that maybe associate with job security and change in work practices and cultural difference (Bruckman and Peter, 1987).

One way to tackle anxiety faced by the staffs is to communicate with them effectively as soon as possible about the anticipated effects of the change (Schweiger and DeNisi, 1991). The delay of communication could possibly lead to rumors negative perception and further magnify the insecurity of employees.

2.3.2 Effects on Shareholders

According to Piloff and Santomero(1998), the author suggested that when the merger creates value, the wealth created by the merger could pass onto the shareholders, resulting in increasing shareholders wealth. Cornett and Tehranian (1992) conducted an empirical study to comparing the pre and post merger performance of thirty large holding firms between the 1982 and 1987 and found out that the performance of the firms’ value have improved after consolidations. Other authors like Spindt and Tarhan (1993) argue that the merger gains are primarily due to the effect of economies of scales.

Another method to measure the merger effect on shareholders is to study the stock market reactions. Hannan and Wolken (1980) and Houston and Ryngaert (1994) found that there is no average wealth creation from the consolidation. Therefore the total shareholder value was not much affected by the merger. However, some authors do find that M&A resulted in negative abnormal returns. For example Zhang (1995) studied 107 mergers took place between 1980 to 1990 suggested that mergers lead to a significant increase in total value of the firm. He also found out that target shareholders benefited the most compared to acquiring shareholders, although both parties experienced an increase in share price around the merger announcement.

2.3.3 Effects on Management and culture compatibility

Culture is one of the main components that could be affected through M&As. Lack of cultural fit could lead to potential merger failure in the creation of human resource problems (Hambrick & Canella, 1993), (Nahavandi & Malekzedah, 1988), ( Weber & Schweiger, 1992) According to the study that Weber and Camerer conducted in 2003, the findings have proofed that culture differences between firms may leads to consistent decreased performance for employees and create misunderstandings, escalated conflicts (Weber, 1996).

Mergers could also influence the management of the firm. In order to achieve high level of synergies, top managements may intervenes the decision-making process of the management team of the firm acquired, such as through setting up rules and opposing standards and expectations on them. This could possibility leads to problems for Human Resources, subject to autonomy removal. Other than that, the cultural differences between two management teams could also result in conflicts (Webwe &Schweiger, 1992) Authors like Penrose 1959 and Shrivastava 1986 suggested that the organizational size might be one of the factors that influence the relationship between cultural differences. They also argue that the larger the firm acquired, the more difficult for the buying firm’s managers to understand all the areas where integrations is needed.

As to tackle and minimize the negative impact of cultural differences, a in recent case study from (Ghoshal and Haspeslagh, 1990) has found out that the impact of cultural differences could be minimized when the buying firm takes time to create a positive atmosphere for capability transfer during the merger process.

2.3.4 Effect on Customers

M&As could have a large effect on customer mainly due to technological improvements. According to Mishkin (1988), with the help of technology, there will be less geographical restrictions, increasing market competition and efficiency of the whole banking sector. Technological advance could improve the distribution networks, lowering the cost of banking services. For example with the help of electronic banking platforms, customers could get access to banking services with ease. Moreover, customers are more accessible to banking system through using computers at home, mobile phones and (Automatic teller machines) ATMs everywhere. (Payne, 2000)

However, there are high fees charged to customers for such banking services. Broaddus (1998) has mentioned in his study that among all those fees, ATM fees received the most attention. He also mentioned that those extra fees are attributed to mergers and this trend is well established and accelerating. Another negative impact of Internet banking is, some peoples may not have knowledge and assess to advance technology; therefore, they may not be able to use the online serves that banks have newly adopted.

2.3.5 Effects on Firm’s Financial Performance

There are mixed views on the firm’s financial performance after the merger. Palepu and Ruback (1992) carried out a study on investigating U.S. top 50 largest firm’s post-merger integration in 1979 to 1984. The author found out that there were significant progresses on firms’ productivity, cash flows from operations and abnormal stock return. However on the other hand, Rhoades (1993) conducted a study on 13 M&As and the outcome shows that there is no improvement in performance of firms due to the mergers. Madura and Wiant, (1994) studied the abnormal returns of the acquired bank, the findings illustrates the abnormal return turns out negative and decreases monthly.

Regarding the liquidity and leverage performance Abbas et al (2014) has carried out a study on evaluating the financials of 10 banks. He found out that the leverage level has little improvement after the merger. In contrast, Ong et al, (2011) and Ghosh and Prem (2000) has found that the position of leverage has surge enormously after merger.

In terms of efficiency ratios, (Akhavein et al, 1997) has found companies significantly improved on their operational and financial synergy after the M&A based on the figures of ROA and ROE. However, (DeYoung, 1993) illustrated opposite results from his study. He found there is no efficiency benefit achieved in both acquiring and acquired firms.

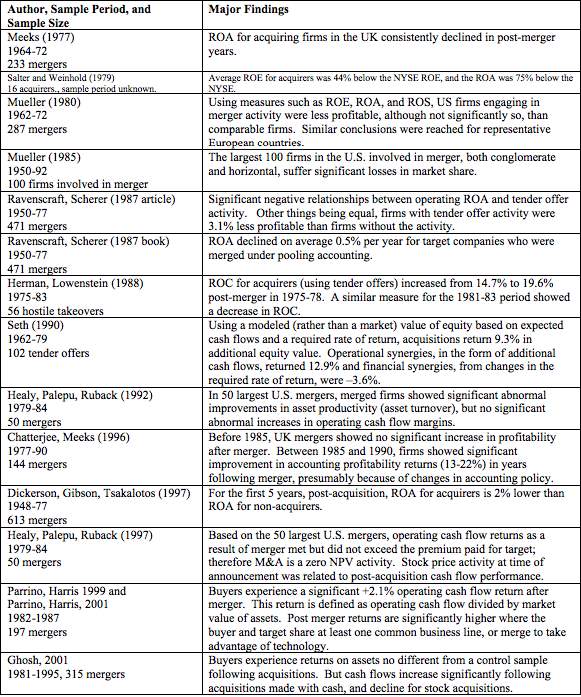

Bruner (2002) conducted a table in his study, summarizing all methods and measurements used by different researchers for evaluating firm’s performances after the merger took place. His findings are illustrated in the Table 2.2.

Table 2.2 Summary of findings in Accounting (Bruner, 2002)

Source: Bruner, 2002,p. 22

2.4 Reason for failure

According to Weber (1996), not many mergers have been successful and met their initial expectations despite an increase in recent M&A activities. Cartwright &Cooper (1993) stated that less than half of the consolidations have met their financial expectations with the rate of failure at around 50% to 60%. Most of the past research has focused on the returns on shareholders and neglected the “human factors” involved in the merger process. Papadakis (2007) pointed out that poor communication, culture differences, and poor planning being possible reasons for merger failure (Schuler and Jackson, 2001). He further elaborated the reasons for M&As failure by dividing the reasons into pre-merger mistakes and post –merger mistakes:

Pre-merger mistakes:

- Lack of clear vision and strategy

- Lack of planning

Mistake after the deal is made:

- Cultural differences

- Poor management during integration

- Poor communication

Source: (Papadakis, 2007, p. 43-44)

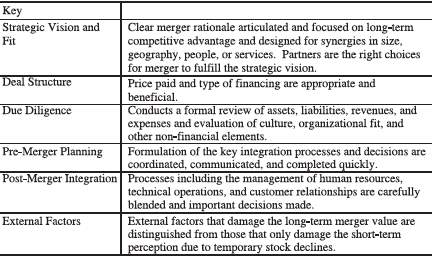

2.5 Strategies leading to merger success

Epstein (2005) has suggested that most studies of M&As focused on analyzing the uninformative measures such as the stock price and synergies. These measurements could only measure the short-term effect of the merger. Therefore, the author recommended that other long-term effects should also be taken into account, such as the technical and human aspects. Another model conducted by De Noble et al (1988) focusing on the strategies that leads to merger success, and the writer also stress about the importance of pre-merger planning and post-merger integration process in a successful M&A. The combination of the two factor models suggested by the authors will be illustrated below in Tables 2.3 and 2.4 Later on in the study, these factors will be applied in order to assess the level of succession in terms of JP Morgan and Bank One’s merger.

Table 2.3 Six Keys to Merger Success

Source: Epstein, 2005

Table 2.4 Eight Lessons for Merger Success

| Factors for Merger Success | |

| Focus on Sources, Not Symptoms | Post-merger integration should be paid attention to and be addressed at an early stage during the M&A process. Effective communication between managements is also the key to success. |

| Get Line Management Involved | Line managers are important to the succession of the merger outcomes. Line managers in both organizations should co-operate and work on the specific areas of integration. |

| Cross- fertilize Management Teams | The first year of the merger is the most crucial phase in a successful merger. Management teams from both firms should stay positive and enthused about the merger, and together work as a team. |

| People Count, Too | M&As will result in job loss; early warning should be given to employees during the merger process as to eliminate anxiety and rumors. Additional training courses should be provided to those staffs that are staying in the firm for the best merger outcome. |

| Find the Hidden Costs | It is important to realize the initial costs result of the merger and close attention should be paid in order to prevent the costs exceeding the expectations. |

| Corporate Culture Will Change | Culture will change after the integration; therefore firms should pay more attention to the acculturation process and closely manage it. |

| Strategy and Structure Should be Linked | Operational synergies will only occur under the circumstances of changing the business structure of the firm. |

| Earlier is Better than Later | Post-merger integration process should be addressed as early as possible. So does any problem encountered should be raised at an early stage. |

Source: (De Nobel et al, 1998)

Chapter 3 (Methodology)

3 Research Purpose

The research purpose of this study is to investigate and evaluate the motives and effects of the integration of two U.S. Banks JP Morgan and Bank One. The effects of the merger will mainly be focused on the company itself. However the impact that the mergers have on customers, shareholders and employees will also be addressed. Along with providing information and strategies on creating a successful merger that generates and maximize value.

Through conducting a case study on the merger of JP Morgan and Bank One in 2004, readers can gain better understanding and insight into the ways of achieving a value maximized M&A. Using secondary data, such as an annual report, can help with analyzing the growth, synergy and efficiency of the company itself. Director’s reports and CEO letters can guild us on the culture capability and give further insight on the business strategy that the company adopted; it can help in understanding if there is any conflicts and staff cutting issue regard to the merger and how it could a be a factor that limiting the firm in creating a successful merger.

The main area focus in this study will be analyzing (1) income, (2) Profitability, and (3) number of customers. Comparing the profitability and income is a direct method to examine the company’s statues. This study includes the quantitative analysis of company branches, ATMs and online banking customers as one of the methods to monitor the post-merger effect on customers.

3.1 Research approach

This study has a mixed approach: qualitative and quantitative. Quantitative is a synonym for any data collection technique. For the data analysis, such approach uses graphs and statistic that generates numerical data (Saunders et al., 2016). While qualitative approach uses interviews as data collection technique, generates non-numerical data during the data analysis procedure (Saunders et. Al, 2016). The research approaches of this study include ratio analysis, calculations, and a model for assessing the factors of merger succession.

Deductive approach means the research begins and builds upon theories through the process of reading different literatures. Theories are tested after combining all the concepts from past literature (Saunders et al, 2016). In contrast, the idea of inductive approach is to develop the study through collecting data, exploring a paradox, then building a framework based upon the findings (Saunders et al, 2016). This study uses a deductive research approach, using theories and models from the past literature and applying them to the case study. This thesis also uses a positivism approach, since the original theories associated to mergers will be tested by further research with the support of a case study in chapter 4.

A case study is a method that factually analyses and investigates a contemporary phenomenon in a real life situation through using various sources as evidence (Yin, 1984). Gummesson, E (1991) agreed with the idea, as researchers can gain a holistic view of a particular event with the help of case studies. Carrying out case studies in a research helps to focus on why and how things happened, allowing researchers to investigate contextual realities and make comparisons between what is planned and the actual event occurred (Anderson, G, 1993). This method allows researchers to address on particular issue, and provides guidance when understanding a particular problem. For this study, the merger of JP Morgan and Bank One is chosen under the affluence of data and JP Morgan’s recognition in the U.S and global banking industry. This case allows us to focuses on the impacts on M&As and the ways to creating successful merger, learning many lessons and gaining understanding from this specific consolidation.

3.2 Data collection

This study is conducted using secondary data; the sources of such data are mainly from academic journals, textbooks, company’s reports and news, increasing the reliability of the data investigation and analyzing process. For any numerical data, they are mostly collected from annual reports, DataStream, Thomson database and news. This study observes the change and development of impacts and outcome of the integration over a time period between 2001 and 2007. The actual acquisition took place in year 2004, however, Rhoades (1998) conducted an empirical study on analyzing different financial ratios, those ratios were analyzed using three years after the merger. He then explained that three-year time period was being used because during other interviews with experts, they agrees that “half of any efficiency gains should be apparent after one year, and all gains should be realized within three years”(Rhoades, 1998, p.278). Sample data in this time period is sufficient to provide information on a short to intermediate term effects and strategies on the consolidation itself. Ratio analysis helps to investigate the trend and patterns of the performance of the firms; it is useful in comparing the pre and post merger performance, allowing issues to come clear.

3.2.1 Fundamental Analysis

Profitability ratio

In order to measure a company’s efficiency and performance, the technique of comparing profitability ratios will be used. For example, return on assets (ROA) and return on equity (ROE). The numerical data used for the calculations are taken directly from JP Morgan’s financial statements. Calculating the ROA can measure the level of operational, financial synergy (Efficiency theory). It can act as an indicator to show how profitable a company is in terms of the total asset, and how the company generates profits through their assets. It also indicate the efficiency of the management, shows how the management is using the assets to generate more earnings (managerial synergy). On the other hand, ROE measures the earnings generated from equity investments, it helps to evaluate the shareholder returns from the merger. This could help in investigate the impact on shareholders. According to the study that Akhavein et al (1997) conducted, they found out that the banks organization increases their profit efficiency after the M&A by using the method of calculating the ROA and ROE.

The definition of ROA and ROE are as follows:

- ROA= Net income/ Total assets

- ROE= Net income/ Shareholder’s equity

Efficiency ratio

According to Cantaluppi and Hug (2000), the efficiency ratio measures the effectiveness of the firm and how well that they are able to generate earnings from the components on balance sheets i.e., assets. At the same time, it shows the effectiveness of the management, it is another evidence to support managerial synergy in efficiency theory.

The total asset turnover is defined as follow:

- Total asset turnover= Net sales or Revenue/ total assets

Liquidity ratio

Liquidity ratios such as, quick ratio and current ratio look into the differences between the assets and liabilities of a company, indicating the level of short-term debt that the company would have to pay. Measuring whether the firm would be able to meets the current or short-term obligations. (Morris and Shin, 2009)

The quick ratio is defined to be:

- Quick ratio= (Current assets-inventory)/ current assets- inventory

Leverage ratio

Leverage ratio measures the level of debt in a company, it also access the capital structure of the firm:

- Debt to capital ratio= Long term debt/ (shareholder’s equity +debt)

Capital Market Ratio

Capital Market ratio measures the stock performance in the short-run (Azhar et al 2009). Therefore, the use of such ratios can analyze the effects of the merger on shareholders. Again, this could be used to test the theory suggested by Piloff and Santomero (1998). The writer stated that a merger that creates value that could be passed onto shareholders and maximizing their wealth.

The two capital market ratios are defined to be:

- Earning per share= (Net profit after tax- preference dividends)/ number of equity shares

- Price earning ratio (P/E ratio)= Market price per share/ earnings per share

3.3 Limitations

The quantitative approach in this study is solely based on accounting ratios, which can be affected by external factors, such as inflation and financial policies, which impacts the pre and post merger observations. The management of the firm could also manipulate the accounting ratios by altering and adjusting the capital structure of the firm. It should be noted that ratios are not a perfect element for measuring long-term effect of the consolidation. The study used data taken between 2001 and 2007; such a short time frame may be insufficient to assess the effects and strategies fully taken by the firm throughout the whole merger process. A longer time span could be used for future studies.

Ch. 4 Data analysis

4 Introduction

This part of the study aims to carry out data analysis of the merger between JP Morgan and Bank One. This process is useful in identifying the strategies and methods that the company has adopted for the consolidation. At the same time, the findings of the research will also be presented and assessed in order to determine whether this M&A is successful. The results will be supported and referred back to the models and theories suggested by other authors in the previous literature review chapter. The chapter begins with a brief background of M&A activities in the US banking industry before 2004, the year that JP Morgan and Bank One merged, following with the market composition and overview of the acquisition. The projected effect and the actual effect of the merger will be compared. And at the end of the data analysis process, the model for merger succession mentioned in Chapter (2.5.) will be used to identify the strategies that the company adopted for the merger. Other numerical data, such as ratio analysis and financial statement analysis will also be used to support the findings. The solutions for merger succession will be conclude and solutions for future M&A activities in this field will be provided.

4.1 State of M&A activities in US. banking industry

M&A activities have alter the whole US. banking industry significantly. A study carried out by the Pilloff (2004) investigated the overview of merger activity during the period of 1994-2003, before JP Morgan and Bank One consolidation took place in 2004. During this period of time, the numbers of banks have decreased to around 8,000 from 16,000. One of the main reasons for such consolidation trend is due to many large institutions was successfully integrated in the past. The share of the total industrial assets form ten of the largest commercial banks have increased to 46% from 22%. There were 3,517 merger deals completed in that 10-year period. A few factors including technological advance and reduction of geographical restrictions has aided the merger process. Although the author observed very little acquisitions of large banks during the period, however, acquisition of those larger banks are mostly responsible for many of the changes in the industry due to holding a large amount of share assets.

4.1.1 Regulation influence

The Federal Reserve has supervisory and regulatory authority over all the bank holding companies (BHC). It controls and monitors the structure of the US. banking system, including the formation, acquisition, and mergers of BHCs. While considering the applications for M&As, the Federal Reserve will look into the financial condition of the applying firm as well as the firm being acquired. On the other hand, the capability of management and the history of the organization that consent with consumer laws plus any potential anti-competition effect will also be closely assessed. For the case of JP Morgan and Bank One, the Board also assessed confidential legislative information, such as the reports of BHCs and data provided by other federal banking agencies on top of published reports . After reviewing all the facts of records of both companies, the Board finds that all the condition for acquisition is met, therefore approving the merge proposal under the BHC Act (Federal Reserve System report, 2004 ).

4.1.2 Overview of the case study

Table 4.1 JP Morgan and Bank One business segment (2003)

| JP Morgan | Bank One |

|

|

Table 4.1 above indicates the main business segments for both of the companies before the merger take place. According to the report from the Federal Reserve System (2004), JP Morgan had approximately $771 billion total consolidate assets prior the merger, being the third largest guaranteed depository organization in the U.S., holding over 3.8% of total deposits in the market. By comparing the total assets that the firm holds, Bank One Corporation size was less than half of JP Morgan’s. Bank One has total consolidation assets around $327 billion. Being the sixth largest depository organization in the US, owning 2.8% of total deposit in the market (Federal Reserve System 2004).

JP Morgan and Bank One announced the merger agreement on 14th January 2004 as a stock-for-stock agreement; the common stock per share of Bank One’s will be exchanged for 1.32 shares of JP Morgan common stock. (JP Morgan, Annual Report, 2004)

The actual merger took place in 1st July 2004. JP Morgan purchased Bank One for $58.5 billion. This was a horizontal merger since the characteristic of the merger matches with the definition of a horizontal merger suggested by author Dringoli (2016) in Chapter 2. Following the merge, JP Morgan became the second national bank in the country, with $1.1 trillion assets and 2,300 branches located in more than 17 states (CNN Money, 2004). This shows that through the merger, JP Morgan is able to increase the market share and exploit a greater market power. This evidence is aligned with the motives of the monopoly theory mentioned by Trautwein (1990), stating that the firm wishes to achieve greater market power after the M&A.

After the consolidation, business segment was being readjusted, reflecting the business structure of the newly combined firm. JP Morgan then operates in the six business segments:

- Investment Bank

- Retail Financial Services

- Card Services

- Commercial Banking

- Treasury &Securities Services

- Asset &Wealth Management

As a result of the merger, the segment previously known as Chase Financial Services is now known as Retail Financial Services; Middle Market which was previously under the division of Chase Financial Services is now moved into the segment of Commercial Banking. Investment Management & Private Banking has been renamed into Asset &Wealth Management. Chase Cardmember Services was originally under the division of Chase Financial Services, it is now developed into a new segment on its own called Card Services.

The above changes to the business segments are consistence with the merger succession model (Table 2.4) in Chapter 2. Strategy and structure of the company must be linked in order to create a successful merger (De Noble et al 1988). The writer further pointed out that operational efficiency could only be attained when there are changes in operation; it cannot be achieved if the acquired firm is operating as a single subsidiary. The author also further suggested that, “new lines of authority and reporting relationships must be established in order to create the context in which operating changes are feasible”. (De Noble et al, 1998, p.84)

Other than changing the business structure of the new firm, the annual report of JP Morgan in 2004 also stated that the merger has brought substantial progress to the firm’s business. By the end of 2004 (6 months after the merger), the company has saved $ 400 million and cutting 6,500 headcount. The company also projected that it could reach a total cost reduction of $3 billion by 2007. The reduction of workforce from the merger fits in the theory suggested by (Conyon et al, 2002) in Chapter 2, staff cutting issues is one of the most substantial impacts on employees during a merger.

Furthermore, the merger also changed the structure of corporate governance in the company. The Board of Directors of JP Morgan after the merger has increased to 16 members from previous 12 members, 8 from Bank One and 8 from JP Morgan. (JP Morgan 2003, annual report) They have worked closely together to managed and lead the new company.

4.1.3 Corporate strategy

There are several main reasons for JP Morgan to acquire Bank One. The merger allows growth and diversification of the corporate’s business, improves its market position, provides cost benefit, allowing geographical expansion, innovation and technological improvements.

4.1.3.1 Growth and diversification

One of the main strategies adopted by JP Morgan is to promote growth and diversification. The firm sees the consolidation with Bank One as a great opportunity for the company to diversify its business into different business areas and serve its client in a much boarder platform, benefiting both the shareholders and clients. This merger motive is also aligned with the idea that author Deng and Elyasiani (2008) suggested, linking back to efficiency theory (operational synergy).

According to JP Morgan’s annual report in 2003, Bank One provides leading Card Services within the banking industry. JP Morgan ceases this chance and aims to double the size of its credit card business, pursuing a strong position in the card industry after the merger. Table 4.2 illustrates that after the merger the number of credit cards in circulation has increased 62.8% from 94 million to 153 million in 2006. This reflects an increase in JP Morgan’s credit card services customer bases. This is evidence to show that the firm has achieved its goal of diversifying its business operations.

Table 4.2 No. of cards in circulation (million) 2004-2007

| Dec 2004 | Dec 2005 | Dec 2006 | Dec 2007 | |

| No. of cards in circulation (mil) | 94 | 110 | 153 | 115 |

Source: JP Morgan annual report 2006,2007

4.1.3.2 Increase market position

Another strategy that JP Morgan embraced is achieving greater market share. The firm believes that the size and the scale of the firm is the key to exploit competitive strength and advantages, leading to cost benefits. This merger motive is aligned with the monopoly theory proposed by Trautwein (1990) in Chapter 2. In his model of merger motive he has mentioned that attaining greater market share is one of a firm’s desirable results from a merger. As mentioned in the Federal Reserve System report (2004) after the consolidation, JP Morgan has approximately $1.1 trillion of consolidated assets and was becoming the second largest bank in the US. Without the merge, JP Morgan on its own would be fallen to the third in position after its competitor Bank of America Corporation acquiring FleetBoston Financial Corporation (CNN Money, 2004).

4.1.3.3 Cost benefits

Due to the large size of the firm, it can easily accomplish economies of scale during the operation process. “Our diversified earning streams lower our risk, increase our credit ratings and reduce the cost of our capital. And since one of our major costs is the cost of money, the ability to raise funds cheaper, better, faster and more effectively around the world than other companies is a major advantage.” (JP Morgan Annual report, 2004, p.5) From this statement, it shows that the firm is aiming to achieve operational and financial synergies through economies of scales and scope by gaining a greater market power. Since the firm is also aiming to earn high profits and adjust its loan and deposit rates through gaining a larger market power, this motive is correspondence with the theory suggested by (Pilloff and Santomero, 1998) previously mentioned in Chapter 2.

4.1.3.4 Geographical expansion

In 2004 annual report of JP Morgan has mentioned the objective of the consolidation is to “ provide the firm with a more balanced business mix and greater geographic diversification.” (JP Morgan, Annual report, 2004 p.89) Before the consolidation, JP Morgan’s businesses mainly operate in California, Connecticut, Delaware, Florida, New Jersey, New York and Texas where most wealth is concentrated. In contrast, Bank One’s operation mainly locates in Arizona, Colorado, Illinois, Indiana, Kentucky, Ohio, and Oklahoma where there is less wealthy population located. Through the merger, JP Morgan expanded its businesses into more diverse geographical area, rebranded Bank One’s branches under the name of Chase, and is projected to services to more than 2,300 bank branches in 17 states in the U.S. A parallel effect from this geographical diversification is diversity in customer groups, reaching to a wider range of wealth and class. The motive behind the merger also matches the theory suggested by Deng and Elyasiani (2008), supporting the efficiency theory.

4.1.3.5 Innovation and technological improvements

Other than the strategy implementation mentioned above, JP Morgan also aimed to focus on innovation, improving on their technological advance, especially on their credit card system. The firm has conducted a large credit card system conversion in order to improve the old processing system into a faster, more flexible and more cost-effective system. Improvements in technology saves cost for the firm as a whole, acting as another piece of evidence of gaining operation synergy, supporting the idea of the efficiency theory.

4.2 Financial data analysis

In this part of the study, the comparisons of the projected and actual effect of the merger will be presented. The findings will be supported up by financial figures and ratios, the main business segment that this case study will be focusing on are: Retail financial services; card services and commercial banking. This is because these three business divisions faced major changes after the merger with Bank One. Focusing on those three segments helps in comparing the effect of the merger. The merger impact on the employees and customers will also be illustrated by comparing the number of employees and number of branches.

The premerger planning stage took place in just 6 months time, and this speedy pre-merger period shows that everyone involved in the integration is communicating effectively, making it one of the keys to merger success. In accordance to Epstein (2005) the author advise that the communication channel in a firm during the premerger planning has to be done coordinately, effectively, widespread and quickly developed.

The one of the main motive of the merger is synergies, resulting in a cost saving effect. JP Morgan stated in the annual report 2003 saying that, through this merger they are expected to save pre-tax cost of $2.2 billion, three years after the merger. There are also hidden costs associated to the merger, as De Nobel et al (1998) mentioned. In this case, JP Morgan was expecting the merger- related costs would be around $3 billion (pre tax) JP Morgan annual report (2003).

In 2006, the Chairman and CEO James Dimon stated in his letter “we are declaring the merger of JPMorgan Chase and Bank One to be essentially complete. So we are-in the best sense of the phrase-back to business as usual.” (JPMorgan annual report, 2006 p, 6) He further commended on the merger outcome, saying that the whole company was very convinced with the up-to-date results achieved. Later in this chapter, the model for merger success from De Noble et al (1988) would be used to analyze the factors leading to JPMorgan and Bank One’s merger success.

One year after the merger, the company has achieved $1.9 billion of realized merger savings. In the long run, the firm has completed the largest credit card conversion in history with Bank One. This combined more than 30 million Chase and Bank One accounts into the same individual platform in order to provide the best system to serve its customers. (JP Morgan annual report, 2005) In 2007, the projected savings of $3 billion dollars has been achieved, meeting the target of total cost savings. Comparisons between the projected expected savings and the actual saving is a good indicator for measuring the merger success. The total target of cost saving that the firm has achieved will be presented in the Table 4.3 below.

Table 4.3 Expected and actual cost savings ($bn) 2005-2007

| Merger cost saving (cumulative) | Dec 2005 | Dec 2006 | Dec 2007 |

| Expected ($bn) | 2.0 | 2.2 | 3.0 |

| Actual ($bn) | 1.9 | 2.5 | 3.0 |

(Source: JP Morgan annual reports, 2005-2007)

Table 4.4 Earning before interest and tax ($mill) 2001-2007

| Years (2001-2007) | Dec 2001 | Dec

2002 |

Dec

2003 |

Dec 2004 | Dec

2005 |

Dec 2006 | Dec 2007 |

| EBIT ($mill) | 0.5 | 0.4 | 1.1 | 0.8 | 1.6 | 3.0 | 2.9 |

(Source: Datastream )

As stated in the JP Morgan’s annual report 2004 the firm expected to relatively save $3.0 billion of costs by 2007 and by 2005; two-third of such amount of saving cost should be realized. Table 4.3, it shows that the expected cost saving matches with the actual cost saved from the merger, excepted from 2005. According to Nobel et al (1988), in order to create a successful merger, firms should focus on the sources of problems, instead of the symptoms. The firm’s actual cost savings did not meet the desired or expected cost savings; an extra $0.1 billion of cost savings was that has to be saved in order to meet the target. Linking back to the successful factor that the author addressed, he suggested that the problem encountered throughout the merger process should be realized and solved immediately; it is always better than later, also communication is also another key to success. Luckily, JP Morgan was able to realized the problem during the early stage and reevaluate the targets.

Also from the Table 4.4 above, the earning before income and tax (EBIT) of the company has decreased in the year of merger followed by an increase after the merger. The increase in earning is consistence with the merger motives of the company, which is to increase the profitability of the firm. It is also a positive sign to show the merger success. However, the figure has decreased slightly in 2007. Mentioned in JP Morgan 2007 annual report, the CEO addressed the issue of the economic downturn and the financial crisis. He then further mentioned that the on-going year, which is 2008, would also be a difficult year ahead, especially dealing with the subprime issues. This is a significant explanation on the plummet earning figures.

As mentioned, innovation and improvement in technological advance is one of the main goals of JP Morgan and Bank One’s merger. By looking at the numbers of branches in retail financial services, ATMs and number of online customers could reflect the effects that the merger is having on customers as well as being a measurement of technological improvement, since the development of more services branches and including the improvement of ATMs services could benefit the customers. Epstein (2005) has brought out that customer focus is vital during the post-merger integration process for a successful merger. The advancement in technology and Internet banking could bring convince to the customers, meeting their needs. Ever since the merger, the number of bank branches and ATMs has increased significantly as shown in Table 4.5. On the other hand, the number of active online customers likewise increased, proving that the merger had led to the achievement of a greater customer base and provided a wider range of services to the customers is accomplished. This is also another piece of evidence of supporting the efficiency theory, since the merger has lead to advance in technologies and had reduced the geographical barriers for banking, increasing their customer bases and hence its profits.

Table 4.5 no. of branches, ATMs and active online customers

| Dec 2003 | Dec 2004 | Dec 2005 | Dec 2006 | Dec 2007 | |

| No. of branches | 561 | 2,508 | 2,641 | 3,000 | 3,100 |

| ATMs | 1,931 | 6,650 | 7,312 | 8,500 | 9,100 |

| No. online customers (thousands) | NA | 3,359 | 4,231 | 4,909 | 5,918 |

Source: JP Morgan annual report, 2004 and 2007

JP Morgan desired to rebrand all of the branches of Bank One’s as quickly as possible in order to get back on track to their daily business as usual. One year after the merger, the firm has already rebranded 1,400 Bank One branches plus 3,400 ATMs in 10 different states. In 2006, two years after the merger, JP Morgan has fully rebranded all of the remaining Bank One branches including all ATMs. This speedy integration is also one of the driving forces leading to JP Morgan and Bank One merge successfully in accordance to Epstein (2005).

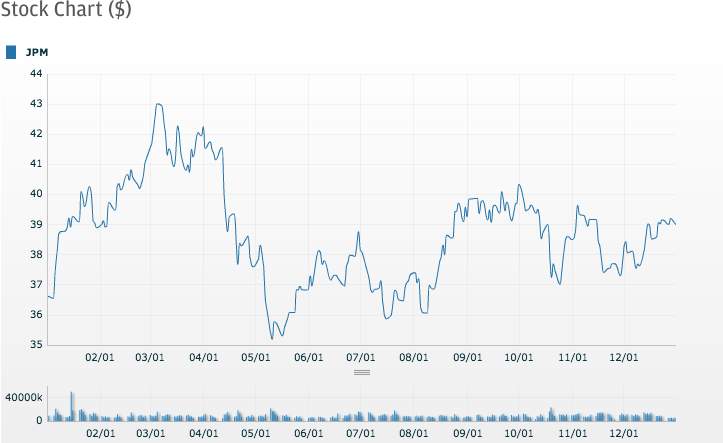

Figure 4.5 Stock price of JP Morgan in 2004

Source: JP Morgan website, investors relations

From Figure 4.5, it is clear that the stock price has surged significantly from January 2004 at around $36.6 and reached its peak at $43.0 in March 2004, a 17.5% increase. The reason for this could possibly be the abnormal return due to merger announcement on the 14th January 2004. The result of the findings is correspondence to Hannan and Wolken (1980) and Houston and Ryngaert (1994)’s studies. Proofing that there is positive abnormal returns after the merger is announced. Leading to shareholders’ wealth creation.

4.3 Effect of the merger

The ratio analysis for JPMorgan will be presented in this part of the study. This will include 4 types of ratios, which are: Profitability Ratio, Efficiency Ratio, Leverage Ratio and Liquidity ratio. Table and graphs will be used to illustrate the trend of the ratios.

4.3.1 Profitability and Efficiency Ratios

Table 4.6 Profitability and Efficiency Ratios

| Profitability | Dec 2004 | Dec 2005 | Dec 2006 | Dec2007 |

| ROA | 0.63% | 0.95% | 1.67% | 1.35% |

| ROE | 5.87% | 7.98% | 12.96% | 12.86% |

| Total Asset turnover | 0.05 | 0.07 | 0.07 | 0.07 |

Source: DataStream and Thomson database

The trends of ROA and ROE are similar, they both increases from the year of merger (2004) to 2006 then decreases slightly in 2007. In 2007 both the ROA and ROE figures are expected to decrease this is due to the economic downturn and financial crises. Other than that, the trend of ROA and ROE remained positive and doubled the figures since the merger. This is a sign of showing that there are confident and promising results following the consolidation. Both ROA and ROE measure the effectiveness of the management of the firm in copping with using assets and equity to generate earnings. A rise in those figures is a piece of evidence that the company has achieved synergies (financial and operational) and the results are correlated with the efficiency theory suggested by Trautwein (1990) The results are also consistence with previous study conducted by Berger et al (1997), which used ROA and ROE to measure the profitability experienced in large banks organizations, suggesting that there are significant improvement in profit efficiency after mergers. DeYoung (1993) study also supported improvements in cost efficiency after consolidation. However, authors like Mishra and Chandra (2010) found that there are no significant effect on the profitability of the firm in which participated in merger activities the long run due to x-inefficiency and the entry of new firms in the market.

Asset turnover is another component in measuring a firm’s efficiency and the effectiveness of the management. It measures the revenues or sales relatively to its assets generated. From the data in Table 4.6 above it shows that the number of asset turnover have increased from 0.05 in 2004 to 0.07 in 2005 one year after the merger and remain unchanged ever since. This shows that the merger has improved the company’s sales and revenue and it is able to exploit and allocate its asset efficiently through managerial and operational synergies. The results also are correspondence to the efficiency theory that author Trautwein (1990) proposed. The study constructed by Healy et al (1992) also has found out that there is a significant improvement in asset turnover after the mergers.

4.3.2 Capital Market ratio

Table 4.7 JPMorgan earnings per share and P/E ratio (2004-2007)

| Dec 2004 | Dec 2005 | Dec 2006 | Dec 2007 | ||

| Earning per share | (53.16)% | 53.55% | 62.61% | 13.18% | |

| Price/earrings ratio

(P/E ratio) |

12 | 20.1 | 16.7 | 13.3 | |

Source: Thomson database and DataStream

Table 4.7 shows that the EPS figure has increased magnificently after the merger from a- 53.16% to 53.55 %. This also proves that the merger was successful and profitable at the same time creating financial benefits. This positive trend of the capital market ratio shows confidence in the future stock market and share price benefiting shareholders in future investments. The percentage of EPS has declined in 2007. That was as expected due to the uncertainty in the economy and Capital market during the credit crisis. Adebayo & Olalekan (2012) carried out a test on comparing the EPS before and after the merger. The author conducted his study with using a sample of 24 commercial banks in Nigeria; his findings were consistence with this study, stating that there is a large improvement with EPS comparing the figures before and after the merger, and at the same time the effect of the change in EPS has a large impact on investors.

After the consolidation, the P/E ratio has also increased from 12 to 20.1 from year 2004 to 2005. It has a total 67.5% surge in the figure, showing that the investors are expected the future prospect of the firm would be good, so that they are expecting higher earning of returns. However the figure stated to decrease after 2005 and fallen to 13.3 in 2007. This may result from the economic crisis and investors may not expect the economy to be great, therefore, they expect the return will be less, at the same time there may be a possibility that the investors may think that the firm is undervalued.

4.3.3 Liquidity Ratio

Table 4.8 above it demonstrates that the quick ratio has slightly decreased from 38.89% to 37.33% one year after the merger. The reason for the fall in the ratio may due to the large amount of merger costs and debt that the firm has to bear, so that it decreases the ability of the company to pay for its current liabilities. The figure further shows a 13.6% evaluation from 2005 to 2007. This could be a sign indicating that the short-term merger gain is being realized and the firm is able to meet its obligation, meaning that the financial health of the company is doing well after the merger. This improvement in the quick ratio is consistence with the study carried out by Selvam et al. (2009) the author’s overall findings are the financial performance of both the acquiring and target firm have improved on their liquidity level and value after the merger took place. Another study conducted by Mitchell and Mulherin (1996) has also found similar results, as there are gains in companies’ liquidity positions after the merger. However the result is in contrast with (Abbas et al, 2014), since his study found out that there is only little improvement after the merger.

Table 4.8 Liquidity Ratios

| Dec 2004 | Dec 2005 | Dec 2006 | Dec 2007 | |

| Quick Ratio (%) | 38.89 | 37.33 | 39.75 | 50.93 |

Source: DataStream

4.3.4 Leverage Ratio

Table 4.9 it illustrates that the debt to capital ratio remains high at over 70%. This could possibly cause harm not only to the firm but also the investors too. This is because a high level of debt to capital ratio may result in downgrading of the credit rating. The ratio surges from 70.72% to 71.59% after the merger took place, and continued to rise. The increasing trend implies that after the merger are more debt added to the firm, affecting the capital structure of the company. In the study of Mitchell and Mulherin (1996), the results of the author shows that most of the firms increases their leverage position after taking part in the merger. However Saboo and Gopi (2007) argues that having high level of leverage or leverage ratio does not always mean a bad thing. This is because high level of debt could indicate that there are growth opportunities and it is a cheaper way for funding the business such as assets.

Table 4.9 Leverage Ratios

| Dec 2004 | Dec 2005 | Dec 2006 | Dec 2007 | |

| Debt to capital ratio (%) | 70.72 | 71.59 | 74.86 | 77.8 |

Source: DataStream

4.4 Comparing JPMorgan/Bank One merger to factor of succession model

The previous part of the chapter includes financial data and ratios in order to provide some quantitative and mathematical approach when looking at the merger effects. This part of the study will focus on using qualitative method to investigate whether JPMorgan and Bank One’s consolidation is successful based on the factor of succession mode conducted by De Nobel et al (1988) and Epstein (2005).

Firstly, focusing on the model of merger succession by De Nobel et al (1988), the author has proposed a few key factors useful in conducting a successful merger. The factors includes:

- Focus on sources, not symptoms

- Get line management involved

- Cross-fertilize management team

- People counts too

- Find the hidden costs

- Corporate culture will change

- Strategy and structure should be linked

- Earlier is better than later

Source: From De Nobel et al (1998)

Based on the factors analyzed by the author, each factor will be compared to the strategy that JPMorgan has adopted during the integration process.

Focus on sources, not symptoms

The author suggested that it is very crucial to pay close attention to post-merger integration issues and should be addressed as quickly as possible. The deal for JPMorgan and Bank One completely in a very short period of time, the merger plan was proposed in the beginning of 2004, carried out on the 1st of July, 2004 and completed the whole deal process by 2006. This has proved that the middle managers of different teams must be communicated efficiently in order to close this merger deal within the short period of time.

Get line management involved

In 2004 annul report stated during the integration process; different managers were assigned to different teams. “ Managers are leading their teams with a deeper understanding of the underlying dynamics of their businesses.” (JP Morgan annual report, 2004, p.6) this shows that the firms had actually involved line managers during the post-merger integration process.

Cross- fertilize management teams

The management teams of both companies worked closely and effectively together to solve different issues during the merger process. Regular meetings and reports was conduct in order to monitor push both companies into a smooth PMI process.

People Counts too

Although the company experienced staffs cutting issues during the merger process, this issue was addressed at a very early stage and employees are being informed before when the merger took part. JP Morgan is also aiming to create a high performance culture after the merger. Therefore, the firm provides leadership programs (LeadershipMorganChase program) for senior managers to learn about the company’s vision and assist the managers to develop their skills to become a great future leader. JP Morgan annual report (2004)

Find the hidden costs

The merger costs increased from the beginning of the merger from $1.4 billion in 2004 to $3.6 billion in 2007. The company identified and accepted the integration-hidden cost. At the same time, the company paid attention to the problem when the actual cost-savings did not meet the target. It shows that the company worked in a very efficient manner and it responded to problems quickly. At the end, the total cost saved from the merger had met the expected target.

Corporate culture will change

As addressed earlier in this chapter, JP Morgan is aware of the change in corporate culture after the merger. Therefore, during the transitioning period the firm has rebranded all of the previous Bank One business to the JP Morgan brand. Hoping to create a productive and sales culture. JP Morgan annual report (2004)

Strategy and structure should be linked

After the merger, there were changes to the business structure of JP Morgan, including new divisions as mentioned in previous part of this chapter. The combining of operations led to more synergies and exploited a greater operational efficiency.

Earlier is better than later

The writer suggested that problems encountered during the merger stage should be identified and solved immediately instead of leaving it till later. A good example of that would be JP Morgan realized the cost savings one year after the merger did not match with the expected cost savings. The managers responded to this problem at an early stage and resolved it. Also as stated in the annual repot of the firm that “ Many managers were asked to dive more deeply into the numbers and be more tough-minded about the reasons why certain initiatives were not on target” (JP Morgan annual report, 2004, p.3)

Based on comparing JP Morgan’s merger to the factors listed in the merger succession model by (De Noble et al, 1988), it shows that the overall merger between JP Morgan and Bank One is successful, since all of the above factors suggested by the author have been met.

5 Conclusion and findings

One of the purposes of this study is to explore different motives of taking part in M&As in the U.S. banking sector. The theories used are based on (Trautwein, 1990)’s model of merger motives which consisted of seven theories. Other specific trends affecting the merger motives specifically in U.S. banking industry have also been addressed. All of the findings of the study are being supported by the theories mentioned in the literature review chapter. At the same time, every motives analyzed in the case study are consistence with the motives suggested by the theories, especially with efficiency theory, gaining value through synergies act as a very vital role in the firm’s merger success. Some of the effects results from the merger could also be the motives. The effects of operational and financial synergies could be realized and used to explain JP Morgan is aiming to accomplish growth and diversification, cost saving phenomenon, geographical expansion and technological advance through the merger deal with Bank One. Monopoly power is another component that the firm hoping to achieve from the merger, and it also leads to the firm’s success especially in reducing the cost of capital, lowering risk and leads to a cheaper funding. All together, the firm has achieved its initial goal from the merger.